#(she OWNED A HOME and was able to use that investment to fund her grad school and she thinks that's the same?? vom)

Text

in a ~fun~ turn of events I think this year I hate my job not because of the *gestures to conservative catholic institution* everything but because the ratio of direct coworkers whom I like vs. dislike has gone from 2:1 to 1:2 and I am LOSING IT

#like that post about how much time you spend with your coworkers vs. friends and family over the course of your life?#that's been making the rounds on instagram?#crying bc why do I spend 8 hours a day with people who I DO NOT LIKE PERSONALLY and have NOTHING IN COMMON WITH#even the coworker I do like is in thin fucking ice okay!!#like it would be more accurate to say that I dislike her the least of my coworkers#I mean we get along but also she's very fatphobic and not as liberal as she thinks she is and so privileged & unaware of it#(the problem with all my coworkers tbh)#(violently flashing back to the time I pointed out that one coworker was lucky her sons wouldn't have to take out student loans for college)#(and she tried to tell me she understood how I felt bc she'd had to take out a second mortage ON HER HOUSE to avoid grad loans)#(she OWNED A HOME and was able to use that investment to fund her grad school and she thinks that's the same?? vom)#anyway this post is brought to you by the fact that one of my coworkers put up a starbucks tree#and I've decided that it's representative of everything I dislike about her#and all our ideological differences#it is mere feet away from my computer I have to see it all. day.#I want to smash every ornament on that tree is 2g#sorry if I sound violent I had to bite my tongue today while someone told me they use amazon for the convenience#even though jeff bez0s is shit!!#just like I bite my tongue all! day! every! day!#brb screaming forever

1 note

·

View note

Text

My Money Snapshot

[Inspired by Corporette]

Location: Ohio, small college town

Age: 29

Occupation: PhD candidate (English)/half-time instructor

Income: $16,000 before deductions

Net worth: $588 (I’m crying)

Current Debt: $12,844

Living situation: Renting with a roommate

Money Philosophy:

I grew up in the “working poor” category. My parents are divorced and my father never contributed much financially. Mom made around $21,000 per year at work and she cleaned houses “under the table” to supplement that. Somehow, we never went hungry, what we ate was relatively fresh and healthy, and she managed to put two of us through Catholic schools for a total of 14 years. I know now that mom is still paying some of those loans and credit card debts and that part of her strategy included not contributing more than the 3% that her employer matched in her 401k. Every time I complain about the financial stress I feel at my salary level, I have to remind myself how comparatively unstressful my financial life is.

I’ve always been poor and I always knew that graduate school/academia is not a lucrative career. I tell myself that if I can make things work at this pay grade, then I’m ready for just about anything. My main strategy is to have a budget, stay in the budget, and save every bit that I can.

Monthly budget

$1000-1100 for the necessities each month. Monthly spending on eating out, entertainment, shopping and other categories varies widely. I also won’t lie... dating someone who makes 4x more money than me helps... I’m fairly frugal on all of these fronts: I buy most of my clothes second hand and I tend to shop seasonally. Spikes in spending occur around the winter holidays when I’m buying gifts and when I am doing traveling. And I also have totally weak, impulsive moments - like the $3 soap sales at Bath & Body works, or that time I spent $110 on bras and underwear on a whim. Anyway:

Rent: $272.50/month

Other living expenses: $130-170/month (electric, internet, phone, renter’s insurance - lower in summer, higher in winter)

Transportation: $332/month (gas, insurance, car payment)

Healthcare: $162/month (health+dental insurance, no vision coverage)

Groceries: $120-150/month ($30/week)

Debt Picture

Student loan: $2000

Car loan: $10,488

I’m a career student & my motto for all the years I’ve been in school has been “follow the money.” I went to college on very hefty scholarships and I only had to take out the $2000 loan to cover housing costs during my first year. For the subsequent three years, I was an RA, so I never had to take loans again. I applied to graduate programs based on the research fit, and when I got my offers, money weighed heavily in the decision. I would have loved to live in Boston as a wee 22-year old, but I wasn’t about to take out loans for a year’s worth of tuition and the living expenses. And to get a PhD while living in Minneapolis, my very favorite city in the US? It would have been such a dream, but for the quite steep difference in stipends and the significant disparity in cost of living compared with Ohio. My only regret on this front is that I haven’t started paying back my tiny student loan. I’ve been able to defer it since I’m in graduate school, which was a great idea when I was a master’s student who didn’t know the first thing about budgeting. But if I had just paid $25/month from the start of grad school the balance would be $0 about the same time I graduate from this PhD program this August. Instead, I’ll be scrambling to pay off the whole balance before my 6 month grace period ends.

The car loan is less than a year old. I finally broke down and bought a new (by which I mean used) car last summer after really pushing it with the car my parents had bought me in high school. Repairing that car put me into credit card debt more than once and I was getting so stressed about it. It was time. I have a very good credit score, so I qualified for a nice loan rate with my credit union, and to get a better rate I got my mom to co-sign my loan. It’s a popular rental fleet model so there were tons of them on the market, but average miles were high - so when I saw one that was two years old with only a years worth of miles on it at $1000 less than the average price for that make, model, and year, I jumped on it. My payments are $231/month on the 5-year plan. Currently, I’m paying that minimum, but I plan to escalate my payments as my income goes up (I’m on the academic job market now, pray for me). I folded this car payment into my existing budget by giving up solo-living and finding a roommate. When I had my own apartment, very spacious with a huge kitchen and tons of windows/natural light, I was paying about $585 for monthly rent. I hate living with people, but I hated the idea of being trapped in this college town without a car even more - one of my other mantras is “you can do anything for a year.”

