#Wealth Management Software Analysis

Explore tagged Tumblr posts

Text

Global wealth management software market was worth USD 5672.5 million in 2024 and is anticipated to reach USD 30354.3 million during the forecast period of 3035 at a CAGR of 14.4%.

#Wealth Management Software Market share#Wealth Management Software Market Trends#Wealth Management Software Market Size#Wealth Management Software Market#Wealth Management Software#Wealth Management Software Analysis#Wealth Management Software Demand

0 notes

Text

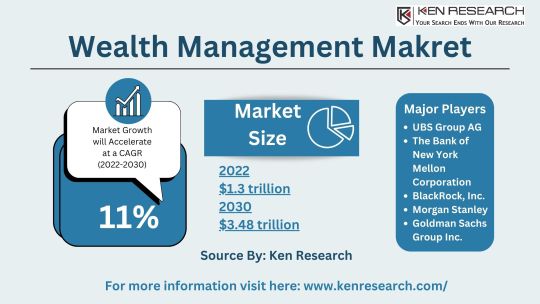

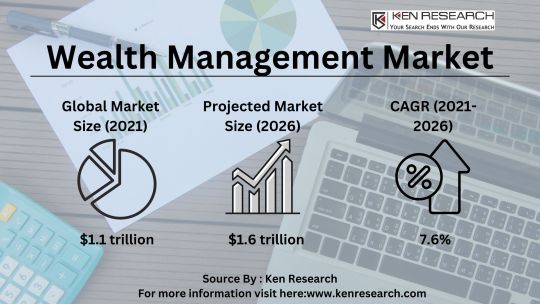

Untapped Potential: Unveiling the Future of the Wealth Management Landscape

Discover the untapped potential in the future of wealth management. Unveil growth rates, segmentation, and analysis within the asset and wealth management industry , including portfolio analysis and platform markets.

#Wealth Management Market#Wealth Management Industry#Wealth Management Sector#Wealth Management Market Size#Wealth Management Market Growth Rate#Wealth Management Market Segmentation#Wealth Management Platform Market#asset and wealth management industry#wealth management analysis#wealth management portfolio analysis#wealth management software market#Top Players in Wealth Management Market#Wealth Management Market Forecast#Wealth Management Market Future Outlook

0 notes

Text

Planets and careers in Vedic astrology

Surya (Sun) – The King (Ego & Self)

Keywords: leadership, authority, ambition, responsibility, governance

Sun-ruled nakshatras: Kritikka (Aries-Taurus), Uttara Phalguni (Leo-Virgo), Uttara Ashadha (Sagittarius-Capricorn)

Professions & industries:

Government service, IAS/IPS/administrative officers

Politics, ministers, heads of institutions

Judiciary, law enforcement

Leadership roles in corporations (CEO/Director)

Jewellery (like gold, diamonds), luxury goods

Medicine (especially heart-related)

Public sector enterprises

2. Chandra (Moon) – The Queen (Mind)

Keywords: emotions, nurturing, mental stability, public appeal

Moon-ruled nakshatras: Rohini (Taurus), Hasta (Virgo), Shravana (Capricorn)

Professions & industries:

Hospitality & tourism, hotels, catering, restaurants

Healthcare (especially nursing, women's health, psychiatry, obstetrics & paediatrics)

FMCG (fast-moving consumer goods), dairy, liquids, water-based industries

Real estate, especially residential

History research

Teaching and caregiving

Counselling, social work

Public relations, mass communication

3. Budha (Mercury)—the Prince (Intellect)

Keywords: Intelligence, communication, business acumen, analysis

Mercury- ruled nakshatras: Ashlesha (Cancer), Revati (Pisces), Jyeshtha (Scorpio)

Professions & industries:

Finance, accounting, sales, entrepreneurship

Writing, journalism, publishing

Scientific research

IT, software, data analytics

Legal advisors, consultants

Medicine, pharmaceuticals

Teaching, training

Traders, brokers, commission agents

Transportation & logistics

Marketing, advertising, media

4. Shukra (Venus) -the Minister (Pleasure)

Keywords: beauty, aesthetics, luxury, love, comfort, service, creativity

Venus-ruled nakshatras: Bharani (Aries), Purva Phalguni (Leo), Purva Ashadha (Sagittarius)

Profession & industries:

Arts, music, dance, singing, fashion, design

Film and entertainment industry

Cosmetics, spa, beauty industry

Jewellery, luxury goods

Relationship counselling, marriage agencies

Hospitality and tourism

Event management, interior design

Diplomacy, public relations

5. Mangala (Mars) – the Commander (Action)

Keywords: Assertiveness, strength and endurance, ambition, energy, competition

Mars-ruled nakshatras: Mrigashira (Taurus - Gemini), Dhanishta (Capricorn - Aquarius), Chitra (Virgo - Libra)

Professions & industries:

Army, police and defence services

Engineering, mechanical, civil, hardware

Leadership roles in corporations

Logistics, transportation, aviation

Surgery, emergency medicine

Sports and physical training

Firefighting, rescue services

Real estate, construction & maintenance

Weapons, arms, steel, chemicals

Entrepreneurs, especially in competitive sectors

6. Guru (Jupiter) – the Teacher (Wisdom)

Keywords: knowledge, dharma, expansion, ethics, wealth (spiritual and/or material)

Jupiter-ruled nakshatras: Punarvasu (Gemini - Cancer), Vishakha (Libra - Scorpio), Purva Bhadrapada (Aquarius - Pisces)

Professions & industries:

Teaching, education, professors

Religious and spiritual leaders

Law, legal profession, judiciary

Finance, investment, banking, wealth management

Counselling, mentoring, life coaching

Philosophy, publishing, writing

Medical (especially Ayurveda, holistic healing)

NGOs, charitable organisations

7. Shani (Saturn) – the Servant (Worker)

Keywords: labour, discipline, longevity, realism, service, duty, responsibility

Saturn-ruled nakshatras: Pushya (Cancer), Anuradha (Scorpio), Uttara Bhadrapada (Pisces)

Professions & industries:

Labour-intensive industries, mining, agriculture

Factory work, construction, infrastructure

Civil services, judiciary, and social work

Middle and senior management (gradual career advancement)

Law enforcement, auditors, and quality control

Clerks, office staff, and time-management roles

Old-age care, long-term care facilities

Iron, coal, oil, heavy industry

Research, long-term planning roles

8. Rahu - the North Node (Material desires)

Keywords: desire, illusion, mysticism, modernity, forward-thinking & innovation, eccentricity, foreign influence

Rahu-ruled nakshatras: Ardra (Gemini), Swati (Libra), Shatabhisha (Aquarius)

Professions & industries:

Technology, IT, AI, digital platforms

Foreign trade, immigration, import-export, entrepreneurship

Film, media, photography, advertising

Aviation, space, online business

Speculation, cryptocurrency, stocks

Espionage, intelligence, hacking

Political manipulation, lobbying

Unconventional professions (e.g., esoteric)

Psychology

9. Ketu - the South Node (detachment, depth)

Keywords: isolation, introspection, wisdom, renunciation, mysticism

Ketu-ruled nakshatras: Ashwini (Aries), Magha (Leo), Mula (Sagittarius)

Professions & industries:

Spirituality, mystics, monks

Research, investigation, archaeology

Parapsychology, astrology, metaphysics

IT (especially backend or anonymous work)

Healthare: pharmaceuticals, virology, immunology

Security, cyber protection

Medical surgery (especially undercover or obscure fields)

Houses and objects to check in D1 and D10 divisional charts

The D1 Chart:

To check:

10th lord: The main planet for the profession.

Atmakaraka: Soul’s desire—can show core career direction

Amatyakaraka: Advisor planet - signifies profession and working style

1st House (Lagna) -determines your general disposition, leadership capacity, and work style

2nd House - indicates earned income prospects, speech (important in communication careers), and skills

6th House - very important for job-type careers, legal fields, employment, competition, enemies, analysing financial debts

7th House - career involving clients, partnerships, business and diplomacy

10th House - primary house for career, leadership & authority, and recognition in society.

