#Dth and Data Card Recharge Services

Explore tagged Tumblr posts

Text

Recharge Software Company

Partner with a leading recharge software company to build secure, scalable multi recharge platforms for B2B and B2C businesses.

Launch a successful multi recharge business with powerful software that manages agents, commissions, payments, and multiple operators.

Streamline your B2B recharge services with advanced b2b recharge software supporting agent wallets, multi-operator recharges, and secure payments.

Choose a trusted recharge software development company for building secure, scalable, and feature-rich recharge solutions

Simplify prepaid, postpaid, DTH, and data card recharges with advanced mobile recharge software. Fast, secure, and multi-operator compatible.

#Recharge software#multi recharge software#recharge software application#recharge software company#recharge software development#mobile recharge software

0 notes

Text

How to Get an Emergency Loan in Delhi Without Any Documents?

Emergencies don’t wait for anyone—especially not for paperwork. Whether it’s a sudden medical expense, last-minute travel, or an urgent repair, the need for instant funds is real. But you can use Emergency Personal Loans. What if you don’t have your salary slips, bank statements, or other conventional documentation ready?

In the past, getting a loan without documents in Delhi was almost impossible. But with evolving financial technology and customer-centric platforms like Loanswala, it's now possible to get Emergency Personal Loans even without traditional paperwork. In fact, you can now apply for an Urgent Cash Loan in Delhi with minimal documentation and receive funds in as little as 24 hours.

This blog explains how to access Fast Loan Services in Delhi, what documentation (if any) may still be required, and how to improve your chances of getting approved quickly.

Why Emergency Loans Matter in a City Like Delhi

Life in Delhi moves fast—and so do financial emergencies. Whether you’re a salaried professional, a gig worker, or a small business owner, access to quick cash can make a huge difference.

Common reasons people look for Emergency Personal Loans include:

Medical emergencies

Unexpected travel

Job loss or income delays

Last-minute educational expenses

House repairs or appliance replacements

Business cash flow issues

In all of these cases, the last thing you want to do is gather and submit a pile of documents. That’s where Fast Loan Services in Delhi shine.

Is It Possible to Get a Loan Without Documents?

Yes, you can apply for an Emergency Personal Loan without physical documents. This doesn’t mean the lender won't verify anything—it means the process has become digital and flexible.

Platforms like Loanswala allow for:

Paperless applications

eKYC using Aadhaar and PAN

Alternative data-based underwriting

Instant eligibility checks

This system is especially useful for those who don’t have conventional proof of income or detailed credit history.

Key Features of Emergency Loans Without Documents

Instant Approval

Get decision within minutes

Online Process

No in-person visits

Minimal or Zero Paperwork

Digital KYC replaces physical forms

24–48 Hour Disbursal

Some lenders disburse same-day

Flexible Loan Amounts

From ₹10,000 to ₹5 lakhs depending on profile

Custom Tenures

Repayment from 3 months to 5 years

No Collateral Required

Unsecured credit access

These features make Urgent Cash Loan in Delhi a lifesaver for people who can’t afford delays.

Who Can Apply for These Loans?

You don’t have to be a salaried employee to get fast cash. Lenders consider:

Salaried professionals

Freelancers

Gig workers (e.g., cab drivers, delivery agents)

Self-employed business owners

Retirees with pension

All you need is a valid ID, a mobile number linked to Aadhaar, and a bank account.

What “No Documents” Really Means

Let’s be clear: “no documents” means no physical documentation. Basic verification still happens digitally. Here’s what’s usually needed:

Aadhaar Card (for eKYC)

PAN Card (for credit check)

Mobile number linked to Aadhaar

Bank account (for disbursal)

Platforms like Loanswala take these inputs to provide a pre-approved limit and match you with lenders that offer Fast Loan Services in Delhi.

Alternative Documents That May Be Accepted

If your profile is weak or your CIBIL score is low, lenders might request soft alternatives, like:

UPI transaction records

Rental income proof

GST returns or basic business proof

Utility bill payments

Mobile or DTH recharges (payment behavior)

Digital lending platforms are evolving to assess your financial behavior, not just your salary slip.

How Loanswala Helps You Get Instant Loans Without Documents

Loanswala is a trusted loan aggregator in Delhi that bridges the gap between borrowers and lenders. Here’s how it makes Emergency Personal Loans easier to access—even without documents.

Simple Application Form

Takes just 2–3 minutes to fill. No uploads needed at the start.

Real-Time Eligibility Check

Get matched instantly with lenders who accept minimal documentation.

Digital KYC

No physical ID needed. Aadhaar OTP-based verification.

Soft Credit Pull

Doesn’t damage your credit score when checking eligibility.

Disbursal Within Hours

If your profile matches lender criteria, loans are disbursed within 24–48 hours.

Zero Hidden Charges

Everything is transparent—from interest to processing fee.

If you’re looking for Fast Loan Services in Delhi, Loanswala is one of the best platforms to use.

Loan Amounts and Interest Rates

Profile Type

Loan Amount Range

Interest Rate Range

Salaried Professionals

₹25,000 – ₹5,00,000

11% – 24% p.a.

Self-Employed / Freelancers

₹10,000 – ₹2,00,000

15% – 28% p.a.

Gig Workers / Others

₹5,000 – ₹50,000

18% – 30% p.a.

Loanswala helps reduce these interest rates by negotiating with partner lenders on your behalf.

