#CPA CPE Credits

Explore tagged Tumblr posts

Text

Getting an Audit Licence in the UAE: Requirements and Business Setup

The UAE continues to establish itself as a regional and global business hub. With the introduction of corporate tax and increasing regulatory compliance standards, the demand for qualified, licensed auditors has surged.

Whether you're a UAE national or a foreign professional, becoming a licensed auditor in the UAE opens the door to lucrative career and business opportunities.

In this post, we’ll take you through everything you need to know about obtaining an audit licence in the UAE and going for your own company formation in the UAE, from meeting educational requirements to setting up a compliant, fully licensed practice.

Overview of Audit Licencing in the UAE

- Introduction

Audit licences in the UAE are issued and regulated by the Ministry of Economy (MoE), ensuring that only qualified professionals can offer auditing services. To practice as an auditor or open an audit firm, individuals must meet specific education, experience, and examination standards.

Both local and international applicants can apply, provided they comply with UAE’s regulatory and ethical auditing frameworks.

- Education, Experience & Certification Requirements

To apply for an audit licence in the UAE, candidates must meet the following criteria:

1. Educational Qualifications:

A bachelor’s degree in accounting, finance, or a related discipline from a recognised institution is required.

Non-accounting graduates must complete at least 15 credit hours in accounting from accredited programs.

A master’s degree in accounting or finance is advantageous but not mandatory.

2. Professional Experience:

A minimum of five years of post-degree experience in auditing is required.

For expatriates, UAE-specific experience requirements depend on total international experience:

10+ years abroad = 1 year of UAE experience

5–10 years abroad = 2 years of UAE experience

2–5 years abroad = 3 years of UAE experience

3. Recognised Professional Certifications:

Credentials such as ACCA (UK), ICAEW, CPA (USA, Canada, Australia), and SOCPA (Saudi Arabia) may grant exemptions from certain exams (e.g., IFRS and ISA).

All candidates, regardless of certification, must pass the UAE Laws & Taxation exam.

- The UAE Fellowship Programme & Exam Details

Before applying for an audit licence, professionals must obtain a UAE Fellowship Certificate, administered by the Emirates Association of Accountants & Auditors (EAAA) in collaboration with the MoE and ACCA.

1. Steps to Obtain the Fellowship Certificate:

a) Register with EAAA Create a membership account with the Emirates Association of Accountants & Auditors.

b)Verify Education and Experience Submit relevant documents showing compliance with education and work history requirements.

c) Pass the Required Exams

International Financial Reporting Standards (IFRS)

International Standards on Auditing (ISA)

UAE Laws & Taxation

Note: Exemptions may apply for IFRS and ISA if you hold qualifying certifications.

d) Complete Continuing Professional Education (CPE) At least 30 hours annually, with 12 hours in core subjects like accounting, auditing, and UAE tax law.

e) Apply for Fellowship Certificate Once all criteria are met, submit your application to receive your official certificate.

2. Exam Format:

Each exam includes 70 multiple-choice questions.

A passing score is 60%.

Exams are conducted online by the ACCA and proctored at British Council centres across the UAE.

All exams must be completed within two years of passing the first.

- Applying for Your Individual Audit Licence

Once you’ve secured the UAE Fellowship Certificate, you can apply for an individual audit licence with the Ministry of Economy.

#Requirements:

Professional Indemnity Insurance: AED 500,000 minimum coverage.

Application Fee: AED 100

Three-Year Licence Fee: AED 4,500

Submit your documents, pay the fees, and upon approval, you’ll receive your licence to practice auditing professionally in the UAE.

- Starting Your Own Audit Firm in the UAE

If you’re looking to create an independent practice through business setup in the UAE, here’s how to start an audit firm in the UAE.

#Step-by-Step Setup Process:

Select a Business Name Ensure it aligns with UAE naming conventions and is available for registration.

Form a Partnership Your firm must include at least two partners, one of whom must be a UAE national with a 25% stake. All partners must have five years of audit experience.

Verify Partner Licences Each partner must hold a valid MoE-issued individual auditor licence.

Establish a Risk Management Framework Demonstrate that your firm operates within accepted regulatory and ethical standards.

Provide International Experience (if applicable) Foreign firms must show a minimum of five years of licenced practice in their country of origin.

Secure an Office Location Set up a compliant and functional office space.

Open a Corporate Bank Account Choose a UAE-based bank for business transactions and operations.

Obtain Insurance Professional indemnity insurance of at least AED 1,000,000 is required.

