Get Best Mutual Fund Advisory at Sigfyn, we are best AI-powered platforms that provides personalized and holistic financial advisory to grow wealth by SIP. Invest in best mutual funds portfolios such SBI, HDFC, ICICI Prudential, Nippon India curated by expert-built algorithms.

Don't wanna be here? Send us removal request.

Text

What is an Emergency Fund?

What is an Emergency Fund? Do I Need One ?

What is your first reaction when you hear the word ‘emergency’? It’s quite common that this word worries most of us. There is a certain kind of tension around this word that creeps in. We all wish to avoid emergencies. But how successful are we? Does an emergency situation tell you beforehand about its arrival? Do you think you are fully prepared to face an emergency without any hiccups? The popular answer here would be a NO.And, did you know creating an emergency fund comes above your investment needs? Well Yes. Investments focus on wealth creation, while an emergency fund addresses sudden and unforeseen financial emergencies.Before we move ahead to determine what an emergency fund is and if you need one or not, let’s understand what an emergency is.

What is an Emergency?

First, let’s understand what exactly an emergency is. Well, different kinds of emergencies will have a different impacts on your life. For example, layoffs, insurance co-payments, accidents, marriage separations, a pandemic, etc., are among the types of emergencies that will impact your financial position. Then, what are not emergencies? Your annual expenses include insurance premiums, your child’s school fees, a last-minute trip to your friend’s destination wedding, cosmetic surgery for yourself, etc. These expenses do not fit into the bracket of emergency. Some of these expenses can be met by proper financial planning. While the others can be categorized as fun and recreation.

How is an Emergency Fund Different from Cash in Hand and Insurance Policy?

Were you always under the impression that your cash would take care of your emergency needs? Well, the answer might come as a surprise to you. Holding cash will lead you nowhere. Holding cash in hand is as good as losing money.Emergencies can arise today, tomorrow, or even six months down the line. Not investing the money and keeping it idle will be heavy on your pockets. Inflation will eat into your savings, and your emergency fund may not be able to cover your emergency costs after all.Similarly, an insurance policy is a scheme for your medical and life cover. You cannot treat it as an emergency fund. Yes, the policy will cover your costs, but not completely at times. You will have to bear certain costs yourself. Also, do not forget the co-payment clause.Furthermore, sometimes you will have to pay the entire hospital and medical costs yourself and claim a refund with the insurance company later. Are you well financially well equipped to bear such an expense? In such scenarios, your emergency fund will act as a cushion for you to fall back on.Therefore, never hold idle cash, and don’t consider your insurance policy an emergency fund.

Features of an Emergency Fund

Before building an emergency fund, you should ensure that your fund is:

Liquid: Your emergency fund’s first and foremost criteria must be liquidity. Only highly liquid funds will help you meet your costs in times of need. You should be able to liquidate your fund within minutes or in a couple of days.

Meets Your Expenses: An emergency fund should ideally meet your emergency requirements in full or majority. To be emergency ready, you should aim to have at least six to eight months of your salary in the fund. At the same time, once you use the funds from the emergency corpus, you should replenish it without any delay.

Not Volatile: Do not chase returns from your emergency fund. High returns require high risk, and you cannot afford to risk your emergency corpus. The emergency fund should focus on stable and guaranteed returns.

Do I need an Emergency Fund?

Yes, without any second thought. Each one of us requires an emergency fund. Having a safety net to fall back on during unforeseen situations is a blessing in disguise. Most of us are of the opinion that ‘I’m earning enough, I don’t need an emergency fund, and my salary will take care of my needs.’ Sadly, this is not enough. Your salary might take care of your costs, but it may not take care of the hefty expenses that emergencies often demand. Therefore, we all need to create an emergency fund for ourselves to lead a stress-free life. How much an emergency fund requires depends on your financial situation, dependent, and other factors. Sigfyn Creating an emergency fund requires a thorough analysis of your earnings, expenses, and savings.

#Emergency Fund#Emergency Funding#mutual funds#sip investment plan#equity mutual funds#mutual fund#portfolio management#sigfyn#best mutual funds

0 notes

Text

What is a Portfolio?

A portfolio is a collection of financial instruments such as stocks, bonds, mutual funds, real estate, and other financial instruments owned by an individual, institution, or entity. The primary objective of a portfolio is to generate revenue, which can include capital appreciation, income generation, wealth preservation, or a combination of these goals. In other words, individuals put their money to earn gains and ensure that the original asset or capital does not erode. However, the performance of the asset depends on the market conditions. Diversifying a portfolio is a key to portfolio management. Also, it helps to manage risk and maximize returns based on the investor's risk tolerance, time horizon, and financial goals.

What are the Components of a Portfolio?

The various financial instruments in a portfolio are called asset classes. Investors should aim for a well-balanced mix of these assets to create a diversified portfolio, fostering capital growth while managing risk effectively. The following are the major components of a portfolio –

Stocks (Equities): This is the most common component representing ownership in a company based on the proportion of shares held by the shareholder. They can be categorized further based on the market capitalization. Also, they offer the potential for capital appreciation but have a significant risk factor.

Bonds (Fixed Income): Bonds are debt instruments issued by governments, corporations, or other entities. They make periodic interest payments (coupon) and return the principal at the time of maturity. Also, they are considered more conservative and provide income and stability to a portfolio.

Cash or Cash Equivalents: These include money market funds, treasury bills, certificates of deposit (CDs), and short-term government securities. They provide liquidity and can serve as a safety net in a portfolio.

Real Estate: Real estate investments can include physical properties (e.g., plots, apartments, villas, buildings, etc.) or real estate investment trusts (REITs), companies that own and manage income-producing real estate properties in a dematerialized form.

Alternative Investments: These may include hedge funds, private equity, commodities (gold, silver, oil, etc.) and other non-traditional assets. They are often used to diversify a portfolio and reduce risk.

