Because no one taught you this shit in high school Real life experience from real life adults (kinda). We're just an awkward couple living on their own and surviving the real world. Come join us! We follow #adulting10h1 (thats 1 zero-h 1!) Share us your adulting tips or issues, or otherwise crazy stories and we’ll share them here!

Don't wanna be here? Send us removal request.

Text

Automatic Cat Feeders for 2 Cats

Our feeder is specially designed for households with two cats, promoting healthy feeding habits and eliminating the stress of sharing meals. With its user-friendly features and sleek design, it’s a must-have for multi-cat families!

#cat#pet#animal#life#hack#auto#living#amazon#promo#jlo#jennifer lopez#jensen ackles#tesla#elon musk#trump

0 notes

Text

An important message to college students: Why you shouldn't use ChatGPT or other "AI" to write papers.

Here's the thing: Unlike plagiarism, where I can always find the exact source a student used, it's difficult to impossible to prove that a student used ChatGPT to write their paper. Which means I have to grade it as though the student wrote it.

So if your professor can't prove it, why shouldn't you use it?

Well, first off, it doesn't write good papers. Grading them as if the student did write it themself, so far I've given GPT-enhanced papers two Ds and an F.

If you're unlucky enough to get a professor like me, they've designed their assignments to be hard to plagiarize, which means they'll also be hard to get "AI" to write well. To get a good paper out of ChatGPT for my class, you'd have to write a prompt that's so long, with so many specifics, that you might as well just write the paper yourself.

ChatGPT absolutely loves to make broad, vague statements about, for example, what topics a book covers. Sadly for my students, I ask for specific examples from the book, and it's not so good at that. Nor is it good at explaining exactly why that example is connected to a concept from class. To get a good paper out of it, you'd have to have already identified the concepts you want to discuss and the relevant examples, and quite honestly if you can do that it'll be easier to write your own paper than to coax ChatGPT to write a decent paper.

The second reason you shouldn't do it?

IT WILL PUT YOUR PROFESSOR IN A REALLY FUCKING BAD MOOD. WHEN I'M IN A BAD MOOD I AM NOT GOING TO BE GENEROUS WITH MY GRADING.

I can't prove it's written by ChatGPT, but I can tell. It does not write like a college freshman. It writes like a professional copywriter churning out articles for a content farm. And much like a large language model, the more papers written by it I see, the better I get at identifying it, because it turns out there are certain phrases it really, really likes using.

Once I think you're using ChatGPT I will be extremely annoyed while I grade your paper. I will grade it as if you wrote it, but I will not grade it generously. I will not give you the benefit of the doubt if I'm not sure whether you understood a concept or not. I will not squint and try to understand how you thought two things are connected that I do not think are connected.

Moreover, I will continue to not feel generous when calculating your final grade for the class. Usually, if someone has been coming to class regularly all semester, turned things in on time, etc, then I might be willing to give them a tiny bit of help - round a 79.3% up to a B-, say. If you get a 79.3%, you will get your C+ and you'd better be thankful for it, because if you try to complain or claim you weren't using AI, I'll be letting the college's academic disciplinary committee decide what grade you should get.

Eventually my school will probably write actual guidelines for me to follow when I suspect use of AI, but for now, it's the wild west and it is in your best interest to avoid a showdown with me.

12K notes

·

View notes

Text

So what does it take to get an honorary degree? 😔🤞

7K notes

·

View notes

Text

You’re never too old to learn something new. Never stop studying.

18K notes

·

View notes

Text

gentle reminder you can rise up from everything. you can recreate yourself. nothing is permanent. you are not stuck. you have choices. you can think new thoughts. you can learn something new. you can create new habits. all that matters is that you decide today and never look back.

30K notes

·

View notes

Text

Mastering Student Loans: A Guide to Managing, Repaying, and Refinancing Your Debt

Student loans can be a significant financial burden, but with the right strategies, you can effectively manage, repay, and even refinance your debt to improve your financial health. Whether you’re just starting to pay off your student loans or looking for ways to make your payments more manageable, this guide will walk you through the key steps to managing student loans and offer tips to help you stay on top of your repayment plan.

