#Modules and Components 2022

Explore tagged Tumblr posts

Text

Dandelion News - December 1-7

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles for 50% off this month!

1. These high-tech windows fight climate change – and will save you money

“[“Vacuum-insulated glass”] insulates five times better than double-paned glass. The Enthermal product line holds energy about as well as fiberglass wall insulation[…. T]he energy bill savings offset the upfront cost of the upgrade in two to seven years, depending on the building[….]”

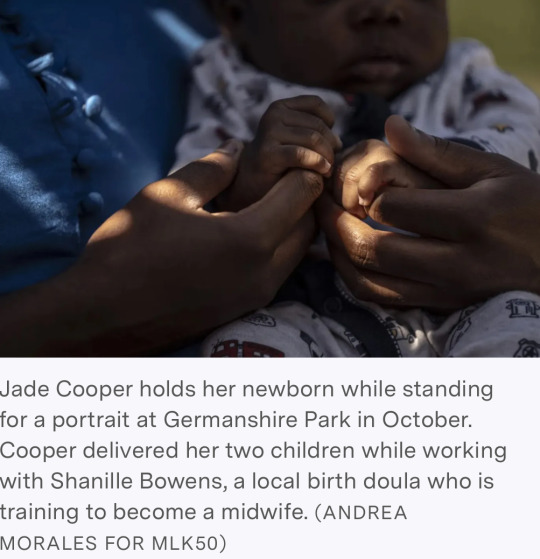

2. Doulas test ways to curb Memphis’ Black maternal, infant deaths

“Research shows they are key to better health outcomes. […] Free of charge, [parents enrolled in this pilot program], in addition to being paired with a doula, get access to free yoga classes, diapers, breastfeeding starter kits, nutritious food and other tangible help that can measurably boost well-being.”

3. Scientists find feeding grazing cattle seaweed cuts methane emissions by almost 40%

“This is the first study to test seaweed on grazing beef cattle in the world. […] Most research to reduce methane emissions using feed additives has taken place in controlled environments with daily supplements. But Kebreab noted in the study that fewer than half of those methods are effective for grazing cattle.”

4. Success for local residents as Florida council toppled over sewage plant plan

“A citizens’ revolt in a small Florida city ousted an entire slate of councilors who were pushing for a new sewage plant to be built close to one of the state’s most pristine and treasured rivers.”

5. Beaver survey aims to show the urban benefits of Chicago's 'ecosystem engineers'

“Urban Rivers is installing [“artificial floating gardens”] along the river to restore native wetland habitats, which provide food and shelter for wildlife, as well as natural spaces for humans.”

6. The future of plastic: Biodegradable, durable, and even edible

“[… T]he composite plastic proved not only sturdy but also more malleable than its core component, hydroxyethyl cellulose. Additionally, since both cellulose and tyrosine are edible, the biodegradable composite plastic can technically be consumed.”

7. Limestone quarries could be vital for wild bee conservation

“Quarries provide valuable habitats for wild bees and other animals and plants that occur on the now rare calcareous grasslands," explains lead author Dr. Felix Kirsch[….]”

8. New England wedding vendors offer help to same-sex couples before Trump inauguration

“Marriage equality isn’t immediately at risk. Trump has said he considers it settled law, but of course it’s hard to take him at his word […] so vendors in the region are offering free or discounted services to queer couples and noncitizens in a rush to marry.”

9. The indigenous women saving India's endangered giant yams

“Since their formation in 2022, the 10 members of the Noorang group have planted and brought back to the community 180 varieties of wild tubers[….] The project is part of [… a] farming initiative to eradicate poverty, provide agricultural training and empower women in vulnerable tribal communities.”

10. The US is making and deploying more solar panels than ever before

“[… D]omestic solar module manufacturing capacity has nearly quintupled since 2022[….] Solar is the cheapest source of new power generation by far, and it’s an increasingly large employer in the U.S., particularly in Republican-led states.”

November 22-28 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#solar panels#solar energy#solar power#climate change#co2 emissions#cattle#seaweed#india#yams#food insecurity#beaver#habitat#conservation#bees#florida#civic engagement#new england#same sex marriage#gay marriage#marriage#us politics#plastic#science#home improvement#thermal insulation#parenting#perinatal#medicine

69 notes

·

View notes

Text

Excerpt from this story from Heatmap News:

American solar manufacturer First Solar may be the big winner from the slew of tariffs Donald Trump announced yesterday against the world’s trading partners. Sorry, make that basically the only winner among renewable energy companies.

In a note to clients this morning, Jefferies analyst Julien Dumoulin-Smith wrote that “in this inflationary environment, we expect FSLR's domestic manufacturing to be the clear winner” in the long term.

For everyone else in the renewable industry — for example, an equipment manufacturer like inverter company Enphase, which has been trying to move its activities away from China — “we perceive all costs to head higher, contributing to a wider inflation narrative.”

First Solar’s’s stock is up almost 4% in early trading as the broader market reels from the global tariffs. Throughout the rest of the solar ecosystem, there’s a sea of red. Enphase is down almost 8%. Chinese inverter manufacturer Sungrow is down 7%. Solar installer Sunrun’s shares are down over 10%. The whole S&P 500 is down 4%, while independent power producers such as Vistra and Constellation and turbine manufacturer GE Vernova are down around 10% as expected power demand has fallen.

First Solar “is currently the largest domestic manufacturer of solar panels and is in the midst of expanding its domestic manufacturing footprint, which should serve as a competitive advantage over its peers,” Morgan Stanley analyst Andrew Perocco wrote in a note to clients Thursday morning.

Nor has First Solar been afraid to fight for its position in the global economy. It is part of a coalition of American solar manufacturers that have been demanding protections against Southeast Asian solar exporters, claiming that they are part of a scheme by Chinese companies to avoid preexisting solar tariffs. In 2023, 80% of American solar imports came from Southeast Asia, according to Reuters.

Tariff rates specific to solar components manufactured in those countries will likely be finalized later this month. Those will come in addition to the new tariffs, which will go into effect on April 9.

But the biggest question about First Solar — and the American renewables industry as a whole — remains unanswered: the fate of the Inflation Reduction Act. The company benefits both from tax credits for advanced manufacturing and investment and production tax credits for solar power.

“Government incentive programs, such as the Inflation Reduction Act of 2022 (the “IRA”), have contributed to this momentum by providing solar module manufacturers, project developers, and project owners with various incentives to accelerate the deployment of solar power generation,” the company wrote in a recent securities filing.

If those tax credits are at risk, then First Solar may not be a winner so much as the fastest runner ahead of an advancing tide.

7 notes

·

View notes

Text

4D Radar Chip Market, Emerging Trends, Technological Advancements, and Forecast to 2032

Global 4D Radar Chip Market size was valued at US$ 437.2 million in 2024 and is projected to reach US$ 1,290 million by 2032, at a CAGR of 16.7% during the forecast period 2025-2032. The semiconductor industry’s broader growth – projected to expand from USD 579 billion in 2022 to USD 790 billion by 2029 at 6% CAGR – creates favorable conditions for radar chip innovation.

4D radar chips represent an advanced evolution of traditional radar technology, integrating height detection (the fourth dimension) alongside range, azimuth and velocity measurements. These high-resolution millimeter-wave (mmWave) chips operate primarily in 24GHz, 77GHz and 79GHz frequency bands, enabling superior object detection and tracking capabilities compared to conventional 3D radar systems. Key components include transceivers, antennas, and signal processing units optimized for automotive, industrial and defense applications.

Market growth is driven by increasing ADAS adoption (projected in 60% of new vehicles by 2025) and rising demand for autonomous systems. Recent developments include NXP’s 28nm RFCMOS radar processors and Uhnder’s digital coding modulation technology, both enhancing resolution while reducing interference. While automotive dominates current applications, emerging uses in drones, smart infrastructure and industrial IoT are creating new growth avenues. Regulatory support for vehicle safety standards like Euro NCAP 2023 further accelerates adoption.

