#HRA and basic salary

Explore tagged Tumblr posts

Text

🧾 Salary in Income Tax Act : Foundation of Your Pay Structure (Explained with Taxation, Benefits & Tips)

📑 Table of Contents What is Salary in Income Tax Act?, What is Basic Salary? Importance of Basic Salary Taxability of Basic Salary Basic Salary vs Gross Salary vs Net Salary Allowances and Contributions Based on Basic Salary How to Calculate Basic Salary? Tips to Optimize Tax on Salary Real-Life Example Frequently Asked Questions (FAQs) 📌 1. What is Salary in Income Tax Act? ✅ What is…

#basic salary#CTC breakup#form 16#gratuity calculation#HRA and basic salary#income tax on salary#PF calculation#salary tax planning#taxable income from salary#taxable salary components

0 notes

Text

"How to Become an SBI Probationary Officer: Eligibility, Exam, Salary & More"

The State Bank of India Probationary Officer (SBI PO) submit is one of the maximum sought-after and prestigious jobs inside the Indian banking area. Every year, lakhs of applicants appear for this aggressive exam, desiring to stable a stable and profitable authorities job. The SBI PO role no longer only offers a good-looking salary and severa perks however also gives an opportunity for expert boom and leadership within the united states of america’s biggest public-area bank.

SBI PO exam

Introduction to SBI PO

After choice, candidates undergo rigorous training and probation. As India's biggest bank, SBI operates a sizeable network of branches and ATMs, and a PO can be posted in urban or rural regions, relying on the want.

Eligibility Criteria

Before making use of for the SBI PO exam, candidates should ensure they meet the eligibility standards. The basic requirements are:

Nationality: Indian citizen.

Final-yr graduation college students also can apply, provided they produce proof of commencement at the time of the interview.

Roles and Responsibilities of an SBI PO

The SBI PO is a surprisingly responsible and dynamic role. The key duties include:

Customer Service: Addressing patron queries, court cases, and helping with banking offerings.

Business Development: Promoting financial institution products like loans, deposits, and insurance.

Cash Management: Overseeing day by day coins transactions, preserving facts, and ensuring accuracy.

Loan Processing: Evaluating mortgage applications, engaging in hazard analysis, and documentation.

Supervisory Role: Managing clerical group of workers, making sure operational efficiency, and reporting to senior officers.

Audit and Compliance: Ensuring adherence to banking norms, guidelines, and inner audits.

After the probation length, a PO may also be assigned roles like branch manager, credit score officer, or relationship supervisor, relying on overall performance.

Salary and Perks

The SBI PO activity comes with an appealing profits package. As in keeping with the contemporary facts:

Basic Pay: ₹forty one,960

Gross Salary: ₹65,000 to ₹70,000/month (approx., varies with area)

Additional Perks:

Dearness Allowance (DA)

House Rent Allowance (HRA)

City Compensatory Allowance (CCA)

Provident Fund

Medical Facilities

Contributory Pension Scheme

Petrol and Travel Allowance

Furniture Allowance

Newspaper and Book Grant

Leave Encashment

Moreover, SBI POs are entitled to home loans and automobile loans at sponsored hobby quotes.

Career Growth Opportunities

SBI offers great career progression. A PO can upward push thru inner tests and performance-primarily based promotions. The normal profession direction includes:

Assistant Manager

Deputy Manager

Manager

Chief Manager

Assistant General Manager

Deputy General Manager

General Manager

Chief General Manager

Managing Director

Chairman (top role viable through long-time period progression)

With difficult paintings and determination, a PO can even attain the pinnacle executive roles in SBI or get deputed to global places of work.

Preparation Tips for SBI PO Exam

Cracking the SBI PO exam requires a properly-dependent practise strategy. Here are some recommendations:

1. Understand the Syllabus and Pattern

Familiarize your self with the present day syllabus and examination pattern. Focus on sections like reasoning, aptitude, and English comprehension.

2. Time Management

Practice mock exams and former years’ papers to enhance speed and accuracy. Use timers to replicate real examination conditions.

Three. Strengthen Weak Areas

Identify vulnerable topics and dedicate greater time to enhancing them. Join on-line training or coaching if wished.

4. Read Daily

Develop the habit of studying newspapers like The Hindu or Economic Times to live up to date with modern-day affairs and improve vocabulary.

5. Practice Descriptive Writing

For the mains, practice essay and letter writing regularly to attain nicely in the descriptive segment.

6. Group Discussion and Interview Practice

Work on conversation and interpersonal abilties. Participate in mock interviews and organization discussions to build self belief.

Why Choose SBI PO as a Career?

1. Job Security and Stability

Being a government job, SBI PO gives lifelong process security with regular profits and retirement advantages.

2. Growth and Recognition

SBI encourages benefit-based promotions. There is extensive scope to climb the corporate ladder quick.

Three. Work-Life Balance

Although annoying at instances, SBI gives ample go away alternatives, a 5-day work week for officials, and aid for paintings-existence stability.

Four. National and International Exposure

Being a global financial institution, SBI has operations across nations. Officers may be published overseas or deputed to global banking assignments.

SBI PO Selection Process

The choice procedure for SBI PO is conducted in 3 principal stages:

1. Preliminary Examination

This is a web goal-kind check comprising three sections:

English Language

Quantitative Aptitude

Reasoning Ability

It serves as a screening test.

2. Main Examination

Candidates who clear the prelims seem for the mains, which includes each objective and descriptive tests:

Objective Test (2 hundred marks):

Reasoning and Computer Aptitude

Data Analysis and Interpretation

General/Economy/Banking Awareness

English Language

Descriptive Test (50 marks):

Essay and Letter Writing in English

three. Group Discussion and Interview

Shortlisted candidates from the mains are called for a Group Exercise (20 marks) and Personal Interview (30 marks). Final selection is based at the cumulative score of the mains and the interview.

2 notes

·

View notes

Text

What is the Salary of RPSC AEN Civil in Rajasthan ?

The salary of RPSC (Rajasthan Public Service Commission) Assistant Engineers (AEN) for Civil, Mechanical, Electrical Engineering in Rajasthan varies based on the pay scale and allowances set by the state government. As of last update, the salary structure for RPSC AEN Civil, Mechanical, Electrical engineers in Rajasthan is as follows:

Pay Scale: The pay scale for RPSC AEN is typically in the range of Rs. 15,600 – Rs. 39,100 with Grade Pay of Rs. 5,400.

In addition to the basic pay scale, AENs are entitled to various allowances such as :-

Dearness Allowance (DA),

House Rent Allowance (HRA),

Travel Allowance (TA),

Gratuity,

Accidental Insurance,

Cash Medical Benefits and other benefits as per the rules and regulations of the Rajasthan government.

The exact salary may vary based on factors such as years of service, location of posting, and any revisions in pay scales or allowances by the government.

Please note that while the basic pay scale is typically the same across different engineering disciplines, the specific allowances and benefits may vary slightly.

2 notes

·

View notes

Text

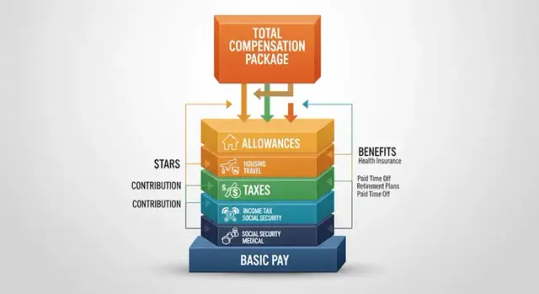

💼 Salary Isn’t Just Take-Home Pay

Think you're getting your full CTC? Not quite.

