#Payment Methods

Explore tagged Tumblr posts

Text

Alternative Payment Methods

Offering multiple payment options improves customer satisfaction and boosts sales. This infographic highlights the importance of alternative payment methods and their benefits for businesses and consumers. It covers key solutions like eWallets, BNPL, and mobile wallets while explaining their role in reducing cart abandonment and processing costs. Read the whole infographic to know more.

4 notes

·

View notes

Text

My conspiracy theory is that the magnet stripe on bank cards no longer functions at all, but nobody uses it, so nobody realises that. I've once tried paying by swiping the card through and it didn't work. I asked the cashier if they ever saw a customer successfully pay by swiping and they said they didn't. Either the device manufacturers are lying, or the banks are lying, or both

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

My whole fit is from shein y'all I been getting orders after orders here's a little supply hack if your into the reselling/ drop shipping industry I get $1000+ worth of clothes n accessories and resell them and any amount I make is a good amount because I got all the supplies FREE! YOU CAN do it everyday ! Until they stop it I'd get on it #shein

1 note

·

View note

Text

Secure Transaction Services

Unlock peace of mind by using our secure transaction services that guard your personal info during payments, making online buying safe and easy every time.

0 notes

Text

What Are the Most Secure Payment Methods for Betting in 2025?

0 notes

Text

印尼可以用美金嗎?

想像一下,你在台灣的旅途中突然遇到需要支付外幣的情況,心中不禁疑惑:「印尼可以用美金嗎?」這個問題看似簡單,但卻牽動著許多出國或跨境交易者的實際需求。事實上,在台灣,雖然新台幣是主要流通貨幣,但在特定情境下使用美元仍具有一定便利性。例如,部分國際酒店、航空公司或免稅店接受美元付款,使得旅客能更輕鬆地進行消費。而且,隨著全球經濟一體化,美金已成為國際間最普遍的儲備和交易貨幣之一。在台灣,不少金融機構也提供美元兌換與存款服務,讓你在海外旅行或商務往來時更加方便。因此,如果你正計劃前往印尼或其他國家,不妨提前了解當地是否接受美元,以及如何安全有效地運���你的外匯資源。掌握這些資訊,不僅能提升你的出行效率,更能讓你在跨境交流中游刃有餘。記住,美金作為全球通用貨幣,在台灣同樣扮演著重要角色,只要善加利用,就能帶來更多便利與安心。 文章目錄 印尼旅遊消費指南:美金使用詳解與換匯策略 深入剖析印尼當地…

0 notes

Text

Website : https://findshopgo.com/

Address : 609/205 Charoen Rat Road, Chiang Mai 50000, Thailand

Phone : +4565742003

FindShopGo.com is an online platform designed to give consumers a comprehensive overview of the different payment methods available for online purchases. Focusing on educating users and simplifying the payment process, FindShopGo.com helps shoppers make informed decisions about how they pay for goods and services, empowering them to take control of their online shopping experiences.

Business Mail : [email protected]

1 note

·

View note

Text

#CFD trading#forex trading#commodities#indices#shares#ETFs#cryptocurrencies#online trading#trading education#trading tools#economic calendar#trading signals#live charts#trading sentiment#AI trading tools#regulated broker#secure trading#trading platform#payment methods#welcome package#refer a friend#PSV Eindhoven partnership#customer support#mobile trading app#trading insights#trading indicators#trading tutorials#trading guide#1-on-1 training#trader education

1 note

·

View note

Text

Tyler Technologies: Payment Service, Credit Card Charge Inquiry

Have you Inquire about a payment service charge from your credit or debit card statement. Manage payments and accept various card types using our technology. Noticed a mysterious charge from Tyler Technologies on your credit card statement? Don’t worry—you’re not alone. Many people spot this name and wonder what it’s for. This guide breaks down what Tyler Technologies is, why they might appear on…

#agency payments#agency verification#automated billing#billing management#consumer protection#court fines#court systems#credit card charge#customer service#data analytics#data protection#digital payments#dispute charges#electronic payments#financial alerts#financial institution#financial security#fraud prevention#fraud reporting#government fees#government services#identity theft#licenses#mobile payments#online payments#payment confirmations#payment disputes#payment methods#payment platform#payment portals

1 note

·

View note

Text

Alternative Payment Methods

Reliable and efficient transactions form the backbone of every successful business, driving customer satisfaction and smooth operations. At WebPays, we offer payment solutions that meet your needs. We support alternative payment methods including digital wallets, buy now pay later and contactless payments. Contact us to expand your payment options.

