About【OPSTRA.AgentOpinionLeader】- Top and up-to-date GTA real estate market watch and insight- Enable agents with KOL (Key Opinion Leader) breakthroughs to expand and cultivate private domain traffic/customers- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technologyCall 647 972 0032 for your own brand-customized copyright co-op (shared/exclusive, depending on availability)Email: service@opstra.cawww.opstra.cawww.property-pulse.cawww.valueinsight.cawww.opinionleader.ca#gtarealestate #gtahomes #gtarealtor #torontorealestate #torontohomes #torontorealtor #trreb

Don't wanna be here? Send us removal request.

Text

youtube

2024 Canada, Ontario, and Greater Toronto Farmland Annual Market Report

In recent years, with the noticeable rise in Canadian farmland prices, coupled with no foreign buyer ban and no foreign buyer taxes, farmland has become highly favored by overseas buyers. It’s time for another update to keep up with the market and share some insights.

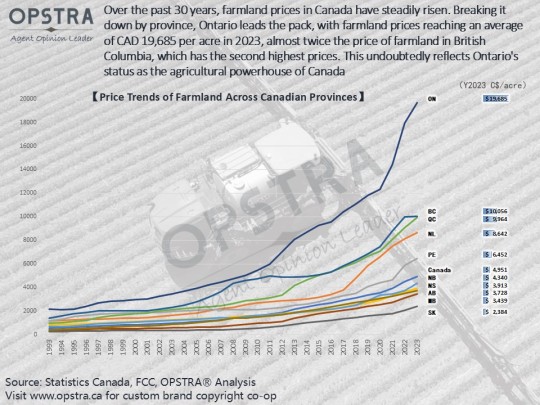

Let’s first take a look at the ’30-Year Price Trends of Farmland Across Canadian Provinces.’ Over the past 30 years, farmland prices in Canada have steadily risen. Breaking it down by province, Ontario leads the pack, with farmland prices reaching an average of CAD 19,685 per acre in 2023, almost twice the price of farmland in British Columbia, which has the second highest prices. This undoubtedly reflects Ontario’s status as the agricultural powerhouse of Canada.

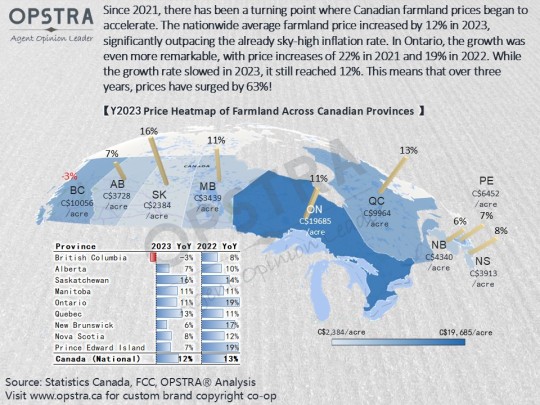

We can further present the average farmland prices in a heatmap, making Ontario's geographical and climatic advantages even more evident at a glance. Ontario boasts fertile land, distinct seasons, balanced rainfall and sunlight, and experiences minimal geological and natural disasters. Moreover, it uniquely enjoys access to the world’s largest freshwater lake system. Four of the five Great Lakes have half their surface area within Ontario. All of this explains why farmland in Ontario has both higher productivity and value compared to other provinces in Canada.

Notably, since 2021, there has been a turning point where Canadian farmland prices began to accelerate. The nationwide average farmland price increased by 12% in 2023, significantly outpacing the already sky-high inflation rate. In Ontario, the growth was even more remarkable, with price increases of 22% in 2021 and 19% in 2022. While the growth rate slowed in 2023, it still reached 12%. This means that over three years, prices have surged by 63%!

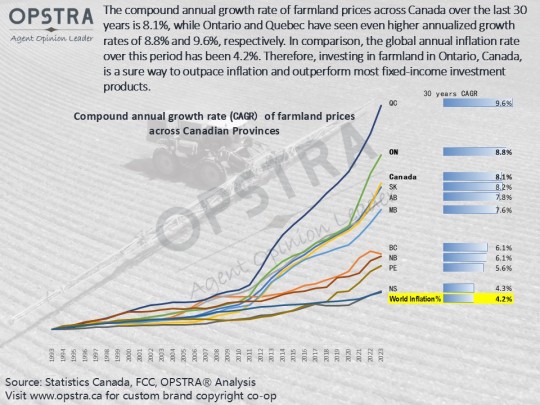

If we create a separate chart showing the annual growth rate of Canadian farmland prices, the ability of farmland to preserve and appreciate in value over the past 30 years becomes undeniably clear. The compound annual growth rate of farmland prices across Canada over the last 30 years is 8.1%, while Ontario and Quebec have seen even higher annualized growth rates of 8.8% and 9.6%, respectively. In comparison, the global annual inflation rate over this period has been 4.2%. Therefore, investing in farmland in Ontario, Canada, is a sure way to outpace inflation and outperform most fixed-income investment products.

