#Telecom API Market Segmentation

Explore tagged Tumblr posts

Link

0 notes

Text

Telecom Operator Detection to Improve Contact Validity

The Phone Number Lookup API helps you determine the exact telecom operator and circle of any Indian mobile number. This is especially useful for improving campaign targeting, ensuring regional compliance, routing SMS through the correct providers, and enhancing call center operations. Businesses can also use it to create location-based user segments and ensure better engagement across sales, support, and marketing channels.

0 notes

Text

Gain and Loss Equalizer Market : Global outlook, and Forecast to 2032

Global Gain and Loss Equalizer Market size was valued at US$ 234.7 million in 2024 and is projected to reach US$ 423.9 million by 2032, at a CAGR of 8.98% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the fastest growth with a projected 7.2% CAGR through 2032.

Gain and Loss Equalizers are critical components in RF and microwave systems designed to compensate for signal amplitude variations across different frequencies. These devices play a vital role in maintaining signal integrity across various applications including satellite communications, radar systems, and 5G infrastructure. The market offers both connectorized and connector-less variants, with the former dominating nearly 68% of total market share in 2024.

The market growth is primarily driven by expanding 5G network deployments worldwide and increasing defense spending on advanced communication systems. Recent technological advancements in equalizer design, such as compact form factors and improved thermal stability, are further propelling market expansion. Key players including Mini Circuits, API Technologies, and Marki Microwave are actively introducing new products with enhanced performance characteristics to capitalize on emerging opportunities in both military and commercial sectors.

Get Full Report : https://semiconductorinsight.com/report/gain-and-loss-equalizer-market/

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for High-Speed Data Transmission to Boost Market Expansion

The global Gain and Loss Equalizer market is experiencing strong growth driven by increasing demand for high-speed data transmission across telecom and aerospace sectors. With 5G network rollouts accelerating worldwide, the need for signal integrity solutions has surged. Gain and Loss Equalizers play a critical role in maintaining optimal signal strength and quality in complex RF and microwave systems. The technology is particularly valuable in modern communication infrastructure where signal degradation over long distances remains a persistent challenge. Recent advancements in satellite communication systems are further propelling adoption, with equalizers being integrated into both ground stations and satellite payloads to ensure consistent performance.

Military Modernization Programs Creating Significant Demand

Defense sector investments in electronic warfare and radar systems represent a major growth driver for Gain and Loss Equalizers. Modern military equipment increasingly relies on sophisticated RF subsystems where signal equalization becomes critical for mission success. Defense budgets across major economies continue prioritizing advanced electronic systems, directly benefiting manufacturers of precision RF components. The United States Department of Defense alone allocated substantial funds for electronic warfare modernization recently, creating ripple effects across the supply chain. As military networks become more complex with the integration of autonomous systems and networked warfare concepts, the demand for reliable equalization solutions is projected to maintain steady growth.

MARKET RESTRAINTS

High Development Costs and Complex Manufacturing Processes Inhibit Growth

While the Gain and Loss Equalizer market shows strong potential, the high costs associated with product development present a significant barrier. Manufacturing precision RF components requires specialized facilities, stringent quality control, and expensive test equipment. The materials used in these devices, including high-performance substrates and precision-crafted components, contribute to elevated production costs. Smaller manufacturers often struggle with achieving economies of scale, limiting their ability to compete effectively. This cost barrier is particularly acute in price-sensitive segments of the civil equipment sector, where buyers frequently prioritize cost over performance features.

Supply Chain Constraints Pose Operational Challenges

The industry continues facing material shortages and supply chain disruptions that impact production timelines and costs. Certain specialized components used in Gain and Loss Equalizers have extended lead times, creating bottlenecks in manufacturing. Semiconductor shortages that began affecting multiple industries have also impacted the availability of supporting electronics for advanced equalizer designs. These supply chain complexities are compounded by geopolitical tensions that have reshaped global trade flows in critical electronic components. Manufacturers are being forced to maintain higher inventory levels or seek alternative sourcing strategies, both of which increase operational costs.

MARKET OPPORTUNITIES

Emerging Millimeter-Wave Applications Open New Revenue Streams

The rapid development of millimeter-wave technologies for 5G and beyond represents a significant opportunity for Gain and Loss Equalizer providers. As communication systems move into higher frequency bands, the challenges of signal attenuation and distortion become more pronounced, creating greater need for sophisticated equalization solutions. The millimeter-wave market is forecast to grow substantially, driven by 5G network densification and emerging applications in automotive radar and security scanning. Manufacturers that can develop equalizers optimized for these high-frequency bands stand to capture significant market share in this high-growth segment. Several industry leaders have already announced dedicated millimeter-wave product lines to address this emerging need.

Integration of AI for Smart Signal Processing Creates Value-Added Solutions

The incorporation of artificial intelligence into RF systems presents innovative opportunities for the Gain and Loss Equalizer market. Smart equalization solutions that can dynamically adjust to changing signal conditions offer significant performance advantages over traditional fixed designs. These intelligent systems are particularly valuable in environments with variable transmission conditions or where channel characteristics change rapidly. Several manufacturers are now developing adaptive equalizers with machine learning capabilities that can optimize performance in real-time. This technological evolution is creating new market segments where premium pricing can be justified by enhanced functionality and reduced maintenance requirements. The defense sector has shown particular interest in these smart solutions for electronic warfare applications.

MARKET CHALLENGES

Intense Competition from Alternative Solutions Pressures Market Position

The Gain and Loss Equalizer market faces growing competition from alternative signal conditioning technologies. Advances in digital signal processing techniques have enabled software-based solutions to address some challenges traditionally handled by hardware equalizers. While hardware equalizers maintain advantages in latency and power efficiency for certain applications, the flexibility of software solutions presents an ongoing competitive threat. This is particularly evident in telecom infrastructure where operators seek to virtualize more network functions. Manufacturers must constantly innovate to demonstrate the continued value proposition of dedicated hardware equalization in these evolving application environments.

Regulatory Compliance Adds Complexity to Product Development

Meeting evolving international standards and regulatory requirements presents ongoing challenges for market participants. Gain and Loss Equalizers must comply with strict electromagnetic compatibility regulations that vary across geographic markets. The certification process for military and aerospace applications is particularly rigorous, requiring significant testing and documentation. Recent changes in export control regulations affecting RF and microwave technologies have further complicated international sales activities. Smaller manufacturers often struggle with the administrative burden and costs associated with maintaining compliance across multiple jurisdictions, potentially limiting their market access and growth opportunities.

GAIN AND LOSS EQUALIZER MARKET TRENDS

Advancements in 5G and Wireless Communication Driving Market Growth

The global Gain and Loss Equalizer market is experiencing significant growth due to rapid advancements in 5G technology and wireless communication networks. These devices play a crucial role in maintaining signal integrity by compensating for transmission line losses and ensuring uniform gain across different frequency bands. The increasing deployment of 5G infrastructure, which requires highly sophisticated RF components, has escalated demand for precision equalizers that can operate efficiently at millimeter-wave frequencies. Recent technological innovations have resulted in equalizers with improved insertion loss characteristics, broader frequency ranges exceeding 40 GHz, and reduced size footprints ideal for compact 5G base stations.

