#ACCA Online Classes

Explore tagged Tumblr posts

Text

ACCA Learning A Path to Global Career Success

Learning for the ACCA is a structured way of acquiring international accolades, henceforth improving the chances of success in the career of accounting and finance. The USA Cash team

could have partnered students and professionals in marketing their work to a countrywide network of clients usually resulting in job opportunities being created within short periods. The expert knowledge of financial management and ethical decision-making makes ACCA professionals the top pick for the employers. Sanjeev Varshney, A faculty at ICAI, employs a hands-on method and makes sure the students understand the complicated concepts and he provides the essential tools for them to do the tasks with ease.

The Sanjeev Varshney Classes is giving both the online and direct coaching for ACCA, CA Foundation, and CA Intermediate. Online teaching is made up of interactive live classes, recording sessions, flexible earnings, and doubt-solving tabs. Face-to-face learning is the best thing to do for social and direct communication learners, they will have the prospect of real-time feedback and guidance instantly. Some prominent features are engaging directly with the faculty, concentrating on the major subject, and getting instant answers.

0 notes

Text

youtube

How Fintram Helps Karan to Become an ACCA Member?

🔴In this video, we follow Karan's journey to becoming an ACCA (Association of Chartered Certified Accountants) member with the help of Fintram Global. Karan shares his experience with Fintram's comprehensive ACCA exam preparation courses, expert guidance, and personalized study plans. From understanding complex concepts to mastering exam techniques, Fintram's support plays a crucial role in Karan's success. Join us as we explore how Fintram helps Karan achieve his goal of becoming an ACCA member and advancing his career in accounting and finance.

🎓Start your ACCA Journey with Fintram Global:- https://fintram.com/

#acca coaching in india#fintram acca#acca scope in india#acca#acca classes#acca india#proud fintramer#fintram acca success stories#acca success stories#acca course#acca success#acca success story#acca vs ca#fintram acca success story#acca global#ca vs acca#acca study plan#acca tutorials#acca course details#acca syllabus#acca online classes#acca exam#scope of acca#acca membership ceremony#acca course 2024 full details#Youtube

0 notes

Text

Top ACCA Online Course in India: Your Guide to Success

Are you looking to pursue a career in accounting? If you also want to create a global career in this field, the ACCA online course is just what you are looking for! The Association of Chartered Certified Accountants (ACCA) global accounting certification was established in 1904 in the UK. However, preparing for the ACCA exam can be like a hard nut to crack, especially if you have other responsibilities like work, family, and personal life.

Thankfully, the ACCA online course program is available here for individuals who want flexible and convenient options to enhance their career to the next level. If so, this newsletter is for you to find the best ACCA course provider in India for online classes, so read this newsletter fully to know clearly.

One more thing is that the ACCA course requires an extreme level of discipline and dedication over two years to become an ACCA cadet. So, it becomes tough for students to find the best ACCA course providers to qualify as global accountants.

Hereafter, there is no further difficulty in selecting the top ACCA online course provider in India. At NorthStar Academy, expert faculties have developed a top-class ACCA online course for you.

Here are some of the facilities of the program:

F&A Basics: A clear understanding of the basics will lead to an expert level of knowledge.

Accreditation and Partnership: NorthStar Academy is an ACCA Approved Learning Partner (ALP) and BPP learning media partner in India.

Comprehensive Training: From elite faculty and India’s top mentors like Mr. M. Irfat sir of NorthStar Academy with 15+ years of industry experience.

Training Environment: NorthStar Academy (NSA) has a Learning Management System (LMS) dashboard for easy access to online courses during your flexible hours.

Outstanding Track Record: 90% pass rate with a 100% placement protection program at NorthStar Academy.

100% Syllabus Coverage: Detailed notes for each subject and topic of the ACCA course.

End-to-End Support System: 24/7 support service and exclusive 360-degree assistance guarantees.

Note: These are the main factors to consider during your research to find the best ACCA institute with top-class ACCA online classes in India.ACCA Curriculum: A Guide to Preparation

ACCA Syllabus

Applied Knowledge Level (3 Papers): Business and Technology (BT), Management Accounting (MA), Financial Accounting (FA)

Applied Skills Level (6 Papers): Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), and Financial Management (FM).