Common Uses of Emergency Personal Loans

Medical treatment

Rent or lease payments

Paying school or tuition fees

Vehicle repair or fuel costs

Home repair during monsoon

Urgent family travel

Business purchase orders

When time is short and needs are urgent, a loan without documents is often the only solution. Platforms like Loanswala streamline the process.

Tips to Get Approved for an Emergency Loan Without Documents

1. Use Your PAN and Aadhaar

These are the minimum digital identity proofs lenders need.

2. Maintain a Clean Bank Record

Even without income proof, regular deposits or digital payments help.

3. Avoid Loan Stacking

Don’t apply to too many lenders simultaneously—it lowers your credit score.

4. Repay Existing Loans On Time

Past repayment behavior is one of the strongest factors in approval.

5. Check Eligibility with Loanswala First

Avoid random applications. Loanswala helps you apply only where you’re most likely to get approved.

Real-Life Scenarios

Scenario 1: College Student

Neha, a student in South Delhi, needed ₹15,000 to pay her hostel rent. Without a job or income proof, she used Loanswala to get a short-term Emergency Personal Loan approved through UPI activity and Aadhaar verification.

Scenario 2: Delivery Partner

Ravi, a Zomato delivery executive, had an accident and needed ₹20,000 for treatment. His bank activity showed regular UPI earnings. Loanswala helped him get an Urgent Cash Loan in Delhi without a salary slip.

Scenario 3: Freelancer

Shweta, a freelance designer, applied for ₹50,000 to buy a new laptop. She used her past invoices and e-wallet records to get approved without physical documents via Fast Loan Services in Delhi.

Advantages of Loans Without Documentation

Zero paperwork hassle

Quick approvals & disbursals

No office visits

Ideal for gig workers & freelancers

Safe & digital process

No collateral needed

Loanswala has partnerships with lenders that specialize in no-doc, emergency loans.

Risks to Consider

While digital lending is helpful, it comes with a few precautions:

Higher interest rates (due to unsecured nature)

Shorter repayment tenure

Strict penalties on late payments

Possible loan app scams—avoid unverified lenders

To avoid these risks, stick to trusted aggregators like Loanswala, which only lists RBI-approved lenders.

Frequently Asked Questions (FAQs)

Q1: Can I really get a loan with no documents?

Yes, lenders accept eKYC and digital data in place of physical documentation, especially via Loanswala.

Q2: How fast can I get the loan?

Approval is possible within 30 minutes, and disbursal within 24–48 hours.

Q3: What if I don’t have a credit score?

Some lenders accept zero or low credit scores based on alternate data. Loanswala can match you with them.

Q4: What’s the interest rate?

Interest rates start at 11% and can go up to 30% depending on the lender and your profile.

Q5: Are these loans safe?

Yes, if you use trusted platforms like Loanswala, which only list RBI-compliant NBFCs and banks.

Conclusion

You don’t need a thick file of documents to get a loan anymore. In today’s digital-first world, Emergency Personal Loans can be approved with just your Aadhaar, PAN, and a smartphone.

Whether you’re a salaried employee, freelancer, or delivery partner, options like Urgent Cash Loan in Delhi are available when you use the right platform. Thanks to Loanswala, accessing Fast Loan Services in Delhi has never been easier or more secure.

The key is to act fast but smart—check your eligibility, avoid random applications, and borrow only what you can repay comfortably.

0 notes

Text

Finkeda Recharge Services: Fast & Reliable Top-Ups

Recharge prepaid mobile, DTH, and data cards instantly with Finkeda. Enjoy quick, secure, and hassle-free digital recharge services anytime, anywhere. For more information visit : https://finkeda.com/recharge/

0 notes

Text

Security and Privacy in Bill Payment Kiosks: Ensuring Safe Transactions

As the demand for digital convenience grows, bill payment kiosks have become a popular and practical solution for customers looking to pay utility bills, recharge services, or complete government transactions quickly and independently. However, as with any financial transaction system, security and privacy are critical.

At Addsoft Technologies, we understand that trust is the foundation of every digital payment experience. That’s why our bill payment kiosks are designed not just for efficiency — but for safety and reliability.

Why Security Matters in Bill Payment Kiosks

Bill payment kiosks often handle sensitive customer data, including:

• Account numbers

• Mobile numbers

• Card or banking details

• Government-issued ID information

Any breach of this data can lead to identity theft, fraud, and reputational damage for the service provider. As digital payment adoption increases, so do the threats. Ensuring end-to-end security is no longer optional — it's essential.

Key Security Features in Addsoft’s Bill Payment Kiosks

Secure Encryption Protocols

All data transmitted between the kiosk and backend systems are protected with end-to-end encryption, including SSL/TLS protocols. This ensures that no unauthorized party can intercept or read the data.

PCI-DSS Compliance

Our kiosks follow Payment Card Industry Data Security Standards, which include secure handling of card information, encryption of stored data, and restricted access to payment interfaces.

User Authentication Options

Kiosks can be equipped with OTP verification, biometric authentication (fingerprint/face recognition), or unique customer IDs to ensure that transactions are completed only by authorized users.

Tamper-Resistant Hardware

All kiosk units are built with tamper-proof materials and secure casings. Internal components are protected against unauthorized physical access, reducing risks of skimming or data theft.

Automatic Session Timeouts

If a user leaves the kiosk without completing a transaction, the system automatically logs out or resets — protecting the customer’s data from exposure.

Privacy Screens and Interface Design

Kiosks are equipped with anti-shoulder-surfing screens and guided workflows that minimize the display of sensitive information — keeping customer details private in public areas.

