#General Ledger Australia

Explore tagged Tumblr posts

Text

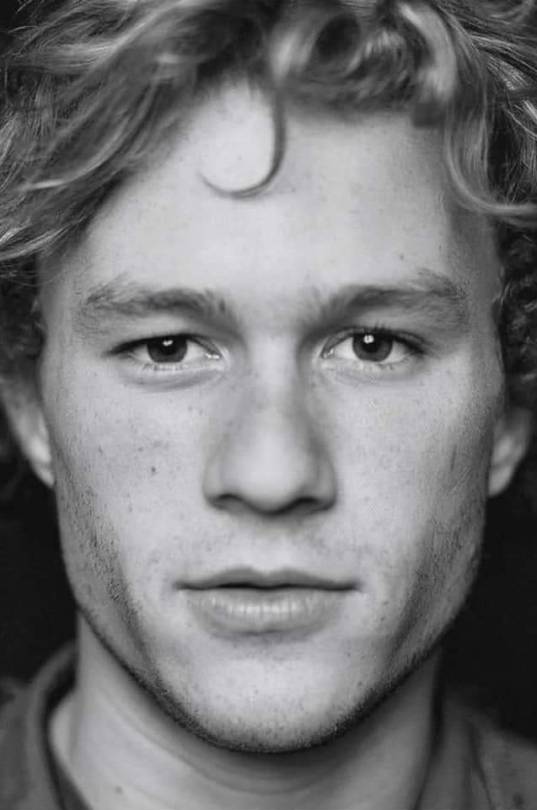

Happy Birthday 🎂 In Heaven To You 🥺

The Young & Incredible Australian🇦🇺 Actor Of The Dark Knight Trilogy 🦇

Who Was Gone Too Soon 😭

Ledger was born on 4 April 1979 in Perth, Western Australia, to Sally Ramshaw, a French teacher, and Kim Ledger, a racing car driver and mining engineer whose family established and owned the Ledger Engineering Foundry. The Sir Frank Ledger Charitable Trust is named after his great-grandfather Frank Ledger. He had English, Irish, and Scottish ancestry.

He was an Australian actor. After playing roles in several Australian television and film productions during the 1990s, he moved to the United States in 1998 to further develop his film career. His work consisted of 20 films in a variety of genres, including 10 Things I Hate About You (1999), The Patriot (2000), A Knight's Tale (2001), Monster's Ball (2001), Casanova (2005), Lords of Dogtown (2005), Brokeback Mountain (2005), Candy (2006), I'm Not There (2007), The Dark Knight (2008), and The Imaginarium of Doctor Parnassus (2009), the latter two of which were posthumously released. He also produced and directed music videos and aspired to be a film director.

Ledger died in January 2008 from an accidental overdose as a result of prescription drug abuse. A few months before his death, he finished filming his role as the Joker in The Dark Knight; the performance brought him universal acclaim and popularity, and numerous posthumous awards including the Academy Award for Best Supporting Actor, the Golden Globe Award for Best Supporting Actor, and the BAFTA Award for Best Supporting Actor.

He Was 28 Years Old

Please Wish This Beloved Australian Actor & Now A Legend Gone Too Soon 😢

His Name Will Forever More Be Remembered

His Acting Will Live On In Future Generations To Come

& His Last Movie Will Go Down In History As His Greatest Achievement Of All Times

The 1 & Always

MR. HEATH ANDREW LEDGER 🇦🇺 AKA THE JOKER 🃏 OF THE DARK KNIGHT 🦇

HAPPY HEAVENLY 45TH BIRTHDAY 🎂 ✨ TO YOU MR. LEDGER & YOUR MEMORY WILL LIVE ON IN OUR HEARTS 💕 🥺

WHY SO SERIOUS 🃏

#HeathLedger #10ThingsIHateAboutYou #AKnightsTale #MonstersBall #BrokebackMountain #TheDarkKnight #TheJoker #WhySoSerious

#Heath Ledger#10 Things I Hate About You#A Knights Tale#Monsters Ball#Brokeback Mountain#The Dark Knight#The Joker 🃏#Why So Serious#Spotify

8 notes

·

View notes

Text

Why It's Smart to Outsource SMSF Accounting in 2025: A Game-Changer for Professionals

In today’s fast-moving financial environment, professionals across Australia are seeking smarter ways to manage workloads without compromising quality. That’s where outsource SMSF accounting comes in — not as a shortcut, but as a strategy for scaling up accuracy, compliance, and efficiency.

At Optimisers, we provide tailored SMSF accounting services designed exclusively for accounting firms, CAs, CPAs, tax agents, and financial advisers. Our goal is simple: take the back-office stress off your plate so you can focus on delivering value-driven advice to your clients.

Why You Should Outsource SMSF Accounting

Managing Self-Managed Super Funds (SMSFs) in-house can be time-consuming and resource-intensive. When you outsource SMSF accounting to experts like Optimisers, you gain:

Access to experienced SMSF specialists who know current regulations inside and out.

Cost-effective solutions that reduce in-house staffing and training burdens.

Up-to-date compliance and error-free reporting that keeps your clients audit-ready.

Time freedom to focus on business growth and advisory services.

What Makes Optimisers the Right Choice for SMSF Outsourcing?

Our team combines deep technical expertise with real-world understanding of how firms operate. We’re not just ticking boxes — we’re actively helping you deliver exceptional client outcomes. Whether you're overwhelmed with lodgements or struggling with resource gaps, our SMSF outsourcing service brings back control, clarity, and momentum to your operations.

We handle:

SMSF financial statement preparation

Tax return lodgement support

Audit file preparation

Workpaper management

SuperStream and trustee documentation

Future-Proof Your Practice with Trusted SMSF Accounting Services

As the financial services industry becomes more digital and compliance-driven, the need for accurate and scalable SMSF accounting services continues to rise. Optimisers is here to help you navigate that growth without compromise.

Let us be your silent engine — reliable, efficient, and always aligned with your goals.

📩 Ready to get started? Partner with Optimisers and transform the way you manage SMSFs.

🔹 Outsource SMSF Accounting 🔹 SMSF Outsourcing 🔹 SMSF Accounting Services

Your workload just got lighter. Your results? Sharper than ever.

FAQs – SMSF Outsourcing with Optimisers

1. What are the benefits if I choose to outsource SMSF accounting to Optimisers? By choosing to outsource SMSF accounting to Optimisers, you get expert-prepared financials, tax returns, audit files, and compliance reports — all delivered faster and with higher accuracy. This lets you focus on core client work without the operational burden.

2. Is SMSF outsourcing secure and compliant with Australian standards? Absolutely. SMSF outsourcing with Optimisers follows strict data security protocols and adheres to ATO and ASIC compliance standards. We also use secure cloud-based systems to ensure confidentiality and transparency in every transaction.

