#high speed chip-to-chip interface protocol

Explore tagged Tumblr posts

Text

The Role of ATE in Ensuring Quality and Speed in Electronics

The global Automated Test Equipment (ATE) market is undergoing a transformative evolution, shaped by growing technological integration across end-use sectors and increasing complexity in electronic systems. According to a recent report by Transparency Market Research, the global ATE market, valued at US$ 5.91 Bn in 2020, is projected to expand at a CAGR of 3.9% from 2021 to 2031, crossing the US$ 9.02 Bn mark by the end of the forecast period.

Market Overview: Automated Test Equipment (ATE) comprises devices that automate the testing of integrated circuits (ICs), printed circuit boards (PCBs), and other electronic components. The market has seen steady growth due to its vital role in testing high-performance semiconductors used across consumer electronics, automotive systems, and defense applications. As electronics become more sophisticated, ATE solutions are crucial for ensuring quality, functionality, and reliability.

Market Drivers & Trends

The expansion of the consumer electronics and semiconductor industries is one of the primary drivers of the ATE market. Increasing demand for System-on-Chip (SoC) products in smartphones, tablets, and communication devices necessitates precise and automated testing processes. Additionally, the rise in 5G infrastructure, electric vehicles (EVs), and autonomous technologies is pushing semiconductor manufacturers to invest in advanced ATE systems.

The aerospace and defense sectors are major contributors to market growth. ATE is indispensable in testing mission-critical electronics for aircraft, radar systems, and communication devices, ensuring operational safety and reliability.

Latest Market Trends

Miniaturization of electronics is encouraging the development of compact and cost-effective ATE solutions.

Transition to 28 nm node and other advanced fabrication processes is boosting demand for precision IC testing equipment.

Integration of AI and machine learning in ATE systems for intelligent diagnostics and predictive maintenance.

Increased R&D spending by manufacturers to develop next-gen testing equipment for high-speed digital interfaces and complex circuits.

Key Players and Industry Leaders

The global ATE market is highly competitive, with several major players focusing on product innovation, strategic partnerships, and global expansion. Notable companies include:

National Instruments Corporation

Advantest Corporation

Cobham Limited

Chroma ATE Inc.

Roos Instruments

Teradyne, Inc.

Xcerra Corporation

Virginia Panel Corporation

MAC Panel Company

SPEA S.p.A.

Marvin Test Solutions, Inc.

Testamatic Systems Pvt. Ltd.

Theta Measurement & Control Solutions Pvt Ltd.

These companies are emphasizing cost-effective and scalable solutions to cater to high-volume testing needs in various industries.

Recent Developments

Testamatic Systems Pvt. Ltd. launched an affordable industrial PC in 2020 designed for high-reliability computing tasks, including industrial IoT, data acquisition, and automated testing.

Teradyne, Inc. partnered with MVTS Technologies to distribute refurbished legacy testers, expanding its service offerings in cost-sensitive markets.

Ongoing product innovations and acquisitions across the industry signal aggressive moves to strengthen market positioning and address diverse end-user requirements.

Market New Opportunities and Challenges

Opportunities:

Proliferation of IoT and connected devices demands extensive testing protocols, creating opportunities for ATE suppliers.

Electric and autonomous vehicle (EV/AV) adoption is significantly increasing the need for IC and component testing.

Emerging markets in Asia Pacific, Latin America, and Africa offer untapped potential due to rapid industrialization and digital adoption.

Challenges:

High initial investment costs of ATE systems pose a barrier for small- and mid-sized manufacturers.

Design complexities of high-speed semiconductors and frequent technological changes require constant innovation and upgrades in ATE.

Discover essential conclusions and data from our Report in this sample https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=249

Future Outlook

Looking ahead, the ATE market is poised for steady expansion. With the growing penetration of semiconductor chips in EVs, ADAS systems, and 5G technologies, the role of ATE in ensuring reliability and performance will only increase. Technological advancements such as AI-driven analytics, cloud-based testing, and remote diagnostics are expected to further revolutionize the testing landscape.

Market Segmentation

The global Automated Test Equipment (ATE) market is segmented as follows:

By Type:

Memory ATE

Non-memory ATE

Discrete ATE

By End-use Industry:

Automotive

Consumer Electronics

Aerospace & Defense

IT & Telecommunication

Healthcare

Others (Industrial, Energy & Utility)

Each segment reflects specific testing needs, with consumer electronics and automotive leading the way due to increased digitization and demand for smart features.

Regional Insights

Asia Pacific dominates the global ATE market and is expected to maintain its leadership position through 2031. Key factors include:

Strong presence of semiconductor and electronics manufacturing hubs in China, Japan, South Korea, and Taiwan

Rise in IoT adoption, smart factories, and government-backed industrial automation

Expanding consumer electronics and automotive sectors, particularly in China, which is projected to remain a key growth engine

North America follows closely, driven by advancements in aerospace, defense, and 5G infrastructure, while Europe continues to invest heavily in automotive testing and EV development.

Why Buy This Report?

Comprehensive Market Coverage: Detailed analysis of current trends, key drivers, market restraints, and future projections.

Regional and Segment Analysis: In-depth insights at the regional and segmental level help identify strategic business opportunities.

Competitive Landscape: Full profiles of key players, recent developments, and strategic initiatives.

Future-Ready Intelligence: Understand how emerging trends such as EVs, 5G, and smart devices will shape market demand.

Strategic Recommendations: Actionable insights for stakeholders looking to capitalize on growing demand and optimize ROI.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Want to know more? Get in touch now. - https://www.transparencymarketresearch.com/contact-us.html

0 notes

Text

Controller Area Network (CAN) Interface ICs Market: Demand Analysis and Future Potential 2025–2032

Controller Area Network (CAN) Interface ICs Market, Trends, Business Strategies 2025-2032

Controller Area Network (CAN) Interface ICs Market was valued at 417 million in 2024 and is projected to reach US$ 712 million by 2032, at a CAGR of 8.1% during the forecast period.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103417

MARKET INSIGHTS

The global Controller Area Network (CAN) Interface ICs Market was valued at 417 million in 2024 and is projected to reach US$ 712 million by 2032, at a CAGR of 8.1% during the forecast period.

CAN interface ICs are specialized integrated circuits that facilitate communication between electronic control units (ECUs) in vehicles through the CAN bus system. These ICs serve as critical components in automotive networks, enabling reliable data transmission between sensors, actuators, and control modules while supporting various data rates including 1Mbps, 5Mbps, and 8Mbps configurations.

The market growth is driven by increasing vehicle electrification and the rising adoption of advanced driver-assistance systems (ADAS), which require robust communication networks. However, the semiconductor industry faces challenges such as supply chain disruptions and inflationary pressures, evidenced by the WSTS reporting a slowdown in global semiconductor market growth to 4.4% in 2022 after 26.2% growth in 2021. Key players like NXP Semiconductor, Texas Instruments, and Infineon Technologies are strengthening their market position through technological advancements in CAN FD (Flexible Data-rate) and CAN SIC (Signal Improvement Capability) protocols to address evolving automotive networking requirements.

List of Key CAN Interface IC Companies Profiled

NXP Semiconductors (Netherlands)

Texas Instruments (U.S.)

Infineon Technologies (Germany)

onsemi (U.S.)

Analog Devices (U.S.)

Microchip Technology (U.S.)

STMicroelectronics (Switzerland)

MaxLinear (U.S.)

Renesas Electronics (Japan)

Silicon IoT (China)

Chipanalog (China)

Novosense Microelectronics (China)

Elmos Semiconductor (Germany)

Guangzhou Zhiyuan Electronics (China)

CAES (U.S.)