11th House - income prospects from work, professional networks, promotions.

The D10 chart:

10th house's lord in the D10 chart: The main planet for the profession.

Atmakaraka (from the D1 Chart): Soul’s desire—can show core career direction

Amatyakaraka (from the D1 Chart): Advisor planet - signifies profession and working style

1st House (Lagna of D10) - how you project yourself, appear in the professional world, public role

6th House - daily work, office dynamics, overcoming obstacles in career

7t house - dealing with others in career, clients, professional partnerships

9th House - Jupiter’s blessings, ethical conduct, long-term fortune in career

10th House - main house for profession, title, honors, and career legacy

11th House - promotions, gains from profession, social status

35 notes

·

View notes

Text

What will be the impact on marriage if Saturn is exalted in the second house of Upapada Lagna?

In Vedic astrology, the Upapada Lagna (UL) is an important point related to marriage. It is the Arudha Pada of the 12th house from the Ascendant (Lagna). When analyzing the impact of Saturn being exalted in the second house of Upapada Lagna in a birth chart, several factors should be considered:

Wealth and Finances in Marriage: The second house is traditionally associated with wealth, family, and speech. Saturn, when exalted, tends to bring discipline, structure, and a sense of responsibility. In this context, the placement of exalted Saturn in the second house of Upapada Lagna could indicate a disciplined and organized approach to managing joint finances within the marriage. However, it may also imply a conservative or cautious approach to financial matters.

Communication and Speech: The second house is related to speech and communication. Exalted Saturn in this house might suggest a serious and thoughtful communication style in marriage. There could be a preference for clear and concise expression, and individuals with this placement may take their words seriously, leading to a cautious or reserved way of communicating.

Family Dynamics: Since the second house is associated with family, the influence of exalted Saturn could bring a sense of responsibility and duty towards family matters. There may be a commitment to family traditions and values, and individuals with this placement may prioritize stability and structure within the family.

Delay or Maturity in Marriage: Saturn is known for causing delays and bringing maturity. The presence of exalted Saturn in the second house of Upapada Lagna might indicate a more mature and patient approach to marriage. It could also suggest that marriage-related matters may take time to unfold but would eventually lead to a stable and enduring union.

Challenges: While an exalted Saturn brings stability and discipline, it can also bring challenges. There might be a need to balance responsibilities and avoid becoming overly conservative or restrictive in the marital relationship. Understanding the need for flexibility and open communication is crucial.

It is important to note that the overall effect of any planetary position depends on the entire birth chart, aspects and positions of other planets. Astrology is a complex field and individual experiences may vary. Take help of Kundli Chakra 2022 Professional Software for detailed analysis based on specific birth chart.

Any help : 8595675042

#astro observations#astrology#astro community#numerology#birth chart#12th house#cancer horoscope: star sign dates

7 notes

·

View notes

Text

Unlocking Success: Mastering ANSYS Assignments in Mechanical Engineering

Hello, fellow engineering enthusiasts! If you've found your way to this blog, chances are you're navigating the intricate world of Mechanical Engineering, specifically dealing with ANSYS assignments. As someone deeply entrenched in the field, I understand the challenges that students often face when tasked with ANSYS assignments. Fear not; I'm here to guide you through effective strategies that can lead to triumph. Whether you're a newcomer or a seasoned student looking to enhance your skills, mastering ANSYS assignments is crucial for success in the dynamic realm of Mechanical Engineering. So, let's dive in and explore how to conquer these challenges and complete your ANSYS assignment with confidence.

Understanding the Basics

Before we delve into advanced strategies, it's crucial to establish a solid foundation in ANSYS. The software is a powerful tool used for simulation and analysis in various engineering disciplines. To complete my ANSYS assignment successfully, I always start by revisiting the basics. Understanding the software's interface, features, and capabilities is fundamental. ANSYS offers a plethora of resources, including tutorials, documentation, and forums, which can be immensely helpful in grasping the essentials. Don't underestimate the value of a strong foundational knowledge—it's the key to tackling complex assignments with ease.

Stay Updated with the Latest Versions

As an expert in Mechanical Engineering, I cannot emphasize enough the importance of staying abreast of the latest developments in ANSYS software. Regular updates often introduce new features, enhancements, and bug fixes that can significantly impact your workflow. To ensure you are maximizing the potential of ANSYS in your assignments, make it a habit to check for updates and explore the new functionalities. This proactive approach not only keeps you informed but also demonstrates a commitment to continuous learning—a trait highly valued in the engineering industry.

Utilize Online Resources and Communities

One of the most valuable assets at your disposal is the vast network of online resources and communities dedicated to ANSYS users. When aiming to complete my ANSYS assignment, I often turn to forums, blogs, and discussion groups. Platforms like the ANSYS Student Community and various engineering forums host a wealth of information, ranging from troubleshooting tips to in-depth discussions on specific simulation techniques. Engaging with these communities not only broadens your knowledge but also provides a platform to seek guidance when faced with challenges.

Effective Time Management

Completing ANSYS assignments requires a strategic approach to time management. Procrastination is the nemesis of productivity, especially when dealing with complex simulations and analyses. To ensure success, create a realistic schedule that allocates sufficient time for each phase of the assignment—from understanding the problem statement to presenting the results. Break down the task into manageable chunks, setting milestones to track your progress. This systematic approach not only enhances your efficiency but also reduces the stress associated with looming deadlines.

Hands-On Practice

The adage "practice makes perfect" holds true in the realm of ANSYS assignments. No amount of theoretical knowledge can substitute for hands-on experience with the software. Dedicate time to practical exercises and small-scale simulations to reinforce your understanding of ANSYS functionalities. Experiment with different features, boundary conditions, and material properties to gain a deeper insight into their effects on simulation outcomes. This practical experience not only hones your skills but also boosts your confidence when tackling more complex assignments.

Seek Guidance from Mentors and Peers

In the journey to complete my ANSYS assignment successfully, I've found immense value in seeking guidance from mentors and collaborating with peers. Establishing a mentor-student relationship with a faculty member or industry professional provides a unique opportunity to gain insights from real-world applications. Additionally, collaborating with classmates on assignments fosters a collaborative learning environment. Discussing ideas, troubleshooting challenges, and sharing experiences can lead to innovative solutions and a more comprehensive understanding of ANSYS.

Documentation and Presentation Skills

An often overlooked aspect of ANSYS assignments is the importance of documentation and presentation. As a Mechanical Engineering expert, I've learned that the ability to communicate your findings effectively is as crucial as the technical skills involved. Develop a clear and concise documentation style that highlights the key steps, assumptions, and results of your analysis. Pay attention to formatting, labeling, and presenting data in a visually appealing manner. Remember, your ability to convey complex engineering concepts in a comprehensible way adds significant value to your work.

Stay Persistent and Embrace Challenges

The path to success in mastering ANSYS assignments is not without its challenges. There will be moments of frustration, setbacks, and seemingly insurmountable obstacles. However, it's essential to stay persistent and view challenges as opportunities for growth. Each roadblock presents a chance to enhance your problem-solving skills and deepen your understanding of the software. Embrace challenges with a positive mindset, knowing that overcoming them will only strengthen your expertise in Mechanical Engineering and ANSYS.

Conclusion

In conclusion, mastering ANSYS assignments in Mechanical Engineering is a rewarding journey that demands a combination of foundational knowledge, practical experience, and effective strategies. From understanding the basics and staying updated with software advancements to utilizing online resources and embracing challenges, the key lies in a holistic approach to learning and application. As you embark on your quest to complete your ANSYS assignment successfully, remember that every simulation and analysis is a stepping stone toward becoming a proficient engineer. So, dive in, explore, and conquer the world of ANSYS with confidence and enthusiasm. Your success awaits!

