#SecurePayments

Explore tagged Tumblr posts

Text

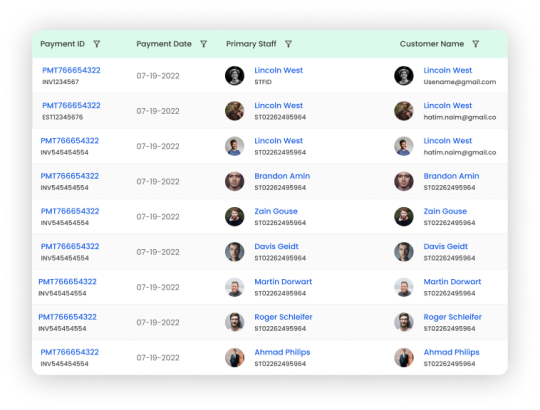

Experience hassle-free payments on TopProz VanLynk. Manage, track, and secure your transactions with ease, all in one convenient platform.

5 notes

·

View notes

Text

Real time payments are here! Say goodbye to waiting! Embrace the future of instant transactions with LightSpeedPay. Get in touch : https://forms.gle/syqTjuJrypPqQ4Ff8

#fintech#paymentsolutions#smallbusiness#instantpayments#businessgrowth#securepayments#entrepreneurlife#digitalpayments#techforgood#paymentgateway#startup#onlinesolutions#businesstips#easytransactions#saas#cashflow#businessowners#innovation#businesssuccess#securetransactions

2 notes

·

View notes

Text

www.peunique.com

Providing Secure & Reliable Payment Gateway Solutions for Every Business

Looking for secure and reliable payment gateway solutions? We provide comprehensive services tailored to your business needs! Whether you're managing an e-commerce store, retail outlet, or offering app-based services, our solutions ensure seamless transactions with maximum security.

Our Payment Services Include: Payment Gateways: Fast, secure, and scalable for online and offline businesses. Payment Links: Easily collect payments through shareable links. API Integration: Streamlined and customizable API solutions for efficient payment processing. Wallet Solutions: Manage payments, recharges, and transfers effortlessly. Retail Payment Solutions: Designed for grocery stores, clothing outlets, department stores, and more. E-Commerce Payment Services: Enhance your customers' experience with faster, secure transactions. Education Payment Gateways: Simplify fee collection and manage academic payments efficiently. App Payment Solutions: Smooth UI/UX and multiple payment modes for app-based businesses. Get started now to boost your business potential with our fast, secure, and trusted payment solutions!

Visit our website: www.peunique.com

1 note

·

View note

Text

Essential features for automotive e-commerce websites include a detailed product catalog with compatibility information and advanced search functionality. Secure payment gateways ensure safe transactions, while integration with inventory management provides real-time stock updates. User accounts offer personalized experiences, and customer reviews and ratings help build trust and inform purchase decisions.

#AutoParts#CarAccessories#Ecommerce#OnlineShopping#AutoRepair#VehicleParts#SecurePayments#CustomerReviews#InventoryManagement#AutoShop#CarMaintenance#AutoEcommerce#CarPartsOnline#ShoppingMadeEasy#PersonalizedExperience

1 note

·

View note

Text

NOIRE is a payment services and risk management company offering comprehensive merchant services, alternative payment methods and worldwide payment solutions.

#Fintech#DigitalPayments#OnlinePayments#PaymentGateway#MerchantServices#PaymentProcessing#MobilePayments#FintechRevolution#PaymentSolutions#Transaction#SecurePayments#DigitalWallet#CryptoPayments#PaymentInnovation#FintechTrends#Ewallet#ContactlessPayments#PaymentSecurity#OnlineTransactions#DigitalBanking#PaymentGatewayIntegration#GlobalPayments#SeamlessPayments#FintechIndustry#PaymentsIndustry#PaymentTech#PaymentSystem#DigitalFinance

1 note

·

View note

Text

Accepting Electronic Checks in Your Small Business: A Comprehensive Guide

Introduction:

In the ever-evolving landscape of business and finance, staying adaptable and responsive to emerging payment trends is crucial for the success of small businesses. One such trend that has gained traction and offers an array of benefits is the acceptance of electronic checks, commonly referred to as eChecks. If you're a small business owner looking to broaden your horizons and enhance your payment options, this comprehensive guide is here to demystify eChecks, providing insights into what they are and, most importantly, how to seamlessly integrate them into your business operations.