Register with the MoE Submit all business and personal documents and pay:

Application Fee: AED 100

Three-Year Firm Licence Fee: AED 10,500

- Renewing Your Audit Licence

1) Renewal Schedule:

Audit licences must be renewed every three years. This involves a review of compliance, updated documentation, and proof of CPD (Continuing Professional Development) hours.

2) CPD Requirements:

Minimum of 30 CPD hours annually

Audit firms must maintain records of each auditor’s CPD compliance.

3) Compliance and Ethics:

Auditors must adhere to ethical principles like integrity, objectivity, and independence. Violations can result in:

Monetary fines

Licence suspension or revocation

Legal action or imprisonment

- UAE Corporate Tax: Audit Obligations

Since June 1, 2023, the UAE has implemented a corporate tax regime, requiring businesses with annual revenues over AED 50 million to submit audited financial statements by MoE-licensed auditors.

Additionally, Qualifying Free Zone Entities must provide audited financials to retain eligibility for the 0% tax rate. More information can be found at the Federal Tax Authority (FTA) website.

Building a Career in Auditing

Obtaining an audit licence in the UAE is more than a legal formality; it’s a professional milestone. Whether you aim to practice individually or establish a firm, your journey involves rigorous qualifications, ethical practice, and commitment to continued learning.

At Nimbus Consultancy, we specialise in helping professionals and businesses navigate UAE licensing requirements and ongoing compliance. From company formation in the UAE to visa processing and PRO services, we’re here to simplify your journey.

0 notes

Text

What Are CPE Credits for CPAs and How Do You Earn Them?

Continuing Professional Education (CPE) credits are essential for Certified Public Accountants to maintain their licenses and stay up to date with industry developments.

Whether you're a newly certified CPA or a seasoned professional, understanding how to earn and manage CPE credits is crucial for maintaining compliance with state board regulations and professional organizations.

Understanding CPE Credits

CPE credits are units of measurement used to quantify professional education and training for CPAs. These credits help accountants remain knowledgeable about tax laws, financial reporting standards, ethical considerations, and other relevant topics in the accounting industry. Most CPAs are required to earn a specific number of CPE credits within a defined reporting period, usually one to three years, depending on state regulations and professional membership requirements.

Why Are CPE Credits Important?

Regulatory Compliance: State boards of accountancy require CPAs to earn CPE credits to maintain their licenses.

Professional Growth: Continuing education helps CPAs stay informed about changes in accounting standards, tax laws, and technology.

Career Advancement: Keeping up with CPE requirements ensures CPAs remain competitive in the job market.

Ethical Responsibilities: Many CPE programs include ethics courses that reinforce the importance of professional integrity and ethical decision-making.

How to Earn CPE Credits

CPAs can earn CPE credits through various methods, including online courses, live seminars, webinars, and self-study programs. Below are the most common ways to earn CPE credits:

Online CPE Courses

Online CPE courses provide a flexible and convenient way for CPAs to earn credits from anywhere. Providers like CPE Inc. offer a wide range of courses covering essential topics such as:

Taxation

Auditing

Financial Reporting

Business Law

Ethics

Technology in Accounting

Many online courses are self-paced, allowing CPAs to learn at their own convenience and complete courses based on their schedules.

Live Webinars and Virtual Conferences

Attending live webinars and virtual conferences allows CPAs to interact with industry experts, ask questions, and participate in discussions. Many organizations, including CPE Inc. offer live CPE events that provide up-to-date information on regulatory changes and accounting best practices.

In-Person Seminars and Workshops

For CPAs who prefer a traditional classroom setting, in-person seminars and workshops offer structured learning environments. These events are often conducted by professional organizations and accounting firms to provide deep insights into specific accounting and financial topics.

Professional Conferences

Accounting and finance conferences often feature keynote speakers, panel discussions, and specialized training sessions that qualify for CPE credit. These events provide an excellent opportunity for networking while earning required credits.

On-the-Job Training and Firm-Sponsored Programs

Some employers provide in-house training programs that qualify for CPE credit. These programs cover company-specific policies, financial regulations, and industry trends that help CPAs enhance their expertise.

CPE Credit Requirements

CPE credit requirements vary by state and professional organization. CPAs should check with their state board of accountancy and other relevant institutions to ensure compliance. Here are some general guidelines:

Annual or Biennial Reporting Periods: Most states require CPAs to complete CPE credits within a one-to-three-year reporting cycle.

Minimum Credit Requirements: The total number of required credits typically ranges from 40 to 120 hours per cycle.