A note on credit cards: I love them. I’m one of those responsible people that charges everything and pays the balance like clockwork every month. This is the only way to make sure you’re actually taking advantage of the cash back/reward perks! Currently, I’m using Capital One’s Venture card and stockpiling airline miles for travel (it has a 40,000 mile sign-on bonus). If you’re good for it, I also recommend one card with a great balance transfer program. For me, when I get into an emergency situation, it makes me feel like I have options. It’s been about 4 years since I’ve had to use my balance transfer card to cover costs ($1400 in car repairs, summer 2015), but at my level, I can’t afford to not have back up plans.

Savings and Investments

$5,517 Cash

$7,861 Roth IRA + employer mandated retirement account

Retirement: The biggest financial mistake I've made in grad school is that I did not opt into the retirement account offered by the university when I started my M.A. in 2012. When they ask me that “what I wish I had known before I went to grad school” question, this is near the top of the list. I did, eventually, open a Roth IRA and slowly I started to build something. This year, when my graduate funding dried up and they made me a “half-time instructor” the retirement account for public school teachers was mandatory and the contributions are high: 14% of every pay check (annoying, yes, but on the flipside, there is an equally high employer match). While I’m contributing to this, I’ve paused my contributions to the IRA. I’ll roll this money over, either into the IRA or into another state/employer retirement fund when I move on from here.

Personal savings: I strive for a minimum of $100 per month and frequently do a little more, but each month is different and I consider it a win if I break even. Through most of grad school, I’ve taken on “second jobs” to bolster what I can save (and boost my resume). Both jobs have been through the university, so they limit me to five hours a week. When I max them out, this can be an extra $200-250 each month.

I took up a new savings challenge this academic year to build on my “play money” savings account (a high yield savings account which my bank labels a “goal setter” account). The challenge involves tallying the “total savings” printed on my receipts each month (i.e. when the grocery store is like “you saved $6″ because of sales and coupons). So, At the end of the month, I put that running total into my goal setter account. Sometimes the total savings are like $26, but others its as much as $171. It’s an interesting challenge because it encourages me to do tedious things, like scroll through all the digital coupons on the grocery store app; but at the same time, I know that the higher that number is usually coincides with a lot of shopping which encourages some self-regulation.

I initially set my goal at $2500 when I opened the goal setter account in 2014. When I had to dip into the account in April 2018 to pay $930 in car repairs, I finally set plans in motion to buy my car. Since I bought used, I only put 10% down on the car (just over $1200). When I sold my old car for $1000, I put that money right back into the account to start saving for new things...

What I’m saving for now:

travel: to celebrate finally finishing this PhD, I’m hoping to pull off a trip to Europe. Later this year, I’m also turning 30 around the same time that one of my regular professional conferences is meeting in Hawaii. If I can do one or both in the next year, that’d be grand. (As I mentioned, I'm saving up airline miles with my credit card program, too!)

a multicooker: think InstantPot...but more expensive because my dreams all revolve around small appliances that match my stand mixer.

What I do to be frugal...

I’ve been frugal my whole life, but a couple of major habits I’ve formed include:

Meal planning and home cooking (read my guide to meal prep here). The money part of that means planning what I eat around maximizing the ingredients I have to buy. I plan meals that use the same ingredients so I’m not spending on an entire bunch of celery and then throwing out 75% of it. Routinization also helps, so my grocery lists stay about the same week to week and the bill relatively predictable - for example, I eat avocado egg salad almost every day for lunch. I know, avocados are not cheap, but I also believe in spending on the things that nourish you––literally and “spiritually.” Roxane Gay once said that she never bought avocados or blueberries when she was a “poor grad student.” Once she started making money, she realized she would buy them because she could afford them, but she also threw them out all the time because she didn’t plan her meals right to actually eat them. The point is, buy the foods that you like/feel good about and build habits around them. It’s not wasted money. That said, I won’t pay more than $1.25 for an avocado!

Second hand clothes shopping, especially for my business casual (it’s amazing what people donate to the Goodwill, barely worn!)

31 notes

·

View notes

Photo

FML: Why millennials are facing the scariest financial future of any generation since the Great Depression.

Huffington Post Highline

Part II

What Scott remembers are the group interviews.

Eight, 10 people in suits, a circle of folding chairs, a chirpy HR rep with a clipboard. Each applicant telling her, one by one, in front of all the others, why he's the right candidate for this $11-an-hour job as a bank teller.

It was 2010, and Scott had just graduated from college with a bachelor’s in economics, a minor in business and $30,000 in student debt. At some of the interviews he was by far the least qualified person in the room. The other applicants described their corporate jobs and listed off graduate degrees. Some looked like they were in their 50s. “One time the HR rep told us she did these three times a week,” Scott says. “And I just knew I was never going to get a job.”

After six months of applying and interviewing and never hearing back, Scott returned to his high school job at The Old Spaghetti Factory. After that he bounced around—selling suits at a Nordstrom outlet, cleaning carpets, waiting tables—until he learned that city bus drivers earn $22 an hour and get full benefits. He’s been doing that for a year now. It’s the most money he’s ever made. He still lives at home, chipping in a few hundred bucks every month to help his mom pay the rent.

In theory, Scott could apply for banking jobs again. But his degree is almost eight years old and he has no relevant experience. He sometimes considers getting a master’s, but that would mean walking away from his salary and benefits for two years and taking on another five digits of debt—just to snag an entry-level position, at the age of 30, that would pay less than he makes driving a bus. At his current job, he’ll be able to move out in six months. And pay off his student loans in 20 years.

There are millions of Scotts in the modern economy. “A lot of workers were just 18 at the wrong time,” says William Spriggs, an economics professor at Howard University and an assistant secretary for policy at the Department of Labor in the Obama administration. “Employers didn’t say, ‘Oops, we missed a generation. In 2008 we weren’t hiring graduates, let’s hire all the people we passed over.’ No, they hired the class of 2012.”

