Text

MYTH #7: "If you have an accident and are charged with reckless driving, you have no defense."

WRONG! Virginia case law specifically holds that there is no presumption of reckless driving, even if there is an accident (in fact, even if it is a single vehicle accident) and the charge must be proved beyond reasonable doubt.

THE RELIANCE LAW GROUP

www.reliancelawgroup.net

0 notes

Text

MYTH #6 "If the officer makes a mistake on the ticket, it's automatically dismissed."

Oh my no! This one is common. Minor errors like misspelled names or wrong addresses won't invalidate a ticket. The court will just amend it.

THE RELIANCE LAW GROUP

www.reliancelawgroup.net

#thereliancelawgroup#virginialaw#autoaccident#personalinjurylawyer#realestate#divorce#businesslaw#LegalMythbusters

0 notes

Text

Myth #5: If a person hits you in an auto accident and they have no insurance, you cannot recover for your injuries and damages. FALSE!

If you have liability insurance, you choose limits of coverage with your own insurer. This looks like 50/100/50 (or something like that). This is YOUR insurance coverage - $50k per person, $100k per occurrence, $50k property damage. You can recover from your OWN insurance company pursuant to your Underinsured/Uninsured provisions of your policy. This gives good reason to get the maximum liability limits you can afford...you might need them someday.

THE RELIANCE LAW GROUP

Bristol: (276) 644-0992

Cedar Bluff: (276) 522-1220

www.reliancelawgroup.net

0 notes

Text

LEGAL MYTHBUSTERS #4 - Personal Injury Payment for Medical Treatment.

MYTH: “If I am in an accident I can’t use my health insurance to pay for medical treatment.”

FALSE. ALWAYS offer your medical insurance for payment. Pursuant to Virginia Code Section 8.01-27.5, if the provider (hospital, doc, radiology, lab, therapy…) is an “in-network provider” by agreement with the provider, they MUST accept payment through and by your health insurance. This is an absolute. Threfore, ALWAYS offer and insist on use of your health insurance by the medical provider for payment for your treatment. Even if there is a lien (which is fairly rare) the reimbursement will be substantially less than the bills - and calculation ofvalue is on TOTAL bills.

THE RELIANCE LAW GROUP

888-374-5078

Cedar Bluff & Bristol

0 notes

Text

LEGAL MYTHBUSTERS

MYTH #3: "Signing a contract means you're stuck no matter what."

Wrong! Many contracts have clauses for termination or ways out. Plus, certain circumstances like fraud or coercion can make a contract voidable. Additionally, there may be a fatal flaw in the drafting that allows a party to void the agreement.

By way of advice - not all contracts must be in writing, but they should a writing memorializes the agreement. Contracts are the very basis of economics; therefore, always have a qualified lawyer assist if the matter is important.

THE RELIANCE LAW GROUP

www.reliancelawgroup.net

888-374-5078

1 note

·

View note

Text

LEGAL MYTHBUSTERS!

Myth #1: "If the police didn't read you your Miranda rights, your arrest is invalid."

False! While Miranda rights are important, not being read them doesn't automatically invalidate an arrest. They're crucial when the police want to use your statements against you in court."

Miranda warnings are necessary for custodial arrest pursuant to Miranda v. Arizona. However, not all stops are custodial arrests and the fact that you aren't provided the warning has no bearing at all on the arrest itself....only on use of information gained during that arrest. The more you know...

0 notes

Text

FOLKS – I IMPLORE YOU TO READ THIS. A word about insurance coverages…

No one “likes” to pay insurance premiums. In many cases, folks scrimp on insurance coverages to save a few dollars thinking that it really does not matter. In many cases, the general public is woefully unaware of the insurance coverages they have and only buy the minimum possible to comply with law or banking rules, etc.

I am writing this to provide general legal advice and a strong warning to all of my family, friends, clients and future clients…and it is CRITICALLY IMPORTANT information about insurance coverages – particularly auto insurance.

I am a personal injury lawyer. Car accidents cases are a big part of our practice. As a result, we have been involved with a number of very sad situations. I am going to share a couple of horror stories that are real cases:

Case No.: 1: Client was hit by another driver causing severe injuries to Client. Client suffered a fractured sternum, broken hip, broken shoulder, and crushed dominant right arm. Client had medical damages of $200,000 with no medical insurance. Client missed six (6) full months of work. Client’s car was a total loss. The defendant driver had only $100,000 in insurance coverage….not even half the value of the client’s medical losses alone.

