#SBI Payment Problem

Explore tagged Tumblr posts

Text

Which Finance is Best for Personal Loan? a Complete Guide

Introduction

Financial needs might strike without notice in the fast-paced environment of today—for a wedding, a medical emergency, or a significant life improvement. Personal loans then become useful. One issue that always begs a question, though, is which finance is better for a personal loan? Having so many lenders available makes one easily confused. By outlining what to search for in a financing firm and which ones are known for offering the best personal loan services in India, this guide hopes to streamline your decision-making process.

A personal loan is what?

Offered by banks and NBFCs, a personal loan is an unsecured financial tool used to cover different personal needs. It doesn't call collateral like secured loans do. Personal loans are rather common since they allow one to spend the money for any kind of goal, including house improvement, travel, or education. Before authorizing your application, lenders usually review your income, credit score, and job status. This is the go-to choice for fast finance since approval is simple and speedy.

Interest Rates and Annual Percentage Rate (APR)

The interest rate of every personal loan is among its most important features. It affects the whole amount of repayments directly. While some businesses provide floating rates that change with the state of the market, others have set interest rates. Always assess the APR, which covers various expenses in addition to the interest rate.

Loan Tenure and EMI Flexibility

Managing your monthly payments much depends on loan term. Shorter tenures produce greater EMIs but lesser interest paid over time. Conversely, longer tenures lower your EMI but raise your total expenses. Selecting a lender with flexible E MI choices will enable you to better handle your money free from concern.

Processing Fees and Other Charges

Apart than the interest, you should know about processing costs, paperwork expenses, and prepayment penalties. Certain financial firms promote low interest rates yet pay expenses with surreptitious fees. Always check the fine print to save later unanticipated costs.

Customer Reviews and Service Support

Customer service quality of a financing organization typically reflects your treatment once your loan is issued. Examining real consumer reviews on websites like Google or financial forums will help you learn about the dependability, attentiveness, and problem-resolving power of the lender.

Top Finance Companies for Personal Loans in India

HDFC Bank

HDFC is well-known for providing low paperwork, fast disbursals, and attractive interest rates. Among salaried professionals needing quick approval, this is a common option.

ICICI Bank

Convenience of digital processing allows ICICI to offer customized personal loan choices. For current account holders seeking quick approval, it is perfect.

Bajaj Finanserv

For providing quick approvals and flexible terms, this NBFC is quite highly rated. It fits those needing quick loans with less documentation.

Tata Capital

Tata Capital offers pre-approved lending solutions together with customer-friendly loan schemes. Its clear prices and simple application technique help to build trust.

SBI (State Bank of India)

Particularly for government workers, SBI distinguishes itself with low-interest personal loans. Being a public sector bank gives credibility and economy together.

Online Loan Aggregators – Are They Reliable?

Online aggregators like Bankbazaar and Paisa Bazaar streamline the hunt for the best personal loan. These sites rank different lenders depending on your income, credit score, loan amount. They are a terrific approach to investigate several choices without personally visiting banks.

Conclusion

In essence, the answer to the question, which finance is best for personal loan, depends on your own needs—loan amount, capacity for payback, and urgency. Before deciding on anything, always evaluate consumer comments, costs, and interest rates. See more broadly using aggregators; never miss reviewing your credit score before applying. Making a wise choice now will save a lot of money down road.

0 notes

Text

5 Documents You Didn’t Know a Hyderabad Virtual Office Could Handle in 2025

For startups, freelancers, and small business owners in Hyderabad, keeping operations lean without compromising professionalism is the name of the game. One of the smartest moves you can make? Investing in a virtual office in Hyderabad. It’s not just about a fancy commercial address anymore. Today’s virtual offices are sophisticated, all-in-one hubs that handle far more than just mail or call forwarding.

In fact, one of the most overlooked advantages is how efficiently these setups can manage key business documents—saving you time, effort, and even legal headaches.

Whether you're just starting your entrepreneurial journey or are shifting from a traditional office, here are five important documents that a Hyderabad virtual office can handle for you—many of which business owners don’t even realize are included.

1. GST Registration Documents and Support

Many business owners know they need a virtual office for a business address, but few realize just how integral that address is for Goods and Services Tax (GST) registration.

If you’re a service provider, eCommerce seller, or consultant in Hyderabad, you’re legally required to register for GST if your turnover exceeds the threshold or you operate across states.

A reliable virtual office in Hyderabad typically provides you with all the necessary documentation to complete this process, including:

No-Objection Certificate (NOC)

Rent or lease agreement

Utility bill (for address verification)

These three documents are often enough to satisfy the compliance checklist for GST. And the best part? You don’t have to physically occupy the space—yet your business is 100% compliant.

Pro Tip: Many premium virtual office providers in Hyderabad even assist you during the actual GST application process, guiding you through the online portal or connecting you with certified tax professionals.

2. ROC Filing Support for Registered Offices

If your business is a private limited company or LLP, you need a registered office address for Registrar of Companies (ROC) compliance under the Ministry of Corporate Affairs (MCA). But here’s where it gets interesting—a virtual office in Hyderabad can be used as your official ROC-registered office.

Your provider supplies all the mandatory documents required by the MCA:

Agreement stating the address use for ROC purposes

NOC from the space owner

Address proof like utility or property tax bills

By using your virtual office address for ROC filings, you can keep your personal residence private and still meet all legal formalities. Plus, all government correspondence and notices will be handled professionally and forwarded to you, reducing risk of missed communication.

This is a huge time-saver for directors who travel often or manage multiple ventures.

3. Business Bank Account Documentation

Opening a business current account with any leading bank requires a business address, identity proof, and legal documentation. If you don’t want to rent a costly commercial space just for this, a virtual office in Hyderabad can again come to the rescue.

Here’s how:

Most banks accept virtual office documentation as valid address proof, provided it includes a signed rent agreement and utility bill. Once you receive these from your virtual office provider, you can confidently submit them to:

SBI

ICICI

HDFC

Axis Bank

Kotak Mahindra Bank

This enables you to open a business account in Hyderabad even if you’re running a remote or freelance operation. With that, you can issue professional invoices, accept B2B payments, and manage cash flow more efficiently.

Many virtual offices also offer assistance with drafting support letters or coordinating with your bank’s KYC officer in case of any clarifications.

4. Courier and Legal Notice Management

Let’s face it—whether you’re in eCommerce, consulting, or freelancing, legal notices and courier packages will eventually become part of doing business.

The problem? If you’re operating from home or constantly on the move, you might miss important deliveries, including legal communication, vendor cheques, or government correspondence. A missed legal notice can lead to penalties, lost clients, or even litigation.

A virtual office in Hyderabad ensures this never happens.

Here’s what most professional setups offer:

Acceptance of all registered posts and courier packages

Immediate notification via SMS, email, or app

Optional mail scanning and email forwarding

Option to physically collect or redirect parcels to your desired address

If any legal documents are served—such as client disputes, vendor issues, or compliance warnings—the virtual office team receives them on your behalf, logs the entry, and notifies you.

This way, you remain informed and compliant at all times, without needing to sit in a physical office every day.

5. Business Licensing & MSME/Udyam Registration Documents

Many industries in Hyderabad, including event management, IT consulting, and digital marketing, require special business licenses—or benefit greatly from registering under government schemes like MSME (now Udyam).

But most of these registrations demand a valid business address with appropriate supporting documentation.

Here’s where a virtual office in Hyderabad can fast-track your growth.

The address documentation provided by your virtual office—especially when located in a commercial zone—is often accepted by:

Telangana State government portals

Udyam registration platforms

Shops & Establishment Act compliance departments

Digital marketing platform verifications (like Facebook Business Manager and Google My Business)

If you apply for government tenders, business insurance, or funding, this address and its paperwork become indispensable.

