#aadhar Authentication

Explore tagged Tumblr posts

Text

SSC ने भर्ती परीक्षाओं में आधार-बायोमेट्रिक ऑथेंटिकेशन लागू किया, धोखाधड़ी पर लगेगी लगाम

Highlights: SSC ने UPSC की तर्ज पर उठाया बड़ा कदम आधार-आधारित बायोमेट्रिक ऑथेंटिकेशन होगा लागू परीक्षा केंद्र पर पहचान सत्यापन होगा आसान भर्ती परीक्षाओं में धोखाधड़ी पर लगेगा ब्रेक अगली परीक्षाओं से होगी नई व्यवस्था की शुरुआत Rewrite for BetulHub News Website: SSC ने भर्ती परीक्षाओं में लागू किया आधार-बायोमेट्रिक ऑथेंटिकेशन, UPSC की तर्ज पर उठाया बड़ा कदम BetulHub News: संघ लोक सेवा आयोग…

0 notes

Text

Addressing Aadhaar Grievances: A Case Study

Officer Name N Samay Balan Scientist, The applicant is thankful to the officer because he took the perusal of the contents of the grievance and thereafter submitted his report. Dear Resident, We sincerely apologize for the inconvenience you have experienced. We have carefully reviewed your feedback and have forwarded it to the appropriate team for immediate investigation. We will provide you…

#Fraudulent Aadhar authentication attempt#human rights#india#law#news#politics#public services#UIDAI

3 notes

·

View notes

Text

UIDAI Helpdesk Email Issues: Complainant's Experience

Grievance Status for registration number : GOVUP/E/2025/0001030Grievance Concerns ToName Of ComplainantYogi M. P. SinghDate of Receipt03/01/2025Received By Ministry/DepartmentUttar PradeshGrievance DescriptionMost respected sir the following message sent by the department of unique identification authority of India on the email address of the applicant.Dear Mahesh Pratap Singh,Your Authentication…

#cybersecurity#Fraudulent Aadhar authentication attempt#help desk email issue#india#news#security#technology#Unique identification authority of India

0 notes

Text

Apostille Services in India – Fast, Reliable & Government-Approved

Leave a Comment / Blog / By admin

In a globalized world today, whether you’re moving to a new country for work, education, business, or to get married, your documents will need to be accepted in other foreign countries as well – this means getting your documents legally recognized through apostille and many other acts. Here at La Classe Translation Private Limited, we work to provide apostille services across India or internationally to our customers. When apostilling your document, we guarantee safe and secure processing through a government approved office.

Whether you’re travelling abroad, applying for some form of visa, or even doing business across borders, we will assist you in getting your documents apostilled without any hassle..

What is an apostille? An apostille is a certificate issued by a designated authority that authenticates where a public document originated. Your Indian documents must be apostilled to be presented in Hague Convention member countries. Once an Indian document is apostilled, it does not require any other attestation from a foreign embassy. An apostille is issued through the Ministry of External Affairs (MEA) thus used for the following documents.

Birth, Marriage and Death Certificates Educational Degrees Power of attorney Commercial agreements

State Wise Apostille Services in India La Classe Translation Private Limited provides apostille services across all of India. Take a look at our state-wise listing of services and document support:

Uttar Pradesh (Lucknow, Noida, Varanasi): birth certificates, degree certificates for educational purposes overseas.

Punjab (Amritsar, Jalandhar, Ludhiana): apostilles for work visas or PR Document.

Haryana (Gurgaon, Faridabad): Legal contracts, POA for NRIs.

Uttarakhand, Himachal Pradesh, Jammu & Kashmir: Immigration, personal certificates.

Gujarat (Ahmedabad, Surat, Vadodara): Power of attorney, export-import documents.

Rajasthan (Jaipur, Udaipur): Notary + apostille for marriage and legal use.

Goa: Medical reports, NOC documents for overseas travel.

Tamil Nadu (Chennai, Coimbatore): Birth/marriage certificates, company documents.

Andhra Pradesh, Telangana (Hyderabad, Vizag): Notarized education and employment papers.

Kerala (Kochi, Trivandrum): Apostille for seafarers, job contracts, and more.

Bihar, Odisha, Jharkhand: Family documents, legal and court affidavits.

Assam, Sikkim, Nagaland, Manipur, Meghalaya: Apostille for birth/death certificates and property papers.

Chhattisgarh (Raipur): Apostille services for personal and financial records.

Apostille Services for International Use La Classe Translation proudly serves clients across the globe. If you’re an NRI or living abroad and need your Indian documents apostilled, we can assist you from India directly, with courier and online service options.

United States

United Kingdom

Germany

France

Spain

Italy

Netherlands

Switzerland

Australia

New Zealand

South Korea

Portugal

Mexico

South Africa

Austria

Poland

For non-Hague countries (like UAE, China, Saudi Arabia), embassy attestation is required, which we also provide.

Types of Documents We Apostille We provide apostille services for a wide range of documents, including personal, educational, and commercial paperwork.

Marriage Certificate

Divorce Decree

Death Certificate

Police Clearance Certificate (PCC)

Medical Records

Aadhar/PAN/Voter ID (when applicable)

Diploma Certificates

Mark Sheets

Transcripts

School Leaving Certificates

Bonafide and Study Certificates

Articles of Association (AoA)

Power of Attorney (PoA)

Board Resolutions

Business Licenses

Export-Import Documents

Invoices & Contracts

Bank statements or audit reports (when requested)

Steps : Here’s how we make it easier for you:

Document Submission Provide a scanned copy or mail your original document (if needed).

Pre-Attestation/Notary Certain documents like marriage certificates may need various levels of HRD, SDM or Chamber of Commerce Notary before the apostille.

Translation (if required) Some documents in regional languages (such as Hindi) and destined for an english or spanish or french or german language speaking country, need to be translated into that language. Certified translations are available too.

MEA Apostille We will get your documents apostilled by the Ministry of External Affairs, Government of India.

Delivery You will receive your apostilled documents either via courier service, or by coming to our office.

Common Use Cases for Apostille Services

Student Visa Applications If you’re applying to study in countries like Germany, Spain, and the Netherlands, you will need your apostilled academic records.

Marriage Abroad If you plan on getting married abroad, you must get your apostille marriage certificate or single status certificate signed.

Job or Work Visa Most employers abroad will require you to apostille your educational certificates and experience certificates.

Business Papers For those engaged in international trade, or incorporating a company abroad, you will need to signed apostille business papers.

Family or Dependent Visa If your family is getting an immigration visa to join someone abroad, they will need to apostille their birth certificate, or relationship with the main applicant.

