#home values

Explore tagged Tumblr posts

Text

Devastating Texas Floods Expose Failures, Real Estate at Risk

Key Takeaways Insurance costs are skyrocketing in flood-prone areas, directly impacting cap rates and resale values. Resilient development, including elevated homes and floodproof materials, may offer new ROI paths. Floodplain zoning and emergency alert reform could redefine property values in Texas and beyond. Texas Floods Cause Heartbreaking Losses, Broken Infrastructure Central and South Texas, especially the Hill Country, were hit by catastrophic flash floods over the July 4 weekend. The Guadalupe River rose to record-breaking levels, overwhelmed by torrential rainfall up to 20 inches in some areas in just hours. The flash flood emergency claimed at least 134 lives and left more than 100 missing. Entire RV communities and trailer parks were wiped out, many with no flood insurance. Systemic Failure in Flood Preparedness Kerr County did not adopt a comprehensive flood alert system, citing cost concerns. That failure delayed warnings. Firefighters reportedly requested alerts nearly 90 minutes before any were sent. Texas faces a multibillion-dollar backlog in flood-mitigation projects. Delays in funding and implementation have left entire communities exposed and without warning systems that could have saved lives. Communities Rally, But Housing Recovery Remains Fragile Local schools, nonprofits, volunteers, and organizations mobilized quickly, setting up supply hubs, distributing meals, and raising relief funds. Yet FEMA approvals lag. Many residents, especially those in RV parks and trailers, remain unprotected. More than 38,600 residential properties fall within the affected flood zone, with tens of thousands already damaged or destroyed. Recovery will take years, and much of it will depend on the state and local government's ability to coordinate funding and rebuild infrastructure quickly. Climate Crisis Upends Risk Perception Extreme rainfall events are intensifying, making Texas's Flash Flood Alley one of the most dangerous regions in the country. Texas has already faced over $300 billion in weather-related economic losses since 1980. This flood alone may add another 18 to 22 billion. Real estate markets in flood-prone zones are seeing rising insurance premiums and stricter underwriting. This increases the cost of ownership and lowers property values. What This Means for Texas Real Estate Investors Insurance and Valuation Pressure Homebuyers and renters now expect flood risk to be disclosed. At the same time, insurance premiums are rising, and underwriting is becoming restricted. Properties in affected zones may require steep price cuts to move. Investors must now factor in climate resilience and insurance readiness when valuing assets. Opportunity for Resilient Development Areas without modern warning systems or elevated building standards will face scrutiny. Investors who prioritize resilient design, floodproof construction, and smart infrastructure have the chance to lead market transformation. Retrofitting homes with water-resistant materials or elevating foundations may become the new standard. Portfolio Risk: Diversification Is Vital Investors holding multiple properties in high-flood zones now carry outsized risk. Diversifying property types and geographic exposure helps hedge against localized disasters. Climate risk is now a financial risk. Policy Advocacy and Community Resilience Public policy around zoning, insurance, infrastructure funding, and early warning systems will shape market outcomes. Real estate professionals must engage with policy leaders to advocate for effective reform and proactive planning. Aligning with resilience-focused initiatives can both reduce risk and create long-term investment upside. Stories from the Flood Maria, a retiree living in an RV park near the Guadalupe River, saw her trailer vanish in the early hours of July 4. She had no flood insurance and lost everything. Today, she helps other survivors clean debris and rebuild. At Camp Mystic, counselors rushed to evacuate children during the flood.

