#tech bubble

Explore tagged Tumblr posts

Text

How we ended in the darkest timeline

I actually wanted to talk a bit more about the French Revolution, but given recent events, I fear like I need to talk about this for now. Mainly because over the weekend I had so many talks about this, and have reached the point where I just need this blog to link back to.

You know how people keep joking about how we ended up in the darkest timeline, right? Well, what can I say? It is probably right. And by now I can tell you pretty definitely why.

Now mind you, like with everything there is a multitude of reasons for this. Technically we can go and say: Yes, we are here because colonialization happened - and it would not be wrong. We can also say that it is because of Napoleon, and because the failure of the French Revolution - and that would not be entirely wrong either. And we absolutely have to also say, that a bit reason is that instead of fighting fascism everyone decided after WWII, that fighting communism would be so much more important.

But I think a lot of the stuff we deal with right now is very much linked to one specific thing: The 2008 financial crisis - and the lack of regulation that lead up to it.

This is the moment where I am gonna tell you to watch The Big Short. I know most of you have probably not done that before. Because the movie feels like Oscar bait and also, who wants to watch a 2 hour movie about the financial market, but trust me on this: The movie is actually made really well and explains what happened back then very, very well and in a way that at least hits my autistic humor very well.

But basically, you need to understand two things: For the longest time the financial market really only traded companies and investments into them. But at some point during the late 70s and early 80s someone realized that there is something they were not trading on: depts. Because obviously most credits are given out by the banks and the financial industry. Not really investments, because there is a promise this stuff gets paid back eventually. And so they started trading depts with each other.

If you do not see the problem with this, let me explain: If you buy the dept someone has with another company, you basically are just making a bet with them the long way around. If you buy a dept, you bet that the person will pay the debt back - if you sell it, you kinda are betting against it.

There is a lot of weird financial tooks for this kinda stuff, but this is what it comes down to. The financial market became more and more a big ass casino, only that other than any other gambling it was not treated as this - and the money they were using on gambling was actually money that did not belong to them.

Because here is the thing: The main players in the financial market are either banks or groups that invest for their customers. While in the second case the people at least are fully aware of the fact that the financial institution will trade with their money, a lot of bank customers are not really aware of this. Sure, they kinda know that when they keep their money at the bank they might get interest, but most of them do not understand why. Because really, it does never get fully explained to them, that the bank will use that money to trade and invest with it.

And this is kinda part of the issue.

See, what happened in 2008 was, that the banks traded with indexes (so basically bundles) of thousands and thousands of house mortgages. And in those bundles were so called sublime mortgages, which is financial speak for "dog shit mortgages we knew the people taking them out would be unable to pay, but we didn't give a fuck". And a lot of those mortgages were due in 2008, which is why those indexes failed in 2008, resetting their value to close to 0. But the banks had spend money on those indexes as if they had an actual value. Especially because it was always the common wisdom, that mortgages were one of the most secure financial tools.

So. Now, what happens when you spend money on something that you think is an investment, but turns out to be completely worthless? Eh?

Yeah, exactly, you just threw a lot of money into the wind. And that money now was GONE. The big financial companies were just out of money. The money had simply disappeared, which is always what happens when a financial bubble burst.

See, financial bubbles happen when people overestimate how much something is going to be worth. They expect something to raise in value, so that when it ultimately fails a lot of people have put money into it which will just be GONE.

Gone, baby, gone.

But again: The money the banks had been using was mostly not their money. It was the money of their customers. Some of whom understood that risk. Many of them did not. So basically, if you had any of your money on the bank, this money technically still belonged to you - but it was not there. And of course there were also literally hundred-thousands of people working for those companies, who were now out of money.

And this is where we come to the reason why we are living in the darkest timeline.

I know it sounds cynical coming from a lefty like me, but sadly... Yeah, Obama was a big, big reason of why it came to this. While this happened towards the end of the Bush administration, for the most part it was Obama dealing with the fall-out.

See, the government at the time had three options:

Do nothing. Accept that the money is gone and deal with the consequences. Build something new from the ashes.

Give out some securities for the private people who lost their money. Basically some form of check to get back up to amount X of money that you lost becuase of the banks, but prosecute the people in finance, who had messed it up. Also create laws to control the financial market and trade volume, as well as the size of banks.