Ethics Requirement: Many states mandate that CPAs complete ethics training as part of their CPE credits.

Technical and Non-Technical CPE: Some state boards differentiate between technical courses (e.g., accounting, auditing, tax) and non-technical courses (e.g., leadership, communication skills).

Earn Your CPE Credits Today

CPE credits are a fundamental requirement for CPAs to maintain their professional licenses and stay ahead in the evolving field of accounting.

By utilizing resources such as CPE Inc., CPAs can conveniently earn credits through online courses, webinars, and self-study programs. Understanding CPE requirements and taking proactive steps to complete courses ensures CPAs remain compliant, knowledgeable, and competitive in their profession.

To explore high-quality CPE courses, visit CPE Inc. and start earning your credits today!

For more information about Ethics CPE Webinar and Accounting CPE please visit:- CPE Inc.

0 notes

Text

Certified Public Accountant - Purpose, Roles, and Path to Licensure

A license to practice as a Certified Public Accountant (CPA) is conferred upon individuals who meet stringent educational, experiential, and examination criteria in the accounting field. Licensure, administered by states and overseen by the National Association of State Boards of Accountancy (NASBA), signifies an accountant’s adherence to established standards in the profession. The primary purpose of the CPA license is to ensure that individuals providing accounting services possess the requisite knowledge and ethical commitment to safeguard the public interest.

CPAs fulfill a variety of crucial roles across diverse sectors. In public accounting, they conduct audits, prepare financial statements, and provide tax services to businesses and individuals. Within corporations, CPAs may serve as controllers or chief financial officers, overseeing financial reporting and strategic financial planning. Their expertise extends to government entities, where they contribute to financial oversight and regulatory compliance. Moreover, CPAs are authorized to represent clients before the Internal Revenue Service (IRS) and prepare reports for submission to the Securities and Exchange Commission (SEC), demonstrating their specialized knowledge of tax law and securities regulations. Beyond these core functions, CPAs offer consulting services, advising on financial matters, risk assessment, and business strategy. Their responsibilities often involve maintaining accurate financial records, identifying discrepancies, and implementing improvements to internal financial processes.

The path to obtaining a CPA license is rigorous and multifaceted. It begins with fulfilling educational requirements, which typically entail earning a bachelor's degree, although specific majors are not universally mandated. Many states require 150 semester hours of post-secondary education, necessitating additional coursework beyond the standard bachelor's degree. This requirement can be met through graduate studies or specialized programs.

Following the attainment of the required educational credits, candidates must pass the Uniform CPA Examination, a comprehensive assessment designed to evaluate their proficiency in financial accounting and reporting, auditing and attestation, taxation and regulation, and a chosen discipline area, which includes business analysis and reporting, information systems and controls, or tax compliance and planning. The examination is administered by NASBA and consists of multiple-choice questions and task-based simulations. Achieving a passing score of 75 on each of the four sections is mandatory.

In addition to educational and examination requirements, candidates must fulfill experience criteria, which typically involve one to two years of full-time, paid work in accounting-related roles. This experience must often be verified by a licensed CPA and may encompass work in public accounting, private industry, or government. Each state board of accountancy sets its specific requirements for licensure, and candidates must ensure that they meet the criteria of the state in which they intend to practice. Upon successful completion of all requirements, individuals are eligible to apply for a CPA license from their respective state board.

Maintaining the CPA license necessitates adherence to continuing professional education (CPE). These requirements, which vary by state, typically involve completing a specified number of CPE hours annually or biennially. CPE courses cover topics such as accounting standards, tax law updates, and professional ethics. Compliance with CPE requirements ensures that CPAs remain current with evolving accounting practices and regulations.

