#Precision Casting for Critical Aircraft Components

Explore tagged Tumblr posts

Text

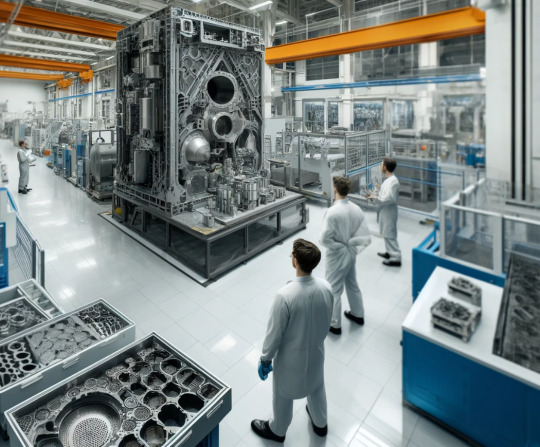

Investment Castings for Aircraft Structural Elements A Focus on Unitritech's Excellence

Investment castings, also known as precision castings, play a crucial role in the aerospace industry, particularly in the manufacturing of structural elements for aircraft. These castings are made using a wax pattern that is coated with a refractory ceramic material. Once the ceramic material hardens, the wax is melted away, leaving a precise mold that can produce high-tolerance, intricate components ideal for aerospace applications.

One of the leading manufacturers in this field is Unitritech, renowned for their superior investment castings for structural elements of aircraft. Unitritech utilizes advanced technologies and stringent quality control processes to ensure that each casting meets the rigorous demands of the aerospace industry. Their investment castings are characterized by exceptional strength, lightweight properties, and the ability to withstand extreme temperatures and pressures, making them perfect for critical structural components of aircraft.

Unitritech's commitment to innovation and excellence has positioned them as a top choice for aerospace manufacturers seeking reliable and high-performance structural elements. Their expertise in producing complex geometries and maintaining tight tolerances ensures that every component contributes to the overall safety, efficiency, and performance of the aircraft.

In summary, investment castings are essential for the aerospace industry, and Unitritech stands out as a premier provider of these critical components, ensuring the highest standards of quality and performance in aircraft structural elements.

#High-Precision Investment Castings for Aerospace Applications#Reliable Structural Elements for Aircraft in Investment Castings#Durable and Lightweight Investment Castings for Aerospace#Quality Investment Castings for Aerospace Structural Elements#Precision Casting for Critical Aircraft Components#Ensuring Flight Safety with Precision Investment Castings

0 notes

Text

Excellence in Non-Ferrous Forging & Casting in India

Non-ferrous forging and casting have emerged as critical processes in the manufacturing landscape, contributing significantly to India's industrial prowess. With a focus on metals like aluminum, copper, brass, and bronze, the country's expertise in non-ferrous forging and casting has reached new heights. Let's explore the excellence that India brings to these essential metallurgical processes.

Non-ferrous forging in India is marked by precision and skill, as manufacturers leverage advanced techniques to shape metals into components with superior mechanical properties. The forging process involves applying heat and pressure to mold metals into desired forms, enhancing their strength and durability. Indian forging facilities are equipped with state-of-the-art technology, ensuring the production of high-quality components that meet international standards.

Casting, another integral part of non-ferrous metal processing, is equally impressive in India. Foundries across the country use advanced casting methods to create intricate and complex shapes from molten non-ferrous metals. The attention to detail in the casting process is evident in the precision components that are vital to various industries.

Industries such as automotive, aerospace, and electronics in India benefit significantly from the excellence in non-ferrous forging and casting. The automotive sector, for instance, relies on these processes for manufacturing engine components, transmission parts, and lightweight structural elements. The use of non-ferrous metals contributes to fuel efficiency and sustainability, aligning with global trends.

In the aerospace industry, where precision and reliability are paramount, non-ferrous forging and casting play a crucial role. Components like aircraft engine parts and structural elements are crafted with meticulous attention to detail, ensuring the highest standards of performance and safety.

The electronics industry in India also reaps the rewards of non-ferrous forging and casting. The superior thermal conductivity of non-ferrous metals makes them ideal for applications such as heat sinks and connectors. The corrosion resistance of these metals ensures the longevity of electronic components in various environments.

As India continues to position itself as a global manufacturing hub, the excellence in non-ferrous forging and casting becomes a cornerstone of its industrial success. The commitment to quality, technological advancement, and sustainability places India at the forefront of non-ferrous metallurgy, contributing to the growth and competitiveness of its industries on the world stage. The journey of excellence in non-ferrous forging and casting in India is undoubtedly a testament to the nation's capabilities in shaping the future of manufacturing.

3 notes

·

View notes

Text

Aluminum Annealing Furnace – Enhancing Ductility, Strength & Surface Finish

Aluminum and its alloys are widely used in industries like automotive, aerospace, construction, packaging, and electronics due to their lightweight, corrosion resistance, and excellent thermal conductivity. However, processes such as rolling, extrusion, or forming introduce internal stresses and reduce ductility. To restore their original properties, annealing is essential.

As a leading aluminum annealing furnace manufacturer in India, JR Furnace & Ovens delivers advanced, high-precision thermal systems specifically designed for annealing aluminum and non-ferrous metals. Our furnaces ensure accurate temperature control, uniform heating, and energy-efficient performance—making them ideal for mass production and critical applications.

What Is an Aluminum Annealing Furnace?

An aluminum annealing furnace is a thermal processing unit designed to heat aluminum sheets, billets, coils, extrusions, or castings to a controlled temperature (usually between 300°C and 450°C) and then cool them slowly. This process:

Relieves internal stresses

Improves ductility and formability

Restores electrical conductivity

Enhances surface finish

Prepares material for further forming or machining

Unlike steel, aluminum requires lower annealing temperatures and more precise control to avoid overheating or surface oxidation.

Applications of Aluminum Annealing Furnaces

Aluminum annealing is a crucial process in various industries, such as:

Automotive – Body panels, frames, and battery enclosures

Aerospace – Aircraft skins, structural components

Packaging – Foil, cans, and containers

Construction – Panels, extrusions, and facades

Electrical – Busbars, wires, and connectors

Furniture & Appliances – Frames, extruded sections, trims

JR Furnace – Advanced Aluminum Annealing Furnace Solutions

At JR Furnace & Ovens, we specialize in custom-designed furnaces optimized for aluminum heat treatment. Our systems are engineered for temperature accuracy, low energy consumption, and operational safety.

Key Features:

Temperature Range: 150°C to 600°C (precisely controlled)

Heating Options: Electric or Gas-Fired

Control System: Digital PID / PLC-SCADA with HMI

Construction: Rigid steel body with high-density ceramic fiber or refractory lining

Atmosphere: Air or Inert Gas (Nitrogen) to avoid oxidation

Cooling Options: Forced air or controlled natural cooling

Loading Systems: Manual, trolley, or automated roller conveyor

Types of Aluminum Annealing Furnaces We Offer

Box-Type Annealing Furnace Suitable for batch annealing of aluminum castings, billets, or fabricated parts.

Bell-Type Annealing Furnace Sealed design used for oxidation-free annealing of aluminum coils or sheets under controlled atmosphere.

Bogie Hearth Annealing Furnace Heavy-duty solution for large and heavy aluminum parts; ideal for extrusion industries.

Chamber Type Furnace Designed for high-throughput annealing processes with excellent temperature uniformity.

Continuous Conveyor Furnace Automated annealing line for large-scale operations in foil and packaging industries.

