#Employee Payroll Software

Explore tagged Tumblr posts

Text

Streamline Salary Processing with Smart Payroll Software

Managing payroll is one of the most important, and one of the most complicated tasks of any business. Payroll by definition is the calculation of an employee's salary, tax deductions, and allowances, as well as disbursing salaries and complying with government and labor regulations. Just one mistake (no matter how minor) can dissatisfy employees or incur penalties and fines. Payroll software can help alleviate many of the issues that businesses face in processing salaries, allowing an organization to make payroll less complicated and error-prone, thereby also saving them time.

What is Payroll Software?

Payroll software is an electronic system that automates all components of payroll (eg salary and wage calculations, tax deductions and allowances, payslips, and compliance). Payroll software makes HR and finance jobs easier by automating payroll and ensuring every employee is paid accurately and on time every time.

Key Features Of Payroll Software

1.Automated salary calculations: Accurately processes earnings, deductions, bonuses, and reimbursements.

2.Tax compliant: Payroll System calculates and deducts tax in accordance with regulations, ensuring compliance to legal requirements.

3.Automatic payslip generation: Automatically creates payslips that are distributed digitally to employees.

4.Attendance and leave integration: Creates and distributes payslips that reflect actual leave used and leave/sick days taken.

5.Direct deposit: Ensures employee salaries are paid directly into the employees bank accounts along secure and timely detailed salary transfers.

6.Custom Reports: Payroll management offers payroll summaries, customization audit trails, and detailed reports that provide transparency of records and support record-keeping.

Why This is Important

Traditional payroll methods are time-consuming, error-prone, and usually involve some duplication of manual entries. The right payroll software can overcome the drawbacks of the traditional methods by streamlining the payroll process, automating the calculations, and ensuring compliance with relevant local laws, where applicable. Payroll software frees up the workload on the HR team, enhances employee trust by ensuring timely payments, and protects the business from costly errors.

Conclusion

Robust payroll software is not optional for growing businesses anymore—it is essential. Payroll software adds certainty, clarity, and accuracy to the payroll process, allowing teams to focus on more strategic work rather than time-consuming spreadsheet work. The right payroll solution will eliminate re-work and enable organizations to run more effectively, and have a happy and motivated workforce.

Don't let errors in payroll affect your business and your employees trust. Invest in payroll software that is just as reliable and hardworking as your team.

TO KNOW MORE VISIT: Savvyhrms

#payroll software#smart payroll software in india#best payroll management software#employee payroll software#smart pay solution software

0 notes

Text

How to Avoid Errors With Payroll Software in India

Payroll management is one of the most critical aspects of running a business. For companies in India, it can also be one of the most complex. Between calculating wages, ensuring tax deductions, managing statutory contributions, and maintaining compliance with the ever-changing labor laws, payroll errors are an all-too-common issue that many businesses face. In fact, errors in payroll processing can lead to dissatisfied employees, compliance issues, and costly penalties. The good news is that with the right Payroll Software in India, businesses can minimize these errors, improve efficiency, and ensure smooth payroll processing.

In this blog, we will explore how Payroll Software can help prevent payroll errors, ensuring your employees are paid accurately and on time. We’ll also dive into the best practices to ensure that your payroll system is set up correctly and that you stay compliant with all applicable laws.

Why Payroll Errors Happen

Payroll errors can stem from a variety of causes. Sometimes, mistakes happen due to manual data entry, incorrect tax calculations, or failure to stay updated on changes to tax laws. Other times, they may arise from miscommunication between HR and employees, or even software limitations. Regardless of the reason, payroll mistakes can have significant repercussions for your business, ranging from financial penalties to damaged employee trust.

For businesses in India, ensuring compliance with labor laws such as Provident Fund (PF), Employees' State Insurance (ESI), and Tax Deducted at Source (TDS) is crucial. Failure to follow these regulations can result in hefty fines and audits, which could easily be avoided with the right tools in place. Payroll Software can automate the payroll process, taking over many of the manual tasks that lead to errors, and reducing the chances of human mistakes.

The Role of Payroll Software in Avoiding Errors

One of the most effective ways to prevent payroll errors is to use Payroll Software in India. These tools are designed to streamline the payroll process, automate calculations, and ensure compliance with regulations. Let's dive deeper into how Payroll Software can help reduce errors in payroll processing.

Automating Tax Calculations

One of the most common areas where errors occur is in tax calculations. In India, tax laws are frequently updated, and businesses must account for changes to tax slabs, exemptions, and deductions. Payroll Software in India automates these calculations based on the latest tax regulations. For example, software like Kredily automatically adjusts TDS calculations for each employee based on their income and tax bracket, reducing the risk of manual miscalculations.

This automation not only ensures compliance but also saves valuable time for HR teams. Instead of manually calculating deductions and tax withholdings, the software does the heavy lifting for you, leaving HR to focus on other tasks that require more attention.

Ensuring Accurate Deductions

In addition to taxes, businesses need to make various deductions from employee salaries, including Provident Fund (PF), Employees' State Insurance (ESI), and professional tax. These calculations can be complex, especially for businesses that have multiple locations or offer different benefits packages to employees.