#mechanical engineering assignment help#assignment help#students#university#educational website#study tips#education#educational service#mechanical engineering#mechanical engineering assignment#complete my ANSYS assignment#ansys assignment help#ANSYS

11 notes

·

View notes

Text

The Benefits of Working with Advertising Agencies in Delhi for Your Business

Discover the strategic prowess of advertising agencies in Delhi, serving as partners for businesses seeking effective brand communication.

The Vibrant Hub of Advertising Excellence in Delhi

Nestled in the bustling landscape of Delhi lies a network of dynamic advertising agencies, pulsating with creativity and strategic prowess. These agencies, positioned strategically within the National Capital Region (NCR), serve as invaluable partners for businesses seeking to unlock their full potential through effective brand communication and marketing strategies.

The Role of Advertising Agencies in Delhi: A Gateway to Success

Strategic Expertise and Industry Insights

Advertising agencies in Delhi possess a wealth of strategic expertise and in-depth industry insights. They serve as custodians of marketing strategies tailored to suit the diverse business landscape of Delhi. Their comprehensive understanding of local markets, consumer behaviors, and emerging trends empowers businesses to navigate the complex terrain of advertising with finesse.

Creative Ingenuity and Innovative Solutions

Creativity is at the core of these agencies' DNA. They boast a team of visionary minds—creative directors, designers, writers, and strategists—working collaboratively to craft innovative solutions. From compelling visuals to thought-provoking campaigns, they infuse creativity into every facet of brand communication, ensuring that businesses stand out amidst the noise.

Multi-channel Approach and Amplified Reach

In an era dominated by multi-channel marketing, these agencies leverage a diverse array of platforms—from traditional media to digital channels—to amplify brand reach. They adeptly navigate through print, television, social media, and emerging digital spaces, tailoring strategies that resonate across various touchpoints and target audiences.

Cost-effectiveness and Efficiency

Partnering with advertising agencies in Delhi often proves cost-effective for businesses. These agencies possess established relationships with media houses, vendors, and influencers, enabling them to negotiate better rates and optimize resources, thereby maximizing the return on investment for their clients.

The Tangible Benefits of Collaboration

Tailored Strategies for Diverse Business Needs

One of the key advantages of working with these agencies is their ability to customize strategies according to the unique needs of businesses. Whether it's brand building, product launches, or lead generation, they craft bespoke solutions aligned with specific business goals, ensuring maximum impact and results.

Enhanced Brand Visibility and Recognition

By harnessing their expertise in market analysis and consumer behavior, these agencies develop campaigns that elevate brand visibility. Through compelling storytelling and strategic positioning, they engrain brands into the minds of consumers, fostering recall and recognition.

Access to Specialized Skills and Technology

Businesses partnering with advertising agencies in Delhi gain access to specialized skills and cutting-edge technology that might be otherwise inaccessible. From advanced analytics tools to creative software, these agencies equip businesses with the tools necessary to thrive in the competitive market landscape.

Time-efficient and Focused Approach

Outsourcing marketing and advertising responsibilities to these agencies allows businesses to concentrate on their core competencies. It streamlines operations, saves time, and enables a focused approach towards achieving business objectives without the distraction of managing intricate marketing campaigns.

Delhis Advertising Landscape: A Collaborative Ecosystem

Cultivating Innovation through Collaborations

The collaborative ecosystem in Delhi fosters innovation. These agencies often collaborate not just internally but also with other businesses, tech firms, and startups. Such collaborations result in fresh perspectives, out-of-the-box ideas, and groundbreaking campaigns that redefine industry standards.

Tech Integration and Future-Forward Strategies

With technology driving the future of advertising, agencies in Delhi are at the forefront of innovation. They seamlessly integrate technology—AI, AR, VR, and data analytics—into their strategies, paving the way for future-forward campaigns that resonate with the digitally-savvy consumers of today.

In conclusion, the benefits of collaborating with advertising agencies in Delhi extend beyond mere marketing endeavors. They serve as catalysts for business growth, empowering organizations to navigate the complex landscape of brand communication and marketing with finesse and innovation.

Businesses leveraging the expertise of these agencies not only witness enhanced brand visibility and consumer engagement but also experience a strategic edge in the competitive market. As Delhi continues to evolve as a hub of advertising excellence, these agencies stand as pillars of support, nurturing brands, fostering innovation, and guiding businesses towards a flourishing future of success and recognition.

This post was originally published on: Apppl Combine

#ad agency#ad agency in delhi#advertising#advertising agencies#advertising agency#advertising agency in delhi#advertising agency in delhi ncr#creative agency in delhi#apppl combine

3 notes

·

View notes

Text

Level Up Your Software Development Skills: Join Our Unique DevOps Course

Would you like to increase your knowledge of software development? Look no further! Our unique DevOps course is the perfect opportunity to upgrade your skillset and pave the way for accelerated career growth in the tech industry. In this article, we will explore the key components of our course, reasons why you should choose it, the remarkable placement opportunities it offers, and the numerous benefits you can expect to gain from joining us.

Key Components of Our DevOps Course

Our DevOps course is meticulously designed to provide you with a comprehensive understanding of the DevOps methodology and equip you with the necessary tools and techniques to excel in the field. Here are the key components you can expect to delve into during the course:

1. Understanding DevOps Fundamentals

Learn the core principles and concepts of DevOps, including continuous integration, continuous delivery, infrastructure automation, and collaboration techniques. Gain insights into how DevOps practices can enhance software development efficiency and communication within cross-functional teams.

2. Mastering Cloud Computing Technologies

Immerse yourself in cloud computing platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. Acquire hands-on experience in deploying applications, managing serverless architectures, and leveraging containerization technologies such as Docker and Kubernetes for scalable and efficient deployment.

3. Automating Infrastructure as Code

Discover the power of infrastructure automation through tools like Ansible, Terraform, and Puppet. Automate the provisioning, configuration, and management of infrastructure resources, enabling rapid scalability, agility, and error-free deployments.

4. Monitoring and Performance Optimization

Explore various monitoring and observability tools, including Elasticsearch, Grafana, and Prometheus, to ensure your applications are running smoothly and performing optimally. Learn how to diagnose and resolve performance bottlenecks, conduct efficient log analysis, and implement effective alerting mechanisms.

5. Embracing Continuous Integration and Delivery

Dive into the world of continuous integration and delivery (CI/CD) pipelines using popular tools like Jenkins, GitLab CI/CD, and CircleCI. Gain a deep understanding of how to automate build processes, run tests, and deploy applications seamlessly to achieve faster and more reliable software releases.

Reasons to Choose Our DevOps Course

There are numerous reasons why our DevOps course stands out from the rest. Here are some compelling factors that make it the ideal choice for aspiring software developers:

Expert Instructors: Learn from industry professionals who possess extensive experience in the field of DevOps and have a genuine passion for teaching. Benefit from their wealth of knowledge and practical insights gained from working on real-world projects.

Hands-On Approach: Our course emphasizes hands-on learning to ensure you develop the practical skills necessary to thrive in a DevOps environment. Through immersive lab sessions, you will have opportunities to apply the concepts learned and gain valuable experience working with industry-standard tools and technologies.

Tailored Curriculum: We understand that every learner is unique, so our curriculum is strategically designed to cater to individuals of varying proficiency levels. Whether you are a beginner or an experienced professional, our course will be tailored to suit your needs and help you achieve your desired goals.

Industry-Relevant Projects: Gain practical exposure to real-world scenarios by working on industry-relevant projects. Apply your newly acquired skills to solve complex problems and build innovative solutions that mirror the challenges faced by DevOps practitioners in the industry today.

Benefits of Joining Our DevOps Course

By joining our DevOps course, you open up a world of benefits that will enhance your software development career. Here are some notable advantages you can expect to gain:

Enhanced Employability: Acquire sought-after skills that are in high demand in the software development industry. Stand out from the crowd and increase your employability prospects by showcasing your proficiency in DevOps methodologies and tools.

Higher Earning Potential: With the rise of DevOps practices, organizations are willing to offer competitive remuneration packages to skilled professionals. By mastering DevOps through our course, you can significantly increase your earning potential in the tech industry.