0 notes

Text

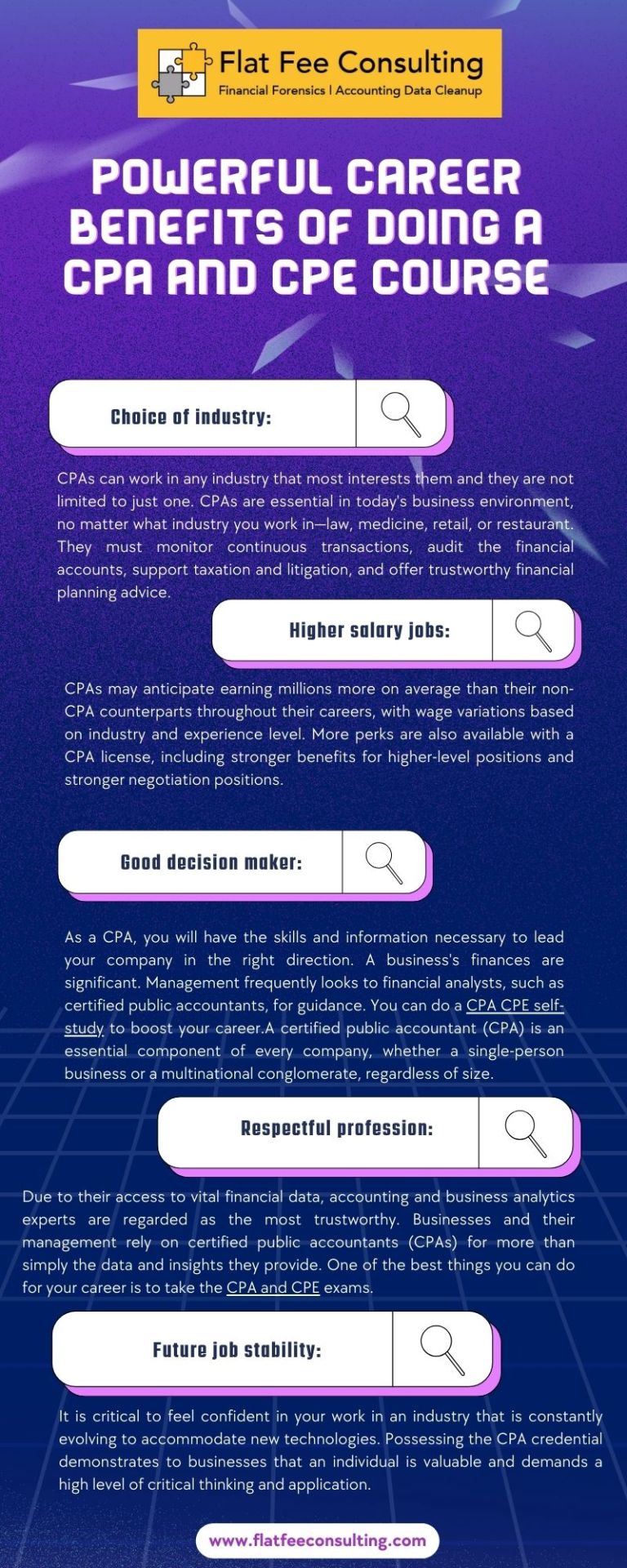

CPA and CPE - Flat Fee Consulting

If you have been considering getting a CPA credit, now is the time to start studying. It is a career change you can feel good about, one that can open doors and support you on your way to the ideal profession, with higher pay, more possibilities, and more respect.

0 notes

Text

Elevate your CPA journey with free CPE! CPE Credit, a licensed provider, offers a vast array of courses crafted by renowned authors and aligned with AICPA and NASBA standards. Explore diverse topics, including ethics and legal considerations. Start your educational journey today! Read more at https://qr.ae/pKzkaQ

0 notes

Text

CPA Licensing Requirements: State-by-State Comparison By Evan Vitale

According to Evan Vitale, State-by-state in the US, there are notable differences in the requirements for obtaining a certified public accountant (CPA) license. Although the basic requirements—a bachelor's degree in accounting, the fulfillment of a certain number of accounting credit hours, and passing the Uniform CPA Exam—remain constant, there are some subtle differences.

States may have different requirements; for example, some may require extra coursework toward a master's degree or more credit hours. It is usually necessary to have one to two years of professional accounting experience in addition to a dedication to ethical standards. Furthermore, maintaining a license frequently requires ongoing continuing professional education, or CPE. Prospective CPAs are advised to frequently check with their state board of accountancy for the most up-to-date information, as these criteria are subject to change. This state-by-state comparison is an invaluable tool that gives prospective CPAs the knowledge they need to understand the unique licensing requirements in the states where they plan to practice. Hope this information is helpful for you. To learn more, visit here: Evan Vitale.

0 notes

Text

Eligibility Requirements of CPA Course

Becoming a CPA: Eligibility Requirements and How Simandhar Education Can Help

The Certified Public Accountant (CPA) designation is a highly sought-after credential that opens doors to exciting career opportunities in the accounting field. However, before embarking on this journey, understanding the eligibility requirements is crucial.

General Eligibility Criteria:

Educational Qualifications: Most states require at least a bachelor's degree with 120-150 college credits, depending on the state. You don't necessarily need to major in accounting, but your coursework should include specific accounting and business subjects.

Examination: Passing the Uniform CPA Exam, a four-part exam covering Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation, is mandatory.

