#TradingCourse

Explore tagged Tumblr posts

Text

Best Stock Market Course in Faridabad – Digi Edu Learning

Boost your investment skills with Digi Edu’s Best Stock Market Course in Faridabad. Learn trading, analysis & portfolio building from experts with practical training. For More Info: ☎️ 9211304067 ✉️ [email protected] 🌐 www.digiedulearning.com

0 notes

Text

5 Best Technical Analysis Course Online in India

Technical analysis is one of the most effective methods traders use to predict future price movements by analyzing past market data, primarily price and volume. The stock market’s complexities can be unraveled with the right knowledge and tools. This article highlights the 5 best technical analysis courses online in India, focusing on key aspects like Dow Theory in technical analysis, Nifty technical analysis, chart patterns, and the fundamental vs. technical analysis debate.

We’ll also explore how ISMT Institute of Stock Market Training excels in providing top-notch in technical analysis course.

About Technical Analysis Course

Technical Analysis Course is a technique used to assess and gauge the future value developments of financial instruments, like stocks, wares, monetary forms, and files, in light of verifiable value information and exchanging volume. Not at all like fundamental analysis, which looks at an organization’s monetary wellbeing and characteristic worth, technical analysis centers exclusively around cost and volume examples to go with exchanging choices.

Advantages & Disadvantages Of Technical Analysis Course

Advantages of Technical Analysis Course

Timing: Helps traders identify precise entry and exit points for trades.

Versatility: Applicable to various financial instruments, including stocks, commodities, forex, and indices.

Simplicity: Relies on price charts and technical indicators, making it easier to learn and apply compared to fundamental analysis.

Quick Analysis: Allows for rapid decision-making, which is particularly useful for short-term trading strategies.

Disadvantages of Technical Analysis Course

Short-Term Focus: Primarily used for short to medium-term trading, which may not be suitable for long-term investments.

Market Noise: Can be influenced by short-term market fluctuations and false signals.

Over-Reliance on Patterns: Solely relying on technical analysis can lead to ignoring fundamental factors that impact price movements.

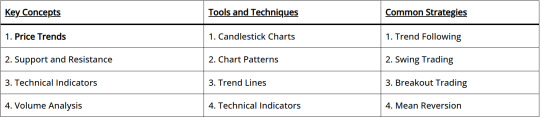

Key Concepts, Tools and Techniques & Common Strategies In Technical Analysis Course Online

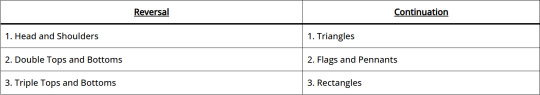

Technical Analysis Chart Patterns

Technical analysis chart patterns are vital tools for traders and investors, helping to predict future price movements by analyzing historical price data. These patterns are formed by the price movements of a stock or index over time and are used to identify potential market trends and reversals. This guide covers some of the most important chart patterns in technical analysis, their significance, and how to use them effectively.

Using Chart Patterns Effectively

Confirm the Pattern: Ensure the pattern is fully formed before acting on it. Prematurely acting on incomplete patterns can lead to false signals.

Volume Analysis: Volume should confirm the pattern. For example, in a head and shoulders pattern, volume should decrease during the formation of the head and increase on the breakout.

Set Target Prices: Measure the height of the pattern and project it from the breakout point to set target prices. For instance, in a double top pattern, the height from the peak to the support level can be projected downward from the breakout point to estimate the price target.

Use Stop-Loss Orders: Protect your capital by setting stop-loss orders at strategic points. For example, place a stop-loss just above the right shoulder in a head and shoulders pattern.

Combine with Other Indicators: Use other technical indicators, such as moving averages, RSI, and MACD, to confirm the signals provided by chart patterns.

Key Patterns

Dow Theory in Technical Analysis Course

Dow Theory in technical analysis course is one of the foundational concepts of technical analysis, developed by Charles Dow, the co-founder of Dow Jones & Company and the creator of the Wall Street Journal. Dow Theory in technical analysis provides a framework for understanding market trends and is based on the observation of market behavior through indices. This theory remains highly relevant and is widely used by traders and investors to predict market movements.

