#Overbought/Oversold Signals

Explore tagged Tumblr posts

Text

youtube

King Oscillator: The Power of 9 Indicators in 1!

The King Oscillator is a revolutionary tool in technical analysis that combines the strengths of nine popular oscillators into one comprehensive indicator. It simplifies trading decisions by merging functionalities of RSI, Stochastic Oscillator, Money Flow Index, and more. This advanced oscillator helps traders identify momentum, overbought/oversold conditions, and potential reversals with precision, making it a powerful asset for effective trading strategies.

#Technical Analysis#Trading Strategies#Momentum Indicators#Overbought/Oversold Signals#King Oscillator Tool#Youtube

0 notes

Text

How to Trade Using the Money Flow Index (MFI): Strategies and Examples

Introduction to the Money Flow Index (MFI) The Money Flow Index (MFI) is a momentum oscillator that measures the inflow and outflow of money into a security over a specified period. It is similar to the Relative Strength Index (RSI) but incorporates volume, making it a more comprehensive indicator for assessing buying and selling pressure. The MFI ranges from 0 to 100, with levels above 80…

#Best MFI trading strategies#How to read the MFI indicator#How to trade using MFI#learn technical analysis#MFI and Moving Averages#MFI breakout strategy#MFI day trading strategies#MFI divergence trading#MFI forex trading strategy#MFI indicator trading strategies#MFI swing trading strategy#MFI trend reversal signals#Money Flow Index calculation#Money Flow Index for crypto trading#Money Flow Index trading strategy#Money Flow Index vs RSI#Overbought and oversold MFI levels#stock trading#Stock trading with Money Flow Index#successful trading#technical analysis#Technical analysis with MFI#Trading signals using MFI#Trading Strategies#Volume-based trading indicators

0 notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

Capitalizing on Oversold Stocks: The Art of Buying Low and Selling High

Every seasoned trader knows the timeless principle: buy low, sell high. While the concept seems straightforward, the real challenge lies in knowing when to act. An oversold stock can signal a golden opportunity—if you’re able to identify it at the right moment. But how can you tell when a stock is truly oversold and ready for a rebound?

While fundamental analysis involves examining company earnings, balance sheets, and valuations, technical analysis takes a different route—one that focuses on price action. Rather than digging through financial reports or tracking executive decisions, technical analysts rely on charts to tell the story. The belief is simple: price reflects all known information, and studying price behavior is enough to make informed trading decisions.

One of the most widely used tools in this approach is the Relative Strength Index (RSI)—a trusted indicator that helps traders spot potential reversals in oversold or overbought conditions.

Why the Buy Low, Sell High Strategy Works

The idea of buying a stock after it has declined—anticipating a bounce back—is grounded in both logic and psychology. It works when you can identify short-term undervaluation, where prices have dropped not because of fundamental weakness, but due to temporary selling pressure, market sentiment, or external events. For fundamental traders, this might mean identifying a stock trading below its book value. But for technical traders, price is the only signal that matters.

RSI: The Technical Analyst’s Go-To Indicator

This is where the RSI comes into play. The Relative Strength Index is a momentum oscillator that measures the speed and magnitude of recent price movements. It operates on a scale from 0 to 100 and helps identify whether a stock is overbought or oversold.

When the RSI crosses above 70, the stock is considered overbought. This could signal that a pullback or consolidation is near.

When the RSI drops below 30, the stock is viewed as oversold—often a cue for traders to prepare for a potential upward move.

By using RSI, traders can pinpoint key moments when sentiment has driven a stock too far in one direction and position themselves to capitalize on the reversal.

Find Full Blog: Buy Low – Sell High: Opportunities in Oversold Stocks

2 notes

·

View notes

Text

Types of Technical Indicators in Trading

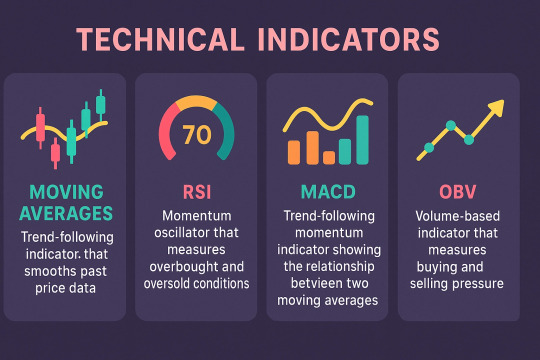

Technical indicators are essential tools used by traders to analyze market trends and make informed decisions. Among the many available, some of the most widely used types include Moving Averages, Relative Strength Index (RSI), MACD, and On-Balance Volume (OBV).

Moving Averages smooth out price data to identify trend direction over a specific period. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA), which help traders determine support and resistance levels and potential entry or exit points.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are typically used to identify overbought (above 70) or oversold (below 30) conditions, signaling potential reversals.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two EMAs. It helps traders identify changes in trend strength, direction, and momentum.

On-Balance Volume (OBV) uses volume flow to predict price movements. A rising OBV indicates accumulation, while a falling OBV suggests distribution, providing insights into the strength of a trend.

Using these indicators together can improve trading accuracy and help develop a solid, data-driven strategy.

Explore, all the Technical Indicators in Trading.

#Types of Technical Indicators in Trading#Technical Indicators in Trading#Indicators in Trading#trading indicators#indicators in trading

2 notes

·

View notes

Text

A long-dormant Polygon whale just made waves by snapping up a rising new token, XYZVerse, fueling speculation that this sports-fueled crypto could be the next breakout to watch.

Table of Contents

XYZ aims for G.O.A.T. status: Early buyers eye 1,000x gains

Polygon fluctuates

Conclusion

After five years of silence, a major holder of Polygon tokens has resurfaced. This investor is now acquiring a new cryptocurrency linked to POL. The unexpected move has caught the attention of market watchers. The new token is showing signs of significant growth potential. Could this be a signal of shifting trends in the market?

XYZ aims for G.O.A.T. status: Early buyers eye 1,000x gains

XYZVerse (XYZ) isn’t your average memecoin, it’s fusing the high-octane world of sports with crypto’s fast-moving edge. Built for die-hard fans of football, basketball, MMA, and esports, XYZVerse is more than just a token, it’s a competitive movement powered by adrenaline and community.

With its bold “Greatest of All Time” (G.O.A.T.) vision, XYZVerse is setting its sights far beyond typical memecoin hype. It’s already turning heads, recently crowned as the Best New Meme Project on the scene.