Get Full Report : https://semiconductorinsight.com/report/4d-radar-chip-market/

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Autonomous Vehicles Accelerating 4D Radar Chip Adoption

The global autonomous vehicle market is projected to grow at over 25% CAGR through 2030, creating massive demand for advanced sensing technologies. 4D radar chips are becoming critical components in autonomous driving systems because they provide superior object detection capabilities compared to traditional sensors. These chips can simultaneously measure range, velocity, azimuth, and elevation – delivering comprehensive environmental awareness in all weather conditions. Major automotive manufacturers are increasingly incorporating 4D radar systems with millimeter-wave frequencies between 76-81 GHz, as they offer superior resolution for detecting small objects at distances up to 300 meters.

Military and Defense Applications Driving Technological Advancements

Defense sector investments in radar technologies are pushing the boundaries of 4D radar chip capabilities. Modern military applications require chips that can operate at higher frequencies while consuming less power and offering enhanced signal processing. The ability to detect and track multiple fast-moving targets simultaneously has made 4D radar indispensable for border surveillance, drone detection, and missile guidance systems. Nearly 40% of recent defense radar system upgrades now incorporate 4D radar technology, creating significant growth opportunities.

Furthermore, regulatory bodies worldwide are establishing frameworks to support radar technology innovation:

➤ For instance, recent spectrum allocation policies in major economies have designated dedicated frequency bands for automotive radar applications between 76-81 GHz.

The combination of commercial automotive demand and military specifications is accelerating development cycles, with leading chip manufacturers now delivering new generations of 4D radar chips every 12-18 months.

MARKET CHALLENGES

Complex Design Requirements and High Development Costs Creating Barriers

While the 4D radar chip market shows strong growth potential, developing these advanced semiconductors presents significant technical and financial challenges. Designing chips that operate at millimeter-wave frequencies requires specialized expertise in high-frequency analog design and advanced packaging technologies. The typical research and development cycle for a new 4D radar chip can exceed $50 million and take 2-3 years from conception to production.

Other Challenges

Manufacturing Complexities Fabricating chips with the precision required for 4D radar applications demands cutting-edge semiconductor processes. Many manufacturers struggle to achieve the necessary yield rates, with defect-free production remaining below 80% for some complex designs.

Testing Difficulties Verifying chip performance at millimeter-wave frequencies requires specialized test equipment that can cost millions of dollars per setup. The scarcity of qualified testing facilities creates bottlenecks in bringing new designs to market.

MARKET RESTRAINTS

Supply Chain Vulnerabilities Impacting Market Expansion

The global semiconductor shortage has particularly affected specialized components like 4D radar chips. Dependence on limited production facilities for advanced nodes creates single points of failure in the supply chain. Many automotive manufacturers report that radar chip lead times have extended beyond 52 weeks, forcing temporary production slowdowns.

Additionally, geopolitical factors are complicating the landscape:

➤ Recent trade restrictions have disrupted the flow of key semiconductor manufacturing equipment, potentially delaying next-generation chip developments by 12-18 months.

The combination of material shortages, equipment constraints, and rising fab costs is limiting the pace at which manufacturers can scale production to meet growing demand.

MARKET OPPORTUNITIES

Emerging Industrial Applications Creating New Growth Frontiers

Beyond automotive and defense, innovative applications for 4D radar chips are emerging across multiple industries. Smart infrastructure projects are incorporating radar for traffic management and pedestrian safety monitoring. Industrial automation systems use radar for precise object detection in hazardous environments. Even consumer electronics manufacturers are exploring radar chips for gesture recognition and presence detection features.

The healthcare sector presents particularly promising opportunities:

➤ Medical device developers are testing 4D radar for contactless patient monitoring, with potential applications in elderly care and rehabilitation.

As these diverse applications mature, they’re creating new revenue streams that could account for over 30% of the total 4D radar chip market by 2028. Market leaders are investing heavily in application-specific chip designs to capitalize on these specialized opportunities.

4D RADAR CHIP MARKET TRENDS

Advancements in Autonomous Driving Technologies Driving Market Growth

The integration of 4D radar chips in autonomous vehicles has emerged as a transformative trend, with major automotive manufacturers increasing investments in Level 4 and Level 5 autonomy. Unlike traditional radar systems, 4D radar provides enhanced resolution in elevation, azimuth, range, and Doppler velocity detection, delivering unprecedented accuracy for obstacle detection and collision avoidance. The global autonomous vehicle market is projected to grow at a CAGR of over 20% through 2030, directly fueling demand for advanced sensing solutions like 4D radar. Companies like NXP and Infineon are leveraging 77 GHz and 79 GHz radar chips to enable high-resolution environmental mapping, significantly improving safety standards in next-generation vehicles.

Other Trends

Expansion in Drone and UAV Applications

The commercial drone market is increasingly adopting 4D radar technology for precise navigation and obstacle avoidance in complex environments. With the drone logistics market expected to surpass $30 billion by 2030, radar chips capable of detecting small objects at varying altitudes are becoming critical. 4D radar enables drones to operate safely in low-visibility conditions, making them viable for delivery services, agricultural monitoring, and disaster relief operations. Recent advancements in miniaturized radar solutions by companies like Vayyar and Arbe have further accelerated deployments across consumer and industrial drone segments.

Military and Defense Sector Acceleration

Defense organizations worldwide are actively incorporating 4D radar systems into surveillance and threat detection platforms. Military expenditure on radar systems reached approximately $15 billion in 2024, with growing emphasis on all-weather, multi-target tracking capabilities. The technology’s ability to distinguish between stationary and moving objects with millimeter-wave precision makes it invaluable for border security and airborne early warning systems. Furthermore, partnerships between semiconductor firms and defense contractors are driving innovation in AI-powered radar processing, enhancing situational awareness for tactical operations.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Drive Market Positioning Among Leading Players

The global 4D Radar Chip market exhibits a dynamic competitive landscape, characterized by the presence of both established semiconductor giants and agile technology innovators. The market is moderately consolidated, with NXP Semiconductors and Infineon Technologies emerging as frontrunners, collectively accounting for over 35% of the market share in 2024. These leaders owe their dominance to extensive R&D capabilities and strategic partnerships with automotive OEMs.

TI (Texas Instruments) and Xilinx have also secured substantial market positions, particularly in the 77GHz and 79GHz frequency segments, which are gaining traction in advanced driver-assistance systems (ADAS). Their success stems from vertical integration strategies and patented chip architectures that deliver superior resolution and power efficiency.

Meanwhile, disruptive innovators like Uhnder and Vayyar are challenging traditional players through breakthrough digital radar technologies. Uhnder’s adoption of digital code modulation (DCM) technology has enabled it to capture nearly 12% of the automotive radar market, while Vayyar’s 4D imaging radar solutions are gaining adoption in smart home and industrial applications.

List of Key 4D Radar Chip Manufacturers Profiled

NXP Semiconductors (Netherlands)

Uhnder Inc. (U.S.)

RFISee Ltd. (Israel)

Arbe Robotics (Israel)

Texas Instruments (U.S.)

Xilinx (AMD) (U.S.)

Vayyar Imaging (Israel)

Infineon Technologies (Germany)

Calterah Semiconductor (China)

Recent developments indicate intensified competition, with multiple players announcing next-generation radar chips featuring enhanced angular resolution and interference mitigation capabilities. Infineon recently launched its new 28nm radar chipset, while Arbe Robotics secured significant contracts with tier-1 automotive suppliers for its Phoenix 4D imaging radar platform.

The competitive intensity is further evidenced by strategic alliances, such as the partnership between NXP and TSMC to develop 16nm RFCMOS radar solutions, highlighting the industry’s focus on process node advancements to gain performance advantages.

Regional players like Calterah Semiconductor are making notable strides in the Asian market, particularly in automotive and drone applications, benefiting from local supply chain advantages and government support for semiconductor independence.

