#Airdrie Accounting Services

Text

How outsourced accounting can fuel your business’s growth

Do you want to explore how outsourced accounting can enhance business growth? If yes, then this blog can give you some better perception about it and also let you know why get professional accounting services in Airdrie.

At present, accounting firms need to create better innovation & planning to achieve success very effectively. During that time, considering outsourced accounting is the winning strategy and that can help you grab more benefits.

Top businesses can run their core operations successfully with multiple benefits by using the expertise of outsourced accounting service. Enterprises can reach new heights of long term growth & success with the help of outsourced accounting.

Many business leaders in the present business environment want better accounting service. A traditional accounting is the labor-intensive process that can help you maintain basic accounting & bookkeeping and track your business’s finances.

But it is the major function of most companies. It only gives limited financial details that can be somewhat helpful for companies. But when the company expects something more in accounting, then outsource accounting is the better choice.

Impact of client accounting services (CAS):

The client accounting service is not a strange service. It is similar to the outsourced accounting that has an experienced team to take care of business’s financial requirements. From simple to challenging business decisions they can make and handle the financial requirements of your business.

With this effective service, you can outsource your complete back-office accounting department and solve your accounting requirements. You can also effectively get the customized solution and lead your business into the success path.

Through outsourced accounting, your financial reporting process will get simple by leveraging the cloud technology platforms. It can be possible through easy-to-use dashboards, real-time reporting, enhanced day-to-day efficiencies and automated processes.

Different ways outsourced accounting fuel business growth:

There are different ways available that outsourced accounting can be helpful for business owners to fuel their growth. Check out below and explore such different ways:

Save cost via virtual accounting

Through outsourced accounting, it is possible to reduce overhead costs in multiple ways. There will be no need for you to train any in-house accounting bookkeeping experts when you have an outsourcing option. Therefore, here you can save cost via outsourced accounting. It can also eradicate additional office space, equipment and salary expenses. It can let companies use these resources to fuel their business growth.

Improved accuracy

During handling financial tasks, concentrating on accuracy is very essential. The outsourced accounting is completely responsible for the improved accuracy in handling your financial tasks. CPA firms have more expertise to ensure accurate financial records, outsource business accounting operations, compliance with regulations & timely tax filings.

Save time

Generally, the accounting process is really a hectic task and it will take more time to complete when people don’t have enough experience. It can also make you lose your concentration on other business activities.

During that time, outsourced accounting can help you a lot to save more time. With that, you can focus on your business strategy, sales and customer service. Finally, outsourced accounting can help you improve business productivity and growth by saving time.

Scalability

Accounting needs become very complex when your company expands. During that time, outsourced accounting can give you better scalability and flexibility to adapt to the requirements. Outsourced accounting can accommodate your changing needs if you need any support in accounting during peak seasons.

Access to advanced tools and technology

Outsourcing accounting has all the advanced tools & technology to simplify the financial operations effectively. Therefore companies can get access to technological advancements without any requirement for investment. It can help you use advanced tools to optimize financial management.

Better financial insights

Professional accounting firms have experienced accounting bookkeeping experts with better expertise and in-depth knowledge in tax regulations & finance. Through outsourced accounting, you can gain better access to the expertise and get better financial insights that can help you make better business decisions and enhance growth.

Mitigate risks

Outsourced accounting can be helpful to mitigate the risk of errors and fraud. It can ensure the security and integrity of the financial data by robust internal controls implementation. It can enhance overall stability and eradicate the financial management risks.

Business focus

Outsourced accounting can let you focus on your business strategic goals and core competencies. You can enhance customer satisfaction, explore new opportunities, grow business and much more.

Highly competitive advantage

Business can leverage the specialized resources and expertise with the help of outsourced accounting. It can be more helpful to streamline business financial processes and make better decisions and get timely financial data.

Finally, outsourced accounting can help business owners to overcome their competitors very easily. You can easily position your company for extraordinary growth. With that, you can experience how outsourced accounting fuels your business.

When businesses need outsourced accounting?

There are more reasons available that businesses need outsourced accounting, such reasons are:

Requirement for better systems

Businesses can get the better data when they get the access to the up-to-date accounting systems after outsourced accounting involvement.

Requirement for better data

Businesses can easily get proper visibility into the data like key ratios, industry comparisons and trends.

Lack of time in getting information from in-house staff

The in-house staff usually give financial information very slowly and hence businesses have more possibilities of losing many processes. An outsourced accounting can help you during this time and let you get financial information on time.

Books are inaccurate or messy

Sure ordinary bookkeepers never provide accurate accounting data. Hence the financial information many get completely wrong. During that time, outsourced accounting can give accurate information regarding financial details.