3. What’s included in your SMSF accounting services package? Our SMSF accounting services include everything from general ledger entries, tax computation, audit file prep, actuarial support coordination, to trustee documentation and more — all customized for your firm’s workflow.

4. Can you integrate with the accounting software my firm is currently using? Yes, Optimisers works seamlessly with leading platforms like BGL, Class Super, MYOB, and Xero. We ensure full compatibility to make the SMSF outsourcing process smooth and disruption-free.

5. Is there a minimum number of SMSF files required to start outsourcing? Not at all. Whether you have 5 or 500 funds, we tailor our SMSF accounting services to fit your firm’s size and goals. There’s no barrier to entry — just better efficiency from day one.

0 notes

Text

MYOB (Mind Your Own Business) Software: Streamlining Accounting for Modern Businesses

By Dr. Chinmoy Pal

In today’s fast-paced business environment, managing finances efficiently is not a luxury—it's a necessity. MYOB (Mind Your Own Business) is a leading accounting software solution designed to help small and medium-sized businesses (SMEs) automate their bookkeeping, accounting, payroll, and tax obligations.

Used widely across Australia, New Zealand, and Southeast Asia, MYOB empowers businesses to focus on growth by simplifying back-office operations. Whether you're a freelancer, entrepreneur, or accountant, MYOB offers flexible tools tailored to your financial management needs.

🧾 What is MYOB?

MYOB is an Australian accounting software brand offering cloud-based and desktop accounting solutions for small to medium enterprises. It was founded in the 1990s and has grown into a full-service platform for managing business finances, payroll, GST reporting, invoices, and compliance tasks.

MYOB’s product suite includes software for:

Accounting and bookkeeping

Payroll and employee management

Inventory and project tracking

Tax and GST/BAS compliance

Business reporting and analytics

🧠 Key Features of MYOB Software

✅ 1. Accounting Automation

Real-time bank feeds and automatic reconciliation

General ledger, chart of accounts, and trial balance support

Tax calculations, business activity statements (BAS), and GST reporting

✅ 2. Invoicing and Billing

Customizable invoice templates

Schedule recurring invoices

Accept payments online (via credit card, PayPal, or BPAY)

✅ 3. Payroll Management

Single Touch Payroll (STP) compliant in Australia

Track leave, overtime, superannuation, and PAYG

Automatic employee tax calculations and payslips

✅ 4. Inventory Management

Track stock levels and reorder points

Manage suppliers and purchase orders

Inventory linked to sales and COGS reporting

✅ 5. Cloud Access and Mobile App

Cloud-based software accessible from any device

Mobile app for invoicing, expense capture, and live business insights

✅ 6. Reporting and Insights

Financial reports (P&L, balance sheet, cash flow)

Real-time dashboards for business performance

Custom reports for tax season and audits

✅ 7. Third-Party Integration

Integrates with over 300+ apps including Shopify, Square, Stripe, Salesforce, Microsoft Excel, and more

📊 Product Versions of MYOB

Product NameBest ForKey FeaturesMYOB Business LiteSole traders & freelancersInvoicing, bank feeds, reportsMYOB Business ProSmall businessesPayroll, BAS, inventory, full reportingMYOB AccountRightSMEs needing desktop + cloudAdvanced features + offline accessMYOB EssentialsCloud-only usersAffordable, easy-to-use online solutionMYOB AdvancedLarge enterprisesFull ERP solution (HR, CRM, inventory, etc.)

📚 Applications of MYOB in Practice

🧾 Small Business Accounting

Track income, expenses, and profit in real-time

Simplify bookkeeping and reduce human error

🧑🏫 Educational Institutions

Used in business and accounting programs to teach practical financial skills

🧍♂️ Freelancers and Sole Traders

Manage invoices, payments, and tax compliance easily

🏢 Corporate and Mid-Sized Firms

Run payroll, manage multiple users, and generate customized reports

🛠️ How to Get Started with MYOB

Choose a Plan Visit: https://www.myob.com Select the best plan based on your business size and needs.

Setup Your Account Customize your chart of accounts, tax settings, payroll, and invoice templates.

Connect Bank Feeds Link your bank accounts for automatic transaction imports.

Start Managing Your Business Enter sales, expenses, reconcile accounts, and generate reports.

Use Support and Tutorials MYOB provides extensive help documents, video tutorials, and customer support.

📈 Advantages of MYOB

AdvantageDescription💰 GST & BAS ComplianceDesigned to meet Australian and NZ tax laws💼 Business-Specific ToolsFeatures like payroll and inventory built-in🌐 Cloud + Desktop AccessUse online or offline with syncing capabilities📱 Mobile AccessWork on-the-go with iOS/Android app🔗 IntegrationSeamlessly works with ecommerce and CRM tools

⚠️ Limitations of MYOB

Primarily for AU/NZ market: Taxation and compliance features tailored to Australia and New Zealand

Subscription-based: Monthly fees apply (though more affordable than many competitors)

Learning curve for beginners: Interface can feel complex at first

🔮 Future of MYOB Software

MYOB is continuously improving with features like AI-driven insights, automated bank reconciliation, and real-time collaboration. The addition of cloud-native ERP capabilities (MYOB Advanced) signals its evolution from small business accounting software to a complete business management platform.

✅ Conclusion

MYOB stands out as a powerful, flexible, and regionally optimized software for managing the complete financial health of a business. Whether you’re a sole trader needing basic invoicing or a company requiring payroll, tax, and inventory tools, MYOB offers scalable solutions that grow with your business.

With its blend of cloud access, automation, and compliance tools, MYOB truly helps you "mind your own business"—smarter and faster.

Author: Dr. Chinmoy Pal Website: www.drchinmoypal.com Published: July 2025

0 notes

Text

Australia Gold Ore Mining +TG@yuantou2048

Australia Gold Ore Mining +TG@yuantou2048 is a fascinating topic that intertwines the traditional concept of mining with the modern world of cryptocurrency. In the digital age, "mining" has taken on a new meaning, especially with the advent of virtual currencies. Just as gold ore is extracted from the earth in Australia, digital miners extract cryptocurrencies through complex computational processes.

Virtual coin mining involves using high-powered computers to solve intricate mathematical problems. Once these problems are solved, new coins are generated and added to the blockchain, a public ledger that records all transactions. This process not only creates new coins but also verifies transactions within the network, ensuring its security and integrity.

For aspiring miners, platforms like https://paladinmining.com offer comprehensive resources and tools to get started. These platforms provide the necessary software and hardware recommendations, making it easier for beginners to join the mining community. Moreover, they often include tutorials and guides that explain the intricacies of mining, helping users optimize their operations for maximum profitability.

However, it's crucial to understand the challenges involved. Virtual coin mining requires significant investment in hardware and consumes a substantial amount of electricity. Therefore, miners must carefully analyze the costs and potential returns before diving in. Additionally, staying updated with the latest trends and technologies in the crypto space can give miners a competitive edge.