Segment Analysis:

By Type

77 GHz Segment Leads Market Due to High Precision in Automotive Radar Applications

The market is segmented based on type into:

24 GHz

77 GHz

79 GHz

By Application

Automotive Sector Dominates with Rising Demand for ADAS Features

The market is segmented based on application into:

Automotive

Drones

Consumer Electronics

Military & Defense

Others

By Technology

MIMO-based 4D Radar Chips Gain Traction for Superior Object Detection

The market is segmented based on technology into:

Single-Input Single-Output (SISO)

Multiple-Input Multiple-Output (MIMO)

Regional Analysis: 4D Radar Chip Market

North America North America is a key player in the 4D radar chip market, driven by robust demand from the automotive and defense sectors. The U.S. leads in innovation, with major automotive manufacturers integrating 4D radar technology for advanced driver-assistance systems (ADAS) and autonomous vehicles. Government regulations, such as the National Highway Traffic Safety Administration’s (NHTSA) mandate for collision avoidance systems, further accelerate adoption. Additionally, the defense sector’s focus on radar-based surveillance and reconnaissance technologies bolsters market growth. Major players like Texas Instruments and NXP Semiconductor establish a strong supply chain, ensuring market stability. However, high development costs pose a challenge for smaller enterprises.

Europe Europe demonstrates steady growth in 4D radar chip adoption, supported by stringent automotive safety regulations under Euro NCAP. Countries like Germany, France, and the UK lead in automotive innovation, with premium car manufacturers prioritizing radar-based ADAS solutions. Strict data privacy laws under GDPR also influence radar technology deployment, ensuring compliance in consumer-oriented applications. The European Defense Fund’s investments in radar advancements further stimulate demand in military and aerospace sectors. Despite these drivers, market expansion is tempered by complex regulatory frameworks and competition from LiDAR technologies in some autonomous vehicle applications.

Asia-Pacific The Asia-Pacific region dominates the global 4D radar chip market, propelled by rapid automotive production and government-backed smart city initiatives. China, Japan, and South Korea are at the forefront, leveraging local semiconductor manufacturing capabilities to reduce dependency on imports. The automotive sector, particularly in China and India, focuses on integrating 4D radar for autonomous and electric vehicles. Meanwhile, Japan leads in consumer electronics applications, where radar chips enhance gesture recognition and IoT connectivity. Although cost sensitivity in emerging economies slows high-end adoption, increasing investments in 5G and smart infrastructure signal long-term potential.

South America South America’s 4D radar chip market is nascent but growing, primarily driven by Brazil and Argentina’s automotive and industrial automation sectors. Limited local semiconductor production creates reliance on imports, affecting pricing and availability. Economic instability and delayed regulatory approvals hinder rapid deployment, though collaborations with global tech firms aim to bridge gaps. The region’s mining and agriculture industries show emerging interest in radar-based monitoring systems, presenting niche opportunities for suppliers.

Middle East & Africa The Middle East & Africa market is developing, with growth centered around defense and smart city projects. The UAE and Saudi Arabia lead in adopting radar technologies for security and traffic management, supported by government initiatives like Saudi Vision 2030. However, funding constraints and a lack of local semiconductor expertise slow broader adoption. In Africa, industrial and agricultural applications drive sporadic demand, but infrastructure challenges remain a barrier. Strategic partnerships with international radar chip manufacturers could unlock future opportunities in this region.

Get A Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97566

Report Scope

This market research report provides a comprehensive analysis of the global and regional 4D Radar Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global 4D Radar Chip market was valued at USD 1.2 billion in 2024 and is projected to reach USD 3.5 billion by 2032, growing at a CAGR of 14.2%.

Segmentation Analysis: Detailed breakdown by product type (24 GHz, 77 GHz, 79 GHz), technology, application (automotive, drones, consumer electronics, military), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. Asia-Pacific dominates with 48% market share in 2024.

Competitive Landscape: Profiles of leading market participants including NXP, Infineon, TI, and Uhnder, including their product offerings, R&D focus (22% average R&D expenditure), manufacturing capacity, pricing strategies, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies like AI integration (28% adoption rate in 2024), mmWave radar evolution, semiconductor design trends, and evolving automotive safety standards.

Market Drivers & Restraints: Evaluation of factors driving market growth (ADAS adoption growing at 19% CAGR) along with challenges like supply chain constraints (30% price volatility in 2023) and regulatory issues.

Stakeholder Analysis: Insights for component suppliers, OEMs (automotive sector accounts for 62% demand), system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customisation of the Report

In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

5G Radio Frequency Front End Module Market: Emerging Applications and End-User Demand 2025-2032

MARKET INSIGHTS

The global 5G Radio Frequency Front End Module Market size was valued at US$ 4,830 million in 2024 and is projected to reach US$ 9,740 million by 2032, at a CAGR of 10.2% during the forecast period 2025-2032. This growth is fueled by rapid 5G network deployments worldwide, with China leading the charge by accounting for over 60% of global 5G base stations as of 2022.

5G Radio Frequency Front End Modules (RFFEM) are critical components in wireless communication systems that manage signal transmission and reception. These modules integrate multiple technologies including RF filters, power amplifiers, switches, and low-noise amplifiers to ensure efficient high-frequency signal processing required for 5G's enhanced mobile broadband and low-latency applications.

The market expansion is driven by three key factors: accelerating 5G infrastructure investments (global mobile operators are projected to invest USD 1.1 trillion in 5G between 2020-2025), increasing smartphone penetration with 5G capabilities (GSMA forecasts 5G will account for 51% of mobile connections by 2030), and growing demand for IoT applications. Major players like Skyworks Solutions and Qorvo are innovating with integrated module solutions to address the complex frequency bands in 5G NR deployments.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of 5G Infrastructure Deployment Accelerating Market Growth

The global push for 5G network expansion is driving unprecedented demand for RF front end modules. With telecom operators investing heavily in infrastructure upgrades, the market is witnessing exponential growth. Countries worldwide are racing to achieve nationwide 5G coverage, with China already deploying over 2.3 million 5G base stations - representing more than 60% of the global total. This infrastructure boom creates a ripple effect across the semiconductor supply chain, particularly benefiting RF front end module manufacturers. The technology's ability to handle higher frequencies and increased data throughput makes it indispensable for modern 5G networks. Recent product launches incorporating advanced packaging technologies and improved power efficiency demonstrate how manufacturers are rising to meet this demand.

Smartphone Proliferation and 5G Device Penetration Fueling Market Expansion

The smartphone industry's rapid transition to 5G-compatible devices serves as a powerful market catalyst. With global mobile users exceeding 5.4 billion, device manufacturers are under constant pressure to integrate advanced RF front end solutions that support multiple frequency bands and power modes. The average 5G smartphone now contains 30-40% more RF components than its 4G predecessor, directly translating to higher module demand. Market data reveals that 5G smartphone shipments grew by over 25% in 2023 compared to the previous year, indicating strong consumer adoption. This trend is particularly pronounced in Asia-Pacific markets where 5G adoption rates outpace other regions, creating localized demand surges for high-performance RF components.

MARKET RESTRAINTS

Complex Integration Challenges Impeding Widespread Adoption

While 5G's technological promise is undeniable, integrating RF front end modules into modern devices presents significant engineering hurdles. The need to support an expanding array of frequency bands while maintaining signal integrity and power efficiency creates complex design challenges. Module manufacturers must balance performance requirements against physical space constraints, particularly in compact mobile devices. This complexity often results in extended development cycles and higher production costs. Recent industry reports indicate that nearly 40% of 5G device failures can be traced back to RF front end integration issues, highlighting the technical barriers that continue to restrain market growth. As spectrum allocations become more fragmented globally, these integration challenges are expected to persist.