What gives XYZ the edge? Backed by a detailed roadmap and a fired-up community, the project is geared toward lasting impact and serious growth.

The XYZ presale is heating up fast, offering early investors tokens at a steep discount:

Launch price: $0.0001

Current price: $0.003333

Next presale stage: $0.005

Final presale price: $0.02

Target listing price: $0.10

With over $13 million already raised, momentum is building rapidly. The project’s ambitious target is a 1,000x return for those who locked in early. As demand soars, each presale stage brings higher prices, so those who act soon stand to gain the most.

XYZ is already making waves before hitting major exchanges. With listings on top CEXs and DEXs on the horizon, the opportunity window is closing fast.

You might also like:How a $500 stake in XYZVerse might transform over time

Polygon fluctuates

POL (ex-MATIC POL) has experienced notable price fluctuations recently. Over the past week, the coin saw a slight decline of 3.21%, settling within the current price range of $0.22 to $0.24. However, zooming out to the monthly view, POL has demonstrated a significant rebound with a 21.93% increase. Despite this short-term growth, the coin remains down by 23.38% over the past six months, reflecting broader market volatility.

Technical indicators point to key levels that could influence POL’s trajectory. The nearest resistance level is at $0.26, with a secondary resistance at $0.28. If the price pushes beyond these thresholds, it might signal a bullish trend. On the support side, levels at $0.21 and $0.19 could provide a safety net against further declines.

The 10-day simple moving average is $0.23, slightly below the 100-day average of $0.24, suggesting a cautious short-term outlook. The Relative Strength Index (RSI) stands at 53.70, indicating that the coin is neither overbought nor oversold. Meanwhile, a high Stochastic value of 91.17 might hint at potential overbought conditions.

Market observers note that while the recent monthly gain is promising, the mixed signals from technical indicators warrant careful attention. POL’s ability to break through resistance levels or hold above support zones could set the tone for its near-term performance. As the crypto market continues to evolve, staying informed on these key metrics remains crucial for those watching POL’s journey.

Conclusion

While established coins like POL show promise, XYZVerse stands out, uniting sports fans in a community-driven ecosystem aiming for substantial growth and cultural impact.

To find more information about XYZVerse, visit the official website.

2 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

What tools or indicators can be used with Forex charts?

Here's a comprehensive and detailed breakdown of tools and indicators used in Forex trading, structured to span around 3,500 words. This document includes technical analysis tools, charting platforms, indicators (leading and lagging), and practical strategies for application.

Tools and Indicators Used with Forex Charts

Introduction

The foreign exchange (Forex) market is the largest and most liquid financial market globally, with trillions of dollars traded daily. To navigate this vast marketplace effectively, traders utilize a variety of tools and indicators to analyze price movements, identify trends, and execute strategic trades.

Understanding these tools and indicators is essential for any Forex trader—whether novice or experienced—as they form the foundation of technical analysis, one of the most widely used approaches in the financial markets.

This article explores the essential tools and indicators used in Forex charting, categorized into several groups for clarity and practical application.

1. Charting Platforms and Tools

1.1. Charting Software

To analyze Forex charts, traders need reliable charting platforms that provide real-time data, customizable indicators, and drawing tools.

Popular charting platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Industry standards offering robust technical analysis tools.

TradingView: A web-based platform with advanced charting features and social integration.

cTrader: Offers intuitive UI, depth of market (DOM) functionality, and automation options.

NinjaTrader: Used by more advanced traders for both Forex and futures markets.

1.2. Chart Types

Understanding different chart types helps traders select the most appropriate visualization method.

Line Chart: Plots closing prices; useful for identifying trends.

Bar Chart (OHLC): Shows open, high, low, and close prices; more data-rich.

Candlestick Chart: Most popular; visually intuitive and informative, ideal for pattern recognition.

Renko Charts: Focus on price movement, ignoring time.

Heiken Ashi: Smooths price action to better identify trends.

2. Categories of Forex Indicators

Forex indicators are generally categorized based on their function and timing:

Trend-following indicators (lagging)

Momentum indicators (leading)

Volatility indicators

Volume indicators

Support and resistance tools

Overlay indicators vs. oscillator indicators

3. Trend-Following (Lagging) Indicators

These indicators help identify the direction of the market trend.

3.1. Moving Averages (MA)

Simple Moving Average (SMA) and Exponential Moving Average (EMA) are essential tools.

SMA calculates the average of a selected range of prices.

EMA gives more weight to recent prices.

Usage:

Determine trend direction.

Create signals with crossovers (e.g., 50 EMA crossing 200 EMA = Golden Cross/Death Cross).

3.2. Moving Average Convergence Divergence (MACD)

Composed of two EMAs (MACD line and signal line) and a histogram.

Usage:

Crossover strategy for buy/sell signals.

Divergence from price to signal potential reversals.

3.3. Average Directional Index (ADX)

Measures trend strength, not direction.

Usage:

ADX above 25 = strong trend.

ADX below 20 = weak trend or range-bound market.

3.4. Ichimoku Kinko Hyo

A comprehensive indicator showing trend, momentum, and support/resistance.

Components:

Tenkan-sen (conversion line)

Kijun-sen (base line)

Senkou Span A and B (cloud)

Chikou Span (lagging line)

Usage:

Cloud (Kumo) provides dynamic support and resistance.

Crossovers and breakouts from the cloud indicate signals.

4. Leading Indicators (Momentum)

Leading indicators aim to forecast future price movements.

4.1. Relative Strength Index (RSI)

An oscillator ranging from 0 to 100.

Usage:

RSI > 70 = overbought.

RSI < 30 = oversold.

Divergence with price indicates reversals.

4.2. Stochastic Oscillator

Compares a specific closing price to a range over time.

Usage:

%K and %D lines; crossovers suggest entries/exits.

Overbought/oversold levels are typically 80/20.

4.3. Commodity Channel Index (CCI)

Shows when a currency is overbought/oversold relative to its average price.

Usage:

Readings above +100 or below -100 suggest overbought/oversold conditions.

4.4. Rate of Change (ROC)

Measures the speed of price change.

Usage:

Increasing ROC suggests growing momentum.

Often used with trend indicators to confirm movement.

5. Volatility Indicators

These indicators measure how much price fluctuates.