Strategic Professional Level (4 Papers): Two compulsory papers — Strategic Business Reporting (SBR), Strategic Business Leader (SBL), and two elective papers from four — (AFM) Advanced Financial Management, (APM) Advanced Performance Management, (ATX) Advanced Taxation, and (AAA) Advanced Audit and Assurance.

ACCA Exemption Allowance: For whom?

Commerce Graduates and Above — Candidates need to face eight ACCA exams with five exemptions.

Commerce Graduates with CA Intern — Candidates need to face seven ACCA exams with six exemptions.

CA, CMA cadet with 5+ years of experience — Will get 9 exemptions, so need to pass 4 ACCA exams to qualify.

0 notes

Text

Embark on a transformative learning journey with a cost and management accounting online course. Dive into the intricacies of financial management, cost analysis, and budgeting from the comfort of your own space. This comprehensive program offers flexible scheduling and expertly crafted modules suitable for learners of all levels. Whether you're a novice or a seasoned professional, this course equips you with valuable skills crucial for success in the world of finance. Join today and unleash your potential through the management accounting course.

0 notes

Text

youtube

Job opportunities in ACCA 2023 | Global CA | Career Opportunities | Imarticus Learning

Discover a world of boundless career possibilities with ACCA certification!

In this video, we delve into the dynamic realm of job opportunities that the Association of Chartered Certified Accountants (ACCA) qualification opens up for aspiring professionals.

ACCA, often referred to as the "Global CA," is revered in 180 countries, making it a passport to success on a truly international scale. The corporate world values the strategic skills and in-depth knowledge that ACCA cultivates, enabling professionals to navigate complex financial landscapes with finesse.

Join us as we delve into the specific responsibilities, growth trajectories, and earning potentials associated with these roles.

Whether you're a recent graduate, a career switcher, or a seasoned professional aiming to propel your career to new heights, ACCA equips you with the tools to excel. If you're ready to seize opportunities that span the globe and embrace a rewarding future, hit that play button and explore the world of ACCA-driven career success.

#Chartered Certified Accountants#acca certificate#acca online classes#acca online courses#acca course#Youtube

0 notes

Text

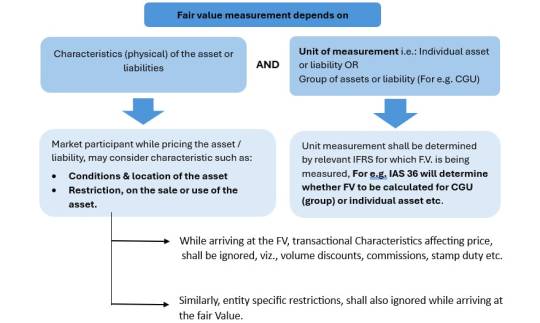

IFRS 13: Fair Value Measurement- Part 1

Under IFRS, fair value is one of the vital measurement basis for the measurement or disclosure of few assets and liabilities. Some of the IFRSs contained limited guidance about how to measure fair value, whereas others contained extensive guidance and that guidance was not always consistent and sometimes ambiguous. Inconsistencies in the requirements for measuring fair value and for disclosing information about fair value measurements have contributed to diversity in practice and have reduced the comparability. This resulted in the issue of IFRS 13 – Fair value measurements, providing single source of guidance on all fair value measurement, clarity in definition, reducing earlier ambiguity and enhancing disclosures etc.

IFRS 13 provides framework for measuring fair value, enhancing consistency and comparability in financial reporting. In this blog we’ll discuss, evaluate the definition of fair value and its key aspects and determine how to apply the same in arriving at the fair value under IFRS 13. IFRS 13 defines fair value and provides the various approaches to arrive at the fair value of an asset or a liability using different levels of inputs.

Definition of Fair Value (FV)

IFRS 13 defines fair value as:

1.The price that would be received to sell an asset or paid to transfer a liability;

2.In an orderly transaction;

3.Between market participants;

4.At the measurement date.

Fair value is the exit price and is a market-based measurement and not entity specific measurement. Thus, FV is not affected by an entity’s intentions towards the asset, liability or equity item that is being fair valued.