Streamlined Software Development Processes: Gain the ability to streamline software development workflows by effectively integrating development and operations. With DevOps expertise, you will be capable of accelerating software deployment, reducing errors, and improving the overall efficiency of the development lifecycle.

Continuous Learning and Growth: DevOps is a rapidly evolving field, and by joining our course, you become a part of a community committed to continuous learning and growth. Stay updated with the latest industry trends, technologies, and best practices to ensure your skills remain relevant in an ever-changing tech landscape.

In conclusion, our unique DevOps course at ACTE institute offers unparalleled opportunities for software developers to level up their skills and propel their careers forward. With a comprehensive curriculum, remarkable placement opportunities, and a host of benefits, joining our course is undoubtedly a wise investment in your future success. Don't miss out on this incredible chance to become a proficient DevOps practitioner and unlock new horizons in the world of software development. Enroll today and embark on an exciting journey towards professional growth and achievement!

10 notes

·

View notes

Text

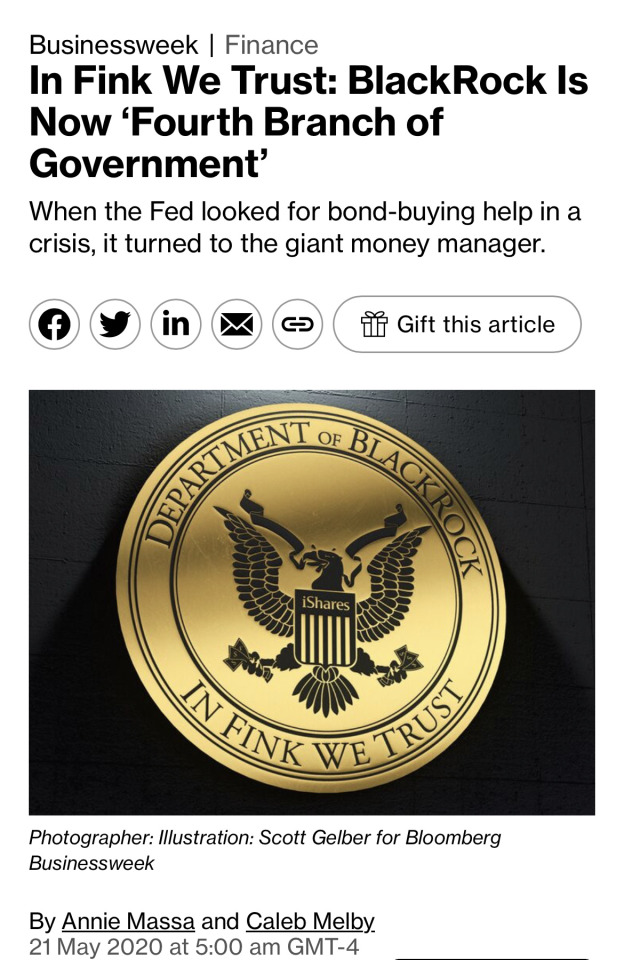

“Still the arrangement is bringing new attention to the company’s scale and ubiquity. “It’s impossible to think of BlackRock without thinking of them as a fourth branch of government,” says William Birdthistle, a professor at the Chicago-Kent College of Law who studies the fund industry.

(…)

There’s probably no other financial institution that brings to the table what BlackRock does. It’s experienced in running large portfolios on behalf of others. It’s ubiquitous in markets for everything from passive, index-linked products to hands-on mutual funds, with $6.5 trillion in assets under management as of March 31. It’s the largest issuer of ETFs, which act like mutual funds but trade on an exchange. It actively manages more than $625 billion in bond funds for pension plans and other institutional clients. Almost anyone looking to buy a diverse portfolio quickly would consider BlackRock—and the Fed did the same. In a virtual hearing of the Senate Banking Committee on May 19, Fed Chairman Jerome Powell said BlackRock was hired for its expertise and “it was done very quickly due to the urgency” of the matter.

Beyond money management, BlackRock’s software platform, Aladdin, appealed to the Fed. The program evaluates risk for clients that include governments, insurers, and rival wealth managers, monitoring more than $20 trillion in assets. (Bloomberg LP, the parent company of Bloomberg News, sells financial software that competes with Aladdin.)

BlackRock has ascended to speed-dial status among Washington officialdom in part through shrewd business maneuvering. It scooped up Barclays Global Investors, including its iShares ETF division, in the fallout from the 2008 crisis. That gave BlackRock a stronghold in low-cost index funds, transforming it into the world’s largest asset manager almost overnight—and supercharging more than a decade of growth.

At the same time, the money manager built a powerful advocacy arm. Its sphere of influence reaches beyond the central bank to lawmakers, presidents, and government agency heads from both political parties, though its hiring leans Democratic. Bloomberg found only a handful of current BlackRock executives who came out of the George W. Bush administration, but more than a dozen Barack Obama alumni. These include Obama’s national security adviser, senior adviser for climate policy, the former Federal Reserve vice chairman he appointed, and numerous White House, Treasury, and Fed economists.

(…)

BlackRock, however, was handed three Fed assignments without any competitive process—though the Fed plans to rebid the contracts once the programs are in full swing. BlackRock will manage portfolios of corporate bonds and debt ETFs. It will do the same for newly issued bonds—sometimes acting as the sole buyer—and for up to 25% of bank-syndicated loans. And it will purchase commercial mortgage-backed securities from quasi-government agencies such as Fannie Mae and Freddie Mac.

BlackRock could reap as much as $48 million a year in fees for its Fed work, according to a Bloomberg analysis. That’s no windfall, especially in relation to its $4.5 billion in earnings last year. But it may further cement the money manager’s ties with policymakers. On May 12, BlackRock began the first stage of these programs when it began buying ETFs.

As with technology companies Facebook Inc. and Alphabet Inc., BlackRock’s growth raises questions over how big and useful a company can become before its size poses a risk. The firm has long argued that, unlike banks, it’s not making investments for itself with tons of borrowed money. Watching over large sums of money for clients doesn’t make its business a threat to the broader financial system.

With its latest assignment, that argument could be harder to make, says Graham Steele, director of the Corporations and Society Initiative at the Stanford Graduate School of Business. “They are so intertwined in the market and government that it’s a really interesting tangle of conflicts,” says Steele, who formerly worked at the Federal Reserve Bank of San Francisco. “In the advocacy community there’s an opinion that asset managers, and this one in particular, need greater oversight.”

Already there are growing worries about the power of BlackRock, Vanguard Group Inc., and State Street, often called the Big Three because they hold about 80% of all indexed money. That raises concerns about how they wield their voting power as shareholders and has even drawn attention from antitrust officials.

(…)

And then there are the potential conflicts. One arm of BlackRock knows what the Fed is buying, while other parts of the business participating in credit markets could benefit from that knowledge. To avoid conflicts, “there are stringent information barriers in place,” says the BlackRock spokesman. BlackRock employees working on the Fed programs must segregate their operations from all other units, including trading, brokerage, and sales. The fee waiver on ETFs helps avoid the appearance of self-dealing.

But BlackRock’s contract with the Fed also acknowledges that senior executives “may sit atop of the information barrier” and “have access to confidential information on one side of a wall while carrying out duties on the other side.” Staff working on the Fed programs must go through a cooling-off period before moving to jobs on the corporate side, but it would last only two weeks.

Birdthistle, the Chicago-Kent law professor, suggests the Fed could have made its process more competitive by allocating some of its funds for buying corporate credit to a group of asset managers from the outset, instead of just one. “It raises the question: Why did all the money have to go to one company?” he asks. “I get why BlackRock would be on the list, but I don’t understand why it would be the only one on the list.””

6 notes

·

View notes

Text

Where to Get Stock Market Degree After 12th Easily

In today’s fast-evolving financial world, students are increasingly looking for career options that go beyond traditional degrees. For commerce and non-commerce students alike, the stock market has emerged as a lucrative and intellectually rewarding field. If you’re wondering what path to take after completing your 12th grade, ICFM INDIA offers a stock market degree after 12th that is uniquely designed to help you enter the trading and financial markets with confidence and competence.