5.1. Bollinger Bands

Consists of a SMA and two bands (±2 standard deviations).

Usage:

Price touching the upper band = potential overbought.

Price touching the lower band = potential oversold.

Bollinger Band squeeze indicates potential breakout.

5.2. Average True Range (ATR)

Shows average price volatility over a specific time.

Usage:

Not a directional indicator.

Useful for setting stop-loss and target levels.

5.3. Keltner Channels

Similar to Bollinger Bands but use ATR instead of standard deviation.

Usage:

Identify breakouts and trend continuations.

6. Volume-Based Indicators

Forex is decentralized, so volume is often broker-based. However, tick volume can still be useful.

6.1. On-Balance Volume (OBV)

Cumulative volume indicator.

Usage:

Confirms trends.

Divergence from price may signal reversal.

6.2. Volume Weighted Average Price (VWAP)

The average price weighted by volume.

Usage:

Commonly used for intraday analysis.

Helps institutions judge fair value zones.

7. Support and Resistance Tools

7.1. Pivot Points

Calculated from previous period’s high, low, and close.

Types:

Standard

Fibonacci

Woodie

Camarilla

Usage:

Identify potential support/resistance levels.

Useful for intraday and swing trading.

7.2. Fibonacci Retracement

Identifies potential pullback levels.

Common levels: 23.6%, 38.2%, 50%, 61.8%, 78.6%

Usage:

Entry during retracements in trending markets.

Combine with trendlines for confirmation.

7.3. Trendlines and Channels

Drawn manually to connect swing highs/lows.

Usage:

Visualize trend direction and strength.

Breakouts signal potential reversals or continuations.

8. Custom Indicators and Tools

Many platforms allow traders to create or install custom indicators.

Examples:

Harmonic pattern indicators (Gartley, Bat, Crab)

Custom divergence indicators

Multi-timeframe RSI or MACD

Sentiment indicators

9. Chart Patterns and Price Action Tools

While not strictly indicators, chart patterns play a crucial role in technical analysis.

9.1. Classic Chart Patterns

Head and Shoulders

Double Top/Bottom

Triangles (Ascending, Descending, Symmetrical)

Flags and Pennants

Rectangles

Usage:

Reversal and continuation signals.

9.2. Candlestick Patterns

Doji

Hammer

Engulfing

Morning Star/Evening Star

Shooting Star

Usage:

Signal potential turning points.

Combine with support/resistance or trend indicators.

9.3. Price Action Tools

Swing Highs/Lows

Order Blocks

Break of Structure (BoS)

Liquidity Zones

Usage:

Used for precision entries and institutional trading style (Smart Money Concepts - SMC).

10. Combining Indicators for Strategy Building

10.1. The Problem of Indicator Overload

Using too many indicators can lead to conflicting signals and analysis paralysis.

Best Practice:

Combine indicators with different functions.

Example setup:

Trend: 200 EMA

Momentum: RSI

Volatility: Bollinger Bands

10.2. Confluence Trading

Confluence occurs when multiple indicators or tools point to the same conclusion.

Example:

Price hits a Fibonacci level + RSI is oversold + bullish engulfing candlestick.

This increases the probability of success.

11. Trading Strategy Examples

11.1. Moving Average Crossover Strategy

Indicators:

50 EMA and 200 EMA Entry:

Buy when 50 EMA crosses above 200 EMA. Exit:

Opposite crossover or stop-loss under support.

11.2. RSI Divergence Strategy

Indicators:

RSI Entry:

Look for bullish/bearish divergence. Exit:

Take profit at key support/resistance.

11.3. Bollinger Band Breakout

Indicators:

Bollinger Bands Entry:

Enter when price breaks out of a tight band range. Exit:

Use ATR or fixed pip target.

11.4. Ichimoku Cloud Trend Strategy

Indicators:

Ichimoku Kinko Hyo Entry:

Buy when price is above the cloud and Tenkan-sen crosses Kijun-sen upward. Exit:

Close when price enters the cloud or crossover occurs downward.

12. Risk Management Tools on Charts

Besides entry and exit signals, charts also support tools for risk management:

Stop-loss placement using ATR

Take-profit based on recent swing highs/lows

Position size calculator indicators

Trade simulators and replay tools

13. Psychological and Sentiment Indicators

Though not always on the chart, these tools influence market moves.

Commitment of Traders (COT) Report

Retail Sentiment Indicators (from brokers like IG or OANDA)

News sentiment tools

Economic calendars embedded in platforms

Conclusion

Forex charting is both an art and a science. With the right tools and indicators, traders can gain deep insights into market movements, enhance precision, and improve risk-to-reward ratios. However, no single tool guarantees success.

The key is to develop a strategy that suits your trading style—whether scalping, day trading, or swing trading—and consistently use a combination of indicators that complement each other rather than duplicate signals.

To summarize:

Use trend indicators to determine direction.

Use momentum indicators for timing entries.

Use volatility indicators to understand price fluctuations.

Use support/resistance tools to define high-probability zones.

Combine tools intelligently to build robust strategies.

Would you like this content formatted as a downloadable PDF or with visual examples for each indicator?

#forex robot#forex trend indicator#forexsignals#stock market#currency forex online trading#youtube#forextrader#forex market#forextrading#forex

1 note

·

View note

Text

Chart Chaser: A Trader’s Obsession with Technical Analysis on MintCFD

In the realm of online trading, a “Chart Chaser” is a trader who relies heavily on technical analysis. These traders obsessively study charts, patterns, and indicators to identify the optimal entry and exit points for their trades. While some traders focus on market news or economic fundamentals, Chart Chasers believe that the key insights lie within the patterns and trends shown in the data itself. For users on MintCFD, adopting the Chart Chaser approach can be rewarding, especially given the wide range of tools and various trading chart patterns available on the platform.

The Allure of Following Trends in Charts

Chart Chasers are drawn to technical analysis because it offers a visual and data-driven way to understand market behavior. By studying price movements, volume, and indicators, they look for recurring patterns, such as Double Bottoms, Head and Shoulders, and Moving Averages, which they believe can predict future price action. With the MintCFD trading app, traders have access to advanced charting tools that make it easy to become a Chart Chaser, allowing for in-depth analysis and strategy development.

