#IoT Communication Protocol Market Share

Explore tagged Tumblr posts

Text

IoT Communication Protocol Market Enabling Next-Gen Industrial IoT (IIoT) Innovations

TheIoT Communication Protocol Market Size was valued at USD 16.95 Billion in 2023 and is expected to reach USD 23.94 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032.

IoT Communication Protocol Market is witnessing notable growth as the demand for seamless device connectivity accelerates across industries. With businesses increasingly adopting smart devices, machine-to-machine communication has become essential for data sharing, automation, and efficiency. Protocols such as MQTT, CoAP, and Zigbee are playing a vital role in enabling reliable, low-power, and scalable communication.

U.S. Leads in Advancing IoT Infrastructure Through Protocol Innovation

IoT Communication Protocol Market is evolving with the integration of edge computing, AI, and 5G, which are reshaping how devices interact in real time. As industries like healthcare, automotive, and manufacturing pivot to intelligent operations, the need for secure, flexible, and interoperable communication standards continues to rise.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6554

Market Keyplayers:

Huawei Technologies (OceanConnect IoT Platform, LiteOS)

Arm Holdings (Mbed OS, Cortex‑M33 Processor)

Texas Instruments (SimpleLink CC3220 Wi‑Fi MCU, SimpleLink CC2652 Multiprotocol Wireless MCU)

Intel (XMM 7115 NB‑IoT Modem, XMM 7315 LTE‑M/NB‑IoT Modem)

Cisco Systems (Catalyst IR1101 Rugged Router, IoT Control Center)

NXP Semiconductors (LPC55S6x Cortex‑M33 MCU, EdgeLock SE050 Secure Element)

STMicroelectronics (STM32WL5x LoRaWAN Wireless MCU, SPIRIT1 Sub‑GHz Transceiver)

Thales (Cinterion TX62 LTE‑M/NB‑IoT Module, Cinterion ENS22 NB‑IoT Module)

Zebra Technologies (Savanna IoT Platform, SmartLens for Retail Asset Visibility)

Wind River (Helix Virtualization Platform, Helix Device Cloud)

Ericsson (IoT Accelerator, Connected Vehicle Cloud)

Qualcomm (IoT Services Suite, AllJoyn Framework)

Samsung Electronics (ARTIK Secure IoT Modules, SmartThings Cloud)

IBM (Watson IoT Platform, Watson IoT Message Gateway)

Market Analysis

The IoT Communication Protocol Market is driven by the explosion of connected devices and the need for efficient, low-latency data transmission. Communication protocols serve as the foundation for interoperability among heterogeneous IoT devices, ensuring real-time synchronization and security. The U.S. is leading with early adoption and robust R&D, while Europe contributes significantly with regulatory support and smart city deployments.

Market Trends

Increasing adoption of LPWAN protocols like LoRaWAN and NB-IoT

Rise of MQTT and CoAP in industrial and home automation applications

Shift towards IPv6 for improved scalability and addressability

Integration of 5G enhancing speed and reliability in protocol performance

Growing emphasis on cybersecurity and encrypted data exchange

Development of hybrid protocols to support multi-layered IoT architectures

Market Scope

The market is expanding beyond traditional device communication and into intelligent ecosystems. Protocols are now expected to support not only connectivity but also data prioritization, edge computing compatibility, and energy efficiency.

Real-time communication for industrial automation

Protocols optimized for ultra-low power IoT devices

Interoperability across cloud, edge, and device layers

Smart city applications requiring scalable communication

Healthcare devices demanding secure and reliable data transfer

Automotive systems relying on low-latency connections

Forecast Outlook

The IoT Communication Protocol Market is set to grow at a rapid pace as device ecosystems multiply and application complexity deepens. Success will depend on protocol adaptability, security, and standardization efforts that support global deployment. With North America at the forefront and Europe driving policy-aligned innovation, the market is primed for a shift from fragmented systems to harmonized connectivity solutions.

Access Complete Report: https://www.snsinsider.com/reports/iot-communication-protocol-market-6554

Conclusion

As industries become increasingly connected, the IoT Communication Protocol Market plays a crucial role in shaping the future of smart operations. From San Francisco’s automated logistics to Berlin’s connected healthcare systems, the demand for agile, secure, and scalable communication protocols is setting new standards. Forward-thinking enterprises that prioritize protocol innovation will lead the charge in building resilient and intelligent digital ecosystems.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A sees rising adoption of IoT middleware as industries push for smarter automation solutions

U.S.A. accelerates financial innovation through Robotic Process Automation in BFSI operations

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

#IoT Communication Protocol Market#IoT Communication Protocol Market Scope#IoT Communication Protocol Market Share#IoT Communication Protocol Market Growth

0 notes

Text

Digital I-O System Market - Latest Study with Future Growth, COVID-19 Analysis

Digital I-O System Market, Trends, Business Strategies 2025-2032

The global Digital I-O System Market size was valued at US$ 1.89 billion in 2024 and is projected to reach US$ 3.01 billion by 2032, at a CAGR of 6.89% during the forecast period 2025–2032.

A digital I/O (input/output) system is a hardware module that enables computers or microcontrollers to interface with external digital signals. These systems feature configurable input and output ports for reading sensor data or controlling devices like relays and actuators. Key components include parallel/serial interfaces, USB connectivity, and specialized I/O modules with software APIs for seamless integration.

Market growth is driven by accelerating industrial automation adoption, where digital I/O systems facilitate machine-to-machine communication in smart factories. The rise of Industry 4.0 and IoT deployments has increased demand for robust signal processing solutions. While North America leads in market share (35%), Asia-Pacific shows the fastest growth (11% CAGR) due to expanding manufacturing sectors in China and India. Major players like Siemens and Emerson Electric are expanding their modular I/O portfolios to address evolving Industry 4.0 requirements.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=103241

Segment Analysis:

By Type

Signal Type Segment Holds Significant Market Share Due to Its Critical Role in Industrial Automation

The market is segmented based on type into:

By Signal Type

Subtypes: Isolated, Non-isolated, and others

By Number of Inputs/Outputs

By Mounting

Subtypes: DIN Rail, Panel Mount, and others

Others

By Application

Industrial Automation Segment Dominates Due to Rising Adoption of Smart Factory Solutions

The market is segmented based on application into:

Industrial Automation

Robotics

Data Acquisition Systems

Process Control

Others

By Communication Protocol

Ethernet Segment Gains Traction Owing to High-Speed Data Transmission Capabilities

The market is segmented based on communication protocol into:

Fieldbus

Ethernet

Professional Network

Others

Regional Analysis: Digital I-O System Market

North America The North American market for digital I/O systems remains highly competitive, driven by advanced industrial automation and IoT adoption across key sectors. The United States, accounting for over 60% of regional market share, leads in the deployment of high-performance I/O modules for manufacturing, energy, and smart infrastructure. Recent investments in Industry 4.0 technologies, including $50 billion allocated for smart manufacturing initiatives, underscore the demand for reliable digital I/O solutions. However, stringent certification requirements (e.g., UL, FCC) and cybersecurity concerns pose challenges for vendors entering this mature but innovation-driven market.

Europe Europe’s digital I/O system market benefits from strong regulatory frameworks promoting industrial digitization under Industry 5.0 initiatives. Germany and France dominate demand, particularly in automotive and pharmaceutical automation where 32-bit I/O modules with real-time Ethernet protocols are preferred. The region’s emphasis on sustainability has accelerated adoption of energy-efficient systems. While the market remains consolidated among legacy players like Siemens and WAGO, opportunities exist for specialized I/O solutions compliant with EU machine safety directives (e.g., IEC 61131-2). Supply chain disruptions from recent geopolitical tensions, however, continue to impact lead times.