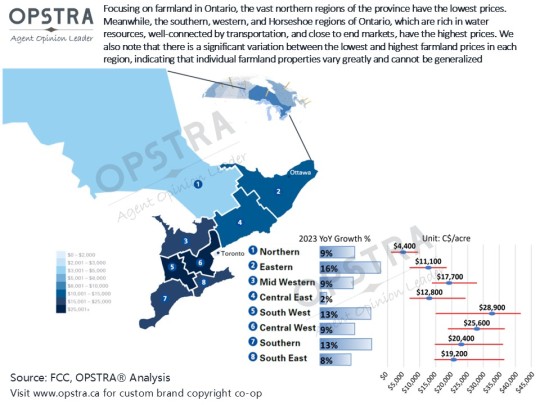

Focusing on farmland in Ontario, the vast northern regions of the province have the lowest prices, with a median price of CAD 4,400 per acre. Meanwhile, the southern, western, and Horseshoe regions of Ontario, which are rich in water resources, well-connected by transportation, and close to end markets, have the highest prices, with a median of CAD 28,900 per acre. We also note that there is a significant variation between the lowest and highest farmland prices in each region, indicating that individual farmland properties vary greatly and cannot be generalized.

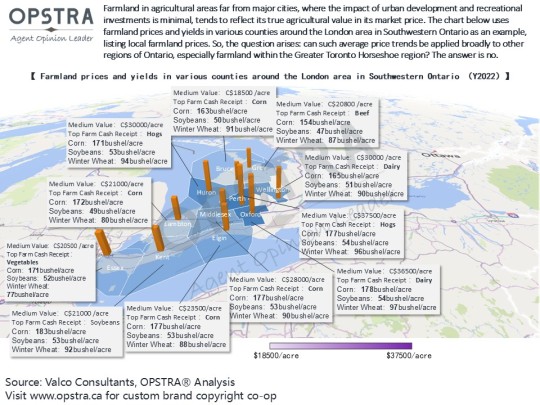

Unfortunately, investing in farmland is not as straightforward as stock market index funds, which offer simple investment options. Each case requires individual analysis, valuation, and transactions. Generally speaking, the most common method for farmland valuation is discounting the future net cash flows of its output. Farmland in agricultural areas far from major cities, where the impact of urban development and recreational investments is minimal, tends to reflect its true agricultural value in its market price. The chart below uses farmland prices and yields in various counties around the London area in Southwestern Ontario as an example, listing local farmland prices.

So, the question arises: can such average price trends be applied broadly to other regions of Ontario, especially farmland within the Greater Toronto Horseshoe region? The answer is no. While all investment assets are ultimately discounted future cash flows, farmland near large cities involves more complex valuation. The market participants and investment motives are much more diverse, so it cannot be easily generalized.

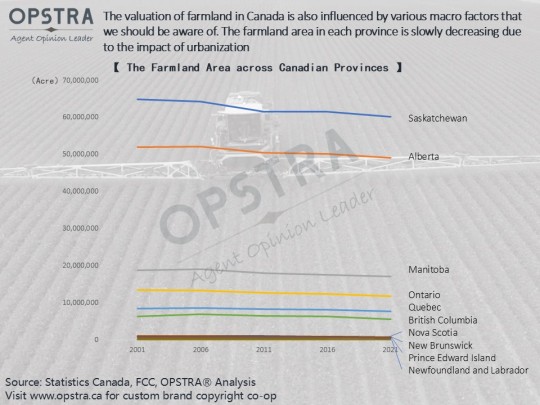

The valuation of farmland in Canada is also influenced by various macro factors that we should be aware of. The farmland area in each province is slowly decreasing due to the impact of urbanization.

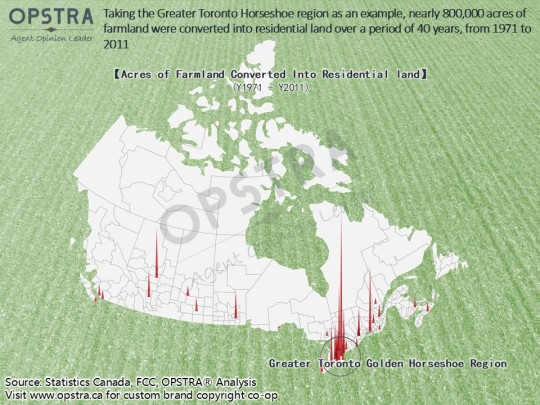

Taking the Greater Toronto Horseshoe region as an example, nearly 800,000 acres of farmland were converted into residential land over a period of 40 years, from 1971 to 2011.

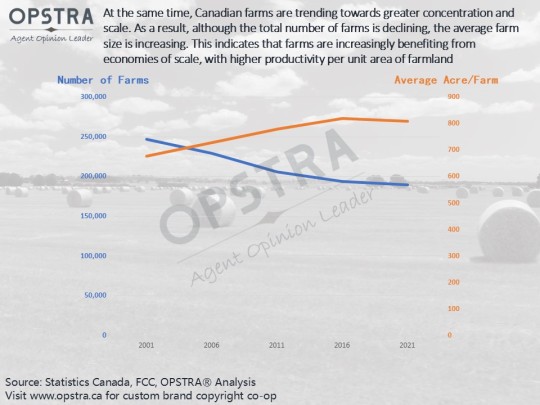

At the same time, Canadian farms are trending towards greater concentration and scale. As a result, although the total number of farms is declining, the average farm size is increasing. This indicates that farms are increasingly benefiting from economies of scale, with higher productivity per unit area of farmland.