Benefits of JR Aluminum Annealing Furnaces

✅ Uniform Heating – Even temperature distribution across all zones ✅ Accurate Control – PLC-based operation ensures consistent annealing cycles ✅ Energy Efficiency – Advanced insulation and burner/heater design reduce energy consumption ✅ Surface Protection – Optional inert gas purging prevents oxidation or discoloration ✅ Flexible Design – Custom-built to fit your space, material size, and productivity goals ✅ Long Equipment Life – Industrial-grade materials and craftsmanship ensure durability

Industries We Serve

✔ Aluminum Extrusion & Rolling Plants ✔ Automotive Component Manufacturers ✔ Aerospace Suppliers ✔ Metal Packaging & Foil Producers ✔ Electrical Equipment Manufacturers ✔ General Metalworking & Foundries

Why Choose JR Furnace & Ovens?

30+ Years of Manufacturing Expertise

ISO-Certified Production & Testing Facility

Fully Customizable Furnace Designs

Global Export Presence

End-to-End Service: Design → Commissioning → AMC

Innovative Solutions with Proven Thermal Engineering

We help manufacturers improve product quality, reduce scrap, and meet international metallurgical standards through advanced aluminum annealing furnaces.

Ready to Upgrade Your Heat Treatment Line?

Whether you're looking to install a new aluminum annealing furnace or retrofit your current setup, JR Furnace & Ovens provides reliable, high-efficiency systems backed by expert service and support.

0 notes

Text

Investment Casting Market Forecast 2034: Industry Set to Double by 2034

The global investment casting market, valued at US$ 16.9 billion in 2023, is poised for significant growth over the next decade. Analysts project the market to expand at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2034, reaching an impressive valuation of US$ 33.9 billion by the end of 2034. This surge is driven largely by expanding demand from the aerospace and defense sectors, as well as the increasing integration of additive manufacturing technologies in the investment casting process.

Understanding Investment Casting

Investment casting, also known as lost-wax casting, is a precision metal-forming process that involves creating a wax replica of the desired part. This wax pattern is then encased in a ceramic mold. Once the ceramic hardens, the wax is melted away, leaving a cavity for molten metal to be poured in, forming the final component. This method is ideal for manufacturing complex shapes with high dimensional accuracy and excellent surface finish.

Materials commonly used in investment casting include carbon steel, stainless steel, alloy steel, aluminum, copper, nickel alloys, titanium, and magnesium. Each offers specific properties like ductility, strength, and corrosion resistance suited for various industrial applications.

Key Growth Drivers

Aerospace & Defense Sector Expansion

The aerospace and defense sector remains a vital growth engine for the investment casting market. Investment casting is essential in manufacturing temperature-sensitive components used in jet engines and industrial gas turbines. These components require intricate geometries and must withstand extreme operating conditions, which investment casting can provide with high precision.

For example, the development of gas turbine engines with advanced aerothermal designs relies heavily on investment cast parts. The rising demand for fuel-efficient, high-performance engines in both commercial and military aviation is significantly propelling market growth.

In 2023, Safran announced plans to establish a maintenance, repair, and overhaul (MRO) facility for LEAP commercial aircraft engines in India, reflecting increasing regional investments. Similarly, GE Aerospace has committed over US$ 650 million to enhance its global manufacturing plants, emphasizing 3D printing-enabled production of LEAP and GE9X engines, which incorporate numerous 3D printed components.

Integration of Additive Manufacturing (Rapid Investment Casting)

The advent of additive manufacturing (AM) has revolutionized the investment casting process. Rapid Investment Casting (RIC) integrates AM technologies to replace traditional pattern-making, drastically reducing lead times and costs without compromising quality.

RIC enables manufacturers to quickly prototype and produce complex castings, improving flexibility and responsiveness in various industries. The technology’s adoption is accelerating, especially in aerospace, where time-to-market and precision are critical.

Regional Insights

Asia Pacific currently holds the largest share of the investment casting market. The region’s dominance is fueled by robust automotive manufacturing, increased defense spending, and investments in marine gas turbine production. Indian companies such as Bharat Heavy Electricals Limited (BHEL) and Bharat Forge are key contributors, supplying marine turbines tailored to naval requirements.

The automotive sector’s rapid growth in India, with nearly 26 million vehicles produced between April 2022 and March 2023, is also boosting demand for precision cast components.

Market Segmentation

The market is segmented by material types—ferrous alloys such as carbon and stainless steel, and non-ferrous alloys including aluminum and titanium. Applications span turbine blades, engine components, suspension parts, medical equipment, valves, and ship propellers, among others. End-use industries include aerospace, automotive, industrial machinery, energy, oil & gas, marine, and medical sectors.

Competitive Landscape

Major players in the investment casting market include Gujarat Precision Cast Pvt. Ltd., Impro Precision Industries Limited, IPCL, Kovatch Castings, MetalTek, Milwaukee Precision Casting, Niagara Investment Castings Ltd., Precision Castparts Corp., and Redstone Manufacturing. These companies invest in digital foundries and advanced ceramic 3D printing technologies to meet stringent fuel economy and emission standards.

Notable recent developments include Texmo Precision Castings’ acquisition of a majority stake in Germany-based Feinguss Blank, and a joint venture between 3DCERAM Sinto and Avignon Ceramic to advance 3D-printed ceramic cores for aviation.

Analyst Viewpoint

The investment casting market is set for robust growth driven by innovation and increasing demand in high-performance industries. The integration of additive manufacturing, strategic investments by aerospace giants, and expanding end-use sectors position the market for sustained expansion.

Industry players that invest in technological advancements and regional production capabilities will likely capture significant market share. The Asia Pacific region, in particular, presents vast opportunities owing to its booming automotive and defense sectors.

Conclusion

The investment casting market is undergoing transformative growth fueled by cutting-edge manufacturing technologies and expanding aerospace and defense applications. With a projected market value of US$ 33.9 billion by 2034, stakeholders

0 notes

Text

How An Aerospace Engineering Recruitment Company Drives Manufacturing Growth Forward

In the fast-paced world of modern manufacturing, success is heavily influenced by access to elite talent—especially in specialized industries like aerospace. As technology rapidly evolves and global competition intensifies, manufacturers must align themselves with top-tier engineering professionals who understand the complexities of aerospace design, development, and production.

This is where a dedicated Aerospace Engineering Recruitment Company like VALiNTRY becomes an invaluable asset. With its industry-specific knowledge, technical recruiting expertise, and deep understanding of the engineering labor market, VALiNTRY plays a critical role in driving manufacturing growth by delivering the right talent at the right time.

The Manufacturing-Aerospace Connection: A Symbiotic Relationship

The aerospace industry relies on high-precision manufacturing to bring cutting-edge technologies to life—from advanced aircraft systems to defense components and space exploration tools. Every innovation in aerospace must be supported by skilled engineers who can transform designs into reality through flawless execution in manufacturing environments.

However, attracting and retaining such talent is a consistent challenge for manufacturers. That’s why they turn to a specialized Aerospace Engineering Recruitment Company like VALiNTRY to access a vetted pool of engineers with deep knowledge in aerospace systems, mechanical design, materials science, and production automation.

The Talent Gap in Aerospace and Manufacturing

The U.S. manufacturing sector is currently facing a growing engineering skills gap. According to Deloitte, nearly 2.1 million manufacturing jobs could go unfilled by 2030 due to retirements, insufficient technical training, and a lack of interest among younger generations.

Aerospace manufacturers feel this pain acutely. With stricter quality standards, global safety regulations, and the need for innovation to remain competitive, companies can’t afford to have unfilled roles or substandard hiring practices.

This is where an experienced Aerospace Engineering Recruitment Company can tip the scales in favor of manufacturers. By leveraging advanced sourcing strategies and a curated database of qualified aerospace engineers, VALiNTRY helps companies overcome this talent gap and ensure operational continuity and growth.

