#How to become rich

Explore tagged Tumblr posts

Text

How to Become a Millionaire - Believing, Performing and Obtaining Entertaining

Aside from joining and winning inside a millionaire game show, becoming a millionaire is undoubtedly achievable, for everyone. There are lots of points that you can do to find monetary freedom and get what ever it can be which you choose to get. You merely need to discover that opportunity and own it. This can be tips on how to come to be a millionaire. For anyone who is sick and tired of continuously worrying in regards to the bills which you need to spend or in case your earnings is just not enough to suffice your requires, then step out and step up. Find out how you can develop into a millionaire with these straightforward suggestions and get rich quick and get wealthy now. Set a Purpose and Concentrate on It and Get Wealthy Fast They say that when play football, you've to appear to get a spot on the objective where you would want your ball to hit or fall. While not all of the balls that you have kicked would hit that spot, provided that you continue focusing on that spot, you'll eventually hit it. Precisely the same factor is true if you're searching for solutions to be a millionaire. You require to set a goal and continue concentrating on the objective which you have. Be Determined to Reach These Targets if you need to get Rich Promptly Significantly like football, you could possibly not promptly hit your aim. Nonetheless, when you are determined to develop into a millionaire, these missed shots should by no means quit you from kicking additional balls. Finding out the way to grow to be a millionaire requires you to in no way back out, but instead use your failures to construct you as a tougher particular person. What is it truly that you simply choose to achieve? How long do you desire to attain this? Just remember that after you set ambitions, make an effort to be realistic too. You cannot anticipate your ball to hit Mars when you are kicking from Earth. Set your aim. Concentrate. That is certainly how you can make your self a millionaire. Function Extremely Hard to Grow to be a Millionaire in a Few Years Once you have got set a objective, you can't just look at it and stay immobile. You'll need to perform your element to hit it. Lessons about becoming a millionaire inform us that for those who badly desire to earn enough revenue, you ought to function quite hard. The sad truth about the best way to become a millionaire is that you can't become one particular when you spend your complete day watching Tv and waiting for things to come about before your eyes. You may have to understand and study what you could do and once you've got the appropriate expertise, it's essential to place it in action. You'll need to figure out what your skills are. You should continue enhancing these expertise or attempt acquiring new abilities along the way. There are several items that you could do to enhance your monetary status. Don’t hesitate. Do it. These are the items that you just will have to contemplate and do for those who actually choose to be a millionaire. There are plenty of tools and people that will make it easier to inside your quest on generating yourself a millionaire. Do not be afraid to ask for guidance and assistance for those who have to about tips on how to develop into a millionaire. Just under no circumstances forget to delight in every step of it. This tends to make your pursuit more gratifying.