Case No.: 2: Clients were hit by another driver. One was killed (wrongful death case) and one was catastrophically injured and will require lifetime care in a nursing home. Medicals totaled over $1 million dollars and will continue until the death of the surviving client. The driver who hit them had only $50,000 in insurance coverage.

These situations are more than just the injuries or deaths. They are also financial tragedies that could easily have been resolved if our client(s) had been aware of the following advice.

Insurance is required by the state of Virginia. It is illegal to operate a vehicle without it. Your auto insurance policy is a contract between you and the insurance company to do one of two things: 1.) pay a claim made against you in an accident; or 2.) defend against a claim made against you by providing a lawyer to protect your interests. The insurance company’s responsibility ends at the value of your policy – known as the “policy limits.” So, if you have $50,000.00 in policy limits, the insurer will pay up to $50,000 to settle a claim against you for negligence or defend that claim depending on several factors.

WHAT THE NUMBERS MEAN: Most insurance policies break out your coverage on an auto policy with three values represented in three numbers like 100/300/50. This is a description of the following limits:

$100,000 per person bodily injury limit

$300,000 per accident bodily injury limit

$50,000 per accident property damage limit

If you have “full coverage insurance” on a vehicle – which is required in most cases to protect the lender who holds your vehicle loan – you will have “Comprehensive and Collision Coverage Limits.” This is usually equivalent to your vehicle's actual cash value at the time of the accident.

It is possible to buy Minimum Liability Limits in an auto policy. In Virginia, minimum limits are $30,000 per person, $60,000 per accident for bodily injury, and $30,000 for property damage. Let me explain “per person” and “per occurrence.” Under that minimum coverage described, each person who is harmed or injured can collect a maximum of only $30,000. That is it. Nothing more. Have you had ANY medical treatment or an emergency room bill in the past 15 years? The flu can get a $30,000 E.R. bill. “Per occurrence” means that there is a total of $60,000 that can be divided among all of the injured parties if 2 or more. Clearly this is NOT enough money to protect you if you cause an accident and injure someone. Not even close.

UNDERINSURED/UNINSURED MOTORIST COVERAGE. All auto policies have underinsured/uninsured coverage. This coverage is just what it sounds like – it provides protection in case someone injures you in an auto accident and they have no coverage or not enough coverage. Here is the IMPORTANT part: The uninsured/underinsured coverage mirrors the amount of your liability coverage. It is the same amount. Therefore, if you “cheap out” on coverage and get minimum limits, you are cheating yourself of coverage you might need if someone else injures you!

Do you know what your insurance policy limits are on your vehicles? Find out. Today. Never buy only minimum coverage on your vehicle. The difference in minimum coverage and much higher coverage limits is usually only a few dollars more per month on your premium. The increased policy limits could prevent you from being sued, from losing your hard-earned property, and it could be the difference in recovering a reasonable value for injuries caused by someone else who does not have enough coverage. Take, for example the two cases mentioned above. If the folks who were injured had increased limits on THEIR policies, the recovery would have been higher – up to the full value of their own policy limits.

You NEED to know your insurance policy limits. Buy the maximum amount you can afford. You should also consider an umbrella policy of $1 million dollars – which is an inexpensive policy (couple hundred bucks a year) that kicks in after the auto policy pays out.

Hope this helps. Please share, share, share. Have a great weekend.

Brad Ratliff

THE RELIANCE LAW GROUP

Cedar Bluff: (276) 522-1220

Bristol: (276) 644-0992

www.reliancelawgroup.net

Reliable, Trustworthy, Effective Legal Representation.

0 notes

Text

0 notes

Text

If you are arrested, what should you do? This is way less complex than most believe since you have constitutional rights against self-incrimination that apply across-the-board. Here are our suggestions:

1. Stop talking. Literally, say NOTHING. You are required, however to provide your identity.

2. Invoke your 6th amendment right to Counsel. State directly and clearly "I WANT A LAWYER."

3. CALL THE RELIANCE LAW GROUP. 888-374-5078

0 notes

Text

Real Estate Settlement services are available in both our Bristol, Virginia and Cedar Bluff, Virginia offices! Professional, efficient, economical closings - ask your realtor/broker or lender for The Reliance Law Group! (888) 374-5078.