A reliable Payroll Software can help by ensuring that deductions are applied correctly. For instance, Kredily automatically calculates and deducts the correct amount for PF, ESI, and other statutory contributions, ensuring compliance with Indian labor laws. The system also generates detailed reports, so you can easily track and verify the deductions.

Handling Statutory Compliance

Payroll software doesn’t just help with calculations; it also ensures your business remains compliant with Indian statutory requirements. Payroll Software in India like Kredily is equipped to handle compliance with a variety of labor laws, including the Payment of Gratuity Act, Payment of Wages Act, and the Employees’ Provident Funds & Miscellaneous Provisions Act. By using the software, your company can automatically calculate contributions, generate reports, and file returns with minimal effort.

The software keeps track of deadlines for filing returns, reducing the risk of missing compliance deadlines and incurring penalties. It also provides you with the most up-to-date information on compliance requirements, so you can rest assured that your payroll is always aligned with current regulations.

Best Practices for Setting Up Payroll Software

While Payroll Software is a powerful tool for reducing errors, the key to success lies in how you set up and configure the system. Here are some best practices to follow when setting up your Payroll Software to avoid errors:

Accurate Data Entry

The accuracy of your payroll system depends largely on the data you input. When setting up your Payroll Software, ensure that all employee details are accurate and up to date. This includes names, contact information, salary structure, tax information, bank account details, and any other relevant data.

Small mistakes during data entry, such as a typo in an employee’s bank account number, can result in payments being made to the wrong account or incorrect deductions being applied. Always double-check the data entered into the system, and encourage employees to keep their personal information current.

Regular Updates and Audits

Indian payroll regulations are constantly evolving. From changes in income tax slabs to modifications in provident fund contributions, businesses need to stay up to date with these changes to ensure they remain compliant. A good Payroll System should automatically update in response to changes in tax laws and other regulations. However, it’s essential to check that these updates have been applied correctly and that the system reflects the most recent changes.

Conducting regular audits of payroll data ensures that everything is accurate and compliant. Reviewing payroll reports and verifying data periodically can catch discrepancies before they turn into serious issues.

Cross-Checking Calculations

Even though Payroll Software in India automates most of the calculations, it’s still essential to regularly cross-check payroll reports to ensure accuracy. Reviewing payslips and tax deduction reports allows HR teams to spot any inconsistencies or errors before they affect employees. Payroll software makes this process easier by providing detailed reports that can be quickly reviewed.

Managing Payroll Timelines

Late payroll processing can result in disgruntled employees and potential legal issues. To avoid delays, establish a consistent payroll processing schedule and stick to it. Many Payroll Software solutions, like Kredily, allow you to set recurring payroll dates and automate reminders for when it’s time to process payroll.

By staying on top of timelines and using payroll software to automate many of the manual tasks, you can avoid last-minute errors and ensure that employees are paid on time, every time.

Benefits of Payroll Software for Indian Businesses

Beyond reducing errors, Payroll Software in India offers numerous other benefits for businesses. Here are some of the key advantages:

Time and Cost Savings

Payroll processing is time-consuming, especially for large organizations with many employees. By automating the payroll process, businesses can significantly reduce the amount of time spent on administrative tasks. This not only saves valuable time but also helps to cut down on operational costs. Instead of dedicating multiple hours to manual payroll processing, HR teams can focus on other strategic tasks that add more value to the business.

Improved Accuracy

By automating tax calculations, statutory deductions, and payroll reporting, Payroll Software eliminates many of the errors that occur in manual systems. The software ensures that all calculations are based on the most up-to-date information and compliant with Indian labor laws, which reduces the risk of mistakes.

Better Compliance

Indian businesses are required to comply with a variety of labor laws, including the Payment of Gratuity Act, Provident Fund, and Employee State Insurance regulations. Payroll Software helps ensure compliance by automatically calculating contributions, generating reports, and filing returns. This reduces the risk of penalties and audits and helps businesses stay on the right side of the law.

Employee Satisfaction

Employees appreciate timely and accurate salary payments. By using Payroll Software in India, businesses can ensure that employees are paid on time, every time. The software can also generate detailed payslips, so employees have clear visibility into their earnings, deductions, and benefits. This transparency helps build trust between employers and employees.

Conclusion

Managing payroll efficiently is crucial to the success of any business. With Payroll Software in India, you can significantly reduce the risk of errors, improve accuracy, and ensure compliance with all applicable labor laws. By following best practices such as accurate data entry, regular updates, and cross-checking calculations, businesses can avoid costly payroll mistakes and ensure a smooth payroll process.

By implementing Payroll Software like Kredily, Indian businesses can automate many of the time-consuming tasks associated with payroll management, saving both time and money. With its ability to handle tax calculations, statutory compliance, and employee benefits, Payroll Software is an essential tool for any business looking to streamline its payroll operations.

Ready to eliminate payroll errors and streamline your payroll process? Sign up for Kredily’s Payroll Software today and experience a seamless, error-free payroll system that ensures compliance with Indian labor laws. Let us help you save time, reduce costs, and keep your employees happy.