1. Understanding Your Student Loans

Before you can effectively manage your student loans, it’s essential to understand what type of loans you have and the terms associated with them. Here are the key things to know:

Federal vs. Private Loans: There are two main types of student loans: federal and private. Federal loans are funded by the government and typically offer more borrower protections, such as income-driven repayment plans and loan forgiveness options. Private loans are provided by banks, credit unions, or other lenders and may have variable interest rates and fewer repayment options.

Loan Terms and Interest Rates: Each loan comes with specific terms, including the interest rate, repayment period, and monthly payment amount. Federal loans often have fixed interest rates, while private loans may have fixed or variable rates. Understanding these terms is crucial for creating a repayment plan that works for you.

Grace Periods: Most federal student loans have a grace period, typically six months after you graduate or leave school, during which you don’t have to make payments. Private loans may or may not offer a grace period. It’s important to know when your payments will begin so you can prepare.

To help you stay organized and keep track of your loans, consider using a Student Loan Tracker.

Student Loan Tracker: Available on Amazon, this tracker helps you organize your loans, track your payments, and monitor your progress toward repayment. Check it out here.

2. Creating a Repayment Plan

Once you’ve identified the type of loans you have and their terms, the next step is to create a repayment plan that fits your budget and financial goals. Here’s how to get started:

Choose the Right Repayment Plan: Federal student loans offer several repayment plans, including standard, graduated, and income-driven options. Standard repayment plans have fixed payments over 10 years, while graduated plans start with lower payments that increase over time. Income-driven plans base your monthly payments on your income and family size, which can make payments more affordable.

Prioritize High-Interest Loans: If you have multiple loans, prioritize paying off the ones with the highest interest rates first. This will reduce the total interest you pay over time and help you pay off your loans faster. Continue making the minimum payments on all your loans while putting extra money toward the highest-interest loan.

Consider Auto-Pay: Many lenders offer a discount on your interest rate if you sign up for automatic payments. Auto-pay ensures that you never miss a payment and can save you money over the life of the loan.

Explore Deferment or Forbearance: If you’re experiencing financial hardship, you may qualify for deferment or forbearance, which temporarily pauses your loan payments. However, interest may continue to accrue, so these options should be used as a last resort.

To help you create a repayment plan and stay on top of your payments, consider using a Student Loan Repayment Calculator.

Student Loan Repayment Calculator: Available online, this tool helps you estimate your monthly payments, compare repayment plans, and see how extra payments can reduce your loan balance. Check it out here.

3. Making Extra Payments to Pay Off Your Loans Faster

One of the most effective ways to pay off your student loans faster is by making extra payments whenever possible. Here’s how to do it:

Pay More Than the Minimum: If you can afford to, pay more than the minimum amount due each month. Even small extra payments can make a significant difference over time by reducing the principal balance and the amount of interest you’ll pay.

Make Biweekly Payments: Instead of making one monthly payment, consider splitting your payment in half and paying biweekly. This results in an extra payment each year, which can help you pay off your loans faster without significantly impacting your budget.

Apply Windfalls to Your Loans: If you receive a windfall, such as a tax refund, bonus, or inheritance, consider using a portion of it to make an extra payment on your student loans. Lump-sum payments can have a big impact on reducing your loan balance.

To help you track your extra payments and stay motivated, consider using a Debt Snowball Tracker.

Debt Snowball Tracker: Available on Amazon, this tracker helps you visualize your progress and stay motivated as you pay off your loans. Check it out here.

4. Refinancing Your Student Loans

Refinancing your student loans can be a great way to lower your interest rate and reduce your monthly payments, especially if you have private loans with high-interest rates. Here’s what you need to know about refinancing:

Eligibility: To qualify for refinancing, you typically need a good credit score, steady income, and a low debt-to-income ratio. If you don’t meet these criteria, you may need a co-signer to qualify for a lower interest rate.

Pros and Cons of Refinancing: The main advantage of refinancing is the potential to lower your interest rate, which can save you money over the life of the loan. However, if you refinance federal loans into a private loan, you’ll lose access to federal protections, such as income-driven repayment plans and loan forgiveness options.

Shop Around for the Best Rates: Different lenders offer different interest rates and terms, so it’s important to shop around and compare offers before refinancing. Look for lenders that offer low fixed rates, no origination fees, and flexible repayment terms.

To compare refinancing offers and find the best option, consider using a Student Loan Refinancing Comparison Tool.