Types of Portfolio

Here, we list a few common types of portfolios because there is no ideal portfolio for an investor. To build a portfolio, you must consider various factors that suit your requirements.

Conservative Portfolio: It is also known as a defensive portfolio which aims towards capital preservation. It typically consists of a higher percentage of bonds and cash equivalents, with a smaller allocation to stocks or equities suitable for low-risk tolerance investors.

Balanced Portfolio: It aims to strike a balance between growth and income. It typically includes a mix of both stocks and bonds, making it suitable for investors with moderate risk tolerance levels.

Aggressive Portfolio: It focuses on capital appreciation and growth. It has a higher allocation to stocks, which can be riskier but has the potential for better returns. This portfolio suits investors with a high-risk tolerance and a long investment horizon.

Income Portfolio: The primary objective is to generate a consistent income stream. The underlying portfolio includes bonds, dividend-paying stocks, real estate investment trusts (REITs), and other income-generating assets. Usually, retirees prefer this portfolio and want regular income.

Speculative Portfolio: The portfolio invests in high-risk instruments with the anticipation of substantial future gains. It includes betting on Initial Public Offerings (IPOs) or high-growth stocks, buying low-rated bonds or debentures for higher returns, or engaging in options or futures contracts for portfolio protection.

Various options are available for investors, but determining which assets effectively align with their investment objectives is crucial. Thus, design a portfolio that matches your financial goals, risk tolerance and time horizon. Also, engaging in regular portfolio monitoring and ensuring frequent rebalancing progress toward your goals is imperative.

How does Sigfyn help in Portfolio Creation?

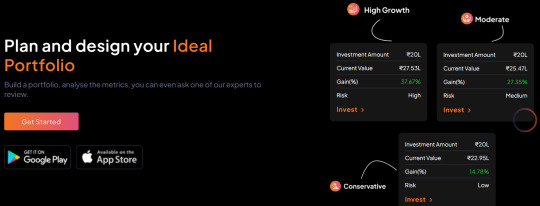

One of Sigfyn's unique features is the "Portfolio Designer." We craft a customized portfolio tailored to your risk tolerance level and the amount you wish to invest, whether through lumpsum or SIP. Additionally, we provide an in-depth analysis of portfolio performance. Furthermore, a dedicated wealth manager will guide you throughout the process.Begin Investing now!

#portfolio management#Financial Instructions#Financial Planner#Financial Advisors#mutual fund#Portfolio Designer#best mutual funds#sip investment plan#debt mutual funds#debt funds#equity mutual funds#sigfyn

0 notes

Text

What is KYC (Know Your Customer)?

KYC, or Know Your Customer, is a mandatory process that financial institutions, including mutual funds, must perform to verify the identity of their clients. The primary objective of KYC is to prevent unlawful activities such as money laundering, fraudulent transactions, and terrorist financing. The Securities and Exchange Board of India (SEBI) has defined specific guidelines in line with the Prevention of Money Laundering Act 2002, mandating Financial Institutions and Financial Intermediaries, including Mutual Funds, to conduct thorough customer identification processes. The Mutual Fund KYC process involves collecting information about an investor's identity and address. This information is then used to conduct due diligence and establish the investor's identity before they can invest in mutual funds.

KYC Process

The KYC process includes the following steps:

Identity Verification: Investors must provide proof of identity, such as a valid government-issued photo ID (e.g., passport, driver's license, PAN card) to establish their identity.

What is CKYC?

CKYC, or Central KYC is an additional step in the KYC (Know Your Customer) process introduced by regulatory authorities in India to streamline and standardize the KYC procedure. It aims to create a centralized repository of KYC records for individuals engaging with various financial entities like banks, mutual funds, insurance companies, etc. In other words, the individual has to undergo the KYC process only once, preventing the need for multiple KYC verifications.Similarly, any updates or modifications to the KYC information can be done through the CKYC system, ensuring the latest data is available for all participating financial entities. Therefore, CKYC simplifies the KYC process for individuals. Also, it enhances efficiency, transparency, and security in the financial sector by promoting a centralized and standardized approach to customer identification and verification.

How to do your KYC?

You can do your KYC either online or offline method –

Online

Visit the website of the KYC Registration Agency like NDML, CAMS, Karvy or NSE.

Fill the KYC registration form

Upload the required documents like ID proof, address proof and photograph

Submit and verify the information provided

Some KRAs require in-person verification (IPV) through a video call

Upon successful verification, you will receive the confirmation of KYC completion.

Offline

Visit the respective financial institution (AMC, bank, etc) or KRA for the KYC completion process

Collect and fill the KYC application form

Attach a self-attested copy of the required documents like ID proof, address proof and photograph.

Submit the application with documents at the branch/office

Complete the in-person verification (IPV) if required

Upon successful verification, you will receive the confirmation of KYC completion

At Sigfyn, we also help you complete your KYC process, i.e., you can register a new KYC or modify the existing KYC information. Our team will assist you to complete the KYC process online.

How to Check KYC Status?

Here are the steps to verify your KYC status online:

Begin by visiting the CVLKRA website.

Input your PAN number and the displayed captcha code, then click on 'submit'.

The KYC status will be displayed on the screen.

Similarly, after you login at Sigfyn and enter your PAN details for your account verification, we will automatically verify your KYC status whether it is completed or not. If it completed, you can proceed with your investment process. If not completed, we help you complete the KYC process online within few minutes.

0 notes

Text

How to Build a Mutual Fund Portfolio?

Are you ready to invest in mutual funds but need clarification about how to start investing in mutual funds and design your portfolio? Creating a mutual fund portfolio involves selecting a mix of mutual funds to help you achieve your financial goals and manage risk. Here are the steps to create a mutual fund portfolio:

Steps to Build Mutual Fund Portfolio

Define Your Financial Goals:

This is the first step towards building a mutual fund portfolio by determining your investment objectives, such as retirement planning, buying a home, saving for children's education, or building wealth. Also, identifying the goals helps you set a timeline for achieving your goals and the risk level you can take. For instance, short-term and long-term objectives may require different investment strategies and risk levels.