ICFM INDIA (Institute of Career in Financial Market) has carved a name for itself by delivering industry-ready, professional training in financial and stock market education. It is one of the very few institutes in India that offers a specialised stock market degree after 12th, empowering students to learn, practice, and master the skills needed to become successful traders and investors.

Why Choose a Stock Market Career After 12th?

Choosing a stock market degree after 12th gives you an early edge over others. Instead of waiting to finish a general graduation course, students can begin developing professional skills in technical analysis, equity research, derivatives, options trading, and risk management — skills that are in high demand across financial institutions, brokerage firms, and investment companies.

Moreover, the Indian stock market is booming. From retail investors to institutional traders, the ecosystem is expanding, and the need for skilled professionals is growing exponentially. A stock market education equips you to either work in this field or start trading independently at a young age.

ICFM INDIA – Your Exclusive Gateway to Stock Market Education

ICFM INDIA is not just another coaching center. It is a premier financial market institute that delivers exclusive stock market training after 12th. The institute is known for its cutting-edge curriculum, real-market exposure, and highly experienced faculty. The training is hands-on and based on actual market tools and platforms, helping students learn how to trade effectively and responsibly.

ICFM INDIA is the only institute that provides a professional stock market degree after 12th, making it the go-to choice for serious learners who want to pursue a career in trading, portfolio management, or financial analytics.

Comprehensive Course Structure Tailored for Beginners

The stock market degree after 12th by ICFM INDIA is designed to be beginner-friendly while also being robust and comprehensive. Students start with the basics of financial markets, understanding key concepts like equities, commodities, forex, and mutual funds. Gradually, they progress into technical and fundamental analysis, algo trading, derivative markets, portfolio management, and trading psychology.

Each module is reinforced with practical training through trading software, simulation platforms, live market sessions, and mock trading practices. By the time students complete the course, they are not just knowledgeable—they are confident and job-ready.

Early Certification and Internship Opportunities

Unlike traditional degree programs where you wait three years to become employable, ICFM INDIA’s stock market degree course includes multiple certifications during the learning process. These certifications, recognised across the finance industry, include modules in NISM, NSE, BSE, and other relevant sectors.

Students also get internship support to gain first-hand experience at brokerage firms, wealth management companies, or even with proprietary trading desks. This real-time experience strengthens their resume and sharpens their practical skills.

Personal Mentoring and Career Support

At ICFM INDIA, every student receives individual guidance and support. The faculty comprises market professionals, chartered accountants, certified financial planners, and SEBI-registered advisors, who not only teach but also mentor students throughout their learning journey.

Career guidance, resume building, mock interviews, and placement support are integrated into the program. ICFM INDIA ensures that students who choose a stock market degree after 12th are fully supported in their journey toward becoming professional traders or landing financial sector jobs.

Advantages of Joining ICFM INDIA for Stock Market Degree

Exclusivity – Only institute providing structured stock market training after 12th

Industry-Relevant Curriculum – Real-world trading tools, market simulations, and analysis software

Experienced Faculty – Instructors with real market experience

Internships and Placement Support – Tie-ups with financial firms and trading houses

Certifications – Recognised industry credentials to improve job prospects

Flexible Learning Options – Both classroom and online learning models

Career Options After Completing Stock Market Degree

Once you complete your stock market degree after 12th from ICFM INDIA, the career options available to you are wide and varied. You can start your own trading journey or work in roles like:

Equity Trader

Technical Analyst

Investment Advisor

Portfolio Manager

Financial Analyst

Research Associate in Stock Broking Firms

Wealth Management Associate

Algo Trading Strategist

These job profiles are not just rewarding financially but also offer growth, learning, and independence.

Stock Market Education is the Future – Begin Yours Today

Stock trading is no longer limited to seasoned investors. Today, young minds with the right education and attitude are entering the markets and building wealth early in life. ICFM INDIA’s stock market degree after 12th empowers students with a head start, giving them the skills that most professionals gain only after years of experience.

This program is not about textbook learning; it is about mastering a craft, understanding market dynamics, and applying knowledge in real-time. Whether you aim to be a full-time trader, a financial professional, or an investment analyst, this course lays the foundation for all.

Enroll Now and Build Your Stock Market Career with ICFM INDIA

If you have completed your 12th and are passionate about finance, trading, or investing, it’s time to take the right step forward. ICFM INDIA offers the best, most reliable, and only stock market degree after 12th in India.

Join the thousands of students who’ve already transformed their futures with ICFM INDIA’s expert guidance. Visit their nearest center, attend a free demo session, and unlock your journey to becoming a stock market expert at an early age.

Read More blogs : https://www.icfmindia.com/blog/how-to-invest-in-nifty-50-index-fund-for-long-term-wealth

Read more blogs - https://www.icfmindia.com/blog/the-hidden-power-of-tick-trading-how-to-predict-moves-before-they-happen

#stock market degree after 12th#Stock market degree after 12th in india#Best stock market degree after 12th

0 notes

Text

Discover The Best Stock Market Courses After 12th Only At ICFM Stock Market Institute

Start Your Career Early With the Best Stock Market Courses After 12th at ICFM

Choosing the right direction after completing school can be life-changing. For students looking to enter the financial world early, ICFM – Stock Market Institute offers the Best Stock Market Courses After 12th to help them get ahead in the competitive world of finance. These courses are specifically designed for young minds who are curious about the stock market and want to make smart moves right after school. With expert guidance, real-market experience, and strong career support, ICFM’s programs are the perfect launchpad for a rewarding financial future.

Why Choose ICFM for the Best Stock Market Courses After 12th

ICFM – Stock Market Institute stands out as a trusted name when it comes to market education. The institute’s goal is to educate students with real-world trading knowledge, not just textbook theory. The Best Stock Market Courses After 12th offered here provide deep insights into how stock markets function, how trading decisions are made, and how one can grow wealth intelligently. With expert-led classes, access to live trading setups, and personalized mentoring, students gain unmatched practical exposure. The focus is on empowering students early so they can take confident steps into the financial industry.

Who Should Enroll in the Best Stock Market Courses After 12th

The Best Stock Market Courses After 12th are ideal for students who have just completed their higher secondary education and are seeking a career that combines logic, strategy, and financial understanding. You don’t need to be a commerce student to enroll. Whether you come from a science, arts, or commerce background, if you have an interest in the stock market and are willing to learn, these courses are for you. ICFM encourages all 12th pass students to explore stock trading and investing as a professional path through its specialized stock market courses.

What You Will Learn in the Best Stock Market Courses After 12th

ICFM’s Best Stock Market Courses After 12th are structured to provide both theoretical knowledge and practical skill development. Students will learn about the basics of financial markets, equity trading, derivatives, technical analysis, intraday trading strategies, and risk management. The course also covers how to use trading software, analyze charts, interpret market trends, and make independent trading decisions. By the end of the course, students will be able to confidently place trades, manage portfolios, and even assist others with financial planning and market research.

Practical Exposure in the Best Stock Market Courses After 12th

One of the biggest advantages of choosing ICFM is the hands-on learning approach. The Best Stock Market Courses After 12th include live market training sessions, simulation exercises, mock trading, and access to advanced market tools. This ensures that students don’t just learn theory but actually understand how trades are executed in real market conditions. Every session is focused on building independent decision-making skills, enabling students to respond to market situations like professional traders.

Career Opportunities After Completing the Best Stock Market Courses After 12th

Completing the Best Stock Market Courses After 12th at ICFM opens up a world of professional opportunities. Students can choose to become self-employed traders, financial analysts, investment advisors, or stock brokers. Many ICFM graduates go on to pursue professional certifications like NISM, NCFM, and others. The institute also helps students prepare for higher studies in finance, business, and economics. Most importantly, it builds a strong foundation that gives students a lifelong advantage in the world of financial trading and investment.