Real-Time Monitoring and Alerts

The kiosk software can be integrated with backend monitoring systems to detect anomalies, flag suspicious activity, and send real-time alerts to administrators.

Privacy Protection: Respecting Customer Trust

Security is only half the equation — privacy matters just as much. Addsoft’s kiosks are built to collect only essential data and follow data minimization principles. No personal data is stored locally, and user details are purged after each session, ensuring compliance with data protection laws like:

• GDPR (Europe)

• DPDP Bill (India)

• CCPA (USA)

Our systems also allow for customer consent before data is captured or used — building transparency and trust.

Use Cases for Secure Bill Payment Kiosks

• Electricity and Water Bill Payments

• Mobile and DTH Recharge

• Government Tax or Fee Collection

• Insurance Premiums and Loan EMIs

• School/College Fee Submissions

Addsoft Technologies: Your Trusted Partner in Secure Transactions

With years of experience in kiosk design and deployment, Addsoft Technologies offers fully secure, customizable bill payment kiosks that meet both industry standards and user expectations. We focus on:

• Secure hardware architecture

• Compliant software solutions

• User-friendly design for all age groups

• 24/7 technical support and monitoring

Make security your strength, not your worry.

Choose Addsoft Technologies for secure, compliant, and customer-friendly bill payment kiosks.

#blog#article#news#business#technologies#software#electronic#productivity software#enterprise software

0 notes

Text

Revolutionizing the Recharge Experience with Multi-Network Services

In today’s fast-paced world, staying connected is essential, and one of the most common ways to do so is through mobile network recharge. As the number of network providers continues to grow, users often find themselves juggling multiple recharges for different services. This is where the RC Panel comes into play. Offering multi-network recharge services, RC Panel is streamlining the recharge process for millions of users.

What is RC Panel?

RC Panel is a digital platform designed to provide seamless and efficient recharge services for a variety of networks. It supports multiple mobile operators, making it a one-stop solution for recharging your prepaid, postpaid, data plans, and DTH services. Whether you're looking to recharge for Airtel, Jio, Vi, or any other provider, RC Panel has you covered.

Key Features of RC Panel’s Multi-Network Recharge Service

One Platform, Multiple Networks RC Panel eliminates the need for users to visit different websites or apps for recharging services on various networks. All you need is a single RC Panel account to recharge for multiple networks, including popular mobile carriers, DTH services, and data plans.

Instant Recharge Traditional recharge methods can sometimes be slow and tedious. With RC Panel, you can recharge instantly, ensuring that your services are back up and running in no time. This is particularly useful in times of emergency when staying connected is critical.

Affordable and Competitive Prices RC Panel doesn’t just offer convenience; it also provides cost-effective recharge options. By partnering with various network providers, the platform ensures that users can avail themselves of affordable plans, ensuring maximum value for their money.

Easy to Use The interface of RC Panel is designed to be simple and user-friendly, making it accessible to people of all ages. You don’t need to be tech-savvy to recharge your account or manage your services. Just a few clicks, and you’re done.

Secure Transactions Security is a top priority at RC Panel. Users can rest assured knowing that their payment details are protected through encrypted transactions. The platform ensures a safe recharge experience every time.

Multiple Payment Methods Whether you prefer credit cards, debit cards, UPI, or e-wallets, RC Panel supports a variety of payment methods to make your recharge process smooth and hassle-free.

Bulk Recharge Options for Businesses RC Panel isn't just for individual users. For businesses or resellers looking to provide recharge services, the platform offers bulk recharge features. This means that you can manage and handle multiple recharge transactions for employees or customers, all through one dashboard.

Why Choose RC Panel for Multi-Network Recharge?

Convenience: Managing different recharge plans for different networks is time-consuming. RC Panel consolidates everything under one roof.

Time-Saving: Recharge your mobile, internet, and DTH accounts in seconds, instead of navigating through multiple platforms.

Reliability: With RC Panel’s fast and secure recharge system, you can trust the platform to deliver quality service every time.

Great for Businesses: If you’re a retailer or business owner, RC Panel offers reseller options that allow you to cater to your customers’ recharge needs, making it easier to grow your business.

Conclusion

In an increasingly digital world, staying connected is crucial. RC Panel simplifies the process by offering multi-network recharge services in one convenient platform. Whether you are a casual user or a business looking to offer recharge services, RC Panel is an excellent solution to streamline your recharge needs. With features like instant recharges, competitive prices, and secure payment methods, it’s clear why RC Panel is the go-to choice for multi-network recharge services.

#mobile recharge#pan card agency#advertising#multi recharge company#cars#business#money transfer software#mobile recharge software#rc panel#biology#RCPanel#MultiNetworkRecharge#MobileRecharge#DTHRecharge#InstantRecharge#AffordableRecharge#StayConnected#RechargeMadeEasy#RechargeServices#SecureRecharge#OneStopRecharge#FastRecharge#DigitalRecharge#RechargePlatform#OnlineRecharge#moneytransersoftware

0 notes

Text

API Services: Powering Business Growth with Seamless Integration

In today’s fast-paced digital world, businesses require efficient and reliable solutions to stay ahead of the competition. At Apiwala, we provide a wide range of API services designed to help businesses enhance their operations, improve customer experiences, and drive growth. Our powerful and secure APIs cater to various industries, enabling businesses to integrate seamlessly and expand their service offerings with ease.

Our API Services for Business Growth

We offer an extensive suite of APIs tailored to meet diverse business needs:

Recharge API

Fast and reliable recharge solutions for mobile, DTH, and other services, ensuring a seamless user experience.

