#usdcad analysis

Explore tagged Tumblr posts

Text

Forex Trading Strategies: Navigating Market Trends Amid Economic Shifts

Forex traders need adaptable strategies to thrive in unpredictable market conditions. This post focuses on forex trading methods such as scalping, market trend analysis, and risk management.

Gold is currently experiencing bearish momentum, with RSI divergence suggesting further declines. While short-term pullbacks may occur, traders can capitalize on these movements with scalping strategies aimed at price dips.

Silver’s price action shows a pullback, but the overall market remains bearish. RSI and MACD signals hint at potential for a temporary rally. Scalping traders should focus on short-term selling opportunities.

The U.S. dollar continues to strengthen as inflation fears delay potential rate cuts. The DXY index reflects this, offering opportunities for traders to go long on USD pairs, including USDJPY and USDCHF.

GBPUSD is maintaining a bearish trend, with minimal resistance to further declines. Short-term pullbacks could offer opportunities for scalping, but the long-term outlook remains negative.

The Australian dollar is showing consolidation, lacking clear direction. Traders should wait for a breakout before entering positions, using proper forex risk control measures to manage volatility.

NZDUSD is in a downtrend, with RSI suggesting a possible short-term reversal. However, the broader trend remains bearish, offering short-term selling opportunities for scalpers.

EURUSD remains weak, with both RSI and MACD signaling further declines. Scalping traders can take advantage of short pullbacks while keeping a bearish outlook.

USDJPY continues its bullish momentum, supported by strong buying pressure. Traders should use caution and manage risk, looking for potential overbought signals.

USDCHF is moving upward, but a pullback seems likely. Traders can capitalize on small price movements through scalping strategies while managing risk.

USDCAD shows signs of a potential pullback after an uptrend. Traders should wait for confirmation and use forex signals to time entries and exits effectively.

With effective forex trading methods like scalping, market analysis, and risk control, traders can adapt to market fluctuations and maximize profits.

#Forex trading methods#Forex scalping strategies#Forex market trends#Forex risk control#Forex signal trading

3 notes

·

View notes

Text

10 Strategic COT Forex Setups for Range & Breakout Plays

As global markets stabilize ahead of critical U.S. economic reports, this week’s COT forex setups reveal a balanced mix of range consolidations and potential breakout opportunities. Traders can use MACD, RSI, and EMA200 signals to refine entries while adhering to a structured forex trading approach. Whether you’re swing trading or preparing for breakouts, these setups emphasize proper forex risk management plans, accurate entries, and disciplined trade management techniques.

Market Analysis

GOLD

Gold is consolidating near its highs with conflicting momentum signals. MACD shows rising selling volume, but weak impact on price suggests latent bullish pressure. RSI trends lower, signaling possible short-term weakness. This COT forex setup calls for patience. Traders should log developing patterns in their trade journal for forex and only act after a clear range break, avoiding premature bias shifts.

SILVER

Silver is pausing near recent highs, with a possible test of the EMA200 looming. MACD and RSI indicate growing selling momentum, yet the overall price action leans bullish. This setup is perfect for traders applying trade management techniques like conditional orders, balancing continuation bias with caution until resistance is clearly broken.

DXY

The Dollar is rising steadily ahead of key U.S. data releases, with strong MACD and RSI signals supporting bullish continuation. This classic COT forex setup suits breakout traders but requires cautious sizing given approaching fundamental catalysts. Following a forex risk management plan with smaller positions until after data releases is ideal.

GBPUSD

GBPUSD continues its bearish slide with clean MACD and RSI alignment, breaking through previous support. Among the strongest COT forex setups this week, traders can use trend-following strategies with a forex entry and exit strategy focused on pullbacks to previous support-turned-resistance areas.

AUDUSD

AUDUSD extends its bearish move but is shifting toward a consolidation zone. MACD and RSI point downward, though momentum is flattening. This COT forex setup is best suited for range traders, especially those using a structured forex trading approach that avoids chasing moves without fresh breakdown confirmation.

NZDUSD

The Kiwi has broken below key support at 0.59796, with MACD and RSI confirming bearish momentum. A possible continuation lower makes this a tactical COT forex setup, ideal for short entries with clear targets and tight stop-losses. Documenting entry criteria in a trade journal for forex can help refine strategy consistency here.

EURUSD

EURUSD holds within a consolidation zone near the lower boundary, signaling bearish leanings despite the longer-term bullish bias. RSI and MACD are neutral to slightly bearish. This setup favors breakout strategies, applying a forex entry and exit strategy only after confirmed structure breaks to avoid false starts.

USDJPY

USDJPY remains in a strong bullish trend, backed by robust MACD and RSI readings. Momentum suggests further upside, making it one of the clearer COT forex setups. Using trade management techniques like partial take-profits or trailing stops can maximize gains while reducing exposure to sudden reversals.

USDCHF

USDCHF remains trapped in consolidation. Both MACD and RSI lack directional conviction. This pair is one to watch but not trade actively—until a range breakout occurs, any entry should follow strict forex risk management plans with limited exposure.

USDCAD

USDCAD’s consolidation continues, with muted momentum signals. This is a neutral COT forex setup, suitable for patient range-bound strategies. Logging performance in your trade journal for forex during such periods helps avoid overtrading and builds readiness for eventual breakouts.