VALiNTRY: Engineering Recruitment With Precision and Purpose

As a trusted Aerospace Engineering Recruitment Company, VALiNTRY stands out through its precision-targeted approach to staffing. Rather than casting a wide net, VALiNTRY focuses on niche engineering talent with specific experience in aerospace applications such as:

Aerodynamics and propulsion systems

Flight control software engineering

Structural and mechanical engineering

Quality assurance and compliance

Advanced manufacturing and CNC machining

Aerospace project management

By understanding these technical disciplines and aligning them with clients’ unique needs, VALiNTRY ensures that each candidate placed contributes directly to the company’s innovation, safety, and growth goals.

How an Aerospace Engineering Recruitment Company Like VALiNTRY Accelerates Manufacturing Growth

Let’s take a closer look at how VALiNTRY, as a top-tier Aerospace Engineering Recruitment Company, actively drives manufacturing growth across the aerospace industry:

1. Faster Time to Hire

In manufacturing, time is money. Every day a critical role remains unfilled is a day of lost productivity and potential revenue. VALiNTRY’s extensive candidate network and deep understanding of aerospace job requirements allow them to deliver highly qualified candidates faster than generalist staffing firms.

2. Access to Pre-Vetted, Specialized Talent

VALiNTRY's recruiters don’t just look for resumes—they assess candidates’ engineering experience, certifications, technical tools proficiency (CAD, SolidWorks, CATIA, etc.), and even soft skills such as collaboration and problem-solving. This ensures manufacturers get candidates who are not only technically capable but also culture-fit ready.

3. Reduced Turnover and Hiring Risks

Hiring the wrong engineer can have serious consequences in aerospace—ranging from failed quality inspections to compliance violations. By leveraging deep industry knowledge, VALiNTRY minimizes hiring risks and improves retention by ensuring better candidate-role alignment.

4. Scalable Workforce Planning

Whether your aerospace manufacturing project is ramping up or scaling down, VALiNTRY provides flexible workforce solutions—from contract engineering staff to full-time aerospace hires—so you can maintain operational agility without sacrificing quality.

5. Strategic Recruitment Consulting

As a seasoned Aerospace Engineering Recruitment Company, VALiNTRY goes beyond placement. The company offers strategic insights into market salary trends, engineering talent availability, workforce planning, and diversity recruitment—helping clients make informed hiring decisions that support long-term growth.

Supporting Innovation Through Talent

Innovation in aerospace manufacturing demands multidisciplinary collaboration—bringing together experts in AI, robotics, material sciences, and aeronautics. To meet this demand, companies must constantly inject fresh talent with modern skill sets into their workforce.

VALiNTRY’s recruitment specialists understand these trends and proactively source engineers with experience in:

Additive manufacturing (3D printing)

Lightweight composite materials

Sustainability and green aviation technology

Embedded systems and IoT integration

Predictive maintenance using AI and machine learning

By placing such forward-thinking professionals, VALiNTRY empowers manufacturers to stay ahead of the innovation curve and develop products that meet the future needs of the industry.

Tailored Staffing Solutions for Every Stage of Manufacturing

From concept to production, aerospace manufacturing has multiple stages, each requiring different engineering skill sets. A capable Aerospace Engineering Recruitment Company like VALiNTRY supports all of them:

R&D and Prototyping: Sourcing engineers who excel in design validation and simulation

Testing and Compliance: Providing specialists in FAA and DoD regulations

Production and Assembly: Staffing hands-on engineers with manufacturing experience

Quality Control: Ensuring top-tier talent to oversee inspection and documentation

Maintenance and Support: Placing reliability engineers to monitor lifecycle performance

This end-to-end recruitment support ensures that manufacturing teams are never short of the skills they need, no matter where they are in the production lifecycle.

Why VALiNTRY is the Aerospace Engineering Recruitment Partner of Choice

With years of experience working alongside aerospace manufacturers, defense contractors, and engineering departments, VALiNTRY has earned a reputation for excellence in recruitment.

Here’s why companies trust VALiNTRY as their preferred Aerospace Engineering Recruitment Company:

Industry-Specific Focus: Deep knowledge of aerospace systems, regulations, and staffing needs

Customized Solutions: Tailored hiring strategies aligned with business growth goals

National Talent Reach: Access to top aerospace engineers across the U.S.

Commitment to Quality: Rigorous vetting and client satisfaction as a top priority

Consultative Partnership: Long-term relationships built on trust and measurable success

Final Thoughts

In a sector as complex and critical as aerospace manufacturing, success hinges on having the right talent in place. Without skilled aerospace engineers, even the most ambitious projects can falter. That’s why working with a specialized Aerospace Engineering Recruitment Company is no longer optional—it’s essential.

VALiNTRY brings unparalleled value to manufacturing firms by helping them find, attract, and retain high-caliber engineering professionals who drive innovation and business growth. Whether you're a defense contractor launching a next-gen aircraft or a private manufacturer optimizing production lines, partnering with VALiNTRY ensures your team is always equipped for success.

When growth is your mission, VALiNTRY is your engineering talent solution.

For more info Contact Us : 1-800-360-1407 or send mail : [email protected] to get a quote

#Aerospace Engineering Staffing Services#Aerospace Engineering Staffing Company#Aerospace Engineering Recruitment Agency#Aerospace Engineering Recruitment Company

0 notes

Text

What Makes Dowel Bars in Rigid Pavement Critical for Airport Runways and Industrial Zones

Precision Under Pressure: The Role of Reinforcement in Heavy-Load Surfaces

The design of airport runways and industrial floors isn't just about laying concrete over a prepared base. These surfaces undergo massive strain from aircraft, box trucks, cranes, and forklifts—every day. In such high-call-for environments, structural performance is non-negotiable, and even the smallest element can have an oversized impact.

This is where dowel bars in rigid pavement step in—not as non-obligatory add-ons, however, but as essential load-transfer gadgets. Their cause is precise: to manipulate joint motion and distribute masses flippantly across slabs. Without them, slabs would shift, aspect-spall, or crack beneath cyclic pressure, leading to pricey repairs, provider disruptions, or worse, safety hazards.

Engineered Durability: What Makes a Dowel Bar Essential

In rigid pavement systems, dowel bars function as silent protectors. Their role is particularly evident in places like aircraft taxiways or large manufacturing yards, where wheel pressures are far above the norm.

A correctly embedded dowel bar absorbs and transfers vertical loads from one concrete slab to the next, reducing the stress concentration at joints. When this transfer is efficient, the slabs act in continuity—minimizing deformation, preventing faulting, and extending pavement life. This simple, cylindrical component, if misaligned or undersized, can lead to joint failure, water ingress, and ultimately, base erosion.

Materials, too, matter. Solid stainless steel or epoxy-coated options are now preferred in high-moisture zones to prevent corrosion—a common concern in open-air runways and industrial loading docks. When paired with components like construction rings and super rings, the overall slab system gains stability at both macro and micro levels.

Why Industrial and Aviation Infrastructure Demands Better Support Systems

Load frequency and load intensity are significantly higher in these zones. Aircraft landing gear applies massive pressure within a small footprint, and industrial forklifts carry dynamic loads that change direction constantly. These repeated, unrelenting stresses can destroy pavement if the joints aren't engineered properly.

While basic rigid pavement slabs can technically function without dowel bars, that setup is a gamble in industrial zones. Surface cracking, differential settlement, and joint breakdown become inevitable over time. In contrast, dowel bars preserve slab alignment and performance by absorbing shear forces that concrete alone cannot handle.

Construction rings, often used in tandem with dowel placements, ensure tight joint formation and alignment integrity. Meanwhile, super rings act as durable spacers or guides to maintain dowel alignment during casting, preventing future misalignment issues that typically emerge under real-world stress.