Huaguan Semiconductor (China)

Segment Analysis:

By Type

Max Data Rate 5Mbps Segment Dominates Due to High Demand in Modern Automotive Systems

The Controller Area Network Interface ICs market is segmented based on data rate capability:

Max Data Rate 1Mbps

Primarily used in legacy automotive systems

Max Data Rate 5Mbps

Max Data Rate 8Mbps

Others

Including specialized high-speed variants

By Application

Automotive Segment Leads as CAN Interfaces are Critical for Vehicle Communication Networks

The market application segments include:

Automotive

Industrial Applications

Aerospace & Defense

Building Automation

Others

By Node Type

Standalone CAN Controller ICs Remain Prevalent for System Integration Flexibility

Segment breakdown by node configuration:

Standalone CAN Controllers

Integrated CAN Transceivers

System-on-Chip Solutions

By Protocol

CAN FD Protocol Gains Traction for Higher Data Throughput Requirements

Protocol standard segments include:

Classic CAN

CAN FD

CAN XL

Specialized Variants

Regional Analysis: Controller Area Network (CAN) Interface ICs Market

North America North America remains a dominant force in the CAN interface ICs market due to its thriving automotive and industrial sectors, coupled with robust technological advancements. The region benefits from stringent regulatory standards in automotive safety and communication protocols, driving demand for high-performance CAN interface ICs with data rates exceeding 8Mbps. Major automotive OEMs and Tier-1 suppliers, particularly in the U.S., continue to integrate advanced CAN solutions into electric and autonomous vehicles. Additionally, industrial automation and building control systems contribute significantly to market growth. Challenges include semiconductor supply chain fluctuations and pricing pressures, though strategic partnerships between local manufacturers and global semiconductor leaders like Texas Instruments and NXP Semiconductor help maintain stability.

Europe Europe’s CAN interface ICs market thrives on its strong automotive heritage and rigorous industrial automation standards. Germany, in particular, leads the region with its well-established automotive industry and emphasis on Industry 4.0 technologies. The EU’s focus on reducing vehicular emissions has accelerated the adoption of CAN bus systems in hybrid and electric vehicles, requiring specialized ICs for optimized communication. While the market faces competition from newer protocols like Ethernet, CAN’s cost-effectiveness ensures sustained demand in mid-range applications. Key players such as Infineon Technologies and STMicroelectronics continue to innovate, offering solutions that comply with Europe’s complex electromagnetic compatibility (EMC) regulations.

Asia-Pacific As the fastest-growing region, Asia-Pacific dominates the CAN interface ICs market in terms of volume, led by China’s expansive automotive production and Japan’s advanced electronics manufacturing. The shift toward smart factories and connected vehicles fuels demand, with local players like Renesas Electronics catering to cost-sensitive segments. However, the market faces fragmentation—while countries like South Korea invest heavily in high-speed CAN solutions, emerging economies prioritize affordability over performance. The rise of electric two-wheelers in Southeast Asia also presents a unique growth avenue for lower-data-rate CAN ICs. Despite recent semiconductor supply chain disruptions, long-term prospects remain strong due to infrastructural investments and urbanization.

South America South America’s CAN interface ICs market is emerging, primarily driven by Brazil’s automotive aftermarket and Argentina’s growing industrial automation sector. Economic instability limits large-scale adoption, but localized manufacturing initiatives are gradually reducing dependency on imports. The region shows preference for durable, medium-speed CAN ICs (1-5Mbps) suited for harsh environmental conditions. While regulatory frameworks lag behind global standards, increasing foreign investments in automotive assembly plants are expected to boost demand for compliant CAN solutions in the coming years.

Middle East & Africa This region represents a niche but growing market, with CAN interface ICs finding applications in oil & gas automation and luxury vehicle segments. The UAE and Saudi Arabia lead in technology adoption, leveraging CAN-based systems for smart infrastructure projects. Challenges include limited local semiconductor expertise and reliance on international distributors. However, partnerships with global manufacturers and increasing focus on industrial digitization suggest steady, long-term growth potential for CAN solutions in critical industries.

MARKET DYNAMICS

Increasing connectivity exposes CAN networks to sophisticated cyber threats that challenge conventional security approaches. Recent studies demonstrate successful remote attacks on vehicle CAN buses through vulnerabilities in interface IC implementations. Addressing these risks requires hardware-based security features like message authentication and encryption accelerators, which were absent from traditional CAN designs. However, retrofitting these capabilities while maintaining backward compatibility presents significant engineering obstacles.

The impending industry shift to CAN XL technology introduces adoption risks across the value chain. While CAN XL promises 10x bandwidth improvements over CAN FD, its phased introduction creates interoperability concerns during transitional periods. Interface IC manufacturers must support multi-protocol capabilities across product generations, increasing inventory complexity. Early adopters face implementation risks, as demonstrated by initial CAN FD rollouts that required subsequent hardware revisions.

Diverging regional standards elevate market entry barriers. Automotive applications particularly face complex certification landscapes, with requirements varying significantly between North America (SAE standards), Europe (EMC Directive), and China (GB/T). Obtaining necessary certifications can consume 12-18 months and increase product development costs by up to 30%, particularly for smaller market participants lacking global compliance resources.

Electric vehicle proliferation creates robust demand for specialized CAN interfaces. Modern EV architectures require isolated CAN solutions capable of withstanding 1,000V+ system voltages while maintaining robust communication between battery management systems, charging controllers, and traction inverters. This application segment is growing at over 25% CAGR, outpacing traditional powertrain CAN applications. Interface IC manufacturers developing optimized solutions for high-voltage environments stand to capture significant market share during the industry’s transition to electrification.

Convergence of CAN networking with edge processing creates value-added opportunities. Modern interface ICs increasingly incorporate local processing capabilities for protocol translation, data filtering, and preprocessing. This trend aligns with the industrial sector’s shift toward distributed control architectures, where over 60% of new installations now implement some form of edge intelligence. Combining CAN interfaces with microcontroller functionality allows manufacturers to deliver complete subsystem solutions rather than discrete components.

Developing automotive and industrial markets offer substantial expansion opportunities. Regions including Southeast Asia and Latin America are experiencing accelerated adoption of CAN-based systems as local manufacturing capabilities mature. Government initiatives supporting domestic vehicle production and Industry 4.0 adoption are creating new demand centers—Thailand’s automotive sector alone requires 300,000+ CAN nodes annually for localized vehicle production. Strategic partnerships with regional players provide established manufacturers pathways to capitalize on these high-growth markets.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103417

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global CAN Interface ICs Market?

Which key companies operate in Global CAN Interface ICs Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

[IOTE2025 Shenzhen Exhibitor] SHANGHAI RSID SOLUTIONS will be exhibited at IOTE International Internet of Things Exhibition

With the rapid development of artificial intelligence (AI) and Internet of Things (IoT) technologies, the integration of the two is becoming increasingly close, which is profoundly affecting the technological innovation of all walks of life. AGIC + IOTE 2025 will present an unprecedented AI and IoT professional exhibition event, with the exhibition scale expanded to 80,000 square meters, focusing on the cutting-edge progress and practical applications of "AI+IoT" technology, and in-depth discussion of how these technologies will reshape our future world. It is expected that more than 1,000 industry pioneers will participate to exhibit their innovative achievements in smart city construction, Industry 4.0, smart home life, smart logistics systems, smart devices and digital ecological solutions.

SHANGHAI RSID SOLUTIONS CO., LTD will participate in this exhibition. Let us learn about what wonderful displays they will bring to the exhibition.

Exhibitor Introduction

SHANGHAI RSID SOLUTIONS CO., LTD

Booth number: 9B31-2

August 27-29, 2025

Shenzhen World Convention and Exhibition Center (Bao'an New Hall)

Company Profile

Shanghai RSID SOLUTIONS Co., Ltd., headquartered in Shanghai, is a professional one-stop equipment supplier specializing in card manufacturing and application solutions. The company is dedicated to providing complete solutions for smart card and RFID production, personalization, and more. With more than 20 years of industry experience and the trust of many users, our company aims to become the most professional international supplier in China. Through our global network, we offer tailored pre-sales and after-sales services to meet diverse customer needs. Whether you are a card manufacturer, personalization center, or card issuer, we provide reliable services and abundant resources to support your business.

