#TDSFiling

Explore tagged Tumblr posts

Text

Stress-Free Tax Compliance in Minutes!

Need to register for GST online? Looking for online TDS return filing, salary return filing, or professional tax registration? Corpbiz has you covered! Our expert team handles all the paperwork, ensures 100% accuracy, and keeps you compliant—so you can focus on growing your business. Get started today and say goodbye to tax headaches!

0 notes

Text

Top Online TDS Filing Services in Delhi

Taxgoal offers top-notch online TDS filing services in Delhi, ensuring hassle-free compliance with tax regulations. Our expert team simplifies the tedious process, making it convenient and error-free. We provide end-to-end solutions, from data collection to submission, saving you time and reducing the risk of penalties. Trust Taxgoal for precise and timely TDS filings, enabling you to focus on your business while we take care of your tax responsibilities. Choose Taxgoal for seamless TDS filing services in Delhi. To know more visit here: https://taxgoal.in/service/tds-filing-for-salary-and-expenses/

0 notes

Text

Tax Deducted at Source

TDS collects tax directly from income at the source. The payer deducts tax and remits it to the government, and the recipient can claim this as a credit using Form 26AS or the TDS certificate.

Call us: 📞 098189 82759

For More Information-

Visit Our Website

➡ https://www.sigmac.co.in/.

.

#sigmac #TDS #TdS2024 #tan #IncomeTax #income #tdscertificate #charteredaccountantingurgaon #CharteredAccountant #CA #taxsavings #accountant #Account #accounting #finance #tdsfiling #advisoryservices #advisory

0 notes

Text

TDS Rules and Regulations: Everything You Need to Know

TDS stands for Tax deducted at the source which means an authorized deduct or deducts tax while making certain payments, e.g.: Rent, Commission, Salary, Interest, etc. In this blog, we will explain the details of 27 sections under TDS with different provisions of deduction and a threshold limit of exemption.

What is TDS in income?

TDS or Tax deduction forms an integral portion of the direct taxation mechanism applicable to heads of Income to deduct taxes for certain payments.

TDA at its source reduces the burden of taxpayers from paying off lump sums of taxes at the end of every budget year. In this way, the TDS process enables a balanced outflow of revenue between the government and taxpayers. For Instance: If ABC group company pays an amount of Rs.30,000/- as a salary to Y, the ABC groups shall deduct a tax of Rs.2,000/ and make a net payment of Rs.28,000/- to Y. Then, the tax deducted by ABC Groups Ltd will be directly credited to the government.

According to the Income Tax Act, of 1961, policies and regulations related to tax deducted at source (TDS) are managed by CBDT (Central Board of Direct Taxes), the person who is liable to pay tax is known as Deducted, and the person who deducts the tax is known as Deduct or.

The deducted amount in the TDS Mechanism shall be sent to the Central Government. The deducted can check the deducted TDS amount in Form 26 As or the TDS certificate issued by the deducted or.

Types of TDS

Even when you are making payments as an individual taxpayer, you need to deduct TDS on certain payments. The following type of payments attracts TDS:

a) Salary Transfer

b) Professional Fee

c) Consultation Fee

d) Rent Payments

e) Commission

f) Interest on Securities & Deposits

g) Dividend on company shares and mutual funds

h) Lottery and similar winnings

I) Payment of Royalty

j) Salary Transfer

k) Professional Fee

l) Consultation Fee

m) Rent Payments

n) Commission & brokerage payments

o) Interest on Securities & Deposits

p) Dividend on company shares and mutual funds

q) Lottery, lucky draw, and similar winnings

r) Payment of Royalty

s) Director’s Remuneration

t) Transfer of Property

u) other interest payments

When and who is liable to deduct TDS?

If you receive payment specified under the Income Tax Act, TDS will be deducted. If you are an individual or a Hindu Undivided Family and your books do not require an audit, then no TDS will be deducted. However, if you pay rent and the amount exceeds Rs. 50,000, a TDS at 5% will be deducted, even if your books do not require an audit. Your employer will deduct TDS from your salary as per the applicable income tax slab rates. The bank with whom you hold an account will deduct TDS at 10%. If you submit your investment proof to your employer and your total taxable income is below the taxable threshold, then you will not need to pay any tax, and no TDS will be deducted. If your total taxable income is below the taxable limit, you can submit Form 15G and Form 15H to the bank, and they will not deduct TDS on your interest income. If the bank has deducted TDS, and you are eligible to claim a refund, you can file a return and claim it.

How to pay TDS?

To ensure compliance with the concept of TDS, the deducting organization or individual is responsible for remitting the deducted income to the government. Here is a step-by-step guide on how to deposit TDS:

Log in to NSDL’s website for e-payment.

Select Challan No ITNS 281 under the section TCS/TDS and enter the required details such as TAN, assessment year, PIN code, and mode of payment.

