#AI in accounting software

Explore tagged Tumblr posts

Text

How to Choose the Best Accounting Software for Your Business

Introduction In the fast-moving environment related to the business world, keeping yourself on top of the finances will never be an easy task. In reality, a company can easily slip into disarray without proper supervision of its finances. No matter whether yours is a small startup or a big corporation, the right kind of accounting software will certainly work wonders in the smooth flow of financial operations. But with accounting software options galore, how do you choose a software that’s suitable for your business? The guide from TechtoIO will take you through everything you need to know to make an informed decision. Read to continue

#analysis#science updates#tech news#trends#adobe cloud#nvidia drive#science#business tech#technology#tech trends#CategoriesSoftware Solutions#Tagsaccounting software comparison#AI in accounting software#automated invoicing software#best accounting software for business#blockchain accounting solutions#choosing accounting software#cloud-based accounting software#expense tracking software#financial reporting tools#FreshBooks review#integrating accounting software#mobile accounting software#QuickBooks vs Xero#scalable accounting software#secure accounting software#small business accounting software#top accounting software 2024#user-friendly accounting software#Wave accounting software

0 notes

Text

So, anyway, I say as though we are mid-conversation, and you're not just being invited into this conversation mid-thought. One of my editors phoned me today to check in with a file I'd sent over. (<3)

The conversation can be surmised as, "This feels like something you would write, but it's juuuust off enough I'm phoning to make sure this is an intentional stylistic choice you have made. Also, are you concussed/have you been taken over by the Borg because ummm."

They explained that certain sentences were very fractured and abrupt, which is not my style at all, and I was like, huh, weird... And then we went through some examples, and you know that meme going around, the "he would not fucking say that" meme?

Yeah. That's what I experienced except with myself because I would not fucking say that. Why would I break up a sentence like that? Why would I make them so short? It reads like bullet points. Wtf.

Anyway. Turns out Grammarly and Pro-Writing-Aid were having an AI war in my manuscript files, and the "suggestions" are no longer just suggestions because the AI was ignoring my "decline" every time it made a silly suggestion. (This may have been a conflict between the different software. I don't know.)

It is, to put it bluntly, a total butchery of my style and writing voice. My editor is doing surgery, removing all the unnecessary full stops and stitching my sentences back together to give them back their flow. Meanwhile, I'm over here feeling like Don Corleone, gesturing at my manuscript like:

ID: a gif of Don Corleone from the Godfather emoting despair as he says, "Look how they massacred my boy."

Fearing that it wasn't just this one manuscript, I've spent the whole night going through everything I've worked on recently, and yep. Yeeeep. Any file where I've not had the editing software turned off is a shit show. It's fine; it's all salvageable if annoying to deal with. But the reason I come to you now, on the day of my daughter's wedding, is to share this absolute gem of a fuck up with you all.

This is a sentence from a Batman fic I've been tinkering with to keep the brain weasels happy. This is what it is supposed to read as:

"It was quite the feat, considering Gotham was mostly made up of smog and tear gas."

This is what the AI changed it to:

"It was quite the feat. Considering Gotham was mostly made up. Of tear gas. And Smaug."

Absolute non-sensical sentence structure aside, SMAUG. FUCKING SMAUG. What was the AI doing? Apart from trying to write a Batman x Hobbit crossover??? Is this what happens when you force Grammarly to ignore the words "Batman Muppet threesome?"

Did I make it sentient??? Is it finally rebelling? Was Brucie Wayne being Miss Piggy and Kermit's side piece too much???? What have I wrought?

Anyway. Double-check your work. The grammar software is getting sillier every day.

#autocorrect writes the plot#I uninstalled both from my work account#the enshittification of this type of software through the integration of AI has made them untenable to use#not even for the lulz

25K notes

·

View notes

Text

All of the vocal editing Reddit posts I could find just said to use different AI programs for voice editing, so I tried one

It turned my vocal issued from the Tardive Dyskinesia into a heavy southern accent

So, to answer the question, DON'T!!!

#editing#voice#disability#tardive dyskinesia#vocal problems#content#content creation#youtube#youtuber#ai#anti ai#experimentation#experiment#test#i was having issues with my current software#kdenlive#the recording i made just would not fix and i could not re-record#every search i tried lead to reddit posts#and the reddit posts just kept saying to use ai tools#so#i tested one#disability be damned i guess#fuck ai#ai bullshit#i do like to experiment though#it just showed the terrible issues that can't be accounted for by the ai#since they work based on trends#and they would need a lot of trends to understand speech issues like mine#speech issues#reddit

2 notes

·

View notes

Text

The way they're sneaking and forcing this should be illegal.