Key Principles of Dow Theory In Technical Analysis

Dow Theory consists of six tenets that form the basis of its market analysis approach:

1. The Market Discounts Everything

This principle asserts that all known information, including earnings, future prospects, and market news, is already reflected in stock prices. According to Dow, the market quickly assimilates information, and price movements are a result of the collective actions of investors.

2. The Market Has Three Trends

Dow Theory Technical Analysis Course identifies three types of market trends:

Primary Trend: It can be a bull market (upward trend) or a bear market (downward trend).

Secondary Trend: It represent corrections within a primary trend.

Minor Trend: It often influenced by day-to-day market fluctuations and noise.

3. Primary Trends Have Three Phases

Each primary trend is broken down into three phases:

Accumulation Phase: In a bear market, it’s the phase when these investors start selling, anticipating a downturn.

Public Participation Phase: This phase is typically supported by improving or deteriorating market conditions.

Excess Phase: The final phase usually sees the highest levels of activity and marks the culmination of the primary trend.

4. The Averages Must Confirm Each Other

According to Dow Theory Technical Analysis Course, for a trend to be considered valid, the movement of one market index must be confirmed by another. Originally, Dow used the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). The idea is that if one average moves in a certain direction, the other should follow, reflecting a broad market consensus.

5. Volume Confirms the Trend

Volume should increase in the direction of the primary trend. In a bull market, higher volumes should accompany upward movements, while in a bear market, increased volumes should accompany downward movements. This principle asserts that volume is a secondary but essential indicator of the strength of a price movement.

6. A Trend Is Assumed to Be in Effect Until It Gives Definite Signals of Reversal

This principle is akin to Newton’s first law of motion, suggesting that a trend will continue in its existing direction until a clear reversal signal is observed. This means that traders should assume a trend remains in place until the weight of evidence suggests otherwise.

Nifty Technical Analysis Course

Nifty technical analysis course involves examining the Nifty 50 index’s historical price data to forecast future price movements. The Nifty 50 index comprises the top 50 companies listed on the National Stock Exchange (NSE) of India, making it a vital indicator of the Indian stock market’s overall health.

Importance of Nifty Technical Analysis

Market Sentiment: Nifty technical analysis helps traders gauge the market sentiment and identify potential bullish or bearish trends.

Risk Management: By analyzing historical data and patterns, traders can set stop-loss levels and manage their risks effectively.

Entry and Exit Points: Technical analysis provides insights into optimal entry and exit points, helping traders maximize their profits.

Key Concepts in Nifty Technical Analysis

1. Dow Theory in Technical Analysis Course

Dow Theory, developed by Charles Dow, is a foundational concept in technical analysis course. It consists of six tenets that help traders understand market trends:

Market Discounts Everything: All information, including news and events, is reflected in the stock prices.

Three Market Trends: The market has three trends – primary (long-term), secondary (medium-term), and minor (short-term).

Primary trends have three phases: Accumulation, public participation, and distribution phases.

Indices Confirm Each Other: For a trend to be valid, it should be confirmed by other market indices.

Volume Confirms Trends: Volume should increase in the direction of the trend.

Trends Persist Until a Clear Reversal: A trend remains in effect until there are clear signals of its reversal.

2. Nifty Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. Popular indicators used in Nifty in technical analysis course include:

Moving Averages: Help smooth out price data to identify the trend direction. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages and helps identify momentum and trend strength.

Bollinger Bands: Consist of a moving average with two standard deviation lines, indicating volatility and potential price reversals.

Applying Dow Theory to Nifty In Technical Analysis Course

When applying Dow Theory to the Nifty 50 index, traders can use the same principles to analyze market trends. Here’s how these principles can be practically applied:

Analyzing Market Trends

Primary Trends: Identify long-term trends in the Nifty 50. Look for price patterns that indicate whether the market is in a bullish or bearish phase.

Secondary Trends: Observe corrections within the primary trend. Use secondary trends to identify buying or selling opportunities.