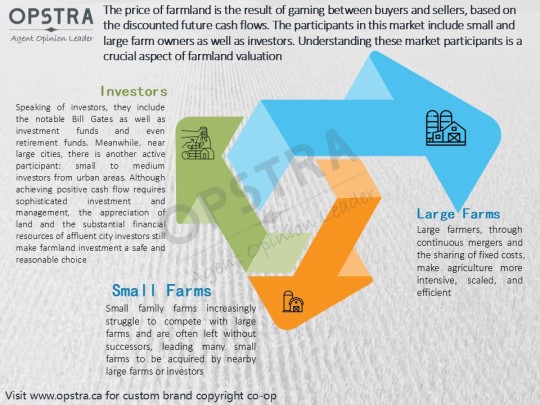

The price of farmland is the result of gaming between buyers and sellers, based on the discounted future cash flows. The participants in this market include small and large farm owners as well as investors. Understanding these market participants is a crucial aspect of farmland valuation. Large farmers, through continuous mergers and the sharing of fixed costs, make agriculture more intensive, scaled, and efficient. Small family farms increasingly struggle to compete with large farms and are often left without successors, leading many small farms to be acquired by nearby large farms or investors.

Speaking of investors, one notable example is Bill Gates, one of the largest farmland owners in the United States. His investment in farmland indicates that wealth created in the virtual world is most securely stored in physical land and become “old money”, which retains value over time. Major farmland investors also include investment funds and even retirement funds.

Meanwhile, near large cities, there is another active participant: small to medium investors from urban areas. These investors build or upgrade residential properties on their farmland and diversify operations based on the characteristics and advantages of each piece of land. Although achieving positive cash flow requires sophisticated investment and management, the appreciation of land and the substantial financial resources of affluent city investors still make farmland investment a safe and reasonable choice.

Of course, no two pieces of farmland are exactly the same. Valuing farmland relies heavily on experience and insight. This is especially true for farmland near cities. If pure farmland is like gold, farmland near cities is akin to precious jade. The value of gold fluctuates with the market, but jade's value is more subjective. If correctly valued, jade's potential is much higher than gold’s. This is perhaps the allure of farmland investment.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

https://opstra.ca/ https://opstra.ca/product/canada-ontario-and-greater-toronto-farmland-annual-report/

0 notes

Text

youtube

GTA Condo Market Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average price of condos in the Greater Toronto Area decreased by 2% year-over-year, while transaction volume dropped by 28%.

- By region wise, most major areas within Toronto saw condo prices either decrease or remain stable year-over-year. However, Midtown condos performed exceptionally well in June, with a 6% year-over-year increase in average prices and a five-month streak of month-over-month gains.

- In the cities surrounding Toronto, most condo prices fell year-over-year, with decreases ranging from 2% to 6%. However, Markham showed relatively strong demand for condos, with stable transaction volumes, a 5% year-over-year increase in average prices, and a 7% price rise month-over-month.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#torontorealtor#gtacondo#trreb#torontocondo#markhamcondo#richmondhillcondo#vaughancondo#mississaugacondo#Youtube

0 notes

Text

youtube

Burlington Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average home price in Burlington decreased by 1% year-over-year, with transaction volume shrinking by 21%.

- By category, detached houses saw a 4% year-over-year increase in average prices and a 2% increase month-over-month. Semi-detached houses experienced a 15% year-over-year decrease in average prices, while townhouses increased by 3% and condos maintained stable year-over-year prices while increased by 6% from the previous month.

- In terms of transaction volume, all categories of homes in Burlington saw declines of over 30% in June.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#burlington#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#burlingtonrealestate#torontorealtor#trreb#burlingtondetached#burlingtontownhouse#burlingtoncondo#Youtube

0 notes

Text

youtube

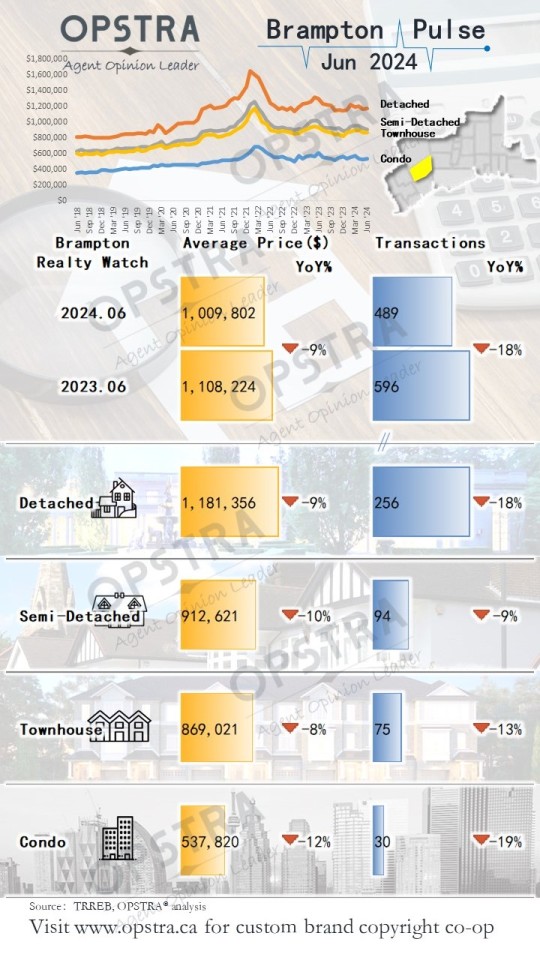

Brampton Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, Brampton's real estate market continued to show persistent weakness, contrasting sharply with the significant speculation during the pandemic.

- Overall, average prices decreased by 9% year-over-year, but there are signs of stabilization month-over-month, while transaction volume declining by 18% year-over-year.

- All categories of housing in Brampton saw declines in average transaction prices year-over-year: detached houses decreased by 9%, semi-detached homes by 10%, townhouses by 8%, and condos price dropped by 12% year on year.