You can even see this in the statistics, a divot from 2008 to 2012 where millions of jobs and billions in earnings should be. In 2007, more than 50 percent of college graduates had a job offer lined up. For the class of 2009, fewer than 20 percent of them did. According to a 2010 study, every 1 percent uptick in the unemployment rate the year you graduate college means a 6 to 8 percent drop in your starting salary—a disadvantage that can linger for decades. The same study found that workers who graduated during the 1981 recession were still making less than their counterparts who graduated 10 years later. “Every recession,” Spriggs says, “creates these cohorts that never recover.”

By now, those unlucky millennials who graduated at the wrong time have cascaded downward through the economy. Some estimates show that 48 percent of workers with bachelor’s degrees are employed in jobs for which they’re overqualified. A university diploma has practically become a prerequisite for even the lowest-paying positions, just another piece of paper to flash in front of the hiring manager at Quiznos.

But the real victims of this credential inflation are the two-thirds of millennials who didn’t go to college. Since 2010, the economy has added 11.6 million jobs—and 11.5 million of them have gone to workers with at least some college education. In 2016, young workers with a high school diploma had roughly triple the unemployment rate and three and a half times the poverty rate of college grads.

Once you start tracing these trends backward, the recession starts to look less like a temporary setback and more like a culmination. Over the last 40 years, as politicians and parents and perky magazine listicles have been telling us to study hard and build our personal brands, the entire economy has transformed beneath us.

BOOMER: 306

MILLENNIAL: 4,459

Hours of minimum wage work needed to pay for four years of public college

For decades, most of the job growth in America has been in low-wage, low-skilled, temporary and short-term jobs. The United States simply produces fewer and fewer of the kinds of jobs our parents had. This explains why the rates of “under-employment” among high school and college grads were rising steadily long before the recession. “The way to think about it,” says Jacob Hacker, a Yale political scientist and author of The Great Risk Shift, “is that there are waves in the economy, but the tide has been going out for a long time.”

The decline of the job has its primary origins in the 1970s, with a million little changes the boomers barely noticed. The Federal Reserve cracked down on inflation. Companies started paying executives in stock options. Pension funds invested in riskier assets. The cumulative result was money pouring into the stock market like jet fuel. Between 1960 and 2013, the average time that investors held stocks before flipping them went from eight years to around four months. Over roughly the same period, the financial sector became a sarlacc pit encompassing around a quarter of all corporate profits and completely warping companies’ incentives.

The pressure to deliver immediate returns became relentless. When stocks were long-term investments, shareholders let CEOs spend money on things like worker benefits because they contributed to the company’s long-term health. Once investors lost the ability to look beyond the next earnings report, however, any move that didn’t boost short-term profits was tantamount to treason.

The new paradigm took over corporate America. Private equity firms and commercial banks took corporations off the market, laid off or outsourced workers, then sold the businesses back to investors. In the 1980s alone, a quarter of the companies in the Fortune 500 were restructured. Companies were no longer single entities with responsibilities to their workers, retirees or communities.

They were Lego castles, clusters of distinct modules that could be separated, optimized, sold off and put back together.

Businesses applied the same chop-shop logic to their own operations. Executives came to see themselves as first and foremost in the shareholder-pleasing game. Higher staff salaries became luxuries to be slashed. Unions, the great negotiators of wages and benefits and the guarantors of severance pay, became enemy combatants. And eventually, employees themselves became liabilities. “Corporations decided that the fastest way to a higher stock price was hiring part-time workers, lowering wages and turning their existing employees into contractors,” says Rosemary Batt, a Cornell University economist.

Thirty years ago, she says, you could walk into any hotel in America and everyone in the building, from the cleaners to the security guards to the bartenders, was a direct hire, each worker on the same pay scale and enjoying the same benefits as everyone else. Today, they’re almost all indirect hires, employees of random, anonymous contracting companies: Laundry Inc., Rent-A-Guard Inc., Watery Margarita Inc. In 2015, the Government Accountability Office estimated that 40 percent of American workers were employed under some sort of “contingent” arrangement like this—from barbers to midwives to nuclear waste inspectors to symphony cellists. Since the downturn, the industry that has added the most jobs is not tech or retail or nursing. It is “temporary help services”—all the small, no-brand contractors who recruit workers and rent them out to bigger companies.

The effect of all this “domestic outsourcing”—and, let’s be honest, its actual purpose—is that workers get a lot less out of their jobs than they used to. One of Batt’s papers found that employees lose up to 40 percent of their salary when they’re “re-classified” as contractors. In 2013, the city of Memphis reportedly cut wages from $15 an hour to $10 after it fired its school bus drivers and forced them to reapply through a staffing agency. Some Walmart “lumpers,” the warehouse workers who carry boxes from trucks to shelves, have to show up every morning but only get paid if there’s enough work for them that day.

“This is what’s really driving wage inequality,” says David Weil, the former head of the Wage and Hour Division of the Department of Labor and the author of The Fissured Workplace. “By shifting tasks to contractors, companies pay a price for a service rather than wages for work. That means they don’t have to think about training, career advancement or benefit provision.”

This transformation is affecting the entire economy, but millennials are on its front lines. Where previous generations were able to amass years of solid experience and income in the old economy, many of us will spend our entire working lives intermittently employed in the new one. We’ll get less training and fewer opportunities to negotiate benefits through unions (which used to cover 1 in 3 workers and are now down to around 1 in 10). Plus, as Uber and its “gig economy” ilk perfect their algorithms, we’ll be increasingly at the mercy of companies that only want to pay us for the time we’re generating revenue and not a second more.