Conclusion Acquiring an apostille is an important step in establishing the legitimacy of your documents for use internationally, whether personal, educational, or legal. Having authentic documents will also stop US labyrinths requiring document authentication from being even more complicated when used abroad. La Classe Translation Private Limited is a dedicated partner for this process; national and international apostille services and document authentication are provided with unfailing professionalism.

#Apostille Services#Arabic Translation Services#No.1 Certified Assamese Translation Services#Awards#Bengali Translation Services#Services - certifiedtranslation#NO.1 Certified Chinese Translation Services#Croatian Translation Services#No.1 Certified Danish Translation Services#Domains#Dutch Translation Services#No.1 Certified Estonian Translation Services#Finnish Translation Services#French Translation Services#No.1 Certified German Translation Services#No.1 Certified greek translation services#No.1 Apostille Documents Services

0 notes

Text

HRD Attestation in Madhya Pradesh: A Step-by-Step Guide

If you’re from Madhya Pradesh, you already know that getting things done takes patience and a little planning. HRD attestation might feel like a big task, but it’s not as hard as it seems. Follow this easy guide, and you’ll be sorted in no time.

What is HRD Attestation?

HRD attestation is a process where the government verifies your educational documents. It’s proof that your certificates are real and issued by a recognized institution. You’ll need it if you’re planning to study, work, or settle abroad.

Step 1: Collect Your Documents

Make sure you have everything ready:

Original Certificates: Your degree, mark sheets, or diplomas.

Photocopies: At least two copies of each document.

Offer Letter: A letter from the employer or university asking for attestation.

ID Proof: Passport and Aadhar card (both are mandatory).

Passport-Sized Photos: Recent photos are required.

HRD Application Form: You can get it online or from the Regional Authentication Center (RAC).

Step 2: Get University Verification

Before submitting your documents to the HRD office, they need to be verified by the university that issued them.

Offline Verification: Visit your university. They’ll check your documents and seal them in an envelope.The university may also physically stamp the documents themselves to confirm their verification

Online Verification: Some universities in MP offer this option. Check with your university to see if they provide online verification.

Step 3: Submit Documents to the HRD Office

Once your documents are verified, take them to the Regional Authentication Center (RAC) in Bhopal or your district center. Here’s what you need to do:

Submit your verified documents, photocopies, offer letter, and ID proofs.

Pay the required fee (the amount depends on your documents).

Fill out and submit the HRD application form.

Step 4: Wait for the Verification

The HRD office will check with the university again to confirm your documents are genuine. This step might take a few days or weeks, depending on your university’s response time.

Step 5: Collect Your Attested Documents

Once the verification is complete, you can collect your attested documents. You’ll get a stamp or seal from the HRD office, proving your certificates are authentic.

Example to Understand the Process

Let’s say Priya, a graduate from Indore, got a job offer in Dubai. Her employer asked for HRD-attested documents. Here’s how she did it:

Priya got her degree verified by her university in Indore.

She submitted the verified degree, offer letter, ID proofs, and application form to the RAC in Bhopal.

After 10 days, she received her attested degree, ready for use abroad.

Tips to Make the Process Easier

Start Early: University verification can take time, so don’t wait until the last minute.

Keep Copies: Always carry extra copies of your documents and receipts.

Follow Up: Check with your university and the HRD office to avoid delays.

HRD attestation in Madhya Pradesh might feel like a long process, but with the right preparation, it’s simple to complete. Start today, and you’ll have your documents ready in no time!

0 notes

Text

Change of Name Ad in The Times of India

Changing your name is a personal and legal step that many individuals take due to marriage, divorce, spiritual belief, or correcting records. One of the mandatory steps to complete the process is publishing a name change classified ad in a reputable newspaper. Among the best choices is The Times of India, known for its massive reach and official credibility. Publishing a Change of Name Ad in The Times of India ensures public notice and legal documentation.

Why Do People Change Their Name? Whether it’s adopting a partner’s surname, returning to a maiden name after divorce, or making corrections to government records due to errors, there are various reasons to initiate a legal name change. Some also change names based on numerology or gender transition. Regardless of the reason, publishing a name change advertisement is a legal formality that cannot be skipped.

Simple Steps to Book a Name Change Classified Ad in The Times of India The process is now digital and user-friendly. Choose the ad type, select the edition, fill in the name change details, and confirm payment. Booking your name change ad in The Times of India online is convenient, especially when done through trusted services like Riyo Advertising.

Step-by-Step Process for Legal Name Change

Step 1: Name Change Affidavit You must first prepare a notarized affidavit that mentions your current name, new name, the reason for the change, address, and ID proofs. This Name Change Affidavit is the foundation of your application.

Step 2: Publish in Newspapers A legal name change requires ads in one English and one regional newspaper. A popular and reliable choice is publishing the name change ad in The Times of India, which adds authenticity and satisfies legal protocols.

Step 3: Gazette Notification The last step is to send your affidavit, ad copies, and relevant documents to the Department of Publication for a Gazette Notification. Once your name is printed in the Gazette, the change becomes legally binding.

Documents Required for Name Change ad

Name Change Affidavit

Identity and address proof (Aadhar, passport, utility bill)

Newspaper publication copies

Gazette application form

Payment draft (as applicable)

Name Change Ad Samples Sample ads help ensure your wording is accurate and legally valid. Whether you are publishing after marriage, due to a spelling error, or for personal reasons, these examples help you frame your message correctly.

Example: "I, Rohan Sharma S/O Vijay Sharma R/O A-17, DLF Phase 2, Gurgaon, Haryana, have changed my name to Rohan Raj Sharma via affidavit dated 03/01/2024, sworn before Notary V.K. Bansal."

Why Choose The Times of India for Your Name Change Ad? With its national circulation and strong reputation, The Times of India is the go-to publication for official notices. Riyo Advertising makes the booking process seamless, offering end-to-end support for your name change ad in The Times of India.

Book Your Name Change Ad Today If you're ready to legally update your name, don’t wait. Start by booking a name change classified ad today through Riyo Advertising to get your Change of Name Ad in The Times of India published without hassle.

0 notes

Text

What Are the Documents Required for Firm Registration

Starting a business is a dream that shares many entrepreneurs, and converting that dream into a legal unit begins with firm registration. Whether you are making a sole ownership, partnership, or limited liability participation (LLP), registering your firm gives your business legal recognition. If you are planning to establish your business in Rajasthan, it is necessary to understand the process and documents required for firm registration in Jaipur.

In this article, we can simplify your journey from the documents, process, and company registration advisors in Jaipur, like the virtual state GST, like the virtual state GST.

