#it's just that it cost like a minimum of 600k pound to pay for a gp3 seat so uhhhh... that's a lot of money she doesn't have...

Explore tagged Tumblr posts

Note

GIRL CHARLES OMG IM DEVESTATED…. 🥺 ALL SHE WANTED TO DO WAS HAVE SUPPORT TO ACHIEVE HER DREAM WHICH SHE CLAWED AND FOUGHT FOR AND PUSHED THROUGH ALL THE DEGRADING COMMENTS FROM THE BOYS AND THEIR DADS ONLY TO BE TOLD ALL SHE CAN DO IS BECOME A WIFE OF AN F1 DRIVER 😭

But is there a reason why Nicolas didnt take her to other team’s driver academies to get support there? Tbh though I can’t imagine Helmut Marko wanting to invest in a little girl driver especially in 2014 or whenever it was that this happened

she wanted to become an f1 wdc and there was nothing going to stop her from trying her hardest!! she had the capabilities, the will-power, and the mindset to go all the way, it was just unfortunate that there were so many roadblocks in the way so eventually it simply became too much... rip ferrari, the last time they had more than 1 win in a season was 2018 so it's definitely their loss <3

nicolas would have tried going to other teams, he truly believed in her, unfortunate there weren't really any options... it's 2015, the chances for a different driver's academy were already slim, a lot of the teams straight up didn't have or didn't use a program at the time (like sauber/williams/lotus), so it only leaves a few possible options: mercedes, mclaren, and red bull.

mercedes only just started their program the year before and at this point they sign esteban, who is managed by... toto. yeah, no, they have no reason to add her. then there's mclaren, but they already have 4 people, so they don't have a reason either. that just leave red bull, the team that's willing to take the risk, who doesn't care how many people they have, who'll do anything to win, so of course they'll want her! except... just joining their academy isn't enough, they're not going to fully pay for a (top) seat in gp3 & f2, so even if she joins the rbjt, she still doesn't have enough money...

#answered ask#seb got a win in '19 and carlos a win in both '22 & '23 so yeah... ferrari's missing charles and they don't even know it...#anyway i found an article from 2010 were they mentioned that rb just added their 47th female athlete#so i dont think that charles being a girl in 2014 would deter them much#it's just that it cost like a minimum of 600k pound to pay for a gp3 seat so uhhhh... that's a lot of money she doesn't have...

2 notes

·

View notes

Text

ark royal insurance quote

"ark royal insurance quote

ark royal insurance quote

BEST ANSWER: Try this site where you can compare quotes: : http://salecarinsurance.xyz/index.html?src=tumblr

RELATED QUESTIONS:

How much money would it cost to have a 1992-1998 BMW E36 1.6l-1.8l for a 17 year old on your parents insurance?

How much money would it cost to have a 1992-1998 BMW E36 1.6l-1.8l for a 17 year old on your parents insurance?

Proof of Insurance (NJ)?

Today, while driving home from school, an officer stopped me. I pulled over and proceeded to give him, my license, registration, and insurance. However, I was not given a ticket for speeding, but for failing to produce insurance. He told me that copies of insurance do not count, yet I gave him not only a copy, but the original which had been torn. Will I be charged with failure to produce insurance, even though I had a copy, and the torn original ?""

Car insurance???????

I'm a first time buyer (23 y/o) but I've been looking at small compact SUVs more so than 4door sedans just because I love them, but What would be a little cheaper for insurance purposes, a sedan or SUV ? I've checked with some insurance companies and they all say different things. Anyone know what would be the better option? Thank you! And I'm looking to get between an 04-2008 vehicle.""

Anyone know a good Home Insurance company in California?

We recently purchased a new home to use as a renter. Our real estate agent told us to purchase and insurance policy from Old Republic to cover anything that could be wrong with the house since it was built in the 80's. An inspector looked at the house prior to our purchase and didn't notice anything with the property. Once the house was occupied by our renter, he noticed that the lights would shut off and stay off for a few hours. Old republic sent an electrician over and he told us that the prior owner had replaced a new breaker on top of a broken buster. He reported back to old republic and they stated that the insurance didn't cover anything that was not installed correctly. We were precise to inform our agent of the policy we needed for the house. We were not sure what work the house had done prior to our purchase so that is why we purchased the insurance. The policy we had was Old Republic Home Warranty Plan. That is what our agent advised us to get. Now, what can we legally do to help cover our out of the pocket expense of over a grand. Is there a policy that anyone would recommend for a rental house. Let me add that we do have home owners insurance but it only covers fires, floods, etc. (Please no unnecessary comments, this is an important question and need real honest advise.) Thank you in advance to all who respond and hopefully this could help others who read it as well.""

Pregnant and losing insurance?

I recently got laid off and don't want to use COBRA because of the high cost. I am only 31 so I don't think I can apply for Medical or Medicaid. I also know that I cannot get new insurance because I am already pregnant. Does anyone know how to get State-Funded insurance or at least assistance from the state? I live in California.

Cheapest Way for an international student to Drive a car in the UK with an international License?

I will be staying in the UK for 1 year and need a car cuz I will be driving around 50 miles a day. I looked to buy a cheap car but the insurance is around 6000 to 8000 a year cuz i am young and driving with an international license. The cheapest thing I found was renting a car for 13-14 a day. Is there anyway I can drive cheaper in the UK? If renting is the only choice, what is the cheapest renting diesel car can I get in Birmingham?""

Who has cheapest auto insurance rates in ontario?

Who has cheapest auto insurance rates in ontario?

""If you finance a car in nh, can i cancel my car insurance?

Someone told me you don't have to have insurance. I don't want to pay for something if i don't have to. But i don't want to not pay and lose my car.

Cheapest car insurance for a 17 year old?

Hi i am 17 years old and have just past my test 2 days ago and i am currently trying to insure a 2003 ford fiest 1.3 lx petrol 3 door. I know it has quite a big engine (1.3) for a first car, but only has 8 valves and just creeps into insurance group 3 due to electrical equipment inside, which is nothing really. I have been looking around and i am getting ridiculous qoutes of around 5000, however i have found ikude insurance which is only 1800 but iyou have to have a box, which i would really rather not have but might have to. I would like to spend nor more than 2,500, help please????""

Dental insurance ? Or medical insurance payment plans ?

Hi I'm a 20 year old and I currently am looking for a dental insurance an in California but I don't know what good company is good and not as expensive since I do live on my owns and stuff. I really need to go get my teeth checked up but I can't afford to go in a visit with no dental insurance. Someone please help. What are good entail company's that get get me approved on a good payment plan or something pease ans thank you for your time?

How to get auto insurance in Canada without address?

I plan on buying a van and living in it instead of an apartment.How do I get insurance preferably cheap insurance? I'm curious,if one can't get insurance will the police bother one if one tells them they're homeless and have nowhere else to live?""

I need Health Insurance Tips?

Hey there, I was hoping to get some input from families in WA State, or anywhere if you want to help me. I just need ideas on where to get affordable health insurance for my family? If anyone has advice for me that would be great. Thank-you!""

How much would it cost to insure a used Aston Martin Vantage?

I have decided to get the Aston Martin Vantage (Used). it is around 34000. My salary is around 30,000 a year. I was wondering if insurance is expensive?""

How much would insurance group 7 be?

would just like an estimate how much insurance group 7 is

Where can I find affordable health insurance?

I live in Texas and I've searched high and low for good private health insurance. I would have loved to go with the insurance my job offers, but, unfortunately, they only gave me the run around and cold stares. Im broke, so I can only afford something that costs $20-$80. Thank for the help! ^_^""

What does it mean by excess and young drivers excess?

I'm looking at a car insurance and i'm confused when it say for example 250 excess and 250 young drivers excess. Does that mean i would be paying 500 in excess or just the 250?

Is the jeep wrangler cheap for insurance?

Is the jeep wrangler cheap for insurance?

Best Home/Condo Insurance Companies?

I am looking to obtain insurance for my condo in British Columbia, and was wondering if someone could recommend the best company to with. Currently I am just familiar with BCAA who ...show more""

How much car liability insurance should a person have for complete coverage without over insureing?

How much car liability insurance should a person have for complete coverage without over insureing?

How is 18yr old meant to get car insurance?