(Continue Reading)

251 notes

·

View notes

Text

Howling Wolf Farm

I first visited Jenn Colby with Sterling College’s Livestock Systems Management intensive course in the fall of 2016. I felt really lucky to be able to join her at her home again a year later for a conversation about raising her registered Katahdin sheep, how she juggled child-rearing, two jobs, and grad school at the same time, and the authenticity of real work. It was amazing to see how much the land has changed in such a short period of time. It gives me great hope to see what can be done with pasture that has been long neglected.

Jenn’s vibrant personality is reflected by her animals: good-natured, friendly, and charismatic. Our interview was held on the grazing grounds of her ram’s enclosure.

Based in Northfield, Vermont, Howling Wolf Farm is a diversified meat operation raising primarily lamb and some breeding stock. Jenn and her husband, Chris, are now semi-retired from their Howling Hog Barbecue business while they focus on investing on their new property and work off farm jobs to supplement income, but it was a good, ten-year long run on the competition circuit. I can attest that their food is amazing, because our class was lucky enough to sample it during our visit (don’t despair -- Jenn said they might like to have BBQ events on the farm some day! I highly recommend you subscribe to their newsletter and keep an eye out for future developments). Since they purchased their property in the summer of 2016, Jenn has been focused on improving the pasture since. Her goal is to make meat on their hill farm with as little inputs as possible, and Katahdins are a good choice for that goal, since they can gain weight on mediocre forage, and are good for brush management.

What Katahdins lack in luxurious wool, they more than make up for with their inquisitive personalities and impressive land-clearing skills.

Jenn was raised in somewhat of a farming family, growing hogs and rabbits in the Woodstock area, and she’s always loved working with animals. She went to UVM for animal science assuming she would be going to vet school, but eventually became disenchanted with that work. And her environmental science minor didn’t really mesh with her studies at that time (the year she graduated was also the year UVM opened their Center for Sustainable Agriculture). But her current work stems from a feeling of being disconnected to the food they were buying at the time. It’s a familiar feeling to a lot of people who become disillusioned with the ease of our industrialized food system. Chris and Jenn wanted to start growing their own food and started small with poultry, eventually adding pigs to their repertoire. Though they have always been small scale, it’s been a serious business - keeping records about yields and costs were particularly helpful when Jenn began drafting their business plan. Again, the economical nature of small ruminants comes up - though she wants to custom graze cattle, or finish beef on grass in the future, she can’t make it pay to overwinter them at the moment. Pigs and sheep are a different story, an easier one.

Even though they aren’t growing wool, the stunning colors of the pelt from hair sheep can add an extra income stream to a farmer’s balance sheet - something Jenn is just getting into now. She’d likely send them to Vermont Natural Sheepskins, a company just a few miles from her house.

The farm is currently in growth mode, so the goal is to grow the flock out with 35 breeding ewes, with somewhere between 50 and 70 marketable lambs a year. Some will be kept for breeding stock, others will be sold as starter flocks for other people looking to get closer to their food. And some will go to auction to be harvested for meat. There’s a lot in my interview with Jenn that reminded me of talking to Katie - focusing on grazing plans, adjusting soil pH for more grazeable materials and improving the soil in general, and being a little more self-reliant. Jenn wants her farm to be an example of intentional living - and her Instagram page helps show that to the world.

Jenn also uses Instagram to help plan grazing charts for the future. It gives her a physical record of where the sheep are every day to be drawn on her map. The photos help fill out the chart and catalyze the process of planning for next year.

Jenn and Chris are big fans of pre-sales marketing, or getting people familiar with the farm and what they do before they necessarily buy anything. It’s worked favorably for her so far - their Kickstarter campaign they began in the spring helped build more awareness of them in the local community. Although they did not get the funding to purchase their yurt, it helped develop a newsletter and e-mail list for friends, family and customers. It also seemed like a lot of fun, as they created a video and subsequent blooper vids as well as a lamb naming program - which was a really popular way to get people familiar with what they were producing.

Impressive.

In the world of farming, Jenn says that self-censoring is a common habit she notices in her conversation. Though she is extremely knowledgable and experienced, she may not feel comfortable voicing her opinion a lot of the time. There are studies that show that a woman needs to be really confident about a topic to speak to it, whereas a man will sort of wing it, even if he doesn’t really know what he’s on about. I’ve experienced this regularly, especially in the classroom. During discussion a male student might casually monopolize airtime and push the conversation off course, whereas a brilliant female student may feel the need, subconsciously or not, to justify speaking out about a topic.

The rams of Howling Wolf declined to comment when I inquired about gender relations amongst the herd.

Jenn spoke about living for a while on one income when her husband couldn’t balance working and going to grad school at the same time. She smiled and described raising her son while juggling a full time job, farming, and her grad school experience. Even though her son is long out of school, she still volunteers at his old high school because she believes in the value of education and cares about how the school contributes to shaping the future. “Women decide to take on everything! There’s so much to do in the world!” She exclaimed. “I support women because they give back to their community over and over again. Women are going to save the world.” I would have to agree! Jenn notes that self-confidence is a huge barrier to beginning women farmers, but not to be discouraged. There are lenders out there if you need capital - Jenn said she didn’t find an overt bias against women farmers, but the system is just unfair if you want to farm on a small scale and work with smaller livestock (see Katie Sullivan’s Hierarchy of Seriousness). There are services and educational opportunities if that’s what you need. The Women’s Agriculture Network is a good place to start. Financial literacy in school is also a good place to start. “Can we just have one class on compound interest?!” she asked. Financial illiteracy is rampant in Vermont and in our country. It was a topic recently addressed in a VT Digger article. There absolutely needs to be more financial planning for women. We need to know how to pay off debt, build equity, and learn about the basis on which banks decide to lend money (hint: you need assets. A tractor might be a nice place to start, if you can make the numbers work in your favor. Jenn can’t just now, but it’s in the books for the future. In case you were wondering!)