Asia-Pacific APAC demonstrates the highest growth potential, with China’s industrial automation sector driving 45% of regional demand for cost-effective digital I/O solutions. The “Make in India” initiative and Japan’s Society 5.0 blueprint are fostering smart factory adoption, though price sensitivity limits premium product penetration. Local manufacturers increasingly blend legacy relay systems with modular I/O configurations. While infrastructure gaps persist in Southeast Asia, government-backed smart city projects are creating new application opportunities, particularly in transportation and utilities automation.

South America Brazil’s manufacturing rebound and Argentina’s mining sector modernization are spurring selective demand for ruggedized I/O systems suited for harsh environments. However, economic instability and import dependency constrain market expansion, with most advanced solutions limited to multinational industrial facilities. Local partnerships are emerging as a key strategy for international vendors, particularly in the food processing and oil/gas verticals where explosion-proof I/O modules show growing adoption. The lack of standardized industry protocols across the region remains a persistent challenge.

Middle East & Africa MEA presents a bifurcated market landscape – Gulf Cooperation Council (GCC) nations lead in adopting high-end industrial I/O systems for oil/gas automation and smart infrastructure projects, while North Africa shows gradual uptake in textile and automotive manufacturing. The UAE’s Operation 300bn industrial strategy is driving demand for Ethernet-based I/O solutions, though budget constraints in other markets favor retrofit solutions over new installations. Political instability and inconsistent power infrastructure continue to hinder broader market development despite long-term growth prospects.

List of Key Digital I/O System Manufacturers

Emerson Electric Co. (U.S.)

Belden Inc. (U.S.)

Siemens AG (Germany)

WAGO Kontakttechnik (Germany)

ACCES I/O Products (U.S.)

Festo (Germany)

Berghof Gruppe (Germany)

KEB Automation (Germany)

Turck (Germany)

Nanda Automation Technology Jiangsu (China)

Chongqing Blue Jay Technology (China)

The global push toward Industry 4.0 and smart manufacturing is significantly boosting demand for digital I-O systems. Manufacturers are increasingly implementing automation solutions to improve productivity, reduce operational costs, and enhance quality control. Industrial automation spending surpassed $240 billion globally in recent years, with discrete manufacturing industries accounting for nearly half of this investment. Digital I-O modules serve as critical components in these automated systems, providing reliable connectivity between controllers and field devices. The automotive sector’s transition toward electric vehicle production has particularly driven adoption, with new assembly lines requiring hundreds of discrete I/O points per manufacturing cell.

The proliferation of industrial IoT deployments is creating substantial growth opportunities for digital I/O solutions. As facility operators deploy thousands of connected sensors across plants, the need for robust signal conditioning and data acquisition hardware has intensified. Digital I-O systems provide the necessary interface between legacy equipment and modern IoT platforms, enabling real-time monitoring and predictive maintenance capabilities. In critical infrastructure sectors like oil & gas, digital I/O modules help bridge the gap between existing SCADA systems and new cloud analytics platforms. The global industrial IoT market’s projected compound annual growth rate of over 15% through 2030 suggests sustained demand for these interfacing solutions.

Urban digital transformation projects worldwide are creating unprecedented demand for distributed I/O solutions. Smart traffic management systems, environmental monitoring networks, and intelligent street lighting installations all require extensive digital I/O capacity. A single smart city project may incorporate thousands of discrete I/O points across various municipal systems. The global smart city technology market’s projected growth to over $1 trillion by 2030 indicates substantial opportunities for I/O system providers. Unlike industrial applications, these municipal deployments favor low-power, wireless-enabled I/O modules with solar power options for remote installations.

The integration of edge processing capabilities into digital I/O modules creates value-added opportunities for manufacturers. Modern I/O systems now incorporate local logic execution, data filtering, and preprocessing functions that reduce network bandwidth requirements. This distributed intelligence enables real-time decision-making at the sensor level while maintaining cloud connectivity for analytics. Industrial users implementing these smart I/O solutions report 30-50% reductions in unplanned downtime through predictive maintenance capabilities. The increasing affordability of edge computing components allows I/O module vendors to offer these advanced features across various price points, accelerating adoption.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103241

Key Questions Answered by the Digital I-O System Market Report:

What is the current market size of Global Digital I-O System Market?

Which key companies operate in Global Digital I-O System Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Analog Measurement Module Market: Rising Demand Across Consumer and Industrial Applications 2025–2032

Analog Measurement Module Market, Trends, Business Strategies 2025-2032

The global Analog Measurement Module market size was valued at US$ 456.78 million in 2024 and is projected to reach US$ 723.45 million by 2032, at a CAGR of 6.78% during the forecast period 2025–2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103297

MARKET INSIGHTS

The global Analog Measurement Module market size was valued at US$ 456.78 million in 2024 and is projected to reach US$ 723.45 million by 2032, at a CAGR of 6.78% during the forecast period 2025–2032. The U.S. market accounted for approximately 28% of global revenue share in 2024, while China’s market is expected to grow at a faster CAGR of 7.9% through 2032.

Analog measurement modules are critical components in industrial automation systems that convert real-world signals (such as temperature, pressure, or voltage) into digital data for processing. These modules typically include both input modules (for signal acquisition) and output modules (for control signals), with applications spanning industrial, automotive, and consumer electronics sectors. Leading manufacturers like Siemens and Rockwell Automation have introduced advanced modules with higher precision (±0.1% accuracy) and faster sampling rates (up to 1MS/s) in recent years.

The market growth is driven by increasing Industry 4.0 adoption and demand for process optimization in manufacturing. However, the transition toward wireless IoT sensors presents both opportunities and challenges for traditional analog modules. In February 2024, Emerson launched its new AMS Trex device communicator supporting both legacy analog and modern wireless HART protocols, reflecting this industry evolution. Other key players include Texas Instruments, Mitsubishi Electric, and Advantech, who collectively held over 45% market share in 2024.

List of Key Analog Measurement Module Companies Profiled

Emerson Electric Co. (U.S.)

WAGO Corporation (Germany)

Siemens AG (Germany)

Schneider Electric SE (France)

Mitsubishi Electric Corporation (Japan)

Robert Bosch GmbH (Germany)

JUMO GmbH & Co. KG (Germany)

Advantech Co., Ltd. (Taiwan)

Texas Instruments Inc. (U.S.)

Rockwell Automation, Inc. (U.S.)

Bachmann electronic GmbH (Austria)

SIGMATEK GmbH & Co. KG (Austria)

Beijer Electronics Group (Sweden)

Campbell Scientific, Inc. (U.S.)

Evikon MCI OÜ (Estonia)

National Instruments Corp. (U.S.)

Metrohm AG (Switzerland)

Eaton Corporation plc (Ireland)

F&F Co., Ltd. (Japan)

Hioki E.E. Corporation (Japan)

Segment Analysis:

By Type

Analog Input Module Segment Dominates Due to High Demand in Industrial Automation

The market is segmented based on type into:

Analog Input Module

Subtypes: Single-channel, Multi-channel, Temperature, and others

Analog Output Module

Subtypes: Voltage output, Current output, and others

Combined I/O Modules

Specialty Measurement Modules

By Application

Industrial Segment Leads Owing to Widespread Use in Process Control and Automation

The market is segmented based on application into:

Industrial

Communication

Consumer Electronics

Automotive

Others

By End User

Manufacturing Sector Dominates Due to Increasing Automation Investments

The market is segmented based on end user into:

Manufacturing

Energy & Utilities

Telecommunications

Automotive

Others

Regional Analysis: Analog Measurement Module Market

North America The North American market for analog measurement modules is characterized by high technological adoption and stringent regulatory standards. The U.S. leads the region, driven by strong demand from industrial automation, automotive, and communication sectors. Investments in Industry 4.0 and IoT infrastructure, along with government initiatives such as the CHIPS Act, are accelerating the adoption of high-precision analog measurement solutions. Major players like Emerson, Rockwell Automation, and Texas Instruments dominate the competitive landscape, focusing on innovations in energy efficiency and miniature designs. However, higher costs associated with advanced modules remain a challenge for small and medium enterprises.