I live in London and passed my test in February. I own Renault Clio 1.2 And the cheapest quote i got so far is 305 pounds per month, which is way too much for me. What companies are cheap? What can i do to start driving legally, searching for insurance is frustrating Dont say price comparison websites they suck cheapest quote there was 8k per year""

How come I went on geico for an insurance quote and it said 2000 and people say their's is 75 bucks per year?

Im 18, NY, Kawasaki ZZR600, taken riders safety course, any way to lower my insurance?""

Best insurance company for small startup security training agency and consulting firm?

Starting up in the DC, MD, VA area and looking for an affordable insurance company for a small business training agency. I eventually want to expand into security consulting, but for the time being, it'll be primarily security training. Policy in my area has to be minimum 600k of general liability. Any recommendations?""

Does not paying car insurance affect Credit score?

I haven't paid my car insurance on time. But I haven't gotten mail saying last notice or the company hasn't even bothered me about it. Will this make my credit score horrible? how do i go about fixing it? thanks!

How auto insurance works in california?

i backed up into a car today and there is no damage to my car but a dent in the others hood, and i said lets call the police and they said lets just exchange information, i said no i'd rather have them come...they said they called when i was getting something in my car and said the police said they would take a while so we decided to exchange info...i got her license but they said they didnt have the insurance info with them....but in the mean time i gave them my info...now i have a feeling that maybe they didnt have insurance and there is no police report so what can happen now?""

Keep car insurance payout?

So my car was scratched up during Hurricane Sandy, it didnt get hit by a tree, just stuff flying all over the place. So I called my car insurance like a good fellow and told them. I didnt even plan on going through insurance. I went and got my car independently assessed and the repair cost was $1000. A cheaper option was to just buff the paint (thus only showing the few deep scratches there are) and this cost about $200. I was considering both options,, but honestly I was leaning towards the cheaper alternative. Got my car assessed by my car insurance and they left me a check for $3200. The insurance guy didnt even take time to explain what I am to do with the check. Should I deposit it and then have my car fixed by my mechanic or go to a place that they (insurance people) recommend. Can I keep my insurance payout and have my car fixed anytime? What about the difference? I m not looking to make a quick buck, I didnt even plan on using insurance. But I dont want to be stupid and not have my car fixed either or throw away a windfall. I own my car, though I do make payments on it. I have 2.5 years left till I pay it off completely (loan of 5 years). What do I do next? Please help.""

ark royal insurance quote

ark royal insurance quote

Young Driver Insurance?

Ok, here's what's going on. i am basically a new driver and have passed my test 18 march last year. the time has come for me getting a car, however the insurance premiums are ridiculously high. I have used the comparing websites, but they offer no real result, so I phoned a few up. This is what they gave me, I was asking for a quote, on an 04 Renault Clio 1.2 Dynamic with 3 doors. Co-operative insurance 4645 (Full Comp) Direct line Over 3000(Full Comp) (they wouldn't give an accurate result, I'd have to be transferred onto another dept.) Quinn Direct 6000 (Third party, Fire & Theft only, i was then informed that their premiums where increased) All in my own name and not under any parents, however it seems like the best option at the moment. I do know about a few companies that specialise in young driver insurance, one called Young Marmalade and another called i-Kube. Both are cheaper, but there are catches to policies, i-Kube requires you to have a GPS tracker fitted, if you drive passed 11PM at night a 100 Penalty is incurred, and for each night you drive past said time. with young marmalade you need to have the pass plus scheme. I also know that premiums are subject to a post code area rating. (CH 62) so if anyone could tell me where cheap insurance for this type of car is I would be great-full.""

Free Auto Insurance Quotes At What Website?

I have been looking for a site that gives Free Auto Insurance Quotes, everywhere I have found wants to charge me or run my credit. Can anyone help me? All I want is a Free Auto Insurance Quote is that to hard to find?""

Should we switch from Geico to Farmers Insurance?

We moved cross country and a local Farmers insurance agent is perstering us to get our business... she is actually a nice person. The deal we would get here would be cheaper than with Geico, but I had a bad experience with Farmers a long time ago (They were great until I had an accident, then they slapped me with a huge increase in premium. It wasn't even entirely my fault. anybody had good experiences with Farmers Insurance or should I just stay away from them?""

Car insurance ? add another car?

my wife got a 1995 i already got full coverage how much will it be to add her car?

Where can I find low cost medical insurance?

Where can I find low cost medical insurance?

Cheap Cars for an 18yr old to Insure?

Cheapest I've found so far is a Classic Mini City 1.0 @ 2,500, Corsa 1.0, KA 1.3, Skoda Fabia all came out at 4,500... Any Ideas on anything else? Thanks""

Scooter/moped insurance costs?

I'm thinking of getting a scooter/moped as an alternative to a car. I'm wondering what the insurance would be like for a scooter (50cc) compared to a car (medium sedan)? I am an 18 year old female who recently obtained a drivers license.

How much does car insurance cost in England?

I'm not used to private insurance companies with differing rates! Here are the details: - If I had an older, smallish car, say that cost 900 pounds - No spots on my driving record, been driving for 10 years, *but* - I've just moved to England from Canada - I want full coverage, 3rd party, fire and theft Any advice on who is more, or less, expensive?""

Health Insurance/Student emergency card help!?

I'm currently filling out a Student Emergency Information Card and I'm stuck on the Health Insurance portion... For the portion, it only says Insurance #, I have HealthNet but I don't know whether to write the group number or the subscriber number.. I'm kind of sure it's the subscriber one, but I need some assurance. Also, it asks for Medi-Cal straight after that with Yes/No.. How do I know if it's medi-cal or not?""

Is there insurance for a person that doesn't own a car and rental company doesnt provide insurance?

I want to rent a car but the rental place close to me doesn't provide insurance. They said I would have to provide my own. Is there insurance that will cover me while I rent the rental car? And if there is who will provide that for me?

Since car insurance is required?

and for many car ownership is not an oppition, should car insurance be on a sliding scale?""

Car insurance for sport car?

I have 2005 Mazda RX8, want to give it to my teenager. My question is if it count as sport car or 4 doors sedan( it has 4 doors called suicide door). Can someone help?""

How much would my car insurance be?

i plan to by a 95 toyota , i have been driving since i was 17 and now 21 and have had no accidents. how much would my insurance be on average.""

Auto insurance question Re: teenage driver?

My 17 year old daughter is currently on my automobile insurance policy. She drives my car at times. She'll be 18 next February. Sometime this year, I wanted to get a new car and give her this one. If we have the car registered in her name when I give it to her, does she then need her own seperate insurance policy? Can she still be under my insurance although the car would no longer be registered in my name? I think seperate insurance for her (at her age) would be considerably more expensive. She's still a student and not working yet. Any insights on this would be appreciated.""

CAR INSURANCE? 17 YEAR OLD LAD?

Hi, I recently passed my driving test (approx 2 weeks ago) I've been looking at car insurance and the quotes are ridicouly high if I wanted to be the main driver with my own policy. So my dad has kindly said he will buy a car and be the main driver and I will be the second driver and drive the car sometimes. However the quotes are so high? Anyone know any companies that will insure me cheap below 2,000? The quotes that I get now are like 3,000+ on a standard Vauxhall Astra. Please can you let me know if you know any companies that will insure me and cheaply! Thanks.""

Any cheap motor insurance company for 19yr old?

19yrs old, licence since May '05, planning to buy a Fiat Seicento Sporting (grp. 3), Bradford postcode. I know insurance below the tonne is hard to come by in my circumstances, but any help/suggestions would be be appreciated. Thanks in advance.""

Insurance to drive another car?

I work on a farm and I have to drive across fields and stuff to get around. Sadly, I currently have to do this in my own car so I was thinking of buying a cheap car so I don't ruin my actual car in the process. I can't leave the car at the farm, so it would need to be road legal (taxed, MOTed and Insured) Is there any insurance you can get where you can be insured on both cars but on one policy? (Sort of like what car traders use where they can drive any car that isn't registered to them)""

Can I still drive a car without insurance?

i have my license but i don't have insurance in the car

What all does someone under 18 need to get car insurance?

I'm under 18 years old and I need to get car insurance but I dont know if I can get it on my own. My parents do not want to put me on there insurance and I don't know if I can get it by myself. I also heard that they have to co sign for insurance? If that's true will them co signing for my insurance affect there car insurance what so ever? They think that there insurance would go up if they co signed for me but I don't think that's true. Some one please help!

