#Real Examples of Double Bottom in Stock Market

Explore tagged Tumblr posts

Video

youtube

Mastering the DOUBLE BOTTOM FOREX TRADING for Maximum Gain 2023

#youtube#youtube trending#Double Bottom Pattern Explained#Trading Strategies with Double Bottom#Identifying Double Bottom Reversals#Double Bottom Chart Pattern Tutorial#How to Spot Double Bottoms in Forex#Double Bottom Candlestick Patterns#Double Bottom Trading Signals#Double Bottom vs. Double Top Differences#Double Bottom Formation Analysis#Successful Double Bottom Trading Tips#Double Bottom Pattern for Beginners#Real Examples of Double Bottom in Stock Market#Double Bottom Breakout Strategies#Double Bottom Technical Analysis Guide#Common Mistakes in Double Bottom Trading

0 notes

Text

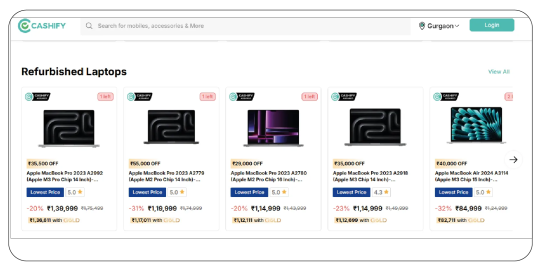

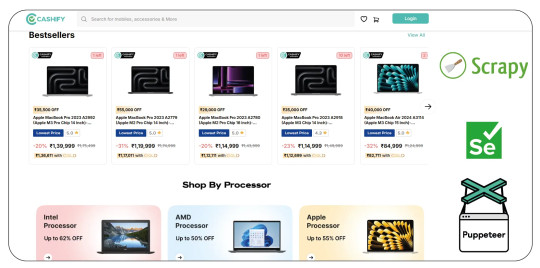

Extract Laptop Resale Value from Cashify

Introduction

In India’s fast-evolving second-hand electronics market, Cashify has emerged as a leading platform for selling used gadgets, especially laptops. This research report investigates how to Extract laptop resale value from Cashify, using data-driven insights derived from Web scraping laptop listings from Cashify and analyzing multi-year pricing trends.

This report also explores the potential of building a Cashify product data scraping tool, the benefits of Web Scraping E-commerce Websites, and how businesses can leverage a Custom eCommerce Dataset for strategic pricing.

Market Overview: The Rise of Second-Hand Laptops in India

In India, the refurbished and second-hand electronics segment has witnessed double-digit growth over the last five years. Much of this boom is driven by the affordability crisis for new electronics, inflationary pressure, and the rising acceptance of certified pre-owned gadgets among Gen Z and millennials. Platforms like Cashify have revolutionized this space by building trust through verified listings, quality checks, and quick payouts. For brands, resellers, or entrepreneurs, the ability to extract laptop resale value from Cashify has become crucial for shaping buyback offers, warranty pricing, and trade-in deals.

Web scraping laptop listings from Cashify allows stakeholders to get a clear, real-time snapshot of average selling prices across brands, conditions, and configurations. Unlike OLX or Quikr, where listings can be inconsistent or scattered, Cashify offers structured data points — model, age, wear and tear, battery health, and more — making it a goldmine for second-hand market intelligence. By combining this structured data with a Cashify product data scraping tool, businesses can identify underpriced segments, negotiate better supplier rates, and create competitive refurbished offerings.

With millions of laptops entering the resale loop every year, the scope of scraping and analyzing Cashify’s data goes far beyond academic interest. For retailers, this data can translate into practical business actions — from customizing trade-in bonuses to launching flash sale campaigns for old stock. The bigger goal is to build an adaptive pricing model that updates dynamically. This is where Web Scraping Cashify.in E-Commerce Product Data proves indispensable for data-driven decision-making.

Technology & Tools: How to Scrape Laptop Prices from Cashify India

Building an efficient pipeline to scrape laptop prices from Cashify India demands more than just basic scraping scripts. Cashify uses dynamic content loading, pagination, and real-time pricing updates, which means your scraper must be robust enough to handle AJAX calls, handle IP blocks, and store large datasets securely. Many modern scraping stacks use Python libraries like Scrapy, Selenium, or Puppeteer, which can render JavaScript-heavy pages and pull detailed product listings, price fluctuations, and time-stamped snapshots.

Setting up a Cashify web scraper for laptop prices India can help businesses automate daily price checks, generate real-time price drop alerts, and spot sudden changes in average resale value. Combining this with a smart notification system ensures refurbishers and second-hand retailers stay one step ahead of market fluctuations.

Additionally, deploying a custom eCommerce dataset extracted from Cashify helps link multiple data points: for example, pairing model resale values with the original launch price, warranty status, or historical depreciation. This layered dataset supports advanced analytics, like predicting when a specific model’s resale value will hit rock bottom — an insight invaluable for maximizing margins on bulk procurement.

A good Cashify product data scraping tool should include error handling, proxy rotation, and anti-bot bypass methods. For larger operations, integrating this tool with CRM or ERP software automates workflows — from setting competitive buyback quotes to updating storefront listings. Ultimately, the technical strength behind web scraping e-commerce websites is what makes data actionable, turning raw pricing into real profit.

Opportunities: Turning Scraped Cashify Data into Business Strategy

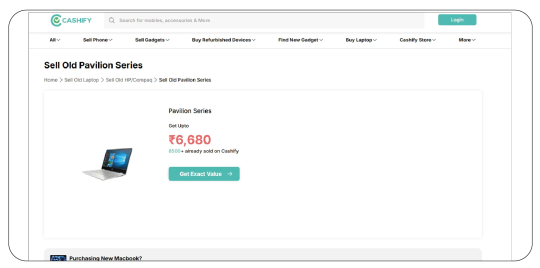

Once you extract laptop resale value from Cashify, the next step is turning this raw pricing intelligence into a clear business advantage. For individual resellers, knowing the exact resale price of a MacBook Air or HP Pavilion in real-time can mean the difference between a profit and a loss. For larger refurbishing chains or online marketplaces, scraped data powers dynamic pricing engines, localized offers, and even targeted marketing campaigns for specific models or city clusters.

For instance, with a robust Cashify.com laptop pricing dataset India, a company can forecast upcoming spikes in demand — say during the start of the academic year when students buy affordable laptops — and stock up on popular mid-range models in advance. Additionally, trends in price drop alerts help predict when it’s cheaper to buy in bulk. With a Cashify web scraper for laptop prices India, these insights update automatically, ensuring no opportunity is missed.

Beyond pricing, the data can reveal supply gaps — like when certain brands or specs become scarce in specific cities. Using Web Scraping Solutions, retailers can then launch hyperlocal campaigns, offering better trade-in deals or doorstep pickups in under-supplied zones. This level of precision turns simple scraping into a strategic tool for growth.

In summary, the real power of web scraping laptop listings from Cashify lies not just in collecting prices, but in transforming them into a sustainable, profitable second-hand business model. With a solid scraping stack, well-defined use cases, and data-driven action plans, businesses can stay ahead in India’s booming refurbished laptop market.

Key Insights

Growing Popularity of Used Laptops

Analysis:

With over 7 million units projected for 2025, there’s a clear demand for affordable laptops, boosting the need to extract laptop resale value from Cashify for resale arbitrage and trade-in programs.