Volume Analysis: Check if volume supports the observed price movements. Higher volumes during upward or downward movements confirm the strength of the trend.

Confirmation with Other Indices: Compare movements in the Nifty 50 with other indices like the Nifty Next 50 or sectoral indices. Confirmation across multiple indices strengthens the trend analysis.

Benefits of Dow Theory in Technical Analysis Course

Framework for Trend Identification: Dow Theory provides a clear framework for identifying and understanding market trends, essential for making informed trading decisions.

Improved Timing of Trades: By recognizing different phases of a trend, traders can better time their entry and exit points.

Enhanced Risk Management: Understanding market phases and volume trends helps traders manage their risk more effectively.

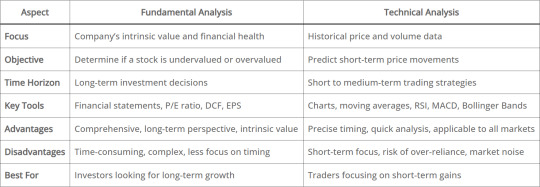

Difference Between Fundamental Analysis and Technical Analysis

In the world of stock market investing and trading, two primary methodologies are used to analyze securities and make investment decisions: fundamental analysis and technical analysis. Both approaches offer unique insights and are often employed by different types of investors depending on their investment goals and strategies. Here’s a comprehensive look at the differences between fundamental analysis and technical analysis:

Fundamental Analysis vs Technical Analysis

Investors and traders in the stock market employ various strategies to make informed decisions about buying and selling securities. Two primary approaches are fundamental analysis and technical analysis. Each method offers unique insights and tools, and understanding their differences can help investors choose the best approach for their investment goals.

Fundamental Analysis

Advantages

Long-Term Perspective: Helps in identifying long-term investment opportunities.

Intrinsic Value Focus: Provides a basis for comparing the stock’s market price to its intrinsic value.

Comprehensive Analysis: Involves a thorough examination of all aspects of a company’s performance and external factors affecting it.

Disadvantages

Time-Consuming: Requires detailed analysis and continuous monitoring of various factors.

Complex: Involves understanding financial statements and valuation models.

Less Focus on Timing: Not particularly useful for short-term trading due to its emphasis on long-term value.

Technical Analysis

Advantages

Timing: Helps in identifying precise entry and exit points for trades.

Quick Analysis: Less time-consuming compared to fundamental analysis.

Applicable to Any Security: Can be used for stocks, commodities, forex, and other trading instruments.

Disadvantages

Short-Term Focus: May not be effective for long-term investment decisions.

Risk of Over-Reliance: Solely relying on technical analysis can lead to ignoring fundamental aspects that affect price movements.

Market Noise: Can be influenced by short-term market noise and false signals.

Comparing Fundamental and Technical Analysis

ISMT Institute of Stock Market Training

The ISMT Institute of Stock Market Training is renowned for offering comprehensive technical analysis courses. These courses are designed to equip traders with the necessary skills to analyze the Nifty index and make informed trading decisions.

Comprehensive Curriculum: Covers key aspects of technical analysis, including Dow Theory, Nifty Technical Analysis, chart patterns, and technical indicators.

Flexible Learning: Offers both in-person and online classes, allowing students to learn at their own pace.

Expert Instructors: Classes are conducted by industry experts with extensive experience in stock market trading.

Practical Training: Provides hands-on training with real-time market data to ensure practical understanding and application.

Ongoing Support: Offers mentorship and support even after the course completion, helping students navigate the stock market with confidence.

CONCLUSION

Choosing the right technical analysis course can significantly impact your trading success. Each of the highlighted courses offers unique advantages, catering to different learning preferences and professional needs. The ISMT Institute of Stock Market Training stands out with its comprehensive curriculum, expert faculty, and flexible online classes, making it a top choice for aspiring traders.