Other Trends

Military Modernization Programs

Defense sector investments are accelerating adoption of Gain and Loss Equalizers in electronic warfare systems and radar applications. Modern military equipment demands robust RF components capable of withstanding harsh environments while maintaining precise signal conditioning. The integration of these equalizers in phased array radars helps mitigate amplitude variations across antenna elements, significantly improving target detection accuracy. Global defense budgets allocating substantial portions to communication systems upgrading creates sustained demand in this sector.

Space Communication Sector Expansion

The burgeoning satellite communication industry presents lucrative opportunities for Gain and Loss Equalizer manufacturers. With increasing numbers of LEO satellite constellations being deployed, there is growing need for RF components that can compensate for signal degradation across long transmission paths. These equalizers are critical in both ground station equipment and satellite payloads to maintain signal quality. The commercial space sector’s projected growth, with estimates suggesting over 50,000 satellites may be launched this decade, underscores the importance of reliable RF signal conditioning solutions like equalizers to prevent data loss in space-ground communication links.

COMPETITIVE LANDSCAPE

Key Industry Players

Microwave Component Suppliers Intensify R&D Investments to Gain Market Share

The global gain and loss equalizer market features a mix of established microwave component manufacturers and specialized suppliers competing across military and civil equipment applications. Mini Circuits emerges as a dominant player, leveraging its extensive portfolio of RF/microwave components and strong distribution network across North America and Asia-Pacific.

API Technologies and Marki Microwave collectively held over 25% market share in 2024, primarily due to their expertise in precision microwave components for defense applications. Their technological leadership in connectorized equalizer solutions has been particularly valuable for military communication systems.

Recent market developments show companies expanding their production capabilities to meet growing demand. Dielectric Laboratories recently announced a new manufacturing facility in Europe, while Eclipse Microwave partnered with a leading defense contractor to co-develop next-generation equalizers with wider frequency ranges.

Meanwhile, regional players like Planar Monolithics Industries and Orion Microwave are gaining traction through competitive pricing strategies and customized solutions for telecom infrastructure projects.

List of Key Gain and Loss Equalizer Manufacturers

Mini-Circuits (U.S.)

API Technologies (U.S.)

Marki Microwave (U.S.)

Dielectric Laboratories (U.S.)

Eclipse Microwave (France)

KeyLink Microwave (China)

Orion Microwave (U.S.)

Planar Monolithics Industries (U.S.)

Polaris (Germany)

AMTI (Japan)

Segment Analysis:

By Type

With Connectors Segment Leads Due to Enhanced Connectivity and Ease of Integration

The market is segmented based on type into:

With Connectors

Without Connectors

By Application

Military Equipment Application Dominates the Market Due to High Demand for Signal Optimization

The market is segmented based on application into:

Military Equipment

Civil Equipment

By Component

Integrated Circuit Segment Holds Significant Share Due to Compact Design and Efficiency

The market is segmented based on component into:

Integrated Circuits

Discrete Components

Hybrid Circuits

By Frequency Range

Ku-Band Segment Shows Strong Growth Due to Space Communication Applications

The market is segmented based on frequency range into:

L-Band

Ku-Band

Ka-Band

Others

Regional Analysis: Gain and Loss Equalizer Market

North America North America remains a mature yet dynamic market for gain and loss equalizers, driven by robust defense spending and advanced telecommunications infrastructure. The U.S. Department of Defense allocated $842 billion for FY2024, with a significant portion directed toward electronic warfare and communication systems requiring precise signal conditioning. Commercial demand is equally strong, with 5G network rollouts and satellite communication upgrades accelerating deployments. While technical expertise and R&D investments keep regional manufacturers like Marki Microwave and Mini Circuits competitive, pricing pressures from Asian suppliers challenge domestic market share. Regulatory compliance with FCC standards further shapes product specifications, favoring modular designs with connectors for ease of maintenance.

Europe Europe’s market thrives on precision engineering and stringent EMI/EMC standards, particularly in aerospace and automotive test applications. The European Space Agency’s €7 billion annual budget fuels demand for high-reliability equalizers in satellite payloads, while telecom operators prioritize low-noise components for fiber-optic backbones. However, fragmented regulatory landscapes across EU member states complicate standardization efforts. German and French manufacturers dominate the supply chain, leveraging localized production to mitigate geopolitical risks. Notably, the region sees growing adoption of MMIC-based equalizers (Monolithic Microwave Integrated Circuits) for their compact footprint—a critical factor in densely populated urban installations.

Asia-Pacific The APAC region is experiencing explosive growth, with China accounting for over 40% of global demand due to massive 5G base station deployments and indigenous defense programs. India’s BharatNet project, aiming to connect 600,000 villages with broadband, further amplifies needs for civil-grade equalizers. Cost competitiveness remains pivotal—Chinese firms like Akon and KeyLink Microwave offer pared-down variants at 30-50% lower prices than Western counterparts, albeit with trade-offs in durability. Japan and South Korea counterbalance this trend with niche high-performance solutions for automotive radar and quantum computing applications. Supply chain localization is accelerating, though dependence on U.S.-controlled semiconductor IP persists as a bottleneck.

South America Market development here is uneven, constrained by economic instability but buoyed by selective modernization initiatives. Brazil’s SISFRON border surveillance system and Argentina’s renewable energy grid expansions drive sporadic demand for military and utility-grade equalizers. Import substitution policies in Argentina and Venezuela incentivize local assembly, yet limited technical expertise forces reliance on knockdown kits from Chinese suppliers. Currency fluctuations and tariff barriers deter long-term commitments from global players, leaving the region underserved for advanced solutions. Nonetheless, partnerships with Russian and Indian manufacturers are emerging as workarounds to circumvent Western export restrictions.

Middle East & Africa The MEA market is bifurcated—Gulf states prioritize cutting-edge defense and oilfield communications, while Sub-Saharan Africa focuses on cost-effective telecom infrastructure. UAE’s $23 billion Edge Group consortium recently invested in localized equalizer production for electronic warfare systems, reducing reliance on U.S. imports. In contrast, African telecom operators often repurpose retired European equipment, creating a secondary market for refurbished units. Political instability in North Africa and supply chain gaps hinder consistent growth, though undersea cable projects along the continent’s coasts present new opportunities. Israeli innovations in GaN (Gallium Nitride) technology are gradually penetrating neighboring markets, offering superior power handling for harsh environments.

Get A Detailed Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97682

Report Scope

This market research report provides a comprehensive analysis of the global and regional Gain and Loss Equalizer markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Gain and Loss Equalizer market was valued at USD million in 2024 and is projected to reach USD million by 2032, at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (With Connectors, Without Connectors), application (Military Equipment, Civil Equipment), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis. The U.S. market size is estimated at USD million in 2024, while China is to reach USD million.

Competitive Landscape: Profiles of leading market participants including Akon, AMTI, API Technologies, Dielectric Laboratories, Eclipse Microwave, KeyLink Microwave, Marki Microwave, Mini Circuits, Orion Microwave, Planar Monolithics Industries, and Polaris, including their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in RF/microwave components, signal processing techniques, and evolving industry standards.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customisation of the Report In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Contact us:

+91 8087992013

0 notes

Text

Gain and Loss Equalizer Market Growth Trends and Forecast 2025–2032

MARKET INSIGHTS

The global Gain and Loss Equalizer Market size was valued at US$ 234.7 million in 2024 and is projected to reach US$ 423.9 million by 2032, at a CAGR of 8.98% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the fastest growth with a projected 7.2% CAGR through 2032.