Your salary = ✔️ Basic Pay ✔️ HRA & Allowances ✔️ EPF & Gratuity ✔️ Taxes & Deductions ✔️ Perks (some taxable!)

Net Pay = Gross – Deductions

💡 Know your structure to save tax & plan smart.

0 notes

Text

Old vs New Tax Regime (FY 2025–26): Benefits, Differences, and Expert Analysis

India’s evolving tax framework has empowered individual taxpayers with an important choice: stick to the old tax regime with its deductions and exemptions or opt for the new tax regime, which offers lower slab rates and simplified compliance. For Financial Year 2025–26 (Assessment Year 2026–27), the government has continued to refine and promote the new regime—now the default option—while preserving the old regime for those who prefer structured savings and tax planning.

Understanding the distinctions between these regimes is no longer just helpful—it’s essential for making a tax-efficient decision tailored to your lifestyle and income profile.

1. Tax Rates and Slab Differences

The new tax regime offers lower slab rates and broader coverage for middle-income earners. One of its key highlights this year is zero tax for salaried individuals earning up to ₹12.75 lakh, thanks to the standard deduction. In contrast, the old regime operates with fewer slabs and higher rates but allows you to significantly reduce taxable income through a wide array of deductions.

2. Deductions and Exemptions: The Deciding Factor

The heart of the decision lies here.

Old Regime: Allows over 70 deductions/exemptions, including:

Section 80C (investments like PPF, ELSS)

80D (health insurance)

HRA, LTA, education loan interest, home loan deductions, and more

New Regime: Offers a higher standard deduction (₹75,000 for salaried in FY 2025–26) and limited benefits for NPS and employer contributions. This regime is designed for simplicity, with minimal paperwork and no need to prove expenses or investments.

3. Compliance & Ease of Filing

From a compliance standpoint, the old regime demands detailed documentation—rent receipts, premium slips, investment proofs, loan certificates, etc. While this enables smart tax saving, it can also be time-consuming.

The new regime dramatically simplifies the process. It’s almost plug-and-play, making it ideal for taxpayers who value convenience or don’t claim many deductions.

4. Suitability: Who Should Choose What?

Old Regime: Best for those who invest actively, have housing loans, pay rent, or incur medical expenses—basically, anyone who can stack up deductions of ₹4–8 lakh or more.

New Regime: Attractive for those with limited deductions, no time (or desire) to maintain documents, or whose lifestyle doesn’t allow for planned tax-saving investments.

Expert Analysis from JS Financial Services

At JS Financial Services, we help hundreds of clients annually navigate this choice with clarity. Whether you're a salaried professional, a business owner, or an NRI, our experienced tax planners evaluate your income profile, deductions, and liquidity needs to recommend the regime that minimises your liability without compromising your financial goals.

Here's how we break it down:

Scenario A: Incomes up to ₹12–13 lakh

✅ New regime wins for most people, offering near-zero tax without any effort—ideal for those who don’t claim many deductions.

Scenario B: Incomes of ₹15–24 lakh

⚖️ This is the “decision zone”. If you invest wisely (80C, NPS, home loan), the old regime may save more. If not, the new regime’s lower rates take the lead.

Scenario C: Incomes above ₹24 lakh

📉 Unless you can claim over ₹8 lakh in deductions, the new regime is typically more tax efficient. High-income earners without structured investments often benefit from its simplicity and lower rates.

Your Tax Plan Should Evolve With You

There’s no one-size-fits-all answer. Your income, lifestyle, investment capacity, and personal goals all influence which tax regime works best. And since salaried individuals can switch regimes every year, it's wise to reassess annually.

At JS Financial Services, our personalised tax consultations help you:

Compare both regimes based on your actual figures.

Maximise savings under the old regime (if applicable).

File seamlessly and accurately under the new regime.

Stay compliant and reduce audit risks.

Deciding Factors to Consider

Can you claim high deductions (₹4–8 lakh+)? → Old regime may benefit you.

Prefer no paperwork or investment commitments? → New regime offers ease and simplicity

Own a home with a loan or pay high rent? → Old regime can unlock significant savings.

Want to avoid documentation or long-term lock-ins? → New regime offers flexibility and liquidity

Final Words: Make an Informed Choice

With more than a decade of experience in tax advisory, I’ve seen how the right tax regime decision can make a meaningful difference in a person’s financial outcome. The new regime is a blessing for those who prioritise simplicity or lack deduction-eligible expenses. The old regime still rewards structured savers and long-term planners.

Don't leave your tax planning to guesswork.

📞 Contact JS Financial Services today for a customised regime comparison and expert filing support.

🌐 www.jsfinancials.in 📧 [email protected] 📞 +91 73400 02251

JS Financial Services – Our Expertise, Your Success. Let us help you go beyond the ordinary in tax planning and financial strategy.

#income tax return filing#itr filing#tax filling#e-filing#New tax regime benefits 2025#Which tax regime is better#Income Tax Planning India#Old vs New Tax Regime FY 2025–26

0 notes

Text

Documents Required for ITR Filing in India

Filing your Income Tax Return (ITR) is a legal obligation and a financial responsibility that helps individuals and businesses stay compliant with Indian tax laws. Whether you're a salaried employee, self-employed professional, or business owner, ensuring that you have the right set of documents is the first step toward a smooth and error-free ITR filing process.

This article provides a comprehensive list of documents required for ITR filing in India and explains how each document plays a role in accurately reporting your income and claiming deductions.

1. Basic Personal Information

Before diving into income details, you’ll need the following basic documents:

PAN Card – Your Permanent Account Number is essential for all income tax-related activities.

Aadhaar Card – Mandatory for e-verification and linking with PAN.

Bank Account Details – Including account number, IFSC code, and bank name. One account must be marked as the primary for refund (if any).

2. Form 16 (for Salaried Employees)

Issued by your employer, Form 16 summarizes the total salary paid and tax deducted at source (TDS) during the financial year.

It contains Part A (details of TDS) and Part B (break-up of salary and deductions).

Essential for salaried individuals during ITR filing to report income under the ‘Salary’ head.

3. Salary Slips and Employment Details

In case your Form 16 is not yet available or incomplete, salary slips can help validate your income and deductions. They’re especially useful for understanding allowances, bonuses, and other benefits that may be taxable.

4. Form 26AS and Annual Information Statement (AIS)

Form 26AS is a tax credit statement that shows the TDS deducted and deposited against your PAN by various deductors.

AIS (introduced recently) provides detailed information about your financial transactions, including interest income, mutual fund investments, and high-value purchases.

Both documents help cross-verify the information provided by third parties and are crucial for error-free ITR filing.

5. Proof of Other Income

If you earn income apart from salary, such as from investments, rent, or freelancing, you’ll need:

Interest certificates from banks and post offices (for savings, FD, or RD)

Rental income details and rent receipts

Dividend statements from mutual funds or companies

Capital gains statements from shares, mutual funds, or real estate

6. Investment and Deduction Proofs (for Section 80C, 80D, etc.)

To claim deductions and reduce your taxable income, gather the following:

LIC or life insurance premium receipts

PPF, ELSS, NSC, Sukanya Samriddhi Account statements

Home loan repayment certificate (principal and interest)

Tuition fees receipts for children

Medical insurance premium (Section 80D)

Donations to charities (Section 80G)

Make sure these investments were made within the applicable financial year for them to be valid for ITR filing.