Some cabins were submerged before anyone could escape. More than a dozen young campers died. The tragedy has forced a reassessment of safety protocols for camps and seasonal rentals along the river. Lucas Brake and his wife survived the flood but lost both his parents, whose riverside cabin was washed away. Their son spent days searching the wreckage for their bodies. Their story now serves as a rallying cry for early alerts and better planning. Insurance Wars: Homeowners and Investors Feel Burned in Disaster Zones In disaster-prone areas like Texas, Florida, and California, the once-stable triangle of homeowner, investor, and insurer is crumbling fast. As natural catastrophes grow more frequent and more severe, the tension between property owners and insurance companies is boiling over. Many people across the United States now view the insurance industry as one of the biggest scams in the country. Premiums are jumping. Deductibles are climbing. And worst of all, when the flood or fire hits and everything is gone, the payout often doesn’t come close to what was lost. After the July 4 floods in Kerrville, families and landlords reported denied claims, delayed checks, or hidden exclusions they didn’t know existed until after the damage. Some investors who faithfully paid into their policies were shocked to learn their homes were now labeled “uninsurable” because they were too close to rivers or located on outdated flood maps. Others were dropped from coverage altogether. Insurance companies, protected by deep legal teams and complex risk models, are using fine print and policy traps to avoid paying out when it matters most. This has turned into a full-blown trust crisis. Homeowners feel betrayed. Investors feel robbed. And many are wondering if insurance is even worth it anymore. Some are starting to bypass the system completely. Instead of relying on traditional carriers, they’re building private reserve funds, exploring risk-pooling networks, or structuring portfolios to absorb potential losses without the middleman. Because here's the new truth no one wants to admit: if you can't get affordable and reliable coverage, your profit is already gone. The math doesn’t work. The system is failing. Unless something changes fast, the insurance industry may become the next major disruptor of long-term investment strategy in disaster zones. Assessment Real estate investors must reevaluate flood-exposed assets and adjust valuations to reflect increased risk. Properties in vulnerable zones face depreciation, lower rental demand, and limited insurability. Flood resilience now presents both a challenge and an opportunity. Investors who act early can lead the way in modernizing housing stock and reshaping regional growth. Policy engagement is no longer optional. The private sector must help drive the development of smarter infrastructure, faster response systems, and sustainable zoning reforms. The Texas floods are a clear warning. Investors who ignore the mounting evidence of climate-related risk do so at their own peril.

#buy and hold#climate adaptation#construction risk#disaster planning#disaster zone housing#emergency alerts#flash flood homes#flood cleanup#flood zone investing#floodplain homes#home values#infrastructure failure#insurance premiums#investor alert#Kerrville#Kerrville Texas#mobile homes#natural disasters#property insurance#property risk#rebuilding costs#rebuilding Texas#risk zones#storm impact#Texas floods#valuation drop#weather impact

0 notes

Text

Brick & Mortar: April 2025 Real Estate Market Snapshot

This infographic provides a comprehensive overview of the U.S. real estate market as of April 2025. It highlights key metrics including home values, existing home sales, inventory levels, rate lock-in trends, mortgage rates, and rental market changes. With home values rising modestly and inventory reaching post-2007 highs, the market is showing signs of cautious recovery. Meanwhile, rate lock-in…

0 notes

Text

The brief’s key findings are:

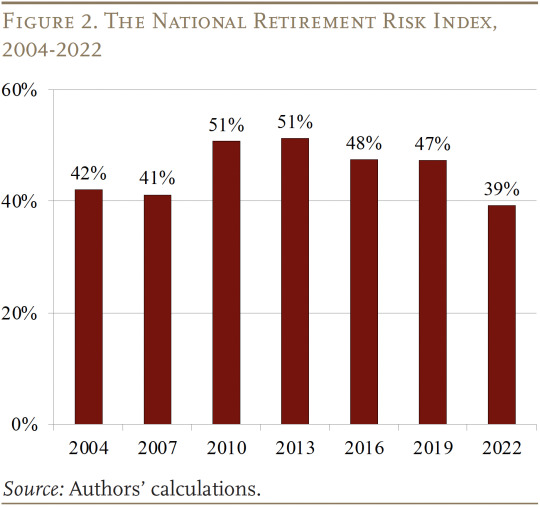

From 2019 to 2022, the National Retirement Risk Index improved substantially, dropping from 47 percent to 39 percent.

Weathering the pandemic turmoil, households were buoyed by government stimulus, strong employment, and rising asset markets.

The single biggest factor driving the improvement was soaring home values.

Though these results are encouraging, most people do not tap their home equity in retirement and prices may not stay at such high levels.

Importantly, even with what may be a temporary improvement, the NRRI shows that 2 in 5 of today’s working households could fall short.

#retirement#retirement planning#household finances#housing#home values#employment#research#older workers

0 notes

Note

Twins in time au.... Would Fiddleford act as a sort of father figure to Stan? Since Filbrick obviously SUCKED to both Stan and Ford and Fidd is more than definitely missing HIS son, and of course Ford has grown to love him but they're still BROTHERS.. Maybe they could act as the father/son the other is missing?

