#fba calculator

Explore tagged Tumblr posts

Text

How To Calculate And Optimize Amazon FBA Storage Fees?

Amazon FBA storage fees can significantly impact your bottom line if not closely monitored. Understanding how these fees are calculated and implementing strategies to reduce them is crucial for long-term success. Consulting with an Amazon FBA accountant can provide deeper insights into your financials and help you build a leaner, more profitable inventory strategy.

0 notes

Text

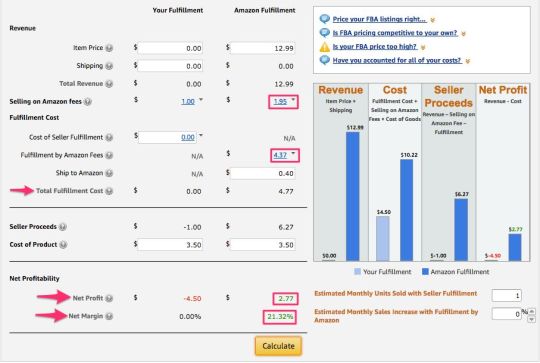

Using the Amazon FBA Calculator to Determine Break-Even Points

Introduction: Mastering Profitability with Amazon FBA

Selling on Amazon through the Fulfillment by Amazon (FBA) program offers numerous benefits, including streamlined logistics and access to a vast customer base. However, to ensure that your business remains profitable, it’s crucial to understand and manage your costs effectively. One key metric in this regard is the break-even point—the point at which your revenue from sales covers all of your costs. Using the Amazon FBA calculator is an effective way to determine your break-even points and make data-driven decisions for your business.

In this article, we’ll guide you through the process of using the Amazon FBA calculator to calculate break-even points and provide tips on how to optimize your pricing strategy to achieve and surpass these critical thresholds.

What is a Break-Even Point?

The break-even point is the sales volume at which your total revenue equals your total costs, resulting in neither profit nor loss. Understanding your break-even point helps you determine how much you need to sell to cover your expenses and start making a profit. In the context of Amazon FBA, this involves accounting for various fees and costs associated with selling on the platform.

Key Costs to Consider for Break-Even Analysis

To accurately calculate your break-even point using the FBA calculator, you need to account for the following costs:

1. Fulfillment Fees

Fulfillment fees are charged by Amazon for storing, picking, packing, and shipping your products. These fees vary based on the size and weight of the item. The FBA calculator provides a detailed breakdown of these fees, allowing you to include them in your cost calculations.

2. Storage Fees

Amazon charges monthly storage fees based on the volume of space your products occupy in their fulfillment centers. There are standard monthly fees and additional long-term storage fees for products stored for more than 365 days. Both types of storage fees should be considered when calculating your break-even point.

3. Referral Fees

Referral fees are a percentage of the product’s selling price that Amazon charges for facilitating the sale. This percentage varies by category, so it’s important to factor in the referral fee relevant to your product category when calculating your break-even point.

4. Cost of Goods Sold (COGS)

The cost of goods sold includes the cost of manufacturing or purchasing your product. This cost is crucial for determining your break-even point as it directly affects your profit margin.

5. Additional Costs

Consider any additional costs associated with selling on Amazon, such as advertising fees, shipping costs (if you handle some aspects of shipping yourself), and any other operational expenses.

Using the Amazon FBA Calculator

The Amazon FBA calculator is a powerful tool for estimating the costs associated with selling on Amazon and determining your break-even point. Here’s a step-by-step guide on how to use the FBA calculator to perform a break-even analysis:

1. Access the FBA Calculator

Visit the Amazon FBA calculator (available through Amazon’s Seller Central or via a web search) and select your product category. You can either enter your product’s ASIN (Amazon Standard Identification Number) or manually input product details to generate cost estimates.

2. Enter Product Information

Input the following details into the calculator:

Selling Price: The price at which you plan to sell your product on Amazon.

Cost of Goods Sold (COGS): The cost to acquire or manufacture the product.

Shipping to Amazon: Any costs associated with sending inventory to Amazon’s fulfillment centers.

3. Review Fee Estimates

The calculator will provide estimates for the following fees:

Fulfillment Fees: Based on the size and weight of the product.

Storage Fees: Calculated based on the volume of space the product occupies.

Referral Fees: A percentage of the selling price.

4. Calculate Total Costs

Add up all the estimated fees and the COGS to determine the total cost per unit. The FBA calculator will show you this total cost, helping you understand your overall expense for each product sold.

5. Determine Break-Even Point

To calculate your break-even point, use the following formula:

Break-Even Point (Units)=Total Fixed CostsSelling Price−Total Variable Costs per Unit\text{Break-Even Point (Units)} = \frac{\text{Total Fixed Costs}}{\text{Selling Price} - \text{Total Variable Costs per Unit}}Break-Even Point (Units)=Selling Price−Total Variable Costs per UnitTotal Fixed Costs

Where:

Total Fixed Costs are the costs that do not change with the number of units sold (e.g., fixed monthly storage fees, advertising costs).

Total Variable Costs per Unit include the sum of fulfillment fees, storage fees (per unit), referral fees, and COGS.

6. Analyze and Adjust

Once you’ve determined your break-even point, compare it with your sales goals and market conditions. If your break-even point is higher than expected, consider strategies to reduce costs or increase your selling price. Conversely, if your break-even point is lower, you have more flexibility to experiment with pricing or expand your product line.

Optimizing Your Break-Even Strategy

1. Reduce Costs

Review your costs regularly and look for opportunities to reduce them. For instance, negotiate better rates with suppliers, minimize storage costs by optimizing inventory levels, or choose cost-effective packaging options.

2. Increase Sales Price

If your break-even point is high, consider increasing your product’s selling price, but ensure that the new price remains competitive in the market. Testing different price points and monitoring customer response can help you find an optimal balance.

3. Improve Efficiency

Streamline your operations to reduce overhead costs. For example, use Amazon’s tools and reports to better manage inventory and sales, or optimize your advertising spend to ensure it contributes effectively to your sales.