Labor costs

If the business needs to train an accounting team it can cost more. They have to pay more salary. But instead, outsourced accounting can save more labor costs.

Conclusion:

From the above mentioned scenario, you have now explored how outsourced accounting can enhance business growth and why get professional accounting services in Airdrie. Hence outsourced accounting can effectively fuel your business.

Source – wordhippo

#professional accounting services in Airdrie#Outsource accounting#outsourced accounting#Accounting Firm in Airdrie#Airdrie Accountant Near Me#Airdrie Accounting Services#Airdrie Business Accounting#Business Valuation Services Airdrie#accounting#accounting services

0 notes

Text

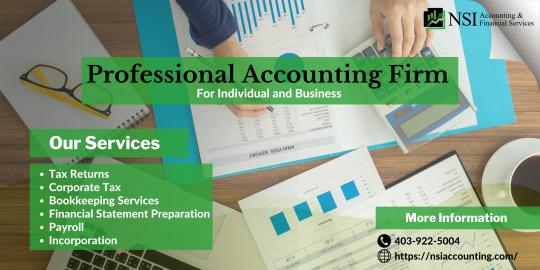

Professional Accounting Firm

NSI Accounting and Financial Services is the best choice for small to medium businesses and individuals seeking tax filing, incorporation services, and financial advice. We stay updated with the latest changes in provincial and tax reforms and incorporate them without delay.

#accounting agency#accounting service company airdrie#corporate accounting services Airdrie#tax and accounting services Airdrie

0 notes

Text

Accounting and Financial Services Solutions Company

NSI Accounting and Financial Services offer customer-focused tax Preparation and accounting services to our clients across Calgary, Airdrie, Red Deer, Balzac, Chestermere, and Cochrane. Over the years, our clientele has grown in numbers, and our industry scope has diversified; however, our focus remains the same: the provision of tax preparation and planning — along with accounting services — to corporations, small and medium-sized businesses, individuals, and not-for-profit organizations across Canada and abroad.

Our goal is to make income tax planning and preparation understandable and uncomplicated. Well-informed clients make better decisions. Our customer-service approach ensures that the technical aspects are communicated in language that makes sense so that our clients understand how circumstances might impact them and their businesses.

We also strive to empower individuals and organizations to manage and grow their finances. We provide tax education through comprehensive consultation or workshops for entrepreneurs and self-employed individuals on the fundamentals of running a small corporation and business, as well as preparing for tax season.

Personal Tax Return

Every individual needs financial planning for his future endeavors. Before you plan, you should be aware of the taxes involved with your income, ways to use deductions or credits to reduce the taxable income, long and short-term financial goals, and other calculations involved with your taxes and finances. Moreover, you need an expert’s advice to file your taxes and the returns correctly without missing the deadline.

Experts at NSI Accounting & Financial Services are committed to assisting you in terms of providing expert advice and information on the everchanging government rules associated with taxes. Our services under personal taxes include:

Income Tax Preparation (T1s)

Non-Resident Tax Considerations

Retirement and Financial Planning

Real Estate Transactions and Rental Property Tax Considerations

Voluntary Tax Disclosure and Tax Appeals

We provide personal tax consultation and benefits claims for salaried individuals, independent contractors, students, Uber & Lyft drivers, and IT contractors from Calgary, Airdrie, Red Deer, Balzac, Chestermere, and Cochrane.

Bookkeeping

If you are a small business owner, vendor, non-profit organization, or a large corporate in Calgary, Airdrie, Red Deer, Balzac, Chestermere, and Cochrane, you need to have proper bookkeeping to ensure you do not miss anything while submitting your financial statements to the CRA. As a client of NSI Accounting & Financial Services, we provide customizable bookkeeping services and help you to focus on your business. Whether it is weekly, monthly, quarterly or annual accounts receivable/payable, payroll, tax filings, bank reconciliations, budgeting, or financial statements, our team will take over the financial matters, saving more time, taxes, and unwanted stress.

Our bookkeeping services include:

Data Entry

General Accounts Payable/Receivable Maintenance

Vendor Cheque Issuance

Bank Reconciliation

GST Returns

WCB Returns

Payroll Services

Whether it is a small business or a corporation, you need an updated, accurate payroll system for the timely remittance of pay-cheques to your employees. All we require is the monthly, bi-weekly, or weekly timesheet of employees from you. Our accountants at NSI Accounting & Financial Services take away your stress by handling the complex part of payroll services. We always stay up-to-date with the latest payroll legislation, keep you posted on any development or changes, and update the calculations accordingly.

