#FinancialSuccess

Explore tagged Tumblr posts

Text

#ambitious women#beautiful women#beauty#glow society#the glow society#fit beauty#health#self love#self improvement#self care#Instagram#women’s health#self development#black girl moodboard#healthy food#health and wellness#boss women#womens workout routines#fit girls#tumblr girls#becoming that girl#finance#financialfreedom#financial planning#financial advisor#financial services#financial aid#financialeducation#financialsuccess#financialindependence

14 notes

·

View notes

Text

Chase YOUR Dream.

life is not a race, it’s a experience. Do things that make YOU happy, things that help YOU succeed.

Other people’s wins and losses will and do not affect where you will end up in life. Do what you really want while you can.

you got this:3

#motivation#cosmetics#studyspo#encouragement#fitspo#self care#self help#self improvement#lashes#lashtech#makeup#makeup artist#cosmetology#financialsuccess#entrepreneur#self employed#self empowerment#lash extensions

42 notes

·

View notes

Text

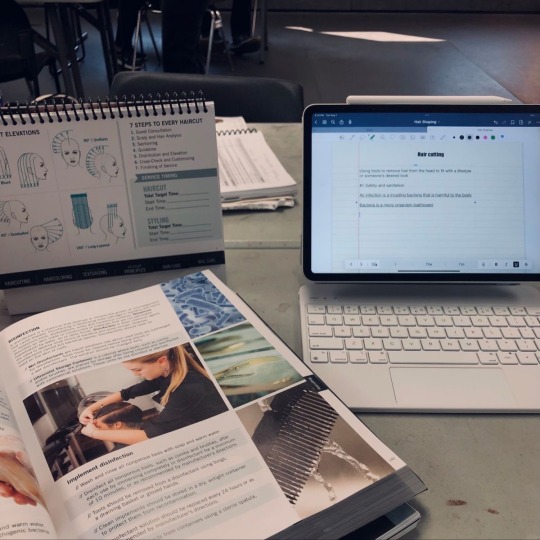

📊 Calling all Accounting and Finance Students in Canada! 🇨🇦

Are you looking for the best tools and resources to excel in your Accounting and Finance studies? From textbooks, calculators, and financial software to study guides and reference materials, we’ve got everything you need to succeed!

💼 Whether you’re preparing for exams, working on assignments, or looking to boost your career in accounting, finance, or auditing, our essential shopping items are designed to give you the edge you need.

🛒 Start shopping now and equip yourself for success! �� Visit: https://cotxapi.com/assignment/?token=token_67cde3ca444640.52844955#products

#AccountingStudents#FinanceStudents#CanadianStudents#AccountingAndFinance#FinancialTools#AccountingBooks#FinanceTextbooks#StudyMaterials#AccountingCareer#FinanceCareer#CanadianAcademia#Accountants#FinancePros#AccountingExams#FinanceExams#StudyResources#FinancialSuccess#AccountingSoftware#FinanceBooks#FinancialLiteracy#AccountingHelp#AccountingAssignments#FinanceAssignments#StudySmart#BusinessStudents#Auditing#CFA#CPA#AccountingProfession#FinancialPlanning