Student Loan Refinancing Comparison Tool: Available online, this tool helps you compare rates and terms from different lenders to find the best refinancing option for your situation. Check it out here.

5. Exploring Loan Forgiveness and Repayment Assistance Programs

If you work in certain professions or meet specific criteria, you may be eligible for loan forgiveness or repayment assistance programs that can help reduce or eliminate your student loan debt. Here are some common programs to explore:

Public Service Loan Forgiveness (PSLF): This federal program forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying employer, such as a government agency or nonprofit organization.

Teacher Loan Forgiveness: If you’re a teacher working in a low-income school or educational service agency, you may be eligible for up to $17,500 in loan forgiveness on your federal student loans after five years of service.

Income-Driven Repayment Forgiveness: If you’re enrolled in an income-driven repayment plan, any remaining balance on your federal student loans will be forgiven after 20 or 25 years of qualifying payments, depending on the plan.

State-Based Repayment Assistance Programs: Some states offer repayment assistance programs for borrowers who work in specific fields, such as healthcare, law, or education. These programs vary by state, so check with your state’s higher education agency to see what’s available.

To see if you qualify for loan forgiveness or repayment assistance, consider using a Loan Forgiveness Eligibility Tool.

Loan Forgiveness Eligibility Tool: Available online, this tool helps you determine whether you qualify for federal loan forgiveness programs and provides guidance on how to apply. Check it out here.

Conclusion

Managing student loans can be challenging, but with the right strategies, you can stay on top of your payments, pay off your debt faster, and explore options for refinancing or loan forgiveness. By understanding your loans, creating a repayment plan, and making extra payments when possible, you’ll be well on your way to reducing your student loan debt and improving your financial future.

Remember, paying off student loans is a marathon, not a sprint. Stay patient, stay consistent, and celebrate your progress along the way.

Helpful Items and Services Recap:

Student Loan Tracker

Student Loan Repayment Calculator

Debt Snowball Tracker

Student Loan Refinancing Comparison Tool

Loan Forgiveness Eligibility Tool

With the right tools and resources, you can take control of your student loans and work toward a debt-free future. You’ve got this!

#college#university#loans#budget#loan#finance#adulting#student#student life#academics#studying#study#tracker#tools#repayment#forgiveness#debt#snowball#refinance

1 note

·

View note

Text

Go back to school in style with these dorm essentials!

Bedside Storage Organizer with Fixed Straps and Water Bottle Holder

Marbrasse Pen Organizer with 2 Drawer, Multi-Functional Pencil Holder

4 Pack Storage Baskets

4 Packs Under Bed Storage Containers Bins

Tank Top Hanger, Rotatable Bra Organizer for Closet

Clothes Hangers Plastic 40 Pack

Purse Organizer with Side Hooks and Baskets, Floor-Standing 3-Tier Rack

ASUS Chromebook Flip CX1 Convertible Laptop, 14"

Bean Bag Chair, Ivory Shag Fur

Pink Gradient Aura Posters

JBL Pulse 5 - Portable Bluetooth Speaker with Dazzling Lights

8X10 ft Purple Fluffy Fuzzy Shag Small Carpet

#college#dorm#life#school#amazon#home#bedroom#organization#organizer#decore#decor#essentials#back to school#first day of school#adulting#how to#adulting101#apartment

4 notes

·

View notes

Text

The school year is officially in full swing. Did you know that I work on a college campus? I see first hand what today's college student struggles with, and with both my professional and personal college experiences, I know just how to make it as easy and stress-free as possible.

Amazon Prime offers customers 18-24 year-olds or college students a free 6-month trial, followed by 50% off a regular Prime membership!

You also get free same-day, one-day, and two-day delivery, PLUS Grubhub+ food delivery! Perfect for those late nights where you maaayyy have forgotten to get dinner.

There are tons of other exclusive offers including Student Universe, which offers 10% off on flights and hotels, a free 3-month premium subscription to Calm, one month of free homework help, live tutors, and more through Course Hero, and more!

Click the link above to sign up today!

0 notes

Text

How to Do Your Taxes for the First Time: A Beginner's Guide

Navigating taxes for the first time can feel overwhelming, but it doesn’t have to be. Whether you’re filing as a full-time employee, a freelancer, or a student with a part-time job, understanding the basics can help you get through tax season with confidence. This guide will walk you through the process, step by step, and highlight some helpful tools and services to make the experience smoother.