So not only does a virtual office support compliance—it also helps you access opportunities you might have otherwise missed.

Why These Document Services Matter More in 2025

In 2025, the lines between virtual, physical, and remote working are thinner than ever. Yet legal compliance and business professionalism are still non-negotiable.

Here's how the document handling power of a virtual office aligns with the needs of modern businesses:

Startups: Avoid the overhead of a physical office while still complying with MCA, GST, and banking norms.

Freelancers: Gain credibility with clients and access full-fledged business accounts using proper documentation.

eCommerce Sellers: Use the virtual office as your legal pickup/drop location for marketplace verification and invoice compliance.

Consultants and Coaches: Impress clients with premium addresses and avoid missing legal notices or bank documents.

Growing SMBs: Maintain multiple city presences without renting multiple offices—all while staying legally sound.

If you're planning to scale in 2025, having a document-savvy virtual office in Hyderabad isn't just useful—it’s essential.

FAQs

Q1. Can a virtual office in Hyderabad provide all documents for GST registration? Yes. You’ll get a NOC, rent agreement, and utility bill—sufficient for GST registration in Telangana.

Q2. Will banks accept a virtual office address for business account setup? Most banks accept virtual office documents like rent agreements and address proof for current account KYC.

Q3. Can I receive legal notices at my virtual office address? Yes. Your virtual office will receive legal notices, log them, and notify you—ensuring nothing is missed.

Q4. Is a virtual office enough for Udyam or MSME registration? Absolutely. Virtual office documentation is accepted for most government schemes and registrations.

Q5. What if I’m not physically present in Hyderabad to collect documents? Most providers offer courier forwarding, scanning, and remote handling options so you can access documents from anywhere.

Final Thoughts: Don't Just Rent an Address—Rent Peace of Mind

A virtual office isn’t just about appearances. It’s about real, operational support—especially when it comes to documentation. In Hyderabad’s fast-paced business scene, staying compliant while projecting professionalism is a balancing act.

By choosing a feature-rich virtual office in Hyderabad, you unlock not just a workspace alternative—but a back-end powerhouse that keeps your business running, legally protected, and always responsive.

Whether it’s GST, ROC, bank compliance, or courier handling—these are five critical tasks you don’t have to worry about anymore.

#VirtualOfficeInHyderabad#HyderabadStartups#RemoteBusinessIndia#VirtualOfficeBenefits#Compliance2025#BusinessDocumentsIndia

0 notes

Text

Competitive Exams Coaching Centers in Hyderabad

RACE4JOB – Best Competitive Exams Coaching Center in Hyderabad

In today’s highly competitive world, securing a government job or cracking prestigious exams like UPSC, TSPSC, SSC, Banking, Railways, or Defense requires expert guidance and strategic preparation. RACE4JOB, Hyderabad’s premier coaching institute, is dedicated to helping aspirants achieve their dreams with top-notch training, experienced faculty, and proven success strategies.

With a high success rate, personalized mentoring, and comprehensive study materials, RACE4JOB stands out as the best coaching center in Hyderabad for competitive exams. Whether you're preparing for civil services, banking, or state-level PSC exams, our structured programs ensure you stay ahead of the competition.

Why Choose RACE4JOB for Competitive Exam Coaching?

✅ Expert Faculty with Years of Experience Our team consists of former IAS/IPS officers, retired bankers, and subject-matter experts who provide: ✔ In-depth conceptual clarity ✔ Exam-oriented coaching ✔ Real-life problem-solving techniques

✅ Comprehensive Study Material & Test Series We provide:

✔ Latest syllabus-based books & notes ✔ Daily/weekly mock tests ✔ Previous year question papers with solutions

✅ High Success Rate & Student Achievements

RACE4JOB has a track record of producing top rankers in:

UPSC Civil Services

TSPSC Group I, II, IV

SSC CGL, CHSL, MTS

Bank PO/Clerk (IBPS, SBI, RBI)

Railway NTPC, ALP, Group D

Defense Exams (NDA, CDS, AFCAT)

✅ Small Batch Sizes for Personalized Attention

Unlike crowded coaching centers, we maintain limited batch sizes to ensure: ✔ One-on-one doubt-clearing sessions ✔ Customized study plans ✔ Regular performance tracking

✅ Affordable Fee Structure with Scholarships We offer:

✔ Flexible payment options ✔ Scholarships for meritorious students ✔ Installment-based fee payment

Popular Courses Offered at RACE4JOB

UPSC Civil Services Coaching (IAS/IPS/IFS)

✔ Prelims + Mains + Interview Guidance ✔ Current Affairs & Essay Writing Classes ✔ CSAT & Optional Subject Specialization

TSPSC Group I, II, IV Coaching ✔ Complete Telangana State PSC Syllabus Coverage ✔ State-specific GK & Current Affairs ✔ Answer Writing Practice & Interview Prep

Banking Exams (IBPS, SBI, RBI) ✔ Quantitative Aptitude & Reasoning Mastery ✔ English & Banking Awareness Classes ✔ Mock Tests with Detailed Analysis

SSC Exams (CGL, CHSL, MTS, GD Constable) ✔ Speed Math & Shortcut Techniques ✔ General Science & Static GK Sessions ✔ Previous Year Paper Discussions

Railway & Defense Exams (RRB NTPC, NDA, CDS) ✔ Mathematics & General Ability Training ✔ Physical Fitness & SSB Interview Tips ✔ Specialized Coaching for Defense Aspirants

State & Central Government Job Exams ✔ State Police, SI, Constable Exams ✔ LIC AAO, FCI, EPFO, ESIC ✔ State & Central Govt. Clerk Exams

Unique Features of RACE4JOB Coaching

🔹 Smart Classroom with Digital Learning

✔ Interactive online & offline classes ✔ Recorded lectures for revision ✔ E-learning portal with study resources

🔹 Daily Current Affairs Updates

✔ Newspaper analysis sessions ✔ Monthly current affairs magazines ✔ GK quizzes & revision notes

🔹 Regular Mock Tests & Performance Analysis

✔ Full-length simulated exams ✔ Sectional & topic-wise tests ✔ Detailed scorecard with weak area analysis

🔹 Interview & Personality Development Training

✔ Mock interviews by retired bureaucrats ✔ Group discussion (GD) practice ✔ Communication skills & body language training

Student Success Stories

"RACE4JOB helped me crack TSPSC Group II in my first attempt!" – K. Rajesh (Rank 12)

"Best UPSC coaching in Hyderabad! Cleared prelims with their guidance." – Priya Reddy

"From zero to hero in banking exams – Thanks to RACE4JOB!" – Suresh Kumar (SBI PO)

Locations & Branches in Hyderabad We have multiple centers for easy access:

📍 Ameerpet (Main Branch) 📍 Dilsukhnagar 📍 Kukatpally 📍 Secunderabad 📍 LB Nagar

Weekend & Online Batches Available!

How to Enroll at RACE4JOB?

1️⃣ Visit Our Center – Walk in for a free counseling session. 2️⃣ Attend a Demo Class – Experience our teaching style. 3️⃣ Choose Your Course – Select the right program for your goal. 4️⃣ Start Your Preparation – Join regular/weekend/online batches.

Frequently Asked Questions (FAQs)

❓ What is the fee structure for UPSC coaching?

✔ Fees vary based on course duration (₹25K – ₹1L). Installments available.

❓ Do you provide online classes? ✔ Yes! Live & recorded lectures for remote students.

❓ How is RACE4JOB better than other institutes? ✔ Small batches, expert faculty, high success rate, and affordable fees!