4. Expand Product Range

Introducing additional products can help you spread fixed costs across a larger number of units and reduce your overall break-even point. Carefully research and test new products that complement your existing offerings.

Conclusion: Achieve Profitability with Informed Decisions

Using the Amazon FBA calculator to determine your break-even points is a crucial step in managing your Amazon business effectively. By understanding the costs associated with selling on Amazon and calculating your break-even points, you can make informed decisions about pricing, inventory management, and overall business strategy. Regularly using the FBA calculator and adjusting your approach based on the insights it provides will help you maintain profitability and achieve long-term success in the competitive world of e-commerce.

0 notes

Text

Freight Rates Calculator Optimize Your Shipping Costs Effortlessly

The ultimate tool for managing your shipping expenses with our Freight Rates Calculator. Designed to provide accurate and real-time estimates, this calculator helps you determine the most cost-effective shipping options based on weight, dimensions, origin, and destination. Simplify your logistics planning and ensure budget-friendly shipments with the Freight Rates Calculator from America Ship. Whether you're handling small parcels or large freight, our intuitive tool ensures you make informed decisions every time.

0 notes

Text

The Amazon FBA calculator is an essential tool for e-commerce success. It empowers sellers to make informed decisions, enhance profitability, and streamline their operations on the world's largest online marketplace.

0 notes

Text

🎉 Exciting news! 🎉 Introducing the ZonGuru Group Buy! 😍🛍️

Are you an Amazon seller looking for the ultimate toolkit to skyrocket your business? Look no further! With ZonGuru Group Buy, you can access the power of ZonGuru at an unbeatable price! 💪💰

Here's how it works in 3 easy steps:

Step 1: Join our exclusive group of Amazon sellers. 📝 Simply sign up and become part of our amazing community. Get ready to connect with like-minded entrepreneurs and share valuable insights!

Step 2: Unlock the full potential of ZonGuru. ⚡️ Gain access to a suite of powerful tools, including product research, keyword tracking, listing optimization, profit calculation, and more. Maximize your sales and dominate the Amazon marketplace!

Step 3: Enjoy huge savings with our group buy offer. 💸 By pooling our resources together, we're able to negotiate a special discounted rate for ZonGuru. You won't find this deal anywhere else! Save big while getting all the premium features you need to succeed.

Don't miss out on this incredible opportunity to level up your Amazon business! Join the ZonGuru Group Buy today and take your sales to new heights. 🚀💼

Visit our website or DM us for more information. Let's conquer the Amazon world together! 💪🌟

#AmazonSeller #ZonGuruGroupBuy #BusinessTools #AmazonSuccess #Entrepreneurship

2 notes

·

View notes

Text

Don’t Sell on Amazon in 2025 Without Knowing These Fees

If you’re planning to sell on Amazon this year, understanding Amazon seller fees in 2025 is essential.

Whether you're a beginner or an experienced seller, these charges directly affect your profit margins.

Let’s explore what fees Amazon charges, how much, and how to calculate them with the help of tools like the Amazon seller calculator and Amazon FBA fees calculator.

What Are Amazon Seller Fees?

Amazon seller fees refer to the total cost a seller pays to list and sell products on Amazon. These include account fees, referral fees, fulfillment charges, and other applicable costs.

If you’ve ever asked, “How much does Amazon charge to sell?” — this guide is for you.

Types of Amazon Seller Fees in 2025

1. Selling Plan Fees

Amazon offers two selling plans:

Individual Plan: $0.99 per item sold — no monthly fee.

Professional Plan: $39.99/month — ideal for high-volume sellers.

Choose wisely based on your sales goals. Use the Amazon seller calculator to estimate which plan fits best.

2. Referral Fees (Amazon Commission Rates)

Amazon charges a referral fee for every item sold. This fee varies by category:

Category

Referral Fee

Electronics

8%–10%

Clothing & Apparel

17%

Books & Media

15%

Home & Kitchen

15%

Referral fees are a major part of your Amazon seller fees and must be considered when setting prices.

3. Amazon Closing Fee

For media items like books, DVDs, and games, Amazon applies a closing fee — generally $1.80 per item. This is in addition to other Amazon seller charges.

4. Fulfillment Fees (FBA)

If you use Fulfillment by Amazon (FBA), Amazon handles storage, packing, shipping, and customer service — but at a cost.

FBA Fees Include:

Pick & Pack fees

Monthly storage fees

Returns processing fees

Use the Amazon FBA fees calculator to understand how these fees impact your bottom line.

5. Other Amazon Marketplace Fees

High-volume listing fees

Removal and disposal fees

Returns processing charges

These fees may not be visible at first but are a part of the broader Amazon seller fee structure.

How to Calculate Amazon Seller Fees

To estimate your total costs, try tools like:

Amazon selling fees calculator

Amazon seller price calculator

Amazon seller cost calculator

These tools help determine exact charges for referral, fulfillment, and closing fees. They’re a must for smart pricing.

Real Example: Bluetooth Speaker @ ₹2,500

Estimated Amazon Seller Fees:

Referral Fee (Electronics – 10%): ₹250

FBA Fulfillment Fee (Medium-size): ₹160

Storage Fee (Per unit): ₹15

Total Amazon Seller Fees: ₹425

Net Earnings: ₹2,075 (before product cost)

Try calculating with an Amazon seller's pricing tool to match your exact product.

Summary

Many new sellers make the mistake of underestimating Amazon seller fees. But understanding these costs helps:

Price your products correctly

Improve profit margins

Avoid surprise deductions

So, before you start selling, take time to use the Amazon seller calculator and understand how much Amazon charges from sellers.

FAQs

Q1. How much is Amazon selling fee in 2025? It varies by category but ranges from 8% to 17%. Other charges include FBA, closing fees, and storage fees.