Choose between TDS on regular assessment and TDS deducted or payable and click on “Submit”.

After confirming the TAN and taxpayer’s name, you will be redirected to the payment page. Make your payment here.

Upon successful payment, you will receive a counterfoil with CIN, payment confirmation, and bank details as proof of payment. You must file a TDS return after this.

What are TDS Returns?

TDS return is the process of returning the excess amount deducted as TDS to the taxpayer. While TDS is a form of income tax, individuals may still have an income tax liability at the end of each year, even after paying TDS. This is because TDS is deducted from the source of income to avoid payment delays. If the total TDS paid in a year exceeds the individual’s tax liability, the excess amount will be returned by the government. To receive this return, the taxpayer must obtain a TDS certificate from their deduct, which is necessary while filing a TDS return.

TDS RATE CHART FOR FY 2023-24

TDS/TCS returns for the assessment year 2023-24.

If you need to file your TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) returns for the budget year 2022-23, here are the deadlines you need to remember. These are the dates by which you must file your TDS/TCS returns for the assessment year 2023-24.

How to upload TDS Statement?

To upload your TDS (Tax Deducted at Source) statements on the official website of the Income Tax Department, follow these simple steps:

Visit https://www.incometaxindiaefiling.gov.in/home and click on the ‘Registered User?’ option on the right side of the page.

Fill in your login details and click on ‘Login’. Your user ID will be your TAN (Tax Deduction and Collection Account Number).

Locate the ‘TDS’ drop-down menu after logging in and select ‘Upload TDS’.

Fill in the required details on the form that appears and click on ‘Validate’.

Finally, validate your returns using either a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC)

What is TDS Certificate?

A TDS certificate is a document that serves as proof of tax deducted at source from a person’s income by an entity. This certificate is issued by the entity that has made the TDS deduction, to the person from whose income the TDS is deducted, also known as the assesses. The certificate indicates that the TDS amount has been deposited in the Government’s account. Knowing about TDS certificates and their types can help in resolving any issues related to TDS deductions from various sources of income. It is important to understand the several types of TDS certificates and which ones you should request.

and which ones you should request.

What is the penalty for filing to Pay TDS?

If you fail to submit or submit late TDS returns/statements, you will be subjected to various penalties by the Income Tax Department, as outlined below:

Failure to submit returns: Section 272A (2) of the Income Tax Act imposes a penalty of Rs. 100 per day for each day that returns remain unsubmitted, with a maximum penalty equal to the TDS amount.

Failure to file returns on time: Section 234E of the Income Tax Act imposes a penalty of Rs. 200 per day for each day that returns remain unfiled, with a maximum penalty equal to the TDS amount.

Defaults in TDS statement filing: Section 271H of the Income Tax Act imposes a penalty ranging from Rs. 10,000 to Rs. 1 lakh if the deduct or defaults in filing a TDS return within the due date.

Incorrect details: Under Section 271H of the Income Tax Act, a penalty ranging from Rs. 10,000 to Rs. 1 lakh will be charged if the deduct or submits incorrect information, such as PAN (Permanent Account Number), challan particulars, TDS amount, etc.

Non-payment of TDS: Section 201A of the Income Tax Act imposes interest along with the penalty if TDS is not paid within the due date. In case a part or the whole of the tax amount is not deducted at the source, interest will be charged at 1.5% per month from the date on which the tax was deductible to the date on which it is deducted.

When can Taxpayers claim a refund?

Taxpayers can claim a refund or reduction of applicable TDS under certain circumstances.

If the total income is not within the income tax payable slab, a refund or reduction can be claimed.

If the TDS paid is more than the tax payable liability, a refund can be claimed.

If the taxpayer has a loss of income in the current month or a previous year’s loss carried forward in the present year, a reduction can be claimed.

If the taxpayer is eligible for tax exemption, a refund or reduction can be claimed.

Form 15G/15H can be submitted to avoid TDS deduction.

Form 13 can be submitted to claim a refund or non-reduction of TDS.

It is important for taxpayers to understand what TDS is and why it is deducted to file their returns and maximize their benefits.

TDS or Tax Deducted at Source is a crucial aspect of the Indian taxation system. It ensures a smooth collection of taxes and reduces the burden of tax collection for the government. TDS also helps to track financial transactions, minimizes tax evasion, and ensures tax compliance. As a taxpayer, it is important to be aware of the rules and regulations related to TDS and ensure timely compliance to avoid any penalties or legal implications. Overall, TDS plays a significant role in the Indian tax regime and contributes to the growth and development of the nation’s economy.