Assess Your Risk Tolerance:

Understanding your risk tolerance is very important. It is your willingness and ability to with stand fluctuations in the value of your investments. Also, consider factors like your age, financial situation, and your emotional response to market volatility.

Diversify Your Investments:

Diversification is a key strategy to spread risk. Hence, invest in a mix of asset classes and investment styles. The common asset classes include stocks, bonds, and cash equivalents. Also, consider adding international or gold ETFs/funds for further diversification.

Choose Mutual Funds:

Select mutual funds that align with your investment objectives and risk tolerance. The different types of mutual funds, including equity funds, bond funds, hybrid funds, money market funds and more. Analyze the historical performance, fees, and management of each fund. Also, past performance does not guarantee future results, but it can provide insights to select a fund.

Determine the Asset Allocation:

Determine how much you want to allocate to each fund in your portfolio. The allocation should be in line with your risk tolerance and financial goals. The common approach is to use a percentage allocation. For example, you might allocate 80% to equity funds and 20% to bond funds if you want to plan for children's education with a 10-12 year time horizon. Therefore, the asset allocation plan seeks to achieve balance by distributing investments based on your objectives.

Invest via SIP/Lumpsum:

Investing in mutual funds via SIP has several benefits. It maintains discipline and a regular approach towards saving and investing your hard-earned money. Also, execution of the plan is more important than planning as many investors postpone their investment decisions. They do this due to a lack of experience and fear of losing money.Therefore, starting with small amounts helps you gain experience in investing, and you can slowly increase the amount with more confidence.

Monitor and Rebalance:

It is important to regularly review your portfolio to ensure it aligns with your target allocation. Over time, certain funds may perform better or worse, causing your allocation to drift. Therefore, rebalance your portfolio by buying or selling funds to restore your desired allocation.

Stay Informed:

Stay informed about market conditions, economic trends, and any changes in the mutual funds you've invested in.However, if you are uncertain about creating a mutual fund portfolio or need personalized guidance, consider consulting a financial advisor.You can always use the Sigfyn online investment platform to check the health of your investments. Also, we help you design a customized portfolio based on your financial goals and risk tolerance level.

How do I Select Funds for my Portfolio?

Choosing funds for your portfolio should revolve around your investment goals, risk tolerance level, and investment horizon. A diversified portfolio ensures that your investments align with your objectives while managing associated risks.You can begin by identifying the fund category that suits your goals and then explore options across various fund houses. Also, consider your age, income, and financial aspirations before making your final selections.You must understand that the 'one size fits all' approach may not serve your unique financial journey. The fund that suits your needs may not be the ideal choice for another investor. Therefore, when venturing into mutual fund investments, it's imperative to identify your investment objectives.

How many funds should comprise my portfolio?

The number of funds in your portfolio should be driven by your investment strategy, not by the multiple investment options available. Some investors are lured by every new investment opportunity and end up with a cluttered portfolio of 10-15 fund schemes due to a lack of planning. However, diversification is the key to maintaining the fund returns in line with your expected returns. This can be achieved by incorporating various fund categories within the portfolio, which are the core components of building a portfolio.

Essence of Diversification

Diversification relies on the principle of not putting all your eggs in one basket. Different securities respond differently to market situations. Also, a well-diversified portfolio cushions you against fluctuations, helping maintain overall returns. An ideal portfolio typically comprises 5-7 mutual fund schemes spanning different market caps and asset classes. Remember, simplicity often leads to better control in the long term.

Conclusion

Rather than pursuing the illusion of the "best" mutual fund to select, the optimal investment strategy involves choosing a fund that aligns with your specific investment needs. Sigfyn is an AI-powered platform that helps you select funds based on your specific requirements and curate a customised portfolio for you.

#mutual funds#portfolio management#best mutual funds#financial advisors#mutual fund portfolio#sip investment plan#sigfyn

0 notes

Text

LTCG in Mutual Funds

Understanding the tax implications is essential for investors seeking to grow their wealth through mutual fund investments. Long-Term Capital Gains (LTCG) is a crucial component of mutual fund taxation that plays a significant role in determining the returns on your investments. In this article, we'll understand LTCG in mutual funds and its impact on investors.

What Are Long-Term Capital Gains (LTCG)?

A sale of any unit in mutual funds is subject to capital gains. However, the taxation depends on the holding period and type of scheme. LTCG refers to the profit earned on the sale of an asset or investment held for a specific duration. In mutual funds, LTCG occurs when an investor sells their mutual fund units after holding them for a particular period, as defined by tax regulations. The following table helps to understand the period of holding for the type of scheme and the taxability rate.

LTCG in Equity Mutual Funds

Equity funds primarily invest in stocks and equities. LTCG in equity mutual funds is subject to specific rules:

Exemption Limit: Investors are exempt from LTCG tax on gains of up to INR 1 lakh in a financial year. You won't incur any tax liability if your LTCG is below this limit.

Tax Rate: Capital gains exceeding INR 1 lakh are taxed at a flat rate of 10%. A 4% Health and Education Cess is also applicable, resulting in an effective LTCG tax rate of 10.4%.

Holding Period: More than 12 months

Calculating LTCG in Equity Mutual Funds

Understanding how LTCG is calculated can provide clarity on the tax liability. Let's understand through an example:An investor holds equity mutual fund units for three years, and the following is the purchase & sale value.

Calculation:

LTCG in Debt Mutual Funds

Debt mutual funds primarily invest in fixed-income instruments like bonds and securities. The rules for LTCG taxation in debt mutual funds differ from those in equity funds:

Holding Period: For LTCG classification in debt funds, the holding period is three years or more. If you sell your debt mutual fund units before three years, the gains are treated as short-term capital gains (STCG) and taxed according to your income tax slab.