Gain and Loss Equalizers are critical components in RF and microwave systems designed to compensate for signal amplitude variations across different frequencies. These devices play a vital role in maintaining signal integrity across various applications including satellite communications, radar systems, and 5G infrastructure. The market offers both connectorized and connector-less variants, with the former dominating nearly 68% of total market share in 2024.

The market growth is primarily driven by expanding 5G network deployments worldwide and increasing defense spending on advanced communication systems. Recent technological advancements in equalizer design, such as compact form factors and improved thermal stability, are further propelling market expansion. Key players including Mini Circuits, API Technologies, and Marki Microwave are actively introducing new products with enhanced performance characteristics to capitalize on emerging opportunities in both military and commercial sectors.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for High-Speed Data Transmission to Boost Market Expansion

The global Gain and Loss Equalizer market is experiencing strong growth driven by increasing demand for high-speed data transmission across telecom and aerospace sectors. With 5G network rollouts accelerating worldwide, the need for signal integrity solutions has surged. Gain and Loss Equalizers play a critical role in maintaining optimal signal strength and quality in complex RF and microwave systems. The technology is particularly valuable in modern communication infrastructure where signal degradation over long distances remains a persistent challenge. Recent advancements in satellite communication systems are further propelling adoption, with equalizers being integrated into both ground stations and satellite payloads to ensure consistent performance.

Military Modernization Programs Creating Significant Demand

Defense sector investments in electronic warfare and radar systems represent a major growth driver for Gain and Loss Equalizers. Modern military equipment increasingly relies on sophisticated RF subsystems where signal equalization becomes critical for mission success. Defense budgets across major economies continue prioritizing advanced electronic systems, directly benefiting manufacturers of precision RF components. The United States Department of Defense alone allocated substantial funds for electronic warfare modernization recently, creating ripple effects across the supply chain. As military networks become more complex with the integration of autonomous systems and networked warfare concepts, the demand for reliable equalization solutions is projected to maintain steady growth.

MARKET RESTRAINTS

High Development Costs and Complex Manufacturing Processes Inhibit Growth

While the Gain and Loss Equalizer market shows strong potential, the high costs associated with product development present a significant barrier. Manufacturing precision RF components requires specialized facilities, stringent quality control, and expensive test equipment. The materials used in these devices, including high-performance substrates and precision-crafted components, contribute to elevated production costs. Smaller manufacturers often struggle with achieving economies of scale, limiting their ability to compete effectively. This cost barrier is particularly acute in price-sensitive segments of the civil equipment sector, where buyers frequently prioritize cost over performance features.

Supply Chain Constraints Pose Operational Challenges

The industry continues facing material shortages and supply chain disruptions that impact production timelines and costs. Certain specialized components used in Gain and Loss Equalizers have extended lead times, creating bottlenecks in manufacturing. Semiconductor shortages that began affecting multiple industries have also impacted the availability of supporting electronics for advanced equalizer designs. These supply chain complexities are compounded by geopolitical tensions that have reshaped global trade flows in critical electronic components. Manufacturers are being forced to maintain higher inventory levels or seek alternative sourcing strategies, both of which increase operational costs.

MARKET OPPORTUNITIES

Emerging Millimeter-Wave Applications Open New Revenue Streams

The rapid development of millimeter-wave technologies for 5G and beyond represents a significant opportunity for Gain and Loss Equalizer providers. As communication systems move into higher frequency bands, the challenges of signal attenuation and distortion become more pronounced, creating greater need for sophisticated equalization solutions. The millimeter-wave market is forecast to grow substantially, driven by 5G network densification and emerging applications in automotive radar and security scanning. Manufacturers that can develop equalizers optimized for these high-frequency bands stand to capture significant market share in this high-growth segment. Several industry leaders have already announced dedicated millimeter-wave product lines to address this emerging need.

Integration of AI for Smart Signal Processing Creates Value-Added Solutions

The incorporation of artificial intelligence into RF systems presents innovative opportunities for the Gain and Loss Equalizer market. Smart equalization solutions that can dynamically adjust to changing signal conditions offer significant performance advantages over traditional fixed designs. These intelligent systems are particularly valuable in environments with variable transmission conditions or where channel characteristics change rapidly. Several manufacturers are now developing adaptive equalizers with machine learning capabilities that can optimize performance in real-time. This technological evolution is creating new market segments where premium pricing can be justified by enhanced functionality and reduced maintenance requirements. The defense sector has shown particular interest in these smart solutions for electronic warfare applications.

MARKET CHALLENGES

Intense Competition from Alternative Solutions Pressures Market Position

The Gain and Loss Equalizer market faces growing competition from alternative signal conditioning technologies. Advances in digital signal processing techniques have enabled software-based solutions to address some challenges traditionally handled by hardware equalizers. While hardware equalizers maintain advantages in latency and power efficiency for certain applications, the flexibility of software solutions presents an ongoing competitive threat. This is particularly evident in telecom infrastructure where operators seek to virtualize more network functions. Manufacturers must constantly innovate to demonstrate the continued value proposition of dedicated hardware equalization in these evolving application environments.

Regulatory Compliance Adds Complexity to Product Development

Meeting evolving international standards and regulatory requirements presents ongoing challenges for market participants. Gain and Loss Equalizers must comply with strict electromagnetic compatibility regulations that vary across geographic markets. The certification process for military and aerospace applications is particularly rigorous, requiring significant testing and documentation. Recent changes in export control regulations affecting RF and microwave technologies have further complicated international sales activities. Smaller manufacturers often struggle with the administrative burden and costs associated with maintaining compliance across multiple jurisdictions, potentially limiting their market access and growth opportunities.

GAIN AND LOSS EQUALIZER MARKET TRENDS

Advancements in 5G and Wireless Communication Driving Market Growth

The global Gain and Loss Equalizer market is experiencing significant growth due to rapid advancements in 5G technology and wireless communication networks. These devices play a crucial role in maintaining signal integrity by compensating for transmission line losses and ensuring uniform gain across different frequency bands. The increasing deployment of 5G infrastructure, which requires highly sophisticated RF components, has escalated demand for precision equalizers that can operate efficiently at millimeter-wave frequencies. Recent technological innovations have resulted in equalizers with improved insertion loss characteristics, broader frequency ranges exceeding 40 GHz, and reduced size footprints ideal for compact 5G base stations.

Other Trends

Military Modernization Programs

Defense sector investments are accelerating adoption of Gain and Loss Equalizers in electronic warfare systems and radar applications. Modern military equipment demands robust RF components capable of withstanding harsh environments while maintaining precise signal conditioning. The integration of these equalizers in phased array radars helps mitigate amplitude variations across antenna elements, significantly improving target detection accuracy. Global defense budgets allocating substantial portions to communication systems upgrading creates sustained demand in this sector.

Space Communication Sector Expansion

The burgeoning satellite communication industry presents lucrative opportunities for Gain and Loss Equalizer manufacturers. With increasing numbers of LEO satellite constellations being deployed, there is growing need for RF components that can compensate for signal degradation across long transmission paths. These equalizers are critical in both ground station equipment and satellite payloads to maintain signal quality. The commercial space sector's projected growth, with estimates suggesting over 50,000 satellites may be launched this decade, underscores the importance of reliable RF signal conditioning solutions like equalizers to prevent data loss in space-ground communication links.