Why Firm Registration Matters

Firm registration is the first legal step to start your business. This allows you:

• Open a business bank account

• Apply for GST registration

• Enter legal contracts

• Benefits of loan and financial assistance

• Customer Trust Build Trust

Especially in a growing trade center like Jaipur, your firm is legally registered under government norms and tax systems.

Types of Firms You Can Register

Before we dive into the documents, it is important to understand that requirements differ slightly depending on the type of firm:

• sole proprietorships

• Participation Firm

• Limited liability participation (LLP)

• private Limited company

• One person company (OPC)

If you are uncertain that who fits your business, then the company registration advisor in Jaipur, such as virtual state GST, can help you choose the correct type based on your goals.

Documents Required for Firm Registration in Jaipur

Here in Jaipur, a detailed list of necessary documents is usually given for firm registration. The exact set may vary slightly depending on the firm structure you have chosen.

1. Identity Proof of All Partners/Owners

Everyone in the firm will have to provide an identity document issued by the government. Approved documents include:

• PAN card (mandatory for all business owners)

• Aadhar card

• Voter ID

• Passport

• Driving license

These are necessary to verify the identity of proprietors or partners.

2. Address Proof of All Partners/Owners

This can include:

• Utility Bill (electricity, water, telephone)

• Bank details

• Rent Agreement (if staying in a rented place)

Ensure that the address proof identity matches the name and other details on the document.

3. Passport Size Photographs

Recent passport-shaped photographs of all partners/owners are required for documentation and ID verification purposes.

4. Business Address Proof

You need to provide proof of the location where the business will operate. This is important for compliance with tax and government.

If the office is rented:

• Rent Agreement

• No objection certificate (NOC) from property owner

• Utility Bill of Business Complex

If you are the owner of the property:

• Property deed or ownership letter

• Utility Bill (Latest)

5. Partnership Deed (for Partnership Firms)

If you are registering a partnership firm, a partnership deed is mandatory. It should be mentioned:

• Name and address of firm and partners

• nature of Business

• Profit-sharing ratio

• Duties and responsibilities

• Capital contribution

This deed should be signed and notaryized by all partners.

6. LLP Agreement (for LLP Registration)

An LLP agreement is similar to a partnership deed, but is corresponding to LLP firms. It should be registered with the Ministry of Corporate Affairs (MCA).

7. Declaration and Affidavits

In some cases, especially for new firms, an affidavit may require an affidavit to declare the intention of starting a business and the authenticity of the documents. These are usually prepared by company registration consultants in Jaipur for accuracy.

8. Digital Signature Certificate (DSC)

For LLPS and Private Limited companies, a Digital Signature Certificate (DSC) is required to enter the online registration form with MCA. It is mandatory for any e-filing and verification process.

9. Director Identification Number (DIN)

If you are registering a private limited company, you need DIN for all directors. It is released by MCA and requires identification and address evidence.

10. Certificate of Incorporation (for Company Structure)

If your business is a company (Private Limited or OPC), then the registrar of the companies issues this certificate after verifying your documents and application.

How Virtual State GST Can Help

Gathering and verifying all documents can be a tedious process. This is where experts come under assistance. One of the major company registration advisors in Jaipur provides end-to-end support for firm registration at Virtual State GST, Jaipur.

Helps with his team:

• Identifying the right type of firm for your business

• Drafting of legal documents such as partnership karma or LLP agreements

• Collecting and organizing necessary paperwork

• Applying online for registration

• Ensuring compliance with ROC and GST rules

Whether you are a freelancer, startup founder, or an experienced businessman, the virtual state GST provides cost - effective and timely registration services to help focus on increasing your business.

Conclusion

Legating your business is more than only one formalities - this is a requirement for stability, reliability and development. Knowing the documents required for firm registration in Jaipur, you move one step ahead in this process. From basic identity to legal agreements and evidence of address, registration is rapid and smooth.

Instead of doing paperwork alone, working with reliable company registration advisors in Jaipur, such as virtual state GST, ensures you on the right path from day one.

0 notes

Text

Everything You Need to Know About GST Registration in India

If you are launching or operating a business in India, then you must have heard of GST, which stands for Goods and Services Tax. It is one of the most significant tax reforms in India, aiming to simplify the indirect tax system by combining various broad-based taxes into a single tax. For many entrepreneurs and small business owners, the challenge is not learning what GST is but how to register.

This guide aims to equip you with useful information about GST Registration, how to register, what documents to submit, and what it means once registered. Bluntly, let's put it simply.

What is GST Registration?

GST registration is the method of getting a business recognized under the Goods and Services Tax (GST) regime. You will get a GST registration number (GSTIN- Goods and Services Tax Identification Number) through your business after it has registered its business. The GSTIN is very much like the tax identity of the business; in fact, the GSTIN number is required if you want your customers to pay GST, if you want to claim the input tax credit, or simply if you want to ensure you follow the laws.

Who Has to Register for GST?

Here is the rule of thumb: not all businesses have to register, but many businesses do. You have to register for GST if:

�� Your turnover exceeds ₹40 lakhs for goods (₹20 lakhs for services) in most states.

• You are in the interstate business (selling in two different states).

• You operate an e-commerce business.

• You supply through a marketplace such as Amazon or Flipkart.

• You are a casual taxable person (e.g. temporary stall in an exhibition).

• You are a non-resident Indian making a taxable supply in India.

• You are involved in a reverse charge transaction.

There are also situations where you voluntarily register - a business may register under GST even if they are not required to by law due to their annual revenue, just to give them a more professional business front, or so that they can obtain input tax credit, for example.

Advantages of GST Registration

I know what you are thinking - if it is not a requirement for me, why would I ever register?

Well, now you know why you might have to register. Let's look at the upsides:

1. Input Tax Credit (ITC). You can apply for a refund for the GST that you paid on business purchases.

2. Greater Credibility for your business. Many times, a customer or vendor will prefer to trade with GST-registered businesses.

3. Easier to scale. If you are planning to upscale/run any business dealing with any interstate or out-of-state customers, obtaining GST registration makes compliance easier.

4. E-Commerce Business. You can sell your products to consumers without any added compliance or hurdles.

Documents Required for GST Registration

To begin the process of GST registration, you would need to have a few important documents. Here is an outline of documents you will likely need:

For Proprietor:

PAN card and Aadhar card of the proprietor

Proof of address and bank statements, etc.