#Payroll Software#Payroll Software in India#Free Payroll Software#Employee Payroll Software#Payroll System

0 notes

Text

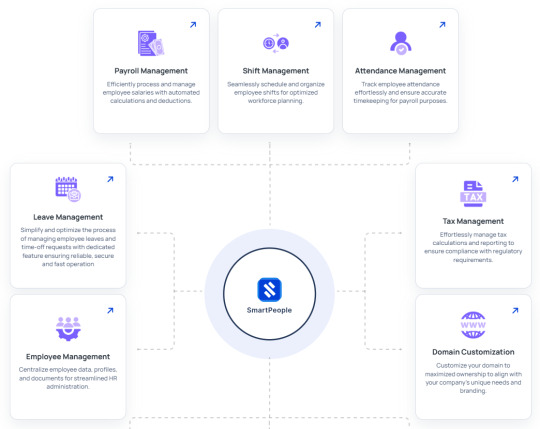

Streamline Workforce Management with SmartOffice: The Smart HR Solution

Effective workforce management is essential for success and growth in today's fast-paced business environment. SmartOffice is a cloud-based HRM solution that offers a comprehensive set of tools to meet current and future business needs. Whether managing internal growth or onboarding new hires, SmartOffice guarantees a smooth, effective, and significant HR experience.

SmartOffice unifies all crucial HR operations into a single, intuitive platform, revolutionizing the way companies handle their human resources. From hiring and onboarding to promotions and staff grouping, this one-stop shop streamlines intricate HR duties and improves overall business performance.

SmartOffice's work slot allocation feature makes onboarding easier than ever by guaranteeing that each new hire is assigned to the appropriate role right away. Productivity is increased, and new hires are able to get started quickly thanks to this strategic placement.

Employee mobility features from SmartOffice make it simple to identify and reward talent. HR professionals can highlight high performers and facilitate career advancement without administrative burden, thanks to the streamlined promotions and transitions.

Advanced access controls and employee grouping can improve security and teamwork. HR managers can assign workers to departments, roles, or projects using SmartOffice, which facilitates efficient teamwork and gives them individualized access to sensitive data.

Businesses that use SmartOffice not only stay up to date with change but also take the lead. Discover a more intelligent approach to personnel management and unleash the full potential of your company. Your doorway to effective, safe, and forward-thinking HR management is SmartOffice.

#hrm#hrmanagement#HR and Payroll Solution#HR and Payroll Software#HRMS Solution#Employee Management#employee management software#employee management system#SmartOffice#SmartPeople

3 notes

·

View notes

Text

Discover the magic of transforming your workplace with our latest YouTube content on the successful implementation of Human Resource Management Systems (HRMS)! Whether you're an HR pro or just curious about the benefits of HRMS, our engaging videos break down best practices, real-life success stories, and practical tips to help you unleash the full potential of your HR strategy. Don't miss out—let's revolutionize your HR game together! To listen to the full video click on the link given.

#best hrms software companies in india#podcast#salesforce implementation#hrms payroll software#learning management system in india#employee helpdesk

2 notes

·

View notes

Text

HR Software in Pakistan: Features That Every Business Needs

HR Software in Pakistan

In today’s rapidly evolving business landscape, HR software in Pakistan has become a necessity for organizations looking to streamline their human resource management processes. With the rise of cloud-based HR solutions, businesses can now automate HR tasks, ensure compliance, and enhance productivity. This article explores the essential features that every business in Pakistan should look for in HR software.

1. Employee Information Management

An efficient HR software should serve as a centralized database for storing employee information, including personal details, job history, salary records, performance reviews, and documents. This ensures that HR teams have quick access to employee records while maintaining data security and compliance.

Key Features:

Employee profiles with customizable fields

Document management for contracts, ID copies, and certificates

Role-based access control for security

Audit logs for tracking modifications

2. Payroll Management and Salary Processing

Payroll management is one of the most critical functions of HR. A robust HR software in Pakistan should provide automated payroll processing to ensure accurate salary calculations, tax deductions, and compliance with local labor laws.

Key Features:

Automated salary calculations

Integration with tax laws and compliance regulations

Direct bank transfer capabilities

Payslip generation and tax reports

3. Attendance and Leave Management

Efficient attendance tracking and leave management are crucial for maintaining workforce productivity. Modern HR software should integrate with biometric systems, RFID, or mobile applications to automate attendance monitoring.

Key Features:

Integration with biometric devices and RFID

Online leave application and approval workflows

Customizable leave policies and holiday calendars

Real-time reports on absenteeism and attendance trends

4. Recruitment and Applicant Tracking System (ATS)

An Applicant Tracking System (ATS) simplifies the hiring process by automating job postings, resume screening, interview scheduling, and candidate evaluations. This helps organizations find the right talent faster and more efficiently.

Key Features:

Automated job posting on multiple platforms

AI-based resume screening and ranking

Interview scheduling and candidate communication

Collaboration tools for recruiters and hiring managers

5. Performance Management System (PMS)

To foster a high-performing workforce, businesses need a Performance Management System that enables continuous goal setting, employee feedback, and performance evaluations.

Key Features:

Goal setting and Key Performance Indicators (KPIs)

360-degree performance reviews

Automated performance reports and analytics

Employee recognition and reward programs

6. Training and Development Modules

Employee training and skill development are essential for improving productivity and job satisfaction. A comprehensive HR software should include an integrated Learning Management System (LMS) to track and manage employee training programs.