Q2. Are there monthly Amazon seller account fees? Yes. The Professional Plan costs $39.99/month, while the Individual Plan has no fixed monthly cost.

Q3. How to estimate total costs on Amazon? Use tools like Amazon seller calculator, FBA fees calculator, and Amazon selling fees calculator.

📌 Pro Tip:

Always keep track of your Amazon seller fees using the Amazon dashboard or trusted third-party calculators. A small oversight can eat into your profits.

#AmazonSellerFees#AmazonFBA#AmazonSellers#EcommerceTips#OnlineSelling#AmazonSelling2025#FBAFees#MarketplaceFees#AmazonBusiness#EcommerceBusiness#SellerStrategy#ProfitMargins#AmazonFeeCalculator#AmazonCharges#AmazonSellingTips

0 notes

Text

weight calculations for 2025

Hey folks, I’ve been selling on Amazon for about a year now and while I’ve had some success, the FBA fees are killing my margins. I feel like no matter how much I adjust my pricing, I’m not making the kind of profit I should. I’m especially confused about the new dimensional weight calculations for 2025 amazon fba fees— https://eboostpartners.com/amazon-fba-fees/ seems like everything changed again. Anyone else struggling with this or found ways to work around it?

2 notes

·

View notes

Text

Amazon Financial Model Template for eCommerce & FBA Sellers

This Amazon Financial Model template is designed for FBA and eCommerce sellers looking to plan, forecast, and scale their business with confidence. Built in Excel, the model includes dynamic revenue projections, COGS, marketing costs, Amazon fees, shipping, inventory planning, and cash flow forecasts. Perfect for new and existing sellers, it helps evaluate profitability, calculate breakeven points, and present investor-ready financials. Fully customizable and easy to use, this template saves time and improves accuracy. Whether you're preparing for fundraising or making data-driven decisions, this tool offers a comprehensive view of your Amazon store’s financial performance.

0 notes

Text

Usando la calculadora FBA para planificar estratégicamente tu negocio

Introducción

Hoy en día, vender en Amazon se ha convertido en una de las formas más populares y efectivas de iniciar un Haga clic para fuente negocio en línea. Con millones de usuarios activos y una infraestructura robusta, Amazon ofrece oportunidades únicas para emprendedores y comerciantes. Sin embargo, con tantas posibilidades, también vienen desafíos significativos. Una herramienta fundamental que puede ayudar a los vendedores a tomar decisiones informadas es la calculadora FBA (Fulfillment by Amazon). En este artículo, exploraremos cómo usar esta herramienta para planificar estratégicamente tu negocio, desde la selección de productos hasta la optimización de precios.

Usando la calculadora FBA para planificar estratégicamente tu negocio

La calculadora FBA es una herramienta esencial que permite a los vendedores estimar costos y calcular beneficios potenciales al utilizar el servicio Fulfillment by Amazon. Pero, ¿cómo funciona exactamente esta herramienta y por qué deberías considerarla en tu estrategia comercial?

1. ¿Qué es la calculadora FBA?

La calculadora FBA es una herramienta gratuita proporcionada por Amazon que ayuda a los vendedores a entender mejor los costos asociados con el uso del servicio FBA. Permite estimar tarifas de envío, costos de almacenamiento y otros gastos relacionados.

2. Cómo funciona la calculadora FBA paso a paso

Para usarla correctamente, sigue estos pasos:

youtube

Acceso a la calculadora: Visita el sitio web oficial de Amazon. Selecciona el producto: Ingresa detalles como el precio del producto y el costo del envío. Revisa las tarifas FBA: La calculadora te mostrará las tarifas de cumplimiento, almacenamiento y otros costos. Calcula tus márgenes: Puedes ver cómo varían tus ganancias según diferentes precios. 3. Errores frecuentes al usar Amazon FBA Calculator

Es común cometer errores al ingresar datos o interpretar resultados. Algunos errores incluyen:

No incluir todos los costos adicionales. Ignorar tarifas estacionales. No considerar descuentos o promociones. 4. Cómo estimar costos y beneficios con la calculadora FBA

Entender tus costos es crucial para establecer precios competitivos. Aquí hay un desglose:

Costos fijos: Alquiler, servicios públicos. Costos variables: Producción, publicidad.

Al combinar estos factores en la calculadora, puedes obtener una visión clara de tus márgenes.

5. Estrategias para maximizar tus beneficios usando la calculadora FBA

Para maximizar tus beneficios:

Ajusta precios según demanda. Ofrece promociones limitadas. Optimiza costes logísticos. Cómo funciona el modelo de dropshipping en Amazon paso a paso

El dropshipping es otro enfoque popular que permite a los vendedores ofrecer productos sin tener que mantener inventario propio.

1. ¿Qué es el dropshipping?

El dropshipping es un modelo comercial donde el vendedor no almacena los productos que vende; en su lugar, compra el artículo de un proveedor externo cuando recibe un pedido.

2. Ventajas del dropshipping en A

0 notes

Text

Amazon Accounting Services: Full Support for Online Sellers

Key Takeaways:

Proper accounting helps Amazon sellers track profitability, prepare for taxes, and avoid cash flow problems.

Amazon accounting services offer specialized support tailored to the unique ecosystem of Amazon’s platform.

Services may include inventory tracking, sales reconciliation, tax prep, and financial forecasting.

Outsourcing saves time, prevents errors, and provides real-time financial insights.

Knowing when to hire an expert vs. doing it yourself is key to scaling smart.

Introduction: The Real Cost of Messy Books

Let’s be real—selling on Amazon can feel like riding a rollercoaster. One minute your product is flying off the shelves, the next you’re juggling returns, ad budgets, and inventory delays. Amidst the chaos, accounting often gets pushed to the back burner.

But here’s the thing: if you’re not keeping tabs on your numbers, you’re not truly in control of your business.

And no, accounting isn’t just some boring backend task. It's how you spot financial leaks, plan for growth, and, most importantly, pay yourself confidently. That’s where amazon accounting services come in.