Product Recommendation

4 edges master is engineered exclusively for high-efficiency, vibrant color edge printing on cards consumping low. Fearturing 4 removable card jigs, each with a 400-card capacity, it can achieve automatically four edges printing in a single pass, reaching speeds to 4000 UPH. Adapting CMYKW printing creates colorful and up to 1440 dpi images, beyond traditional colored core laminating process. It’s also a cost-effective alternative gold/silver stamping to stimulate gold/silver color. What’s more, its material versatility extends to metal, glass, wood, and silicone surfaces. New templates can be inverted within seconds for quick job changes. Environmentally friendly UV inks ensure toxin-free, virtually odorless printing. The printer obtains sufficient certifications including CE, FCC, RoHS, REACH, and HC for guaranteed compliance and safety.

Efficient & Precise:

Automatically saves test results and waveforms with pass/fail judgment. Short test time (typically 0.5s).

Flexible Operation:

Supports three control modes: Manual, Digital I/O (DIO), and external software control (via Windows registry).

Multi-format Output:

Generates log files (TXT), waveform images (JPEG), and data files (CSV) for analysis and archiving.

Portable & Reliable:

USB bus-powered with compact dimensions (125×165×40mm). Ideal for lab and field applications.

PT300 : Next-Gen Industrial-Grade Reader/Writer, Supporting parallel testing for high efficiency.

Comprehensive Product Line:

Covers contact/contactless/dual interface reading/writing & electrical testing. Compatible with smart cards, modules, semiconductor chips, and products.

Exceptional Performance:

Contact interface: 1.2~5.5V wide voltage range | 2A high-current output

Contactless interface: 5~25dBm adjustable RF power | parameter testing (capacitance/Q-value)

Modular Flexibility:

Modular design for chassis compatibility and seamless expansion.

Protocol Compatibility:

Supports ISO7816, ISO14443, I2C, SPI, and Class D high-end requirements.

Applicable scenarios:

Industrial manufacturing, laboratory testing and R&D fields. It is on par with international brand readers in terms of high speed, high precision and high compatibility.

At present, industry trends are changing rapidly, and it is crucial to seize opportunities and seek cooperation. Here, we sincerely invite you to participate in the IOTE 2025, the 24th International Internet of Things Exhibition, Shenzhen Station, held at the Shenzhen World Convention and Exhibition Center (Bao'an New Hall) from August 27 to 29, 2025. At that time, you are welcome to discuss the cutting-edge trends and development directions of the industry with us, explore cooperation opportunities, and look forward to your visit!

0 notes

Text

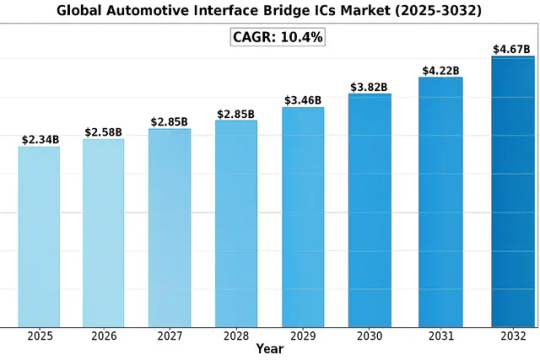

Global Automotive Interface Bridge Integrated Circuits Market is projected to reach US$ 5.67 billion by 2032, at a CAGR of 10.4%

Global Automotive Interface Bridge Integrated Circuits Market size was valued at US$ 2.34 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 10.4% during the forecast period 2025-2032.

Automotive Interface Bridge ICs are specialized semiconductor devices that facilitate communication between different protocols in vehicle electronics systems. These chips bridge interfaces such as USB to UART/I2C/SPI, PCIe to SATA, or other protocol translations critical for modern automotive architectures. Key types include USB Interface ICs, PCI/PCIe Interface ICs, and SATA Interface ICs, which enable seamless data transfer between infotainment systems, ADAS components, and vehicle control units.

The market growth is primarily driven by increasing vehicle electrification and the rising adoption of advanced driver-assistance systems (ADAS), which require robust interface solutions. While North America currently leads in technological adoption, Asia-Pacific shows the highest growth potential due to expanding automotive production in China and India. Major players like NXP, Toshiba, and Infineon Technologies are investing heavily in developing next-generation bridge ICs to support automotive Ethernet and 5G-V2X applications, further accelerating market expansion.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-automotive-interface-bridge-integrated-circuits-market/

Segment Analysis:

By Type

USB Interface IC Segment Leads Due to Proliferation of Connected Vehicle Technologies

The market is segmented based on type into:

USB Interface IC

Subtypes: USB 2.0, USB 3.0, USB-C, and others

PCI/PCIe Interface IC

Subtypes: PCIe 3.0, PCIe 4.0, and others

SATA Interface IC

Other Interfaces

Includes I2C, SPI, UART, and CAN bus bridges

By Application

Passenger Vehicle Segment Dominates with Increasing Demand for In-Vehicle Connectivity

The market is segmented based on application into:

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Autonomous Vehicles

By Vehicle System

Infotainment Systems Account for Major Market Share Due to Rising Consumer Demand

The market is segmented based on vehicle system into:

Infotainment Systems

Advanced Driver Assistance Systems (ADAS)

Telematics Systems

Powertrain Control Systems

By Technology

Wired Interface Bridges Maintain Dominance While Wireless Bridges Show Rapid Growth

The market is segmented based on technology into:

Wired Interface Bridges

Wireless Interface Bridges

Hybrid Interface Bridges

Regional Analysis: Global Automotive Interface Bridge Integrated Circuits Market

North America The North American market for automotive interface bridge ICs is characterized by strict automotive safety regulations and rapid adoption of vehicle electrification technologies. The U.S. leads regional demand, driven by high automotive OEM concentration and investments in autonomous driving systems exceeding $15 billion annually. Canada’s growing EV market (projected 20% of total sales by 2025) creates additional demand for advanced interface solutions. USB and PCIe interface ICs dominate applications, particularly in premium vehicle infotainment systems. However, supply chain disruptions and semiconductor shortages have temporarily impacted regional growth.

Europe Europe presents the most technologically mature market for automotive interface bridge ICs, with German automakers driving innovation. The region’s focus on vehicle connectivity (with 90% new cars featuring embedded connectivity by 2025) fuels demand for high-speed interface solutions. The EU’s Type Approval regulation imposes strict electromagnetic compatibility requirements on all automotive electronics, creating a competitive advantage for established players like NXP and Infineon Technologies. While Western Europe maintains technological leadership, Central and Eastern European markets show growing potential as automotive production hubs.

Asia-Pacific As the global automotive production hub, Asia-Pacific accounts for over 60% of interface bridge IC consumption, with China leading both production and innovation. Chinese domestic IC manufacturers are rapidly catching up technologically while offering competitive pricing. The Indian market shows particularly strong growth potential, with automotive electronics demand expanding at 15% CAGR. Japan maintains leadership in quality standards through automotive-grade IC certifications adopted across the region. However, price sensitivity among local OEMs and protectionist policies in some countries create market entry barriers for international suppliers.

South America The South American market remains constrained by economic volatility, though Brazil and Argentina demonstrate steady growth in automotive electronics adoption. Local content requirements in Brazil promote domestic IC production for basic interface applications, while premium vehicles continue relying on imports. The region’s aftermarket sector shows unexpected strength, with interface bridge IC demand growing for vehicle upgrade and retrofit solutions. However, infrastructure limitations and currency fluctuations continue to deter significant market expansion.

Middle East & Africa This emerging market is witnessing gradual growth through luxury vehicle sales in GCC countries and increasing Chinese automotive imports across Africa. The UAE serves as a regional technology hub with advanced vehicle connectivity adoption. South Africa’s automotive manufacturing sector drives steady demand, though mainly for basic interface solutions. Market development is hampered by limited local technical expertise and reliance on international distribution channels, creating opportunities for suppliers offering comprehensive technical support services.

MARKET OPPORTUNITIES

Vehicle-to-Everything (V2X) Communication to Create New Demand

The emerging V2X ecosystem presents significant opportunities for interface bridge IC manufacturers. As vehicles increasingly connect with infrastructure, other vehicles, and urban systems, they require sophisticated bridging solutions between communication protocols like DSRC, C-V2X, and traditional automotive networks. Regulatory mandates in several regions are accelerating V2X adoption, with China planning nationwide implementation by 2025 and the EU considering similar requirements. Interface bridge ICs that can seamlessly connect these diverse communication technologies while meeting stringent automotive requirements will be well-positioned to capitalize on this growth.

