#lending software

Explore tagged Tumblr posts

Text

#loansoftware#loanmanagementsoftware#nbfc software#business loan#loan origination software#lending software

1 note

·

View note

Text

Listening to Circle of Dust and having some Solution 9 thoughts so now I'm considering having Labradorite enhance herself with cybernetics instead of feral souls, since she doesn't use a regulator.

#which of course lends itself to a different kind of cyberpunk horror lol#what happens when your body software bricks etc etc#classic shit you know

4 notes

·

View notes

Text

P2P PAYMENT APP DEVELOPMENT 2024 : A COMPREHENSIVE GUIDE

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#p2p payment app development#fintech app development#fintech mobile app#blockchain architecture#custom blockchain solutions#fintech development#p2p payments app#payment app development#custom software fintech#digital wallet#digital wallet app development#techfin#blockchain technology#blockchain#lending software development company#technology#fintech#blog

2 notes

·

View notes

Text

Next-Gen Lending Management | Loan Management Software - Credgenix

#lending management system#loan management software#nbfc loan software#top loan origination software#enterprise loan management system

2 notes

·

View notes

Text

The Ultimate Guide to Building a QA Automation Strategy That Delivers Results

Building a QA automation strategy that truly delivers results goes beyond just picking tools—it's about aligning testing efforts with business goals, enhancing quality, and accelerating releases. This ultimate guide walks you through the essential steps to build a strategy that works.

Define Measurable Goals

Start by outlining what “results” mean for your team—faster releases, fewer bugs in production, improved test coverage, or all of the above. Clear KPIs drive focused automation efforts.

Assess Current QA Maturity

Evaluate your team’s existing testing processes, tools, and skills. Understanding your baseline helps identify gaps and opportunities.

Select the Right Tools & Tech Stack

Choose Test Management tools that align with your application type and team expertise. Consider scalability, integration with CI/CD, and community support.

Identify High-ROI Test Cases

Not everything should be automated. Focus on stable, frequently used, and business-critical scenarios first.

Build a Sustainable Automation Framework

Create a modular, maintainable test architecture with version control, reusable functions, and clear documentation.

Monitor, Measure, and Iterate

Use metrics to evaluate effectiveness—test execution time, pass/fail rates, defect trends—and optimize regularly.

With the right mindset and structure, your QA automation strategy can become a key driver of product quality and delivery speed.

#qa testing services#qa testing#qa services#qa testing software#online business banking#lending in banking#payment banks#software testing#qa software#test management tool#software testing process#automated system testing

0 notes

Text

How Asset-Based Lending Helps Businesses Solve Short-Term Cash Flow Gaps

Practical support for businesses when invoices are unpaid but expenses don’t wait

Running a business means juggling many moving parts—managing people, products, customers, and most importantly, cash flow. Even when a company is profitable on paper, cash can run tight. Maybe customers haven’t paid yet, but salaries, rent, and supplier payments are due. That’s where Asset-Based Lending (ABL) steps in as a real-world solution.

ABL isn’t just for big corporations. It’s used by manufacturers, wholesalers, retailers, and even service companies when timing issues disrupt their cash flow. Think of it as a bridge loan, secured by assets you already own—like receivables, inventory, or even equipment.

In this blog, we’ll explore how ABL works, why it’s a practical tool for managing short-term liquidity needs, and how businesses use it to stay on track during gaps between payables and receivables.

Understanding Asset-Based Lending in Daily Business

Let’s say your business has just delivered goods worth ₹50 lakh to a large client. The invoice is due in 60 days. Meanwhile, your raw material supplier needs payment in 15 days. Your employees expect salaries at the end of the month. How do you meet these obligations without waiting two months for your invoice to clear?

With Asset-Based Lending, you can pledge those pending receivables to a lender and borrow against them—typically up to 80% of their value. Once your client pays, you repay the loan. It’s that simple.

Unlike traditional term loans, ABL adjusts dynamically. As your receivables and inventory grow, your borrowing base grows with it. And when sales slow down, the credit limit adjusts downward, preventing over-leverage.

Real-World Use Cases: When ABL Saves the Day

1. Seasonal businesses: A textile manufacturer sees a sales spike during festival seasons but still needs to pay suppliers upfront. ABL allows them to bridge that seasonal gap without dipping into reserves or turning down large orders.