❓ Is there a scholarship program? ✔ Yes, based on entrance test performance.

❓ What is the batch timing? ✔ Morning (7 AM – 10 AM) & Evening (5 PM – 8 PM) batches.

Why RACE4JOB is the Best Choice in Hyderabad?

✔ Highest selection rate in govt. jobs ✔ Affordable fees with EMI options ✔ Weekend batches for working professionals ✔ Free career counseling & exam strategies

🚀 Join RACE4JOB Today & Turn Your Dreams into Reality!

For More Details:

Race Coaching center,

Call Us: +91-9985999900

Gmail: [email protected]

Website: https://www.race4job.com/

Address: Pillar No.1544, Megha Theatre Lane, Metro Station Dilsukhnagar, 1st Floor, Mumbai Complex, Sai Baba Temple Rd, near Metro Station, Hyderabad, Telangana 500060.

0 notes

Text

Best Bank Coaching Institute in Guwahati

https://www.visionq.co.in (VisionQ) – Best Bank Coaching Centre in Guwahati

Located in the heart of Guwahati, VisionQ is a premier institute dedicated to preparing aspiring candidates for various banking exams, including IBPS PO, IBPS Clerk, SBI PO, SBI Clerk, RBI Assistant, and other competitive banking sector exams. With a strong track record of success, expert faculty, and a student-friendly learning environment, we ensure that every student gets the best guidance to achieve their dream of securing a job in the banking sector.

Why Choose VisionQ for Best Bank Coaching Institute in Guwahati?

✅ Experienced Faculty: Our team comprises highly qualified and experienced faculty members who specialize in banking exam coaching. They provide in-depth subject knowledge and exam-oriented strategies.

✅ Comprehensive Study Material: We offer well-structured study materials, mock tests, and practice sets that cover the latest exam syllabus and pattern. Our study materials are designed to simplify complex topics and enhance conceptual clarity.

✅ Regular Mock Tests & Performance Analysis: Our institute conducts weekly mock tests, speed tests, and full-length exams to track students’ progress and help them improve their speed and accuracy. We also provide personalized performance analysis to identify strengths and areas for improvement.

✅ Doubt-Clearing Sessions: To ensure that no student is left behind, we conduct regular doubt-clearing sessions where students can interact with faculty members and get their queries resolved effectively.

✅ Updated Exam Pattern & Syllabus Coverage: We stay updated with the latest changes in banking exams and update our syllabus accordingly to ensure that students are well-prepared for any modifications in the exam pattern.

✅ Time Management & Shortcut Techniques: Bank exams require smart time management. Our trainers provide exclusive shortcut tricks and problem-solving techniques for quantitative aptitude, reasoning ability, and data interpretation.

✅ Affordable Fee Structure: We believe that quality education should be accessible to everyone. Our coaching programs are offered at an affordable price, with flexible payment options.

✅ Online & Offline Classes Available: We offer both classroom coaching and online classes to accommodate the needs of every student. Our online learning platform includes live sessions, recorded lectures, and practice quizzes.

✅ Library & Study Environment: Our centre provides a well-equipped library with a vast collection of books, previous year question papers, and practice materials. The study environment is calm, focused, and student-friendly.

Courses Offered:

✔ IBPS PO & Clerk Coaching ✔ SBI PO & Clerk Coaching ✔ RBI Assistant & Grade B Coaching ✔ Specialist Officer (SO) Coaching ✔ Insurance & Government Exam Coaching

Join Us Today & Achieve Your Banking Career Goals!

If you are looking for the best Bank Coaching Centre in Guwahati, Best Bank Coaching Institute in Guwahati, Banking Coaching Centre in Guwahati, Banking Institute in Guwahati, Banking Coaching in Guwahati and Bank Coaching in Guwahati, VisionQ is your ultimate destination. With our expert guidance, structured curriculum, and dedication to student success, we ensure that you are well-prepared to crack any banking exam with confidence.

✔ Location: TRIYAMBAK, 1st Floor, House Number 11, Nabagraha Road, Silpukhuri, Guwahati - 781003, Assam, India

✔Contact: 0361-3560206 / 6001214044 / 8506067394

✔ Website: https://www.visionq.co.in

✔ Email: [email protected] Enroll Now & Start Your Journey Toward a Successful Banking Career! 🚀

0 notes

Text

Unlocking Financial Freedom: Doctor Loan in India

Physicians, as with any professionals, have their share of problems when it comes to finances, whether it is for opening or increasing their practice, new equipment, or just covering personal financial requirements. Luckily, loan for doctors is an excellent option tailored for them. Herein, let us see how doctor loans help, what are the advantages of doctor loans, and the interest rates for doctor loans in India.

What is a Loan for Doctors?

A doctor loan is a specific financial instrument created to address the special requirements of medical practitioners. As a general practitioner, surgeon, or dentist, these loans have flexible terms and conditions that cater to the requirements of your line of work. These loans are available for use in several purposes, such as establishing a clinic, buying medical equipment, expanding your practice, or even addressing personal financial objectives.

Advantages of Loan for Doctors

Lower Interest Rates: Doctor loans, as compared to standard personal loans, have comparatively lower interest rates, ensuring ease in repayment without much financial burden on medical professionals.

Flexible Repayment Options: Banks and other financial institutions provide flexible repayment options to doctors, enabling them to select the loan tenure according to their convenience.

Increased Loan Amount: Doctors can apply for higher loan amounts since they are high-income professionals with a secure earning capacity.

Less Documentation: Doctors' loan applications often need less documentation, thereby expediting the approval process and streamlining it.

What is a Professional Doctor Loan?

A doctor's professional loan is another form of financial assistance that enables medical practitioners to access funds to expand their practice. These loans are different from personal loans because they are specifically designed for medical professionals who require financial support to invest in their business or self-improvement. This loan can assist doctors with costs of upgrading their clinic, purchasing sophisticated medical equipment, or even financing their education.

Key Features of Professional Loans for Physicians:

Personalized Loan Amounts: Depending on the qualifications of the doctor and the type of practice, the loan amount is fixed.

Collateral-Free Loan: Most professional loan for doctors are collateral-free, so doctors do not need to mortgage personal assets as security.

Loan Tenure: The tenure of the loan is longer than that of normal loans, so monthly payments are more manageable for doctors.

Loan for Physicians in India: How Does it Work?

In India, doctor loan is becoming a highly sought-after option, particularly as the healthcare industry continues to develop at a rapid pace. Doctor loans in India are offered by different banks, financial institutions, and NBFCs (Non-Banking Financial Companies), providing customized solutions to doctors at competitive interest rates.

Doctor Loan Interest Rate in India

The interest rate of the doctor loan in India generally varies between 9% and 16%, based on the bank, loan size, and tenure. Banks like SBI, HDFC, and Axis Bank provide specialized doctor loan products with lower interest rates and special benefits.

Eligibility Criteria for Doctor Loan in India

In order to get a doctor loan in India, the applicant should fulfill the following basic requirements:

Be a medical doctor with a recognized degree (MBBS, MD, BDS, etc.)

Have a stable source of income (either from an established practice or salaried job in a hospital)

Be 25 years or older (varies with lenders)

At least two years of professional experience is commonly demanded by banks.

Documentation Required:

The documentation process is normally straightforward and consists of:

Proof of qualification (medical degree, registration certificate)

Proof of income (tax returns, bank statements)

Proof of identity and address (Aadhar card, passport, etc.)

How to Get a Loan for Doctors?

Getting a loan for doctors is simple and can be done online or offline. The following are the general steps to take:

Research:

Compare different loan products offered for doctors, considering interest rates, loan amount, and repayment terms.

Application: Complete the application form either online or physically at the bank or lender of your choice.