Software-Defined Vehicles to Drive Long-Term Growth

The automotive industry’s shift towards software-defined vehicles represents a paradigm shift that will require new generations of interface bridge solutions. These vehicles require flexible hardware platforms that can support evolving software features through over-the-air updates. This creates demand for programmable interface bridge ICs that can adapt to changing protocol requirements and feature sets without hardware modifications. Leading semiconductor companies are already developing solutions that combine traditional bridging functionality with FPGA-like programmability, opening new market opportunities.

Additionally, the growing importance of cybersecurity in connected vehicles presents opportunities for interface bridge ICs with built-in security features. ICs that can implement protocol-level security while maintaining real-time performance are becoming increasingly valuable in automotive designs.

AUTOMOTIVE INTERFACE BRIDGE INTEGRATED CIRCUITS MARKET TRENDS

Rising Automotive Electrification to Drive Market Growth

The global automotive industry is undergoing a transformative shift toward electrification and advanced connectivity, significantly boosting the demand for interface bridge ICs. With the automotive semiconductor market projected to reach $78 billion by 2027, bridge ICs are becoming critical components in modern vehicles. These chips enable seamless communication between legacy protocols like UART or I2C and contemporary interfaces such as USB-C or PCIe, supporting evolving in-vehicle infotainment (IVI) and advanced driver-assistance systems (ADAS). The proliferation of electric vehicles (EVs), expected to account for 30% of global vehicle sales by 2030, further amplifies this demand as automakers integrate more electronic control units (ECUs) requiring robust interface solutions.

Other Trends

Automotive Connectivity and 5G Integration

The integration of 5G networks in vehicles is accelerating the need for high-speed data bridges between telematics systems and onboard sensors. Automotive interface bridge ICs facilitate low-latency data transfer, enabling real-time V2X (vehicle-to-everything) communication. With over 50 million connected cars on the road globally, automakers are prioritizing chips that support multi-protocol interoperability, such as USB to CAN or Ethernet to SPI. This trend is particularly prominent in premium vehicles, where over 80% of new models now feature embedded connectivity modules.

Miniaturization and Power Efficiency Innovations

As automotive electronics become increasingly compact, interface bridge ICs are evolving to meet stringent space and power constraints. Leading manufacturers are leveraging 28nm and 16nm process nodes to deliver chips with 40% lower power consumption compared to previous generations. This is critical for EVs, where energy efficiency directly impacts range. Additionally, the trend toward zone-based E/E architectures in vehicles is driving demand for bridge ICs with integrated power management, reducing component counts by up to 25% in next-gen vehicle designs.

COMPETITIVE LANDSCAPE

Key Industry Players

Rapid Electrification and Connectivity Demands Drive Strategic Market Expansion

The global automotive interface bridge IC market exhibits a moderately consolidated competitive landscape, with major semiconductor companies and specialized interface solution providers vying for market share. NXP Semiconductors leads the segment, commanding approximately 22% market share in 2023, owing to its comprehensive portfolio of CAN FD and Ethernet bridge solutions for advanced driver-assistance systems (ADAS).

Infineon Technologies and Texas Instruments maintain strong positions through their vertical integration capabilities and strategic partnerships with Tier 1 automotive suppliers. The companies have collectively invested over $450 million in automotive interface R&D during 2022-2023, focusing on high-speed data transmission for electric vehicle architectures.

Japanese players like Toshiba and Fujitsu dominate the Asian market, particularly in cost-sensitive segments, with specialized bridge ICs for infotainment systems and hybrid vehicle power management. Their regional manufacturing advantages and JIS-compliant solutions give them an edge in domestic OEM supply chains.

Meanwhile, Microchip Technology and Silicon Labs are gaining traction through innovative USB-C and wireless bridge solutions, capitalizing on the growing demand for in-vehicle connectivity. Both companies have expanded production capacity by 30% since 2021 to meet the surging demand from European and North American automakers.

List of Key Automotive Interface Bridge IC Companies

NXP Semiconductors (Netherlands)

Infineon Technologies (Germany)

Texas Instruments (U.S.)

Toshiba Electronic Devices & Storage Corporation (Japan)

Fujitsu Semiconductor (Japan)

Microchip Technology Inc. (U.S.)

Silicon Laboratories (U.S.)

ROHM Semiconductor (Japan)

Cypress Semiconductor (U.S.)

Learn more about Competitive Analysis, and Forecast of Global Automotive Interface Bridge IC Market : https://semiconductorinsight.com/download-sample-report/?product_id=95784

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Automotive Interface Bridge ICs?

-> Automotive Interface Bridge Integrated Circuits Market size was valued at US$ 2.34 billion in 2024 and is projected to reach US$ 5.67 billion by 2032, at a CAGR of 10.4% .

Which companies lead the automotive interface IC market?

-> Market leaders include NXP Semiconductors (22% share), Toshiba (18%), Infineon Technologies (15%), followed by Microchip, Silicon Labs, and Renesas.

What drives demand for automotive interface ICs?

-> Key drivers are in-vehicle networking requirements (growing at 11% CAGR), EV adoption, and advanced driver assistance systems (ADAS) needing high-speed data bridges.

Which interface standard dominates automotive applications?

-> PCIe interface ICs account for 38% market share due to high bandwidth needs, while USB-C bridges are the fastest growing segment (14% CAGR).

How is the supply chain evolving?

-> Major players are establishing regional manufacturing hubs (e.g., NXP’s Singapore facility) and developing automotive-grade (AEC-Q100) interface solutions to meet quality requirements.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

The Future in Your Hand: A Deep Dive into the 2025 Autel MaxiIM KM100 Key Programming Tool

2025 Autel MaxiIM KM100 Key Fob Programming Tools KM100X key Programmer 60s Key Generation OBD IMMO Key Learning Key Free Update

👍👍Buy now: https://youtu.be/ii9ACScdZh8

🔥🔥 DISCOUNT: 51% 🔥🔥

The world of an automotive locksmith is one of constant evolution. Gone are the days of simple key cutting; today's professionals navigate a complex digital landscape of transponders, immobilizer systems, and an ever-growing variety of key fob technologies. In this high-stakes environment, having the right tool is not just an advantage—it's a necessity. Enter the 2025 Autel MaxiIM KM100, a key fob programming tool that is rapidly becoming the go-to device for locksmiths and automotive technicians seeking efficiency, power, and versatility. This comprehensive tool, with its promise of 60-second key generation, seamless OBD IMMO key learning, and free lifetime updates, is more than just a key programmer; it's a future-proof investment in your business.

Unpacking the Powerhouse: A Revolution in Key Programming The Autel MaxiIM KM100 is engineered to streamline the often-intricate process of key programming. Its user-friendly interface, built on a responsive Android touchscreen, guides technicians through complex tasks with remarkable ease. But beyond its intuitive design lies a suite of powerful features that truly set it apart.

The Game-Changer: 60-Second Key Generation Time is money, and in the fast-paced world of automotive services, every second counts. The KM100's standout feature is its ability to generate a universal smart key in as little as 60 seconds. This incredible speed is a significant leap forward, allowing professionals to serve more customers and tackle more jobs in a single day. The process is remarkably straightforward: identify the vehicle, select the desired key, and the KM100 handles the rest, programming the key with the correct data and frequency. This rapid generation, combined with a broad vehicle coverage of over 700 models, makes it an indispensable tool for any mobile locksmith or busy workshop.

Seamless Integration with OBD IMMO Key Learning The immobilizer (IMMO) system is the digital gatekeeper of modern vehicles. The Autel MaxiIM KM100 simplifies the often-daunting task of IMMO key learning by connecting directly to the vehicle's On-Board Diagnostics (OBD) port. This direct communication allows the tool to read and write key data, add new keys, and even handle "all keys lost" situations for a wide range of makes and models. The guided on-screen instructions demystify the process, making it accessible even to technicians who are new to key programming. This seamless integration eliminates the need for complex and time-consuming procedures, reducing the risk of errors and ensuring a smooth and successful key learning process.