Europe Europe’s analog measurement module market is fueled by industrial digitalization and strict EU directives on energy efficiency. Countries like Germany and France are at the forefront, leveraging precision measurement tools for manufacturing and automotive applications. The presence of leading automation providers such as Siemens, WAGO, and Schneider Electric ensures consistent technological advancements. The shift toward sustainable industrial practices is driving demand for low-power modules, though supply chain constraints and high R&D costs may slow short-term growth. Eastern Europe presents untapped potential due to increasing manufacturing investments.

Asia-Pacific As the fastest-growing market, Asia-Pacific is propelled by China’s dominance in electronics manufacturing and India’s expanding industrial base. Affordable labor and large-scale production facilities make the region a hub for cost-sensitive analog module solutions. While Japan and South Korea prioritize high-performance modules for automotive and consumer electronics, Southeast Asian nations focus on basic industrial applications. However, competition from local manufacturers and fluctuating raw material prices could impact profit margins for international suppliers. The region’s growth trajectory is further supported by government policies promoting smart factories and automation.

South America South America’s market remains nascent but opportunistic, with Brazil and Argentina leading adoption in mining, oil & gas, and agriculture sectors. Economic instability and limited industrial diversification hinder widespread implementation of advanced modules. However, increasing foreign investments in automation and gradual infrastructure improvements are creating pockets of demand. Local suppliers face challenges in competing with global brands, but partnerships with regional industrial players offer growth potential. Price sensitivity remains a key consideration for market entry.

Middle East & Africa The region shows moderate growth in analog measurement module adoption, primarily driven by oil & gas and construction industries. The UAE and Saudi Arabia lead due to smart city projects and industrial diversification efforts. Limited local manufacturing capabilities result in heavy reliance on imports, creating opportunities for global suppliers. While funding constraints and geopolitical factors pose risks, long-term prospects are bolstered by increasing automation in energy and utilities sectors. The lack of skilled labor for module integration remains a persistent challenge.

MARKET DYNAMICS

The analog measurement module market faces ongoing challenges from global semiconductor supply chain constraints. Specialized components like precision amplifiers and analog-to-digital converters frequently experience lead time extensions exceeding 20 weeks, disrupting manufacturers’ production schedules. These bottlenecks have forced some vendors to redesign modules with alternative components, potentially affecting performance specifications. The concentration of semiconductor fabrication in limited geographic regions creates vulnerability to geopolitical tensions and trade restrictions that could further exacerbate supply challenges.

Furthermore, maintaining stringent quality standards while navigating these supply chain uncertainties requires manufacturers to implement more rigorous testing protocols. This increases both production costs and time-to-market, particularly for high-accuracy modules used in mission-critical applications.

The global smart city initiative is creating significant opportunities for analog measurement module manufacturers. Urban infrastructure modernization projects require extensive deployment of environmental sensors, smart utility meters, and traffic monitoring systems that rely on precise analog measurement capabilities. With over 500 smart city projects currently underway worldwide, the demand for rugged, low-power measurement modules capable of long-term outdoor operation is increasing rapidly. Applications range from air quality monitoring (measuring particulate matter down to PM2.5 levels) to water management systems tracking flow rates with ±0.5% accuracy.

Innovations in wireless sensor networks and edge computing are further expanding the addressable market. New module designs incorporating energy harvesting capabilities and wireless connectivity (LoRaWAN, NB-IoT) enable deployment in previously inaccessible locations without power infrastructure. These advancements align perfectly with the needs of municipal authorities implementing comprehensive urban monitoring solutions.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103297

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Analog Measurement Module Market?

Which key companies operate in Global Analog Measurement Module Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

-> Emerging trends include AI-powered m

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Satellite Servicing Market Trends Shaped by Reusability Focus

The global satellite servicing market was valued at USD 2,996.1 million in 2024 and is expected to reach USD 7,061.9 million by 2033, growing at a CAGR of 10.1% from 2025 to 2033. This growth is fueled by the increasing demand to extend satellite lifespans, the rising number of aging satellites in orbit, greater investments in space infrastructure, and advances in robotic servicing and on-orbit solutions.

The need for cost-effective satellite maintenance—such as in-orbit refueling, repairs, and upgrades—is accelerating the adoption of autonomous servicing technologies. Defense and commercial satellite operators are driving this demand to maximize ROI and mission continuity. The adoption of modular satellite designs and standardized servicing protocols is further enhancing mission feasibility and scalability.

As more satellites are deployed for communication, defense, and Earth observation, satellite servicing has become essential for maintaining their operational efficiency. These technologies help reduce replacement costs, extend functionality, and improve overall mission value, attracting significant attention from both government and private space stakeholders.

Key Market Insights:

North America led the global market with over 38% share in 2024, supported by strong government backing, private sector investments, and advanced space infrastructure.

Low Earth Orbit (LEO) dominated with over 83% market share in 2024, driven by the proliferation of satellite constellations for broadband, IoT, and Earth observation.

Robotic servicing held the largest service segment share in 2024, due to growing needs for in-orbit maintenance and life-extension capabilities.

Large satellites (>1000 Kg) accounted for the highest share by type in 2024, due to their use in defense, communication, and Earth monitoring.

Commercial end-use led the market in 2024, driven by rising demand from operators for efficient and cost-effective servicing of high-value assets.

Order a free sample PDF of the Satellite Servicing Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 2,996.1 Million

2033 Projected Market Size: USD 7,061.9 Million

CAGR (2025-2033): 10.1%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key players in the satellite servicing market include established companies like Northrop Grumman and Maxar Technologies, alongside emerging participants such as Orbit Fab, Inc. and Starfish Space.

Northrop Grumman, through its subsidiary Space Logistics, leads in satellite servicing with its Mission Extension Vehicle (MEV), extending satellite life through on-orbit operations like docking and refueling. Maxar Technologies is a major force, known for its robotic arms and in-space assembly technologies that enable satellite repair, refueling, and upgrades, enhancing mission flexibility.

Among the emerging players, Orbit Fab, Inc. is pioneering "Gas Stations in Space" with its in-orbit propellant depots, aiming to create a sustainable orbital economy. Starfish Space is a rapidly growing startup focusing on autonomous satellite servicing and docking solutions, with its Otter vehicle designed to capture, relocate, and extend satellite lifespans using advanced robotics.

Key Players

Northrop Grumman

Maxar Technologies

Astroscale

Orbit Fab, Inc.

Thales Alenia Space

AIRBUS

Lockheed Martin Corporation.

ClearSpace

Altius Space Machines

Starfish Space

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The satellite servicing market is experiencing significant growth, driven by the need to extend the operational lives of satellites and the increasing number of aging assets in orbit. This expansion is further fueled by substantial investments in space infrastructure and the demand for more cost-effective space operations. Key trends include the rising importance of in-orbit servicing, refueling, and repairs, alongside the rapid development of autonomous and robotic servicing technologies. Additionally, a strong focus on space sustainability and debris mitigation is propelling the market forward. Collaborations among industry players are also crucial in developing standardized servicing solutions, underscoring the dynamic evolution of this essential space sector.

0 notes

Text

Software Defined Radios Market

📈 Market Size & Forecast

The global SDR market was valued at approximately USD 32.68 billion in 2025 and is projected to nearly double to USD 68.78 billion by 2034, growing at a CAGR of 8.62% over that period.

Alternative reports estimate values between USD 16.9 billion and USD 27.7 billion in the early 2020s, with projected growth of 7–8% to USD 47–49 billion by 2030 . Differences reflect variations in report scope, including hardware versus full-system definitions.