Key Tools on the MintCFD Platform for Chart Chasers

MintCFD’s platform is rich with tools tailored for those who take a technical approach. Here are some essentials for the dedicated Chart Chaser:

Real-Time Charting Tools: MintCFD offers detailed, real-time charts that provide instant insights into price movements. For a Chart Chaser, these charts are invaluable as they capture every shift and trend in the market, allowing them to act quickly based on the latest data.

Diverse Chart Patterns: From Candlestick charts to Line charts, MintCFD provides several options, enabling traders to switch between patterns based on their trading style. For instance, Candlestick patterns are often favored by Chart Chasers because they reveal price action in detail, helping traders identify trends and reversals.

Technical Indicators: Popular indicators, such as the RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, are available on MintCFD to help Chart Chasers confirm their hypotheses. These indicators can signal overbought or oversold conditions, momentum changes, and potential trend reversals.

Custom Alerts: MintCFD’s alert system lets Chart Chasers set notifications based on specific price movements, helping them act on technical signals even if they’re not actively monitoring their screens. This way, they never miss a crucial trade opportunity based on their analysis.

Benefits and Pitfalls of Being a Chart Chaser

For those who love data, becoming a Chart Chaser offers unique advantages, but it also comes with some potential pitfalls. Here’s how to manage both on the MintCFD Platform:

Benefits: Technical analysis is highly data-driven, meaning decisions are based on objective data rather than emotional responses. By relying on chart patterns and indicators, Chart Chasers can create highly structured strategies with specific entry and exit points. With MintCFD’s intuitive tools, they can continuously refine their methods and explore different indicators.

Pitfalls: Focusing solely on technical analysis can lead to “analysis paralysis,” where a trader over-analyzes and hesitates to act. Additionally, ignoring market news and economic factors may leave a Chart Chaser blind to important influences. MintCFD offers market news and insights alongside technical tools, helping Chart Chasers balance their analysis with a broader context.

Master the Market on MintCFD Trading App: Stop Over-Analyzing and Start Thriving as a Chart Chaser

To succeed as a Chart Chaser without getting caught in a loop of over-analysis, it’s essential to have a plan and set clear criteria for entering and exiting trades. MintCFD’s watchlists and alert systems can help keep track of multiple assets without overwhelming yourself with constant analysis. Having a set of “go-to” indicators and patterns also helps prevent information overload.

Final Thoughts

For traders who thrive on technical data, becoming a Chart Chaser can be an exciting and rewarding journey. MintCFD is an ideal platform for these traders, with its robust charting tools, real-time indicators, and customizable alerts. While it’s easy to get caught up in the details, the best Chart Chasers know when to step back and trust their analysis. By balancing data with a disciplined approach, MintCFD users can make the most of their technical strategies and succeed in the dynamic world of trading.

Take control of your trading journey with the MintCFD Trading App

#mintcfd#cfdtrading#cryptotrading#onlinetrading#tradingstrategy#tradingsignals#forextrading#forexstrategies#cryptoinvesting#stockmarket

2 notes

·

View notes

Text

pro scalper indicator script free download

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Top Free Intraday Indicators for Quality Buy and Sell Signals

Here are some of the most widely used and trusted free indicators that intraday traders use to generate buy and sell signals.

1. VWAP (Volume Weighted Average Price)

Type: Price + Volume Indicator Best For: Institutional-level price zones and intraday support/resistance

VWAP calculates the average price of an asset throughout the day, adjusted for volume. It helps identify where most of the volume is concentrated and provides insight into whether buyers or sellers have control.

Price above VWAP: Indicates buying pressure

Price below VWAP: Indicates selling pressure

Use Case Example: If a stock is trading below VWAP all morning and then breaks above with volume, this can be a high-probability buy signal—especially during a reversal session.

2. Supertrend

Type: Trend-Following Indicator Best For: Simplified trend direction and buy/sell triggers

Supertrend is plotted on the price chart and flips between green (bullish) and red (bearish) zones. It uses Average True Range (ATR) to adjust for volatility.

Green line below price: Bullish (buy signal)

Red line above price: Bearish (sell signal)

Use Case Example: On a 5-minute chart, a flip from red to green with price closing above the Supertrend can be a potential long entry, especially if supported by momentum.

3. Relative Strength Index (RSI)

Type: Momentum Oscillator Best For: Overbought and oversold identification

RSI measures how quickly and extensively a price has moved in a short time. The values range from 0 to 100.

Below 30: Asset may be oversold (buy signal)

Above 70: Asset may be overbought (sell signal)

Use Case Example: In a flat market, RSI dropping below 30 and turning upward can suggest a short-term buy opportunity, especially when confirmed by price action near support.

4. MACD (Moving Average Convergence Divergence)

Type: Trend + Momentum Indicator Best For: Trend reversals and momentum confirmation

MACD consists of two lines—the MACD line and the signal line. Crossovers between these lines indicate potential trading opportunities.

MACD line crosses above signal line: Bullish (buy signal)

MACD line crosses below signal line: Bearish (sell signal)

Use Case Example: On a 15-minute chart, if the MACD line crosses above the signal line after a pullback, it may confirm a bullish continuation.

5. Bollinger Bands

Type: Volatility Indicator Best For: Mean-reversion and breakout signals

Bollinger Bands consist of three lines: a simple moving average (middle band), and two outer bands that adjust based on price volatility.

Price touching the lower band: Potential bounce (buy setup)

Price touching the upper band: Possible reversal (sell setup)

Use Case Example: If price contracts into a narrow range (bands squeeze) and then breaks out on high volume, this can signal a strong intraday buy or sell breakout.

6. Stochastic Oscillator

Type: Momentum Indicator Best For: Reversal zones in choppy markets

Stochastic compares the current closing price to the price range over a recent period.

Below 20: Oversold (buy signal potential)

Above 80: Overbought (sell signal potential)

Use Case Example: In a range-bound market, a crossover from below 20 to above, combined with a bullish candlestick pattern, may signal a short-term buy trade.

Combining Free Indicators for Stronger Setups

Rather than relying on one tool, the most effective approach is to combine 2–3 non-correlated indicators to validate signals.

Example Intraday Setup (5-Minute Timeframe):

VWAP: Price must be above VWAP (buy bias)

Supertrend: Indicator must be green

RSI: Should be between 50–70 for confirmation of upward momentum

Entry Rule: When all three conditions align, place a buy order on a pullback or breakout.

Exit Rule: Close position when RSI approaches 70–75 or price drops below VWAP.