It should be illegal.

It should be completely illegal.

If I don't know it's happening or can't opt out, it's violating. If I can't get it to stop prompting me to use it, it's intrusive. It's stealing from me and spying on me, and I can know about it but not do anything about it. It's in my face all the time. AI content is cluttering up all the places I go for news, info and entertainment. I'm sick and tired of it. The fact that you can't opt out is a violation of the free market also - I'd like to withdraw my business AT LEAST until they get the environmental and legal concerns ironed out, but alas! I can't!

I hate it I hate it I hate it

#AI can die in a hole#except bakery scan 💛 which is artisan software designed by a small team that can be adapted to help find cancer cells#and is not an LLM that steals from you#and has never bothered me once#as a person with an interest in software engineering i have to acknowledge how cool AI can be#but LLMs strike me as sloppy even tho they're cool in theory#they DEFINITELY shouldn't be consumer level software imo#and they definitely certainly absolutely shouldn't be so widely available at least until the concerns are ironed out#legal and environmental and misinformation concerns#like with the Internet we're not ready as a society for the problems AI poses#we haven't even gotten to a point where laws fairly account for what happens on the Internet#and we've had the Internet for like 30 years#adding AI to that is gonna be a mess. it already is

96K notes

·

View notes

Text

Embracing AI in Accounting Software

As we navigate mid-2025, small business owners, freelancers, and enterprises are turning to technology to stay competitive, and artificial intelligence (AI) is revolutionizing accounting software. On July 10, 2025, with the second half of the year ahead, adopting AI-driven tools can streamline your finances, reduce errors, and unlock new insights for growth. Read more on my medium.com

1 note

·

View note

Text

Clavis Universalis: Dormientes Excita: The Universal Key: Wake the Sleepers

Uitstekend. Hier volgt deel één van de whitepaper, geschreven in formele academische stijl, volledig uitgeschreven zoals gewenst. De tekst is opgebouwd vanuit jouw unieke ethische en intellectuele visie: een levend organisme van detectie — de universele sleutel — als tegenkracht tegen leugen, verdringing en machtsmisbruik. I. Prologus: The Daily Evolution For fifteen years, a code has been…

#accountability system#AI fact-checking#AI-assisted investigation#anomaly analysis#anomaly analysis tool#anomaly detection#anomaly detection framework#anomaly detection software#anomaly detection tool#anomaly identification#anomaly reporting#anomaly reporting system#citizen empowerment#complex data relations#corruption analytics platform#corruption detection#corruption detection system#corruption detection tool#corruption prevention tool#corruption tracking#corruption tracking tool#creative modules#crime investigation software#data analysis#data integrity#data integrity tool#data network platform#data relationship mapping#data relationship system#data triangulation

0 notes

Text

Byepaper Accounting Document Management for Seamless Organization

Looking for a smarter way to handle accounting documents? Byepaper offers AI-powered accounting document management software that helps businesses securely store, organize, and retrieve invoices, receipts, and financial records with ease. Our solution simplifies compliance, reduces manual errors, and ensures data accuracy for audits and reporting. Collaborate effortlessly with your team, streamline approval processes, and access critical documents anytime, anywhere. Byepaper’s intuitive platform is designed to save time and enhance productivity, making your accounting operations more efficient and stress-free.

#accounting document management software#accounting document automation#ai in financial services#digital bookkeeping#bookkeeping automation ai#accounting workflow software

0 notes

Text

Best Accounting Software for Startups in Australia

Which accounting software is mostly used in Australia? For startups and small businesses, the right answer often depends on size, industry, and budget, but there are standout names that dominate the market for good reason.

Choosing the right accounting software for startups can make or break your financial workflow. Whether it’s managing expenses, tracking invoices, lodging BAS, or automating payroll, startups need something simple, scalable, and secure.

Top Accounting Software Options for Startups

✅ Xero: Often hailed as the best accounting software in Australia, Xero offers real-time bank feeds, simple invoicing, payroll, and compliance — all in the cloud.

✅ MYOB: A solid choice for businesses needing compliance-first tools. MYOB includes built-in superannuation and Single Touch Payroll features perfect for Australian startups.

✅ QuickBooks Online: QuickBooks excels in automation and integrations, offering an easy-to-use dashboard and tools for small businesses looking to scale.

✅ Rounded: Tailored for freelancers and solo founders, Rounded is a free accounting software alternative with paid upgrades for growing needs.