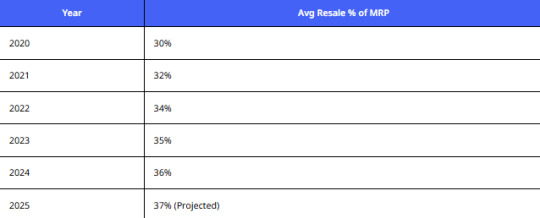

Average Resale Value Trend

Analysis:

Consumers get back an average of 30–37% of the original price. This data justifies why many refurbishers and dealers scrape laptop prices from Cashify India to negotiate smarter buyback deals.

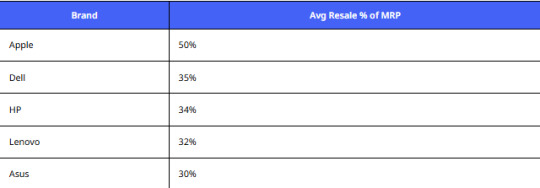

Brand-wise Resale Premium

Analysis:

Apple retains the highest value — a key insight for businesses using a Cashify.com laptop pricing dataset India to optimize refurbished stock.

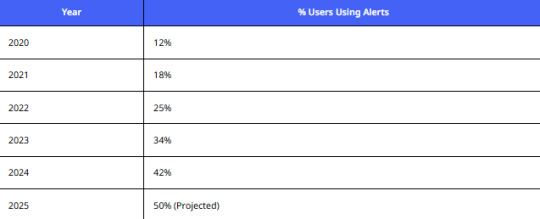

Price Drop Alerts Influence

Analysis:

More users want real-time price drop alerts for laptops on Cashify, pushing resellers to deploy a Cashify web scraper for laptop prices India to monitor and react instantly.

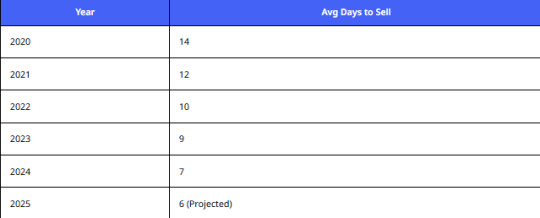

Average Listing Time Before Sale

Analysis:

Faster selling cycles demand real-time tracking. Extract laptop resale value from Cashify in near real-time with a robust Cashify product data scraping tool.

Popular Price BracketsPrice Band (INR)% Share< 10,00020%10,000–20,00045%20,000–30,00025%>30,00010%

Analysis:

The ₹10k–₹20k band dominates, highlighting why Web Scraping Cashify.in E-Commerce Product Data is crucial for budget-focused segments.

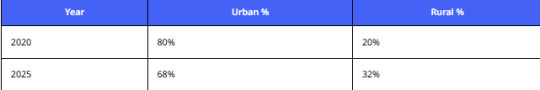

Urban vs Rural Split

Analysis:

Growth in rural demand shows the need for local price intelligence via Web Scraping Solutions tailored for regional buyers.

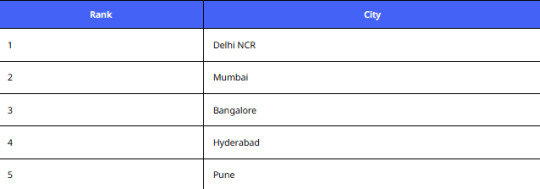

Top Cities by Resale Listings

Analysis:

A Custom eCommerce Dataset from Cashify helps brands target these hubs with region-specific offers.

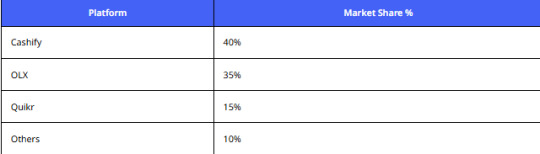

Analysis:

Cashify’s stronghold makes web scraping laptop listings from Cashify vital for second-hand market trend research.

Projected Market Value

Analysis:

The second-hand laptop market will surpass INR 6,000 Cr by 2025 — a clear opportunity to build a Cashify web scraper for laptop prices India and lead the arbitrage game.

Conclusion

From real-time price tracking to building custom pricing datasets, this research shows that to stay ahead in the resale game, businesses must extract laptop resale value from Cashify with smart Web Scraping E-commerce Websites strategies. Ready to unlock hidden profits? Start scraping smarter with a custom Cashify product data scraping tool today!

Know More >> https://www.productdatascrape.com/extract-laptop-resale-value-cashify-market-trends.php

#ExtractLaptopResaleValueFromCashify#WebScrapingLaptopListingsFromCashify#ScrapeLaptopPricesFromCashifyIndia#CashifyComLaptopPricingDatasetIndia#CashifyProductDataScrapingTool#WebScrapingEcommerceWebsites

0 notes

Text

Dominate Stock Markets Using ICFM’s Powerful Technical Analysis Tools

Technical analysis is one of the most powerful tools in the world of trading and investing. It helps traders understand market psychology and price behavior by analyzing past market data, primarily price and volume. Whether you're a beginner exploring the world of stock markets or an experienced investor aiming to refine your strategy, technical analysis can give you the edge you need.

At ICFM (Institute of Career in Financial Market), technical analysis isn’t just a concept—it’s a hands-on, practical skill that is taught by industry experts with real market experience. As one of the most trusted names in stock market education, ICFM offers an intensive technical analysis course that caters to everyone from novice traders to seasoned market participants.

H2: What is Technical Analysis and Why is it Important?

Technical analysis involves studying chart patterns, technical indicators, and price movements to predict future price trends in stocks, commodities, or currencies. Unlike fundamental analysis, which focuses on financial statements and company performance, technical analysis strictly focuses on historical market data.

This method is essential for intraday traders, swing traders, and even long-term investors who want to time their entries and exits more accurately. The idea behind technical analysis is that all current market information is already reflected in the price, and patterns tend to repeat over time due to market psychology.

By mastering technical analysis, traders can identify support and resistance levels, trends, reversals, and potential breakouts—tools that are vital for making informed trading decisions.

H2: Why Choose ICFM for Technical Analysis Training?

ICFM stands apart in the financial education industry because it offers a structured and highly practical course on technical analysis. The institute focuses on teaching students how to read charts, understand price action, and apply indicators in live market scenarios.

Here’s why ICFM is the ideal place to learn technical analysis:

Experienced Faculty: The trainers are active market participants with years of hands-on trading experience.

Live Market Practice: Students get to analyze real-time charts and trade setups in live markets.

Latest Tools and Software: The course involves training with modern charting platforms like TradingView and MetaTrader.

Doubt Sessions and Strategy Building: ICFM helps students not just learn concepts but also build personalized strategies based on their risk appetite.

H3: The Core Concepts Covered in ICFM’s Technical Analysis Course

While the entire course is deeply rooted in practical learning, it also covers all essential theoretical concepts that form the foundation of technical analysis. Some of the major topics include:

Chart Patterns: Head and Shoulders, Triangles, Double Top and Bottom, Flags and Pennants.

Candlestick Analysis: Understanding Doji, Hammer, Engulfing patterns and more.

Technical Indicators: RSI, MACD, Bollinger Bands, Moving Averages, Stochastic Oscillator.

Trend Analysis: Recognizing bullish and bearish trends, using trendlines effectively.

