#bitcoinhalving

Explore tagged Tumblr posts

Text

21 Million Reasons You’re Late: Over 93% of Bitcoin Is Already Mined

If Bitcoin were a pizza, you'd be showing up when there's only crusts and napkins left. The party started in 2009, and while the music's still playing, the good seats are already taken. Here's the wake-up call: over 93% of all Bitcoin has already been mined. Let that sink in.

Bitcoin isn't some speculative toy for nerds anymore. It's a global, borderless, uncensorable financial system that keeps growing while most people scroll past it like it's just another meme. But while you're deciding whether or not it's "too late to buy," the scarcity clock is ticking.

The Scarcity Blueprint

Bitcoin's supply is hard-coded. There will only ever be 21 million coins. No bailouts. No printing more. No inflationary policy committee deciding to dilute your stack. It was designed to mimic digital gold, but in many ways, it surpasses it. Bitcoin is portable, divisible, verifiable, and incorruptible. And unlike fiat currencies that print themselves into irrelevance, Bitcoin’s issuance is fixed and transparent.

Where We Are Now

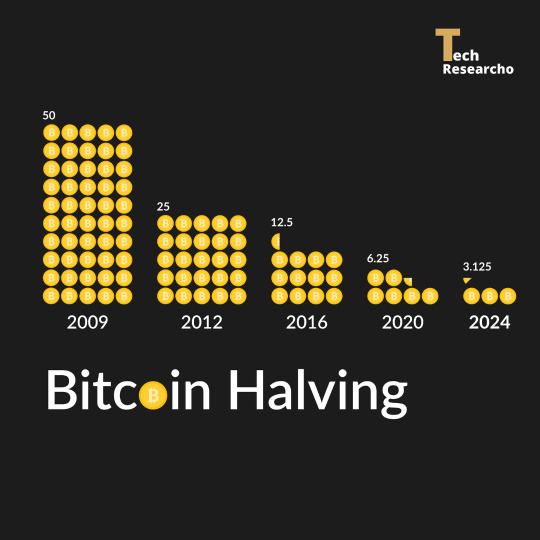

As of May 2025, approximately 19.63 million BTC have been mined. That means less than 1.4 million remain. That’s all that’s left, forever. And those remaining coins won’t be mined overnight. Thanks to Bitcoin’s halving cycles, mining rewards are cut in half every four years. The next halving is in 2028, which will make it even harder to earn new coins.

Here’s the kicker: by the time we hit 2035, over 99% of Bitcoin will have been mined. You read that right. That last 1%? It'll trickle out slowly until 2140. That's 105 more years of mining for a sliver of what was already mostly claimed.

The Race Is On

Most of Bitcoin's supply was mined in its first decade, and a chunk of that was lost forever. Think hard drives in landfills, private keys forgotten, early adopters who had no idea they were holding a future asset harder than gold. Estimates vary, but some say over 3 million BTC may be gone for good.

What does that mean for you? It means that the functional supply is even tighter than it looks. While everyone argues on the internet, whales are accumulating, corporations are making moves, and countries are exploring adoption. This isn't theory anymore. It is game theory in motion.

What You Can Still Do

No, you’re not early. But you're also not too late. Bitcoin is divisible into 100 million satoshis. You don’t have to buy a whole coin. Buy what you can. Learn how it works. Use it. Hold it. Because once the world wakes up, the remaining satoshis are going to get more expensive, not just in dollar terms, but in opportunity cost.

This is your heads-up before the lights flicker and the door closes. We are deep into the Bitcoin era. The protocol doesn't care if you believe in it. It is still running. Still securing. Still producing blocks every 10 minutes, like clockwork.

Final Thoughts

Bitcoin's brilliance is in its brutal honesty. It doesn’t beg for your attention. It doesn’t advertise. It simply is. And in a world full of broken systems, that’s more than enough.

The question isn’t "Should I buy Bitcoin?"

The question is:

How much longer can I afford to ignore it?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#FinancialRevolution#DecentralizeEverything#BitcoinScarcity#SoundMoney#TickTockNextBlock#DigitalGold#Only21Million#CryptoEducation#BTC#BitcoinFacts#StackSats#HardMoney#ScarcityMindset#FutureOfFinance#ProofOfWork#BitcoinHalving#WakeUpTime#BitcoinTruth#cryptocurrency#blockchain#financial education#financial empowerment#digitalcurrency#financial experts#finance#globaleconomy#unplugged financial

3 notes

·

View notes

Text

The rewards for mining Bitcoin are about to be chopped in half for miners in a scheduled event called “the halving.” This anti-inflationary measure is predicted to occur on or about April 17, 2024.