Lapu Recharge API

Enabling instant LAPU recharges with secure and efficient transactions.

DTH Recharge API

Quick and hassle-free DTH recharge services, enhancing customer satisfaction.

Utility Bill Payment API

Effortless bill payments for electricity, water, and more with a user-friendly interface.

BBPS API

Comprehensive bill payment solutions integrated with Bharat Bill Payment System for secure transactions.

Fast Tag API

Streamline toll payments with instant and reliable Fast Tag recharges.

Credit Card API

Secure credit card processing for seamless and safe transactions.

Flight Booking API

Effortless flight bookings with a wide range of options and real-time updates.

Hotel Booking API

Simplify hotel reservations with fast and accurate booking solutions.

Train Booking API

Hassle-free train ticket bookings with real-time availability checks.

Bus Booking API

Convenient bus ticket bookings with a user-friendly interface and secure payment gateway.

WhatsApp Business API

Engage customers effectively with automated messages and smart communication solutions.

PAN Verification API

Instant and secure PAN verification with OTP-based authentication.

Aadhaar Authentication API

Ensure secure Aadhaar-based identity verification with trusted and reliable integration.

GST Authentication API

Verify GST numbers seamlessly and authenticate businesses with real-time data.

Insurance Premium API

Streamline premium payments for various insurance services with a secure and efficient solution.

Challan API

Enable smooth challan payments and improve service efficiency.

DMT API

Direct money transfer solutions with secure and instant transactions.

All-In-One API Solutions

Comprehensive API suite for all business needs, from payments to bookings, under one roof.

Benefits of Choosing Our API Services

Seamless Integration: Easily integrate our APIs into your existing systems without any hassle.

Fast and Secure Transactions: Enjoy secure and speedy transactions that enhance customer experience.

Reliable Support: Get round-the-clock support from our expert team to ensure smooth operations.

Scalable Solutions: Our APIs are designed to grow with your business, ensuring long-term success.

Cost-Effective: Affordable and flexible pricing plans to suit businesses of all sizes.

Why Choose Apiwala for Your API Needs?

Trusted by Leading Businesses: Our APIs are trusted by top businesses across industries for their reliability and efficiency.

Wide Range of Services: From recharge solutions to travel bookings and financial transactions, we offer a comprehensive suite of APIs.

Innovative Technology: We leverage the latest technology to provide secure and efficient solutions for all your business needs.

Dedicated Support: Our customer support team is always available to assist you with seamless integration and troubleshooting.

Ready to take your business to the next level?Discover how our API solutions can drive your business growth!

Contact Us:

📧 Email: [email protected]📞 Phone: +91 9310842731

Contact us today at www.apiwala.com

0 notes

Text

The In-Building Wireless Market is projected to grow from USD 14772.25 million in 2024 to an estimated USD 24448 million by 2032, with a compound annual growth rate (CAGR) of 6.5% from 2024 to 2032.The global Master Recharge API (Application Programming Interface) market is rapidly evolving, driven by the growing demand for seamless and efficient digital payment solutions. With the increasing penetration of smartphones and the surge in digital financial services, this market is witnessing a significant boost. Businesses across various sectors, from telecom to e-commerce, are leveraging these APIs to provide recharge and utility payment services to their customers. A Master Recharge API serves as an intermediary that connects service providers with end users. It allows businesses to integrate recharge services for mobile, DTH (Direct-to-Home), data cards, utility bill payments, and more into their platforms. Through a single API integration, companies can access multiple service providers, ensuring a seamless user experience.

Browse the full report https://www.credenceresearch.com/report/in-building-wireless-market

Market Drivers

Growing Smartphone Penetration: With billions of smartphone users worldwide, there is a surging demand for digital payment and recharge services. Mobile recharges, bill payments, and subscription renewals are now a part of everyday life, creating a robust demand for Master Recharge APIs.

Digital Transformation: Governments and organizations are promoting cashless transactions and digital ecosystems, further fueling the need for APIs that streamline payment processes.

E-commerce Growth: E-commerce platforms often integrate recharge and bill payment services to enhance customer retention and engagement. Master Recharge APIs enable them to offer these services efficiently.

Rising Demand for White-Label Solutions: Businesses, especially startups, prefer white-label recharge platforms powered by Master Recharge APIs to reduce development costs and accelerate time-to-market.

Challenges in the Master Recharge API Market

Despite its growth, the Master Recharge API market faces some challenges:

Security Concerns: As digital transactions increase, so does the risk of cyberattacks and fraud. Ensuring robust security measures is a priority.

Market Saturation: The entry of numerous players has led to fierce competition, making differentiation a challenge for API providers.

Regulatory Compliance: Adhering to varying regulations across regions can be complex, especially in cross-border operations.

Technological Integration: Businesses need to ensure that APIs are compatible with their existing systems, which can sometimes pose difficulties.

Emerging Trends

The Master Recharge API market is adapting to changing consumer behavior and technological advancements. Notable trends include:

Blockchain Integration: Blockchain technology is being explored to enhance transparency, security, and efficiency in transactions.

AI-Powered Insights: Artificial Intelligence (AI) is being used to provide data-driven insights, helping businesses improve customer experience.

Expansion into Rural Areas: With increasing internet penetration, API providers are targeting underserved regions to broaden their customer base.

Personalized Offerings: Companies are focusing on tailored solutions to meet the unique needs of businesses and consumers.

Future Outlook

The Master Recharge API market is expected to grow exponentially in the coming years. With advancements in technology and the increasing reliance on digital payment systems, this sector presents immense opportunities for innovation and expansion. Industry players must focus on improving API security, scalability, and user experience to stay competitive.