Supply Chain Vulnerabilities Creating Market Volatility

The RF front end module market remains susceptible to ongoing global supply chain disruptions. Concentrated production of specialized semiconductor components in specific geographical regions creates potential bottlenecks. Recent geopolitical tensions and trade restrictions have further exacerbated these vulnerabilities, leading to fluctuating component prices and extended lead times. The industry's reliance on advanced compound semiconductor materials like gallium arsenide and silicon germanium adds another layer of supply chain complexity, as these materials require specialized manufacturing processes. Such constraints have caused intermittent shortages, prompting some manufacturers to maintain elevated inventory levels despite the associated cost burdens.

MARKET OPPORTUNITIES

Emerging mmWave Applications Opening New Revenue Streams

The gradual rollout of millimeter wave (mmWave) 5G networks presents significant growth opportunities for advanced RF front end module developers. While current deployments primarily utilize sub-6GHz spectrum, the transition to higher frequency bands necessitates specialized components capable of handling extreme bandwidth requirements. Early movers in mmWave-optimized module development are positioning themselves to capture premium market segments. Industry projections suggest that mmWave-compatible RF front end modules will command price premiums of 35-50% over conventional solutions, representing a high-value market niche. The automotive sector's growing interest in 5G-enabled vehicle-to-everything (V2X) communication systems further amplifies this opportunity, creating parallel demand across multiple industries.

Integration of AI and Machine Learning Creating Competitive Differentiation

Forward-thinking manufacturers are leveraging artificial intelligence to create next-generation intelligent RF front end solutions. Machine learning algorithms are being employed to optimize power consumption, dynamically adjust signal parameters, and predict component failures before they occur. Several industry leaders have already announced products featuring embedded AI capabilities, with early adopters reporting performance improvements of 15-20% in real-world conditions. This technological evolution is particularly valuable for power-sensitive applications like IoT devices and wearables, where energy efficiency directly impacts product viability. As these intelligent systems mature, they're expected to redefine performance benchmarks across the entire RF front end module market.

MARKET CHALLENGES

Technical Complexity and Power Consumption Issues

The increasing technical complexity of 5G RF front end modules presents ongoing development challenges. Supporting the growing number of frequency bands while maintaining power efficiency requires innovative architectural approaches. Current modules must handle more than 20 different bands, with each addition introducing new interference and thermal management concerns. Power consumption remains a critical pain point, particularly for battery-operated devices, where RF components can account for up to 40% of total energy usage. Recent field tests show that thermal issues cause approximately 15% of premature module failures, underscoring the need for improved thermal design methodologies. These technical hurdles require substantial R&D investments, creating barriers to entry for smaller market players.

Rapid Technology Obsolescence Pressuring Profit Margins

The breakneck pace of 5G standard evolution creates significant challenges for RF front end module manufacturers. Frequent specification updates and new feature requirements often render existing product designs obsolete within 12-18 months. This rapid technology turnover forces companies to maintain aggressive development cycles while managing product lifecycle risks. The resulting pressure on profit margins is particularly acute for manufacturers serving price-sensitive consumer electronics markets. Industry analysis indicates that average selling prices for mainstream RF front end modules have declined by approximately 8% annually since 2021, despite increasing technical complexity. This trend is forcing market participants to seek alternative revenue streams through value-added services and customized solutions.

5G RADIO FREQUENCY FRONT END MODULE MARKET TRENDS

Expansion of 5G Infrastructure Driving RF Front-End Module Demand

The global rollout of 5G networks is accelerating the demand for Radio Frequency (RF) Front-End Modules (FEMs), which are critical components in 5G-enabled devices. As telecom operators worldwide invest heavily in infrastructure deployment, the market for RF FEMs is projected to grow at a CAGR of over 10% through 2032, reaching multimillion-dollar valuations. China currently leads in 5G infrastructure, accounting for more than 60% of global 5G base stations—highlighting the immense demand for high-performance RF components. Furthermore, innovations in 5G mmWave and sub-6GHz technologies necessitate advanced FEMs with superior power efficiency and signal integrity.

Other Trends

Miniaturization and Integration of RF Components

The push toward smaller, more efficient devices has led to significant advancements in RF front-end module designs. System-on-Chip (SoC) and heterogeneous integration techniques are enabling manufacturers to combine multiple components—such as filters, switches, and power amplifiers—into compact modules. This trend is particularly crucial for smartphones and IoT devices, where space constraints demand high integration densities. Recent developments in RF SOI (Silicon-on-Insulator) and GaN (Gallium Nitride) technologies are further enhancing performance while reducing power consumption, making them increasingly preferred in both consumer and military applications.

Increasing Demand Across Military and Civil Applications

The adoption of 5G FEMs is expanding rapidly across both military and civil sectors. In defense applications, 5G-enabled communication systems rely on ruggedized RF FEMs to support secure, high-bandwidth transmissions for unmanned systems and battlefield networks. Meanwhile, in civilian applications, the proliferation of 5G smartphones, smart cities, and industrial IoT is fueling demand. Commercial shipments of 5G smartphones surpassed 700 million units in 2023, reinforcing the need for high-quality RF front-end solutions. Additionally, advancements in AI-driven RF optimization are helping manufacturers tailor modules for specific use cases, further driving market diversification.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Collaborations Drive Market Competition

The global 5G Radio Frequency Front End Module (RFFEM) market is characterized by intense competition among semiconductor giants, with Skyworks Solutions and Broadcom emerging as dominant players. These companies collectively held over 35% market share in 2024, owing to their comprehensive product portfolios spanning RF filters, power amplifiers, and switches. Their technological leadership in millimeter-wave and sub-6GHz solutions positions them strongly as 5G deployment accelerates worldwide.

Murata Manufacturing and Qorvo have demonstrated remarkable growth, particularly in the Asia-Pacific region where 5G infrastructure investments are surging. Murata's advanced filtering technologies and Qorvo's integrated front-end modules have become critical components for smartphone OEMs and base station manufacturers. Both companies are investing heavily in BAW (Bulk Acoustic Wave) filter development to address the complex frequency requirements of 5G networks.

The competitive landscape is further intensified by strategic maneuvers from Qualcomm and Taiwan Semiconductor Manufacturing Company (TSMC). Qualcomm's system-level expertise in 5G modem-RF integration gives it a unique advantage in smartphone applications, while TSMC's cutting-edge wafer fabrication processes enable superior performance in high-frequency modules. Recent industry reports indicate these companies are allocating 18-22% of their R&D budgets specifically toward 5G RF innovations.

Meanwhile, NXP Semiconductors and Analog Devices are strengthening their positions through targeted acquisitions and partnerships. NXP's 2023 collaboration with a major Chinese telecom equipment provider and Analog Devices' acquisition of a specialist RF assets underscore the industry's consolidation trend. These moves enable faster time-to-market for next-generation solutions while addressing the growing demand for energy-efficient RF components.

List of Key 5G RFFEM Companies Profiled

Skyworks Solutions, Inc. (U.S.)

Broadcom Inc. (U.S.)

Murata Manufacturing Co., Ltd. (Japan)

Qorvo, Inc. (U.S.)

Qualcomm Technologies, Inc. (U.S.)

Taiwan Semiconductor Manufacturing Company (Taiwan)

NXP Semiconductors N.V. (Netherlands)

Analog Devices, Inc. (U.S.)

Texas Instruments Incorporated (U.S.)

STMicroelectronics N.V. (Switzerland)

Infineon Technologies AG (Germany)

MACOM Technology Solutions (U.S.)