17 notes

·

View notes

Text

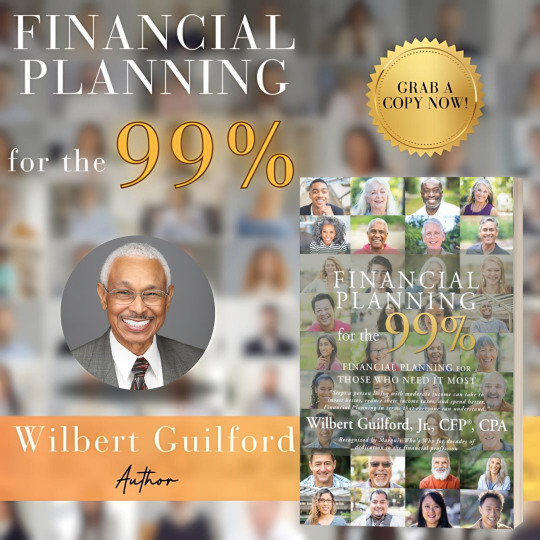

The financial services industry often hinders average Americans from receiving reliable financial advice, leading to 99% not using financial advisors. "Financial Planning for the 99%" offers comprehensive education on personal finance, including investing, income taxes, retirement planning, life insurance, and more. Written by a seasoned financial professional, it provides a one-stop guide to help Americans achieve financial success.

Do you want to gain valuable insights and strategies for effectively managing your finances? Visit https://guilfordtaxman.com/ to learn more.

10 notes

·

View notes

Text

💰Master Your Money | The Ultimate Guide to Financial Success and Smart Spending💵✨

Master Your Money

youtube

#100 days of productivity#MasterYourMoney#FinancialSuccess#SmartSpending#WealthBuilding#DebtFree#Investing#MoneyManagement#FinancialFreedom#Budgeting#EmergencyFund#PersonalFinance#Youtube

2 notes

·

View notes

Text

AI Expert: How Rick Green is Transforming Finance with Artificial Intelligence

Artificial intelligence has revolutionized many industries, and the financial sector is no exception. Rick Green has been at the forefront of AI-driven financial solutions, using technology to improve investment decision-making, risk management, and market analysis.

1. AI in Forex Trading

The forex market is one of the most volatile and fast-moving financial markets in the world. Traders must analyze economic indicators, global news, and market trends to make informed decisions. AI has made this process more efficient by offering:

✔ Automated Trading Bots – AI-powered bots execute trades based on real-time market analysis, eliminating emotional decision-making. ✔ Predictive Analytics – Machine learning algorithms analyze historical price movements to predict future trends. ✔ Risk Management Tools – AI identifies potential risks in the market and suggests strategies to minimize losses.

Rick Green has helped traders and investors integrate AI-powered solutions into their forex trading strategies, leading to more accurate predictions and increased profitability.

2. AI in Financial Technology (Fintech)

Beyond forex trading, Green has also made a significant impact in financial technology (fintech). As fintech continues to evolve, businesses must adopt AI-driven tools to remain competitive. Some of the key areas where Green’s expertise has been valuable include:

✔ Fraud Detection – AI detects suspicious transactions and cyber threats, protecting businesses and consumers. ✔ Automated Customer Support – AI chatbots and virtual assistants improve customer service by providing instant, accurate responses. ✔ Personalized Financial Advice – AI-powered platforms analyze spending habits to offer customized investment recommendations.Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

2 notes

·

View notes

Text

#financialfreedom#financialsuccess#financial services#finance#financial drain#success#books and reading#learning

3 notes

·

View notes

Text

instagram

#financialsuccess#retirementsavings#account#missingmoney#gold 401k rollover#howtorollover#good financial planning#Instagram

8 notes

·

View notes

Text

Are You a Cautious Planner or a Bold Risk-Taker?

In the fast-paced world of entrepreneurship and career growth, understanding your decision-making style can be a game changer. Are you someone who plays it safe with a solid plan, or do you jump at bold opportunities without hesitation? It’s time to find out with Lokesh Dave’s Risk-Taking Ability Test!

Why Knowing Your Risk Profile Matters Success in business isn’t just about hard work — it’s about smart decisions. Your risk-taking personality impacts:

How you handle investments

The way you respond to market changes

Your leadership style

How you manage uncertainty and growth

Whether you’re a cautious strategist or a bold innovator, knowing where you stand gives you a competitive edge.

What the Test Reveals? Lokesh Dave, Your Growth Partner, offers a unique test to help you assess your entrepreneurial instinct. This psychometric-style assessment gives you deep insights into:

Your natural approach to uncertainty

Your tolerance for failure or unpredictability

How well you adapt under pressure

Strategic vs. spontaneous decision-making traits

🎯 The goal? Help you align your growth path with your personality for smarter results.

