#Algo Trading Algorithms

Explore tagged Tumblr posts

Text

Algo Trading Course

Get the best algo trading course from My Equity Guru in Noida, India. In this course you will learn to analyze data, technical indicators, risk management, build automated trading strategies and many more. This courses is ideal for traders who are looking to enhance and refine their stock market technical skills.

#stock market#stock market courses#Algo Trading Course#benefits of algo trading#hft high frequency trading#algo trading#Algo Trading Algorithms#algo trading buy sell signals indicator

0 notes

Text

5 notes

·

View notes

Text

7 Growth Functions in Data Structures: Behind asymptotic notations

Top coders use these to calculate time complexity and space complexity of algorithms.

https://medium.com/competitive-programming-concepts/7-growth-functions-in-data-structures-behind-asymptotic-notations-0fe44330daef

#software#programming#code#data structures#algorithm#algo trading#datastructures#data#datascience#data analytics

3 notes

·

View notes

Text

DeepSeek AI Can Enhance Algo Trading and Option Trading Strategies.

DeepSeek AI - Algo Trading

DeepSeek AI is a low - cost advanced chatbot. DeepSeek AI can excel in many areas of technology and business, one of these areas is Algo Trading and Option Trading.

Read more..

#Algo Trading#DeepSeek V3#DeepSeek AI#DeepSeek R1#Algorithmic Trading#bigul#ipo price band#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#best algo trading app in india#AI#algorithm#algo trading software india#algorithmictradingsoftware#investment#Investment Platform#Investment Platform in India#Best share trading app in India#trading with algo#algorithmic trading software free#best algorithmic trading software#bigul algo trading#best online trading platforms#bigul algo trading review

4 notes

·

View notes

Text

SureShotFX Algo: The Best Algo for MT4 and MT5

SureShotFX Algo is the best algo trading app for Forex that works with MT4 and MT5. It isn’t just about automated trading—it’s your secret trading weapon in the forex market. With its smart algorithms and hands-off approach, it stands with you 24/7 like a trading expert on your team, providing accurate and profitable forex signals.

SSF Algo uses an advanced algorithm combining multiple strategies and advanced indicators to operate seamlessly within the MetaTrader 4 – MT4, MT5 & cTrader platforms. It executes trades based on predefined parameters and market data to generate automated Forex trading signals like a pro.

Whether you’re new to trading or a seasoned pro, this tool offers precision, flexibility, and total control over your investments.

Benefits of Using SureShotFX Algo:

Smart Trading: Harness the power of advanced algorithms for intelligent trade execution and decision-making.

Enhanced Accuracy: The algorithm’s sharp entry strategy increases the likelihood of successful trades.

Effective Risk Management: Adaptive stop-loss modes and flexible lot management help traders manage risks effectively.

Automated Profit Securing: The Auto Close Partial feature ensures that profits are secured at optimal points during a trade.

Proven Performance: Real-time results and performance data are available on Myfxbook, demonstrating the algorithm’s effectiveness with a potential monthly growth of 8-30%.

Total Control and Flexibility: Maintain control over your trading capital and strategy parameters, with the flexibility to customize settings to suit your preferences.

2 notes

·

View notes

Text

Does Algorithmic Trading Work in 2025?

In today's data-driven markets, the rise of algorithmic trading, or algo trading, has sparked both fascination and skepticism. The burning question many investors ask is, “Does algorithmic trading work?” The short answer is yes—but with important caveats.

Let’s learn more about automated trading.

What Is Algorithmic Trading?

Algorithmic trading refers to using computer programs to automate the process of placing and managing trades. These programs follow defined sets of rules—based on price, volume, timing, or other market data—to execute trades faster and more accurately than a human could.

Evolution of Algo Trading:

1970s: Program trading begins with institutional traders.

2000s: Rise of high-frequency trading (HFT) on Wall Street.

2020s: Widespread access for retail traders through platforms like MetaTrader, QuantConnect, and Alpaca.

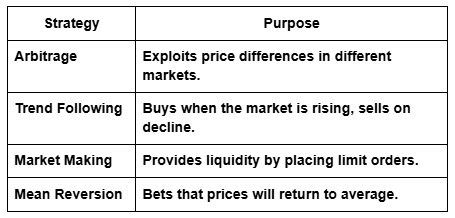

Types of Algorithmic Trading Strategies

Why Algorithmic Trading Appeals to Investors

In February 2025, London Stock Exchange Group highlighted rising algorithmic execution uptake that is rising demand for the sub-milisecond order execution and consistent profit. Besides, some other reasons include:

Speed: Trades are executed in milliseconds.