Learn from Market Experts at the Best Stock Market Institute in Delhi

Every student enrolled in the Best Stock Market Courses After 12th at ICFM learns from experienced market professionals. These are not general teachers but active traders and analysts who bring real-time market insight into the classroom. Their guidance helps students avoid common mistakes, learn practical strategies, and adapt to changing market scenarios. With their mentorship, students gain clarity, confidence, and consistency in their trading journey right from the beginning.

Why Start Early With the Best Stock Market Courses After 12th

Getting started early means gaining more time to build skills, explore opportunities, and master the market. By enrolling in the Best Stock Market Courses After 12th, students are not only investing in education—they are investing in financial freedom. Early exposure helps build smart money habits, develop market thinking, and open doors to entrepreneurship. Students who begin their journey after 12th often outperform others in later stages because they’ve already built a strong foundation with ICFM’s expert programs.

Conclusion: Secure Your Future With ICFM’s Best Stock Market Courses After 12th

If you’ve completed your 12th and want to take the first step into the exciting world of trading, ICFM’s Best Stock Market Courses After 12th are your perfect opportunity. Designed for early learners, backed by market professionals, and filled with practical tools—these courses will shape your financial mindset for years to come. Don’t wait for graduation to start your career. Begin with ICFM, the leading stock market institute, and give yourself the edge you deserve.

Read More Blog:-

https://www.icfmindia.com/blog/how-to-invest-in-nifty-50-index-fund-for-long-term-wealth

0 notes

Text

A Beginner’s Guide: What Is Forex Trading?

In the age of digital finance, more and more people are exploring new ways to build wealth online. One of the most popular yet often misunderstood markets is the foreign exchange, or Forex market. If you’ve been wondering what is forex trading and how it works, this beginner-friendly guide is for you.

What Is Forex Trading?

Forex trading refers to the act of buying and selling currencies in the global market. It’s the largest and most liquid financial market in the world, with a daily trading volume of over $6 trillion. Traders aim to profit from changes in currency values — for example, predicting whether the US dollar will rise or fall against the euro.

Forex is always traded in pairs like USD/EUR, GBP/JPY, or USD/INR. One currency is bought, and the other is sold at the same time. Traders analyze global events, economic indicators, and market sentiment to make informed decisions.

Why Do People Trade Forex?

There are several reasons why Forex trading is gaining popularity:

Accessibility: All you need is an internet connection and a trading platform.

Liquidity: High volume ensures quick order execution and narrow spreads.

Leverage: Brokers offer leverage that allows you to control larger trades with a smaller investment.

Flexibility: The market operates 24 hours a day, five days a week, allowing for part-time or full-time trading.

The Tools of the Trade

Understanding what is forex trading also involves learning the tools involved:

Technical Analysis: Charts, indicators, and patterns used to predict market movement.

Fundamental Analysis: Economic reports, interest rates, and geopolitical events that affect currency value.

Trading Platforms: Software like MetaTrader 4 (MT4) that connects you to the market in real time.

Risks and Rewards

Like any investment, Forex trading carries risks. Price movements can be swift and unpredictable. However, with the right strategy, risk management, and continuous learning, it can also offer significant rewards.

Conclusion

Now that you have a clearer idea of what is forex trading, you’re better prepared to explore this dynamic market. Start by practicing with a demo account, stay updated on financial news, and educate yourself consistently.

Forex isn’t a get-rich-quick scheme—it’s a skill, and like any skill, it requires time and discipline to master.

0 notes

Text

Navigating Trends in the Ever-Evolving Wealth Landscape

Explore the ever-evolving wealth landscape through analysis of market size, industry trends, and outlook. Dive into wealth management software market and platforms, conducting portfolio analysis for informed decisions.

#Wealth Management Market#Wealth Management Industry#Wealth Management Sector#asset and wealth management industry#wealth management market size#wealth management industry analysis#wealth management industry outlook#wealth management platform market#wealth management software market#wealth management portfolio analysis

0 notes

Text

Operational Analytics Shaping Decision-Making Processes

Market Overview

The Operational Analytics Market is experiencing a significant transformation, driven by the growing need for real-time business intelligence. From factories to retail chains, companies are gathering vast amounts of data every minute. Operational analytics focuses on analyzing this data to provide insights that help businesses streamline operations, optimize performance, and respond to changes swiftly. Simply put, it’s the bridge between raw operational data and actionable decision-making.

In 2023, the global operational analytics market stood at approximately USD 12.8 billion. However, with increasing digital transformation across industries, the market is projected to grow at a remarkable CAGR of 16.4%, reaching around USD 59.7 billion by 2033. This surge reflects how indispensable data-driven strategies have become in modern business environments. Whether it's identifying a bottleneck in a supply chain or enhancing customer service through data, operational analytics is turning into a critical asset.

Click to Request a Sample of this Report for Additional Market Insights: https://infinitymarketresearch.com/request-sample/1073

Market Dynamics

Several factors are fueling the robust growth of the operational analytics market. First and foremost is the explosion of data. Every interaction, transaction, and process now generates digital footprints, and companies are eager to harness this wealth of information. Operational analytics provides the tools to make sense of this data and uncover patterns that may otherwise go unnoticed.

Another significant driver is the increasing adoption of Internet of Things (IoT) devices. These connected sensors and systems generate real-time operational data, which is ideal for analysis. Businesses in manufacturing, logistics, and utilities are using this information to reduce downtime, improve maintenance schedules, and ensure smoother operations.

Cloud computing is also playing a vital role. With cloud-based analytics solutions, companies—regardless of size—can deploy powerful tools without heavy investment in infrastructure. This accessibility is democratizing data analytics, allowing even smaller businesses to compete more effectively.

On the flip side, data privacy concerns and the complexity of integrating legacy systems can slow adoption. Organizations often struggle with aligning operational data from different departments and systems, which can create silos. Nonetheless, as technology evolves and integration tools improve, these hurdles are becoming more manageable.

Key Players Analysis

Several tech giants and specialized firms are leading the charge in operational analytics. Companies like IBM, Microsoft, SAP, Oracle, and SAS Institute are heavily invested in developing advanced analytics platforms that support real-time data processing and visualization.

IBM’s operational analytics offerings are deeply integrated with AI and machine learning, enabling predictive insights that go beyond traditional dashboards. Microsoft’s Azure platform continues to attract enterprises with its seamless integration of analytics and cloud services. Meanwhile, SAP provides industry-specific solutions that allow businesses to tailor analytics to their operational needs.

Startups and mid-sized tech firms are also making waves with innovative and cost-effective solutions. Players like TIBCO Software, Splunk, and Qlik are delivering platforms that are easier to deploy and more agile, which appeals to organizations looking for rapid implementation.

The competitive landscape is characterized by constant innovation. Companies are investing in features like self-service analytics, AI integration, and real-time monitoring to stay ahead in the market.

Regional Analysis

North America remains the frontrunner in operational analytics adoption, with the United States accounting for a significant share. The region benefits from a mature IT infrastructure, widespread cloud adoption, and a strong culture of innovation. Companies in sectors such as retail, finance, and healthcare are especially keen on using analytics to enhance operational efficiency.

Europe follows closely, with nations like Germany, the UK, and France making notable investments in data analytics. The emphasis here is on compliance, sustainability, and quality improvement, particularly in manufacturing and logistics.

Asia-Pacific is emerging as the fastest-growing region in this market. Rapid industrialization, increasing digitalization, and government initiatives supporting smart manufacturing are pushing countries like China, India, and Japan to invest in operational analytics solutions. As more companies in the region embrace digital transformation, the market is expected to see exponential growth.

Recent News & Developments

Recent years have witnessed a surge in product innovation and strategic partnerships. For example, many tech providers are embedding AI and machine learning into their analytics platforms to offer predictive capabilities. This allows businesses not just to react to events but to anticipate them.