- Transaction volumes for all home categories also decreased year-over-year.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#brampton#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#bramptonrealestate#torontorealtor#trreb#bramptondetached#bramptontownhouse#bramptoncondo#Youtube

0 notes

Text

youtube

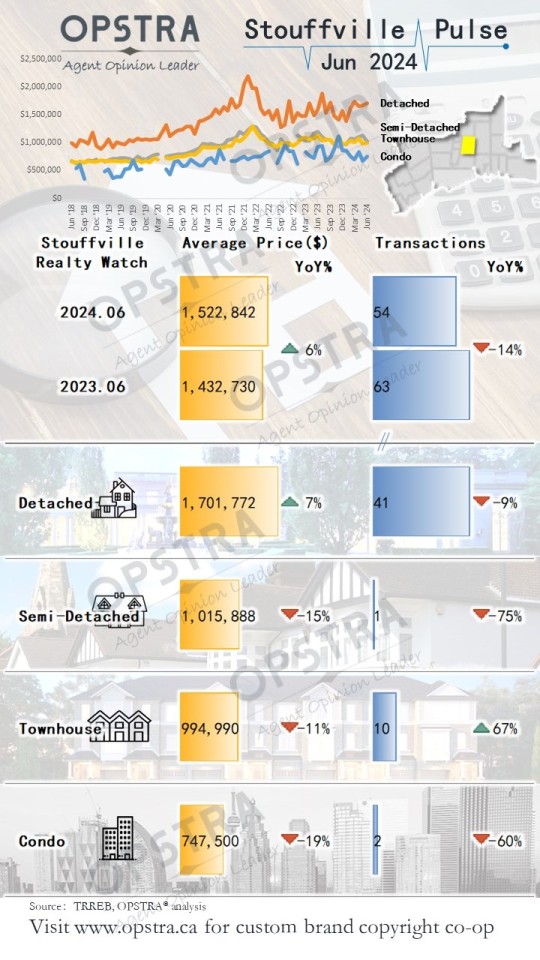

Stouffville Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average resale home price in Stouffville rose by 6% year-over-year, with transaction volume shrinking by 14%.

- Looking at different categories, detached houses, which are the mainstream, saw a 7% year-over-year increase in average prices, with a month-over-month increase as well. Transaction volume for detached homes decreased by 9% year-over-year.

- Semi-detached houses, townhouses, and condos all saw double-digit declines in average transaction prices year-over-year, though transaction volumes were relatively low for these categories.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#stouffville#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#stouffvillerealestate#torontorealtor#trreb#stouffvilledetached#stouffvilletownhouse#stouffvillecondo#Youtube

0 notes

Text

youtube

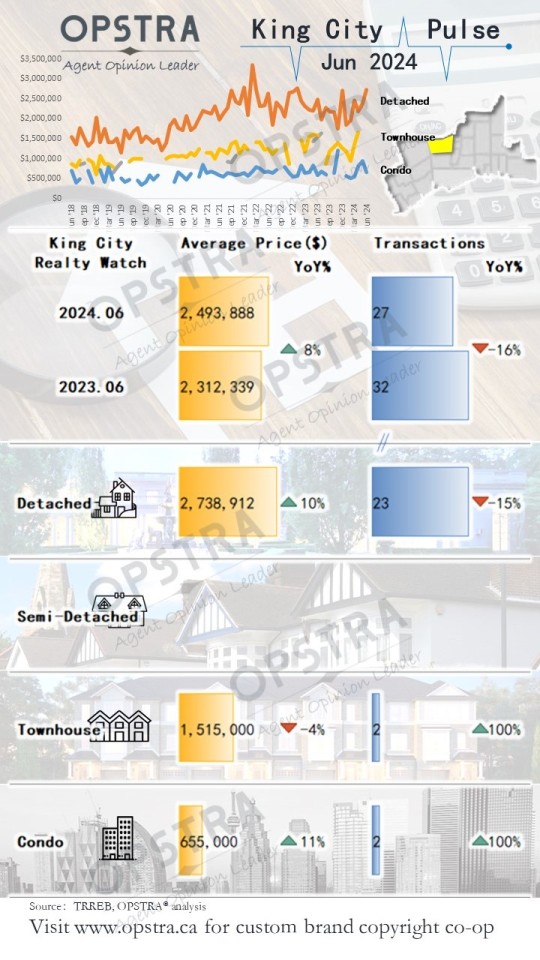

King Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average transaction price of resale homes in Township of King rose by 8% year-over-year, with a total of 27 transactions, marking a 16% decrease in transaction volume compared to the same period last year.

- King Township's real estate market primarily consists of large detached houses on sizable plots. In June, the average transaction price of detached houses increased by 10% year-over-year and saw a substantial 15% increase compared to the previous month.

- Transaction volumes for other types of homes were minimal and can be largely disregarded.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#kingcity#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#kingrealestate#torontorealtor#trreb#kingdetached#kingtownhouse#kingcondo#Youtube

0 notes

Text

youtube

Newmarket Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, Newmarket's resale home market showed stable performance, with an overall average price increase of 2% year-over-year and a 17% decline in transaction volume.

- Detached house remained the primary focus of transactions in Newmarket, with a 1% year-over-year increase and a 5% increase month-over-month in transaction prices. However, transaction volume for detached houses decreased by 10% year-over-year.

- Additionally, semi-detached houses saw a 2% year-over-year increase in average prices, while townhouses and condos both experienced decreases in average prices compared to the previous year.