Objectivity: No emotional decision-making.

Scalability: Multiple markets traded simultaneously.

Backtesting: Strategies tested against historical data.

These advantages have made algo trading a favorite among hedge funds, proprietary firms, and even retail traders with a tech background.

Key Success Factors for Algorithmic Trading

Clean, high-quality data

Thorough backtesting and walk-forward analysis

Understanding market microstructure

Regular optimization and monitoring

Successful traders treat algo development like engineering—not gambling.

Common Misconceptions About Algorithmic Trading

“It’s a money printer” – Not true. Poor strategies lose money fast.

“Set it and forget it” – Markets evolve. Algorithms need updates.

“There’s zero risk” – Flash crashes and bad code can cause disaster.

Who Should Use Algorithmic Trading?

Beginner traders

Tech-Savvy Retail Traders

Institutional Hedge Funds

Data Scientists with Trading Knowledge

If you love data, code, and logic—algo trading could be for you.

Can a beginner do algorithmic trading?

Yes, with algo traders like SureShotFx Algo, beginners can easily get started and trade without any manual input or even with zero trading knowledge.

How much capital do I need?

Retail algo traders can start with $500–$5,000, but institutional-grade systems often need millions.

Is algorithmic trading profitable?

It can be. However, profitability depends on strategy robustness, risk management, and execution quality.

Is Algorithmic Trading Worth It?

Algorithmic trading works—but not for everyone.

If treated seriously, backed by data, and properly maintained, it can be highly effective. But for those hoping for easy, passive profits with zero effort—it will likely disappoint.

0 notes

Text

The Best Crypto Algo Trading Platform in the World

In the fast-moving world of cryptocurrency, every second counts. Prices shift in milliseconds, emotions run high, and if you're not moving fast—you’re probably missing out. That’s exactly why crypto algorithmic trading platforms have taken center stage. They allow you to automate trades, reduce emotional decision-making, and take advantage of market inefficiencies 24/7.

And among them, one platform is consistently being talked about as the best in the game—trusted by pro traders, institutions, and smart investors alike. If you're serious about crypto trading, this is the platform that redefines the way you trade.

Trade Like a Pro—Even While You Sleep

Let’s face it—no human can sit at a screen 24 hours a day, seven days a week, watching the markets tick. But with a powerful crypto algo trading platform, your trading strategies can.

The best platforms today come loaded with:

Real-time market analysis

Pre-built and custom algorithmic strategies

Lightning-fast execution speeds

Risk management tools that protect your capital

Imagine setting your strategy once and letting the system do the work. No more missed entries. No more emotional exits. Just clean, calculated trades—all based on logic, not luck.

Built for Traders Who Think Ahead

What sets the best platform apart? It’s not just about tech—it’s about trader-first innovation.

We’re talking about:

Intuitive dashboards that give you total visibility

Drag-and-drop strategy builders for non-coders

Deep integration with major exchanges like Binance, Coinbase, Kraken, and more

Real-time backtesting so you know what works before you go live

Whether you're a retail trader just starting out or a hedge fund looking for institutional-grade performance, this platform is built to scale with your ambition.

Trade with Confidence—Security Comes Standard

In the crypto space, security isn’t optional. The best crypto algo trading platform in the world understands this and bakes enterprise-grade security into every layer.

You get:

API key encryption

Multi-factor authentication

Secure cloud architecture

Real-time monitoring & threat detection

You can focus on strategy while the platform handles the safety net. Your data, your funds, and your strategies are locked down tight.

Powering Profits for Businesses and Individuals Alike

This isn’t just a tool for lone wolf traders. The top-tier platforms are powering trading desks, asset managers, and crypto startups who need performance, accuracy, and uptime—always.

Their infrastructure is designed for high-frequency trading, institutional use cases, and big-time volume—without losing accessibility for everyday users.

So whether you’re a one-person operation or leading a team of analysts, this is the crypto trading partner that grows with you.

AI Meets Algo: Smarter Strategies, Better Outcomes

What happens when you bring artificial intelligence into the mix? Magic.

The best crypto algo trading platforms now offer AI-enhanced algorithms that can:

Detect trading patterns in real time

Adjust strategies dynamically based on live data

Optimize risk-reward ratios across multiple markets

This is next-level stuff. You’re no longer reacting to the market—you’re anticipating it.

Data-Driven Decisions at Your Fingertips

Great traders rely on one thing above all: data. And the world’s leading algo trading platform delivers a goldmine.