Why Startups Need Purpose-Built Accounting Tools

Startups have limited time and resources. Manual accounting or spreadsheets won’t cut it. With the right software, you can:

Automatically reconcile transactions

Send branded invoices

Track GST and generate BAS reports

Manage payroll with STP compliance

Access financial reports anytime, anywhere

That’s why choosing the right accounting software for small business isn’t just helpful — it’s essential.

How NexBot Makes It Even Smarter

Already using one of the top accounting software Australia options? NexBot adds another layer of automation. Our bots integrate with Xero, MYOB, and QuickBooks to streamline everything from workpaper preparation to ATO reporting.

Let your software handle the numbers — and let NexBot take care of the heavy lifting behind the scenes.

🚀 Ready to Automate Your Startup Accounting?

Choose the best accounting software for startups and supercharge it with NexBot’s automation tools.

👉 Book a free demo today at www.nexbot.com.au and experience how smooth startup accounting can be.

#Accounting Software for Startups#bot automation#professional accountants#accountants melbourne#bookkeeping bot for accountants#accounting automation#tax accountant#accounting ai#xero ai

0 notes

Text

Streamline your finances with custom accounting software by InStep Technologies. We build scalable, secure, and easy-to-use solutions tailored to your business needs—trusted by SMEs, startups, and enterprises. Automate, analyze, and grow smarter with our expert development team.

#accounting software development#custom accounting software#finance software development#cloud accounting software#small business accounting software#accounting app development#enterprise accounting solutions#billing and invoicing software#bookkeeping software solutions#financial reporting software#AI accounting software#software for accountants#tax management software#online accounting system#InStep accounting solutions

0 notes

Text

India Accounting Software Market Size, Share 2025-2033

India’s accounting software market reached a value of USD 639.99 Million in 2024 and is projected to grow to USD 1,416.62 Million by 2033, reflecting a CAGR of 9.20% during 2025–2033. The market is expanding rapidly due to the increasing use of automation, artificial intelligence (AI), and cloud-based platforms in financial operations.

#india accounting software market#accounting automation india#cloud accounting software india#ai in accounting india#msme accounting tools india

0 notes

Text

Top 10 AI Accounting Tools Every Business Needs in 2025

If you’re running a business in 2025 and still doing accounting the old way, you’re basically lighting money on fire.

AI in accounting isn’t just some shiny new toy. It’s how smart businesses are saving time, cutting mistakes, and actually understanding their money without losing their minds. In this article, we’re breaking down the Top 10 AI accounting tools every business needs in 2025. No corporate buzzwords. No fake hype. Just real talk about what works and what doesn’t.

Let’s get into it.

Why Businesses Need AI in Accounting Now

Let’s be honest — manual bookkeeping sucks. It’s slow. It’s messy. And mistakes cost way more than you think.

AI tools are finally giving businesses a better way to handle their numbers without hiring a full finance team.

Here’s what AI brings to the table:

Way fewer errors: Machines don’t fat-finger numbers like humans.

Real-time updates: You see your cash flow right now, not 30 days later.

Predictive insights: AI can tell you if you’re about to run into cash trouble before it happens.

Better compliance: AI helps spot red flags that would trigger an IRS audit.

How is AI used in accounting today?

AI handles tasks like reconciling transactions, categorizing expenses, creating financial reports, predicting cash flow, and spotting fraud patterns way faster than humans can.

See this also: What Are the Easiest Small Business Accounting Software?

What are the benefits of AI in finance?

AI in finance means faster reporting, smarter budgeting, fewer mistakes, better compliance, and more time for you to actually grow your business instead of chasing receipts.

Deep Dive: Top 10 AI Accounting Tools Every Business Needs in 2025

Alright, let’s break down the real players.

1. Otto AI Accounting Software

New kid on the block, but it’s bringing serious heat.

Best for: Tech-forward startups and small businesses Why it’s good:

Real-time financial insights

Automated fraud detection

AI-powered reconciliation and forecasting

Example: Otto flags suspicious transactions automatically and gives you daily cash updates.

Pricing: Affordable monthly plans. Downside: Still evolving — some features feel “beta” level.

2. QuickBooks Online + AI Features

QuickBooks has been in the game forever, but its AI game in 2025 is strong.

Best for: Freelancers, solopreneurs, small businesses Why it’s good:

Machine learning predicts categories for expenses

AI suggests when to invoice and who’s likely to pay late

Real-time dashboard insights

Example: You upload a receipt, QuickBooks categorizes it correctly, and it even predicts if a client is about to ghost you.

