#Budget 2022 Key Announcement

Explore tagged Tumblr posts

Text

Amy Maxmen at KFF Health News:

Keith Poulsen’s jaw dropped when farmers showed him images on their cellphones at the World Dairy Expo in Wisconsin in October. A livestock veterinarian at the University of Wisconsin, Poulsen had seen sick cows before, with their noses dripping and udders slack. But the scale of the farmers’ efforts to treat the sick cows stunned him. They showed videos of systems they built to hydrate hundreds of cattle at once. In 14-hour shifts, dairy workers pumped gallons of electrolyte-rich fluids into ailing cows through metal tubes inserted into the esophagus. “It was like watching a field hospital on an active battlefront treating hundreds of wounded soldiers,” he said. Nearly a year into the first outbreak of the bird flu among cattle, the virus shows no sign of slowing. The U.S. government failed to eliminate the virus on dairy farms when it was confined to a handful of states, by quickly identifying infected cows and taking measures to keep their infections from spreading. Now at least 875 herds across 16 states have tested positive.

Experts say they have lost faith in the government’s ability to contain the outbreak. “We are in a terrible situation and going into a worse situation,” said Angela Rasmussen, a virologist at the University of Saskatchewan in Canada. “I don’t know if the bird flu will become a pandemic, but if it does, we are screwed.” To understand how the bird flu got out of hand, KFF Health News interviewed nearly 70 government officials, farmers and farmworkers, and researchers with expertise in virology, pandemics, veterinary medicine, and more. Together with emails obtained from local health departments through public records requests, this investigation revealed key problems, including deference to the farm industry, eroded public health budgets, neglect for the safety of agriculture workers, and the sluggish pace of federal interventions. Case in point: The U.S. Department of Agriculture this month announced a federal order to test milk nationwide. Researchers welcomed the news but said it should have happened months ago — before the virus was so entrenched.

“It’s disheartening to see so many of the same failures that emerged during the covid-19 crisis reemerge,” said Tom Bollyky, director of the Global Health Program at the Council on Foreign Relations. Far more bird flu damage is inevitable, but the extent of it will be left to the Trump administration and Mother Nature. Already, the USDA has funneled more than $1.7 billion into tamping down the bird flu on poultry farms since 2022, which includes reimbursing farmers who’ve had to cull their flocks, and more than $430 million into combating the bird flu on dairy farms. In coming years, the bird flu may cost billions of dollars more in expenses and losses. Dairy industry experts say the virus kills roughly 2% to 5% of infected dairy cows and reduces a herd’s milk production by about 20%. Worse, the outbreak poses the threat of a pandemic. More than 60 people in the U.S. have been infected, mainly by cows or poultry, but cases could skyrocket if the virus evolves to spread efficiently from person to person. And the recent news of a person critically ill in Louisiana with the bird flu shows that the virus can be dangerous.

Just a few mutations could allow the bird flu to spread between people. Because viruses mutate within human and animal bodies, each infection is like a pull of a slot machine lever. “Even if there’s only a 5% chance of a bird flu pandemic happening, we’re talking about a pandemic that probably looks like 2020 or worse,” said Tom Peacock, a bird flu researcher at the Pirbright Institute in the United Kingdom, referring to covid. “The U.S. knows the risk but hasn’t done anything to slow this down,” he added. Beyond the bird flu, the federal government’s handling of the outbreak reveals cracks in the U.S. health security system that would allow other risky new pathogens to take root. “This virus may not be the one that takes off,” said Maria Van Kerkhove, director of the emerging diseases group at the World Health Organization. “But this is a real fire exercise right now, and it demonstrates what needs to be improved.”

[...] Curtailing the virus on farms is the best way to prevent human infections, said Jennifer Nuzzo, director of the Pandemic Center at Brown University, but human surveillance must be stepped up, too. Every clinic serving communities where farmworkers live should have easy access to bird flu tests — and be encouraged to use them. Funds for farmworker outreach must be boosted. And, she added, the CDC should change its position and offer farmworkers bird flu vaccines to protect them and ward off the chance of a hybrid bird flu that spreads quickly. The rising number of cases not linked to farms signals a need for more testing in general. When patients are positive on a general flu test — a common diagnostic that indicates human, swine, or bird flu — clinics should probe more deeply, Nuzzo said. The alternative is a wait-and-see approach in which the nation responds only after enormous damage to lives or businesses. This tack tends to rely on mass vaccination. But an effort analogous to Trump’s Operation Warp Speed is not assured, and neither is rollout like that for the first covid shots, given a rise in vaccine skepticism among Republican lawmakers.

KFF Health News reports on how America lost control on containing the bird flu that could set the stage for another pandemic. If we see another COVID-level or even Ebola-level pandemic, America will be in for a world of hurt, thanks to the rise of anti-public health sentiments.

See Also:

CNN: How America lost control of the bird flu, setting the stage for another pandemic

199 notes

·

View notes

Text

CNN 3/17/2025

As bird flu continues to spread, Trump administration sidelines key pandemic preparedness office

By Brenda Goodman, CNN

Updated: 9:50 AM EDT, Mon March 17, 2025

Source: CNN

The Trump administration has not staffed an office established by Congress to prepare the nation for future pandemics, according to three sources familiar with the situation.

The White House Office of Pandemic Preparedness and Response Policy was established by Congress in 2022 in response to mistakesthat led to a flat-footed response to the Covid-19 pandemic.

The office, called OPPR, once had a staff of about 20 people and was orchestrating the country’s response to bird flu and other threats until January 20, including hosting regular interagency meetings to share plans.

“We did it very much behind the scenes,” said Dr. Paul Friedrichs, a physician and retired Air Force major general who was director of OPPR during the Biden administration.

As of this this week, only one staffer will remain, and it’s unclear who that person reports to, according to a source who spoke on the condition of anonymity because they were not authorized to share the information. OPPR’s pages have also been removed from the White House website.

The new administration has not halted the country’s response to bird flu completely, but recent agency announcements and interviews with government sources show its focus has changed. For example, a leading goal of the response now is to bring down egg prices, rather than tackling the spread of the virus or preparing for a worst-case scenario in which the virus mutates and spreads easily from person to person.

OPPR exists “in name only,” said a source familiar with the status of the office who worked inside the White House during the last administration. “It has fallen into the abyss.”

Trump downsizes pandemic planning

President Donald Trump disbanded a similar White House pandemic unit in 2018 and was heavily criticized for the move when Covid-19 hit the US.

Despite this, in an interview with Time magazine when he was campaigning in April, Trump said he thought he would disband OPPR if elected because it was expensive and potentially wasteful when pandemics are difficult to predict.

In reality, Friedrichs said, OPPR operated on a shoestring. The office was established without a budget. “That was one of the real challenges,” said Friedrichs, who was the office’s inaugural director.

Eventually, Congress was able to add money to the budget of the Executive Office of the President, but it wasn’t specifically designated for OPPR. Friedrichs said they estimated that if the office performed all the functions it had been assigned, it would cost about $6.8 million. That money was never appropriated by Congress, however, because the government has been functioning under a series of temporary stopgap measures called continuing resolutions since the office was created in 2022.

OPPR was staffed by people who were detailed, or assigned, to the office from other organizations, which agreed to continue paying their salary while they worked for OPPR. Nearly all have gone on to other opportunities, Friedrichs said.

On January 20, the first day of his second term, Trump issued an executive order that laid out the structure of his National Security Council, naming the director of the Office of Pandemic Preparedness and Response Policy as having a seat on the council.

During the first few weeks of the administration, the White House quietly hired Dr. Gerald Parker, a veterinarian with a long history of government service and expertise in zoonotic diseases, or infections that can be transmitted from animals to people. His appointment was never formally announced but was reported in the media. Infectious disease experts praised the move to bring him into the administration.

Parker’s title is senior director for biosecurity and pandemic response. He sits on the National Security Council and has been attending meetings on bird flu, a source said.

The White House press office did not respond to a request to interview Parker and did not answer questions about Parker’s role or title, or whether his office has a budget or staff.

Friedrichs said he has not been able to meet with Parker since he was appointment and never had an opportunity to hand off OPPR’s work to him.