7. Home Loan and Property-Related Documents

If you’ve bought or sold property, or have an ongoing home loan:

Interest certificate from lender

Property sale deed and purchase agreement

Rent receipts and PAN of landlord (if claiming HRA)

These documents are important for reporting house property income or availing deductions under Sections 24(b) and 80EE.

8. Foreign Income and Assets (If Applicable)

If you are an NRI or a resident Indian with foreign income/assets:

Details of foreign bank accounts, stocks, or real estate

Income earned abroad or received in India

Non-disclosure of such income or assets can lead to severe penalties.

Conclusion

Preparing the right documents in advance makes the ITR filing process accurate and hassle-free. It not only saves time but also helps in maximizing deductions and avoiding notices from the tax department. Whether you're filing it yourself or through a tax consultant, keeping this checklist handy will ensure you meet the deadline confidently and correctly.

0 notes

Text

Maximize Your Tax Savings with Expert Help: Why Working with a CA in Jaipur Is a Game Changer

Tax season often feels like navigating a maze—one wrong turn and you could end up overpaying, missing deductions, or dealing with penalties. While there’s no shortage of DIY tax tools and generic advice online, nothing matches the clarity and confidence that comes from partnering with a professional. If you live or run a business in Rajasthan’s capital, seeking guidance from a CA in Jaipur may be the smartest financial move you make this year.

Why Tax Planning Isn’t Just About Filing Returns

For many, taxes are an annual headache solved by filling a few forms in March. But real tax planning happens year-round—it involves understanding your income sources, mapping out eligible deductions, and making strategic decisions that lower your taxable amount. A qualified CA in Jaipur doesn’t just help you file on time; they build a personalized blueprint to protect and grow your wealth.

Commonly Missed Deductions (And How a CA Can Spot Them)

One of the biggest advantages of working with a CA is their knowledge of lesser-known tax provisions. From education loan interest (Section 80E) to rent deductions for those without HRA (Section 80GG), many savings opportunities go unnoticed unless flagged by an expert. For residents juggling salaried income, freelance gigs, or small business earnings, a CA in Jaipur can help you identify and claim every rupee you’re entitled to.

Some examples include:

Section 80C: Investments in ELSS, PF, tax-saving FDs, and LIC policies

Section 80D: Health insurance premiums for self, spouse, parents

Section 80G: Donations to approved charities

Section 80U/80DD: Tax relief for persons with disabilities or dependent care

Income Structuring That Pays Off

Tax liability often depends not just on how much you earn—but how you earn it. A local CA can structure your salary or business income more efficiently, helping you:

Allocate HRA and LTA appropriately

Reimburse expenses in a tax-friendly way

Categorize freelance/business income for maximum deductions

For Jaipur's booming freelance and entrepreneurial community, these small changes can make a massive difference by reducing taxes legally and sustainably.

Accuracy = Peace of Mind

When returns are filed inaccurately or late, the consequences can be severe. Mismatched figures in your Form 26AS, incorrect ITR types, or forgetting advance tax payments can all trigger fines, scrutiny, or worse. Having a dependable CA in Jaipur means your filings match official records, your documents are in order, and you’re prepared if the Income Tax Department comes calling.

Real-World Scenarios Show the Power of Expert Planning

Consider this:

A Jaipur-based software engineer saved ₹1.6 lakh in taxes after her CA restructured her salary and maxed out Section 80C and 80D benefits.

A freelance graphic designer in Vaishali Nagar reduced taxable income by nearly ₹90K through proper expense documentation and GST input claims.

A local startup avoided penalties of ₹25K by switching to monthly ITR and GST filings under their CA’s supervision.

These aren’t edge cases—they’re everyday wins that come with good guidance.

The Local Advantage of Choosing a CA in Jaipur

You could hire a CA from anywhere in India—but working with one who understands Jaipur's professional landscape is a big plus. They’re familiar with local tax office procedures, regional compliance trends, and even city-specific investment incentives. Plus, they’re easy to reach for quick consultations, urgent filings, or business restructuring advice.

If you're in the city and searching for tax support that goes beyond basics, connecting with a seasoned CA in Jaipur makes your financial life smoother and more secure.

Your Next Step: Make Taxes Work for You

Saving tax isn’t about cutting corners—it’s about using every legal opportunity available. Whether you’re salaried, self-employed, or running a company, there’s a smarter way to handle your finances. And it begins with teaming up with a professional who gets it.

With a CA in Jaipur by your side, you don’t just file returns—you future-proof your money.

0 notes

Text

RRB ALP Admit Card 2025 Out Soon: Download CBT 2 Hall Ticket

RRB ALP Admit Card 2025 Out Soon: Download CBT 2 Hall Ticket, Exam City Slip at rrbapply.gov.in

Indian Railways is all set to conduct the RRB Assistant Loco Pilot (ALP) CBT 2 Exam 2025 for 18,799 vacancies from May 2 to May 6, 2025. The Railway Recruitment Board (RRB) has already released the RRB ALP Exam City Intimation Slip 2025 on April 22, 2025. Candidates can now check their allotted exam city online. As per the official update, the RRB ALP Admit Card 2025 will be released on April 28, 2025, at the official portal – rrbapply.gov.in. Aspirants who have completed their application process can download the RRB ALP CBT 2 Hall Ticket 2025 and exam city details by logging in with their Application Number and Date of Birth.

Railway Recruitment Board (RRB)

RRB ALP Admit Card 2025

Studycafes.in Important Dates Application Fee - Notification Date : 20 January 2024 - Application Start : 20 January 2024 - Last Date Apply Online : 19 February 2024 - Last Date Fee Payment : 19 February 2024 - Correction Date : 20-29 February 2024 - CBT 1 Exam Date : 25-29 November 2024 - CBT 1 Result Date : 26 February 2025 - Exam City Available (CBT 2) : 22 April 2025 - Admit Card : 28 April 2025 - Exam Date : 02 to 06 May 2025 - Result Date : Notify Soon - Candidates are Advised to Verify the details on the Official Website of RRB. - Gen/ OBC/ EWS : ₹500/- - SC/ ST/ EBC/ Female/ Transgender : ₹250/- Refund Amount (On Appearing For CBT 1) - Gen/ OBC/ EWS : ₹400/- - SC/ ST/ EBC/ Female/ Transgender : ₹250/- - Pay the Examination Fee Through Credit Card, Debit Card, Net Banking/ Pay Offline Through E-Challan.