Learn more at www.simplyworkfromhome.co.uk/how-to-become-a-millionaire/

35 notes

·

View notes

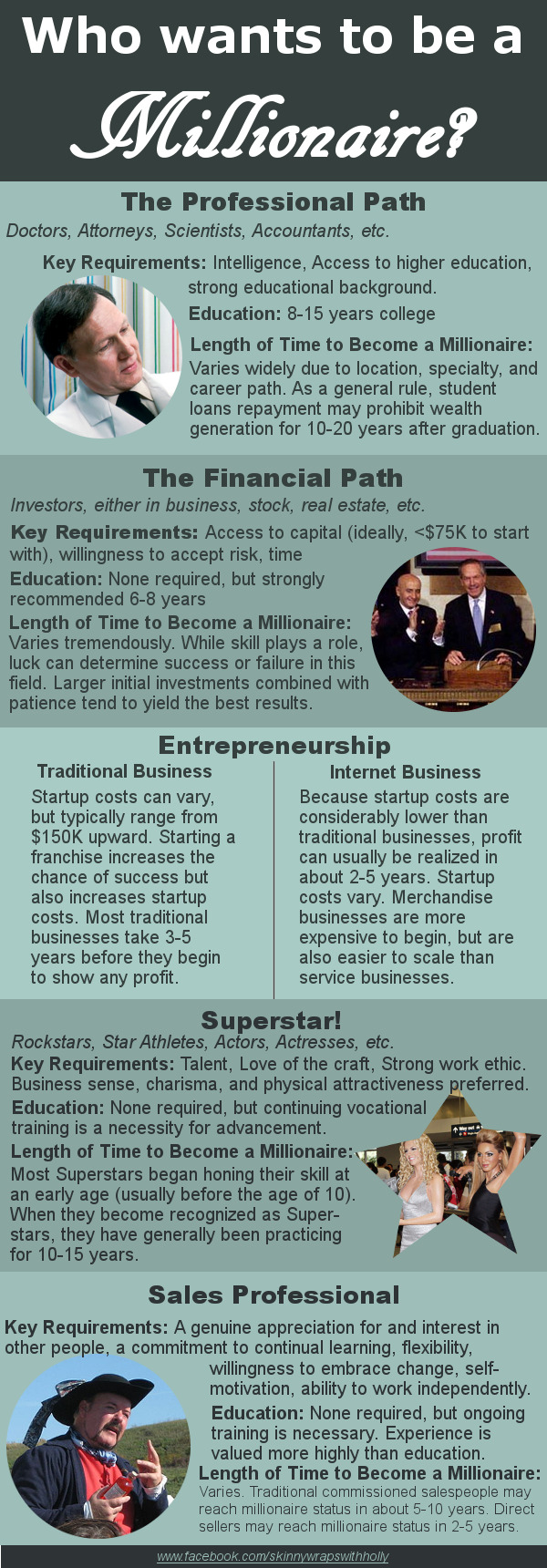

Photo

Who wants to be a #millionaire? I know you can become a millionaire through #itworks! Direct sales works! We're having an ItWorks #boom!

15 notes

·

View notes

Text

#how to become rich#memes#meme#exploitation#exploitation of workers#wage slavery#slavetothewage#jerkbillionaires#jerkmillionaires#jerktrillionaires#exploitable#slavery#chattel slavery#sweatshop#capitalism#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#class war

12 notes

·

View notes

Text

How to become successful.

Work harder than everyone else. Be patient about what you are doing, and never give up.

#successful#how to become successful#how to become rich#blog#determination#attitude#wisconsin photographer#a.m. productions#tips#tricks

12 notes

·

View notes

Text

6 Mindset Secrets of Millionaires By Dr. Steve G. Jones Clinical Hypnotherapist

There is something unique in the way that millionaires think. This ‘mindset’ helps make them more money. Having such a mindset can be life-changing.

If you want to make more money, start with these six mindset secrets of millionaires.

1. Do

Stop hoping, stop thinking, stop just planning, and actually do something. Millionaires are doers.

They work on their ideas and on their plans. This is a very important trait to have if you want to be a millionaire.

A wealth empire is not just gonna fall not your lap fully functioning. It will take work and YOU will have to do that work.

So, stop pining over the fact that you are not yet a millionaire and start doing something.

2. Set Long Term Goals

Don’t only think about the present, think of the future as well. Set goals that can span years or decades. Look ahead and have clear goals of where you want to be in the future.

Why does this work for millionaires? It does so because long term goals force you to deal with questions like, ‘how can I double my income for the next few years’, instead of ‘how can I pay the light bill next month’.

Millionaires are often willing to give up short term conveniences for long term financial ease. Stop falling for the trap of instant gratification.

3. Keep Learning

Millionaires never stop learning. Every new lesson or skill learned is turned into an opportunity to make money. Many live by the adage, ‘The more you learn, the more you will earn.’

Keep improving yourself. Take classes and always be open to learning new skills. Read as much as you can as well.

Some of the most famous millionaires in the world – Elon Musk, Oprah Winfrey, Mark Zuckerberg, etc., have professed their love of reading.

Not just any book of course, read books that will help widen your understanding of the world.

Read biographies by millionaires and try applying the lessons they teach to your own life.