Unlike general accounting, these services are designed to tackle Amazon’s unique challenges—like reconciling FBA fees, tracking sales tax, understanding your profit margins per SKU, and keeping your business compliant with IRS and state-level tax rules.

This guide breaks down what Amazon accounting services include, who needs them, and how they help sellers stay profitable—not just busy.

Chapter 1: Why Amazon Accounting Is Not Like Regular Bookkeeping

Most traditional bookkeepers aren’t built for eCommerce, let alone Amazon.

When you’re selling on Amazon, you’re not just dealing with basic income and expenses. You’re dealing with:

Marketplace fees

FBA storage costs

Refunds & reimbursements

Ad spend on Amazon PPC

Multiple SKUs and inventory levels

Daily sales across different regions

Each of these line items tells a story. But if you’re lumping everything into “miscellaneous” or “sales income,” you’re missing out on valuable insights.

Imagine trying to understand your business performance without separating PPC costs from returns. Or calculating profit while forgetting that FBA storage has quietly eaten into your margins. These are rookie mistakes that become costly fast.

An expert in amazon accounting services knows how to dig deep into Seller Central reports, extract meaningful data, and transform it into a clear picture of your store’s health.

Chapter 2: What Do Amazon Accounting Services Actually Include?

Not all accounting services are created equal—especially when it comes to selling on Amazon. The eCommerce space has its own set of rules, moving parts, and pressure points. You’re not just running a business; you’re navigating a platform with complex fee structures, intense competition, and constant changes. That’s why cookie-cutter bookkeeping won’t cut it.

The best Amazon accounting services aren’t just data-entry firms—they act like a financial co-pilot, helping you see what’s happening behind your sales figures and supporting your growth. Here’s what to look for in a service that truly understands the Amazon seller landscape:

1. Revenue Reconciliation

Amazon sends payouts every two weeks, but they rarely match up cleanly with your sales figures. Why? Because those deposits already subtract things like fees, returns, and reimbursements. If you’re just recording what hits your bank account, you’re missing the full picture. Proper revenue reconciliation compares your disbursements with actual sales, refunds, and Amazon’s long list of deductions—ensuring you’re reporting real income, not just deposits. This step is the foundation of accurate accounting.

2. Inventory Accounting

For Amazon sellers, inventory is everything. But tracking it goes way beyond knowing how many units are in stock. True inventory accounting includes calculating Cost of Goods Sold (COGS), understanding how Amazon’s storage fees affect your margins, and accounting for shrinkage or obsolete stock. If you’re not matching COGS to your revenue each month, your profits are probably overstated—or worse, you could be losing money and not even know it.

3. Expense Tracking

Sellers often underestimate how many costs quietly eat into their profits. From Amazon’s FBA and referral fees to subscriptions, shipping software, ad spend, product photography, and even office supplies—every expense matters. A proper accounting service categorizes these accurately, helping you deduct every allowable cost while showing you where you may be overspending.

4. Sales Tax Reporting

This is a hot mess if it’s not handled right. Marketplace facilitator laws mean Amazon now collects and remits sales tax in many states on your behalf—but not all. You still need to know where your business has “nexus,” how to register in those states, and what tax Amazon handles vs. what you're responsible for. A knowledgeable accounting service keeps this straight so you stay compliant and avoid nasty surprises.

5. Financial Statements

If you don’t know your numbers, you’re flying blind. Monthly or quarterly financial statements—like profit & loss reports, balance sheets, and cash flow statements—are essential tools. They show how your business is really doing, let you spot trends, and help you make better decisions. Amazon accounting pros provide these reports in plain English, not just accountant-speak.

6. Tax Preparation & Filing

When tax season hits, you don’t want to be digging through spreadsheets and PayPal records. A great service will help you file accurate quarterly estimates and prepare your year-end returns efficiently. The goal? Avoid overpaying, dodge penalties, and minimize the stress tax time usually brings.

7. Consultation & Strategy

Lastly, the best services go beyond the numbers. They act as advisors. That means helping you plan inventory cycles, price more competitively, navigate lending options, and even explore international marketplaces. With a skilled accounting partner, you can stop guessing and start scaling smart.

Chapter 3: The Risks of DIY Amazon Accounting

Doing your own books might feel like a good way to save money—until it costs you.

Here’s what usually goes wrong:

Missed tax deductions

Overpaying sales tax

Inaccurate profit calculations

Miscalculated inventory value

Confusing business vs. personal expenses

Audit triggers due to poor record-keeping

Most sellers aren’t trained accountants, and Amazon’s reports aren’t exactly plug-and-play for QuickBooks or Xero. Missteps lead to penalties, overpayments, or worse—burnout from trying to wear too many hats.

There’s nothing wrong with bootstrapping, but once you’re doing more than $10K/month in sales, outsourcing becomes not just smart—but necessary.

Chapter 4: How to Choose the Right Amazon Accounting Service

Not every accounting firm understands Amazon—and that matters.

What to look for:

Amazon-specific experience: Can they read your Settlement Reports and understand FBA reimbursements?

Tech integration: Do they connect with tools like A2X, QuickBooks, or Xero seamlessly?

Scalability: Will they grow with you as you expand into new marketplaces or sales channels?

Responsiveness: Will you get real human advice, or just cookie-cutter reports?

Data security: Make sure they follow strict data privacy and security standards.

Read reviews, ask for eCommerce client references, and don’t be afraid to quiz them about how Amazon’s fees work. A true expert will speak your language.

Chapter 5: Cost vs. Value—Is It Worth It?

On paper, Amazon accounting services might cost a few hundred dollars a month. But what do you gain?

Saved time (more hours to focus on growth)

Tax savings (smart categorization = better deductions)

Accurate inventory tracking

Cash flow clarity

Stress reduction (especially during tax season)

Peace of mind when an audit notice shows up

Think of it like hiring a mechanic. Could you fix the engine yourself? Maybe. But are you confident you won’t blow something up in the process?