Choosing the Right Joint System for Long-Term Reliability

The choice isn’t just about whether to use dowel bars in rigid pavement—it’s about selecting the right diameter, length, spacing, and support components based on project type. For a regional airstrip, a 32 mm epoxy-coated dowel may suffice. For international cargo hubs, larger, stainless steel bars might be warranted. Industrial warehouses, on the other hand, benefit from closer bar spacing to manage frequent, dynamic axle loads.

The integration of construction rings and super rings into the setup further assures precise alignment and reduces the margin for human error—critical in large-scale projects where even millimetric deviations can lead to uneven joint behavior over time.

Conclusion

In environments where concrete is constantly tested—by way of tons of rolling strain, shifting masses, and environmental exposure—structural shortcuts aren’t an option. Dowel bars in inflexible pavement play an irreplaceable position in distributing strain, preserving joint integrity, and lengthening surface lifespan. Supported via precision-engineered elements like construction jewelry and remarkable jewelry, those structures deliver the reliability that vital infrastructure needs.

Whether it’s the roar of a jet engine or the nonstop grind of commercial logistics, what is underneath the surface is simply as vital as what’s visible on top. And in that unseen layer, quality and precision decide whether the surface performs or fails.

#dowel bars#rigid pavement#airport runways#industrial zones#load transfer#concrete joints#joint stability#slab design#heavy load slabs#runway strength#dowel alignment#pavement joints#bar spacers#super rings#construction rings#slab durability#dowel spacing#slab cracking#runway concrete#industrial flooring

0 notes

Text

The Future of Precision Manufacturing: How Metal Injection Molding is Changing Industries

Precision and efficiency are absolutely critical in the fast-changing environment of production. Leading this revolution is metal injection molding (MIM), one technique. MIM is changing the way businesses approach challenging component manufacture, offering the design freedom of plastic injection molding alongside the strength and durability of metal. From aeroengines to medical devices, the future of advanced manufacturing is increasingly centered on the innovations and applications enabled by Metal Injection Molding Solutions.

What is Metal Injection Molding?

Manufacturing procedure Metal injection molding calls for combining small metal particles with a binder material to produce a feedstock, which is next injected into molds. Following shaping, the binder is eliminated and the pieces are sintered to create the final, dense metal pieces. With little machining, this technique enables the creation of complicated, high-strength metal components in enormous quantities, therefore making it cost-efficient as well as effective.

Why Is MIM Becoming Popular?

When creating small, complicated components with strict tolerances, classic metalworking methods like machining, casting, and forging sometimes run into limitations. By allowing the production of pieces with complex forms, constant quality, and great mechanical characteristics, Metal Injection Molding Solutions helps to overcome several of these issues. The capacity to create near-net-shape components dramatically lowers trash and further processing, therefore saving resources and time for producers.

Changing Sectors

MIM is becoming more and more relied upon by industries including automobile, aircraft, medicine, and consumer electronics to fulfill their precision manufacturing demands. For instance, in the medical field, MIM enables the creation of small, complex surgical equipment and implants that need biocompatible metals and tight standards. Lightweight but sturdy parts made by means of MIM help to improve fuel efficiency and performance in aerospace.

Solving Issues in Metal Injection Molding

Metal injection molding has several benefits, but it is not without problems. Common metal injection molding challenges are powder feedstock homogeneity, binder removal difficulties, and controlling shrinking throughout sintering. These hurdles are increasingly being overcome thanks to ongoing research and technical advancements, however. Advances in powder-compacting techniques, better binder systems, and better modeling software are providing better quality parts and improved process reliability. Manufacturers are more and more using adapted metal injection molding solutions to solve these issues, so enable more adaptation and better results.

MIM's role in precision manufacturing is expected to grow even more as these solutions mature, therefore becoming a must-have technology for effective production of challenging metallic components.

Future Viewing

Metal injection molding seems promising for the future of exact manufacturing. MIM provides a sustainable and scalable solution as sectors need more performance components with intricate geometries and tighter tolerances. Through ongoing solutions to Metal Injection Molding Problems via innovation, the technology is set to transform manufacturing methods all around.

Conclusion

Metal Injection Molding Solutions reflect a revolutionary approach combining material science with sophisticated engineering rather than merely a manufacturing method. For companies wanting to stay competitive in a growingly complex industrial environment, accepting MIM is not only beneficial; it is imperative.

0 notes

Text

Improving Inspection Efficiency with Industrial CR: Real-Time Results and Digital Archiving

In industries where safety, precision, and compliance are non-negotiable—such as aerospace, oil and gas, automotive, and manufacturing—non-destructive testing (NDT) plays a vital role in quality assurance. Among NDT techniques, Industrial Computed Radiography (CR) has emerged as a powerful alternative to traditional film-based radiography. It offers faster, safer, and more efficient inspection workflows—thanks in large part to real-time results and digital archiving capabilities.

This article explores how CR technology is revolutionizing industrial inspections by accelerating the process, improving data management, and enabling better defect traceability.

The Shift from Film to Digital: A Productivity Leap

Traditional radiographic testing (RT) using film has long been a standard method for detecting internal defects in welds, castings, and other critical components. However, film processing is time-consuming and involves chemicals, darkrooms, and physical storage—all of which slow down operations and increase costs.

Industrial Computed Radiography addresses these inefficiencies by replacing film with a phosphor imaging plate, which captures X-ray energy and stores it as a latent image. This image is then scanned, digitized, and processed using specialized software—eliminating the need for film processing altogether.

Real-Time Results: Faster Inspections, Faster Decisions

One of the biggest advantages of industrial CR is the speed of image acquisition and evaluation.

How it enhances inspection efficiency:

Immediate image capture: Inspectors can view the radiographic image within seconds of scanning the plate, enabling rapid defect identification.

On-the-spot retakes: If image quality is insufficient or a part needs re-inspection, it can be done instantly—no waiting for film to develop.

Quick feedback loops: Inspection teams can relay results to manufacturing or engineering teams in real time, minimizing downtime and accelerating decision-making.

This rapid feedback is especially valuable in high-stakes environments like pipeline construction or aircraft maintenance, where project delays or undetected flaws can lead to costly and hazardous outcomes.

Enhanced Image Quality and Analysis Tools

Digital images produced by CR systems are more versatile and analyzable than traditional film. With digital post-processing tools, inspectors can:

Adjust contrast and brightness

Zoom in for fine detail

Apply filters or annotations

Compare with baseline or historical images

These capabilities lead to more accurate defect detection, reducing the risk of false positives or overlooked discontinuities. Moreover, automated tools can flag anomalies, helping standardize results across operators and shifts.

Digital Archiving: Secure, Searchable, and Shareable

Another game-changer for industrial CR is its digital archiving capability. Unlike film-based systems that require large physical storage space and are prone to damage or loss, digital CR stores files in centralized, secure repositories.

Key benefits of digital archiving:

Instant retrieval: Locate inspection records by asset, date, operator, or part number in seconds.

Remote access: Engineers, auditors, or clients can access records from anywhere, improving collaboration and compliance reviews.

Data security and backup: Files can be encrypted, backed up, and stored redundantly to prevent data loss.

Traceability: Every inspection is logged, creating an auditable history that supports ISO, ASME, and API compliance.

For companies operating in highly regulated sectors, digital archiving reduces the burden of manual documentation and simplifies audit preparation.

Real-World Impact: Time, Cost, and Safety

By adopting industrial CR, organizations can experience:

Up to 50% faster inspection cycles

Lower operational costs (no film, chemicals, or darkrooms)

Improved safety by minimizing exposure time and handling

Reduced material rework through better defect visibility

The cumulative effect is a more streamlined, responsive, and scalable inspection program that aligns with lean manufacturing, Six Sigma, and Industry 4.0 principles.

Conclusion

Industrial computed radiography is not just a digital upgrade—it’s a transformation of how inspections are performed and managed. Through real-time imaging and digital archiving, CR empowers companies to detect flaws faster, store data smarter, and maintain full traceability throughout the asset lifecycle.