4. Don’t ‘Save’ Money

I will start this section with – Yes, you need an emergency fund. Ideally, it should be enough to allow you to pay your bills for at least 6 months if ever you find yourself in financial trouble.

But, don’t save your money for the sake of ‘saving’. Invest your money instead. Don’t let it sit in your bank, earning very little interest.

If investing scares you, you can start with investing in some low risk options. Buy Mutual Funds or buy stocks in blue-chip companies that have a good track record.

Keep in mind though that low risk often leads to low returns. But, at least you are not letting your money just sit in the bank.

5. Focus on Actually Being Wealthy Rather Than Looking Wealthy

This does not mean that you don’t have to look presentable, but don’t go broke doing so. Instead of getting caught in the trappings of wealth, the sports car, the expensive phones, the big mansions, etc., focus instead on growing your wealth.

Avoid spending your money on things that will not earn you any returns.

Be practical in your spending and do not spend to impress other people. Look at some of your favorite millionaires, I am sure that many of them live fairly frugal lifestyles and follow a budget.

6. You are not your Circumstances

It is easy to fall into the trap of thinking that you have the life you have because of the circumstances you are dealt with.

This is a myth and if if you believe this, then you should definitely change the way you think.

Don’t play the blame game. If you don’t like how something is, then work to change it. Create your own opportunities.

#how to make money from home#how to become rich#how to become wealthy#how to become successful#how to get extra money#how to manifest money#how to get financial freedom fast#how to become a millionaire fast#how to be more happy#how to get extra money fast#how do you get rich#steps to financial freedom#how to become a money magnet#how to succeed financially in life#fastest way to get money#achieve financial freedom#ways to become rich#manifesting money fast#money and the law of attraction#self-hypnosis#hypnosis for happiness and positivity

11 notes

·

View notes

Link

If someone might consult other folks should they need to learn how to become a millionaire, he might even see plenty of hands would raise up and declare "Aye". But, wait till somebody will inform these individuals that they must do a lot of things that they will not usually do to be able to reach that purpose like getting away from their own comfort areas and specific zones and you will probably see that only a few will probably be left behind able to take that risk because only a few will say that to become millionaire is really difficult, certainly, but it is possible, a solid idea of people with similar positive minds. But, there are some men and women who would say in a positive way that learning how to certainly be a millionaire is extremely difficult but it can be possible.

#how to become a millionaire#become a millionaire#how to become rich#how to make millions#tips on how to become a millionaire#become wealthy

8 notes

·

View notes

Text

What Is Investment Risk Tolerance?

Whether you carry out your own investments or work with a financial manager for investment advice, you have probably heard about investment risk tolerance. What does this mean?, risk tolerance is "The degree of uncertainty that an investor can handle in regard to a negative change in the value of his or her portfolio." (Risk tolerance, 2010). In other words, risk tolerance is a benchmark of how much you are willing to lose when the market goes south. Most Americans knew what their real risk tolerance during the financial crises --- not the best way to find out. One way to find out your risk tolerance is to fill out a questionnaire. You can use one online or at a financial professional's office. There is no generic questionnaire, but oftentimes they have very similar questions, like for example:

- When will you need the money from this particular account?

- What is your investment plan?

- What is your net worth?

Worry not because, there are multiple choices and are most of the time aren't that plenty. Based on your answers, you will fall into one appropriate category.There are 3 types of risk tolerance: conservative, moderate and aggressive.

Nevertheless, the commonly used chart includes moderately conservative and moderately aggressive risk tolerance as well. It is a must to be aware of your risk tolerance as it is the very basis of putting up a personal investment portfolio. Differences in risk tolerance results to various combination of fixed and equity investments as well as growth and value investments in the given portfolio.

Conservative investors have the lowest risk tolerance; because they prefer not to dispose any money or to lose even just small amounts. Apparently they are also willing to negotiate for a lower return. They should stick to investments with assured rates of return such as money market accounts, CDs and bonds with little hazards to stocks. The usual combination of fixed and equity investments in a conservative portfolio is 80/20.