Chapter 6: When to Bring In the Experts

Hiring an accountant might feel like something you only need after your business has taken off—but that mindset can cost you big. In reality, the earlier you invest in professional financial support, the easier it is to avoid costly mistakes, grow with confidence, and keep your sanity intact.

So, how do you know when it’s time to stop doing your books in a spreadsheet and bring in the pros?

Here are some telltale signs it’s time to consider expert help:

✅ You're Selling Over $10,000/Month

Once your revenue crosses five figures monthly, your financials get more complex—fast. There are more transactions, more fees, more opportunities for things to slip through the cracks. At this level, you're not just a hobbyist—you’re running a serious business, and the IRS will treat it that way too. Accurate bookkeeping and tax planning become critical. It’s no longer optional to “figure it out later.”

✅ You’ve Added Multiple SKUs or Marketplaces

Managing one product is simple enough. But once you start juggling multiple SKUs or expanding to other marketplaces (like Shopify, Walmart, or international Amazon sites), tracking COGS, fees, and profit margins by product or platform becomes a full-time job. And without proper systems, it's almost impossible to know what's working and what’s draining your time and cash.

✅ You’re Feeling Overwhelmed During Tax Season

If tax time feels like pulling an all-nighter with 200 browser tabs open, that’s a red flag. Scrambling to find receipts, guess at your income, or explain weird Amazon disbursements to a generalist CPA isn’t sustainable. A specialist in amazon accounting services can streamline this process—filing your taxes accurately while maximizing deductions you didn’t even know you could claim.

✅ You’re Unsure What Your Actual Profit Is

This one is huge. Many sellers confuse revenue with profit, or rely on their Amazon dashboard, which doesn’t paint the full picture. Between ad spend, product returns, platform fees, and hidden costs like inventory shrinkage, your "real" numbers might shock you. If you're not crystal clear on what you keep after everything is paid for, it's time to get expert eyes on your books.

✅ You Want to Make Data-Driven Decisions—But Don’t Trust Your Numbers

Thinking about launching a new product? Scaling up ad spend? Hiring a virtual assistant? These decisions should be driven by solid financial data—not gut instinct. But if your books are messy or outdated, it’s hard to know what you can afford. Clean, reliable reporting from a qualified accountant turns confusion into clarity, and fear into action.

Don’t Wait Until It’s a Mess

Most sellers wait too long. They bring in help when their books are already tangled, receipts are missing, and tax deadlines are looming. But the best time to start working with an accountant is before things get messy. Setting up clean, scalable systems from the beginning saves you time, money, and frustration down the road.

Whether you’re scaling fast or just tired of playing financial whack-a-mole, bringing in experts can be a game-changer. With the right support, you stop reacting—and start running your Amazon business with purpose.

Chapter 7: How It All Comes Together

With the right accounting support, you stop guessing and start leading. You’ll know what products are truly profitable, what expenses to cut, and when to double down on advertising.

And instead of dreading tax season, you’ll approach it with clarity, confidence, and maybe even a little smugness (it’s okay—we won’t tell).

Accounting doesn’t have to be your favorite part of running an Amazon store. But it can be the part that gives you the freedom to keep growing it.

Conclusion: Keep Your Head in the Numbers, Not in the Sand

At the end of the day, selling on Amazon isn’t just about moving products—it’s about building a business. And that business needs a strong financial foundation to survive and thrive.

Whether you’re just starting out or scaling past six figures, getting your finances in order will pay off tenfold. You’ll save time, reduce stress, and—most importantly—make smarter decisions.

Amazon accounting services aren’t a luxury; they’re a lifeline. So stop flying blind. Get the support you need, and keep more of what you earn.

FAQs About Amazon Accounting Services

1. Can’t I just use Amazon’s reports to do my bookkeeping?

You can, but Amazon’s reports are notoriously hard to read and don’t always tie together cleanly. A good accounting service will translate those raw data dumps into usable financial insights.

2. How much do Amazon accounting services cost?

It depends on your sales volume and service needs. Expect to pay anywhere from $150 to $750+ per month. Higher-volume sellers with inventory complexity will pay more.

3. Do I still need accounting software like QuickBooks?

Yes, most services integrate with tools like QuickBooks or Xero. These platforms serve as the home base for your financials, while the service handles the categorization and reconciliation.

4. What if I also sell on Shopify or Walmart?

No problem. Many Amazon-focused accounting firms also support multichannel sellers. Just make sure they have experience syncing all platforms into one clean reporting system.

5. Will they help me with taxes too?

Most do! They can help you file quarterly estimated taxes, prepare year-end returns, and stay compliant with IRS and state-level rules. Just be sure to clarify whether tax filing is included.

0 notes

Text

Importar desde Alibaba a Amazon: evita errores legales comunes

La venta en línea ha revolucionado la manera en que los emprendedores y las empresas hacen negocios. Uno de los métodos más populares para iniciar un negocio es importar productos desde plataformas como Alibaba y venderlos en Amazon. Sin embargo, este proceso puede estar lleno de complicaciones legales si no se maneja correctamente. En este artículo, exploraremos cómo importar desde Alibaba a Amazon sin caer en errores legales comunes, además de ofrecerte recursos valiosos para maximizar tu éxito.

¿Por qué elegir Alibaba para importar productos? Amplia variedad de productos

Alibaba ofrece una plataforma donde puedes encontrar casi cualquier tipo de producto imaginable. Desde electrónica hasta ropa, hay miles de proveedores dispuestos a ofrecerte sus mercancías.

Precios competitivos

Una de las razones principales por las que muchos emprendedores optan por Alibaba es la posibilidad de adquirir productos a precios mucho más bajos comparados con los disponibles en el mercado local.

Oportunidad de personalización

Algunos proveedores en Alibaba permiten la personalización de productos, lo que te da la oportunidad de crear una marca única y diferenciada.