Tax Rate: LTCG in debt mutual funds is taxed at a rate of 20%, with indexation benefits.

New Regime: From 1 April 2023, capital gains from debt mutual funds will be taxable as per the investor's income tax slab rate. The above rates are applicable for investments before 31 March 2023.

Indexation Benefits

Indexation is a significant advantage when calculating LTCG in debt mutual funds. It accounts for the impact of inflation on your investment, which reduces your taxable gains. The cost of acquisition is adjusted to reflect the increase in the general price level over time.The following is the formula to calculate the indexed cost of acquisition -Indexed cost of acquisition = {Cost of Inflation Index (CII) for the year of transfer (sale)/ CII for the year of purchase} * cost of acquisition

Calculating LTCG in Debt Mutual Funds with Indexation

Let's understand with an example: An investor holds debt mutual fund units for four years, and the following is the purchase & sale value.

LTCG on Systematic Investment Plans (SIP)

A Systematic Investment Plan (SIP) is a simple method to save and invest money in mutual funds. SIPs help you invest a small amount regularly in mutual funds, and the frequency of investment can be chosen, like every week, month, or year. On every SIP purchase, you receive some mutual fund units. But the redemption of these units works on the first in, first out method (FIFO). For instance, if you invest in an equity fund through SIP for more than a year and take out your money after 13 months, the first units you get are considered long-term (because they are invested for more than 12 months). However, the units you receive later, from the second month onwards, are considered for short-term taxation (because holding period is less than 12 months). These units are taxable at a flat rate of 15%, irrespective of your income tax slab.

Conclusion

Understanding LTCG in mutual funds is crucial for investors to make informed decisions. Whether you're investing in equity or debt mutual funds, the holding period and tax implications differ significantly. Also, exploring various tax saving options and staying updated with the latest tax regulations can help you optimise long-term capital gains and work towards long-term wealth creation. At Sigfyn, we consider all these factors before making buy/sell mutual fund recommendations. Happy Investing!

#mutual funds#best mutual funds#sip investment plan#Systematic Investment Plans#Debt Mutual Funds#SIP#Equity Mutual Funds#Long-Term Capital Gains#LTCG#Sigfyn

0 notes

Text

Exit Load on Mutual Funds

Mutual funds have gained popularity among investors for their potential to offer diversification, professional fund management, and ease of investment. However, investors need to understand the various fees and charges associated with mutual funds, one of which is the exit load. In this article, we will understand what exit loads on mutual funds are and how to calculate them.

What is Exit Load?

An exit load is also known as an exit fee or redemption fee. It is a charge imposed by mutual funds when investors redeem (sell) their mutual fund units within a specified period after the units were purchased. The primary purpose of an exit load is to discourage short-term trading and to protect the interests of long-term investors in the fund.Exit loads are typically expressed as a percentage of the net asset value (NAV) of mutual fund units held by investors. The AMC deducts the exit load from the total NAV, and the remaining redemption amount gets credited to the investor's account. The specific terms and conditions, the duration for which the exit load is applicable, and the exit load rate are outlined in the mutual fund's offer document or scheme information document (SID).

How to Calculate Exit Load in Mutual Funds?

Calculating the exit load on mutual funds is relatively simple. It can be expressed as a percentage of the NAV and the following are the steps to calculate it:

Determine the Exit Load Terms:

Firstly, examine the mutual fund's offer document to find the specific terms and conditions regarding the exit load. Pay attention to the exit load percentage and the holding period.

Identify the Holding Period:

This fee is applicable only if you redeem your mutual fund units within a specific holding period, as specified in the fund's terms. This holding period is usually expressed in days, weeks, or months.

Calculate the Redemption Amount:

To calculate the exit load, you first need to determine the redemption amount, which is the total value of the mutual fund units you intend to sell. The following is the formula to calculate redemption amount: Redemption Amount = Number of units to redeem × NAV per unit

Calculate the Exit Load:

As the exit load is expressed as a percentage, you can calculate it by using the following formula:Exit Load = Exit Load Percentage × Redemption Amount

Deduct the Exit Load:

To find the final redemption amount you'll receive after deducting the exit load, subtract the exit load from the calculated redemption amount.Final Redemption Amount = Redemption Amount - Exit LoadExample: Suppose you have 1,000 units of an equity mutual fund with an exit load of 1% if you redeem your units within the first 180 days of purchase. The NAV per unit on the day of redemption is INR 10.

Therefore, you INR 9,900 will be credited to your bank account at the time of redemption.

Exit Load on Different Types of Mutual Fund

Exit loads on mutual funds in India vary depending on the type of mutual fund. The following is an overview of how exit loads may apply to different types of mutual funds in India:

Equity Funds:

Equity mutual funds primarily invest in stocks. Exit loads are typically lower for equity funds, and they often have no exit load if you hold your investment for a specified period, usually one year. Exit loads for equity funds are usually designed to discourage short-term trading and promote long-term investment.

Debt Funds:

Debt mutual funds invest in fixed-income instruments like bonds and debentures. The exit load for debt funds can vary based on the investment horizon and the type of debt securities in the portfolio.

Liquid funds, a type of debt fund, may have minimal or no exit load. However, other debt funds, like medium or long-term bond funds, might have higher exit loads if you redeem your units within a short period.

Hybrid Funds:

Hybrid or balanced funds invest in a mix of equities and debt instruments. Exit loads for hybrid funds can be a blend of those for equity and debt funds, depending on the fund's asset allocation.An arbitrage fund, a type of hybrid fund, has an exit load for redemptions within 15-30 days. Also, some balanced funds may have an exit load, particularly if the equity component in the fund is substantial.

Conclusion

Exit load is an important aspect of mutual fund investments that every investor must be aware of. By understanding the exit load terms and knowing how to calculate them, investors can make more informed decisions about their mutual fund investments.At Sigfyn, we consider the exit load and other charges before advising a redemption for any scheme because it can impact the overall returns from your fund. Our wealth manager will help you understand these charges if applicable.