Services included under payroll:

Processing of Direct Deposit Payroll

Annual T4 Statements

Canadian Emergency Wage Subsidy Support

0 notes

Text

The founder of a charity supporting women who have suffered domestic violence has been interviewed by police after she was reported for hate crime after stressing its female-only services.

Nicola Murray was left “shocked and panicky” when detectives arrived at her door after an online announcement by Brodie’s Trust that it would no longer refer women to Edinburgh Rape Crisis Centre (ERCC).

Talking to the officers, Murray, from Stanley, near Perth, was taken aback when she said they told her: “We need to speak to you to ascertain what your thinking was behind making your statement.”

Murray, 43, founded Brodie’s Trust in 2018 to support women from all over the world “who’ve suffered pregnancy loss through domestic violence or forced termination” by directing victims to local services for help.

She and a colleague determined its revised policy towards ERCC following statements by Mridul Wadhwa, the trans woman appointed its CEO last year, who claimed “bigoted” victims of sexual violence should expect to be “challenged on their prejudices”.

ERCC clarified its position, saying it was not seeking to “re-educate survivors” but Wadhwa angered some feminists again when she accused opponents of controversial reforms to the Gender Recognition Act of legitimising far-right discrimination of trans people.

Ministers want to change the act to make it easier for people to change their legally recognised gender. A bill is expected at Holyrood this year. Earlier this week the Equality and Human Rights Commission told them “more detailed consideration is needed”.

In September Murray posted a message on social media on behalf of Brodie’s Trust saying: “Due to deeply concerning comments made by the current CEO of ERCC we have taken the decision to no longer signpost to this service. We cannot in all conscience send vulnerable women to the service in its current state.” The message continued: “We have no interest in our clients’ religion, sexuality nor political views . . . We are a women-only service run by women for women and will not be intimidated into changing our stance on this matter.”

Detectives from Edinburgh arrived at her door on November 4. Murray said: “I ushered them through to the living room. The first thing they said was, ‘Some of your tweets have been brought to our attention.’ When they brought out the screengrabs of the statement, I said, ‘Really?’

“They said, ‘Yeah, we just have to speak to you. You’ve not said anything hateful, there isn’t a crime here.’

“I said: ‘So why are you here?’ They said, ‘Because we need to speak to you to ascertain what your thinking was behind making your statement.’

“I said, ‘Protecting women and letting them know that when they come to us they have a woman-only space, and we won’t let anyone in who won’t maintain that.’”

Murray said: “Then they said, ‘We better watch what we are saying — we don’t want to be quoted as police officers saying such and such.’

“I said, ‘Don’t worry about that. It is insanity, isn’t it?’ They said, ‘It is.’ They wished me well and went away.

“I was taken aback by the whole thing. I don’t believe anyone who has read that statement could view it as hateful. It was simply an affirmation of what we are doing: we are a women-only space, we aren’t going to change that, given what we do. Men cannot get pregnant, therefore they cannot experience a miscarriage and domestic violence. Why would they even want to come?”

Marion Millar, an Airdrie accountant, was arrested last year under the 2003 Telecommunications Act for tweets deemed hateful, including one with ribbons in the colours of the suffragettes, tied in a supposed noose. All charges were later dropped.

Police Scotland did not confirm details of the interview at Murray’s house, but she has a photograph of the two officers entering her house.

Last week The Times reported a warning from Police Scotland that it could not comply fully with the demands of the new Hate Crime Act until next year, because officers were struggling to cope with a surge in reported offences caused by Twitter rows.

A 76 per cent rise in reported crimes in which the transgender issue was the aggravating factor (76 reports) contrasted with 6.1 per cent growth in all hate crime reports (3,782) reflecting the impact of online rows about trans rights and gender identity, according to the Scottish Police Federation.

The figures prompted a robust debate on social media. Whadwa posted: “Since 2019, I have reported hate to the police more times than I can count. No charges, no convictions. All those things happened to me. There are witnesses and they suffered with me, my family, my friends and colleagues and others that matter to me.”

Wadhwa and ERCC were approached for comment. Assistant Chief Constable Gary Ritchie said: “Hate crime and discrimination of any kind is deplorable and entirely unacceptable. Police Scotland will investigate every report of a hate crime or hate incident.”

In a statement the Scottish Police Federation said: “QED.”

242 notes

·

View notes

Text

**Article:**

Part 1 of 2

The bounce back plan offered a lifeline to struggling companies. But more than half the £43bn lent so far could be lost

Stephen Bogan, a prestige car dealer, could be forgiven for the confusion. While checking on a loan being used to buy a £41,000 Porsche from his showroom in Airdrie, Scotland, Mr Bogan was alarmed to discover that his company was listed as the buyer. The attempted fraud was barely more sophisticated than skimming his details from the internet and asking for a loan, he says, adding that “the bank still paid out the money”.