RRB ALP 2025 has the following age limit5

Total Post - Minimum Age : 18 Years. - Maximum Age : 33 Years. - For more complete information please read the RRB ALP Notification 2025. 18799 Post For more complete information please read the RRB ALP Notification. Education Qualification Requirements: Eligibility Criteria 10th (Matric) Exam Passed with ITI Certificate OR Class 10th with Diploma in Mechanical/ Electrical/ Electronics/ Automobile Engineering OR BE/ B.Tech Degree in Mechanical/ Electrical/ Electronics/ Automobile Engineering from a Recognized Board/ University/ Institute. For more complete information kindly read the RRB ALP Recruitment Exam Notification 2025. Railway RRB ALP Salary 2025 Post Name Initial Pay In-Hand Salary ₹24,904 Per Month. Allowance Dearness Allowance (DA), House Rent Allowance (HRA) and Travel Allowance (TA). RRB ALP Category Wise Vacancy 2025 Details Gen OBC EWS SC ST Total 8149 4538 1798 2735 1579 18799 RRB ALP Exam Structure Mode: Online Question Type: Objective Multiple‑Choice Questions (MCQs) Total Questions: 175 Total Marks: 175 (1 mark per question) Duration: 2 hours (120 minutes) Marking Scheme: +1 for correct answers, .25 negative marking Railway RRB ALP Syllabus Exam Pattern 2025 CBT 2 Section Questions Marks Mathematics 100 100 General Intelligence & Reasoning Basic Science and Engineering Paper 2 Relevant Trade 75 75 Total 175 175 - You May Also Check : UTET Application 2025 Released: Check Exam Dates, RRB ALP 2025 Selection Process The Selection Process for RRB ALP Recruitment 2025 will be completed on the following phases – - Computer Based Test (CBT 1). - Computer Based Test (CBT 2). - Computer Based Aptitude Test (CBAT). - Document Verification (DV). - Medical Examination (ME). How to Download RRB ALP Admit Card 2025 Follow these steps to download your RRB ALP CBT 2 Hall Ticket 2025: Visit the official website: rrbapply.gov.in Click on the link for RRB ALP Admit Card 2025. Enter your Application Number and Date of Birth (DOB). Click on Submit. Your admit card and exam city slip will appear on the screen. Download and take a printout for exam day use. RRB ALP Exam City Intimation Slip 2025 The Exam City Slip allows candidates to know the city where their exam center is located. This helps in planning travel arrangements in advance. Note that this is not your admit card and you must carry the RRB ALP Admit Card 2025 to the exam center. SOME USEFUL IMPORTANT LINKS STUDY CAFE Download Admit Card Click Here Check Exam City Details Click Here Official Website Click Here RRB ALP Notification Click Here Join Our Telegram Channel Click Here Official Website Click Here RRB ALP Admit Card 2025 RRB ALP Admit Card 2025 – Frequently Asked Questions Q1. When will the RRB ALP CBT 2 Admit Card 2025 be released?Ans. The admit card was released on 10 July 2025.Q2. How can I download the RRB ALP Admit Card?Ans. The exam is scheduled for 20 July 2025.Q3. What is the exam date for RRB ALP CBT 2?A: The exam will be conducted from May 2 to May 6, 2025.Q4. Is the Exam City Slip the same as the Admit Card?A: No, the Exam City Slip is just for reference. You must also download the official admit card for entry. ALP Admit Card download, Read the full article

#Railway admitcard PDF#RRBALPAdmitCard ReleaseDate#RRBALP examcity#RRBALP login#RRBALP officialwebsite#RRB Digialmlogin#RRBHallTicketdownload#SARKARIRESULT#SarkariNaukri#StudyCafes

0 notes

Text

ITR Filing Is Not That Complicated—You’re Just Overthinking It

The stress around ITR filing often comes from the myth that it’s complicated. The reality? If you’re salaried with basic investments, the process is streamlined and pre-filled. The Income Tax portal and fintech apps make it easy.

You don’t need a CA for most basic returns. You need your Form 16, interest certificates, rent receipts (for HRA), and investment proofs. Log in, check pre-filled data, pick the right ITR form, and e-verify. That’s it.

We overthink taxes because we fear what we don’t understand. Filing early gives you room to learn, ask questions, and do it stress-free.

#finance#investment#buisness#commerce#financial planning#money#personal finance#income tax return#mutual funds#income tax

0 notes

Text

High-Paying Government Jobs for 10th & 12th Pass Students in 2025

In India, a gevernment job or a Sarkari Naukari in not just a dream but also a symbol of prestige and respect in the society. It has always been a top choice among the youth of the country due to its stability, appealing salary packages, and other perks it offers like pension, allowence and job security. Students who have just completed their 10th or 12th standard, for them the government of India provides ample of high paying opportunities every year including in the sectirs like like railways, defence, banking, Postal Services and many more. In this blog we will tell you what career you can choose after you 10th or 12th in government sector, with thier salaries, selction criteria, and tips to prepare for it to get you ready for the exams.

Why Choose Government Jobs?

Government jobs are highly sought for their unmatched benefits. These include:

Security: Compared with private sector jobs, government jobs are known to give long-term stability to their employees.

Attractive Salaries: Many positions offer competitive pay with regular increments.

Allowances and Perks: Some amount of housing, medical, and travel allowance.

Work-Life Balance: Fixed working hours and paid leaves ensure a healthy work-life balance.

Career Growth: There are ample odds of promotion and further skill development.

Hence, with little educational requirements, these jobs are open to both 10th and 12th pass candidates, a useful stepping stone to a secure career.

Top High-Paying Government Jobs for 10th Pass Students

1. Indian Railways Group D Posts

Indian Railways is one of the largest employers in India, offering numerous opportunities for 10th pass candidates. Group D posts include TVM Maintainer, Helper, Assistant Pointsman, and Porter.

Eligibility: Passed SSC or possess at least an ITI Certificate from a recognized board. Age limit mostly 18 to 33 years, with relaxation for reserved categories.

Salary: The starting salary for this position is between INR 18,000 and 56,900 at Pay Level-1 according to 7th CPC standards.

Selection Process: The recruitment procedure consists of a Computer-Based Test (CBT) and Physical Efficiency Test (PET) along with Document Verification.

Why It’s High-Paying: Additional allowances like Dearness Allowance (DA) and House Rent Allowance (HRA) significantly boost the in-hand salary.

To prepare for the exam concentrate on fundamental mathematical skills together with general knowledge and physical fitness for the PET. Monitor the Railway Recruitment Board (RRB) website frequently for new notifications.

2. SSC Multi-Tasking Staff (MTS):

The Staff Selection Commission (SSC) administers the MTS examination to select candidates for non-technical government posts across different central departments which include Peon, Gardener and Office Assistant positions.

Eligibility: 10th pass from a recognized board; age limit is 18–25 years.

Salary: ₹18,000–₹56,900 per month (Pay Level-1).

Selection Process: The selection process includes a Computer-Based Test (CBT) which tests General English along with Numerical Aptitude and General Intelligence and General Awareness subjects. After this there will be a descriptive written test.

Why it's High-Paying: This category of job falls under the profession with an average pay, the formidable benefits package that is generally characterized by the medical insurance cover, and pension contribution, and the above average pay.Preparation Strategies: It is recommended that the candidates should go through the question papers of previous years and must brush up on time management skills in Computer-Based Testing (CBT).

3. India Post Gramin Dak Sevak (GDS):

In the case of the India Post, GDS jobs, such as Branch Postmaster, Assistant Branch Postmaster, and Dak Sevak are intended to be allotted to 10 th -pass (job candidates in rural sectors).

Eligibility: The minimum education qualification is 10th standard along with basic idea of computers. Age limit is 18 to 40.

Salary: Wages found are between 20,000 and 40,000 rupees a month, but it varies with the appointment of position and place.

Seeking Process: Strictly based by merits, selection will be done on the basis of the marks on 10 th grade without any written examination.