Key Player Analysis:

Airspan Networks

Cobham Limited

CommScope, Inc.

Corning Incorporated

Huawei Technologies Co., Ltd.

JMA Wireless

Nokia

Samsung Electronics Co., Ltd.

TE Connectivity

Telefonaktiebolaget LM Ericsson

Segmentation:

By Solutions:

System Components

Hardware

Software

Services

By System Components:

Antennas

Cabling

Distributed Antenna System

Repeaters

Small Cells

By Business Type:

Existing

New

By Building Size:

Large and Medium Buildings

Small Buildings

By Business Models:

Carrier

Enterprise

Host

By Application:

Commercials

Residential

Government

Hospitals

Industrial Uses

Defense

Retail

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report https://www.credenceresearch.com/report/in-building-wireless-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]: www.credenceresearch.com

0 notes

Text

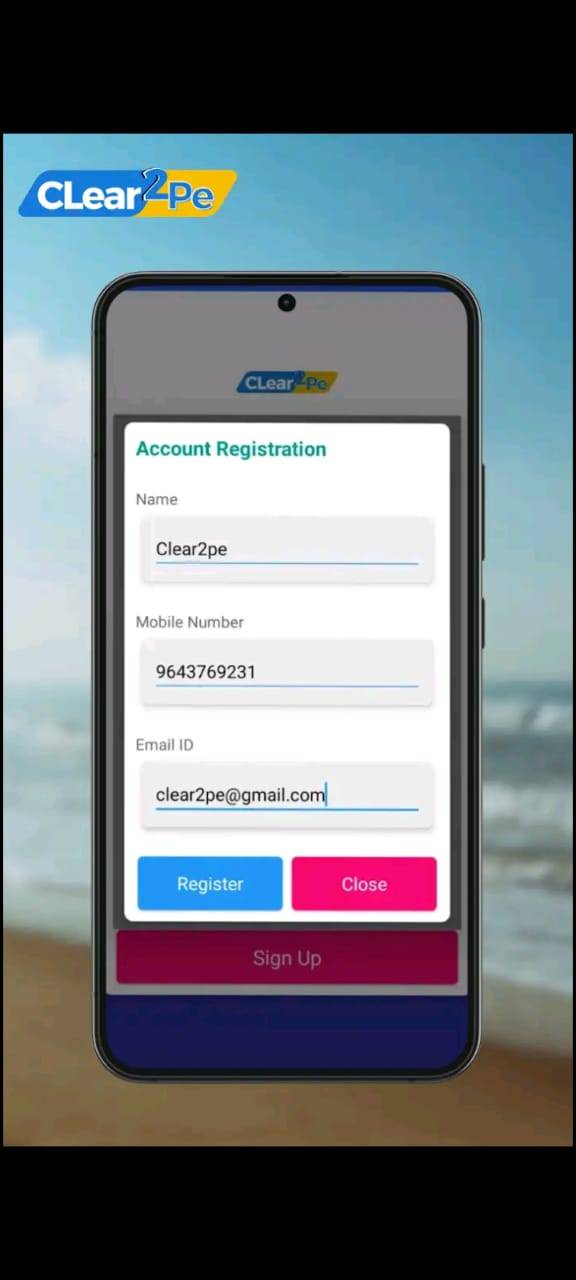

MOBILE RECHARGE COMMISSION APP

clear2pe is a mobile and DTH Recharge Company in India. We provide the facility of one sim all recharge that enables one process for mobile, DTH, postpaid, data card, gas, utility, insurance, landline, electricity bill payment solutions. With the help of this facility, all prepaid and postpaid mobile, bill payments can be done in convenient and secure manner. You would be able to give your customer simple and fast service by using our single SIM for multiple recharges.

Join us to earn additional benefits. We offer attractive margins for all prepaid/postpaid operator including Airtel, Aircel, Vodafone, Idea, Videocon, Tata Docomo, BSNL, Reliance, MTS and leading DTH operator which includes TATA Sky, Dish TV, Sun Direct, Airtel Digital TV, Videocon D2h and Reliance Digital TV. You can check our app or website www.clear2pe.com

1 note

·

View note

Text

Bank of Baroda Tabit

In the fast-paced world of banking, where convenience and efficiency are paramount, the emergence of digital banking solutions has been nothing short of transformative. One such innovation that has been making waves in the financial landscape is the Bank of Baroda Tabit – a cutting-edge digital platform that redefines the way customers interact with their bank.

Introduction to Bank of Baroda Tabit

Bank of Baroda Tabit is a comprehensive digital banking platform introduced by Bank of Baroda, one of India's leading public sector banks. It is designed to offer a seamless banking experience to customers, leveraging the power of technology to simplify financial transactions and enhance accessibility.

Key Features and Benefits

The Bank of Baroda Tabit comes equipped with a plethora of features aimed at streamlining banking operations and enhancing customer satisfaction:

User-Friendly Interface: The platform boasts an intuitive interface that ensures ease of navigation, making banking transactions convenient for users of all demographics.

24/7 Accessibility: With Bank of Baroda Tabit, customers have round-the-clock access to their accounts, enabling them to conduct transactions and manage their finances anytime, anywhere.

Account Management: Customers can view their account balance, transaction history, and account statements with just a few taps on their mobile devices, providing them with real-time insights into their financial activities.

Fund Transfers: The platform facilitates seamless fund transfers between Bank of Baroda accounts as well as to accounts in other banks via NEFT, RTGS, and IMPS, making money transfers hassle-free.

