#CharteredAccounting

Explore tagged Tumblr posts

Text

Efficient Online Chartered Accounting (CA) Services in Delhi

Get expert Chartered Accounting (CA) services in Delhi with Taxgoal. Streamline your finances, maximize tax benefits, and ensure compliance. Trust our experienced professionals for reliable online accounting solutions tailored to your needs. To know more visit here: https://taxgoal.in/

#Taxgoal#Delhi#CA#FinancialServices#CharteredAccounting#OnlineServices#Accounting#Finance#TaxPlanning#FinancialAnalysis#Business#PersonalFinance#Consulting#DigitalTransformation

0 notes

Text

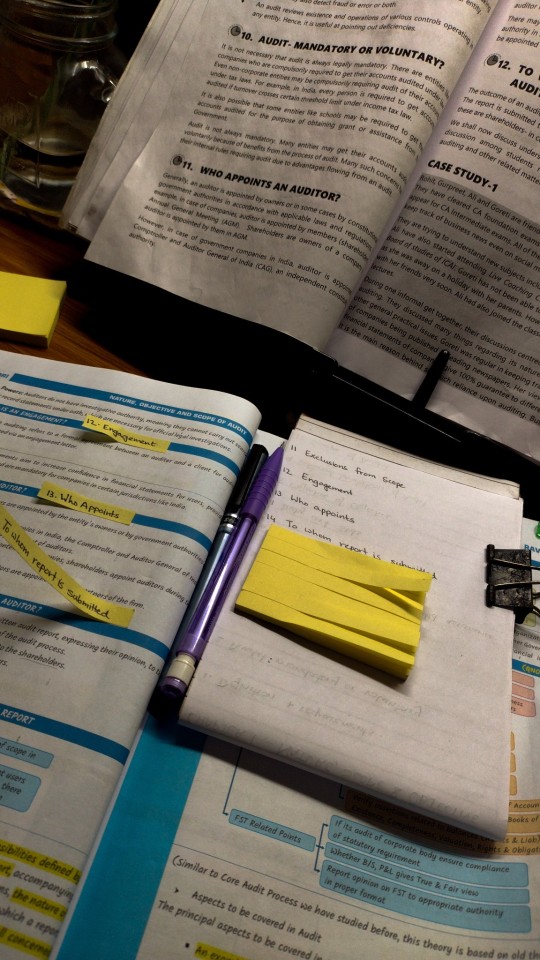

15 March 2024, Friday.

There's 60 days till exams are over, so I thought I could do a 60 Days of Productivity challenge.

Revision has not been as smooth as I had hoped it would be. Everyday is a struggle and my mental health has never been worse, but I'm stuck on this miserable plane of existence so I may as well just focus on today and forget the existential horror of the years ahead, right?

Anyway.

-G

#studyblr#studygram#study blog#study#economics#finance#accounting#business#commerce#motivation#study motivation#studyinspo#studying#study aesthetic#study inspiration#student#student life#education#desk#notes#study notes#college#university#academia#studyspo#chartered accountant#charteredaccountant#🐿️💬#g speaks

66 notes

·

View notes

Text

Why Tax Auditors in Delhi are Essential for Your Business’s Financial Health

Tax auditors in Delhi are essential for businesses that want to ensure financial compliance and avoid unnecessary tax penalties. As tax laws become increasingly complicated, having professional tax auditors who specialize in navigating the nuances of tax regulations can save your business from costly mistakes. Whether you're a small business or a large corporation, tax audits help ensure that your financial statements reflect accurate information while also ensuring full compliance with India’s tax laws.

Understanding the Role of Tax Auditors

A tax auditor’s job goes beyond simply reviewing your financial records. These professionals are responsible for ensuring that your business complies with the legal requirements, including correct tax filing, and accurate reporting. In Delhi, tax auditors serve as an important resource for businesses, offering critical guidance on how to efficiently manage tax liabilities and comply with local, state, and national tax laws.

Tax auditors look at various areas of your financial operations, checking for discrepancies, potential risks, and areas for improvement. Their insights can help reduce your tax liabilities, optimize your financial strategies, and ensure that you're on track with your tax obligations.

Why Do You Need a Tax Auditor in Delhi?

Compliance with Changing Tax Laws The complexity of India’s tax laws means that staying compliant can be overwhelming. Tax auditors in Delhi specialize in understanding both central and state-specific tax rules. Their expertise ensures your business remains in compliance and avoids the risk of costly penalties or legal issues.

Risk Mitigation Tax non-compliance can lead to severe penalties and audits from the tax authorities. With the help of a tax auditor, you can ensure that all your filings are accurate, reducing the chances of facing scrutiny or fines.

Optimizing Tax Liabilities One of the core functions of tax auditors is to help businesses minimize their tax liabilities. They provide expert advice on tax-saving strategies, exemptions, and deductions that you may not be aware of, ensuring you pay the lowest legal amount.

Promoting Financial Transparency Through the auditing process, tax auditors help businesses ensure their financial records are clear and accurate. This transparency is vital not only for regulatory bodies but also for gaining trust from investors and business stakeholders.

The Process of Tax Auditing

Tax auditing typically follows a systematic approach:

Data Collection: Auditors gather all relevant documentation, including tax returns and financial records.

Verification and Review: The auditor verifies the accuracy of your financial statements, ensuring that they align with applicable tax laws.

Compliance Assessment: The auditor checks whether your business is complying with tax laws and meeting all legal requirements.

Reporting and Advisory: After completing the audit, the tax auditor provides a detailed report outlining findings, suggestions, and areas for improvement.

Selecting the Right Tax Auditor in Delhi

When searching for tax auditors in Delhi, consider:

Experience in Your Industry: Look for auditors who have experience working with businesses in your industry, as they will be more familiar with the specific tax laws that apply.

Reputation: Opt for auditors with a strong reputation for reliability and professionalism. Client testimonials and reviews can provide insight into their credibility.

Comprehensive Services: Choose auditors who offer a range of services, from tax planning to compliance, in addition to traditional audits.

Transparency: Ensure your auditor is transparent and communicative throughout the audit process. Clear communication helps ensure you're fully aware of the findings and suggestions.

Conclusion

Hiring a trusted Tax auditors in Delhi is an essential step for any business seeking to navigate the complexities of tax laws and financial reporting. Their expertise in ensuring compliance, reducing tax liabilities, and promoting financial transparency can significantly contribute to the long-term success and growth of your business.

3 notes

·

View notes

Text

Powered By : Accountants Practice Management Software

Our website: https://www.caofficeautomation.com/

Follow us on…

Facebook: https://www.facebook.com/caofficeautomation

Instagram: https://www.instagram.com/ca_office_automation/

Twitter (X): https://twitter.com/caofficeauto

LinkedIn: https://www.linkedin.com/company/ca-office-automation/

YouTube: https://www.youtube.com/channel/UC2iMV5-pkrQ6Pdh6q6m1I0A

3 notes

·

View notes

Text

https://mdpassociates.in/

2 notes

·

View notes

Text

Looking for the best tax consultant company in Chennai? Discover SPR&CO, your trusted Chartered Accountant firm, providing expert financial services and guidance.

#SPRandCO#CharteredAccountants#FinancialExperts#TaxConsultants#ChennaiAccountants#FinancePros#AccountingServices#AuditExperts#TaxAdvisors#FinancialConsultants#AccountingFirm#TaxPlanning#BusinessFinance#FinancialSolutions#ChennaiBusiness#CorporateFinance#TaxationServices#AuditandAssurance#SmallBusinessFinance#FinancialAdvisory#FinancialPlanners#SPRandCOChennai#TaxExperts#CharteredAccounting#FinancialStrategy#IncomeTax#AccountingProfessionals#ChennaiConsultants#TaxCompliance#FinancialManagement

2 notes

·

View notes

Text

Hi I'm ca aspirant

I want to know how to clear ca intermediate

2 notes

·

View notes

Text

Audit company in Oman | Al Bustan

Al Bustan is a trusted audit company in Oman, delivering accurate, transparent, and compliant financial auditing services for businesses of all sizes. Our expert auditors help ensure regulatory compliance, identify financial risks, and strengthen your internal controls. Whether you're a startup, SME, or large enterprise, Al Bustan offers timely audit reports and personalized support to help you make confident financial decisions. Partner with us for reliable auditing backed by integrity and professionalism.

https://miauditing.com/top-annual-account-finalization-services/

#auditing firm in oman#incometax#incometaxreturns#audit company in muscat#charteredaccountant#accounts#advisory#consultancy#auditing#audit firm in muscat

0 notes

Text

Top 5 Important Chapters in CA Foundation Business Mathematics

The CA (Chartered Accountancy) Foundation exam is the first phase that you would have to clear to start working as a chartered accountant in India. Business mathematics, logical reasoning, and statistics is one of the most difficult papers in the exam. The paper requires sharp numerical skills, along with strong conceptual clarity, but you must also prepare smartly for it. For that, you must know the most important chapters in this specific context. In this blog, we will discuss the five most important chapters in the business mathematics section that can help you score highly if you master them well.

Ratio, proportion, indices & logarithms

This chapter serves as the backbone of many questions that appear in the mathematics section and also influences problem-solving in the statistics and logical reasoning sections. Here, you need to understand the rules of indices, the relationship between proportions and ratios, and the laws of logarithms so that you can solve a wide range of word problems as well as questions that are related to quantitative aptitude. In this chapter, the most important topics may be enumerated below:

· Laws of exponents

· Solving logarithmic questions

· Simplifying algebraic expressions

· Proportion methods and ratio comparison

Time value of money

This chapter fuses the understanding of real-world functioning of mathematical concepts along with the concepts themselves. You can expect this to become a part and parcel of the latter stages of the CA program. It deals with important topics of financial mathematics such as compound and simple interest, annuity, future and present value, and discounting. The most crucial topics in this context are:

· Calculating simple and compound interest

· Perpetuities and annuities

· Future value and present value of lump sums

· Effective rate of interest

This chapter is important because its main topics are applicable directly in practical decisions related to finance.

Permutations and combinations

The chapter on permutations and combinations is frequently considered to be a tough topic by students because of its conceptual depth. As such, it is a crucial chapter because it contains questions that involve selection and arrangement. Not only does this chapter enhance your mathematical thinking, but it also has close links with logical puzzles and probability. The most important topics in the chapter may be enumerated as below:

· Factorial notation

· Selections (combinations)

· Fundamental principle of counting

· Circular permutations

· Arrangements (permutations)

This chapter always carries around 8–10 marks in the exam, and mastering it can assist you in dealing well with different kinds of difficult problems.

Sets, Functions & Relations

This chapter lays the theoretical basis for understanding data organization, relationships, and classification. Some of the tools that you will typically learn in the chapter are Venn diagrams, function types, and domain-range concepts. One of the best things about these skills is that you can transfer them to statistics and logical reasoning as well. The most important topics taught in the program are:

· Types of set operations and sets

· Range of functions and domain

· Venn diagrams

· Cartesian product and relations

· Functions — one-one, many-one, onto

Linear Equations and Linear Inequalities

Linear inequalities and equations are the fundamental areas of algebraic reasoning. This chapter details the ways in which students can solve the likes of graph inequalities and simultaneous equations. It also teaches how to understand feasible regions, and all these skills are essential in the context of business and quantitative analysis. The following are the most critical topics in the chapter:

· Solving linear equation systems and single linear equations

· Applications in business situations

· Graphically representing the inequalities

· Word problems that involve constraints

This is an important chapter because it is tested frequently in the exam.

Study tips for mastering these chapters

The five most important tips that students can keep in mind in this context may be enumerated as below:

· Practice is important

· Use examples from the actual world

· Make formula sheets

· Clear your basics in the beginning

· Solve the ICAI (Institute of Chartered Accountants of India) mock papers available at BoS Knowledge Portal.

You do not need to mug up the formulas of business mathematics — rather, you need to apply them repeatedly. You must summarize all the shortcuts and formulas in a single place for convenient revision. You should also focus on solving questions from the previous year and take mock tests so that you can be accurate in pressure situations.

Hence doing well in the business mathematics section of the CA Foundation exam is not only about hard work — you also need to be smart in the way you work. So, you can focus on these crucial chapters to maximize your efficiency, reduce exam stress, and score higher.

0 notes

Text

Struggling with GST returns? Real Tax India offers professional GST Return Filing starting at just ₹999!

💼 GSTR-1, GSTR-3B, GSTR-4 👨💼 Expert CA Support 📊 Late fee & ITC Management 📞 Call us at +91 9899767300 🌐 www.realtaxindia.com

Stay compliant. Avoid penalties. File with ease.

#GSTReturn#TaxFiling#RealTaxIndia#FinanceServices#GSTCompliance#SmallBusinessSupport#StartupIndia#CharteredAccountant#BusinessGrowth#MSMEIndia#LinkedInBusiness

0 notes

Text

Applicability of GSTR 9C: A Detailed Explanation for Accountants

📢 GSTR-9C: Mandatory headache or strategic opportunity? 🤯✅

If you're a Chartered Accountant or GST practitioner, you already know that GSTR-9C isn't just another form. It's a reconciliation report + audit tool + compliance checkpoint all rolled into one.