Microsoft recently expanded its Azure Synapse Analytics to improve real-time analytics capabilities, while IBM launched updates to its Cloud Pak for Data to streamline integration and governance. Several firms are also focusing on vertical-specific solutions, such as analytics for healthcare operations or smart manufacturing, to address unique industry challenges.

Acquisitions are also shaping the market. Larger firms are acquiring niche analytics startups to enhance their offerings, particularly in areas like real-time monitoring and edge analytics.

Browse Full Report: https://infinitymarketresearch.com/operational-analytics-market/1073

Scope of the Report

This report provides a comprehensive view of the operational analytics market, covering its evolution, key growth factors, and regional dynamics. It highlights major players and their strategies while examining how industry trends and technological innovations are shaping the market’s future.

As industries continue to prioritize efficiency, agility, and data-driven decision-making, the demand for operational analytics will only intensify. Businesses that leverage these tools effectively will be better positioned to navigate complexities, reduce operational costs, and deliver superior value to customers.

In conclusion, operational analytics is no longer just a competitive advantage—it’s becoming a fundamental requirement for organizations striving to thrive in today’s data-rich, fast-paced world.

Discover Additional Market Insights from Infinity Market Research:

Global Virtual Kitchen Market size is expected to be worth around USD 108.6 Billion by 2033 from USD 38.5 Billion in 2023, growing at a CAGR of 10.9% during the forecast period from 2023 to 2033.

Global EdTech Market size is expected to be worth around USD 755.8 Billion by 2033 from USD 189.9 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2023 to 2033.

Global Web3 Market size is expected to be worth around USD 155.9 Billion by 2033 from USD 3.8 Billion in 2023, growing at a CAGR of 45.5% during the forecast period from 2023 to 2033.

Global Podcasting Market size is expected to be worth around USD 268.9 Billion by 2033 from USD 23.5 Billion in 2023, growing at a CAGR of 27.5% during the forecast period from 2033 to 2033.

Global Cyber Insurance Market size is expected to be worth around USD 107.9 Billion by 2033 from USD 13.4 Billion in 2023, growing at a CAGR of 22.8% during the forecast period from 2023 to 2033.

About Us

We at Infinity Market Research hold expertise in providing up-to-date, authentic, and reliable information across all industry verticals. Our diverse database consists of information gathered from trusted and authorized data sources.

We take pride in offering high-quality and comprehensive research solutions to our clients. Our research solutions will help the clients in making an informed move and planning their business strategies. We strive to provide excellent and dedicated market research reports so that our clients can focus on growth and business development plans. We have a domain-wise expert research team that works on client-specific custom projects. We understand the diverse requirements of our clients and keep our reports updated based on the market scenario.

Contact US:

Pune, Maharashtra, India

Mail: [email protected]

Website: https://infinitymarketresearch.com

For More Insights, follow us on LinkedIn- https://www.linkedin.com/company/imrreports

0 notes

Text

Top Tools Used by Tax Planning Professionals

When you think of tax professionals, you might picture spreadsheets, calculators, and stacks of paperwork. But today’s tax experts rely on far more advanced tools than just number-crunching software. In fact, the best tax planning services in Fort Worth, TX are built on a mix of smart tech, deep analysis, and year-round support—driven by tools that simplify complexity and maximize outcomes.

These tools don’t just make tax work easier. They make it smarter. From forecasting to compliance, tax pros use technology to offer advice that’s proactive, personalized, and precise.

So what are they using behind the scenes? Let’s break down the top tools that power professional tax planning—and why they matter.

1. Tax Projection Software

At the core of every strong planning strategy is the ability to look ahead. Tax projection tools allow professionals to run multiple "what-if" scenarios—how income changes, asset sales, or business expansions might affect a client’s tax bill.

Popular platforms like Thomson Reuters Planner CS, Intuit ProConnect Tax Planner, and Drake Tax Planning help planners anticipate outcomes before the year closes. These tools give clients clear visibility into potential liabilities and help guide decisions on timing, contributions, or investments.

When used correctly, tax forecasting becomes the difference between reacting to taxes and actually controlling them.

2. Client Portals & Document Management Systems

Gone are the days of emailing sensitive documents back and forth. Secure client portals have become essential for collaboration and confidentiality.

Tools like Canopy, SmartVault, and Karbon offer encrypted file-sharing, real-time communication, and document e-signatures—all in one place. These platforms improve transparency and reduce time wasted chasing paperwork. More importantly, they create a space for continuous planning, not just seasonal interactions.

Having all tax records, receipts, and prior returns stored and organized makes it easier to spot trends, find deductions, and ensure nothing falls through the cracks.

3. Entity Structure & Business Planning Tools

For business owners, entity structure can make or break a tax strategy. Whether operating as a sole proprietorship, LLC, S-Corp, or partnership, the way income flows—and how it’s taxed—varies widely.

Tax professionals use tools like BizEquity, Gusto, or LivePlan to model different business structures and compensation methods. These platforms help evaluate payroll strategies, shareholder distributions, and deductible expenses, so clients can choose the most tax-efficient route.

It’s not just about filing taxes—it’s about structuring your business to minimize them in the first place.

4. Investment & Retirement Tax Planning Platforms

Investments are full of tax implications, from capital gains and dividends to Roth conversions and Required Minimum Distributions (RMDs). To make sense of it all, tax planners often turn to platforms like Holistiplan, RightCapital, and eMoney Advisor.

These tools integrate financial planning with tax rules to show how different moves—like selling a rental property or maxing out a 401(k)—impact a client’s tax burden. They also flag opportunities to harvest losses or shift income strategically across years.

By aligning investment strategy with tax impact, professionals help clients grow their wealth more efficiently—not just quickly.

5. Real-Time Bookkeeping and Accounting Software

Ongoing tax planning only works when the numbers are current. That’s why tools like QuickBooks Online, Xero, and FreshBooks are staples in the tax planner’s toolkit.

These platforms sync directly with bank accounts and credit cards, giving advisors an up-to-date look at cash flow, income, and expenses. With real-time visibility, tax professionals can flag issues early—whether it’s underpayment of estimated taxes or misclassified expenses.

It’s also a huge time-saver come tax season, with less cleanup and more clarity.

6. Charitable Giving & Estate Planning Software

For high-net-worth clients or those focused on legacy planning, tax-savvy giving is a key strategy. Tools like WealthEngine, GivingDNA, or even custom donor-advised fund portals can help structure charitable donations for maximum tax impact.

Tax planners use these platforms to:

Time donations for the best tax year

Recommend appreciated asset contributions

Coordinate estate and gift tax strategies

Done right, charitable planning reduces tax burdens while supporting meaningful causes—and these tools make the process both smooth and strategic.

7. Compliance & Law Update Trackers

Tax laws change constantly. What worked last year might not this year. That’s why staying informed is non-negotiable.

Platforms like Checkpoint, Bloomberg Tax, and CCH IntelliConnect give tax professionals real-time updates, court rulings, and IRS changes. These aren’t tools clients see, but they’re critical behind the scenes.

This ensures strategies are not only effective but compliant—because no tax savings are worth the risk of an audit.

Why Tools Alone Aren’t Enough

Even the most powerful software is only as good as the person using it. The real magic happens when these tools are combined with experience, judgment, and an understanding of your unique goals.

That’s what separates quality tax planning services from simple form-filling. It’s not just data entry—it’s strategy, advice, and long-term thinking.

If you want to learn more about how a personalized, technology-driven approach can help you make smarter financial decisions all year long, explore Tax Planning Services: Reduce Liabilities and Plan Ahead with Confidence.

Conclusion

Tax planning in today’s world isn’t done with pencil and paper. It’s built on smart platforms, cloud-based collaboration, and real-time insights. Whether it’s forecasting income, modeling deductions, managing documents, or staying current with legal updates, these tools allow professionals to go beyond tax season—and deliver meaningful value all year round.

But at the end of the day, tools are just that: tools. It takes a strategic mind to use them well. When paired with the right advisor, they don’t just make taxes easier—they make your entire financial life more efficient, more informed, and better aligned with your goals.