1. Understand the Basics of Tax Filing

Before diving into tax forms and deductions, it’s essential to understand the fundamentals of taxes. In the U.S., most people are required to file an annual tax return with the IRS by April 15th. Here’s a breakdown of key terms:

W-2 Form: If you're an employee, your employer will provide you with a W-2 form. This document shows your total earnings and the taxes that were withheld from your paycheck throughout the year.

1099 Form: If you worked as a freelancer, contractor, or gig worker, you'll likely receive a 1099 form from each client. This form reports the income you've earned that wasn't subject to withholding taxes.

Standard Deduction vs. Itemized Deductions: The standard deduction is a fixed amount you can subtract from your income to reduce your taxable income. Alternatively, if you have significant deductible expenses (like mortgage interest, charitable donations, etc.), you might benefit from itemizing deductions.

2. Choose the Right Tax Filing Method

You have several options for filing your taxes, depending on your comfort level and financial situation. Here are the most common methods:

Tax Software: This is one of the easiest and most affordable ways to file taxes. Tax software like TurboTax, H&R Block, or TaxSlayer can guide you through the process by asking simple questions about your income, deductions, and credits. Many of these platforms offer free filing for basic returns, with paid versions available for more complex filings.

TurboTax Deluxe 2024: Available on Amazon, TurboTax Deluxe is ideal for those with deductions like mortgage interest or donations. This software maximizes your deductions and ensures you get the largest possible refund. Check it out here.

Professional Tax Preparer: If your taxes are more complicated—perhaps you have investments, rental income, or own a small business—you may want to hire a certified tax preparer or CPA. They can handle the details and ensure that everything is accurate. You can find reputable tax professionals through services like H&R Block or Jackson Hewitt.

IRS Free File: If your adjusted gross income (AGI) is below a certain threshold, you may qualify for free federal tax filing through the IRS Free File program. This is a great option for young adults with simple tax situations.

3. Gather Your Documents

Filing your taxes requires several essential documents. Make sure you have the following on hand:

W-2 Forms from all employers.

1099 Forms if you're a freelancer or gig worker.

1098 Forms for mortgage interest, student loan interest, or tuition payments.

Receipts for deductible expenses, such as charitable donations or medical expenses.

Social Security Numbers for yourself and any dependents.

One useful item for staying organized is an Income Tax Organizer. This document sorter can help you keep all your forms and receipts in one place, making tax time a little less stressful.

Income Tax Organizer: Available on Amazon, this organizer has multiple sections for W-2s, 1099s, receipts, and other documents. It’s a helpful tool for staying organized year after year. Check it out here.

4. Deductions and Credits: How to Maximize Your Refund

Now that you’ve gathered your documents, it’s time to look for ways to reduce your taxable income and maximize your refund. Here are some of the most common deductions and credits:

Student Loan Interest Deduction: If you’re repaying student loans, you may be able to deduct up to $2,500 of interest paid during the year.

Education Credits: The American Opportunity Credit and Lifetime Learning Credit can help offset the cost of tuition and other educational expenses.

Earned Income Tax Credit (EITC): This credit is available to low-to-moderate-income workers, especially those with children. It can significantly boost your refund if you qualify.

Retirement Contributions: Contributions to retirement accounts like an IRA or 401(k) can be deducted from your income, reducing your tax liability.

To make sure you’re not missing any potential deductions or credits, consider using a Tax Deduction and Credit Checklist. This checklist can help you identify opportunities to reduce your tax bill.

Tax Deduction and Credit Checklist: Available on Amazon, this guide walks you through all the available deductions and credits, ensuring that you don’t miss any important tax-saving opportunities. Check it out here.

5. File Your Return and Pay Any Taxes Owed

Once you’ve entered all your information and reviewed your return, it’s time to file. If you’re using tax software, filing is usually as simple as clicking a button. If you owe money, you’ll need to pay the IRS by April 15th to avoid penalties. Here are a few payment options:

Direct Debit: You can have the IRS withdraw the money directly from your bank account on a specified date.

Credit Card: You can pay your taxes with a credit card, but be aware that there are processing fees associated with this option.

Payment Plan: If you can’t afford to pay your taxes in full, you can set up a payment plan with the IRS.

If you’re due a refund, you can choose to receive it via direct deposit, which is the fastest method, or by mail.