Over the year OPPR worked intensely on bird flu and other threats, Friedrichssaid they created the infrastructure for the office and made detailed plans for how the US could work across agencies to respond quickly to an outbreak, called the Playbook for Biological Incident Response.

Friedrichs said they worked across many government agencies to gather best practices and lessons learned from past incident responses.

“Hopefully, that will allow future administrations to have all that in place for the first time,” he said.

OPPR’s H5N1 bird flu plans had been focused on infection surveillance and on safeguarding human and animal health, but the Trump administration seems ready to take a different approach.

“Now, there are economic policy considerations in the mix that wasn’t there before,” one source said.

In late February, US Department of Agriculture Secretary Brooke Rollins announced that the agency would spend $1 billion on a new strategy to combat avian flu and “deliver affordable eggs.”

Independent office vs. a seat on the council

Because OPPR was created by statute, Trump cannot wipe it out of existence completely.

“That’s been one of the big issues with so many of his executive orders, that he’s trying to undo what Congress has done,” said Lawrence Gostin, a distinguished professor of global health law at Georgetown University. “If Congress has set up an agency, he can’t dismantle it or transform it into another.”

But by not staffing or funding the office, Trump can greatly diminish its function and its influence, experts said.

The National Security Council has long had a position dedicated to pandemic preparedness and biological threats.

Dr. Raj Panjabi was senior director for global health security and biodefense on the NSC before OPPR was created. After OPPR began taking shape, he was tasked with global biosecurity at the NSC,while OPPR focused on domestic threats. He said the two offices worked closely together during the Biden administration.

Panjabi said there are some advantages to having pandemic preparedness within the NSC. One is that the NSC has a strong policy-making process, which makes it easier to get things done. Another is that members of NSC have access to a different computer system, which is sometimes necessary for navigating the complexities of the government.

“Now that it’s one person, in one office, I think that’s good,” said Panjabi, an associate physician in the division of global health equity at Brigham and Woman’s Hospital and Harvard Medical School.

Sen. Patty Murray, a Democrat from Washington, co-wrote the bill that created OPPR with former Sen. Richard Burr, a Republican from North Carolina. She said the office was intended to be reportable to Congress.

“Under the last administration, OPPR served, as intended, as the central hub coordinating a whole-of-government response to pandemic threats,” she said in a written statement to CNN.She met regularly with OPPR’s director, Friedrichs, to discuss the administration’s response to bird flu and other outbreaks.

“While President Trump cannot legally disband OPPR, as he has threatened to do, it is deeply concerning that he has moved the statutorily created OPPR into the NSC.

“As intended by law, OPPR is a separate, distinct office for a reason, which is especially relevant now as we are seeing outbreaks of measles, bird flu, and other serious and growing threats to public health,” Murray said. “This should be alarming to everyone.”

Pandemic planning with less transparency

When it was a standalone office in the White House, OPPR’s activities were more transparent. The office was subject to open records requests under the Federal Records Act, but records of the National Security Council are covered by the Presidential Records Act, which protects them from disclosure.

Friedrichs hosted regular interagency calls between the US Centers for Disease Control and Prevention, the USDA, the Administration for Strategic Preparedness and Response, the US Food and Drug Administration and the National Institutes of Health. Someone from the office of the secretary of the US Department of Health and Human Services would also attend.

Those meetings were held daily right after bird flu was first detected in dairy cattle in March 2024. They moved to three times a week and finally weekly by the end of the Biden administration.

“At the end of the day, bringing everybody together and having those meetings was incredibly important, so that we had a shared set of facts,” Friedrichs said. “When decisions were made, everyone understood why the decision was made, what facts were used to inform the decision.”

Some interagency meetings continue to be held about twice a month, one source said. It’s not clear who’s attending and which agencies are joining the calls.

HHS was also hosting regular news briefings on developments related to the outbreak, but there hasn’t been a briefing on bird flu since Trump took office.

Friedrichs said that in addition to standing up the office and developing a playbook for managing biological threats, the office spent $2.8 billion to fund a compensation program for dairy farmers anddevelop a milk testing program to spot new outbreaks, among other efforts.

The risk that bird flu poses to the general public is low, according to the CDC, but a major focus of OPPR’s efforts had been to ready the nation to respond in the event the virus changed or mutated enough to spread efficiently between people.

They had assembled subject-matter experts with the expertise needed to quickly spin up a response if the virus gained new abilities, including people with knowledge of supply chains, public health messaging, vaccine development and distribution. That’s all gone now, one expert said.

OPPR also coordinated with the US Department of Veterans Affairs, the Federal Emergency Management Agency and partners from industry to maintain therapeutics in the Strategic National Stockpile.

One of those efforts was to contract with Moderna to make a vaccine against H5N1, should it be needed. Moderna has completed early-stage studies of its vaccine, called mRNA-1018, and said it planned to present its finding at upcoming medical meeting.

In February, Bloomberg News reported that US health officials are reevaluating that $590 million contract.

“I’m very disappointed, candidly,” Friedrichs said. “One of the real challenges when a new pathogen emerges is that it takes time to produce therapeutics, and it takes time to produce vaccines.

“So we worked very closely with industry to try and find ways to fund research and clinical trials and make sure that we had a variety of options available if this virus became more dangerous,” he said. “Because we just don’t know what’s going to happen next with this virus.”

See Full Web Article

THEY WANT AS MANY OF US DEAD AS POSSIBLE!

THE MORE OF US WHO DIE, THE BETTER!

THEY ARE A FUCKING DEATH CULT!

8 notes

·

View notes

Text

After record loss, Brazil's Correios announces restructuring plan

Cost-cutting measures include shorter workweeks and lower pay; equity turns negative at R$4.36bn

Brazil’s national postal service, known as Correios, unveiled a broad cost-cutting plan in response to a record R$2.6 billion loss in 2024, its worst result on record and more than four times the deficit posted in 2023.

After posting a R$1.5 billion loss in 2016, the state-run company had several years of positive results, only returning to the red in 2022 with a R$767.6 million loss.

In a statement to Valor, Correios said it is implementing a cost-reduction strategy “aimed at strengthening financial sustainability and ensuring continued service delivery.” The company expects to save up to R$1.5 billion as early as 2025.

Key initiatives already underway include encouraging employees to reduce their work hours—along with proportional pay cuts—slashing at least 20% of management budgets, temporarily suspending vacation time (with leave to resume in January 2026), and extending the deadline for accepting a buyout plan to May 18, 2025.

Continue reading.

3 notes

·

View notes

Text

Detroit Mayor Mike Duggan expected to announce political future next week

Detroit, Michigan - Mayor Mike Duggan is expected to make an announcement next week about his political plans.

The third-term mayor told the Free Press Tuesday night at the Michigan Democratic Party election watch event that he will soon have more information to share. Duggan has been long-rumored to be eying a run for governor in the 2026 election. Democratic Gov. Gretchen Whitmer is barred from running again after finishing her current, second term.

"Next week, I'll have an announcement about the mayor's race, and we'll go from there," Duggan told news agencies.

Wayne County campaign records show that Duggan has not been actively fundraising for the 2025 election. His latest campaign statement from July through October shows an ending balance of more than $25,000, while others with candidate committees for mayor show having more than $100,000. Duggan raised more than $1 million for his 2021 reelection campaign.

Duggan has run Detroit for 10 years, immediately following the city’s municipal bankruptcy filing. He was confronted with restoring Detroit’s losses, driving revenue and businesses to invest in the city, and balancing the budget. The city’s budget fluctuated over the years during his tenure and dipped during the pandemic. However, he cited online gaming taxes and growing income taxes as revenue streams that helped offset losses.

One of his key indicators of success as a big city mayor is the ability to grow population. Detroit has significantly lost population since the 1960s. The latest decennial census results reported a 10.5% decline but Duggan legally fought to restore uncounted residents.

According to annual population estimates, which the bureau released in May, Detroit's population grew from 631,366 in 2022 to 633,218 residents in 2023. “This is the news we’ve been waiting for for 10 years,” Duggan said at the time.

Others who filed candidate committees for mayor include City Council President Mary Sheffield, former Councilwoman Saunteel Jenkins, Councilman Fred Durhal III and businessman Joel Haashiim.