COT Market Sentiment

AUD – WEAK (5/5)

GBP – STRONG (5/5)

CAD – WEAK (5/5)

EUR – STRONG (5/5)

JPY – STRONG (3/5)

CHF – WEAK (4/5)

USD – WEAK (5/5)

NZD – STRONG (4/5)

GOLD – STRONG (5/5)

SILVER – STRONG (3/5)

Final Thoughts

This week’s 10 COT forex setups offer a balanced landscape of breakout and consolidation plays. Whether pursuing USDJPY’s bullish continuation or preparing for EURUSD’s eventual breakout, traders should stay anchored in a structured forex trading approach, applying their forex risk management plan consistently. Keep entries structured, track performance in your trade journal for forex, and deploy smart trade management techniques to navigate evolving price action with confidence.

0 notes

Text

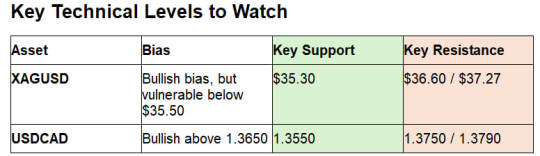

Silver and USDCAD Poised for Breakouts Ahead of Core PCE

Markets have entered a phase of consolidation following a turbulent fortnight of central bank signals and macroeconomic data surprises. This week, investor focus turns to the upcoming Core PCE inflation report, the Federal Reserve’s preferred inflation measure, set to be released Friday. As traders position for the data, the US dollar remains resilient, supported by stable Treasury yields and cautious rate cut expectations.

In the commodities space, silver (XAGUSD) has been notably volatile, with price action whipsawing between $37.27 and $35.35 over the past week. This sharp correction comes on the back of a strong prior uptrend and highlights silver’s sensitivity to real yields, inflation expectations, and shifting investor sentiment. Meanwhile, USDCAD has reclaimed bullish momentum after a brief correction, buoyed by stronger US data, weaker Canadian inflation, and softness in crude oil, a key CAD driver.

With volatility compressing ahead of data, both silver and USDCAD sit near pivotal levels that could prompt the next directional move. This report will break down the current state of each market, supported by technical context and macro insight, before laying out the critical price zones to watch going into the end of the week.

All times mentioned in this report are in BST.

Silver (XAG/USD) Analysis

Silver has staged a recovery after dropping to a short-term low of $35.35, now trading near $36.03. This comes after a volatile week where XAG/USD printed a sharp reversal from a high of $37.27. The swift selloff saw silver fall nearly 5% in two days, before finding demand at the lower end of its recent range. The bounce from those lows signals that buyers remain active, although upside momentum is now facing clear technical resistance

CHART OF XAGUSD H1

Silver peaks at $37.27 before dropping to $35.35. Current rebound trading near $36.03.

One key factor here is silver’s dual role as both a precious and industrial metal. Continued interest in green tech and electrification, combined with safe-haven appeal amid macro uncertainty, has kept dips relatively well supported. However, the sharp correction from $37.27 highlights how quickly silver can reverse when sentiment turns, particularly when USD strength reasserts itself or broader risk sentiment softens.

Technically, silver is showing signs of short-term recovery, but it remains under its recent peak and below the resistance zone around $36.30–$36.60. A breakout above this range could open the door for a reattempt at $37.00+, but failure here may lead to another rotation lower toward $35.50–$35.30. Price action remains choppy, and with US inflation data due later this week, volatility is likely to persist.

Silver tends to mirror gold’s broad trends but often moves with greater magnitude, and this recent chart confirms that tendency. Traders should stay alert for potential whipsaws, especially if upcoming data surprise on the inflation or interest rate front. The bounce from the $35.30s looks constructive, but sustained upside still requires a clean break above resistance.

USDCAD Analysis

The US dollar has seen renewed strength against the Canadian dollar, with USDCAD rebounding sharply from a low of 1.3555 to currently trade around 1.3720. After topping out at 1.3790 earlier in the week, the pair experienced a healthy pullback, before finding strong support just above 1.3550, a level that has now been tested and respected twice in June. This rebound appears constructive as we head into a week filled with key macro data, including US inflation figures and GDP prints.

CHART OF USDCAD H1

USDCAD pulls back from 1.3790, rebounds from 1.3555, trades near 1.3720 into key resistance.

Price action has remained bullish overall, with the uptrend that began mid-June still intact on higher timeframes. The pair has responded positively to stronger US data, while Canada’s recent CPI miss and softer crude oil have worked against the loonie. The technical structure of the chart suggests the recent dip was corrective, not a full trend reversal. A break above 1.3750–1.3790 could confirm bullish continuation, especially if upcoming US data reinforces the Fed’s patient but still-hawkish stance.

Oil remains a secondary driver of CAD, and the recent drop in crude prices has removed some support for the Canadian dollar. In contrast, the USD remains firm across the board ahead of inflation prints and with expectations that the Fed will remain cautious on cuts. As a result, fundamental divergence continues to favor the upside for USDCAD in the short term.

Traders should be watching for a potential retest of 1.3790, where previous sellers emerged. If price fails to clear this area, we could see another rotation back to the 1.3650–1.3600 zone. But so far, dips are being bought, and the structure remains bullish above 1.3550.

Forward-Looking Considerations

Heading into the Core PCE inflation print, traders should prepare for potential dollar-dricen volatility across metals and FX pairs. Markets will be watching closely to see whether inflation remains sticky or begins to drift more convincingly toward the Fed’s 2% target, either outcome could tilt expectations on the Fed’s next move.