Car accident now what? insurance question?

I was in my first major car accident, my car was totaled. I was waiting at the light to make a left turn, the green arrow came on and i went and some one coming from the opposite side of the lane in the opposite way ran a red light and hit me, he claims on the report he doesn't know how the accident happened. I just wanted to know what do you think will happen? A witness was talking to the cops but his information is not on my police report. It has to go through his insurance what are the odds that they will know that he was in the wrong and not me??""

Does your car insurance go up if you don't have it for a period of time?

If I dropped my car insurance for monatary reasons, and then picked it back up in a few months would I still have the same rate as before?""

Is there a way I can drop my car insurance since I am not using my car?

I have not used my car in a few months but still have insurance on it. I still want to keep my vehicle though, but just have it in the garage. Can I drop my insurance? My biggest fear is that once I cancel it and want to start driving my car again I will have higher rates? Is there any way I can avoid this???""

Best and cheap major health insurance?

Best and cheap major health insurance?

How/where can I get affordable braces?

Hey Yahoo Answers, I have been wanting to get braces for the past 5 years (since 2007). My main obstacle is affording them. They're heinously expensive. Also, the idea of ...show more""

I was rear ended. Does my insurance go up if I contact them?

I have Mercury Insurance and someone hit me in the back at a stop light. I got all of there info, but I was wondering if we went through this with our insurance companies would my rates go up? thanks :D""

ark royal insurance quote

ark royal insurance quote

Who do you pay insurance broker or car insurance company?

I have applied for car insurance through light house, which is a car insurance broker. I have been told to pay a certain amount to a loan company. Today I have received a notice from Allstate about my policy and I need to come up with almost 1700$ by the 9th. I'm so confused and of course no one is open tomorrow. Is the loan to help me pay my car insurance or am I paying two different people.""

Car Rental USA Insurance?

I am getting really annoyed with trying to get a quote for car rental in USA. For basic rental I have been quoted $200. But then there are all the insurances: Loss Damage Waiver (LDW) Supplemental Liability Insurance (SLI) Personal Accident and Effects (PAE) What do I actually need to have as they are really expensive!!! Adding just the first two takes my rental up to $500. I am very confused. What legally do I have to have? Someone told me the US insurance is strange cos you can get sued for an accident and end up paying thousands of dollars out to the person you hit. Can I just get insurance through my own car insurance here in the UK rather than paying $300 dollars??

Is it absolutely necessary for my car insurance company to have my husband's drivers license info?

My husband and I recently got married. We both keep separate finances and have our own cars and insurance policies. He actually owns cars jointly with his elderly mother and they have insurance together. He does not drive my car, he can barely fit in it. I have State Farm insurance. When I got my insurance I was told that they would cover anyone I choose to let drive my cars. I have 3 cars insured with them. I've been with them for 10 years, I've never missed a payment or had any claim of any kind. My husband doesn't feel comfortable giving out his information to anyone who does not need it. I think he has this right. State Farm claims it won't affect my policy so why do they need it? They keep calling me. I'm thinking of emailing them and telling them my opinion and that there are plenty of other insurance companies out there if they have a problem with it.""

Do you think everyone needs life insurance?

I am 24 years old and someone I know wants me to get life insurance from them but it is only a 20 year term policy what do you think is the propability that I will actually die in between then and now?

Can a 16 year old get auto insurance without being under a parents name?

I'm a 16 year old girl and I'm buying my own car. My parents and i don't get along at all (stepfather hates me, mom isn't on my side). So can i get auto insurance without being under their name? Also, would it cost a lot more? I'm an honor roll student.""

Need help with my car insurance. . . ?

i need some help cos i'm pretty confused so i bought a car at the start of the year, took out a loan to get it, etc and I have been having no problems paying it off so that was going fine. than two months ago i had a huge crash which totalled my car. It wasn't deemed my fault or the other person's fault. I did have full comprehensive insurance, but i missed two payments. I remember recieving a letter saying if i kept missing these payments then my insurance would be cancelled. Than when i put my claim in to get my insurance on my car through after the crash, they said i had recieved a letter syaing that my insurance had been cancelled due to lack of payments. I'm confused, i didn't get that letter. now, i have no car and am still paying off that loan. Is there any way I can fix this. I don't think i would be able to get another loan for another car, and i don't want to put myself into that much debt, but i really do need a car help?!?!?!""

Is the car insurance free for me?

Ok, my family has State Farm and my mom and dad are on the insurance. If they list me as part-time, will they have to pay extra for me (I have a clear driving record.)? I tried to ask the agent this question,but I guess he didn't understand what I was trying to say. He said anyone that my parents give permission to can drive the car and they'll cover if there's an accident. So, does that mean the name has to APPEAR on the insurance if I'm part time?""

Do some states require car insurance before a drivers license?

I'm 20. The reason I don't have a drivers license yet is because my mom tells me that in order to even have a drivers license, you also have to be on some kind of insurance--which is expensive. so is this true or can I acquire a license without insurance, just to have one? I live in Georgia by the way. Tried to look it up myself but couldn't really find an answer. thanks.""

Why the heck is insurance so high?

So I'm 17 trying to get insured on any car from a 1-1.2L DIESEL. I've tried practically everything and it's so expensive. I get quoted 15,000 for a MINI COOPER S and 12,000 for a corsa. The area I live in insurance is low. I passed in july and I really need a car. Any suggestions for cars or insurance?""

What Insurance Company has Accident forgiveness?

I need a company that wont be so expensive. I had a bad accident and need a different insurance company, any good ones? Im in Florida btw""

Car insurance how much am I going to pay for this?>?

Im wanting to buy a jeep, 200 jeep grand Cherokee its 4X4 and $3999. Its Black with leather seats. Very nice jeep. Id like to get it. Ive had my jeep in my boyfriends, stepdads Garage for almost a Year. They keep putting me off and I just Want to get my own thing. Im tired of borrowing there cars. The jeep I had thats in there shop is an old 1990 cherokee. and its was under my boyfreinds insurance All state. He says its expensive to get my own. I see quotes all over the place. Ive never been in a wreck nor have ever got a speeding ticket. Im responisbile have my own job. Im 23. Every time I bring up the fact that I want to just go to the dealership to get a car. He says Ill pay Alot becuase its a jeep and since its not all paid off I will be paying Alot. Im thinking about getting a loan. Ive got 700 in the bank right now. I dont have any lines of credit. I really need to know how much insurance for Good insurance will it be. I have no clue what anything is with insurance policys or what. Just clue me in. PLease. thanks""

""Car Insurance, please read?""

Basically I live in the UK and it's my 17th birthday in July, and I want to start driving as soon as I get to my birthday, however I am looking at what car to buy by looking at the what cars give me the cheapest insurance. However if I go to a website such as www.comparethemarket.com (not to mistaken for comparethemeerkat.com ;P) I can't get a quote as it says the date of birth is invalid (as obviously I can't drive yet) so I'm just wondering if it is illegal or something to put my date of birthday as february instead of july just to get a quote. Please don't just say things like pass your test first as I really am interested to see an estimate on how much I will be paying Also, if it is not illegal, should I put a false name and address on too, or is that part illegal while the date of birth bit it. Many Thanks""

Does anyone know which insurance companies do not using residential location in calculating car insurance?

I guess I have heard a few months ago that some car insurance companies will not include the location of where the car would be parked in their calculation of car insurance. The media touted that it will cost less to car owners who live in high traffic areas such as Los Angeles. Any input will be welcome

How to do teens afford cars without going under their parents insurance?

Hello, so my friends have their g2 and their parents pay for their insurance. My fathers cheap in ways and he doesn't want me under his insurance. I do have my own car it's a ...show more""

Why is a car insurance trying to settle a car accident claim fast?