ABSOLUTELY!!!!

#fidds father instincts kicking when he sees a sad child#don’t worry ford will definetly get chewed out when they get home too#I also think fiddleford has some kind of giant robot project he and Stan work on#maybe he’s building one of Stan’s drawings or something#cutie pies#he sees a lot of value in the way Stan thinks and he thinks his creativity is actually a huge benefit in his and fords studies#my art#ask#gravity falls#twins in time au#fiddleford hadron mcgucket#fiddleford mcgucket#Stan pines#Stanley pines#ford pines#Stanford pines

5K notes

·

View notes

Text

Like actually in general my parents never just. bought me video games unprompted. I listen to Scott the Woz talk about his parents buying him games and Nintendo Power subscriptions just for no reason and I'm like. ?????? Families do that?

#I know mine was better for my development and growingn up to value money and shit I guess#But it meant I had like. Max 5 games. ever#When I first met Ken he asked me if I had played all these nintendo games ajd I just lied and said yes#I got like. Mario Kart for my birthday and stuff. Never got a home console or anything

6K notes

·

View notes

Text

infinitely funnier visuals in my head, likely because they werent subject to my actual skill level in art

#he read space facts book and found out the sun is a star and nearly got them all killed#dont ask how they didnt notice sooner i ignored that for comedic value#i dont know how to communicate that the sun is supposed to be out in the second panel#well i do but i didnt feel like coloring#i had this awesome visual earlier i was like “im gonna like color and shade in a painting style and its gonna look awesome”#and then i realized i dont know how to do any of that#so here we are#i read requiem and made like a mental plan in my head of what their home looks like and have not been able to fix it since#im too tired to tag more and i want this out of my sight before i start despising it for realsies#art#murder drones#murder drones uzi#uzi doorman#murder drones n#serial designation n#murder drones v#serial designation v#nuvi#violentbitingbiscuits#i love me some nuvi. favorite ship right now#second place is jessa but like i dont know how to draw humans so itll be a while before ya see that#oh i forgot#murder drones cyn#if im being totally honest this entire thing was just an excuse to draw uzi in that second panel

2K notes

·

View notes

Text

Who is this sassy lost child?

[First] Prev <–-> Next

#poorly drawn mdzs#mdzs#lan wangji#a-yuan#A-Yuan knows how to to utilise his big wet eyes to get treats. What a little legend.#The crowd comments about LWJ being 'daddy' and WWX being 'the mother' are a little too 'fan-service bait' for me.#So I am personally reimagining it as another layer of 'misinterpretation of a more complex situation' commentary.#I like how the different styles of interacting with children WWX an LWJ exhibit say so much about their own childhoods.#We - human beings in the real world - take two lessons from how we were parented: What we valued and what we wish we had.#LWJ leaning into indulgence is him pushing back against his own childhood of asceticism. It's something he didn't have - so he gives it.#WWX on the other hand has been *so* defined by his drive to indulge. And here he is the restrictor!#It takes a bit more to see what's going on here. The factors are not singular.#but to keep it in theme with LWJ; I'd propose it is partly his way of establishing structure when he did not have it as a child.#Both approches are a way of saying 'I didn't have this and I wish I did.'#With LWJ it's pretty obvious why...but WWX? What is at your core? What is your regret towards a lack of restriction?#Or...What benefit do you think it gives this child to learn the harsh lessons of going without?#Did it make you strong when you were a child? Do you think it is just the nature of the world and we all must learn it?#How we interact with children is such a fascinating topic to delve into our psychology and neuroses.#In a more light hearted turn of topic:#WWX confirmed to be 'person taking the car to the drive through to order one black coffee for himself' on the triangle spectrum.#LWJ is saying 'we have food at home' as he is opening his wallet ready to order for everyone.#(Technically this is comic 213 but yippee! We are in the 200's now! Thank you all so much for reading and cheering me on!)

2K notes

·

View notes

Text

Is That Estimated Home Value Worth Anything?

Is That Estimated Home Value Worth Anything? A simple internet search will tell you what a home is worth. Or will it?