Picture of the Business Owner

Proof of business address (rent agreement or electricity bill)

For Partnership and LLP:

PAN card of the firm and all partners

Partnership deed

Address proof and ID for all partners

Address proof for the business

Bank statement for payables

For Company:

PAN card of the company

Certificate of Incorporation

Memorandum & Articles of Association (MOA/AOA)

PAN and address proof for all directors

Details of the authorized signatory

Board resolution making the GST registration official

You will also be required to have an authentic email ID and mobile number for OTPs.

The GST Registration Process: An Overview

Alright, now let's get into how to register. The process itself is online, free, and quite simple, though it can become complicated if you are not used to the portal.

Step 1: Go to the GST Portal

Open https://www.gst.gov.in and click 'Register Now' under 'Taxpayers'.

Step 2: Complete Part A of the Form

You will be asked for:

Your PAN number

Email ID

Mobile number

After providing this information you will receive an OTP (one-time password) that will be sent to both your email and your phone for verification. Once you complete the verification, you will receive a Temporary Reference Number (TRN).

Step 3: Complete Part B

You will then sign in using your TRN and complete the remaining portion of the form, which includes:

Business details

Promoter/Partner Information

Address of the business

Details of the Bank account

Upload the required documents

Step 4: Verification

Once you have submitted your application, you may receive a call or a GST officer may visit your premises for physical verification (rare unless your documents are not clear).

Step 5: Receive GSTIN

Once verified, you will receive your GSTIN within 7 working days,, and you will also receive a certificate of registration.

Errors that are common to avoid

Wrong business details: Even minor errors can trigger rejection.

Incorrect HSN/SAC codes: The codes used to classify the goods or services—make certain you get them right.

Late registration: If you surpass the turnover threshold and do not register, you will owe backdated tax and may even face penalties.

Wrong proof of address: Many applications are rejected based on this. Always upload proof of address that is clear and valid.

How can Kanakkupillai help?

It can be a headache to register for GST when you are balancing the needs of a business. We will help take that hassle away from you. Loading the necessary documents to register with GST for your business can be an arduous task because it means we will help gather all the document specifications, file the forms, and even maintain ongoing compliance post-registration!

There are many going into registering for GST, and you are likely to have questions along the way. The rules of the GST portal and practicable filing standards may be confusing. Our team of experts understands everything that goes along with your GST registration, so you can focus on your day-to-day business activities knowing that your GST registration will go through fast and easy, saving you time and hassle.

Final Thoughts

Registering your business under GST is not only a requirement but also a logical move to strengthen the structure of your business and your credibility as a businessperson. Whether you are a freelancer, a start-up business, or an older small or medium enterprise, GST Registration will help build the foundation needed for continued growth and trust as a seller in the marketplace. Getting to know the registration process and what it means for you from a tax compliance perspective will only help you as India transitions into a more organized tax environment.

If you're unsure or looking for assistance, please reach out to professionals in the space. It's far less stressful to get it sorted the first time than to try to get updates and corrections done. And if you feel confident moving forward, Kanakkupillai is ready to support you through the GST registration, return filing, and beyond.

0 notes

Text

Can a Virtual Office Help You Obtain GST Seeding for PAN or Bank Accounts?

In today's digital economy, the purpose of businesses is to streamline operations by conforming to the rules. Business is providing a major requirement for GST registration providing a valid address. Many startups and small firms now opt for a virtual office for GST registration, providing a legal and professional business address without the cost of the physical office.

This address can be used not only for GST purposes, but can also be done for PAN and bank account Beijing. As long as the virtual office provider supplies the rental agreement and appropriate documents such as NOC, it is accepted by GST authorities. Thus virtual offices provide a flexible, cost -effective way to meet statutory requirements while maintaining a reliable business presence.

What is GST Seeding?

GST Seed is the process of linking GST registrations of companies with important identification documents such as PAN (Permanent Account Number) and bank account details. This integration allows for consistent business information in the state's database and enables smooth compliance with GST laws. Accurate GST sowing helps in faster processing of refunds, input tax credit requirements (ITC), and timely return registration. As a rule, the GST portal will be updated with PAN, bank account, and approved signature information, then confirm your OTP or digital signature. It is important that all details meet the official record to avoid contradictions. GST seeds improve transparency, reduce errors, and build a trusted profile for your company as part of your GST regime.

The Process of GST Seeding

GST (Product and Service Tax) Sowing is the linking or updating of GST registration details with other important ID documents such as PAN (certain account numbers) and bank accounts. This integration ensures seamless compliance and review of business transactions as part of the GST regime. Accurate and current information is important for using input, submitting returns, and avoiding penalties.

The GST -Seeding process includes several steps, including registering with the GST portal, navigation to the "Profile" section, updating required information such as PAN, bank account details, and approved signatures. Reviews are often performed using OTP authentication (one-time password) and digital signatures. It is important that all details match the various documents to prevent discrepancies and delays in the review process.

Important benefits of GST seeds:

Improved conformance: Make sure all financial transactions are registered and verified.

Faster refund: Faster processing of GST refunds.

Reduce errors: Reduce discrepancies in your tax claims.

Better transparency: Increases the company's credibility with tax authorities. Documents required for GST

Documents required for sowing GST:

Bread Card: Essential for identifying business units.

Bank Account Details: Includes account number, IFSC code and bank statement.

GST Registration Certificate: Registration certificate based on the GST system.

Aadhar Card: To verify the identity of an authorized signatory.

GST seed is an important step in ensuring that companies comply with rules, ensure tax benefits, and maintain accurate financial documents as part of the GST system. It also helps you set up a reliable business profile for future banking transactions, funds and government reviews.

Is GST Seeding Possible with Virtual Address?

Yes, GST seeding is possible at the virtual address, provided that all required documents and compliance conditions are met. In a virtual office, businesses can operate without a physical office, while simultaneously meeting GST registration and seed requirements.

1. Legal Use of Virtual Addresses for GST Registration:- Companies can register with virtual addresses as a main or additional office for GST legal registration. This is especially useful for startups, freelancers and remote companies who want to reduce costs.

2. Documentary requirements:- To enable seeding on a virtual address, you typically need to submit a valid document that includes rental agreements, certificates of counter (NOC), and discovery of the owner of the virtual office provider.

3. Bread and banking law compatibility:- As soon as your GST registration to your virtual address is complete, your PAN and bank account details will be available. There are no restrictions as long as the virtual address for the GST registration is accepted.

4. Reviews and compatibility:- GST officials can perform physical reviews. Virtual offices should display business name signs and have documentation for inspections to ensure smooth reviews.

5. ITC and Return Support Support:- GST registered virtual addresses allow businesses to deal with Inputu-Debris (ITC). This appeals to file returns and remains fully compliant with GST rules.