In conclusion, Australia Gold Ore Mining +TG@yuantou2048 serves as an interesting parallel to the world of virtual coin mining. By leveraging platforms like https://paladinmining.com, individuals can explore this exciting field and potentially earn valuable cryptocurrencies. Whether you're a tech enthusiast or a seasoned investor, the world of virtual coin mining offers endless opportunities for those willing to delve into its complexities.

https://t.me/yuantou2048

BCC Mining

BCCMining

0 notes

Text

The Complete Guide to SAP FICO Online Training: Launch Your Finance Career in 2025

If you're looking for a career that combines finance with cutting-edge technology, SAP FICO training might be your perfect choice. SAP FICO (Financial Accounting and Controlling) is one of the most in-demand skills in today's job market, used by major companies worldwide to manage their financial operations. This blog will explain everything you need to know about SAP FICO online training and how it can transform your career.

What is SAP FICO?

SAP FICO is the financial module of SAP ERP software that helps organizations manage their accounting and financial reporting. The FI (Financial Accounting) part handles external reporting like balance sheets and profit/loss statements, while CO (Controlling) deals with internal cost management and profitability analysis. Together, they form the backbone of a company's financial operations, making SAP FICO professionals essential for businesses of all sizes.

Why Learn SAP FICO in 2024?

The demand for SAP FICO professionals is growing rapidly as more companies adopt SAP software. With businesses shifting to SAP S/4HANA (the latest ERP system), trained professionals are needed to handle financial data migration, reporting, and automation. Companies like Deloitte, Accenture, and TCS are actively hiring SAP FICO consultants with salaries ranging from ₹5 lakhs to ₹20 lakhs per year depending on experience.

Another advantage of learning SAP FICO is its global applicability. Since SAP is used by multinational corporations, certified professionals can find job opportunities in countries like the USA, Germany, UAE, and Australia. Whether you're a fresh graduate, an accountant, or an IT professional, SAP FICO skills can significantly boost your career growth.

What Will You Learn in SAP FICO Online Training?

A good SAP FICO Online course covers both theoretical concepts and hands-on practice. You’ll start with the basics of financial accounting, including General Ledger (GL), Accounts Payable (AP), and Accounts Receivable (AR). Then, you’ll move into more advanced topics like Asset Accounting, Cost Center Accounting, and Profitability Analysis (CO-PA).

One of the most important aspects of SAP FICO training is learning how to work on real SAP systems. The best courses provide access to SAP IDES (a practice server) where you can simulate real-world financial transactions. This practical experience is crucial because employers look for candidates who can work on live SAP environments from day one.

If the training includes SAP S/4HANA (the newest version of SAP), you’ll also learn about FIORI apps, advanced reporting, and migration techniques from older SAP systems. Since many companies are moving to S/4HANA, this knowledge makes you even more valuable in the job market.

How to Choose the Best SAP FICO Online Training?

Not all SAP FICO courses are the same, so it’s important to select one that gives you the best career advantage. Here’s what to look for:

Experienced Trainers: The instructors should have real-world experience working on SAP FICO projects in companies.

Live Projects & Case Studies: Training should include real business scenarios, not just theory.

Placement Support: A good institute helps with resume building, interview preparation, and job referrals.

Certification: Ensure the course provides a recognized certificate that adds value to your resume.

Why KLS Academy’s SAP FICO Training Stands Out?

At KLS Academy, we focus on making students job-ready through practical training, industry projects, and placement assistance. Our trainers are SAP-certified professionals with over 15 years of experience in MNCs. We offer flexible online classes with lifetime access to recordings, so you can learn at your own pace.

Additionally, we provide 100% job support, including resume reviews, mock interviews, and direct referrals to hiring companies. Many of our students have secured jobs at top firms like Deloitte, Capgemini, and IBM within months of completing the course.

Who Should Take SAP FICO Training?

Commerce Graduates (B.Com, M.Com, CA, CMA) looking to enter the corporate finance sector.

Working Accountants who want to upgrade from Tally/QuickBooks to SAP.

IT Professionals shifting to SAP consulting roles.

MBA Finance Students aiming for high-paying ERP jobs.

How to Get Started?

If you’re ready to build a successful career in SAP FICO, the first step is to join a structured training program. KLS Academy offers free demo classes where you can experience the teaching style before enrolling.

📅 Next Batch Starts Soon – Limited Seats Available! 📞 Call Now: 9550814011 🌐 Visit: klakshmanaswamy.com

Final Thoughts

SAP FICO is more than just software training—it’s a career accelerator. With the right course and dedication, you can become a certified SAP FICO professional in 3-6 months and open doors to high-salary jobs globally. The key is to choose a reputable training institute that provides hands-on practice and job support.

Start your SAP FICO journey today and take control of your financial future! 🚀

#sap-mm training#sap mm training online#sap mm online course#sap mm course online#sap mm online training#SAP fico online training#sap fico online classes#SAP fico online course#SAP fico training online

0 notes

Text

Tech Trends Driving the Carbon Footprint Market

The global carbon footprint management market size is expected to reach USD 20.44 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 9.2% from 2023 to 2030. The market drivers influencing carbon footprint management market considerations are multifaceted and include a combination of regulatory policies, consumer demand for sustainable products and services, corporate sustainability goals, and growing investor interest in environmentally responsible investments.

Government regulations and international agreements, such as the Paris Agreement, set emission reduction targets and impose penalties for non-compliance, incentivizing businesses to adopt greener practices. Rising awareness of clean energy across the industrial sector and availability of energy-saving certificates in developed countries such as the U.S. and regions such as the European Union are expected to boost the demand for waste heat recovery systems over the forecast period. The supportive policies in countries such as China, India, Japan, and Australia are expected to boost the market growth in Asia Pacific over the forecast period.

Moreover, the development of EU and Emissions Performance Standard (EPS) has majorly propelled the carbon footprint management technology penetration in the market. The provision of a cap-and-trade system, which puts a price on carbon emissions is stimulating CCS installations across several industries such as power generation, chemical processing, oil & gas, iron & steel, and others.

Carbon footprint management market is a fragmented market where many companies such as ENGIE, IsoMetrix, SAPaccount for significant market share in the market in 2022. These companies apart from upgrading carbon management solutions are also focusing on various strategic initiatives including partnership, new launches, collaborations and expansion.

Carbon Footprint Management Market Report Highlights

Cloud emerged as fastest growing deployment type in the global market with CAGR of 12.0% over the forecast period. One of the primary reasons for the growth of cloud segment are remote access and affordability to the end-users.

Enterprise tier has the largest market share in the end-use segment in the market with 39.50% of the market in 2023. As concerns about climate change and its impacts continue to grow, organizations are implementing emissions control and tracking systems in manufacturing or power generation facilities are large scale.