THE RELIANCE LAW GROUP

www.reliancelawgroup.net

Reliable, Trustworthy, Effective.

#thereliancelawgroup#virginialaw#realestateattorney#realestateclosing#realestatesettlement#realtor#broker#mortgage

0 notes

Text

Accident & Injury Law - Put our expertise to work for you.

THE RELIANCE LAW GROUP

Cedar Bluff, VA: (276) 522-1220

Bristol, VA: (276) 644-0992

www.reliancelawgroup.net

0 notes

Text

Here is a scenario: Husband and wife are happily married for years. Most property is titled in both names. Suddenly, one day, Husband has a stroke - he is incapacitated and required long term care. Wife needs to sell some property - a car, an acre of real estate - to help pay.

PROBLEM. She cannot do so.

Why? Because all of their property is in both names - she should be able to sell, right? Wrong. She inherits everything - but Husband did not pass away. He is living...yet does not have capacity to sign. All jointly titled property is stuck in limbo until a guardianship and/or conservatorship can be petitioned in Circuit Court - which is expensive and takes time.

A General Durable Power of Attorney would save the day.

THE RELIANCE LAW GROUP

www.reliancelawgroup.net

Bristol: (276) 644-0992

Cedar Bluff: (276) 522-1220

Reliable, Trustworthy, Effective Legal Representation.

0 notes

Text

- Also Bankruptcy and General Practice. 2 offices, 5 lawyers, 1 goal: provide reliable, trustworthy, effective legal representation to all of our clients.

CALL NOW: 888-374-5078

0 notes

Text

Legal representation? We are skilled in many areas of law and ready to assist. Call today! Bristol or Cedar Bluff, Virginia.

5 lawyers, 2 offices, 1 goal: to provide reliable, trustworthy, effective legal representation for all of our clients.

Bristol: (276) 644-0992

Cedar Bluff: (276) 522-1220

www.reliancelawgroup.net

#thereliancelawgroup#virginialaw#realestate#autoaccident#recklessdriving#bristol#familylaw#divorce#custody

0 notes

Text

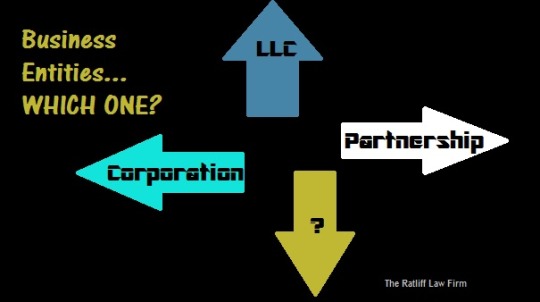

Business Entities - you know, corporation, "S" corp., Limited Liability Company (LLC), partnership...this is an important thing to think about if you are starting a business! So...which one? How do you know? What are the benefits? How does one set an entity up properly?

We can help! Put our expertise to work for you in all business matters - entities, contracts, leases, franchising, partnership agreements, organizational structure, bylaws, operating agreements, and more.

THE RELIANCE LAW GROUP

Cedar Bluff, VA: (276) 522-1220

Bristol, VA: (276) 644-0992

www.reliancelawgroup.net

Reliable, Trustworthy, Effective Legal Representation.

0 notes

Text

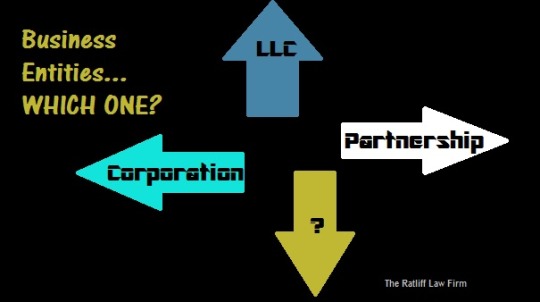

Business Entities - you know, corporation, "S" corp., Limited Liability Company (LLC), partnership...this is an important thing to think about if you are starting a business! So...which one? How do you know? What are the benefits? How does one set an entity up properly?

We can help! Put our expertise to work for you in all business matters - entities, contracts, leases, franchising, partnership agreements, organizational structure, bylaws, operating agreements, and more.

THE RELIANCE LAW GROUP

Cedar Bluff, VA: (276) 522-1220

Bristol, VA: (276) 644-0992

www.reliancelawgroup.net

Reliable, Trustworthy, Effective Legal Representation.

0 notes