Fair value is an estimate of price based on the exit price from the perspective of market participants in an orderly transaction who hold the asset or owe the liability at the measurement date.

Such an estimate of price for an asset or a liability shall be based on identical or similar asset or a liability. However, when such price is not observable, then estimate shall be based on another valuation technique which maximises the use of observable inputs and minimises the use of unobservable inputs.

IFRS 13 requires management to determine four aspects while determining FV:

1.Asset or liability subject to measurement (unit of account);

2.The (orderly) transaction

3.Market participants;

4.The (exit) price.

We will now check each one of the above aspects which will contribute to arrive at the fair value of the asset or a liability.

1. Asset or liability subject to measurement (Unit of account)

The fair value is for a particular asset or liability or group of assets or liabilities depending on the requirements of respective IFRS for which entity is calculating fair value. One should also consider physical characteristics of the asset subject to fair value.

This essentially defines the level of aggregation or disaggregation while calculating fair values of the assets/ liabilities.

Example 1 - Entity Specific restrictions

An entity ABC is having a land which has a restriction to develop into a commercial house because of restricted business objective in which currently the entity operates. The entity wants to sell the land and there would not be any restriction for a buyer of the land to develop a commercial house, since this restriction is entity specific. Hence, it will not be considered while calculating fair value of the land.

Examples 2 - Asset / Liability specific restrictions

A car has been bought for private use and there is a restriction of not to use the car for any commercial purposes. Commercial vehicle is having more fair value than private vehicle. Since the restriction to use the vehicle is asset specific and market participant will also consider the asset specific restrictions while calculating fair values for such asset, hence this condition will be considered while evaluating fair value of the car.

2. The (orderly) transaction

A fair value measurement assumes that the asset or liability is exchanged in an orderly transaction.

An orderly transaction is the transaction which takes place in the principal market or in case of absence of principal market, the most advantageous market.

Principal market –

It is the market with greatest volume and level of activity for the asset or liability.

For e.g. Stock price of TML on NSE is INR 600 (Volume – 1.5 million) and stock price on BSE is INR 610 (Volume – 1 million); thus, principal market is NSE, thus fair value would be INR 600.

Most advantageous market –

It is the market that maximises the amount to be received for sell of the asset or minimises the amount to be transferred of liability.– While determining this market – entity would reduce transaction costs from the exit price only to evaluate maximum cash recovery amongst available markets. After deciding ‘most advantageous market’, fair value of that market would be arrived by adding back the transaction cost to the exit price.

1.Transportation cost is not a transaction cost, it is a physical attribute of the asset under measurement.

2.An entity need not undertake an exhaustive search for all possible markets to determine the principal market or most advantageous market.

3.Most advantageous market is to be considered for fair value determination only when there is no information available for the principal market.

4.The entity must have access to the principal (or most advantageous) market at the measurement date as different entities with different business activities may have access to the different markets.

5.Although an entity must be able to access the market, the entity does not need to be able to sell the particular asset or transfer the liability on the measurement date to be able to measure fair value.

6.It is a hypothetical sale transaction on a measurement date that establishes a basis for estimating the price which will be considered as a fair value of an asset or a liability.

Example 3

Shares of a company which is listed at BSE and NSE have different closing prices at the year end. The price at BSE has greatest volume and activity whereas at NSE it is less in terms of volume transacted in the period. Since BSE has got highest volume and significant level of activity comparing to other market although the closing price is higher at NSE, the closing price at BSE would be taken.

Example 4

Diamond (a commodity) has got a domestic market where the prices are less compared to the price available for export of similar diamonds. The Government has a policy to cap the export of Diamond, maximum up to 10% of total output by any such manufacturer. The normal activities of diamond are being done in the domestic market only i.e. 90% and balance 10% only can be sold via export. The highest level of activities with the highest volume is being done in the domestic market. Hence, the principal market for diamond would be the domestic market. Export prices are more than the prices in the principal market, and it would give the highest return as compared to the domestic market. Therefore, the export market would be considered as the most advantageous market. However, if principal market is available, then its prices would be used for fair valuation of assets/ liabilities.