What is an eCheck?

An electronic check, or eCheck, is a digital version of a traditional paper check. It enables businesses and customers to conduct transactions electronically, making it a convenient and cost-effective payment method. Instead of writing a physical check, the payer enters their banking information online, and the funds are transferred directly from their bank account to the recipient's account.

Why Accept eChecks?

Cost-Effective: eChecks are often cheaper than credit card transactions because they have lower processing fees, making them an attractive option for small businesses.

Reduced Fraud Risk: Electronic checks are more secure than paper checks as they involve encryption and authentication processes, minimizing the risk of fraud.

Faster Settlement: eChecks typically clear faster than paper checks, improving your cash flow.

Convenience: eChecks are convenient for both you and your customers, as they can be processed online, reducing the need for physical paperwork.

How to Accept eChecks in Your Small Business:

Now that you understand the benefits of accepting eChecks, let's explore how to implement this payment method in your small business.

1. Choose an eCheck Service Provider:

Start by researching eCheck service providers. Look for companies that offer competitive pricing, robust security features, and user-friendly interfaces. Some popular eCheck service providers include:

Compare the fees, features, and compatibility with your existing systems to make an informed choice.

2. Set Up Your Business Account:

Once you've selected an eCheck service provider, create a business account. You'll need to provide your business information, banking details, and contact information.

3. Integrate eCheck Payment:

Depending on your chosen provider, you may need to integrate eCheck payment into your website or point-of-sale system. Many providers offer plugins or APIs to facilitate this integration. Ensure that the payment process is user-friendly and straightforward for your customers.

4. Educate Your Customers:

Inform your customers that you now accept eChecks as a payment option. Include this information on your website, invoices, and any other customer-facing materials. Provide clear instructions on how they can make payments using eChecks.

5. Test the Process:

Before fully launching eCheck payments, conduct a few test transactions to ensure everything is functioning correctly. Verify that funds are deposited into your business account as expected.

6. Monitor Transactions:

Regularly monitor your eCheck transactions and reconcile them with your accounting records. This will help you stay on top of your finances and quickly identify any discrepancies.

7. Maintain Security:

Security is paramount when dealing with electronic payments. Ensure that your eCheck service provider has robust security measures in place to protect sensitive customer data and financial information.

8. Provide Excellent Customer Support:

Offer reliable customer support for any payment-related inquiries or issues. Promptly address customer concerns to build trust and confidence in your eCheck payment process.

Conclusion:

Embracing eChecks as a payment option in your small business can enhance your payment processing capabilities, reduce costs, and improve customer satisfaction. By following these steps and choosing a reputable eCheck service provider, you can seamlessly integrate eCheck payments into your business operations and provide added convenience to your customers. Stay up to date with the latest payment

#echeck#high risk merchant account#payment processor#echecks#echeck payment processing solutions#echeck payment#credit card#merchant account#merchant services#electronic#ECheckPayments#SmallBizPayments#ElectronicChecks#PaymentProcessing#DigitalChecks#SmallBusinessFinance#SecurePayments#BusinessPayments#FintechSolutions#ConvenientPayments#MoneyManagement#PaymentSolutions#ECommercePayments#CashlessTransactions#BusinessTransactions#FinancialTech#PaymentSecurity#CustomerPayments#OnlinePayments

4 notes

·

View notes

Text

Google Pay (via Google Wallet) rolls out in Oman (via Sohar Bank) and Lebanon, allowing Android users to make secure tap‑to‑pay in stores, apps, and web. It uses tokenised payments and dynamic security codes. This follows regional digital finance pushes and keeps Google competitive.

1 note

·

View note

Text

Why Choose Our Airbnb Clone for Your Rental Startup?