#mutual funds#sip investment plan#best mutual funds#debt funds#equity mutual funds#financial advisors#debt mutual funds#mutual fund#portfolio management#sigfyn

0 notes

Text

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes

Text

When and How to Plan for Your Retirement?

Retirement is one of the biggest expenses that a person needs to consider. During the retirement years, you’re not earning anymore, but you still need to pay for your expenses. The period of retirement can also be very long with rising life expectancy. The average age that people live in India is now around 72 years, but it can be much higher by the time you retire. The biggest question that people have when they think of retirement is – how much money will I need? This is a complex question, and you need to think carefully about it. The answer depends upon a range of factors such as the lifestyle you want at retirement, whether you own a house, whether you will receive a pension, what the inflation rate will be, and so on. In this article, we’ll try to provide the tools that you need in order to arrive at the answer.

Importance of Having a Retirement Corpus

A retirement corpus is a sum of money that you save during your working years. This money is then used to fund retirement. The retirement corpus should be large enough that it generates monthly income on which you can live. The retirement corpus will slowly vanish over time, as you will consume the funds. As most people retire by the age of 60, they need money in order to meet their expenses. Those who do not accumulate a sufficiently large retirement corpus may need to dramatically lower their cost of living. They may even need to rely on their children or other relatives. Or, they may have to work during their golden years as well. None of these options are ideal. Hence, retirement planning is essential for everyone.

When to Start Saving for Retirement?

You should start saving as early as possible. In fact, ideally, you should set aside a small portion of your income from your first earnings itself. This is much easier said than done. This is why most experts agree that you should give yourself around 20 to 30 years to build your retirement corpus.The age at which you start saving for retirement also depends on the other big expenses in your life. How many kids are you planning on having? Are you planning on buying a house? Do you have generational wealth that you can rely on? Are you a single-earner for your family?Depending on the answer to these questions, you can start saving earlier or later. Most people should start saving and investing for retirement at the age of 30, assuming a retirement age of 60.Retirement is a huge expenditure in every person’s life. Even though retirees usually live a low-cost life, the fact that they will not be earning any money for decades means that you need to have an appropriately large amount of money as your retirement fund.

How to Calculate the Amount for Retirement Corpus?

The appropriate retirement corpus depends from person to person. There is no single answer that will suit everyone. However, there are certain factors that each person must keep in mind while calculating their retirement corpus. These factors are: Inflation – How much average inflation there is during your accumulation phase and during your retirement years? The average answer is usually around 6% per year, but it can vary depending on what you consume. Monthly Expenses –What is the monthly amount that you will be spending during your retirement years? You need to decide what kind of lifestyle you want after you’ve retired. Are you going to spend less? Are you going to spend more? What will be your expenses after retirement? Rate of Returns – What is the rate of interest you’re earning from your savings and investments? Usually, fixed-income investments provide a lower rate of interest while riskier market-linked investments provide a higher rate of interest. You can decide which type of investment to aim for depending on your goals and risk appetite. How to Build Retirement Corpus? The best way to build your retirement corpus is to save a portion of your monthly income and then invest it. For example, you can save around 10% on your monthly income and then deposit that money into a recurring deposit account held with your bank. This will provide guaranteed (but low) returns for a long period of time. For salaried employees, 24% of the basic salary is deducted from the provident fund. You can also invest up to 10% of your basic salary in your provident fund and also avail tax benefits. There are several ways you can invest your money depending on what your desired retirement life looks like, how many years you have till retirement, how much your present and future earnings are, and what your risk appetite is. A few of the ways in which you can invest your money are a provident fund, NPS and other pension plans, fixed deposit, recurring deposit, government or corporate bonds, mutual funds, real estate, or even riskier methods.

Wrapping Up

The question of retirement should be tackled as early as possible. This is because the earlier you start saving, the less you’ll have to save in total. Keep in mind that inflation could triple or quadruple your monthly expenses when compared to today. This is why saving and investing your money in a prudent manner is the best option.

#Retirement Planning#NPS#National Pension Scheme#Mutual Fund#sip investment#retirement savings#Retirement Mutual Fund#Sigfyn

0 notes

Text

What is a Portfolio?

A portfolio is a collection of financial instruments such as stocks, bonds, mutual funds, real estate, and other financial instruments owned by an individual, institution, or entity. The primary objective of a portfolio is to generate revenue, which can include capital appreciation, income generation, wealth preservation, or a combination of these goals. In other words, individuals put their money to earn gains and ensure that the original asset or capital does not erode. However, the performance of the asset depends on the market conditions.Diversifying a portfolio is a key to portfolio management. Also, it helps to manage risk and maximize returns based on the investor's risk tolerance, time horizon, and financial goals.

What are the Components of a Portfolio?

The various financial instruments in a portfolio are called asset classes. Investors should aim for a well-balanced mix of these assets to create a diversified portfolio, fostering capital growth while managing risk effectively. The following are the major components of a portfolio –

Stocks (Equities): This is the most common component representing ownership in a company based on the proportion of shares held by the shareholder. They can be categorized further based on the market capitalization. Also, they offer the potential for capital appreciation but have a significant risk factor.

Bonds (Fixed Income): Bonds are debt instruments issued by governments, corporations, or other entities. They make periodic interest payments (coupon) and return the principal at the time of maturity. Also, they are considered more conservative and provide income and stability to a portfolio.

Cash or Cash Equivalents: These include money market funds, treasury bills, certificates of deposit (CDs), and short-term government securities. They provide liquidity and can serve as a safety net in a portfolio.

Real Estate: Real estate investments can include physical properties (e.g., plots, apartments, villas, buildings, etc.) or real estate investment trusts (REITs), companies that own and manage income-producing real estate properties in a dematerialized form.

Alternative Investments: These may include hedge funds, private equity, commodities (gold, silver, oil, etc.) and other non-traditional assets. They are often used to diversify a portfolio and reduce risk.