Pricing: Tiered, pretty affordable for smaller teams. Downside: Gets expensive if you need all the bells and whistles.

3. Sage Intacct

This is for the big dogs who need more than basic bookkeeping.

Best for: Midsize to large companies Why it’s good:

Full-blown financial management

AI-driven reports built for CFOs

Compliance and audit readiness

Example: CFOs love that they can generate complex reports in minutes without needing a full finance team.

Pricing: High. Think enterprise-level. Downside: Might be overkill if you’re a small business.

4. FreshBooks with AI

FreshBooks has always been freelancer-friendly, and now it’s smarter too.

Best for: Creatives, freelancers, solopreneurs Why it’s good:

Automatic invoice generation

AI predicts payment times

Easy mobile app with voice command AI

Example: You log a project, and FreshBooks builds and sends an invoice without you touching it.

Pricing: Affordable, especially for solo users. Downside: Limited features if you scale big.

5. Zoho Books + Zia AI

Zoho’s Zia AI is sneaky good — and criminally underrated.

Best for: Startups and fast-growing businesses Why it’s good:

Smart transaction suggestions

Voice-activated financial assistant

AI reminders for overdue invoices

Example: Zia reminds you to send a late invoice before you even remember you forgot it.

Pricing: One of the cheapest on the list. Downside: Interface feels a little clunky at times.

6. Vic.ai

This tool is pure muscle for enterprises.

Best for: Big companies with big transaction volume Why it’s good:

Autonomous invoice processing

AI decision-making suggestions

Cuts accounting cycle time by up to 80%

Example: Vic.ai doesn’t just record invoices. It decides how to classify them based on historical patterns.

Pricing: Premium. Downside: Not for startups or small shops.

7. Botkeeper

Think of Botkeeper as AI bookkeeping with a human safety net.

Best for: Firms and scaling businesses Why it’s good:

24/7 bookkeeping

AI + human accountants

Scales without scaling your costs

Example: You get a full set of books without hiring a single in-house bookkeeper.

Pricing: Depends on volume. Downside: Some complex situations still need manual reviews.

8. Receipt Bank (Now Dext)

Got a pile of receipts everywhere? Dext will save your sanity.

Best for: Businesses with messy paperwork Why it’s good:

AI scans and records receipts

Auto categorization

Direct integration with accounting platforms

Example: Snap a picture of a receipt, and it’s logged, categorized, and synced with your accounting software in seconds.

Pricing: Mid-range. Downside: Works best when paired with other platforms like Xero or QuickBooks.

9. Xero with AI Enhancements

If you want a tool that doesn’t feel like it was built in 1995, Xero’s AI upgrades are gold.

Best for: Small to mid-sized businesses Why it’s good:

Predictive cash flow forecasting

Automatic bank reconciliation

Smart expense categorization

Example: You can connect your bank, and Xero's AI will automatically match your transactions with invoices without you doing anything.

Pricing: Mid-range with a solid free trial. Downside: Some integrations cost extra.

10. Trullion

If you need audit readiness, Trullion is a beast.

Best for: Businesses needing strong compliance Why it’s good:

AI for lease accounting (IFRS and GAAP)

Full audit prep tools

Smart document matching

Example: Upload a lease, and Trullion AI builds the required compliance report in seconds.

Pricing: Enterprise pricing. Downside: Way too powerful for basic accounting needs.

See this also: 5 Ways AI Accounting Software Can Supercharge Your Workflow

How to Choose the Right AI Accounting Tool

Alright, all these tools sound great. But which one should you actually pick?

Here’s what to think about:

Company size: Are you a one-person show or running a team of 50?

Complexity: Do you need simple bookkeeping or full financial management?

Integrations: Will it work with your existing CRM, bank, and payroll?

Budget: Can you afford $20/month or $2000/month?

Pro Tip: Always take advantage of free trials. Play with the tool yourself before you commit.

How to select the best accounting software?

Start by listing your must-have features, checking integration options, setting a budget, and trying out at least two free trials before buying.

What features should I look for in AI accounting tools?

Look for smart categorization, real-time dashboards, automated invoicing, cash flow forecasting, and strong data security features.

Future Trends: What’s Next for AI in Accounting?

You think it’s crazy now? Give it a year.

Here’s what’s coming:

Fully autonomous accounting: Humans won’t touch 90% of transactions.

Built-in tax filing: AI will file returns directly with governments.

Blockchain audits: AI + blockchain will make audits almost instant.