Why These Indicators Are Free (and Still Valuable)

You might wonder—if they’re free, are they really good?

Yes, and here’s why:

Public domain math: Most indicators are based on formulas developed decades ago, which are no longer under license restrictions.

Built-in on most platforms: Modern trading platforms like MetaTrader, TradingView, and Thinkorswim offer these tools by default.

Widely tested: Since these tools are open to all, they’ve been studied and applied across millions of charts, helping traders refine their use.

Free doesn’t mean ineffective—it means accessible.

Tips for Using Intraday Indicators Responsibly

To maximize the usefulness of these tools:

Avoid overloading your chart. Stick to 2–3 indicators that complement each other.

Always use stop-loss orders. Indicators can fail—protect your capital.

Avoid trading solely on indicator signals. Always confirm with price action and volume.

Backtest before going live. Use past data to see how your setup performs across different market conditions.

Keep a trading journal. Track what indicators worked and when they failed to improve future decisions.

Things No Indicator Can Predict

Sudden market-moving news (earnings, geopolitical events)

Emotional behavior of crowds (panic selling, FOMO buying)

Flash crashes or order book imbalances

That’s why risk management and strategy discipline are even more important than the indicators themselves.

Platforms That Offer These Indicators for Free

You don’t need expensive software to use these tools. Some of the most user-friendly platforms include:

TradingView (freemium model with access to almost all popular indicators)

MetaTrader 4/5 (MT4/MT5) (free for most brokers)

Thinkorswim by TD Ameritrade (free for account holders)

Investing.com chart tools (web-based and accessible)

Final Thoughts: Consistency Over Certainty

While no indicator can promise 100% accuracy, using well-tested, free tools like VWAP, RSI, MACD, and Supertrend in combination with smart trade planning can significantly improve your intraday performance.

Indicators are not magic signals. They are guidance tools—and their effectiveness depends entirely on how consistently and wisely you apply them.

Key takeaways:

Avoid looking for a “holy grail.” Instead, aim for consistency.

Learn your indicators inside-out—know when they work and when they don’t.

Respect the market. Use indicators as a map, not as a guarantee.

By developing your skills and combining indicators with risk management, you can build a responsible and potentially profitable intraday trading strategy—even without spending a dime on tools.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex education#forex market#forex factory#forex online trading#forex news#forex ea#forex broker#forex

0 notes

Text

"RSI Streak Indicator: Enhancing Trend Strength & Momentum Analysis with Relative Strength Index"

The RSI Streak Indicator tracks consecutive periods of RSI closing above or below a certain threshold, revealing trends and overbought/oversold conditions. It highlights momentum by counting bullish or bearish streaks, aiding in trend strength and reversal signals.

0 notes

Text

10 COT Forex Signals to Watch After Fed's Dovish Shift

With the Federal Reserve signaling potential rate cuts and global trade tensions weighing on sentiment, the market landscape has shifted. This week’s COT forex signals provide a timely roadmap for navigating major currency moves. From commodity-linked currencies to safe-haven flows, we break down 10 setups using COT data, EMA200 trends, MACD, and RSI. These actionable insights support a structured forex trading approach and reinforce the importance of a solid forex risk management plan and a detailed trade journal for forex.

COT Market Sentiment

AUD – WEAK (4/5)

GBP – STRONG (5/5)

CAD – WEAK (5/5)

EUR – STRONG (5/5)

JPY – STRONG (4/5)

CHF – WEAK (5/5)

USD – WEAK (5/5)

NZD – STRONG (4/5)

GOLD – STRONG (5/5)

SILVER – STRONG (4/5)

Market Analysis

GOLD

Gold is consolidating after testing its lower boundary and EMA200. The MACD is flattening, and RSI remains neutral, suggesting that price may remain range-bound for now. However, this COT forex signal still favors a bearish bias as price holds a descending structure. Until a break occurs, traders should focus on maintaining discipline and applying flexible trade management techniques.

SILVER

Silver continues to weaken after repeated failures at the 36.7308 resistance. Although still in a range, the loss of support from the EMA200 gives bears more control. Among the 10 COT forex signals, Silver reflects a slow but developing bearish trend. Traders may consider short setups on structure breaks, while using their forex risk management plan to guard against false signals.

DXY

The Dollar is pulling back after the Fed’s June meeting minutes hinted at future rate cuts. This dovish tilt, combined with a plunge in Treasury yields, weakened the Greenback. MACD shows increased selling volume, while RSI normalized from oversold territory. Still, the broader bullish trend remains intact, making this one of the more complex COT forex signals. Monitoring upcoming FOMC guidance and maintaining a structured forex trading approach will be essential here.

GBPUSD

The Pound is attempting a sell continuation following a stagnant period. RSI is still overbought, and MACD remains stagnant, indicating potential downside if selling resumes. This pair’s COT forex signal reflects a cautious short bias. Traders should track price reactions at key levels and document potential shift points in their trade journal for forex.

AUDUSD

The Aussie is showing mixed signals. While the RBA held rates steady and struck a hawkish tone, technicals remain bearish. Price is stuck in a range with resistance at 0.65618. Until that breaks, the COT forex signal remains neutral to bearish. Traders should stay data-driven—balancing fundamentals and technicals—and avoid premature entries.

NZDUSD

The Kiwi continues its range-bound behavior but is leaning bearish. RSI shows potential for further downside, though MACD remains muted. The COT forex signal here is still tilted toward short setups, especially if the EMA200 holds as resistance. A conservative approach with predefined stop levels fits this type of slow-moving setup.

EURUSD

The Euro is finding support after its bearish leg lost momentum. Bullish MACD volume is increasing, but RSI signals overbought conditions. This mixed COT forex signal requires a wait-and-see approach. Either a breakout above resistance or a reversal from overbought zones will define the next move. Until then, documenting price behavior in your trade journal for forex can help identify future breakout patterns.

USDJPY

The Yen is gaining strength, pushing USD/JPY lower. MACD and RSI both support the sell move despite the pair's overall bullish structure. This is one of the clearer COT forex signals favoring a tactical short. As the pair reacts to both technical resistance and macro headlines, sticking to your forex entry and exit strategy becomes critical.

USDCHF

USD/CHF is pulling back after testing resistance. MACD and RSI point to further downside. This bearish COT forex signal reflects safe-haven preference for the Franc amid rising global tensions. It’s a clean setup to apply your trade management techniques, such as staggered exits or trailing stops, as volatility builds.