#detroit michigan#ddot#detroit#downtowndetroit#detroit evolution#detroitparks#detroit history#detroit politics#politics#us politics#michigan#mayor#detroit river#detroit news#us news#world news#public news#news#news media#news usa#government#governance#governor#election news#election day#us elections#american elections#mike dugan#economy#vote democrat

5 notes

·

View notes

Text

“After years of accusations of financial mismanagement, the Republican National Committee is overhauling its 2024 election operations—a full-on MAGA makeover that the RNC claims will curb excessive spending and steer as much money as possible to supporting Donald Trump’s campaign,” the Daily Beast reports.

“But it appears that one of those strategic spending moves may have a profound effect on a successful minority outreach program, potentially erasing gains with groups of gettable new voters who have cooled on the Democratic Party.”

After years of accusations of financial mismanagement, the Republican National Committee is overhauling its 2024 election operations—a full-on MAGA makeover that the RNC claims will curb excessive spending and steer as much money as possible to supporting Donald Trump’s campaign.

But it appears that one of those strategic spending moves may have a profound effect on a successful minority outreach program, which two people with knowledge of the plans characterized as self-defeating, potentially erasing gains with groups of gettable new voters who have cooled on the Democratic Party.

As one of the sources put it to The Daily Beast, the tagline might as well be “Make the RNC White Again.”

The program at issue is an initiative from the 2022 midterms where RNC field staff engaged voters through gatherings and events held at community centers in areas with heavy minority populations, most specifically Latino communities.

In January, The Messenger reported that the RNC had already shuttered most of the nearly two dozen Hispanic Community Centers that served as the base for the program, leaving just five open. (The Messenger’s content vanished when it went out of business shortly thereafter, but the article was captured by the nonprofit Internet Archive.)

At the time, however, the RNC chalked the closures up as a temporary byproduct of its budget cycle. However, the organization also announced that it was preparing to double down on these efforts for 2024, opening 40 new centers in Latino, Black, Asian American, Native American, Jewish, and veteran communities across the country. That would include establishing outposts in key battlegrounds like Las Vegas, Nevada, Tuscon, Arizona, Milwaukee, Wisconsin, and Allentown, Pennsylvania, The Messenger reported.

Jaime Florez, the RNC’s Hispanic communications director, told The Messenger that “Democrats have taken the Hispanic community for granted for far too long” and vowed that the RNC planned to capitalize on those opportunities.

“Republicans will continue to make historic investments in Hispanic voter outreach, from opening more community centers to launching ‘Deposita Tu Voto’, that will further our gains with Hispanic voters and deliver Republican victories in 2024,” Florez said at the time.

But two people with knowledge of the plans told The Daily Beast that the RNC has decided to scrap that effort. Instead, the people said, the community center program now appears to be another casualty of the RNC’s recent restructuring—a bloodbath that has already claimed several dozen jobs, including senior leadership posts, along with the apparent decimation of field operations and other strategic realignments that could come at the cost of Republican candidates across the country not fortunate enough to be named Trump.

Instead of going after minority voters, the RNC apparently plans to remake itself even more in Trump’s image.

While the size and complexity of modern presidential races demands close coordination between the candidate’s campaign and the national party, the unique pressures on Trump and the RNC—external and internal—forced a reckoning that has taken that standard teambuilding exercise to a new realm.

The catalyst for those events is the very real prospect of financial crisis now facing the two groups, thanks to stratospheric personal legal costs on Trump’s part and unsustainable fundraising and spending for both organizations. Coupled with demands for unconditional fealty to the MAGA brand—which have exacerbated fault lines within the party—the RNC found itself at an inflection point coming into 2024.

To resolve the tension, Trump essentially took control of the RNC. He forced out longtime chair Ronna McDaniel, replacing her with a trio of MAGA loyalists—including his own daughter-in-law, Lara Trump—who uprooted some of the RNC’s most experienced staff and welded the two organizations into what amounts to a single-purpose machine designed to fuel Trump’s attempt to reclaim the White House.

While one short-term goal is to minimize costs, the moves could come at great political expense in the long term, especially for down-ballot candidates who depend on the RNC for critical funding and other resources. But there are other intangible losses, like the exodus of talent, a blooming vacuum of institutional knowledge, and sapping momentum from field projects like the community center program.

That project not only had promise, it came at the right time. After ignoring their own “autopsy” of the GOP’s 2012 presidential loss, many Republicans began to court minority voters in the wake of Trump’s 2016 win. As paradoxical as that may seem, given Trump’s rhetoric and policies, those efforts appear to be bearing some fruit.

Today, a sizable portion of minority voters—historically a reliable well of Democratic support—have exhibited a disaffection with the party, particularly in younger demographics, drifting towards Republicans who champion conservative ideologies that have long been culturally ingrained in those communities but had not in themselves inspired voters to change parties.

There are competing explanations for this shift. For instance, some analysts argue it’s more an expression of educational shifts than of racial realignment. But no matter the underlying cause, after Trump’s decisive 2020 defeat in the popular vote, the RNC set about trying to connect with Hispanic groups on the grassroots level.

The community centers were key to that effort. They were viewed as a success and point of pride, sources with knowledge of the project told The Daily Beast. The Messenger described the project’s pitch as “a dream intersection of fun, civic life, candidate recruitment, and GOTV muscle,” reporting that in the midterms the centers hosted events like toy drives, religious services, holiday meals, cultural celebrations—and, for some reason, cryptocurrency workshops.

“Community centers continued to pop up in Hispanic communities and positive headlines continued to flow,” The Messenger reported.

While it’s difficult to measure the cost of these programs, people familiar with the effort shrugged off the expenses as comparatively minimal, especially given the positive preliminary returns. Most of the overhead, they said, would be related to renting space for the centers, along with staffing expenses and incidentals for events.

The RNC previously indicated that the rationalization for temporarily closing the centers was financial, considering the party’s cash woes. But if that’s also the explanation for a permanent shutdown, the savings would be thin.

Federal Election Commission filings show that in 2022, the RNC spent a grand total of just over $2 million on rent, with much of it going to campaigns and state and local parties for joint field work in the midterms. But some outlays give an idea of the cost—such as the $3,500 per month that the RNC paid to “No Limits Community Development” in Georgia. By comparison, around the same time, the RNC agreed to pay $1.6 million to cover Trump’s personal legal costs.

These rent payments also wouldn’t divert a penny of the RNC’s political money. Instead, the rent expenses came out of the party’s “building” account, a specially segregated bank account that can only be tapped for expenses related to buildings and maintenance.

The Daily Beast reached out to an RNC spokesperson for comment, who provided a statement from Trump campaign communications director Steven Cheung. The statement called the criticism of the community center closures “racist” and “complete bullshit,” but did not deny that the program had shut down.

“The racist accusations about the RNC and Trump campaign are complete bullshit, President Trump did more to benefit minority communities during his first term than any other President, especially Crooked Joe Biden, and that’s why he’s polling better with Black and Hispanic Americans,” Cheung said in the statement. (The metric Trump most favors to measure his efficacy as an advocate for the Black community—Black unemployment—reached new record lows under Biden.)

Cheung was apparently referencing a recent New York Times/Siena poll that put Trump 6 points ahead of President Joe Biden in Hispanic voters—a major shift, but in line with the recent inroads that Trump and the GOP have made in certain Latino communities, like southern Florida.

However, the same poll showed that, while Biden’s support among Black voters has appeared to weaken, he still holds a 66-23 lead in that demographic over Trump, who has repeatedly expressed that his multiple criminal indictments are something he has in common with the Black community.

“I think that’s why the Black people are so much on my side now," Trump told attendees at an event for Black conservatives in South Carolina last month. "Because they see what’s happening to me happens to them.”

“President Trump will only continue to make gains with minority communities, just as he did from 2016 to 2020, no matter what the lowlifes at the Daily Beast report,” Cheung added.

The shuttered community outreach program would certainly be one way to do so. But that program was not an entirely smooth ride. It had its critics even within the GOP, who argued that while the initial effort was commendable, minority outreach works best as a long-term, continual investment, not an election-year burst of interest.