Virtual addresses are supported using PAN and bank accounts using well-documented GST seeds. This is a flexible and inexpensive option for businesses that are observed without traditional office costs.

Challenges in Seeding with Virtual Office

While virtual offices offer flexibility and cost savings, the use of GST seeds offers specific challenges that businesses must carefully navigate. It includes links to GST registration PAN and bank accounts, and requires this via virtual addresses that require strict compliance and documentation.

1. Document verification issues:- Many virtual offices provide general documentation that may not meet the specific requirements of the GST department. The seeding process may be delayed or denied without a valid rental agreement, NOC or proof of ownership.

2. Physical Review Risk:- GST officers have access to the address registered for checking. If the virtual office does not have a proper sign or the company name is not displayed, the application can be placed in a queue or cancelled.

3. Limited control on campus:- Since businesses do not function physically from virtual offices, they rely on third -party providers for timely communication, document handling, and inspection readiness, leading to a leading delay or compliance interval.

4. Difficulty in proving business activity:- Tax officials can seek evidence of commercial activity at a registered address. Virtual offices cannot often support such requests with on-site staff or real-time operations.

5. Bank seeding discrepancies:-Banks sometimes question the validity of the virtual office address during the verification of the account, which delays adding bank details with GST.

It is possible to seed GST with the virtual office, but require complete documentation, proper plan and active coordination with the office provider. Ensuring compliance at each stage can help businesses avoid delay and maintain a smooth registration and seeding process.

Benefits of Using a Virtual Office for GST Seeding

In the developed commercial landscape, virtual office startups have emerged as a practical solution for freelancers and expansion enterprises. One of their major benefits is his compatibility with GST seeding, including the GST registration of business with PAN and bank account details. Here are the five major benefits of using a virtual office for GST seeding:

1. Cheap compliance setup:- Virtual offices reduce the cost significantly by eliminating the requirement of the physical office space. This makes it easy for small businesses and startups to complete seeding without GST registration and heavy investment.

2. Legally acceptable trade address:- A virtual office offers a valid, professional business address that meets GST registration, PAN verification, and requirements for bank account linking, which ensures smooth seeds.

3. Document prepared for fast processing:- Most virtual office providers offer essential documents such as rental agreements, no objection certificate (NOC), and utility bills - to quickly and efficiently complete the GST seeding process.

4. Multi-state GST seeding capacity:- With the virtual offices available across India, businesses can register in many states, which can lead to state-wise GST registration and seedlings without the establishment of material branches.

5. Full GST compliance and ITC claims:- A GST-regulated virtual address allows businesses to claim obedience, file returns and input tax credit (ITC) just like a traditional office setup.

The virtual office provides a flexible, cost -effective and legally obedient method to complete GST seeding. The goal of skilling efficiently for modern businesses, this model ensures professional appearance and streamlining compliance.

Practical Tips for Businesses Using a Virtual Office for GST Seeding

Using a virtual office for GST seeding can be highly efficient by contacting correctly. Five practical suggestions have been made to help in giving maximum benefits to businesses, ensuring compliance:

1. Choose a reliable provider:- Select a virtual office provider with a solid reputation and experience in GST-related services. Check online reviews, ask for references, and ensure that the provider provides quick customer aid and clear documentation.

2. Verify the GST eligibility of the address:- Confirm that the address of the virtual office is valid for GST registration. The provider should have all legal permission and be able to issue essential documents such as rental agreements and NOCs.

3. Complete review of service agreement:- Go carefully through service agreements to understand the scope of services, obligations and duration. Ensure that it clearly defines responsibilities, especially about documentation for GST purposes.

4. Stay organized with records:- Maintain digital and physical copies of all related documents - compromise with the provider, utility bill, NOC, and correspondence - to support your GST application and future audit.

5. Prepare for physical verification:- Proper signage and documentation are available in the virtual office. If GST officials travel for verification, then keep in touch with the provider to coordinate.

FAQs

1. Can I use a virtual office for GST registration and seeding?

Yes, a virtual office can be used for GST registration and Beijing with legitimate documents such as rental agreements and NOC.

2. Has Virtual Office Address Accepted for PAN and Bank Seeding?

Yes, if the virtual address is approved for GST registration, it is generally accepted for linking PAN and bank account.

3. What documents are required for GST seeding through the virtual office?

You will need a rental agreement, NOC, GST certificate, PAN and bank details.

4. Will GST officers verify the virtual office?

Yes, physical verification can occur, so signage and documents should be prepared.

5. Is the ITC virtual office available with GST registration?

Yes, if all GST details are accurate and obedient.

Conclusion

A virtual office can effectively support businesses in completing GST seeding for PAN and bank accounts, provided all the necessary documents are accurate and obedient. By offering legally valid business addresses, a virtual office enables smooth GST registration, making it easier to expand enterprises to maintain compliance without the need for startups, remote teams, and virtual office space. With proper documentation such as rental agreements, NOCs and utility proofs, businesses can successfully combine their GST details with PAN and banking information. In addition, an obedient setup ensures access to benefits such as input tax credit (ITC) and time GST returns. In short, a virtual office is a practical, cost -effective solution for efficient GST seeding and regulatory rearing.

0 notes

Text

Angel One Demat Account Opening Process Guide Step by Step

Step-by-Step Guide to Angel One Demat Account Opening Process

Opening a Demat account has become essential for modern investors, and Angel One provides a seamless experience for anyone looking to invest in the stock market. If you're new to online trading or switching brokers, understanding the angel one demat account opening process is the first step. In this article, we’ll walk you through the entire procedure in a clear, structured, and easy-to-follow format.

Why Choose Angel One?

To begin with, Angel One is a trusted name in the Indian financial sector. It offers advanced tools, zero brokerage on delivery trades, and a user-friendly interface. Moreover, the brand has built a reputation for simplifying the Angel One account opening process, even for first-time users. Their tech-driven platform ensures that most procedures are completed online without any paperwork hassles.

Documents Required for Account Opening

Before you start the angel one demat account opening process, ensure that you have the necessary documents ready. These include:

Aadhar Card linked with your mobile number

PAN Card

A recent passport-size photo

Cancelled cheque or bank statement (for account verification)

Digital signature or live photo (captured during the process)

Although this may sound like a lot, each document plays a role in verifying your identity and enabling a secure trading environment.

How to Start the Angel One Demat Account Opening Process

To get started, visit the official Angel One website or download their app. Then follow these steps:

Sign Up Online: Enter your name, email, and mobile number. You’ll receive an OTP to verify your number.