6. Stay Organized for Next Year

Taxes are an annual obligation, so staying organized throughout the year will make the process easier when tax season rolls around again. Here are a few tips:

Keep All Receipts: For deductible expenses, it’s crucial to keep receipts and records. You can use a digital receipt scanner like the Doxie Go SE Portable Scanner to digitize and organize your documents.

Doxie Go SE Portable Scanner: Available on Amazon, this scanner allows you to scan receipts, invoices, and other important documents. It’s portable and easy to use, making it perfect for keeping your tax records in order. Check it out here.

Track Your Income and Expenses: Using apps like Mint or YNAB (You Need A Budget) can help you track your spending, save receipts, and organize your finances in preparation for tax season.

Conclusion

Filing taxes for the first time doesn’t have to be intimidating. By understanding the process, gathering your documents, taking advantage of deductions and credits, and using the right tools, you can make tax season a breeze. Remember that preparation is key, so start organizing your finances early to avoid the last-minute scramble. And if you feel overwhelmed, don’t hesitate to seek help from tax software or a professional tax preparer.

Helpful Items and Services Recap:

TurboTax Deluxe 2024

Income Tax Organizer

Tax Deduction and Credit Checklist

Doxie Go SE Portable Scanner

By equipping yourself with the right knowledge and tools, you’ll be well on your way to mastering the tax-filing process and securing the best possible outcome. Happy filing!

#adulting#life#Taxes#life hacks#hacks#adulting101#young adult#adult#how to#howto#Amazon#w2#1099#Deductions#TurboTax#H&R Block#taxslayer#CPA.jackson Hewitt#irs#1098#organizer#credit#interest#deduction#retirement#Dixie go#mint#tnab

0 notes

Text

Tips from my dad about buying a car

- Go in at the end of the month - Buy the model of the year right before the model for the next year comes out (dealers get desperate to sell the old models) - Refuse to put any money down. Say that if they ask you to put down money, you’ll leave - Seriously. If they ask you to put down money say you need to go and walk out - If there’s another dealership nearby, tell them that you’re walking there right after you leave - If a deal seems unfair but you really like the car, tell them you’re going to another dealership and leave. Chances are, they’ll call back the next day with a better deal - If possible, after the first call wait till the last few days of the month and they’ll likely call again with an even better deal - Look around for family and friends that need a car. If you buy more than one car from the same dealership you’ll get a much better deal - If a family member/friend is looking for a used car while you’re looking for a new car or vice versa, still get the used car from the same dealership - If you decide to buy a new car after a few years, trade in the old car and buy a new one from the same dealership. Companies appreciate loyalty and will likely offer you a lower price

57K notes

·

View notes

Text

Adulting 10h1: A Series | Chapter 1: The Independent Adult Moves Out!

A weekly how-to series on adulting by Adulting10h1. We cover a variety of topics including apartments and leases, loans, taxes and w2s, grocery shopping, and everything in between.

Moving out of Mom and Dad’s house is often times the first and biggest step of adulthood. Often times, this happens after high school when you go to college. But even then, that doesn’t quite compare to the experience of finding your first apartment and signing your name on that lease! You will feel a range of emotions during this process, and I bet the biggest thing you’ll be feeling is overwhelmed! So, take a deep breath, relax, and let me give you a step-by-step guide on how to go about finding the perfect apartment! (Because I almost called this Adulting for Dummies! ;) )

What’s Covered in this Post:

Budget

The Apartment Hunt

Utilities Explained

Questions to Ask

Things to Look for

Signing the Lease

Leases Explained

Red Flags in a Lease

Have a question that wasn’t answered here or need further explanation? Ask us!

Budget: before you even begin the hunt, you need to establish a budget for yourself. Do some research before anything else and see what kinds of apartments are out there and how they are priced. Depending on where you’re looking, you’ll likely find a wide range of prices. In the city, and the closer you are to the city, you will find that apartments will be way more expensive. Often times, the further away from the city you are, the cheaper things will be. In Boston, for example, you could easily spend over $1000 on a studio apartment. In New Hampshire, about an hour away, you could find that same studio for around $500. So, you’ll want to first figure out the location that is best suited for you and the budget you can afford. REMEMBER: Just because you make, say, $2000 a month, DOESN’T MEAN YOU SHOULD LOOK FOR APARTMENTS THAT ARE $2000 A MONTH.