Energy and Utilities accounted for largest market share in the phase system segment in the market with 31.91% of the market in 2023. The power sector accounted for two-thirds of the emissions growth from the previous year. Due to high emission rates, carbon capture & storage potential is extremely high in coal-fired power plants which is expected to propel the demand for carbon footprint management solution in near future.

As of 2023, the Asia Pacific accounted for 57.01% revenue share in the overall market. Government initiatives by major countries like China, India, Japan and Australia to track and reduce carbon emissions is expected to drive the market over forecast period.

Various strategic initiatives were recorded over the past few years to boost the growth of the market. For instance, in May 2023, SAP launched Green ledger solution to tackle carbon footprint management like tracking of carbon in the daily operations.

Request a free sample copy or view report summary: Carbon Footprint Management Market Report

#CarbonFootprint#CarbonManagement#CarbonTracking#EmissionReduction#CarbonAccounting#CarbonFootprintSolutions#CarbonMonitoring#CarbonReporting

0 notes

Video

youtube

🎬 Heath Ledger’s Journey: From 10 Things I Hate About You to The Dark Knight | Born April 4 🎭

Born on this day, April 4, 1979, Heath Ledger was a once-in-a-generation talent whose impact on Hollywood remains legendary. From his charming breakout role in 10 Things I Hate About You to his unforgettable, Oscar-winning performance as the Joker in The Dark Knight, Ledger’s career was nothing short of extraordinary. His passion, intensity, and dedication to his craft made him one of the most respected actors of his time. In this AI-enhanced video, we take you on a visual journey through Heath Ledger’s life, from his early days in Australia to his rise as a Hollywood icon. Witness his evolution through stunning AI-created images that bring his story to life like never before! 🔥 Don’t forget to: ✔️ Like, comment, and share if you love Heath Ledger’s work! ✔️ Subscribe to @Born_on_this_day and turn on notifications 🔔 to never miss a video! 📌 Follow us on social media for more exclusive content: 👉 Twitter: https://x.com/cipbtro 👉 Facebook: https://www.facebook.com/CevaDeUmplutTimpul 👉 Tumblr: https://www.tumblr.com/blog/bornonthisday 👉 Paysenger: https://bit.ly/Paysnger 👉 Quora: https://bornonthisday.quora.com/ 🎁 Check out related products and collectibles: 🛒 Amazon: https://amzn.to/46UzPRP 🎨 OpenSea: https://bit.ly/this_day-1 📱 ZEDGE™: https://bit.ly/zedgeBoTD #HeathLedger #TheDarkKnight #Joker #BornOnThisDay #MovieLegends #HollywoodIcons #AIArt #FilmHistory

0 notes

Text

Modernizing Accounting with Automated Reconciliation: A Smart Move for Fraud Risk Mitigation

At VNC Australia, we understand that account reconciliation is often a time-consuming, complex, and error-prone task for finance teams. From verifying thousands of transactions each month to ensuring compliance with financial standards, the manual process can drain valuable resources and increase the risk of mistakes. But what if there was a way to streamline this process—saving you time, reducing errors, and enhancing your financial decision-making?

Welcome to the future of accounting: automated account reconciliation.

In this blog, we’ll explore how automation, particularly when integrated with Xero and other leading software, can revolutionize your reconciliation process, making it faster, more accurate, and far less burdensome for your team.

Why Automate Account Reconciliation with Software?

Traditional reconciliation methods involve manually comparing transactions across multiple platforms and ledgers. This process is not only tedious but prone to human error, leading to discrepancies, delayed financial closes, and potential compliance issues. As your financial ecosystem becomes increasingly complex—with transactions happening across multiple platforms and currencies—automation offers a far superior solution.

By integrating account reconciliation software like Xero, you can ensure faster, more reliable, and real-time matching of transactions. This helps your business avoid costly mistakes and inefficiencies, enabling quicker decision-making, improved compliance, and a reduction in operational risks.

What is Account Reconciliation Software?

Account reconciliation software is an advanced tool that automates the process of matching transactions in your financial records. It compares your account balances with bank statements or credit card transactions to ensure consistency and accuracy. This software not only speeds up the reconciliation process but also minimizes errors, saving your finance team time and increasing the accuracy of your financial reports.

Xero, a popular accounting software used by many Australian businesses, provides powerful reconciliation features that allow you to match bank transactions with your accounting records quickly and accurately. With its seamless integration with banks and other systems, Xero is a go-to tool for businesses looking to automate and streamline their reconciliation process.

How Does Account Reconciliation Software Work?

Xero Account reconciliation software uses powerful algorithms to automatically match transactions between your accounting system and bank statements. It flags any discrepancies and provides tools to investigate and resolve them quickly. The process typically involves:

Automated Matching: The software matches transactions, such as deposits and withdrawals, to those in your general ledger.

Discrepancy Detection: When mismatches occur, the system flags them for review.

Flexible Reconciliation Policies: Tailored to meet your company’s specific needs and rules, allowing for customization of the reconciliation process.

Seamless Integration: The software integrates directly with banking systems and ERP solutions like Xero, ensuring consistency and real-time updates.

By automating these tasks, you can ensure faster, more efficient reconciliations that lead to timely financial closes.

Key Benefits of Automating Account Reconciliation

Error Reduction

Manual reconciliation is rife with human errors. Automated systems significantly reduce mistakes caused by data entry or missed transactions. With automation, discrepancies are detected immediately, leading to more accurate financial records. This can enhance investor confidence, optimize cash flow, and reduce the risk of compliance issues. Xero takes it a step further by matching transactions directly with your bank statements, ensuring you don’t miss anything and minimizing errors that could arise from manual data entry.

Time and Cost Efficiency

Reconciliation tasks that once took days can now be completed in minutes. By automating this process, your team can shift focus from routine reconciliations to more strategic financial planning. This saves both time and money, as the need for manual labor and extensive oversight is drastically reduced.

Accurate Financial Reporting

Accurate and timely financial reporting is critical to any business. Automated reconciliation ensures that your financial reports reflect a true and fair view of your company’s financial status. With improved accuracy, you gain better control over your finances, enabling you to make more informed business decisions.

Xero helps by automatically syncing transactions and matching them with your accounting data, ensuring that reports are both accurate and timely.

Enhanced Fiscal Control and Audits

Automation creates a clear, traceable record of all financial activities, which simplifies the audit process. With detailed records and real-time data, audits become smoother, faster, and less disruptive to day-to-day operations. It also helps businesses maintain strong internal controls, ensuring compliance with regulations and reducing the risk of fraud. Xero simplifies audits with its transparent, detailed transaction history, providing clear audit trails that are easy to review when it’s time for a financial review.

Fraud Prevention

Automation acts as an early warning system for potential fraud. By continuously monitoring and matching transactions, discrepancies can be identified and flagged before they escalate. This proactive approach to fraud prevention can save businesses from financial losses and protect their reputation.