2 notes

·

View notes

Text

Demystifying Bitcoin Halving: Unveiling its Importance and Impact on the Cryptocurrency Market

Bitcoin Halving, a scheduled and programmed event within the Bitcoin protocol, holds profound significance for the cryptocurrency market. As each halving event approaches, it ignites discussions and speculation among investors and enthusiasts worldwide. But what exactly is Bitcoin Halving, why is it important, and how does it affect the cryptocurrency market?

Source: investopedia.com

At its core, Bitcoin Halving is a mechanism designed to control the rate at which new Bitcoins are created. Approximately every four years, the reward for miners who validate transactions on the Bitcoin network is halved. This reduction in the reward serves to maintain the scarcity of Bitcoin, ensuring that the total supply does not exceed 21 million coins—a fundamental aspect of Bitcoin's value proposition.

The importance of Bitcoin Halving lies in its direct impact on the supply dynamics of Bitcoin. By reducing the rate of new coin issuance, halving events introduce scarcity into the market. This scarcity, coupled with the growing demand for Bitcoin, often leads to upward pressure on its price. In essence, Bitcoin Halving serves as a catalyst for supply-demand dynamics, potentially triggering significant price appreciation in the aftermath of each halving event.

However, the impact of Bitcoin Halving extends beyond mere price speculation. These events serve as a litmus test for the resilience and maturity of the cryptocurrency market. They highlight the underlying principles of decentralization, consensus, and algorithmic governance that govern the Bitcoin network. Moreover, Bitcoin Halving events underscore the unique economic incentives that drive the behavior of miners and participants within the ecosystem.

In practical terms, the effects of Bitcoin Halving reverberate throughout the cryptocurrency market. Heightened anticipation and speculation leading up to halving events often result in increased volatility in Bitcoin's price and trading volumes. This volatility can present both opportunities and risks for traders and investors, depending on their risk tolerance and investment horizon.

Furthermore, Bitcoin Halving events serve as a reminder of the protocol's robustness and resilience in the face of external pressures. Despite the fluctuations and uncertainties inherent in the cryptocurrency market, the predetermined and transparent nature of Bitcoin Halving instills confidence in its long-term viability as a digital store of value.

In conclusion, Bitcoin Halving represents a fundamental aspect of the Bitcoin ecosystem, embodying principles of scarcity, decentralization, and economic incentives. Its importance lies not only in its impact on price dynamics but also in its broader implications for the cryptocurrency market as a whole. As each halving event approaches, it serves as a reminder of Bitcoin's evolution and its potential to reshape the future of finance.

In case you want to watch Bitcoin Halving Countdown Clock Live, please visit Coincu.

1 note

·

View note

Text

🚀 Bitcoin's BIGGEST Secret: Why Your "Hold" Strategy Could Make You Rich! 🤯

Thinking about selling your crypto? THINK AGAIN! 💡 This mind-blowing graphic reveals the jaw-dropping journey of Bitcoin from just $0.05 in 2010 to a staggering $41,900 in 2021! That's an incredible 83,800X return for those who simply HELD ON!

This isn't just about past performance; it's a powerful reminder of the immense potential within the crypto market for those with vision and patience. While volatility is often the "price of potential," understanding the long-term game can be a game-changer. 🚀💰

Are you ready to truly understand the dynamics of digital assets and make informed decisions that could redefine your financial future? This isn't just about speculating; it's about being part of the evolution of money itself!

Ready to dive deeper into the world of Bitcoin, explore advanced strategies, and discover how to navigate the crypto landscape like a pro? 👇

Unlock the ultimate guides to understanding, investing in, and securing your Bitcoin! Click here for essential knowledge and insights that could transform your financial journey! 👉 https://t.co/Ttddedmvoc

Don't let short-term fluctuations deter you from long-term gains! What's your crypto strategy? Share in the comments! 👇

#Bitcoin#Crypto#Cryptocurrency#HODL#InvestSmart#Blockchain#FinancialFreedom#MillionaireMindset#WealthCreation#DigitalAssets#BullMarket#CryptoInvesting#BitcoinHalving#FutureOfMoney#PassiveIncome#CryptoNews#FinancialEducation#ViralCrypto#MoneyMoves#LongTermInvesting

0 notes

Text

Bitcoin (BTC) Predicted to Reach $110K by End of June or July 2025

The world of cryptocurrency is evolving faster than ever, and Bitcoin (BTC), the pioneer of this digital revolution, continues to capture global attention. Whether you're a seasoned investor or someone exploring a cryptocurrency exchange in India, understanding Bitcoin’s potential trajectory is crucial. With predictions suggesting that BTC could soar to $110K by mid-2025, now is the time to dive deeper into what this means for you. Let’s explore why this bold forecast is gaining traction and how you can position yourself for success.