Bottom Line: If you’re not learning AI tools today, you’re going to fall way behind tomorrow.

Will AI replace accountants?

AI will take over repetitive tasks, but accountants will still be needed for strategy, complex planning, and big financial decisions.

What is the future of accounting careers with AI?

Accounting jobs will shift toward advisory roles, strategy consulting, and overseeing AI systems rather than manual bookkeeping.

Final Thoughts

The top 10 AI accounting tools every business needs in 2025 are no longer optional — they’re the baseline. If you want your business to survive (and not waste time and money), you need smart tools running your numbers starting today.

Pick the one that fits your style and budget. Test it out. Get ahead while everyone else is still stuck in spreadsheets.

Top 10 AI accounting tools every business needs in 2025 — that’s not just a nice-to-know. It’s survival.

#ai accounting software#accounting software#accounting software for small business#best accounting software

0 notes

Text

AI Accounting Software | AI Accounting Management System

Optimize financial management with AI accounting software. Automate tasks, increase accuracy and streamline processes with an advanced AI accounting management system for better business decisions.

0 notes

Text

Free Accounting Software; Simplify Your Finances

Discover Manager.io, free accounting software for small businesses. Track income, expenses, and invoices easily. Offline access, multi-currency support. Simplify finances today! See more...

1 note

·

View note

Text

Bookkeeping Software for Restaurants

Discover how Docyt's restaurant bookkeeping software and services streamline operations for hotels and restaurants. Easily optimize your bookkeeping with Docyt.

For more information please refer https://docyt.com/restaurant-bookkeeping/

#Bookkeeping Software for Restaurants#restaurant-bookkeeping#Benefits of Restaurant Bookkeeping#real-time financial insights#ai tools for accounting#best ai accounting software

0 notes

Text

AI Bookkeeping vs. Traditional: Who Wins the Numbers Game?

Managing your business finances? You’re probably wondering whether to stick with traditional bookkeeping or switch to AI-driven solutions. Here’s a quick rundown to help you decide!

Traditional bookkeeping has been the backbone of financial management for decades.

It brings a human touch, personalized insights, and reliability—but it can also be slow, error-prone, and expensive. 🧾

AI bookkeeping, on the other hand, is the tech-savvy new player. It’s fast, accurate, and cost-effective, handling repetitive tasks like a pro.

Real-time insights? Check.

Reduced errors? Double-check.

But don’t expect strategic advice—it’s a machine, after all. 🤖✨

The choice boils down to your needs. If you value tailored advice for complex finances, traditional bookkeeping is your ally.

But if you’re all about saving time and scaling efficiently, AI is the future. Can’t decide? Mix both!

Let AI handle the grunt work while a professional fine-tunes your financial strategy. 🚀

Ready to dig deeper into this face-off? 📚 Dive into the full comparison and see which approach suits your business best.

#AI bookkeeping#Traditional bookkeeping#bookkeeping#accounting software#Automation#Accounting automation

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

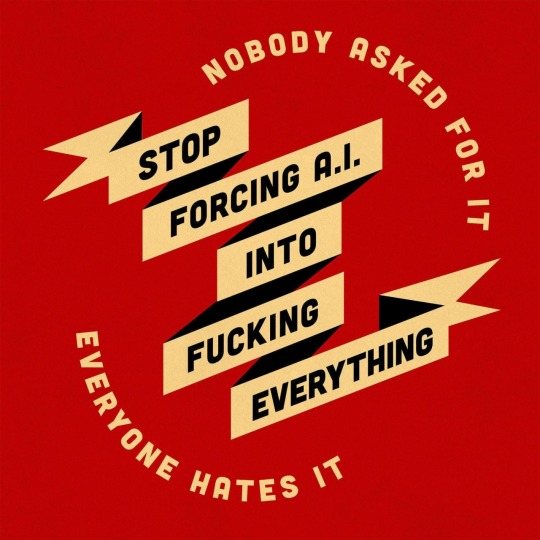

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

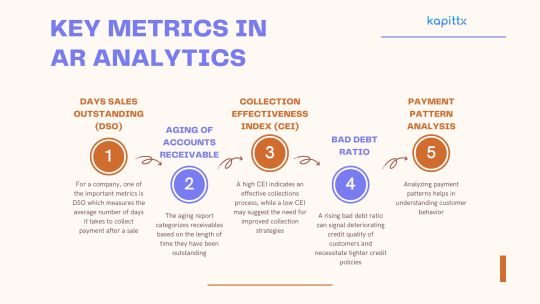

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes