#CopyTrading

Explore tagged Tumblr posts

Text

Gold Copy Trading: Real Trades, Real Gains (May 9~20)

🌟 6 Trades 📉 1 Loss (-4,646 USD) 📈 5 Wins = +17,847.05 USD 📅 From 2025.05.09 to 2025.05.20 💹 Strategy: Buy XAUUSD on rebounds and take quick profits

“Followed the strategy, minimized risks, and the profits came through. Let the results speak.”

#copytrading#goldtrading#forexjournal#xauusd#realresults#forexstrategy#dailytrades#profitproof#tumblrtraders#smartmoney#investmentsuccess

3 notes

·

View notes

Text

Yes, copy trading is legal in most countries. However, its legality depends on the regulations of the country you reside in and the platform you choose to trade with. Many brokers and trading platforms offering copy trading services are regulated by financial authorities such as the SEC (USA), FCA (UK), ASIC (Australia), or CySEC (Cyprus).

It's essential to ensure the platform you use complies with the regulations of your jurisdiction. Always conduct thorough research to confirm that the broker or platform is reputable and authorized to operate.

Copy trading can be profitable for beginners, but it's not without risks. Here are some key considerations:

Advantages:

1. Leverages Expertise: Beginners can benefit from the expertise of experienced traders without needing in-depth market knowledge.

2. Learning Opportunity: By observing the strategies of top traders, beginners can gain insights into market trends and decision-making.

3. Time-Saving: Since trades are executed automatically, it's suitable for those who lack the time to analyze the markets.

Challenges:

1. No Guarantee of Profits: Even skilled traders can have bad days. Past performance is not indicative of future

Risk of Over-Reliance: Solely depending on others' decisions might limit your understanding of trading principles.

3. Fees and Costs: Some platforms charge fees for copy trading services, which can eat into profits.

Tips for Beginners Considering Copy Trading:

1. Choose the Right Trader: Analyze the track record, risk levels, and strategies of the traders you wish to copy.

2. Diversify: Spread your investments across multiple traders to mitigate risk.

3. Start Small: Begin with an amount you can afford to lose while you get familiar with the process.

4. Stay Informed: Even with copy trading, understanding the basics of trading will help you make better decisions.

In conclusion, copy trading is legal and can be a valuable tool for beginners when used wisely. However, it's essential to manage your expectations, understand the risks, and choose reputable platforms and traders.

#copytrading#saintvincent#cyprus#turksandcaicos#business#success#bitcoin#cryptoinvestment#cryptotrading

3 notes

·

View notes

Text

🚀 Want to Profit Like a Pro Without Being One?

With StartCopyFX.com, you can start earning from the forex market by automatically copying top-performing traders. No trading experience needed!

💡 Why StartCopyFX? ✅ 100% hands-free copy trading ✅ Follow expert traders with proven results ✅ Real-time earnings & full transparency ✅ Trusted platform – secure & user-friendly ✅ Ideal for beginners and busy investors

📊 Whether you’re looking to grow your wealth passively or diversify your investment portfolio, StartCopyFX.com gives you the tools to succeed.

🌍 Join a global network of smart investors today. Click here to start your journey → StartCopyFX.com

1 note

·

View note

Text

ZuluTrade: The World's Oldest Broker-Agnostic Social Trading Platform

Founded in 2007, Headquartered in Greece, ZuluTrade is the world’s first social trading platform that leveraged the powers of the trading community and algorithmic performance ranking to connect traders with investors.

An industry leader for 17 years and winner of the Best Social Trading Solution in the Middle East and African Region (MEA) in 2024, ZuluTrade has been credited with revolutionizing copy trading by creating a “one of its kind” socially-powered broker and platform-agnostic social network. We have over one million users in 198 countries, who not only benefit by copying the trades of experienced traders, but also leverage our social trading platform to share their knowledge, ideas with a strong, irreplaceable social community.

2 notes

·

View notes

Text

How to Open DEMO ACCOUNT for FOREX TRADING? in PUPRIME Broker!

youtube

#stockmarket#डेमोअकाउंटखोलें#ब्रोकरतुलना#metatrader5#scalpingtradingstrategy#copytrading#puprime#makemoneyonline#puprimereview#Youtube

0 notes

Link

🔥 NEW on CopyTraderCrypto: $TRUMP Token is making waves! 🇺🇸💰 Whether you're riding the meme coin momentum or betting big on 2024 energy, this one's grabbing serious attention.

📈 Check the charts, copy top traders, and see what the hype is about 👉

🧠 DYOR. Copy smart. Trade smarter.

1 note

·

View note

Text

Copy trading is basically like hitting the “copy-paste” button on someone else’s trades. You choose a trader who’s experienced, and whatever they trade — your account does the same, Visit to learn more.

0 notes

Text

Chancen und Risiken beim Copy-Trading – Warum Sie es ausprobieren sollte

Neuer Artikel: https://multibank.cash/chancen-und-risiken-beim-copy-trading-warum-man-es-ausprobieren-sollte/

Chancen und Risiken beim Copy-Trading – Warum Sie es ausprobieren sollte

Copy-Trading ist eine beliebte Methode, um in den Finanzmärkten zu investieren, insbesondere für Einsteiger. Dabei kopiert man automatisch die Trades erfahrener Trader. Doch wie bei jeder Anlagestrategie gibt es Vor- und Nachteile.

✅ Chancen von Copy-Trading

Keine Vorkenntnisse nötig

Ideal für Anfänger, die noch keine Trading-Erfahrung haben.

Man lernt von Profis, indem man ihre Strategien beobachtet.

Zeitersparnis

Keine stundenlange Marktanalyse notwendig.

Der ausgewählte Trader übernimmt die Entscheidungen.

Diversifikation möglich

Man kann mehrere erfolgreiche Trader kopieren, um das Risiko zu streuen.

Emotionsloses Trading

Automatische Ausführung verhindert impulsive Entscheidungen aus Angst oder Gier.

Potenzial für passive Einkommensströme

Bei richtiger Trader-Auswahl kann man langfristig profitieren.

❌ Risiken von Copy-Trading

Verlustrisiko

Auch erfahrene Trader machen Verluste – diese werden 1:1 kopiert.

Keine Garantie für Erfolg, selbst bei Top-Tradern.

Blindes Vertrauen in fremde Strategien

Man weiß nicht immer, warum der Trader bestimmte Entscheidungen trifft.

Einige Trader nutzen riskante Hebel oder kurzfristige Spekulationen.

Gebühren und versteckte Kosten

Plattformen und erfolgreiche Trader verlangen oft Gebühren oder Performance-Provisionen.

Psychologische Fallen

Nach einigen Verlusten neigen Anleger dazu, ständig den Trader zu wechseln – das kann die Performance verschlechtern.

Marktrisiken & Black Swan-Events

Unvorhersehbare Marktcrashs können auch die besten Trader treffen.

🔥 Warum man Copy-Trading ausprobieren sollte

Trotz der Risiken ist Copy-Trading einen Versuch wert, weil:

✔ Man ohne eigenes Wissen vom Wissen anderer profitiert. ✔ Es eine einfache Möglichkeit ist, in den Finanzmarkt einzusteigen. ✔ Man dadurch Trading-Strategien lernen kann. ✔ Es weniger zeitintensiv ist als aktives Selbst-Trading.

🔎 Wichtig:

Nur mit Geld investieren, das man bereit ist zu verlieren.

Mehrere Trader mit langfristig erfolgreicher Performance auswählen.

Risikomanagement beachten (z. B. Stop-Loss nutzen).

Fazit:

Copy-Trading kann ein guter Einstieg ins Trading sein, aber es ist kein ��sicherer Geldverdienst“. Wer es ausprobiert, sollte sich über die Risiken bewusst sein und verantwortungsvoll investieren.

➡ Würdest du Copy-Trading versuchen? Oder hast du schon Erfahrungen damit? 🚀

Die 2 besten CopyTrading Anbieter:

Vantage Markets

MultiBank Group

0 notes

Text

Unlocking Forex Success: Master the Art of Compounding Your Small Account

Compounding is the unsung hero of Forex success. Many traders, especially those who are new to Forex trading for beginners, underestimate its power. Yet, by reinvesting profits wisely, even a modest account can evolve into a robust portfolio. In this post, we explore practical steps to harness the benefits of compounding, with insights that benefit everyone from those looking to learn forex to experienced professionals working with Forex trading and investment consultants.

What Is Compounding in Forex?

Compounding means using your profits to generate even more profits. Rather than withdrawing gains, you reinvest them to boost the base on which future profits are calculated. This method is not only used by seasoned traders but also recommended by experts at PipInfuse. When applied carefully, the cumulative effect of compounding can turn a small starting balance into a substantial nest egg over time.

How to Grow Your Small Account

Set Realistic Goals

For Forex trading for beginners, the temptation to chase quick wins can lead to impulsive decisions. A measured approach involves setting realistic monthly growth targets—typically between 3% and 10%—to ensure that your account grows steadily while managing risks effectively.

Implement Smart Risk Management

Even the most promising strategy can falter without robust risk management. Limiting risk to a small percentage of your account per trade (commonly 1-2%) protects your capital from severe drawdowns. This discipline is crucial for long-term growth and is often highlighted by Forex trading and investment consultants when advising traders.

Embrace Copy Trading for Beginners

If the intricacies of compounding seem overwhelming, copy trading for beginners offers a viable alternative. By mirroring the trades of experienced market players, you not only potentially benefit from their expertise but also gain valuable insights. Trusted platforms such as PipInfuse facilitate this process, enabling you to learn forex in a practical, hands-on manner.

Reinvest Strategically

The key to compounding lies in reinvesting your profits gradually. Instead of increasing trade sizes dramatically, consider a measured scale-up as your account grows. This careful approach ensures that you remain within your risk tolerance while capitalising on the snowball effect that compounding offers.

The Long-Term Benefits of Compounding

To illustrate, imagine starting with £1,000 and achieving a steady monthly return of 5%. Over time, the account doesn’t just grow—it accelerates:

After 6 months, your balance could exceed £1,300.

In 12 months, it might reach close to £1,800.

With consistent reinvestment, a few years down the line, a small account can transform significantly.

These figures are illustrative, but they underscore the exponential potential of compounding, a fundamental concept that every trader should learn forex thoroughly to exploit.

----

Success in Forex isn’t solely about high-risk, high-reward trades; it’s about steady, disciplined growth. Whether you are a novice embarking on your journey with Forex trading for beginners or an experienced trader seeking refined strategies from reputable Forex trading and investment consultants, the principles of compounding remain universally applicable. By embracing techniques such as copy trading for beginners and relying on trusted experts like those at PipInfuse, you can build a strong foundation for long-term financial growth.

Remember, the road to success in the Forex market is a marathon, not a sprint. With patience, consistency, and the right strategies, even a small account can yield impressive results.

Happy Trading!

PipInfuse

#ForexTrading#ForexForBeginners#CopyTrading#ForexInvestment#TradingStrategy#PipInfuse#ForexEducation#LearnForex#TradingTips#FinancialGrowth#CompoundingForex#ForexSuccess#InvestmentConsulting#ForexTraders#RiskManagement#TradingMindset#WealthBuilding#ForexSignals#ForexCommunity#MarketAnalysis

0 notes

Text

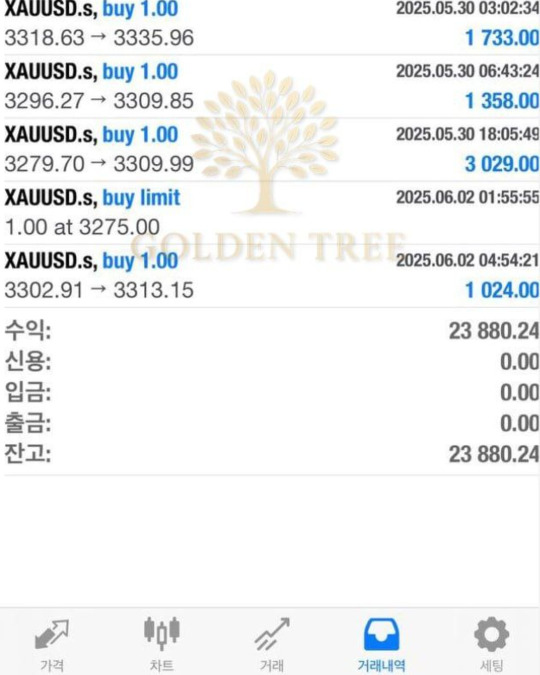

Trading Log: May 30 – June 2 (XAUUSD.s Copy Trades)

Tracked positions: 3318.63 → 3335.96 3296.27 → 3309.85 3279.70 → 3309.99 3302.91 → 3313.15

Total profit: ₩23,880 over 4 trades. Nothing fancy, just smooth following.

Steady and consistent results even without touching anything directly.

#xauusd#goldtrading#copytrading#tradingjournal#profitreport#forextrader#tumblrfinance#dailytrades#copytradejourney#goldmarket#매매후기

0 notes

Text

Copy Trading on 3Commas: How to Earn Like a Pro Without Trading Experience

💰 Want to make money in crypto but lack trading experience? Copy trading on 3Commas lets you automate your trades by following professional traders, helping you earn like a pro without spending hours analyzing charts. With copy trading, you can:✅ Automatically copy trades from top-performing traders✅ Profit from market moves without needing expert knowledge✅ Minimize risks by diversifying your…

0 notes

Text

Choose a Trader to Follow

Explore the traders' leaderboard to find and select the best-performing trader that suits your investment goals.

Set Your Investment Amount

Determine and allocate the amount you wish to invest in copying the selected trader.

Subscribe and Start Copytrading

Click the ‘Subscribe’ button to automatically replicate the trader’s activities in your account.

0 notes

Text

vimeo

Trade stocks, indices, commodities & more with Giraffe Markets.

Discover the power of trading with Giraffe Markets! Trade stocks, indices, commodities, and options with ease. Explore our unique Copy Trading feature and start following expert traders today. Visit Giraffe Markets to get started!

#GiraffeMarkets#CopyTrading#Forex#StockTrading#Indices#Commodities#Options#TradingMadeEasy#Investing#TradeLikeAnExpert#Vimeo

0 notes

Text

Today’s Business Environment and Starting a Business

Hey there! Since I’ve personally experienced trading as a part-time hobby along with a day job, I’ve come to understand how daunting it can be to venture into the world of business if you are starting with no capital. Now let me inform you, success is definitely not out of the realm of possibilities now is it, newb?

Today, I would like to discuss several trends that affect businesses currently and how you can benefit from them following what I have learned over the years as well as through ORION Wealth Academy.

Digital Transformation

In both trading and business, digital transformation is a game-changer. When I first started, I quickly realized how essential it was to embrace technology — not just to keep up, but to get ahead. Whether it’s using AI to analyze market trends or cloud tools to manage business operations, digital tools are your best friend. If you’re starting a business, integrating these technologies from the beginning can set you up for success.

2. Remote and Hybrid Work Models

Balancing trading with a full-time job made me appreciate the flexibility of remote work. It’s no surprise that more businesses are adopting remote and hybrid models. The freedom to work from anywhere has not only made my life easier but also shown me how businesses can thrive by offering flexibility. If you’re starting out, consider how you can structure your business to take advantage of remote work — it can open up opportunities you might not have thought possible.

3. Sustainability and Corporate Responsibility

One thing I’ve learned is the importance of aligning with today’s values — especially sustainability. More and more, consumers want to support businesses that care about the environment and social issues. Starting a business with a focus on sustainability isn’t just a trend; it’s a way to build trust and loyalty with your customers from day one.

4. Personalization and Customer Experience

In trading, just like in business, understanding your audience is key. People want personalized experiences, whether they’re investing or shopping. Thanks to what I’ve learned at ORION, I now know how to use data to tailor my strategies — and you can do the same in your business. Start with a customer-first mindset, and you’ll see how it pays off in the long run.

5. E-commerce and Omnichannel Strategies

E-commerce has exploded, and if you’re not online, you’re missing out. When I was just getting started, having an online presence seemed daunting. If you’re launching a business, make sure you’re not only present online but also thinking about how your customers interact with you across all channels — both online and offline.

How to Get Started

Therefore, what are you going to do to begin at the beginning, that is from scratch? I assume that is mainly about attitude and equipment or tools. First you should check them out with your line of business and learn how you can turn these trends to your advantage. Then, it is possible to create a clear strategy to incorporate technology, be as flexible as possible, and focus on the customer. You do not have to make big investments initially — each trader or businessman once in their entrepreneurial journey begins with something small. Networking has also been important for me i think people should go out there and seek experienced people in their line of work and learn from them and even seek for guidance. I would also like to emphasize the need to continue learning always. The commercial world is dynamic and everyone requires to be keen and be on the look out at all times.

Ready to Level Up?

If I have learned anything from this journey it has to be the importance of education. I was given a different way of enhancing my understanding of things through the knowledge that was taught in ORION Wealth Academy in situations that may relate to trading or even management of a business to mention but a few. They have classroom and internet based programs that can assist you in grasping today’s challeging market. Beginner or advanced, ORION has a place for you to start, or to advance your skills as a dancer. Go ahead do not procrastinate, begin constructing your dreams right away!

0 notes

Text

Introduction to Copy Trading: What It Is and Why It Has Become Popular

1. Introduction

In the landscape of modern investments, Copy Trading has emerged as one of the most accessible and innovative strategies to participate in global financial markets. Its growing popularity signals a significant shift in how people, especially those new to the world of investing, manage and grow their capital.

If just a few years ago the idea of operating in financial markets seemed reserved for a select few with advanced technical knowledge, today, thanks to Copy Trading, even novice investors can benefit from the expertise of professionals. This article aims to explore in detail what Copy Trading is, how it works, and why more and more people in Europe and around the world are choosing this investment method to diversify and optimize their portfolios.

2. What Is Copy Trading?

Copy Trading represents a true revolution in the world of investments. It is a system that allows investors to automatically replicate the trades executed by expert traders in financial markets. In practice, every buy or sell operation carried out by the selected trader is automatically executed on the investor's account in real-time.

Origins and Development

The origins of Copy Trading date back to the early 2000s, when online trading platforms began to gain traction, making financial market investment more accessible. Initially, these platforms were primarily used by expert traders, but it soon became apparent that there was potential to make trading accessible to the general public. Copy Trading emerged as a response to this need, making it possible for anyone, regardless of their level of experience, to benefit from the knowledge and skills of professional traders.

How It Works

The operation of Copy Trading is simple and intuitive. After registering on a trading platform that offers this service, the investor can select one or more traders to copy. The platform automatically replicates all the chosen trader’s operations on the investor’s account, in proportion to the capital that the investor has decided to allocate. While the process is fully automated, the investor always retains control over their account settings, such as deciding to stop copying at any time or adjusting the capital allocation.

3. Advantages of Copy Trading

Accessibility for New Investors

One of the main strengths of Copy Trading is its ability to make investing in financial markets accessible to those who do not have a specific technical background. This tool allows anyone to start investing by following in the footsteps of experienced traders, learning directly from their operations. For those new to the investment world, Copy Trading represents a unique opportunity to understand market dynamics without immediately facing the risk of costly mistakes.

Reduction in Time Management

Copy Trading is particularly advantageous for those who do not have the time or ability to constantly monitor the markets. The ability to automatically replicate the operations of an expert trader frees the investor from the need to make complex trading decisions and to continuously monitor market fluctuations. This approach allows for a more relaxed and less demanding portfolio management, ideal for those who want to invest without having to directly manage every operational detail.

Intelligent Diversification

Another significant advantage of Copy Trading is the ability to diversify one’s portfolio intelligently. Thanks to this tool, investors can follow multiple traders simultaneously, each with their own strategy and market approach. This not only reduces overall risk but also allows for benefiting from different market perspectives, increasing the chances of success. Diversification, as is well known, is one of the fundamental principles for prudent and profitable capital management.

Passive and Continuous Learning

Beyond the financial benefits, Copy Trading also offers a learning opportunity. Investors can observe the strategies implemented by the traders they follow, thereby gaining a better understanding of market logic and gradually improving their own trading skills. This passive but continuous learning can prove extremely valuable in the long term, especially for those who aspire to become independent traders.

4. Risks Associated with Copy Trading

Dependence on the Selected Trader

While offering numerous advantages, Copy Trading is not without risks. One of the main risks is the dependence on the selected trader. If the chosen trader goes through a period of poor performance or changes strategy, the investor will inevitably bear the consequences. Therefore, it is essential to select traders carefully, based on an in-depth analysis of their historical performance, risk approach, and transparency.

Market Risks and Volatility

Like all forms of investment, Copy Trading is subject to market risks. Unpredictable market fluctuations, influenced by economic, political, or social events, can significantly impact the performance of the copied traders and, consequently, the results achieved by the investor. Although Copy Trading reduces the need to make direct operational decisions, it is important to be aware that financial markets remain inherently volatile and that no strategy can guarantee success in every circumstance.

Risk of Overexposure

Another risk associated with Copy Trading is overexposure, or the excessive allocation of capital to a single trader or specific strategy. This can happen when too many traders are copied without careful capital management or when too much capital is entrusted to one trader. It is crucial to maintain a balance in the portfolio, regularly monitoring operations and, if necessary, intervening to rebalance exposure to risk.

5. Why Has Copy Trading Become Popular?

Growing Interest in Online Investments

The rise of Copy Trading is closely linked to the increased interest in online investments. In an era where more and more people are looking for ways to diversify their income streams, Copy Trading offers an accessible and transparent solution. The ability to participate in global financial markets without necessarily having advanced technical skills has attracted a broad audience, ranging from novices to more experienced investors seeking new opportunities.

Simplicity, Transparency, and Control

Simplicity and transparency are two key factors that have contributed to the spread of Copy Trading. Platforms offering this service allow users to clearly see the past performance of traders, their strategies, and the associated risk level. This level of transparency enables investors to make informed decisions and feel more secure in their investment choices. Additionally, the ability to maintain full control over one’s account, with the option to stop copying or modify settings at any time, provides added security.

Proven Performance and Success Stories

One of the elements that have most contributed to the popularity of Copy Trading is the ability to see concrete and documented results. Copy Trading platforms often highlight the successes of their top traders, showing detailed statistics and success stories that inspire confidence in new users. This transparency in performance has helped many investors recognize Copy Trading as a viable and profitable option.

6. Introduction to Solidity: A Success Story

In the context of Copy Trading, Solidity stands out as one of the most reliable and transparent platforms available. Specializing primarily in the AUD/CAD currency pair, Solidity offers investors a unique opportunity to access a robust and time-tested trading strategy.

A Transparent and Reliable Platform

Solidity is based on principles of transparency and reliability, ensuring that every operation is executed with precision and that the results are easily verifiable by users. Solidity's back test, conducted with real historical data and verified with broker FP Markets data, has demonstrated 99.9% accuracy compared to actual performance, providing investors with the confidence that the adopted strategies are solid and well-founded.

Continuous Expansion and Innovation

Beyond the success already achieved with the AUD/CAD pair, Solidity is expanding with the introduction of a new bot for the GBP/NZD pair. This new opportunity is currently available in preview for community leaders and will be open to the public starting in November. This expansion demonstrates Solidity’s commitment to providing diversified and cutting-edge investment solutions, always keeping security and strategy effectiveness at the forefront.

7. Conclusion

Copy Trading represents one of the most interesting innovations in the world of modern investments. It offers investors, regardless of their level of experience, the opportunity to participate in global financial markets with simplified risk management and the potential for significant returns. While Copy Trading is not without risks, the ability to select and follow experienced traders provides an important competitive advantage, especially for those approaching the trading world for the first time.

Solidity, with its transparent platform and verified investment strategies, represents a unique opportunity for those looking to maximize their returns through Copy Trading. With continuous expansion and a commitment to innovation, Solidity is poised to become a benchmark for investors seeking security and performance in financial markets.

1 note

·

View note

Text

CFD (Contract for Difference) trading is a type of trading where you speculate on the price movements of financial assets—such as stocks, forex, commodities, and indices—without owning the underlying asset. Instead, you trade contracts that reflect the asset's price changes. CFDs allow you to trade with leverage, meaning you can control larger positions with a smaller amount of capital. However, while leverage can amplify profits, it also increases potential losses. CFD trading is popular for its flexibility, as traders can go long (buy) or short (sell) to profit from both rising and falling markets.

0 notes