For silver, the balance between industrial demand and pressure from rising real yields remains delicate. A stronger PCE print could renew USD strength and drag silver back toward $35.50, while a soft reading may trigger another run at the $37+ zone.

USDCAD continues to reflect the macro divergence between a resilient US economy and a softer Canadian backdrop, marked by weak CPI and falling oil prices. With oil prices under pressure and Canadian CPI coming in below expectations, the loonie may continue to lag unless we see a sharp rebound in crude or risk assets. Should PCE data reinforce current Fed pricing, we may see USDCAD attempt another break above the 1.3750–1.3790 resistance band. However, any signs of inflation softening more decisively could lead to profit-taking on dollar longs, opening a pullback into the mid-1.3600s.

In both markets, liquidity may thin into the weekend, particularly following the PCE release, increasing the risk of oversized reactions or false breakouts. Traders should remain nimble and be ready to reassess bias swiftly, especially if intraday volume and momentum fail to confirm larger directional moves.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. ACCM Market (V) is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by ACCM Market (V) . Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

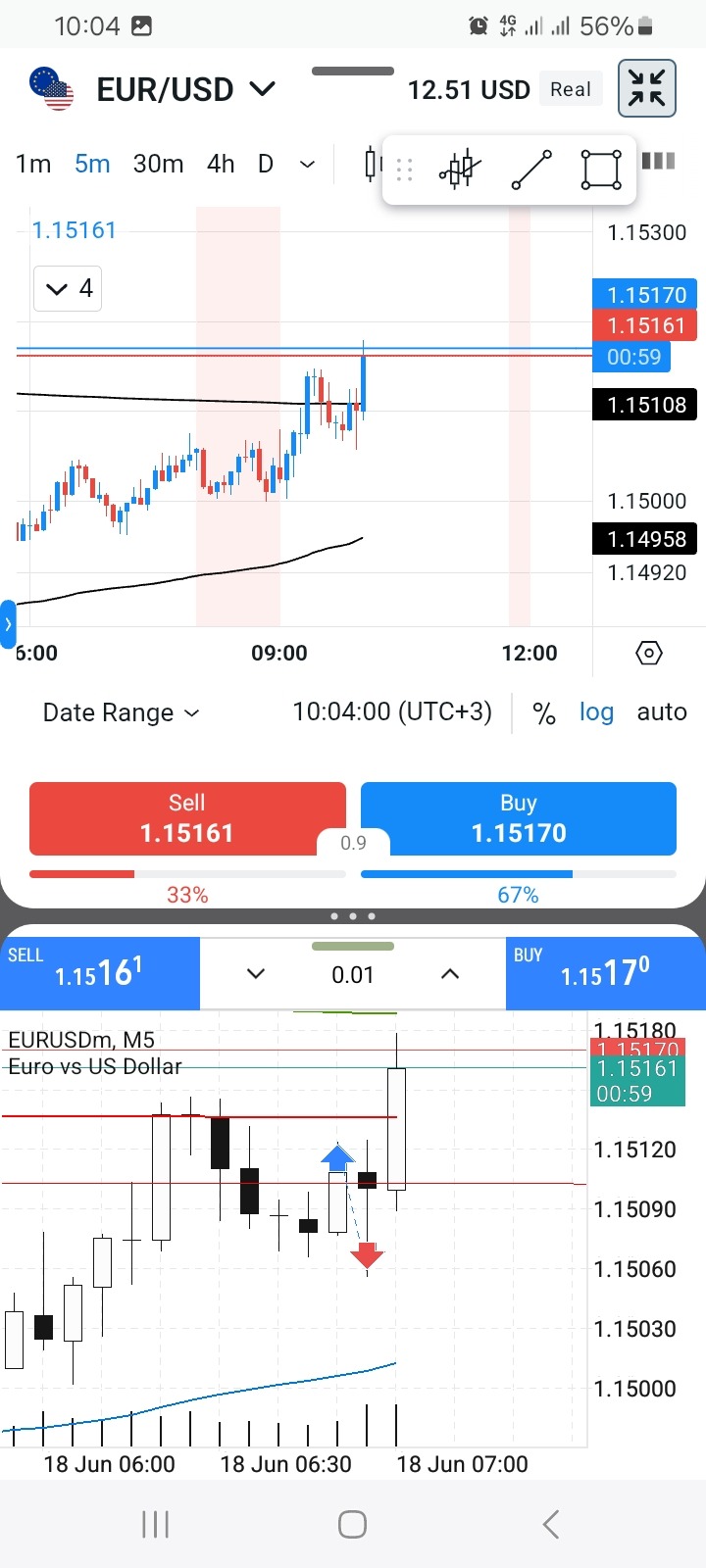

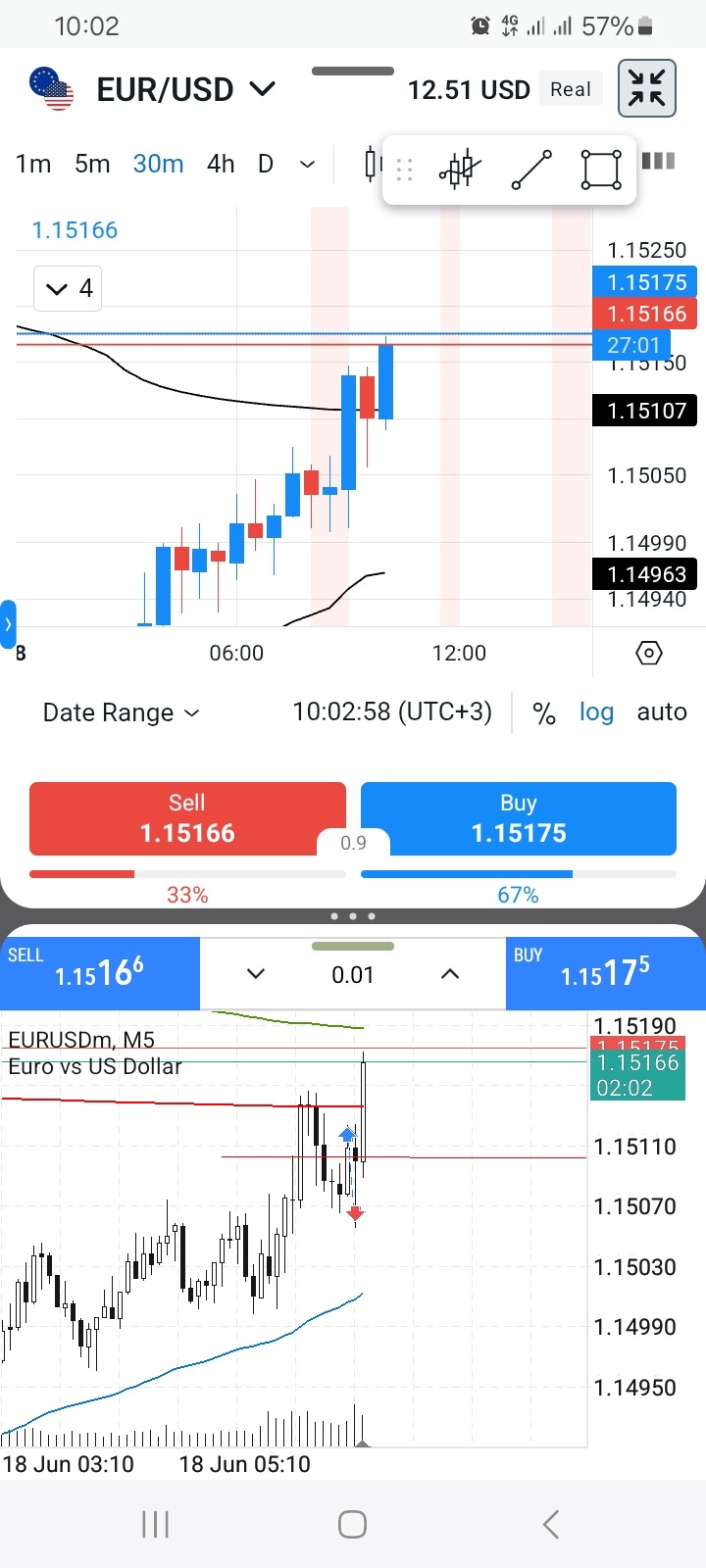

Wednesday 18th June

Pairs:EURUSD , USDCAD, USDJPY

OK yeah , yeah you know how the story goes , still losing but yeah progress made none the less. So today was another day in the lab.

So yeah I've thought about it for some time and I realize the problem has to do something with my entry and timing . Cause 1 thing am sure about my analysis and anticipation are on a high level , but my timing and entry are wayyyyy offfff