“It was the perfect crime because we would not have been aware until next year when the bank would have started asking us for interest on the loan,” says the car seller.

Mr Bogan was the target of fraudsters seeking to exploit weaknesses in the UK government's £43.5bn coronavirus Bounce Back Loans Scheme. Launched by chancellor Rishi Sunak in May, it was designed to provide cash quickly for struggling businesses, but its loose rules were immediately exposed with some estimates suggesting as much as £26bn will be lost to defaults and fraud.

The Financial Times has spoken to more than a dozen senior bankers, fraud experts and people involved in the creation and running of the programme. In the words of one, “the scheme was being abused and defrauded on an industrial scale”.

Several bankers point to a range of attacks from impersonation of legitimate businesses, such as Mr Bogan’s car showroom, to the use of willing “money mules” who take out loans only to then file for bankruptcy.

“In 10 years' time, people will still be looking for the money,” says David Clarke, chairman of the Fraud Advisory Panel and a former head of the City of London Police fraud squad. He adds that the political reckoning could be just as long-lasting, “when the inquiries start into what happened with this scheme”.

Even greater losses are set to come from the billions lent to companies with little chance, or ability, to repay, after a devastating year that is set to cause widespread business failures in 2021 and beyond.

“The period from April to June was essentially a giant bonfire of taxpayers' money,” says one senior banker, “with banks just handing out matches”.

The UK’s bounce back scheme was hailed as the saviour of small businesses fighting to stay afloat amid national lockdowns. Under attack from MPs and companies running out of cash, Treasury officials agreed to guarantee all money lent by the banks. As a result bankers were more comfortable with waiving credit checks to speed up the process, relying on basic “know your customer” and fraud checks.

Mr Sunak told MPs: “There will be no forward-looking tests of business viability; no complex eligibility criteria; just a simple, quick, standard form for businesses to fill in.”

The terms were equally attractive: loans of up to £50,000 with no capital or interest repayments for one year — and then just 2.5 per cent for up to a decade. “People saw it and thought, ‘wow’! Why on earth wouldn't they take it? It’s basically free money,” says the senior banker.

Within days, more than £8bn had been lent to 250,000 small businesses. As of December 17, more than £43.5bn had been lent under the scheme to 1.4m companies, far more than the £18bn to £26bn anticipated at launch.

The Office for Budget Responsibility said in November that it expected a total of up to £87bn of business borrowing to be backed by government guarantees — the majority in bounce back loans.

“The key objective was to get money out, at scale, quickly, and to a broad range of business,” Sarah Munby, permanent secretary at the Department for Business, Energy and Industrial Strategy, told the public accounts committee in November.

It did not take long for bankers to realise that loans were being taken by borrowers who would struggle to repay. “By definition,” says one person involved in the creation of the scheme, “the sort of borrowers who take the loans cannot afford to pay them back under normal banking conditions”.

Within weeks of the scheme launching, senior executives at high-street banks were raising concerns that up to half of the money could be lost.

The government itself had estimated losses from the scheme could be between a third and 75 per cent due to the parlous nature of many businesses going into the crisis. The threat of such huge losses required a ministerial direction — in effect an order by Alok Sharma, the business secretary — to overrule concerns.

Ms Munby told MPs in November: “We are not able to sit here today and tell you how many of these loans will be paid back . . . from a managing public money [perspective] that is a concern.”

This is seen as unavoidable by officials — the cost of having to rush money to the type of small businesses that need it most. The focus now is on whether more could have been done to tackle the fraud and default risk earlier.

MPs on the House of Commons’ public accounts committee last week criticised the Treasury for its lack of data to assess the levels of fraud or even the scheme’s economic benefits — as well as its “woefully under-developed” plans with lenders to deal with fraudulently obtained loans or borrowers unable to repay. “Dropping the most basic checks was a huge issue that puts the taxpayer at risk to the tune of billions,” said Meg Hillier, chair of the committee.

At the end of November, the OBR increased its estimates of overall losses to as much as £29bn, the vast majority related to bounce back loans. In the best-case scenario, total losses from all the loan schemes could add up to £22bn; in the worst, taxpayers would foot a £40bn bill — almost half of all government lending to business during the crisis. On Thursday, the chancellor extended the scheme for a second time, to the end of March.

“A lot of the money has been spent having a good time. It becomes unrecoverable,” says Mike Levi, professor of criminology at Cardiff University, who is researching fraud activity during pandemics. “There will be an almighty row in a few years but by then it will be too late.”