Volume Analysis: How volume supports or contradicts price movement.

Support and Resistance Levels: Identifying key price zones for entry and exit.

Price Action and Breakouts: Learning to spot real breakouts and avoid false signals.

Every topic is explained with real-time chart examples, so the learner can immediately apply the knowledge to real market conditions.

H3: Who Can Benefit from ICFM’s Technical Analysis Course?

The technical analysis course by ICFM is suitable for:

Beginner Traders: Those who are just entering the world of stock or forex trading.

Investors: People who want to time their investments better and maximize returns.

Job Seekers in Finance: Those aiming for careers in stockbroking firms, research houses, or asset management companies.

Self-employed Traders: Individuals who want to build a full-time or part-time career from trading.

ICFM ensures that the training is simple enough for beginners yet detailed enough for intermediate traders. The practical, step-by-step approach helps learners build confidence and discipline in trading.

H2: Practical Learning Approach – The ICFM Edge

What truly differentiates ICFM from other institutes is its practical training model. Unlike most theoretical courses, ICFM’s technical analysis course is grounded in real-time application. Students aren’t just reading textbooks or watching videos—they’re analyzing charts daily, understanding current market trends, and executing demo trades.

This hands-on experience helps bridge the gap between knowledge and action. With market simulators, live analysis sessions, and one-on-one mentorship, ICFM gives you the confidence to analyze and execute your own trades.

Moreover, the course includes access to market discussions, doubt-clearing webinars, and continued support even after course completion—something very few institutes offer.

Certification and Career Opportunities

Upon completing the technical analysis course at ICFM, students receive a certification that validates their expertise in the subject. This certification is highly valued by employers in the financial services and broking industries.

In addition to personal trading benefits, students can pursue careers in:

Equity Research

Technical Analyst at brokerage firms

Portfolio Management Assistance

Trading Desk Operations

Proprietary Trading Firms

ICFM’s placement support and industry connections make it easier for students to find rewarding career opportunities in the financial sector.

Why Technical Analysis is the Future of Trading

With the rise of algorithmic trading, automation, and high-frequency trading, the need for precise and quick decision-making in the market has grown. This is where technical analysis becomes indispensable. It helps traders and investors cut through the noise and rely on data-driven insights.

Learning technical analysis today puts you ahead of the curve, especially when it is taught by a reputed institute like ICFM. The institute’s curriculum evolves with market changes and keeps students up-to-date with the latest developments and techniques.

Whether it’s cryptocurrency, stock markets, commodities, or forex, the tools and principles of technical analysis remain relevant and powerful across all asset classes.

Testimonials and Student Feedback

Many ICFM alumni have gone on to become successful traders, research analysts, and financial consultants. Their feedback speaks volumes:

“ICFM’s technical analysis course changed the way I look at markets. I can now analyze trends and make confident trades. The instructors were helpful and highly knowledgeable.” – Rahul Sharma, Independent Trader

“The practical exposure I received at ICFM was unmatched. I now work as a Technical Analyst in a reputed brokerage firm, thanks to their training.” – Priya Mehta, Analyst

These testimonials show that ICFM doesn’t just teach; it transforms.

Conclusion – Learn Technical Analysis from the Best at ICFM

In today’s volatile and competitive markets, having an edge is crucial. Technical analysis gives you that edge by helping you predict price movements and manage risk effectively. And there’s no better place to learn it than ICFM.

With its expert trainers, live market training, and strong industry reputation, ICFM offers the most comprehensive and effective technical analysis course in India. Whether your goal is to trade independently or land a high-paying finance job, this course can open the door to endless opportunities.

Make the smart move—join ICFM and become a confident, successful market analyst.

READ MORE BLOG : https://www.icfmindia.com/blog/hdb-financial-ipo-gmp-decoded-the-smart-blueprint-investors-need-now

0 notes

Text

Trading Chart Patterns PDF Guide & Algo Tools

Mastering Market Moves: The Ultimate Guide to Trading Chart Patterns Book PDF

Introduction

Have you ever looked at a stock chart and thought, “What am I even looking at?” You’re not alone! Deciphering those zig-zagging lines can feel like trying to read an alien language. But what if I told you that those shapes — those patterns — actually tell a story? And once you understand that story, you could make smarter trading decisions. That’s where a trading chart patterns book PDF becomes your secret weapon.

In this article, we'll break down trading chart patterns in a friendly, no-nonsense way. We'll also explore how combining this knowledge with algorithmic trading software — especially the best algo trading software in India — can supercharge your trading game.

Download the best trading chart patterns book PDF. Learn how chart patterns, algorithmic trading software, and the best algo trading software in India help you win.

What Are Trading Chart Patterns?

Think of chart patterns like footprints in the snow. They show you where traders have been — and sometimes where they might go next. A chart pattern is just a visual formation on a price chart that helps traders make predictions. Whether it’s a triangle, a head and shoulders, or a double bottom — these shapes can signal buying or selling opportunities.

Why Use a Trading Chart Patterns Book PDF?

Let’s be real — the internet is loaded with scattered info. But a trading chart patterns book PDF puts everything in one place. It’s your go-to guide, available offline, structured, and perfect for both beginners and seasoned traders. Plus, you can refer to it anytime — even during a coffee break.

The 3 Main Types of Chart Patterns

Just like in movies, there are three main types of chart patterns:

Reversal Patterns: These hint that the trend is about to change.

Continuation Patterns: These suggest the trend will likely continue.

Bilateral Patterns: They could go either way — like a cliffhanger ending.

Understanding these gives you the power to react smartly, not emotionally.

Top Reversal Patterns Explained

Reversal patterns are like plot twists. They tell you the story is changing.

Head and Shoulders: Think of it like a person slumping. It often signals a shift from up to downtrend.

Double Top and Bottom: These patterns look like the letter ‘M’ or ‘W’. They scream, “Change is coming!”

Learning to spot these can save you from a bad trade — or help you enter just in time.

Key Continuation Patterns You Should Know

Continuation patterns keep the story flowing in the same direction.

Triangles (Ascending, Descending, Symmetrical): Imagine price compressing like a spring — ready to break out.

Flags and Pennants: These are like pit stops in a rally. The price pauses, then zooms off again.

Master these, and you’ll catch trends before others even notice.

How to Read Patterns Like a Pro

Reading chart patterns is part art, part science. Here’s how to get good at it:

Use candlestick charts for clarity.

Watch volume — it tells you how strong a move is.

Use support and resistance lines like guardrails.

It’s like learning to read music — confusing at first, but magical once you get it.

Common Mistakes Traders Make

Even the best traders mess up. Here are common traps:

Forcing patterns: If it doesn’t fit, don’t force it.

Ignoring volume: Patterns without strong volume are weak.

Overtrading: Don’t jump into every “almost” pattern.

Remember: Quality over quantity wins the game.

Best Resources for Chart Pattern PDFs

Here are some great places to find your next trading chart patterns book PDF:

Chart Patterns & Technical Indicators by Edward Dobson

Technical Analysis of the Financial Markets by John Murphy

Online libraries like Scribd, Academia, and even Reddit threads

Official broker platforms often offer free downloads

Just make sure you pick one with charts and examples, not just theory.

How Algorithmic Trading Software Helps

This is where things get exciting. Algorithmic trading software uses computer code to place trades. It can recognize patterns faster than any human. When you combine this with your knowledge of chart patterns, you’ve got a winning formula.