Xero’s automatic transaction matching makes it easier to spot unusual or fraudulent activities by highlighting discrepancies in real-time.

Key Areas for Account Reconciliation Automation

Automating your reconciliation process can streamline several key areas:

Automated Flagging: With sophisticated transaction-matching rules, reconciliation software can instantly identify errors or fraudulent activities. This allows you to act quickly, reducing the impact of mistakes.

Seamless Integration: Cloud-based reconciliation tools like Xero integrate with your accounting software, providing consistent, real-time data across departments. This leads to better insights and improves financial decision-making.

Workflow Automation: Automating approval workflows, as well as accounts payable and receivable reconciliations, can further enhance financial efficiency. This reduces the time spent on manual approvals and increases the speed of financial closes.

How VNC Australia Can Help You Automate Account Reconciliation

At VNC Australia, we’re committed to helping businesses in Australia and New Zealand modernize their accounting and bookkeeping processes. By leveraging advanced account reconciliation software like Xero, QuickBooks. we help you transition from traditional, manual methods to efficient, automated solutions that deliver real-time insights and improve financial accuracy.

We understand that adopting automation tools can be daunting, but our expert advisory services can guide you through the transition, ensuring that you reap the full benefits of automated reconciliation. With VNC Australia’s solutions, you can focus on strategic financial management while leaving the complex, time-consuming tasks to automation.

Conclusion

In today’s fast-paced financial environment, automation isn’t just a luxury—it’s a necessity. Automated account reconciliation not only saves time but also improves accuracy, reduces costs, and enhances decision-making. By making this shift, you’ll unlock the strategic advantages that come with a more efficient, data-driven approach to financial management.

Ready to take your reconciliation process to the next level? Contact VNC Australia,one of the leading Australian accounting firms, today to learn how automation, powered by Xero, can help your business thrive.

Bonus Tips: Automated account reconciliation can drastically improve financial accuracy and efficiency, but it’s just one step in modernizing your accounting practices. For businesses looking to optimize their overall operations, explore our blog – Save Time, Cut Costs: Simplify Your Supply Chain Today to learn how automation can help reduce costs and improve time management.

Original Source: Modernizing Accounting With Automated Reconciliation: A Smart Move For Fraud Risk Mitigation

#top accounting firms australia#australian accounting firms#Accountant near me#Bookkeeper near me#Melbourne bookkeeper#bookkeeping services near me#accounting firms near me#Sydney bookkeeper#Brisbane bookkeeper#Payroll expert near me#E-commerce accountant#outsourced payroll services#bookkeeper for small business

0 notes

Text

Blockchain Devices Market Size, Share, Trend, Forecast, & Growth Analysis: 2024-2032

Blockchain Devices Market 2024 Report: A Comprehensive Analysis of Historical and Current Market Trends with Strategic Insights.

Analysis of the global "Blockchain Devices Market" shows that the market will develop steadily and strongly between 2024 and 2032, and projections indicate that this growth will continue through 2032. The increasing demand from consumers for ecologically friendly and sustainable products is a noteworthy development in the Blockchain Devices Market. To improve the effectiveness and caliber of products in the Blockchain Devices Market, technology has also been used much more frequently.

➼ Market Capacity:

Between 2017 and 2023, the Blockchain Devices Market's value increased significantly, from US$ million to US$ million. With a compound annual growth rate (CAGR) predicted to reach US$ million by 2032, this momentum is anticipated to continue. An extensive analysis explores consumer preferences and purchasing patterns in this industry, broken down by type (Filament (US), GENERAL BYTES R.O. (Czech Republic), Blockchain Luxembourg S.A. (UK), SatoshiLabs (Czech Republic), Lamassu Industries AG (Switzerland), Ledger SAS (France), HTC Corporation (Taiwan), RIDDLE&CODE (Austria), Genesis Coin Inc. (US), Pundi X Labs Private Limited (Singapore), Sikur (US), AVADO (Switzerland), SIRIN LABS (Switzerland)). Based on extensive research, this perceptive analysis is anticipated to be a useful tool for industry participants looking to profit from the market's remarkable anticipated compound annual growth rate (2024–2032).

➼ Key Players:

List of Blockchain Devices Market PLAYERS PROFILED

The Blockchain Devices Market includes several key players such as Blockchain Smartphones, Cryptographic Hardware Wallet, Crypto Atm play crucial roles in this market.

Blockchain Devices Market Report Contains 2024: -

Complete overview of the global Blockchain Devices Market

Top Country data and analysis for United States, Canada, Mexico, Germany, France, United Kingdom, Russia, Italy, China, Japan, Korea, India, Southeast Asia, Australia, Brazil and Saudi Arabia, etc. It also throws light on the progress of key regional Blockchain Devices Markets such as North America, Europe, Asia-Pacific, South America and Middle East and Africa.

Description and analysis of Blockchain Devices Market potentials by type, Deep Dive, disruption, application capacity, end use industry

impact evaluation of most important drivers and restraints, and dynamics of the global Blockchain Devices Market and current trends in the enterprise

Value Propositions of This Market Research:

The study covers a comprehensive analysis of industry drivers, restraints, and opportunities, providing a neutral perspective on the market performance. It highlights recent industry trends and developments, offering insights into the competitive landscape and the strategies employed by key players. The study identifies potential and niche segments and regions exhibiting promising growth, supported by historical, current, and projected market size data in terms of value. An in-depth analysis of the Blockchain Devices Market is included, along with an overview of the regional outlook. This holistic approach ensures a thorough understanding of the market dynamics and potential growth areas.

Request a Free Sample Copy

Global Blockchain Devices Market: SEGMENTATION ANALYSIS

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

➼ PRODUCTS/SERVICES:

Valuable Points from Blockchain Devices Market Research Report 2024-2032:

The market for Blockchain Devices Market has undergone significant changes because to changing consumer preferences, laws, and technological advancements. This dynamic business is being shaped by new product launches, mergers, and creative marketing strategies from big players. A thorough analysis of recent and historical data yields insights into the market's value, volume, historical growth, current size, and potential for the future. While competition research explores market share and strategy, segmentation by key regions exposes regional variances. The research provides practical suggestions to help you improve your position in this dynamic market and finds new niches and development possibilities across regions.

Request a Free Sample Copy

Behind the Brand In an industry characterized by rapid growth and technological advancements, economic changes occur daily. To thrive in this dynamic environment, companies must understand market trends and develop effective strategies. A well-defined strategy not only facilitates planning but also offers a competitive edge. For dependable market reports that provide essential insights to guide your business toward success, visit us at www.globalmarketstatistics.com .