Submit Documents:

Submit the required documents like your medical degree, proof of income, and other personal details.

Conclusion

A doctor loan can go a long way in helping medical professionals realize their aspirations, be it expanding their practice or handling financial crises. At pocket-friendly doctor loan interest rates, professional doctor loans, and accessible loan for doctor in India, this product helps empower doctors to take control with the financial abilities they require. By knowing what loan options you have, you can maintain your financial independence and be able to continue doing what really matters to you excelling in providing great medical services to patients.

1 note

·

View note

Text

Why every modern wallet needs a Credit Card? Kredit Wala

Are you planning to get a credit card in India: Yes, No, Maybe? Well you will be happier to know that you are not alone who are stuck in this question. The answer to this should be given after a lot of research and that's why we are here today with Kredit wala.

Why you should get a credit card as soon as you start working? | Kredit wala

Credit cards are one of the most important things in this modern world and today we will be going through pros and cons of credit cards. Reading this Kreditwala article completely will help you make your decision more precisely.

Pros of Having a Credit Card in India

Okay, let’s discuss the pros of the presented models! Well, let me state that having a credit card in India is rather convenient. Here's why:

1. Convenience and Cashless Transactions

First of all, let me say it is incredibly handy. It is no longer necessary to walk around with pocket money all the time. All you need to do is to swipe your card and that’s it! It also suits shopping online very well. No more concerning whether it is possible to make it through the week without sufficient money.

2. Build Credit Score

On the heels of that, credit cards can assist one in establishing a good credit rating. What's that, you ask? Well, in a way, it is kind of equivalent to a report card of how you are performing in terms of your money matters. If you manage your card properly; make your payments on time, then your score improves. This can in turn assist you get loans easier in the future.

3. Rewards and Cashback

Now, who does not like to get something for free? Most of the credit cards come with bonus offers or cash back offers. This is like a thank you every time you are spending, such a wonderful thing to have. Kredit Owner provides best credit cards that award you what you can use to travel or shop. Some return you money. It's pretty cool!

4. Interest-Free Credit Period

Here is another advantage – the interest free period. Credit cards allow you free spending for approximately 45-50 days before it is due and attracts an interest. It is like a short term, no interest credit if you pay on time.

5. Emergency Financial Support

Credit cards can also be handy especially in emergency situations. Car broke down? Unexpected medical bill? Your credit card is a savior when you are in a fix.

6. Online Shopping Benefits

All you shoppers who shop online then you know that Kredit wala credit cards have offers most of the time. There might be additional percentage cuts or free delivery services that you could be accorded. It's worth checking out!

7. Travel Perks

Finally, Kreditwala Reviews provides credit cards have good benefits if you are a regular travellers. Lounge access at the airport, insurance, air miles and so on. It can make your trips a bit more comfortable and does not have to be as expensive.

However, it is vital to understand that these benefits are only useful when you are using the card wisely. Quite often students think that such money is free money and do not have to pay it back. If used wisely, a credit card is actually a very good thing to have in your wallet and pocket.

Read Also: Elevate your shopping experience with Reliance SBI Card

Cons of Having a Credit Card in India

Okay, time to discuss the drawbacks about having a credit card in India. It is equally necessary to know these!

1. High Interest Rates

First of all, the interest rates are rather high here. If you fail to pay the full amount at the due date, then you have to pay some more amount. Believe me, it all sums up very quickly! There are cards that attract interest rates of 3-4% on the principal sum every month. That's a lot!

2. Annual Fees and Hidden Charges

And there are the fees of course. The problem is many credit cards have an annual fee that one is charged just for having the card.

3. Overspending Temptation

Here is a big one – overspending is relatively easy to do. That could be why when you are using your card to swipe, it does not feel like actual money. One could always spend money on things they do not require for instance. You blink an eye and you realize you have gone way over budget.

4. Risk of Debt Accumulation

That is the truth; if you are not careful, you land yourself in a fix whereby you have to pay some money you did not plan to. It begins with a very small area, but can expand rapidly. Credit card debt can take some people for ages to pay off. It also does not sound like a pleasant position to be in.

5. Impact on Credit Score if Mismanaged

Well, if you tamper with your credit card, then your score will be affected. If you go on to miss payments or to reach your credit limit you are likely to see your score drop. This can prove cumbersome when trying to obtain loans in the future.

Well, now, let me be very clear not to be misunderstood. What many people do not realize is that credit cards are not necessarily a bad thing in society. But it is very crucial to know these disadvantages because without it no one can be good at it.

Conclusion

In conclusion, credit cards can be good in India but they should be used wisely. If after going through this article, you conclude that a credit card is suitable for you, why not try Kreditwala? They give many choices, and useful suggestions.

Also, you can visit the Kreditwala News to be aware of the latest pieces of advice on credit card usage. Credit card is a great tool – just be smart using it and it can indeed assist you a lot. Don’t you think it is high time you consider your options with Kredit Wala?

Read Also: Kredit Wala | Are you aware of the Credit Card Hacks?

#kreditwala#kreditwalaowner#kreditwalanews#kreditwala news#kreditwala owner#kredit wala#kreditwala reviews

0 notes

Text

State Bank of India Balance Checking Number

Checking your bank balance is crucial for managing your finances effectively. The State Bank of India (SBI) offers multiple convenient methods for customers to check their account balance. This article will guide you through these various options, focusing on the SBI balance check number and other helpful services.

State Bank of India Balance Checking Number

https://paisainvests.com/wp-content/uploads/2024/07/sdsfdsfdsf.webp

Why Knowing Your Balance is Important

Understanding your bank balance helps you keep track of your spending, avoid overdrafts, and ensure that your financial health is in check. It’s essential for budgeting, planning expenses, and avoiding unexpected fees.

Methods to Check SBI Account Balance

1. SBI Balance Check Number

How to Use the SBI Balance Check Number

To check your SBI account balance, dial the SBI balance check number: 09223766666 from your registered mobile number. Within seconds, you’ll receive an SMS with your account balance details.

Benefits of Using the SBI Balance Check Number

This method is quick, easy, and doesn’t require internet access. It’s especially useful for those who need their balance information instantly and for customers who aren’t tech-savvy.

2. SBI Missed Call Service

How to Use the Missed Call Service

Simply give a missed call to 09223766666 from your registered mobile number. You’ll receive an SMS with your account balance shortly after.

Advantages of Missed Call Service

The missed call service is free and convenient, making it accessible to all customers, including those with basic mobile phones.

3. SMS Banking

Steps to Use SMS Banking

Send an SMS in the format BAL to 09223766666 from your registered mobile number. You will get an SMS response with your account balance details.

Pros of SMS Banking

SMS banking is useful for those who prefer texting over calling. It provides a written record of your balance, which can be handy for future reference.

4. Internet Banking

Checking Balance Online

Log in to your SBI Internet banking account using your credentials. Navigate to the ‘Account Summary’ section to view your balance and recent transactions.

Security Tips for Internet Banking

Ensure you use strong passwords, log out after each session, and avoid accessing your account from public Wi-Fi networks to maintain security.

5. SBI YONO App

Using the YONO App to Check Balance

Download the SBI YONO app from the App Store or Google Play. After registering, you can easily check your balance and perform other banking operations through the app.

Features of the SBI YONO App

The YONO app offers a comprehensive range of features, including fund transfers, bill payments, loan applications, and investment services, making it a one-stop solution for all your banking needs.

How to Register for SBI Balance Services

Registering Your Mobile Number

Visit your nearest SBI branch or ATM to link your mobile number with your account. This is essential for using SMS banking and missed call services.