It’s like pairing Sherlock Holmes (your pattern spotting) with Watson (your algo software). Together, unbeatable!

Best Algo Trading Software in India

If you’re in India, here are some top-rated options:

Quanttrix – Known for speed and user-friendly interface.

Zerodha Streak – Drag-and-drop logic for non-coders.

AlgoTrader India – Offers institutional-grade automation.

Each has features like backtesting, live execution, and real-time analysis — ideal for traders who want results.

Using Chart Patterns in Algorithmic Strategies

Good algorithmic traders don’t just rely on numbers. They bake in pattern recognition rules:

Code to detect head and shoulders

Alerts for double tops

Algorithms that track breakout triangles

These strategies can be coded in platforms like MetaTrader, Python scripts, or even Streak.

Getting Started With a Chart Pattern Book

Here’s how to start:

Download a recommended trading chart patterns book PDF.

Start with 3-5 basic patterns.

Print a cheat sheet.

Look at real charts daily.

Journal what you see.

Consistency is key — don’t expect overnight success.

Tips to Practice Pattern Recognition

Think of pattern spotting like facial recognition. The more faces (charts) you see, the better you get.

Use trading simulators

Join trader communities

Quiz yourself using historical charts

Mark up charts manually

This hands-on practice boosts your confidence and instincts.

Mobile Apps & Tools for Chart Learning

Want to learn on the go? Try these:

TradingView: Mobile-friendly and packed with features.

Investing.com App: Clean charts and lots of news.

ChartSchool by StockCharts: A mini chart encyclopedia.

These help reinforce what you read in your chart pattern PDF.

Final Thoughts

Trading isn’t magic — it’s mastery. Understanding chart patterns gives you a serious edge. And when paired with powerful algorithmic trading software, especially the best algo trading software in India, you can turn insights into intelligent action.

So go ahead. Download that trading chart patterns book PDF, open up a demo account, and start seeing the market with new eyes. The journey from confusion to clarity starts with one pattern.

FAQs

What is the best trading chart patterns book PDF for beginners? “Technical Analysis for Dummies” and “Chart Patterns Explained” are great PDFs for those starting out.

Can I use chart patterns with algorithmic trading software? Yes! Many algorithmic tools allow you to code or automate pattern recognition and trading rules.

Which is the best algo trading software in India? Quanttrix and Zerodha Streak are widely recommended due to their user-friendly tools and performance.

Are trading chart patterns reliable for predicting markets? They’re not perfect, but when combined with volume and confirmation signals, they greatly improve your odds.

Where can I practice chart pattern recognition for free? Websites like TradingView and platforms like MetaTrader offer free tools and demo accounts.

0 notes

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

How Bookkeeping Can Drive Sales

The CEO’s Secret Weapon for Sales Success

Bookkeeping is not just about keeping track of numbers—it’s a strategic tool that helps entrepreneurs unlock the secrets to driving sales success. With accurate sales records and financial insights, you can make smarter decisions, refine your strategies, and build stronger relationships with your customers.

Whether you’re spotting trends, identifying high-value customers, or optimizing your marketing efforts, bookkeeping equips you with the knowledge to seize opportunities and crush your sales targets.

Key Ways Bookkeeping Impacts Sales

1. Revenue Generation Tracking

Every sale counts, and bookkeeping ensures that nothing slips through the cracks. By monitoring all sales transactions, you get a crystal-clear view of your revenue streams.

Example: Are your online sales outperforming in-store sales? With accurate records, you can double down on what’s working and address gaps where needed.

2. Trend Analysis

Your sales data holds valuable clues about seasonality, customer preferences, and product popularity. Bookkeeping lets you identify these trends and refine your strategies to capitalize on them.

Example: If you notice a spike in sales during the holiday season, you can plan promotions or stock inventory accordingly to maximize revenue.

3. Customer Segmentation

Not all customers are created equal. Bookkeeping helps you segment your audience, identify high-value customers, and uncover upselling or cross-selling opportunities.

Example: If one group of customers consistently buys premium products, you can target them with exclusive offers or complementary items.

4. Performance Metrics

Bookkeeping isn’t just about tracking sales—it’s about understanding how those sales happen. By evaluating performance metrics, you can measure the effectiveness of your sales channels or teams and identify areas for improvement.

Example: If one sales rep consistently outperforms others, you can analyze their approach and apply best practices across the team.

5. Feedback Loop

Sales and marketing are dynamic; bookkeeping provides the financial data needed to create a feedback loop. Adjust your strategies based on real-time performance to stay ahead of the curve.

Example: If a marketing campaign generates higher-than-expected revenue, you can allocate more budget to similar campaigns in the future.

The CEO’s Secret Weapon for Sales Success

Bookkeeping isn’t just about crunching numbers—it’s about empowering you with the insights to:

Spot opportunities.

Fine-tune your sales approach.

Build lasting relationships with your customers.

As a CEO, it’s your ultimate tool for turning financial data into actionable strategies that boost sales and drive growth.

Ready to unlock your full sales potential?

It’s time to embrace bookkeeping as your secret weapon for driving success.

Choose an Options:

Worksheets to Track Sales

Learn How to do Bookkeeping

Our Monthly Bookkeeping Services

The Bottom Line

Bookkeeping transforms your sales efforts from guesswork to precision. It gives you the clarity and control to track revenue, analyze trends, and optimize every aspect of your sales strategy.

Check out these resources:

How to Build BUSINESS CREDIT

Cost and Price for MicroBusiness

How to Plan for Financial Freedom

How Taxation Works

How To Pay Yourself as a Business Owner

BOOKKEEPING: The Compass Guiding Your Success

CASH FLOW: The Lifeblood of Business

0 notes

Text

Market Sentiment and Forex Market Sentiment: Key Insights and Trend Predictions

In today’s fast-paced financial landscape, understanding market sentiment is essential for informed decision-making and effective strategy development. Market sentiment reflects the prevailing mood or emotions of investors toward financial markets, shaping prices and influencing trading behaviors. In the Forex market, where the value of global currencies fluctuates continuously, sentiment plays a pivotal role. At Trending Neurons, we explore how traders can utilize market sentiment analysis to stay ahead and align with profitable trends.

Understanding Market Sentiment

Market sentiment is the collective attitude of investors toward a particular financial asset or market. It can be bullish (positive), bearish (negative), or neutral, driven by factors like economic data, geopolitical events, and investor psychology. Market sentiment influences price direction and volatility, often preceding fundamental economic changes.

Investors analyze sentiment through various indicators, including:

Technical Analysis: Technical indicators, such as moving averages, candlestick patterns, and volume, provide insights into the market's mood. Patterns, like “head and shoulders” or “double bottoms,” often reveal bullish or bearish sentiment shifts.

News and Social Media Sentiment: Platforms like Twitter and Reddit have become hubs for gauging real-time sentiment. News events, major earnings reports, and macroeconomic data releases cause immediate changes in sentiment, influencing market trends.

Fear and Greed Index: Widely used in stock and commodity markets, this index offers a snapshot of market sentiment, gauging if fear or greed drives current investment patterns.

Commitment of Traders (COT) Report: This report by the U.S. Commodity Futures Trading Commission provides insights into how major players, like hedge funds, are positioning themselves. Analyzing these positions gives a valuable perspective on market sentiment.