-

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#torontorealestate#torontohomes#newmarketrealestate#trreb#newmarketdetached#newmarkettownhouse#newmarketcondo#Youtube

0 notes

Text

youtube

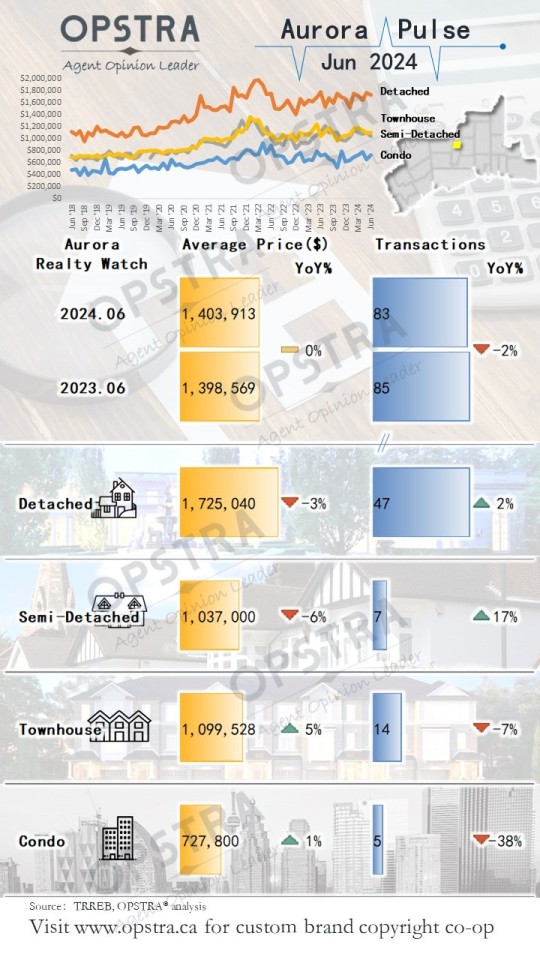

Aurora Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, Aurora’s resale home prices remained flat year-over-year, with a slight 2% decrease in transaction volume.

- Average transaction prices for different types of homes showed mixed changes compared to the previous year: detached houses decreased by 3%, semi-detached houses by -6%, townhouses increased by 5% year-on-year, and condos increased by 1%.

- Meanwhile, transaction volumes varied: detached houses maintained stability with a slight increase of 2%, while other types saw reductions in year-on-year sales volume.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#aurorarealestate#torontorealtor#trreb#auroradetached#auroratownhouse#auroracondo#Youtube

0 notes

Text

youtube

Mississauga Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, Mississauga saw a slight 1% year-over-year decrease in property prices, with transaction volume shrinking by 19%.

- By home types, except for townhouses which saw a 2% year-over-year increase in average prices, other property types such as detached houses, semi-detached houses, and condos saw decreases of 3%, 6%, and 2% respectively in average prices.

- In terms of transaction volume, all types of homes saw declines ranging from 10% to 50% year-over-year.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#mississaugarealestate#torontorealtor#trreb#mississaugadetached#mississaugatownhouse#mississaugacondo#Youtube

0 notes

Text

youtube

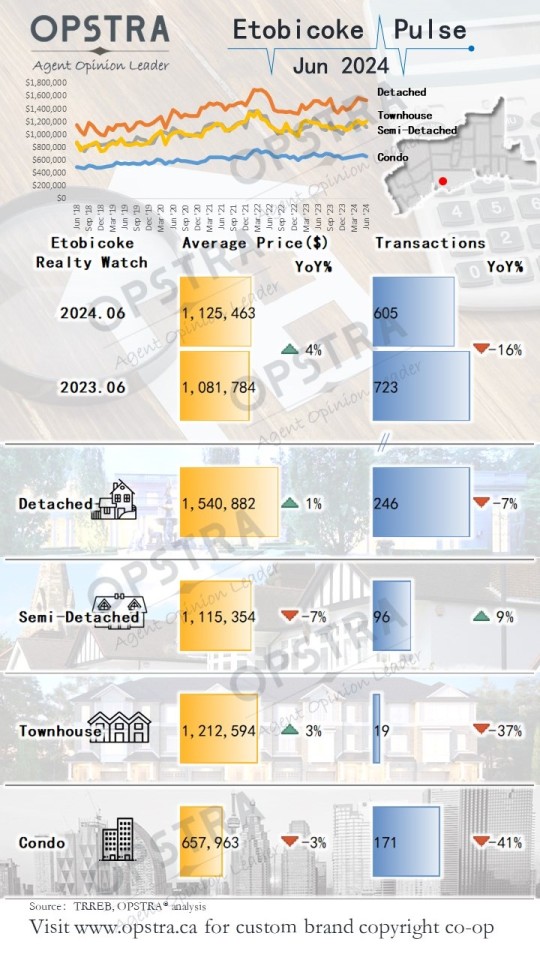

Etobicoke Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average home price in Etobicoke Toronto increased by 4% year-on-year, with transaction volumes down 16% compared to the same period last year.

- The average prices for various types of homes showed mixed results: detached homes and townhouses rose by 1% and 3%, while semi-detached homes and condos declined by 7% and 3% respectively.

- Regarding transaction volumes, semi-detached homes saw an increase year-over-year, while other categories experienced declines, with condo sales volume seeing the largest drop at -41%.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#etobicoke#gtarealestate#gtahomes#torontorealestate#torontohomes#etobicokehomes#trreb#etobicokedetached#etobicoketownhouse#etobicokecondo#Youtube

0 notes

Text

youtube

Vaughan Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, Vaughan's real estate market showed highlights compared to many areas of Greater Toronto with overall prices rising by 7% year-over-year and 5% month-over-month.