Types of Portfolio

Here, we list a few common types of portfolios because there is no ideal portfolio for an investor. To build a portfolio, you must consider various factors that suit your requirements.

Conservative Portfolio: It is also known as a defensive portfolio which aims towards capital preservation. It typically consists of a higher percentage of bonds and cash equivalents, with a smaller allocation to stocks or equities suitable for low-risk tolerance investors.

Balanced Portfolio: It aims to strike a balance between growth and income. It typically includes a mix of both stocks and bonds, making it suitable for investors with moderate risk tolerance levels.

Aggressive Portfolio: It focuses on capital appreciation and growth. It has a higher allocation to stocks, which can be riskier but has the potential for better returns. This portfolio suits investors with a high-risk tolerance and a long investment horizon.

Income Portfolio: The primary objective is to generate a consistent income stream. The underlying portfolio includes bonds, dividend-paying stocks, real estate investment trusts (REITs), and other income-generating assets. Usually, retirees prefer this portfolio and want regular income.

Speculative Portfolio: The portfolio invests in high-risk instruments with the anticipation of substantial future gains. It includes betting on Initial Public Offerings (IPOs) or high-growth stocks, buying low-rated bonds or debentures for higher returns, or engaging in options or futures contracts for portfolio protection.

Various options are available for investors, but determining which assets effectively align with their investment objectives is crucial. Thus, design a portfolio that matches your financial goals, risk tolerance and time horizon. Also, engaging in regular portfolio monitoring and ensuring frequent rebalancing progress toward your goals is imperative.

How does Sigfyn help in Portfolio Creation?

One of Sigfyn's unique features is the "Portfolio Designer." We craft a customized portfolio tailored to your risk tolerance level and the amount you wish to invest, whether through lumpsum or SIP. Additionally, we provide an in-depth analysis of portfolio performance. Furthermore, a dedicated wealth manager will guide you throughout the process. Begin Investing now!

0 notes

Text

What is Market Capitalization?

Market capitalization or market cap refers to the total market value of the company. It is derived by multiplying the total number of outstanding company shares and its current market price. This is used to categorise and compare the size of the companies.

Classification based on Market Capitalization

1. Large-cap companies: These are well-established companies and have a significant market share. The market cap for large-cap companies is more than INR 20,000 crores. Also, these companies are less risky bets because they are stable, but the returns are comparatively low. Example - Reliance, TCS, Infosys, etc.2. Mid-cap companies: These are fast-growing companies that aim for expansion to grow their market share. The market cap for mid-cap companies ranges between INR 5000 crores to 20,000 crores. Also, these companies can be risky bets because they are still not established in their industry, but the returns can be potentially higher. Example - Canara Bank, SAIL, BHEL, etc.3. Small-cap companies: Most of the companies in India belong to this market cap. These companies have the potential to grow rapidly but may struggle during an economic slowdown. The market cap for small-cap companies ranges below INR 5000 crores. Also, success can skyrocket their share prices, but failure can lead to significant losses to investors. They are considered to be very aggressive bets. Example - CAMS, PVR, Bajaj Electric, etc.

#Market capitalization#Mutual Funds#sip investment plan#Debt Funds#Wealth Management#financial advisor#financial planning#Sigfyn

0 notes

Text

Types of Debt Mutual Funds

Debt mutual funds primarily invest in debt instruments like treasury bills, certificate of deposits, government bonds, corporate bonds, money market instruments, etc. These funds can be categorized based on the securities they invest in and the maturity period of the underlying securities.

Overnight Funds

Investment mandate: Invest in debt securities with a maturity of one day. Risk: Low risk Suitability: To park idle cash Duration: 0 to 7 days

Liquid Funds

Investment mandate: Invest in money market instruments and high-grade debt securities with 91 days maturity period. Risk: Low risk Suitability: An alternative to a savings bank account Duration: 7 days to 3 months

Ultra Short Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio between 3 to 6 months. Risk: Low risk Suitability: To park surplus funds/create an emergency fund Duration: 3 to 6 months

Low Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio between 6 to 12 months. Risk: Low risk Suitability: To park short-term funds Duration: 6 to 12 months

Money Market Funds

Investment mandate: Invest in money market instruments with a maturity period of upto one year Risk: Low risk Suitability: An alternative to fixed deposit Duration: up to 1 year

Short Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio is between 1 to 3 years Risk: Low risk Suitability: To plan for short-term goals Duration: 1 to 3 years

Medium Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio is between 3 to 4 years. Risk: Low risk Suitability: To plan for medium-term goals Duration: 3 to 4 years

Medium to Long Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio is between 4 to 7 years. Risk: Moderate risk Suitability: To plan for medium-term goals Duration: 4 to 7 years

Long Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio of more than 7 years. Risk: Moderate risk Suitability: To plan for long-term goals Duration: More than 7 years

Dynamic Bond Funds

Investment mandate: Invest in debt securities with varying maturities based on interest rate scenarios. Risk: Moderate risk Suitability: Investors finding it difficult to understand interest movement Duration: 3 to 5 years

Corporate Bond Funds

Investment mandate: Invest a minimum of 80% of portfolio assets in high-rated corporate bonds (rated AA+ or higher) Risk: Low risk Suitability: Looking for regular income and capital protection Duration: 3 to 5 years

Credit Risk Funds

Investment mandate: Invest a minimum of 65% of portfolio assets in corporate bonds (rated AA or below) Risk: Low risk Suitability: Investors willing to take higher default risk Duration: 3 to 5 years

Banking and PSU Funds

Investment mandate: Invest a minimum of 80% of portfolio assets in debt securities issued by banks, PSUs and public financial institutions. Risk: Moderate risk Suitability: Investors seeking to balance yield, safety and liquidity Duration: 1 to 3 years

Gilt Funds

Investment mandate: Invest a minimum of 80% of portfolio assets in government securities with varying maturities (medium to long term) Risk: No risk Suitability: Investors seeking a safer investment option Duration: 3 to 20 years