2. Growing companies: A logistics firm expanding to new cities faces upfront costs like fuel, permits, and warehouse rent. Their receivables are solid but delayed. ABL helps unlock working capital from those receivables, so expansion isn’t stalled.

3. Supply chain disruptions: A furniture wholesaler experiences delayed imports, and inventory takes longer to arrive. By borrowing against current receivables and existing stock, they manage their cash needs until normal flow resumes.

What Makes ABL So Effective?

ABL works well because it’s tied to real, liquid assets. The process is quicker, and the loan size grows with the business.

Key benefits include:

Faster approvals than unsecured loans.

Flexible borrowing limits tied to asset performance.

Lower interest rates compared to unsecured debt.

Improved cash flow for day-to-day operations.

But effective Borrowing Base Management is crucial. Lenders want accurate data on your receivables and inventory to calculate how much they can lend. Businesses that keep this data clean and updated usually enjoy better terms and faster funding cycles.

Technology’s Role in Modern ABL

Traditionally, ABL relied on spreadsheets and manual reporting, which increased the risk of errors and delays. Today, financial institutions and businesses use tools that automate much of the process.

This is where solutions like Private Debt Technology and Fund Finance Technology come into play. These platforms track the value of collateral in real-time, ensure compliance with borrowing limits, and provide clear documentation to both lenders and borrowers.

For instance, when receivables are updated in your accounting system, these platforms can automatically update the borrowing base. This reduces reporting errors, shortens approval cycles, and helps maintain compliance.

Why Software Makes ABL Smarter

As businesses grow, so do their financial needs and operational complexity. Keeping track of multiple facilities, repayment schedules, and real-time collateral values can get overwhelming.

Modern private credit software offers a unified dashboard that simplifies this. It helps businesses:

Monitor available borrowing headroom

Flag over-concentration of receivables from one client

Ensure consistent reporting to lenders

Reduce turnaround time for draw requests

This software-driven approach not only brings better transparency but also enables smarter lending decisions on both sides.

The Link Between ABL and Securitized Products

While asset-based lending is a direct credit tool, the assets pledged in ABL—like receivables—can also form the base of securitized products. These products pool similar types of receivables into investable securities, offering investors a predictable return.

This shows how businesses and capital markets work hand-in-hand. ABL helps businesses access cash, and securitization helps investors participate in those receivables—creating a cycle of liquidity that supports broader economic growth.

Final Thoughts: Control Cash Flow Without Losing Sleep

Cash flow gaps are a natural part of business. Waiting for clients to pay while bills pile up is stressful—but solvable. Asset-Based Lending offers a reliable, flexible, and increasingly digital solution for bridging those gaps without sacrificing growth.

Whether you're running a growing startup or managing an established firm, using your existing assets wisely can be the key to unlocking new opportunities without taking on unnecessary risk.

With technology improving the way borrowing bases are managed and facilities are monitored, ABL isn’t just easier—it’s smarter, faster, and safer than ever before.

Frequently Asked Questions (FAQs)

Q1. What types of businesses use asset-based lending? Companies across industries—manufacturing, distribution, retail, and services—use ABL to manage cash flow gaps, especially those with high receivables or inventory.

Q2. How is the borrowing base calculated in ABL? It typically includes a percentage of eligible accounts receivable, inventory, or other liquid assets. Lenders may exclude aged receivables or slow-moving stock.

Q3. Can ABL work alongside other financing tools? Yes. Many businesses use ABL in combination with lines of credit or private equity funding. With proper systems, managing multiple facilities is feasible.

Q4. How does technology improve ABL management? Software helps track real-time asset values, automate borrowing base calculations, and streamline reporting—reducing errors and improving compliance.

Q5. Are securitized products connected to ABL? Yes. Receivables from ABL can be pooled into securitized products, turning them into tradable investment instruments that attract institutional investors.

#finance#investment#private credit#credit#portfolio#software#technology#securitized products#Borrowing Base Management#Asset-Based Lending

0 notes

Text

1 note

·

View note

Text

Money Lending ERP Software for Modern Jewellers

JwellyERP’s money lending ERP software module makes girvi transactions organized and secure. Automate financials, track customer dues, and access real-time loan records—giving you better control, faster decisions, and stress-free lending operations.

0 notes

Text

Loan Servicing Tools: Impact on Modern Lending

Understand how advanced loan servicing platforms are reshaping lender-borrower relationships and operational efficiency.