Whether you prefer a structured certification course like those offered by NSE and NIFM or the flexible, self-paced learning options from Coursera and Udemy, these top five technical analysis courses in India provide excellent opportunities to enhance your trading skills and market knowledge. By understanding and applying technical analysis, traders can make more informed decisions and navigate the complexities of the stock market with greater confidence.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#technicalanalysis#tradingcourse#learnstocktrading#indianstockmarket#onlinetradingcourse#financialeducation#stockmarketindia#stocktraderlife#onlinecoursesindia#technicalindicators#ismtinstitute#ismt#learnfromismt

0 notes

Text

Start Trading Training for Beginners – Learn with Chart Monks

Want to learn trading from scratch? Chart Monks brings you the perfect opportunity with our Trading Training for Beginners program. Designed for complete beginners, this course covers stock market basics, chart analysis, risk management, and live trading sessions. Whether you're a student, working professional, or simply curious, our expert mentors simplify trading step-by-step. Gain real-world skills and confidence to start your trading journey smartly and safely. Call Now: +91-9220943789 Visit: www.chartmonks.com

0 notes

Text

Futures Trading Course | Master Market Strategies — Empirical Academy

Empirical Academy offers a comprehensive Futures Trading Course designed to help traders understand market trends, price movements, and trading strategies for consistent profitability. Whether you’re a beginner or an experienced trader, this course covers everything from the basics of futures contracts to advanced risk management techniques. Learn technical and fundamental analysis, leverage trading, hedging strategies, and real-time market applications. Our expert-led training provides practical insights to help you navigate volatility and capitalize on trading opportunities. Enroll now and take your futures trading skills to the next level with Empirical Academy!

0 notes

Text

Master the art of trading with our Stock Market Technical Analysis Course at Finowings Training Academy! This course is designed to help beginners and experienced traders understand price movements, chart patterns, technical indicators, and trading strategies. Learn how to analyze market trends, identify entry and exit points, and make informed investment decisions.

With expert-led sessions, real-world examples, and practical insights, you'll gain the confidence to navigate the stock market effectively. Whether you're a trader or investor, this course will equip you with essential skills to maximize your profits.

Join Now: Finowings Training Academy

#StockMarket#TechnicalAnalysis#TradingCourse#Investing#ChartPatterns#TradingStrategies#LearnTrading#StockMarketEducation#Finowings

1 note

·

View note

Text

Upcoming Master Trader Program 2023.

Master Trader Program Last 3 years 2020-2022

Minervini Private Access videos of last 10 years

Everything from mark minervini in one bundle just at 1999$, for more info check here.

https://thecourseresellers.com/mark-minervini-course-bundle/

#markminervini#markminervinimastertraderprogram#mastertraderprogram2023#MTP2023#CourseReseller#premiumcourse#tradingcourse

0 notes

Text

📈 Master Technical Analysis with Real-World Trading Insights

Looking to sharpen your chart-reading skills? At PriceActionCourse.com, we bring you a curated library of technical analysis ebooks and courses—designed for traders who want practical, no-nonsense education.

✅ Learn how to read charts like a pro ✅ Decode market structure, support/resistance, trendlines ✅ Understand patterns, momentum, and volume shifts ✅ Trade without relying on lagging indicators

Perfect for traders at every level—especially those who want to trade with clarity and confidence.

📚 Start building your edge today → PriceActionCourse.com

#TechnicalAnalysis#PriceAction#TradingCourses#ChartReading#Forex#Crypto#StockTrading#PriceActionCourse

3 notes

·

View notes

Text

Learn to Trade: Stock Market Training in Ahmedabad

The stock market is not anymore a playground for financial experts alone. Anyone can become a master trader and investor if properly guided and educated. To be a master in the markets, enrolling in a reputed Stock Market Training Institute in Ahmedabad is the wisest move. One of the finest in the market is Aapka Investments, a name that can be relied upon to offer quality stock market training in Ahmedabad.

Why Stock Market Training Is Important

The stock market has immense wealth-generating capability, yet it is also full of pitfalls. As a new or even an intermediate investor, you need to be well-equipped in trading methods, technical analysis, as well as risk management. This is where a professional Stock Market Training Institute steps in—to prepare you with hands-on knowledge and tools to excel.