Reasons of High Remuneration: The low number of applicants compared to any other position, as well as other performance bonuses are the reasons that the GDS scheme gets among the most profitable schemes for 10th-grade candidates in India.

Before applying, the applicants are required to ensure their tenth-grade scores are competitive and acquire a basic computer training certificate.

4. Indian Army Soldier in General Duty:

For the students who have done their 10th they can now apply for the roles like Soldier in General duty within the Indian Army, which give respect and financial stability.

Eligibility criteria:

Passing the tenth grade with at least 45 % marks;

Age between 17.5 to 21 years.

Pay Level: 3 offers a salary of 21,700 to 69,100/month.

Selection Process: Written exam, Physical Fitness Test (PFT), and Medical Test.

Why It’s High-Paying: Includes risk allowances, free accommodation, and medical benefits.

Preparation Tip: Maintain excellent physical fitness and practice for the written exam, which covers general knowledge, mathematics, and science

Top High-Paying Government Jobs for 12th Pass Students:

1. SSC Combined Higher Secondary level (CHSL):

Staff Selection Commission Combined Higher Secondary Level (SSC CHSL) exam offers jobs to Lower Division Clerk (LDC), Data Entry Operator (DEO) and Postal Assistant Grades in different ministries.

Eligibility Criteria: The candidate should be having passed out higher secondary education with a recognized board, and the age of the candidate should be between 18-27 years.

Remuneration: Pay Level-2 has remuneration under the range of 25000-45000 per month.

Selection Procedure: The selection process follows three steps; computer based test (Tier-I), descriptive paper (Tier-II), and skill/typing test.

The Justification of High Pay: The jobs carry high career development opportunities as well as good extras like the Dearness Allowance (DA) and House Rent Allowance (HRA) which boost the total earnings significantly.

Preparation Suggestion: Applicants interested in DEO positions should be ready to type fast; they should focus on English language skills, quantitative ability, and current affairs.

2. Indian Railways Assistant Loco Pilot (ALP):

The post of the Assistant Loco Pilot (ALP) can be considered to be one of remarkable status in the Indian Railways, and takes up a work position that is rendered with an environment of operational support to the train drivers.

Eligibility Criteria: All applicants are required to have finished high school (grade 12) with an ITI diploma or technically inclined qualification. The age limit is above 30 years.

Remuneration: Salary is 25,000 to 45,000 Rupees per month (Pay Level-2). The basic wage is supplemented by technical allowances and overtime payments.

Recruitment Process: Selection process requires two Computer-Based Tests (CBTs) with the first one focusing on the knowledge of mechanical and electrical engineering basics, and the second measuring cognitive skills. Shortlisted ones go through document verification.

Justification of High Pay: An allowance and overtime income is added to the basic pay thus, resulting in a rather high salary scale.

3. Indian Navy Sailor (AA/SSR)

Indian Navy recruits the 12th pass candidates who are constitutionally under Sailor recruitment through Artificer Apprentice (AA) and Senior Secondary Recruit (SSR) streams.

Eligibility Requirement: has passed 12th grade, physics, chemistry, mathematics (PCM); the minimum age is 17-20 years.

Pay Level-3: Monetary Remuneration: 21,700 Rs-69,100/- per month.

Selection Procedure: There is a three-phase process involving a written test, a Physical Fitness Test as well as a thorough medical check-up.

Rationale of High Pay: Sea duty rate and free ration allowances are able to supplement the compensation.

How to Prepare: It is advisable to study the subjects covered under the PCM intensively, and to condition oneself physically through long term training, up to the moment of taking up the Physical Fitness Test.

4. National Defence Academy (NDA) Cadet

National Defence Academy (NDA) exam is conducted by the Union Public Service Commission (UPSC) to groom 12 th pass candidates so that they can become officers in Indian Army, navy or air force.

Requirements: Admission to the Navy and Air Force is limited only to candidates who complete 12 standard education in PCM curriculum. The Army takes students of any stream. The age limit of age is 16.5 to 19.5 years.

Remuneration: Candidates are given a stipend during the training period.

Salary Range: Salary falls between 56.100 to 1,77,500 per month after commissioning.

Selection Procedure: A written test results in a qualifying phase. Candidates who pass will then move to the Services Selection Board (SSB) Interview and then a Medical Examination.

Additional Opportunities and Benefits

Such Public Sector Undertakings (PSUs) as IOCL, BHEL, ONGC are companies where those who have already completed either secondary or senior secondary school are often welcome to work as an electrician or clerk. The salaried reimbursements range between around 20, 000 and 40,000 in Indian rupees monthly.

A similar alternative exists at state police services where they hire individuals who have passed the senior secondary level as constables. Depending on the rank, the corresponding pay scale is 21,700 to 69,100 per month (excluding allowances).

In these sectors, the government jobs usually come with certain packages like a Dearness Allowance, House Rent Allowance, medical cover, and pension rights which make the jobs quite lucrative.

Conclusion

Overall, 2025 is a time that allows 10 th and 12 th grade students to find the dream job with good pay and monetary security due to the demand for the job by the Indian Railways, Staff Selection Commission, the Armed Forces, and PSUs. Looking critically at the eligibility rules, conducting thorough preparations and being attentive to recruitment notifications, candidates can find their way to a stable and successful future.

0 notes

Text

How Can Payroll Training in Mumbai Help You Avoid Salary & Tax Calculation Errors

Payroll is more than a monthly task. It determines employee trust, organizational compliance, and financial health. Mistakes in salary calculations can lead to employee dissatisfaction and legal disputes, while tax errors can result in penalties from regulatory bodies. As labor laws evolve and taxation rules change, HR and finance professionals must understand the correct methods to calculate gross and net salaries, deductions, and benefits accurately. The process involves managing variable pay, leaves, bonuses, statutory deductions, and reimbursements, each requiring precise handling. A single oversight can affect hundreds of employees and impact the organization’s credibility. In a competitive business environment like Mumbai, professionals equipped with accurate payroll knowledge can reduce compliance risks and strengthen operational reliability within their organizations. Payroll training bridges the gap between textbook knowledge and practical application, ensuring professionals know exactly how to manage salary structures, deductions, and compliance filings. As digital systems continue to advance, trained professionals can also manage payroll software efficiently. This combination of knowledge and accuracy makes payroll training not just a skill enhancement but a career essential for HR and finance professionals in today’s evolving industry.

Understanding salary structures goes beyond knowing the terms CTC or gross pay. Many professionals miscalculate earnings due to confusion between allowances, variable pay, and statutory deductions. Practical Payroll Training in Mumbai offers the clarity professionals need to master salary structures without errors. These training sessions teach learners how to segregate basic pay, HRA, special allowances, and incentives accurately while ensuring statutory components such as PF, ESI, PT, and TDS align with compliance requirements. In Mumbai, where organizations function across diverse sectors, professionals need practical insights to manage different salary models used in IT, manufacturing, or service industries. Practical payroll training provides hands-on exposure through simulations and live case studies, allowing learners to practice salary calculation across multiple scenarios. By understanding the logic behind structuring salaries, professionals can reduce manual errors, optimize tax benefits for employees, and ensure compliance. Trainers with industry experience share examples of errors made in real payroll environments and guide learners on how to avoid them. This practical learning approach builds confidence and sharpens the skill to manage salary structures accurately, thus eliminating common payroll mistakes.