In October, three people were arrested in Birmingham on suspicion of involvement in a £145,000 fraud involving bounce back loans. Separately, a human resources manager in Essex has been accused of trying to steal £240,000 in bounce back loans, using claims from oblivious employees on the payroll.

This will be “the first of many operations planned by my officers,” said Michael Dineen, head of fraud operations at the National Investigation Service, after the Birmingham raid.

Ms Munby told MPs that it was recognised that there “would be fraud because of choices about the design of the scheme”.

“This is basically [a criminal’s] dream scenario,” says a person familiar with the banks’ internal reviews. “An incredibly lucrative fraud that requires very little work and has almost no chance of law enforcement action.”

One senior executive at a high street bank says that as many as 15 per cent of applications were deemed fraudulent in the first weeks of the scheme. “This was the highest rate of cyber fraud that we have ever seen pretty much immediately,” he says. “We realised we were going into something scary.”

In a letter to the business department just two days before its launch, Keith Morgan, the then chief executive of the British Business Bank, which administers the scheme, said there were “very significant fraud and credit risks” and that it was “vulnerable to abuse by individuals and organised crime”.

A review of the scheme in May, by PwC, the consultancy, calculated the fraud risk as “very high”. The Cabinet Office said that fraud losses would likely be higher than the estimates of public sector fraud across all government spending of between 0.5 per cent and 5 per cent.

During the first two months, high street banks rejected hundreds of fraudulent applications on a daily basis, according to senior executives. Much of this initial surge was caused by a loophole that allowed the filing of multiple applications across banks — it was at least two months before cross-industry checks were put in place.

“We were flying blind,” says the chairman of one high street bank.

Criminals adapted the tools of established financial fraud to target the scheme. Acuris Risk Intelligence, which tracks online fraud, found one gang that claimed to have taken £6m using stolen UK identities. Acuris’ head of market planning Nick Parfitt says compromised credit card details were also used.

“At first, criminals were not going for the full £50,000 as they expected banks to check. But when that didn’t happen,” he adds, “they went hell for leather.”

His findings are supported by another bank fraud expert, who says that criminals would apply for loans of £48,000, assuming that applying for the full £50,000 would raise a red flag. But, he says, since the government allowed a further “top up” to the full amount for businesses, fraudsters have tried to come back for the remainder.

Bankers have also highlighted the use of “mules” — people in financial difficulties recruited by organised gangs to borrow money then declare bankruptcy. One banker describes bounce back customers who already had sizeable overdrafts and other debts; customers who rarely used personal accounts suddenly turning them into business ones; customers sending the balance overseas; and multiple occupancy houses where several people all successfully applied for the maximum £50,000 loans.

“We had some indications this was happening,” says another senior banker, “but could do very little to stop it because the government had taken a calculated risk and just wanted the money out there. It accepted that people would take advantage.”

Part 2 of 2

About £1.1bn in fraudulent applications for UK bounce back scheme loans from almost 27,000 people have been rejected since May, according to a letter from the BBB to MPs in November. But fraud experts worry that many other false claims were successful.

Applicants were checked against a national fraud database and with basic anti money laundering checks, but other measures only took place once a loan was granted. The BBB says that banks expecting to use the government's loan guarantee are required to take on clear anti-fraud obligations.

Anne Boden, chief executive of Starling Bank, told a Treasury select committee last week: “If . . . the fraudster gets through and they self-certify something and they lie, then that will be a claim against the taxpayer. That is the consequence of this scheme.”

The UK is not alone in seeing a spike in fraud. More than 10,000 cases of potential fraud related to the pandemic are being investigated in Germany. While in the US, the agency that manages Covid-related loans found “strong indicators of widespread potential fraud”.

The money provided by the scheme has helped hundreds of thousands of struggling businesses survive the national lockdowns. For others, it was comforting to have money in the bank for a rainy day. Deposits in business accounts rose sharply as government money flooded into company coffers.

But some business owners saw a chance to pay down a credit card or a deposit for a property, invest in equities or even cryptocurrency, says one bank fraud expert. “Completely against the spirit and terms of the scheme but we honestly don’t know how we should treat these customers,” he adds.

Banks can only lend up to £50,000, or a maximum of a quarter of a company’s turnover. This meant, according to a different banker, “we found a strangely large number of business customers had precisely £200,000 turnover last year”.

Another executive points to the owner of 10 shops who used different business accounts to apply for £50,000 for each of them. In this case, the bank spotted the multiple applications and said no — which led to a complaint from the hopeful borrower. “Maybe he went and opened accounts at other banks . . . this is the type of thing that is going on maybe hundreds or thousands of times.”