But here’s the catch: not every business needs to file it. So, who does? 🧾

🔍 Here’s the quick lowdown:

Applicable if aggregate turnover exceeds ₹5 Cr

Mandatory self-certified reconciliation between GSTR-9 & audited financials

Filed by a CA/CMA but reviewed closely by the department 👀

With constant changes in GST thresholds and audit norms, missing this filing = penalties, notices, and compliance nightmares. 😬

⚙️ Smart CAs are already using automation tools like Suvit to:

Reconcile data faster

Minimize human error

Generate clean reports without last-minute panic

Why get buried in Excel chaos when smarter, faster workflows exist?

📈 Stay ahead of GST compliance season or risk falling behind.

👉 Dive into the full guide here: https://www.suvit.io/post/applicability-of-gstr-9c

0 notes

Text

Advance your career with FinPro’s IFRS Certification tailored for Chartered Accountants. Gain global recognition, enhance your finance skills, and open international career opportunities—right from India. Enroll now to upskill for success! Contact US Now:- +91 8421438047

#FinPro#IFRSCertification#GlobalRecognition#CharteredAccountant#FinanceProfessionals#UpskillIndia#CareerInFinance#CAIndia#GlobalAccountant#AccountingStandards#FinanceCareerGrowth#StudyIFRS

0 notes

Text

Not All Superheroes Wear Capes Some balance books, audit accounts, and protect the economy!

Happy CA Day to all the Chartered Accountants who keep businesses running smoothly and the nation financially strong!

0 notes

Text

Outsource Accounting Services for Hassle-Free Business Management

Simplify your business finances with our expert Outsource Accounting Services. We handle bookkeeping, tax filing, payroll, and reporting so you can focus on growing your business. Our certified professionals ensure compliance, accuracy, and timely submissions helping startups, SMEs, and enterprises manage financial operations efficiently and cost-effectively. For more info: https://www.acumenfs.in

#OutsourceAccountingServices#AccountingSolutions#BookkeepingServices#TaxFiling#PayrollManagement#FinancialReporting#RemoteAccounting#BusinessAccounting#StartupSupport#CostEffectiveAccounting#ComplianceExperts#OnlineCA#CharteredAccountant#AccountingForSMEs#VirtualAccounting

0 notes

Text

Unlocking Business Scalability: The Role of #Technology in #Future-Proofing your Firm.

Introduction: In the rapidly evolving world of accounting and #financialmanagement, scalability is the name of the game. Every accounting firm aspires to grow, thrive, and adapt to the ever-changing market demands. Scalability is not just expansion: it's about adaptability, resilience, and seizing opportunities while managing challenges effectively. To achieve this, technology emerges as a pivotal ally. In this #Blog, we will explore your accounting firm. From embracing cloud-based solutions to integrating scalable systems and processes, we will provide actionable insights to help your firm meet the evolving needs of your clients and the market.

The Power of Scalability: Meet Client Needs Stay Competitive Operational Efficiency #Revenue_Growth

Leveraging Technology for Scalability: #Cloud_Based_Solutions Integrated Systems Scalable Processes #Data_Analytics #Security and Compliance

Actionable Insights for Your Firm: Evaluate Current Systems Embrace the Cloud Training and Skill Development Data-Driven Decision-Making Cybersecurity and Compliance

read more: (https://www.caofficeautomation.com/unlocking-business.../)

Powered By : #Accountants_Practice_Management_Software Our website: https://www.caofficeautomation.com/ Follow us on... Instagram: https://www.instagram.com/ca_office_automation/ Twitter (X): https://twitter.com/caofficeauto LinkedIn: https://www.linkedin.com/company/ca-office-automation/ YouTube: https://www.youtube.com/channel/UC2iMV5-pkrQ6Pdh6q6m1I0A

5 notes

·

View notes

Text

September 2025 CA Final Exams: Mock Test Papers Schedule Released

Board of Studies (Academic) The Institute of Chartered Accountants of India

ANNOUNCEMENT Mock Test Papers Series – I & Series II for CA. Final students appearing in September 2025 Examinations The Board of Studies is commencing Mock Test Papers Series – I from July 21st , 2025 & Mock Test Papers Series – II from August 4th, 2025 for CA Final students appearing in September 2025 Examinations. The Mock Test Paper Series I & Series II will be conducted in physical/virtual mode(s). Students interested in physical mode may approach the respective branches in their area. The schedule for the same is as follows:

The Question Papers for each subject will be uploaded at BoS Knowledge Portal on www.icai.org as per the schedule by 1:30 PM during this period. Students are advised to download and attempt these papers in the stipulated time limit designated for the papers. The Answer Key to these papers will be uploaded within 48 hours from the date and time of commencement of the respective paper, as per the schedule. Students can examine their answers with respect to the Answer Keys and self-assess their performance.

0 notes