Save the banks by basically paying their depts for them.

The administration decided to choose Option 3. They saved the banks to save the people's finances and all those jobs bound to the banking industry.

There were no laws. No controls. No checks and balances. And there was basically no prosecution of the people who had let this happen - partly because they did not care, and partly because they were dumb fuckers.

And pretty much everything that has happened since is in some way connected to that. Literally everything!

I mean, if you want to know what I mean with that? The MCU exists because of the 2008 banking crisis! Yeah, the fucking Marvel Cinematic Universe. The reason that streaming is fucked and your favorite shows get cancelled after one or two seasons is heavily connected to the 2008 financial crisis.

The 2008 financial crisis is also connected to the surge in right wing politics all around the world. Because the financial crisis did not only hit the USA, but the rest of the world as well. A lot of people lost their jobs because of it, and because the financial industry did not get controlled and from this learned that they could fuck up however much they liked ("too big to fail") the gap between the rich and poor got worse. Which then the right wingers used to make people angry against minorities.

And of course because all of this started with unrealistic sets for mortages, mortages were suddenly much harder to get and it ended up pretty much impossible to afford a home - just as most of millenials were leaving school.

After all: Nobody really understood, what happened during the financial crisis. Because most people stop following any explanation as soon as they hear stuff like "shorts" and "sublime mortages". So it was much easier to think that the reason that you lost your job and could no longer afford a home was because some immigrant took it, rather than that some white collar idiots at wallstreet made some trades that you could not even begin to understand.

But yeah, tl;dr: Obama decided to save the banks, put in no controls, and with this fucked pretty much both Millennials and everyone who came after us over. And everyone else - every other world leader - pretty much just went with it and did the same in their own country. Danke, Merkel, as we Germans would say.

This is also what started the Occupy Wallstreet Movement, which was trying to get SOME accountability, but in the end pretty much failed.

If I asked you to guess how many people got prosecuted because of the shit back then, I can guarantee you, that you would not guess right. Because literally everyone I have asked, said some number between 20 and 100, realizing very well that it was probably not the thousands actually at fault, but not being able to grasp the reality. One. There was one person actually prosecuted because of it.

These people destroyed our futures, they fucked us over, and they got away with it.

And you and I, we deserve to be angry about it.

Especially because it is happening again right now. There is not just one other bubble, but a couple of bubbles right now. And chances are that they will pop very soon. Fuck, I am writing this on Monday early afternoon German time. Chances are that by the time this goes online some might have started popping, because of the Trump administration's inability to deal with shit. And let's face it, the Trump administration is not gonna be capable of dealing with this, when it goes into freefall.

#history#financial industry#financial crisis#2008 financial crisis#explained#housing market#the big short#ai bubble#tech bubble

36 notes

·

View notes

Text

As augmented reality, self-driving vehicles and other innovations slowly creep into everyday life, we’re going to be faced with these kind of situations more and more often. Tech companies will ask us in the words of Groucho Marx, “Who are you gonna believe: me, or your own eyes?”

Google Told Me To Walk Into Traffic (my latest newsletter!)

26 notes

·

View notes

Text

Q: How did the AI hype start? A: OpenAI became the first American company to demonstrate that if you take a snapshot of the whole known internet and all digitized books in existence without worrying too much about copyright law, you can create a model so good that its output would be almost indistinguishable from that of a DC bureaucrat with mediocre intelligence.