Reference

https://incometaxindia.gov.in/Pages/Deposit_TDS_TCS.aspx

https://www.caclubindia.com/articles/tds-rate-chart-for-the-fy-2023-24-ay-2024-25-49539.asp

https://taxguru.in/income-tax/tds-rate-chart-fy-2023-2024-ay-2024-2025.html

https://groww.in/p/tax/tds

0 notes

Text

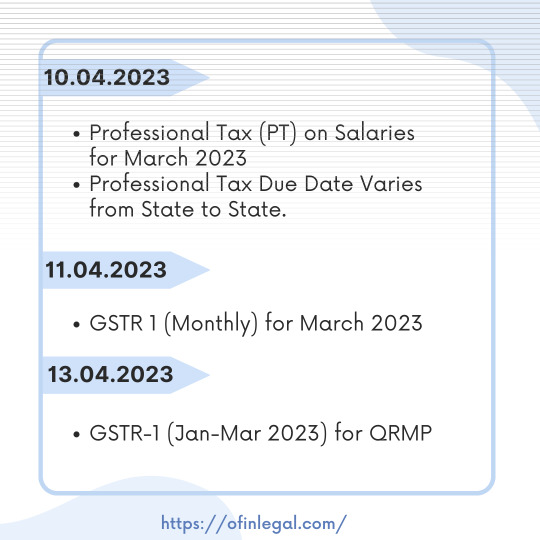

Compliance Calendar for the month of April 2023.

#compliance#compliancecalendar#incometax#TDS#tdsfiling#GST#gstr#providentfund#startupindia#startup#business#ServiceTax#april2023#ofinlegal

1 note

·

View note

Link

TDS (Tax Deducted at Source) is an indirect system of deduction of tax according to the Income Tax Act, 1961 at the point of generation of income. Tax is deducted by the payer and is remitted to the government by him on behalf of the payee.

Different types of TDS forms are as follows :-

Form 24Q -TDS on Salaries

Form 26Q – TDS on payments other than Salaries

Form 27Q – TDS on payments made to Non-Residents

Form 27EQ – TCS

0 notes

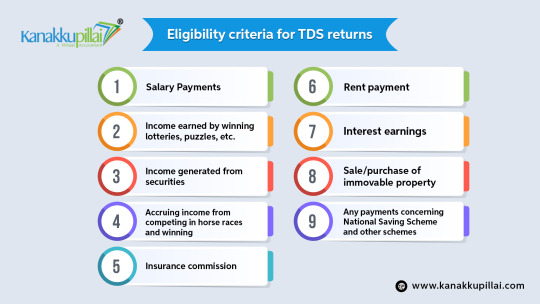

Photo

Eligibility Criteria for TDS Return

TDS return filing is compulsory for all the assesses who fall under the tax slab as prescribed by the Income Tax Department.

To file a TDS return, one must be thorough with the application procedure and the eligibility criteria.

https://www.kanakkupillai.com/

0 notes

Text

TDS Filing Registrar of Companies Filing ROC Services Delhi

The world of business is dynamic and in this case, a firm must comply with statutory compliance and financial regulations to assure success and survival. The companies must file their TDS compliance and ROC on time as they have an obligation towards fulfilling various regulatory requirements. Taxgoal serves as a dependable companion in Delhi for you to smooth out the filing of TDS and ROC with the least hassles to help keep your businesses legally fit. In this regard, we explore the necessity of TDS and ROC compliance and make a case as to why you should trust Taxgoal for your corporate filing requirements.

Understanding TDS Filing

What is TDS?

TDS or Tax Deducted at Source is an avenue of earning income through tax collection. It is used on different types of payment like salary, interest, professional fees and many others.

The Importance of TDS Compliance

Businesses can be penalized and suffer legal damages if their TDS fail to comply.

Correct filling of TDS results in payment of sufficient taxes by the government at the due time.

The Complexity of TDS Filings

Filing tax deducted at source (TDS) is quite complex – it includes calculation, submission, as well as giving away form 16/16A to employees as well as vendors.

Streamlining TDS Filing with Taxgoal

Expertise in TDS Filings

The expert taxgoal team is highly familiar with the rules and regulations on TDS and also helps to avoid errors in the filing process.

Timely Filing

We recognize that the timeliness aspect of TDS filings is crucial for saving your company from fines and legal problems.

Accuracy and Compliance

You can be assured that we will make accurate TDS deductions and submit the required documents within the stipulated time frames.

Comprehensive TDS Services

Taxgoal provides complete TDS support, that is tax deduction till the filing of returns and issuance of Form 16/16A.

Streamlining TDS Filing with Taxgoal

Expertise in TDS Filings

TDS is handled by Taxgoal’s experienced team which guarantees correct return filing without any errors.

Timely Filing

Punctuality is important when it comes to TDS filings Delhi because it helps you avoid being penalized or prosecuted.

Accuracy and Compliance

This ensures that exact TDS calculations are done and returns submitted in time enabling you to adhere to statutory requirements.