🚗 Core Growth Drivers

Defense & Tactical Communications: SDR enables flexible frequency, encryption, and waveform support in multi-domain military operations. Joint Tactical Radio Systems (JTRS) and EU’s ESSOR highlight growing defense reliance

5G, IoT & Commercial Rollouts: Telecom and enterprise users adopt SDR for spectrum agility, enabling dynamic protocol support and future-proof upgrades.

Cognitive & Intelligent Radios: Integration of AI-driven cognitive capabilities boosts spectrum efficiency and adaptability

Public Safety & Emergency Services: SDR solves interoperability issues across agencies during crises by enabling real-time modulation adjustments

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

🔍 Emerging Trends

Digital & Cognitive Capabilities: SDRs increasingly integrate cognitive radio features, enabling autonomous spectrum sensing and dynamic waveform adaptation.

AI/ML & SaaS Models: Providers are embedding AI for smart resource allocation and predictive maintenance; SaaS offerings for SDR software deployment are emerging .

Open Architectures: Frameworks like the Software Communications Architecture (SCA) promote waveform portability and vendor-neutral development.

Platform Expansion: The ‘airborne’ and ‘space’ segments are notable growth areas for 2025–2030, alongside terrestrial deployments

⚠️ Challenges

High Initial CapEx & Complexity: SDR hardware and ecosystem deployment requires significant investment; integration with legacy systems is often complex.

Cybersecurity Vulnerabilities: The software-based nature of SDR increases exposure to cyber threats, calling for robust cryptographic and secure boot infrastructures

Spectrum Regulation & Calibration Needs: Regulatory constraints and the necessity for accurate calibration hardware pose hurdles

🌍 Regional Dynamics

North America leads with ~33–35% share, supported by its defense sector and advanced telecom infrastructure.

Asia‑Pacific is the fastest-growing region, fueled by rising defense budgets, telecom investments, and IoT adoption.

Europe benefits from collaborative projects like ESSOR; smaller but evolving markets in Latin America, the Middle East, and Africa are emerging.

🏢 Competitive Landscape

Major defense and aerospace firms — L3Harris, Thales, Northrop Grumman, BAE Systems, Raytheon, Lockheed Martin, Rohde & Schwarz, Leonardo, Collins Aerospace — dominate. Meanwhile, innovators and open-source platforms (e.g., Ettus Research, OSSIE via SCA) are expanding capabilities.

🔭 Outlook

The SDR market is on a steady growth trajectory, expected to reach USD 50–70 billion by 2030–2034. Continued expansion across defense, public safety, telecom, and IoT sectors will be driven by needs for flexible, secure, and software-upgradeable communication systems. Key success factors include addressing integration complexity, cyber hardening, and evolving regulation. With AI advances, open architecture standards, and SaaS models, SDR is evolving toward modular, intelligent, and interoperable radio infrastructures — paving the way for next-generation wireless networks and applications.

0 notes

Text

Wireless Charging SOC Chips Market, Trends, Business Strategies 2025-2032

The global Wireless Charging SOC Chips Market size was valued at US$ 1.28 billion in 2024 and is projected to reach US$ 2.84 billion by 2032, at a CAGR of 10.4% during the forecast period 2025-2032. This growth is fueled by increasing adoption in smartphones, wearables, and IoT devices, supported by advancements in wireless power technology.

Wireless charging SOC chips are integrated circuits that combine power management, control logic, and communication protocols to enable inductive or resonant wireless power transfer. These chips facilitate contactless charging across various power ranges, including low-power (below 10W) for wearables, medium-power (10-15W) for smartphones, and high-power (above 15W) for industrial applications. Leading manufacturers are developing chips compatible with Qi, AirFuel, and proprietary standards.

The market expansion is driven by growing consumer demand for cable-free charging solutions and increasing investments in infrastructure development. While Asia-Pacific dominates production with over 60% market share, North America leads in R&D innovation. Recent developments include NXP’s 15W automotive-grade SOC and Texas Instruments’ multi-mode chips supporting both inductive and NFC charging. However, thermal management challenges and standardization fragmentation remain key industry hurdles.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/wireless-charging-soc-chips-market/

Segment Analysis:

By Type

10-15W Segment Leads the Market Due to Optimal Balance Between Efficiency and Charging Speed

The market is segmented based on power rating into:

10W Below

Subtypes: Standard Qi-based charging, proprietary low-power solutions

10-15W

Subtypes: Fast charging variants, multi-device solutions

15W Above

Subtypes: High-power industrial solutions, automotive-grade charging

By Application

Mobile Terminal Segment Dominates Owing to Widespread Smartphone Adoption

The market is segmented based on application into:

Mobile Terminal

Subtypes: Smartphones, tablets, e-readers

Wearable Device

Subtypes: Smartwatches, earbuds, fitness trackers

Industrial Electronics

Medical Electronics

Others

By Technology

Inductive Charging Leads the Market with Over 80% Adoption Rate in Consumer Electronics

The market is segmented based on technology into:

Inductive Charging

Resonant Charging

RF-based Charging

Others

Regional Analysis: Wireless Charging SOC Chips Market

North America The North American market for Wireless Charging SOC Chips is driven by high adoption rates of advanced consumer electronics and strong R&D investments in semiconductor technologies. The U.S. leads in innovation due to the presence of key players like Texas Instruments and Analog Devices, alongside growing demand for fast-charging solutions in premium smartphones and wearables. Regulatory initiatives promoting energy efficiency further accelerate market expansion. However, supply chain disruptions and semiconductor shortages pose challenges for regional growth. The 2024 Inflation Reduction Act’s provisions supporting semiconductor manufacturing are expected to mitigate some of these constraints by incentivizing domestic production.

Europe Europe’s market is characterized by strict energy efficiency standards and increasing adoption of wireless charging in automotive and healthcare applications. The EU’s push for universal charging solutions under the Common Charger Directive bolsters demand for standardized SOC chips. Germany and France are key contributors, with automotive OEMs integrating wireless charging for electric vehicle applications. Despite growth potential, high production costs and reliance on imports from Asia create pricing pressures. The region’s focus on sustainable semiconductor manufacturing aligns with broader environmental goals, influencing long-term market dynamics.

Asia-Pacific Asia-Pacific dominates global Wireless Charging SOC Chip production and consumption, with China accounting for over 40% of global output. The region benefits from robust electronics manufacturing ecosystems in South Korea, Japan, and Taiwan, coupled with aggressive pricing strategies from local players like Renesas and ROHM. India’s expanding smartphone market and Southeast Asia’s emerging industrial electronics sector present new opportunities. While cost competition is intense, technological advancements in high-power charging (15W+) for flagship devices drive premium segment growth. Supply chain localization efforts aim to reduce reliance on imported components, fostering self-sufficiency.

South America South America remains a nascent market with growth concentrated in Brazil and Argentina, where increasing smartphone penetration fuels demand for entry-level wireless charging solutions. Economic volatility limits adoption of high-end SOC chips, while import dependency results in price sensitivity. The absence of strong local semiconductor fabrication capabilities constrains market expansion. However, gradual infrastructure improvements and rising FDI in electronics manufacturing indicate long-term potential, particularly for mid-range consumer applications.

Middle East & Africa This region shows pockets of growth in GCC countries and South Africa, driven by luxury electronics adoption and smart city initiatives. The UAE’s focus on becoming a tech hub supports demand for advanced charging infrastructure in commercial spaces. In contrast, Africa’s market growth is hampered by low purchasing power and fragmented distribution networks. Regional players prioritize cost-effective solutions below 10W for budget devices, though partnerships with Chinese manufacturers could accelerate technology transfer in coming years.