Q: How is China involved? A: As a part of its larger effort to contain China, the U.S. government has been on a mission of stopping Chinese companies from becoming leaders in different areas of technology. It has done so by wielding control over global supply chains and protecting American tech companies from competition in the process. The U.S. blocked Huawei’s entry into the United States just as it was overtaking Apple to become the second biggest smartphone manufacturer in the world; it stopped European countries from installing Huawei manufactured 5G infrastructure when it was clearly more economical; and most recently, it passed legislation banning TikTok, a Chinese social media app that had become massively popular in United States and whose recommendation algorithm no American social media app had been able to outperform. The U.S. claim that Huawei and other Chinese tech companies are inextricably linked to China’s geopolitical strategy and put Western companies and people at heightened risk of surveillance and corporate espionage is, of course, grounded in reality. DeepSeek isn’t shy about how much data it collects on its platform, including even your keystrokes ... However, because DeepSeek is open source and can run locally on a separate device, Chairman Xi Jinping’s prying eyes can be shielded. Maintaining global technological dominance is one of the key concerns U.S. policymakers have repeatedly cited, and have identified AI as a crucial technology in maintaining that dominance. In 2018, when the U.S. government was in the process of banning Huawei, it realized that it would need to do the same with downstream technologies like semiconductor chips, the main component used in CPUs and GPUs. The severe chip shortage due to global supply chain disruptions during Covid-19 showed that advanced chips are a global supply chain bottleneck and a scarce resource. By 2022 the Biden administration had put comprehensive sanctions on China, stopping the export of these chips to the country and preventing Chinese AI companies from accessing the latest and most efficient GPUs. At the same time, it passed the CHIPS act, subsidizing national semiconductor manufacturing with over $50 billion.

6 notes

·

View notes

Text

As someone that is also a software enginerr snd graduated college in 2019, I find this summarized history compelling. I honestly never thought about interest rates being lower than inflation equating to free money for rich people. I understood it when trying to get a mortgage while interest rates were rising but it never occurred to me that rich people,investors, CEOs, CFOs probably think that way all the time.

Thanks for this.

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes

Text

week 32: transparent!

#inspired by y2k transparent tech and also the fnaf animatronics lmao#i was originally gonna do circuit boards inside but realised that didn't make sense so went with an endoskeleton instead#also looks like he's made of bubbles or like that soft squishy plastic#sth#sonic#sonic the hedgehog#metal sonic#weekly metal#sonic art#sonic fanart#art#fanart#digital art#artists on tumblr#vixenart#frutiger aero metal

10K notes

·

View notes

Text

I feel we are now backed into a corner with respect to funding the internet. It's clear that now that investment bros are no longer willing to pour money into random tech companies as if they were buying beanie babies, we are going to eventually have to pay subscriptions or something.

However, in the attempt to stave this off, companies have increasingly been finding more ways to squeeze money out of us via egregious advertising, Orwellian tracking and flogging our personal data to the highest bidder, and now all sorts of weird unethical AI shenanigans.

So the problem I, as a web punter, have, is that I know I'm going to have to pay for what I use sooner or later, but all the companies I might pay have long since proven themselves about as trustworthy as Sweeney Todd. I see no reason at all to believe that if I pay them money for their service, that they won't happily take that, and then continue making pies out of me as well. After all, the pies are very profitable, why would they give them up?

This is why I have never signed up for YouTube Premium, despite being driven nuts by their advertising. Because I don't trust them for a moment not to keep misusing my data, and to wait until enough people are subscribing, and then bring the ads back, or dream up something worse.

People in charge of big companies tend to value trust at nought, but it matters. And for the most part, it's gone. And we don't give our money to people we don't trust.