Forex Market Sentiment and Its Significance

In the Forex market, sentiment analysis is particularly critical as currency values fluctuate with investor sentiment, interest rates, and global economic conditions. Forex traders often use sentiment analysis to:

Detect Trend Reversals: Sharp shifts in sentiment can signal trend reversals. For instance, if investors suddenly grow optimistic about the U.S. dollar, it may rise against other currencies, impacting related trading pairs.

Identify Overbought or Oversold Conditions: Sentiment indicators like the Relative Strength Index (RSI) and Commitment of Traders (COT) positions indicate when a currency may be overbought or oversold, suggesting potential reversals.

Align with Major Market Players: By understanding where major market players are directing their investments, individual traders can make more informed predictions on currency movements.

Predicting Market Trends Using Sentiment Analysis

While market sentiment provides immediate insights, combining it with other predictive methods enhances its accuracy. Here are some ways to predict market trends effectively:

Sentiment and Technical Analysis Fusion: When sentiment aligns with technical indicators, it confirms a trend’s strength. For example, if technical analysis shows an uptrend and sentiment is positive, the trend is more likely to continue.

Global Economic Data Integration: Market sentiment often fluctuates with economic releases like GDP, unemployment rates, and interest rate announcements. Traders who stay aware of upcoming data releases and analyze sentiment pre- and post-announcement can identify profitable trends.

Correlation with Commodity Prices: Forex and commodity markets often move in tandem. For example, the Australian dollar often correlates with gold prices. By analyzing sentiment in both the currency and commodity markets, traders can develop more accurate predictions.

Machine Learning and Sentiment Analysis Tools: Machine learning models are increasingly effective for analyzing large datasets from news, social media, and market data, giving investors a real-time edge. Sentiment analysis tools powered by artificial intelligence (AI) help identify sentiment trends at a scale and speed that human analysis can’t match.

Conclusion

Market sentiment is a powerful driver in both stock and Forex markets, capable of influencing asset prices and generating opportunities. Traders and investors who leverage sentiment analysis, especially with AI-driven tools, can gain a clearer view of market trends, enabling more strategic and timely decisions. At Trending Neurons, we aim to help investors harness the power of market sentiment to better understand current conditions and forecast future market movements accurately.

0 notes

Text

Price Action Trading Strategy

Financial markets keep moving, and one always wants an edge. One of the oldest methods which have always worked in this regard is the Price Action Trading Strategy. Unlike most trading strategies that depend upon a host of technical indicators, price action trading depends upon the movement of price itself. In this tutorial, Profithills Education will walk you through the basics of price action trading and help you build a solid foundation.

What is Price Action Trading?

Price action trading is a methodology of trading that is based on the analysis of past prices. It does not depend on the usage of lagging signals like moving averages or oscillators. Price action traders express interest in raw data interpretation from price charts. Emphasis is on the interpretation to read market sentiment and patterns repeated over time.

The key aspects include:

Candlestick patterns

Support and resistance levels

Trendlines

Market structure

Price action simply portrays the psychology of all participants in the market and, for this reason, serves as a strong tool for deciphering the probable future movements.

Why Trade with Price Action?

Simplicity: It doesn't involve complicated technical indicators when trading with price action, which makes it very simple to understand and apply by traders of any level.

Flexibility: The trading strategy can be applied to any market, from stocks and forex to commodities and cryptocurrencies.

Timeliness: Price action strategies allow for timely entry and exit signals with no lag, as price is generally a leading indicator.

Key Components of Price Action Trading

1. Candlestick Patterns

Candlestick patterns are the foundation upon which price action trading rests. These serve as a window to the sentiment of market participants and also identify impending price reversals. Commonly used patterns include:

Doji: It shows indecision in the market.

Hammer: A probable bullish reversal pattern.

Engulfing Pattern: A candlestick reversal pattern in which one candle completely engulfs the real body of the preceding candle. It signals a change in the balance of power between the buyers and sellers.

2. Support and Resistance

Support and resistance are those price levels where usually a sudden change is seen in the movement of price, causing the trend to reverse or consolidate. Price action traders define these zones in order to extract buying or selling opportunities.

Support: A level where a lower degree of price swing is likely to be witnessed, resulting in the termination or reversal of the downtrend.

Resistance: A price level from which an uptrend is likely to meet resistance and may temporarily or ultimately be turned around.

The ability to successfully identify these enables the trader to effectively place their trades, for example, opening a trade when the price nears support and closing when approaching resistance.

3. Trendlines

Trendlines are-diagonal lines that are drawn in price charts to help somebody identify the direction of a market. They basically aid a trader in determining whether the market is in an uptrend, a downtrend, or range-bound. Normally, if the price breaks a trendline, it can indicate a possible reversal or acceleration of the trend.

4. Price Patterns

The trading of price action also involves the identification of patterns that suggest impending movements of the market. Some of the common patterns include:

Head and Shoulders: A trend-reversing setup.

Double Tops/Bottoms: The market has reached a turning point.

Triangles: The price will break upwards or downwards, indicating that the consolidation phase is ending.

How to Create a Price Action Trading Strategy

Price action trading is somewhat straightforward. However, you still need to have a specific strategy in place. Here's how to do this in detail:

Step 1: Define Your Market and Time Frame

Before looking into any price charts, first define what asset you are going to trade and what timeframe you want to trade on. One can trade price action on lower or higher timeframes: stocks, forex, commodities, etc. Every timeframe has its characteristics: for example, more turbulence is evident in the lower timeframes, while stronger trends are produced by higher timeframes.

Step 2: Identify Key Levels

Mark the key levels of support and resistance on your chart. These levels provide the potential points of return and enable you to have an idea of the best places to get in and out of trades.

Step 3: Confirm

The most important thing in trading price action is patience. Once you have identified a key level, wait for a confirmation signal-this could be a certain candlestick pattern, such as an engulfing pattern, or even a break of a trendline.

Step 4: Set Stop Loss and Take Profit

One must manage the risk. Always place a stop loss to limit your potential losses if the trade doesn't go your way. Conversely, have a take-profit level where you'll close the trade and bank that profit.

Step 5: Refine and Adapt

As the market is in continuous evolution, price action trading also needs ongoing evolution. Continuous refinement should be done with respect to your approach through reviewing of trades you have taken and modifying your approach according to new price data.

Common Mistakes in Price Action Trading

Overtrading: One may be seduced into laying on many trades, but one should always be on the lookout for setups. Fewer but of high quality always beats the high quantity and low quality.

Market Context: The price action needs to make sense in the broader context of the market. For example, a bearish candlestick pattern will not have as much force in a bull market that's in good shape.

Lack of Discipline: Emotional trading-like cutting losses or overly leveraging a position-can quickly whittle away at one's profits. Stick to one's plan and rules of risk management.

Conclusion

Price action trading is an incredibly powerful and adaptable approach that aligns you with the natural rhythms in the market. Understanding a few crucial ones, like candlestick patterns, support and resistance, and trendlines, will enrich your trading choices, both in how timely they are and in the quality of timing.

At Profithills Education, we firmly believe that mastery of price action will finally equip you with the necessary skills to venture into different markets with confidence. Some cornerstones for being a successful price action trader are practice, patience, and discipline.