COMPETITIVE LANDSCAPE

Key Industry Players

Microwave Component Suppliers Intensify R&D Investments to Gain Market Share

The global gain and loss equalizer market features a mix of established microwave component manufacturers and specialized suppliers competing across military and civil equipment applications. Mini Circuits emerges as a dominant player, leveraging its extensive portfolio of RF/microwave components and strong distribution network across North America and Asia-Pacific.

API Technologies and Marki Microwave collectively held over 25% market share in 2024, primarily due to their expertise in precision microwave components for defense applications. Their technological leadership in connectorized equalizer solutions has been particularly valuable for military communication systems.

Recent market developments show companies expanding their production capabilities to meet growing demand. Dielectric Laboratories recently announced a new manufacturing facility in Europe, while Eclipse Microwave partnered with a leading defense contractor to co-develop next-generation equalizers with wider frequency ranges.

Meanwhile, regional players like Planar Monolithics Industries and Orion Microwave are gaining traction through competitive pricing strategies and customized solutions for telecom infrastructure projects.

List of Key Gain and Loss Equalizer Manufacturers

Mini-Circuits (U.S.)

API Technologies (U.S.)

Marki Microwave (U.S.)

Dielectric Laboratories (U.S.)

Eclipse Microwave (France)

KeyLink Microwave (China)

Orion Microwave (U.S.)

Planar Monolithics Industries (U.S.)

Polaris (Germany)

AMTI (Japan)

Segment Analysis:

By Type

With Connectors Segment Leads Due to Enhanced Connectivity and Ease of Integration

The market is segmented based on type into:

With Connectors

Without Connectors

By Application

Military Equipment Application Dominates the Market Due to High Demand for Signal Optimization

The market is segmented based on application into:

Military Equipment

Civil Equipment

By Component

Integrated Circuit Segment Holds Significant Share Due to Compact Design and Efficiency

The market is segmented based on component into:

Integrated Circuits

Discrete Components

Hybrid Circuits

By Frequency Range

Ku-Band Segment Shows Strong Growth Due to Space Communication Applications

The market is segmented based on frequency range into:

L-Band

Ku-Band

Ka-Band

Others

Regional Analysis: Gain and Loss Equalizer Market

North America North America remains a mature yet dynamic market for gain and loss equalizers, driven by robust defense spending and advanced telecommunications infrastructure. The U.S. Department of Defense allocated $842 billion for FY2024, with a significant portion directed toward electronic warfare and communication systems requiring precise signal conditioning. Commercial demand is equally strong, with 5G network rollouts and satellite communication upgrades accelerating deployments. While technical expertise and R&D investments keep regional manufacturers like Marki Microwave and Mini Circuits competitive, pricing pressures from Asian suppliers challenge domestic market share. Regulatory compliance with FCC standards further shapes product specifications, favoring modular designs with connectors for ease of maintenance.

Europe Europe’s market thrives on precision engineering and stringent EMI/EMC standards, particularly in aerospace and automotive test applications. The European Space Agency’s €7 billion annual budget fuels demand for high-reliability equalizers in satellite payloads, while telecom operators prioritize low-noise components for fiber-optic backbones. However, fragmented regulatory landscapes across EU member states complicate standardization efforts. German and French manufacturers dominate the supply chain, leveraging localized production to mitigate geopolitical risks. Notably, the region sees growing adoption of MMIC-based equalizers (Monolithic Microwave Integrated Circuits) for their compact footprint—a critical factor in densely populated urban installations.

Asia-Pacific The APAC region is experiencing explosive growth, with China accounting for over 40% of global demand due to massive 5G base station deployments and indigenous defense programs. India’s BharatNet project, aiming to connect 600,000 villages with broadband, further amplifies needs for civil-grade equalizers. Cost competitiveness remains pivotal—Chinese firms like Akon and KeyLink Microwave offer pared-down variants at 30-50% lower prices than Western counterparts, albeit with trade-offs in durability. Japan and South Korea counterbalance this trend with niche high-performance solutions for automotive radar and quantum computing applications. Supply chain localization is accelerating, though dependence on U.S.-controlled semiconductor IP persists as a bottleneck.

South America Market development here is uneven, constrained by economic instability but buoyed by selective modernization initiatives. Brazil’s SISFRON border surveillance system and Argentina’s renewable energy grid expansions drive sporadic demand for military and utility-grade equalizers. Import substitution policies in Argentina and Venezuela incentivize local assembly, yet limited technical expertise forces reliance on knockdown kits from Chinese suppliers. Currency fluctuations and tariff barriers deter long-term commitments from global players, leaving the region underserved for advanced solutions. Nonetheless, partnerships with Russian and Indian manufacturers are emerging as workarounds to circumvent Western export restrictions.

Middle East & Africa The MEA market is bifurcated—Gulf states prioritize cutting-edge defense and oilfield communications, while Sub-Saharan Africa focuses on cost-effective telecom infrastructure. UAE’s $23 billion Edge Group consortium recently invested in localized equalizer production for electronic warfare systems, reducing reliance on U.S. imports. In contrast, African telecom operators often repurpose retired European equipment, creating a secondary market for refurbished units. Political instability in North Africa and supply chain gaps hinder consistent growth, though undersea cable projects along the continent’s coasts present new opportunities. Israeli innovations in GaN (Gallium Nitride) technology are gradually penetrating neighboring markets, offering superior power handling for harsh environments.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Gain and Loss Equalizer markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Gain and Loss Equalizer market was valued at USD million in 2024 and is projected to reach USD million by 2032, at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (With Connectors, Without Connectors), application (Military Equipment, Civil Equipment), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis. The U.S. market size is estimated at USD million in 2024, while China is to reach USD million.

Competitive Landscape: Profiles of leading market participants including Akon, AMTI, API Technologies, Dielectric Laboratories, Eclipse Microwave, KeyLink Microwave, Marki Microwave, Mini Circuits, Orion Microwave, Planar Monolithics Industries, and Polaris, including their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in RF/microwave components, signal processing techniques, and evolving industry standards.

Market Drivers & Restraints: Evaluation of factors driving market growth along with challenges, supply chain constraints, regulatory issues, and market-entry barriers.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Gain and Loss Equalizer Market?

-> Gain and Loss Equalizer Market size was valued at US$ 234.7 million in 2024 and is projected to reach US$ 423.9 million by 2032, at a CAGR of 8.98% during the forecast period 2025-2032.

Which key companies operate in Global Gain and Loss Equalizer Market?

-> Key players include Akon, AMTI, API Technologies, Dielectric Laboratories, Eclipse Microwave, KeyLink Microwave, Marki Microwave, Mini Circuits, Orion Microwave, Planar Monolithics Industries, and Polaris.

What are the key growth drivers?

-> Key growth drivers include increasing demand for advanced RF components, growth in military and aerospace applications, and expanding telecommunications infrastructure.

Which region dominates the market?

-> North America currently holds the largest market share, while Asia-Pacific is expected to witness the highest growth rate during the forecast period.

What are the emerging trends?

-> Emerging trends include miniaturization of components, integration with 5G infrastructure, and development of wideband equalizers.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/hazardous-lighting-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/mobile-document-reader-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gan-drivers-market-outlook-in-key-end.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/airbag-chip-market-research-report-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-peripheral-device-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/single-ended-glass-seal-thermistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/commercial-control-damper-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pcb-board-terminals-market-investment.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/bandpass-colored-glass-filter-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/video-surveillance-hardware-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pfc-ics-market-technological.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modulator-bias-controller-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tubular-cable-termination-market-demand.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/logic-buffer-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/broadband-polarizing-beamsplitters.html

0 notes

Text

0 notes

Text

BULK SMS: The Cornerstone of Scalable Business Communication

Revolutionizing Enterprise Messaging Through BULK SMS

Modern businesses operate in a world where real-time communication is critical. BULK SMS empowers companies to instantly disseminate messages at scale, bolstering client engagement and operational efficiency. From promotional alerts to transactional updates, enterprises leverage BULK SMS to stay connected across diverse geographies and customer bases.