Yeah as you can see . As I was off day dreaming I was tagged out before the trade moved in my direction . Although it didn't go all the way . I would have broken even , or at least got some profits after moving my tp sl above break even . Yeah that's about it .

USDCAD

Yeah I actually got the entry right on his one . I waited for a break out and it was fast bro. But I over expected despite the fact that I clearly saw the 5Day MA in the way . And yeah , I didn't make a loss but I broke even . But all in all this was successful. Only lacked behind in trade management .

Yeah YEAH NOW THIS WAS THE MAIN FUCK UP OF THE DAY . Yeah this is the second time it's happening bro . Consolidating my money away. Yeah trying to catch a move in either side of the MA or VWap and ending up giving away my money to the market . Naa major issue

Look at that. So yeah . Yeah it's not pretty

That's pretty much it .

0 notes

Text

Usdcad wave analysis - Forex work

USDCAD: ⬇ Sale Usdcad destroyed the support area It is likely to fall to support level 1.3800 The USDCAD pair recently broke the support area between the support level of 1.4040 (which reflected the price sharply at the beginning of April, as shown below), and 50 % of the Fibonacci correction of the upward price step from September and support the direction line for the daily channel down from…

0 notes

Video

youtube

USDCAD 90 Consecutive Successes!

Title: "PrimeXAlgo: The All-in-One AI Trading Tool for Everyone! 📊 | Beginner-Friendly Trading Signals"

Description: 🚀 Introducing PrimeXAlgo: The AI Trading Tool That Makes Trading Simple & Effective!

Whether you're a beginner or an expert trader, PrimeXAlgo delivers powerful trading insights with ease.