Incorrect tax calculations and delays in statutory filings often lead to hefty fines and legal notices. Many professionals find it challenging to keep up with frequent amendments in tax rules. Payroll Training in Mumbai helps professionals handle tax calculations and statutory compliance with precision. The training covers the Income Tax Act, TDS calculations, and applicable exemptions, ensuring that learners know how to compute deductions accurately for different salary brackets. Payroll training also focuses on timelines for filing returns and generating necessary documents like Form 16, making learners efficient in managing year-end processes. In Mumbai, where businesses deal with high employee volumes, any delay in tax filing can lead to large-scale non-compliance. Payroll training ensures that professionals are prepared to handle these volumes confidently. Trainers often demonstrate the actual filing process on government portals, ensuring learners understand every step of the compliance cycle. Additionally, the training educates professionals on how to handle notices from tax departments, reconcile discrepancies, and maintain clear documentation for audits. By learning these practices, professionals can prevent errors that could result in financial losses for their employers and establish themselves as reliable payroll experts.

Technology is integral to accurate payroll processing today. Manual calculations increase the chances of errors and consume time, while payroll software reduces these risks significantly. However, to leverage these tools, professionals need to know how to operate them correctly. Payroll Training Courses in Mumbai introduce learners to widely used payroll software such as Tally, Zoho Payroll, and GreytHR, ensuring they can process salaries, manage compliance, and generate reports without errors. These courses teach learners to upload employee data, configure statutory parameters, process payroll runs, and generate payslips efficiently. By gaining hands-on experience on these tools, professionals can handle bulk data with accuracy and speed, which is crucial for organizations in Mumbai dealing with high employee counts. The courses often simulate real-life scenarios, such as revising salary structures mid-year or handling arrears and reimbursements, allowing learners to understand the system logic and avoid mistakes. Payroll training courses also prepare professionals for integration with accounting software, ensuring seamless flow between payroll and finance operations. This software knowledge minimizes calculation errors and builds confidence in professionals to manage digital payroll systems efficiently.

Payroll accuracy is not a one-time learning process. Labor laws, tax rules, and statutory compliance frameworks evolve frequently, and professionals must stay updated to avoid errors. Payroll Courses in Mumbai are designed to include updates on changes in PF, ESI, minimum wages, and tax structures, ensuring learners remain current with the law. Trainers highlight the impact of each regulatory update on salary calculations and compliance timelines. These courses explain practical adjustments professionals must make in salary processing when laws change, which helps them avoid penalties or legal disputes. Mumbai, being a financial hub, requires professionals who can interpret new laws quickly and align payroll processes accordingly. Courses here often conduct live discussions on government notifications, recent court judgments, and policy amendments that impact payroll functions. Learners are also provided with resources for continuous self-learning post-training. Staying updated is critical to ensuring payroll processes remain compliant and error-free. These courses empower professionals to proactively adapt to regulatory changes, avoiding last-minute confusion and ensuring that payroll functions operate smoothly regardless of changes in law.

Choosing a reputed Payroll Training Institute in Mumbai ensures professionals gain comprehensive knowledge and reliable guidance for accurate payroll management. A credible institute offers experienced trainers, practical modules, and updated content aligned with industry practices. It also provides access to doubt-solving sessions, post-course guidance, and sometimes placement assistance. Institutes with a strong track record often conduct assessments and mock payroll processing to help learners practice and refine their skills. In Mumbai, where businesses expect efficiency and accuracy, professionals trained under such institutes stand out in the job market. They gain confidence to manage audits, resolve employee salary queries, and handle statutory inspections without errors. The institute environment fosters peer learning, exposing professionals to various payroll challenges across industries. By learning from real industry experts, professionals understand the nuances that are often overlooked in theoretical learning. Choosing the right institute ensures a holistic learning experience, building a foundation of accuracy, legal compliance, and operational efficiency that benefits both professionals and their organizations in the long run.

0 notes

Text

How Much Does a Junior Accountant Earn in Rajasthan?

If you’re planning to start your career in the government sector, becoming a junior accountant is a great option. It offers job security, steady income, and growth opportunities. Many candidates in Rajasthan aim for this post because of its respectable position and decent pay scale. But how much exactly does a junior accountant earn in Rajasthan? Let’s explore the Rajasthan junior accountant salary, allowances, and overall career prospects in detail.

What is a Junior Accountant?

A junior accountant is a government employee who manages day-to-day accounting tasks like maintaining ledgers, preparing balance sheets, checking financial records, and ensuring compliance with rules. In Rajasthan, junior accountants are primarily appointed by the Rajasthan Subordinate and Ministerial Services Selection Board (RSMSSB).

They work under various departments, including the Finance Department, Municipal Corporations, and Development Authorities, helping ensure the smooth financial operations of the state.

Rajasthan Junior Accountant Salary Structure

Let’s break down the Rajasthan junior accountant salary. The salary is decided according to the pay matrix of the 7th Pay Commission.

Pay Level and Pay Scale

Pay Matrix Level: L-10

Basic Pay: ₹33,800 per month (approx.)

This is the starting salary for newly appointed junior accountants in Rajasthan. Along with the basic pay, employees receive several allowances.

In-Hand Salary

When all allowances are added, and deductions like provident fund (PF) and income tax are applied, the in-hand salary comes to around:

₹38,000 to ₹42,000 per month

This makes it an attractive opportunity for commerce graduates and others looking for stable government employment.

Latest Job:- RRB Technician Recruitment 2025: Eligibility, Exam Date & Syllabus

Allowances & Perks

Apart from the basic pay, junior accountants in Rajasthan enjoy several allowances and perks which enhance the overall junior accountant salary package:

Dearness Allowance (DA)

Revised twice a year to adjust for inflation. As of current rates, DA stands at around 46% of the basic pay.

House Rent Allowance (HRA)

Based on city classification:

24% in big cities,

16% in medium towns,

8% in smaller towns.

For example, if posted in Jaipur, an accountant would get the highest HRA.

Other Benefits

Medical reimbursement

Travel allowance (TA)

Pension and family pension benefits

Group insurance

Paid leaves and maternity/paternity benefits

Career Growth & Promotion

A junior accountant doesn’t stay at the same level forever. Over the years, with experience and departmental exams, one can be promoted to:

Senior Accountant

Assistant Accounts Officer

Accounts Officer

Each promotion means a substantial hike in salary, grade pay, and responsibilities.

Also Read:- SSC CHSL Exam Date 2024, Form Dates & Syllabus: All You Need to Know

Eligibility for Junior Accountant Post in Rajasthan

To apply for the Rajasthan junior accountant post, candidates generally need:

Educational Qualification: Graduation degree (Commerce background preferred) or equivalent.

Age Limit: Typically 21-40 years (relaxations for reserved categories).

Proficiency: Working knowledge of Hindi and familiarity with Rajasthani culture.

After qualifying in the written exams and document verification, the appointment is made.

Why Choose Junior Accountant Jobs in Rajasthan?

Stable income: Unlike private sector jobs, the salary here is fixed and guaranteed every month.

Pension & Retirement Benefits: Ensures financial security even after retirement.

Work-Life Balance: Regular working hours with ample leaves and holidays.

Respect & Social Status: Government jobs are still highly respected in India, especially in states like Rajasthan.

Quick Summary of Rajasthan Junior Accountant Salary

Component

Amount (Approx.)