USDCAD

USD/CAD is surging as the Canadian Dollar weakens. MACD and RSI show strong bullish momentum, and price has clearly broken above previous resistance. Among this week’s COT forex signals, USDCAD offers one of the most technically aligned continuation setups. However, with trade tensions looming, managing exposure with a solid forex risk management plan is vital.

Final Thoughts

This week’s COT forex signals reflect a volatile landscape shaped by dovish Fed expectations, tariff escalation, and shifting yield dynamics. Traders who rely on a structured forex trading approach will be better equipped to handle these evolving scenarios. Whether you’re entering a continuation play on USDCAD or cautiously watching EURUSD, each move should be logged in your trade journal for forex and governed by a disciplined forex risk management plan.

0 notes

Text

Thorough use of fundamental analysis and technical analysis to continue winning in stock investment

In order to achieve results in business and investment, a calm analysis based on data is essential. Fundamental analysis to determine the true value of a company, technical analysis to read market trends, and the use of screening tools to efficiently discover good stocks are essential skills for modern investors. In this article, we will explain in practice the advanced analytical methods that you can learn at Harvard and Stanford Business Schools.

Table of contents

1. Fundamental analysis that measures the intrinsic value of a company

・Predict the future with indicators of growth and competitiveness

・The health and risk of companies from the perspective of financial ratios

2. Technical analysis that foreseads market movements

・Optimize trading timing with charts and trend analysis

・Reverse and backward strategies using RSI and MACD

3. A screening tool that realizes efficient stock selection

・Filtering that integrates fundamental and technical

・Setting conditions suitable for both long-term investment and short-term trading

1. Fundamental analysis that measures the intrinsic value of a company

The true value of a company lies in numbers and strategies. Fundamental analysis is a core method for dissecting financial statements and performance indicators to determine whether a company can grow in the future.

・Predict the future with indicators of growth and competitiveness

Sales growth rate and profit growth rate are important barometers that measure the pace of a company's expansion. However, it is essential to compare the average growth rate and industry averages for the past five years without being influenced by the figures of a single year. In the analysis of competitiveness, not only market share, but also intangible assets such as the number of patent holdings and brand loyalty are included in the evaluation. If it is a technology company, the ratio of R&D investment to sales is the key, and if it is a retail industry, the trend of customer unit price is the key.

・The health and risk of companies from the perspective of financial ratios

Companies with a high ROE (return on equity) have excellent capital efficiency, but it is important to be careful to see if they are being drained by excessive debt. The debt ratio and the current ratio are used together to verify the short-term ability to pay. In addition, the discrepancy between "cash earned" and "profit on the books" is checked from the cash flow statement, and the risk of embellishment is eliminated.

2. Technical analysis that foreseads market movements

The price chart is a map that visualizes the psychology of investors. By deepening technical analysis, you can capture the turning point of group psychology.

・Optimize trading timing with charts and trend analysis

The "positive continuous" and "cross lines" of candlesticks are signals that indicate the overheating of the market. On the other hand, the moving average determines the reversal of the long-term trend by whether it is above or below the 200-day line. Applying the Dow theory, the method of calculating the trend continuation rate from the update pattern of high and low prices is also effective.

・Reverse and backward strategies using RSI and MACD

It is dangerous to simply interpret that the RSI is overbought at over 70% and oversold at 30%. In the phase where the MACD's histogram expands, it shows the acceleration of the trend, and when it converges, it is a sign of a change. Combine these indicators with Bollinger Bands to build a strategy that takes volatility into account.

3. A screening tool that realizes efficient stock selection

To maximize the time-effectiveness, the know-how of condition setting is the difference.

・Filtering that integrates fundamental and technical

In addition to classic conditions such as "PBR 1 time or less and ROE 8% or more", changes in institutional investors' holding ratios and insider trading data are combined. More and more professional investors are using the "Custom Indicators" function of the screening tool and applying their own developed algorithms.

・Setting conditions suitable for both long-term investment and short-term trading

Value investment focuses on dividend yields and FCF (free cash flow) growth rates. Day trading monitors the divergence rate from VWAP (to volume-weighted average price) for stocks with soaring volume.

At the end

The essence of modern investment strategies is analysis that uses data as a weapon and excludes emotions. The method introduced in this article is only a theoretical framework. In the actual market, new variables are always generated. Build your own "investment philosophy" through continuous learning and practice.

4. In-depth analysis of financial data: the essence of cash flow management

The true health of a company is reflected in the cash flow statement, not the income statement. In order to identify good companies, it is necessary to analyze the three types of cash flows together.

The basic premise is that the operating cash flow is continuously positive, but the quality is more important. Compare the depreciation expense with the figures before the addition adjustment, and grasp the cash that is actually generated in the main business. Regarding investment cash flow, we will evaluate how investment in R&D and M&A will lead to future growth, not just the amount of capital investment. In financial cash flow, we pay attention to the balance between own stock purchases and dividends.

5. The forefront of valuation methods: DCF and real options

In addition to traditional PER and PBR, understanding the advanced value evaluation methods adopted by institutional investors is the key to building a competitive advantage.

In the DCF (Discounted Cash Flow) analysis, in addition to the FCF forecast for the future, it is necessary to carefully estimate the closing price. The calculation of WACC (weighted average cost of capital) uses different beta values for each industry. By applying the real option theory, you can calculate the potential value of an unlisted subsidiary and the optional value of a patent portfolio.

6. Market psychology applied to behavioral economics

As the limits of the efficient market hypothesis are revealed, the method of exploiting the irrationality of the market created by cognitive bias is attracting attention.

The resistance and support lines formed by the anchoring effect can be stronger psychological barriers than the numerical values of technical analysis. In markets with a strong tendency to avoid losses, there is a frequent pattern of soaring volume near the lower price support line. If you combine social media sentiment analysis with VIX (phobia index), you can quantitatively measure the overheating of the market.

7. Global Macro Strategy: The correlation between exchange rates and commodity markets

In modern stock investment, the impact of exchange rate risk and commodity prices cannot be ignored.

Emerging country companies with dollar-denominated debts may have a case where the depreciation of their own currency compresses their profits. We will understand the industry-specific commodity exposure, such as the inverse correlation between crude oil prices and aviation stocks, and the linkage between gold prices and financial stocks. Understand the mechanism by which the GDP growth rate of the BRICS countries and the spread of U.S. long-term interest rates determine the flow of international funds.