Explore why Bitcoin (BTC) could hit $110K by mid-2025, key drivers, risks, and how to prepare for this potential milestone in crypto trading.

Historical Context of Bitcoin’s Price Movements

Bitcoin’s journey has been nothing short of extraordinary. From its humble beginnings at mere cents to surpassing $69K in late 2021, BTC has consistently defied skeptics. Each bull run has been fueled by adoption, technological advancements, and macroeconomic shifts. These patterns suggest that history may repeat itself, making $110K a realistic target if current trends persist.

Factors Driving Bitcoin’s Potential Surge to $110K

Several key factors are aligning to propel Bitcoin toward new heights. Institutional adoption is skyrocketing, with major companies adding BTC to their balance sheets. Additionally, tools like BTC to USDT trading pairs on exchanges have made it easier than ever to buy, sell, and hedge positions. Coupled with the upcoming halving event—which historically reduces supply and boosts price—Bitcoin’s fundamentals remain stronger than ever.

Technical Analysis Supporting the $110K Target

From a technical perspective, Bitcoin’s chart tells an exciting story. Long-term moving averages and Fibonacci extensions indicate significant upside potential. Resistance levels previously seen as insurmountable are now being breached, signaling growing market confidence. If these trends continue, breaking $100K—and eventually reaching $110K—seems inevitable.

Potential Risks and Challenges

While optimism abounds, it’s essential to acknowledge risks. Regulatory uncertainty, geopolitical tensions, and unexpected market crashes could derail Bitcoin’s ascent. Staying informed and using reliable platforms, such as a trusted crypto trading app, will help mitigate these challenges.

How to Prepare for Bitcoin’s Potential Rise

To capitalize on this opportunity, consider diversifying your portfolio while maintaining a long-term mindset. Set clear investment goals, stay updated on market news, and use secure exchanges to trade assets like BTC and USDT efficiently.

Conclusion

The prediction of Bitcoin hitting $110K by June or July 2025 isn’t just speculation—it’s rooted in data, trends, and expert analysis. As we move closer to this milestone, arming yourself with knowledge and leveraging resources like crypto trading apps will be vital. The future of Bitcoin looks bright; don’t miss out on this transformative journey.

FAQs

1. What is the Basis for the $110K Price Target?

The projection stems from historical price patterns, macroeconomic factors, and increasing institutional adoption.

2. How Likely is Bitcoin to Reach This Price by Mid-2025?

While no prediction is guaranteed, strong indicators suggest a high probability of BTC achieving this milestone.

3. Should I Invest in Bitcoin Based on This Prediction?

Invest wisely and only allocate funds you’re comfortable risking. Conduct thorough research before making any decisions.

0 notes

Text

Cryptocurrency & Blockchain Adoption

Cryptocurrency and blockchain technology have revolutionized the financial landscape, offering new ways to transact and store value securely. As key terms like Bitcoin Halving, Decentralized Finance (DeFi), Central Bank Digital Currency (CBDC), and Web3 continue to gain traction, it's essential to understand their impact on the market and regulatory environment. This article delves into the core concepts of cryptocurrency and blockchain technology, explores the implications of Bitcoin Halving, investigates the rise of DeFi platforms, examines the advantages and challenges of CBDCs, analyzes the evolving regulatory landscape, and discusses the potential of Web3 as the future of decentralized internet. 1. Introduction to Cryptocurrency and Blockchain Technology The Basics of Cryptocurrency Cryptocurrency is digital or virtual money secured by cryptography, making it nearly impossible to counterfeit. #BitcoinHalving #CentralBankDigitalCurrency #CryptoRegulation #DecentralizedFinance #Web3 Read the full article

0 notes

Text

Bitcoin halving is a pivotal event in the cryptocurrency world. 🌍 It controls inflation, affects mining, and drives market trends. Learn more in this comprehensive guide:

#BitcoinHalving#Blockchain#Finance#cryptocurrency#bitcoin#cryptoinvesting#defi#cryptonews#cryptotax#bitcoinat100k#bitcoineconomy#financialinnovation