Floater Funds

Investment mandate: Invest a minimum of 65% of portfolio assets in floating rate instruments Risk: Moderate risk Suitability: Investors willing to take advantage of interest rate movements Duration: 3 to 5 years

Fixed Maturity Plans

Investment mandate: Passively managed closed-ended fund where securities are held till maturity. Risk: Low risk Suitability: Alternative to fixed deposit investment for a fixed duration Duration: Varies depending on each FMP

#Debt Mutual Funds#Mutual Fund#Liquid Funds#Money Market Funds#Short Duration Funds#Overnight Funds#Floater Funds#Gilt Funds#Credit Risk Funds#Dynamic Bond Funds#Corporate Bond Funds#Fixed Maturity Plans#Sigfyn

0 notes

Text

Types of Equity Mutual Funds

Equity funds are mutual funds that invest at least 65% of their total assets in equity and equity-related instruments. These funds can be actively or passively managed and categorised according to the market capitalisation, investment style of the stock holdings in the portfolio and geography. The following are the different types of equity mutual funds -

Large Cap Funds

Investment Mandate: Invest at least 80% of its assets in equity and equity-related instruments of large-cap companies. (Top 100 companies by market capitalization). Risk: Very High Risk Suitability: Investors looking for consistent returns to plan for their goals. Duration: Minimum 5+ years

Mid Cap Funds

Investment Mandate: Invest at least 65% of its assets in equity and equity-related instruments of mid cap companies (101-250 companies by market capitalization). Risk: Very High Risk Suitability: Risk takers with medium to long term goals. Duration: Minimum 5+ years

Small Cap Funds

Investment Mandate: Invest at least 65% of its assets in equity and equity-related instruments of small-cap companies (251 or below companies by market capitalization). Risk: Very High Risk Suitability: Aggressive investors with long term goals. Duration: Minimum 7+ years

Diversified/Multi Cap Funds

Investment Mandate: Invest at least 65% of its assets in equity and equity-related instruments of large-cap, mid-cap and small-cap companies in varying proportions. Risk: Very High Risk Suitability: For medium to long term goals. Duration: Minimum 5+ years

Large and Mid Cap Funds

Investment Mandate: Invest at least 35% of its assets in equity and equity-related instruments of large-cap and mid-cap companies each. Risk: Very High Risk Suitability: For medium to long term goals. Duration: Minimum 5+ years

Thematic/Sectoral Funds

Investment Mandate: Invest at least 80% of its assets in equity and equity-related instruments of a specific theme (ESG theme, sharia law, etc.) or sector (pharma, IT, infrastructure, banking etc). Risk: Very High Risk Suitability: Investors looking to take advantage of the potential sector/thematic boom. Duration: Minimum 5+ yearsA thematic fund can invest in stocks from multiple sectors that follows a theme, thus can be slightly more diversified than sectoral fund.

Focused Equity Fund

Investment mandate: Can invest in a maximum of up to 30 stocks of companies having a specific market capitalization. Risk: Very High Risk Suitability: Investors who want limited stock exposure in long term investing. Duration: Minimum 5+ years

Contra Equity Fund

Investment mandate: Invest at least 65% of their total assets in equity following a contrarian investment strategy that involves buying and selling in contra (opposite) to the current market sentiments. Risk: Very High Risk; Suitability: For medium to long term goals. Duration: Minimum 5+ years

Value Fund

Investment mandate: Invest at least 65% of their total assets in equity following a value investment strategy that involves buying undervalued stocks. Risk: Very High Risk Suitability: For long term goals. Duration: Minimum 5+ years

Equity Linked Savings Scheme (ELSS)

Investment mandate: Invests at least 80% of its assets in equity and equity-related instruments based on the Equity Linked Savings Scheme, 2005, notified by the Ministry of Finance. Risk: Very High Risk Suitability: For tax saving purpose under Section 80C. Duration: Has a mandatory lock in period of 3 years.

#Equity Mutual Funds#Invest Mutual Funds#Equity Linked Savings Scheme#ELSS#Mutual Funds#Mutual Funds India#SIP Mutual Funds#SIP Investment Plan#Sigfyn

0 notes

Text

Types of Mutual Funds in India

There are many mutual funds available for investors to pick based on their financial objectives and risk appetite. The following are the categories of mutual funds -

Based on Asset Class

Equity Mutual Funds

The majority portion of money in these funds is invested in company stocks. Because the returns are linked to market movements, they are inherent to a higher degree of risk. Therefore, understanding of associated risks is necessary. There are different types of equity mutual funds based on their investment style, market capitalization and portfolio holdings.

Debt Mutual Funds

These funds are also known as fixed-income funds, where the majority of the corpus is invested in debt instruments like government securities, debentures, corporate bonds and money market instruments. These funds aim to provide reasonable returns to investors with relatively low risk. Moreover, there are different types of debt mutual funds based on the securities they invest in and their maturity period.

Hybrid Mutual Funds

These funds invest in equity and debt instruments depending on the fund's investment objective. The fund aims to give diversified exposure to various asset classes. Moreover, there are different types of hybrid mutual funds based on portfolio asset allocation.

Based on Structure

Open-ended Mutual Funds

This fund is available for subscription and redemption every business day. Thus, these funds have no maturity day.

Closed-ended Mutual Funds

This fund is available for subscription only during the offer period. They have a fixed tenure and a fixed maturity date. Hence, these funds can be redeemed only on maturity. Moreover, it is mandatory for these funds to be listed on the stock exchange after the new offer period. This helps investors to exit the scheme before maturity by selling their units on the exchange.

Based on Portfolio Management

Actively Managed Funds

The fund manager actively manages the fund portfolio deciding which stocks to buy/sell using his market expertise backed by research. Also, they aim to generate maximum returns and outperform the scheme's benchmark returns.