Aapka Investments – Best Stock Market Training Institute in Ahmedabad

Aapka Investments has received a great name for providing pragmatic, practical training to prospective investors and traders. As a top Stock Market Training Institute in Ahmedabad, it offers different courses suitable for students, professionals, entrepreneurs, and retired people to gain secondary income.

The institute's expert trainers focus on simplifying complex stock market concepts. Their teaching methodology blends theory with live market experience, enabling students to gain confidence and clarity before stepping into the actual trading environment.

What You’ll Learn at Aapka Investments

At Aapka Investments, the curriculum is designed to empower learners with everything they need to know, including:

Fundamentals of stock market

Technical and fundamental analysis

Intraday and swing trading techniques

Portfolio building and long-term investment strategies

Trading psychology and risk management

Whether you are interested in equity, commodities, or derivatives, Aapka Investments ensures that you are well prepared to navigate the market with finesse and confidence.

Why Aapka Investments?

✅ Experienced Trainers with rich market experience

✅ Live Market Sessions for learning with real-time exposure

✅ Flexible Batches: Weekend as well as weekday batches

✅ Lifetime Mentorship as well as post-course assistance

✅ Reasonable Fees with amazing value

One thing that actually sets Aapka Investments apart as a premier Stock Market Training Institute is mentorship. Even after courses have been completed, students are offered ongoing guidance in order to fine-tune their strategies and grow as traders.

Visit https://aapkainvestments.in/ to view courses and join the most trusted Stock Market Training Institute in Ahmedabad.

#StockMarketTrainingInAhmedabad#AapkaInvestments#LearnTrading#AhmedabadTraders#TradingCourses#FinancialEducation#InvestSmart#StockMarketIndia#TradingSkills#StockMarketTrainingInstitute

3 notes

·

View notes

Text

Stock market training institute in Bangalore

Ready to dive into the world of investing and trading? Join our Stock Market Training Course in Bangalore and learn how to trade smart, manage risks, and grow your wealth with confidence!

#StockMarketTraining#StockMarketCoursesBangalore#TradingCourses#UpshotTechnologies#InvestSmart#TradingEducation#FinancialFreedom#TechnicalAnalysis#LearnTrading#StockMarketIndia#UpskillWithUpshot#BangaloreCourses#TradingMadeEasy#BookYourSeat

0 notes

Text

Unveiling 7 Best Option Trading Course in India 2025

Option Trading Tick has emerged as a lucrative avenue for investors seeking to maximize profits and manage risks effectively in the dynamic world of financial markets. In India, the demand for comprehensive options trading courses has surged, catering to both novice traders and seasoned investors. So, Best Option Trading Course in India is comprehensive guide, we delve into the top 7 option trading courses available in India for 2024, offering a detailed analysis of each course’s features, curriculum, and value proposition.

What Is Option Trading?

Option trading refers to the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (known as the strike price) within a predetermined time frame. Option trading allows investors to profit from price movements in the underlying asset without having to own the asset itself, offering flexibility and leverage in their investment strategies.

7 Best Option Trading Course in India:

1. Advanced Options Trading Mastery

Option trading course offers a deep dive into advanced option trading strategies, focusing on complex concepts such as butterfly spreads, iron condors, and straddles. With a blend of theoretical insights and practical application, students gain a comprehensive understanding of risk management and profit generation in volatile market conditions. One of 7 best option trading course in India.

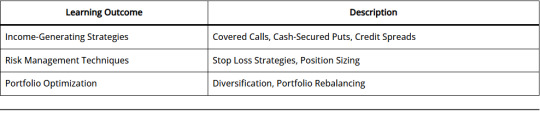

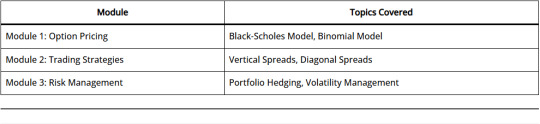

Table: Sample Curriculum Overview

2. Options Trading Bootcamp

Geared towards beginners, option trading course provides a foundational understanding of options trading, covering essential topics such as option pricing, strategies for income generation, and risk mitigation techniques. Through interactive sessions and real-life case studies, participants gain the confidence to execute trades effectively in diverse market conditions. Second best option trading course in India.