- Of particular note, detached homes saw a 5% year-over-year increase in average prices and a significant 6% increase month-over-month in June.

- Other property types in Vaughan in June, such as semi-detached homes, townhouses, and condos, experienced year-over-year decreases in transaction prices of 3%, 6%, and 4%, respectively. Additionally, detached homes and condos saw a decrease in transaction volume year-over-year, while semi-detached homes and townhouses saw an increase in transaction volume year-over-year.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#vaughanrealestate#torontorealtor#trreb#vaughandetached#vaughantownhouse#vaughancondo#Youtube

0 notes

Text

youtube

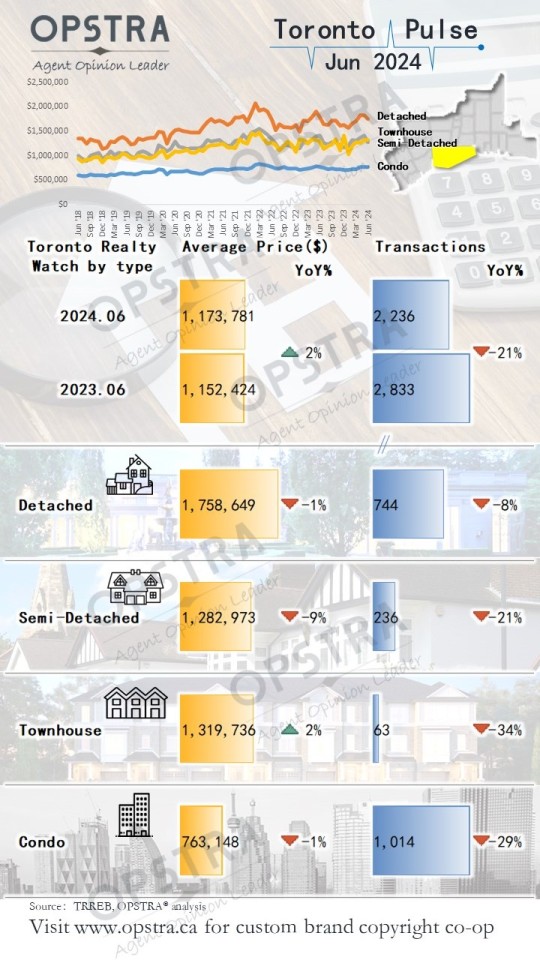

City of Toronto Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average resale property price in the city of Toronto increased by 2% year-over-year, while transaction volume decreased by 21%.

- Across different areas of Toronto, there were mixed changes in home prices year-over-year: Downtown saw the largest decline with a 5% decrease, followed by Midtown with a 1% decrease. North York remained stable, Scarborough saw a 1% increase, and Etobicoke saw a 4% price increase year on year. Additionally, North York and Etobicoke saw month-over-month price increases of 2% and 3%, respectively.

- Category-wise, detached houses and condos in Toronto saw slight year-over-year decreases of 1%, while semi-detached houses decreased by 9%, and townhouses increased by 2% year-on-year

- In terms of transaction volume, all regions and housing types in Toronto saw declines year-over-year, with condos and Downtown Toronto experiencing the largest decreases in year-over-year transaction volume.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#torontorealestate#torontohomes#trreb#dtrealestate#midtownrealestate#northyorkrealestate#scarboroughrealestate#etobicokerealestate#torontcondo#torontodetachedhome#torontotownhouse#Youtube

0 notes

Text

youtube

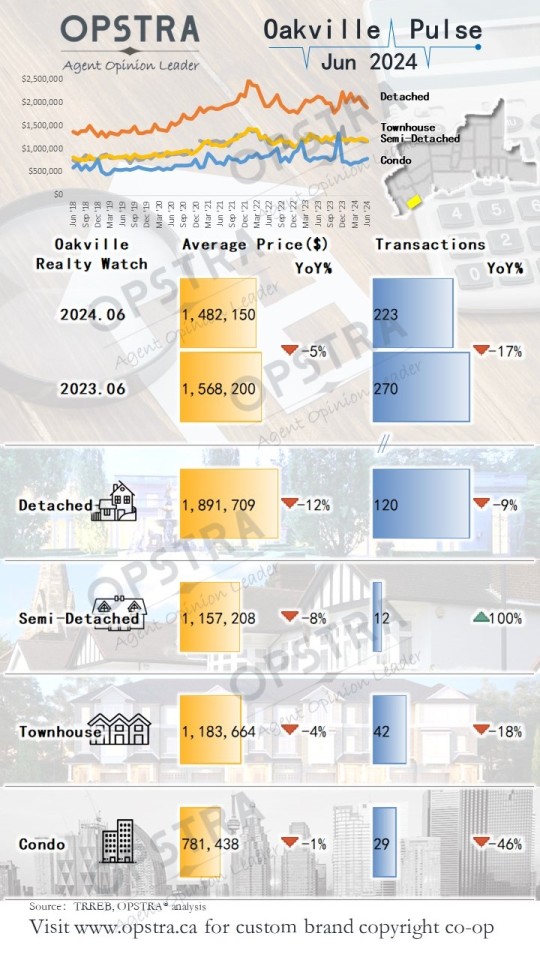

Oakville Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, Oakville experienced a 5% year-over-year decrease in housing prices, with transaction volume shrinking by 17%.