0 notes

Text

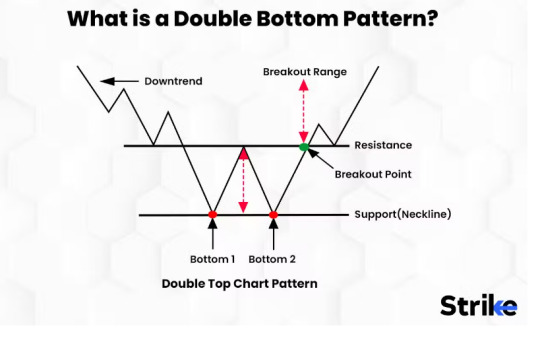

Complete Guide to Double Bottom Pattern: How to Spot, Trade & Win with This Powerful Reversal Signal

📉 What Exactly Is a Double Bottom Pattern (And Why Traders Love It)

The Double Bottom Pattern is one of the most powerful bullish reversal patterns in technical analysis. Shaped like a "W", this chart formation signals the potential end of a downtrend and the start of a new upward movement.

It forms when the price hits a low, bounces up, then returns to approximately the same low before rising again. This behavior suggests that sellers are exhausted and buyers are gaining control — a clear bullish signal for smart traders.

Traders and analysts across markets – whether stocks, forex, or cryptocurrencies – use this pattern to anticipate trend reversals with higher conviction.

In India, this pattern has played out beautifully in stocks like Tata Motors, Adani Ports, and Infosys after market corrections.

🧩 Understanding the Building Blocks of a Double Bottom

For a pattern to qualify as a true double bottom, it must have these components:

🔹 First Bottom: Occurs at the end of a downtrend — shows initial support 🔹 Neckline: Resistance level between the two lows 🔹 Second Bottom: Retest of the same support zone — often with lower volume 🔹 Breakout: Price breaks above the neckline with strong volume confirmation

On charting platforms like Strike Money, you can easily identify these levels and monitor volume spikes that confirm breakouts.

An ideal example? In 2023, Axis Bank formed a textbook double bottom around ₹720 with a neckline near ₹850. After breaking out, it surged past ₹1,000 — delivering over 30% return in weeks.

🔍 How to Confirm a Double Bottom and Avoid Costly Mistakes

Just spotting the "W" isn't enough. False signals can occur, especially in sideways markets.

✅ Volume Confirmation: Look for a noticeable increase in volume on the breakout above the neckline. ✅ RSI Divergence: If the Relative Strength Index shows higher lows when the price hits the second bottom, momentum is shifting. ✅ MACD Crossover: A bullish crossover close to the second bottom increases the chances of a real reversal.

A 2021 study by Bulkowski, a well-known chart pattern researcher, found that double bottom patterns have a success rate of around 65% when confirmed with volume and momentum indicators.

In the Indian market, HDFC Life gave a strong RSI divergence on the second dip in mid-2022 — leading to a 25% move post-breakout.

📈 Real Examples of Double Bottoms in Indian Stocks

Let’s explore some recent double bottom patterns in Indian stocks that worked well:

💹 Tata Steel: In late 2022, it formed a double bottom near ₹95. After breaking above ₹110, it touched ₹130 within two months. 💹 IndusInd Bank: The stock bottomed around ₹800 twice before rallying above ₹1,000 after volume surged. 💹 Zomato: In 2023, Zomato formed a clean double bottom near ₹45. The breakout above ₹55 attracted massive buying, taking it to ₹72.

All these setups were easier to visualize and analyze using Strike Money, which provides real-time charts, pattern recognition, and volume overlays.

🧠 Why the Double Bottom Pattern Works: Market Psychology Explained

The pattern reflects a shift in market sentiment:

💥 First drop → Panic selling 🔁 First bounce → Short covering and bargain hunting 📉 Second drop → Retest of lows; sellers lose momentum 🚀 Breakout → Bulls take over; institutional buying may kick in

This transition from fear to confidence is the core of why the double bottom is a bullish signal.

⚔️ Double Bottom vs Double Top: Don’t Confuse These Opposites

While a double bottom predicts a bullish reversal, a double top is its bearish cousin — shaped like an "M".

In a double top, prices rise, face resistance, fall, attempt another high, fail again, and then collapse — a sign of distribution and selling pressure.

Understanding the difference helps traders time both long and short trades effectively. Platforms like Strike Money let you switch seamlessly between chart patterns for fast comparison.

🚀 Smart Ways to Trade the Double Bottom Pattern for Maximum Profits

Here’s how experienced traders approach it:

📍 Entry: Enter on a confirmed breakout above the neckline. 🛡️ Stop-Loss: Place it just below the second bottom to protect against false breakouts. 🎯 Target: Measure the distance between the bottoms and neckline. Project it above the breakout level.

Let’s break this down with Infosys in 2023:

➤ First bottom at ₹1,200 ➤ Neckline at ₹1,360 ➤ Second bottom at ₹1,210 ➤ Breakout happened near ₹1,370 ➤ Target = 1,370 + (1,360 - 1,200) = ₹1,530 ➤ Stock rallied to ₹1,525 within a month!

This pattern consistently shows up in mid-cap and Nifty 50 stocks, especially after earnings-driven corrections.

❌ Common Mistakes Traders Make With Double Bottoms

🚫 Entering too early: Don’t jump in before confirmation — wait for the neckline breakout 🚫 Ignoring volume: Weak volume = weak breakout 🚫 Confusing with consolidation: Not every sideways move is a double bottom 🚫 Forgetting timeframes: Patterns on 5-minute charts behave differently from daily or weekly charts

Strike Money helps you spot fakeouts by integrating multi-timeframe analysis and volume filters directly on its dashboard.

🔬 What the Research Says About Double Bottom Pattern Performance

📊 According to a backtest by Thomas Bulkowski, well-confirmed double bottom patterns:

🧪 Have a 64-70% success rate in upward breakouts 🧪 Perform best when they take longer to form — at least 4-6 weeks 🧪 Work more reliably in large-cap stocks with high liquidity

In Indian markets, double bottoms often precede bullish rallies post-budget announcements or RBI policy updates, especially in sectors like Banking, FMCG, and Auto.

🛠️ Strike Money: Your Edge in Pattern Recognition & Trade Timing

Manually spotting chart patterns can be time-consuming. That’s where Strike Money steps in.

✅ Real-time double bottom alerts ✅ Instant neckline and support zone identification ✅ RSI, MACD, and Volume indicators built-in ✅ Works for Indian equities, indices, and crypto

With Strike Money, you don’t miss opportunities in fast-moving stocks like TCS, IRCTC, or Reliance.

❓FAQs About the Double Bottom Pattern

❔ Is the double bottom pattern reliable? Yes, especially when supported by high volume and momentum indicators.

❔ Can the double bottom fail? Yes, fakeouts can occur. Use stop-loss and confirm with volume.

❔ What’s the ideal timeframe? Daily and weekly charts provide stronger signals than intraday charts.

❔ How long does it take to form? Typically 3–8 weeks. Too short or too long may reduce effectiveness.

📣 Final Thoughts: Should You Trust the Double Bottom Pattern?

Absolutely — if used correctly. The double bottom pattern has proven its reliability across global and Indian markets for decades.

It’s not a silver bullet, but when combined with tools like Strike Money, volume confirmation, and momentum indicators, it becomes a potent strategy for:

✨ Swing traders looking for entry signals ✨ Position traders catching early reversals ✨ Investors timing re-entries after corrections

Remember: Always backtest, paper trade, and follow disciplined risk management.