Work Experience: Many states require a minimum of 1-2 years of experience in public accounting under the supervision of a licensed CPA.

Ethics and Character: You must meet specific ethical and character standards to be eligible for a CPA license.

Additional Requirements:

Each state has its own specific requirements, so it's important to check the regulations of the state where you wish to practice. These may include additional education courses, specific experience requirements, or continuing professional education (CPE) hours.

How Simandhar Education Can Help:

Simandhar Education understands the complex process of becoming a CPA and offers comprehensive support to aspiring accountants throughout their journey. Their services include:

CPA Exam Preparation Courses: Intensive and flexible courses designed to help you understand key concepts, master exam techniques, and pass all four sections of the CPA exam.

Expert Faculty: Learn from experienced CPA instructors who provide personalized guidance, answer your questions, and address your specific learning needs.

Comprehensive Study Materials: Access a wealth of study materials, including textbooks, practice questions, mock exams, and online resources, tailored to each section of the CPA exam.

Bridge Courses: If your educational background falls short of the required credits, Simandhar offers bridge courses to help you meet the eligibility requirements.

Career Services: Receive personalized career coaching and assistance with resume writing, interview preparation, and job placement after obtaining your CPA license.

Start Your CPA Journey with Confidence:

Embarking on the CPA journey can be exciting, but it also requires dedication and the right guidance. Simandhar Education provides the perfect platform to equip yourself with the knowledge, skills, and support you need to achieve your goals and become a successful CPA.

0 notes

Text

#Professional#Development#Finance#Accounting#Certification#Courses#Skill#Enhancement#Platform#E-Learning#Training#Resources#Business#Skills

0 notes

Text

Understanding the Certified Public Accountant (CPA) Course: A Complete Guide

The Certified Public Accountant (CPA) course is a prestigious professional certification designed for individuals aspiring to become licensed accountants in the United States. Renowned for its rigor and comprehensiveness, the CPA course prepares candidates to excel in various critical areas such as accounting, auditing, taxation, and business law.

Whether you are considering CPA coaching in Chandigarh or elsewhere, it is essential to understand the course structure, eligibility, and requirements to successfully navigate the path toward certification.

Education Requirements for the CPA Course

To begin your journey toward CPA certification, a foundational step is meeting the education eligibility criteria. Most states require candidates to hold at least a bachelor’s degree from an accredited college or university. This degree must include a specified number of credit hours in accounting and related business subjects.

While the total required credit hours vary by state, many require around 150 credit hours to qualify for the CPA exam. These coursework requirements ensure that candidates possess a solid grounding in essential accounting principles and business knowledge before moving forward.

The CPA Exam: Four Critical Sections

The Uniform CPA Examination is a pivotal part of the certification process, designed to comprehensively test candidates’ proficiency across four distinct sections:

Auditing and Attestation (AUD): This section evaluates knowledge of auditing standards, procedures, and attestation engagements. Candidates must understand how to prepare, compile, and review financial statements according to professional standards.

Business Environment and Concepts (BEC): BEC focuses on business-related concepts, including economics, financial management, information technology, and business law. This section tests candidates on their understanding of the broader business environment affecting accounting practices.

Financial Accounting and Reporting (FAR): FAR covers financial accounting principles and the preparation of financial statements for various entities. Candidates are tested on topics such as accounting standards and financial reporting frameworks.

Regulation (REG): REG assesses candidates on federal taxation, business law, ethics, and professional responsibilities. It ensures candidates understand regulatory frameworks governing the accounting profession.

Candidates are required to pass all four sections within a state-specific timeframe, highlighting the importance of thorough preparation and time management.

Work Experience: Gaining Practical Accounting Skills

In addition to education and examination requirements, relevant work experience is crucial for CPA certification. Most states mandate candidates to accumulate one to two years of professional accounting experience under the supervision of a licensed CPA.

This hands-on experience helps candidates apply theoretical knowledge in real-world settings, building critical skills that enhance their competence and readiness for professional practice.

Ethics Exam: Upholding Professional Integrity

Many states require candidates to pass an ethics exam as part of the CPA certification process. This exam covers ethical standards and professional conduct expected of CPAs, emphasizing the importance of integrity, objectivity, and responsibility in accounting practice.

The ethics requirement reinforces the commitment of CPAs to uphold public trust and maintain the profession’s reputation.

Continuing Education: Lifelong Learning for CPAs

Becoming a CPA is not the final step; maintaining the license involves ongoing continuing professional education (CPE). CPAs must regularly update their knowledge of evolving accounting standards, regulations, and best practices to remain competent and effective in their roles.