- Detached homes saw a 12% year-over-year decline in average prices, while semi-detached homes experienced an 8% price decrease, and average townhouse price decreased by 4% year-over-year.

- Condo apartments in Oakville saw a slight 1% year-over-year decrease in average prices, but there was a 3% month-over-month increase in average prices in June.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#oakvillerealestate#torontorealtor#trreb#oakvilledetached#oakvilletownhouse#oakvillecondo#Youtube

0 notes

Text

youtube

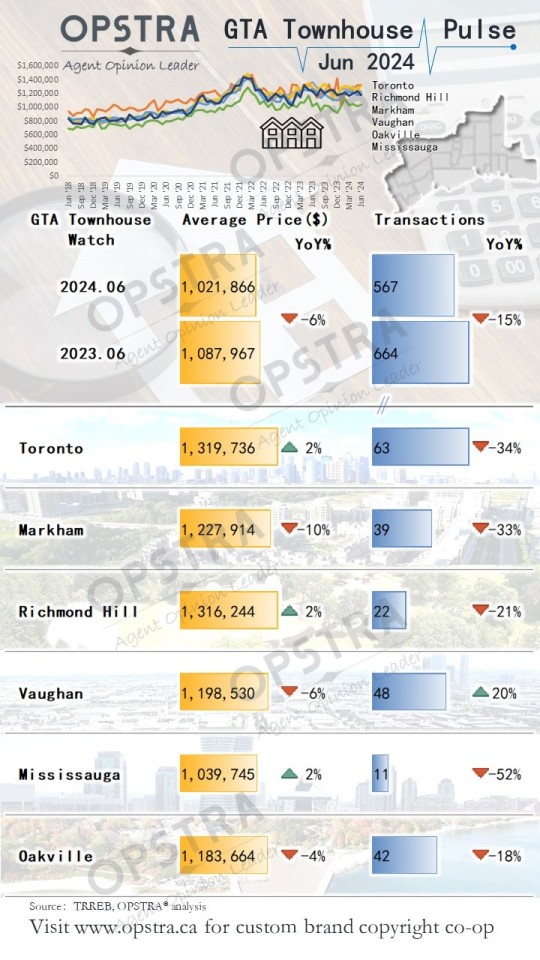

GTA Townhouse Market Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average price of townhouses in the Greater Toronto Area decreased by 6% year-over-year, with transaction volume shrinking by 15%.

- Among GTA's major municipalities, Markham, Vaughan, and Oakville saw year-over-year decreases in townhouse prices of 10%, 6%, and 4% respectively, while Toronto, Richmond Hill, and Mississauga each experienced a 2% year-over-year increase in townhouse prices.

- In terms of transaction volume, townhouse transactions declined year-over-year across all GTA cities.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#torontorealtor#gtatownhouse#trreb#torontotownhouse#markhamtownhouse#richmondhilltownhouse#vaughantownhouse#mississaugatownhouse#oakvilletownhouse#Youtube

0 notes

Text

youtube

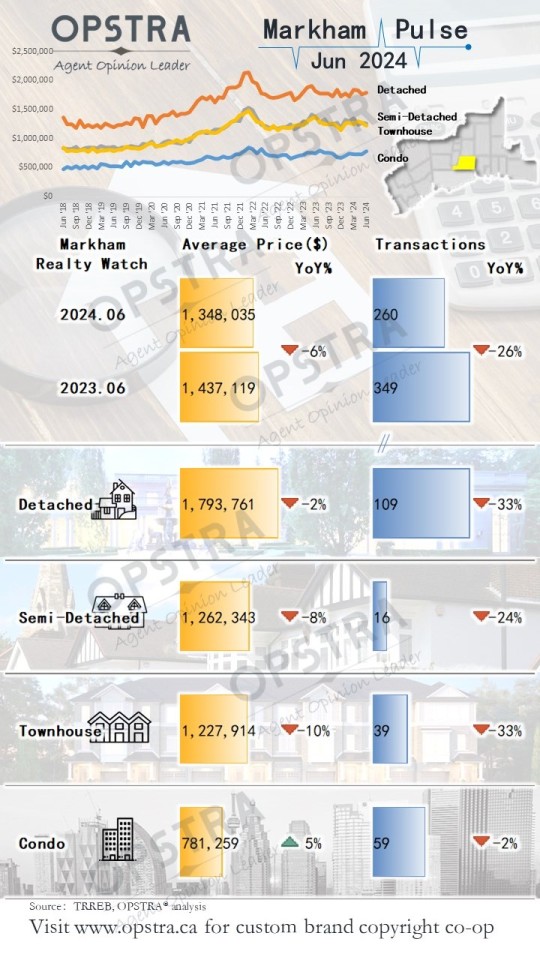

Markham Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average resale home price in Markham declined by 6% year-over-year, with transaction volume shrinking by 26%.

- Regarding average transaction prices, detached homes, semi-detached homes, and townhouses saw declines of 2%, 8%, and 10% respectively compared to the previous year. However, detached home prices rose by 2% from the previous month.

- Markham condos showed strong performance in June, with average prices increasing by 5% year-over-year and 7% month-over-month.