A Transponder Titan: Reading, Writing, and Cloning At the heart of modern car keys lies the transponder chip. The KM100 is a true powerhouse when it comes to transponder management. It can read, write, and clone a vast array of transponder types, offering a versatile solution for key duplication and replacement. The device also boasts transponder editing capabilities for 20 different protocols, providing an advanced level of control for experienced professionals. Whether you need to create a new transponder from scratch or clone an existing one, the KM100 offers the flexibility and power to get the job done right. Furthermore, its ability to simulate transponders can be a lifesaver in emergency situations where a physical chip is not readily available.

Demystifying the Designations: KM100 vs. KM100X A common point of confusion for potential buyers is the distinction between the Autel MaxiIM KM100 and the KM100X. Extensive research and user feedback indicate that the core functionality of these two models is largely identical. The "X" designation often signifies a newer release or a specific retail package that may include additional accessories, such as the Autel APB112 Smart Key Simulator. The APB112 further expands the tool's capabilities, particularly in scenarios involving data collection from the ignition coil and smart key simulation for certain Toyota and Hyundai models. For most users, however, the fundamental power and performance of the KM100 and KM100X are the same, offering the same exceptional key programming experience.

An Investment That Grows With You: The Power of Free Lifetime Updates In the ever-advancing automotive industry, a tool that doesn't evolve is a tool that quickly becomes obsolete. Autel addresses this challenge head-on by offering free lifetime software updates for the MaxiIM KM100. This is arguably one of its most compelling features. These regular updates continuously expand the tool's vehicle coverage, add new functionalities, and refine existing processes. A prime example is the February 2025 update, which introduced new transponder generation and cloning capabilities for a wider range of vehicles. This commitment to ongoing development ensures that your investment in the KM100 is future-proof, allowing you to service the latest vehicles and tackle emerging key technologies without incurring additional subscription fees.

From the Front Lines: What Professionals Are Saying The true measure of any tool is its performance in the real world. Across locksmith forums and professional communities, the Autel MaxiIM KM100 has garnered significant praise for its speed, ease of use, and comprehensive features. Many users highlight the 60-second key generation as a game-changer for their daily workflow. However, it's also important to note the valuable insights shared by experienced technicians. Some users advise caution when working on high-end European vehicles, suggesting that while the KM100 is a versatile tool, more specialized equipment may be preferable for these complex systems. This feedback underscores the importance of understanding the tool's capabilities and limitations to ensure the best possible outcomes for your clients.

The Verdict: Is the Autel MaxiIM KM100 Your Next Essential Tool? The 2025 Autel MaxiIM KM100 Key Fob Programming Tool stands as a testament to innovation in the automotive locksmith industry. Its powerful combination of rapid key generation, intuitive OBD IMMO learning, and extensive transponder capabilities makes it a formidable asset for any professional. The promise of free lifetime updates ensures that this tool will remain a relevant and valuable part of your arsenal for years to come.

For the mobile locksmith, the busy automotive workshop, or the technician looking to expand their service offerings, the Autel MaxiIM KM100 presents a compelling value proposition. It is more than just a key programmer; it is a comprehensive solution that empowers you to work smarter, faster, and more efficiently. In a world where vehicle technology is constantly advancing, the Autel MaxiIM KM100 is the key to staying ahead of the curve.

0 notes

Text

A Deep Dive into Interface & Connectivity Semiconductors: Market Opportunities and Challenges

The rapid acceleration of digital transformation across industries has ushered in a critical dependence on robust data communication systems. At the heart of these systems lie interface and connectivity semiconductors, which serve as essential conduits for transferring data between integrated circuits, sensors, and peripheral devices. Whether it is automotive, consumer electronics, industrial automation, or telecommunications, the ability of devices to communicate effectively defines their functionality and performance. The significance of these semiconductors is steadily increasing as devices grow smarter, more connected, and more autonomous.

Connectivity demands are evolving in complexity and scope. Advanced applications require high-speed data transmission, low latency, signal integrity, and resilience against electromagnetic interference. The role of interface and connectivity semiconductors, therefore, is not just to bridge data paths but to ensure seamless, reliable communication under increasingly demanding conditions. As markets grow more competitive and consumer expectations rise, semiconductor manufacturers are tasked with not only meeting technical requirements but also innovating at the architectural level to stay ahead of the curve.

The Role of Interface & Connectivity Semiconductors

Interface and connectivity semiconductors provide the vital infrastructure that allows systems and subsystems within electronic devices to interact efficiently. These chips manage data protocols, handle voltage level translation, and mitigate noise in data paths, enabling high-fidelity signal transfer. Their functionality extends from simple serial interfaces to sophisticated high-bandwidth interconnects that support emerging technologies like artificial intelligence, 5G, and autonomous vehicles.

As electronic systems grow more complex, the role of these semiconductors becomes increasingly critical. In automotive systems, for instance, various subsystems—ranging from infotainment units to advanced driver-assistance systems (ADAS)—need to communicate swiftly and reliably. Similarly, in consumer electronics, users demand seamless interaction between components such as cameras, displays, and storage devices. Interface and connectivity semiconductors make these interactions possible by supporting a diverse array of standards and physical media.

Furthermore, these semiconductors play a foundational role in enhancing system scalability and modularity. Designers can develop systems with swappable modules or components without sacrificing performance, thanks to well-engineered interface chips. The abstraction they provide allows manufacturers to iterate on designs without overhauling the entire architecture, thus accelerating time-to-market and reducing development costs.

Market Dynamics Driving Growth

The market for interface and connectivity semiconductors is experiencing robust growth, driven by several converging trends. First and foremost is the explosive proliferation of connected devices, from smartphones and tablets to industrial sensors and medical devices. The demand for high-speed, reliable communication in these devices has propelled investments in advanced interface technologies.

The automotive sector, in particular, represents a burgeoning opportunity. With the shift toward electric and autonomous vehicles, there is a growing need for high-bandwidth communication channels between components like LiDAR sensors, cameras, and central processing units. This trend is complemented by the increasing complexity of vehicle infotainment systems and the integration of advanced navigation and telematics.

Meanwhile, in the industrial space, the advent of Industry 4.0 has catalyzed a surge in machine-to-machine communication. Factories are evolving into smart manufacturing hubs, requiring resilient and fast communication among robots, controllers, and cloud-based analytics platforms. Interface and connectivity semiconductors serve as the glue that holds these complex networks together, ensuring that data flows securely and efficiently.

Technological Innovations and Trends

The evolution of interface and connectivity semiconductors is marked by significant technological advancements aimed at overcoming traditional limitations. One of the key trends is the miniaturization of components. As devices become more compact, there is a need for smaller semiconductor packages that can still handle high data rates and power requirements. Innovations in 3D stacking and system-in-package (SiP) designs are addressing these needs effectively.

Another important trend is the integration of multiple interface standards within a single chip. Multi-protocol transceivers reduce the number of components required, simplifying board layout and reducing power consumption. This is particularly beneficial in space-constrained applications such as wearables and mobile devices. Furthermore, advances in signal conditioning, such as equalization and pre-emphasis, are enhancing signal integrity over long and noisy channels.

Power efficiency is also a growing concern, particularly in battery-operated and environmentally sensitive applications. Engineers are developing interface semiconductors that consume less power without compromising performance. These improvements contribute to longer device lifespans and lower environmental impact. As a result, sustainability has become an increasingly important design consideration in the semiconductor industry.

Challenges in Development and Deployment

Despite the exciting growth prospects, the development and deployment of interface and connectivity semiconductors come with a host of challenges. One of the primary hurdles is ensuring compatibility with a wide range of industry standards and legacy systems. Manufacturers must strike a balance between supporting new protocols and maintaining backward compatibility, which often requires complex design strategies.