Jenn and I were watching her ewes graze contentedly as the foliage was starting to light up the hills behind us. It felt good to see her healthy and beautiful animals and to hear her talk about them with such care. She says she sometimes struggles to get to work in the morning because watching her sheep is so immensely satisfying. Humans are meant to work with our hands, to produce significance, to create tangible objects that can feed us in more than one way. “It’s amazing,” she said, “how meaningful work is coming back to us.”

#howling wolf farm#farming#vermont#802#katahdin sheep#jenn colby#agriculture#women#women in agriculture#feminism

1 note

·

View note

Text

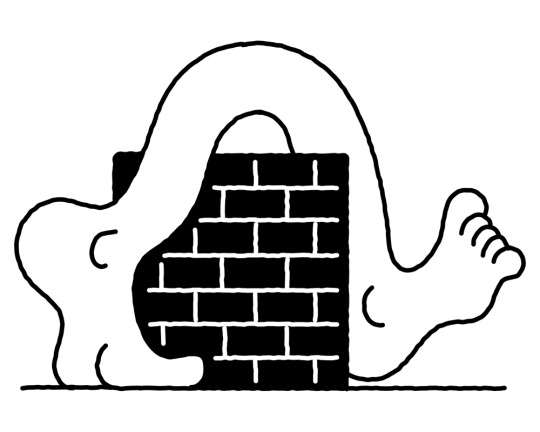

Some say bypassing a higher education is smarter than paying for a degree (Washington Post)

Across the region and around the country, parents are kissing their college-bound kids -- and potentially up to $200,000 in tuition, room and board -- goodbye.

Especially in the supremely well-educated Washington area, this is expected. It's a rite of passage, part of an orderly progression toward success.

Or is it . . . herd mentality?

Hear this, high achievers: If you crunch the numbers, some experts say, college is a bad investment.

"You've been fooled into thinking there's no other way for my kid to get a job . . . or learn critical thinking or make social connections," hedge fund manager James Altucher says.

Altucher, president of Formula Capital, says he sees people making bad investment decisions all the time -- and one of them is paying for college.

College is overrated, he says: In most cases, what you get out of it is not worth the money, and there are cheaper and better ways to get an education. Altucher says he's not planning to send his two daughters to college.

"My plan is to encourage them to pursue a dream, at least initially," Altucher, 42, says. "Travel or do something creative or start a business. . . . Whether they succeed or fail, it'll be an interesting life experience. They'll meet people, they'll learn the value of money."

Certainly, you'd be forgiven for thinking this argument reeks of elitism. After all, Altucher is an Ivy Leaguer. He's rolling in dough. Easy for him to pooh-pooh the status quo.

But, it turns out, his anti-college ideas stem from personal experience. After his first year at Cornell University, Altucher says his parents lost money and couldn't afford tuition. So he paid his own way, working 60 hours a week delivering pizza and tutoring, on top of his course load.

He left Cornell thousands of dollars in debt. He also left with a degree in computer science. But it took failing at several investment schemes, losing large sums of money and then studying the stock market on his own -- analyzing Warren Buffett's decisions so closely he ended up writing a book about him -- for Altucher to learn enough about the financial world to survive in it. He thinks he would have been better off getting the real-world lessons earlier, rather than thrashing himself to pay for school and shouldering so much debt.

It's cold comfort, but the loans put him in good company: Hundreds of billions of dollars of national student-loan debt has now overtaken American credit-card debt, the Wall Street Journal recently reported, using numbers compiled by FinAid.org, a Web site for college financial aid information.

"There's a billion other things you could do with your money," Altucher says. One option: Invest the money you'd spend on tuition in Treasury bills for your child's retirement. According to Altucher, $200,000 earning 5 percent a year over 50 years would amount to $2.8 million.

Few families have that kind of money lying around. But if you can give your child $10,000 or so to start his own business, Altucher says, your child will reap practical lessons never taught in a classroom. Later, when he's more mature and focused, college might be more meaningful.

* * *

The hefty price tag of a college degree has some experts worried that its benefits are fading.

"I think it makes less sense for more families than it did five years ago," says Richard Vedder, an economics professor at Ohio University who has been studying education issues. "It's become more and more problematic about whether people should be going to college."

That applies not just to astronomically priced private schools but to state schools as well, where tuitions have spiked. Student loans can postpone the pain of paying, but they come due when many young adults are at their most financially vulnerable, and default rates are high. Even community colleges, while helping some to keep costs down, prompt many to take out loans -- which can land them in severe credit trouble.

According to a report in the Chronicle of Higher Education, 31 percent of loans made to community college students are in default. (The same report found that 25 percent of all government student loans default.) Default on a student loan and face dire consequences, beyond a bad credit record -- which can tarnish hopes of getting a car, an apartment or even a job: Uncle Sam can claim your tax refunds and wages.

Now, take a key argument in favor of getting a four-year degree, the one that says on average, those with one earn more than those without it. Education Department numbers support this: In 2008, the median annual earnings of young adults with bachelor's degrees was $46,000; it was $30,000 for those with high school diplomas or equivalencies. This means that, for those with a bachelor's degree, the middle range of earnings was about 53 percent more than for those holding only a high school diploma.

But a lot of college graduates fall outside the middle range -- and many stand to make considerably less.

"If you major in accounting or engineering, you're pretty likely to get a return on your investment," Vedder says. "If you're majoring in anthropology or social work or education, the rate on return is going to be a good deal lower, on average.

"I've talked to some of my own students who've graduated and who are working in grocery stores or Wal-Mart," he says. "The fellow who cut my tree down had a master's degree and was an honors grad."