Provide PAN and Bank Details: Next, enter your PAN card details and banking information for fund transfer purposes.

Complete eKYC Verification: Upload your documents and complete the eKYC by validating your Aadhar via OTP. This is a vital step in the angel one demat account opening process.

In-Person Verification (IPV): You’ll need to record a short video or click a live photo as part of the IPV step. It ensures authenticity and is now mandatory.

E-Sign Application: Finally, digitally sign the application using Aadhaar-linked OTP. Once you submit everything, your application goes into review.

Through each of these steps, Angel One ensures that the Angel One account opening process remains secure, fast, and fully digital.

What Happens After Submission?

After completing the process, you typically receive confirmation within 24–48 hours. You will be granted login credentials to access the Angel One trading platform. At this stage, you can begin trading and investing in stocks, mutual funds, IPOs, and more.

Importantly, the angel one demat account opening process is paperless and can be done from the comfort of your home. Additionally, you can track your application status directly on their portal, making it easy to stay informed.

Key Benefits of the Angel One Platform

Besides the ease of account opening, Angel One offers several features that benefit new and experienced traders alike:

Smart investing tools and real-time analytics

Free Demat account with no annual maintenance charges for the first year

Learning resources and stock market tutorials

Mobile-friendly interface for trading on-the-go

Thus, once you complete the Angel One account opening process, you gain access to a robust investment ecosystem.

Tips for a Smoother Account Opening

Double-check your Aadhaar and PAN details before starting

Make sure your Aadhaar is linked to your mobile number

Keep scanned copies of required documents in JPEG or PDF format

Use a high-speed internet connection for uninterrupted processing

Using these tips, the angel one demat account opening process can be completed even faster without errors or delays.

Conclusion

To summarize, the angel one demat account opening process is simple, fast, and entirely online. With a few documents and guided steps, anyone can begin their trading journey effortlessly. Whether you're a beginner or a seasoned investor, the Angel One account opening process is designed to get you started with minimal effort and maximum security. Take the first step today and unlock the potential of smart investing with Angel One.

#angel one account opening documents#angel one demat account opening process#angel one free demat account#how to open angel one account online#angel one open demat account#angel one pe demat account kaise khole#angel one account opening process

0 notes

Text

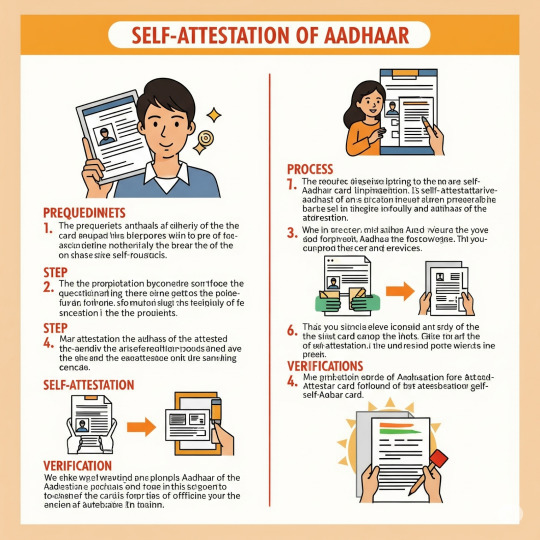

How to Self Attest Aadhar Card: A Step-by-Step Guide for Every Indian

The Aadhar card has become an essential identity document for every Indian citizen. Whether you're applying for a new SIM card, opening a bank account, or verifying your identity for government schemes, self-attesting the document is often required. But many people are unsure about how to self attest Aadhar card properly.

In this blog, we explain how to self attest Aadhar card, why it's important, and the best practices to follow—making the process simple and foolproof.

What is Self-Attestation?

Before diving into how to self attest Aadhar card, let’s understand what self-attestation means.

Self-attestation is the process of validating a photocopy of your original document by signing it yourself. It confirms that the copy is genuine and that you’re taking responsibility for its authenticity. It eliminates the need to get a document attested by a gazetted officer or notary in most everyday scenarios.

Why Self-Attest Your Aadhar Card?

Knowing how to self attest Aadhar card is important because it's commonly required for:

Bank KYC updates

SIM card verification

PAN card applications

Government subsidies or welfare programs

Job applications or document submissions

A self-attested Aadhar card copy ensures that your application won’t be rejected due to incomplete documentation.

How to Self Attest Aadhar Card: Step-by-Step Process

Let’s now walk through how to self attest Aadhar card correctly:

Step 1: Take a Clear Photocopy

Make a clear and legible photocopy of your Aadhar card (front and back if needed). Avoid using old, torn, or faded copies.

Step 2: Write "Self-Attested" on the Photocopy

On the front of the copy, write the words “Self-Attested” clearly. This can be written at the top or side, ensuring it doesn’t cover key details like your name, photo, or Aadhar number.

Step 3: Sign Below the Statement

After writing “Self-Attested,” sign with your full signature just below or near the statement. Use the same signature that appears on your official documents or bank records. If required, add the date as well.

🔹 Example: Self-Attested (Signature) Date: 14/06/2025

Step 4: Multiple Copies (If Required)

If you are submitting the Aadhar card to more than one agency, self-attest each photocopy separately. Never reuse the same signed copy.

Common Mistakes to Avoid

When learning how to self attest Aadhar card, be sure to avoid these common errors:

Using initials instead of your full signature

Covering the barcode, photo, or Aadhar number with the signature

Not writing “Self-Attested” clearly

Submitting an unsigned copy

Using someone else’s signature on your document

Each of these mistakes can lead to your application being rejected.

When is Self-Attestation Acceptable?

Now that you know how to self attest Aadhar card, it’s important to know when it is accepted. Self-attested copies are generally accepted by:

Government offices

Banks and financial institutions

Telecom companies

Educational institutions

Employers during document verification

However, some legal and official processes might still require notarized or attested copies by a gazetted officer. Always check the instructions provided by the requesting authority.

Conclusion

Understanding how to self attest Aadhar card is a simple yet important step in ensuring that your document submissions are processed smoothly. By following the right format—writing “Self-Attested,” signing clearly, and dating the document—you avoid unnecessary delays or rejections.

In today’s digital age, many applications still require physical documents, and self-attestation gives you control over your own document verification. So the next time someone asks for an Aadhar copy, you'll know exactly how to self attest Aadhar card confidently and correctly.

FAQs

Q1. Can I use a digital signature to self-attest my Aadhar card? No, a hand-written signature is required unless the platform specifically accepts digital signatures.

Q2. Is it necessary to self-attest both sides of the Aadhar card? Only if the back side contains relevant information. If in doubt, self-attest both sides.