As industries continue to demand higher quality standards, faster turnaround times, and regulatory compliance, investing in industrial CR is a strategic move toward efficiency, accuracy, and long-term value.

0 notes

Text

Aerospace Forging Materials Market Share, Industry Growth, Trend, Drivers, Challenges, Key Companies by 2034

The Global Aerospace Forging Materials Market was valued at USD 12.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 22.2 billion by 2034. This growth is primarily influenced by the industry's increasing focus on material performance and durability. Aerospace components operate under extreme conditions such as high pressure, intense heat, and significant mechanical stress, demanding materials that exhibit exceptional fatigue resistance, mechanical strength, and longevity. As a result, forged materials are gaining widespread adoption due to their reliability and structural integrity in critical aerospace functions. Unlike cast or machined parts, forged components are less prone to defects and deliver enhanced metallurgical properties, making them ideal for high-risk applications across the aerospace sector.

Get sample copy of this research report @ https://www.gminsights.com/request-sample/detail/13632

Demand is also rising as the industry leans toward lighter, more efficient aircraft to improve fuel economy and reduce carbon emissions. Reducing aircraft weight directly contributes to lower fuel consumption and aligns with global sustainability objectives. This shift has increased the adoption of advanced metal alloys in aerospace forging, particularly those known for their high strength-to-weight ratios. Metals like titanium and aluminum are becoming the go-to options, thanks to their ability to deliver lightweight solutions without compromising strength or performance. These trends highlight the broader shift toward material innovation and efficiency in aviation manufacturing.

In 2024, the aerospace forging materials market was segmented by material into aluminum alloys, titanium alloys, steel alloys, magnesium alloys, nickel-based alloys, and others. Titanium alloys held the largest share, accounting for 33.2% of the market, owing to their excellent combination of strength, corrosion resistance, and lightweight characteristics. Their ability to endure extreme environments makes them especially suitable for aerospace structures and engine systems. Aluminum alloys are widely favored for their cost-efficiency and ease of formability, especially in airframe structures. Although heavier, steel alloys remain essential in high-load areas where strength and fatigue resistance are critical.

Based on forging techniques, the market in 2024 was classified into closed die forging, roll forging, open die forging, precision forging, and others. Closed die forging led the segment with a 45.4% market share due to its precision, dimensional stability, and efficiency in producing complex aerospace components. This method is especially valued for its ability to produce high-strength parts with consistent repeatability. Open die forging followed as a significant segment, especially for producing large, heavy-duty components that require high mechanical integrity. Roll forging, with its controlled grain flow, is typically used for manufacturing long, flat parts. Precision forging continues to gain traction among manufacturers for its ability to reduce raw material waste and minimize machining requirements.

In terms of applications, the market was segmented in 2024 into engine components, airframe components, transmission and rotor components, landing gear components, control surfaces, and others. Airframe components accounted for the largest share at 32.5%, driven by the widespread use of forged materials in structural parts such as fuselage frames, spars, and bulkheads. Engine components also represent a significant portion, given the demand for high-stress, high-temperature-resistant parts. Forged components are vital in ensuring durability and performance under harsh operating conditions. Landing gear components, which must endure repetitive impact and stress, typically rely on steel and titanium forging to ensure long-term reliability.

Browse complete summary of this research report @ https://www.gminsights.com/industry-analysis/aerospace-forging-materials-market

The United States captured a notable share of the global aerospace forging materials market, holding 17.8% in 2024. This equated to USD 2.3 billion and is projected to rise to USD 4.1 billion by 2034. The U.S. aerospace sector plays a vital role in the country's economy, encompassing commercial aviation and aircraft manufacturing. With a workforce of over 600,000 professionals and substantial contributions to the national GDP, the industry supports continuous innovation and global competitiveness.

Leading companies shaping the competitive landscape include Arconic Corporation, Precision Castparts Corp., Allegheny Technologies Incorporated (ATI), Bharat Forge Limited, KOBE STEEL, LTD., VSMPO-AVISMA Corporation, and Nippon Steel Corporation. These players employ diverse strategies, including technological advancements, global expansions, and strategic partnerships, to maintain and strengthen their market positions.

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Contact Us:

Contact Us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: +1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

Metal Manufacturing Company in India: Fueling Industrial Growth and Innovation

India is fast becoming a global hotspot for metal manufacturing, thanks to its robust infrastructure, skilled workforce, and competitive pricing. From automotive components and aerospace structures to construction-grade steel and precision-machined parts, the demand for metal products is growing rapidly. At the center of this boom are the metal manufacturing companies in India, delivering high-quality solutions for both domestic and global markets.

In this article, we take a closer look at India’s metal manufacturing sector — its strengths, services, top players, and why it’s a strategic choice for industries worldwide.

Understanding Metal Manufacturing in India

The metal manufacturing industry in India is broad and dynamic, encompassing various processes and products such as:

Steel and aluminum production

Sheet metal fabrication

Casting and forging

Precision machining

Metal forming and welding

This sector is vital to India’s economy, playing a key role in infrastructure development, automotive engineering, defense manufacturing, and more.

Government support through initiatives like Make in India and the National Steel Policy has further boosted the sector’s growth, aiming to position India as a global manufacturing powerhouse.

Why Global Companies Choose Metal Manufacturing Companies in India

Working with a metal manufacturing company in India offers multiple advantages:

1. Cost Efficiency

India offers lower manufacturing and labor costs, helping businesses reduce production expenses without sacrificing quality.

2. Advanced Capabilities

Modern manufacturing plants in India are equipped with CNC machines, robotic automation, laser cutters, and advanced inspection tools.

3. Skilled Talent Pool

India is home to a large number of experienced engineers, machinists, and technicians who specialize in high-precision metalwork.

4. Quality Certifications

Indian manufacturers often adhere to international standards such as ISO, IATF, and AS9100, making them reliable partners for global supply chains.

5. Custom Solutions

Whether it's a low-volume prototype or a high-volume production run, Indian metal manufacturers offer flexible and scalable solutions.

Industries Served by Indian Metal Manufacturers

Metal manufacturing in India supports a wide range of industries, including:

Automotive: Engine parts, frames, suspension systems

Construction: Structural steel, pipes, roofing, and scaffolding

Aerospace & Defense: Aircraft parts, enclosures, brackets

Electrical & Electronics: Housings, panels, heat sinks

Heavy Equipment: Machinery parts, chassis, and mounts

Energy: Components for wind, solar, and thermal power systems

Leading Metal Manufacturing Companies in India

Here are some of the top metal manufacturing companies in India that are setting benchmarks in quality and innovation:

1. Tata Steel

One of the largest steel producers in the world, known for its wide range of steel products and sustainability initiatives.

2. JSW Steel

Offers integrated steel manufacturing solutions and exports to over 100 countries.

3. Hindalco Industries

A global leader in aluminum rolling and copper production, part of the Aditya Birla Group.

4. Jindal Steel and Power

Produces steel, power, and infrastructure materials for industrial and commercial use.

5. Bharat Forge

Renowned for precision forging, this company supplies critical parts to the automotive, defense, and energy sectors.

6. Essar Steel

Offers a wide range of flat steel products and serves industries like automotive, engineering, and infrastructure.

7. L&T Heavy Engineering

Provides custom metal fabrication and assembly solutions for defense, aerospace, and oil & gas.

8. Godrej & Boyce - Precision Engineering

Specializes in precision sheet metal and heavy fabrication for advanced applications.

9. Amtek Auto

Manufactures forged and machined automotive components with a global footprint.

10. Metalman Auto Pvt. Ltd.

Focused on chassis parts and assemblies for two-wheelers and commercial vehicles.