MARKET OPPORTUNITIES

Medical Device Charging Presents Untapped Potential

The healthcare sector offers significant growth potential for wireless charging SOC chips, particularly in implantable devices and diagnostic equipment. Current developments include wireless-powered pacemakers and continuous glucose monitors that eliminate battery replacement surgeries. The medical wireless charging market is projected to grow at 28% CAGR through 2030, driven by aging populations and increasing chronic disease prevalence. SOC chips tailored for medical applications command premium pricing while benefiting from longer product lifecycles compared to consumer segments.

Industrial IoT Adoption Creates New Use Cases

Industry 4.0 implementations are driving demand for wireless power in harsh environments where physical connectors are prone to failure. Applications include condition monitoring sensors in oil pipelines, robotic systems in manufacturing plants, and agricultural equipment in precision farming. These industrial applications require ruggedized SOC chips capable of operating in extreme temperatures and high-vibration conditions. The opportunity is particularly significant in predictive maintenance systems, where wireless power enables continuous operation of distributed sensor networks.

Emerging Markets Offer Expansion Potential

Developing economies present substantial growth opportunities as wireless charging infrastructure expands beyond mature markets. Government initiatives in Southeast Asia and Latin America are incentivizing public wireless charging deployment in transportation hubs and urban centers. Local smartphone manufacturers are increasingly incorporating wireless charging in mid-range devices, creating demand for cost-optimized SOC chip solutions. This geographic expansion is supported by improving 5G networks and rising disposable incomes, which facilitate adoption of premium charging-enabled devices.

WIRELESS CHARGING SOC CHIPS MARKET TRENDS

Rising Demand for Fast and Efficient Wireless Charging Solutions

The wireless charging SOC chips market is experiencing substantial growth, driven by the increasing adoption of fast-charging technologies across consumer electronics. Recent advancements in gallium nitride (GaN) and silicon carbide (SiC) semiconductor materials have significantly improved the efficiency of wireless power transfer, enabling faster charging cycles while minimizing heat dissipation. The market for wireless charging SOC chips, valued at approximately $1.2 billion in 2024, is projected to grow at a CAGR of 18.7% through 2032, fueled by the widespread integration of Qi wireless charging standards in smartphones, wearables, and automotive applications. Furthermore, the shift toward higher power output (15W and above) in mid-range smartphones has accelerated demand for cost-effective, integrated SOC solutions.

Other Trends

Expansion in Automotive Applications

The automotive sector is emerging as a key growth driver for wireless charging SOC chips, with electric vehicle (EV) manufacturers increasingly adopting in-cabin and static wireless charging solutions. Major automakers are incorporating 11-15kW wireless charging systems for EVs, requiring high-efficiency SOC chips to manage power delivery. This trend is bolstered by government incentives for wireless EV charging infrastructure, particularly in Europe and North America. Additionally, the integration of SOC chips in infotainment systems and smart surfaces within vehicles is creating new revenue streams for suppliers.

Miniaturization and Multi-Device Charging Capabilities

Technological advancements are enabling smaller form factors with enhanced functionality, allowing a single SOC chip to manage simultaneous charging of multiple devices at varying power levels. This innovation addresses the growing consumer demand for clutter-free charging stations in homes and workplaces. The development of SOC chips supporting both near-field magnetic resonance and far-field RF wireless charging technologies is further expanding application possibilities. Meanwhile, the medical electronics segment is adopting these solutions for implantable devices and diagnostic equipment, where wired charging poses operational challenges.

COMPETITIVE LANDSCAPE

Key Industry Players

Semiconductor Giants and Emerging Players Compete on Innovation in Wireless Charging SOC Market

The global wireless charging SOC chips market exhibits a dynamic competitive landscape, with established semiconductor leaders competing alongside specialized emerging players. Texas Instruments and NXP Semiconductors currently dominate the market share, leveraging their extensive R&D capabilities and partnerships with major smartphone manufacturers. These industry veterans account for approximately 35% of the total market revenue in 2024, owing to their comprehensive product portfolios covering low to high-power applications.

Meanwhile, Asian players like Richtek Technology (a subsidiary of MediaTek) and Renesas Electronics are gaining traction through cost-effective solutions tailored for mid-range devices. Their growth is further fueled by strong demand in China’s electronics manufacturing ecosystem, which consumes nearly 40% of global wireless charging SOC chips. These companies are actively expanding their production capacities to meet the increasing requirements of smartphone OEMs and wearable manufacturers.

The competitive intensity is increasing as companies invest heavily in qi2.0 standards compatibility and higher power solutions. Infineon Technologies recently launched a new 15W wireless charging SOC with 95% energy efficiency, while STMicroelectronics introduced a chipset supporting both transmitter and receiver functions. Such product innovations are crucial as the market transitions from conventional 5W charging to fast wireless charging standards.

Emerging Chinese players like Halo Microelectronics and Injoinic Technologies are disrupting the market with aggressive pricing and rapid customization capabilities. While currently holding smaller market shares, these companies are expected to capture significant growth opportunities in IoT and automotive wireless charging applications through strategic partnerships with regional manufacturers.

The competitive scenario remains fluid as companies balance between technology innovation and cost optimization. Larger players focus on vertical integration by developing complete wireless charging solutions, while smaller specialized firms concentrate on niche applications like medical devices and industrial equipment where customized SOC solutions command premium pricing.

List of Key Wireless Charging SOC Chip Companies Profiled

Texas Instruments (U.S.)

NXP Semiconductors (Netherlands)

Renesas Electronics (Japan)

Richtek Technology (Taiwan)

STMicroelectronics (Switzerland)

Infineon Technologies (Germany)

Microchip Technology (U.S.)

Analog Devices (U.S.)

Injoinic Technologies (China)

Halo Microelectronics (China)

Semtech (U.S.)

Maxic Technology (U.S.)

Learn more about Competitive Analysis, and Forecast of Global Wireless Charging SOC Chips Market : https://semiconductorinsight.com/download-sample-report/?product_id=103509

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Wireless Charging SOC Chips Market?

-> Wireless Charging SOC Chips Market size was valued at US$ 1.28 billion in 2024 and is projected to reach US$ 2.84 billion by 2032, at a CAGR of 10.4% during the forecast period 2025-2032.

Which key companies dominate this market?

-> Market leaders include Texas Instruments (18% share), NXP (15%), STMicroelectronics (12%), Renesas (10%), and Infineon Technologies (8%).

What are the primary growth drivers?

-> Key drivers are smartphone adoption (1.56 billion units shipped in 2024), automotive wireless charging mandates, and medical device innovations.

Which region shows highest growth potential?

-> Asia-Pacific dominates with 58% market share, led by China’s electronics manufacturing sector and India’s growing consumer electronics market.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

0 notes

Text

Body Area Network Market Size Enabling the Future of Connected Health and Human-Centric IoT

The Body Area Network Market Size is rapidly emerging as a cornerstone of next-generation healthcare and wearable technologies. Body Area Networks (BANs), or Body Sensor Networks (BSNs), enable real-time monitoring, data exchange, and communication between sensors attached to, or implanted in, the human body. These systems are revolutionizing patient care, sports performance, fitness tracking, and even military applications. According to Market Size Research Future, the global body area network Market Size is projected to reach USD 22.7 billion by 2030, growing at a robust CAGR of 12.5% from 2024 to 2030.

Overview

Body Area Networks consist of wearable computing devices, medical sensors, implantable sensors, and wireless communication systems that transmit physiological and movement data to external devices or healthcare servers. These networks operate in close proximity to the human body and are designed for continuous data collection and low power consumption.

BANs are driving significant advancements in preventive healthcare, remote patient monitoring, rehabilitation, and performance optimization in sports. As 5G, IoT, and AI technologies mature, body area networks are becoming more intelligent, reliable, and secure—unlocking new applications in both civilian and defense domains.