Signal integrity is another critical challenge, especially as data rates increase. As frequencies rise, the susceptibility to noise, crosstalk, and electromagnetic interference also grows. This necessitates meticulous engineering of both the semiconductor and the surrounding PCB layout to maintain performance. Additionally, thermal management becomes a more pressing concern as power densities increase.

Supply chain constraints can also impede the rapid deployment of new interface technologies. Global disruptions, such as those seen during the COVID-19 pandemic, have highlighted the vulnerabilities in semiconductor manufacturing and logistics. Ensuring a stable supply chain, therefore, becomes essential for meeting market demand and maintaining product timelines.

Competitive Landscape and Key Players

The interface and connectivity semiconductor market is highly competitive, featuring a mix of established players and innovative startups. Leading semiconductor manufacturers have leveraged their scale and R&D capabilities to develop cutting-edge solutions that cater to a broad range of applications. These include companies known for their leadership in high-speed data interfaces, power-efficient transceivers, and robust physical layer implementations.

In addition to large corporations, a growing number of specialized firms are focusing on niche applications such as automotive Ethernet, USB-C, and industrial fieldbus systems. These companies often bring innovative approaches and agility to the market, helping to drive technological progress. Strategic partnerships, mergers, and acquisitions are common as companies look to expand their capabilities and market reach.

Collaborative efforts with industry standards bodies also play a vital role. By participating in the development of new interface specifications, companies can influence the direction of technology and ensure that their products align with future market needs. This collaborative model fosters innovation while ensuring a level of interoperability that benefits the broader ecosystem.

Regulatory and Standardization Factors

The development and deployment of interface and connectivity semiconductors are heavily influenced by regulatory and standardization considerations. Industry standards ensure that devices from different manufacturers can interoperate effectively, which is crucial for fostering market adoption. Organizations such as the IEEE, USB-IF, and MIPI Alliance play central roles in defining and maintaining these standards.

Compliance with electromagnetic compatibility (EMC) and safety regulations is mandatory for products intended for use in consumer, automotive, and industrial environments. These regulations vary by region, necessitating a thorough understanding of global compliance requirements during the design phase. Failure to meet these standards can result in costly redesigns, delays, and market access restrictions.

Environmental regulations, such as those related to hazardous substances and energy efficiency, further shape the design and manufacturing of semiconductors. Manufacturers must adopt sustainable practices and materials to comply with regulations like RoHS and REACH. These requirements are not just legal obligations but also key factors in building trust with environmentally conscious consumers and clients.

Strategic Opportunities Ahead

Several strategic opportunities are emerging within the interface and connectivity semiconductor space. One of the most promising areas is the continued integration of artificial intelligence (AI) and edge computing. These technologies demand rapid and reliable data transfer, which opens up new use cases for high-performance interface chips.

The transition to electric and autonomous vehicles also presents significant opportunities. Modern vehicles are becoming data centers on wheels, requiring robust and high-speed connections between sensors, processors, and control units. The adoption of MIPI A-PHY as a standardized communication protocol for automotive applications highlights the growing need for specialized interface solutions.

In the realm of industrial automation, the move toward decentralized control and real-time analytics necessitates low-latency, high-reliability communication links. Interface semiconductors designed for deterministic networking and time-sensitive applications will play a crucial role in enabling the smart factory of the future.

Navigating Market Complexities

Entering the interface semiconductor market requires a nuanced understanding of application-specific requirements, customer expectations, and competitive dynamics. OEMs and system integrators seek partners who can deliver not just chips, but comprehensive solutions that address performance, reliability, and scalability. This has led to a rise in value-added services, including design support, custom firmware, and system-level validation.

Design cycles are becoming shorter, and time-to-market pressures are intensifying. Companies must invest in simulation tools, prototyping platforms, and agile development practices to stay ahead. Additionally, customer engagement models are shifting toward co-development and joint innovation, particularly in high-stakes markets like automotive and aerospace.

Building strong customer relationships and offering differentiated value are key to thriving in this environment. Companies that can demonstrate deep application expertise and provide tailored solutions will have a competitive edge. This customer-centric approach aligns well with the strategies of leading OEM Semiconductor providers who prioritize integration, performance, and longevity.

The Future of Connectivity Semiconductors

Looking forward, the interface and connectivity semiconductor industry is poised for transformative change. Innovations in materials, such as the use of gallium nitride (GaN) and silicon carbide (SiC), promise higher efficiency and better thermal performance. These materials are particularly valuable in high-power and high-frequency applications.

Quantum computing, although still in its infancy, represents another frontier. The ultra-sensitive nature of quantum bits will necessitate entirely new paradigms of data interfacing and signal integrity. Early research and prototyping in this area suggest that interface technologies will need to evolve rapidly to meet future demands.

Interdisciplinary collaboration will be critical in shaping the next generation of connectivity solutions. Cross-functional teams involving materials scientists, electrical engineers, software developers, and system architects will drive innovation. As the industry moves forward, the ability to integrate and optimize at both the chip and system level will determine long-term success.

Conclusion

Interface and connectivity semiconductors are more than just components—they are enablers of modern digital life. From smart homes and connected cars to automated factories and cloud computing, the need for fast, reliable data communication is ubiquitous. The industry is brimming with potential, shaped by emerging technologies, evolving standards, and a relentless demand for performance.

As the ecosystem grows more interconnected, the importance of these semiconductors will only intensify. Solutions like the Interface & Connectivity Semiconductors platform are paving the way for scalable, high-performance architectures. Those who can navigate the complexities of design, regulation, and market dynamics will be well-positioned to lead in this dynamic and essential sector.

0 notes

Text

AXI DMA Scatter Gather Enhancing Real-Time Data Streaming in SoC Designs

In today’s high-performance SoC designs, real-time data movement plays a critical role. Applications in communications, video processing, and AI demand reliable and efficient data streaming. To support these demands, AXI DMA Scatter Gather has become a powerful tool. At the forefront of this advancement stands Digital Blocks, delivering IP solutions that streamline data flow with precision and speed.

Meeting High-Speed Data Requirements

System-on-Chip designs today face increasing pressure to handle complex workloads with minimal latency. Traditional DMA approaches often fall short in scenarios where data sources and destinations are fragmented. AXI DMA Scatter Gather addresses this problem by allowing data transfers across non-contiguous memory regions without software intervention for each block.

Digital Blocks provides AXI DMA Scatter Gather IP that ensures consistent data flow in real-time systems. This approach helps manage bandwidth and reduces CPU load, which is critical in time-sensitive applications. With fewer interrupts and lower processing overhead, system responsiveness improves across all operations.

Smart Buffer Management

The AXI DMA Scatter Gather model enables intelligent buffer management. It uses a descriptor-based mechanism to define memory segments. Each descriptor holds address, length, and control data for a segment. The DMA engine reads these descriptors and processes them autonomously.

Digital Blocks integrates this structure with a focus on flexibility and stability. Their IP handles both memory-to-stream and stream-to-memory directions efficiently. It supports continuous and burst transfers with minimal CPU involvement. This results in streamlined operations that are ideal for multi-channel or multi-core systems.

Supporting Advanced Use Cases

Applications like 4K video processing, machine learning, and software-defined radio benefit directly from AXI DMA Scatter Gather. These use cases require large amounts of data to be moved quickly and reliably. Any delay can disrupt system behavior or cause quality issues.

Digital Blocks designs their AXI DMA Scatter Gather IP to match such requirements. It supports programmable burst sizes, interrupt coalescing, and address alignment. This ensures that the IP adapts to system needs without placing stress on core resources. In environments where data integrity and speed matter, this feature set makes a measurable difference.

Seamless SoC Integration

Another strength of Digital Blocks' solution lies in its ease of integration. The AXI interface enables smooth connection with standard bus architectures used in SoC designs. The IP core works with AXI4 and AXI4-Stream protocols, allowing wide compatibility across platforms.

Digital Blocks supports engineers through every phase of implementation. Their design ensures scalability, making it suitable for both low-power embedded designs and high-throughput computing systems. It helps reduce development time and allows design teams to focus on application-level innovation.