Importar desde Alibaba a Amazon: evita errores legales comunes

Importar productos no es solo cuestión de comprar y vender; hay varios aspectos legales que debes considerar para evitar problemas futuros. Aquí te mostramos algunos aspectos cruciales:

1. Conocer las regulaciones locales e internacionales

Antes de realizar una importación, asegúrate de conocer las leyes tanto del país exportador como del país importador. Esto incluye impuestos, aranceles y regulaciones específicas sobre ciertos tipos de productos.

1.1. Aranceles e impuestos

Los aranceles son impuestos aplicables a las mercancías importadas. Investiga cuáles son https://seoneoadrianarangel.blob.core.windows.net/dec2024/dec2024/uncategorized/como-utilizar-amazon-fba-calculator-para-evaluar-productos-nuevos.html los aranceles relacionados con los productos que deseas importar desde Alibaba.

1.2. Normativas sanitarias y técnicas

Existen regulaciones específicas sobre alimentos, juguetes y productos electrónicos que debes cumplir antes de poder comercializarlos en Amazon.

2. Protección de tu propiedad intelectual

Es fundamental proteger tu marca y tus diseños antes de comenzar a vender en Amazon. Considera inscribir tu marca en el Registro de Marcas (Brand Registry) para evitar falsificaciones.

2.1. Cómo registrar tu marca en Brand Registry Amazon fácilmente

El proceso es relativamente simple pero requiere ciertos documentos como el registro legal y una prueba del uso comercial.

2.2. ¿Qué hacer si alguien infringe tu propiedad intelectual?

Amazon ofrece mecanismos para reportar infracciones rápidamente, pero tener asesoría legal siempre es recomendable.

youtube

3. Seleccionar el proveedor adecuado

No todos los proveedores son iguales; investigar su reputación es clave para evitar problemas legales futuros.

3.1. Verificación del proveedor

Revisa las opiniones y calificaciones del proveedor en Alibaba antes de hacer cualquier compra significativa.

3.2. Solicitar muestras antes de realizar un pedido masivo

Esto te permitirá eval

0 notes

Text

FBA Calculator: qué incluir para un análisis efectivo

En el mundo del comercio electrónico, Amazon se ha posicionado como una de las plataformas más importantes para los vendedores. Con opciones como Fulfillment by Amazon (FBA), es crucial entender cómo funciona y cómo usar herramientas como la FBA Calculator para tomar decisiones informadas sobre tus productos. En este artículo, exploraremos en profundidad cada aspecto relevante a considerar al utilizar la calculadora FBA, brindando una guía completa que te ayudará a maximizar tus beneficios y minimizar tus costos.

FBA Calculator: qué incluir para un análisis efectivo

La FBA Calculator es una herramienta esencial para cualquier vendedor en Amazon. Permite calcular los costos asociados con el uso del programa FBA y, por lo tanto, ayuda a determinar si un producto es viable. Cuando te adentras en el uso de esta herramienta, hay varios factores que debes considerar:

youtube

Costos de envío: Es fundamental tener en cuenta cuánto costará enviar tu producto a los centros de distribución de Amazon. Tarifas de almacenamiento: Amazon cobra tarifas por almacenar tus productos en sus almacenes, así que asegúrate de calcular esto. Comisiones por venta: Cada vez que vendas un producto, Amazon toma una parte como comisión. Costos de producción: No olvides incluir el costo de fabricación o adquisición del producto. ¿Cómo funciona la calculadora FBA?

La calculadora FBA te permite ingresar todos estos datos y obtener un desglose claro de cuál será tu margen de ganancia tras vender un producto específico.

Paso 1: Ingreso de datos básicos

Primero, debes introducir información básica sobre el producto: su precio de venta, costo del producto y dimensiones. Esto ayudará a la calculadora a estimar las tarifas precisas.

Paso 2: Estimación de costos adicionales

Después, tendrás que añadir costos adicionales como el envío a Amazon y las tarifas mensuales asociadas al almacenamiento.

Errores frecuentes al usar Amazon FBA Calculator

Es fácil cometer errores al utilizar la calculadora FBA si no se tiene experiencia previa. Algunos errores comunes incluyen:

No considerar todos los costos: Muchos vendedores solo ingresan los costos más evidentes y olvidan otros gastos ocultos. Ignorar las tarifas cambiantes: Las tarifas pueden variar según la época del año; asegúrate de estar actualizado. No realizar simulaciones con diferentes precios: Probar diferentes escenarios puede darte una mejor idea de cómo fluctúan tus beneficios. Cómo vender en Amazon desde cero: estrategia 2025

Si estás considerando empezar a vender en Amazon, Visitar este sitio es vital contar con una estrategia sólida. Aquí están algunos pasos clave:

Investigación del mercado: Utiliza herramientas como Helium 10 para identificar productos con alta demanda y menor competencia. Creación de una cuenta en Seller Central: Este paso es esencial para comenzar tu andadura como vendedor. Establecer tu inventario inicial: Decide cuántas unidades vas a comprar inicialmente basándote en tu análisis con la FBA Calculator. Prime

0 notes

Text

Cómo usar Amazon FBA Calculator para productos nuevos y emergentes

Introducción

En el competitivo mundo del comercio electrónico, Amazon se ha consolidado como una de las plataformas más poderosas para emprendedores y empresarios. Sin embargo, al ingresar a este vasto mercado, es crucial comprender cómo funcionan las herramientas disponibles para maximizar tus ganancias. Una de estas herramientas es el Amazon FBA Calculator, que permite a los vendedores calcular costos y márgenes de beneficio antes de lanzar un producto.

En este artículo, exploraremos a fondo cómo usar Amazon FBA Calculator para productos nuevos y emergentes, abordando todos los aspectos necesarios para que puedas tomar decisiones informadas. Además, discutiremos diversos temas relacionados con la venta en Amazon, como el dropshipping, la protección de tu marca y estrategias efectivas para crecer en esta plataforma.