Activating Internet Banking

You can activate internet banking by visiting the official SBI website (State Bank of India (onlinesbi.sbi)) and following the registration process. Alternatively, you can request assistance at your local branch.

Downloading and Setting Up the SBI YONO App

Download the app, complete the registration process by entering your account details and OTP, and set up your login credentials to start using the YONO app.

Troubleshooting Common Issues

Missed Call Service Issues

If you’re not receiving balance updates via missed calls, ensure your mobile number is registered with the bank and check for network issues.

SMS Banking Errors

Double-check the SMS format and ensure your mobile number is correctly registered. If issues persist, contact SBI customer service for assistance.

Internet Banking Login Problems

If you’re facing login issues, try resetting your password or contact SBI customer support for help. Ensure your browser is updated and clear your cache regularly.

Conclusion

SBI offers multiple convenient ways to check your account balance, making banking easy and accessible for everyone. Whether you prefer calling, texting, or using the internet, SBI has got you covered. Keeping track of your balance has never been simpler!

By Paisainvests.com

#balance inquiry SBI#bank balance check#SBI account balance#SBI account details#SBI account management#SBI balance#SBI balance check#SBI balance check number#SBI balance checking number#SBI balance enquiry#SBI balance information#SBI customer service#SBI mobile banking#SBI phone banking#SBI SMS balance check#State Bank of India

0 notes

Text

Top Institute for Banking Preparation in Kolkata | VANIK

In recent years, the demand for banking jobs in India has surged, with aspirants across the country seeking top-notch training to secure their dream positions. Kolkata, a city renowned for its rich educational heritage, offers a plethora of coaching centers specializing in banking exam preparation. Among these, Vanik Institute stands out as a premier choice for many aspirants. This essay explores why Vanik Institute is considered one of the best institutes for banking preparation in Kolkata.

Comprehensive Course Structure

Vanik Institute offers a meticulously designed curriculum that covers all aspects of banking exams, including the IBPS PO, IBPS Clerk, SBI PO, SBI Clerk, and other regional rural bank exams. The course structure is divided into various segments to address the different sections of these exams:Quantitative Aptitude: Focuses on enhancing numerical ability and problem-solving skills. Reasoning Ability: Develops logical thinking and analytical skills. English Language: Aims at improving grammar, comprehension, and vocabulary. General Awareness: Keeps students updated with current affairs and banking-related news. Computer Knowledge: Provides essential computer literacy required for banking jobs.

Experienced Faculty

The backbone of any educational institute is its faculty, and Vanik Institute prides itself on having a team of highly qualified and experienced educators. The faculty members are experts in their respective fields, bringing a wealth of knowledge and practical insights to the classroom. Their teaching methodologies are designed to simplify complex concepts, making learning an engaging and effective process. State-of-the-Art Infrastructure

Vanik Institute boasts state-of-the-art infrastructure, providing a conducive learning environment for students. The institute offers:Well-equipped Classrooms: Spacious and air-conditioned classrooms with modern teaching aids. Library Facilities: A well-stocked library with an extensive collection of books, journals, and online resources. Computer Labs: Access to computer labs for practicing online mock tests and computer-based learning.

Personalized Attention and Doubt Clearing Sessions

Understanding that each student has unique strengths and weaknesses, Vanik Institute emphasizes personalized attention. The batch sizes are kept manageable to ensure that instructors can focus on individual students. Regular doubt-clearing sessions are organized where students can seek clarifications on difficult topics, ensuring that no one is left behind. Regular Mock Tests and Performance Analysis

One of the standout features of Vanik Institute is its rigorous testing mechanism. Regular mock tests are conducted to simulate the actual exam environment, helping students manage time and stress effectively. Detailed performance analysis follows each test, providing insights into areas of improvement and guiding students on how to enhance their performance. Success Stories and Alumni Network

The success rate of Vanik Institute speaks volumes about its effectiveness. Many of its alumni have secured prestigious positions in various banks across the country. The institute maintains a strong network of successful alumni who often return to share their experiences and tips with current students, fostering a sense of community and motivation. Affordable Fee Structure

While quality education often comes at a price, Vanik Institute strives to make its courses affordable without compromising on quality. The institute offers various payment plans and scholarships to deserving students, ensuring that financial constraints do not hinder one's educational aspirations. Conclusion

In the competitive landscape of banking exam preparation, Vanik Institute in Kolkata has carved a niche for itself through its comprehensive curriculum, experienced faculty, excellent infrastructure, and student-centric approach. It not only prepares students for exams but also equips them with the confidence and skills needed to excel in their banking careers. For aspirants in Kolkata looking for the best institute for banking preparation in kolkata, Vanik Institute stands out as a beacon of quality education and success.

#best institute for banking preparation in kolkata#Best Coaching centre for Bank job#Best coaching institute for banking Exam in Kolkata

0 notes

Text

How To Get The Best Credit Card Out There

The first step in choosing a credit card is making sure the benefits outweigh the costs. Keep reading to learn how to use your charge cards wisely in order to avoid some common problems. Many people have cards that do not even understand the proper way to use them and this leads to bad debt.

Credit Card Companies

These days, many credit card companies offer large incentives for using their card. Make sure that you’re fully aware of what’s in the fine print, as bonuses offered by credit card companies often have strict requirements. The most common is that you have to spend a certain amount of money within a few months, so be sure that you will actually meet the qualifications before you are tempted by the bonus offer.

Make your credit payment before it is due so that your credit score remains high. Your score is damaged by late payments, and that also usually includes fees that are costly. Avoid this problem by setting up automatic payments to come out of your bank account on the due date or earlier.

Set yourself a budget you can stick with. Just because there are limits on your card, does not mean you can max them out. Know how much you will be able to afford to pay for that month so you can pay it off each month to avoid interest payments.

Be sure you go over the terms that come with your credit card as carefully as possible prior to using it. Credit card issuers will generally interpret the use of the credit card as an acceptance of the credit card agreement terms. Be aware of all of the “fine print” that comes with your credit card!

Don’t put off signing the back of any new credit cards you’ve been issued. If you don’t sign it immediately, your card can easily be stolen and used. Most merchants require that your signature matches your I.D. This can help to ensure no one uses your card unauthorized.

Credit cards are often tied to different kinds of loyalty accounts. If you use bank cards often, try to find a card with a great loyalty program. Used wisely, they can even provide an extra source of income.

When dealing with a credit card, make sure you’re always paying attention so that various term changes don’t catch you by surprise. It is common for companies to change credit terms very often. Often, there will be changes buried in the small print. Remember to read through all that might affect you, like adjustment rates and additional fees.

Never, ever use your credit card to purchase something that you cannot afford. Just because you can use your card to get a new TV doesn’t mean you can afford it. You will be paying much more than the initial cost due to interest. Get out of the store so you can think about it for a while prior to making a decision. If you decide that it is still worth purchasing, look into the retail store’s financing offers.

Credit Card

Never use a public computer for online purchases. Your credit card number could be stored in the auto-fill programs on these computers and other users could then steal your credit card number. Typing sensitive account information on a public computer invites trouble. Only make purchases from your own computer.

As mentioned earlier, it is far too simple to get yourself in trouble with charge cards. If you spend too much on too many cards, you will be in a tight spot. Hopefully, you can use what you went over in this article to help you use your credit card more wisely.

References

Best Credit Cards for Good Credit for 2020 - CreditCards.com

10 Best Credit Cards in India 2020 | Top Cards from SBI, Axis & More

1 note

·

View note

Text

Saving Bank Account: The Best Banks to Open Saving Accounts in India

Before moving ahead, you must answer yourself why need saving bank account and what is the importance of that for you?

A simple short answer to this question is: Protecting your money. Keeping your money at home will not serve any purpose or you will not get any interest.

