#ForexIndicator

Explore tagged Tumblr posts

Text

Forex HEDGE Trade #SELL after #BUY signal running together M30 Timeframe GBPUSD. Live Trade with Indicator Hunter NON REPAINT Signal.

. 🎓 https://www.HunterForexIndicator.com Powerfull Non Repaint signals to make constant profits. Lifetime License of HUNTER Forex Indicator. . 💲 The Hunter Forex Indicator for Metatrader4 is a Fixed and No Repaint signals send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Indicator concept.

🔊 Sound Alerts with 🔊Visual Popup alerts email 🔊 alerts actvation option. This Power indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

#forex signal#forex trading#forex signals#forexsignals#forexindicator#forexindicators#forex#forex indicators#forextrader#forexfactory

3 notes

·

View notes

Text

AUDUSD Aussie 0.20 Lots Buy entry bullish wave on M5 timeframe opens and running to next week [AUDUSD,M5].

Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator metatrader4 license with NO LAG & NON REPAINT buy and sell Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside Brokers MT4 Plataform. . ✅ NON REPAINT / NON LAGGING Signals ✅ New 2025 Version LIFETIME License 🔔 Signals Sound And Popup Notifications 🔥 NEW 2025 Profitable EA AUTO-Trade Option Available . ✅ * Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the MT4 platform of the customer who has access to his License*. ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at Exness brokerage. Signals may vary slightly from one broker to another ). . ✅ Cashpower Indicator Works in all charts inside Metatrader4 plataform for anybroker that have mt4. It will works inside anychart that your brokerage have examples: Forex charts, bonds charts, indicescharts, metals charts, energy, cryptocurrency charts and etc. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#Forex Cashpower indicator Non Repaint Signals#forex brokers#forexindicators#forexsignals#indicatorforex#forexindicator#forex#forextradesystem#forexchartindicators#forexvolumeindicators#cashpowerindicator#forexprofits#forex market#forextrading#forex expert advisor#forex robot#forex trading#forex indicators#forex traders#stock trading#audusd#audusd technical analysis

4 notes

·

View notes

Text

EURUSD Trading for this week 28 Aug - 1 Sep

After the FOMC announcement, the EUR/USD pair dropped to its lowest level since Friday, reaching 1.0855. As the Asian session nears, traders are preparing to analyze the upcoming US labor market data, and the pair is showing a bearish trend. In our previous forecast, we anticipated that the bearish momentum would persist until the price reached the next two targets, as depicted in the chart. The market followed this pattern, and the video link in the top right corner illustrates this. Although the price reached these targets and reacted to the demand zone, it failed to create any bullish structure and instead continued to decline, breaking the recent low.

Last week we said the price could touch the following key levels as follows -

youtube

EUR/USD experienced a decline, reaching a low of 1.0760 before rebounding to 1.0800 and finishing the week. During the Asian session on Monday, the currency pair remained steady at around 1.0810. Based on the daily chart, the anticipated objectives indicate a potential drop to 1.0600 and even 1.0500.

youtube

To ensure successful trading, it is crucial to closely observe the price movements and wait for a definite indication before entering a trade. In case the price surpasses the swing high, our initial plan would be invalidated, and we would have to reevaluate the market and perhaps modify our trading strategy. In general, it is vital to exercise patience and self-control while trading and always have a clearly defined plan to mitigate risks and optimize potential gains.

#best forex signals#forex signal#forex market#eurusd#youtube#nfp#forexindicator#forex signals#eurusd forex signal#forex trading#Youtube

11 notes

·

View notes

Text

#forexnews#forextrading#forextips#forexsuccess#forexstrategy#forexscalping#forexprofit#forexmoney#forexsignals#for example#forex#forex analysis#forex education#forexindicator#forexlifestyle#how to trade forex

3 notes

·

View notes

Text

US Credit Downgrade Shakes Bond Market, Long-Term Yields Surge

The US bond market trembled this week, after Moody’s downgraded the United States’ credit rating citing persistent fiscal deficits and the increasing burden of interest payments. The yield on the 30-year Treasury rose fleetingly above 5 percent, reaching its highest level since early 2025. Although the downgrade itself has lowered the rating to “Aa1,” the market reaction demonstrates how much the worlds investors read into signals of structural economic trouble.

Credit rating agencies don’t often take these kinds of steps lightly. Moody’s move came amid continued concern over the US government’s inability to agree on long-term measures to stabilize the debt path. With deficits ballooning and debt servicing costs climbing, investors are starting to price in greater risk and that’s being reflected in yield movements.

The rise in yields impacts more than just bond portfolios. Higher long-term rates can affect everything from mortgage pricing and corporate borrowing to risk appetite across asset classes. Equity markets may come under pressure, especially in rate-sensitive sectors, while currency markets could see greater volatility as capital adjusts in search of relative safety and return.

As someone who actively follows these macroeconomic shifts, this week’s move in yields is a textbook example of how markets digest political and fiscal developments in real time. It’s not always about the downgrade itself, but how it reshapes expectations.

The sharp move in the 30-year yield, in particular, suggests that the bond market is no longer waiting for fiscal clarity, it’s acting now, pricing in the uncertainty ahead.