0 notes

Text

Mastering Trading Candlesticks: Decoding Stock Charts Patterns for Success

In the ever-evolving landscape of financial markets, mastering the art of technical analysis is essential for traders seeking an edge. Two crucial elements in this realm are "Trading Candlesticks" and understanding "Stock Charts Patterns." Let's delve into the intricacies of these concepts to unlock their potential and enhance your trading strategy.

Understanding Trading Candlesticks

Trading Candlesticks, a fundamental component of technical analysis, provides valuable insights into price movements and market sentiment. Candlestick charts visually represent price data for a specific time period, presenting a story of market dynamics. Each candlestick consists of a body and wicks, with the body indicating the opening and closing prices, and the wicks representing the high and low points during the period.

Different candlestick patterns convey distinct messages. For instance, a "doji" signals market indecision, while a "hammer" suggests potential reversal. By recognizing these patterns, traders gain a deeper understanding of market psychology, aiding in decision-making.

Deciphering Stock Charts Patterns

Stock Charts Patterns serve as roadmaps for traders, offering insights into potential future price movements. Recognizing these patterns can be a game-changer in navigating the volatile waters of the stock market.

1. Head and Shoulders:

This classic reversal pattern signals a potential trend change. Identifiable by three peaks – a higher peak (head) between two lower peaks (shoulders) – it indicates a shift from bullish to bearish sentiment.

2. Double Tops and Bottoms:

These patterns signify trend reversal as well. A double top suggests a potential bearish reversal, while a double bottom indicates a bullish reversal. Identifying these patterns early empowers traders to make informed decisions.

3. Triangles:

Symmetrical, ascending, and descending triangles are continuation patterns, reflecting a brief consolidation before the previous trend resumes. Understanding triangle patterns aids in predicting potential breakout or breakdown points.

Integrating Candlesticks and Stock Charts Patterns

The synergy between Trading Candlesticks and Stock Charts Patterns is where the magic happens for traders. Candlestick patterns often coincide with specific chart patterns, reinforcing the likelihood of a particular market move.

For example, imagine a double bottom pattern forming on a stock chart, indicating a potential bullish reversal. Concurrently, the presence of bullish engulfing candlesticks within the pattern reinforces the upward momentum. This convergence of signals enhances the reliability of the trade setup.

Practical Tips for Traders

1. Education is Key:

Understanding the nuances of Trading Candlesticks and Stock Charts Patterns requires continuous learning. Familiarize yourself with different candlestick formations and chart patterns through educational resources and real-world examples.

2. Combine with Other Indicators:

While candlesticks and chart patterns are powerful tools, combining them with other technical indicators such as moving averages or relative strength index (RSI) can provide additional confirmation and strengthen your trading strategy.

3. Practice Patience:

Successful trading is not about constant activity but about strategic patience. Wait for a clear confirmation of the identified patterns before making your move. Rushed decisions often lead to poor outcomes.

4. Risk Management:

Prioritize risk management to protect your capital. Set stop-loss orders based on the identified patterns to limit potential losses and let profits run.

Conclusion

In the dynamic world of trading, mastering Trading Candlesticks and Stock Charts Patterns is an invaluable skill. These tools provide a nuanced understanding of market behavior, enabling traders to make informed decisions and stay ahead of the curve. By integrating these techniques and staying committed to continuous learning, you can navigate the complexities of the financial markets with confidence and precision.

0 notes

Text

“Stocks closed higher today amid brisk trading…” On the radio, television, in print and online, news outlets regularly report trivial daily changes in stock market indices, providing a distinctly slanted perspective on what matters in the economy. Except when they shift suddenly and by a large margin, the daily vagaries of the market are not particularly informative about the overall health of the economy. They are certainly not an example of news most people can use. Only about a third of Americans own stock outside of their retirement accounts and about one in five engage in stock trading on a regular basis. And yet the stock market’s minor fluctuations make up a standard part of economic news coverage.

But what if journalists reported facts more attuned to the lives of everyday Americans? For instance, facts like “in one month, the richest 25,000 Americans saw their wealth grow by an average of nearly $10 million each, compared to just $200 dollars apiece for the bottom 50% of households”? Thanks to innovative new research strategies from leading economists, we now have access to inequality data in much closer to real time. Reporters should be making use of it.

The outsized attention to the Dow Jones and Nasdaq fits with part of a larger issue: class bias in media coverage of the economy. A 2004 analysis of economic coverage in the Los Angeles Times found that journalists “depicted events and problems affecting corporations and investors instead of the general workforce.” While the media landscape has shifted since 2004, with labor becoming a “hot news beat,” this shift alone seems unlikely to correct the media’s bias. This is because, as an influential political science study found, biased reporting comes from the media’s focus on aggregates in a system where growth is not distributed equally; when most gains go to the rich, overall growth is a good indicator of how the wealthy are doing, but a poor indicator of how the non-rich are doing.

In other words, news is shaped by the data on hand. Stock prices are minute-by-minute information. Other economic data, especially about inequality, are less readily available. The Bureau of Labor Statistics releases data on job growth once a month, and that often requires major corrections. Data on inflation also become available on a monthly basis. Academic studies on inequality use data from the Census Bureau or the Internal Revenue Service, which means information is months or even years out of date before it reaches the public.

But the landscape of economic data is changing. Economists have developed new tools that can track inequality in near real-time:

From U.C. Berkeley, Realtime Inequality provides monthly statistics and even daily projections of income and wealth inequality — all with a fun interactive interface. You can see the latest data and also parse long-term trends. For instance, over the past 20 years, the top .01% percent of earners have seen their real income nearly double, while the bottom 50% of Americans have seen their real income decline.

The State of U.S. Wealth Inequality from the St. Louis Fed provides quarterly data on racial, generational, and educational wealth inequality. The Fed data reminds us, for example, that Black families own about 25 cents for every $1 of white family wealth.

While these sources do not update at the speed of a stock ticker, they represent a massive step forward in the access to more timely, accurate, and complete understanding of economic conditions.

Would more reporting on inequality change public attitudes? That is an open question. A few decades ago, political scientists found intriguing correlations between media coverage and voters’ economic assessments, but more recent analyses suggest that media coverage “does not systematically precede public perceptions of the economy.” Nonetheless, especially given the vast disparities in economic fortune that have developed in recent decades, it is the responsibility of reporters to present data that gives an accurate and informative picture of the economy as it is experienced by most people, not just by those at the top.

And these data matter for all kinds of political judgments, not just public perspectives on the economy. When Americans are considering the Supreme Court’s recent decision on affirmative action, for example, it is useful to know how persistent racial disparities remain in American society; white high school dropouts have a greater median net worth than Black and Hispanic college graduates. Generational, racial, and educational inequality structure the American economy. It’s past time that the media’s coverage reflects that reality, rather than waste Americans’ time on economic trivia of the day.

13 notes

·

View notes

Text

About a certain livestock de-wormer...

Ivermectin

.