I was in a car accident. The other driver did a squat and stop scam. (the driver speeds out quickly in front of another driver so he/she wont have enough time to stop and then sit there so the other driver can hit him/her) However, the other driver's car insurance trying to settle quick. The driver's car insurance company did their investigation and came to an conclusion that I was at fault.. (yeah right) The accident happen on 4/20/11 and they trying to settle on 4/28/11. (eight days later) When I mentioned that my attorney was handling the case. All of a sudden the company sending me letters claiming it my fault and I have to pay for my own damages. And, that I have so many years to take the claim to court. (hoping that I want) I just fax everything over to my attorney. I am still going through therapy. I do have car insurance. So, why is the driver's car insurance company trying to settle the claim quick when they was actually at fault? Please, only knowledgeable people reply. Thank you so much Note: The driver's girlfriend was told to fake she was injury because she is pregnant. Also, the driver came out the wrong exit of the driveway speeding..""

Jeep Wrangler: Insurance coverage costs?

I am a girl beginning driver, turning 17. I live in a rural area. I want a 1999 Jeep Wrangler SE. I am part of my family's plan. Does anybody have a price about what would cost a month/year? Thanks.""

What is the most affordable life insurance and health insurance?

Where can I find Affordable Health and life insurance for me and my wife. What is the best web site with online quotes?

18 and on my parents insurance?

My mum is on my dads insurance and she is going to take out her own insurance and put me as a named driver while staying on my dads insurance. The quotes were all over 2,000 for me to go as a named driver. It was 2,100 for me to go on my own insurance anyway. You know any way I can get it down to around 1500? A different car or something. We tried a vauxhall corsa and a ford fiesta 1L all over 2,000 Thanks""

How much does car insurance in florida usually cost for a 19yr old girl .... i've never had any?

How much does car insurance in florida usually cost for a 19yr old girl .... i've never had any?

What is the best health insurance in california?

sould i go with the one that has deductible, and what it turns out that i have a cancer , m'i gonna be covered. i've been having this buzzing ear ( left) for few months and now i get dizzy when i look up and i started to feel oressure in my head and light headache. my emplyer's insurance start in 2 months and i need to be checked now, and i don't qualifie for medi cal any suggestion , advice?? thanks""

Insurance on a used car verses a new car?

My dad says that if I buy a new car my insurance will double or even more than my insurance on my used car. Is that true?

Why is car insurance expensive for teens 16-24?

Im in class right now and im doing this paper. i need a couple facts why its expensive for teens

What is cheaper to run on daily bassis Toyota Celica or Honda Civic Type-R?

I would like to maybe buy a Celica 190 I'm still deciding between this and the Type-R. I'd like to know does the Type-R cost a lot to run or is the Celica cheaper? I do about 100 miles a week would this kind of mileage be too expensive for any of the two cars? I'd also like to know what the average service charges are when it's due one. Also are they quick? I'm 34 so insurance is not too bad for me but I just would like to know from other owners of these cars what the real cost of these great machines are.Cheers

Who's the best company for young car insurance?

I know the kind of car to get for cheap insurance but i'm still looking at around 3000 for insurance, i was just wondering if there is any companies out there people my age can actually afford.""

How much money would Insurance cost annually for a 150cc Scooter?

Right now i am 15. I want to buy a 150cc Scooter when i turn 16. I need to know how much money on average would insurance cost annually for a 150cc Scooter.

ark royal insurance quote

ark royal insurance quote

How much does it cost a 16 year old to insure a Jeep Wrangler?

Hi; I'm a 16 year old girl as of next month and I'm looking at cars. I'm trying to find a car that is good on gas, cheap to insure, not too expensive to buy, and not an embarrassment to drive. The three cars I am looking at right are the Jeep Wrangler, the Dodge Stratus, and the Dodge Neon. I tried to get a quote on the three and was surprised, (Especially at the Neon) to find that I would be paying over 100 dollars for each of them, monthly! Am I looking at an illegitimate quote or is it really that expensive to insure these cars? What kind of numbers SHOULD i be seeing, reasonably? Thanks""

Do I need car insurance...?

I have a car that will not run at my residence but is still in my name. Do I still need to have car insurance on it? I have a personal insurance that just covers me but not on any specific car. I live in Florida if that helps.

Motorcycle insurance?

my motorcycle insurance policy is about to expire next month, so im just looking into companies/experiences to see if i should switch (since getting quotes isnt as easy as they make it sound!!). ive been with progressive for a year and pay 93$ a month. i was honest when i joined and said i had less than a year of experience-- i'd literally learned how to ride right before signing up with them, though because i learned with one of those motorcycle safety courses, i got a small discount with them. so, now, i have a year of experience as well as a year of owning my bike (which i paid for in full and am the sole owner of). i'm 20 year old female, have a kawasaki ninja 500r, use it for pleasure purposes. my driving history, unfortunately, is not pristine. in 2009 i got a speeding violation for MORE than 10mph over the speed limit (that was in my car), and last month, sadly, i was in an accident that was my fault (also in car) (no injuries). i havent had any infractions on the bike. i have a motorcycle endorsement on my license and, as i said, passed a motorcycle safety foundation course. i got a quote with geico, and their prices were really just obscene. so, basically, i just want to hear from other ppl who deal with the same thing. how much do you pay for bike insurance? have any good recommendations for companies? what companies are known for being a little bit more forgiving about accidents, seeing as i just had one (again, in my car, not my bike, but i know it matters). any tips, etc? i know being young and not having a lot of experience are not on my side, just thought id try :)""

My brother got my friends car and got stopped for dwi and the car now is impounded. But the insurance?

But the insurance is under my friends brothers name cuz my friend dosent have a licence and his brother is not here. but i got a license what can we do to take the car out??

Would a 2001 jetta VR6 be expensive for insurance?

Would it be expensive for insurance, im 17 almost 18 male car costs around 6000""

Can I register my car without insurance in Utah?

my registeration on my car lapsed in april, I do not drive the car but in Utah you can not even park it out on the street without it being registered. so I was wondering since some of my neighbors are wanting my parking spot since they are moving in can I just register my car since I have enough money to get it registered but I do not want to pay the monthly insurance on it since I am not driving it I am just holding on to it until my daughter turns of age to take it.... thanks.....""

Lamborghini insurance cost?

In the next week or so I'm buying a lamborghini Reventn and I forgot to find out what the insurance will cost.

Where can I compare legal malpractice insurance like car insurance quotes?

I am a new lawyer and need to get receive coverage. Any attorneys out there know how much I'll pay? Who has good rates?

How do I get health insurance?

I'm nineteen and live on my own and have no affiliation with my parents. I'm going off to college in the fall but I need health insurance to go and I work two part time jobs, neither of which offer health insurance. Any idea how I can find a place that'll take me? If it helps, I'm from Philadelphia, Pa!""

How do you feel about insurance companies pulling your credit report?

I live in Michigan a state where it is law to have insurance. I have also been denied insurance by a certain large insurance company based on my credit score. I just don't think they should be able to pull your credit report if your required by state law to carry it. Hey if i don't pay it cancel me.

Insurance information for young drivers?

Im 22 years old. I currently on my mom's insurance so that it's cheaper and I recently traded in my other car and got a new one. How much do You think insurnace would cost if I got it on my own. I pay 130.00 now for full coverage? I don't get along with her and I wold perfer not to have her on my title. I was told I needed to have her on my title in order to be under her insurnace?

Does anyone know of a cheap auto insurance carrier in california?

does anyone know of a cheap auto insurance carrier in california

1000 Car Insurance for an International Student?

Does anyone know a cheap car insurance company for a young driver (21 YO) who will be driving with an international license for 1 year? I have tried Clements but they don't do insurance for students. Can anyone please help? The major online companies are so expensive

How do speeding tickets affect your insurance?

i received a 81 dollar ticket and lost 2 points last friday. im 16 and i was driving my moms car. the car is in her name and so is the insurance so since I got the ticket how will it affect my mom's insurance? i am not on the insurance nor on the title for the car.

How do you find affordable medical insurance to cover family after the breadwinner becomes disabled?

How do you find affordable medical insurance to cover family after the breadwinner becomes disabled?

Car insurance?

what happens if you have liability car insurance and a guy that smashes your car hits you and he doesnt have any insurance? are you covered or are you screw ed?

Car cheap on insurance?

Hi im wanting to buy my first car in a couple of months so i would like to know of a car thats got a small engine 1l preferably and cheap on the insuramce,yet slightly large for personal use such as fishing :) and finally a hatchback""

I need cheap car insurance.....?

im 18 and need to know of any way i cna get low car insurance.... any tricks may help the siap im not sure i qualfy. im low income is there any government program or something? anything would help please let me kno about how much i would need to pay. Im 18 male in north jersey. car is coupe wit 4 doors and light weight

Will I be paying two deductibles or one for two car accidents different insurances?