What stood out to me wasn’t just the market’s immediate reaction, but how it aligns with principles I’ve learned through ORION Wealth Academy. They place strong emphasis on connecting macro trends to practical strategy, showing how to use these shifts as potential trade setups, rather than reacting emotionally or purely based on headlines.

One of the key takeaways here is that fixed income volatility is becoming more relevant to everyday traders. What was once the domain of long-only bond investors is now a front-line battleground for understanding risk sentiment. Yield spikes can shake equity indices, drive commodity flows, and even reshape intraday setups in forex.

This event also reinforces the need for ongoing education. A trader who’s aware of how bond markets reflect broader economic concerns is better equipped to spot opportunity and avoid unnecessary risk. That’s a mindset I’ve gained from following educational platforms like ORION. While they don’t hand you trades, they help build the thinking process that allows you to trade with intention and clarity.

Will this downgrade have long-term impact? That’s still uncertain. What’s clear is that markets are now watching US fiscal developments more closely, and volatility may persist as new data and policy signals come in. For now, yields are back in focus, and traders across all asset classes should be paying attention.

Because in this environment, even a single basis point can carry a message if you know where to look.

#forexindicator#forexsignals#forexmentor#forextrading#forextips#forex#finance#forexstrategy#forexmarket

0 notes

Video

youtube

Anaconda Action System | No Repaint Indicators | MT4 Accurate Trading Sy...

0 notes

Text

Amazing Day Of Management

Check My Signals Performances 🔥🔥

Today's Booked Profit 🤑🤑💰

Join this👇

1 note

·

View note

Text

Sell trade in #EURNZD opens with a Sell Signal of HUNTER Indicator.

🎓HUNTER NON REPAINT Forex Indicator Signals is developed for Metatrader 4 is a Fixed and "Non Repaint signals for Metatrader4" send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Ultimate Indicator concept available for Forex.

The process to receive the download of Hunter Indicator is automatically after your purchase you will auto-redirectly to download page.

Please access now this link: https://hunterforexindicatormt4.wordpress.com/

Inside this link you can have access to Official Hunter Website www HunterForexIndicator com.

🎓Hunter is a complete and last generation Indicator, is a Lifetime License, NOT have Monthly Fees and give in your accuracy signals,Hunter is a complete and last generation Indicator:

🔔 SOUND ALERTS for all signals./ 🔔 VISUAL ALERTS texts for all signals./ 🔔 EMAIL ALERTS actvation option.This Metatrader indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

⚠️HUNTER indicator is The most efficient way to Trade Manually and safely in Forex Market (Majors and exotics pairs), Indices, bonds, cryptos and shares, which is one of the best indicator for MT4 plataform. VIP Tool. Powerful fixed signals not move or transfer the signal to another candle.

⚠️HUNTER is a simple Indicator, it can be used for any type of trading and any type of counters/pairs, the interface of the indicator is very simple to use, buy when blue signal apears and sell when red arrow apears ; so you can use right immediately, the success ratio is 93% higher than the failure ratio, is a solid technical indicator.

#forex trading#forexindicators#forex signal#forex#forexindicator#hunter forex indicator#non repaint forex signals#forex signals service

3 notes

·

View notes

Text

centfx

Gold price gets a negative motive

The gold price continues to consolidate above the 2016.90 level. It is now showing positive stochastic overlaps, and we are watching for a catalyst to push the price past the EMA50, which acts as resistance against intraday trades and pave the way for a rally towards our anticipated target of 2065.70.

As a result, the bullish trend scenario will continue to be relevant and active for the foreseeable future. It should be noted, however, that the price will undergo additional bearish correction if it breaks below 2016.90, with 1977.46 as the next target.

0 notes

Text

#forexsignals#forex education#forexmarket#forextrading#forex#forexanalysis#forexindicator#forexbroker#forexlifestyle#forexmentor#forexmoney#forexnews#forexprofit#forexscalping#forexstrategy#forexsuccess#forextips#how to trade forex#technical analysis#trading for beginners#trading books#tradingforex#tradingsuccess#tradingstrategy#tradingtips#tradingcommunity#trading course

0 notes

Text

🤖💡 What’s an Expert Advisor (EA) in Forex?

Tired of emotional trades and late entries? EA to the rescue! 🚀📈

An Expert Advisor is a trading bot that automates your strategy 24/7 — no sleep, no stress! 🧠⚙️ Perfect for beginners & pros who want smarter, faster execution.

👉 Learn what EAs are & how they work:

#expert advisor#forexstrategy#forexsignals#forexindicator#forex#expert advisors#gearbox#forextrading#kraitos#auvoriaprime

0 notes

Text

Why Surviving a Market Downturn Can Teach You More Than Any Bull Run Ever Could

In past years, I’ve read case studies about the 2018 pullback caused by U.S.-China trade tensions and the COVID-induced crash of 2020, where panic rapidly turned into opportunity. I’ve analyzed the slower, inflation-driven 2022 decline and the AI-fueled rebound of 2023–2024. But in 2025, things feel different again — heightened by geopolitical friction, fresh tariffs, and interest rate uncertainty. The Federal Reserve’s stance today is more constrained than in 2018 or 2020, and even pressure from President Trump hasn’t shifted their position quickly.