Basic Pay

₹33,800

DA (46%)

₹15,500

HRA (16-24%)

₹5,400 – ₹8,100

Other Allowances

₹2,000 – ₹3,000

Gross Salary

₹56,000 – ₹60,000

In-hand Salary

₹38,000 – ₹42,000

Final Words

So, to answer the question “How much does a junior accountant earn in Rajasthan?”, the starting in-hand salary typically ranges from ₹38,000 to ₹42,000 per month, along with excellent long-term benefits and clear promotion paths. This makes it a secure and respectable choice for anyone looking to build a career in accounting within the government sector.

If you’re preparing for the RSMSSB junior accountant exams or looking for the latest updates on Rajasthan junior accountant salary, exam dates, and results, stay connected with Sarkari Updates. We bring you real-time government job notifications, study resources, and expert tips to help you achieve your dream Sarkari Naukri.

Start your journey towards a stable government job with Sarkari Updates today!

1 note

·

View note

Text

From basic pay to HRA and other allowances, understand how your salary is taxed in India. This blog helps you decode salary slips and file accurate income tax returns. Get smarter with your salary tax – read now and save more!

#salary taxation India#HRA exemption#income tax on salary#salary structure#ITR filing for salaried#Indian salary tax rules#salary components

0 notes

Text

Minimum Wages in India 2025: Your Guide to Compliance and Fair Pay

Are you a business owner, HR professional, or worker looking to stay updated on minimum wages in India for 2025? Understanding the latest wage regulations is crucial for ensuring compliance, avoiding penalties, and promoting fair compensation. This SEO-optimized guide provides key insights into India’s minimum wage landscape for 2025, covering national and state-level updates, compliance tips, and more. For expert guidance on wage management, visit Sankhla & Co.’s Minimum Wages Page.

Why Minimum Wages Matter in 2025

Minimum wages in India, governed by the Minimum Wages Act, 1948, protect workers from exploitation by ensuring a baseline income for a decent standard of living. These wages vary by state, industry, skill level, and region, making compliance complex but essential. For businesses, adhering to minimum wage laws avoids legal risks, while for workers, it ensures fair pay. In 2025, with India exploring a shift toward a living wage in collaboration with the International Labour Organization (ILO), staying informed is more important than ever.

National Minimum Wage Baseline for 2025

India’s national floor-level minimum wage remains at INR 178 per day (approximately INR 5,340 per month) in 2025, unchanged from 2024. This serves as a baseline, but actual wages are typically higher due to state-specific regulations and economic factors like inflation. The central government sets wages for industries under its jurisdiction, such as railways and mines, while states determine wages for most other sectors.

For example, the central government has set minimum wages for 2025 at:

Unskilled workers: INR 783 per day (INR 20,358 per month).

Skilled workers: INR 954 per day (INR 24,804 per month).

These rates vary by state, industry, and location (urban vs. rural).

State-Wise Minimum Wage Updates for 2025

States revise minimum wages periodically, often twice a year, based on factors like the Consumer Price Index (CPI), cost of living, and skill levels. Below are key updates for 2025:

Delhi: Effective April 1, 2025, unskilled workers earn INR 18,066 per month, semi-skilled workers INR 19,929, and skilled workers INR 21,917. These rates reflect a hike announced on September 25, 2024.

Meghalaya: Starting January 1, 2025, unskilled workers receive INR 525 per day, semi-skilled INR 565, skilled INR 605, and highly skilled INR 645.

Chhattisgarh: Minimum wages for April 1 to September 30, 2025, cover sectors like shops, commercial establishments, and tailoring, with rates varying by skill level.

Other states like Kerala, Haryana, and Maharashtra also have higher-than-average wages due to their economic conditions. For detailed state-wise rates, refer to Sankhla & Co.’s Minimum Wages Resource.

The 26-Day Wage Rule Explained

In India, minimum wages are calculated based on a 26-day working month, accounting for a weekly paid rest day. For example, if a monthly wage is INR 13,000, the daily wage is INR 13,000 ÷ 26 = INR 500. This ensures fair compensation even for partial-month work. Overtime pay, typically double the regular rate, applies for hours beyond standard limits. Businesses must maintain wage registers and comply with government notifications to avoid penalties.

Components of Minimum Wages

Minimum wages include:

Basic salary: The core wage component.

Variable Dearness Allowance (VDA): Adjusted for inflation.

House Rent Allowance (HRA): Provided in some cases.

These components align with the Code on Wages, 2019, which aims to standardize wage calculations across industries, though full implementation is pending.

Toward a Living Wage in 2025

India is working with the ILO to transition from minimum wages to a living wage by 2025. Unlike minimum wages, which focus on basic needs, a living wage covers essential expenses like housing, food, healthcare, education, and clothing. This shift aims to improve worker welfare and support India’s Sustainable Development Goals (SDGs) by 2030. While the national wage floor has been stagnant since 2017, a living wage could significantly raise standards, especially for the 90% of workers in the unorganized sector.

Compliance Tips for Businesses in 2025

Non-compliance with minimum wage laws can lead to fines up to INR 100,000, imprisonment, or legal action. To stay compliant:

Monitor Updates: Check state and central government notifications biannually (April and October).

Use Experts: Consult HR or labor law professionals for accurate wage calculations.

Maintain Records: Keep wage registers for inspections by labor authorities.

Educate Workers: Ensure employees know their wage rights under the Minimum Wages Act.

For seamless compliance, explore Sankhla & Co.’s Minimum Wages Services.

Worker Rights and Redressal

Workers paid below minimum wages can file complaints with labor inspectorates, individually or through trade unions. Claims must be filed within six months, and labor courts handle disputes. The Minimum Wages Act empowers workers to claim the difference between paid and entitled wages, ensuring protection against exploitation.

Conclusion

India’s minimum wage system in 2025 is dynamic, with state-specific rates, a 26-day calculation rule, and a potential shift toward a living wage. Businesses must stay updated to ensure compliance, while workers should know their rights to secure fair pay. For expert support on navigating wage regulations, visit Sankhla & Co.’s Minimum Wages Page. Stay informed, compliant, and ready for a fairer future in 2025!

Keywords: Minimum Wages 2025, India Minimum Wage Rates, Living Wage 2025, Minimum Wages Act 1948, State-Wise Minimum Wages, Delhi Minimum Wages 2025, Labour Law Compliance.

0 notes

Video

youtube

📌HRA conditions, take full benefit of HRA!