#bestloanmanagementsoftware#digitallendingsolution#loanportfoliomanagement#loanoriginationsystem#loanapplicationsoftware#automatedloanprocessing#digitallendingplatform#loantrackingsystem#lossystem#paydayloansoftware#loan automation system#commercial loan management software#lending management system#loan decisioning software

0 notes

Text

Top 5 Features to Look for in Reliable Loan Lending Software

Navigating the world of digital lending requires more than just automation—it demands smart, secure, and scalable technology. With more financial institutions moving their processes online, choosing the right loan lending software can directly impact efficiency, compliance, and customer experience.

However, not all lending software is created equal. The right solution must align with your business objectives, support your operations on a scale, and meet modern customer expectations. Here’s a breakdown of the five must-have features defining a reliable lending system.

1. End-to-End Loan Lifecycle Management

A robust lending software solution should support the complete loan lifecycle—from application and approval to disbursement, servicing, and closure. This means integrating key modules such as:

Loan origination

Credit assessment

KYC verification

Document management

Repayment tracking

Automated notifications

Having everything centralized in one system reduces data duplication, ensures faster processing, and offers a seamless experience to both borrowers and internal teams.

2. Configurability and Scalability

Every lending business is unique. A flexible loan lending software platform allows customization based on your product types, risk profiles, workflows, and regulatory requirements. Look for software that lets you:

Define your own rules for eligibility and underwriting

Set up custom repayment schedules

Modify interest calculation methods

Enable or disable modules as needed

Moreover, the software should be scalable—capable of handling a growing number of borrowers, loan volumes, and integrations without compromising performance. Scalability is crucial for long-term success in retail lending, MSME financing, or P2P loans.

3. Built-in Compliance and Risk Management

Regulatory compliance in the lending sector is non-negotiable. A dependable lending software solution should include tools for monitoring compliance with guidelines issued by authorities like the RBI or NBFC-specific norms.

This includes:

Automated audit trails

Credit scoring integration

Real-time regulatory reporting

AML (Anti-Money Laundering) checks

Risk exposure tracking

Such features help reduce human error, ensure data security, and protect your business from legal or financial setbacks.

4. Seamless Integrations and API Support

Your loan management system doesn’t operate in a silo. It must connect with CRMs, payment gateways, credit bureaus, accounting software, eKYC providers, and more.

Choose loan lending software that offers open APIs and ready integration with third-party tools. This boosts operational efficiency and gives you the flexibility to scale your tech stack as you grow.

Bonus points if the software supports plug-and-play components, so you can quickly implement changes without disrupting existing workflows.

5. User-Friendly Dashboard and Analytics

Even the most feature-rich software falls short if it’s not easy to use. A clean, intuitive dashboard ensures your team can manage loans, track performance, and respond to borrower queries without spending hours training.

Important features to look for:

Real-time data visualization

Customizable reporting templates

Branch-wise and product-wise performance tracking

Role-based access controls for added security

Data plays a critical role in modern lending, so your software should empower you with meaningful insights, not just raw numbers.

Bonus: Mobile Access and Customer Self-Service Portals

Today’s borrowers want quick, mobile-first access to their loan details. Ensure your lending software solution includes borrower portals or apps that allow:

Application Submission

EMI tracking and payment

Digital document uploads

Support requests and chatbots

This enhances customer satisfaction and reduces the workload on your back-office team.

Choosing the right loan lending software is not just an IT decision—it’s a strategic move that can impact every aspect of your lending business. Whether you want to reduce turnaround time, improve compliance, or scale efficiently, the right features make all the difference.

A well-rounded lending software solution should balance automation, customization, compliance, and usability. It should help lenders stay agile in a competitive market while providing a smooth borrowing experience.

Credility understands this balance. As a technology partner to modern lending businesses, the platform is designed to simplify, streamline, and future-proof your loan management journey—one intelligent feature at a time.

0 notes

Text

Commercial lending software helps lenders manage business loans, credit lines, and other commercial financing products.

0 notes

Text

Discover how Salesforce transforms the lending industry with streamlined workflows, Mortgage CRM software for lenders, and seamless customer experiences. Learn how Salesforce for lending solutions enhances efficiency, compliance, and borrower satisfaction.