CPE requirements vary by state but generally include completing a specified number of education hours every licensing period to ensure continuous professional development.

State-Specific Requirements: Importance of Local Guidelines

While the core components of the CPA course are consistent, state-specific variations exist regarding eligibility, exam administration, experience, and fees. Each state’s Board of Accountancy establishes its own rules, so candidates must consult their local board to understand precise requirements.

For those seeking CPA coaching in Chandigarh or other locations, it’s important to align preparation with the regulations of the state where certification is pursued.

Conclusion

The CPA course offers a robust pathway for aspiring accountants to develop expert knowledge and gain licensure to practice professionally. Understanding the education prerequisites, exam structure, work experience, ethics, and continuing education requirements is key to successfully earning and maintaining the CPA designation.

By choosing the right coaching, committing to disciplined study, and adhering to state-specific guidelines, candidates can confidently achieve their CPA goals and open doors to rewarding careers in accounting and finance.

0 notes

Text

How to Choose Tax Resolution Software

Regardless of the industry, customer relationship management software is an indispensable resource. You may have one already or are thinking about getting one. You will learn everything you need to know about selecting the best-automated software for your company, regardless of whether you've already been using one and are ready to compare your options. Choosing the appropriate business software involves several factors. So that you can make an informed choice, let's go over everything you need to know about IRS tax resolution software.

Important aspects of tax-resolution software

• Capabilities of IRS Forms

When deciding on an IRS tax resolution software program, look for features like fillable IRS forms and a user-friendly interface. Having this makes it a useful purchase. It's crucial to use programs that help you locate the optimal solution for your client.

Thanks to automated analysis tools and form features, you can quickly access the resolution information you need to represent your client's interests. If you need to switch from Form 433-A to Form 433-A(OIC), you shouldn't have to re-enter any data.

• Full report

To provide excellent service, you should tell the client exactly what you're doing for them behind the scenes. Using IRS tax resolution software, you can compile a report detailing your efforts, potential outcomes, and next steps. Having this report automatically generated by your software will make it simple for clients to stay informed and for you to demonstrate your worth.

• All-in-one system

The software you select should help you in every facet of running your company, from advertising to streamlining routine tasks to providing first-rate customer support. Having comprehensive tax resolution software makes it simple to keep track of everything and makes sure everything gets noticed. This is crucial for the smooth operation of your tax resolution business, especially if you're a busy professional.

• Tax Forms

It's important to have access to a wide range of federal forms, whether dealing with a simple or complex tax resolution case. If you're helping people with their tax problems, you must know what paperwork is necessary.

• IRS Notices

Responding appropriately to IRS notices is an important part of a successful tax resolution professional. The selected software should explain each alert and how to fix the problem. As a result, you can give your client excellent service without wasting too much time on research. You need to learn about each notice and how to deal with it to succeed in your job.

• Industry education and customer support

As a result of the dynamic nature of tax policy and practice, CPAs must renew their certification every year. Professionals in the tax resolution field must keep up with the ever-changing tax code and regulations and the annual continuing education requirements to do their jobs effectively.

As an integral part of the program, some tax resolution software will offer educational resources, such as live classes taught by seasoned professionals in the field that can be used to earn Continuing Professional Education (CPE) credits.

Conclusion

As a tax professional, you can greatly expand your career prospects by offering tax resolution services. You can significantly impact your clients' lives, increase your practice's bottom line, and reclaim valuable time in your week. With the right software, you can launch your tax resolution business with minimal fuss and start immediately.

#tax resolution software#irs solutions tax resolution software#irs resolution#irs resolution software#tax practice management software

0 notes

Text

Why Accountants Need CPE Credits: A Quick Guide

In a world where financial regulations, standards, and technology continually evolve, the need for accountants to maintain their knowledge and expertise is absolutely critical.

CPE credits are a foundational component of an accountant’s career, providing essential opportunities to stay compliant, competitive, and capable of offering top-tier service to clients. Let’s explore why CPE courses for accountants are vital, what benefits they offer, and how they keep professionals at the forefront of the industry.

Maintaining Licensure and Compliance

For Certified Public Accountants (CPAs) and many other accounting professionals, CPE credits are not just recommended — they’re required. State boards of accountancy, professional organizations, and licensing bodies mandate a certain number of CPE hours to ensure that accountants remain competent in their field. Requirements vary by state and licensing body, but the general expectation is for accountants to complete around 40 hours of CPE annually. Failing to meet these requirements can lead to fines, suspension of licenses, or even a total loss of licensure.