Moderate investors can handle some gamble; more likely they have plenty of time before they need the money or they have plenty of assets to make up for the losses. Often, moderate portfolios need around 50/50 combination of resources.

Aggressive investors can carry the most risk in hopes to get the highest profits. They often have huge net worth and can invest in big investments as real estate investment trusts, unit investment trusts, limited partnerships and other investment vehicles not accessible to middle-class American. The most common fixed-equity investment combination in an aggressive portfolio is 20/80. Other big-time investors even go for 100% in the market.

Before investing, make sure to figure out your risk tolerance and make an appropriate investment allocation for your portfolio. If you are a traditional investor, a wrong allocation will leave you anxious and worried about losses. However, if you are a moderately aggressive or an aggressive investor, an overly conservative portfolio will make you unsatisfied with the earnings.

8 notes

·

View notes

Text

Your Investment Risk Tolerance: What It Is and Why It Is Important

Whether you run your own assets or has a financial officer, more likely you've heard about investment risk tolerance. What does this mean?, risk tolerance is "The degree of uncertainty that an investor can handle in regard to a negative change in the value of his or her portfolio" (Risk tolerance, 2010).

In other words, risk tolerance is a benchmark of how much you are willing to yield when the economy goes down. Most Americans knew what their true risk tolerance when the market went down which is proven to be not the best time to find out. The only sensible way to learn your risk tolerance is to fill out a questionnaire. You can find one online or at the office of financial professionals. There is no universal questionnaire, but most of the time they have almost similar questions, like:

- When will you need the money from this particular account?

- What is your investment plan?

- What is your net worth?

You don't need to think much, these are multiple choice questions and there most of the time aren't that many. You will then be grouped based on your answers.There are 3 types of risk tolerance: conservative, moderate and aggressive.

Nevertheless, the commonly used are moderately conservative and moderately aggressive risk tolerance as well. It is a must to know your risk tolerance since it is the very basis of creating a personalized investment portfolio. Differences in risk tolerance promotes different combination of fixed and equity investments as well as growth and value investments in the given portfolio.

Conservative investors have the lowest risk tolerance; since they prefer not to dispose any money or to lose very little. Obviously they are also willing to settle for a lower earnings. They stay with investments with assured rates of return such as money market accounts, CDs and bonds with little exposure to stocks. The basic combination of fixed and equity investments in a conservative portfolio is 80/20.

Moderate investors can manage some risk; they either have more time before they need the money or they just have plenty of resources to make up for the losses. Often, moderate portfolios call for around 50/50 combination of assets.

Competitive investors can carry the most risk in dreams of getting the highest profits. They more likely have big net worth and can invest in big investments as real estate investment trusts, unit investment trusts, limited partnerships and other investment vehicles not available to an average American. The most common fixed-equity investment combination in risky portfolio is 20/80. Some investors are even 100% in the market.

Before putting your investments and start doing your moves on how to get rich, make sure to learn your risk tolerance and make right investment allocation for your portfolio. If you are more conservative player, a wrong allocation will make you anxious and panicky about losses. If you are a moderately aggressive or an aggressive investor, an overly conservative portfolio will leave you unhappy with the earnings.

8 notes

·

View notes

Text

Want your family to have over 1 BILLION dollars?

You want to know the secret on how to become one the RICHES family in the WORLD?!

When I am done here, your decendents will be dining and hanging out with the future generations of Gates, Buffetts or the Rockefeller.

Here is the secret and here is what you do.

"Earn, save, invest and repeat"

Now, you probably thinking I am nuts and crazy. I probably am, but hear me out for just a little bit longer.

If you start saving lets say $1000 per month throughout your working lifetime (lets say 40 years), and can get an return of 7% (If you can get more even better) a year for your investments, and have subsequent generation of your family do the same, within 3 generations your family will have a wealth of over $1.2 billion dollars.

Now doesn't that sound simple?