Also, after the demonetization campaign, it is advisable to put a small portion of your savings in a bank account anyway.

Therefore, you can easily transfer and reinvest deposits in savings bank account according to your financial objectives.

Points to be considered before selecting any bank for opening a SAVING BANK account

Security: To protect your hard-earned money.

Interest: To earn a fixed interest rate on the amount deposited.

Simplicity: This is probably the simplest way to invest your money and earn a definite return in it.

Automatic payment: You can give standing instructions for automatic payment of bills and auto debit for certain transactions in a hassle free manner.

Net-banking facilities: These days banks provide online banking facilities where you can easily transfer funds when needed.

Best banks to OPEN A SAVING BANK ACCOUNT in India:

The list given below for opening a saving bank account in India has been selected based on various factors which are necessary for every person who is thinking to open a bank account.

The factors, which are taken into consideration before selecting the following list, consist of Interest Rate, Security level in a bank to protect the entitlement to the money of account of the account holders, Easy accessibility to bank services, Network level of banks, Centralization of Banks, Customer support services, Technology adoption, Banking Process simplicity, staff support etc.

So Here is list which you must be desiring for your information needs. For further details, you can go to the official website of the banks.

State Bank of India or SBI

Axis Bank

Kotak Mahindra Bank

Yes Bank

Punjab National Bank or PNB

Bank of India

HDFC bank

ICICI Bank

Canara Bank

Union Bank

IndusInd Bank

The above banks generally gives on an average 3% to 4% interest on saving bank account. So Interest rate is not the good factor to compare the level of banks for comparison purposes. The important point for consideration is that

Kotak Mahindra Bank's 811-Zero balance account

is generally giving around 6% interest on saving bank to open more saving bank account.

The network level of all of the above banks is of world class. Yes, There can be some problems in some branch of the above banks, but overall all are same. Differences in the bank services depend on the place of the branch. Generally in urban areas, banking facilities are better in comparison to rural branches.

The most important factor which you can consider for opening a saving bank account is maintenance of minimum balance of saving bank account. Because if you don't maintain that level, the banks start to charge you for non-maintenance of minimum saving bank account balance.

Let us have a look on minimum balance requirement and non maintenance charges of some banks:

See the list here

Now I think you are in a better position to take your decision to open your saving account. What you need to remember before you take your decision:

Your money is your convenience to choose your bank for account opening.

Like this post? Please share. Don't forget to Subscribe and Join other subscribers for direct updates in your inbox.

DISCLAIMER

The information provided in this article is for general informational purposes only. All efforts have been made to provide accurate information in this document, however it should not be perceived as a professional or legal advice. Reader should consult a professional before making any decision based upon this document. Under no circumstance author or the publisher shall have any liability to you for any loss or damage of any kind incurred as a result of the use of this information.

Secondary Source: Website of above banks and of RBI websites.

1 note

·

View note

Text

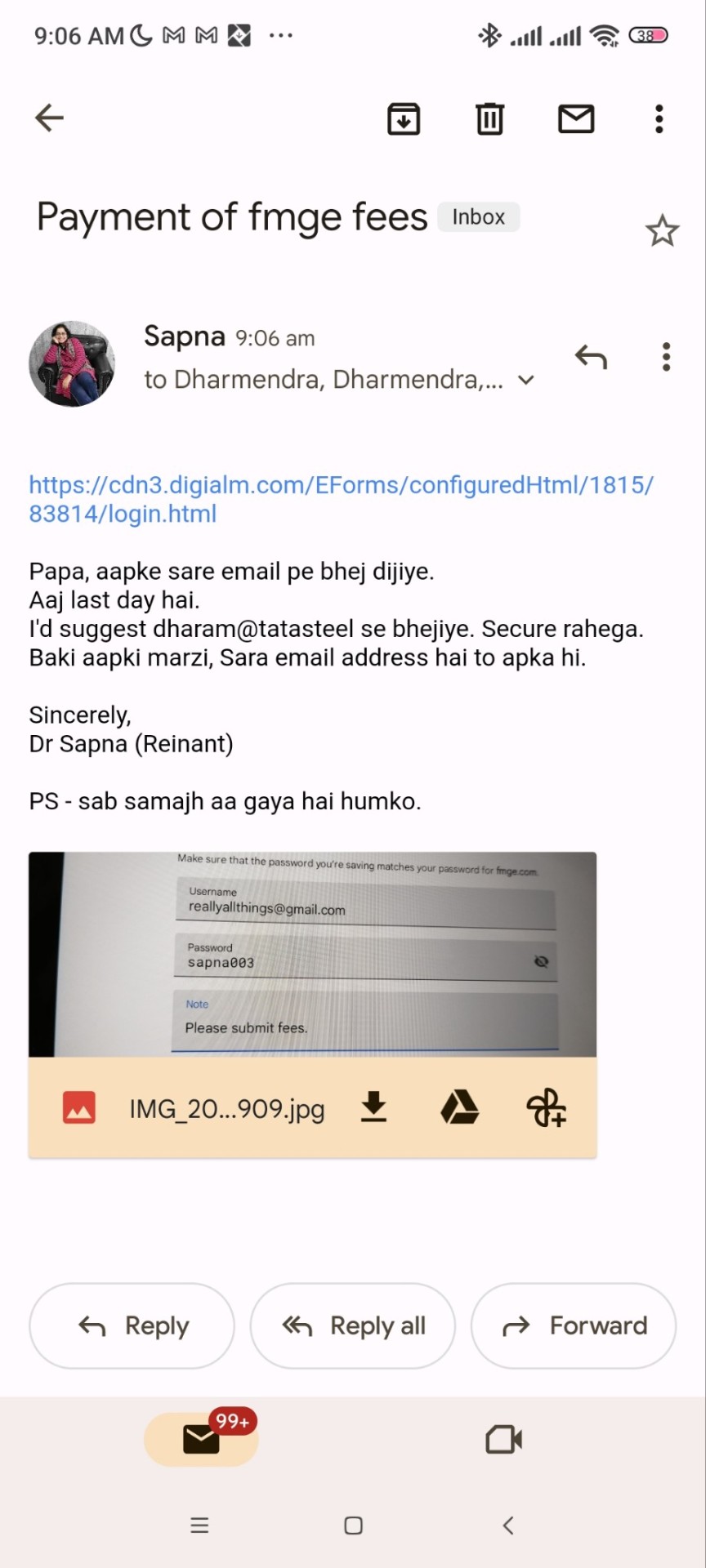

Finally done with fmge form filling. Payment still remaining. SBI account India se khulega and I'm in Dharan. So that's dad's problem. Already talked to him on the phone and he was on his way to Tata Steel.

0 notes

Text

MSME Sector: Decoding Rural India’s Growth Led By QR Codes

Article by: Sanjay Shah - Chief Operating Officer, India / SEA

Quick responses (QR) codes are inescapable and rural India is not untouched by this magic as they have made payments data collection of small businesses very easy that even a financially illiterate can use this with ease, experts say

As India recovers from the deadly Covid-19 pandemic, the talks about micro, small and medium enterprises (MSMEs) have rapidly increased. Every other platform is seen talking about the hurdles faced by this sector, however, a concrete outcome of these discussions is yet to touch the ground because the industry is still struggling to find a base to move forward.

Urban India is somewhat equipped with resources, though not immune to crises, but it is rural India that bears the brunt of major events like demonetisation and the Covid-19 pandemic.

In early 2022, MSME Minister Narayan Rane in Lok Sabha cited a survey report and said that during FY21, 67 per cent of MSMEs were temporarily shut for up to three months due to Covid. More than 50 per cent of the respondent units witnessed a decrease of over 25 per cent in their revenues in 2020-21.