Who Should Take This Test? This test is ideal for:

✅ Entrepreneurs & Startups ✅ Small Business Owners ✅ Corporate Professionals in Leadership Roles ✅ Career Switchers ✅ Aspiring Consultants or Freelancers

If you’re making strategic decisions about your business, career, or finances — this test is for you!

How to Get Started

📝 Step 1: Visit www.lokeshdave.in 📧 Step 2: Email us at [email protected] 📲 Step 3: Call or WhatsApp us: +91–9653469522 🔗 Or click the “Contact Us” button to book your session directly.

Unlock Growth with Self-Awareness

The journey to success begins with self-awareness. Whether you’re aiming for rapid business scaling or long-term sustainable growth, understanding your risk profile can help you make smarter, more confident decisions.

👉 Don’t wait — Take the Risk-Taking Ability Test today and discover the leader within you!

#RiskTaker#BusinessGrowth#FinancialSuccess#EntrepreneurMindset#DecisionMaking#StrategicPlanning#WealthManagement#InvestSmart#Leadership#BoldMoves#CareerSuccess#MoneyMatters#StartupSuccess#FinancialFreedom#Risk taking ability Test#Risk Taking ability Assessment#Business Risk Evaluation#Career Growth Assess#Future Growth Assess#Consultation Services

1 note

·

View note

Text

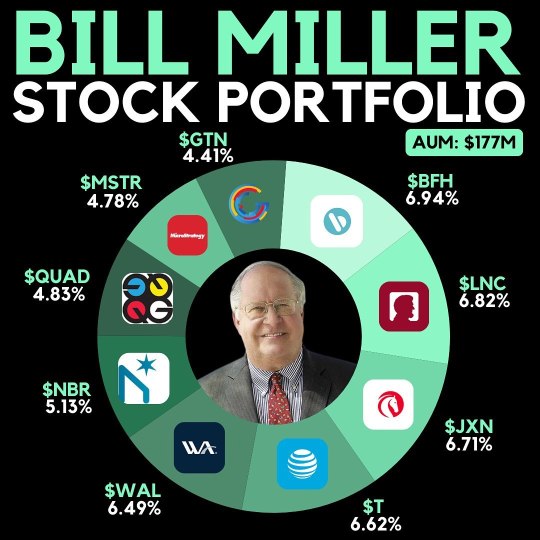

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

जन्म पत्रिका विश्लेषण के माध्यम से निवेश के अवसरों को समझने का तरीका क्या है?

जन्म पत्रिका (कुंडली) का विश्लेषण न केवल व्यक्तिगत जीवन के विभिन्न पहलुओं को समझने में सहायक होता है, बल्कि यह कुंडली में निवेश के अवसरों और वित्तीय संभावनाओं को भी उजागर करने में महत्वपूर्ण भूमिका निभा सकता है। वैदिक ज्योतिष के माध्यम से, व्यक्ति अपनी कुंडली के विश्लेषण द्वारा यह जान सकता है कि कौन से निवेश मार्ग उसके लिए लाभदायक हो सकते है��� और किन क्षेत्रों में सतर्कता बरतनी चाहिए।

#Investmentthroughbirthchart#Investmentopportunitiesthroughbirthchartanalysis#kundli#kundali#kundlireading#financeastrology#financialastrology#kundlireadingforfinancialsuccess#financialsuccess#financialsuccessbykundli#Investmentthroughbirthchartanalysis

1 note

·

View note

Text

Fast Profit System Best Review: Unlock the $1,000+ Daily Passive Income Formula

Introduction: Fast Profit System Best Review

Do you want a process to be able to get steady high ticket commission sales without having to work for it? Get to know the Fast Profit System — the product that can OVERWHELM your account with $1,000+ daily profit within 10 minutes, knowing or not knowing how to operate the computer. This massive review will explain what sets this system apart, how it operates, why many are calling it a game changer in affiliate marketing.