Retailers, banks, logistics firms, real estate developers, and e-commerce platforms harness BULK SMS to deliver time-sensitive messages that capture attention and drive action. With significantly higher open rates than email, BULK SMS provides unmatched immediacy and penetration.

Selecting the Right BULK SMS PROVIDERS for Optimal Reach

Not all BULK SMS PROVIDERS are created equal. Enterprises seeking consistency, security, and scalability need providers that offer high-throughput infrastructure and seamless integration options. Advanced platforms deliver:

API-first ecosystems for automated execution

SLA-backed delivery speeds with real-time analytics

AI-augmented personalization at scale

Leveraging a trusted BULK SMS GATEWAY ensures rapid message delivery and cross-network compatibility. The best BULK SMS PROVIDERS offer global reach with localized delivery assurance, including superior service in high-growth markets like Tanzania.

The Rise of BULK SMS PROVIDERS IN TANZANIA

With mobile penetration surging, BULK SMS PROVIDERS IN TANZANIA have become pivotal to brand outreach and operational automation. Tanzanian enterprises—from fintech innovators to logistics companies—are adopting BULK SMS to:

Dispatch OTPs and payment confirmations

Automate customer notifications

Launch geo-targeted promotions in Swahili and English

Local compliance, multilingual templates, and carrier-grade infrastructure make BULK SMS GATEWAY IN TANZANIA an essential tool for regional scalability.

How BULK SMS GATEWAY Delivers Strategic Advantages

An enterprise-grade BULK SMS GATEWAY enables frictionless communication across fragmented systems. Integration-ready with CRMs, ERPs, and marketing suites, it allows:

Multi-channel fallback to ensure message delivery

Real-time delivery reports with engagement metrics

Time-zone aware scheduling for maximum visibility

BULK SMS PROVIDERS leveraging AI-driven routing engines and smart delivery rules increase conversions while minimizing latency and message loss.

AI + BULK SMS: A Force Multiplier for Campaign Efficiency

Intelligent automation is redefining BULK SMS engagement. Today’s forward-thinking BULK SMS PROVIDERS embed machine learning to predict customer behavior, refine messaging cadence, and dynamically alter content based on intent.

Features include:

Sentiment-aware response handling

A/B testing across audience segments

Location-aware delivery logic using telecom APIs

In regions like Tanzania, this tech-forward approach unlocks deeper customer engagement and improved ROI on communication spend.

Conclusion: Embrace BULK SMS for Unmatched Business Agility

Enterprises looking to scale fast and connect deep must adopt BULK SMS as a central communications strategy. Whether driven by global ambitions or regional growth in markets like Tanzania, choosing the right BULK SMS PROVIDERS and integrating a robust BULK SMS GATEWAY delivers tangible gains—from customer retention to operational resilience.

0 notes

Text

Inside the evolution of telecom loyalty platforms: From discounts to behavior-based rewards

1. From discounts to data: The shift in telecom loyalty

For years, telecom loyalty programs relied on one tactic—discounting. Whether it was 10% off your bill, free top-ups, or annual anniversary offers, these tactics prioritized short-term appeal. But today’s subscribers are more value-conscious than price-sensitive. They want relevance, not rebates.

Discounts also hurt profitability and fail to drive loyalty. They don’t reinforce engagement or reward positive behavior. In fact, they often attract deal-chasers who leave once the discount ends.

The new loyalty model is behavior-based, not budget-based. Instead of handing out flat offers, brands are now rewarding actions—like activating eSIM, referring friends, renewing a plan, or engaging with the app.

This shift is powered by telecom loyalty platforms that track user actions in real-time and deliver rewards at critical touchpoints. The result? A loyalty experience that feels earned, not expected—and builds deeper emotional connections with the brand.

By replacing static discounting with data-driven engagement, telecom brands are finally moving from transactional incentives to transformational loyalty. And it’s not only increasing retention—it’s improving customer lifetime value and driving upsells without undercutting core pricing.

2. Behavior-driven loyalty campaigns that scale

Scaling loyalty is hard—especially when personalization is involved. Most legacy systems require manual setup for every reward, leading to fragmented campaigns and limited segmentation.

Modern telecom loyalty platforms solve this by allowing marketers to automate rewards based on user segments and behavioral triggers. Whether it’s new users, dormant customers, or high-value clients, campaigns can be configured to launch automatically when users complete predefined actions.

Examples of scalable, behavior-driven campaigns include:

Refer a friend → unlock a stackable reward

App reactivation after 30 days → surprise gift card

Upgrade to a higher-tier plan → bonus entertainment perks

12-month tenure milestone → loyalty badge + premium data pack

Because the platform integrates with billing systems, CRM, and apps, rewards are triggered instantly and delivered natively—via push notifications, SMS, or dashboard embeds.

This automation doesn’t just save time. It ensures consistency across all user journeys and reduces the dependency on internal dev or ops teams.

Loyalty teams can create and deploy 5–10 targeted campaigns per month, each personalized by audience and behavior—without writing a single line of code.

That’s the power of platform-based loyalty: it’s measurable, repeatable, and built for long-term scale.

3. The tech backbone behind telecom loyalty platforms

What makes these loyalty platforms transformative isn’t just the front-end user experience—it’s the technical foundation they’re built on. Unlike generic rewards tools or third-party coupon systems, telecom loyalty platforms are purpose-built to work with a telecom provider’s unique ecosystem.

They offer:

API-based integration with billing, app, and CRM systems

Real-time reward delivery tied to customer actions

White-labeled UIs to preserve brand identity

Dynamic content slots for app, email, SMS, and onboarding

Support for internal offers + external partner deals

No need for third-party redirects or external logins

This architecture means perks can be delivered without leaving your ecosystem—keeping users engaged on your platform and reinforcing your brand identity at every step.

It also means your teams can A/B test, iterate, and optimize without waiting for dev cycles. Whether it’s adjusting rewards by region or launching a special weekend campaign for loyal users, everything is modular and responsive.

In short, the tech backbone of platforms like Paylode makes telecom loyalty agile, personalized, and deeply embedded into the customer experience.

4. Final takeaways: Loyalty that adapts to customer actions

The telecom customer journey is no longer linear. Users bounce between prepaid and postpaid plans, switch devices often, and explore offers across carriers before committing. In this dynamic landscape, static loyalty programs simply don’t work.

To stay relevant, telecom brands must meet users where they are—through loyalty programs that respond in real-time to customer actions.

Modern telecom loyalty platforms make this possible. They allow operators to:

Recognize and reward specific behaviors

Deliver perks instantly, across digital touchpoints

Segment customers by behavior, not just demographics

Optimize rewards based on data, not assumptions

And most importantly—they let you reward users without discounting your core offering. You retain value while delivering personalized experiences.

As the telecom space becomes more commoditized, loyalty becomes the key differentiator. Not the product. Not the price. The experience.