Core Services Offered by Indian Metal Manufacturers

Most metal manufacturing companies in India offer end-to-end services that include:

CNC machining and turning

Sheet metal cutting and bending

Welding and assembly

Die casting and pressure molding

Laser cutting and plasma cutting

Prototyping and mass production

Surface finishing (powder coating, painting, polishing)

Quality control and testing

This comprehensive service range makes India an attractive one-stop destination for global manufacturers.

Market Trends and the Road Ahead

India’s metal manufacturing sector is evolving with modern technology and sustainable practices. Some key trends include:

✅ Smart Manufacturing & Automation

Indian manufacturers are integrating IoT, robotics, and AI to enhance productivity and precision.

✅ Sustainability Initiatives

There’s a growing emphasis on green practices, such as energy-efficient processes, recycling, and renewable energy usage.

✅ Export Expansion

India is increasing its share in global exports of fabricated metal components, especially to Europe, the US, and the Middle East.

✅ Digital Sourcing Platforms

B2B platforms like FindingMFG are making it easier for global buyers to connect with trusted Indian metal manufacturers, compare quotes, and manage orders online.

How to Choose the Right Metal Manufacturing Company in India

When selecting a metal manufacturing partner in India, consider the following:

Years of experience and industry focus

Compliance with international standards

Manufacturing capabilities and infrastructure

Testimonials and project case studies

Willingness to scale production

Location and logistics advantages

Support and communication throughout the project lifecycle

You can also use platforms like FindingMFG to discover verified and vetted suppliers across India, ensuring quality and reliability from day one.

Conclusion

India’s metal manufacturing industry is a pillar of its economic development and global manufacturing reputation. With cost advantages, skilled talent, and advanced capabilities, metal manufacturing companies in India are perfectly positioned to support international industries with high-quality, scalable, and custom solutions.

Whether you’re a startup, OEM, or global enterprise, working with Indian metal manufacturers can help you streamline your supply chain, reduce costs, and accelerate production timelines.

Looking for Trusted Metal Manufacturers in India? Let FindingMFG help you connect with verified metal manufacturing partners that match your exact project requirements. From RFQ to delivery, simplify your sourcing process today

0 notes

Text

The Science of Strength: Understanding the Heat Treating Market

Heat Treating Industry Overview

The global Heat Treating Market, valued at an estimated USD 107.18 billion in 2023, is projected to expand at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030. This growth is anticipated to be driven by the rapid advancement of the electric vehicle industry, alongside the increasing demand for metallurgical alterations to meet specific application requirements. The rising need for heat treatment in EVs is fueled by its vital role in improving the performance, efficiency, and longevity of critical components within EV drivetrains and battery systems.

In the pursuit of optimizing the efficiency of electric propulsion systems by automakers, heat treatment is becoming essential for components like electric motor components, gears, and battery cells. Moreover, heat treating contributes to enhancing the hardness, durability, and overall structural integrity of materials, ensuring that components can withstand the rigorous demands of EV operations.

Detailed Segmentation:

Material Insights

The demand for cast heat treating services remains robust, driven by the persistent growth in industries such as automotive, aerospace, construction, and oil and gas, all of which heavily rely on cast components for various applications. The automotive sector, in particular, continues to expand, fueled by increasing consumer demand and technological advancements, thereby elevating the need for heat-treated castings to enhance component durability and performance.

Process Insights

The demand for annealing processes in the market remains significant, driven by industries that prioritize material refinement, stress relief, and improved mechanical properties. Annealing is widely employed in sectors such as metallurgy, electronics, and manufacturing, where it is instrumental in reducing hardness, enhancing ductility, and relieving internal stresses in metal components. In the electronics industry, annealing is crucial for optimizing the electrical properties of semiconductor materials.

Equipment Insights

The demand for fuel-fired furnace equipment remains robust, particularly in industries where high-temperature processes are essential, such as metal casting, heat treatment, and glass manufacturing. Fuel-fired furnaces powered by natural gas, propane, or other fuels offer a cost-effective and versatile solution for achieving elevated temperatures required in various industrial applications. These furnaces are crucial for processes like melting, forging, and annealing, providing efficient heat transfer and precise temperature control. Low cost as compared to electrically-heated furnaces has led to a high preference for fuel-fired furnaces among the industry players. However, unstable fuel prices and emissions of greenhouse gases have restrained the growth of conventional fuel-fired furnaces. The demand for natural gas-fired furnaces from developing economies is likely to boost the segment growth.

Application Insights

The demand for heat treating in the aerospace industry remains high, driven by the stringent requirements for precision, reliability, and material performance in critical aerospace components. Heat treating plays a pivotal role in enhancing the strength, hardness, and structural integrity of materials used in aircraft parts, such as turbine blades, landing gear components, and structural elements. Aerospace manufacturers rely on heat treatment processes to achieve specific metallurgical properties that meet the demanding standards for safety, weight reduction, and performance in extreme operating conditions.

Regional Insights

Asia Pacific led the market with a revenue share of 39.6% in 2023. The demand for heat treating in the region is experiencing significant growth, driven by the burgeoning industrialization, expanding automotive and aerospace sectors, and the continuous development of infrastructure projects. As manufacturing activities surge in countries like China, India, Japan, and South Korea, there is an increasing need for heat treating processes to enhance the mechanical properties of critical components across diverse industries. The rising automotive production, coupled with the expansion of aerospace and electronics manufacturing, underscores the pivotal role of heat treating in ensuring the quality, durability, and performance of materials. In addition, the construction boom in the region fuels demand for heat-treated components in infrastructure projects. With a dynamic and rapidly evolving industrial landscape, the Asia Pacific region stands as a key driver in the global demand for heat treating services.

Gather more insights about the market drivers, restraints, and growth of the Heat Treating Market

Key Companies & Market Share Insights

To increase market penetration and cater to changing technological requirements from various end-uses, such as automotive, machine, construction, aerospace, and metalworking, manufacturers use a variety of strategies, such as joint ventures, mergers, acquisitions, new product launches, and geographical expansions. Manufacturers are undertaking strategic acquisitions to gain an edge in the industry and increase their geographic presence. For instance, in January 2022, Honeywell International Inc. inaugurated a new production facility in Jubail, Saudi Arabia, outfitted with Callidus Flare technology. This technology is specialized in manufacturing products utilizing thermal combustion for the oil and gas industry. The range of flares produced encompasses basic utility flares to high-performance ultra-low steam flares.

Key Heat Treating Companies:

The following are the leading companies in the heat treating market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these heat treating companies are analyzed to map the supply network.

Bluewater Thermal Solutions LLC

American Metal Treating Inc.

East-Lind Heat Treat Inc.

General Metal Heat Treating, Inc.

Shanghai Heat Treatment Co. Ltd.

Pacific Metallurgical, Inc.

Nabertherm GmbH

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

SECO/WARWICK Allied Pvt. Ltd. saw an increase of 15% in its production in 2023 compared to that of 2022, and in January 2024, invested in production capacity development, by expanding its plants in China, India, and the U.S., by as much as 60%.

In August 2022, SECO/WARWICK delivered a Vector vacuum furnace to Atlas Autos Ltd. The furnace is designed for tempering and hardening processes, featuring a unique design that enables efficient gas cooling of elements and dies essential for automotive production components.

0 notes

Text

The Role of Material Science in Mechanical Engineering Design

When most students think about mechanical engineering, the first things that come to mind are machines, engines, and design. But there’s a core subject that quietly supports almost every decision an engineer makes—material science. Without understanding materials and their behavior, no mechanical design can truly succeed.

Let’s look at why material science is such an essential part of mechanical engineering and how it influences every stage of the design process.

Why Materials Matter in Mechanical Design

Imagine designing a lightweight bicycle frame. You can’t just sketch it and call it done. You need to decide whether to use steel, aluminum, or carbon fiber. Each comes with different properties—strength, weight, cost, corrosion resistance, and fatigue life. These choices impact not just performance but also safety and durability.