Our Airbnb clone app offers seamless UX, secure payments, and instant scalability. Perfect for startups aiming for rapid growth.

See features!

#entrepreneur#startup#branding#b2b#onlinerentalbusiness#online business#saasbasedplatform#saas#AirbnbClone#RentalStartup#UX#SecurePayments

0 notes

Text

How to Access a Verified Revolut Account Safely in 2025 Trusted Tips by USA Shop SMM

In 2025, digital banking is more advanced and flexible than ever, and Revolut is one of the leading platforms offering global money transfers, crypto access, multi-currency wallets, and business finance tools. But for users in the U.S. seeking a verified Revolut account for professional or personal purposes — security and policy compliance are crucial.

This post offers a Tumblr-safe, SEO-optimized guide from USA Shop SMM to help you responsibly explore Revolut’s capabilities.

🌐 Why Use a Verified Revolut Account?

✔️ Send, receive, and hold funds in 25+ currencies ✔️ Access crypto trading & budgeting tools ✔️ Supports virtual and physical cards ✔️ Real-time payment notifications ✔️ Ideal for freelancers, travelers, and small businesses ✔️ Manage international payments seamlessly

🧾 What Does “Verified” Mean for Revolut?

ID and address verified through official documents

Email, phone, and identity confirmation completed

Card activated for online/offline transactions

Linked with valid U.S. personal or business details

Meets compliance for KYC/AML checks

🛡️ How to Access a Verified Revolut Account Safely:

Never rely on untrusted or unauthorized sources

Learn account setup processes from guides like USA Shop SMM

Ensure credentials can be fully personalized post-setup

Respect Revolut’s terms and local U.S. laws

Use the account responsibly — for real transactions, not violations

🚀 Why Choose USA Shop SMM for Guidance?

🔹 Transparent digital banking education 🔹 Guidance for safe and compliant access 🔹 No illegal or high-risk methods shared 🔹 Real-time support and friendly consultation 🔹 Resources suitable for beginners and pros

⚠️ Tumblr-Compliant Disclaimer:

This post is intended for informational and educational purposes only. It does not promote buying or selling of digital or banking accounts. Always follow Revolut’s official guidelines and financial compliance laws.

🔗 Tumblr-Safe Call to Action:

Looking to explore how verified users access Revolut accounts in 2025 with confidence? Visit USA Shop SMM for expert insights, tips, and policy-aware guidance.

#Revolut2025#VerifiedRevolut#USAshopSMM#DigitalBankingGuide#MultiCurrencyAccount#FreelancerTools#CryptoFriendlyBanking#TumblrSafePost#SecurePayments#FinanceIn2025

0 notes

Text

Zil Money makes RTP (Real-Time Payments) seamless. Send and receive payments instantly, anywhere, at any time!

Learn more: https://zilmoney.com/rtp/

Click here for interactive demo: https://zilmoney.storylane.io/share/8hvfdb5mu5nr

0 notes

Text

instagram

#FintechSolutions#UPIPaymentApp#DigitalPayments#BiometricSecurity#OfflinePayments#TechForBusiness#StartupIndia#MadeInIndia#AppDevelopment#OmegaSoftwares#BusinessGrowth#SecurePayments#softwarecompany#softwarecompanyindia#software#softwaredeveloper#softwareengineering#SoftwareDevelopment#CustomSoftware#customsoftwarecompany#customsoftwaredesign#customsoftwaredevelopment#Instagram

0 notes

Text

FINdi Gets Green Light from RBI: A New Era of Digital Transactions Begins

In a significant leap for the Indian fintech landscape, FINdi Technologies has received official authorization from the Reserve Bank of India (RBI) to operate as a Payment Aggregator (PA). This landmark approval places FINdi among the elite group of fintech firms helping to shape the future of cashless transactions in the country.

This RBI license serves as a powerful endorsement of FINdi's security framework, compliance standards, and business model—signaling confidence in its ability to facilitate seamless and secure digital payments across various sectors.