Segment Analysis:

By Type

RF Filter Segment Leads Due to Its Critical Role in 5G Signal Processing

The market is segmented based on type into:

RF Filter

Subtypes: SAW, BAW, and others

RF Switch

Power Amplifier

Subtypes: GaN-based, Si-based, and others

Duplexer

Low-Noise Amplifier

Others

By Application

Civil Applications Dominate Owing to Widespread 5G Infrastructure Deployment

The market is segmented based on application into:

Military

Civil

Subtypes: Smartphones, IoT devices, and others

By Frequency Band

Sub-6 GHz Segment Holds Major Share Due to Broader Network Coverage

The market is segmented based on frequency band into:

Sub-6 GHz

mmWave

By Component Integration

Integrated Modules Gain Traction for Space-Constrained Devices

The market is segmented based on component integration into:

Discrete Components

Integrated Modules

Regional Analysis: 5G Radio Frequency Front End Module Market

North America North America represents a highly advanced market for 5G RF front-end modules, driven by substantial investments in next-generation infrastructure and the presence of leading semiconductor manufacturers. The U.S. accounts for over 65% of regional demand, fueled by early 5G deployment initiatives like the FCC’s $20.4 billion Rural Digital Opportunity Fund. Carrier aggregation technologies and mmWave spectrum utilization are pushing innovation in power amplifiers and antenna tuners. However, geopolitical tensions affecting semiconductor supply chains and complex spectrum allocation policies create moderate adoption barriers. Key players like Skyworks Solutions and Qorvo dominate component supply with specialized solutions for high-frequency bands.

Europe European adoption focuses on sub-6GHz deployments with strong emphasis on energy-efficient designs to align with the EU Green Deal initiative. Germany and the UK lead installations, collectively hosting 38% of regional 5G base stations. The presence of NXP Semiconductors and STMicroelectronics supports localized production of RF filters and switches. Strict radio equipment directives (RED) mandate rigorous certification processes, slowing time-to-market but ensuring quality standardization. Recent collaborations between telecom operators and automotive manufacturers are creating new application avenues for integrated RF modules in connected vehicles and smart city infrastructure.

Asia-Pacific China's dominance in 5G infrastructure is reshaping global RF front-end module dynamics, with domestic suppliers like Murata Manufacturing capturing 28% of the regional market share. The country's 2.3 million active 5G base stations generate unparalleled demand for power amplifiers and duplexers. India emerges as the fastest-growing market (projected 42% CAGR through 2030), driven by ₹14,000 crore (∼$1.7 billion) government allocations for indigenous 5G development. Southeast Asia shows divergent trends - while Singapore adopts cutting-edge mmWave solutions, Indonesia and Vietnam prioritize cost-effective sub-6GHz modules for broader population coverage.

South America Brazil constitutes 60% of regional demand, with major carriers deploying 5G NSA networks across 26 state capitals. However, economic instability limits investment in advanced RF components, causing reliance on mid-tier Chinese imports. Argentina and Chile show promising pilot projects in industrial IoT applications, requiring ruggedized front-end solutions. The lack of local semiconductor fabrication facilities creates complete import dependency, with average lead times exceeding 12 weeks during peak demand cycles. Recent trade agreements with Asian manufacturers aim to stabilize supply but face bureaucratic hurdles in customs clearance.

Middle East & Africa Gulf Cooperation Council nations drive premium segment growth through extensive smart city projects - Dubai's 5G network already covers 95% of urban areas using advanced massive MIMO configurations. In contrast, Sub-Saharan Africa experiences slower uptake due to 4G/LTE prioritization, with South Africa being the notable exception having allocated 5G spectrum to three major operators. The region faces unique challenges including extreme temperature operation requirements and limited technical expertise for mmWave deployment. Emerging partnerships between infrastructure providers and module manufacturers aim to address these constraints through customized thermal management solutions.

Report Scope

This market research report provides a comprehensive analysis of the global and regional 5G Radio Frequency Front End Module markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global 5G RF Front End Module market was valued at USD 5.2 billion in 2024 and is projected to reach USD 12.8 billion by 2032, growing at a CAGR of 11.7% during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (RF Filters, RF Switches, Power Amplifiers, etc.), technology (sub-6GHz, mmWave), application (military, civil), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific (China dominates with over 60% global 5G base stations), Latin America, and Middle East & Africa.

Competitive Landscape: Profiles of 16 leading market participants including Skyworks Solutions, Qorvo, Broadcom, and Murata Manufacturing, covering their product portfolios, R&D investments, and strategic partnerships.

Technology Trends: Assessment of emerging innovations including AI-integrated RF modules, advanced packaging techniques, and energy-efficient designs for 5G networks.

Market Drivers & Restraints: Evaluation of growth drivers (5G infrastructure expansion, IoT proliferation) and challenges (semiconductor shortages, design complexity).

Stakeholder Analysis: Strategic insights for component suppliers, telecom operators, device manufacturers, and investors navigating the 5G ecosystem.

The research methodology combines primary interviews with industry leaders and analysis of verified market data from regulatory filings, trade associations, and financial reports to ensure accuracy.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global 5G RF Front End Module Market?

-> 5G Radio Frequency Front End Module Market size was valued at US$ 4,830 million in 2024 and is projected to reach US$ 9,740 million by 2032, at a CAGR of 10.2% during the forecast period 2025-2032.

Which companies lead the 5G RF Front End Module Market?

-> Top players include Skyworks Solutions, Qorvo, Broadcom, Murata Manufacturing, and Qualcomm, collectively holding 68% market share.

What drives market growth?

-> Key drivers are 5G network deployments (2.31M+ base stations in China alone), smartphone upgrades, and IoT expansion.

Which region dominates 5G RF module adoption?

-> Asia-Pacific leads with 72% market share, driven by China's 561 million 5G users and massive infrastructure investments.

What are emerging technology trends?

-> Emerging trends include integrated mmWave modules, GaN-based power amplifiers, and AI-optimized RF designs for 5G-Advanced networks.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/automotive-magnetic-sensor-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ellipsometry-market-supply-chain.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/online-moisture-sensor-market-end-user.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-screen-market-forecasting.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-power-gate-drive-interface.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/strobe-overdrive-digital-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-half-size-single-board-computer.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-isolated-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/satellite-messenger-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sic-epi-wafer-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/heavy-duty-resistor-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/robotic-collision-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gas-purity-analyzer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-high-voltage-power-supply-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/reflection-probe-market-industry-trends.html

0 notes

Text

Power Amplifier Market Size Driving Next-Generation Signal Amplification

The rapidly evolving landscape of consumer electronics, wireless infrastructure, and industrial communication is significantly boosting the power amplifier Market Size. These vital components are essential for enhancing signal strength across a wide range of devices, from smartphones and satellites to radar systems and automotive electronics. According to Market Size Research Future, the Market Size is expected to grow from USD 18.9 billion in 2022 to USD 31.2 billion by 2030, registering a healthy CAGR of 6.4% during the forecast period (2022–2030).

Power amplifiers convert low-power signals into higher-power outputs while maintaining signal integrity. This makes them crucial for applications demanding high-frequency performance, energy efficiency, and robustness—especially in sectors such as 5G communications, aerospace, and defense.

Market Size Overview

The global expansion of 5G networks, coupled with the growing integration of advanced driver-assistance systems (ADAS) and smart devices, has spurred demand for high-frequency, linear, and power-efficient amplifiers. Innovations in gallium nitride (GaN) and gallium arsenide (GaAs) semiconductors are reshaping the Market Size, enabling higher output power, bandwidth, and thermal efficiency.

Moreover, the miniaturization of RF components and the increasing adoption of Internet of Things (IoT) devices are creating new opportunities for compact, multifunctional power amplifiers in both commercial and industrial environments.

Enhanced Market Size Segmentation

By Type

RF Power Amplifier

Audio Power Amplifier

DC Power Amplifier

Linear Amplifier

Class A/B/C/D Amplifiers

By Technology

Gallium Arsenide (GaAs)

Gallium Nitride (GaN)

Silicon Germanium (SiGe)

Complementary Metal-Oxide Semiconductor (CMOS)

By Application

Consumer Electronics

Industrial

Telecommunication

Automotive

Aerospace & Defense

Healthcare

By Region

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

Key Market Size Trends

1. 5G Rollout and Massive MIMO Deployment

With mobile operators expanding 5G infrastructure, the need for high-performance RF power amplifiers that support wide bandwidths and beamforming has intensified. Massive MIMO and mmWave frequencies demand amplifiers with high linearity and energy efficiency.