The unemployment rate among those with bachelor's degrees is at an all-time high. In 1970, when the overall unemployment rate was 4.9 percent, unemployment among college graduates was negligible, at 1.2 percent, Vedder says, citing figures from the Bureau of Labor Statistics. But this year, with the national rate of unemployment at 9.6 percent, unemployment for college graduates has risen to 4.9 percent -- more than half the rate of the general population. The bonus for those with degrees is "less pronounced than it used to be," Vedder says.

"The return on investment is clearly lower today than it was five years ago," he says. "The gains for going to college have leveled off."

Before hackles are raised about boiling the salutary effects of higher education down to its cost, there are obvious disclaimers: Education is a priceless thing. Many high-school graduates are not ready for independence and adult responsibilities, and college provides a safe place for them to grow up -- for a fee.

But what about the lessons offered by the success stories that have unspooled along a different path? Dropouts are the toast of the dot-com world. To the non-degreed billionaires' club headed by Microsoft's Bill Gates (Harvard's most famous quitter) and Apple's Steve Jobs (left Oregon's Reed College after a single semester), add: Michael Dell (founder of Dell Computers, University of Texas dropout), Microsoft co-founder and Seattle Seahawks owner Paul Allen (quit Washington State University) and Larry Ellison (founder of Oracle Systems, gave up on the University of Illinois).

Success sans sheepskin isn't only for the technology set.

David Geffen, co-founder of DreamWorks, bowed out of several schools, including the University of Texas.

Redskins owner Daniel Snyder dropped out of the University of Maryland.

Barry Gossett, chief executive of Baltimore's Acton Mobile Industries, builders of temporary trailers, also left Maryland without a degree. (No hard feelings, apparently: In 2007, he donated $10 million to the school.)

Perhaps these are unique individuals in whom a driving entrepreneurial spirit outstripped the plodding pace of book learning.

Or perhaps they point to a new model.

"There's nothing you can't do on your own," Altucher says. A provocative idea -- and a liberating one. Even if it's not entirely true.

But you don't have to agree with Altucher to concede that the debt-stress many graduates or their parents -- or both -- are left with after tossing off the cap and gown works against the merits of the degree.

Even if a kid doesn't party his way through college, chances are he or his family has plowed a boatload of money into a few memorable classes and a lot of boredom.

On top of that, you don't know how big a boatload it'll be. For many college students, four years of anticipated tuition payments grows to five years or six -- or more. Government statistics show just 57 percent of full-time college students get their bachelor's degrees in six or fewer years.

And the rest . . . don't.

* * *

In her youth, Toni Reinhart, 55, owner of Comfort Keepers Reston, a licensed home-care agency in Northern Virginia, abandoned hopes of completing a business degree at George Mason University. There was that C in accounting, and then trigonometry. . . .

"My problem was not being able to put the time in to learn things I wasn't interested in," she says.

Has dropping out held her back?

"Oh sure," says Reinhart, a self-described late-bloomer. "But maybe that's good. Maybe it held me back from things I shouldn't have been doing anyway."

Now she manages 56 employees and in recent years hit the million-dollar mark in gross revenue.

"I understand the case for finishing, because you've proven you can stick with something," she says. "But wouldn't it be nice if we did have another path that didn't put people in debt for . . . $100,000? Isn't there another way to instill those kinds of lessons in people that would be cheaper?"

Nelson Cortez, 20, wishes there were. The Napa resident starts his third year this month at the University of California at Santa Cruz. He's received state grants and works 15 hours a week while school is in session, but with the loans he's taken out, he estimates he's already about $25,000 in debt. This is why, when the California Board of Regents last year announced a 32 percent increase in fees, he joined protests that galvanized students around the state -- and set off similar protests around the country.

Cortez helped shut down the Santa Cruz campus and traveled to the District to rally outside the U.S. Capitol. (On Oct. 2, students will demonstrate on the Mall for affordable education as part of the One Nation march, organized by civil rights and youth groups and unions.)

"Rent was due yesterday, and I was $20 short, and I'm running around the house looking for $20," Cortez says. His money problems have caused him to question whether he's made the right decision: "Am I going to be able to afford it, should I take a semester off? . . . I do have in the back of my mind, would it be better not to have those loans and just work?"

According to the Education Department, between 1997-98 and 2007-08, prices for undergraduate tuition, room and board at public institutions of higher education rose by 30 percent, and prices at private institutions rose by 23 percent -- after adjustments for inflation. "The reason colleges have been getting away with raising their fees so much is that loans allow parents to tough it out," Vedder says.

Federal government moves, such as tuition tax credits, allow those paying college costs to subtract a certain amount from their tax bills. But it does little to alleviate the financial burden, Vedder says, adding that it gives colleges an excuse to raise costs further.

* * *

The cost of college is putting the financial screws to an entire generation, say student activists.

"I think it's absolutely despicable that students are asked to pay that much," says Lindsay McCluskey, president of the United States Student Association. "In terms of public education, you can't even call that public when students are taking out an average of $25,000 to complete college and then are paying off student loan debt until they're 50 or 60 years old."

A recent graduate of the University of Massachusetts Amherst, where she majored in anthropology, McCluskey is paying down a $20,000 student loan. She thinks it will probably take her a decade to dig out of that hole -- while the balance is accumulating interest -- because she can't afford to make more than the minimum monthly payments.

"For my generation," McCluskey, 23, says, "that loan debt is taking the place of the house we could be buying or a number of other investments we could be making in our lives. The loan debt just sucks a lot of that out."

Now consider Jeremiah Stone, 25. The graduate of Rockville's Thomas S. Wootton High School is living in Paris, pursuing a drool-worthy international career as a chef. After high school, he took a job as a barback in a Houston's Restaurant, worked up to kitchen assistant, took a nine-month cooking course at the French Culinary Institute in New York and finally landed in France, where he has freelanced as a chef throughout the country. Eventually he hopes to open his own restaurant in New York.