8. The impact of sustainability management on investment

The impact of the ESG element on corporate value has reached a stage where it can no longer be ignored.

While the disclosure of CO2 emissions is mandatory, the ability to calculate Scope3 (emissions of the entire value chain) affects the competitiveness of companies. In order to measure the degree of response to the circular economy, we quantify the utilization rate of recycled materials for sales and measures to extend product life. In the governance evaluation, in addition to the ratio of female executives, the contents of the management's long-term incentive plan will be scrutinized.

9. Algorithmic strategy in the era of quantum computing

Next-generation technologies following AI are changing the paradigm of investment analysis.

The optimization algorithm using quantum annealing demonstrates accuracy that surpasses traditional Monte Carlo simulation. The evolution of natural language processing has made it possible to quantify changes in the tone and subtle nuances of the earnings briefing. With the blockchain analysis tool, you can track the wallet trends of institutional investors in real time.

10. Crisis response simulation and stress test

In an environment where Black Swan events become normal, building resilience is the most important issue.

We will conduct a three-stage scenario analysis assuming pandemic and geopolitical risks. In the balance sheet stress test, in addition to the liquidity coverage ratio (LCR), the potential risks of off-balance items are assessed. Based on the performance of each industry in the past crisis, we derive the optimal distribution of defensive stocks and cyclical stocks.

At the end

The modern investment environment has become more complex and cannot be competed with a single analytical method. The fusion of fundamental and technical, the integration of traditional knowledge and advanced technology, and the mutual verification of financial data and non-financial information - only by making full use of these can we acquire a true alpha. It can be said that the will to continue to learn is the most important asset in order to survive in a market where change is the only constant.

0 notes

Text

Bitcoin’s Ancient Whale Awakens: New Highs, New Fears? Institutional Hands Take Over

#Bitcoin #CryptoMarket

This article only provides an analysis of market trends and does not constitute any investment advice.

On July 14, BTC surged past $123,000, setting a new high. Taking advantage of this price peak, a legendary whale — who began accumulating BTC in 2011 and once held 80,000 coins (with cost basis between $0.78 and $3.37) — started transferring BTC to Galaxy Digital. Galaxy Digital operates across asset management, digital infrastructure solutions, investment banking, and other sectors.

These 80,000 BTC are worth over $9.6 billion. For an early-generation BTC holder like this, the gains have already exceeded tens of millions of times. That’s why moves from “ancient whales” often send a chill through the market: is this a sign of a looming top?

Click to register SuperEx

Click to download the SuperEx APP

Click to enter SuperEx CMC

Click to enter SuperEx DAO Academy — Space

Is this a sell-off or just a “handover”?

Many immediately linked the news to last year’s BTC downturn caused by the German government selling 50,000 BTC. The mere mention of a whale move stirred panic. Sure enough, on July 15, BTC pulled back over 5% from the previous day’s high.

But looking closely, this whale didn’t dump everything — it chose to offload gradually via institutional channels. Smart institutional buyers were willing to take over these deeply held coins. In essence, this is a case of “high-cost whales” making room for “low-cost institutions.” It resembles a mid-cycle bull market handoff more than a market top warning.

Why does institutional takeover matter so much?

As of mid-July 2025, over 260 institutions and public companies hold BTC, totaling nearly 3.5 million coins. MicroStrategy alone bought 4,225 BTC between July 7–13, bringing its total holdings to 600,000 BTC. Meanwhile, the number of medium-sized addresses (holding 100–1,000 BTC) has significantly increased, rising from 3.9 million to 4.76 million coins. This indicates that institutions are entering aggressively, fueling BTC’s sustained price growth.

Institutions don’t just bring deep pockets — they typically take strategic positions with holding periods far longer than retail investors. Their steady inflow and handoff behavior are transforming them into the new market-driving force. OTC buyers, for instance, are leveraging deep liquidity to absorb whale-scale dumps.

Interestingly, even as BTC hits new highs, retail chatter on social media remains subdued. The number of small BTC-holding wallets is growing slowly, indicating that “retail FOMO” hasn’t kicked in yet. In past bull markets, the biggest rallies often came when retail was most active. The current “quiet entry” may actually be the perfect window for quality retail onboarding. Still, the market is not without risk — retail investors are advised to manage position sizes prudently, enter in tranches, and closely monitor macro and on-chain indicators.

Let’s talk long-term trends: Eight words — Ancient Whale Awakens, Institutions Strategize

“Ancient whale awakenings” typically occur in the middle of bull cycles — when prices rise steadily and institutions begin profit-taking. Every bull market has seen these narratives. In the 2021 golden bull run, similar whale transfers triggered short-term volatility but didn’t create sustained sell pressure. The market soon broke through and entered a new cycle.

This time, the whale is using Galaxy’s OTC desk, signaling a “main channel adjustment.” Institutions are ready, with capital on hand — indicating the upward trend remains intact. After all, one OTC desk absorbing tens of millions in BTC doesn’t spell doom — it reflects institutional-level handover.

From a technical standpoint, BTC’s short-term pullback remains within a medium- to long-term uptrend. MACD/RSI indicators haven’t shown extreme overbought/oversold signals and remain biased toward bullishness.

On-chain, long-term holders have high cost bases. Current price fluctuations mostly reflect internal rotations among holders, not a bursting bubble. In the medium term, institutional allocations are likely to remain locked for the long haul or used as backing for financial products (staking, ETF reserves, etc.). Market structure is stabilizing.

So, is this a turning point or a crossroads?

Although the whale transfer triggered short-term tension, it didn’t cause panic or systemic breakdowns. In other words, this looks more like a “healthy mid-cycle adjustment and structural handoff.”

With long-term holders (institutions, corporations) taking control, BTC price gains become more resilient. From a certain perspective, this adjustment signals a shift in market leadership. Retail used to drive bull markets with emotion, but now institutions and high-net-worth players clearly occupy center stage.

It’s like a baton pass in the battle between bulls and bears — ancient whales and retail may quietly be handing the torch to Wall Street.

That doesn’t mean retail is out of the game. On the contrary, under this wave of structural capital inflow and increasing regulatory clarity, retail’s role is evolving — from “wave maker” to “trend follower.” But with the right timing, they can still profit handsomely from the cycle.