The five most critical problems faced by MSMEs were identified as liquidity (55 per cent units), fresh orders (17 per cent units), labour (nine per cent units), logistics (12 per cent units) and availability of raw material (eight per cent units), as per the data.

However, one thing that worked for small businesses, particularly in rural India, was the stunning penetration of digital connectivity during the Covid period. Presently, the majority of businesses in the rural belt use digital payments led by QR codes.

Following demonetisation and the pandemic, there has been a significant surge in digital payments within the rural economy. This shift in behaviour has led to various stakeholders, including agri tech platforms, urban farm-to-fork and direct-to-consumer (D2C) companies, actively participating in the value chain.

“With technological advancement, India’s rural areas have experienced positive changes,” said Sanjay Shah, Chief Operating Officer of the Wadhwani Foundation, India/South East Asia. “One example is the widespread use of QR codes by MSMEs, enabling seamless transactions, expanding their reach to a broader audience, and facilitating business growth. QR codes have brought transparency, promoted digital payments, and reduced transaction costs. Most importantly, they have connected rural areas with the rest of the world. The future of India’s rural economy looks much brighter with the widespread implementation of QR codes, as they can help MSMEs reach a broader customer base.”

As per the data (industry sources), month-on-month growth of merchant onboarding has increased from eight per cent to 23 per cent in the last 12 months. Furthermore, the rural merchant retention rate stands at 66 per cent. Additionally, the average number of transactions in rural areas has increased from less than one to five.

“MSMEs, being micro-entrepreneurs operating their businesses, often lack an institutional presence in many cases. However, the scenario is changing as banks, including public sector, private, and regional banks, increasingly embrace digital technology, particularly with the adoption of the Unified Payments Interface (UPI). QR codes, enabled through UPI and complemented by the JAM Trinity (Jan Dhan, Aadhaar, and Mobile), are leading the way in digitally including rural MSMEs. This development is not a myth but a reality,” said Ramprashanth Ganesan, Chief Strategy Officer, IppoPay.

Talking about digital payments, the State Bank of India (SBI) in a report said that the total digital payments percentage to nominal GDP has increased to 767 per cent in FY23 from 668 per cent in FY16. Additionally, retail digital payments (excluding RTGS) as a percentage of GDP have reached 242 percent in FY23, up from 129 percent in FY16.

Among all the payment modes, the Unified Payments Interface (UPI) has emerged as the most popular and preferred method in India. It has pioneered person-to-person (P2P) as well as person-to-merchant (P2M) transactions, accounting for approximately 73 percent of the total digital payments in the country.

The volume of UPI transactions has increased multifold from 1.8 crore in FY17 to 8,375 crore in FY23. The value of UPI transactions has also experienced substantial growth, rising from Rs 6,947 crore to Rs 139 lakh crore during the same period, representing a remarkable increase of 2004 times.

The SBI report said that rural and semi-urban areas are now accounting for 60 per cent of the share in UPI value/volume, dismantling the popular perception that metro/urban areas are hotbeds of digital payment adoption and innovations. The top 15 states accounted for about 90 per cent of the share in value/volume.

Even according to a survey by NeoGrowth, an MSME-focused digital lender, about 70 per cent of MSMEs believe more than half of their retail sales will be via UPI. The study titled ‘Decoding digital payments: a retailer perspective’ stated that close to 80 per cent of retailers use digital payments for customer payments due to convenience.

“As 1.4 billion people of this country move towards a cashless society, QR codes have become omnipresent across Bharat and have proven to be a powerful tool for driving economic development in India, particularly for MSMEs. With this technology, businesses are now able to expand their reach and improve their sales. As QR codes continue to gain traction, they are expected to further spur the growth and development in rural areas,” said Sanjeev Kumar, Co-founder, Executive Director and CEO, Spice Money.

The rural economy is not only about agriculture

When analysing the rural economy, it is often associated with the agriculture sector however, it is more business-led than agriculture-led. While the agriculture and allied sectors contribute approximately 17 to 18 per cent to India’s total GDP, the non-agricultural sectors, particularly MSMEs involved in manufacturing, construction, and services, contribute around 28 to 29 per cent.

With a population of 68 percent, India’s rural economy currently contributes around 46 percent to India’s GDP, with 33 percent of savings and 64 percent of total expenditure.

IppoPay’s Ganesan said that the health of rural MSMEs, similar to that of Indian agriculture, is closely intertwined with the monsoon seasons. Fortunately, India has experienced four consecutive years of normal to above-average monsoons, and it is projected to have another year of normal monsoons in 2023.

“This is crucial because rural consumption is closely tied to agricultural production. Other indicators, such as rural FMCG consumption volumes (which have shown a lower decline rate in Q4FY23 compared to previous quarters) and tractor sales, point towards an overall economic recovery in rural areas,” Ganesan added.

Struggle continues

In the recent past, various challenges such as demonetization, GST implementation, and the pandemic led to the closure of many MSMEs, along with difficulties in meeting salary expenses, resulting in layoffs. Issues like financial liquidity and debt repayment also arose.

According to a report, an estimated 5.9 percent of the gross value added (GVA) in the Indian economy, which amounts to Rs 10.7 lakh crore, is trapped in delayed payments from buyers to Micro, Small, and Medium Enterprise (MSME) suppliers.

A report by Global Alliance for Mass Entrepreneurship (GAME) with Dun and Bradstreet and Omidyar Network India highlighted that payment delays to MSME suppliers have remained endemic and an intractable problem in India for more than 15 years.

The report stated, “The problem is not new or a consequence of the pandemic. The proportion of MSME sales affected by delayed account receivables has remained consistent and stable for years before the pandemic.”

Although the economic lockdowns during this period did intensify the problem, the numbers in the preceding five years were no less alarming, it mentioned.

Experts pitched for the constant handholding of the sector and support where MSMEs could be exempted from some statutory compliances and declarations, high interest and increasing cost of raw material.

Talking about rural MSMEs, Aggarwal mentioned, “They need support in building entrepreneurship, increasing employment, enhancing financial literacy and education. For MSMEs to grow in rural India, there has to be prosperity and a sense of positivity in rural India. They need to be the torchbearers for rural entrepreneurship.”

Shah mentioned that in India, there is an option for small businesses to make safe and secure transactions. Awareness of tech solutions which are available along with a variety of incentives from the government and various cluster organisations. Furthermore, digital payment wallets allow MSMEs to operate cashless, making low-value transactions convenient.

Financial and digital literacy for rural MSMEs

Earlier, financial inclusion was as important to policymakers as it is current time. However, as India strives to become a USD five trillion economy, there is a need to boost the rural economy. The rural economy faces challenges such as a lack of banking infrastructure, widespread financial illiteracy, and limited access to formal financial services, which pose a significant challenge for merchants in rural India.

“NBFCs, banks are doing their bit to enhance financial inclusion and services like banking, lending, insurance services are being offered to unserved, unbanked population. Digital infrastructure has a major scope of development in rural areas and work needs to be done around smartphone access and knowledge to use financial applications and education on usage, avoiding frauds, building trust in digitisation,” said Sameer Aggarwal, Founder and CEO, RevFin.

Experts said that MSMEs and financial organisations need to maintain constant communication with customers to explain and explore opportunities where they can use the digital platforms across their lifestyle and for this, they can have their field agents or on-ground educators, NGOs focus on increasing financial literacy amongst men, women and youth of rural India.