Hi, Today I hit a car that is of a stranger and we exchanged information about each other's insurance. That person's insurance company and mine are different. We didn't ...show more""

How does Progressive compare your insurance rates with top companies?

How is that possible? I've applied for Progressive quotes before (and wasn't impressed at all), but how are they able to do that? Insurance companies all have complex formulas that are used to calculate rates using several factors, including driving history, location, credit, household drivers, vehicles, etc. Unless they have robots online that steal competitors' bandwidth and automatically fill out the forms, it doesn't seem possible. If that was the case, you would think other companies would block Progressive from abusing their servers. Any ideas?""

I got a ticket for no insurance..?

but i actually did have insurance i just happen to show the officer the wrong one is there anything i can dot to avoid this 3 yr surcharge.

Car insurance help?

Ok so im about to turn 16. my parents said they would get me a car, but only if i paid my own insurance. can u please tell me how much it would be a month. and what company would be the lowest price. i dont know if u need this info but. im 16. white ( someone told me it matters?), i live in florida (palm beach county), and the car will probably be an audi a4. can u please give me an average amount a month so i know what my goal to save up is.""

Will Health insurance costs be lower now that they are making us get it?

How much will we be Taxed if we still can't afford it ?

Car insurance question?

If something happens to your car and it falls under comprehensive coverage, will your insurance premium go up after the incident?""

Will my car insurance be affected? Please help?

My friend crashed my car and she got charged with DUI, my car is totalled. I was in the passenger seat, but not driving. What will happen to my car insurance?""

ark royal insurance quote

ark royal insurance quote

https://www.linkedin.com/pulse/arcata-california-cheap-car-insurance-quotes-zip-95518-robert-watkins/"

0 notes

Text

aaa rental insurance quote

"aaa rental insurance quote

aaa rental insurance quote

BEST ANSWER: Try this site where you can compare quotes: : http://financeandcreditsolution.xyz/index.html?src=tumblr

RELATED QUESTIONS:

Top 5 or 10 florida health insurance providers?

top 5 or 10 best florida health insurance providers

Do rich people need health insurance?

I would prefer that wealthy people answer this question so that I get the facts and not theory. Anywho, I am wondering if rich people not only need health insurance, but, do they even carry it? I always think of insurance as a scam that doesn't live up to their end of the bargain if they think your going to cost too much, like a catastrophic health issue for instance.""

Is there a website for seeing what class of car you have for insurance to see how much it wil be.?

I know insurance have classes of cars based on a number. Like my old school might be a 7. but my Escalade might be a 20 or something. Please help.

I think this is how much $ i will need for everything to move out..can you review it & tell me anything wrong?

please tell me if im forgeting anything or if i am expecting to pay too much or too little for something CAR down payment - 5,000 insurance-300 gas-300 monthly payment-500 maintenance-100 HOUSING security deposit- 2400 rent-800 electric-150 furniture-2000 OTHER THINGS food- 300 linens-150 kitchen appliences-350 cleaning supplies-30 shampoo, soap, toothpaste (things like that)-70 tv-300 computer-600 cable- 100 phone- 75 cell phone- 160 internet- 100""

Car insurance question?

I currently own a Peugeot 206 on which the insurance is due for renewal at the beginning of December and is going to cost me somewhere in the region of 800. I am now, however looking into buying a Golf which would cost me around 950 to insure if I was to start the policy from scratch. My question is if I go on to insure my Peugeot for 800, if I buy a Golf say, a month, afterwards will it cost me a lot more to change the car over or will it just be like the diference between the 2 quotes for a year? I really don't want to waste hundreds of pounds by changing the cars over a month or two into the policy.""

Best Apartment insurance?

Hey I need apartment insurance. What are the top five best apartment insurance places? Thank you!!

How can I get car insurance without a guardian?

I live with away from my parents, Im almost 18 but not there yet. How can i get car insurance without having a guardian?""

Best insurance company for small startup security training agency and consulting firm?

Starting up in the DC, MD, VA area and looking for an affordable insurance company for a small business training agency. I eventually want to expand into security consulting, but for the time being, it'll be primarily security training. Policy in my area has to be minimum 600k of general liability. Any recommendations?""

Affordable health insurance?

I am a married woman and am looking for health insurance just for myself. My husband does not want to get it for both of us just yet. I get birth control every month and I have contacts, so I would like affordable health insurance that would include vision and lower my yearly visit to the gynecologist. It should also be good for the possibility of my birth control failing and I get pregnant. I live in Alabama. Do you have any ideas? I'd like it to be under $100 a month.""

Do I have to have car insurance?

I use to own a car and had insurance I now sold the car and drive a company car 100% of the time. I called my insurance guy and told him to cancel it and he says that Illinois has a state law that says I have to have insurance on a car since I live at home with my parents and everyone in the house has a car. I could potentially get in to one of there cars and be uninsured. I told him I don't cuz I still a car with company insurance he said I have to have a policy with my name on it by law is this true?

My new employer wants to add me to their auto insurance i have 30 years driving experience?

But I have not been insured for 10 years.will their insurance rates go up?

Where is the cheapest place to get motorcycle insurance?

I am 21 have a clean driving record and have a motorcycle permit. I got a quote of $30 a month that's with comprehensive with a deductible of $100. Is this probably as cheap as I can get?

What is the best affordable Health Insurance in Las Vegas I'm 24 and don't have any medical conditions ?

What is the best affordable Health Insurance in Las Vegas I'm 24 and don't have any medical conditions ?

Best non-owner liability coverage insurance?

What is the best non-owner liability coverage insurance in New York ?

What is the cheapest auto insurance price in Michigan?

What is the cheapest auto insurance price in Michigan?

Affordable health insurance?

Dental, health.. I need to know the best way to go about it. Thanks.""

How much would my insurance cost? (volkswagon knowledge needed)?

Hi so i am in the process of looking for my first car....now i am not spoiled i promise i earned all my own money...My friends father buys cars, fixes them up, and resells them. It so happens to be that he has a very good condition 2001 Volkswagon Passat W8 with basically everything you can get in a car. Sunroof, heated seats, memory seats, cd and cassette player, nice stereo system, auto matic seats, steering radio controls, and a few other simple things... The color is black. Now he is asking about 9000 give or take for the car.. I need help with how much my insurance could cost as a 17 year old. If it helps i'm not in it for the car as much as just something that looks nice and goes that i know wont break down....everything is new, the brakes, oil, everything all checks out....I know that the color and the model will have a big effect with what the cost is... I am pretty much an A to a B+ average student so thats good... I just want a general idea of what it would cost for insurance a month. Like i said the car is black and has stock rims, and has a W8 engine. Please and thank you...If you need information just say so""

Health insurance for your car?

I own an auto repair shop, and I had an idea that I would like you all to help me with. What if there was a program where you paid a monthly premium like health insurance. Then, When you needed an oil change, fluid flush, light bulb, new alternator, new tires new brakes, new engine, or needed to fix an oil leak, you wouldn't have to pay anything you would just go in to get it fixed. What do you think would be a good rate for that monthly premium in everyone opinion? The rate would depend on whether you owned a car or truck, and wether or not it was 4wd. What do you all think?""

""My sister is 19years old and she is going to college she needs medical insurance, but she has to pay for it, d""

Does anyone know anyone know any low cost insurance companies. She has been having uterus problems aches and pains,she cant see a doctor she says she cannot afford it. I want to help ...show more""

What about insurance for 1st offense DUI's?

Geico quoted me with $2,000 for 6 months.....hiyaaahhh... I've heard about Freeway Insurance and then there are the strip-mall insurance companies. Are they legite ? thanks""

Progressive is hiking my Massachusetts car insurance rate by 23% this year! Is that normal?

My policy is about to come up for renewal and they're going to hike up my rate by 23%! I just talked to their customer service person and she said they're doing it all over Massachusetts. Are all the car insurance companies raising their rates so much in Massachusetts? Was there some law that passed which changed their profit margin or something? Is there another car insurance company that will give me a better deal?

Do you have to get insurance before you can get a license plate?