Key Features:

Course creation and content management

Tracking employee progress and certifications

Automated reminders for training schedules

Employee feedback on training effectiveness

7. Employee Self-Service (ESS) Portal

A self-service portal empowers employees by allowing them to access HR-related information, apply for leave, view payslips, and update their details without HR intervention.

Key Features:

Online access to personal records

Leave and attendance tracking

Payroll and payslip downloads

HR policy documents and announcements

8. Compliance and Legal Management

HR software should assist in ensuring compliance with Pakistan’s labor laws and corporate regulations by automating record-keeping and reporting.

Key Features:

Automated labor law compliance checks

Digital contract management

Audit reports and compliance tracking

Tax calculations and e-filing integrations

9. HR Analytics and Reporting

Data-driven HR decisions are crucial for business growth. A powerful HR software in Pakistan should include advanced analytics and reporting tools to provide insights into employee performance, payroll expenses, and workforce trends.

Key Features:

Customizable dashboards with real-time analytics

Predictive HR analytics for trend forecasting

Automated report generation

Graphical insights and visualization tools

10. Mobile Accessibility and Cloud Integration

With remote work and on-the-go workforce management becoming more prevalent, mobile-friendly and cloud-based HR software ensures accessibility from anywhere.

Key Features:

Cloud-based access with secure login

Mobile application for HR tasks

Push notifications for important HR updates

Integration with other business tools (ERP, CRM, accounting software)

Conclusion

Choosing the right HR software in Pakistan is essential for businesses aiming to streamline their HR operations and improve workforce management. By investing in a feature-rich HR solution, companies can enhance productivity, compliance, and employee satisfaction while reducing administrative burdens.

Follow Us

Facebook — Decibel HRMS

Instagram — Decibel HRMS

LinkedIn — Decibel HRMS

#HR Software in Pakistan#Best HR Software#Payroll Software#HRMS Service in Pakistan#employee management software

1 note

·

View note

Text

Verification of Uploaded Documents

We have robust measures in place to verify the authenticity of uploaded documents such as address proofs and employment contracts. This includes automated verification tools that cross-reference details provided with trusted databases or through verification services. Additionally, designated personnel review documents to ensure compliance with organizational standards and regulatory requirements.

#hrms#hr#humanresources#hrsoftware#hrtech#payroll#humanresource#hrmanagement#payrollsoftware#hris#business#humanresourcemanagement#employee#software#hrsystem#recruitment#humanresourcesmanagement#payrollmanagement#hrd#leadership#payrollservices#shrm#hrconsultant#technology#hrsolutions#attendance#management#hrtips#hrm#hrblog

3 notes

·

View notes

Text

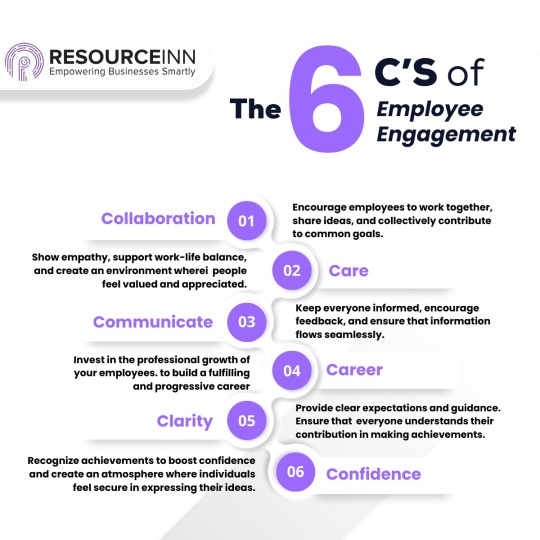

According to 𝐆𝐚𝐥𝐥𝐮𝐩'𝐬 𝐒𝐭𝐚𝐭𝐞 of the Global Workplace, only 23% of employees are actively engaged globally 📉💼

It’s more crucial than ever for organizations to reduce turnover, retain top talent, increase productivity, and build better workplace relationships. 🤝

However, it can be managed with the 𝟔𝐂𝐬 𝐨𝐟 𝐄𝐦𝐩𝐥𝐨𝐲𝐞𝐞 𝐄𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭

1 → Collaboration 2 → Care 3 → Communicate 4 → Career 5 → Clarity 6 → Confidence

From commitment to communication, each C intertwines for workplace brilliance (You can view more details in the infographics 📊 below)

Which of the 6 Cs of employee engagement do you struggle with the most? Share your experience with us 💬👇

4 notes

·

View notes

Text

Employee Management Software in India: The AI-Led Upgrade Your Workforce Deserves

The way India works has changed. Radically.

The 9-to-5 is extinct by 2025, hybrid teams are the new norm, and the workforce's expectations are shifting at a rate never seen before. Gen Z workers in Noida and remote teams in Pune—they all want something more than a "system" to make their work life better. They want experiences.

That's where Employee Management Software in India is undergoing a serious transformation and TheCloudTree.ai is leading the change.