Table: Key Learning Objectives

3. Technical Analysis for Options Trading

Best Option Trading course in India focuses on leveraging technical analysis techniques to identify profitable options trading opportunities. Through in-depth chart analysis and trend identification, participants learn to make informed decisions while executing option trades, enhancing their probability of success in the market. Third and best option trading course in India.

Table: Sample Course Modules

4. Options Trading Fundamentals

Option trading course are designed for beginners and intermediate traders, this course provides a comprehensive overview of options trading fundamentals, including option pricing models, volatility analysis, and popular trading strategies. With a focus on practical application, participants develop a strong foundation to navigate the complexities of the options market confidently. Fourth best option trading course in India.

Table: Curriculum Highlights

5. Options Trading Masterclass

Option trading course with comprehensive masterclass covers a wide range of topics, including advanced options trading strategies, risk management techniques, and portfolio optimization strategies. With personalized coaching and interactive sessions, participants gain practical insights into executing profitable trades in the options market. Fifth best option trading course in India.

Table: Course Overview

6. Options Trading for Income

Option trading course are targeted towards investors seeking to generate consistent income through options trading, this course explores various income-generating strategies such as covered calls, cash-secured puts, and credit spreads. Participants learn to capitalize on market volatility while minimizing downside risks, thereby enhancing their overall portfolio returns. Sixth best option trading course in India.

Table: Key Takeaways

7. Options Trading Certification Program

Option trading course are comprehensive certification program covers a wide spectrum of topics, including option pricing models, advanced trading strategies, and risk management techniques. With a focus on hands-on learning and practical application, participants develop the skills and expertise required to navigate the complexities of the options market confidently. Seventh best option trading course in India.

Table: Program Highlights

Option Trading Books:

Some best option trading course books in India that are certainly highly regarded:

“Option Trading: Bear Market Strategies” by Ajay Jain: This book focuses on strategies specifically designed for bearish market conditions, which can be particularly useful in volatile markets like those often found in India.

“Options as a Strategic Investment” by Lawrence G. McMillan: This is often considered the bible of options trading. It covers a wide range of strategies and provides comprehensive insights into the world of options.

“Option Volatility and Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg: This book is great for understanding the theoretical aspects of options pricing and volatility. It’s well-regarded for its clear explanations and practical examples.

“Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits” by Dan Passarelli: This book focuses on understanding the Greeks (Delta, Gamma, Theta, Vega) and how they affect option pricing and trading strategies.

“The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies” by Guy Cohen: This book offers a wide array of strategies, ranging from basic to advanced, with detailed explanations and real-world examples.

“Options Trading: The Hidden Reality” by Charles M. Cottle: Cottle, also known as Risk Doctor, provides insights into the realities of options trading, emphasizing risk management and practical strategies.

“A Beginner’s Guide to Options Trading: Unlocking the Secrets of the World’s Most Versatile Investment Strategy” by Matthew R. Kratter: As the title suggests, this book is great for beginners, offering a straightforward introduction to options trading concepts and strategies.

Remember, while books are excellent resources, practical experience and ongoing learning are key to mastering options trading. It’s also advisable to complement book knowledge with real-world trading experience and staying updated with market trends and developments.

Option Trading Strategies:

Option trading strategies encompass a wide range of approaches aimed at achieving specific investment objectives while managing risk effectively. Some popular strategies include:

Covered Call Strategy: Involves selling call options on a stock while simultaneously holding a long position in the underlying asset.

Protective Put Strategy: Involves purchasing put options to hedge against potential downside risk in an existing stock position.

Bullish Spread Strategies: Include strategies such as bull call spreads and bull put spreads, designed to profit from upward price movements in the underlying asset.

Bearish Spread Strategies: Include strategies such as bear call spreads and bear put spreads, aimed at profiting from downward price movements in the underlying asset.