Ethics CPE Requirements: Many states require that a portion of CPE hours be dedicated to ethics courses. These courses help ensure accountants understand their ethical responsibilities and can navigate complex ethical dilemmas.

Regulatory Changes: With frequent changes in tax laws, reporting standards, and regulatory frameworks, CPE courses ensure that accountants are aware of the latest requirements, reducing the risk of compliance issues.

Enhancing Technical Skills

The accounting field is no stranger to technical complexity. With emerging topics such as blockchain accounting, cryptocurrency, international financial reporting standards (IFRS), and artificial intelligence (AI) in finance, accountants must be prepared to integrate these innovations.

Technological Advancements: With advancements in software, data analytics, and automation, accountants can leverage new tools to streamline work and provide deeper insights. CPE courses in technology prepare accountants to harness the power of modern software and ensure they can offer clients or employers the benefits of efficient, tech-enabled service.

Specialized Areas of Practice: As accountants may choose to specialize in niches such as forensic accounting, cybersecurity, or business valuation, CPE credits allow them to develop these skills and expand their career opportunities.

Boosting Client Confidence and Building Trust

Accountants are advisors, and clients place high value on their ability to provide up-to-date and accurate financial advice. Meeting CPE requirements and pursuing additional certifications signals to clients that an accountant is committed to their profession, compliance, and continued learning.

Enhanced Reputation and Trust: Earning and maintaining CPE credits builds trust with clients and colleagues by demonstrating an accountant’s commitment to staying informed on current laws and regulations.

Increased Client Retention: Clients often remain loyal to accountants who show a proactive approach to professional growth and learning. Knowledge gained from CPE courses allows accountants to offer relevant insights that benefit client businesses.

Preparing for Regulatory and Economic Changes

Economic conditions and regulatory landscapes are always evolving, often with significant implications for businesses and individuals. Accountants who engage in ongoing professional education are better prepared to anticipate and respond to these shifts, providing clients with timely and relevant guidance.

Adaptation to Tax Code Changes: For tax accountants, changes in tax codes are a constant challenge. Completing CPE courses specific to tax updates is crucial for providing accurate tax preparation and planning services.

Economic Impact Awareness: CPE courses can include topics on economic trends, preparing accountants to advise clients on how to respond to economic downturns, inflation, and other external forces affecting financial health.

The Critical Role of CPE Credits in Accounting

In a profession where accuracy, ethics, and expertise are paramount, CPE credits form the backbone of an accountant’s commitment to continuous improvement and client service. Meeting CPE requirements goes beyond compliance; it empowers accountants to stay informed about industry developments, expand their knowledge base, and offer unparalleled service in a rapidly changing landscape.

Whether it’s to keep up with new laws, enhance technical skills, or pursue career advancement, the pursuit of CPE credits through accounting CPE is essential for accountants at all levels. With the right CPE courses from reputable leaders like CPE Inc., accounting professionals not only stay relevant but also gain the expertise needed to adapt, grow, and succeed in an increasingly complex financial environment.

For more information about Online CPE For Cpas and CPE Course please visit:- CPE Inc.

0 notes

Text

AICPA and CIMA National Tax Conference - Stay Updated on Tax Law

The American Institute of Certified Public Accountants (AICPA) & Chartered Institute of Management Accountants (CIMA) National Tax Conference offers tax professionals a comprehensive update on the latest federal tax laws and their practical implications. Set for November 11-12, 2024, at the Omni Shoreham Hotel in Washington D.C., this two-day event provides attendees with insights from industry experts and practical guidance on incorporating tax law changes into their practices.

The conference agenda delves into various tax updates, planning strategies, and hot topics relevant to tax professionals. Attendees can expect in-depth sessions covering individual income tax, business tax, estate planning, and retirement plans, among other subjects. Specific areas of focus include the use of AI in CPA firms, the impact of rising interest rates on estate planning, and tax considerations related to employee use of company assets. Various networking opportunities are also available, fostering connections with fellow professionals and industry leaders. Additionally, the conference fulfills continuing professional education (CPE) requirements.

Early-bird pricing for the conference ends on September 27. AICPA and CIMA members are also eligible for a reduced registration fee. For details on the conference agenda, registration, and CPE credit specifics, visit the official conference website.