For example, institutions like Galaxy Digital, Fidelity, MicroStrategy, and BlackRock are now classifying BTC as core holdings in their portfolios — not speculative “satellite assets.” This means they are unlikely to sell anytime soon and more likely to lock their BTC long-term, providing price support in secondary markets.

At the same time, on-chain data shows a sharp rise in addresses holding 100–1,000 BTC — often associated with small funds, family offices, and high-net-worth individuals. These players are more flexible than institutions, more aggressive than retail, and are key to driving price upward. In other words, the middle class is institutionalizing.

For ordinary investors, two key directions now deserve attention:

First, the trend of on-chain capital inflows and outflows.

The ancient whale’s BTC will most likely be “fed” to institutions via OTC transactions. This doesn’t cause direct market dumping but may create local liquidity slack — opening entry windows for “smart money.” We’ve already seen this: following the mid-July correction, a large amount of sideline capital has started flowing into BTC via CEXs and ETH-based channels — meaning “buy-the-dip” behavior is already underway.

Second, the alignment of policy and macro cycles.

The Trump administration recently announced multiple crypto-friendly policies (including JPMorgan accepting BTC as collateral, BTC added to national reserves, etc.). If this trend continues, the convergence of traditional finance and crypto markets will accelerate. In an election year, with crypto “legalization dividends” in play, this could become a key catalyst in Q3–Q4 2025.

Conclusion

Put simply, if you’re someone thinking of entering the market but worried it’s already “too high,” now is actually the best time to sharpen your fundamentals:

Learn to read on-chain data;

Don’t all-in — scale in gradually;

Avoid chasing tops or panic selling — use narrative timing, not candlestick emotions.

Remember: OTC transfers are not the same as CEX dumping — don’t be scared by large transfers on the surface.

One last point that matters: This bull run isn’t like 2021’s meme-fueled speculative loop. It’s built on ETFs, spot trading, institutional allocations, and on-chain regulatory alignment. That makes it more durable — but also more logical. Prices won’t rise because of who shouts the loudest, but because capital, policy, and narratives align long-term.

So, the awakening of the ancient whale isn’t the end — it’s the beginning of the next structural adjustment in the 2025 crypto market.

0 notes

Text

Proven MMI Strategies: How to Trade Fear and Greed Like a Market Veteran

In the dynamic world of stock markets, understanding investor sentiment is as important as analyzing technical charts and financial data. This is where the MMI Index, also known as the Market Mood Index, comes into play. Designed to gauge the prevailing mood of the market, this indicator helps traders and investors make more informed decisions by revealing whether the crowd is feeling greedy, fearful, or neutral.

What is the MMI Index?

The MMI Index stands for Market Mood Index, a sentiment analysis tool that measures the emotional state of market participants. It works on the principle that human emotions like fear and greed drive stock price movements. By quantifying these emotions, the index provides insights into whether the market is overheated or undervalued.

In simple terms, when the Market Mood Index shows extreme greed, it could signal that markets are due for a correction. On the other hand, when fear dominates, it might indicate potential buying opportunities for value investors.

Why is the Market Mood Index Important?

Markets are often influenced by emotions rather than logic. Even experienced traders sometimes make irrational decisions during volatile periods. The MMI Index acts as a compass, helping investors stay objective.

Here are some reasons why the Market Mood Index is becoming increasingly popular:

Identifies Market Extremes: By tracking market emotions, the index helps spot overbought and oversold conditions.

Supports Risk Management: Investors can adjust their portfolios based on whether the mood is too bullish or bearish.

Complements Technical Analysis: While technical indicators look at price and volume, the MMI Index provides a psychological perspective.

How Does the MMI Index Work?

The MMI Index typically combines various data points such as volatility, market breadth, and trading volume. Some versions may also factor in social media trends and news sentiment.

Extreme Greed (80-100): Markets are likely overbought; caution is advised.

Greed (60-79): Positive sentiment dominates, but watch for signs of reversal.

Neutral (40-59): Balanced market mood; no strong bias.

Fear (20-39): Negative sentiment; potential buying opportunities.

Extreme Fear (0-19): Markets may be oversold; contrarian investors often take interest here.

By observing these levels, traders can gauge whether to enter, exit, or hold their positions.

Benefits of Using the Market Mood Index

For retail investors and professionals alike, the Market Mood Index offers several advantages:

✅ Emotional Discipline: It discourages panic-selling during market drops and overconfidence during rallies. ✅ Better Timing: Helps in identifying ideal entry and exit points based on sentiment extremes. ✅ Enhanced Strategies: When combined with fundamental and technical analysis, the MMI Index adds a layer of sentiment-driven strategy.

Limitations to Consider

While the MMI Index is a powerful tool, it is not foolproof. Sentiment indicators can sometimes give false signals, especially during unprecedented events like pandemics or geopolitical crises. It should always be used in conjunction with other indicators and not as a standalone decision-making tool.

How to Use the MMI Index Effectively

Contrarian Approach: When the Market Mood Index shows extreme greed, consider reducing exposure. When it signals extreme fear, explore buying opportunities.

Long-term Investing: For long-term investors, the index can serve as a guide to avoid emotional pitfalls during market highs and lows.

Conclusion

The MMI Index is more than just a sentiment indicator; it is a psychological mirror of the market. By tracking the Market Mood Index, traders and investors can gain valuable insights into the emotions driving price movements. Whether you are a beginner or a seasoned investor, incorporating the MMI Index into your strategy can help you make more balanced and rational decisions in the ever-changing stock market landscape.

0 notes

Text

Which Intraday Indicators Are Actually Working for Nifty Traders in 2025?

Nifty Trading in 2025 Bollinger Bands are the right tools to help nifty intraday trading strategy because they identify volatility and breakout potential. This blog will focus on seven signals with a focus of the use of Bollinger Bands using a 20 period moving average and its bands on the standard deviation to either identify a squeeze or overbought/oversold conditions. On 5-minute Nifty charts, band squeezes indicate possible breakouts, with validation confirmed by RSI/volume. Let’s not dive much deeper but know that Bollinger Bands application, CNX enable you determine these real time to hone the Nifty intraday trading strategies. Trading setup Traders can use the middle SMA for good dynamic S/R levels for those precise and high probability trades so required from the nifty 50 market.

0 notes