Market Size Segmentation

By Device Type:

Wearable Devices

Implantable Devices

Wearable devices dominate the Market Size due to their widespread adoption in fitness, health tracking, and chronic disease monitoring. Implantable devices, though a smaller segment, are critical in cardiovascular monitoring, neurology, and prosthetics.

By Component:

Sensors

Communication Interfaces

Processors

Power Management Units

Sensors form the backbone of body area networks, enabling real-time physiological monitoring. Communication modules (e.g., Bluetooth Low Energy, ZigBee, Wi-Fi) ensure seamless data exchange.

By Application:

Medical

Fitness and Sports

Military

Others (Gaming, AR/VR)

Medical applications hold the largest share, particularly in remote health monitoring and diagnostics. Fitness and sports are growing fast as consumers seek deeper insights into physical performance and health trends.

By End User:

Hospitals and Clinics

Sports Organizations

Defense

Individuals/Consumers

The healthcare sector remains the leading end user, supported by a surge in telemedicine, aging populations, and chronic disease prevalence.

Market Size Trends

Several transformative trends are driving growth in the body area network space:

Rise of Personalized Healthcare: Wearables and implantables enable personalized treatment plans based on real-time data.

Integration with AI and IoT: AI algorithms analyze sensor data for diagnostics, while IoT platforms enable remote care and cloud-based storage.

Advancements in Power Management: Low-power chips and energy harvesting technologies are extending device battery life and usability.

Military and Tactical Wearables: BANs are being used in soldier monitoring systems, enhancing battlefield awareness and health tracking.

Data Security Emphasis: As sensitive biometric data is shared wirelessly, secure encryption and privacy protocols are becoming essential.

Segment Insights

Wearables:

This segment is seeing massive adoption across healthcare, fitness, and consumer electronics. Popular devices include smartwatches, fitness bands, ECG monitors, glucose trackers, and posture correction wearables.

Implantables:

Used for deep diagnostics and intervention—such as pacemakers, cochlear implants, and neurostimulators—implantable BANs are gaining regulatory approval for broader medical use cases.

Communication Standards:

Technologies like Bluetooth Low Energy (BLE), ZigBee, and proprietary protocols ensure reliable short-range communication with minimal power drain.

End-User Insights

Healthcare Providers:

Hospitals and clinics benefit from BANs by reducing hospital visits through remote monitoring, especially for patients with heart disease, diabetes, and hypertension.

Athletes and Sports Teams:

Body area networks track muscle performance, respiration, hydration levels, and fatigue in real time, giving athletes and coaches a competitive edge.

Military:

Used in dismounted soldier systems to monitor physiological stress, location tracking, and equipment status—critical for situational awareness and safety.

Key Players

Major players in the BAN Market Size are focused on miniaturization, improved data accuracy, battery efficiency, and HIPAA/GDPR compliance:

Apple Inc.

Medtronic plc

Huawei Technologies Co. Ltd.

Garmin Ltd.

Philips Healthcare

Samsung Electronics Co. Ltd.

Xiaomi Corporation

Fitbit (Google LLC)

Abbott Laboratories

NeuroMetrix, Inc.

These companies are pushing innovation in health-tech ecosystems, partnering with software platforms and AI vendors for integrated solutions.

Regional Outlook

North America leads due to early technology adoption, strong healthcare infrastructure, and investment in wearable diagnostics.

Europe follows closely with regulatory support and a growing demand for home-based care.

Asia-Pacific is witnessing the fastest growth, driven by a tech-savvy population, expanding middle class, and healthcare digitization.

Future Outlook

The global body area network Market Size is poised for significant expansion over the next decade. The convergence of healthcare and technology is creating new opportunities for continuous, real-time health monitoring that improves outcomes and reduces costs.

By 2030, the BAN Market Size is expected to achieve USD 22.7 billion, growing at a CAGR of 12.5%, fueled by innovation, preventive care trends, and the expanding role of wearables in everyday life.

Trending Report Highlights

Explore related Market Sizes reshaping the connected device and sensor ecosystems:

Electronic Toy Market Size

Flood Warning System Market Size

Overhead Cable Market Size

Dismounted Soldier System Market Size

Emerging Lighting Technology Market Size

Conclusion

Body Area Networks are redefining human-centric technology with applications that span healthcare, fitness, military, and smart consumer products. As these networks become more intelligent, secure, and interoperable, they are set to become a standard component in the digital lives of individuals and institutions alike.

From tracking heartbeats to saving lives on the battlefield, the future of BANs is dynamic, connected, and vital to the next generation of health and performance monitoring.

0 notes

Text

Wireless Testing Market to Record Sturdy Growth by 2028

Allied Market Research, titled, “Wireless Testing Market By Offering, Technology, and Application: Global Opportunity Analysis and Industry Forecast, 2021–2028”, the global wireless testing market size was valued at $10.48 billion in 2019, and is projected to reach $16.80 billion by 2028, registering a CAGR of 6.9% during the forecast period. North America accounted for the highest share, owing to the expansion of the telecom and consumer electronics market.

The wireless communications market has grown significantly with devices that required to undergo effective wireless testing to ensure they perform correctly and are reliable, safe, and secure. The increased integration of wireless technologies is enabling connectivity services in all kinds of devices and applications, such as connected cars, smartphones, wearable’s, smart cities, smart grids, smart homes, and eHealth. In addition, wireless testing solutions like chipset testing, UE testing, and wireless security testing focus on the performance and quality of experience for the latest technologies. There are also pre-silicon verification and post-silicon verification that help improve the quality and performance of the devices, which use wireless protocols like Wi-Fi, Bluetooth, Zigbee, NFC, LTE, 2G, 3G, 3GPP, 4G, and 5G.

The collaboration between Bureau Veritas and Keysight enables to address radio frequency, radio resource management (RRM), and performance test cases validated by GCF and PTCRB. With its regulatory test and global market access services and a full suite of wireless conformance testing, module developers, device manufacturers, as well as 5G technology integrators can now access global market access services from Bureau Veritas’ technical competence center.

The prominent factors that drive the wireless testing market growth include increase in adoption of smart electronic appliances, increase in advancement in wireless technologies and surge in usage of smart devices. Rise in adoption of smart devices in emerging economies creates growth opportunities for wireless testing market. In addition, growth in population and surge in Internet penetration are some of the key factors boosting the demand for smart devices. However, lack of skilled workforce and high cost are expected to hamper the market growth. On the contrary, high adoption of Internet of things (IoT) technologies are anticipated to provide lucrative opportunities for the expansion of the wireless testing industry during the forecast period.

The global wireless testing market is segmented into offering, technology, application, and region. On the basis of offering, the market is classified into services and equipment. By technology, it is categorized into Bluetooth, WI-FI, 2G/3G, 4G/LTE, and 5G. The applications covered in the market include consumer electronics, IT & telecommunication, automotive, energy & power, healthcare, and other.

IT & telecommunication segment was the largest contributor of revenue in 2019 and is expected to grow at a CAGR of 6.60% from 2021 to 2028. 5G mobile networks are expected to be the next telecommunication standards as 5G technology exhibits advanced characteristics. Also, this technology is expected to bring new unique network and service capabilities to the market. The consumer electronics industry vertical is the second largest contributor of revenue in 2019 and expected to growth at a highest CAGR of 8.60% during the forecast period.

By region, the wireless testing market trends have been analyzed across North America, Europe, Asia-Pacific, and LAMEA. The analysis had identified that North America contributed maximum revenue in 2019. The wireless testing market in Asia-Pacific is expected to grow at a faster rate as compared to other regions. Factors such as increase in adoption of smart device and mobile devices and surge in demand for wireless technologies contribute to the market growth in Asia-Pacific.

Key Findings of the Study

In 2019, the Wi-Fi segment accounted for the maximum revenue and is projected to grow at a notable CAGR of 5.8% during the forecast period.