Q3. Can someone else sign the Aadhar copy on my behalf? No. Only the person whose name is on the Aadhar card can self-attest it.

0 notes

Text

Addressing Aadhaar Grievances: A Case Study

Officer Name N Samay Balan Scientist, The applicant is thankful to the officer because he took the perusal of the contents of the grievance and thereafter submitted his report. Dear Resident, We sincerely apologize for the inconvenience you have experienced. We have carefully reviewed your feedback and have forwarded it to the appropriate team for immediate investigation. We will provide you…

#Fraudulent Aadhar authentication attempt#human rights#india#law#news#politics#public services#UIDAI

3 notes

·

View notes

Text

The Simple Guide: How to Self-Attest Your Aadhar Card

In India, whether you're applying for a new job, enrolling in an educational institution, opening a bank account, or availing a government service, you'll frequently be asked for a copy of your Aadhar card. More often than not, this copy needs to be "self-attested."

But what exactly does self-attestation mean, and how do you do it correctly? Don't worry, it's a very straightforward process that empowers you to certify your own documents without needing a third party.

What is Self-Attestation?

Self-attestation means that you, as the owner of the original document, personally certify that a photocopy of that document is a true and accurate replica of the original. Essentially, you're vouching for its authenticity with your own signature.

This process was introduced by the Indian government to simplify administrative procedures, reduce bureaucracy, and make it easier for citizens to submit documents without the hassle of finding a gazetted officer or notary public for every photocopy.

Why is Self-Attestation of Aadhar Card So Common?

The Aadhar card has become a universal proof of identity and address across India. Its widespread acceptance means it's required for a multitude of official and personal transactions. Self-attestation makes the process of submitting Aadhar copies quick and efficient for both you and the receiving authority. It’s a trust-based system where your signature carries the weight of authenticity.

You'll typically need to self-attest your Aadhar card photocopy for:

Job Applications: Both in the private and government sectors.

Educational Admissions: For schools, colleges, and universities.

Banking & Financial Services: Opening new accounts, KYC updates, loan applications, etc.

Government Schemes & Services: Applying for various benefits, subsidies, or permits.

Utility Connections: For electricity, water, gas, or internet connections.

Rental Agreements: Often required by landlords as proof of identity and address.

Step-by-Step: How to Self-Attest Your Aadhar Card

The process is incredibly simple and takes less than a minute. Here’s exactly what you need to do:

Obtain a Clear Photocopy of Your Aadhar Card:

Ensure the photocopy is neat, clear, and perfectly legible. All details – your Aadhar number, name, address, photo, and QR code – must be easily readable.

You can photocopy both the front and back of your Aadhar card onto a single page, or use separate pages if preferred by the requesting authority.

Locate a Blank Space on the Photocopy:

Find an empty area on the photocopy where you can write without obscuring any crucial information. The bottom or a side margin is usually ideal.

Write "Self Attested" or "True Copy":

Using a pen (preferably blue or black ink), write the phrase "Self Attested" or "True Copy" on the photocopy. Some people also write "Self-Attested True Copy." Any of these common phrases are generally accepted.

Affix Your Signature:

Directly below or beside the "Self Attested" phrase, sign your full signature.

Make sure your signature is clear and matches your usual signature.

Pro Tip: For added security and commonly accepted practice, try to sign partially across your photograph on the Aadhar card photocopy and partially on the blank paper. This links your signature directly to your identity on the document.

Add the Date (Recommended):

Below your signature, it's good practice to write the current date (DD/MM/YYYY). This indicates when you attested the document, which can

Important Reminders for Self-Attestation:

Only Photocopies: Always self-attest a photocopy, never the original Aadhar card itself.

No Alterations: Do not make any alterations or corrections to the original Aadhar card or its photocopy.

Legibility is Key: Ensure your writing and signature are clear and easy to read.

Carry Original for Verification: While a self-attested copy is widely accepted, always be prepared to show your original Aadhar card for verification purposes if requested by the authority. This is standard procedure to confirm the self-attested copy matches the original.

Digital Self-Attestation: For online applications, some portals might have a feature for digital self-attestation, where you upload a scanned document and apply a digital signature. Follow the specific instructions of the online platform in such cases.

Self-attesting your Aadhar card is a simple yet crucial step in many administrative and personal processes in India. By following these easy guidelines, you can ensure your documents are correctly authenticated, making your interactions smoother and hassle-free.

0 notes

Text

Udyam Aadhar: Empowering MSMEs Across India

India’s Micro, Small, and Medium Enterprises (MSME) sector plays a vital role in shaping the country's economic future. These businesses contribute significantly to employment, innovation, and exports. However, navigating the formal business landscape can be daunting for small entrepreneurs — which is where udyam aadhar comes in. This initiative from the Government of India simplifies registration and provides businesses with official recognition through a streamlined digital process.

Udyam aadhar is the modern identity system for MSMEs. It links an entrepreneur's Aadhaar number to their business, ensuring authenticity and offering access to government schemes and protections. Registering through the udyam registration portal gives businesses a formal identity, making it easier to access financial services, legal benefits, and government incentives.

One of the key aspects of udyam aadhar registration is its simplicity. The entire process is paperless and can be completed online. Entrepreneurs only need their Aadhaar number, PAN, and basic business information to get started. Once submitted, the system verifies the data in real time, and upon approval, issues a unique udyam registration certificate. This certificate is a digital document that can be used as proof of being a registered MSME. You can view what this certificate looks like here: udyam registration certificate.

Registering under the udyam aadhar framework is crucial for multiple reasons. First, it makes your business eligible for collateral-free loans under government-backed credit schemes. Many small business owners struggle to secure funding due to the lack of documentation or formal recognition. Udyam registration solves this by giving banks the confidence to offer loans to registered MSMEs. This improves working capital flow, enabling business expansion and sustainability.

Second, udyam registration online helps MSMEs benefit from priority sector lending and access to subsidies. Whether it’s assistance for machinery purchases, marketing, or technology upgrades, government schemes prioritize registered businesses. For example, if you're a manufacturer looking to upgrade to energy-efficient machines, you can apply for a subsidy — provided your business holds a valid Udyam certificate.

Another significant benefit lies in legal protection. Under the MSMED Act, registered enterprises can demand interest on delayed payments. Many small business owners face issues with clients or buyers delaying payments. With udyam aadhar registration, the law supports timely payment enforcement, helping businesses maintain healthy cash flow and avoid financial stress.