3. Market participants

Market participants are buyers and sellers in the principal market or the most advantageous market that are:

1.Independent i.e. not related parties;

2.Knowledgeable i.e. having reasonable understanding about the asset/ liability and the transaction;

3.Able to transact;

4.Willing to transact in the asset or liability.

It is assumed that the market participants act in their best economic interest i.e. market participants seek to maximise the fair value of an asset or minimise the fair value of a liability.

4. The (exit) price

1.Under IFRS 13, fair value estimate is based on the "exit price" and does not consider entry price or replacement cost etc.

2.IFRS 13, prohibits to adjust transaction cost in the fair value estimate as it is specific to transaction.

3.Transaction cost do not include 'transport costs'. Location is generally the characteristic of the asset and thus, the exit price shall be adjusted for the transport cost that would be incurred to transfer asset from current location to principal market.

Example 5

An entity sells certain commodity which are available actively at location ‘X’ and which is considered to be its principal market (being significant volume of transactions and activities takes place). However, fair value of the commodity is required to be assessed for location ‘Y’ which is far from location ‘X’ and requires a transport cost of Rs.100. Since the transport cost is not a transaction cost and it is not specific to any transaction, but it is inherent cost which required to be incurred while bringing such commodity from location X to location Y, it will be considered while evaluating fair value from the principal market.

Example 6

XYZ Limited holds an asset that is traded in three different markets. XYZ generally trades in Market 3, however, the details of other markets are as below:

a) Calculate the fair value based on information provided.

b) Assume that principal market is not determinable for absence of total volumes in each market and calculate fair value.

Solution

Fair value is the exit price of the asset in the principal market or in absence of principal market, the most advantageous market. Principal market is the market with highest volume, which is readily determinable. In above example, Market 1 is the market with the highest volume amongst all three markets and will be considered as principal market. Hence, exit price in Market 1 will be considered as fair value. Exit price is the price that would be received to sell an asset in question. Exit price to be determined after considering the transport costs but before the transaction costs. Transport cost is the cost associated with physical characteristics (location) of the asset and not with the sale transaction of an asset. Transactional characteristics cannot be considered while arriving at the exit price. It is thus, prohibited to adjust transaction costs while arriving at the exit price. Thus, fair value of the asset in case ‘XYZ’ is 57.

Assuming, principal market is not readily determinable, evaluation of exit price will be based on the ‘most advantageous market’. Most advantageous market is evaluated based on highest cash recovery amongst the available markets. Cash recovery is highest in Market 3 after considering the expense towards the transaction costs. This makes Market 3 as most advantageous market. The exit price in Market 3 will be considered as fair value in second scenario. Exit price in market 3 is 59 before adjusting transaction costs and NOT 57. It means that, transaction costs shall be deducted only to determine the highest cash recovery and consequently the most advantageous market. Thus, fair value of asset in second scenario is 59.

We hope this blog helps to understand the fair value definition, various aspects management requires to determine under IFRS 13, and other factors need to be considered while measuring fair value of asset or liability, with the help of suitable examples & question as well. In our next blog we’ll outline some other concepts of fair value measurement like– consideration for non-financial assets, valuation techniques and fair value hierarchy.

Thank you for reading this article. Stay tuned for more simplified insights on accounting standards!

#ifrs#accounting#dipifr course#dipifrs#diploma in ifrs#finproconsulting#finpro consulting#ifrs online classes#diplomainifrs#acca

0 notes

Text

How US CMA Classes in Indore Are Changing Students' Lives

Why Choose US CMA Classes in Indore?

Indore has become a rising hub for finance and accounting education, especially for US CMA aspirants. The growing demand for globally recognized certifications has led many students to choose US CMA classes in Indore. These classes offer a perfect blend of theoretical knowledge and practical skills essential for today's finance professionals.

Srajan International School of Finance, one of the leading institutes, has designed its US CMA coaching to meet international standards, ensuring students are fully equipped to succeed.

Globally recognized curriculum

Industry-relevant case studies

Personalized mentorship

Advanced study resources

Top Benefits of Pursuing US CMA in Indore

Students enrolling in US CMA programs in Indore gain multiple advantages. The city offers quality education combined with affordable living costs, making it a prime destination for professional courses.