Evolution from Admin Tool to Employee Experience Engine

Put away the outdated image of HR tools as glorified attendance trackers. Employee management systems now are data-driven, AI-fueled, and super-personalized. The goal? Not merely to manage, but to amplify the employee experience.

From onboarding procedures that are more similar to consumer-grade applications to burnout pre-emptive analytics, the shift is from control to care. Indian businesses are not just automating procedures but building workforce ecosystems that think, learn, and transform.

Why Employee Management Software in India is Having a Moment

This is why 2025 is the year of the tipping point:

1. AI-Powered HR Isn't Optional— It's Expected

AI is no longer science fiction. It's used within employee self-service portals, interview scheduling, engagement surveys, and even predicting attrition. Best-of-breed technology now utilizes machine learning to learn mood trends, recommend training classes, and even answer routine questions using chatbots.

2. Localization Isn't a Feature—It's a Standard

From state-level PF rules to local holiday calendars and multilingual dashboards, Indian businesses need Indian-built HR software, not Western-based grafted ones.

3. Gen Z Enters the Workplace with UX Expectations

Employees today demand mobile-first, notification-centric, and Slack-integrated solutions. If your HR software is cumbersome, you are losing attention and interest.

Beyond Features: Building Culture with Code

Let's elevate it. The top employee management software in India is not just a tool—it is a culture accelerator. Here's why:

Personalized Career Tracks: AI recommends next-step jobs and skills based on performance and interests.

Pulse Surveys with Action Loops: Feedback loops in real time that don't capture data but actually turn it into actionable HR actions.

Gamified KPIs: Real-time performance dashboards with badges, streaks, and team leaderboards—Duolingo, but for HR.

Wellbeing Insights: Passive markers like delayed check-ins or unscheduled leave trends can signal mental health vulnerabilities, prompting gentle nudges or interventions.

How TheCloudTree Is Redefining Employee Management

We don't build software at TheCloudTree.ai—we build experiences.

Our employee management solution is 100% cloud-native, modular, and AI-integrated—designed for Indian businesses that want to scale people, not paperwork. Here’s how we’re doing it differently:

Predictive People Analytics: Identify attrition risks, skill gaps, or underutilized potential before they impact business.

Auto-Adaptive Workflows: Leave policies or approval flows that evolve as your org grows.

Geo-Flexible Attendance: GPS-based punch-ins, Wi-Fi log verification, and geofencing for modern hybrid teams.

Integrated Compliance Engine: From maternity leave benefits to ESI, TheCloudTree is updated with live changes in government regulations—no human intervention needed.

And yes, it's all mobile-first. Because HR doesn't occur on desktops anymore.

Key Metrics That Matter (and How Indian Companies Are Using Them)

Firms adopting intelligent employee management software in India today are seeing:

30–50% reduced onboarding cycles

70% reduction in HR support tickets

25% improved internal mobility

40% boost in eNPS (employee Net Promoter Score)

From soaring SaaS startups to seasoned manufacturing giants, Indian companies are showing one thing: when HR technology aligns with business strategy, results follow.

What To Do When Choosing Your Software Partner

Choosing the ideal employee management software in India isn't just about checklists. Look for:

Cloud-native architecture (not legacy hosted)

India-compliant compliance workflows

Embedded integrations (Slack, Teams, Google Workspace)

AI-powered insights, not just reports

A UX that employees would want to use

Bonus: Look for a provider that understands the nuances of Indian work culture—and isn't foisting a Western model on your business.

Last Word: Managing People Isn't Enough Anymore

In India's hyper-dynamic business environment, managing people is just step one. Engaging them, retaining them, and growing them—that's the game. And that game demands software that's as intelligent, responsive, and humane as your people.

Ready to unleash your HR strategy from ordinary to extraordinary?

TheCloudTree is where employee experience begins—and where it gets reimagined.

Let's redefine what's possible. Together!

0 notes

Text

#attendance management software#crm software#payroll#hrms software#software#employee timesheet software#hrms management#hr management#hr software

0 notes

Text

Transform your HR operations with Dextrous Info's ERP system. Automate payroll, attendance, performance reviews, and more to boost efficiency by 50%. Contact us today! 🌐 www.dextrousinfo.com | 📧 [email protected] | 📞 +91 981-001-9909

#HR ERP software#Payroll automation#Employee performance management#Attendance tracking system#HR productivity tools

0 notes

Text

Why the Best Payroll Software in India Essential for Growing Companies?

Payroll is not just paying people. It’s about getting it right — every time, on time — keeping compliant, and earning trust with your people. In India, where laws are layered, and changing rapidly, essentially, managing payroll manually can become complicated quickly. A minor oversight can mean employees not getting paid, tax problems, or angry people. This is the reason that more companies are adopting payroll software that takes the pressure off and automates the process.

Payroll Software

When determining the best payroll software in India, you will be looking for something that can do more than just calculate monthly employee salaries. You will also want to integrate other features related to monthly salaries, with features related to all benefits such as the provident fund, professional tax, reimbursements, bonuses, etc, as well as the ability to manage policy updates related to labour laws. Payroll software will alleviate scheduling and expense paperwork, and provide HR teams with time to focus on the people's side and growth.