“They tried; we appreciate that,” Daniel Garza, executive director of grassroots Latino outreach group the LIBRE Initiative, told The Messenger in January. “But you have to have people on the inside who can advise you—these are long-term things that need to be backed by resources.”

In fairness, some projects themselves had setbacks. In Oklahoma City, the RNC Hispanic Community Center—which has since shuttered—got off to a rocky start.

At the opening of the site in July of 2022, the RNC honored Jonathan Hernandez, president of the Oklahoma College Republicans and a political operative in the state. But Hernandez was arrested less than a week later on charges of indecent or lewd acts with a minor and forcible oral sodomy. He pleaded guilty, got a five-year suspended sentence, and was ordered to register as a sex offender.

After the charges, he had no further involvement with the community center. Now, no one else will either.

6 notes

·

View notes

Text

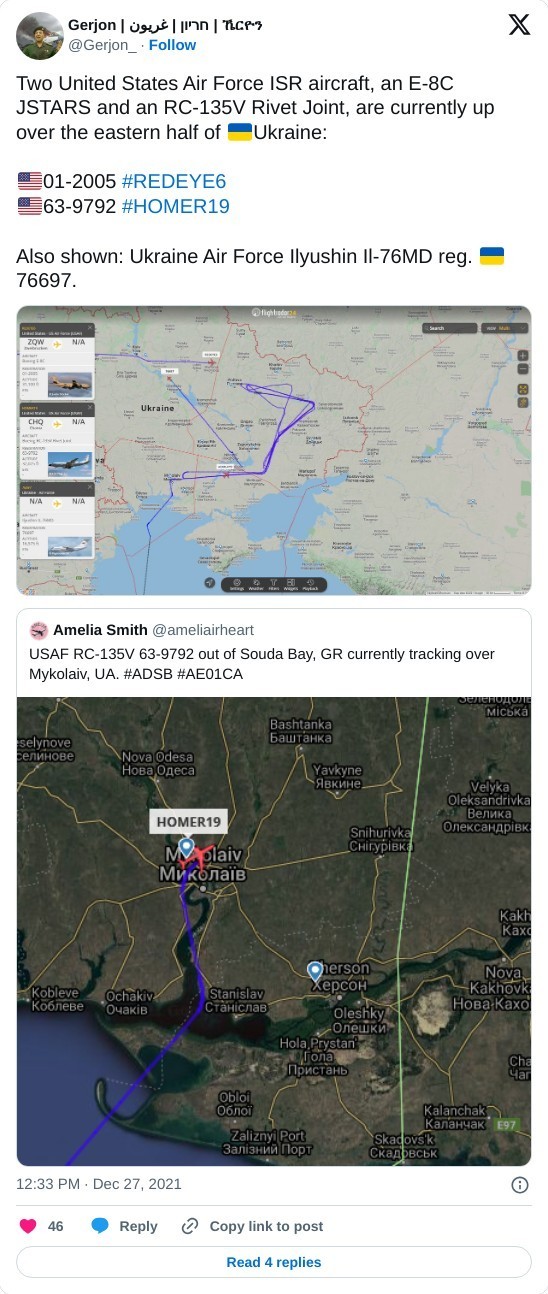

IMAGES: E-8 JSTARS flies on its last operational mission before retirement in November

Fernando Valduga By Fernando Valduga 10/05/2023 - 10:00am Military

A crew of aviators at Ramstein Air Base, Germany, carried out the last operational operation of the E-8C JSTARS aircraft on September 21, paving the way for the last plane in the fleet to be retired early next month.

Members of the 116ª Air Control Wing of the Georgia National Air Guard carried out the last of more than 14,000 JSTARS missions, which is used for direction, battle management and command and control.

U.S. Airmen with the 116th Air Control Wing, Georgia Air National Guard, sign an engine of an E-8C Joint STARS for its last mission at Ramstein Air Force Base, Germany, Sept. 21, 2023. The JSTARS have been in service since 2002. (U.S. Air National Guard photo by Master Sgt. Jeff Rice)

"It's bittersweet," said Colonel Christopher Dunlap, commander of the 116ª Air Control Wing, in a statement. "I have been flying on this mission on this aircraft since the spring of 2003. There have been many changes over the years."

A 116º ACW spokesman said that two JSTARS aircraft now remain at Robins Air Base, Georgia. The provisional plan is to send the last one to the "Boneyard" (aircraft cemetery) at Davis-Monthan Air Base, Arizona, in the first week of November.

Until then, “the aircraft can be used locally for crew proficiency training, as needed,” the spokesman added.

Still, the final operational missions mark one of the last phases of life for the E-8. Mainly used for the indication of moving targets on the ground, JSTARS also served as a battle management platform. Its most distinctive feature is the canoe-shaped radome of about 9 meters in length under the front fuselage that houses a phased antenna of 8 meters in length and lateral appearance.

The aircraft first supported combat operations during the Desert Storm and played a key role in the contributions of the U.S. Air Force during the Global War on Terror. More recently, the E-8 carried out missions over Eastern Europe in preparation and immediately after the invasion of Ukraine by Russia in 2022.

USAF has been planning to retire JSTARS for some time. In June 2021, service leaders announced their intention to cut Robins' aircraft, which has hosted them since 1996.

In its place, Robins is receiving a battle management control squad, an E-11A Battlefield Airborne Communication Node (BACN) squad, a Spectrum Warfare group and support units focused on the service's Advanced Battle Management System (ABMS).

The first E-8 left Robins in February 2022. A month later, the USAF announced its intention to divest 12 of the 16 aircraft in fiscal years 2023 and 2024, and Congress accelerated the change by repealing a previous law that required the U.S. Air Force to maintain at least six E-8s.

Last March, the USAF budget request revealed a plan to accelerate the divestment plan, with the entire fleet retiring by the end of the fiscal year 2024, which began on October 1º.

The leaders of the Armed Forces said that the U.S. Air Force needs to retire JSTARS because it would not survive in future combat with an advanced opponent like China. Instead, they want to invest in various information and guidance technologies, including space-based platforms.

In recent months, Robins has ended JSTARS operations, deactivating squads and conducting final flights. In June, the 461ª Air Control Wing in Active Service completed its last operational mission in Ramstein.

The 116º ACW spokesman said that before the final aircraft is officially retired, there will be “a private farewell celebration for the former students of the JSTARS program”.

Tags: Military AviationE-8C JSTARSUSAF - United States Air Force / U.S. Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

MILITARY

U.S. Marine Corps F-18 Hornet fighter pilots help locate crashed civilian aircraft

05/10/2023 - 08:20

MILITARY

HAL delivers the first LCA Tejas biplace to the Indian Air Force

04/10/2023 - 18:25

MILITARY

The F-35 fighter, the most expensive weapons program in the world, has just become more expensive

04/10/2023 - 08:11

MILITARY

Russia reactivates Beriev Be-12 seaplanes from the Cold War era to detect Ukrainian naval drones

03/10/2023 - 23:10

MILITARY

Meet the cockpit of the Saab F-39 Gripen, the most advanced fighter in Brazil

03/10/2023 - 19:14

MILITARY

RAF typhoons are sent to Poland for joint exercises before the Warsaw Security Forum