Access to experienced faculty with global exposure

Availability of mock tests and simulation exams

Networking opportunities with finance professionals

Support for internship and placement opportunities

Additionally, many students also explore ACCA classes in Indore to broaden their international accounting credentials alongside US CMA.

Career Opportunities After US CMA Certification

The US CMA certification opens doors to numerous career paths globally. Certified professionals are highly sought after in sectors like financial planning, analysis, auditing, and consulting.

Financial Analyst

Cost Accountant

Internal Auditor

Finance Manager

Budget Analyst

Indore's top institutes help students tap into these opportunities by offering placement assistance and career counseling, much like the options available through ACCA Coaching in Indore.

How US CMA Coaching in Indore Prepares You for Global Careers

Global career readiness is a key focus of US CMA coaching in Indore. The curriculum is structured to match the standards set by the Institute of Management Accountants (IMA) USA.

Real-world financial scenarios and case studies

Practical applications of management accounting

Soft skills training for international workplaces

Access to global alumni networks

With the right training, students from Indore are landing jobs not just in India but across the world, similar to the global opportunities provided by the ACCA Institute in Indore.

Success Stories of US CMA Students from Indore

Several students from Indore have successfully transitioned into rewarding finance careers after completing their US CMA certification.

Ankit Jain, now a Financial Analyst at a multinational corporation

Priya Mehta, promoted to Senior Accountant within a year of certification

Rahul Sharma, working as a Cost Accountant in Dubai

These success stories are a testament to the quality education provided by institutes like Srajan International School of Finance.

Experienced Faculty and Expert Guidance in Indore

Quality education is directly linked to the expertise of the faculty. Indore's US CMA coaching institutes employ seasoned professionals who bring real-world experience into the classroom.

Faculty with years of industry and teaching experience

Personalized doubt-clearing sessions

Regular feedback and performance tracking

Guest lectures by industry leaders

Many students also benefit from faculty who have experience teaching CMA coaching in Indore, providing a holistic learning experience.

Affordable Fee Structure for US CMA Coaching in Indore

Unlike major metro cities, Indore offers high-quality coaching at much more affordable rates. This makes US CMA education accessible to a broader group of students.

Flexible payment options

Scholarship opportunities for deserving students

Cost-effective study material and resources

Lower cost of living compared to big cities

This affordability allows many students to also consider enrolling in CMA classes in Indore to enhance their qualifications further.

Flexible Online and Offline US CMA Classes in Indore

Flexibility in learning modes is one of the strongest points of US CMA coaching in Indore. Students can choose between online and offline classes based on their convenience.

Interactive online classes with live sessions

Classroom training with personalized attention

Recorded lectures for revision

Weekend and evening batches for working professionals

This hybrid learning model has made it easier for students to balance their studies with internships or jobs.

International Exposure Through US CMA in Indore

The US CMA qualification itself provides a strong international credential. Indore's coaching centers further enhance this by offering global exposure through:

International webinars and workshops

Collaboration with foreign faculty

Participation in global finance forums

Preparation for international job interviews

Students gain confidence to apply for roles in the US, Middle East, and Europe, making them truly global professionals.

How US CMA Certification Boosts Your Salary and Growth

One of the most significant reasons students opt for US CMA is the substantial salary boost and career growth it offers.

Average salary increase of 30-50% post-certification

Faster promotions into managerial roles

Higher job stability and demand

Increased credibility with employers

With proper guidance from institutes like Srajan International School of Finance, students witness tremendous career growth soon after completing their US CMA.

Conclusion

US CMA classes in Indore, especially at Srajan International School of Finance, are truly transforming students' lives. With expert faculty, global exposure, affordable fees, and flexible learning modes, students are well-equipped to achieve international careers in finance and accounting.

Whether you're aiming for your first job or looking to switch to a global finance role, enrolling in US CMA classes in Indore could be your game-changing decision.

FAQs

Q1. Is US CMA coaching in Indore suitable for working professionals? Yes, most institutes offer flexible weekend and evening batches to accommodate working professionals.

Q2. What is the average duration of US CMA coaching in Indore? Typically, it takes 6-12 months to complete US CMA coaching, depending on the student's pace.