This is where material science steps in. It helps engineers understand how materials behave under stress, temperature changes, repeated use, and different environmental conditions. It’s not just about choosing the strongest material but choosing the right one for the job.

Common Materials in Mechanical Engineering

Mechanical engineers typically work with metals like steel, aluminum, titanium, and copper, as well as polymers, ceramics, and composites. Each material type has its strengths:

Steel is tough and widely available, making it ideal for structures and automotive components.

Aluminum is lightweight and corrosion-resistant, so it’s often used in aircraft and lightweight frames.

Composites combine two or more materials to get the best of both worlds—strength and flexibility, for example.

By studying material properties such as ductility, hardness, elasticity, and thermal conductivity, engineers can make informed decisions about which material will work best in a design.

Material Selection and Innovation

Choosing the right material doesn’t just affect strength or weight—it can also influence manufacturing methods and costs. For example, if a component must be cast or forged, the material must be suitable for those processes. Similarly, if it's going to be used in a corrosive environment, corrosion resistance becomes a major factor.

Thanks to continuous research in material science, new alloys and composite materials are being developed that offer better performance at lower costs. This is especially important in industries like aerospace, defense, and energy, where both precision and safety are critical.

How Students Engage with Material Science

At the college level, students learn about materials not just in theory but also through lab experiments and projects. Colleges that invest in proper lab facilities and industry exposure give students a clearer idea of how material properties play out in the real world.

For example, some of the best engineering colleges in Bhubaneswar include practical lab sessions on material testing—tensile strength, hardness, impact testing, etc.—as part of the curriculum. This hands-on experience helps students grasp how materials respond to different conditions.

A good example is NMIET in Bhubaneswar. Students there have access to well-equipped labs and get to work on real-time projects where material selection is part of the process. This kind of exposure prepares them for industry-level thinking and decision-making.

How Material Science Shapes Career Opportunities

Understanding material science opens up diverse career paths in mechanical engineering. Whether you’re into product design, quality control, or research and development, knowing how to choose and test materials is a critical skill.

Many companies, especially in sectors like automotive, aerospace, electronics, and even biomedical engineering, rely on engineers who can evaluate materials for safety, performance, and cost-efficiency.

And if you're planning to work on your own startup or invention someday, knowing your materials inside out gives you a major advantage.

A Skill Every Engineer Should Master

Material science isn’t just another subject on the syllabus—it’s a foundation. When you’re building a product that’s meant to last, perform under pressure, or operate in extreme environments, the choice of materials can make or break the design.

So, if you’re studying at one of the best engineering colleges in Bhubaneswar, take your material science labs and lectures seriously. These lessons might seem like theory now, but they’ll shape how you think as an engineer for years to come.

Engineering is about finding practical solutions—and choosing the right materials is one of the most practical decisions you’ll make in any design. Keep your curiosity alive, ask questions, and try to understand the “why” behind each material choice. It’s a skill that truly pays off in the long run.

#best colleges in bhubaneswar#college of engineering bhubaneswar#best engineering colleges in orissa#best engineering colleges in bhubaneswar#best private engineering colleges in odisha#best engineering colleges in odisha

0 notes

Text

Best Casting Moulding & Forging Machine in Ahmedabad

Casting, moulding, and forging machines are integral to modern manufacturing, enabling the efficient production of complex metal components across various industries. These machines facilitate the transformation of raw materials into precise, durable parts essential for applications in automotive, aerospace, construction, and more.Casting machines operate by introducing molten metal into moulds, allowing it to solidify into desired shapes. This process is versatile, accommodating intricate designs and a range of metals. Common casting methods include sand casting, die casting, and centrifugal casting. Sand casting is cost-effective and suitable for large components, while die casting offers high precision and is ideal for mass production. Centrifugal casting, on the other hand, is used for cylindrical parts, ensuring uniform density and strength. These methods are employed to manufacture engine blocks, turbine blades, and structural components, among others. Moulding machines are primarily used in the preparation of moulds for casting. They compact moulding sand around patterns to create cavities for metal pouring. Techniques such as jolting, squeezing, and slinging are employed to achieve uniform density and surface finish in moulds. Machine moulding enhances productivity and consistency compared to manual methods, making it indispensable in foundries and large-scale production facilities. Forging machines shape metal through compressive forces, often at elevated temperatures, to enhance mechanical properties like strength and toughness. Processes such as open-die forging, closed-die forging, and upset forging are utilized based on the complexity and size of the component. Open-die forging is suitable for large, simple shapes, while closed-die forging allows for intricate designs with high precision. Upset forging increases the diameter of a workpiece by compressing its length, commonly used for bolts and fasteners. Forged parts are prevalent in critical applications, including aircraft components, automotive parts, and industrial machinery, due to their superior strength and reliability.

For More Details Click Here: https://www.indiantradebird.com/product/casting-moulding-&-forging-machines

0 notes

Text

Investment Casting Market Forecast 2034: Industry Set to Double by 2034

The global investment casting market, valued at US$ 16.9 billion in 2023, is poised for significant growth over the next decade. Analysts project the market to expand at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2034, reaching an impressive valuation of US$ 33.9 billion by the end of 2034. This surge is driven largely by expanding demand from the aerospace and defense sectors, as well as the increasing integration of additive manufacturing technologies in the investment casting process.

Understanding Investment Casting

Investment casting, also known as lost-wax casting, is a precision metal-forming process that involves creating a wax replica of the desired part. This wax pattern is then encased in a ceramic mold. Once the ceramic hardens, the wax is melted away, leaving a cavity for molten metal to be poured in, forming the final component. This method is ideal for manufacturing complex shapes with high dimensional accuracy and excellent surface finish.

Materials commonly used in investment casting include carbon steel, stainless steel, alloy steel, aluminum, copper, nickel alloys, titanium, and magnesium. Each offers specific properties like ductility, strength, and corrosion resistance suited for various industrial applications.

Key Growth Drivers

Aerospace & Defense Sector Expansion

The aerospace and defense sector remains a vital growth engine for the investment casting market. Investment casting is essential in manufacturing temperature-sensitive components used in jet engines and industrial gas turbines. These components require intricate geometries and must withstand extreme operating conditions, which investment casting can provide with high precision.

For example, the development of gas turbine engines with advanced aerothermal designs relies heavily on investment cast parts. The rising demand for fuel-efficient, high-performance engines in both commercial and military aviation is significantly propelling market growth.

In 2023, Safran announced plans to establish a maintenance, repair, and overhaul (MRO) facility for LEAP commercial aircraft engines in India, reflecting increasing regional investments. Similarly, GE Aerospace has committed over US$ 650 million to enhance its global manufacturing plants, emphasizing 3D printing-enabled production of LEAP and GE9X engines, which incorporate numerous 3D printed components.

Integration of Additive Manufacturing (Rapid Investment Casting)

The advent of additive manufacturing (AM) has revolutionized the investment casting process. Rapid Investment Casting (RIC) integrates AM technologies to replace traditional pattern-making, drastically reducing lead times and costs without compromising quality.

RIC enables manufacturers to quickly prototype and produce complex castings, improving flexibility and responsiveness in various industries. The technology’s adoption is accelerating, especially in aerospace, where time-to-market and precision are critical.

Regional Insights

Asia Pacific currently holds the largest share of the investment casting market. The region’s dominance is fueled by robust automotive manufacturing, increased defense spending, and investments in marine gas turbine production. Indian companies such as Bharat Heavy Electricals Limited (BHEL) and Bharat Forge are key contributors, supplying marine turbines tailored to naval requirements.

The automotive sector’s rapid growth in India, with nearly 26 million vehicles produced between April 2022 and March 2023, is also boosting demand for precision cast components.