- In terms of transaction volume, except for condos which saw a slight 2% decrease year-over-year, other property types experienced contraction of around 30%.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#markhamrealestate#torontorealtor#trreb#markhamdetached#markhamtownhouse#markhamcondo#Youtube

0 notes

Text

youtube

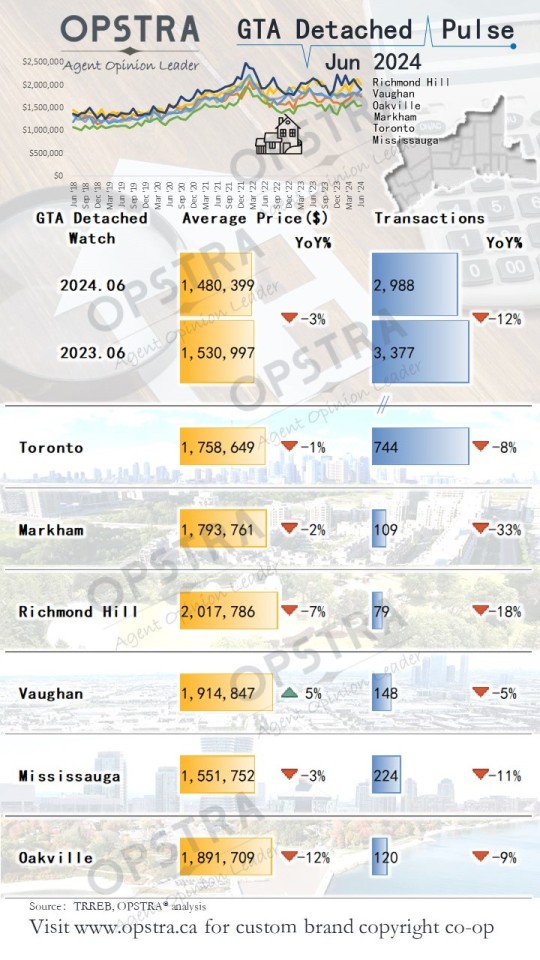

GTA Detached House Market Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average price of detached houses in the Greater Toronto Area decreased by 3% year-over-year, with transaction volume shrinking by 12%.

- Among the major municipalities in the GTA, most saw year-over-year declines in the average price of detached houses. Oakville experienced the largest decrease with a 12% decline, while in June, Vaughan's detached houses stood out with a 5% year-over-year increase and a notable 6% increase month-over-month.

- Regarding transaction volumes for detached houses, all major municipalities saw declines year-over-year. Markham experienced the largest decline in year-over-year transaction volume for detached houses, while Vaughan saw the smallest contraction.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#torontorealtor#gtadetachedhouse#trreb#torontodetached#markhamdetached#richmondhilldetached#vaughandetached#mississaugadetached#oakvilledetached#Youtube

0 notes

Text

youtube

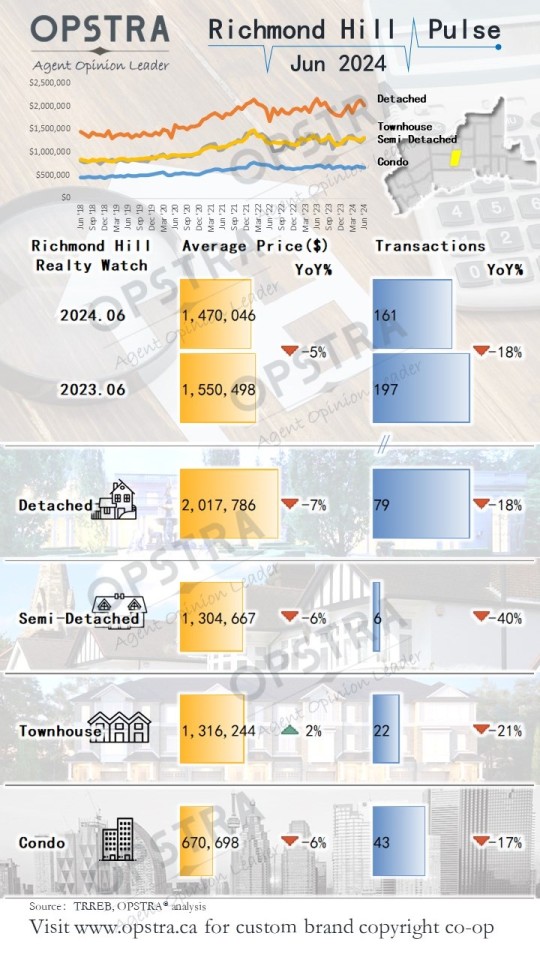

Richmond Hill Property Pulse™ - June 2024【OPSTRA®AgentOpinionLeader™】

- In June, the average home price in Richmond Hill fell by 5% year-on-year, with transaction volumes decreasing by 18%.

- By category, detached home prices saw both year-on-year and month-on-month declines, with a 7% drop year-on-year. Semi-detached homes and condo prices both fell by 6% year-on-year, while townhouse prices increased by 2%.

- Notably, semi-detached homes and townhouses experienced a roughly 5% month-on-month price increase.

- In June, transaction volumes for all types of homes in Richmond Hill contracted.

About【OPSTRA®AgentOpinionLeader™】

- Top and up-to-date GTA real estate market watch and insight

- Equip agents with KOL (Key Opinion Leader) breakthroughs to attract and expand private domain traffic and to influence, cultivate and convert to customers

- Our high-quality KOL deliverables are backed by world-class consultants, industry's top expertise and AI-powered technology

Visit www.opstra.ca for your own brand-custom copyright

Email: [email protected]

#gtarealestate#gtahomes#gtarealtor#torontorealestate#torontohomes#richmondhillrealestate#torontorealtor#trreb#richmondhilldetached#richmondhilltownhouse#richmondhillcondo#Youtube

0 notes