The IT & telecommunication segment accounted for more than 25.0% of the wireless testing market share in 2019.

The 4G/LTE segment witness highest growth rate during the forecast period.

Germany was the major shareholder in the Europe wireless testing market analysis, accounting for approximately 30.0% share in 2019.

The key players profiled in the report include SGS Group, Anritsu Corporation, Bureau Veritas, DEKRA SE, Rohde & Schwarz GmbH & Co., Intertek Group Plc., TUV Rheinland, Viavi Solutions Inc., Electro Magnetic Test, Inc., and EXFO Inc. Market players have adopted various strategies such as product launch, collaboration, partnership, and agreement to expand their foothold in the industry.

0 notes

Text

What Is a Wholesale Voice Carrier? A Complete Guide

United States of America – The Insight Partners is delighted to announce the release of its recent market research report, "Wholesale Voice Carrier Market: A Deep Dive Analysis of Trends, Growth Inducers, Challenges, and Opportunities". The market research report presents a detailed analysis of the global market based on trends, growth drivers, challenges, and opportunities with respect to the forecast period.

Overview

The Wholesale Voice Carrier industry is in the midst of a transformative era fueled by technology advancements, changing regulatory landscapes, and altered customer behavior. This report offers a 360-degree view of these trends, giving businesses the strategic insights they require to remain competitive in an ever-changing telecommunications environment.

Key Findings and Insights

Market Size and Growth

Historical and Forecast Data: The size of the wholesale voice carrier market is anticipated to grow to US$ 36.28 billion by 2031 from US$ 25.32 billion in 2023. The market is anticipated to achieve a CAGR of 4.6% over the forecast period.

Key Growth Drivers:

Rising demand for international VoIP services

Expansion in cloud communication platforms

Growth in cross-border voice traffic

Increased adoption of 5G and edge computing technologies

Benefits of cost efficiency and scalability due to wholesale routing

Get Sample Report: https://www.theinsightpartners.com/sample/TIPRE00015760

Market Segmentation

By Service

Voice Termination

Interconnect Billing

Fraud Management

By Transmission Network

Owned Network and Leased Network

By Technology

VoIP and Traditional Switching

Detection of Emerging Trends

Technological Innovations

SIP trunking

AI-driven voice quality optimization

Blockchain for secure routing and detection of fraud

Transition from TDM to IP networks

Cloud-native communication platforms

Shifting Consumer Preferences

Stepping towards unified communications and collaboration (UCaaS)

Prioritizing voice quality, uptime, and seamless international connectivity

Calling for flexible pricing models and zero-latency voice experiences

Regulatory Developments

Adoption of STIR/SHAKEN protocols to counter call spoofing

More global rules on call termination and routing transparency

Regional telco models that enable number portability and equitable competition

Growth Opportunities

Strategic collaborations with cloud communication companies

Creating services in underpenetrated markets like Africa and Southeast Asia

Utilizing AI and analytics for smart routing and real-time monitoring

Expansion of IoT voice traffic and enterprise-quality voice services

Investment in 5G infrastructure to offer improved services

Conclusion

The Wholesale Voice Carrier Market: Global Industry Trends, Share, Size, Growth, Opportunity, and Forecast Period is a key resource for stakeholders who seek to build or expand their presence in this dynamic market. Based on thorough competitive analysis, thorough examination of trends, and actionable growth tactics, the report is a critical instrument for strategic and well-informed decision-making.

About The Insight Partners

The Insight Partners is among the leading market research and consulting firms in the world. We take pride in delivering exclusive reports along with sophisticated strategic and tactical insights into the industry. Reports are generated through a combination of primary and secondary research, solely aimed at giving our clientele a knowledge-based insight into the market and domain. This is done to assist clients in making wiser business decisions. A holistic perspective in every study undertaken forms an integral part of our research methodology and makes the report unique and reliable.

0 notes

Text

Need for Advanced Surveillance Drives USD 538.4 Bn Security Market Boom

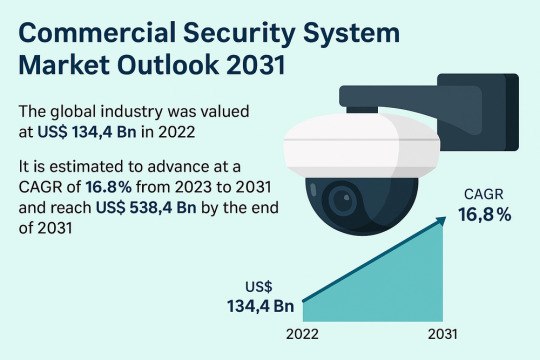

The global commercial security system market is set to experience a robust surge, rising from a valuation of USD 134.4 billion in 2022 to an impressive USD 538.4 billion by 2031, expanding at a CAGR of 16.8% during the forecast period from 2023 to 2031. This growth is driven by a rising need for sophisticated security infrastructure in response to increasing crime rates, technological advancements, and the ongoing global push toward smart cities and IoT integration.

Market Overview

Commercial security systems encompass a wide range of products and services designed to protect physical assets, personnel, and data across commercial premises. These include surveillance cameras, access control solutions, alarm systems, intrusion detection, and remote monitoring services. The rapid digitalization of businesses and the growing emphasis on regulatory compliance across sectors such as BFSI, government, defense, and transportation are fueling the demand for comprehensive, scalable security solutions.

The adoption of cloud-based platforms, smart analytics, and integrated Internet of Things (IoT) technologies is transforming the industry, enabling businesses to implement real-time, automated security protocols with remote monitoring capabilities.

Market Drivers & Trends

The increasing deployment of surveillance systems in smart cities and the integration of IoT in security systems are major drivers. IoT-based platforms offer cloud connectivity, enabling centralized monitoring and control, anomaly detection, and predictive analytics. The flexibility to manage systems remotely via mobile applications or web portals has become a game-changer for organizations with multiple facilities.

According to Nasscom, the IoT market in India alone reached US$ 9 billion in 2020, indicating the explosive potential for integration with commercial security solutions. The demand for AI-powered video analytics, smart sensors, and automated response systems is also growing, giving rise to sophisticated, layered defense mechanisms.

Furthermore, increasing incidents of theft, vandalism, and violent intrusions are pushing organizations—particularly in retail, government, and education sectors—to bolster their security infrastructure, driving continuous market expansion.

Key Players and Industry Leaders

The global commercial security system market is fragmented and highly competitive, with numerous global and regional players vying for market share through innovation, expansion, and strategic partnerships. Key players include:

Assa Abloy AB

Axis Communications AB

Bosch Sicherheitssysteme GmbH

Carrier Global Corporation

Dahua Technology Co., Ltd.

Hangzhou Hikvision Digital Technology Co., Ltd.

Honeywell International Inc.

Johnson Controls International

Nortek Security & Control LLC

Tyco International Ltd.

These companies are investing heavily in R&D and expanding their product portfolios to include cloud-enabled platforms, AI surveillance, and integrated access control systems.

Recent Developments

The industry has witnessed a wave of innovation and strategic moves aimed at consolidating leadership and expanding global footprints:

May 2023: Carrier Global Corporation launched i-Vu Pro v8.5 software, offering enhanced building automation with MQTT integration and secure operator reporting.

March 2023: Johnson Controls unveiled its IQ Pro Security Panel, designed for intrusion protection in large-scale commercial properties and campuses.

October 2021: Nice North America acquired Nortek Security & Control LLC, boosting its regional presence and strengthening its distribution network.

These developments reflect the industry's shift toward intelligent, scalable, and future-ready commercial security ecosystems.

Gain a preview of important insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=81695

Latest Market Trends

Some key trends reshaping the industry include:

AI-powered surveillance and predictive analytics: Cameras that can recognize suspicious behavior in real time.