Market Segmentation

The market is segmented by material types—ferrous alloys such as carbon and stainless steel, and non-ferrous alloys including aluminum and titanium. Applications span turbine blades, engine components, suspension parts, medical equipment, valves, and ship propellers, among others. End-use industries include aerospace, automotive, industrial machinery, energy, oil & gas, marine, and medical sectors.

Competitive Landscape

Major players in the investment casting market include Gujarat Precision Cast Pvt. Ltd., Impro Precision Industries Limited, IPCL, Kovatch Castings, MetalTek, Milwaukee Precision Casting, Niagara Investment Castings Ltd., Precision Castparts Corp., and Redstone Manufacturing. These companies invest in digital foundries and advanced ceramic 3D printing technologies to meet stringent fuel economy and emission standards.

Notable recent developments include Texmo Precision Castings’ acquisition of a majority stake in Germany-based Feinguss Blank, and a joint venture between 3DCERAM Sinto and Avignon Ceramic to advance 3D-printed ceramic cores for aviation.

Analyst Viewpoint

The investment casting market is set for robust growth driven by innovation and increasing demand in high-performance industries. The integration of additive manufacturing, strategic investments by aerospace giants, and expanding end-use sectors position the market for sustained expansion.

Industry players that invest in technological advancements and regional production capabilities will likely capture significant market share. The Asia Pacific region, in particular, presents vast opportunities owing to its booming automotive and defense sectors.

Conclusion

The investment casting market is undergoing transformative growth fueled by cutting-edge manufacturing technologies and expanding aerospace and defense applications. With a projected market value of US$ 33.9 billion by 2034, stakeholders must focus on innovation, regional expansion, and strategic collaborations to capitalize on emerging opportunities and maintain competitive advantage.

0 notes

Text

Custom Metal Parts: Precision Engineering for Specialized Applications

Custom metal parts are essential for industries requiring tailored components that meet exact specifications. These precision-engineered metal parts enhance efficiency, durability, and functionality across sectors such as automotive, aerospace, medical, and industrial machinery.

The Value of Custom Metal Parts in Manufacturing

Custom metal parts are fabricated using methods such as CNC machining, laser cutting, stamping, and casting. Businesses select materials—including stainless steel, aluminum, brass, and titanium—based on their mechanical properties, corrosion resistance, and performance requirements.

Industries That Depend on Custom Metal Parts

Automotive Engineering – Engine components, structural reinforcements, and specialized fittings require custom metal fabrication.

Aerospace & Defense – Aircraft frames, military hardware, and precision-machined parts demand high-strength metals.

Medical Equipment Production – Surgical instruments, implants, and diagnostic devices rely on custom metal parts for accuracy and longevity.

Construction & Infrastructure – Custom beams, fasteners, and brackets support large-scale architectural projects.

Electronics & Machinery – Heat sinks, circuit board housings, and machine parts benefit from precision-cut metal components.

Advantages of Custom Metal Parts

Precision Engineering – Components are tailored for perfect fit and functionality.

Material Versatility – Available in multiple metals to suit different industry needs.

Enhanced Durability – Long-lasting materials ensure resistance to wear, corrosion, and environmental factors.

Cost-Efficient Production – Optimized fabrication reduces material waste and enhances manufacturing efficiency.

Scalability & Adaptability – Supports small-batch customization and large-scale industrial applications.

SEO Strategies for Custom Metal Parts

To boost online visibility, businesses should integrate keywords such as "custom metal parts," "precision-machined metal components," and "high-performance metal fabrication." Publishing technical articles, industry applications, and engineering case studies can attract potential clients and establish brand authority.

Final Thoughts

Custom metal parts enable manufacturers to achieve precision, efficiency, and reliability in industrial production. As technology continues to evolve, specialized metal fabrication remains a critical component in engineering and manufacturing excellence.

0 notes

Text

Best Ferro Alloys Suppliers for Sourcing Ferro Titanium Alloys & Scrap!

Ferroalloys play a critical role in the production of high-quality steel and other metal-based applications. Ferro titanium is widely used to strengthen steel, improve its corrosion resistance, and reduce impurities. Additionally, recycled titanium scrap is a cost-effective and environmentally friendly alternative for industries looking to optimise their raw material usage.

For industries that rely on these essential materials, finding the right suppliers is crucial. A reliable source ensures consistent quality, competitive pricing, and timely delivery. In this article, we will explore the importance of ferrotitanium and scrap, their applications, and the best providers for sourcing these materials.

What Are Ferro Alloys?

Ferro alloys are iron-based compounds that include elements such as titanium, manganese, chromium, and silicon. These alloys are essential in steel manufacturing and metallurgy to enhance properties such as strength, ductility, and oxidation resistance. Titanium-based ferroalloys are among the most sought-after due to their unique benefits in steel production.

Understanding Ferro Titanium

Ferro titanium is an alloy containing iron and titanium, typically with 10% to 70% titanium content. It is used as a deoxidizer and alloying agent in steel production, helping improve mechanical properties and reducing the presence of harmful elements like sulfur and oxygen.

What Is Ferro Titanium Scrap?

Ferro titanium scrap is a recycled material that contains titanium-rich remnants from previous manufacturing processes. Industries prefer using titanium scrap as it offers an economical solution while reducing material waste. This scrap is often used in secondary steelmaking to introduce titanium without the need for new raw materials.

Why Is Sourcing Ferro Titanium and Scrap Important?

The demand for titanium-based alloys and recycled material is steadily increasing due to its application in multiple industries, including:

1. Steel Manufacturing

Titanium is widely used in the steel industry to produce high-strength, corrosion-resistant steel. It enhances weldability and prevents grain growth, making it essential for automotive, aerospace, and construction industries.

2. Aerospace Industry

Titanium-based alloys are highly valued in aerospace for their strength-to-weight ratio and resistance to extreme temperatures. They contribute to the production of high-performance aircraft components.

3. Foundries and Metal Casting

Foundries utilise titanium scrap to adjust the chemical composition of molten steel, ensuring precise alloying and cost reduction.

4. Automotive Industry

Vehicle manufacturers incorporate titanium-enhanced materials into components to improve durability, fuel efficiency, and overall performance.

5. Defense and Military Applications

Titanium-based materials are extensively used in military applications for manufacturing lightweight and impact-resistant armor and weaponry.

Qualities of the Best Suppliers

When selecting a provider for titanium alloys and scrap, it is essential to consider the following factors:

High-Quality Standards: A reliable supplier should adhere to international quality standards such as ISO certification and maintain strict quality control measures.

Competitive Pricing: The best suppliers offer fair pricing while ensuring premium-grade material, making procurement cost-effective for manufacturers.

Consistent Supply and Timely Delivery: Industries require a steady supply chain to maintain uninterrupted production. A trustworthy provider ensures on-time delivery and adequate stock availability.

Customisation and Bulk Orders: Many manufacturers require customized compositions. Leading sources offer tailored solutions and accommodate bulk orders.

Sustainable and Ethical Sourcing: Reputable providers prioritize eco-friendly sourcing, including responsible recycling practices.

Top Ferro Alloy Suppliers

Here are some of the best sources specializing in these materials:

1. Bansal Brothers (India)

Bansal Brothers is a leading name in India, specializing in titanium alloys and recycled scrap. They are known for their commitment to quality, competitive pricing, and reliable supply chain.

2. AMG Advanced Metallurgical Group (Netherlands)

AMG is a global leader in speciality alloys, offering premium-grade titanium products for the aerospace, automotive, and steel industries. They prioritise sustainability and innovation.

3. Tremond Metals (USA)

Tremond Metals supplies high-purity titanium alloys and scrap, serving clients in North America and Europe. They have a reputation for superior quality control and efficient logistics.

4. Minex Metallurgical Co. Ltd. (India)