¿Qué es Amazon FBA Calculator? Definición y Función Principal

El Amazon FBA Calculator es una herramienta diseñada por Amazon que permite a los vendedores estimar sus costos asociados con el uso del servicio Fulfillment by Amazon (FBA). Esto incluye tarifas de almacenamiento y envío, así como otros gastos relacionados con la venta en la plataforma.

youtube

Importancia de la Calculadora para Nuevos Productos

Para aquellos que están considerando lanzar nuevos productos o ingresar al mercado de productos emergentes, esta calculadora se convierte en un recurso invaluable. Permite analizar la rentabilidad potencial y ajustar precios antes del lanzamiento.

Cómo funciona Amazon FBA Calculator Pasos Iniciales para Usar la Calculadora Accede a la Herramienta: Visita la página oficial de Amazon y busca "FBA Calculator". Selecciona tu Mercado: Asegúrate de elegir el mercado adecuado (por ejemplo, México, Argentina). Ingresa Detalles del Producto: Proporciona información relevante como el precio de venta, costos de producción y dimensiones del producto. Revisa los Resultados: Analiza los márgenes de ganancia y compara diferentes escenarios. Ejemplo Práctico de Cálculo

Supongamos que quieres vender un producto por $20. Si tus costos totales son $12 (incluyendo producción, envío y tarifas), puedes calcular:

Precio de venta: $20 Costos totales: $12 Ganancia: $20 - $12 = $8

Este tipo de análisis te ayudará a decidir si tu estrategia es viable.

Claves para tener éxito vendiendo en Amazon Investigación de Mercado Efectiva

Antes de lanzarte al agua, realiza una investigación exhaustiva sobre qué productos están teniendo éxito en tu nicho. Utiliza herramientas como Helium 10 para hacer un análisis detallado.

Uso Estratégico del Marketing Digital

Implementa estrategias sólidas de marketing digital que incluyan publicidad pagada dentro de Amazon y redes sociales para atraer tráfico hacia tus listados.

Echa un vistazo a este sitio web Errores Comunes al Iniciar en Amazon y Cómo Evitarlos No Usar la Calculadora FBA: Muchos vendedores novatos no utilizan esta herramienta esencial, lo cual puede lleva

0 notes

Text

Cómo usar Amazon FBA Calculator antes de lanzar tu primer producto

Introducción

Lanzar un producto en Amazon puede ser una experiencia emocionante, pero también puede ser abrumadora si no estás preparado. Una de las herramientas más útiles que puedes utilizar antes de dar ese gran paso es el Amazon FBA Calculator. En este artículo, exploraremos cómo usar Amazon FBA Calculator antes de lanzar tu primer producto, así como otros aspectos relevantes para asegurarte de que tu negocio en Amazon sea exitoso.

En el mundo del comercio electrónico, tener claridad sobre tus márgenes de beneficio y costos asociados es fundamental. El aquí Amazon FBA Calculator te permite realizar estos cálculos de manera sencilla y eficaz. Además, abordaremos temas como estrategias efectivas para vender en Amazon, cómo registrar tu marca y mucho más.

Cómo usar Amazon FBA Calculator antes de lanzar un producto ¿Qué es el Amazon FBA Calculator?

El Amazon FBA Calculator es una herramienta diseñada por Amazon para ayudar a los vendedores a calcular los costos asociados con la venta de productos a través del programa Fulfillment by Amazon (FBA). Esta herramienta considera varios factores como tarifas de envío, tarifas de almacenamiento y otros costos operativos que pueden afectar tus ganancias.

¿Por qué es importante utilizar esta calculadora?

Utilizar la calculadora es crucial porque:

youtube

Te ayuda a comprender los costos totales asociados con tus productos. Permite simular diferentes escenarios para ver cómo afectan tus márgenes. Facilita la toma de decisiones informadas sobre qué productos vender. Pasos para acceder al Amazon FBA Calculator Visita la página oficial: Dirígete al sitio web de vendedor de Amazon. Inicia sesión en tu cuenta: Si aún no tienes una cuenta, deberás crear una. Accede a la sección del calculador: Busca "Calculadora FBA" en el menú principal. Introduce los datos del producto: Ingresa información como precio, costo y dimensiones del paquete. Ejemplo práctico con la calculadora

Supongamos que estás considerando vender un gadget electrónico por $50. Introducirías:

Precio por unidad: $50 Costo del producto: $20 Dimensiones: 10 cm x 5 cm x 2 cm Otros gastos relacionados

La calculadora entonces te dará un desglose completo de tus ganancias netas después de deducir todos los costos.

Calcula tus márgenes con Amazon FBA Calculator de forma precisa ¿Cómo interpretar los resultados?

Cuando utilices el Amazon FBA Calculator, recibirás información sobre:

Costos totales Tarifas FBA Ganancia neta

Es vital entender cada componente para poder ajustar tu estrategia según sea necesario.

Errores comunes al usar la calculadora

A continuación se muestran algunos errores frecuentes que debes evitar:

No incluir todos los costos adicionales. Ignorar tarifas estacionales o descuentos especiales. No considerar cambios en precios o costos futuros. ¿Cómo

0 notes

Text

Don’t List Anything Until You Read This! How Much Are Amazon Seller Fees in 2025?

Selling on Amazon seems like a dream, right? Millions of customers, 24x7 visibility, and a chance to grow your business online.

But wait – how much does it actually cost to sell on Amazon? 🤔 That’s where many new sellers get confused.

What Are Amazon Seller Fees?

Think of Amazon seller fees as the cost you pay for using Amazon’s powerful marketplace. These include:

📦 Amazon FBA fees

💰 Amazon seller account fees

📃 Amazon listing fees

🚚 Amazon seller shipping charges

📉 Amazon closing fee

And a few more based on what and how you sell

1️⃣ Amazon Seller Account Charges – Individual vs Professional

You have two options when signing up:

✅ Individual Account (Best for new sellers):

No monthly fee

Pay ₹10 per item sold + other charges

Professional Account (Best for growing businesses):

Fixed ₹499/month + GST

No ₹10/item charge

🔎 Pro Tip: If you sell more than 50 items a month, go with the Professional Plan to save more.