With built-in analytics, you can:

Track P&L in real time

Analyze trade history by asset, exchange, or strategy

Identify trends that give you a strategic edge

Even better, these platforms offer API access so you can plug in your own dashboards or analytics tools. It’s not just plug-and-play—it’s plug-and-dominate.

Global Reach, Localized Support

One of the reasons this platform stands out as the best in the world? It’s truly global—but never out of reach.

It supports multiple languages, local currencies, time zones, and exchanges—making it perfect for traders anywhere on the map. And when you need help, their support team actually talks to you like a human being. Fast responses, real solutions, and friendly advice? That’s rare in crypto. But not here.

Ready to Launch Your Smartest Trading Journey Yet?

In today’s market, speed and precision aren’t optional—they’re essential. And that’s exactly what the best crypto algo trading software platform in the world offers.

Whether you’re looking to automate your strategy, scale your operations, or simply free up your time, this platform delivers the ultimate edge.

Don’t just trade. Trade smarter. Trade confidently. Trade with a platform that puts you first.

#crypto algo trading platform#crypto algo trading software#algorithmic crypto trading software#algo crypto trading platform

0 notes

Text

Enroll in ICFM’s Algo Trading Course and Transform Your Financial Skills with Real-World Automated Trading Experience

Welcome to the Future of Trading: Why Algo Trading Matters Today

In today’s digital age, speed and accuracy define success in the stock market. Manual trading strategies, while still relevant, often fail to match the precision and efficiency of automated systems. That’s where algorithmic trading—commonly known as algo trading—takes center stage. For those looking to dive into this advanced method of trading, enrolling in a specialized algo trading course is essential. And when it comes to quality training in this domain, ICFM – Stock Market Institute offers one of the most comprehensive and practical programs in India.

ICFM’s Algo Trading Course – Learn to Trade with Logic, Speed, and Discipline

ICFM has developed a uniquely structured algo trading course that helps students, finance professionals, and traders understand the mechanics behind automated systems. This course is designed to provide a strong foundation in algorithmic logic, strategy creation, backtesting, and real-time execution. It goes beyond theory and dives deep into the actual workings of automation tools, trading APIs, and risk control mechanisms. The program is tailored to bridge the gap between traditional trading practices and the modern, data-driven approach that dominates today’s financial world.

How ICFM Makes Algo Trading Easy to Understand and Apply

One of the common misconceptions about algorithmic trading is that it’s only for coders or IT professionals. ICFM breaks this myth through its thoughtfully curated algo trading course, where even non-technical learners can understand complex concepts with ease. The course is taught using simple language, practical examples, and live demonstrations. Whether you're a trader aiming to automate your strategy or a student aspiring to enter the fintech world, this course equips you with actionable knowledge to start building and deploying trading algorithms efficiently.

Course Structure Designed for Real-World Market Application

The curriculum of ICFM’s algo trading course has been designed by industry experts with years of experience in algorithmic trading. The course begins with an introduction to the basics of financial markets and gradually moves into advanced topics like Python programming for trading, API integration, strategy development, and algo testing environments. Each module is aligned with real-world trading needs. By the end of the course, learners not only understand the concepts but also develop the skills to implement their own trading algorithms confidently.

Live Market Exposure and Hands-On Practice

Unlike many theory-heavy courses available online, ICFM’s algo trading course emphasizes practical learning. Students work on actual datasets, simulate trades, and test their strategies in real market conditions. This hands-on approach is what sets ICFM apart. It allows learners to troubleshoot in real-time, observe the behavior of different trading models, and fine-tune their strategies for better accuracy and profitability. The live trading lab provides the perfect environment to transition from a theoretical learner to a capable algo trader.

Ideal for Beginners, Professionals, and Financial Enthusiasts

ICFM’s algo trading course has been designed to cater to learners from all backgrounds. Whether you are a student of finance, an MBA graduate, a software developer, or even a self-taught trader, this course can help enhance your understanding of algorithmic trading. For working professionals already in the trading space, the course adds depth and automation to their existing skillset. For new entrants, it builds the entire framework needed to enter the domain with confidence and clarity.

Tools, Technologies, and Industry-Relevant Knowledge

In the rapidly evolving financial sector, keeping up with new tools and technologies is critical. ICFM’s algo trading course introduces learners to a variety of software and platforms commonly used in the industry. From Python and SQL to broker APIs and backtesting libraries, students become familiar with everything needed to execute an automated trading strategy. Additionally, the course keeps learners informed about current regulations, risk management practices, and the ethical use of algorithms in the financial markets.