Driving Innovation in Real-Time Systems

AXI DMA Scatter Gather by Digital Blocks is helping shape the future of real-time data streaming in SoCs. Its efficient use of system memory, reduced CPU intervention, and high-speed performance make it a valuable asset in advanced designs.

By focusing on reliability and intelligent data handling, Digital Blocks continues to deliver IP that meets today’s performance challenges and prepares systems for tomorrow’s demands. For more details visit us

#ahb dma controller#axi dma ip core#axi dma controller ip#axi stream dma#axi bridge ip core#ahb dma verilog#axi dma scatter gather#axi4 data mover#axi dma verilog#axi4 stream dma

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] Our 3.0 Portable HDD Drive (1TB) – Ready To Store. Simple To Use. Portable HDD Drive external hard drive uses USB 3.0 Gen 1 technology for transfer speeds of up to 5 Gbit/s – and with plug-and-play technology you’re able to quickly save and secure up to of media to a compact, portable device. Our 3.0 Portable HDD Drive includes ramp load design that prevents damage to the disk while mobile, and a shock sensor that will cut the power to protect data in the event of physical stress – so you can rest assured that your files are safe. 2.5” External Hard Drive | Two-Tone Matte and Gloss Finish | SuperSpeed USB 3.0 Gen 1 | USB-Powered | Drag-and-Drop Us COMPATIBLITY: Setting up this portable hard drive is effortless. Just connect it to your gaming console, PC, or laptop using the provided USB 3.0 cable, and you're all set. It works seamlessly with popular gaming systems. offering a versatile storage solution for all your data needs. ULTRA STORAGE CAPACITY: This external HDD provides plenty of storage for all your favorite games, game saves, and multimedia files. You'll never have to stress about running out of space again, as you can conveniently house your entire game library, music, photo, documents all in one location and access it effortlessly whenever you choose. USB3.0 - Adopting with USB 3.0 interface and UASP accelerated transmission protocol supported, the 2.5” HDD/SSD can help with the data transfer rate up to 5Gbps, about 20% faster than traditional USB data port, transfers 1G file in 3 seconds, no data delay. All-round Protection & Security Crafted - with high-quality ABS plastic and equipped with a high-performance chip, the 2.5" hard drive enclosure ensures all-round protection. It features over-current protection, over-voltage protection, and overheating protection to safeguard your drives and valuable data. The attached EVA foam pad also protects your hard disks from shaking and crashing issues. Universal Compatibility - This SATA to USB 3.0 offers broad compatibility with Windows, Mac, Linux, and most operating platforms. It is designed for 2.5-inch 7mm/9.5mm SATA HDD & SSD up to 6TB, providing quick connectivity to your laptop, PC, TV, PS4/5, and more. Compatible with brands like Western Digital, Toshiba, Samsung, Kingston, Crucial, Hitachi, and others. EASY PLUG & PLAY - This external hard drive is designed for hassle-free setup, with no need for extra software. Just plug the USB drive into your laptop, Mac, PC, or desktop, and you can begin transferring files immediately, without any complex setup.. [ad_2]

0 notes

Text

Why India’s Drone Industry Needs Periplex: The Hardware Tool Drones Didn’t Know They Needed

As drones fly deeper into critical roles — from agricultural intelligence to autonomous mapping, from disaster response to military ops — the hardware stack that powers them is undergoing a silent revolution.

At the center of that transformation is Periplex — a breakthrough tool from Vicharak’s Vaaman platform that redefines how drone builders can interface with the real world.

What is Periplex?

Periplex is a hardware-generation engine. It converts JSON descriptions like this:{ "uart": [ { "id": 0, "TX": "GPIOT_RXP28", "RX": "GPIOT_RXN28" } ], "i2c": [ { "id": 3, "SCL": "GPIOT_RXP27", "SDA": "GPIOT_RXP24" }, { "id": 4, "SCL": "GPIOL_63", "SDA": "GPIOT_RXN24" } ], "gpio": [], "pwm": [], "ws": [], "spi": [], "onewire": [], "can": [], "i2s": [] }

…into live hardware interfaces, directly embedded into Vaaman’s FPGA fabric. It auto-generates the FPGA logic, maps it to kernel-level drivers, and exposes them to Linux.

Think of it as the “React.js of peripherals” — make a change, and the hardware updates.

Real Drone Applications That Truly Need Periplex

Let’s break this down with actual field-grade drone use cases where traditional microcontrollers choke, and Periplex thrives.

1. Multi-Peripheral High-Speed Data Collection for Precision Agriculture

Scenario: A drone is scanning fields for crop health with:

2 multispectral cameras (I2C/SPI)

GPS + RTK module (2x UART)

Wind sensor (I2C)

Sprayer flow monitor (PWM feedback loop)

ESCs for 8 motors (PWM)

1 CAN-based fertilizer module

The Periplex Edge: Microcontrollers would require multiple chips or muxing tricks, causing delays and bottlenecks. With Periplex:

You just declare all interfaces in a JSON file.

It builds the required logic and exposes /dev/pwm0, /dev/can0, etc.

Zero code, zero hassle, zero hardware redesign.

2. Swarm Communication and Custom Protocol Stacks

Scenario: Swarm drones communicate over:

RF LoRa (custom SPI/UART)

UWB mesh (proprietary protocol)

Redundant backup over CAN

Periplex lets you:

Create hybrid protocol stacks

Embed real-time hardware timers, parity logic, and custom UART framing — none of which are feasible in most MCUs

Replacing Microcontrollers, Not Just Augmenting Them

| Feature | Microcontroller | Periplex on Vaaman | |---------------------------|----------------------------|------------------------------------| | Number of peripherals | Limited (4–6) | Virtually unlimited (30+ possible) | | Reconfiguration time | Flash + reboot | Real-time, dynamic reload | | Timing precision | Software-timer limited | FPGA-grade nanosecond-level timing | | AI compatibility | Not feasible | Integrated (Gati Engine) | | Sensor fusion performance | Bottlenecked | Parallel FPGA pipelines |

Developers Love JSON, Not Register Maps

No more:

Scouring 400-page datasheets

Bitmasking registers for I2C configs

Writing interrupt handlers from scratch

Just declare what you need. Let Periplex do the work. Peripherals become software-defined, but hardware-implemented.

Built in India, for India’s Drone Revolution

Vaaman + Periplex isn’t just about tech. It’s about self-reliance.

India’s defence, agriculture, and logistics sectors need secure, reconfigurable, audit-friendly hardware — not black-box SoCs from questionable supply chains.

Periplex is the hardware engine for Atmanirbhar Bharat in drones.

TL;DR

Periplex lets drones adapt hardware to the mission — instantly.

It replaces tangled microcontroller logic with clean, structured JSON.

It unlocks use cases microcontrollers can’t touch: AI at the edge, dynamic reconfiguration, secure protocol stacks, and more.

And it’s built into Vaaman, India’s first reconfigurable edge computer.

Ready to Get Started?

Explore Vaaman on Crowd Supply Reach out for Periplex SDK access: [email protected]

Raspberry Pi

Drones

Drones Technology

Jetson Orin Nano

Technology

0 notes

Text

【step by step】Easyi3C Host I3C adapter (1)

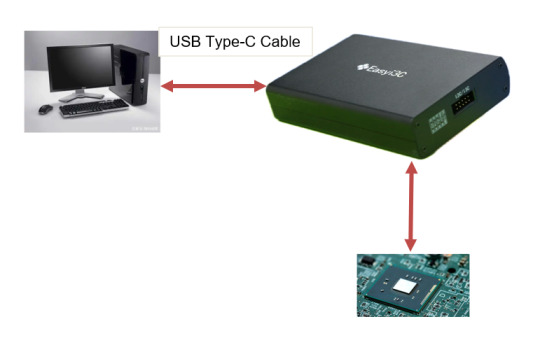

Easyi3C is a leading supplier of embedded system tools that simplify the development and debugging of various communication protocols. The company offers a range of products designed to help engineers and developers use I3C/I2C , USB and MIPI, JEDEC, MCTP and other protocols more efficiently.