03/10/2023 - 16:00

I

11 notes

·

View notes

Text

Mining Company Accelerates Development of High-Grade Gold in Chile

Source: Streetwise Reports 08/01/2025 Rio2 Ltd. (RIO:TSX.V; RIOFF:OTCQX; RIO:BVL) updates the ongoing development of its wholly owned Fenix gold project, which is under construction in the Atacama region of Chile. Read why analysts think the company is at a great point to buy.Rio2 Ltd. (RIO:TSX.V; RIOFF:OTCQX; RIO:BVL) announced an update on the ongoing development of its wholly owned Fenix gold project, which is under construction in the Atacama region of Chile. As of the close of the second quarter in 2025, the project is 41% complete, staying on course and within the budget set for the commencement of gold production in January 2026, the company said in a release. The company recently secured a significant boost for Fenix, receiving a third installment of CA$50 million from Wheaton Precious Metals. This funding is part of a comprehensive construction finance package that includes a flexible prepayment option and a gold stream agreement, ensuring the full financing of the Fenix project's construction phase, reported Jeff Clark for The Gold Advisor. "It’s always great for us investors when a company has access to a non-dilutive form of financing," noted Clark. Despite Friday's positive movement in the stock, it remained 7% below last week’s high, Clark said, which could present a buying opportunity for those not yet invested in this promising pre-production gold venture. For those holding positions that have doubled, it might be time to consider realizing some profits. Here are some key construction milestones the company said were achieved between October 1, 2024, and June 30, 2025: Health and Safety: The project has accumulated 1,270,141 person-hours of labor so far, with one lost-time incident involving a finger injury, leading to a lost-time incident frequency rate (LTIFR) of 0.79. As of June 30, 2025, the total incident frequency rate (TIFR) stood at 6.30. Budget: The total expenditure since October 2024 has reached US$56.4 million against a budget of US$57.8 million. These figures exclude corporate overheads and do not account for preconstruction costs incurred in 2022. Schedule: The project is currently 41 percent complete, with the company on track to start gold production in January 2026. All critical long lead time procurement items have been secured. Construction Progress: As of the end of June 2025, construction teams have installed 12.7 hectares (ha) of geosynthetics on the leach pad, ensuring sufficient capacity for the first six months of production. Additionally, 4 ha of overliner material have been placed on the leach pad, which will be ready to receive mineral by August 2025. First Gold Pour Coming Next Year? Regarding infrastructure, Haul Road 1 is 90% complete, and Haul Road 4 is 40% complete, Rio2 said. These roads are crucial as they link the Fenix South pit to the leach pad, facilitating the start of operations. At the ADR plant, efforts are ongoing in the adsorption area, reagent handling facilities, and chemical reagent storage. The structural assembly of the plant building has been finished, with the cladding now 90% complete, according to the release. The first of three electrical switch rooms is currently en route from Santiago to the project site, marking another step forward in the project's progression. Atrium Research Analyst Ben Pirie rated the stock a Buy with a CA$2.40 per share price target. The project currently employs a total of 1,514 personnel, including contractors, the company said. The workforce is predominantly Chilean, with 94% being nationals and 41% hailing from the Atacama region. Additionally, women make up 10% of the workforce. According to the company, key upcoming milestones for the Fenix gold mine include: commencement of mining and ore stacking on the leach pad in August; completion of the PLS pond in August; installation of all three electrical switch rooms in August; commissioning of the ADR plant in November; and finalization of the mine expansion study in December, with the first gold pour in January 2026.

Analysts Note Positive Developments Analyst Matthew O'Keefe of Cantor Fitzgerald wrote in an updated research note on July 31 that the developments were positive. "Rio2 Ltd. remains well-funded for the CA$122 MM construction CAPEX," wrote O'Keefe. "The stock continues to offer good value as a near-term low-cost gold producer trading at 0.5x NAV vs producing peers at 0.6 – 0.8x. Our Buy rating and CA$2.50/share price target are unchanged." He continued, "A mine expansion study that looks to increase capacity to 80,000 tpd and raise gold production from 100 Koz to 250-300 Koz annually is targeted for late 2025 should also be a positive catalyst" for the stock." Similarly, Atrium Research Analyst Ben Pirie noted in a new note on July 31 that the update was "encouraging." He rated the stock a Buy with a CA$2.40 per share price target. "We are impressed by the Company’s ability to hit its timelines and work beneath its budget, as almost all construction projects we have seen across the globe have been far over budget and time (especially considering the elevated inflation)," Pirie wrote. "This speaks to the team’s experience, operational skillset, and excites us as the company moves towards first gold." Conditional Approval for New Listing Rio2 also announced that it has received conditional approval from the Toronto Stock Exchange to transition from the TSX Venture Exchange and list its common shares on the TSX. The final approval of this listing is contingent upon the company fulfilling certain standard conditions set by the TSX. Rio2 is actively working to meet these conditions, and further details along with a timeline for the graduation will be shared in due course, the company said. Once the final approval is granted by the TSX, Rio2's common shares will begin trading on the TSX and will be delisted from the TSX-V. Shareholders will not need to exchange their share certificates or take any other action regarding the TSX listing, as there will be no change to the trading symbol or Cusip of the common shares. The Catalyst: Gold Set to Boom Even More? Gold futures opened at US$3,342.70 per ounce on Friday, reflecting a 1.5% rise from Thursday's close of US$3,293.20, as reported by Catherine Brock for Yahoo! Finance on August 1. Throughout the week, gold prices saw a range from a low of US$3,263.90 on Wednesday to a high of US$3,352 on Friday morning. This increase in gold prices follows Trump's announcement of new tariffs ranging from 10% to 41% on international imports, according to Brock. These tariffs are scheduled to take effect on either August 7 or October 5, depending on when the goods were shipped, with Mexico being the only exception. Trump announced on social media on Thursday that he has extended Mexico's trade negotiation period by 90 days. Meanwhile, the S&P 500 experienced a modest drop of 0.37% in Thursday's trading, setting the stage for a strong start for gold on Friday, Brock noted. Gold and silver prices have been relatively stable this summer, but according to Florian Grummes in a July 29 interview with Jeremy Szafron of Kitco News, a major breakout is expected. Patient investors are likely to see significant rewards. "We're in a crack-up boom overall," Grummes, managing director of Midas Touch Consulting, told Kitco News. "That means everything will move higher because they destroy the purchasing power of your fiat money — whether it's the euro, the dollar, or the Canadian dollar." Ownership and Share Structure According to Refinitiv, about 8% of the company is owned by insiders and management, about 7% by holding companies, and about 23% by institutions. The rest is retail. Top shareholders include Mackenzie Investments with 8.74%, 2176423 Ontario Ltd. with 7.3%, Knowave AG with 4.62%, Alexander Black with 4.27%, and SSI Wealth Management AG with 3.29%. Its market cap is CA$639.44 million with 425.55 million shares outstanding. It trades in a 52-week range of CA$0.50 and CA$1.64. Sign up for our FREE newsletter at: www.streetwisereports.com/get-newsImportant Disclosures:

Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company. For additional disclosures, please click here. ( Companies Mentioned: RIO:TSX.V;RIOFF:OTCQX;RIO:BVL, ) 📊 Market Context & Insight The current gold trends are being shaped by factors such as inflation, central bank moves, USD strength, and geopolitical tensions. Understanding how these forces interact can help investors make informed decisions. 💡 What This Means for Malaysian Investors As a Malaysian investor, gold remains a strategic hedge against currency depreciation and economic uncertainty. Consider platforms like Public Gold or Maybank GSA to start building your gold portfolio. 🔗 Useful Resources Live Gold Price in Malaysia Live Silver Price in Malaysia Harga Emas Hari Ini Original Article: Mining Company Accelerates Development of High-Grade Gold in Chile from The Gold Report - Streetwise Exclusive Articles Full Text Note: This article was auto-fetched from trusted news sources. For educational purposes only. Please verify with official sources before making financial decisions. #EmasMalaysia #HargaEmas #Emas24K #PelaburanEmas #EmasPelaburan #EmasOnline #BeliEmasOnline #PromosiMalaysia #PureGoldMalaysia #GoldInvestmentMY #GoldCollector #LuxuryGiftsMY #MalaysianJewellery #纯金 #9999黄金 #黄金投资 #黄金收藏 #黄金价格

0 notes

Text

The Role of Manga Readership in Anime Adaptation Decisions: A Data-Driven Perspective

Abstract

This study investigates the influence of manga readership behavior on anime adaptation decisions within the Japanese entertainment industry. While numerous factors—such as production budget, scheduling, and genre trends—contribute to anime production, the preferences and actions of manga readers serve as a key predictive metric. Through analysis of sales data, digital engagement, and consumer behavior, this paper argues that manga readers act as market indicators, helping studios evaluate a manga’s potential success as an animated property.

---

1. Introduction

The anime industry is a multi-billion-dollar global enterprise, with many of its properties originating from manga, Japan’s long-standing comic book format (Statista, 2023). While production companies and publishers hold the final authority in greenlighting anime projects, early consumer behavior—specifically that of manga readers—has become a crucial factor in identifying which titles are worthy of adaptation. This paper examines the mechanisms by which manga readers influence these decisions.