View On WordPress

#DFW#allen#buyer agent#dallas#first time buyers#frisco#home buyers#home buying#home for sale#home sales#home seller#home values#house hunting#housing market#mckinney#north texas#plano#real estate#real estate ag#realtor#seller agent#selling my house#selling your home#texas

0 notes

Text

#tradblr#traditional femininity#traditional gender roles#traditional relationships#tradfem#traditional family#traditional wife#tradmen#trad wife#traditional masculinity#stay at home wife#stay at home parent#stay at home mom#home maker#homesteading#traditional values#traditional marriage#traditionalism#traditional art#crunchy mom#tradwife#wholesome trad#christian tradwife#tradwest#tradwoman#trad wives#trad women#ex feminist#anti feminist women#anti pornography

545 notes

·

View notes

Text

Thorins Farewell 4k

#lotr#lord of the rings#the hobbit#lotredit#thorin oakenshield#bilbo baggins#richard armitage#martin freeman#4k#battle of the five armies#botfa#my emotions whenever this scene is playing are not okay#tolkien#one of the best things tolkien ever wrote#if more people valued home over gold#😭

269 notes

·

View notes

Text

😏

#don’t try this at home kids#ICE thugs#immigration and customs enforcement#republican assholes#maga morons#ice terrorizes American communities#traitor trump#crooked donald#resist#republican hypocrisy#republican family values#trump sycophants#political humor

227 notes

·

View notes

Text

Houston Flood Zones Slash Home Values 18%, Buyers Pause

FEMA Flood Maps Create Stark Value Divisions Across Harris County PropertiesInvisible lines from federal flood mapping now cut through Harris County's real estate, sharply dividing property values. Neighbors can see dramatic wealth differences with properties just feet apart.Homes within FEMA's 100-year floodplains face an 18% drop in value. Meanwhile, nearby homes outside these zones keep their full market price. This makes buyers wary of flood-zone properties.Real estate sales in flood areas often drag on as buyers carefully check insurance requirements and lender restrictions. Market activity slows significantly for homes marked with federal flood zone designations.A looming expansion threatens to add thousands more Harris County properties to high-risk categories by early 2025. Updated maps will stretch flood zones from 150,000 to almost 200,000 acres. Properties within the floodway face the strictest regulations as this zone closest to water bodies is heavily regulated by city or county authorities.Reclassification from new maps will suddenly require insurance for homeowners previously unaffected. Mortgage lenders will demand flood insurance on properties entering risk zones, changing neighborhood market dynamics.New 2025 Disclosure Laws Force Transparency in High-Risk Neighborhood SalesStarting January 1, 2025, new disclosure laws will eliminate the secrecy previously surrounding flood-damaged properties in Texas. Sellers must disclose if properties have experienced flooding or if flood damage insurance claims have been made.Properties in 100-year or 500-year floodplains, floodways, flood pools, or reservoirs now require mandatory disclosure. Real estate agents face increased liability, with potential legal consequences for not advising proper flood risk inquiries.The case *Calhoun v. I-20 Team Real Estate, LLC* highlights these risks.Beyond homeowners, landlords must also inform tenants of flood hazards affecting rental properties. One-third of flood insurance claims occur in low to moderate risk areas, demonstrating that flooding can happen anywhere regardless of official risk designations.Buyers gain enhanced awareness through required disclosure of drainage issues and flood insurance histories. Legal experts anticipate these transparency mandates will further disrupt markets, following 2019 laws that led to a 4.2% price drop in 500-year flood zones.Concealing flood-related information now poses serious ethical violations and legal penalties for professionals in the industry.Home Elevation Emerges as Critical Strategy to Protect Investment ValueHow can Houston homeowners salvage their property investments when flood zones continue to devastate real estate values across the region?Home elevation has emerged as one of the most effective flood resilience strategies available to property owners facing the relentless threat of flooding.The practice involves raising house foundations above FEMA base flood elevations. This provides essential investment protection against future disasters.Benefit CategoryFinancial ImpactTimelineInsurance PremiumsReduced ratesImmediateProperty ValueMaintained/increased1-2 yearsDamage PreventionAvoided repair costsPer flood eventMarket AppealFaster salesOngoingNew Houston regulations mandate elevation 24 inches above 500-year flood levels. This replaces the weaker 18-inch requirements above 100-year floods.Elevated homes show measurable resilience against the 18% average value decline plaguing Houston flood zones. Properties using pier and beam foundations with proper elevation maintain competitive positioning.These homes stand strong despite widespread market hesitancy surrounding flood-prone areas.Insurance Costs and Extended Market Times Reshape Buyer Decision-MakingProperty elevation strategies alone cannot shield Houston homeowners from the cascading financial pressures reshaping the local real estate market.Flood insurance premiums averaging $1,500 to $2,000 annually now force buyers into extensive insurance comparisons before committing to purchases.