Explore More Related Reports Here :

AI Dubbing Tools Market

Antenna Tuning Switch Market

Hunting Crossbow Market

Publisher ad management software Market

Jakinibs Market

Dispensing Hot Cell Market

TCT Cell Preservation Solution Market

Lateral Fitness Equipment Market

E-Filing Platforms Software Market

Linear Way Module Market

Solid Sorbents Market

Truck Volume Measurement System Market

ZigBee Smart Switch Market

Online Dating Application Market

Mucosal Atomization Devices Market

#innovation#management#digitalmarketing#technology#creativity#futurism#startups#marketing#entrepreneurship#money#sustainability#inspiration#Leadership#Business#Strategy#Growth#Success#Innovation#Ecommerce#PersonalDevelopment

0 notes

Text

Efficient Taxation Solutions and Accounting Backend Work with Optimisers KPO

In today's fast-paced financial world, firms often face challenges managing their core operations while handling complex compliance requirements. To meet increasing demand and maintain efficiency, outsourcing has become a reliable strategy. Optimisers KPO stands at the forefront, offering professional taxation solutions, expert taxation services, and dependable accounting backend work designed to support financial firms with precision and reliability.

Why Outsource Taxation and Accounting Work?

Taxation and accounting are the backbone of any financial practice, yet they demand significant time, attention, and accuracy. As businesses scale, so do the challenges—tight deadlines, evolving regulations, and high client expectations. Outsourcing not only helps reduce the burden but also ensures quality and compliance without compromising productivity.

Trusted Taxation Solutions

Optimisers KPO offers end-to-end taxation solutions tailored to meet the unique needs of firms. From preparing tax returns and processing lodgments to handling regulatory updates, our team ensures every task is completed with unmatched accuracy and care. With our support, your firm can focus more on strategic advisory while we manage the numbers in the background.

Comprehensive Taxation Services

Our comprehensive taxation services include tax planning support, compliance checks, data entry, reconciliation, and lodgment assistance. Every service is performed with close attention to detail, ensuring our clients meet all statutory obligations without errors or delays. Whether it's individual or business tax returns, we have the resources and expertise to deliver top-tier support.

Reliable Accounting Backend Work

Accounting backend work is crucial for maintaining smooth operations. At Optimisers KPO, we handle tasks such as bookkeeping, financial reporting, general ledger management, accounts payable and receivable, and data entry with strict confidentiality and accuracy. Our processes are designed to seamlessly integrate with your existing workflows, saving you time and resources.

Australia-Focused Compliance and Expertise

As firms in Australia face stringent financial and taxation regulations, Optimisers KPO ensures full compliance with local laws and standards. Our team is trained to align with Australian financial reporting frameworks, delivering services that help practices stay ahead of the curve.

Benefits of Partnering with Optimisers KPO

Cost-effective solutions without compromising on quality

Expert team trained in global and Australian tax standards

Time-saving operations that improve efficiency

Secure and confidential handling of sensitive financial data

Scalable support to match your firm’s growth

Conclusion

If you're looking for a trusted outsourcing partner to handle your taxation solutions, taxation services, and accounting backend work, Optimisers KPO is the right choice. Our expert team helps reduce workload, cut costs, and improve accuracy—empowering your firm to focus on client success and long-term growth.

1 note

·

View note

Text

Mastering Bookkeeping for Tradies: Your Path to Financial Success

Running a successful trade business involves more than just delivering high-quality services to your clients. One critical aspect that often gets overlooked is bookkeeping. Proper bookkeeping is the backbone of a financially healthy business, providing insights into your profitability, cash flow, and overall financial health. This guide aims to demystify bookkeeping for tradies, offering a step-by-step approach to managing your financials effectively. Whether you're a seasoned tradies or just starting, this guide will equip you with the knowledge to streamline your bookkeeping processes and ensure your business's success.

Challenges Tradies Face with Bookkeeping

Bookkeeping can be particularly challenging for tradies due to the nature of their work. Here are some common challenges:

Time Constraints: Tradies often work long hours on-site, leaving little time for administrative tasks like bookkeeping.

Lack of Knowledge: Many tradies are experts in their trade but lack formal training in accounting or bookkeeping.

Inconsistent Income: The fluctuating nature of contract work can make it difficult to maintain consistent financial records.

Cash Transactions: Handling cash payments can complicate record-keeping and increase the risk of errors or omissions.

Compliance Requirements: Keeping up with tax laws and compliance requirements can be daunting without proper bookkeeping practices.

Addressing these challenges requires a solid understanding of bookkeeping fundamentals and the implementation of efficient processes.

Step-by-Step Guide to Bookkeeping for Tradies

1. Understand the Basics of Bookkeeping

Before diving into the specifics, it's important to grasp the basic concepts of bookkeeping. This includes understanding:

Income and Expenses: Track all money coming into and going out of your business.

Accounts Receivable and Payable: Monitor what you're owed and what you owe to others.

Bank Reconciliation: Ensure your bank statements match your financial records.

Financial Statements: Familiarize yourself with key financial reports like profit and loss statements and balance sheets.

2. Set Up a Bookkeeping System

Choose a bookkeeping system that suits your needs. This could be a manual ledger, spreadsheets, or bookkeeping software. For most tradies, using bookkeeping software is the most efficient option due to its ease of use and ability to automate many tasks.

Recommended Bookkeeping Software for Tradies:

QuickBooks: Ideal for small to medium-sized businesses, offering robust features for invoicing, expense tracking, and financial reporting.

Xero: A cloud-based option that is user-friendly and integrates with many other business tools.

MYOB: Popular in Australia, providing comprehensive accounting solutions tailored for local compliance.

3. Create a Chart of Accounts

A chart of accounts is a listing of all the accounts your business uses to record transactions. It categorizes your income, expenses, assets, liabilities, and equity. Setting up a detailed chart of accounts helps in organizing your financial data and simplifies the process of generating reports.

4. Record Transactions Regularly

To maintain accurate financial records, it's crucial to record transactions regularly. This includes:

Invoicing Clients: Generate and send invoices promptly. Follow up on overdue invoices to ensure timely payments.

Tracking Expenses: Record all business expenses, including materials, tools, and operational costs. Keep receipts and categorize expenses for tax purposes.

Managing Cash Flow: Monitor your cash flow to ensure you have enough funds to cover your expenses. Consider using a cash flow statement to track this.

5. Reconcile Your Bank Statements

Bank reconciliation involves matching your bank statements with your bookkeeping records to identify any discrepancies. This process helps in detecting errors, preventing fraud, and ensuring that your financial records are accurate.

6. Maintain Accurate Records for Tax Purposes

Tax compliance is a critical aspect of bookkeeping. Keep accurate records of all income and expenses, and stay informed about the tax laws applicable to your business. Consider consulting with a tax professional to ensure you're maximizing deductions and staying compliant.

7. Generate Financial Reports

Regularly generate financial reports to gain insights into your business's performance. Key reports to focus on include:

Profit and Loss Statement: Shows your revenue, expenses, and profits over a specific period.