Forward-thinking brands that invest in behavior-led, platform-powered loyalty will turn subscribers into brand advocates—and loyalty into a true growth engine.

If your loyalty program still runs on discounts and generic perks, it’s time to evolve. The future belongs to telecom loyalty platforms that are intelligent, responsive, and built for today’s mobile-first customer.

0 notes

Text

Go Global with Confidence: How International SMS Empowers Business Communication

In an age of instant gratification and real-time connectivity, communication is everything. Whether you're a growing startup or a global enterprise, one thing is clear — if you want to reach customers worldwide, you need reliable, fast, and effective communication tools. International SMS (Short Message Service) has emerged as a critical solution for businesses aiming to engage with users across borders. Despite the rise of social media and messaging apps, SMS remains a trusted, direct, and efficient way to stay connected.

This article delves into how international SMS works, its business advantages, and why it's still a go-to strategy for cross-border customer engagement.

What is International SMS?

At its core, international SMS allows you to send text messages from one country to mobile subscribers in another. Using international SMS gateway providers, businesses can dispatch messages to customers in multiple countries through a single platform. These gateways integrate with telecom operators globally, ensuring your messages are delivered efficiently and reliably.

Unlike app-based messaging services that require internet and specific applications, SMS is universal — it works on virtually every mobile phone without any additional downloads. This universality makes SMS an essential part of global communication strategies.

Why Businesses Choose International SMS

Despite the buzz around modern chat apps and email marketing, international SMS offers benefits that other channels can’t always match:

Unmatched Reach and Accessibility SMS reaches over 7 billion mobile users globally, even in areas with low internet penetration. This means your message can get to anyone, anywhere — regardless of device type or connectivity.

Lightning-Fast Delivery Messages are typically delivered within seconds. This makes SMS ideal for urgent alerts, transactional notifications, and time-sensitive promotions.

Higher Engagement Rates SMS boasts open rates of over 90%, with most texts read within minutes. Compare this to email or push notifications, and the impact becomes clear — SMS demands attention.

Simplicity and Directness SMS is straightforward. No visuals, no formatting — just a short, clear message. That simplicity makes it powerful in cutting through the noise and reaching your audience quickly.

Global Consistency Whether you're sending a message to Tokyo or Toronto, the experience remains consistent for the end user. SMS behaves the same way globally, ensuring reliable communication.

Use Cases of International SMS Across Industries

International SMS is used across various sectors for both marketing and operational purposes. Here are some common use cases:

Retail & E-commerce: Sending promotional offers, discount codes, and cart reminders to international shoppers.

Banking & Finance: Delivering secure OTPs, balance alerts, and fraud notifications.

Healthcare: Notifying patients about international health services, virtual appointments, or medical updates.

Travel & Tourism: Confirming bookings, sending flight reminders, and sharing travel advisories.

Education: Informing international students about class schedules, fees, results, and emergency updates.

Logistics & Delivery: Keeping customers informed with shipment tracking and delivery notifications.

How to Implement International SMS for Your Business

Select a Reliable SMS Gateway Provider Choose a partner with global coverage, proven delivery rates, scalability, and support for APIs. Leading providers also offer features like two-way messaging, DLT compliance (in countries like India), and real-time analytics.

Segment and Personalize Don't just broadcast — segment your list based on region, behavior, or preferences. Use the recipient’s first name, language, and local time zone to create a personal touch.

Comply with Global Regulations Ensure your messaging follows privacy laws like GDPR, TCPA, or TRAI. Use double opt-in where required and provide easy opt-out options.

Track and Optimize Use reporting tools to analyze delivery rates, open rates, click-throughs, and conversion metrics. This data can help you refine your message and timing for better results.

Best Practices for Global SMS Success

Be Concise: Stick to the 160-character limit for clarity. Say what matters upfront.

Add a Strong CTA: Encourage action, whether it's clicking a link, confirming an appointment, or replying to a message.

Localize Your Messaging: Adapt content to match the language, cultural nuances, and tone of each region.

Avoid Sending During Off-Hours: Respect the recipient’s local time zone to avoid disruption and improve engagement.

Test Before Launching at Scale: Run pilot campaigns in different regions to check delivery and response performance.

Future of International SMS

With the rise of A2P (Application-to-Person) messaging, the future of international SMS is evolving. It is being integrated with rich communication channels like RCS (Rich Communication Services) and WhatsApp Business API, yet SMS continues to be the fallback channel when others fail.

As new markets emerge and mobile penetration increases globally, the demand for reliable SMS services will only grow. Businesses that adopt SMS as part of their communication stack will benefit from better customer engagement, stronger brand trust, and wider global outreach.

Conclusion

International SMS is far from outdated — it’s a strategic asset for any business with global ambitions. Its ability to deliver quick, targeted, and reliable communication makes it a pillar of modern customer engagement. Whether you're sending critical updates, running global campaigns, or supporting international customers, SMS ensures your message arrives, is seen, and gets results.

If you're looking to expand into new regions or strengthen your global communication efforts, it's time to consider international SMS not just as a messaging tool, but as a key part of your growth strategy.

0 notes

Text

Unlock Business Growth in 2025 with the Right Bulk SMS Service in Mumbai

By 2025, if your business isn’t mobile-first, you’re already too late. In a place like Mumbai, where industries change overnight, and competition is fierce, being connected to your consumers instantly is no longer a choice; it’s a necessity. And here is exactly when you need a reliable bulk SMS service provider in Mumbai.

In an age when mobile users are increasingly conditioned to get quick bites or instant updates, SMS is still among the easiest and the most effective channels of communication. Whether you’re a startup, retailer or service provider, messaging with SMS lets you reach all your clients with a single app, and they receive all messages quickly,��no Internet or equivalent complex applications needed.

Why SMS Marketing Still Hits The Mark

You’d think, in an age with countless apps, emails, social platforms, and the like, that SMS would be as relevant as separating eggs for a poached egg recipe. But the truth is: bulk SMS service is as effective as ever—and here’s why:

1. Reaches Everyone, Everywhere

Not everyone has a smartphone, but just about everyone has a cellphone. That makes SMS about as inclusive as it gets. It’s compatible with all devices, which means it’s a savvy way to reach Mumbai’s diverse population across neighborhoods, languages, and age groups.

2. Instant Visibility

Unlike emails that often go unopened or notifications that get buried in clutter, text messages are practically read immediately. Perfect for urgent updates, real-time alerts, or last-minute deals.

3. Encourages Action

Whether it’s confirming a reservation or a limited-time offer, SMS often results in quick customer reactions. And a snappy, customized message can inspire someone to tap through, call, or come by — right now.

4. Budget-Friendly and Scalable

You don’t have to have a huge marketing budget to make waves. A bulk SMS service in Mumbai allows you to contact hundreds—or even thousands—at a time, without breaking the bank.

How Bulk SMS Services Work – The Truth

A bulk SMS service enables you to send a single message to many people simultaneously. But the best services do more than that, providing intelligent tools to help you send with impact.

Here’s how it usually works: Craft your message: Make your message brief, direct, and purposeful — whether it’s an offer, update, or alert.

Select your audience: Upload your contact list or segment off of your contact list depending on your campaign objectives.

Send through dashboard or API: A good bulk SMS service provider in Mumbai will have web portals or APIs from which you can handle campaigns or automate sending.

Track results: Stay connected and keep track of who received, opened your emails, and clicked on any links, so you know how to follow up easily.