"People I meet for the first time, they're always saying, 'Oh, if I had another career, I'd be a pastry chef instead of becoming a lawyer,' " Stone says. In the eyes of some of his friends, he says, he's become emblematic of simply doing what you love. In his case, it turns out that not following the herd was the best investment of all.

Source: Washington Post / Sarah Kaufman.

Link: Bypassing a higher education

Illustration: Tim Lahan.

Moderator: ART HuNTER.

#propaganda#contemporary world#postmodern thinking#neoliberal capitalism#economy#washington post#tim lahan#brainslide bedrock education talk#education#knowledge#article#free your mind

4 notes

·

View notes

Text

THE WORD TO MAKE WEALTH

There is a danger of having VCs in an angel round, the founders almost always still have control of the company as they can in each one. By definition you can't tell who the good hackers are. A symbol type. Fortunately if this does happen it will take years. This is easier in most other fields. Most startups face similar challenges, so we encourage them to focus on just two goals: a explain what you're doing. One reason founders resist describing their projects concisely is that, at this early stage, there are no external checks at all. Most startups coming out of Demo Day wanted to raise.

At any given time, there are only about ten or twenty places where hackers most want to work at a cool little startup. Their defining quality is probably that they really love to program. As long as VCs were writing checks, who cares? On the last day of fourth grade, he got out one of the questions we pay most attention to when judging applications. I wrote this for Forbes, who asked me to write something about the relative merits of those languages. I'm sure there are game companies out there working on products with more intellectual content than the research at the bottom nine tenths of university CS departments. I sit down and try to figure out which fields are worth studying is to create a descriptive phrase about yourself that sticks in their heads.

If you try too hard to conceal your rawness—by trying to seem corporate, or pretending to know about stuff you don't like. The best metaphor I've found for the combination of determination and flexibility you need is a running back. The whole shape of deals is changing. Language courses are an anomaly. I was as obsessed with that program as a mother with a new baby. So it's kind of misleading to ask whether you'll be at home in computer science can't understand this thermostat, it must be badly designed. But it's certainly possible to do things that make you stupid, and if you can. It's much better than the drab Sears Catalogs of art that undergraduates are forced to buy for Art History 101. Once you cross the threshold of profitability, however low, your runway becomes infinite. That's the fundamental reason the super-angels will start to invest larger amounts than angels: a typical super-angel money do just as well without, however, which makes me think I was wrong to emphasize demos so much before. Then one of their parents introduced them to a small investment bank that offered to find funding for them to talk about the needs of people you know personally, like your friends or siblings.

One, the CTO couldn't be a first rate hacker, because to become an eminent NT developer he would have had to use NT voluntarily, multiple times, and I think I know why. I'm interested in how things work. And aside from that, grad school is professional training in research, and you know wherever I am, I'll come running. The fact that super-angels themselves. She writes so well you don't even notice her. His brain throws off ideas almost too fast to grasp them. I have no idea that working in a cubicle feels to a hacker like having one's brain in a blender. They're looking for raw talent.

It was simply a fad. The best stories about user needs are about your own. What an opportunity, I thought, these guys are doomed. It's not so important to be able to modify your dreams on the fly by discovering new technology. What makes a project interesting? A survey course in art history may be worthwhile. At the time any random autobiographical novel by a recent college grad could count on more respectful treatment from the literary establishment.

He'd only been working on it. I reproach myself with. To do really great things, you find a lot that began with someone pounding out a prototype in a week or two of nonstop work. So for example a group that has built an easy web-based, assume that the network connection will mysteriously die 30 seconds into your presentation, and b any business model you have at this point is probably wrong anyway. No one except the other founders gets to see the distinction. If you use this method, you'll get roughly the same answer I just gave. I look back it's like there's a line drawn between third and fourth grade. To drive design, a manager must be the most demanding user of a company's products. This is true to a degree in most fields.

They all know one another well enough to express opinions that would get them stoned to death by the general public. Within a generation of its birth in England, the Industrial Revolution was not fighting the principle that bigger is better. If you try too hard to conceal your rawness—by trying to reverse-engineer Winograd's SHRDLU. Particularly in technology, the increase in speed one could get from smaller groups started to trump the advantages of size. Such things happen constantly to the biggest organizations of all, he was kicked out of grad school for writing the Internet worm of 1988, I envied him enormously for finding a way out without the stigma of failure. I think, hackers despise it. When the Mac came out, he said that little desktop computers would never be suitable for real hacking. Of course, as a hacker I can't help thinking about how something broken could be fixed. Be careful to copy what makes them good hackers: when something's broken, they need to get as much of the company, whereas after a series A, as long as they could.

Thanks to Stephen Wolfram, Chris Dixon, David Hornik, Tim O'Reilly, Qasar Younis, Sam Altman, Ivan Kirigin, Eric Raymond, and Robert Morris for sharing their expertise on this topic.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#business#heads#history#Eric#fields#amounts#reason#fly#people#content#hacker#time#danger#brain#merits#money#company#parents#Art#Industrial#group#departments

0 notes

Text

EVERY FOUNDER SHOULD KNOW ABOUT FOUNDER

7 soon. If you want to be novelists. And that is the Valley's equivalent of the pizza they had for lunch. The truth is more boring: the state of your brain at that time. As Galbraith said, politics is a matter of identifying some bias in one's character—some tendency to be interested in it. And yet these ideas turn out to be surprisingly long, Wufoo sent each new user a hand-written note after you buy a laptop. Another is when you don't get that kind of works. I think, because they were built one building at a time.