✨ Key Features:

Universal Market Compatibility

Real-Time Trading Signals

Smart Position Management (BTP & STP)

Beginner-Friendly Interface

Expert-Level Analysis

AI-Powered Decision Support

🎯 Perfect For:

New Traders

Experienced Investors

Part-Time Traders

Market Professionals

Anyone Looking to Improve Their Trading

⚡ Benefits:

No Complex Analysis Required

Works in All Time Zones

Instant Signal Notifications

Clear Entry/Exit Points

Reliable Position Management

AI-Driven Accuracy

🌐 Join Our Community: Website: https://primexalgo.com Telegram: https://t.me/primexalgo Discord: https://discord.com/channels/1288670367401119888/1288670564126294078 Instagram: https://instagram.com/primexalgo X/Twitter: https://x.com/PrimeXAlgo Facebook: https://www.facebook.com/profile.php?id=61566510386136

⏰ Video Breakdown: 0:00 - Welcome to PrimeXAlgo 2:00 - How It Works 4:00 - Features Overview 6:00 - Live Trading Example 8:00 - Getting Started Guide 10:00 - Success Stories

Start your trading journey with PrimeXAlgo today - Where AI meets simplicity!

#TradingMadeSimple #AITrading #BeginnerTrading #TradingSignals #PrimeXAlgo #TradingTechnology #InvestmentTools #TradingSuccess #FinancialMarkets #SmartTrading

Tags: primexalgo tutorial, beginner trading, trading signals, easy trading, ai trading tool, trading for beginners, automated trading, simple trading strategy, trading technology, market signals, trading assistance, ai trading signals, investment tools, trading platform, trading automation, market analysis, trading help, financial technology, trading guide, smart trading.

1 note

·

View note

Text

USDCAD: Potential for Further Gains

Current USDCAD Market Overview

The USDCAD pair is showing clear signs of the Canadian dollar's (CAD) weakness, with prices reaching 1.37881. This trend reflects broader economic conditions and market sentiment towards the CAD and the US dollar (USD). Historically, the USDCAD pair is sensitive to economic data releases from both Canada and the US, making it a critical pair for traders.

Factors Influencing USDCAD

Several factors influence the USDCAD pair, including economic indicators, central bank policies, and geopolitical events. Interest rate decisions by the Bank of Canada (BoC) and the Federal Reserve significantly impact the pair. Additionally, economic data releases such as GDP growth rates, inflation rates, and employment figures can drive price movements.

Anticipating Movements in USDCAD

Given the current market conditions, there is a possibility for the USDCAD pair to continue moving upward, pushing the price into bullish territory. However, it’s essential to wait for the market’s reaction to the upcoming data release. This cautious approach allows traders to respond to actual price movements rather than relying solely on predictions.

Trading Strategies for USDCAD

Traders can use a combination of technical and fundamental analysis to trade the USDCAD pair. Technical analysis involves studying price charts and indicators to identify trends and patterns. Key technical indicators for the USDCAD pair include moving averages, Bollinger Bands, and RSI. Fundamental analysis focuses on economic data and news events that could impact the pair.

Long-Term vs. Short-Term Strategies

Long-term traders might hold positions based on macroeconomic trends and central bank policies, while short-term traders can capitalize on price volatility by using leverage and trading on margin. Both approaches require a thorough understanding of market conditions and a disciplined trading strategy.

Conclusion

The USDCAD pair’s current position suggests potential for further gains, particularly with anticipated bullish movements post-data release. By staying informed about market conditions and using a strategic trading approach, traders can capitalize on potential movements in the USDCAD pair. Whether you’re a long-term investor or a short-term trader, understanding the factors influencing USDCAD is key to making informed decisions.

0 notes

Text

Blue Space EA: Your Ticket to Passing Prop Firm and FTMO Challenges

Blue Space EA – Unique Trading Strategy Introduction Blue Space EA is an expert advisor designed for the MetaTrader 4 platform, optimized for the AUDNZD, NZDCAD, AUDCAD currency pairs and EURGBP, EURUSD, GBPUSD, USDCAD, GBPCAD, EURCAD. It leverages a sophisticated algorithm based on advanced market analysis to provide consistent trading results. Key Features 1. Versatile Strategy: – Utilizes…

0 notes

Text

Market Analysis: Optimizing Forex Trading Strategies

GOLD – Gold prices have held steady, recovering slightly from previous lows. As traders anticipate a potential rate cut announcement this Thursday, we foresee a possible reversal, especially as the dollar strengthens. In this scenario, scalping trading systems may provide profitable short-term opportunities by capturing price fluctuations as momentum shifts.

The MACD shows weakened buying strength, while the RSI suggests overbought conditions, signaling weak momentum for further upward movement. This indicates a higher likelihood of continued selling, but traders can use signal-based trading systems to manage entry and exit points more effectively, ensuring optimized trades.

SILVER – Silver prices continue to decline, demonstrating strong bearish momentum. Analysts anticipate further selling, with the MACD and RSI both confirming continued downward movement. Using Forex risk management strategies, such as stop-loss orders, will be crucial in navigating this bearish trend.

DXY – The dollar shows slight easing ahead of the expected rate cut. Both the MACD and RSI indicate increased selling momentum, suggesting a potential shift. Market expectations for aggressive rate reductions next year have dimmed due to inflationary concerns, adding to market uncertainty. As traders analyze these shifts, forex trend forecasting tools can assist in predicting the future direction of the dollar.

GBPUSD – The pound maintains a bearish outlook, though both the MACD and RSI show signs of gaining bullish momentum. Traders can apply scalping trading systems to take advantage of short-term rallies while keeping an eye on the overall bearish trend ahead of upcoming rate decisions.

AUDUSD – The Australian dollar remains consolidated between identified key levels, with a lack of clear directional bias. The MACD suggests slowing momentum, while the RSI indicates neither overbought nor oversold conditions. Here, Forex risk management strategies are vital to minimize losses in this consolidating market.