Straddle and Strangle Strategies: Involve purchasing both call and put options simultaneously to profit from significant price movements in either direction.

CONCLUSION:

In conclusion, mastering best option trading course in India requires a combination of theoretical knowledge, practical skills, and hands-on experience. By enrolling in one of the top 7 option trading courses outlined above, investors and traders in India can gain the expertise and confidence needed to navigate the complexities of the options market successfully. Whether you’re a beginner looking to build a strong foundation or an experienced trader seeking for best option trading course in India must join ISMT.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#optiontrading#stockmarketindia#tradingcourse#learntrading#indiainvesting#financialliteracy#tradingtips#investmenteducation#stocktradingcourse#optionsstrategies#learnfromismt#ismtinstitute

0 notes

Text

Psychology Of Trading: Win the Inner Game

At Chart Monks, we know that true trading success begins in the mind. Our specialized Psychology of Trading training empowers you to control emotions, silence fear and greed, and develop laser-sharp discipline. Strengthen your mental resilience, cultivate patience, and build a winning mindset that keeps you steady—even in the most unpredictable markets.Call: 9220943789Visit: https://shorturl.at/qEtbf

0 notes

Text

Certificate in Technical Analysis - Master Market Trends with Empirical Academy

Whether you are a beginner or an experienced trader, mastering technical analysis can significantly improve your ability to navigate the financial markets. In this blog, we will explore the fundamentals of technical analysis and the advantages of taking an advanced certification course.

Key Concepts of Technical Analysis

Price Trends: The market moves in trends — upward (bullish), downward (bearish), or sideways (consolidation). Identifying these trends helps traders make informed decisions.

Support and Resistance Levels: These are key price levels where buying or selling pressure increases, influencing market direction.

Chart Patterns: Traders analyze patterns such as head and shoulders, double tops, and triangles to anticipate price movements.

Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands help traders identify potential entry and exit points.

Candlestick Patterns: Patterns like doji, hammer, and engulfing provide insights into market sentiment and possible reversals.

Why Enroll in a Technical Analysis Certification Course?

A structured certification course provides in-depth knowledge and hands-on experience with technical analysis tools. Here are a few reasons why enrolling in a Technical Analysis Certification Course can benefit you:

Comprehensive Learning: Covers everything from the basics to advanced concepts.

Practical Application: Real-world case studies and live market analysis.

Trading Strategies: Learn tested and effective trading strategies.

Risk Management: Understand how to manage risks and minimize losses.

Industry Recognition: A certification enhances your credibility as a trader or investor.

Advanced Technical Analysis: Taking Your Trading to the Next Level

For seasoned traders looking to refine their skills, an Advanced Technical Analysis Course offers deeper insights. Here’s what you can expect:

Advanced Charting Techniques: Mastering Fibonacci retracement, Elliott Wave theory, and Gann analysis.

Algorithmic Trading: Learning how to automate trading strategies using algorithms.

Market Psychology: Understanding the psychology behind price movements.

Intermarket Analysis: Studying the relationship between stocks, commodities, and forex markets.

Volume Analysis: Learning how to use volume data for better decision-making.

Conclusion

Technical analysis is a valuable skill that can help traders make more informed and strategic decisions in the stock market. Whether a beginner or an advanced trader, taking a Technical Analysis Certification Course can give you the tools and knowledge needed to succeed. If you’re serious about improving your trading skills, explore Empirical Academy’s courses and take the first step towards becoming a professional trader.

Start your journey today and unlock the power of technical analysis!

0 notes

Text

Boost Your Trading Skills - Find the Best Share Market Classes Near You

Investing in the stock market can be a life-changing opportunity, but without the right knowledge, it can also be risky. Whether you are a beginner or an experienced trader, learning from experts can help you make informed decisions and maximize profits. If you’re searching for share market classes near you, look no further than EMS Share Market Classes a trusted institute for mastering stock trading, futures, and options in Pune.

Why Join Share Market Classes?