The Hunt: Once you figure out what you want to spend, this will make the hunt for an apartment a lot easier. There are many websites and Facebook groups that have apartments listed, and often times, you can sort these by price. Websites like ForRent.com, Zillow, Trulia, and Rent.com give you many options to help narrow your search. Plug in the price range you’re looking for, the location you’d like, and start scrolling through your options. Pay attention to the pricing and utilities. An important phrase you will come across are whether utilities are included or not. Utilities often refers to heat, hot water, and electric. More often than not, heat and hot water go hand in hand. You may find a place where there is heat and hot water included, but electric is not. Sometimes abbreviations are used, and you may see things like H&HW or H/HW included - this refers to heat and hot water. Sometimes, if the apartment is listed in a two-family home or similar set up, Wifi and Cable may (or may not) be included. Keep an eye out for these keywords, and do a little more research to see what other people pay for their utilities. For reference, I live in a 16- unit building in southern New Hampshire. My one bedroom apartment essentially consists of 2 rooms and the bathroom and is roughly 750 sq. Feet. The highest I have paid for electric is always in the summer when we have the AC going. We have an additional fan between rooms that goes on to help cool on the living room since the AC is in the bedroom. We also have two large TVs, Jon’s gaming computer, and a variety of gaming consoles. The most I paid was this past July, and my bill came to $90. On average, I spend around $50 a month for electric. And yes, we spend quite a few hours a week gaming, but I can tell you now the AC uses the most electricity. It has a nice feature, though, that allows us to set it by temp and it will turn off itself to save power when it reaches that temp. Heat and hot water often go hand in hand because the water is heated by whatever heat source is used. This means that, not only are you paying for the heat you use to heat the apartment in the winter, you’re also paying for the hot water used in the shower, doing dishes, in a dishwasher, etc. If all utilities are included, this can sometimes be great in the long run. However, be careful not to abuse that, as a landlord can increase the rent to make up for any excess utility usage, especially if you’re in an apartment in a smaller complex or in a two family styled home, as this usage will become more noticeable. Always schedule time to see the apartment in person. Pictures can often be deceiving, so you’ll want to see it for yourself, especially to judge the size of the rooms. Go in with an idea of what you will be bringing. If you have a large bed, like a king or queen sized bed, take measurements beforehand and take a measuring tape with you to make sure it will fit in the bedroom. Come up with a list of questions that may not have been answered in the ad and don’t be afraid to ask.

3. Signing the Lease

Once you’ve found the perfect place and submitted your application, (and, assuming you are accepted) you’ll be asked to sign a lease! In this contract, you should find all the rules for the apartment (things stated may include when the rent is due, how it is due, where to send it (some will allow you to give them your bank info and it will be automatically taken out every month) pet policy, etc). You should also find the length of the lease, clearly stated, with the price you are expected to pay every month and what, if any, utilities are included. If you are moving in with a friend, partner, etc, they may be expected to sign the lease as well. Other information may be collected such as vehicle information, pet information, emergency contact, and employment information. You will want to read this carefully and make sure that everything is as discussed and looks reasonable. If there is anything you are unsure about, ASK! DO NOT sign anything until you are confident you have all the right information. Ask your parents, or even do a quick Google search to see if there are any red flags in the lease. If it all looks good, sign away, give them your payment, and receive your key!

Check this out for an in depth look at leases!

Potential Red Flags:

“As Is”: Be wary of anything that is listed as “As Is.” This can essentially mean that the apartment is in very poor condition and that you are agreeing to take it exactly as you see it. Landlords have a responsibility to maintain apartments and keep them in livable condition. In fact, this is law in 49 out of the 50 states in the US, whether it is stated in the lease or not. The apartment and common spaces should be fit for human habitation and not subject to dangerous or hazardous conditions.

Landlord Access: By law, a landlord DOES NOT have complete access to your apartment. They must give a notice for entering your apartment for any reason. The only time a landlord may enter without warning is if there is a flood or fire or other emergency. Beware of any clauses that gives the landlord freedom to enter your apartment. Your lease may describe specific things that constitute emergencies and may also describe circumstances when the landlord can enter the apartment with notice. Be clear on what these situations are.