Bill Payments: Customers can pay their utility bills, credit card bills, and other recurring payments directly through the Bank of Baroda Tabit, eliminating the need for manual intervention and ensuring timely payments.

Mobile Recharge: The platform allows users to recharge their prepaid mobile phones and DTH connections instantly, providing added convenience.

Investment Services: Bank of Baroda Tabit offers investment services, enabling customers to invest in mutual funds, fixed deposits, and other financial products through a seamless digital interface.

Customer Support: In case of any queries or assistance required, customers can avail themselves of dedicated customer support services through the Bank of Baroda Tabit platform, ensuring prompt resolution of issues.

Security and Reliability

Bank of Baroda Tabit prioritizes the security and confidentiality of customer data, employing robust encryption techniques and multi-factor authentication protocols to safeguard against unauthorized access and fraud. With state-of-the-art security measures in place, customers can rest assured that their financial information is protected at all times.

Future Outlook

As technology continues to evolve and customer expectations evolve with it, the Bank of Baroda Tabit is poised to adapt and innovate further, introducing new features and functionalities to meet the ever-changing needs of modern banking customers. With a commitment to excellence and a focus on customer-centric innovation, Bank of Baroda remains at the forefront of digital banking transformation in India.

In conclusion, the Bank of Baroda Tabit represents a paradigm shift in the way banking services are delivered, offering unparalleled convenience, security, and reliability to customers. As digital banking continues to gain momentum, platforms like Tabit are set to play a pivotal role in shaping the future of banking, driving financial inclusion and empowerment on a global scale.

0 notes

Text

Best Recharge API Provider

Looking for the best recharge API provider in India? Get secure, fast, and scalable mobile & DTH recharge solutions with high uptime and real-time processing. Start earning commissions today with trusted recharge API services.

Power your platform with a reliable mobile and DTH recharge API. Support all major operators like Airtel, Jio, Vi, BSNL, and Tata Sky. Perfect for apps, portals, and resellers.

Access multiple services with one integration! The best multi recharge API supports mobile, DTH, data card, and utility bill payments—ideal for B2B and white-label businesses

#recharge api#recharge api provider#mobile recharge api#recharge api provider company#multi recharge api

0 notes

Text

Recharge Effortlessly with Muthoot FinCorp ONE

Recharging your mobile phone, FastTag, and DTH connection has never been easier, thanks to the Muthoot FinCorp ONE app. This all-in-one financial app offers a seamless and hassle-free recharge experience, allowing you to stay connected without the inconvenience of visiting physical stores or dealing with complicated processes. In this article, we will delve into the convenient features of the Muthoot FinCorp ONE app that make recharging your devices a breeze.

Quick and Convenient Mobile Recharge: Gone are the days of scrambling to find a recharge shop or running out of balance at critical moments. The Muthoot FinCorp ONE app enables you to recharge your mobile phone instantly, anytime and anywhere. Whether you have a prepaid connection or need to top up your data plan, the app provides a user-friendly interface that allows you to select your service provider, enter your mobile number, and recharge in just a few taps.

FastTag Recharge for Seamless Travel: With the increasing adoption of electronic toll collection systems, having a FastTag has become essential for hassle-free travel on highways. The Muthoot FinCorp ONE app offers the convenience of recharging your FastTag account directly from your smartphone. No need to wait in long queues or worry about carrying cash. Simply open the app, select the FastTag recharge option, enter your account details, and recharge your FastTag balance effortlessly.

Streamlined DTH Recharge: Enjoy uninterrupted entertainment by recharging your DTH connection through the Muthoot FinCorp ONE app. Whether you have Tata Sky, Dish TV, Airtel Digital TV, or any other DTH service, the app supports a wide range of operators. Simply choose your service provider, enter your customer ID or registered mobile number, select your recharge amount or plan, and complete the payment. The app ensures a seamless DTH recharge experience with just a few taps.

Multiple Payment Options: To cater to your preferences, the Muthoot FinCorp ONE app offers a variety of payment options for recharging your devices. You can choose to pay using your debit card, credit card, net banking, or even popular mobile wallets. The app ensures the security of your financial information by implementing advanced encryption techniques, giving you peace of mind while making transactions.

24x7 Availability and Zero Wait Time: The Muthoot FinCorp ONE app is available 24 hours a day, 7 days a week, allowing you to recharge your devices at your convenience. Say goodbye to waiting in line or relying on store timings. Whether it's early in the morning, late at night, or even on weekends and holidays, the app is always ready to serve you. Experience the freedom of recharging your mobile, FastTag, and DTH connection with zero wait time.

Transaction History and Offers: The app provides a comprehensive transaction history, allowing you to keep track of your recharges and payments. You can easily review your past recharges, track your expenditure, and stay updated on your account balance. Additionally, the Muthoot FinCorp ONE app often features exclusive offers and discounts on mobile recharges, FastTag top-ups, and DTH plans, ensuring that you get the best value for your money.

The Muthoot FinCorp ONE app simplifies and enhances the recharge experience for your mobile phone, FastTag, and DTH connection. With its user-friendly interface, multiple payment options, and 24x7 availability, you can recharge your devices anytime, anywhere. Say goodbye to long queues, complex procedures, and the inconvenience of carrying cash. Embrace the convenience of the Muthoot FinCorp ONE app and stay connected effortlessly.