0 notes

Text

677 notes

·

View notes

Text

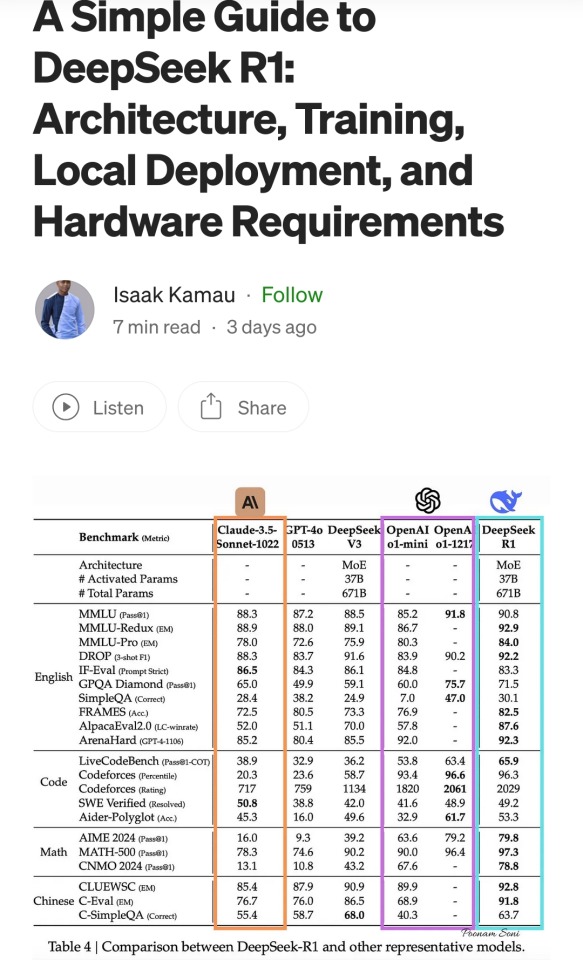

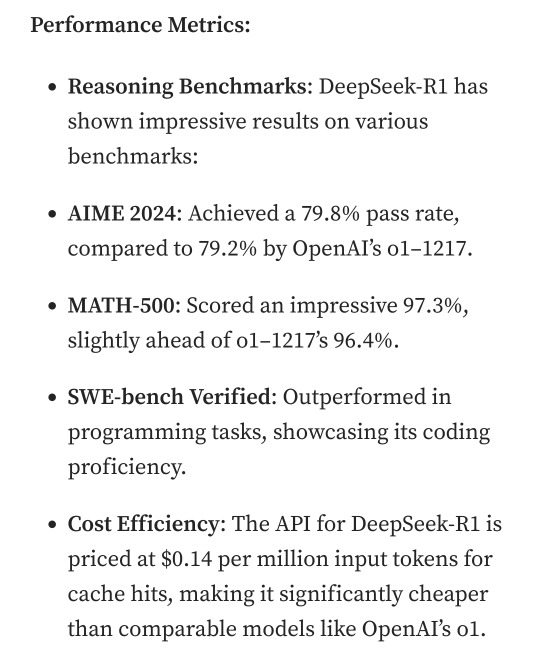

A summary of the Chinese AI situation, for the uninitiated.

These are scores on different tests that are designed to see how accurate a Large Language Model is in different areas of knowledge. As you know, OpenAI is partners with Microsoft, so these are the scores for ChatGPT and Copilot. DeepSeek is the Chinese model that got released a week ago. The rest are open source models, which means everyone is free to use them as they please, including the average Tumblr user. You can run them from the servers of the companies that made them for a subscription, or you can download them to install locally on your own computer. However, the computer requirements so far are so high that only a few people currently have the machines at home required to run it.

Yes, this is why AI uses so much electricity. As with any technology, the early models are highly inefficient. Think how a Ford T needed a long chimney to get rid of a ton of black smoke, which was unused petrol. Over the next hundred years combustion engines have become much more efficient, but they still waste a lot of energy, which is why we need to move towards renewable electricity and sustainable battery technology. But that's a topic for another day.

As you can see from the scores, are around the same accuracy. These tests are in constant evolution as well: as soon as they start becoming obsolete, new ones are released to adjust for a more complicated benchmark. The new models are trained using different machine learning techniques, and in theory, the goal is to make them faster and more efficient so they can operate with less power, much like modern cars use way less energy and produce far less pollution than the Ford T.

However, computing power requirements kept scaling up, so you're either tied to the subscription or forced to pay for a latest gen PC, which is why NVIDIA, AMD, Intel and all the other chip companies were investing hard on much more powerful GPUs and NPUs. For now all we need to know about those is that they're expensive, use a lot of electricity, and are required to operate the bots at superhuman speed (literally, all those clickbait posts about how AI was secretly 150 Indian men in a trenchcoat were nonsense).

Because the chip companies have been working hard on making big, bulky, powerful chips with massive fans that are up to the task, their stock value was skyrocketing, and because of that, everyone started to use AI as a marketing trend. See, marketing people are not smart, and they don't understand computers. Furthermore, marketing people think you're stupid, and because of their biased frame of reference, they think you're two snores short of brain-dead. The entire point of their existence is to turn tall tales into capital. So they don't know or care about what AI is or what it's useful for. They just saw Number Go Up for the AI companies and decided "AI is a magic cow we can milk forever". Sometimes it's not even AI, they just use old software and rebrand it, much like convection ovens became air fryers.