“While digital financial infrastructure (DFI) has expanded access to financial services in rural areas, it alone cannot guarantee financial inclusion. The lack of digital literacy, high mobile data charges, and limited access to financial services and banking are still major roadblocks. Enhancing the inclusivity of DFIs in rural areas requires a multi-faceted approach beyond technology. It requires interventions that translate into education and training that can bridge the digital divide and strive towards true, equitable financial inclusion in rural India,” added Shah.

To achieve Prime Minister Narendra Modi‘s ambitious goal to make India a USD 5 trillion economy, it is imperative to address certain challenges faced by rural MSMEs. These challenges include the need for financial literacy training, access to credit, and technology.

According to the International Finance Corporation (IFC), India is home to 55.8 million MSMEs that employ close to 124 million individuals, with around 60 per cent of these enterprises located in rural areas.

A survey conducted by the Development Intelligence Unit and Development Alternatives in December 2022 revealed that around 44 per cent of young adults residing in rural India aspire to start their own businesses. Therefore, with the appropriate support, rural SMEs can play a significant role in India’s economic development by creating jobs, enhancing incomes, and alleviating poverty.

Read the article online here: https://www.businessworld.in/article/MSME-Sector-Decoding-Rural-India-s-Growth-Led-By-QR-Codes/25-05-2023-477940/

------------------------------------------------------------------------

The ‘no fees, no equity’ Wadhwani Advantage program has a repository of business advisors, SME consultants and mentors, and curated experts who have successfully transformed businesses. You can avail of their services by applying to the Wadhwani Advantage program, which builds capacity to accelerate the revenue of businesses by 2x to 10x.

Businesses with revenue > INR 3Cr can apply here:

0 notes

Text

Perks Of Having SBI Bank Credit Cards

One of the most reputable credit card companies in India is SBI. GE Capital and SBI Credit Card together released the SBI Credit Card for the first time in October 1998. The largest public sector bank in India is State Bank of India. Low interest rates are offered with the SBI Credit Card. If you want to get a new SBI Credit Card, you may easily do so by applying online. Once you are eligible for an SBI credit card, your SBI credit card might come at any time. Additionally, SBI Credit Card Offers will astound you due to their abundance of merchant partners.

Benefits on SBI credit cards

Lower Interest Option: Customers have the option of converting their transactions into equal monthly installments or transferring their existing balances from other credit cards to SBI cards, which have reduced interest rates (EMIs).

Encash: With SBI cards, you may withdraw cash anywhere and up to or above your credit limit. You can meet all of your immediate demands by staying prepared.

Money Simplified: With the SBI Card's easy money and ATM cash services, SBI provides straightforward methods for giving you fast cash. Insurance: With your SBI Card, you may select from three different insurance covers, giving you the ability to handle a variety of situations, including health problems, accidents, card loss, card theft, and more. Utility Bill Payments: With features like auto pay, register & pay, and rapid pay, SBI Card claimed that paying your utility bills has never been so simple.

Easy Access Channel: With sbicard.com, you have access to your SBI Card account whenever and wherever you are. Maintain current using "Simply SMS" or the SBI Card mobile app.

0 notes

Text

What can you Accomplish through your Bank CSP Apply Process?

The Bank CSP Apply process will empower you to carry out the services of micropayments as well as remittance digital business in real-time. You will become the most sought-after payment solutions provider not only for your parent bank but also for the citizens living in your neighborhood. The business revolves around banking service aggregation as well as delivery, web for online money transfer as well as payment processing services. There is a range of CSP services you can offer to your area people, which can help in the additional processing of services that you can handle effortlessly and effectively as an agent between your parent bank and the citizens in your rural area.

Your Bank CSP Apply will provide you an opportunity to offer a quick and simple solution for the entire bank transaction problems of people in your neighborhood. You will be capable of functioning as a one-stop source for their wide array of banking transaction as well as other payment needs. You can help them in several ways and at the same time play a crucial role in the overall development of your parent bank. If you are running an SBI Kiosk Banking outlet in your village, you can help your customers perform a variety of acquisitions, avail a range of banking facilities, as well as the benefits of the country's social welfare schemes. You will be capable of using the enormous development of the service segment as well as expending the power of the average consumer, as well. You will be working with the mission of bringing convenience to the doorstep of people in your area and facilitating them to access a varied range of services through a vivacious delivery mechanism. As an operator of an SBI Kiosk Banking outlet, you can also fulfill the banking needs of all classes of people, including low-income people as well as middle-income groups. You will be capable of connecting them to your parent bank right from the comfort of your kiosk outlet to resolve their variety of money transactions as well as payment problems. Above all, you can empower the young population in your neighborhood with entrepreneurial opportunities, as well. Blog Source: https://thenictcsp.wordpress.com/2023/01/24/what-can-you-accomplish-through-your-bank-csp-apply-process

#Bank Mitra Registration#SBI Kiosk Banking#SBI CSP Apply#CSP Provider#Bank CSP Provider#PNB CSP Apply#PNB CSP Registration

0 notes

Text

What is RERA and Its benefits for Property Buyers?

An important aspect of buying or selling property in India is the requirement of a RERA registration certificate. This law will also allow real estate consultants to guide your decisions. Buyers must know that the sale deed they are signing has been registered with RERA. At the same time, sellers should ensure that the property they sell is RERA-registered before entering into negotiations. It can help them avoid any hassles later due to unregistered sale deeds

What is the RERA?

RERA is the acronym for Real Estate (Regulations & Development) Act and was adopted in 2016 to protect the interests of homeowners. The primary goal behind RERA is to offer buyers relief from builders’ unfair practices..

It has granted various rights to home buyers and outlined specific rules and regulations that must be adhered to by all builders/homebuyers.

Major Benefits of the RERA Act

#1 — STANDARDIZED CARPET AREA

Before RERA implementation, the carpet area on which builders charge clients for the property needed to be properly defined. This law states that carpet includes the net floor area of the apartment (i.e. excluding any exterior walls and some areas for specific services, like a balcony or verandah).

#2 — ADVANCE PAYMENT

For buyers, there is a lot to like about this act. It forbids builders from making more than 10% of the apartment’s cost as an advance payment before signing the contract.

#3 — TOTAL TRANSPARENCY

The RERA act has made it mandatory for builders to provide total transparency. To do so, they must disclose major & minor aspects of their project and make sure that homebuyers are aware of them.

#4 — BUILDERS WON’T BE ABLE TO DELAY THE PROJECTS

Under the new RERA regime, not getting possession of apartments from the builder will not be a problem. Builders failing to deliver residential properties in time will be asked to pay an interest rate of 2% above SBI’s lending rate to the home buyers.

#5 — REDUCES THE RISK OF BUILDER’S INSOLVENCY/ BANKRUPTCY

Builders traditionally have some projects in progress at the same time. They might use funds from one project to finance another. With the benefits of RERA 2016 in action, builders are liable to deposit 70% of the upfront funds for a project into a single account.

#6 — BUILDER’S RESPONSIBILITY FOR FAULT IN THE CONSTRUCTION

Under RERA, any structural defect in a property handed over for less than five years will have to be repaired by the builder. They’ll have 30 days to fix it.

CONCLUSION

RERA ensures all regulatory and legal compliances and brings transparency and accountability while removing disputes in land ownership between the developer and buyers. Ensure your choice of real estate consulting services is right for what you need, as not only are they able to help you work through this process.

1 note

·

View note

Text

Alert! SBI warns customers against UPI fraud; Suggests these six TIPS while doing UPI payments

Alert! SBI warns customers against UPI fraud; Suggests these six TIPS while doing UPI payments

UPI transactions have rose astronomically in the last few years. This also unravels the problem of UPI fraud with scammers trying to make customers fall into the trap. To protect citizens against these scams, SBI has shared six TIPS to follow while making UPI transactions. source…

View On WordPress

0 notes