---

2. Manga Sales as a Quantitative Metric

Manga volume sales provide one of the most direct and quantifiable forms of reader influence. Titles that exceed 1 million copies in print, such as Jujutsu Kaisen, Spy x Family, and Tokyo Revengers, have frequently transitioned to anime within 12–24 months of hitting major sales milestones (Oricon Sales Reports, 2020–2023). According to a report by the Association of Japanese Animations (AJA, 2022), 78% of anime released between 2015 and 2021 were adaptations of manga that had exceeded 500,000 copies sold prior to announcement.

---

3. Online Engagement and Trend Monitoring

In the digital era, manga fandoms frequently express enthusiasm through platforms such as Twitter (X), Reddit, MyAnimeList, and Pixiv. This engagement creates visible indicators—hashtags, meme trends, fan art volume—which publishers and studios monitor through social media analytics (Nakamura & Ito, 2021). A case study of Chainsaw Man revealed that the title trended globally on Twitter during key manga chapter releases well before its anime adaptation was announced, indicating that studios often interpret digital buzz as evidence of adaptation potential.

---

4. Reader Polling and Serialized Popularity

Manga serialized in weekly or monthly magazines such as Weekly Shōnen Jump rely heavily on reader feedback through rankings and surveys. Titles that consistently place in the top three of internal readership polls are often earmarked for anime development (Shueisha Editorial Notes, 2019). This direct feedback loop acts as a real-time test of narrative engagement and character popularity—two essential components of anime viability.

---

5. Reprints and Market Demand

Rapid depletion of print volumes and subsequent reorders act as signals of market viability. For example, Demon Slayer: Kimetsu no Yaiba experienced a 500% increase in circulation within months after its anime aired, but publishers had already reprinted its earlier volumes three times before the anime was announced (Kondasha Publishing Data, 2019). Manga readers create the early sales trends that predict post-anime boom potential.

---

6. Reader-Led Merchandising Indicators

Consumer activity, including unofficial merchandise creation and cosplay, acts as an informal market test. Titles with strong reader-driven fan economies—such as My Hero Academia and Attack on Titan—demonstrated high levels of fan engagement before receiving any anime adaptation. This suggests that anime studios evaluate not only narrative strength but also a title’s “merchandising elasticity” based on early reader behavior (Yamamoto, 2020).

---

7. Discussion: Readers as Gatekeepers

This data supports the hypothesis that manga readers serve as early validators of story viability. Their purchasing power, digital advocacy, and community-building efforts allow studios to minimize risk in selecting titles to adapt. Though studio decisions are also influenced by internal business strategy and cross-media opportunities, readers form the foundation of market research.

---

8. Conclusion

Manga readers are not passive consumers; they are dynamic participants in the content pipeline that leads to anime adaptation. By driving sales, creating social media momentum, and building informal fandom economies, they help determine which titles are seen as financially and culturally viable. Understanding this relationship is essential for anyone analyzing the content selection process within the anime industry.

---

References

Association of Japanese Animations (AJA). (2022). Anime Industry Report 2022.

Kondasha Publishing Data. (2019). Quarterly Manga Circulation Analysis.

Nakamura, H., & Ito, K. (2021). Digital Fan Engagement and Anime Adaptation Trends. Tokyo Media Review, 15(2), 33–47.

Oricon Inc. (2020–2023). Weekly Manga Sales Rankings.

Shueisha Editorial Department. (2019). Internal Reader Survey and Title Performance Reports.

Statista. (2023). Manga market size in Japan from 2012 to 2023 [Data set].

Yamamoto, A. (2020). Consumer Merchandising Trends in Manga-based Franchises. Kyoto Cultural Journal, 9(1), 12–26.

0 notes

Text

USB Type-C Cables market CAGR Overview : Growth, Share, Value and Trends Insights

According to global market analysis, the USB Type-C Cables market was valued at $1.33 billion in 2024 and is projected to reach $1.96 billion by 2032, growing at a CAGR of 5.8% during the forecast period (2024-2032). This growth is driven by the widespread adoption of USB-C across consumer electronics, the need for faster charging solutions, and the interface's versatility in data transfer and display connectivity.

What are USB Type-C Cables?

USB Type-C is a 24-pin symmetrical connector system that enables reversible plug orientation and supports multiple protocols through alternate modes. Unlike traditional USB ports, these cables can simultaneously handle power delivery (up to 240W with USB PD 3.1), data transfer (up to 40Gbps with USB4), and video output (DisplayPort Alt Mode). The standard has become mandatory for mobile devices in the European Union under new regulations, accelerating its industry dominance.

Key Market Drivers

1. Universal Adoption Across Device Categories

The USB-C interface has become ubiquitous, featured in over 90% of new smartphones, including Apple's iPhone 15 series which finally transitioned from Lightning. Laptop manufacturers have largely abandoned proprietary charging ports - even Apple's MacBooks exclusively use USB-C. The standardization simplifies accessory ecosystems, as noted in IDC's 2023 Peripheral Market Report showing 65% year-over-year growth in USB-C accessory sales.

2. Advancements in Power Delivery and Data Transfer

USB Power Delivery 3.1's 240W charging capability enables rapid charging for power-hungry devices like gaming laptops. Meanwhile, USB4 Version 2.0 (announced 2022) doubles bandwidth to 80Gbps, making USB-C cables viable for high-resolution displays and external GPUs. These technological leaps position USB-C as the future-proof standard, especially with Thunderbolt 4/5 compatibility.

Market Challenges

Despite its advantages, the market faces quality control issues with counterfeit cables causing device damage. The USB-IF reports 37% of unbranded USB-C cables fail basic safety tests. Additionally, the complexity of the standard confuses consumers - not all USB-C cables support the same features (PD, Alt Mode, etc.), leading to compatibility frustrations that may temporarily hinder adoption.

Opportunities Ahead

Emerging applications in automotive infotainment systems and IoT devices present new growth avenues. The EU's common charger directive will mandate USB-C for all portable electronics by 2024, creating a 300+ million unit annual replacement market. Major brands are investing in eco-friendly cable designs, with Anker and Belkin recently launching cables using recycled materials to meet sustainability targets.

Regional Market Insights

Asia-Pacific dominates production and consumption, with China manufacturing 78% of global USB-C cables and India's smartphone boom driving demand.

North America leads in premium accessory adoption, with 45% of consumers preferring branded USB-C cables for their Apple and Samsung devices.

Europe shows the fastest growth post common charger regulation, particularly in Germany and France where compliance deadlines approach.

Latin America and MEA markets remain price-sensitive with strong demand for budget cables, though premium segments grow as economic conditions improve.

Competitive Landscape

Anker Innovations leads the premium segment with its PowerLine+ III series, commanding 28% market share in North America.

Chinese brands like Baseus and UGreen dominate the mid-range through aggressive pricing, while Samsung and Apple leverage device bundling strategies.

The 2024 CES showcased breakthrough self-healing cable technology from Belkin and modular connector systems by Cable Matters, indicating the next phase of product innovation.

Market Segmentation

By Type:

USB-C to USB-A

USB-C to USB-C

USB-C to Lightning

USB-C to Micro USB

Specialty Cables (Thunderbolt, etc.)