Bankers suspect that the authorities will only pursue larger, high value cases, or where there are clear links to organised crime. “How will you prove [a loan] was intentionally misspent,” asks another senior banker, “rather than a bad business decision or the result of another lockdown?”

Banking sources say fraud levels have decreased since additional controls were introduced after June, with weekly prevention meetings between banks, and audits carried out by the BBB and PwC. At the same time fraud teams are scouring business accounts that have received bounce back loans to identify those dormant since the funds were withdrawn.

“The government has made it clear that action will be taken against individuals found to have fraudulently accessed, or attempted to access, bounce back loan funding,” says the BBB.

But bankers say criminals are still trying to game the system, even if many are detected ahead of approval. “The truth is we will not know how much money will come back until May,” when loans start to charge interest, says the bank fraud expert.

“Don't forget these are 10-year loans,” says one bank chairman. “So we could be dealing with this for decades”.

“We targeted this support to help those who need it most as quickly as possible and we won’t apologise for this,” says a department of business spokesperson. “We are acting to crack down on fraud — with lenders implementing a range of protections including anti-money laundering and customer checks, as well as transaction monitoring controls.”

Although banks have to pursue lost money, they remain confident that the Treasury and Mr Sunak will ultimately foot the bill. Yet the government insists that the banks will need to do their best to recover the money. “We were expecting to just flip them to the government if they didn't pay,” says another senior banker, “but now, I think we are going to have to try for a year to get our money back before we can go for the guarantee.

“Which I feel is unfair,” she adds, “it wasn't our decision to lend”.

2 notes

·

View notes

Link

Edmonton and Sherwood Park Bomcas Accounting and Tax Services Phone: 780-667-5250 email: [email protected] Website: https://ift.tt/3qNKqZe and https://bomcas.ca Grande Prairie Income Tax Return Preparation Services Medicine Hat Income Tax Return Preparation Services Airdrie Income Tax Return Preparation Services Camrose Income Tax Return Preparation Services Spruce Grove Income Tax Return Preparation Services Wetaskiwin Income Tax Return Preparation Services Lacombe Income Tax Return Preparation Services Cold Lake Income Tax Return Preparation Services Fort Saskatchewan Income Tax Return Preparation Services Canmore Income Tax Return Preparation Services Lloydminister Income Tax Return Preparation Services Brooks Income Tax Return Preparation Services Chestermere Income Tax Return Preparation Services Banff Income Tax Return Preparation Services Cochrane Income Tax Return Preparation Services High River Income Tax Return Preparation Services Stony Plain Income Tax Return Preparation Services Sylvan Lake Income Tax Return Preparation Services Okotoks Income Tax Return Preparation Services Strathmore Income Tax Return Preparation Services Drumheller Income Tax Return Preparation Services Morinville Income Tax Return Preparation Services Whitecourt Income Tax Return Preparation Services Hinton Income Tax Return Preparation Services Wood Buffalo Income Tax Return Preparation Services Blackfalds Income Tax Return Preparation Services Taber Income Tax Return Preparation Services Edson Income Tax Return Preparation Services Rocky Mountain House Income Tax Return Preparation Services Saint Paul Income Tax Return Preparation Services Wainwright Income Tax Return Preparation Services Olds Income Tax Return Preparation Services Slave Lake Income Tax Return Preparation Services Jasper Income Tax Return Preparation Services Coaldale Income Tax Return Preparation Services Stettler Income Tax Return Preparation Services Fort MacLeod Income Tax Return Preparation Services Cardston Income Tax Return Preparation Services Devon Income Tax Return Preparation Services Innisfail Income Tax Return Preparation Services Pincher Creek Income Tax Return Preparation Services Ponoka Income Tax Return Preparation Services

1 note

·

View note

Text

Choosing the Best Accounting Services

We can track our home and small business financial matters using software applications, and that’s why there is an increase in their popularity every day. However, a lot of people still prefer to use accounting services. Your financial issues will be taken care of when you hire such professionals, and this will make you enjoy peace of mind. Several factors have to be checked before accounting services are hired. Your personal situation will be suited by the accounting service that you will find with the help of those factors. Before you hire such service providers you should check their credentials. Before you sign any contract with them, this should be the first step you should make. The accounting service that you should hire is the one that has the proper credentials and training.

Because the laws and regulations for accounting keep changing every day, you should pick the one that is updated with the latest news. Accounting is governed by different laws even though this depends with where you come from. You should make sure you choose an accounting service that is appropriately qualified to work in your area. You should ask for referrals from people you know if you do not know where you can find the best accounting services. You can find several reputable accounting services also when you ask for referrals from business associates. Check out also Airdrie business accounting for more insight.