Core Features To Look For:

1.Automated Salary Processing: No longer have to worry about quickly managing earnings, deductions, and take-home pay with monthly leave records, working days, and company policies. You will even eliminate manual payroll processes in the salary calculation tasks.

2.Built-in Tax Compliance: This feature should allow for monthly tax processing, whether it is EPF, ESI, TDS, or professional tax, and automatically update rules and regulations to ensure your business is compliant.

3.Instant Payslip Generation: Creating and sharing payslips should take seconds (and look professional) so importing reports and payslips will take less time and difficult to make errors. The payslips can be completed and then shared to be downloaded whenever someone needs it.

4.Manage Bonuses & Reimbursements: Payroll Management software process one-off payments like incentives or expenses consistently and accurately.

5.Employee Self-Service: Provide employees with the ability to check payslips, view salary history, and update their information without having to contact human resources every time.

6.Bank Transfer: Make direct salary payments in bulk, with built-in payment transfer capabilities.

7.Statutory Reports: Create required audits, filings, and records—monthly and annually--all in just a few clicks.

Conclusion:

Smart Payroll software is not just a time-saving solution; it’s an essential commercial tool. It helps you maintain transparency within your operations and fosters employee trust while ensuring compliance with Indian law. In an environment where tax obligations are ever-changing and employees are increasingly diverse in their requirements, the right payroll process can take the stress out of the project and ensure you are mindful of what matters most: your people. As we all tractor through a fast-paced world, payroll is something you can't get wrong; however, getting payroll right is easier than ever before.

#smart payroll software#best payroll software#smart pay solution#employee payroll software#payroll management software

0 notes

Text

Payroll Software Features That Improve Compliance

In this constantly evolving world of speed and hustle, pay roll compliance is something which creates a lot of headache for companies. With constant changes in tax laws and labor regulations, it becomes very important for a company to always follow the very updated legal requirement in order to stay clear from penalties. Manual Payroll Management increases the risk of human errors and takes a toll on time. Here, Payroll Software becomes the most important tool in automating the compliance process and ensuring error-free payroll processing. When we have the Best Payroll Software in India, businesses can maintain proper taxation, employee class types, and reporting while complying with labor laws.

How Payroll Software Can Be Helpful in Maintaining Business Compliance

Payroll compliance means complying with tax regulations, wage laws, or other statutory requirements. A robust Payroll Software in India brings automation and accuracy so that businesses can pay more attention to these matters of compliance. Here are the main features that keep the payroll complaints for organizations:

Automatically Calculate and File Taxes

Accurate and timely tax computing and filing turns out as one of the busiest and most challenging affairs for businesses. Payroll Software calculates federal, state, and local taxes automatically under the updated tax laws. This feature helps businesses:

Deduct correct amounts of tax from employee salaries.

File the tax forms and payments in front of prescribed deadlines.

Keep updated with the changes in tax rules that arise.

Wage and Hour Tracking

Wage and hours regulations are important with respect to compliance with labor regulations for businesses. Payroll Software in India helps in tracking working hours, overtime, and break time of employees. It may fulfill the minimum wage and overtime laws. It also:

Provides accurate timesheets and attendance reports for employees.

Alerts businesses regarding wage discrepancies.

Helps in avoiding any labor law violations.

Employee Classification

Wrong employee classifications may lead to legal penalties and back payment claims. The Best Payroll Software in India helps to classify employees accurately by:

Differentiating between full time, part time and employees on contract basis.

Applying the correct tax rates and wage policies Authorizing, and detailing, any possible risk for misclassification during payroll.

Compliance with Leave Management

Leave management is yet another very important aspect that has been considered in payroll compliance. Payroll Software has all the features required for automating leave tracking and aids companies in meeting their obligations regarding sick leave, maternity, and paid time off policies. It:

Government policies consider how to accrue leave based on the given policies of the particular company.

Tracking leave balances without any possible manual errors.

It helps confirm that the organizations are compliant with the laws of the federal and state governments regarding leave.

Reporting New Employees

Businesses are required to report new hires to state agencies. Indian Payroll Software does this with minimal manual intervention by:

Submitting employee data to the government.

Maintaining I-9 and W-4 forms, and so on.

Integrating new-hire-reporting functions into employee onboarding workflows.

Audit Trails and Compliance Reporting

Maintaining payroll records in detail is of utmost importance to get compliance. Free Payroll Software maintains all Payroll Records and audit trails on any payroll action. This will enable companies to:

Incorporate factual compliance reports while audits.

Keep track of changes that were done in payroll data.

Ensure transparency and accountability in the payroll process. Why Choosing the Right Payroll Software is Important

Choosing the Best Payroll Software in India is imperative for businesses to ward off legal pitfalls and ensure compliance. The right payroll software solution should provide for automated compliance, continuously updated with the latest labor laws, and integrates seamlessly with HR systems. Kredily provides a full Payroll Software solution for efficient payroll while enabling businesses to be compliant.

Conclusion

Payroll compliance is not merely paying employees; however, it is actually about compliance with tax laws, wage laws, and reporting requirements. Right Payroll Software gives the extra power of automating compliance and eliminating legal penalties which arise on manual errors. Kredily Payroll Software in India provides an integrated solution for smooth payroll processing and puts businesses on the right side of the law.