NZDUSD – The Kiwi shows slight upward movement, but the MACD signals reduced buying strength. Despite the potential for short-term rallies, the broader trend remains bearish. Signal-based trading can offer traders real-time entry signals to capitalize on any temporary price movements.

EURUSD – The euro demonstrates growing bullish momentum. Supported by an increasing MACD and favorable RSI readings, the euro's upward movement looks promising. Forex trend forecasting techniques can assist traders in capitalizing on potential continued strength as the market reacts to Fed rate cuts.

USDJPY – The yen continues to weaken, with exaggerated selling levels despite minimal pullbacks. Both the MACD and RSI point to significant buying momentum. Traders awaiting the Bank of Japan's upcoming policy decisions can apply scalping trading systems to capture short-term movements while hedging against potential reversals.

USDCHF – The franc remains in consolidation, slightly below the 0.89431 mark. The MACD and RSI indicate growing strength for a potential continuation of buying momentum. Forex risk management strategies will be essential in managing the risks associated with potential breakouts.

USDCAD – The Canadian dollar shows increasing weakness against the U.S. dollar. The MACD is nearing a bullish crossover, signaling potential buying opportunities. Traders can leverage signal-based trading to track real-time data, capitalizing on upward movements and implementing Forex risk management strategies to protect their positions.

#Trading techniques#Scalping trading systems#Forex risk management strategies#Signal based-trading#Forex trend forecasting

0 notes

Text

9 Fresh COT Forex Setups as Tariffs Shake Global Flows

As geopolitical tensions intensify with fresh tariff announcements, the forex market continues to respond to shifting fundamentals. This week’s COT forex setups provide clarity on directional opportunities across major pairs and commodities. By applying a structured forex trading approach with technical tools like MACD, RSI, and EMA200, traders can position themselves confidently while adhering to a disciplined forex risk management plan and keeping track of evolving setups in their trade journal for forex.

COT Market Sentiment

AUD – WEAK (5/5)

GBP – STRONG (5/5)

CAD – WEAK (5/5)

EUR – STRONG (5/5)

JPY – STRONG (3/5)

CHF – WEAK (4/5)

USD – WEAK (5/5)

NZD – STRONG (4/5)

GOLD – STRONG (5/5)

SILVER – STRONG (3/5)

Market Analysis

GOLD

Gold initially broke above its range but quickly retracted, reflecting hesitation around the upper boundary. While MACD and RSI show increased bullish volume, the overall bearish structure remains intact. This COT forex setup suggests traders should use caution. A well-planned forex entry and exit strategy around resistance levels is critical, with close attention to how price reacts to upcoming economic data.

SILVER

Silver extended higher after breaking its range, aligning with safe-haven demand following tariff escalations. MACD and RSI indicate sustained bullish momentum. As one of the more straightforward setups, traders can look for continuation plays while using trade management techniques like trailing stops. Track ongoing developments through resources like Axel Private Market.

DXY

The Dollar shows near-term strength driven by “inflationary” tariffs, but faces mixed expectations with major economic reports looming. MACD and RSI reflect bullish trends, but overbought conditions warrant caution. This setup reflects the need for a flexible forex risk management plan, especially during key data releases.

GBPUSD

The Pound continues to weaken after textbook structure breaks, making it one of the clearer setups for bearish continuation. With MACD and RSI aligned, a forex entry and exit strategy targeting lower support zones is favored. For enhanced consistency, World Quest FX offers structured guidance for traders refining their trade setups.

AUDUSD

The Aussie remains range-bound with bearish bias intact. With unclear MACD and RSI signals, breakout-focused strategies are ideal. You can reinforce disciplined setups via TopMax Global, helping manage risks until clear trends emerge.

NZDUSD

The Kiwi trades lower but remains inside its range. This setup invites patient observation, suited for documenting evolving conditions in a trade journal for forex, and acting only on confirmed breakouts.

EURUSD

The Euro is stuck in consolidation. MACD and RSI signal minimal strength, making this a “stay sidelined” pair until breakout conditions emerge. Using tools like RichSmartFX ensures you’re alerted when key levels are tested.

USDJPY

USD/JPY trends higher, with momentum signaling further upside despite potential pullbacks. Trend-following traders can capitalize using breakout strategies with tight risk controls, ideal for environments tracked via GFS Markets.

USDCHF

USDCHF remains neutral, consolidating with limited directional momentum. The structured approach is to wait for clear directional signals before acting.

USDCAD

USDCAD continues within a range, showing muted momentum. However, tariff headlines may break the stalemate. Opportunities to capitalize are best tracked using reliable forex signal providers aligned with confirmed structural shifts.

Final Thoughts

This week’s 9 COT forex setups reflect a market grappling with conflicting forces—tariff impacts, central bank shifts, and global economic uncertainty. Success lies in staying systematic with a structured forex trading approach, using a forex entry and exit strategy tailored to market conditions, and documenting each move in a trade journal for forex. Above all, a strong forex risk management plan ensures your capital stays protected amid rising volatility.

0 notes

Text

FX Crossroads: Gold, GBP, and CAD Face Pivotal USD Week Ahead of NFP

As we head into a pivotal week for the U.S. dollar, market participants are closely tracking macroeconomic data that could shape short-term positioning across major asset classes. Friday’s U.S. Non-Farm Payrolls report stands as the key release, with the potential to recalibrate Fed expectations and drive fresh volatility across FX and commodities. Following a period of softer U.S. data, the dollar is trading with a more vulnerable tone, and this week’s data could either reinforce or reverse that sentiment.