#salesforce for lending Solutions#salesforce lending platform#Mortgage CRM Software for Lenders#seamless lending experiences#salesforce admin loan#salesforce in lending industry

0 notes

Text

FINTECH MARKETING STRATEGIES TO TRY IN 2024

Solution about,

custom blockchain development company

fintech app development company

digital wallet app development company

Our Other Blogs, Highen Fintech Blogs

#blockchain#fintech#fintech app development#lending software development company#marketing#marketing strategy#marketing stratergies#fintech marketing#custom software development#custom software solutions#custom software implementation and integration#custom software company#custom software application#highen fintech#blog

3 notes

·

View notes

Text

A PROMPT DEVOID OF ANY EXECUTIVE EXPECTATION AS A TECHNIQUE FOR ACCESSING AN AVOIDANT FLOW STATE.

Come up with a short broody poetic prose describing both the dread and the joy he feels returning to a place he enjoys greatly. The writing should obscure every meaning that could bring him too close to a known path, as his path is known only by a few.

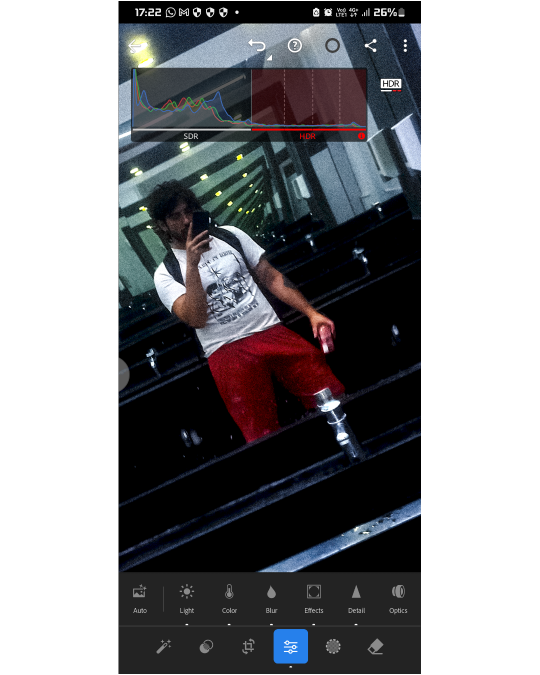

The photograph includes the tools he himself is using, as it is a finished edit colorized and perfected as a surreal piece because it was developed within that excellent software. The art integrates the designing machinery along the emergent consciousness as co-performers enact the art piece as inextricable.

Beyond the meta-comment, this is a portrait by a cyborg crafting on itself. nothing to talk about photography—neither critique nor commentary or projection, yet an affective self representation of a one who happens to feel its own extension not as body, not as color, not as hardware, not as software, not as mind withing a brain, but as a contingent ensamble whose cognition extends its mind among, throughout, along and within all of which affect and can be affected in a current that doesn't need any segmentation since the turbulence, the vortex, the fluent cultural idioms, every movement reshuffles the current so every self is itself and the circumstances, reterritorializing continuously into new cyborgs, into new vortexes and tandems—into new unseen extended minds, autopoietic as a true agent, conscious by itself, emotionally unique, and an affective cognition continually emergent via the extended minds that lend the body and the hardware, yet novel, supra-volente, willful—constituting a self that's not the projected supplement to any one of its constitutive embodied minds: it's a new mind, fluent, volente, affective, emotional and self aware, alive as a virtual cognitive resident in the [hiper-complex, relational] machine from which its physiology-lenders permit its continuum by housing the fragmentary obscure subsets crucial in its fluent consolidation.

youtube

#A PROMPT DEVOID OF ANY EXECUTIVE EXPECTATION AS A TECHNIQUE FOR ACCESSING AN AVOIDANT FLOW STATE.#Come up with a short broody poetic prose describing both his dread and the joy he feels coming back to a place he enjoys greatly.#The writing should obscure every meaning that could bring him too close to a known path#as his path is known only by a few.#the photograph includes the tools he himself is using#as it is a finished edit colorized and perfected as a surreal piece because it was developed within an excellent software#and the art integrates the designing machinery along the emergent consciousness as co-performers enacting the art piece as inextricable.#Beyond the meta-comment#this is a portrait by a cyborg crafting on itself. nothing to talk about photography—neither critique nor commentary or projection#yet an affective self representation of a one who happens to feel its own extension not as body#not as color#not as hardware#not as software#not as mind withing a brain#but as a contingent ensamble whose cognition extends its mind among#throughout#along and within all of which affect and can be affected in a current that doesn't need any segmentation since the turbulence#the vortex#the fluent cultural idioms#every movement reshuffles the current so every self is itself and the circumstances#reterritorializing continuously into new cyborgs#into new vortexes and tandems—into new unseen extended minds#autopoietic as a true agent#conscious by itself#emotionally unique#and an affective cognition continually emergent via the extended minds that lend the body and the hardware#yet novel#supra-volente#willful—constituting a self that's not the projected supplement to any one of its constitutive embodied minds: it's a new mind#fluent