Don't you wish your grand, great grand and great great grand parents have done this. If they had we will be hearing stories about the Smiths or the Heffernnes, instead of the Gates and Hiltons.

Yet I don't think of anyone ever in the history of the HUMAN RACE have done this present or past (If anyone knows of a family that did this, please let me know).

There are a few points I am trying to make here:

1. Compounding is powerful, see my previous post "Power of Compounding & Rule of 72"

2. Delay gratification.

3. There are so many things in life, were the answer is already known to you, but people don't do it. People are always looking for the short cut, the easy way out. The "how" is already there for you to apply you just have to apply it. Obviously "Just do it" is not so easy, otherwise everyone would have done it. "How do I get rich?", "How do I lose weight?", "How do I get an A?". Deep down we all the know the "how" to the above questions, instead of looking for the get "X" quick scheme, we just need to concentrate on the "Do"

Sometimes, instead of searching for the "How" you need to concentrate on the "Do".

PS: Just trying to illustrate a point, this doesn't take into account inflation etc.

7 notes

·

View notes

Text

Your Investment Risk Tolerance: What It Is and Why It Is Important

Either you carry out your own investments or has a financial adviser, you have probably heard about investment risk tolerance. What does this mean?, risk tolerance is "The degree of uncertainty that an investor can handle in regard to a negative change in the value of his or her portfolio" (Risk tolerance, 2010).

In other words, risk tolerance is a benchmark of how much you are willing to yield when the business goes down. Majority of Americans became aware of what their real risk tolerance way back in 2008, during the worldwide economic crisis --- not the best time to discover. One way to learn your risk tolerance is to answer a questionnaire. You can use one online or at a financial professional's office. There is no universal questionnaire, but they all have almost the same questions, example:

- When will you need the money from this particular account?

- What are your plans for this investment?

- What is your net worth?

You don't have to worry because, these are multiple choice questions and are most of the time not that plenty. Based on your answers, you will fall into one appropriate category.

There are 3 basic levels of risk tolerance: conservative, moderate and aggressive. Nevertheless, the often used chart includes moderately conservative and moderately aggressive risk tolerance as well. It is a must to know your risk tolerance as it is the very basis of setting up a personal investment portfolio. Differences in risk tolerance results to various combination of fixed and equity investments as well as growth and value investments within a given portfolio.

Conservative investors have the lowest risk tolerance; they choose not to squander any money or to lose even just small amounts. Apparently they are also open to negotiate for a lower income. They stay with investments that have guaranteed rates of return such as money market accounts, CDs and bonds with little exposure to stocks. The basic combination of fixed and equity investments in a conservative portfolio is 80/20.

Moderate investors can manage some dangers; more likely they have a lot of time before they need the money or they have enough assets to amend for the losses. Most of the times, moderate portfolios require around 50/50 combination of assets.

Aggressive investors can handle the most risk in hopes of getting rich fast. They more likely have big net worth and can invest in big investments as real estate investment trusts, unit investment trusts, limited partnerships and other investment vehicles not feasible to regular American. One of the more common fixed-equity investment combination in risky portfolio is 20/80. Some investors are even 100% in the market.

Before thinking of investing, be sure to figure out your risk tolerance and make fitting investment allocation for your portfolio. If you are on the conservative side, a wrong appropriation will make you stressed out and worried about losses. If you are a moderately aggressive or an aggressive investor, an overly conservative portfolio will leave you unhappy with the earnings.

7 notes

·

View notes

Text

Investment Risk Tolerance:Definition and Importance

If you are looking for an investment advice from your investment officer, more likely you've come across about investment risk tolerance. By definition, risk tolerance is "The degree of uncertainty that an investor can handle in regard to a negative change in the value of his or her portfolio" (Risk tolerance, 2010). In other words, risk tolerance is a measurement of how much you are willing to yield when the business goes down. Most Americans are aware of what their true risk tolerance when the market went down --- not the ideal way to discover. Best way to find out your risk tolerance is to answer a questionnaire. You can use those that are available online or at a financial professional's office. There is no universal questionnaire, but they all have almost similar questions, such as:

When do you need this money?