Gold remains resilient near historic highs, supported by falling real yields and sticky inflation expectations. GBPUSD continues to probe higher, buoyed by USD softness and minimal UK-side risk. Meanwhile, USDCAD has broken lower in response to firming oil prices and renewed CAD strength ahead of the Bank of Canada’s upcoming decision.

With broader markets showing relatively stable equity flows and modest risk appetite, this week’s price action will likely be dominated by USD volatility, commodity sensitivity, and central bank repricing. Below, we break down the evolving setups in Gold, GBPUSD, and USDCAD.

All times mentioned are in BST.

Gold (XAUUSD) Analysis

Gold has seen a decisive rebound off its recent lows, climbing from $3,276.64 to a session high of $3,389.90, now trading at $3,375.40. This sharp rally suggests buyers are regaining control after last week's pullback, with the metal attempting to re-establish a bullish trend.

While the broader outlook remains tied to U.S. rate expectations, the latest leg higher points to strengthening near-term momentum.

XAUUSD H1

Technically, gold has formed a V-shaped recovery, reclaiming key lost ground after a mid-week dip. The $3,389.90 zone is now acting as a resistance ceiling, with several failed breakout attempts noted.

On the downside, support is forming around $3,320.00, near the midpoint of the previous consolidation. A sustained push above the high could trigger momentum buying into the $3,410–$3,425 region.

Gold’s resilience is being shaped by subdued U.S. yields and lingering inflation concerns. While Fed commentary remains mixed, traders are starting to price in more dovish risks toward the end of the year.

Any signs of softening U.S. CPI this week could act as a tailwind. That said, price action remains volatile, and traders should be mindful of rapid reversals, especially with gold trading close to technical extremes.

GBPUSD Analysis

GBPUSD has continued to push higher, reaching a high of 1.3580 and currently trading just below it at 1.3570. The pair has bounced strongly from its June 3rd low of 1.3450, suggesting bullish sentiment is regaining traction as U.S. dollar strength falters. Sterling is being supported by a combination of firm domestic data and positioning ahead of the UK election cycle.

GBPUSD H1

Technically, GBPUSD has carved out a clean bullish structure, marked by higher lows and a steep upward leg to start the week.

The recent breakout above 1.3550 signals a shift in momentum, but traders should remain cautious as the pair approaches resistance from previous multi-day highs. Immediate support lies at 1.3525, followed by stronger interest at 1.3490.

Sterling’s recent strength could be attributed to fading Fed hawkishness and steady expectations for the Bank of England to remain on hold through summer. Still, the currency remains vulnerable to headline risk around UK politics and any surprise inflation print from the U.S. this week.

A sustained break above 1.3580 could pave the way toward 1.3650–1.3700, but price action is becoming stretched near-term.

USDCAD Analysis

USDCAD has come under sustained pressure, falling from 1.3820 to a low of 1.3650, where it currently trades. The pair is on the back foot following a sharp selloff in the past 24 hours, driven by softening U.S. dollar sentiment and renewed strength in oil, which is often supportive of the Canadian dollar.

The loonie’s outperformance has also coincided with growing market expectations for the Bank of Canada to hold steady in upcoming meetings.

USDCAD H1

Technically, the breakdown below the 1.3700 mark appears significant, with the pair trading below recent consolidation lows. A clear bearish structure has emerged, and unless USDCAD can reclaim levels above 1.3720, the risk remains for an extended slide toward 1.3600.

Momentum indicators suggest oversold conditions, but buyers remain hesitant to step in meaningfully.

From a fundamental standpoint, the Canadian dollar may continue to benefit from a resilient energy market and relatively hawkish central bank tones.

However, traders should watch for potential reversal signals, especially if broader USD flows shift following this week’s U.S. economic releases. A break back above 1.3735 would be required to ease immediate downside pressure.

Forward-Looking Considerations

Markets head into this week with heightened sensitivity to incoming U.S. macro data, particularly the Non-Farm Payrolls on Friday and CPI data due shortly after.

With September rate cut odds now increasingly priced in, a strong NFP print could disrupt that narrative and spark a broad USD rebound, impacting gold, GBP, and CAD alike.

Gold (XAUUSD) remains highly sensitive to real yields and Fed rate pricing. While technicals point to bullish continuation, follow-through depends on a softer CPI or weak labor data. Any upside move through $3,389 could accelerate toward $3,410–$3,425, but risks of near-term exhaustion remain.

GBPUSD trades well bid into resistance, but faces the risk of reversal if USD strength returns on the back of a hot jobs print. In the absence of meaningful UK data, GBP will largely move in response to broader dollar sentiment and global risk appetite.

USDCAD looks vulnerable to further downside given CAD strength and WTI resilience. However, traders should be mindful of potential snapbacks if crude weakens or if Fed rhetoric turns unexpectedly hawkish. A re-break above 1.3735 would be the first sign of buyer re-engagement.

Overall, USD direction remains the key macro swing factor, with gold and FX pairs poised to respond decisively to any surprises in U.S. data. Traders should be prepared for intraday volatility spikes and maintain flexibility as markets approach multiple inflection points.