Passively Managed Funds

The fund manager aims to replicate the scheme's benchmark index in the same proportion. The fund manager does not perform research or analysis to buy and sell stocks. They merely replicate the index holdings. Thus, they aim to generate the same returns as the benchmark index.

Based on Investment Objective

Growth-Oriented Funds

The primary objective of these funds is to ensure capital appreciation in the medium and long term. The fund manager predominantly allocates the corpus in equities and shuffles the portfolio to reap the benefits of market movements.

Income-Oriented Funds

The primary objective of these funds is to generate regular income where the underlying assets also ensure steady returns. The fund manager predominantly allocates the corpus in fixed-income securities. However, these products have limited potential for wealth creation for a particular period.

Liquid Mutual Funds

The primary objective of this scheme is to ensure capital protection, liquidity and reasonable returns.

Tax Saving Mutual Funds

These funds are typically Equity Linked Savings Schemes (ELSS) that invest in equity and equity-related instruments. Investing in this scheme makes you eligible for deductions under Section 80C of the Income Tax Act 1961.

Based on Speciality

Index Mutual Funds

These funds are a class of mutual fund schemes that tracks and replicates the asset allocation and performance of a specific benchmark index. These are passively managed funds where 95% of total assets are similar to the index that it is tracking.

Funds of Funds (FOFs)

As the name suggests, these funds invest in other mutual funds (domestic or international). They are also known as multi manager funds. In other words, the pooled money is invested in other mutual funds rather than assets like equity or debt. Also, the returns may vary depending on the performance of the target fund.

Commodity Mutual Funds

These funds invest in commodities like agricultural products, raw materials, metals, etc. The returns are based on the performance of the commodity that the fund is tracking. For instance, gold mutual funds invest in gold which is a commodity.

Asset Allocation Funds

These funds are more like balanced funds where the fund manager balances between equity, debt or sometimes even gold. The asset allocation ratio depends on the market conditions and fund investment objective. Also, the fund manager aims to distribute the burden or risk and enhance the scope of earnings.

Pension/Retirement Mutual Funds

These funds help to gain regular returns after retirement. The fund splits its investment between equity and debt instruments where the equity component offers returns and the debt component helps balance risk with steady returns.

Children's Fund

This is an open-ended scheme for children having a lock-in period for 5 years or till the child attains majority (18 years), whichever is earlier. Also, these work like hybrid funds with exposure to both equity and debt instruments. It aims to create wealth for children for various purposes like education or marriage.

#Mutual Funds#Commodity Mutual Funds#Best Mutual Funds#Debt Mutual Funds#Equity Mutual Funds#Hybrid Mutual Funds#Liquid Mutual Funds#Debt Funds#Portfolio Management#Investment Mutual Funds#Retirement Mutual Funds#Sigfyn

0 notes

Text

What is mutual fund?

A mutual fund is a financial instrument that pools money from different investors. This pooled money is invested in various securities like stocks, bonds, money market instruments, etc. The objective of the mutual fund is to provide diversification and professional management at a relatively low cost. Every mutual fund portfolio has a common investment objective and is managed by a professional fund manager. The fund manager aims to maximize returns for its investors. However, the profits and losses are shared among the investors' proportionate basis of holding in the fund.

Understanding How Mutual Funds Work?

Mutual Funds invest pooled money in financial assets like stocks, bonds, etc. Investors whose investment objective aligns with that of the mutual fund can invest to generate returns. Money thus pooled from different investors is managed and invested in the assets by a fund manager.

What is Mutual Fund Units (NAV)?

When you invest in a mutual fund, you buy the fund units. This is similar to buying company shares at a market price. Each unit gives exposure to all the assets in the fund. For instance, if a Fund XYZ invests in Company A (15%), Company B (20%), Company C (25%), Company D (30%) and 10% in debt instruments. Thus, buying one fund unit in a mutual fund gives you exposure to all the instruments in the same ratio. You must buy and sell each fund unit at the prevailing Net Asset Value (NAV). The NAV is the combined market value of all the securities the fund holds on a particular day. In other words, NAV represents the market value of units of the mutual fund scheme. This value is subject to change daily based on the performance of underlying assets of the mutual fund scheme.\text{Net Asset Value (NAV)} = \frac{\text{Market Value of All Assets} - \text{Liabilities \& Expenses}}{\text{Outstanding Mutual Fund Units}}Example: If you invest Rs.500 in a mutual fund scheme and the NAV is Rs.10, you will have 50 units (500/10) of the mutual fund scheme. Learn more on https://www.sbimf.com/learn-about-mutual-funds

Glossary

Financial Instrument - It is a monetary contract between parties which holds capital and can be traded, modified and settled. Money Market Instrument- They are short term financing instruments which can be converted to cash easily like bonds, T-bills, commercial paper, etc. Securities - It is a financial asset that holds monetary value and represents ownership of financial assets like shares, bonds, options, etc. Stock - It is a security that represents a fraction of ownership of a company. Bonds - It is a security that represents a loan from an investor to borrower where the borrower promises to pay interest and principal on the loan.

#Mutual Fund#Invest Mutual Funds#SIP Investment#Certified Financial Planner#Portfolio Management#Wealth Management#Financial Advisors#Sigfyn

0 notes

Text

Best Mutual Funds, Online Investment Platform, Certified Financial Advisor | Sigfyn

https://www.sigfyn.com/ Get Best Mutual Fund Advisory at Sigfyn, we are best AI-powered platforms that provides personalized and holistic financial advisory to grow wealth by SIP. Invest in best mutual funds portfolios such SBI, HDFC, ICICI Prudential, Nippon India curated by expert-built algorithms.

#Best Mutual Funds#Online Investment Platform#Certified Financial Advisor#Financial Advisors#Mutual Funds#SBI Mutual Funds#HDFC Mutual Funds#ICICI Prudential Mutual Funds#Nippon India Mutual Funds#Sigfyn

4 notes

·

View notes