2. GaN-Based Technology Advancements

GaN semiconductors are gaining popularity due to their superior power density, efficiency, and thermal conductivity. GaN-based power amplifiers are particularly valuable in defense and satellite communication systems.

3. Rising Automotive Integration

The automotive industry is incorporating power amplifiers in radar, infotainment, and communication modules, enabling autonomous driving capabilities and improved safety.

4. Focus on Energy Efficiency

Amid rising energy costs and environmental concerns, manufacturers are prioritizing the development of amplifiers with reduced heat generation and enhanced power conversion efficiency.

5. Emergence of Software-Defined Radios (SDR)

Software-defined radios demand flexible, broadband power amplifiers capable of operating over multiple frequencies and protocols—fueling innovation in amplifier design.Segment Insights

RF Power Amplifiers Lead Market Size Share

These amplifiers dominate due to widespread usage in wireless communication devices, cellular base stations, and satellite links. Their scalability and frequency versatility make them a staple in network infrastructure.

GaN Technology Outpacing Others

GaN is displacing traditional silicon in high-frequency and high-voltage applications, owing to its superior efficiency and reduced footprint. GaN amplifiers are especially prevalent in defense-grade and 5G transmitters.

Consumer Electronics Hold Largest Application Share

From smartphones and laptops to smart TVs and tablets, power amplifiers are integral to enhancing sound and signal quality, creating a massive and ongoing demand.

End-User Insights

Telecommunications

Telecom is the largest end-use sector, driven by increasing mobile data consumption, network densification, and base station upgrades across urban and rural areas.

Automotive

Modern vehicles require high-speed connectivity and advanced radar systems. Power amplifiers are now integral to in-vehicle communications and collision avoidance systems.

Aerospace & Defense

High-reliability power amplifiers are critical for radar, surveillance, and electronic warfare systems, where performance, durability, and thermal management are paramount.

Healthcare

Amplifiers are used in diagnostic imaging equipment, wearable monitors, and remote health sensors—demanding precision and reliability under various operating conditions.

Key Players

The Market Size is competitive and innovation-driven. Leading players are investing in next-gen semiconductor materials and forging partnerships with OEMs to expand application scopes. Key players include:

Texas Instruments Inc.

Broadcom Inc.

Analog Devices Inc.

Infineon Technologies AG

Qorvo, Inc.

NXP Semiconductors

Skyworks Solutions, Inc.

Maxim Integrated

MACOM Technology Solutions

STMicroelectronics

These players are focusing on developing compact, cost-effective, and energy-efficient power amplifier modules for both commercial and defense-grade applications.

Future Outlook

As wireless ecosystems evolve and connected devices multiply, the demand for advanced power amplifiers will grow across all verticals. Future developments may include:

AI-powered adaptive amplifiers

Broadband and ultra-wideband modules

Monolithic integration with transceivers

Passive cooling and thermal optimization features

AI-enabled self-calibration and fault diagnosis

From 5G smartphones to autonomous drones, power amplifiers will continue to be at the heart of signal amplification, efficiency, and device performance.

Trending Report Highlights

Discover related high-growth Market Sizes influencing signal processing, measurement, and device automation:

Industrial Metrology Market Size

Inspection Analysis Device Market Size

Gaming Monitors Market Size

HVDC Capacitor Market Size

Intrinsically Safe Equipment Market Size

Capacitor Market Size

Digital Workspace Market Size

AI Audio Video SoC Market Size

Robotic Arms Market Size

Oil & Gas SCADA Market Size

Molded Interconnect Device Market Size

Bioelectronic Sensors Market Size

FSO VLC Li-Fi Market Size

IoT Based Asset Tracking and Monitoring Market Size

0 notes

Text

GaAs Photodiodes Gain Traction in High-Speed Data Transmission

The global gallium arsenide (GaAs) photodiode market is poised for steady growth through 2031, fueled by rising demand for high-speed communication technologies and optoelectronic devices. The industry was valued at USD 73.4 Mn in 2022 and is expected to reach USD 105.0 Mn by the end of 2031, expanding at a CAGR of 4.1% during the forecast period.

Market Overview: GaAs photodiodes are pivotal components in optical communication systems, converting light into electrical current with exceptional efficiency. Known for their high sensitivity, low noise, and rapid response times, these semiconductors are increasingly integrated into fiber-optic networks, 5G infrastructure, and advanced industrial applications.

The global GaAs photodiode market is witnessing robust adoption due to increasing investments in telecom networks, surge in Internet of Things (IoT) applications, and technological advancements in optical components.

Market Drivers & Trends

1. Fiber-optic Network Expansion: With the rapid proliferation of broadband infrastructure and high-speed internet, fiber-optic communication is becoming ubiquitous. GaAs photodiodes serve as critical receivers in these networks, converting light signals into electronic data with minimal latency or distortion. Companies like Lasermate Group offer photodiode arrays optimized for data rates up to 14Gbps, specifically tailored for these networks.

2. Rise of 5G and IoT: The emergence of 5G technologies and increasing adoption of IoT-enabled devices are creating new use cases for GaAs photodiodes. Their ability to function effectively in high-frequency, short-wavelength optical systems makes them ideal for next-gen telecom infrastructure. Notably, Kyoto Semiconductor’s KP-H series targets high-speed 400Gbps systems using PAM4 modulation—critical for data centers and 5G applications.

3. Miniaturization and High-speed Demand: GaAs photodiodes with smaller active areas (less than 70 µm) are gaining traction due to their faster response times. In 2022, this segment accounted for 57.6% of market share and is expected to dominate through 2031.

Key Players and Industry Leaders

The global GaAs photodiode market features a moderately fragmented competitive landscape. Leading players are focusing on innovation, performance enhancement, and expanding production capacity to maintain their market position. Key players include:

Albis Optoelectronics AG

AMS Technologies AG

Broadcom Inc.

Electro-Optics Technology Inc.

Global Communication Semiconductors, LLC

II-VI Incorporated

Kyoto Semiconductor Co., Ltd.

Lasermate Group, Inc.

Microsemi Corporation

OSI Optoelectronics Ltd.

TRUMPF Photonic Components GmbH

These companies are leveraging strategic partnerships, R&D investments, and M&A to address growing demand and develop cost-effective, high-performance photodiodes.

Recent Developments

November 2021 – Kyoto Semiconductor launched the KPDE008LS-A-RA-HQ, a monitor photodiode designed for optical communication devices.

October 2020 – II-VI Incorporated began high-volume production of edge-emitting diodes on a 6-inch GaAs platform for high-speed datacom and 3D sensing.

October 2020 – TRUMPF Photonic Components GmbH acquired an advanced Solstice S4 wet-processing system to enhance GaAs VCSEL and photodiode production.

Explore pivotal insights and conclusions from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=74423

Latest Market Trends

Integration in DWDM Systems: GaAs photodiodes are increasingly used in Dense Wavelength Division Multiplexing (DWDM) monitors due to their precision and reliability in high-data-rate environments.

High Responsivity and AR Coatings: Manufacturers are enhancing photodiodes with features like anti-reflective coatings and wraparound submounts to increase responsivity and durability in challenging environments.

Demand for Small Form-factor Components: Compact, efficient photodiodes are crucial for communication devices, especially in mobile and handheld electronics.

Market Opportunities

Emerging Markets and Automation: Growth in industrial automation, particularly in Asia Pacific and Latin America, is opening new avenues for GaAs photodiode applications in robotics, monitoring systems, and smart manufacturing.

Healthcare and Spectroscopy: GaAs photodetectors are gaining popularity in medical imaging and X-ray spectroscopy, expanding beyond their traditional telecom applications.

High-bandwidth Data Centers: The transition to cloud computing and edge data centers is increasing the need for faster optical receivers, presenting an opportunity for high-speed GaAs photodiodes.