You need to know that there pros and cons of both small and large accounting services before you hire such services. The smaller service are the ones you should hire if a more personalized level of service is the one you want. Even though they might be the best option for you, they do not have a proper level of expertise for every situation. All the accountants of large accounting service handle the financial areas, and because of that reason, they are the best ones. The best option for you should be large accounting services if you have complicated taxes or financial issue. Sometimes they are impersonal even if they are the best option for your issues.

Before the financial issues of your business are handled by accounting services which you have haired, you should check how their price their services. Because large accounting firms want to remain competitive with other firms, they of the best rates sometimes. But some small firms may suit your budget because they have lower expenses. An advanced level of education is found with those account firms that employ certified public accountants. All kinds of financial issues can be solved by accountants of such services when hired. You should be prepared to pay higher fees if you want to employ the best services. See more here!

Try also to read this related post - https://www.huffingtonpost.com/deborah-sweeney/five-reasons-why-your-accounting_b_5120911.html

1 note

·

View note

Text

#financial consulting services airdrie#corporate accounting#corporate accounting calgary#financial management

0 notes

Text

Tax Preparation Services

Need help in Tax preparation in Calgary? NSI Accounting is here to help with all types of tax preparation for your business. Call now at 403-922-5004.

#tax and accounting services airdrie#accounting company irricana#tax prep#tax preparation Calgary#Tax Preparation Airdrie

0 notes

Link

Phone No (403) 831-6969

Address 94 Windford Drive Southwest, Airdrie, AB T4B 3Z9

Website http://www.airdriestarcab.com/

Airdrie Star Cab is an Airdrie Taxi Services offers good service and a pleasant way of transportation in and around Airdrie and Calgary Airport. We focus on absolute customer satisfaction and managed to become one of the best Airdrie Cab Services.We provides taxi service to major hotels in the downtown core and also to the Calgary International Airport, and throughout the City of Airdrie.

With technology like our GPS dispatch system and online booking, we are able to reduce wait times and get to you within minutes. Whether you need a taxi to Calgary Airports or anywhere else, we’ll get you there quickly and safely.

Our excellent customer service is the obvious #1 reason why so many people chose to use Airdrie Star Cab. Providing excellent service does not just happen, it requires COMMITMENT, DEDICATION AND ACCOUNTABILITY. At Airdrie Star cab, we have our TEAM making this happen.

Facebook https://www.facebook.com/pg/Airdrie-Star-Cab-Local-Airport-Taxi-Service-930580123619033/

Twitter https://twitter.com/AirdrieStarcab

Pintarest https://www.pinterest.ca/airdriestarcablocalairporttaxi/

1 note

·

View note

Text

With Mounties due for a pay bump, cash-strapped municipalities seek reprieve from Ottawa

Mounties are due to obtain a chunk of retroactive pay after negotiating their first-ever collective agreement. Some municipalities say the looming income bump will stress their budget — and they prefer Ottawa to step up.

This summer, the federal government and the union representing RCMP participants ratified an agreement to deliver a large pay increase to nearly 20,000 members. Constables — who account for more than half of all RCMP officers — will see their maximum earnings jump from $86,110 as of April 2016 to $106,576 next year.

The deal also lays out retroactive pay increases going back to 2017. The RCMP last updated its wage scale in 2016. According to the agreement, the prices of pay will change within 90 days of Aug. 6, when the collective agreement was signed. It's then up to the RCMP to make its "best effort" to enforce the retroactive payable amounts within 270 days of signing.

The Federation of Canadian Municipalities (FCM) says communities that pay the RCMP for policing services are growing alarmed over the agreement's cost. "It's widespread coast to coast to coast and our municipalities are really very concerned, very, very concerned," said FCM president Joanne Vanderheyden, also the mayor of the municipality of Strathroy-Caradoc in Ontario.

"This problem is really urgent given the possible impacts on municipal finances." The RCMP is a federal organization but it offers policing services, under contract, to eight provinces, all three territories, about 150 municipalities and more than 600 Indigenous communities.

The price of the RCMP's offerings — including salaries and equipment — is split between the federal government and other levels of government. How much a municipality is on the hook for depends on its size.

Municipalities with populations of less than 15,000 pay 70 per cent of the costs, while the federal government can pay 30 per cent. Municipalities with more than 15,000 residents pay 90 per cent. Vanderheyden said that while negotiations on the collective agreement were happening behind closed doors, municipalities were advised through the federal government to set money aside to cover the expected pay hike.