0 notes

Text

Best Utility Bill Payment API Solution in India

Apiwala is the leading Utility Bill Payment API Solution provider, offering secure and seamless electricity bill payments. With our API, you can integrate a reliable payment gateway, ensuring fast and hassle-free transactions with no hidden charges. 👉 Explore Now: https://www.apiwala.com/utility-bill-payment-api.html

#PaymentGateway#APIIntegration#FintechSolutions#BusinessGrowth#Apiwala#TechInnovation#SecurePayments#DigitalIndia#BillPaymentSolutions#APISolutions

0 notes

Text

Education Payment Gateway for Institutions

Streamline fee collections with a Education Payment Gateway for Institutions in India designed for schools, colleges, universities, coaching centers, training institutes, and online learning platforms.

Student & Parent-Friendly Fast & Secure Transactions Instant Payment Links & QR Codes Customized Solutions for Institutions https://www.peunique.com/education

0 notes

Text

Expanding Horizons: Accepting International Payments as a High-Risk Merchant

In the dynamic landscape of e-commerce, reaching customers globally has become a pivotal strategy for businesses seeking growth and expansion. For high-risk merchants operating in industries such as online gaming, travel services, or adult entertainment, the ability to accept payments from international customers can open doors to new opportunities. However, navigating the complexities of international payments as a high-risk merchant requires careful consideration and adherence to compliance standards. Let's explore the possibilities and challenges of accepting payments from international customers in the high-risk merchant space. Understanding the Landscape of High-Risk Merchants and International Payments Embracing Global Reach: High-risk merchants cater to diverse customer bases worldwide, making it essential to offer payment options that accommodate international transactions. Accepting payments from customers across borders not only expands market reach but also enhances competitiveness and revenue potential. Compliance Considerations: Operating as a high-risk merchant entails heightened scrutiny and compliance requirements, particularly when engaging in international transactions. Regulatory frameworks, such as anti-money laundering (AML) laws and international payment regulations, impose stringent obligations on merchants to ensure transparency and security in cross-border transactions. Strategies for Accepting International Payments as a High-Risk Merchant 1. Partner with Global Payment Providers: Collaborate with payment service providers that specialize in facilitating transactions for high-risk merchants. These providers offer tailored solutions and expertise to navigate regulatory complexities and ensure compliance with international payment standards. 2. Implement Robust Fraud Prevention Measures: Strengthen fraud detection and prevention mechanisms to mitigate the risk of fraudulent activity in international transactions. Utilize advanced fraud detection tools, address verification systems (AVS), and card security codes to authenticate transactions and safeguard against fraudulent behavior. 3. Maintain Compliance Vigilance: Stay abreast of evolving regulatory requirements and compliance standards governing international payments. Regularly review and update internal policies and procedures to align with regulatory expectations and mitigate compliance risks associated with cross-border transactions. Conclusion: Seizing Opportunities in Global Commerce Accepting payments from cross border customers presents a valuable opportunity for high-risk merchants to expand their reach and drive business growth. By partnering with trusted payment providers, implementing robust fraud prevention measures, and maintaining compliance vigilance, high-risk merchants can navigate the complexities of cross border payments effectively while mitigating associated risks. In the interconnected world of e-commerce, embracing global commerce is not just a strategy for growth but a necessity for staying competitive. Embrace the possibilities of international payments, and unlock new avenues for success as a high-risk merchant in the global marketplace. Read the full article

#Acceptingpayments#Cross-bordertransactions#FraudPrevention#GlobalPayments#high-riskmerchants#internationalpayment#internationalpaymentregulations#Internationalpayments#paymentprocessors#PaymentSolutions#Regulatorycompliance#SecurePayments#TheFinRate

0 notes

Text

Shaping Financial Integrity with Aharon Lev

Aharon Lev, originally from New York and now a key figure in New Jersey’s financial sector, is reshaping the future of transactional analytics. Known for his ethical leadership, Aharon helps businesses design transparent, compliant loyalty programs while building secure payment frameworks that mitigate risk. His mission: transform fraud prevention into future-proof strategies that deliver long-term trust.

0 notes