Overview: Fast Profit System Best Review

The product creator: Glynn Kosky

Product name: FAST PROFIT SYSTEM

Front-end price: $17

Sales Page: Check

Bonus: Yes, Huge Bonuses

Niche: Affiliate Marketing

Guarantee: 180-days Money Back Guarantee

What is the Fast Profit System?

Fast Profit System is a ready-made affiliate marketing launch jack high ticket affiliate funnel by a 7 figure Internet marketing super affiliate. The system is designed to produce big revenues anywhere from $500 to $1,000 per transaction while the users seemed to do little to nothing to earn this money. It is built for both newbies and seasoned marketers and ensures that you get results with no product creation, video creation, e-mail marketing, or any kind of technical skills.

#fastprofitsystem#bestreview#passiveincomeformula#makemoneyonline#financialfreedom#workfromhome#onlinebusiness#passiveincome#makemoneyfast#earnmoneyonline#financialsuccess#passiveincomestrategy#passiveincometips#passiveincomemastery#passiveincomeideas#passiveincomelifestyle#passiveincomereview#passiveincomerevolution#passiveincomemindset#passiveincomestrategies#passiveincomemagic#passiveincomemillionaire#passiveincomemethod#passiveincomemasteryguide

1 note

·

View note

Text

The Power of Budgeting: Your Key to Getting Ahead

In today's uncertain economic climate, one principle remains steadfast: the importance of a good budget. Far from being restrictive, budgeting is the cornerstone of financial freedom and success. Let's explore why a solid budget is essential and how it can set you on the path to getting ahead.

The Foundation of Financial Health

Imagine your finances as a garden. Without proper planning, weeds can quickly overrun it. A good budget is like a well-thought-out garden plan, ensuring every financial decision supports your long-term goals.

A budget provides a clear picture of your financial situation. According to a 2021 survey by Debt.com, 80% of people who budget say it helps them get out of debt or stay out of debt. This clarity allows you to identify unnecessary expenses and redirect funds towards more meaningful goals.

Empowerment Through Control

Budgeting isn't about restriction; it's about taking control of your financial destiny. It breaks the stressful cycle of living paycheck to paycheck.

Take Sarah, for example. She was always stressed about her finances until she created a budget. She discovered she had been spending $500 monthly on takeout and impulse buys. By reallocating those funds, she built an emergency fund and started saving for a house down payment.

The Path to Savings and Investment

A good budget makes saving achievable by breaking it down into manageable steps. The "50/30/20 rule" is a popular budgeting technique: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

James, a young professional, started budgeting in his mid-20s using this rule. By consistently saving and investing 20% of his income, he built a robust investment portfolio by his 40s, providing financial security and freedom to pursue his passions.

Reducing Stress and Increasing Peace of Mind

Financial stress can take a heavy toll on your health. A study by the American Psychological Association found that 72% of Americans feel stressed about money at least some of the time. A good budget acts as a safety net, providing peace of mind and reducing anxiety.

Emily, a single mother of two, experienced this firsthand. After creating a budget, she felt a huge weight lift off her shoulders, knowing she had a plan to cover expenses and save for her children's education.

Building Discipline and Financial Habits

Budgeting teaches discipline that can extend beyond finances. Mark, a young entrepreneur, found that budgeting improved his business practices. By applying budgeting principles to his business, he cut costs by 15%, increased profitability, and reinvested in growth opportunities.

Achieving Your Financial Goals

A good budget transforms dreams into achievable goals. Whether you want to pay off debt, save for a home, or retire early, a budget provides the roadmap.

The SMART goal-setting technique (Specific, Measurable, Achievable, Relevant, Time-bound) can be particularly effective when budgeting. For instance, instead of "save more," set a goal like "save $5,000 for a vacation in 12 months."