Expert Faculty and Personalized Mentorship

The success of any educational program lies in its faculty, and ICFM doesn’t compromise here. Every instructor involved in the algo trading course is a seasoned market practitioner with a background in algo development, financial modeling, or quantitative research. Their real-world experience translates into practical teaching that goes far beyond textbook knowledge. ICFM also offers mentorship support throughout the course, where students can clarify doubts, receive career guidance, and get help in building customized trading bots.

Career Prospects After Completing the Algo Trading Course

Completing ICFM’s algo trading course opens the doors to several career opportunities. Graduates can work as algorithmic traders, quant analysts, strategy developers, or even independent automated traders. The fintech industry in India and abroad is witnessing exponential growth, and demand for skilled algo professionals is at an all-time high. ICFM’s certification and real-market training make students job-ready and highly competitive in the global job market.

Why Choose ICFM Over Other Institutes?

There are many online courses available on algorithmic trading, but few match the depth, support, and live exposure offered by ICFM. Their algo trading course is structured for serious learners who want more than just theoretical knowledge. With access to experienced mentors, real-time platforms, and industry-specific training, ICFM helps learners evolve into full-fledged algo traders.

Conclusion: Embrace the Future of Trading with ICFM’s Algo Trading Course

Technology is redefining financial markets, and those who adapt early will lead tomorrow’s trading landscape. By enrolling in the algo trading course offered exclusively by ICFM – Stock Market Institute, you gain the tools, techniques, and confidence to navigate and excel in automated trading. Whether you're planning to start your career or scale your existing skills, this course is your gateway to the future of finance. It’s not just about learning to trade—it’s about learning to trade smarter.

#algo trading course#online algo trading course#learn algorithmic trading#algo trading course with certification#algo trading classes#algo trading course near me#practical algo trading course

1 note

·

View note

Text

Q-Learning in Trading Utilize Q-learning algorithms for adaptive trading strategies. Q-learning helps in identifying optimal actions by learning from market interactions. Learn more: https://brokeragetoday.com/machine-learning-trading-strategies/ #QLearning #AdaptiveTrading #MarketInteractions

#forextrading#brokers#finance#financial#forex market#forex#algotrading#algo#algorithm#algo trading#machine learning

0 notes

Text

Algorithmic Trading Strategies - Types and Benefits

Key algorithmic trading strategies, including their types, advantages, and how they affect trade execution and decisions in dynamic stock markets.

0 notes

Text

0 notes

Text

2 notes

·

View notes

Text

Discover Success Enroll in Algo Trading Course at ICFM

If you’re wondering how to break into the world of algorithmic trading, ICFM (Institute of Career in Financial Market) offers the perfect Algo Trading Course to get you started. This course is designed for traders who want to automate their strategies and trade smarter using technology. With ICFM’s hands-on approach, the Algo Trading Course teaches you everything from market logic and strategy coding to real-time execution. Whether you're a beginner or want to upgrade your skills, ICFM’s Algo Trading Course is the best way to learn the future of trading with confidence and clarity.

#Algo trading course#Best Algo trading course in India#Algorithmic trading course#Algo Trading courses#Algo Trading course India#Algo trading course online#Algo trading course in Delhi

0 notes

Text

DeepSeek AI vs Algo Trading: Automate Your Stock Trading Strategies

DeepSeek AI is a low cost Artificial intelligence chatbot Integrating DeepSeek AI with Algo Trading can improve the decision making process in stock market.

Read more..

#deepseek ai#open ai#algo trading india#artificial intelligence#open AI#algo trading#algo trading app#algo trading platform#algo trading strategies#algorithm software for trading#bigul#bigul algo#finance#free algo trading software#ai#stock market#share market#share market news#DeepSeek LLM#DeepSeek Coder#Python#Algorithmic Trading#algorithm#algo trading software india#best algo trading app in india#Best share trading app in India#best algorithmic trading software

5 notes

·

View notes

Text

Explore IndiraTrade's cutting-edge algorithmic trading software designed to automate your trades, reduce emotional bias, and enhance market efficiency. Perfect for both beginners and seasoned traders seeking faster, smarter execution in stock markets.

#algorithmic trading#algorithmic trading software#algo trading software#algorithm software for trading#algorithmic trading program#algo trading program#algorithmic trading software india

0 notes

Text

Algorithmic strategies are one of the most trending topics in the stock world. Traders and individuals from different markets consider algorithmic trading their primary method of investment. To understand how to develop algorithmic trading software, you can go through the following article and determine strategies based on historical data, backtesting, and financial goals for the algorithmic trading strategies.

0 notes