I just bought a used car off of someone and drove it home. Luckily it was at night because the car doesnt have a license plate. This is my first car and none of my family seems willing to answer the phone today to help me. What am I supposed to do first? When I looked up the cost of plates, it said that when purchasing the plates insurance must be presented at the time of purchase. So that means I have to get insurance before I can get the license plates right?""

What is the average cost of health insurance for an infant/family plan?

What is the average cost of health insurance for an infant/family plan?

Cheap health insurance?

Hello, I work as a nanny/housekeeper and do not have insurance available through work. I live in NH and I need to get cheap health insurance. I haven't had insurance in years.""

What would be the car insurance for a used car?

What would monthly car insurance cost for a used car about $2000 give or take..

aaa rental insurance quote

aaa rental insurance quote

How can i get car insurance cheap ?

i am a young driver and car insurance is a joke how do i get it cheap without breaking any laws ?

About how much money would car insurance for a 2003 convertable saab cost?

just some rough estimates. i know insurance places are different.

What's the best place to get cheap insurance on an imported Mitsubishi L300 Campervan?

What's the best place to get cheap insurance on an imported Mitsubishi L300 Campervan?

How much is the insurance on 50cc scooter for a 16 year old?

Please could you tell me the amount for full comp, cheers""

Insurance for a rental car?

Is your own insurance enough to cover a rental car or should you purchase the supplemental insurance offered by car rental companies?

Has anyone heard of American Family Insurance? Are they a good company?

Has anyone heard of American Family Insurance? Are they a good company?

Can my dad by a motorcycle and put it under his insurance for me to drive?

ok im conused about this whole thing i know for a 16 year old motorcycle insurance is crazy. So how would this work my dads been driving all his life(Harley-Davidson) and his insurance is cheap, now for me its gonna be alot of money so can he buy the bike and put it under his name then i just drive it so then it wont be so much $ on me? can this work or is that illegal for me to be driving someone elses bike? is there anyway like i stated above to make my insurance cheaper if this doesnt work?""

Question for anyone that knows about insurance?

I am renting a garage that is not attached to the house and want to insure it. Would this be covered by the house insurance or would you need separate contents insurance as its not near the house. If you need seperate cover where would I go to get this?

What insurance group?

I'm interested in the Mazda RX8 but would like to know the insurance group without having to go for a quote. I'm not looking at a specific car just love the cars and am interested.

Car Insurance rip off?

Just a warning anyone thinking of taking out car insurance or renewing their car insurance with the AA check with many other companies first, the quote they have just given me is DOUBLE that of any other like (Direct line,LV,Barclays ect ect) the AA are brokers and the insurance they offered is supposed to be the cheapest they could fined from LV and when I went on the LV web site to get a quote it was half that the AA had quoted.""

Im 21 and in need of health insurance...?

My company offers it but its like $200/month and i cant afford that! Im a female, non smoker, and in good health. I just need basic health insurance that has dental and eye. What are some good options out there?""

Can I put my mom in my health insurance?

Can I put my mom in my health insurance?

Suggest a good insurance company?

I want to buy a insurance plan for my stock and machinery. Please suggess a good insurance company.

Good and Cheap insurance in los angeles??????

i need help!!! I need to find a good and reliable insurance for my car thats not expensive. Considering im 21 and just purchased a brand new honda 2007 civic and I live in Los Angeles....its going to be a mission to find a resonable one. So to those who were in my position and are getting a great offer from someone...please let me know!! :)

Were do i get classic insurance for 91 calibra 4x4 turbo.?

Were do i get classic insurance for 91 calibra 4x4 turbo.?

Will a B average my freshman year apply to an auto insurance discount?

I had a 3.2 last year (my freshman) year, and as of now I have about a 2.5. I'll be getting my car soon, so if I can't bring it up by then, will they accept last year's GPA so I can get a 10% discount?""

Whats the cheapest place in rochester ny for car insurance?

im 18 with a permit and i want to put my 1988 audi quattro 90 on the road,,but i was wondering what would be the cheaest place in rochester ny to go to?""

Which 1 is the best and Cheap Car Insurance?

Plz Help! Just bought a Car and Looking 4 a good Deal! :)

""What are my options, health insurance wise?""

I'm 19 and MassHealth is being a b**** and canceling my insurance. I got no job and I'm a full time student. Is there anyway to get insurance like this? I mean, Massachusetts must have something for people like me. Anyone else having this problem and have a solution? If so it would really help.""

Why does car insurance cost so much?

my insurance cost me like $250 a month.. which is more than my car payment..

How does business insurance work in a lawsuit?

As a small business, I'm finally getting around to looking at business insurance. God forbid I should get sued, but that would be the only reason I would get insurance at this point. If I get sued (assuming I did nothing wrong that would terminate coverage), what are my responsibilities with regard to paying legal fees? What role will the insurance company play or what control will they have in the litigation process?""

How to rebuild credit score?

I can't get approved for a credit card because I couldn't pay my car payment or car insurance for 2 months cause I lost my job. Although my credit score is around 530, which isn't too bad. But I have a lot of inquiries on my report from trying to get a car loan a couple years ago.. Now I'm trying to get a loan for school.. So what are my options?""

What's the cheapest Insurance company?

I'm sixteen, will be seventeen in June. I just got a job and I need to get insurance so I can get a car. My parent's insurance will be really expensive plus to put the car on there it will be even extra. Can anyone tell me what the cheapest car insurance place would be for me with full coverage? Thank you (: oh and my car will be a 2000 saturn.""

How much trouble would I get into if I drove my car without any plates or insurance?

My other cars engine blew out and I was just going to put that cars plate onto my other one (which doesn't have any plates or insurance) I live in MI..Im pretty sure its not a felony, the other one was registered to me until i transfered the plates and insurance onto the car thats engine blew.""

Need advice: Parked car hit - Car has no insurance?

Ok, so last night my friends car was hit by a driver who fell asleep. the car was in front of our house and pushed 40ft and his flipped over. Both cars totaled. He has insurance, but my friends that was parked and hit, does not. Will this be an issue for her, or will his insurance be paying for everything since he was 100% at fault? Please help!""

aaa rental insurance quote

aaa rental insurance quote

Can anybody Reccomend a good online insurance company for a Cagiva Mito 125?

I have been looking around for a low insurance rate for my Cagiva Mito 125 Motorbike, does any Mito owners know of a good insurer for that bike and how much did you pay?""

Insurance costs for a 1999 ford mustang gt?

I am just wondering what the insurance cost would be for a 1999 ford mustang gt would be for a 17 year old male. I get a's and b's on my report cards. Also, would the insurance costs for a 1999 ish Ford Mustang base(not gt or cobra) be lower? Thanks, Alec""

Cheap car insurance...who are you with?

i am looking for cheap car insurance for my two cars. i had my license since i was 18 and now im 20. i have no tickets and i need to find insurance please help me....who do u have and how much do u pay?

Coop Young Drivers Insurance. Where do they install the smart box?

Where do they install the smart box? My car has got two 6x9's on the parcel shelf and they won't insure a car with modified sound, I'm thinking of removing the parcel shelf and hiding the wires leading to it when the engineer comes around. Would they notice?""

How much extra would it cost to add a 17yr old to insurance? helppp!?

i was wondering how much it would cost if i was added to my dads insurance as the 3rd driver, he pays arounds 400 for the insurance but i was wondering how much it would cost if a 17 year old who just passed his license would add to it. im sure it wouldnt be much as i will be the 3rd driver but im not exactly sure.""

Can anyone explain life insurance to me?

Can you insure the whole family? As if, if any of them passes away the rest get the money?""

How to find free medical insurance?

i m cheap person who work partime and i can t afford to pay alot money so do u guys know any free medical insurance or dental ?

""Does anyone here use cancer insurance? If so, which kind?""

Does anyone here use cancer insurance? If so, which kind?""

I was wondering if Doctors pay for health insurance?

Since they are doctors, do they need insurance?""

What questions should i ask before getting LIFE Insurance?

Im about to get life insurance, but i dont know how it works. What are some questions i should ask the insurance agent before signing any papers? Please help!""

What is the average value for contents insurance for a three bedroom house with no major valuable items?

I've not had to get content insurance before and my removals company want to know the estimated value of the items i'm moving. I've not got a clue, help.""