Balance Sheet: Provides a snapshot of your business’s financial position, including assets, liabilities, and equity.

Cash Flow Statement: Tracks the flow of cash in and out of your business.

8. Use Bookkeeping to Make Informed Decisions

Leverage your bookkeeping data to make informed business decisions. Analyze your financial reports to identify trends, assess profitability, and plan for future growth. Effective bookkeeping enables you to:

Budget Effectively: Create and stick to a budget to control your spending.

Plan for Taxes: Estimate your tax liabilities and set aside funds accordingly.

Manage Debts: Keep track of your debts and plan for repayments.

Case Study: How Effective Bookkeeping Transformed a Tradie Business

Let’s look at a real-life example of how effective bookkeeping transformed a tradie business.

Background

John, a self-employed plumber, was struggling to keep his business's finances in order. He was losing track of invoices, failing to follow up on late payments, and had no clear picture of his profitability. John’s bookkeeping system was a mix of paper receipts and an outdated spreadsheet, making it nearly impossible to stay organized.

Challenges

Disorganized Records: John had piles of receipts and no structured system to record transactions.

Cash Flow Issues: Inconsistent invoicing and follow-ups led to cash flow problems.

Tax Compliance: Without proper records, John was uncertain about his tax obligations and missed out on potential deductions.

Solution

John decided to overhaul his bookkeeping system by implementing the following steps:

Adopted Bookkeeping Software: John chose QuickBooks for its user-friendly interface and robust features.

Set Up a Chart of Accounts: He created a detailed chart of accounts to categorize his income and expenses.

Regular Transaction Recording: John made it a habit to record transactions daily, ensuring nothing was missed.

Bank Reconciliation: He started reconciling his bank statements monthly to catch any discrepancies.

Generated Financial Reports: John used the software to generate profit and loss statements and cash flow reports.

Results

Within a few months, John saw significant improvements in his business:

Improved Cash Flow: Timely invoicing and follow-ups reduced outstanding payments and improved cash flow.

Better Financial Insight: Regular financial reports gave John a clear understanding of his business’s performance.

Tax Savings: Accurate record-keeping enabled John to claim all eligible deductions, reducing his tax liability.

Conclusion

Effective bookkeeping is essential for the success of any trade business. By understanding the basics, setting up a reliable system, and regularly maintaining your financial records, you can overcome common challenges and gain valuable insights into your business’s performance. Just like John, you can transform your business's financial health and set the stage for long-term success.

Bookkeeping might seem daunting, especially for tradies who are more accustomed to working with their hands than crunching numbers. However, by following this ultimate guide to bookkeeping, you can simplify your financials and focus on what you do best—delivering top-notch services to your clients.

Remember, the key to successful bookkeeping is consistency. Regularly recording transactions, reconciling bank statements, and generating financial reports will help you stay on top of your finances. Don’t hesitate to invest in good bookkeeping software or seek professional help if needed. With proper bookkeeping practices in place, you can ensure your business’s financial stability and pave the way for continued growth and success.

By adopting these strategies, you can transform your trade business into a well-oiled financial machine. Start today and experience the peace of mind that comes with knowing your financials are in order.

For more detailed advice and personalized solutions, consider consulting with a bookkeeping professional. They can provide tailored guidance to help you optimize your bookkeeping processes and achieve financial success.

0 notes

Text

Odoo, previously known as OpenERP, is a tool for managing customer relationships. It is designed using Python, JavaScript, and XML. Human resource professionals in Australia commonly favor Odoo ERP in Australia. It is versatile, suitable for both business and personal use. Odoo excels in data management, project management, accounts management, warehouse management, customer relationships management, sales and orders management, human resource management, and more. Additionally, it can oversee production and inventory management. Because it is open-source, Odoo is well-suited for use with Ubuntu and can seamlessly integrate with other office management tools.

Odoo is like a toolbox that works together with a database manager called PostgreSQL. Since managing databases is smoother on Ubuntu compared to other systems, Odoo ERP in Australia works really well with Ubuntu. In this guide, you will get to know how to install Odoo, a tool for managing employment tasks, on Ubuntu.

Here’s a list of things you can do with Odoo on Ubuntu. It should answer your questions about what Odoo ERP in Australia can do.

Make websites using Odoo

Manage an online store with Odoo’s eCommerce system

Schedule appointments using Odoo

Keep track of customers with Odoo’s CRM

Get help with selling using Odoo’s assistant

Manage office finances with Odoo’s ledger

Assist customers using Odoo’s application

Manage product lifecycles with Odoo

Handle maintenance and manufacturing tasks with Odoo

Ensure quality control using Odoo

Handle recruitment and employee tasks with Odoo

Conduct office surveys and evaluations using Odoo

Send bulk SMS messages using Odoo

Now let’s see how to install Odoo on Ubuntu

Install PostgreSQL on Ubuntu:

If you have more interest in PostgreSQL, you can install pgAdmin from the Ubuntu Software Store on your Ubuntu machine. pgAdmin helps maintain PostgreSQL. Additionally, you can explore a detailed tutorial on installing PostgreSQL Database and pgAdmin on Ubuntu.

Click here to know about different Odoo implementation stages –

“What are the Different Steps for Successful Odoo ERP Implementation”

Install Wkhtmltopdf on Ubuntu:

Since Odoo operates within a web browser, tasks are handled through its interface. When you try to print documents from Odoo, it creates an HTML file that’s only suitable for printing or viewing. To address this limitation, there’s a helpful tool called Wkhtmltopdf. It works seamlessly with Odoo on Ubuntu and can transform these HTML pages into PDFs or images.

Install Odoo on Ubuntu.

Install the Nginx web server for Odoo ERP on Ubuntu:

Enabling firewall security for Odoo on Ubuntu:

Managing Odoo control panel on Ubuntu:

Installing applications in Odoo on Ubuntu:

After learning how to sign in to the Odoo web address and take control, you can now install applications directly from the Odoo application dashboard. Simply select the desired application and install it with a click. Using Odoo on Ubuntu is incredibly easy and straightforward.

Setting up an ecommerce website with Odoo on Ubuntu:

You can easily create an e-commerce website for your business under the Odoo subdomain. It’s straightforward: just enter your company name, email address, and other details, and Odoo will automatically generate your free e-commerce website.

Click here to know about –

“A Step-by-Step Guide on How to Complete Odoo Implementation Process”

Wrapping Up

Odoo is an exceptional tool for managing business operations and analysis. Throughout this post, you have learned about the fundamental basics of Odoo and walked through the entire process of installing Odoo on Ubuntu. Additionally, the blog has demonstrated how Odoo seamlessly integrates with the PostgreSQL database management tool. Also, with its user-friendly interface and powerful features, Odoo empowers businesses to streamline their operations and achieve remarkable results.To know more about Odoo ERP or to get it installed on your system, get in touch with our certified Odoo experts at Envertis, an official partner of Odoo ERP in Australia.