Overcoming Common Budgeting Challenges

While budgeting offers numerous benefits, it's not without challenges. Here are some common obstacles and how to overcome them:

Inconsistent Income: If your income varies, budget based on your lowest-earning month and save extra during better months.

Unexpected Expenses: Build an emergency fund into your budget to cover unforeseen costs.

Lack of Motivation: Set small, achievable milestones and reward yourself for meeting them.

Budgeting Fatigue: Use budgeting apps or tools to simplify the process and make it more engaging.

Conclusion

Having a good budget is not just a financial strategy; it's a fundamental step towards getting ahead in life. It equips you with the knowledge, control, and discipline needed to navigate the complexities of the financial landscape. Remember, budgeting isn't about depriving yourself; it's about empowerment. It ensures every dollar you earn works towards your future.

A study by The Penny Hoarder found that 65% of people who maintain a budget consider themselves "very financially secure," compared to only 13% of those who don't budget.

Start today with a simple budget. Track your income and expenses for a month, then set realistic goals. Use tools like spreadsheets or budgeting apps to make the process easier. With time and consistency, you'll see how a simple budget can transform your financial reality and help you get ahead.

Your financial success begins with this single step. Are you ready to take control of your financial future? Download a budgeting app or set up a simple spreadsheet today and start your journey to financial freedom.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Budgeting#FinancialPlanning#MoneyManagement#PersonalFinance#FinancialFreedom#BudgetTips#SaveMoney#Investing#FinancialHealth#DebtFree#SmartMoney#FinancialGoals#MoneyMatters#EconomicWellness#FinancialSuccess#financial education#digitalcurrency#blockchain#finance#cryptocurrency#financial experts#financial empowerment#globaleconomy#bitcoin#unplugged financial

3 notes

·

View notes

Text

Discover the secrets that wealthy people use to achieve success and abundance. Uncover the mindset, discipline, and strategies they employ to build their fortunes. Click now to transform your life and start your journey to financial freedom!

2 notes

·

View notes

Text

#RobertDowneyJr#RDJNetWorth#IronMan#MarvelCinematicUniverse#MCU#Hollywood#CelebrityNetWorth#RobertDowneyJrFans#TeamDowney#RDJ#HollywoodSuccess#MovieStar#FinancialSuccess#ActorLife#Philanthropy#LuxuryLifestyle#FilmIndustry#SherlockHolmes#Endgame#FootprintCoalition

2 notes

·

View notes

Text

Achieve Financial Clarity with Expert Financial Statements, Forecasts, and Projections

Welcome back to the SAI CPA Services blog! Today, we’re focusing on the value of our financial statement, forecast, and projection services in helping your business achieve financial clarity and strategic growth.

Why Financial Statements, Forecasts, and Projections Matter

Understanding your business’s financial health is crucial for informed decision-making and strategic planning. Here’s how our services can benefit your business:

Accurate Financial Reporting: Our detailed financial statements provide an accurate and comprehensive view of your company’s financial position, helping you understand your income, expenses, and profitability.

Strategic Planning: Financial forecasts and projections are essential for planning future growth and identifying potential challenges. Our expert analyses enable you to make data-driven decisions and plan effectively for the future.

Performance Monitoring: Regularly updated financial statements and forecasts allow you to monitor your business’s performance over time, ensuring you stay on track to meet your goals.

Investor Confidence: Providing accurate and detailed financial information helps build trust with investors, stakeholders, and lenders, potentially leading to more investment opportunities and better financing options.

How SAI CPA Services Can Help

At SAI CPA Services, we offer comprehensive financial statement, forecast, and projection services tailored to your business’s unique needs. Our experienced team provides the insights and analysis necessary to guide your strategic planning and ensure your business’s long-term success.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#accounting#StartUpSuccess#business startups#new business#business planning#enterprenuership#finance#financialsuccess

2 notes

·

View notes