1. Basic Introduction

Easyi3C Host I3C adapter is a powerful and easy-to-use I3C and I2C host adapter produced by Easyi3C. It connects the computer to the downstream embedded system environment through the USB interface and adopts the advanced I3C and I2C protocol.

Based on the application programming interface (API) function and the Easyi3C Tower console graphical user interface (GUI) tool, combined with the Python development environment, the Easyi3C Host adapter greatly simplifies the development process of I3C/I2C chip testing and data transmission environment. It provides great convenience for AE engineers, FAE engineers, etc. to verify I3C/I2C chips. Simple verification can be done through the graphical console interface, which is easy to use and easy to learn. If you want to test more complex functions or perform automated testing, you can use the rich API functions provided by the manufacturer to quickly implement automated scripts in the Python development environment.

We know that I2C was invented by Philips Semiconductors in 1981, and its history is a bit old and mature. The I3C protocol I3C specification was originally released by in 2017. I3C is the abbreviation of improved internal integrated circuit, which is a 2-wire digital interface similar to I2C. It improves and optimizes the previously released I2C and SPI interfaces, solves the problem of slow I2C communication speed, and optimizes the shortcomings of SPI through four-wire connection. The I3C specification is managed by MIPI Alliance Inc. I3C also solves the problem of high power consumption of I2C. I3C becomes a low-power, low-cost and fast digital interface. It supports multi-point connection between host MCU and peripheral devices such as sensors and multi-master devices. Because the protocol is still very new, there are not many good tools on the market. The series of products launched by Easyi3C will fill this gap. The same interface supports I3C/I2C protocols at the same time, which is convenient for engineers to write automated scripts for chip protocol testing, shorten the product launch cycle, and help the company’s products win the competition.

2. Key features:

Supports MIPI I3C BASIC v1.1 JEDEC JESD403–1 Specifications (JEDEC DDR5 Sideband Bus Spec) I3C Master in SDR mode Variable Working Frequencies (Open-Drain Mode: 1 kHz to 4 MHz (Default: 1MHz); Push-Pull Mode: 100KHz to 12.5 MHz (Default: 4MHz)) Adjustable SCL Duty Cycle Amplitude Variation: 0.8V to 3.3V in steps of 10mV 5ns resolution Supports 7-Bit Slave Addressing Supports Common Command Code (CCC) transactions Supports flexible payload length’s IBI Supports Hot Plug Supports all Dynamic Address Assignments Supports legacy I2C Master, Software configurable I2C pull-up Error Injection such as parity errors USB Type-C port, Max. Current & Voltage: 500 mA @ 5 V Supports online upgrade API support for automation test in Python Physical Size: 114mm x 81mm x 27mm Operating Temperature From –20°C to +85°C

3. Hardware

Accessories:

4. Interface Introduction 4.1 Front Panel

5. Test chip connection method

5.1 Connect the Easyi3C adapter to the I2C/I3C device using a 10-pin cable.

5.2 Connect the Easyi3C adapter to the computer with a USB Type-C cable. The adapter is powered by USB Type-C communication, so no separate external power supply is required, which simplifies device connection.

Next, we will continue to introduce the use of the product in depth.

1 note

·

View note

Text

FET-MA35-S2 SoM: A Multi-core Secure Industrial-grade Solution for EV Charging Pile TCU

Charging piles provide electrical energy for electric vehicles (EVs), converting grid power for fast and safe charging. As EVs become more popular, charging pile construction is increasingly important. TCU is the core control module of the charging pile, undertaking key functions such as charging process management, safety monitoring, data interaction, and billing control. As the hub connecting the vehicle, the grid, and the operation platform, the TCU effectively manages the charging process by integrating various functional modules.

TCU Core Functions:

Control & Communication

Supports multiple interfaces for real-time interaction with the vehicle’s BMS, charging modules, and cloud platforms.

Safety Protection

Real-time monitoring of equipment voltage, current, temperature, and other status, abnormal conditions trigger the protection mechanism and report fault codes; hardware support for secure encryption to protect payment and data privacy and security.

User Interaction

Display charging progress, cost, abnormal alarm information and other multi-mode interaction through LCD/HMI interface; record charging process data to provide data support for equipment maintenance and energy efficiency optimization.

As the "intelligent brain" of the charging pile, TCU must realise core functions such as charging control, data communication, safety monitoring, and human-machine interaction. With its high-performance multi-core heterogeneous architecture and rich interface design, the embedded FET-MA35-S2 SoM can be used as an ideal hardware platform for charging pile TCU.

1. Multi-Core Heterogeneous Architecture Architecture

Dual-core A35 + M4 collaborative control: It is equipped with 2 x 64-bit ARM Cortex-A35 (main frequency 800MHz) and 1 x Cortex-M4 (180MHz), running Linux system and real-time operating system respectively, and meeting the requirements of high efficiency and real-time control.

Application Scenario Adaptation: A35 kernel handles the main control logic of the charging pile (e.g., billing, communication protocol parsing), and M4 kernel monitors the voltage/current parameters in real time to ensure the safety of the charging process.

2. Interface Expansion

The SoM uses LCC + LGA packaging (48mm×40mm), with all 260 pins led out. It can support 17 x UART interfaces and the protocol conversion between RS232 and RS485. It can be directly connected to devices such as electric meters, barcode scanners, and card readers without the need for additional conversion chips. 2 x Gigabit Ethernet ports enable real-time data transmission between the charging pile and the cloud platform (such as charging status monitoring and remote operation and maintenance). 8 x ADC channels achieve accurate acquisition of voltage, current, and temperature, and cooperate with the dynamic PWM adjustment algorithm to prevent the device from overheating. 4 x CAN-FD interfaces meet the high-speed communication requirements with BMS, charging controllers, etc., ensuring the accurate matching of charging parameters.

3. Security & Reliability

Hardware-level security: It integrates Nuvoton's TSI (Trusted Security Island), TrustZone, secure boot, AES/SHA/ECC/RSA encryption accelerators, and a True Random Number Generator (TRNG) to ensure the security of key storage and communication data.

Industrial-grade reliability: It supports operation in a wide temperature range from -40°C to 85°C and has passed the EMC anti-interference test, making it adaptable to the harsh environments of outdoor charging piles.

4. Function Expansion

Multimedia interaction: It supports RGB display interfaces (with a maximum resolution of 1080P) and I2S audio interfaces, and can drive touch screens to implement user interface (UI) interaction and voice prompt functions.

Remote management: It supports OTA (Over-the-Air) upgrades and AI predictive maintenance through a 4G module or Ethernet.

In summary, the FET-MA35-S2 CPU module features a trinity design of performance, interfaces, and security. It has passed the strict industrial environment testsForlinx Embeddedin the laboratory to ensure product stability. The full-pin-out design reduces the complexity of hardware development and shortens the product's time-to-market. It has become a key driving force for the intelligent upgrade of the TCU in charging piles, contributing to the efficient construction of new-energy vehicle charging infrastructure.

0 notes

Text

Universal Asynchronous Receiver Transmitters (UART) Market: Global Opportunities 2025–2032

MARKET INSIGHTS

The global Universal Asynchronous Receiver Transmitters (UART) Market size was valued at US$ 892.4 million in 2024 and is projected to reach US$ 1,560 million by 2032, at a CAGR of 8.52% during the forecast period 2025-2032.

Universal Asynchronous Receiver Transmitters are fundamental hardware components that enable serial communication between devices. These integrated circuits convert parallel data to serial format for transmission and vice versa for reception, supporting asynchronous communication protocols. UARTs are widely deployed in embedded systems, industrial automation, consumer electronics, and telecommunications equipment due to their simplicity and reliability.

The market growth is driven by increasing demand for industrial automation and IoT devices, which extensively utilize UART interfaces for device communication. While traditional applications dominate current usage, emerging sectors like automotive electronics and medical devices are creating new growth opportunities. Leading manufacturers such as NXP Semiconductors, Texas Instruments, and Microchip Technology are investing in advanced UART solutions with higher data rates and lower power consumption to address evolving market needs.

MARKET DYNAMICS

MARKET DRIVERS

Growing Adoption of IoT Devices to Fuel UART Market Expansion