Comprehensive TDS Services

Tax Goal provides all-inclusive TDS services ranging from the deduction of TDS to the final stages of issuance of Form 16/16A.

Understanding ROC Services

What is ROC?

ROC is an abbreviation for Registrar of Companies, a state body in charge of registering companies and ensuring their compliance with the law.

The Importance of ROC Compliance

ROC compliance remains critical in upholding business legality.

The Complexity of ROC Filings

Annual returns, financial statements and any other relevant document forms part of the ROC filings and this might be cumbersome without professional advice.

Streamlining ROC Services with Taxgoal

Experienced ROC Experts

Taxgoal’s experts undertake all paperwork and submissions required during ROC compliance for smooth compliance.

Annual ROC Filings

This assists in your yearly ROC filings without attracting penalties and other possible legal problems.

Document Preparation

Such important documentation taxgoal help include financial statements and annual returns.

The Taxgoal Advantage

One-Stop Solution

taxgoal covers all TDS as well as ROC services easily with minimal interference in your company.

Cost-Efficient Services

Our services are affordable and can save you both money and time.

Personalized Guidance

Our experts provide you with specialized advice making sure that you fulfil every requirement for compliance.

Transparent and Ethical Practices

Taxgoal embraces an open and honest approach that keeps your business above board at all times.

Dedicated Customer Support

At your disposal, our customer support is available 24/7.

Conclusion

Your reliable Taxgoal partner who helps you make straight TDS filing as well as speedy ROC filing in Delhi When any business is seeking a partner in simplifying and adhering to compliance then we are the best bet due to our expertise, commitment to regulation and affordable services. In addition, with Taxgoal being there for you, you can concentrate on what you are best at, i.e., running and improving your business, without worrying about TDS and ROC filing nuances. Let Trust Taxgoal take care of all your business requirements to comply with the law so that you do not have to worry about anything. Reach out to us today and see how we can make it easier to file those TDS and ROC returns.

0 notes

Text

Online TDS Filing For Property Delhi

Taxgoal offers hassle-free online TDS filing for property in Delhi. Our user-friendly platform ensures a seamless experience, helping you meet your tax obligations effortlessly. With expert guidance and timely updates, we simplify the complex process, saving you time and stress. Trust Taxgoal for accurate and efficient TDS filing, so you can focus on what matters most – your property investments. Start your journey to stress-free tax compliance with Taxgoal today! To know more visit here: https://taxgoal.in/service/tds-filing-for-property-26-qb/

0 notes

Text

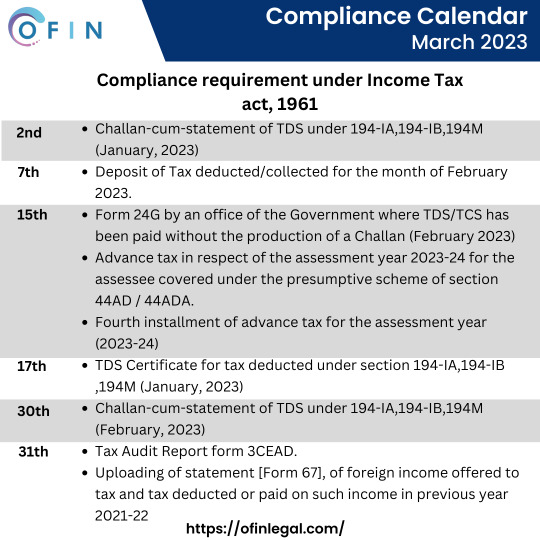

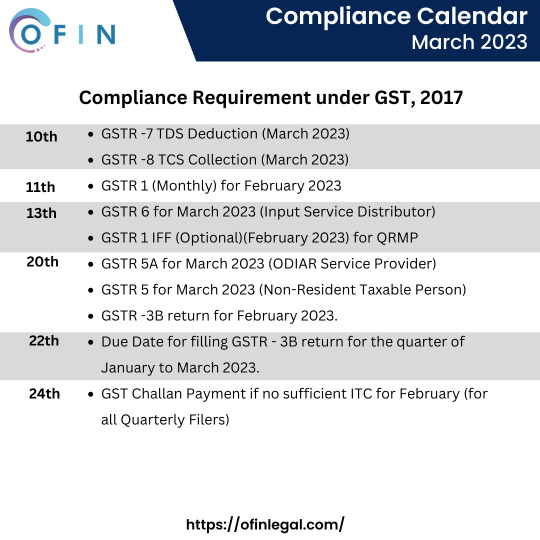

Compliance Calendar for the month of March 2023.

#compliance#compliancecalendar#incometax#TDS#tdsfiling#GST#gstr#startupindia#providentfund#ServiceTax#March2023#ofinlegal

1 note

·

View note