Integration with building management systems: Security systems now function seamlessly alongside HVAC, lighting, and fire safety solutions.

Cloud-first architecture: Remote management, data sharing, and instant alerts are becoming essential for large enterprises.

Customization and modular solutions: Businesses are demanding tailor-made security infrastructures based on specific threat profiles and compliance needs.

Market Opportunities

Significant market opportunities lie in:

Smart city initiatives across developing countries, particularly in Asia Pacific and Latin America.

Expansion of retail and logistics infrastructure, where real-time theft deterrence is critical.

Government investments in public surveillance, particularly for traffic monitoring and urban safety.

Integration of biometric access systems in high-security industries such as defense and banking.

The rise of cloud-native security and analytics-as-a-service (AaaS) models also offers opportunities for SaaS providers to enter the market.

Future Outlook

The commercial security system market is expected to become increasingly data-driven and proactive, moving beyond surveillance to predictive threat management. By 2031, integrated platforms capable of unifying cybersecurity, physical security, and enterprise resource planning (ERP) will become standard in large enterprises.

Technological breakthroughs in edge AI, 5G, and blockchain-enabled identity verification will drive the next phase of market growth. As automation continues to evolve, the role of human intervention will shift from active monitoring to decision-making and incident response.

Market Segmentation

By Offering:

Hardware: Burglar alarms, fire & life safety devices, surveillance cameras, keycard access systems.

Software: AI-powered analytics, video management, IoT dashboards.

Services: Installation, maintenance, cloud hosting, consulting.

By Application:

Indoor/Outdoor Surveillance

Flood Detection/Protection

Theft Deterrence (dominant segment – 31.1% share in 2022)

Occupancy Monitoring

Queue Management & Crowd Control

By End-use Industry:

Government (28.1% share in 2022)

Military & Defense

Retail

BFSI

Sports & Leisure

Education & Hospitality

Regional Insights

Asia Pacific leads the global market, accounting for 33.1% share in 2022, driven by rapid urbanization, increased crime rates, and a surge in smart infrastructure projects in countries like China, India, and Southeast Asian nations.

North America (30.1% share in 2022) and Europe are also key markets, benefiting from robust investment in R&D, early adoption of smart technologies, and well-established security infrastructure. Latin America and the Middle East & Africa regions are emerging as high-potential markets due to rising demand for commercial surveillance and intrusion prevention systems in urban and high-risk areas.

Why Buy This Report?

This comprehensive market analysis report offers:

In-depth market forecasts to 2031, with accurate sizing in USD and volume metrics.

Extensive segmentation insights by offering, application, industry, and region.

Detailed competitive landscape analysis, including company profiles, financials, strategies, and recent developments.

Evaluation of key drivers, restraints, opportunities, and threats using frameworks such as Porter’s Five Forces and value chain analysis.

Cross-segment and regional quantitative and qualitative insights to support strategic decision-making.

The report provides invaluable insights for security system vendors, technology providers, government agencies, investors, and consultants seeking to understand the dynamics of the evolving global commercial security system market.

0 notes

Text

Rugged Embedded System Market Experiences Surge Amid Rising Adoption in Transportation and Defense Sectors

The rugged embedded system market has emerged as a pivotal segment in the global embedded technology landscape. These systems are engineered to operate reliably in harsh environments where standard commercial-grade systems would fail. Applications range from military and aerospace to industrial automation, transportation, marine, and energy sectors—driving steady demand and innovation.

What are Rugged Embedded Systems?

Rugged embedded systems are specialized computing devices built to withstand extreme temperatures, vibrations, moisture, dust, and electromagnetic interference. Unlike consumer-grade electronics, they are designed for durability, long lifecycle performance, and uninterrupted operation in mission-critical scenarios. Typically, these systems include industrial-grade processors, solid-state drives, fanless enclosures, and are compliant with industry standards such as MIL-STD-810G, IP67, and EN50155.

Market Drivers

One of the most significant drivers of the rugged embedded system market is the growing demand for automation and smart technologies across industries. In manufacturing, rugged systems control robotic arms and industrial machinery, enabling predictive maintenance and real-time monitoring. In defense, they are integrated into surveillance equipment, drones, and battlefield communication tools, ensuring reliable data processing in combat zones.

Transportation also plays a critical role. With the rise in smart transportation and intelligent traffic systems, rugged embedded computers are essential in railways, metro networks, and autonomous vehicles. They enable tasks such as signal control, navigation, communication, and safety system management.

The rise of the Internet of Things (IoT) has further propelled the market. Edge computing devices in remote or outdoor locations, such as oil rigs or weather monitoring stations, rely heavily on rugged systems to process and transmit data efficiently without centralized servers.

Regional Landscape

North America holds a dominant share in the rugged embedded system market, largely due to its advanced defense industry and high adoption of industrial automation. The U.S. Department of Defense’s consistent investment in advanced electronics for unmanned systems and battlefield management continues to fuel demand.

Europe is also a significant player, particularly in railways and energy. Countries like Germany, France, and the UK are investing in smart infrastructure and green energy, where rugged systems monitor and optimize performance.

Meanwhile, the Asia-Pacific region is expected to witness the fastest growth. The rapid industrialization of India, China, and Southeast Asia, combined with increasing defense budgets and infrastructure development, presents massive opportunities for rugged embedded technology.

Key Challenges

Despite its growth, the rugged embedded system market faces challenges. High development and testing costs can limit the entry of new players. Moreover, the long design cycles and strict compliance requirements pose barriers to innovation. System integration is also complex, especially in legacy environments where interoperability and backward compatibility are essential.

Cybersecurity is another pressing issue. As rugged systems become more connected, they are vulnerable to cyber threats. Ensuring secure communication protocols and firmware integrity is critical to maintaining operational resilience.

Future Trends

The future of the rugged embedded system market is tied closely to advancements in artificial intelligence (AI), 5G, and edge computing. AI-integrated rugged systems can enable real-time decision-making in remote environments, enhancing efficiency and responsiveness. The deployment of private 5G networks in industrial zones will allow faster, more reliable communication among devices.

Another trend is modularity. Manufacturers are focusing on developing flexible, modular systems that allow for upgrades and scalability without full hardware replacement—an essential feature for long-term cost-efficiency and adaptability.

Sustainability is becoming a design priority. Environmentally friendly materials and energy-efficient components are increasingly used to meet global sustainability standards and reduce the carbon footprint.

Competitive Landscape

Leading players in the rugged embedded system market include Kontron, Advantech, Curtiss-Wright, Crystal Group, and Eurotech. These companies invest heavily in R&D and collaborate with OEMs to develop customized solutions across industries. Strategic partnerships, mergers, and geographic expansions are common tactics to gain market share.

Conclusion

The rugged embedded system market is poised for robust growth as industries increasingly depend on reliable, durable, and intelligent systems to perform in the harshest conditions. With expanding applications, ongoing technological innovations, and rising global demand, the sector offers vast opportunities for manufacturers and developers. However, navigating the challenges of cost, complexity, and cybersecurity will be essential for sustained success.

0 notes

Text

Data Bus Box Coupler Market - Trends, Market Share, Industry Size, Growth, Opportunities And Forecast

Data Bus Box Coupler Market, Trends, Business Strategies 2025-2032

The global Data Bus Box Coupler Market was valued at 1369 million in 2024 and is projected to reach US$ 2241 million by 2032, at a CAGR of 7.5% during the forecast period.

Data bus couplers are critical components in electronic systems that enable seamless power transfer between busbars while preventing hazardous arcs. These devices play a vital role in maintaining uninterrupted power supply across various applications, from aerospace systems to medical equipment. The market offers two primary types: unterminated and internally terminated couplers, each serving distinct connectivity needs in complex electronic architectures.