By Application:

Smartphones

Laptops/Tablets

Peripherals

Automotive

Industrial

By Power Rating:

Standard (60W)

High Power (100W+)

E-marked Cables (240W)

By Sales Channel:

Online Retail

Electronics Stores

OEM Bundling

Report Scope & Offerings

This comprehensive analysis provides:

2024-2032 market forecasts with COVID-19 impact analysis

Competitive benchmarking of 25+ manufacturers

SWOT/PESTLE analysis of regulatory landscapes

Patent analysis of connector technologies

Download FREE Sample Report: USB Type-C Cables Market - View in Detailed Research Report

Download Full Report:

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision. International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

0 notes

Text

Anywhere RE Stock Plunges 11%, Now Down 65 Percent

Stock Performance and Market Reaction AnalysisAnywhere RE stock experienced a significant plummet, declining 11% in just one session. This dramatic selloff underscores a substantial drop in investor confidence, further exacerbating the company's ongoing market challenges.The steep decline triggered an increase in trading volume. Stop-loss orders and margin calls fueled the downward pressure, indicating intensified investor behavior amid rising market concerns.Currently, the company's shares are trading 65% below their previous peak. In stark contrast, the broader U.S. market is only 3% below its fair value estimates as of late May 2025.This marked divergence points to severe company-specific or sector-related issues. The real estate sector as a whole remains at a 10% discount to fair value. It suggests that these challenges, rather than broad economic factors, are primarily driving the selloff.Market analysts view the magnitude of the decline as a signal of a fundamental shift in sentiment toward Anywhere RE.Additionally, the real estate sector is under increased scrutiny with expectations of heightened volatility in the coming quarters.Earnings Revisions and Financial ImpactAs market pressures mount, the real estate giant has revised its Q2 2025 Operating EBITDA guidance downward to $125-135 million. This reflects intensifying challenges in homesale transaction volumes. The company's earnings guidance decreased by 10% compared to April 2025 projections. Consequently, this announcement led to a 7% decline in the stock price. Additionally, current mortgage rates, which have surged to 8.8%, exacerbate affordability issues for buyers, adding to the company's woes. Despite these near-term headwinds, management retains its full-year outlook. They anticipate improved transaction volumes in the latter half of 2025. The company's aggressive cost-cutting measures are vital to its financial strategy. These initiatives achieved $14 million in savings during Q1 and target $100 million in annual savings to counter market pressures. Q1 2025 results were mixed. Revenue increased by 7% year-over-year to $1.204 billion, while net losses improved by 23% to $78 million from $101 million the previous year. The latest analyst rating of Sell and $3.50 price target reflect ongoing concerns about the company's performance.Housing Market Slowdown EffectsWhile major market indicators paint a bearish outlook for residential real estate, Anywhere RE faces pressure from a severe housing market slowdown.This issue extends beyond company-specific challenges. The nationwide decline in housing demand has created significant headwinds. The Pending Home Sales Index dropped 6.3% month-over-month in April 2025, marking the steepest decline since 2022.Key market conditions impacting the company include a housing inventory surge of 32.5% year-over-year. This has reached five-year highs.Increased buyer leverage is happening, notably in the Midwest region. Price cuts are affecting 19.1% of listings, the highest for May since 2016.Builder confidence has plummeted to 34, well below the neutral benchmark. There are regional disparities, with the West experiencing the steepest sales declines.These pressures have created a challenging operating environment for real estate brokerages. The "lock-in effect" further constrains transaction volumes as sellers are reluctant to list their homes. Additionally, construction sector challenges such as rising labor costs and permitting delays continue to hinder housing development efforts, exacerbating the inventory shortage.Strategic Cost Management InitiativesSeveral strategic cost management initiatives are underway at Anywhere RE. The company is targeting aggressive savings of $100 million for 2025 amid challenging market conditions.To optimize expenditures, dynamic budget flexibility measures and disciplined financial management have been implemented. The focus is on leveraging technology investments and data-driven decision-making.

This strategy aims to streamline operations while maintaining service quality. Strategic budget reallocations occur quarterly, adapting to market volatility and operational needs.Emphasizing the importance of building resilience and consistency, Anywhere RE's approach underscores their commitment to achieving long-term success despite market challenges.Initiative AreaPrimary FocusExpected ImpactTechnologyAI/Data AnalyticsCost OptimizationOperationsProcess EfficiencyResource ManagementDiscretionarySpending ControlCash PreservationThe initiatives seek to sustain EBITDA margins and positive cash flow. Automated workflow solutions are part of the approach to ensure financial resilience.Strategic hiring practices and continuous expense monitoring support this all-encompassing strategy. These measures guarantee long-term stability despite market headwinds.Debt Financing and Analyst SentimentMounting debt obligations at Anywhere Real Estate have sparked growing concerns among market analysts. The company's total net debt has reached $2.66 billion amid rising borrowing costs and deteriorating credit ratings.Debt reduction strategies have included refinancing activities that extended maturities from 2026 to 2030. However, these came at considerably higher interest rates.A notable shift occurred with the replacement of 0.25% exchangeable senior notes with 9.75% senior secured second lien notes. This has intensified financial liquidity concerns for Anywhere Real Estate.Key developments in the company's debt profile include S&P's downgrade to a "B-" rating in August 2023. The net leverage ratio also increased to 22.6x from 14.8x.Interest expenses have reached $150 million for the four-quarter period. Despite this, the company successfully priced $500 million in senior secured second lien notes.Anywhere Real Estate has maintained compliance with the senior secured leverage covenant at 1.51x.Although maturity extensions reduce near-term refinancing risks, elevated borrowing costs continue to pressure the company's cash flow outlook.AssessmentAnywhere Real Estate's dramatic stock decline reflects broader challenges in the residential real estate sector. Rising interest rates and cooling demand are key contributors to this downturn.The company's aggressive cost-cutting measures and strategic repositioning may provide near-term stability. However, these actions underscore the persistent market headwinds it faces.Analyst sentiment remains cautious. Housing market indicators show continued weakness.Anywhere faces a challenging path to recovery. The real estate environment is increasingly uncertain.

0 notes

Text

This political cartoon by Louis Dalrymple appeared in Judge magazine in 1903. It depicts European immigrants as rats. Nativism and anti-immigration have a long and sordid history in the United States.

* * * *

LETTERS FROM AN AMERICAN

March 28, 2024

HEATHER COX RICHARDSON

MAR 29, 2024

Yesterday the National Economic Council called a meeting of the Supply Chain Disruptions Task Force, which the Biden-Harris administration launched in 2021, to discuss the impact of the collapse of the Francis Scott Key Bridge and the partial closure of the Port of Baltimore on regional and national supply chains. The task force draws members from the White House and the departments of Transportation, Commerce, Agriculture, Defense, Labor, Health and Human Services, Energy, and Homeland Security. It is focused on coordinating efforts to divert ships to other ports and to minimize impacts to employers and workers, making sure, for example, that dock workers stay on payrolls.

Today, Transportation Secretary Pete Buttigieg convened a meeting of port, labor, and industry partners—ocean carriers, truckers, local business owners, unions, railroads, and so on—to mitigate disruption from the bridge collapse. Representatives came from 40 organizations including American Roll-on Roll-off Carrier; the Georgia Ports Authority; the International Longshoremen’s Association, the International Organization of Masters, Mates and Pilots; John Deere; Maersk; Mercedes-Benz North America Operations; Seabulk Tankers; Under Armour; and the World Shipping Council.

Today the U.S. Department of Transportation’s Federal Highway Administration announced it would make $60 million available immediately to be used as a down payment toward initial costs. Already, though, some Republicans are balking at the idea of using new federal money to rebuild the bridge, saying that lawmakers should simply take the money that has been appropriated for things like electric vehicles, or wait until insurance money comes in from the shipping companies.

In 2007, when a bridge across the Mississippi River in Minneapolis suddenly collapsed, Congress passed funding to rebuild it in days and then-president George W. Bush signed the measure into law within a week of the accident.

In the past days, we have learned that the six maintenance workers killed when the bridge collapsed were all immigrants, natives of Mexico, Honduras, Guatemala, and El Salvador. Around 39% of the workforce in the construction industry around Baltimore and Washington, D.C., about 130,000 people, are immigrants, Scott Dance and María Luisa Paúl reported in the Washington Post yesterday.

Some of the men were undocumented, and all of them were family men who sent money back to their home countries, as well. From Honduras, the nephew of one of the men killed told the Associated Press, “The kind of work he did is what people born in the U.S. won’t do. People like him travel there with a dream. They don’t want to break anything or take anything.”

In the Philadelphia Inquirer today, journalist Will Bunch castigated the right-wing lawmakers and pundits who have whipped up native-born Americans over immigration, calling immigrants sex traffickers and fentanyl dealers, and even “animals.” Bunch illustrated that the reality of what was happening on the Francis Scott Key Bridge when it collapsed creates an opportunity to reframe the immigration debate in the United States.