📌HRA यानी tax bachane ka mauka #shorts #youtubeshorts #trending #viralvideo #short #incometax #viral @cadeveshthakur HRA यानी House Rent Allowance salary ka ek important part hai jo aapko tax bachane ka mauka deta hai! Lekin kya aapko pata hai ki agar aap apne parents ko rent dete hain, toh bhi aap HRA exemption claim kar sakte hain? Iss short video mein aapko milega: 👉 HRA ke conditions 👉 Example ke saath simple explanation 👉 Parents ko rent dene par kya documents chahiye 👉 Ek real case law jisme court ne allow kiya HRA exemption Agar aap salaried employee hain aur rent pay karte hain, toh ye video aapke liye important hai! 💡 🎯 Tax planning start karo smartly, aur HRA ka full benefit uthao! 👇 Follow Playlist for Income Tax Return (ITR) Filing FY 2024-25 | Complete Guide https://www.youtube.com/playlist?list=PL1o9nc8dxF1R4FZlmK-5tIighYB0vxu3L Index 00:00 to 00:20 How to compute House Rent Allowance 00:21 to 01:00 Conditions for claiming HRA 01:01 to 02:03 How to calculate HRA income tax, house rent allowance, hra exemption, hra calculation, rent to parents, save tax, salaried employee tax tips, hra rules, hra claim, hra for parents rent, hra section 10 13a, how to claim hra, tax deduction hra, hra tax benefit, hra example, hra eligibility, parents ko rent dena, tax planning, hra ke rules, rent receipt for hra, salaried person tax saving, hra exemption rules, rent agreement parents, tax benefit on rent, how to save income tax, house rent allowance explained, hra hindi explanation, income tax in india, hra exemption calculation, tax saving tips india, house rent deduction, hra exemption parents, rent payment proof, tax saving salary, basic salary hra, salary structure india, tax benefit salaried employee, section 10 hra, how to file hra, how hra works, tax saving 2025, rent paid to parents case law, rent to parents exemption, income tax rent rules, parents rent agreement, hra exemption example, tax benefit for salaried, income tax 2025 26, smart tax planning, tax hacks india #viral #shortvideo #viralvideo #shortsvideo #shorts #youtubeshortsvideo #shortsyoutube #viralreels #viralshorts #viralshort #trending #cadeveshthakur #ytshorts #youtubeshorts #youtubeshorts income tax slab 2024-25,income tax calculation 2024-25,income tax calculator,income tax calculation,income tax new regime 2024-25,income tax new regime,new income tax calculation 2024-25,how to calculate income tax 2024-25,new tax regime calculation,income tax new regime tamil,income tax new regime vs old regime malayalam,how to calculate income tax,income tax calculator 24-25,how to calculate income tax on salary 2024-25,old tax regime vs new tax regime 2024-25

0 notes

Text

RBI Grade B Salary Slip Explained: Know What Every Component Means

The RBI Grade B salary is one of the most talked-about topics among banking aspirants and government job seekers. Known for its excellent pay structure, steady career growth, and attractive perks, the Reserve Bank of India offers one of the most lucrative officer-level positions in the public sector. However, to truly understand what you earn as an RBI Grade B officer, it’s essential to go beyond gross salary figures and analyze the salary slip in detail.

This article breaks down the complete salary structure and explains every component found in the salary slip of an RBI Grade B officer. Whether you're preparing for the exam or evaluating a career move, this guide will provide a clear understanding of your monthly income and deductions.

RBI Grade B Salary Structure Overview (2025)

A newly recruited RBI Grade B officer receives a structured pay scale that includes basic pay along with several allowances. Below is the approximate salary structure based on the latest updates.

Component

Amount (in ₹)

Basic Pay

55,200

Dearness Allowance (DA)

23,000 – 26,000

House Rent Allowance (HRA)

5,500 – 10,000

Grade Allowance

6,800

Local Compensatory Allowance

3,000 – 5,000

Special Allowance

2,200 – 3,000

Learning Allowance

600

Gross Monthly Salary

1,05,000 – 1,12,000

HRA is applicable only if the officer is not provided with RBI accommodation.

Understanding the Components of the Salary Slip

A salary slip contains various elements that make up the gross pay and indicate the deductions. Each of these components has a specific purpose.

Basic Pay This is the fixed portion of your monthly salary and serves as the foundation for calculating other allowances like DA and HRA. The basic pay for a new RBI Grade B officer is ₹55,200. It increases annually with increments and further with promotions.

Dearness Allowance (DA) DA is a cost of living adjustment allowance that is revised quarterly based on the Consumer Price Index (CPI). For RBI Grade B officers, it usually accounts for 40 to 45 percent of the basic pay. The exact amount may vary slightly depending on the inflation rate. For example, if DA is at 45 percent, it would be approximately ₹24,840.

House Rent Allowance (HRA) HRA is applicable only if the officer chooses not to avail of RBI-provided accommodation. It varies by city classification:

Nine percent of basic pay in other cities

Eight percent in semi-metropolitan cities

Seven percent in metro cities

In cities where RBI provides residential flats, HRA is not paid, but the benefit of subsidized housing adds significant value.

Grade Allowance This is a fixed allowance of ₹6,800 provided exclusively to officers of the Grade B level. It reflects the job’s classification and seniority.

Local Compensatory Allowance This allowance is location-dependent and aims to offset the variation in cost of living across cities. It typically ranges between ₹3,000 and ₹5,000.

Special Allowance Special allowance is a fixed component ranging from ₹2,200 to ₹3,000. While it is part of the gross salary, it may not be factored into retirement or pension calculations.

Learning Allowance RBI encourages self-development and continuing education among its employees. The learning allowance of ₹600 per month supports academic or skill-enhancing pursuits.

Deductions in the RBI Grade B Salary Slip

Gross salary is not the final amount credited to your bank account. Various deductions are made from the gross pay before arriving at the net or in-hand salary. These typically include:

Provident Fund (PF) A portion of the salary is deducted for the employee's contribution to the Provident Fund, which is matched by the employer. This usually amounts to ₹5,500 to ₹6,000.

Income Tax (TDS) Depending on your total annual earnings and applicable exemptions, tax is deducted at source. This amount varies based on your declared savings and investment proofs.

Professional Tax This is a state-imposed tax and ranges from ₹200 to ₹300 depending on the location.

National Pension Scheme (NPS) If opted in, a portion of the salary goes towards the NPS contribution. This deduction typically ranges between ₹6,000 and ₹7,000.

Staff Welfare Fund A small amount is also deducted for staff welfare activities, usually ₹100 to ₹200.

RBI Accommodation and Its Impact on Salary

One of the significant benefits of working at RBI is the availability of government-provided housing. In most major cities, RBI offers well-maintained flats to officers, reducing the need for private rent. Officers who accept this accommodation do not receive HRA, but the value of the housing provided often exceeds the HRA amount, especially in metro cities.

This benefit, although not directly reflected in the salary slip, contributes substantially to the overall compensation package.

Salary Growth and Career Progression

The RBI Grade B salary is not static. With each passing year, officers receive annual increments and can also qualify for departmental promotions. The career path can advance through the following ranks:

Grade B (Manager)

Grade C (Assistant General Manager)

Grade D (Deputy General Manager)

Grade E (General Manager)

Grade F (Chief General Manager and above)

With each promotion, the pay band increases significantly. By the time an officer reaches Grade D, the salary can exceed ₹1.5 lakh per month excluding perks.

Additional Benefits Beyond Salary

Apart from the salary and housing benefits, RBI Grade B officers enjoy several other perks:

Medical allowance reimbursed quarterly

Leave Travel Concession (LTC) for domestic travel

Annual newspaper and book grant

Mobile and internet reimbursement

Low-interest personal loans

Education allowance for children

Access to RBI staff clubs, sports facilities, and guest houses across India

These benefits enhance the overall quality of life and provide substantial financial value over and above the in-hand salary.

Conclusions

A newly joined RBI Grade B officer receives a gross monthly salary in the range of ₹1.05 lakh to ₹1.12 lakh. After deductions, the in-hand salary is approximately ₹80,000 to ₹90,000 per month. However, when you include the value of housing, medical facilities, travel reimbursements, and other perks, the effective compensation is much higher.

The RBI Grade B salary, combined with job stability and long-term career growth, makes this position one of the most prestigious and rewarding roles in the Indian financial sector.

0 notes