1 note

·

View note

Video

youtube

Pre-halving Crypto Preparation Tips

#CryptoHalving #InvestmentStrategy #CryptocurrencyMarket #BitcoinHalving #EthereumHalving #MarketVolatility #DiversifyPortfolio #ResearchandStayInformed #DollarCostAveraging #StakingOpportunities #LendingOpportunities #BingXCryptoExchange #RiskManagement #LongTermHolding #ProfessionalAdvice #PreHalvingRetrace #BTCPriceIncrease #Psychology #HalvingProcess #CryptoPreparation #CryptoInvestment #CryptoTips #CryptocurrencyTrading #CryptocurrencyInvestor #CryptoMarketInsights #HalvingEvent

#youtube#cryptohalving#investmentstrategy#investment strategy#cryptocurrencymarket#bitcoinhalving#ethereumhalving#marketvolatility#diversifyportfolio

0 notes

Video

youtube

Pre-halving Crypto Preparation Tips

#CryptocurrencyHalving #CryptoPreparation #BitcoinHalving #EthereumHalving #InvestmentTips #MarketVolatility #DiversifyPortfolio #CryptoNews #HalvingEffects #RiskManagement #LongTermInvesting #ProfessionalAdvice #BingXExchange #StakingOpportunities #LendingOpportunities #PriceRetrace #CryptoMarket #CryptoStrategy #HalvingCycle #CryptoInvesting #MarketAnalysis #CryptoExperts #CryptoScarcity #CryptoSupply #CryptoSecurity #CryptoVolatility

#youtube#CryptocurrencyHalving#CryptoPreparation#bitcoinhalving#EthereumHalving#investmenttips#marketvolatility

0 notes

Text

Was ist eigentlich #BitcoinMining? Einfach erklärt mit Untertitel auf #YoutubeDE. Freue mich auf euch und natürlich neue Zuschauer. Klickt www.youtube.com/hakobert

#youtube#hakobert#bitcoin#onestandstudio#blockchain#youtubechannel#youtubestudio#satoshi#altcoins#kryptowelt#bitcoinhalving#halving

0 notes

Text

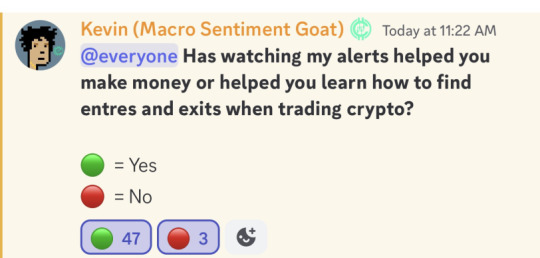

Crypto Signals Discord

87% of our customers make money on our alerts - ⚠️👀 12 new alerts have been posted in the last hours: tradingalerts.online

#cryptocurrency#bitcoin#daytrader#daytrading#forextrading#BitcoinHalving#CMCLive#Runes#TON#Token2049h#WIF

0 notes

Text

Bitcoin Halving Signal inside Metatrader4.

Forex Buy trade inside #Bitcoin #BTCUSD M1 chart ( Halving ) Bullish entry.

( More info inside Official Website: wWw.ForexCashpowerIndicator.com ).

.

🔥 Cashpower Indicator *Lifetime License with right to Future updates version for FREE.

No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees; Lifetime License

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notification

✅ Powerful & Profitable AUTO-Trade Option

.

✅ ** Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

Recommended FX Brokerage to run Cashpower-XM Broker:

https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

1 note

·

View note

Text

Forget the Hype! JPMorgan's Take on the 2024 Bitcoin Halving #BitcoinHalving #Cryptocurrency

BRAUN Spring Sale - Up to 50% off

Disclosure: This post may contain affiliate links. By clicking on a link and making a purchase, I may earn a commission at no additional cost to you.

0 notes

Text

Bitcoin's upcoming halving event has sparked intense speculation and debate within the cryptocurrency community. While some investors express fear and uncertainty (FUD) about potential price impacts, others anticipate a shift towards fear of missing out (FOMO) as the halving approaches.

Analysts offer various perspectives on this topic:

Historical Precedent: Past halving events have typically been associated with significant price rallies post-event, driven by reduced supply and increased demand.

Market Sentiment: FUD surrounding the halving may lead to short-term volatility, but long-term sentiment remains optimistic due to Bitcoin's scarcity and growing adoption.

Institutional Interest: Institutional involvement continues to grow, potentially offsetting FUD with increased investment and demand.

Overall, while FUD may persist in the lead-up to the halving, many analysts anticipate that market sentiment will shift to FOMO as the event draws nearer, catalyzing a potential bullish trend for Bitcoin.

0 notes

Text

Riding the Wave of Curiosity: The world tunes into the Bitcoin Halving event like never before!

Are you ready for the shift? 🌐🔍

0 notes