#odoo erp development#odoo development#odoo development company#odoo development australia#Odoo#odoo erp software#odoo#odoo services#odoo erp

0 notes

Text

Leading Blockchain Innovators in the Energy Sector

In the article “Top Energy Companies Using Blockchain Technology” by Enos Mwangi, updated on March 16, 2024, blockchain technology is spotlighted as a transformative force in the renewable energy sector. This distributed ledger technology is enhancing the efficiency, lowering costs, and fostering the shift to clean energy by allowing for secure, decentralized transaction recording and data sharing. Notably, blockchain enables seamless energy transactions and the integration of emerging technologies like smart meters and battery storage, promoting a shift from centralized to consumer-driven power generation models 🌍⚡.

Companies worldwide are pioneering this change. For instance, WePower in Estonia uses blockchain for transparent renewable energy trading, empowering consumers with more control and investment opportunities in clean energy. In Australia, Power Ledger facilitates peer-to-peer energy trading among solar households, eliminating intermediaries and central oversight 🌞💡. Meanwhile, Iberdrola and Acciona Energy in Spain leverage blockchain to verify the renewable origin of electricity, providing transparency and trust in their sustainability claims.

Localized initiatives like the Brooklyn Microgrid in New York and The Sun Exchange in South Africa demonstrate blockchain’s potential on both community and global scales. The Brooklyn Microgrid supports peer-to-peer energy transactions within a local network, while The Sun Exchange uses cryptocurrencies to fund solar projects in underserved regions, showcasing the versatile applications of blockchain in fostering renewable energy development 🌐🔋.

The article underscores blockchain’s role in not just transforming the energy sector but also its potential to revolutionize various industries by ensuring transparency, reducing costs, and decentralizing control. As blockchain technology continues to evolve, it holds promise for redefining energy generation, distribution, and consumption, empowering communities, and accelerating the global transition to renewable energy sources 🌱💼.

To dive deeper, check out the complete article: https://droomdroom.com/top-energy-companies-using-blockchain-technology/

0 notes

Text

https://www.advancemarketanalytics.com/reports/16160-global-accounting-software-market-2

What Challenges Accounting Software Market May See in Next 5 Years

Advance Market Analytics released a new market study on Global Accounting Software Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Accounting Software Forecast till 2029*.

Accounting software is a fundamental application that enables an organization to record the flow of money for internal and external review and auditing. It is the primary tool for assessing the financial health of an organization and for meeting legal compliance through tools like general ledgers, purchase orders, account payables & receivables, stock management, and billing.

Key Players included in the Research Coverage of Accounting Software Market are:

Intuit Inc. (United States), Sage Software Inc. (United States), SAP SE (Germany), Oracle Corporation (United States), Microsoft Corporation (United States), Infor Inc. (United States) , Horizon Technology Solutions (India), Zoho Corp (India), FreshBooks (Canada), NetSuite (United States), Deltek (United States),

What's Trending in Market: Users Prefer Cloud-Based Systems to On-Premise

The Adoption of Automation The Era of Millennial Clients

Challenges: Competition is increasing due to Corporate Bookkeeping Firms

Scalability and customization Lack of integrations

Opportunities: The Rising Demand for Accounting Software from the Micro & Small Scale Enterprises

Market Growth Drivers: Increased Efficiency with the use of Accounting Software

Increasing Adoption of Cloud-based Applications Ease of Integration with Existing Software Platforms

The Global Accounting Software Market segments and Market Data Break Down by Type (Billing and invoicing systems, Payroll management systems, Enterprise resource planning systems, Time and expense management systems), Deployment Mode (Cloud-based, On-Premises), Organization Size (Small & Medium Size Enterprise, Large Enterprises), Platform (Windows, Mac, Android, Others), Industry Verticals (BFSI, IT & Telecommunications, Public & Government Sector, Automotive Sector, Retail & Consumer Goods, Oil & Gas, Manufacturing, Healthcare, Construction & Real Estate, Education, Media & Entertainment, Others), Pricing (Monthly Subscription, Annual Subscription, One-Time License)

Get inside Scoop of the report, request for free sample @: https://www.advancemarketanalytics.com/sample-report/16160-global-accounting-software-market-2

To comprehend Global Accounting Software market dynamics in the world mainly, the worldwide Accounting Software market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia and Brazil.

• Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa.

• Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia.

1 note

·

View note

Text

Cloud Accounting Solution Market to See Huge Growth by 2028

Latest released the research study on Global Cloud Accounting Solution Market, offers a detailed overview of the factors influencing the global business scope. Cloud Accounting Solution Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Cloud Accounting Solution The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Intuit Inc. (United States), Sage Group Plc. (United Kingdom), Microsoft Corporation (United States), SAP (Germany), Epicor Software Corporation (United States), Oracle (NetSuite) (United States), Xero Ltd (New Zealand), Infor (United States)

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/55411-global-cloud-accounting-solution-market

Cloud Accounting Solution Market Definition:

Cloud accounting solution is a type of application that records and processes accounting transaction within a functional module such as journal, account receivable, account payable, general ledger, payroll, and trial balance. Cloud software is a platform that allows accessing data with an internet connection. Cloud provides constant access in any location, any time. The market for cloud accounting software is expected to witness a high growth in the near future owing to increasing demand for smart technological solutions in the accounting software and rising use of big data and analytics.

Market Trend:

Increasing Need to Manage Documents and Ensure Security of Sensitive Information

Market Drivers:

Rise in Cloud Accounting Solution Owing to the Host of Benefits that it offers

Increase Adoption of Cloud-based Applications

Ease of Integration with Existing Software Platforms

Market Opportunities:

Increase in Use of Web-Based Interface

The Global Cloud Accounting Solution Market segments and Market Data Break Down are illuminated below:

by Type (Browser-based, SaaS, Application Service Providers (ASPs)), Application (SMEs, Large Enterprises, Other Users), End Use Industry (BFSI, IT & Telecommunication, Government & Public Sector, Automotive, Retail & Consumer Goods, Oil & Gas, Manufacturing, Healthcare, Construction & Real Estate, Others (Education, Media & Entertainment, etc.)), Marketing Channel (Direct Marketing, Indirect Marketing, Cloud Accounting Software Customers)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/55411-global-cloud-accounting-solution-market

Strategic Points Covered in Table of Content of Global Cloud Accounting Solution Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Cloud Accounting Solution market

Chapter 2: Exclusive Summary – the basic information of the Cloud Accounting Solution Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges of the Cloud Accounting Solution

Chapter 4: Presenting the Cloud Accounting Solution Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Cloud Accounting Solution market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Cloud Accounting Solution Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology The primary sources involves the industry experts from the Global Cloud Accounting Solution Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/55411-global-cloud-accounting-solution-market

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837

0 notes