Bulk SMS Mumbai – Why Your Business Needs It

SMS is more than delivery — SMS is about connecting. There are a lot of things a good bulk SMS service can do for your company if you are looking for a Bulk SMS Provider in Mumbai:

· Build trust with timely updates and confirmations

· Drive conversions through special offers and limited-time deals

· Enhance engagement with clickable links, CTAs, or surveys

· Improve user experience through tailored, relevant messaging

· Stay compliant with India’s DND and TRAI regulations

In a city as competitive and fast-paced as Mumbai, the right SMS strategy gives your brand a valuable edge.

How can you find the right bulk SMS service company in Mumbai?

With so many options, how do you choose the right provider for your business? Here’s what to focus on:

· TRAI & DND Compliance: Collaborate only with those providers who are completely India telecom Act. Not only is this a matter of legality— it’s a protection of your brand as well.

· Fast & Reliable Delivery: It’s all about timing in Mumbai. Search for providers who send lightning-quick messages with high uptime and dead-reliable connectivity.

· Strong API Capabilities: If your company makes use of software, apps, or CRM, make sure your bulk SMS service can be seamlessly connected via an API. This allows you to send automated messages such as OTPs, alerts, updates, etc., very easily.

· Simple, Smart Dashboard: Your team should not be fighting to send the message. Simple, easy-to-use interface enables you to schedule, organize, and analyze campaigns neatly.

Final Thoughts

SMS marketing isn’t just surviving in 2025—it’s thriving. With unmatched reach, immediacy, and simplicity, SMS remains one of the most effective tools for business communication. But to get the most out of it, you need more than just a messaging tool—you need the right bulk SMS service company in Mumbai backing you.

A provider that offers reliability, compliance, integration, and personalized support becomes more than a vendor—they become a strategic partner in your growth.

So, whether you're sending promotional offers, service alerts, or simple thank-you messages, make every text count. Choose a bulk SMS service that helps you reach faster, engage better, and grow smarter.

#sms marketing#bulk sms#bulk sms service#bulk sms provider#bulk sms marketing#bulk sms service provider in bangalore

0 notes

Text

Unlocking Business Growth with Analytics Solutions Companies

In today's data-driven world, businesses no longer make decisions based on gut instinct—they rely on data. Analytics solutions companies help organizations harness the power of data to drive strategic decisions, optimize operations, and uncover new growth opportunities. Whether you're in retail, healthcare, finance, or telecom, analytics plays a crucial role in staying competitive.

Customer Rating: ⭐⭐⭐⭐⭐ (4.9/5 from 12,300+ businesses worldwide)

Explore how these companies provide value through modern tools, platforms, and services.

What Do Analytics Solutions Companies Do? Analytics solutions companies provide software, tools, and services that help businesses collect, manage, analyze, and visualize data. Their core mission is to turn raw data into actionable insights. These companies offer:

Data integration and warehousing: Combining data from multiple sources into a central system.

Descriptive analytics: Analyzing historical data to understand what happened.

Predictive analytics: Using AI and machine learning to forecast future trends.

Prescriptive analytics: Offering data-driven recommendations for decision-making.

Data visualization: Presenting insights in interactive dashboards and reports.

These companies often deploy popular analytics platforms like Tableau, Power BI, Looker, and Qlik to create custom reporting solutions for clients. Many also offer advanced capabilities such as real-time analytics, data mining, and customer segmentation.

Benefits of Partnering with Analytics Solutions Companies Collaborating with an analytics company unlocks powerful benefits:

a. Faster Decision-Making With real-time data dashboards and automatic reporting, executives and managers can act faster and more confidently.

b. Improved Operational Efficiency Analytics uncovers inefficiencies in workflows, supply chains, and customer journeys, allowing teams to streamline operations.

c. Customer Insights By analyzing consumer behavior, preferences, and feedback, businesses can improve product offerings and personalize experiences.

d. Revenue Growth Data-driven strategies lead to better product targeting, pricing models, and campaign performance, boosting profits.

e. Risk Management Predictive models can forecast risks such as churn, fraud, and market volatility, helping companies mitigate them proactively.

These companies often provide industry-specific analytics tailored to the unique challenges of healthcare, telecom, manufacturing, and financial services.

Key Features to Look for in Analytics Solutions Providers When choosing an analytics partner, businesses should consider several critical capabilities:

a. Scalability Can the platform handle growing data volumes across multiple departments or locations?

b. Data Security and Compliance Depending on your industry, the provider must support regulatory standards like GDPR, HIPAA, or SOC 2.

c. Cloud and Hybrid Deployment Options Flexibility matters whether on-premises, hybrid, or fully cloud-based (e.g., AWS, Azure).

d. AI and Machine Learning Integration Advanced algorithms can reveal deeper trends and automate decision-making.

e. Custom Dashboards and Visualization A good UI/UX design with customizable reports enhances user adoption and understanding.

Top analytics companies also offer APIs for data integration with tools like Salesforce, HubSpot, Shopify, ERP systems, and CRMs.

Top Analytics Solutions Companies in 2025 Here are some of the best-performing companies based on performance, innovation, and customer satisfaction:

a. Tableau (by Salesforce) Known for intuitive data visualization and real-time dashboards.

b. Power BI (by Microsoft) Ideal for businesses already in the Microsoft ecosystem, with strong Excel and Azure integration.

c. Qlik A self-service analytics platform focused on data literacy and AI insights.

d. Looker (by Google Cloud) Modern BI platform built for cloud scalability and embedded analytics.

e. SAS A leader in advanced analytics, AI, and statistical modeling for enterprise needs.

f. Domo Offers full-stack cloud analytics and real-time data alerts for proactive decision-making.

Many providers offer free trials, demo dashboards, and consulting services to assess fit before a full deployment.

Future Trends in Analytics Solutions The world of data analytics is constantly evolving. Here are key trends shaping the future of analytics solutions companies:

a. Augmented Analytics Combining AI and machine learning with traditional BI to automate insight generation.

b. Edge Analytics Data is processed closer to where it is generated, such as in IoT devices, to reduce latency and improve speed.

c. Data Democratization Empowering non-technical users to create and interpret reports with no-code or low-code tools.

d. Natural Language Querying Allowing users to ask questions in plain English (e.g., “What were Q1 sales in California?”) and get visual answers instantly.

e. Unified Data Platforms Eliminating silos by integrating data across marketing, sales, operations, and customer service into one source of truth.

Companies that embrace these technologies can outpace competitors by adapting faster to market changes and customer needs.

Conclusion Analytics solutions companies are no longer a luxury but a necessity for modern businesses. From improving decision-making to reducing operational costs and identifying new revenue streams, these partners help you harness your most valuable asset: data.

As your company grows, managing information becomes more complex. Partnering with the right analytics provider ensures you're not just collecting data but using it to lead your industry.

Ready to transform your business with data? You can start evaluating analytics solution partners that align with your goals and watch your insights turn into impact.