Q3. Can I pursue US CMA along with my college degree? Absolutely! Many students start their US CMA journey during their undergraduate studies.

Q4. How is Srajan International School of Finance different from others? Srajan offers personalized mentorship, expert faculty, affordable fees, and global exposure, making it a preferred choice.Q5. Are placement services available after completing US CMA? Yes, most reputed institutes, including Srajan International School of Finance, offer placement assistance to their students.

#acca institute#acca classes#acca classes in indore#us cma offline classes#acca coaching in indore#us cma classes in rajasthan#acca institute in indore#acca coaching#us-cma coaching#us cma online classes

0 notes

Text

" Advance Your Finance Career with CIMA in Pretoria at IMAS South Africa"

In today's dynamic financial landscape, professionals seek qualifications that offer both global recognition and practical skills.

The Chartered Institute of Management Accountants (CIMA) provides such an opportunity, and IMAS South Africa stands out as a premier institution offering CIMA courses in Pretoria.

IMAS South Africa offers flexible learning options, experienced faculty, and comprehensive support services to ensure student success. Their tailored programs cater to diverse learning needs, making them a preferred choice for CIMA courses in South Africa. Medium

Visit Us: https://imas-sa.co.za/cima-professional-qualification/ Contact Us: +27 (0) 861 434 333 +27 (011) 331 7343

#education#acca#south africa#imas#virtual classes#build your career#flexible schedule#learn new skills#study from anywhere#cima#online & offline#classes

0 notes

Text

Wegyde ACCA Coaching Institute in Kerala, Cochin

#ACCA Coaching kerala#ACCA Classes in Cochin#ACCA Coaching Center in kerala#ACCA Classes in kerala#ACCA Offline Coaching Classes kerala#Best ACCA Coaching in kerala#ACCA with Anshul Mittal#CA Anshul Mittal Classes#CMA career opportunities#CMA coaching Kerala#CMA Institute online coaching#FR Online Classes Kerala#Income Tax Classes Cochin#Jobs after ACCA#ACCA Free classes#How to pass ACCA exemptions for acca#ca exemptions for acca#acca exemptions for cma#cima exemptions for acca#cfa acca exemptions

0 notes

Text

Best ACCA Online Classes for Your Success | Unique Global Education

Elevate your accounting career with the best ACCA online classes offered by Unique Global Education. Our expert-led sessions provide comprehensive coverage of all ACCA levels, ensuring a flexible, interactive, and engaging learning experience. With tailored study plans, cutting-edge resources, and unmatched mentorship, we help you achieve your ACCA certification goals seamlessly. Join today and unlock your potential with the finest online ACCA training available.

0 notes

Text

The Benefits of ACCA Online Coaching in India: What You Need to Know

ACCA online coaching in India offers flexibility, expert instruction, and convenience. A Team Commerce Academy provides top-tier ACCA online coaching, helping them balance their studies with other commitments. They receive personalized support and access to comprehensive resources, enhancing their ability to succeed in their ACCA exams and advance their careers.

#online education#accounting#commercestudents#onlinecourses#acca#financial#smart classes#finance and accounting#onlinelearning#accastudy#accastudents

0 notes

Text

ACCA Professional Strategic Level with Sanjeev Varshney Classes Your Key to Success.

Sanjeev Varshney Classes is one of the prime classes for those who want to become accountants and finance professionals through getting the ACCA Professional Strategic Level. Headed by the top teacher of the country, Sanjeev Varshney, the institute provides both online and offline coaching. The institution with an experience of more than 25 years offers a program which is very comprehensive and is covering all the topics of ACCA Professional Strategic Level syllabus.

Sanjeev Varshney's approach to teaching is based on combining theory with practical aspects so that students can fully understand the subject at hand. The academic helps those students who tend to use both methods of learning like distance e-learning and face-to-face, thus meeting their needs in different aspects of education.

The courseware is well structured and provides a deep academic approach so that learners acquire theoretical as well as practical ideas, which makes it a perfect solution for those who prepare as an ACCA Professional Strategic Level or for pursuing their Chartered Accountancy (CA) course.

The main advantages of Sanjeev Varshney Classes are systematic learning, mock exams and regular means of either collective or individual attention given to the students. The use of these tools enables the student to understand the complex topics which they a more challenging task in the exams at the ACCA Professional Strategic Level are.