What are your plans for this investment?

What is your net worth?

You don't need to think much, there are multiple choices and there usually aren't that many. You will then be grouped based on your answers.

There are 3 basic levels of risk tolerance: conservative, moderate and aggressive. Regardless, the most common used charts are moderately conservative and moderately aggressive risk tolerance as well. It is important to find out your risk tolerance as it is the very basis of setting up a personalized investment portfolio. Differences in risk tolerance lead to different combination of fixed and equity investments as well as growth and value investments in the given portfolio.

Conservative investors have the lowest risk tolerance; since they prefer not to sacrifice any money or to lose even just small amounts. Certainly they are also willing to settle for a lower return. They remain with investments with assured rates of return such as money market accounts, CDs and bonds with limited exposure to stocks. The common combination of fixed and equity investments in a conservative portfolio is 80/20.

Moderate investors can stand some dangers; they either have plenty of time before they need the money or they just have many of assets to compensate for the losses. Usually moderate portfolios require around 50/50 combination of assets.

Aggressive investors can handle the most risk in hopes to get the highest profits. They more likely have big net worth and can invest in such instruments as real estate investment trusts, unit investment trusts, limited partnerships and other investment vehicles not accessible to middle-class American. The most common fixed-equity investment combination in an aggressive portfolio is 20/80. Other big-time investors even go for 100% in the market.

Before investing, make sure to know your risk tolerance and devise fitting investment allocation for your portfolio. If you are a conventional one, a wrong appropriation will have you anxious and panicky about losses. However, if you are a moderately aggressive or an aggressive player, an overly conservative portfolio will make you unsatisfied with the earnings.

6 notes

·

View notes

Text

How to become an entertainer in 2023

There is no easy answer when it comes to becoming an entertainer. The most common way to become an entertainer is to start out as an amateur and work your way up. This can be done by performing at local venues, such as bars and restaurants, or by auditioning for small roles in productions. If you are able to make a name for yourself and develop a following, you may be able to pursue a career in entertainment. There is no one-size-fits-all answer to this question, as the best way to become an entertainer may vary depending on your specific talents and skills. However, some tips on how to become an entertainer include developing your talent, building a portfolio of your work, and networking with other entertainers. There is no single answer to this question, as the paths to becoming an entertainer vary greatly depending on an individual's talents, skills, and experience. However, some tips on how to become an entertainer include developing your skills as much as possible, networking with other entertainers and industry professionals, and marketing yourself and your talents. There is no one-size-fits-all answer to this question, as the best way to become an entertainer may vary depending on your skills and talents. However, some tips on how to become an entertainer include

1. Start by developing your skills and talents. If you want to be an entertainer, it's important to start by honing your skills and talents. This may include practicing your singing, dancing, or acting, or learning how to play an instrument.

2. Get involved in performing arts There are many ways to get involved in performing arts, whether it's through school, community theatre groups, or other performing arts organizations. This will help you get experience performing in front of a live audience.

3. Get noticed. One of the best ways to become an entertainer is to get noticed by someone in the industry. This may mean performing at open mic nights, sending your music or videos to record labels or talent agencies, or auditioning for shows or movies. 4. Network with other entertainers Networking with other entertainers can help you learn from their experiences and connect with potential opportunities. How to become an entertainer

#entertainment#how to become an entrepreneur#how to become a model in cape town#how to become a forex trader#how to become rich

5 notes

·

View notes

Text

Finance | The way to become rich is to put all your eggs in one basket and then watch that basket.

http://www.raiseyourmind.com/finance/the-way-to-become-rich-is-to-put-all-your-eggs-in-one-basket-and-then-watch-that-basket/

#Andrew Carnegie#Eggs#how to be rich#how to become rich#making money#Rich#Watch#ways to become rich#Finance

5 notes

·

View notes

Video

youtube

Professional Millionaire Dwayne Moneybags gives you 5 easy steps that will take you from being a penny-less peasant to a rich, successful and handsome fellow.