Before I even start this post, let me get the legal shit out of the way.I am not a doctor. I haven't even been to a doctor in over 5 years.I have no medical training except for maybe 100 hours of outdated first aid training when I was in the army 40 years ago and my First Sergeant needed a break from me.I am not a pharmacist, although back in the 1980s and 90s, I have dispensed dru..... Wait, I better leave that one alone.The point being, don't take my word for shit here. Do your own research. I'm going to refer to the drug as IM in this post because I don't want Google/Blogger taking my blog down or red-paging it for not toeing the party line. It is not my purpose to try to talk you into taking it any more than I'd try to talk you out of taking the vaccine if that's what you want to do. Your body, your choice.All I'm doing is making you aware of it if you haven't already checked it out, and to pass on my own experiences and thoughts. IM has been approved for use in humans, although it's more widely known as an parasitic medication for livestock.IM, sold under the brand name Stromectol among others, is a medication that is used to treat parasite infestations. In humans, this includes head lice, scabies, river blindness (onchocerciasis), strongyloidiasis, trichuriasis, ascariasis, and lymphatic filariasis. In veterinary medicine, it is used to prevent and treat heartworm and acariasis, among other indications. It can be taken by mouth or applied to the skin for external infestations.MORE Question: If it's already been proven safe for human use, why isn't there full speed ahead testing being done to see if it works for covid?Answer: Big Pharma. IM has been off patent for years and is dirt cheap. If it's found out to be effective for covid, guess who's profits are going to nosedive in that vaccine market? * Back a few weeks ago, a very good friend who shall remain nameless - fuck it, I'll out him, it was WiscoDave - initiated a conversation with me about IM and wanted to know if I had considered taking it to 1) prevent covid and 2) use it to cure covid if I were to contract it. Me, being invincible, said no, so he turned me onto a few links and pretty much left it at that.He's a sly devil - he knew I'd eventually get bored and read them. One of them concerned a study in India. As you may recall, there was a major outbreak a couple months ago and motherfuckers were dying like flies, then all of a sudden..... nothing.Why? Because they introduced IM. HERE is the link to the study in the first sentence of this paragraph.HERE is a 25 minute youtube video along the same lines. There's more out there if you take a few seconds to look them up. Okay, I read that, then I started digging and found more articles and videos on youtube, although youtube seems to be pulling a bunch of them if they even mention covid and IM.To make a long story short, I figured to give it a try. Hell, I never was shy about trying new drugs when I was younger, so it wasn't that big of a deal.My reasoning was this: While I may be invincible, my wife is not and with her health problems, she is one of those high risk people. She doesn't get out much, so about the only way she'd get it would be from me, so I needed to protect myself, but I really don't want to get vaccinated.Besides, I keep hearing about all the deaths and complications from taking the vaccines, but I've yet to hear about anybody dying from taking IM. On top of that, every day I read about fully vaccinated people being diagnosed with covid in spite of their precautions, so even if I got vaccinated, there's a good possibility that's not going to protect my wife from getting it. Wisco had also directed me to Ann Barnhardt's IM page HERE and told me to be sure that I read it - it tells you where to buy it, how to buy it, what kinds to buy (very important!) and dosage instructions. So, armed with that knowledge, I went into town to score some of this miracle drug in the liquid form. First stop was the Farmer's Co-op in town. There was none to be had and the old boy behind the counter said they can't keep it in stock for the past few months. That seemed a little weird seeing as I haven't noticed a massive influx of livestock around here lately - unless people are buying it up to use on themselves. Bubba also told me he couldn't guarantee a hold for me when it did come in, so I headed down to Tractor Supply. Once there, I couldn't find the liquid 1% solution so I asked one of the guys and immediately started getting the 3rd degree - just exactly what I did I want it for and shit like that, so I told him it was to worm a sick donkey. He went to the back to see if there was any there, but came back to tell me there was none in stock, so I asked him to order it for me. He hemmed and hawed around until the manager walked by and told him to order anything I wanted, with as much money as I've spent in that store, so he ordered a 50ml bottle for me and I got it 3-4 days later.While I'm on the subject of Tractor Supply, if you order something online from your home, YOU pay the shipping. If you have them order it for you, it ships to your address and shipping is free - something to keep in mind. Ten bucks is ten bucks. Anyways, after I got home and was re-reading Miss Ann's page, I realized I saw the 1.87% paste there at Tractor Supply, so I hustled back down there and scored a tube for about 8 bucks.Once I got it home, I figured to give it a whirl as a preventive measure, but I didn't want to use the liquid, figuring to hold off on that in case it became 'unavailable' in the future.Now Wisco had told me the paste tasted like ass, but what the fuck, I've eaten British food before. I ain't scared. Besides, this shit was apple flavored. So I took a piece of bread, squeezed out the recommended dose (I thought), put it on the bread, folded it over and wolfed it down. I got a very slight taste of bitter apple, so I shoveled in a load of Copenhagen and that was the end of that. Now, while IM in the liquid form is taken orally, it's drawn from the bottle and measured using a syringe which can be bought at Tractor Supply, livestock supply stores and even online at vet supply sites such as Chewy.com.In the liquid form and by using a little math, you can get the dosage down for your body weight pretty easily. Using the paste, the tube dispenses the doses in 50 kilogram increments for your body weight. Luckily, as I found out, it's pretty fucking hard to overdose yourself. As I was putting the tube away, I realized I had accidentally dosed myself with double the amount recommended for my weight. It's okay to round up - better a little too much than too little according to everything I had read, but damn, I really rounded up.Like I said, the shit measures out in 50 kilo increments for body weight and I did 3 clicks instead of 2. I weigh 170 pounds and took enough for a 330 pounder.I sat down and waited to die. What I got was a very slight headache and I do mean very slight - it wasn't even bad enough to require aspirin. I didn't even cop a buzz, damn it. Okay, that's my experience. Did I have any side effects? Nope.Did I get sick to my stomach? Huh-uh.Does my dick still get hard in the morning? Most of the time, but that's my age showing.Any frothing at the mouth? Only when I brush my teeth.Do my trigger fingers still work? Yes, praise the Lord.Any newfound empathy or tolerance for Biden? Fuck no.Do I have an urge to gallop in the pasture? What happens in that pasture is between me and God. Obviously, there's precautions.Ladies, you probably don't want to take it if you're pregnant or trying to get pregnant.If you're taking medication, you most definitely want to talk with your doctor first to see if there's going to be any kind of interactions. There's a website HERE that you can check, but I think I'd want to hear it from a doctor. How you word those questions is up to you, but if it was me I wouldn't ask IF I can take it, I'd let him or her know I was going to take it and what should I know. Okay, bottom line for me: Like I said earlier, I've heard of many, many cases of horrible side effects and even deaths from taking the vaccines, but I've yet to hear of anybody taking the correct dosage of IM having any adverse effects. I'm sure there's some out there, but if they were even remotely common, the FDA would be spreading those examples everywhere. Instead, they're putting out vague warnings like this HERE.Do I believe the hype about how deadly covid is for healthy people? No. But I do believe it can make you sicker than a dog, and I generally try to avoid shit like that. And again, I do have to protect my wife by protecting myself. With her health issues, death is a very real possibility. * So, if you are considering it, please go to Ann Barnhardt's page on the stuff and read it. Again, you'll find instructions on the kind to buy (they're not all the same), dosage, how to take it, and even a little video on how to use the paste.HEREIf you're concerned about the correct dosage, she addresses that as well.HERE

2 notes

·

View notes

Text

3 Of The Top 9 Reasons That The Real Estate Bubble Will be Bursting