Last month, Catherine Rampell of the Washington Post noted that immigration is a key reason that the United States experienced greater economic growth than any other nation in the wake of the coronavirus pandemic. The surge of immigration that began in 2022 brought to the U.S. working-age people who, Director Phill Swagel of the nonpartisan Congressional Budget Office wrote, are expected to make the U.S. gross domestic product about $7 trillion larger over the ten years from 2023 to 2034 than it would have been otherwise. Those workers will account for about $1 trillion dollars in revenues.

Curiously, while Republican leaders today are working to outdo each other in their harsh opposition to immigration, it was actually the leaders of the original Republican Party who recognized the power of immigrants to build the country and articulated an economic justification for increased immigration during the nation’s first major anti-immigrant period.

The United States had always been a nation of immigrants, but in the 1840s the failure of the potato crop in Ireland sent at least half a million Irish immigrants to the United States. As they moved into urban ports on the East Coast, especially in Massachusetts and New York, native-born Americans turned against them as competitors for jobs.

The 1850s saw a similar anti-immigrant fury in the new state of California. After the discovery of gold there in 1848, native-born Americans—the so-called Forty Niners—moved to the West Coast. They had no intention of sharing the riches they expected to find. The Indigenous people who lived there had no right to the land under which gold lay, native-born men thought; nor did the Mexicans whose government had sold the land to the U.S. in 1848; nor did the Chileans, who came with mining skills that made them powerful competitors. Above all, native-born Americans resented the Chinese miners who came to work in order to send money home to a land devastated by the first Opium War.

Democrats and the new anti-immigrant American Party (more popularly known as the “Know Nothings” because members claimed to know nothing about the party) turned against the new immigrants, seeing them as competition that would drive down wages. In the 1850s, Know Nothing officials in Massachusetts persecuted Catholics and deported Irish immigrants they believed were paupers. In California the state legislature placed a monthly tax on Mexican and Chinese miners, made unemployment a crime, took from Chinese men the right to testify in court, and finally tried to stop Chinese immigration altogether by taxing shipmasters $50 for each Chinese immigrant they brought.

When the Republicans organized in the 1850s, they saw society differently than the Democrats and the Know Nothings. They argued that society was not made up of a struggle over a limited economic pie, but rather that hardworking individuals would create more than they could consume, thus producing capital that would make the economy grow. The more people a nation had, the stronger it would be.

In 1860 the new party took a stand against the new laws that discriminated against immigrants. Immigrants’ rights should not be “abridged or impaired,” the delegates to its convention declared, adding that they were “in favor of giving a full and efficient protection to the rights of all classes of citizens, whether native or naturalized, both at home and abroad.”

Republicans’ support for immigration only increased during the Civil War. In contrast to the southern enslavers, they wanted to fill the land with people who supported freedom. As one poorly educated man wrote to his senator, “Protect Emegration and that will protect the Territories to Freedom.”

Republicans also wanted to bring as many workers to the country as possible to increase economic development. The war created a huge demand for agricultural products to feed the troops. At the same time, a terrible drought in Europe meant there was money to be made exporting grain. But the war was draining men to the battlefields of Stones River and Gettysburg and to the growing U.S. Navy, leaving farmers with fewer and fewer hands to work the land.

By 1864, Republicans were so strongly in favor of immigration that Congress passed “an Act to Encourage Immigration.” The law permitted immigrants to borrow against future homesteads to fund their voyage to the U.S., appropriated money to provide for impoverished immigrants upon their arrival, and, to undercut Democrats’ accusations that they were simply trying to find men to throw into the grinding war, guaranteed that no immigrant could be drafted until he announced his intention of becoming a citizen.

Support for immigration has waxed and waned repeatedly since then, but as recently as 1989, Republican president Ronald Reagan said: “We lead the world because, unique among nations, we draw our people—our strength—from every country and every corner of the world. And by doing so we continuously renew and enrich our nation…. Thanks to each wave of new arrivals to this land of opportunity, we're a nation forever young, forever bursting with energy and new ideas, and always on the cutting edge, always leading the world to the next frontier. This quality is vital to our future as a nation. If we ever closed the door to new Americans, our leadership in the world would soon be lost.”

The workers who died in the bridge collapse on Tuesday “were not ‘poisoning the blood of our country,’” Will Bunch wrote, quoting Trump; “they were replenishing it…. They may have been born all over the continent, but when these men plunged into our waters on Tuesday, they died as Americans.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#immigration#history#Letters From An American#Heather Cox Richardson#Know Nothings#supply chains#economic growth

5 notes

·

View notes

Text

Yeast Extract Price Trend: Market Insights, Analysis, and Forecasts

Yeast extract is a prominent ingredient used across various industries, including food & beverage, pharmaceuticals, animal feed, and biotechnology. As the global market becomes increasingly sensitive to raw material costs, the trend of Yeast Extract Price has emerged as a critical indicator for procurement managers, manufacturers, and investors. Whether you're tracking cost fluctuations for budgeting or optimizing sourcing strategies, understanding the key factors driving the yeast extract market is essential.

This article provides comprehensive insights into the yeast extract price movement by focusing on the latest pricing data, historical patterns, forecast trends, regional dynamics, and industry developments. We also explore critical metrics such as demand-supply scenarios, production economics, and regulatory impacts.

Latest Price Overview

Tracking the latest yeast extract prices allows stakeholders to align purchasing decisions with real-time market conditions. Prices in this segment are affected by several variables, including yeast availability, energy prices, transportation logistics, and downstream demand.

Moreover, recent volatility in global logistics and energy costs has had a tangible impact on yeast extract production and distribution. Many food and pharma companies rely on timely yeast extract sourcing, and thus, accurate and updated price monitoring becomes a key business priority.

Yeast Extract Price Trend and Market News

The Yeast Extract Price Trend has experienced significant fluctuations over the past few quarters, shaped by geopolitical factors, supply chain disruptions, and raw material shortages. In recent market news, several yeast extract manufacturers announced capacity expansions, which are expected to balance out the tight supply and help stabilize prices in the medium term.

Additionally, growing applications in nutritional supplements and natural flavoring agents have led to a steady increase in demand. This surge, paired with limited global supply due to climatic impacts on molasses (a primary feedstock for yeast), has kept the market bullish.

Market Drivers:

Rising demand from processed food sectors

Increased consumption in nutraceuticals and animal feed

Advancements in fermentation and biotechnological processes

Consumer shift toward clean-label and natural ingredients

Market Challenges:

Raw material volatility (especially sugar and molasses)

Energy-intensive production processes

Regulatory limitations in pharmaceutical-grade yeast extract

Yeast Extract Market Analysis

A detailed market analysis reveals the multifaceted dynamics affecting yeast extract pricing and consumption. Globally, the market is segmented based on application, product type (autolyzed vs hydrolyzed yeast extract), and geography.

In the food and beverage sector, yeast extract is favored for its umami flavor, making it a popular replacement for MSG. The meat processing industry also uses yeast extract for flavor enhancement and sodium reduction, which has further spiked demand.

On the supply side, production is largely concentrated in Europe, China, and North America. Manufacturers in these regions operate under strict compliance, with many shifting toward sustainable production methods to address environmental concerns.

Historical Data & Forecasts

Looking into historical price data is essential for identifying long-term patterns. Over the past five years, yeast extract prices have shown a cyclical nature, often peaking during global sugar shortages and dipping when molasses supply is abundant.

Historical price trend analysis indicates:

Sharp increases during the COVID-19 pandemic due to production disruptions

Relative stabilization in 2022 with recovery in supply chains

Continued moderate growth driven by industrial application expansion

As per market projections, the forecast suggests a gradual incline in prices, attributed to heightened demand across Asia-Pacific and Latin America. Innovations in fermentation technology are expected to enhance production efficiency, potentially easing upward pressure on prices.

Database and Chart Representation

To aid procurement and sourcing decisions, accessing structured yeast extract pricing data through a reliable database is crucial. Historical pricing charts enable decision-makers to identify seasonal variations and predict future trends based on macroeconomic indicators.

These databases typically include:

Monthly and quarterly price charts

Regional breakdowns (Asia, Europe, North America, etc.)

Import-export trends

Production costs and raw material indices

Such data-centric insights are especially useful for businesses aiming to optimize their procurement cycles and mitigate risks associated with market volatility.