Repairs: A lease should never say that you as the tenant are responsible for repairs - whether it be an appliance that breaks or a window that won’t close. Plumping issues, faucets, and otherwise anything that involves the structure of the apartment and anything that does not personally belong to you are the responsibility of the landlord. If the apartment isn’t currently habitable, or is unsafe, your landlord is required at his expense to fix it up, no matter what the lease says. A landlord trying to get you to take an unsafe apartment may be trying to make you pay to fix his problem. Don’t do it.

Landlord will not be held liable for any damages: If the landlord fails to keep the apartment or building safe, the landlord should be liable if you get hurt or your property is damaged as a result. Ask what damages the landlord is concerned about and why. You’ll get clues as to what’s important to the landlord.

Security Deposit: This is meant to fix any damages you make to the apartment at the end of your lease. If there are no damages, you are supposed to get this deposit back at the end of the lease/when you move out. The lease should state a purpose for the security deposit. If the terms are vague, you may not get your leased return, regardless of the condition you leave the apartment. Take photos of the apartment when you move in and discuss the process for repairs ahead of time, especially if something needs to be fixed.

Late fees: Some landlords will charge a late fee for late rent, but this fee should not be more than 3-5% of the rent.

Mandatory Insurance: While renter’s insurance can be a good thing to have, you should not be paying the landlord’s insurance (which is different from your own renter’s insurance). This should only be up to the renter/tenant.

Tenant will pay in maintenance/guest/cleaning fees: If you’re going to be charged a monthly cleaning fee, for example, make sure you know what’s being cleaned, by whom, how often, and whether the cleaners will be able to access your apartment without you there. Certain types of fees may not be legal in some states.

Anything where you waive a right: It’s difficult in almost all states to waive rights to which you’re entitled by law, even if the lease says you’re doing so. That said, whenever you’re waiving anything make sure you understand what you’re waiving and why you’re being asked to waive it.

Landlord has the right to change lease provisions at any time: The landlord cannot change key terms of the lease without your consent or making you aware. The lease should include restrictions on the landlord’s ability to change the terms of the lease before your lease is up.

Rules: After the lease has been signed by both parties, the landlord does not have the right to change any terms. You are agreeing to pay rent for a set amount of time and the landlord must adhere to the agreed upon set rules.

Noise Clauses: Go over any quiet hours with your landlord to determine what they mean and how they are enforced. Reasonable quiet hours should not begin at 3 in the afternoon, for example. I’ve never seen an apartment that has quiet hours except in common areas (unless you are living on campus in a college dorm).

Extra Charges: Be aware of any extra charges. Sometimes, these can be things like ‘tax’ or generally things the landlord should be responsible for, not you.

Lack of Provisions for Living Conditions: A landlord should provide speedy fixes to critical components like running water and sewer systems. Ask about their policy on fixing what goes bad in a unit and read the language in the lease carefully.

#adulting#101#apartment#hunt#moving out#college#life#renting#lease#leases#how to#how-to#adult#adulting10h1#series#1#adultingseries

3 notes

·

View notes

Text

Introducing a Step-by-step Guide on Adulthood!

We’ve (finally!) got some posts made up and ready to go, so I’m happy to officially announce our series on adulting! Once a week, we will post a new chapter in our little make-shift how-to book on adulting. We cover a variety of topics including apartments and leases, loans, taxes and w2s, grocery shopping, and everything in between.

In between our weekly posts, we will continue to reblog and share other adulting related things, whether it be DIY projects, hacks, or general rants and advice.

Our ask box and our submit box are both open! We encourage every adult to share their own tips, hacks, advice, or even complaints for us to post, share, and discuss. We’re always open for questions, and some questions may even make it into a part of our adulting series if it is something we haven’t covered yet and needs thorough explanation!

So come on over and say hello, check out our series, and survive adulthood together with us. Because they didn’t teach you this shit in high school!

#life#adulting#101#how to#adult#adulthood#apartments#apartment#lease#contracts#guide#series#high school#adults#young

0 notes

Text

The biggest joke in the world is the fact that I can do everything right to start a career for myself, including getting myself all the required degrees, etc to do so, but no one wants me because I don't have previous experience. How the hell are you supposed to get actual experience if you can't even get in anywhere to get that experience in the first place? Maybe instead of complaining about 'millennials' people should consider the fact that they're the ones screwing things up for us. They push us to go to college, get a degree, work our ass off, and we do all these things only to have it get us no where closer than where we want to be. We can do everything 'right' and still not be able to establish ourselves. How do people not see the problem in that? Hmm..