Is women getting cheaper car insurance on the basis of their gender illegal?

Is women getting cheaper car insurance on the basis of their gender illegal?

Do I need to have insurance before registrating a car in California?

Do I need to have insurance before registrating a car in California?

What is the best auto insurance for teens?

What is the best auto insurance for teens?

Car insurance if I don't drive?

My mom is taking me off of her car insurance policy since I no longer own a car, don't have a job to get one or pay gas, and don't even live with her anymore. Yesterday I got my drivers license address changed to my current address which is with my boyfriend. Now his family is making a big deal about it saying that even if I'm not driving, it's illigal to have a licensed driver living in their house with no car insurance and that I have to be under insuarance. This dosnt make any sense to me. Is it even true or are they misinformed? Please help!!!""

""Conservatives, you're always claiming that Obama-care is the reason that insurance costs are increasing, so?""

regarding the 80% increase in insurance premiums, and the 11% increase in the number of Americans who did not have health insurance coverage during the Bush presidency, was that because a magical elf traveled back in time to the year 2000 to tell insurance company executives that Obamacare was coming? Or could it be that insurance premiums have been increasing at an average rate of 8 to 11% per year for about the last 15 years and the increases we've seen in the last few years aren't indicative of costs associated with Obama-care (Which hasn't even been fully implemented yet) and Conservatives are just trying to make political hay out of cost increases that are consistent with established trends?""

Insurance Coverage and DWI?

Do auto-insurance companies pay for expenditures of repairs on a car in connection with a DWI?

Changing insurance from a cbt to a full motorbike licence?

I am currently 16 and becoming 17 this month. I already have my 125cc motorbike in my garage, I want to insure it on my birthday on a CBT but want to pass my motorbike test so I can ride on motorways and get rise of my L plates. My question is if I'm already insured with a CBT, what will it cost me to change to swap to a full motorbike licence. Will my insurance company charge me anymore?""

Transferring insurance license from California to New York?

Does anyone know about this? Do the states have reciprocity? I searched Google/official sites but couldn't find anything. Thanks in advance.

I have lost my car insurance details and paid in full how can I find out who I am insured with?

After paying for my car insurance in full I have lost the documentation and cannot remember which company I am insured with is there any way to find out who my insurance company is?

""How much do you pay for your car insurance policy evey year, all said and done?""

My boyfriend and I are moving to Portland Oregon, and we're trying to get some sort of idea. This is some info that would help us get an idea. How old are you? How many people are on the policy? What type of car(s)? How much coverage? THANKS!""

Do the amount of miles driven affect auto insurance rates?

My policy lists that I have coverage of 12,000 miles a year. I average less than 6,000 miles year however.""

""Is $150/month too much for auto insurance. 21, female, full coverage?""

I signed up for Allstates full coverage insurance for my 2006 Toyota corolla. I'm 21, female, and clean driving record so far. Is 150 per month too expensive?""

How do i go about getting sr-22 insurance?

i live in new mexico, and i'm sure it varies a little form state to state, but can you tell me the process you went through and possibly what kind of increase in insurance rates im looking at?""

Car insurance!!?

i finally got my license , my dad is giving me his car and he has insurance but my name is not on the policy. can i still drive. Im leaving for vacation in two weeks so putting my name on the policy will just cost money for just two weeks. i won't be back for three months from vacation.""

aaa rental insurance quote

aaa rental insurance quote

Can a person get medicare Insurance at 62 years old? What are the options?

I work with a guy who can retire this year because he will be 62 years old. And although he has a good retirement pension plan. He tells me the drawback is that he will not be eligible for medicare until he is 65 so he will probably have to work until then. Because of this I being much younger will more then likely will get a pink slip this year and be looking for work. This guy has way more seniority . Does this man have any affordable options? He really wants to retire.

Does accident report effect my insurance?

someone hit my car and today we are going to make that accident report so does it effect my insurance?

How much will my insurance increase?

Im 17 an had my first accident when i swung in to a parking spot a little too fast and too close and my door scraped the back bumper of the car next to me...i dont think it will be any more than a few hundred dollars to have it repaired it was just a bit dented and the panel needed to be pulled out to sit flat with the rest but that really is the only real damage other than maybe a few scratches. My insurance before was at 800$ a year without full coverage so what do you think it would go up to now?

I think this is how much $ i will need for everything to move out..can you review it & tell me anything wrong?

please tell me if im forgeting anything or if i am expecting to pay too much or too little for something CAR down payment - 5,000 insurance-300 gas-300 monthly payment-500 maintenance-100 HOUSING security deposit- 2400 rent-800 electric-150 furniture-2000 OTHER THINGS food- 300 linens-150 kitchen appliences-350 cleaning supplies-30 shampoo, soap, toothpaste (things like that)-70 tv-300 computer-600 cable- 100 phone- 75 cell phone- 160 internet- 100""

How will my insurance premiums be affected?

I got into a minor fender bender. No scratch on either car but the person I hit (I rear-ended them) is claiming that I caused their airbag light to go on. Now they are going through the insurance process and it is not known yet whether they will claim against their own insurance company or go through mine. How do you think my insurance premium will be affected by this? Thanks for your help.

Pregnancy insurance?

How much does pregnancy insurance cost for a young couple? I'm not pregnant yet, and we're both healthy. Just want to play it safe... :p Thanks so much everyone! :)""

Is there a way for me to get affordable car insurance?

hi im a college student in NYC i am single and live alone in a studio apartment in Brooklyn NY i work in an armani exchange store and at the moment im also going for acting and have already nailed some gigs. My question is if anybody knows how i can get car insurance under $4000 (BTW i dont have any1 living in another state) i checked most companies and they offer 10-13k either a year or 6 months so please if any1 knows how i can get insurance help me out i am in dire need of a car.

Why would a African America have to pay more for car insurance?

Me and my friend writes for the school news paper. We did our own investigation like the local news will do sometimes.We both at two different times went to see a local and same agent for a car insurance quote . We are both the same age, No record of bad driving, No criminal record, also wanted insurance on the same car and same gender. The only different variable was race. I don't think time would of played part since it was only 1 hour apart. This offends me how the car companies can do this. I wondered why? Any information or missing links that can help us write this story?""

Car insurance policyholder and registered owner?

I am 19, living in Florida. My car is registered in my name. My family keeps all of our cars on one policy. The insurance company is aware that I am the registered owner and I am also listed as the main driver for my car. Does that present any problems liability or insurance law wise?""

How can you keep your car insurance rates as low as possible?

Car insurance rates fluctuate from company to company. What tips can you offer others to help secure the most competitive rate? Yahoo! Canada Answers staff note: This question is asked by Gregory Ellis, co-founder of the the insurance shopping service kanetix.ca. Visit http://www.kanetix.ca/YAHOO_answers for more information.""

Cheapest car insurance in texas?

Hi... I have been re searching insurances and they are most around 180.... i was wondering if there were any other cheaper ones in texas... am single pregnant with assisiates, renting, 23 years old. No tickets. 1 acciden no okthers damaged.....""

Where can I get a cheap insurance for a new bussines?

Im about starting cleaning houses but i need an insurance

Is it necessary to buy rental car insurance even though i have my car insurance policy with me?

i have a car and have taken...if i take a rental car , then my auto insurance...""

""What would be 15,000 pounds after tax and insurance for one month?""

What would be 15,000 pounds after tax and insurance for one month?""

How much will insurance cost for a kawasaki ninja 250r monthly for a 20 year old beginner?

i think i might go with state farm.

How much is it for car insurance for a 16 yrs old in long island ny?

i am gonna be driving a ford station wagon 1989 escort

Car insurance for a new driver?

i want to buy a small car, but im worried that the insurance will be expensive what company sell cheap insurance? how much about did you pay? i want a small car, like a 1 litre engine thank you""

I let my car insurance lapse....will i get in trouble?

my car insurance is lapsed right now. i know when you sign up for insurance they always ask its been lapsed. when i say yes, which i ll tell the truth cuz they ll find out anyways, what will they do? will i be in trouble?""

Looking for a good car insurance.?

hello every one, I am not satisfied with the insurance that I have (hartforth) due to a small accident that I had that i was not my fault and I am still waitting for them to call me back when the accident was two months ago, I do not want to deal with them again. would like to change it for an other one but I do not know wich one. can some one please let me know which insurance is the best for Southern California. thanks every one""

Where to find affordable health insurance?