0 notes

Text

The Future is Now: Navigating the Data Monetization Market Evolution

Data Monetization Industry Overview

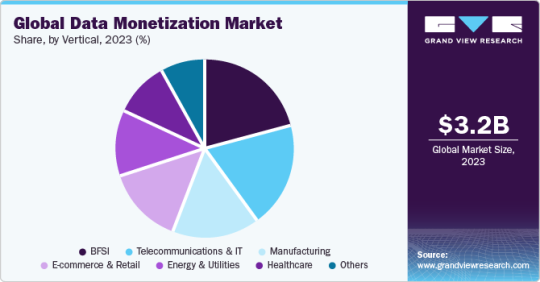

The global Data Monetization Market was valued at approximately USD 3.24 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 25.8% from 2024 to 2030. Data monetization involves the exchange of data between organizations to generate new revenue streams. This can be categorized into two main types: direct and indirect data monetization. Direct data monetization includes the sale of unprocessed data, the commercialization of a company's analyses, data bartering or trading, and the development of application programming interfaces (APIs). Conversely, indirect monetization focuses on leveraging data to achieve tangible benefits such as cost reduction, enhanced productivity and efficiency, the creation of novel products or services, and the identification of new customer segments or business opportunities. For example, with user consent, Uber shares its ride data with companies in the food and retail sectors, enabling these businesses to identify promising locations for new establishments.

Several factors are expected to propel market growth, including the increasing volume of enterprise data, a growing understanding of data monetization's potential, and the availability of external data sources. Additionally, the rising application of data processing and artificial intelligence, the increasing adoption of data-driven decision-making strategies, and advancements in big data analytics are anticipated to further stimulate growth throughout the forecast period.

Detailed Segmentation:

Method Insights

Embedded analytics segment is expected to witness a significant CAGR of 26.2% from 2024 to 2030. Embedded analytics can integrate existing applications with additional features such as data visualization, dashboard reporting, and analytics. This method accelerates time to market, creates customized embedded analytics solutions, and lowers TCO. Similarly, insight as a service combines external and internal data sources that use analytics to provide data insights. This method can support specific datasets and provide updated data to customers.

Organization Size Insights

The SMEs segment is expected to grow at the fastest CAGR of 29.4% from 2024 to 2030. The rising adoption of data monetization by SMEs to sustain in the competitive market is expected to power the segment growth over the forecast period. Furthermore, SMEs are expected to face resource shortages, resulting in business complexities and the increased need to optimize costs. In this situation, the rising presence of cloud-based data monetization is expected to play a pivotal role in ensuring reduced operations costs and increased efficiency, thereby positively affecting segment growth.

Vertical Insights

The telecommunications & IT segment is expected to witness a significant CAGR of 26.7% from 2024 to 2030. The increasing amount of data generated by these companies, the growing demand for data-driven decision-making, the increasing adoption of cloud computing, and the growing popularity of big data analytics. These factors make it easier for telecom and IT companies to store, analyze, and monetize their data.

Regional Insights

The data monetization market in the U.S. is growing significantly at a CAGR of 23.1% from 2024 to 2030. Growing government focus on encouraging digitization across industries to improve the transparency of processes is creating a positive outlook for the U.S. market. Furthermore, advancements in emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) are expected to drive the market growth in the region. In addition, various IT and telecom companies are shifting their businesses to Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) platforms in the U.S. to initiate remote operation management. This has bolstered the demand for system infrastructure software in the IT and telecom sectors in the region.

Gather more insights about the market drivers, restraints, and growth of the Data Monetization Market

Key Companies & Market Share Insights

Some of the key companies include Accenture, Cisco, and IBM Corporation, and others are some of the leading participants in the global data monetization market.

Accenture provides technology solutions and professional services in areas such as network management and consulting. It operates through five business lines: Accenture Technology, Accenture Operations, Accenture Digital, Accenture Strategy, and Accenture Consulting. The company offers business process services, infrastructure services, security services, and cloud services under the Accenture Operations business line.

Cisco Systems, Inc. specializes in developing and distributing hardware and software solutions. The company serves industries such as mining, oil and gas, smart buildings, retail, education, financial services, government, transportation, utilities, healthcare, insurance, and entertainment. It offers solutions across a range of technologies, including cloud, data center, network infrastructure, mobility, IoT, security, AI, and analytics and automation.

Key Data Monetization Companies:

The following are the leading companies in the data monetization market. These companies collectively hold the largest market share and dictate industry trends.

Accenture

Adstra

Cisco Systems, Inc.

Comviva

Domo, Inc.

Thales (Gemalto NV)

Gulp Data

IBM Corporation

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

In February 2024, Gulp Data announced a partnership with Snowflake that enables organizations to explore, share, and unlock value from their data, providing data valuation, data-backed loans, and data monetization services.

In December 2023, Thales completed the acquisition of Imperva. By providing the most comprehensive solutions for the broadest range of application, data security, and identity use cases, Thales and Imperva will help customers address cybersecurity challenges that are increasing rapidly in frequency, severity, and complexity.

0 notes

Text

Digital BSS Solutions Drive Cloud-First Agility in Telecom

Telecom operators face one of the most volatile and demanding technology markets. Customers demand fast service delivery, flexible billing, and personalized experiences. Meanwhile, new services like 5G and IoT require systems that scale quickly and work seamlessly.

Sadly, most providers still use legacy stacks. Legacy stacks are the old systems. They stifle agility. They drive up operating expenses. Most significantly, they hinder innovation.

To meet today's expectations, telecom operators are investing in digital BSS solutions. These support automation, reduce time-to-market and allow real-time customer interaction. Combined with telco cloudification efforts, the outcome is a leaner, more agile telecom business.

The shift to digital is no longer an option. It's the path to competitive success. It begins with the right telecom digital BSS solution: one engineered for speed, scale, and change.

Getting Unshackled by Legacy Constraints

Legacy stacks are heavyweight. Fixes require weeks. Tailoring demands extended cycles. Integration consistently falls apart. Such problems burn cycles and budgets.

Digital BSS for telcos upends this math. Cloud-native architecture unbundles functions so telcos can upgrade features separately. Teams are set up instead of code. This reduces development expenditure and accelerates deployment.

Furthermore, microservices and containerized architecture enable modular rollouts. Telcos can modify billing rules or introduce new plans without disrupting the system.

Supporting the Push Toward Cloud-Native Networks

The move toward cloud-native networks has already begun. In the U.S., over 60% of telecom operators have started shifting core systems to the cloud, according to a Deloitte survey.

This shift is not possible without compatible software. Here, digital BSS solutions align perfectly. They enable API-driven integration with both legacy and cloud-native components. As network functions move to containers and virtual machines, business processes must keep up.

A modern telecom digital BSS solution supports this shift. It doesn’t just process orders or calculate invoices. It syncs with distributed systems in real time, making the cloudification of telecom technologies and equipment seamless.

Shortening Time to Market for New Offers

Time is of the essence. Prepaid bundles or enterprise 5G offerings—customers want options in an instant. Telcos can't afford to spend months setting up offers.

With digital BSS for telecom, offer creation is quicker. Teams can test, change, and roll out services without having to write new code. Drag-and-drop catalog builders and dynamic policy engines minimize IT dependency.

This adaptability enables experimentation by sales and marketing teams. They can create promotions, try out market segments, and refine based on customer feedback. Briefly, the idea-to-launch cycle is reduced.

Facilitating Scalable Growth Without Overloading Infrastructure

With every additional user, device, and service added by telcos, back-end systems need to keep pace. Legacy BSS tools buckle under the load. Cloud-based tools automatically scale.

Telco cloudification needs BSS systems that flexibly adapt without disruption. A contemporary stack processes millions of transactions without human intervention. When using behavior changes, the system increases or decreases demand.

This elasticity saves on infrastructure. It also ensures service reliability under peak loads.

Providing Operational Resilience Through Automation