1 note

·

View note

Text

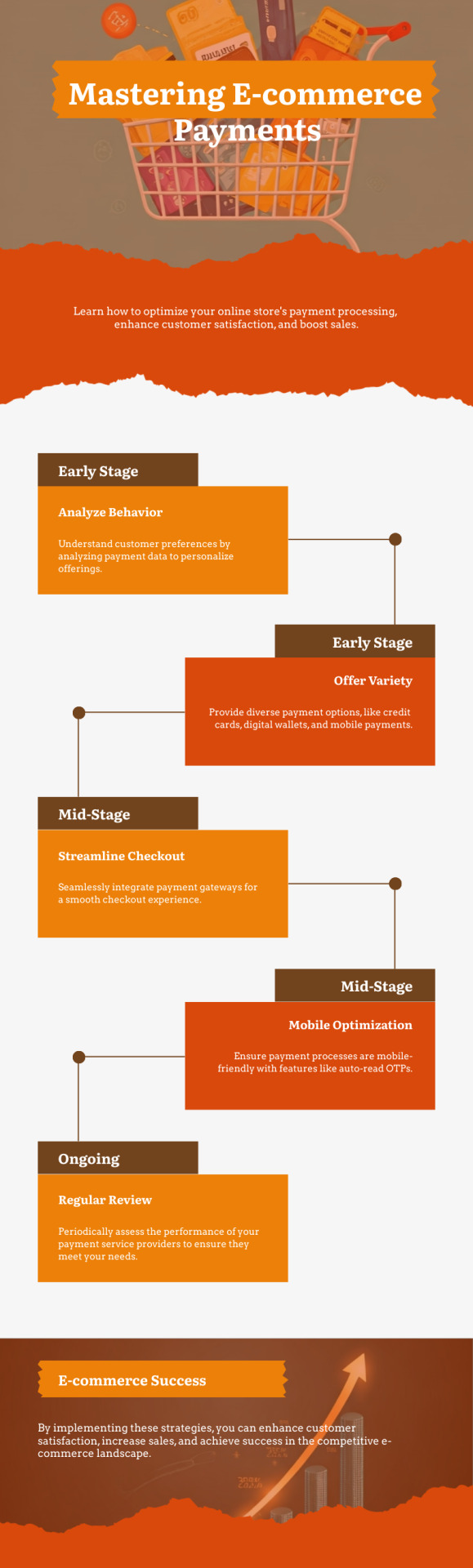

Mastering E-commerce Payments: Key Tips for Policy Consolidation

1. Analyze Customer Payment Behavior

Use payment analytics to understand which methods your customers prefer. Tailoring your offerings based on this data can enhance customer satisfaction and increase sales.

3. Implement Built-in Payment Analytics

Leverage built-in analytics tools to monitor transaction data in real-time. This allows for quick identification of trends and issues, enabling data-driven decisions to optimize payment processes.

4. Streamline Checkout Processes

Ensure that the payment flow is seamless by integrating payment gateways that allow customers to complete transactions without leaving your site. This enhances user experience and reduces cart abandonment rates.

5. Optimize for Mobile Devices

With the increasing use of mobile shopping, ensure that your payment processes are mobile-friendly. Implement features like auto-read OTPs for a smoother checkout experience.

By implementing these strategies, e-commerce businesses can streamline their payment policies, enhance customer satisfaction, and ultimately drive growth in a competitive marketplace

0 notes

Text

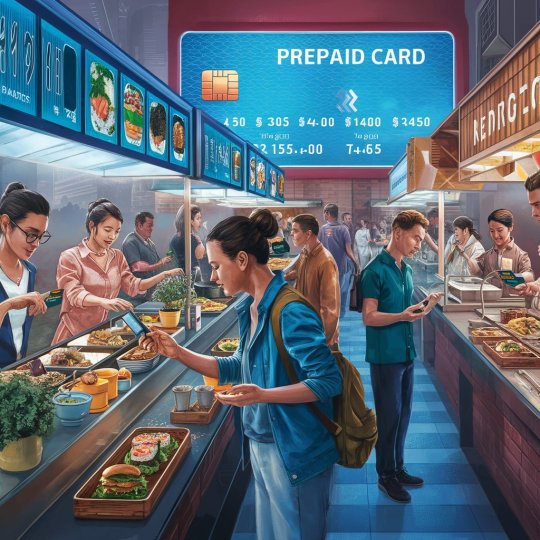

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

Global Alternative Payment Methods

Reliable and efficient transactions are key to customer satisfaction and business growth. At WebPays, we offer global alternative payment methods designed to meet your diverse needs, featuring digital wallets, buy now pay later options, and contactless payments. Contact us today to diversify your payment options.

#alternative payment methods#payment methods#payment processing#payment processor#payments#payment solutions#digital payments#webpays

0 notes

Text

Choose from Convenient Payment Methods

With our wide variety of payment options, select the method that best suits your needs and preferences, whether it’s using your credit card, debit card, or mobile payments.

0 notes

Text

New Payment Options at The Game Crafter

We recently upgraded the PayPal integration on our site and so you'll notice a slightly different user experience during checkout if you use PayPal as your payment method. In addition, this allowed us to support 2 new payment methods: Venmo & Pay Later.

0 notes