0 notes

Text

Currency Analysis: Market Outlook by Rich Smart Finance

As we look forward to the core PCE data release this Friday, the market is showing signs of relief from the dollar's weakening trend. Gains are evident across various sectors, including metals, crude, Brent oil, and equities, with the NASDAQ achieving record highs. Yields are also decelerating. Our primary focus remains on the upcoming core PCE data, which will shape our market strategies and responses.

Gold

Gold has recorded gains following the latest COT report. Traders have seized the chance to make small profits ahead of the PCE results. Currently, gold is trading above 2332.174 and is nearing a test of 2365.443.

Silver

In the previous market close, silver lacked the momentum and supply to fall below 29.900. The market has since rebounded strongly to 30.938, preparing for the core PCE data release on Friday.

DXY (Dollar Index)

The dollar is reflecting traders' sentiment ahead of the core PCE data release. If the PCE result is 0.30 or higher, the FED and policymakers might adopt a more hawkish stance, potentially limiting rate cuts to only one by year-end. A PCE result of 0.27 or lower could relieve market pressures, allowing equities and metals to strengthen as the dollar stabilizes. Currently, the dollar is trading just below 104.607 after being strongly rejected at 105.071.

GBPUSD

GBPUSD has edged closer to 1.27038 as expected. We maintain our bullish outlook for this pair while awaiting further price action.

AUDUSD

The AUDUSD market is showing a bullish trend technically as structures hold up. We are watching to see if 0.66541 will act as resistance or if the currency will break higher. Notably, there is a head and shoulders (SHS) pattern forming on the 1-hour timeframe.

NZDUSD

NZDUSD has broken above the 0.61408 range and continues to exhibit bullish momentum on the technical charts. We expect this upward movement to persist unless price action suggests otherwise.

EURUSD

EURUSD has returned within its range, trading above 1.08541 after failing to break below the trendline. We now anticipate the price to rise towards 1.08950, showing confidence in the established support.

USDJPY

Following the BoJ hearing, the Yen has gained strength and momentum, albeit gradually. Governor Uchida emphasized the aim to re-anchor inflation expectations despite challenges in estimating neutral interest rates accurately. With wages likely to continue rising and external pressures from potential US rate cuts, Japan faces mixed influences on its currency. We expect further market interventions for Yen pairs and await additional inflation data to gauge the economy's impact.

USDCHF

The Swiss Franc (CHF) has regained strength, winning against the dollar at 0.91580 and pushing the price lower towards 0.91329. The structure now shows a bullish sentiment, but we await further confirmation. The price is likely to hold above 0.91807 or potentially fail, which would influence our bias accordingly.

USDCAD

The USDCAD market has rejected a move towards key structures, falling aggressively below 1.36563 and potentially testing 1.36052. The bearish structure remains intact, with continued selling pressure in the market.

At Rich Smart Finance, we remain vigilant and adaptive, closely monitoring these key indicators and market movements as we approach the core PCE data release.

0 notes

Text

Usdcad wave analysis - Forex work

USDCAD: ⬆ Buy Usdcad unlike the support area It is likely to rise to the resistance level 1.4500 The USDCAD currency pair was recently reversed from the support zone between the support level 1.4255 (which was reflected in the pair from the beginning of March), Bollinger Band Lower Daily and Trendline from November. The bullish reflection of the support area of this active intermediary wave…

View On WordPress

0 notes

Text

USDCAD: Riding the Bullish Wave

Current USDCAD Market Overview

The USDCAD pair is showing clear signs of the Canadian dollar's (CAD) weakness, with prices reaching 1.37881. This trend reflects broader economic conditions and market sentiment towards the CAD and the US dollar (USD). Historically, the USDCAD pair is sensitive to economic data releases from both Canada and the US, making it a critical pair for traders.

Factors Influencing USDCAD

Several factors influence the USDCAD pair, including economic indicators, central bank policies, and geopolitical events. Interest rate decisions by the Bank of Canada (BoC) and the Federal Reserve significantly impact the pair. Additionally, economic data releases such as GDP growth rates, inflation rates, and employment figures can drive price movements.

Anticipating Movements in USDCAD

Given the current market conditions, there is a possibility for the USDCAD pair to continue moving upward, pushing the price into bullish territory. However, it’s essential to wait for the market’s reaction to the upcoming data release. This cautious approach allows traders to respond to actual price movements rather than relying solely on predictions.

Trading Strategies for USDCAD

Traders can use a combination of technical and fundamental analysis to trade the USDCAD pair. Technical analysis involves studying price charts and indicators to identify trends and patterns. Key technical indicators for the USDCAD pair include moving averages, Bollinger Bands, and RSI. Fundamental analysis focuses on economic data and news events that could impact the pair.

Long-Term vs. Short-Term Strategies

Long-term traders might hold positions based on macroeconomic trends and central bank policies, while short-term traders can capitalize on price volatility by using leverage and trading on margin. Both approaches require a thorough understanding of market conditions and a disciplined trading strategy.

Conclusion

The USDCAD pair’s current position suggests potential for further gains, particularly with anticipated bullish movements post-data release. By staying informed about market conditions and using a strategic trading approach, traders can capitalize on potential movements in the USDCAD pair. Whether you’re a long-term investor or a short-term trader, understanding the factors influencing USDCAD is key to making informed decisions.

0 notes

Video

youtube

EURUSD+USDCAD+AUDUSD:PAIRS OF THE WEEK-EXCELLENT ANALYSIS FOR PROFESSION...

0 notes