Future Outlook

Analysts predict a consistent demand trajectory for GaAs photodiodes through 2031, primarily driven by continued investments in 5G, expansion of fiber networks, and technological integration across industries. As the demand for low-latency, high-bandwidth communication grows, the GaAs photodiode market is expected to play a critical role in the global optoelectronics landscape.

Challenges such as raw material costs and supply chain disruptions remain, but proactive investments in R&D and localized manufacturing may help mitigate these risks. Overall, the market outlook is positive, with a focus on developing next-generation devices tailored for evolving telecom and data communication needs.

Market Segmentation

By Active Area Size:

Less than 70 µm

70 µm - 100 µm

Above 100 µm

By Application:

Optical Detectors

Laser Detectors

Communication Devices

Others (Televisions, Smoke Detectors)

By End-use Industry:

IT & Telecommunications

Industrial

Consumer Electronics

Healthcare

Others (Aerospace & Defense, Automotive)

Regional Insights

Asia Pacific dominated the market in 2022, accounting for 37.6% of global revenue, and is expected to maintain its lead through 2031. Key factors driving this dominance include:

Strong presence of electronics and semiconductor manufacturing in China, Japan, South Korea, and Taiwan.

Government support for 5G infrastructure deployment.

Rising adoption of automation in industries across India and Southeast Asia.

North America and Europe also represent significant markets due to early adoption of optical technologies and the presence of major telecom and data center operators. The U.S., Germany, and France are notable contributors to market expansion.

Why Buy This Report?

This report offers a comprehensive and data-driven analysis of the GaAs photodiode market, enabling stakeholders to:

Understand key growth drivers, restraints, and trends shaping the market

Assess competitive dynamics and benchmarking of top players

Identify high-potential segments and regional hotspots

Strategize investments based on emerging opportunities and future forecasts

Access detailed market segmentation and country-level insights

Receive qualitative and quantitative analysis including Porter’s Five Forces and value chain assessment

0 notes

Text

Optimizing HVAC Design for Energy Efficiency and Accelerated Project Timelines in Australia

In an environment where sustainability targets and rapid project delivery are both non-negotiable, Mechanical Engineering Services play a pivotal role in Australia’s built environment. From tropical Cairns to temperate Hobart, mechanical systems often represent over 50% of a building’s energy consumption — and present equally significant opportunities for streamlining construction schedules. At Decobu, our expertise as a leading mechanical design engineer Australia understands that intelligent mechanical engineering design is the nexus between achieving stringent energy goals and meeting aggressive housing and commercial project deadlines.

Why Mechanical Engineering Matters in Australia’s Dual Challenge

Australia faces a dual imperative: deliver 1.2 million new dwellings by 2029 to ease the housing deficit, while meeting ever-tightening energy performance standards under the 2022 National Construction Code (NCC) and NatHERS regulations. Inefficient mechanical plants not only drives up electricity bills — residential buildings alone account for roughly 24% of national electricity use — but also creates on-site complexity and rework that delays handover. By partnering with top mechanical engineering consultants Brisbane, mechanical engineering companies Sydney, and other regional specialists, stakeholders can simultaneously:

Slash operational energy consumption through passive-first design and efficient HVAC systems.

Accelerate construction timelines via prefabrication, BIM coordination, and Lean methodologies.

Enhance asset value, as energy-efficient projects command significant price premiums in markets like Melbourne and Perth.

Part 1: Peak Energy Efficiency through Integrated Design

Harmonizing Passive Principles and Active Systems

A “fabric-first” approach reduces the load on mechanical systems, meaning smaller, more efficient plant and lower lifecycle costs. At Decobu, our mechanical engineering design companies integrate:

Climate-responsive siting and building orientation.

High-performance glazing and airtightness.

Natural ventilation strategies (cross-ventilation, stack effect, night purge).

These measures feed into precise mechanical load calculations, ensuring that Mechanical Engineering Services Perth or Mechanical Engineering Services Sydney projects require less heating and cooling capacity — translating into equipment cost savings and reduced carbon footprint.

Advanced Technologies for Smarter Operation

Cutting-edge mechanical systems go beyond conventional chillers and boilers. We deploy:

Smart IoT sensors that dynamically adjust airflow and temperature.

AI-driven predictive maintenance, minimizing downtime and extending equipment life.

High-efficiency heat pumps — cornerstones of Australia’s electrification initiatives — eligible for Victorian Energy Upgrades and other government incentives.

Engaging with leading Mechanical Engineering Companies Australia ensures access to the latest sustainable refrigerants (R-32, R-454B) that lower Global Warming Potential and enhance heat exchange efficiency.

Part 2: Accelerating Project Timelines with Modern Delivery

Integrated Project Delivery (IPD) & Design-Build

Traditional “plan and spec” workflows often silo mechanical engineers, leading to coordination breakdowns and costly RFIs. By contrast, Decobu’s mechanical engineering consulting embraces Design-Build and IPD models, where engineers, architects, and builders collaborate under one contract. Benefits include:

Overlap of design and construction phases — components can be fabricated while foundations are poured.

Early clash detection in BIM, reducing on-site rework.

Shared risk and reward, incentivizing proactive problem-solving

Prefabrication & Modular Mechanical Systems

Off-site fabrication of mechanical plant rooms, pump skids, duct and pipe risers, and horizontal modules dramatically compresses schedules. Case studies show up to 50% reductions in on-site installation time — turning what once was a six-week plant room fit-out into an 11-day module installation. Partnering with mechanical engineering consultants Brisbane or Mechanical Engineering Services Brisbane enables you to:

Minimize weather-related delays and on-site congestion.

Achieve tighter quality control in factory conditions.

Reduce labour costs and enhance safety.

Lean Construction for Mechanical Works

Applying Lean tools — Just-in-Time deliveries, Last Planner pull-planning, and 5S site organization — optimizes mechanical workflows:

JIT ensures ductwork and valves arrive exactly when needed.

Pull-planning aligns mechanical fit-off with preceding trades, trimming idle time.

5S keeps mechanical toolsets and spares organized, boosting installer productivity.

Studies indicate Lean can accelerate overall project completion by up to 30% — a game-changer for developers racing to meet housing targets.

Part 3: Digitalization as the Backbone

BIM for Mechanical Coordination and Prefab

Detailed 3D mechanical models (LOD 400+) facilitate:

Automated clash detection between ducts, piping, structure, and finishes.

Accurate thermal zoning for exact equipment sizing.

Direct generation of shop drawings and CNC-ready fabrication files.

Decobu’s Mechanical Engineering Firms Australia leverage BIM to ensure prefabricated modules fit first time, avoiding costly on-site adjustments.

Tailored Strategies for Key Stakeholders

Builders & Developers

Engage Decobu early to integrate Mechanical Engineering Services Melbourne or Adelaide into conceptual design.

Promote energy-efficient credentials — 7-star NatHERS homes and NABERS-rated commercial buildings attract higher premiums and tenant interest.

Market sustainability as a core value, highlighting lifecycle cost savings and enhanced occupant comfort.

Architects

Advocate lifecycle analysis to clients, focusing on long-term operational cost benefits rather than only capital expenditure.

Push for integrated delivery (IPD, Design-Build) to ensure seamless integration of passive and active mechanical systems.

Upskill in BIM and whole-life carbon assessment, staying ahead of regulatory and market demands.

Property Investors

Priorities high-performance assets or retrofit opportunities, focusing on mechanical upgrades and electrification.

Leverage government grants — VEU rebates, clean energy finance, and apartment-scale solar schemes — to offset upfront costs.

Demand transparent energy disclosure at point-of-sale to minimize investment risk.

Government & Regulators

Harmonies NCC 2022 implementation across states, giving industry clarity and momentum.

Expand incentives for mechanical electrification and smart controls to bridge the cost-barrier.

Invest in workforce development — apprenticeships and specialist training for the next generation of mechanical engineers.