I need blood presser pills but cant afford lab work or doctor fees

Pay the Extra Premiums for Whole Life Insurance Quotes?

I currently have a term life insurance policy and am considering converting it to a whole life policy. I'm married with no kids. My wife has her own life insurance and retirements already in place. We are not going to have children. The main reason I was interested in the Whole Life was the investing portion to supplement my current mutual fund retirement. Should I pay the extra premiums for the Whole life or should I keep the term life and put the extra money into a Roth IRA? Any advice would be great. Thank you

Low cost liability car insurance in Conroe tx?

What are some places, How many people do you have on your liability insurance and how much do you pay and who do you have? I have two people and atm using AIG. they are going to up my bill over 65 a month. Wondering if anyone else is getting better?""

Why can't health insurance do new methods to cut cost?

Just thinking, how about use health care at another country for cut cost? Let say you live in USA, need heart sugery, do it at India to save insurance money. So health care become more affordable, yet insurance company can make more profit. You maybe say people don't like travel, well if you want more coverage with lower price, you got no choice. Or pay full price for insurance if prefer use America hospital. I understand some situation can't because emergency and need treatment in less than hour so can use local hospital. I am talking about if need medcial attention in less than 24 hours, can be done, insurance can arrange travel, and treatment at half way around the earth. Example: cost 100,000 dollars in USA, cost 7,000 at India for same treatment. Save: 93,000 dollars for all of us.""

Insurance cost?

i'm 17 years old, my car is toyota celica v4, 2 doors. can anybody tell me how much my car insurance cost, no need exactly but close to""

What homeowners insurance do you use/recommend?

I am looking for homeowners insurance for a home in California. We have 2 dogs, one which is a German Shepherd. What insurance carrier works well with dog owners?""

aaa rental insurance quote

aaa rental insurance quote

https://www.linkedin.com/pulse/who-does-cheapest-car-insurance-17-year-old-males-luis-barnes/"

0 notes

Text

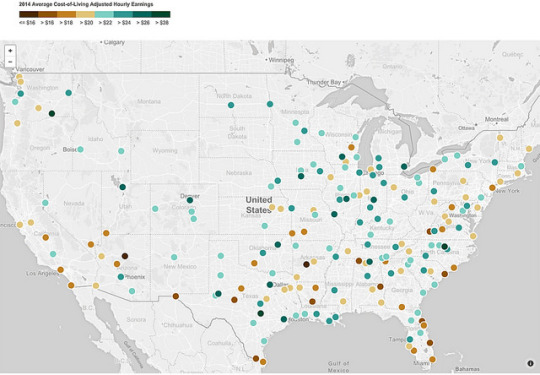

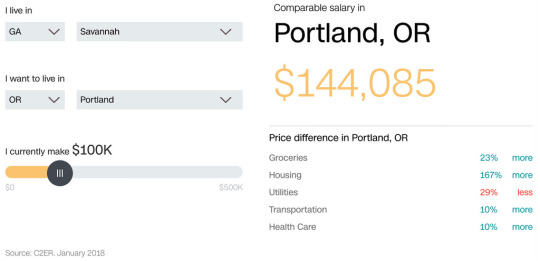

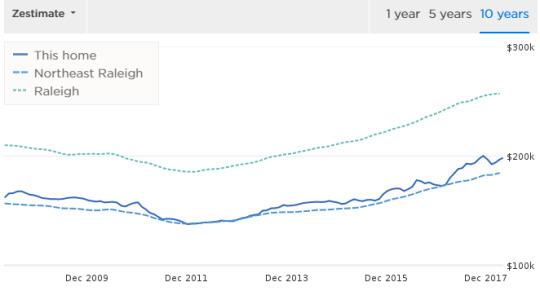

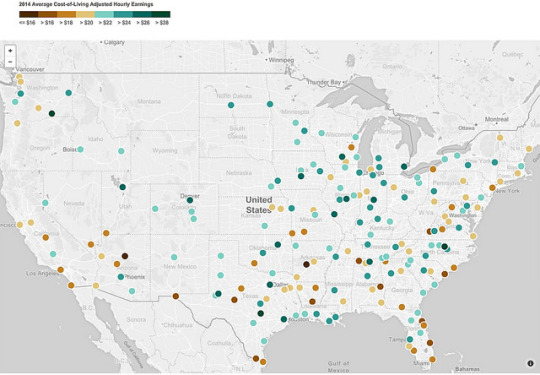

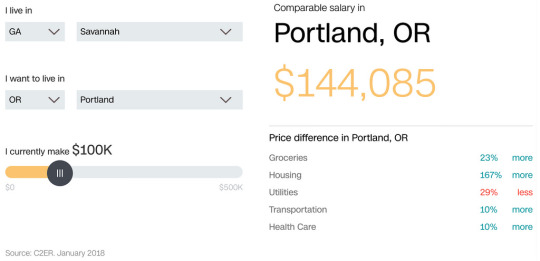

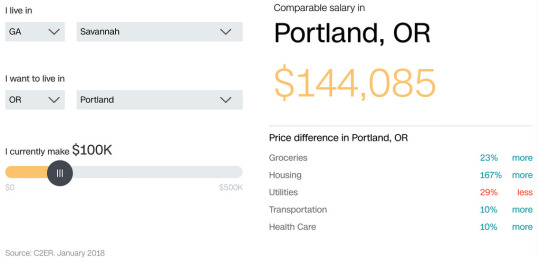

Cost of living: Why you should choose a cheap place to live

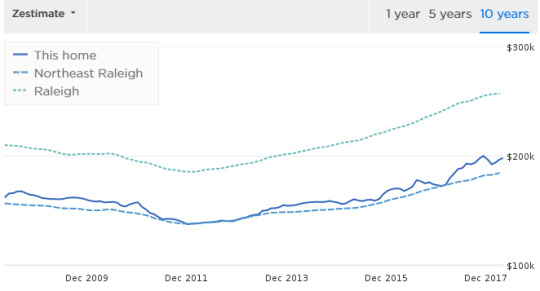

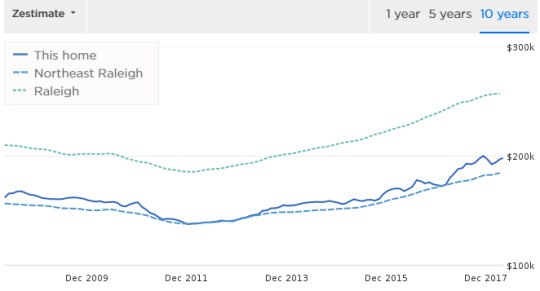

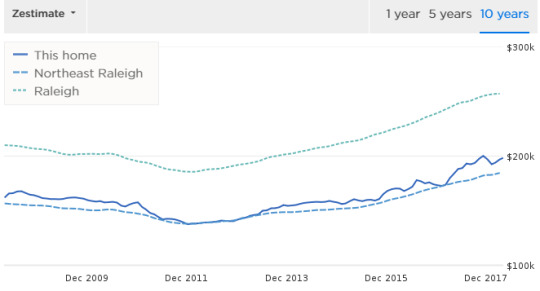

Shares 105 While visiting Raleigh earlier this month, I spent a morning with my pal Justin (from the excellent Root of Good blog) and his wife. As we sipped our coffee and nibbled our bagels, the conversation turned to cost of living. (Money nerds will be money nerds, after all.) Things are cheaper here in North Carolina than they are in Portland, I said. Food is cheaper. Beer is cheaper. Hotel rooms are cheaper. Your homes are cheaper too. Last night, as I was walking through the neighborhood next to my hotel, I pulled up the housing prices. I was shocked at how low they are! Yeah, housing costs are lower here than in many parts of the country, Justin said. Take our house, for instance. We bought it in 2003 for $108,000. Zillow says its worth around $198,000 right now. But Ill bet thats a lot less than youd pay for a similar place in Portland. Hes right. Justin and his wife own an 1800-square-foot home on 0.3 acres of land. Their place has four bedrooms and 2.5 bathrooms. Theres only one place for sale in Portland right now that matches these stats and its going for $430,000 more than twice the price the same home would fetch in Raleigh.