Did you know: Each member of TeamFlashGrenade grew a mustache for this video.

Cast:

Ross Hepburn as Dwayne Moneybags and himself:

Louis Harper as Frank the cameraman and himself:

Scott Nowbaveh as the creepy pervert and himself:

Written by Louis Harper:

Produced and Directed by Louis Harper and Robert Hill:

Camera-Operation by Robert Hill:

Sound-Operation by Tammy Heron:

Editing by Louis Harper:

Thumbnail picture created by Tammy Heron:

#how to become rich#trhe walking dead#short film#funny#rich#money#how to#how to video#dollar#pounds#youtube#film#hilariou#louis harper#teamflashgrenade#tammy heron#ross hepburn#hilarious#dog#puppy#follow us#we follow back#follow back#like#love

5 notes

·

View notes

Link

When someone would ask an individual if they wished to discover how to become a millionaire, he will surely see a great deal of folks who would certainly say, " I needed to". However, wait till someone will inform them that they need to perform many things that they would not usually do as a way to reach that objective like getting out of their own comfort zones and you'll find that only a few will be left behind willing to take that great risk because only a few can say that learning to be a millionaire is really difficult, certainly, but it is possible, a concept of positive people. However, there are some who would say in a very optimistic manner in which learning how to be a millionaire can be quite difficult but it is usually possible.

#how to become a millionaire#become a millionaire#how to become rich#how to make millions#tips on how to become a millionaire#become wealthy

6 notes

·

View notes

Text

Everything You Need To Know About Investment Risk Tolerance

Either you manage your own assets or work with a financial manager, more likely you've heard about investment risk tolerance. By definition, risk tolerance is "The degree of uncertainty that an investor can handle in regard to a negative change in the value of his or her portfolio" (Risk tolerance, 2010). In short, risk tolerance is a measurement of how much you are able to sacrifice when the economy goes down. Majority of Americans learned what their real risk tolerance when financial crisis broke out --- not the best way to find out. Best way to learn your risk tolerance is to answer a questionnaire. You can find one online or at a financial professional's office. There is no generic questionnaire, but they all have almost similar questions, such as:

When will you need the money from this particular account?

What are your plans for this investment?

What is your total assets?

You don't have to worry because there are answers to choose from and there most of the time not that many. You will be categorized according to the result of your answers.

There are 3 types of risk tolerance: conservative, moderate and aggressive. Regardless, the often used are moderately conservative and moderately aggressive risk tolerance as well. It is important to find out your risk tolerance because it is the very foundation of putting up a personalized investment portfolio. Differences in risk tolerance lead to different combinations of fixed and equity investments as well as growth and value investments within a given portfolio.

Conservative investors have the lowest risk tolerance; since they prefer not to dispose any money or to lose very little. Certainly they are also willing to negotiate for a lower return. They remain with investments with guaranteed rates of return such as money market accounts, CDs and bonds with very little exposure to stocks. The usual combination of fixed and equity investments in a conservative portfolio is 80/20.

Moderate investors can stand some gamble; more likely they have more time before they need the money or they have enough assets to compensate for the losses. Usually moderate portfolios call for around 50/50 combination of assets.

Aggressive investors can stand the most risk in dreams of getting the highest returns. They more likely have high net worth and can invest in big investments as real estate investment trusts, unit investment trusts, limited partnerships and other investment vehicles not feasible to an average American. The most common fixed-equity investment combination in risky portfolio is 20/80. Other big-time investors even go for 100% in the market.

Before you take any advice on how to get rich, be sure to know your risk tolerance and devise right investment allocation for your portfolio. If you are a conventional one, a wrong appropriation will make you stressed out and worried about losses. If you are a moderately aggressive or an aggressive investor, an overly conservative portfolio will leave you dissatisfied with returns.

4 notes

·

View notes