Many traders lose money due to a lack of proper education and strategy. Enrolling in a professional share market class ensures you gain the skills and confidence needed to trade successfully.

🔹 Learn the Stock Market from Scratch

Start with the basics, including market structure, trading platforms, and key financial instruments.

🔹 Master Technical & Fundamental Analysis

Understand market trends, price action, and stock valuation techniques for smarter investments.

🔹 Trade Futures & Options (F&O) Confidently

Discover hedging techniques, leverage benefits, and advanced trading strategies for higher returns.

🔹 Risk Management & Psychology

Develop disciplined trading habits, minimize losses, and handle market fluctuations effectively.

🔹 Live Market Training & Practical Exposure

Practice trading in real-time market conditions to build hands-on experience.

What You Will Learn at EMS Share Market Classes

At EMS Share Market Classes, students receive expert guidance on:

📌 Stock Market Basics – Understand stock exchanges, market indices, and trading platforms. 📌 Chart Reading & Technical Indicators – Learn how to analyze price charts and use indicators like Moving Averages, RSI, and MACD. 📌 Fundamental Analysis – Study company financials, earnings reports, and economic factors that impact stock prices. 📌 F&O Trading Strategies – Master futures contracts, options trading, and risk management techniques. 📌 Live Trading Sessions – Gain hands-on experience by trading in real market conditions.

Why Choose EMS Share Market Classes?

If you are looking for the best share market classes near you, EMS Share Market Classes offers:

✅ Expert Faculty – Learn from seasoned traders with years of market experience. ✅ Comprehensive Curriculum – Covers everything from beginner to advanced trading strategies. ✅ Hands-on Practical Training – Participate in live trading sessions to apply your knowledge. ✅ Affordable & Flexible Learning – Choose between online and offline classes at reasonable fees. ✅ 100% Career Support – Get guidance on trading careers, investment strategies, and financial growth.

📢 For more details, visit: https://sharemarketclasses.in/

Start Your Stock Market Journey Today!

Don’t let lack of knowledge hold you back from achieving financial success. With the right training, you can confidently navigate the stock market and build a profitable trading career.

💡 Enroll in the best share market classes near you and take control of your financial future!

#ShareMarketClasses#StockMarketTraining#TradingCourses#LearnTrading#StockMarketEducation#FutureAndOptionsTrading#TradingStrategies#ShareMarketClassesNearMe#TechnicalAnalysis#FundamentalAnalysis#IntradayTrading#InvestmentEducation#FinancialFreedom#TradingSuccess#EMSShareMarketClasses

0 notes

Text

#stock market#StockMarketTraining#AhmedabadInstitute#TradingStrategies#FinancialEducation#LearnTrading#InvestmentTraining#StockMarketForBeginners#TradingCourses#ExpertGuidance#StockMarketEducation#ProfessionalTradingInstitute#share trading#tradingclasses#trading courses online#stock market courses#stock market classes#stocks#stockmarketcourses#tradingtips#trading workshops

0 notes

Text

[DOWNLOAD NOW] - George Hutton – Weaponized Hypnosis

#GeorgeHuttonWeaponizedHypnosis#Courses24.site#downloadcourse#premiumcourse#tradingcourse#marketingcourses#businesscourses

0 notes

Text

Four Candles Formula Masterclass Review| Unlock Financial Freedom!

Welcome to my Four Candles Formula Masterclass Review blog Post. In an era where economic turbulence has become the norm, the quest for a stable, flexible, and substantial source of income has led many to explore paths less traveled.

Amidst this backdrop, the Four Candles Formula Masterclass emerges as a lighthouse for those navigating the stormy waters of financial uncertainty. This masterclass is not just a course; it’s a groundbreaking expedition toward achieving financial independence and resilience.

Read the full review here>>>

#FourCandlesFormula#MasterclassReview#InvestmentStrategies#FinancialEducation#WealthBuilding#TradingTips#StockMarketInsights#FinancialFreedom#InvestmentMastery#ProfitableTrading#MarketAnalysis#TradingCourses#ExpertInsights#LearnToInvest#FinancialSuccess

0 notes