Properties in FEMA-designated high-risk zones experience extended market times as potential buyers hesitate over mandatory insurance requirements and perceived flooding risks.Buyer hesitance intensifies when flood insurance estimates arrive, leading many deals to pause or collapse entirely.The thorough cost evaluation includes recurring insurance expenses alongside traditional homeownership costs, making flood-prone properties notably less attractive.Market data reveals properties in designated flood zones remain unsold longer than comparable non-flood zone homes.Extended listing periods create downward pressure on prices as sellers reduce asking amounts to compensate for insurance burdens.FEMA flood zone classifications directly influence buyer confidence levels.Zone D uncertainty creates prolonged decision timelines.Rising premiums tighten lending requirements, while private insurance markets offer limited relief at higher costs, fundamentally altering Houston's real estate dynamics.AssessmentHouston's flood zone crisis represents a fundamental shift in real estate dynamics. FEMA designations now dictate property values with mathematical precision.The 18% decrease in value signals a permanent change in risk assessment for America's fourth-largest city.Mandatory disclosure laws eliminate decades of information asymmetry. They force unprecedented transparency in flood-prone markets.Elevation strategies and insurance calculations have become survival mechanisms. In this investment environment, water determines wealth.

0 notes

Text

I think it's incredibly important to remind folks on testosterone or folks who want to reverse patterned baldness about their options, but man, does it sometimes suck wondering how much of our insecurities about our hair stem from backwards beliefs that to strive towards beauty is not only preferable but "makes you good."

As someone with a rather masculinized body pre-medical transition, patterned baldness has always seemed neutral. Hair is incredibly important (hell, much of my own energy is spent on my hair because I like it), but the pressure to have hair, to have hair the "right way" is something that I absolutely loathe.

I'm not here to judge people who don't want patterned hair loss or baldness, I'm here to say that those traits will never make you lesser. Not only is it neutral, but it is also just as worthy and beautiful.

#trans#transgender#lgbt#lgbtq#ftm#mtf#nonbinary#this especially goes for folks who may be transfem or trans women experiencing patterned hair loss/baldness#i love you and think you are gorgeous<3#i mentioned trans folks going on t because that's a lot of my own experience#i already had a somewhat masc hairline before t and now it's just settling in...#...i found that i'm fortunate in that way for having an already masculine body and i think that's why my changes are more...#...like unpacking your house rather than moving to a new home if that makes sense#but i find that the beauty culture around hair adds even more unnecessary stress for those who want or value their hair#i am beauty culture's number one hater

2K notes

·

View notes

Text

#homemaker#homemaking#trad#trad wife#trad wives#tradwife#traditional relationships#tradfem#traditional marriage#traditional lifestyle#traditional living#traditional gender roles#traditional wife#traditionalism#traditional#femininity#traditional femininity#trad women#tradblr#tradlife#traditional values#stay at home mom#cottage aesthetic#cottage kitchen#cottage living

195 notes

·

View notes

Text

being angry at fictional teenagers for having the emotional maturity of teenagers is very stupid in my opinion.

#deltarune#kris deltarune#susie deltarune#ralsei deltarune#noelle deltarune#berdly deltarune#KRIS IS NOT EVIL THEY ARE BEING MANIPULATED#THEY WANT TO HANG OUT WITH THEIR FRIENDS AND PLAY VIDEO GAMES AND EAT PIE#actually haven't seen many people hate susie#RALSEI HAS DEPRESSION HE IS INSECURE NOT EVIL#NOELLE HAS ANXIETY AND A TERRIBLE HOME LIFE#BERDLY IS NOT AN INCEL LOSER HE RESPECTS HIS FRIENDS BUT DOESN'T FEEL VALUED AS A PERSON#tw caps

150 notes

·

View notes

Text

Every time I see anti-immigration leftists on here (or see how attractive Trump's rhetoric is to "left behind" workers) I have to remind myself that they're operating in a long and odious tradition

171 notes

·

View notes