For the record, this will definitely be a topic explored further. Feel free to weigh in with your current struggles on getting a career for yourself. And I’m not talking getting a job at McDonalds - let’s discuss things beyond entry level, where you have the appropriate degrees needed but it just doesn’t seem to be good enough. You know, after graduation kinda thing. Come vent to me, express your own frustrations, and stay tuned for more on this topic.

Because they definitely didn’t teach us this shit in school...

And that’s why this blog exists so we can tackle these problems together and prepare ourselves for the screw overs in the world!

2 notes

·

View notes

Text

Extreme Makeover: Blog Edition!

Adulting10h1 got a make over because we’re coming back in full force!

I tried to get this blog started/going a while back but life got busy. And now life is less busy and we have lots of adulting knowledge and experience to share with all you youngins!

Below is a little preview of some of the posts we have in store over the next few months, with the goal of posting a different in-depth topic every week! (These are also listed just about in the order we will be posting them). If there’s something you don’t see that you’d like us to talk about, shoot us a message and we’ll add it to the list!

Apartment Hunting and the 411 on renting

Moving - what to pack!

Grocery shopping

Finances and bills - get organized and don’t get screwed!

Pinching Pennies

Household chores

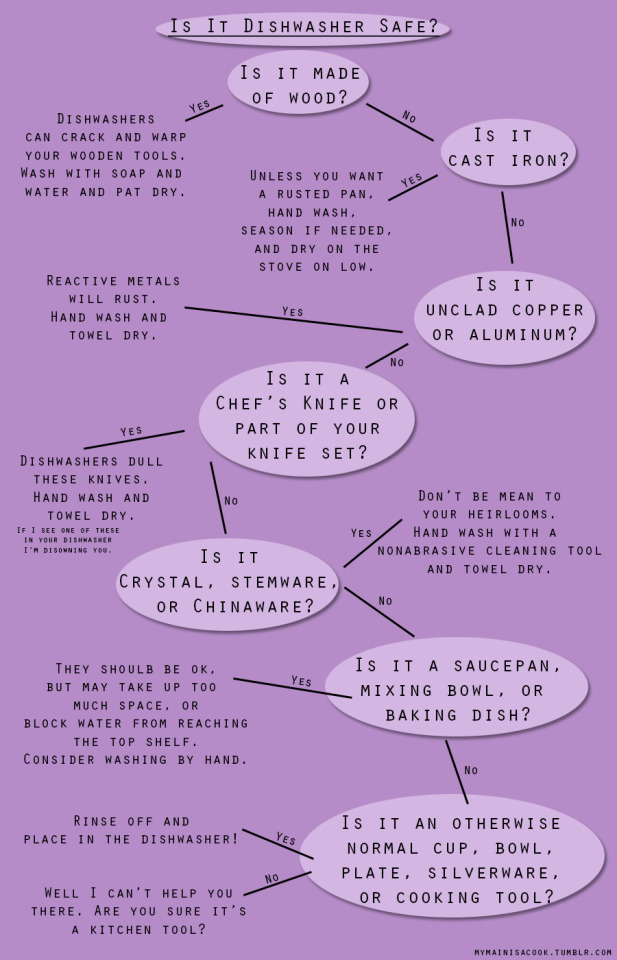

Cooking without burning the house down

Interviews and Jobs

W2s and all those weird forms

Insurances

Doctors. Go to see them.

Cars because sometimes things break

FAFSA and loans explained

Taxes

Banks

Interest, Rates, APRs, and other adulting terms

The real estate market

Apps to help you adult

DIY and other various posts and reblogs daily

Fair warning, these posts may be text heavy, which is why we will (eventually) start a Youtube series for those who’d rather have some videos to watch. We’ll do our best to make our posts interesting and without blocks and blocks of text, because we know that’s no fun to read. But we’re going to do our best to explain everything to you - because they didn’t teach you this shit in high school!

We follow #adulting10h1 (thats 1 zero-h 1!) Share us your adulting tips or issues, or otherwise crazy stories and we’ll share them here!

#adulting#101#how to adult#college#life#young adult#adults#apartment#living#experiences#millenials#how to#adult#school

2 notes

·

View notes