0 notes

Text

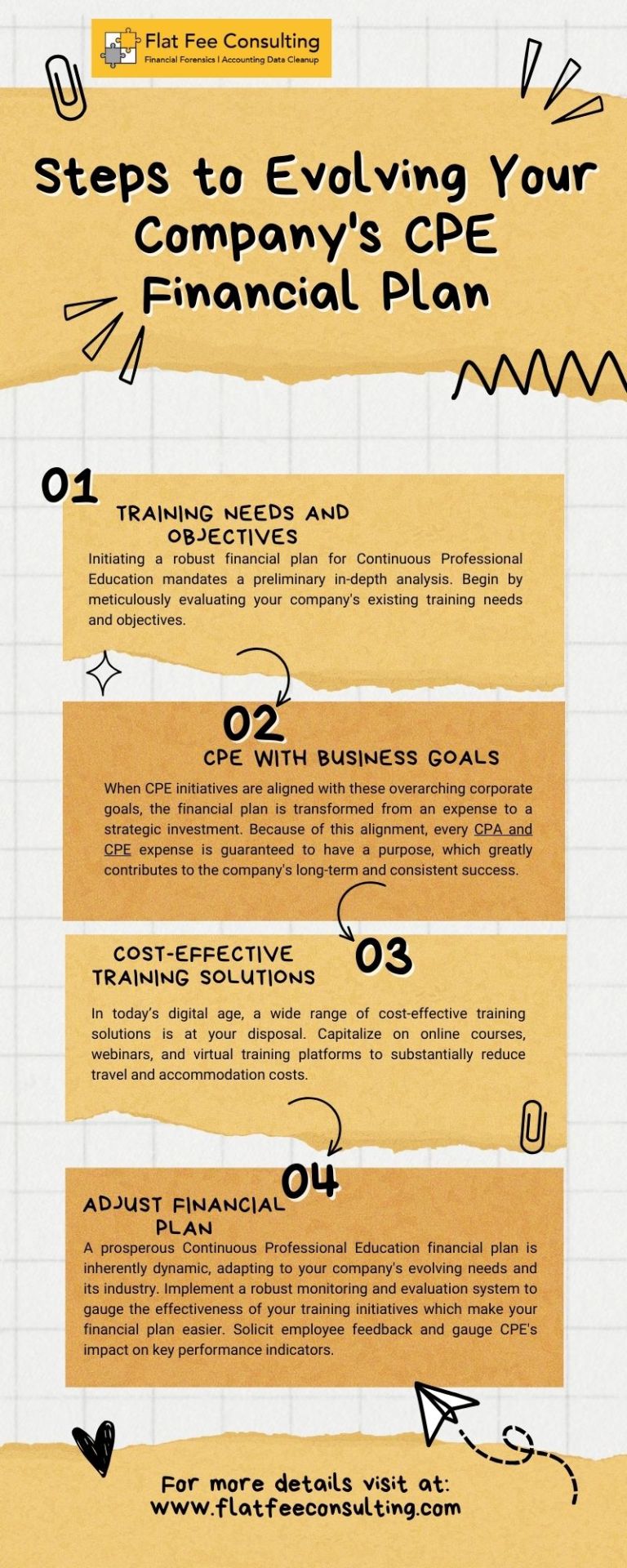

CPA and CPE - Flat Fee Consulting

You can ensure that your CPE investments yield tangible returns in the form of a skilled and adaptable workforce, ultimately contributing to your company's success. Moreover, meeting CPA credit requirements is crucial for career advancement and regulatory compliance.

1 note

·

View note

Text

Whether you're a CPA or on a different career path, CPE credits showcase your commitment to staying sharp and growing in your field. Grow your career with ongoing learning! Read more at https://qr.ae/pKUEcQ

1 note

·

View note

Text

Here Are 9 Provoking Reasons For Pursuing CPA Online Course

CPA online courses offer flexibility, convenience, access to quality content, interactive learning experiences, cost-effectiveness, exam preparation support, CPE credits, networking.

More Info: https://gtiaindia.blogspot.com/2023/07/here-are-9-provoking-reasons-for.html

#onlineaccountingcertificatecourses#onlineaccountingcoursesforcpa#cpaclassesonline#cpatrainingonline

0 notes

Text

Here Are 9 Provoking Reasons For Pursuing CPA Online Course

CPA online courses offer flexibility, convenience, access to quality content, interactive learning experiences, cost-effectiveness, exam preparation support, CPE credits, networking.

Learn More: https://gtiaindia.blogspot.com/2023/07/here-are-9-provoking-reasons-for.html

#cpatrainingonline#cpaclassesonline#onlineaccountingcoursesforcpa#onlineaccountingcertificatecourses

1 note

·

View note