Remember, whether it's a recharge, bill payment, or financial transaction, the Muthoot FinCorp ONE app is your go-to destination for all your payment needs.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Seamless Recharges, Limitless Possibilities: Exploring Payniko Payment Gateway's Transformative Recharge API

Embark on a journey of digital empowerment with Payniko Payment Gateway's cutting-edge Recharge API. In this blog post, we uncover the dynamic features and functionalities that define Payniko's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Payniko is redefining the recharge experience for users and businesses alike.

Effortless Recharge Experience: Delve into the unmatched efficiency of Payniko's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Versatility in Operator Support: Highlight the flexibility of Payniko's Recharge API with its extensive support for diverse operators. Users enjoy the freedom to recharge with their preferred mobile service providers, DTH operators, and data card services, enhancing the overall user experience.

Real-Time Transaction Transparency: Emphasize the importance of real-time transaction updates integrated into Payniko's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Tailored Solutions for Businesses: Illustrate the customizable options available for businesses integrating Payniko's Recharge API. From branded interfaces to personalized features, Payniko empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security at Its Core: Assure users of Payniko's unwavering commitment to security, fortified by robust encryption and authentication protocols. Payniko's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance: Showcase the user-friendly documentation and integration guides provided by Payniko. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Payniko's Recharge API without unnecessary complexities.

User-Centric Design and Accessibility: Explore how Payniko places user-friendliness at the forefront of its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Payniko guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences: Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Payniko's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Payniko Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Payniko is at the forefront of reshaping the recharge landscape within the digital era.

1 note

·

View note

Text

Revolutionizing Refills: Yumype Payment Gateway's Recharge API for Seamless Digital Transactions

Step into the future of digital convenience with Yumype Payment Gateway's groundbreaking Recharge API. In this blog post, we explore the dynamic capabilities and user-centric features that define Yumype's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Yumype is redefining the recharge experience.

Effortless Recharge Journey: Delve into the unmatched efficiency of Yumype's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Multi-Operator Harmony: Highlight the versatility of Yumype's Recharge API with its support for a myriad of operators. Users enjoy the flexibility to recharge with their preferred mobile service providers, DTH operators, and data card services, creating a truly personalized experience.

Real-Time Transaction Transparency: Emphasize the importance of real-time transaction updates integrated into Yumype's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Customization for Unique Brands: Illustrate the customizable options available for businesses integrating Yumype's Recharge API. From branded interfaces to personalized features, Yumype empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security Reinforced: Assure users of Yumype's unwavering commitment to security, fortified by robust encryption and authentication protocols. Yumype's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance: Showcase the user-friendly documentation and integration guides provided by Yumype. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Yumype's Recharge API without unnecessary complexities.

User-Centric Design for Accessibility: Explore how Yumype prioritizes user-friendliness in its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Yumype guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences: Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Yumype's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Yumype Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Yumype is leading the way in reshaping the recharge landscape within the digital era.

0 notes

Text

Recharge Transaction System

RC Panel Recharge Transaction System offers seamless and secure recharge services for mobile, DTH, data cards, and utility bills. Manage all your recharge needs in one place.

In today's fast-paced digital world, the convenience of seamless recharge services is a necessity. Whether you're managing mobile top-ups, DTH services, or utility bill payments, having a reliable recharge transaction system can save you both time and effort. This is where the RC Panel Recharge Transaction System comes into play, offering you a comprehensive solution for all your recharge and transaction needs.

What is RC Panel Recharge Transaction System?

RC Panel's Recharge Transaction System is an advanced, user-friendly platform designed to provide a wide range of digital recharge services. Whether you're an individual looking to top-up your phone, or a business aiming to offer multiple recharge services to your customers, RC Panel makes it easy to manage all your digital transactions in one place.

Key Features of RC Panel Recharge Transaction System

Instant Recharge Services The RC Panel Recharge Transaction System allows you to recharge your mobile, DTH, data cards, and more in real-time. The process is simple and instantaneous, ensuring that you never run out of balance when you need it most.

Wide Range of Services From mobile recharge to bill payments, RC Panel covers a wide array of services. You can handle recharges for prepaid, postpaid, and data card services, as well as utility bills for electricity, water, gas, and broadband. It's an all-in-one solution!

Multi-Operator Support RC Panel works with multiple operators, so you don't have to worry about compatibility. Whether it's for Airtel, Vodafone, Jio, BSNL, or any other telecom operator, you can perform transactions for different service providers, all through a single platform.

Easy Integration for Businesses If you're a business owner, RC Panel offers an easy integration process, enabling you to add recharge services to your existing platform. With a simple API integration, you can start offering recharge services to your customers in no time.

Secure Transactions The security of financial transactions is a top priority at RC Panel. The system uses encryption technology to ensure that all your transactions are protected from fraud and unauthorized access.

24/7 Support RC Panel's customer support team is available around the clock to assist you with any issues or queries you may have. Whether it's about a recharge issue or a technical query, help is always available.

Why Choose RC Panel Recharge Transaction System?

Convenience: Whether you're at home or on the go, you can manage your recharges anytime, anywhere.

Reliability: With real-time processing, you can be assured of instant transactions with minimal downtime.

Cost-Effective: RC Panel offers competitive pricing for recharge services, making it an economical choice for both businesses and individual users.

Comprehensive Dashboard: The dashboard is easy to navigate and gives you a complete overview of your recharge transactions, balances, and history.

Business-Friendly: RC Panel is designed with businesses in mind, offering scalable solutions that grow with your needs.

How to Get Started with RC Panel Recharge Transaction System

Getting started with RC Panel’s Recharge Transaction System is simple. Here’s a step-by-step guide:

Sign Up: Create an account on the RC Panel website.