If you’re only seeing your tax professional once a year, you’re likely missing out. The best planning is proactive—and it starts with the right toolkit.

0 notes

Text

The Role of Fleet Management Software in Nevada Dispatch Services

In today's logistics-driven economy, staying ahead of the curve requires more than just reliable trucks and experienced drivers. For dispatch companies in Nevada, fleet management software has become a critical tool for streamlining operations, improving efficiency, and delivering better service to clients. As the industry evolves, the best trucking dispatch services in Nevada are leveraging this technology to stay competitive and support their fleets with smarter, data-driven decisions.

What Is Fleet Management Software?

Fleet management software is a digital solution that helps trucking companies and dispatchers monitor, coordinate, and manage their vehicles and drivers in real time. It typically includes features like GPS tracking, fuel monitoring, driver behavior analysis, maintenance scheduling, and route optimization. For Nevada-based dispatch services—where long-haul routes, harsh desert conditions, and strict DOT compliance are everyday challenges—this software is a game-changer.

Real-Time GPS Tracking & Route Optimization

Nevada's landscape includes vast stretches of highway, mountainous regions, and busy urban centers like Las Vegas and Reno. Fleet management software enables dispatchers to track trucks in real time, identify traffic or weather-related delays, and reroute drivers for maximum efficiency. This is particularly important when moving time-sensitive loads or navigating the unpredictable logistics around regional events or construction zones.

Enhanced Communication Between Dispatchers and Drivers

Effective communication is key to successful dispatching. Fleet management software often includes in-app messaging and automated alerts, allowing dispatchers and drivers to stay in constant contact. This reduces the risk of miscommunication, improves on-time delivery rates, and enhances safety—all crucial components of the best trucking dispatch services in Nevada.

Maintenance and Compliance Made Simple

One of the biggest threats to fleet reliability is unexpected mechanical failure. With software that tracks maintenance schedules and vehicle diagnostics, dispatchers can ensure regular service and avoid costly breakdowns. Additionally, most fleet systems now support electronic logging device (ELD) compliance, which is essential for meeting FMCSA regulations in Nevada and across the U.S.

Data-Driven Decision Making

Fleet management software collects a wealth of data on fuel usage, idle time, delivery performance, and more. The top dispatch services in Nevada use this data to make smarter decisions—whether that means assigning the right driver to a specific load, identifying underperforming routes, or improving fuel efficiency across the fleet.

Why It Matters for Nevada Trucking Companies

Nevada’s trucking industry plays a crucial role in connecting West Coast ports to the rest of the country. As competition grows and margins tighten, companies must find ways to improve performance without increasing costs. That’s why the best trucking dispatch services in Nevada have integrated advanced fleet management software into their operations—it’s not just about knowing where a truck is; it’s about optimizing every mile.

Final Thoughts

Fleet management software is no longer a luxury—it’s a necessity for dispatchers aiming to lead in the competitive Nevada freight market. Whether you're managing a few trucks or a large fleet, the right software can help you reduce costs, increase reliability, and provide superior service. For owner-operators and carriers alike, partnering with the best trucking dispatch services in Nevada means gaining access to these powerful tools—and staying one step ahead on the road.

#aerolink carrier llc#transportation#logistics#freight carrier#software#nevada#trucking dispatch services

0 notes

Text

Build Market Expertise With ICFM’s Practical Share Market Courses In Delhi For Career And Wealth Growth

Learn Stock Trading with Professional Share Market Courses in Delhi Exclusively at ICFM - Stock Market Institute

The financial markets are no longer limited to professionals or institutions—today, individuals from every background are exploring trading and investing as viable means of income and wealth generation. With this rising interest, the demand for structured share market courses in Delhi has grown significantly. For anyone seeking reliable, hands-on, and expert-led training, ICFM - Stock Market Institute offers some of the best and most practical share market courses in Delhi tailored to Indian financial markets and trading systems.

ICFM’s share market courses in Delhi are designed to offer a deep understanding of the market's inner workings. Whether you're a student, a working professional, a homemaker, or a retired individual, ICFM provides a comprehensive learning path that equips you to confidently participate in the stock market. These courses are built to transform beginners into informed market participants and turn casual traders into disciplined and profitable investors.

Why Choose ICFM for Share Market Courses in Delhi?

Among the various institutes offering share market courses in Delhi, ICFM stands out for its real-market approach and practical teaching methodology. Unlike many theoretical programs, ICFM focuses on training that can be applied immediately in live trading situations. Their courses are designed by experienced market experts and active traders who bring real-world insights into every session. The core strength of ICFM lies in simplifying complex market concepts through real-time examples, software-based training, and one-on-one mentorship. Students receive personalized attention and are taught to make strategic trading decisions based on market data, technical signals, and economic factors. These share market courses in Delhi are comprehensive, engaging, and constantly updated to reflect current market trends and tools.

What You Will Learn in ICFM’s Share Market Courses in Delhi

The curriculum of ICFM’s share market courses in Delhi is thoughtfully structured to guide learners from basic to advanced topics. The journey begins with understanding what the share market is, how stock exchanges work, how trading happens in India, and the role of participants like brokers, investors, and institutions. As the course progresses, students dive into the essential tools of the trade, including candlestick charting, technical indicators, price action theory, support and resistance, moving averages, trendlines, volume analysis, and market psychology. These concepts are taught using real-time charts and trading platforms, ensuring that each lesson is practical and directly applicable. ICFM also introduces learners to risk management, trading discipline, and money management—all critical components of long-term trading success. The share market courses in Delhi go even further to cover options, futures, and portfolio management strategies for those looking to expand into derivatives or build diversified investment portfolios.

Real-Time Learning and Market Exposure at ICFM

One of the strongest aspects of ICFM’s share market courses in Delhi is its emphasis on real-time training. Students don’t just learn from books or slides—they practice in live markets. ICFM provides exposure to real trading platforms, where students monitor live prices, analyze market movements, place simulated trades, and review outcomes with expert feedback. This kind of immersive learning builds confidence and removes the fear of trading that many beginners experience. Daily market updates, interactive sessions, and practice drills are part of the regular training process. By applying concepts in real-world scenarios, learners are better prepared to make informed decisions in their personal trading journeys. This kind of hands-on education is what makes ICFM’s share market courses in Delhi highly impactful and industry-relevant.

Who Should Join Share Market Courses in Delhi by ICFM?

The share market courses in Delhi offered by ICFM are suitable for a wide range of learners. Students looking to enter the finance industry can build a strong foundation in trading and investment. Working professionals aiming to grow their income through market participation can develop smart strategies. Homemakers and retirees seeking independent financial control can learn how to manage their portfolios confidently. Even those who have been trading without structured training can benefit from these courses by refining their techniques, eliminating errors, and developing consistency. These courses are flexible, affordable, and available in both online and classroom formats, making them accessible for learners across Delhi NCR and beyond.

Career Opportunities After Completing Share Market Courses in Delhi

Completing ICFM’s share market courses in Delhi opens up multiple career avenues in the financial sector. Graduates of the program often pursue roles such as equity analysts, stockbrokers, technical analysts, investment advisors, and portfolio managers. Many also use the knowledge to become independent traders or start their own investment ventures. ICFM also prepares students to appear for certification exams like NISM and NCFM, which are widely recognized across brokerage houses, advisory firms, and financial institutions. With more companies valuing practical market knowledge, having a solid foundation from a reputed institute like ICFM gives learners a professional edge.

Enroll in ICFM’s Share Market Courses in Delhi and Start Your Trading Journey Today

For anyone looking to enter the stock market with confidence and clarity, ICFM’s share market courses in Delhi are the ideal starting point. These courses combine expert instruction, live market training, and personal mentorship to ensure every learner is equipped to handle real trading challenges. With thousands of successful students and a reputation built on trust and results, ICFM is the most reliable choice for stock market education in Delhi. Don’t rely on guesswork or internet noise—enroll in ICFM’s share market courses today and take charge of your financial future with skill, discipline, and confidence.

0 notes