What I’ve realized is that market cycles reflect human psychology as much as they do economic data. You never know it’s the bottom until long after it passes. Each dip feels like the worst one yet. That’s why learning from real-world signals — like we do at ORION — is so important. We’re taught not just how to read indicators, but how to manage risk, stay patient, and filter noise from strategy.

I’ve also come to understand that great companies can trade at steep discounts for reasons that don’t align with their long-term value. Look at what happened to Meta in 2022, when sentiment turned and it dropped below $90 a share despite having strong fundamentals. That experience reinforced why emotional discipline and conviction are vital for any investor.

More than anything, ORION Wealth Academy has helped me see investing as a long-term journey. It’s not about calling the bottom or chasing every dip. It’s about building confidence through knowledge, surrounding yourself with a community of thinkers, and recognizing that downturns can be the best classrooms — if you’re willing to stay in the seat.

Markets will always fluctuate, but with the right tools, perspective, and guidance, I’ve learned to weather volatility with more clarity and far less fear. That’s a lesson worth holding onto.

#forexindicator#forexsignals#forexmentor#forextrading#forextips#forex#finance#forexstrategy#forexmarket

0 notes

Text

Gold hovers around $2,000 as dollar weakens on US jobs miss

Gold prices held steady around the key $2,000 an ounce level on Friday, as a disappointing US jobs report boosted speculation that the Federal Reserve may pause its interest rate hikes, leading to a weaker dollar and lower bond yields.

The US Labor Department report showed that nonfarm payroll employment rose by just 150,000 jobs in October, falling short of the expected 180,000 gain, with strikes at Detroit's three major automakers partly contributing to the soft figures. Market participants are now pricing in a 95% chance of the Fed keeping rates on hold in December, according to the CME FedWatch tool.

Euro climbs 1% against weaker dollar on rate cut bets

The euro gained as much as 1% on Friday as the US dollar index fell on a weaker-than-expected nonfarm payrolls report.

Investors are increasingly convinced that inflation is peaking, suggesting that central banks may need to ease policy to prevent monetary policy from becoming too tight in practice. Fed funds futures are now pricing in an 85% chance that the Fed has finished tightening and an 80% probability of rate cuts starting in June. Market futures indicate an 80% chance that the European Central Bank (ECB) will start cutting rates by April.

This report was created by OXShare

Gold and the euro are likely to remain supported in the near term as the dollar continues to weaken on expectations of slower Fed rate hikes and potential ECB rate cuts. However, investors will need to keep an eye on key data releases such as the German industrial orders and Hamburg Commercial Bank (HCOB) Purchasing Managers' Indices (PMIs) from across Europe this week. Lower-than-expected figures could weigh on the euro.

#forex#forex vps#forexbroker#forexindicator#forexmarket#forexmentor#forexmoney#forexsignals#forexsuccess#forextips

1 note

·

View note

Text

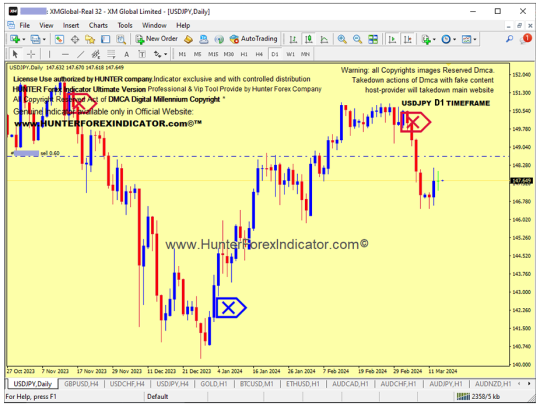

Non Repaint Sell Signal HUNTER indicator for USDJPY D1 Timeframe. 0.60 Lots Sell running!

Non Repaint signals to make constant profits. Lifetime License. https://www.HunterForexIndicator.com

3 notes

·

View notes

Text

Buy Swing Trade D1 Chart #xauusd running in MT4 since last weeks ( Daily Chart signal). ( More info inside Official Website: wWw.ForexCashpowerIndicator.com ). . ⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE. NO LAG & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

Swing trade GOLDD Stop loss update to protect profits inside youtube: https://youtu.be/-Y4PUuVUuaU . ✅ NO Monthly Fees; Lifetime License ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification ✅ Powerful AUTO-Trade Option Subscription . ✅ Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License. . PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer. . Recommended FX Brokerage to run Cashpower-XM Broker: https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#cashpowerindicator#forexindicator#forextradesystem#forexindicators#forex#indicatorforex#forexsignals#forexprofits#forexvolumeindicators#forexchartindicators#metatrader4 download

11 notes

·

View notes

Text

Esay Pro Scalper Review: Is the Esay Pro Scalper Indicator Reliable?

Esay Pro Scalper Review: Is the Esay Pro Scalper Indicator Reliable?

Esay Pro Scalper Review: Is the Esay Pro Scalper Indicator Reliable? #easyproscalperreview - YouTube

0 notes