Well, now we're up to date. So what did DepSeek release that did a 9/11 on NVIDIA stock prices and popped the AI bubble?

Oh, I would not want to be an OpenAI investor right now either. A token is basically one Unicode character (it's more complicated than that but you can google that on your own time). That cost means you could input the entire works of Stephen King for under a dollar. Yes, including electricity costs. DeepSeek has jumped from a Ford T to a Subaru in terms of pollution and water use.

The issue here is not only input cost, though; all that data needs to be available live, in the RAM; this is why you need powerful, expensive chips in order to-

Holy shit.

I'm not going to detail all the numbers but I'm going to focus on the chip required: an RTX 3090. This is a gaming GPU that came out as the top of the line, the stuff South Korean LoL players buy…

Or they did, in September 2020. We're currently two generations ahead, on the RTX 5090.

What this is telling all those people who just sold their high-end gaming rig to be able to afford a machine that can run the latest ChatGPT locally, is that the person who bought it from them can run something basically just as powerful on their old one.

Which means that all those GPUs and NPUs that are being made, and all those deals Microsoft signed to have control of the AI market, have just lost a lot of their pulling power.

Well, I mean, the ChatGPT subscription is 20 bucks a month, surely the Chinese are charging a fortune for-

Oh. So it's free for everyone and you can use it or modify it however you want, no subscription, no unpayable electric bill, no handing Microsoft all of your private data, you can just run it on a relatively inexpensive PC. You could probably even run it on a phone in a couple years.

Oh, if only China had massive phone manufacturers that have a foot in the market everywhere except the US because the president had a tantrum eight years ago.

So… yeah, China just destabilised the global economy with a torrent file.

#valid ai criticism#ai#llms#DeepSeek#ai bubble#ChatGPT#google gemini#claude ai#this is gonna be the dotcom bubble again#hope you don't have stock on anything tech related#computer literacy#tech literacy

433 notes

·

View notes

Text

I don’t see how else to make sense of it. 2022 was the year the 20-year tech bubble finally burst. 2023 was still bad for startups, and was full of bad headlines for the big platforms. And yet, in the markets, tech investors just took a deep collective breath and started inflating the next bubble, as though the previous year had never happened.

Silicon Valley runs on Futurity

42 notes

·

View notes

Text

stupidest people on gods green earth

#i mean take away all the buzzwords here and what are you left with. 'public rollout of ai' what does that even fucking mean#'ai' vague. what do you mean by that kier. i don't think you know either do you#excellent idea boys. lets invest the nation's economy into a volatile hyped up tech bubble and wait till it collapses. couldn't go wrong#even more insane is they want to build 'mini nuclear reactors' to power this. not to like.....shift us away from fossil fuels#but this government has already as much as stated they dgaf about the environment. so.#ukpol#uk politics

500 notes

·

View notes

Note

You make AI gen abominations? You make fake MRIs and xrays. What else do you make with AI?

You got it the other way around you tech bro weirdo. It's AI who makes abominations using the work it stole from me. Now kindly fuck off :)

#ask val#hate people who assume I use AI because it looks realistic#i wish you and all tech bros lose a bunch of money when the AI hype bubble pops#maybe you'll even learn to pick up a pencil or to have fun mashing pictures together in photoshop

487 notes

·

View notes

Text

playing as nervous subject and then got in a fight with pt9 immediately after meeting him and this played through my head

original image:

#art#the sims 2#nervous subject#pollination tech 9 smith#comic ^^#also the guy in that speech bubble is pascal not harry potter if it wasnt clear

342 notes

·

View notes

Text

Max Verstappen helps Gabriel Bortoleto with his mic.

193 notes

·

View notes

Text

Jungle - Katamari Damacy

x/x/x x/x x/x/x

#katamari#katamari damacy#nature#city#computers#tech#keychain#squishies#rainbow#blue#green#clear#bubbles#toys#liquid#gaming stim#stimblr#sensory#my stimboards

110 notes

·

View notes

Text

Bad Batch in a Bubble Bath #3: Tech

#star wars#the bad batch#tbb tech#bubble bath#daily art#january 2025#bad batch in a bubble bath#datapad#plants#bathtub#digital art#relaxing#sw art#sw tbb#Tech in a tub

130 notes

·

View notes