Step into a seamless journey of payroll compliance - Schedule for a free demo on Kredily's Payroll Software right away!

#Payroll Software#Employee Payroll Software#Best Payroll Software in India#Payroll Software in India#HR and Payroll Software#Online Payroll Software

0 notes

Text

The Future of Payroll: How Real-Time Calculations Are Revolutionizing Employee Compensation

In the dynamic world of modern business, payroll is no longer just about issuing paychecks at the end of the month. The landscape of employee compensation is evolving rapidly, driven by the growing demand for transparency, accuracy, compliance, and employee satisfaction. At the heart of this transformation lies real-time payroll calculation, a cutting-edge innovation that’s changing how companies manage compensation.

Real-time payroll, once considered a luxury, is now becoming a necessity. Leveraging the power of advanced payroll software, businesses—especially in fast-paced regions like the UAE—are reimagining payroll systems to ensure precision and speed.

What Is Real-Time Payroll Calculation?

Real-time payroll calculation refers to the continuous and automatic processing of payroll data as it is entered into the system. Instead of waiting for a monthly or bi-weekly payroll cycle, the software calculates earnings, taxes, deductions, and other payroll elements in real time.

This modern approach eliminates the lag between time worked and compensation calculated. Any change—such as a bonus, deduction, or leave—is immediately reflected in the employee's earnings profile.

Key Benefits of Real-Time Payroll

Enhanced Transparency and Trust: Employees gain access to their up-to-date pay information at any time. This transparency fosters trust and allows employees to better understand their compensation structure.

Improved Accuracy: Real-time payroll significantly reduces errors caused by manual entries or batch processing. Any discrepancies can be spotted and corrected instantly.

Regulatory Compliance: Especially in regions like the UAE, where labor laws and tax regulations frequently evolve, real-time payroll helps businesses stay compliant by immediately adjusting to legal updates.

Time and Cost Savings: By eliminating the need for repetitive manual tasks and end-of-cycle crunches, businesses save both time and administrative costs.

Better Decision Making: HR and finance departments can make quicker, data-driven decisions when payroll data is instantly available.

How Payroll Software Powers Real-Time Payroll

The backbone of real-time payroll is modern payroll software equipped with automation, data analytics, and cloud integration. Here’s how it works:

Data Synchronization: The software integrates seamlessly with attendance, HRMS, accounting, and time-tracking systems.

Rule Engine: Embedded logic that processes tax slabs, deductions, bonuses, and other rules in real-time.

Cloud Access: Enables HR professionals and employees to access payroll information from any device, anywhere.

Alerts & Notifications: Automatic alerts help flag anomalies or potential compliance breaches before payroll is finalized.

Businesses in the UAE are rapidly adopting these tools to meet the demands of a digital workforce. If you're searching for the best payroll software in UAE, look for solutions that offer full real-time capabilities, local compliance integration, and cloud-based flexibility.

The Impact on Employee Satisfaction

Today’s workforce is more informed and expects quicker, clearer compensation insights. Real-time payroll meets these expectations by:

Offering instant visibility into pay structure and deductions.

Enabling access to updated pay slips and tax documents.

Reducing anxiety caused by payroll delays or errors.

This level of engagement directly enhances employee satisfaction, which in turn boosts retention and productivity.

Use Cases: Real-Time Payroll in Action

Case 1: Remote Teams A Dubai-based tech firm with global remote employees uses real-time payroll to manage compensation across multiple time zones and currencies. With automated tax compliance for each region, the company processes payroll without delays.

Case 2: Gig and Part-Time Workers A retail chain in Abu Dhabi uses real-time payroll to handle fluctuating work hours. Employees can view their up-to-date pay any time they clock out.

Case 3: Mid-Sized Enterprises A mid-sized logistics company adopts the best payroll software in UAE to scale payroll processing as they grow. Real-time calculations help manage new hires, promotions, and benefits effortlessly.

Challenges and How to Overcome Them

1. Data Integration Complexity To implement real-time payroll effectively, all HR and financial systems must be interconnected. Choose software that supports wide integration and provides local UAE support.

2. Security Concerns Real-time access to sensitive data requires robust cybersecurity. Look for software with multi-factor authentication, encrypted databases, and access control.

3. Change Management Employees and HR teams may need time to adapt to new tools. Invest in proper training and onboarding programs when switching to a real-time payroll system.

How to Choose the Best Payroll Software in UAE

When evaluating solutions, consider the following:

Compliance with UAE Labour Laws: Your payroll software must be up to date with WPS regulations and tax requirements.

Localization: Language, currency, and regional tax systems should be built in.

Automation Features: From payslip generation to year-end reporting.

Scalability: The software should support your company as it grows.

Support and Training: Look for vendors that offer localized customer support and onboarding.

What’s Next? Predictive Payroll & AI

The future of payroll doesn’t stop at real-time. The next leap will be predictive payroll, where AI-driven systems forecast compensation changes, cash flow needs, and compliance risks before they happen.

Incorporating machine learning algorithms, these platforms will help companies proactively manage payroll with greater accuracy and foresight.