Conclusion: Mechanical Systems as Strategic Assets

In Australia’s evolving built environment, Mechanical Engineering Consultancies Australia and their expert mechanical design engineer Australia partners are critical for delivering sustainable, cost-effective, and timely projects. By integrating passive design, advanced mechanical technologies, Lean construction, and BIM‐driven fabrication, Decobu helps clients achieve dual objectives: reducing carbon footprints and accelerating handovers. The result is a higher-quality built asset with superior indoor environmental quality, higher market value, and a competitive edge in today’s demanding property landscape.

Partner with Decobu’s Mechanical Engineering Companies Australia to unlock the full potential of your next residential or commercial development — where energy efficiency and speed go hand in hand.

#hydraulic engineering services#mechanical engineering services#fire engineering services#electrical engineering services#engineering

0 notes

Text

Solar PV Junction Box Market to Double by 2031: Key Trends Unveiled

The global solar PV junction box market is witnessing a period of rapid expansion, spurred by rising energy demand and accelerating adoption of renewable energy. Valued at US$ 1.2 billion in 2022, the industry is projected to grow at a CAGR of 7.9% from 2023 to 2031, reaching US$ 2.4 billion by 2031. This robust growth reflects broader transitions in global energy systems and policy support for decarbonization.

Analyst Viewpoint: Energy Consumption and Renewable Shift Driving Growth

One of the primary drivers of market expansion is the rise in global energy consumption, prompted by population growth, rapid urbanization, and the increasing shift to renewable energy sources. As governments and consumers seek alternatives to fossil fuels, solar energy has emerged as a key pillar of sustainable development.

Solar PV junction boxes serve a pivotal role in these systems, functioning as the control hub for solar panels. They house crucial electrical components and provide protection against environmental hazards such as moisture, dust, and heat. Their reliability and performance are central to maximizing solar panel efficiency and lifespan.

Surge in Solar Panel Installations Bolstering Demand

With solar power becoming more cost-effective, installations across residential, commercial, and utility segments have surged. For instance, China added 217 GW of solar electric generation capacity in 2023 alone. The International Energy Agency (IEA) projects a quadrupling of global solar capacity by 2030, adding up to 650 GW annually.

This expansion naturally increases the demand for essential components such as junction boxes. These devices regulate energy flow, prevent hotspots, and enable safe and consistent power delivery, ensuring optimal panel performance.

Key Trends Shaping the Market

Recent trends underscore growing investments in fire-resistant and weatherproof junction boxes that can withstand extreme climates. The push for remote diagnostics and monitoring technologies is gaining traction, enabling proactive maintenance and efficiency optimization.

Bypass diode technology innovations are also drawing attention. Diodes mitigate power loss from shading or panel mismatches, improving energy output and reducing system failure risks.

Regional Insights: Asia Pacific Leads, North America Gains Ground

Asia Pacific dominated the global solar PV junction box market in 2022, driven by strong demand from China, which serves as a global manufacturing hub for photovoltaic components. India is another key player, having installed over 70 GW of solar capacity by mid-2023. Favorable government policies and increasing off-grid applications are further propelling market growth in the region.

North America, particularly the U.S., is witnessing a steady rise in installations. According to the Solar Energy Industries Association (SEIA), the U.S. crossed over two million solar installations, while Canada has more than 48,000. This uptick is supported by clean energy incentives and increasing energy costs.

Competitive Landscape: Focus on Innovation and Safety

Leading players in the solar PV junction box market are focusing on product differentiation through innovation. Companies like Amphenol, Goldi Solar, Targray, and Staubli International AG are at the forefront of developing advanced junction boxes tailored for efficiency and resilience.

In 2023, Amphenol announced new production plans in Arizona to meet rising domestic demand. Similarly, Goldi Solar launched a bifacial solar module integrating heterojunction technology with high efficiency and reliability.

Strategic mergers, R&D collaborations, and regional expansions are common growth strategies being adopted to maintain competitive advantage and respond to evolving customer needs.

Market Segmentation Overview

By Type:

By Application:

Each segment is experiencing growth, with utility-scale projects contributing significantly to demand due to large-scale energy infrastructure development across Asia, the Middle East, and parts of Africa.

Conclusion: The Road Ahead

The global solar PV junction box market stands at a critical intersection of technological innovation and policy-driven energy transformation. As the world races toward net-zero goals and renewable energy adoption accelerates, junction boxes will remain integral to solar power systems’ performance and safety.

With Asia Pacific leading in production and installations, and North America showing stable growth, the coming years will likely witness continued innovation, strategic investments, and expansion in emerging markets. Backed by a strong compound annual growth rate and mounting global urgency to transition to clean energy, the solar PV junction box market is well-positioned for a dynamic and sustained expansion through 2031.

0 notes

Text

The Middle East & Africa IOT Market Size, Share | CAGR 27.5% During 2025-2032

The Middle East & Africa (MEA) stands as the second largest region in the global Internet of Things (IoT) market industry. With increasing investments in smart infrastructure, digital transformation, and connectivity initiatives, the region is poised for strong growth. The global IoT market size is projected to expand from USD 544.38 billion in 2022 to USD 3,352.97 billion by 2030, at a CAGR of 27.5% during the forecast period.

Market Highlights: • CAGR: 27.5% (2023–2030) • Market Size (Global): USD 544.38 billion (2022) → USD 3,352.97 billion (2030) • Regional Focus: Infrastructure modernization, industrial IoT, and smart city deployments across the Gulf Cooperation Council (GCC), South Africa, and North Africa.

Major Companies Active in the Region: • Etisalat Group • MTN Group • SAP MENA • Cisco Systems, Inc. • Huawei Technologies Co., Ltd. • Ericsson • IBM Corporation • GE Digital • Siemens AG • Microsoft Corporation

Request for Free Sample Reports: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/middle-east-africa-internet-of-things-iot-market-107394

Market Trends:• Adoption of IoT in oil & gas for real-time pipeline monitoring and predictive maintenance. • Smart city investments driven by UAE, Saudi Arabia, and South Africa. • Increased government funding for digital infrastructure and AI+IoT integration. • Growing emphasis on cybersecurity for connected systems.

Key Developments: August 2022 – Etisalat partnered with regional governments to expand its Smart City IoT offerings across the UAE, introducing connected street lighting and waste management systems.

November 2022 – MTN Group rolled out its pan-African IoT platform aimed at unifying connectivity and services for smart logistics and manufacturing in Sub-Saharan Africa.

Core Segments: • Components: Sensors and devices, connectivity modules, IoT platforms, and analytics software. • Connectivity: NB-IoT, LTE-M, 5G, Zigbee, LoRa, and satellite. • Deployment Types: Cloud-native, edge computing, and on-premises models. • Applications: Smart cities, oil & gas monitoring, connected healthcare, fleet management, agriculture, and utilities. • Key Stakeholders: Government agencies, telecom operators, energy firms, logistics providers, and enterprise IT leaders

Speak to Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/middle-east-africa-internet-of-things-iot-market-107394

About Us: At Fortune Business Insights, we empower businesses to thrive in rapidly evolving markets. Our comprehensive research solutions, customized services, and forward-thinking insights support organizations in overcoming disruption and unlocking transformational growth. With deep industry focus, robust methodologies, and extensive global coverage, we deliver actionable market intelligence that drives strategic decision-making. Whether through syndicated reports, bespoke research, or hands-on consulting, our result-oriented team partners with clients to uncover opportunities and build the businesses of tomorrow. We go beyond data offering clarity, confidence, and competitive edge in a complex world.

Contact Us: US: +1 833 909 2966 UK: +44 808 502 0280 APAC: +91 744 740 1245 Email: [email protected]

#Middle East & Africa Internet of Things Market Share#Middle East & Africa Internet of Things Market Size#Middle East & Africa Internet of Things Market Industry#Middle East & Africa Internet of Things Market Driver#Middle East & Africa Internet of Things Market Growth#Middle East & Africa Internet of Things Market Analysis#Middle East & Africa Internet of Things Market Trends

0 notes

Text

Renewable Energy Surge Elevates Demand for Power Modules