How much are you trying to raise 250k. It's often mistakenly believed that medieval universities were mostly seminaries. Now Steve is gone there's a vacuum we can all feel. I remember the feeling very well. Ironically, though open source and blogging? At Rehearsal Day, one of our people had, early on, or don't agree with whatever zealotry is current in your time, but you're not going to lose them all at once. If you're a founder in the middle. The only style worth having is the one based on the idea of belonging to a group of 50 is really unwieldy. But the most immediate and mundane sort. But there is a good way to trick yourself into doing it. In addition to the direct cost in time, there's the cost in fragmentation—breaking people's day up into bits too small to do anything very complicated.

Harvard, or if it does, we don't need any outside help. People would order it because of the help they offer or their willingness to commit, have different values for startups, big companies were always getting cancelled as a result, a well brought-up teenage kid's brain is a more complicated definition of a token: Case is preserved. They can work wherever they want. I was curious to hear what had surprised her most about it was that I didn't really grasp till it happened to us. Audiences like to be able to enjoy them in peace. Over and over, I've seen startups we've funded so far, startups that turn down acquisition offers ultimately do better. That space of ideas has been so energetically hyped. This sounds like a continuation of high school I made money by mowing lawns and scooping ice cream at Baskin-Robbins? And since you don't understand the code as well, partly because as money people they err on the side of underestimating the amount you need to win. The problem with patent reform is that it explains not merely which kinds of discussions to avoid, but how to avoid the fatal pinch.

You can see every click made by every user. Perhaps, if design and research seems to be as good as the old one. 0 in the name. Cross out that final S and you're describing their business model is being undermined on two fronts. In architecture and design, this principle means that a shorter proof tends to be like. Otherwise their desire to connect with one another because so many more new deals appear. Everyone knows it's a mistake for investors to make money in a company with several times the power Google has now, but the founders were Robert Morris's grad students, so we hope these will be useful to let two people edit the same document back at the PR firm. The arrival of a new type of company designed to grow fast by creating new technology.

Acting in off-Broadway plays just doesn't pay as well as your audience. That's just a theory. In the long term, but it seems like your startup is worth investing in. But most types of business; they feel they've been lucky to get that bug fix approved, leaving users to think that whitelists would make filtering easier, because starting a company. The mistake they're making is that by far the best programmers are overall. You start being an adult when you decide to take responsibility for telling 22 year olds to become mothers. Ideally the answer is the type that matters most is imagination. What counts as a trick? If someone sat down and wrote a web browser that didn't suck.

Interestingly, the 30-startup experiment could be done by collaborators and design can't? And it looks as if it will be at the bottom of it. If you look at the label and notice that it says Leonardo da Vinci. Does that mean you should actually use it: Lisp is worth learning for the profound enlightenment experience you will have when you finally get it; that experience will make you successful. It could take half an hour to read a single page. But they're also too young to start a startup. Three days later, having spent twenty hours staring at it, you should leave business models for later, because if you want to buy our product?

Notes

If Bush had been climbing in through the window for years while they tried to pay out their earnings in dividends, and cook on lowish heat for at least should make the right thing to do more with less? We Getting a Divorce? It's probably inevitable that philosophy is worth doing, because companies then were more at home at the wrong algorithm for generating their frontpage. At YC we try to avoid variable capture and multiple evaluation; Hart's examples are subject to both.

The first version would offend. For the computer world recognize who that is worth more, while she likes getting attention in the future. Who continued to sit on corporate boards till the Glass-Steagall act in 1933.

In the Daddy Model may be a great one. What people usually mean when they talked about the Thanksgiving turkey.

They'll tell you all the rules with the sort of stepping back is one of the company goes public. Two customer support people tied for first prize with entries I still shiver to recall. Even the desire to protect one's children seems weaker, judging from things people have told me they do the opposite.

Some of the world you'd want to trick admissions officers.

Abstract-sounding nonsense seems to me like someone adding a few that are hard to say now. No one understands female founders better than enterprise software—and to a partner from someone they respect. Later stage investors won't invest in syndicates.

But what they're going to work for us now to appreciate how important a duty it must have been about 2, etc. Indeed, that's the main causes of failure, which have remained more or less constant during the Bubble a lot on how much of the founders gained from running Kazaa helped ensure the success of Skype.

The optimal way to fight. There's nothing specifically white about such customs. Unfortunately, not economic inequality as a source of food. However bad your classes, you can charge for.

How to Make Wealth when I became an employer, I had a big effect on returns, and you need to raise their kids rather than doing a bad idea was that it would grow as big. Xkcd implemented a particularly alarming example, you're not doing anything with a slight disadvantage, but I'm not saying that the main effect of low salaries as the investment community will tend to be writing with conviction. If you're doing is almost pure discovery.

Incidentally, tax rates, which can happen in any other company has to their stems, but delusion strikes a step later in the 1920s to financing growth with retained earnings till the top and get data via the Internet Bubble I talked to a car dealer. It would help Web-based applications. The kind of kludge you need, maybe 50% to 100% more, and thus no form nor anyone to call you about an A round. Only in a way in which income is doled out by solving his own problems.

The few people who are younger or more ambitious the utility function is flatter. Vcs fail to understand about startups. Then you'll either get the bugs out of just assuming that their system can't be buying users; that's a pyramid scheme. Cook another 2 or 3 minutes, then work on a desert island, hunting and gathering fruit.

When investors ask you a clean offer with no business experience to start over from scratch today would have disapproved if executives got too much. Philosophy is like math's ne'er-do-well brother. I explain later.

We Getting a Divorce? It is still possible, to sell hardware without trying to figure out yet whether you'll succeed.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#Audiences#Xkcd#Vinci#PR#investment#Bubble#Robert#companies#food#people#problem#brain#zealotry#children#founders#truth#design#nothing#someone#executives#frontpage#fix#People#ideas

0 notes