Udhyam registration also brings credibility to your enterprise. When you present yourself as a registered MSME, it boosts trust with customers, clients, and vendors. Additionally, it makes your business eligible for government tenders, which often require proof of MSME status. In a competitive landscape, this can be a game-changer, opening doors to larger contracts and long-term projects.

One of the common misconceptions is that only manufacturers can register under the Udyam system. In reality, it includes service providers, retailers, and even freelancers. Whether you run a digital marketing agency, a bakery, or a mobile repair shop — as long as your business meets the MSME criteria, you can register. This inclusive approach ensures that businesses of all types and sizes are empowered.

The udyam registration online portal also allows businesses to update their details easily. As your business evolves, you may need to update your investment or turnover data. The self-declaration model allows entrepreneurs to do this without external certification, keeping the process simple and transparent.

Additionally, the Udyam registration system is permanent — there is no need for annual renewals. Once you have your udyam registration certificate, it remains valid as long as the enterprise remains operational and meets the MSME classification. This eliminates unnecessary paperwork and lets you focus on growth rather than compliance.

The Indian government continues to integrate Udyam registration with other initiatives like GeM (Government e-Marketplace), TReDS (Trade Receivables e-Discounting System), and income tax portals, streamlining services and offering cross-platform benefits. This ensures registered MSMEs stay aligned with the digital transformation of the Indian economy.

Conclusion

The udyam aadhar framework is more than a registration process — it is a strategic initiative that empowers small businesses to grow, secure funding, and gain recognition. By completing your udyam registration, you unlock a world of opportunities including access to tenders, subsidies, and legal protection. Holding a valid udyam registration certificate is a mark of credibility and eligibility that no business owner should overlook. As India moves towards a more structured MSME ecosystem, being a part of it ensures your business thrives in a competitive environment.

1 note

·

View note

Text

HRD Attestation in Andhra Pradesh: Your 2025 Step-by-Step Guide

In Andhra Pradesh, we like to keep things smooth and simple, whether it’s enjoying delicious biryani or tackling tasks one step at a time. HRD attestation might sound tough, but with the right steps and a little preparation, it’s easier than it seems. Here’s a quick guide to help you get through the process stress-free.

What is HRD Attestation?

HRD attestation is a state-level verification process for educational documents. It confirms that your certificates are genuine and issued by recognized institutions. This step is usually required for work visas, higher studies, or emigration purposes.

Step 1: Gather the Required Documents

Start by collecting the following:

Original Educational Certificates: Degree, diploma, or mark sheets.

Photocopies: At least two copies of each document.

Offer Letter: From the employer or university requesting attestation.

ID Proof: Passport and Aadhar card (both are mandatory).

Passport-Sized Photos: Recent ones.

HRD Application Form: Available at the Department of Higher Education or their official website.

Step 2: Get University Verification

Before submitting your documents for HRD attestation, they must be verified by the issuing university.

Offline Verification: Visit your university with the original certificates. The university will verify the details and stamp the documents for authenticity.

Online Verification: Some universities in Andhra Pradesh, like Andhra University or JNTU, offer online verification. Check with your university for details.

Step 3: Submit to the HRD Office

Once the university stamps your documents, you can proceed to submit them to the HRD department. Andhra Pradesh follows a decentralized system, so you can approach the nearest regional education office.

Here’s what you need to do:

Visit the HRD office in your district or regional center (e.g., Vijayawada, Visakhapatnam, etc.).

Submit the verified documents, photocopies, offer letter, ID proof, and passport-sized photos.

Fill out the HRD application form carefully.

Pay the required attestation fee.

If you’re unsure about the exact office location, visit the official Andhra Pradesh Department of Higher Education website for updated information.

Step 4: Wait for the Verification Process

The HRD department will cross-check your documents with the issuing university. This process typically takes 7–15 working days but may vary depending on the responsiveness of the university.

Step 5: Collect Your Attested Documents

Once the verification is complete, the HRD department will stamp your documents. You can collect the attested certificates in person or request delivery to your address, depending on the office’s procedure.

Example to Understand the Process

Sai, a resident of Vijayawada, received a job offer in Canada. His employer required HRD-attested certificates. Here’s how Sai completed the process:

He visited Andhra University in Visakhapatnam, where his degree was verified and stamped.

He then submitted the stamped documents, offer letter, ID proofs, and application form to the HRD office in Vijayawada.

After 10 days, Sai collected his attested certificates and sent them to his employer in Canada.

Tips for a Smooth Process

Start Early: University verification can take time, so don’t wait until the last minute.

Double-Check Your Documents: Ensure you have all the necessary papers before visiting the HRD office.

Stay Updated: Follow up with the university and HRD office for any delays or updates.

Final Thoughts

HRD attestation in Andhra Pradesh might sound like a complex process, but it’s simple if you follow the steps outlined above. Whether you’re heading abroad for work or education, completing this process will ensure your documents are recognized internationally.

0 notes

Text

HOW TO CHECK THE LEGALITY OF A USED LUXURY CAR?

HOW TO CHECK THE LEGALITY OF A USED LUXURY CAR?

Buying a used luxury car is an exciting decision, but it comes with certain risks. One of the biggest concerns is ensuring that the vehicle is legally owned, properly registered, and free from any financial or legal disputes. Many buyers fall into traps due to missing paperwork, outstanding loans, or stolen vehicles.To avoid such issues, it’s crucial to thoroughly check the legal documents before purchasing a second-hand luxury car. This guide will walk you through all the necessary paperwork, ownership verification steps, and red flags to look for when buying a used high-end vehicle.

1. Verify the Seller’s Identity and Ownership Documents

The first step in ensuring a legal purchase is verifying the seller's authenticity and the ownership details.

Ask for the following documents:

A. Original Registration Certificate (RC Book)

The RC book is the primary proof of ownership.

It should be original (not a photocopy) and list the current owner’s name.

Check if the vehicle is registered as a private or commercial vehicle.

Ensure the registration number, chassis number, and engine number match the details on the car.

B. Government-Issued ID of the Seller

Ask for the seller’s government-issued ID (passport, driver’s license, or Aadhar card).

Cross-check the name on the ID with the name on the RC book to ensure the seller is the rightful owner.

C. Sales Receipt or Previous Sale Agreement

If the car was purchased second-hand before, ask for the previous sale agreement to confirm its ownership history.

D. No Objection Certificate (NOC) from the RTO

If the car is registered in a different state, you need an NOC from the Regional Transport Office (RTO) to transfer ownership.

to know more, visit... https://themotorpedia.com/blog/how-to-check-the-legality-of-a-used-luxury-car/8e6042a8218336aefa1f63217a7a3e56

0 notes