Choose Your Plan: Select the best plan that fits your needs, whether you're an individual or a business.

Recharge & Start Transacting: Once your account is set up, you can start performing recharge transactions right away.

Monitor Transactions: Keep track of your recharge history and balances through the user-friendly dashboard.

#mobile recharge#multi recharge company#business#money transfer software#pan card agency#rc panel#mobile recharge software#advertising#biology#cars#RechargeTransactionSystem#moneytransersoftware#RCPanel#RechargeServices#MobileRecharge#DTHRecharge#BillPayments#SecureTransactions#InstantRecharge#RechargeMadeEasy#DigitalRecharge#UtilityBillPayments#RechargeSystem#OnlineRecharge#RechargePlatform#BusinessSolutions#APIIntegration#InstantTransactions#RechargeBusiness#SeamlessRecharge

0 notes

Text

Powerful Recharges, Seamless Integration: Unveiling the UPIADDA Payment Gateway’s Recharge API

In the fast-paced world of digital transactions, UPIADDA Payment Gateway stands out with its groundbreaking Recharge API, setting new standards for efficiency and user experience. Join us in this blog post as we delve into the innovative features and functionalities that define UPIADDA's Recharge API, transforming the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how UPIADDA is revolutionizing the recharge experience.

Effortless Transactions, Swift Results: Dive into the efficiency of UPIADDA's Recharge API, designed to simplify and accelerate the recharge process. Explore how users can effortlessly top up their mobile phones, DTH subscriptions, and data cards, providing unparalleled convenience.

Multi-Operator Support for Diverse Choices: Highlight the versatility of UPIADDA's Recharge API with its support for a multitude of operators. Whether users have varied preferences for mobile service providers or DTH operators, UPIADDA's API ensures a seamless recharge experience with their preferred choices.

Real-Time Transaction Monitoring: Emphasize the significance of real-time transaction updates integrated into UPIADDA's Recharge API. Users can stay informed at every step, enhancing transparency and building trust throughout the recharge process.

Tailored Solutions for Businesses: Illustrate the customizable options available for businesses integrating UPIADDA's Recharge API. From branding elements to tailored features, UPIADDA empowers businesses to craft a recharge experience that aligns perfectly with their unique brand identity.

Security at the Forefront: Assure users of UPIADDA's commitment to security, boasting robust encryption and authentication protocols. Explore how UPIADDA's Recharge API prioritizes the protection of sensitive information, ensuring a secure environment for all transactions.

Comprehensive Documentation and Integration Guidance: Showcase the user-friendly documentation and integration guides provided by UPIADDA. Businesses and developers can effortlessly navigate the integration process, harnessing the full potential of UPIADDA's Recharge API without unnecessary complications.

User-Centric Design and Experience: Explore how UPIADDA places a premium on user-friendliness in its Recharge API. Whether users are seasoned tech enthusiasts or newcomers to digital transactions, UPIADDA ensures a seamless experience, fostering accessibility and convenience for all.

Success Stories and Transformative Outcomes: Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of UPIADDA's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By illuminating the features and impact of UPIADDA Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users, showcasing how UPIADDA is leading the charge in reshaping the recharge landscape within the digital era.

0 notes

Text

Oxype Recharge API: Transforming Transactions with Confidence

In the rapidly evolving digital landscape, Oxype Payment Gateway emerges as a frontrunner with its groundbreaking Recharge API. Join us in this blog post as we explore the dynamic features and capabilities that define Oxype's Recharge API, revolutionizing the way we approach mobile, DTH, and data card recharges. From speed and security to customization, discover how Oxype is reshaping the recharge experience.

Efficiency in Action: Dive into the efficiency of Oxype's Recharge API, designed to streamline the recharge process. Explore how users can effortlessly top up their mobile phones, DTH subscriptions, and data cards, enhancing convenience and speed.

Multi-Operator Flexibility: Highlight the versatility of Oxype's Recharge API with its support for multiple operators. Whether it's a variety of mobile service providers or DTH operators, Oxype's API ensures users have the flexibility to recharge with their preferred operators.

Real-Time Transaction Updates: Emphasize the significance of real-time transaction updates embedded in Oxype's Recharge API. Users can stay informed at every step, enhancing transparency and trust throughout the recharge process.

Customization for Businesses: Illustrate the customizable options available for businesses integrating Oxype's Recharge API. From branding elements to tailored features, Oxype enables businesses to create a recharge experience that aligns seamlessly with their unique identity.

Top-Notch Security Measures: Assure users of Oxype's commitment to security with robust encryption and authentication protocols. Explore how Oxype's Recharge API prioritizes the safeguarding of sensitive information, ensuring a secure environment for all transactions.

Comprehensive Documentation and Integration Guides: Showcase the user-friendly documentation and integration guides provided by Oxype. Businesses and developers can effortlessly navigate the integration process, maximizing the benefits of Oxype's Recharge API without unnecessary complexities.

User-Friendly Experience: Explore how Oxype prioritizes user-friendliness in its Recharge API. Whether users are seasoned tech enthusiasts or newcomers to digital transactions, Oxype ensures a seamless experience for all, fostering accessibility and convenience.

Success Stories and Transformative Impact: Conclude the blog post by sharing success stories or testimonials from businesses that have leveraged Oxype's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By delving into the features and impact of Oxype Payment Gateway's Recharge API, this blog post aims to enlighten and inspire businesses and users, showcasing how Oxype is at the forefront of reshaping the recharge landscape in the digital era.

0 notes