0 notes

Text

youtube

🌟Jagpreet's Journey to Success with Fintram Global | A Proud Fintramer

🔴Join us in this inspiring journey with Jagpreet, a determined individual who embarked on a path to success with Fintram Global. Discover how Jagpreet overcame challenges, honed his skills, and achieved his goals with the guidance and support of Fintram Global's expert team.

🎓Start your ACCA Journey with Fintram Global:- https://fintram.com/

#acca coaching in india#fintram acca#acca scope in india#acca#acca classes#acca india#proud fintramer#fintram acca success stories#acca success stories#acca course#acca success#acca success story#acca vs ca#fintram acca success story#acca global#ca vs acca#acca study plan#acca tutorials#acca course details#acca syllabus#acca online classes#acca exam#scope of acca#acca membership ceremony#acca course 2024 full details#Youtube

0 notes

Text

Finance Courses Online

Types of Finance Courses After 12th

Every Finance aspirant can even choose online finance courses with certificates. There are a variety of finance courses available after the 12th, ranging from undergraduate degrees to professional certifications. Here are some of the most popular options:

Chartered Accountancy (CA): CA is one of the most prestigious and sought-after finance qualifications in India. The CA course is conducted by the Institute of Chartered Accountants of India (ICAI) and is divided into three levels: Foundation, Intermediate, and Final.

Company Secretary (CS): CS is another professional course that deals with corporate governance and legal matters. The CS course is conducted by the Institute of Company Secretaries of India (ICSI) and is divided into three levels: Foundation, Executive, and Professional.

BBA in Finance: BBA in Finance is a three-year undergraduate degree that provides a comprehensive foundation in financial concepts and principles. The BBA in Finance syllabus includes subjects such as accounting, financial management, economics, and investment management.

B.Com: B.Com is a three-year undergraduate degree that focuses on the principles of commerce and accounting. The B.Com syllabus includes subjects such as accounting, economics, business law, and marketing.

Certified Financial Analyst (CFA): CFA is a professional certification that is highly valued by employers in the financial industry. The CFA exam is administered by the CFA Institute and covers a wide range of financial topics, including investment analysis, portfolio management, and financial reporting.

Certified Financial Planner (CFP): A Certified Financial Planner (CFP) is a highly qualified financial professional who helps individuals and families achieve their financial goals. CFPs must complete rigorous education, experience, and ethical requirements before earning their certification. They are also required to complete continuing education courses to maintain their credentials.

#acca classes#acca coaching#economy#accaglobal#entrepreneur#finance#acca course#acca online#marketing#fintram

0 notes

Text

youtube

The ACCA Advantage: How is ACCA better than MBA/BBA ?

Your career journey is about to get a whole lot clearer as we dive deep into the battle of ACCA (Association of Chartered Certified Accountants) vs. MBA/BBA in this enlightening video! In this must-watch video, we bring you a comprehensive breakdown of the advantages that ACCA holds over an MBA or a BBA, helping you make an informed decision for your professional aspirations.

Whether you're a budding accountant, an aspiring business leader, or someone looking to enhance their financial acumen, this video is tailor-made for you. Join us as we explore the key differences between ACCA and MBA/BBA. Imarticus Learning is India’s leading professional education institute, offering certified industry-endorsed training in Financial Services, Investment Banking, Business Analysis, IT, Business Analytics & Wealth Management.

0 notes

Text

Get the latest and most comprehensive Diploma in IFRS (ACCA DipIFR) study material to prepare confidently for your upcoming exams. Our study kit includes updated notes, practice questions, revision summaries, and past exam papers with solutions—perfect for self-study or revision. ✅ Covers entire ACCA DipIFR syllabus ✅ Updated as per latest IFRS standards ✅ Instant digital access or courier delivery ✅ Ideal for June & December exam sessions Boost your exam success rate with expert-curated IFRS content. 📞 Contact us today to get your material!:- +91 8421438047

#diploma in ifrs#accounting#dipifrs#dipifr course#ifrs#ifrs online classes#finpro consulting#finproconsulting#diplomainifrs#acca

0 notes