2️⃣ Amazon Listing Fees & Charges

There are no fees to list a product on Amazon. But once it sells, you pay:

Referral Fees (a % of product price, depending on category)

Closing Fees (fixed fee per item)

💡 These are part of Amazon seller pricing and vary across categories like electronics, fashion, groceries, etc.

3️⃣ Amazon FBA Fees – For Storage & Delivery 📦

If you want Amazon to handle everything (packing, storage, shipping), you pay:

FBA storage fees (per cubic foot per month)

FBA pick & pack fees

Amazon delivery charges for seller

Amazon shipping charges for seller

It’s convenient but you can eat within your budget. Use FBA when your volume is high, and speed matters.

4️⃣ Amazon Shipping Cost (Self-Ship & Easy Ship)

If you don’t use FBA, you can go for:

🚚 Easy Ship:

Amazon picks up and delivers it to customers. Charges based on:

Weight

Distance (local, regional, national)

📦 Self-Ship:

You handle shipping on your own. You bear full Amazon seller shipping cost, but you control packaging and speed.

💼 Hidden Fees You Might Miss

Here are a few Amazon seller charges that often surprise new sellers:

Returns processing fee

Storage fee for unsold inventory (FBA)

Amazon merchant fees for advertising/promotions

Amazon private seller fees (if you use branded/private label items)

🧮 How to Calculate Total Cost?

Use Amazon’s fee calculator tool to check how much you’ll pay before listing your product. It shows:

Amazon sales fees

Amazon seller rates by category

Shipping & delivery charges

👉 This helps you price your product smartly and stay profitable.

✅ Summary: What You’ll Typically Pay as an Amazon Seller

Fee Type Approx. Amount

Amazon seller account fees ₹0 or ₹499/month

Amazon listing charges Free

Referral Fee 5% to 20%

Closing Fee ₹5 – ₹45

Shipping Based on size, weight, and method

FBA Fees Based on storage + handling

🙋♂️ Trending FAQs about Amazon Seller Fees (2025)

🔹 Q1. Is selling on Amazon profitable after all these fees?

Yes, if you calculate costs smartly and manage your margins. Using the fee calculator and comparing FBA vs Self-Ship helps you stay ahead.

🔹 Q2. Do I have to pay if my product doesn’t sell?

If you’re using FBA, then yes – you’ll pay storage charges. But for non-FBA, you only pay when an item is sold.

🔹 Q3. What’s the best way to reduce Amazon seller fees?

Bundle low-cost items together

Choose categories with lower Amazon referral fees

Use Self-Ship if volumes are low

Avoid long-term FBA storage

🎯 Final Thought

Selling on Amazon is a golden opportunity – but knowing your costs is the key to success. Now that you understand all Amazon seller account charges, Amazon listing fees, shipping, and FBA costs, you’re ready to start smart.

Start selling confidently, stay aware of Amazon seller rates, and grow your online business 📈.

#AmazonSellerFees#AmazonFBAFees#AmazonSellerIndia#SellOnAmazon#AmazonSellerTips#EcommerceFees#AmazonFBA2025#AmazonCharges#OnlineSellingTips#AmazonSellingGuide

0 notes

Text

FBA Account Reconciliation: Solving Inventory Discrepancies and Maximizing Your Profits

Managing an Amazon FBA (Fulfillment by Amazon) business comes with many advantages, but it also brings its own set of operational challenges especially when it comes to FBA account reconciliation. As sellers scale their business, keeping track of inventory inflow and outflow becomes more complex. Without accurate reconciliation, you may end up losing both inventory and profit without even realizing it.

Common FBA Reconciliation Issues Sellers Face

When sellers attempt FBA reconciliation themselves, they often run into several problems:

Missing or misplaced inventory: Products may go missing in Amazon’s warehouse, and without proper tracking, they remain unaccounted for.

Unclaimed reimbursements: Amazon has policies to reimburse lost or damaged inventory, but if you don’t catch these discrepancies, you lose money.

Complex reports and data overload: Navigating through Amazon’s reports can be confusing and time-consuming for most sellers.

Delayed settlement reports: It becomes difficult to match inventory and reconcile charges with sales when data is delayed or inconsistent.

Overcharged FBA fees: Sometimes, FBA fees may be incorrectly calculated based on product dimensions or weight, affecting profitability.

Why FBA Account Reconciliation is Crucial

Proper FBA account reconciliation ensures that every unit shipped, sold, returned, or damaged is accurately recorded. This process helps:

Identify inventory discrepancies and take corrective action before it impacts your bottom line.

Ensure accurate reimbursements from Amazon for lost, damaged, or incorrectly processed items.

Maintain financial accuracy, allowing for smarter decisions on inventory and pricing.

Avoid unnecessary FBA fees due to incorrect product weight/dimension classifications.

Gain better visibility and control over your inventory flow across Amazon fulfillment centers.

How We Can Help You with FBA Reconciliation

Our FBA account reconciliation services are designed to simplify your Amazon operations and recover revenue you might be missing. Here’s how we can support you:

Detailed inventory audits: We track every SKU and cross-reference it with Amazon’s data to uncover gaps or discrepancies.

Automated and manual claim filing: We ensure you get the reimbursements you’re entitled to by raising accurate claims.

Fee analysis and dispute resolution: Our team checks for FBA overcharges and disputes them with the correct documentation.

Monthly reconciliation reports: You’ll receive transparent, easy-to-understand reports that give a clear view of your inventory and claims.

Conclusion

Don’t let hidden errors eat into your FBA profits. With expert FBA account reconciliation, you can focus on growing your business while we take care of the behind-the-scenes auditing and reporting. Let us help you recover lost revenue, streamline your inventory, and boost your bottom line.

Ready to take control of your FBA inventory? Contact us today to get started with a comprehensive reconciliation strategy tailored for your business!

0 notes