FAQs: Payroll Software & Real-Time Calculations

Q1. Is real-time payroll safe to use? Yes, when implemented with proper cybersecurity protocols, real-time payroll is secure and often safer than traditional methods due to real-time fraud detection.

Q2. Can I use real-time payroll for part-time or freelance employees? Absolutely. Real-time payroll is ideal for flexible workforce structures and provides accurate, on-the-go compensation updates.

Q3. What is the cost of implementing real-time payroll in the UAE? Costs vary depending on features, company size, and vendor. However, many cloud-based options offer affordable monthly subscriptions with local compliance features.

Q4. Which is the best payroll software in UAE? The best payroll software in UAE is one that includes real-time processing, WPS compliance, cloud access, and support for multi-currency and multi-language needs.

Q5. How long does it take to transition from traditional to real-time payroll? With a reliable vendor, implementation typically takes 2–6 weeks including training and data migration.

Conclusion

The future of payroll is fast, accurate, and transparent. With real-time payroll calculations powered by intelligent payroll software, companies can ensure employee satisfaction, maintain legal compliance, and scale effortlessly. For businesses in the UAE, adopting the best payroll software in UAE with real-time features is no longer optional—it's a strategic move toward sustainable growth and digital transformation.

Stay ahead of the curve. Invest in future-ready payroll systems today.

#payroll management software#best hr software in dubai#employee management software#software#payroll#payroll software

0 notes

Text

https://msell.in/attendance-and-leave-management-solution

Attendance Tracking Software

mSELL Attendance Tracking Software enables real-time monitoring of field sales teams, ensuring accurate check-ins, geo-tagged locations, and shift compliance. Designed for mobile workforce management, it streamlines attendance, enhances productivity, and integrates seamlessly with mSELL’s complete sales automation suite.

#Time & Attendance Software#Employee Time Clock#Workforce Management#Absence Management#Payroll Integration

0 notes

Text

Streamline Your Workforce Management with an Advanced HRMS Software Solution

In today's fast-paced business world, managing human resources efficiently is key to organizational success. From recruitment to retirement, every phase of an employee's journey needs careful handling. This is where a robust HRMS Software Solution (Human Resource Management System) plays a pivotal role by automating and streamlining complex HR processes.

What is an HRMS Software Solution?

An HRMS software solution is an integrated suite designed to manage HR activities such as hiring, on boarding, payroll processing, performance appraisal, training, leave management, and compliance tracking — all from a single platform. It replaces outdated manual processes with digital workflows, ensuring accuracy, efficiency, and improved employee experience.

Key Features of a Modern HRMS Software Solution

Employee Information Management: Store, manage, and update employee records securely in a centralized database accessible anytime.

Payroll & Compensation Management: Automate salary calculations, tax deductions, reimbursements, and payslip generation to minimize payroll errors.

Leave & Attendance Tracking: Monitor attendance, leave balances, and approvals through self-service portals and mobile apps.

Performance Management: Set KPIs, conduct evaluations, and manage appraisals for objective performance tracking.

Recruitment & on boarding: Manage end-to-end recruitment, from job postings to candidate shortlisting and digital on boarding.

Compliance & Statutory Reporting: Stay updated with the latest labour laws and generate statutory reports with ease.

Training & Development: Plan and deliver employee training programs to boost skills and organizational productivity.

Benefits of Using an HRMS Software Solution

Time & Cost Efficiency: Automating routine HR tasks saves time and reduces administrative costs.

Data Accuracy: Centralized data eliminates redundancies and errors.

Improved Decision Making: Real-time reports and analytics help in workforce planning and management.

Enhanced Employee Satisfaction: Self-service portals allow employees to manage their own profiles, apply for leaves, and access payslips easily.

Compliance Assurance: Ensure that all statutory and regulatory requirements are met without manual intervention.

Why Every Business Needs an HRMS Solution?

Whether you’re a start-up or a large enterprise, an HRMS software solution ensures smooth HR operations, reduces human errors, and fosters a transparent work environment. It is scalable to fit the unique needs of various industries like IT, manufacturing, retail, healthcare, and more.

Choosing the Right HRMS Software Solution

When selecting an HRMS solution, consider the following:

Cloud or On-Premise Model

User-friendly Interface

Scalability & Customization Options

Integration with Other Enterprise Tools

Security Features & Data Protection

A reliable HRMS system ensures your workforce stays productive, engaged, and motivated while giving HR teams more time to focus on strategic initiatives rather than routine tasks.

Conclusion

In the digital transformation age, embracing an HRMS software solution is no longer optional — it’s essential. It empowers organizations to manage their most valuable asset — human capital — efficiently and effectively, driving business growth and success.

#HR Automation Solutions#Employee Management Software#Human Resource Management System#Payroll and HR Software#Cloud HRMS#HR Software India#Best HRMS Software#HRMS Software Solution

0 notes

Text

#hrms#hr#humanresources#hrsoftware#hrtech#payroll#humanresource#hrmanagement#payrollsoftware#hris#business#humanresourcemanagement#employee#software#hrsystem#recruitment#humanresourcesmanagement#payrollmanagement#hrd#leadership#payrollservices#shrm#hrconsultant#technology#hrsolutions#attendance#management#hrtips#hrm#hrblog

2 notes

·

View notes