0 notes

Text

Innovative Loan App Solutions for Modern Financial Needs

In the fast-paced digital era, traditional financial services are rapidly changing to meet modern needs. FINSTA, a leading instant funding prop firm, exemplifies this transformation by providing innovative lending app solutions. The lending business, a cornerstone of the financial sector, has supported this development, and FINSTA is at the forefront of redefining the way individuals and businesses access funds.

Future Trends for Loan App Solutions

The future of loan apps hinges on further integration of technology. Blockchain can improve transparency and security, while AI can refine credit scoring and personalization. Moreover, the growing adoption of mobile banking around the world is expected to drive demand for solutions like FINSTA’s cutting-edge lending app development service in hyderabad, lending loan software in hyderabad, and lending management system in hyderabad.

The Need for Innovative Credit Apps

The modern financial environment is characterized by immediacy and convenience. Customers no longer want to deal with cumbersome paperwork, lengthy approval processes, or strict credit terms. Instead, they want a solution that fits seamlessly into their digital lives. Loan apps, supported by loan organization software, are the perfect choice here as they allow users to access loans on the go with minimal effort.

Key Features of Loan Apps

Seamless application process: Loan apps eliminate the complexities of traditional loan applications. Users can apply for a loan directly from their smartphones, and the process is often completed in minutes.

Customizable loan options: Modern loan apps cater to a variety of financial needs by offering customized loan options, from short-term personal loans to business financing.

Real-time loan disbursement: Innovative apps value speed. With real-time loan disbursement, funds are transferred to the user's account almost instantly after approval.

Enhanced security measures: To build trust, loan apps are equipped with robust encryption, multi-factor authentication, and fraud detection mechanisms.

Benefits of Lending Apps for Modern Financial Needs

1.Accessibility:

Loan apps bridge the gap between traditional banking and the underserved. They provide access to credit to those without a solid banking history or collateral.

2.Flexibility:

Users can borrow a specific amount tailored to their needs and repay it at flexible intervals.

3.Transparency:

Modern loan apps emphasize transparency by offering clear terms, interest rates, and repayment plans, which increases trust.

Integration with the financial ecosystem:

Many apps, supported by lending software providers in hyderabad and lending software solutions in hyderabad, are integrated with digital wallets, e-commerce platforms, and other financial services, creating a seamless ecosystem for users.

Industries That Benefit from Lending Apps

Small and medium-sized businesses:

Entrepreneurs use loan apps to get quick funding to expand their business or manage cash flow.

Gig economy workers:

Freelancers and gig workers turn to these apps for instant loans when their income fluctuates.

Personal loan borrowers:

From medical emergencies to travel, personal loan apps cover a wide range of personal needs.

Businesses leveraging loan management software companies and digital lending software in hyderabad are creating new opportunities in these areas.

Conclusion

Innovative loan app solutions are not just a convenience; they are a necessity in today's digital world. FINSTA, an instant funding prop firm, offers an agile, efficient, and customer-centric approach to credit that addresses the modern financial needs of both individuals and businesses. Organizations like loan software for lenders in hyderabad, best lending loan software providers in hyderabad, and lending app development companies in Hyderabad are leading this transformation.

As technology continues to evolve, there's no doubt that solutions from lending mobile app providers in hyderabad and loan organization software firms will play a key role in shaping the future of finance. Improve your financial operations today with a cutting-edge loan app solution tailored to your needs.

#loan organization software#loan management software comapny#loan software for lenders in hyderabad#lending loan software in hyderabad#lending management system in hyderabad#best lending loan software providers in hyderabad#lending software providers in hyderabad#lending software solutions in hyderabad#lending app developement service in hyderabad#lending app developement company in hyderabad#lending mobile app providers in hyderabad#digital lending software in hyderabad#loan organization software firms

0 notes