"Well, the percentage was way too low," she said, adding the retroactive pay also came as a surprise to most mayors. "We are really not against collective bargaining. That's not it. It's when you're not at the table and the direct impact comes to you."

The FCM has written a letter to the federal government asking it to absorb all retroactive costs associated with the collective agreement. Without federal help, Vanderheyden said, "municipalities will be forced to make quite difficult decisions because they're either along have to make cuts to their imperative services or bypass it alongside to the property tax, local residents. Because they can't go into arrears, they can't go to deficits."

Peter Brown, mayor of Airdrie in Alberta, said that while he firmly supports paying RCMP officers more, he was surprised by the final price tag. He said his city, just north of Calgary, has budgeted and held money back over the past few years but nonetheless has only about half of what it wishes to cover the added policing costs.

"The message from me is, recognize that we've all been hit. We're all suffering," he said, referring to the pandemic. Malcolm Brodie, mayor of Richmond, B.C., said his municipality estimates the retroactive pay lump sum will cost it something between $9 million and $11 million, plus the annual pay increase itself.

"What that means for us is to cover that the amount going forward on our budget, it is about a one-time 2.5 to 3.5 per cent tax increase," he said. "We certainly have stayed with the RCMP for a good reason. We think that they've achieved a proper job for our community. Having said that, you know, it's getting a whole lot more expensive."

A spokesperson for the federal Department of Public Safety said the department has kept in touch with regions with RCMP contracts on a normal basis since 2018. "Contracting jurisdictions were aware that the salary of RCMP officers had been frozen since 2016 and that the collective bargaining process began in 2020. With the new collective agreement for RCMP regular members and reservists, salaries are in line with other police services across Canada," said Tim Warmington.

"It is fair for regular members and reservists as well as reasonable for Canadian taxpayers."

0 notes

Text

Awning Windows in Airdrie.

Awning Replacement Windows in Airdrie

Awning windows are established and run in the extremely same method as casement windows, except they open vertically while casement windows turn horizontally to open.

Awning windows make use of the very same innovation as sashes. A distinguishing characteristic that offers these windows a remarkable level of performance is the compression seals in the location where the window sash meets the frame. However what does it do?

Older crank windows and contemporary sliders depend on fiber weatherstripping in the location where the window closes. Fiber weatherstripping is not as proficient at keeping the components out and generally wears much quicker.

In windows with compression seals, the seal completely fills the location in between sash and frame, making the system airtight. As an outcome, the window is less prone to leakages and drafts.

A significant feature that makes awning windows more suitable is that these windows can be opened all year without letting rain or wetness into your home. This is key for homes where ventilation is constantly required, like bathrooms and kitchen areas.

Another reason property owners in Airdrie choose crank windows is because of the truth that they are considerably simpler to run than sliders. A sash in the slider window has to be moved by hand, which can get tiring. Crank windows require roughly 1/10th of the strength to run.

Window Replacements

Whether you need a replacement from broken, ineffective, or old-fashioned windows, Window Seal West has high quality, custom-made made windows to meet your specific requirements.

Whether it's a misguided baseball or storm damage, eventually most homeowners will need to handle window replacements, a task that is low on any handyman's list of things they want to finish with their spare time. This could involve full window repair work, replacement of window screens, or setting up a whole replacement window. No matter the factor for the work, you actually require to take a couple of things into account before heading for the building supply store. The first consideration is the age of your home. Older houses, especially farm-style, inner-city homes, or nation houses, tend to have very old types of windows, consisting of wooden sashes and hardware that are no longer at the window effectiveness standard. Thankfully for you, here at Window Seal West, we can supply you with the top of the line, greatest basic windows in Airdrie with cost effective prices using our versatile budgeting techniques, no matter the home or budget, our groups here can offer you with the very best window replacements in Airdrie.

Here at Window Seal West, we provide a large line of vinyl replacement windows. Whether you require a replacement of a single home window, or you want to update your whole house with more energy-efficient and beautiful windows, Window Seal West supplies you with whatever you require. Our items are made right here in Airdrie, licensed by the Canadian Standards Association, and custom-made for your home by our group of well trained and educated window professionals.

We supply a series of designs in addition to sizes to suit every one of your requirements, consisting of vinyl, sash, awning, sliding, single/double sliding, single/double hung, customized formed windows, and many more to make your home more energy-efficient however also offer you with a one of a kind visual charm. Whether you want to contribute to the value of your residence or eliminate those cold drafts, Window Seal West has the right selection of windows at the best rates.

Vinyl windows and doors manufacture in Canada. Vinyl windows replacement and windows installation services. Serving Calgary, Edmonton, Red Deer, Medicine Hat, Lethbridge, Saskatoon and Regina, Kelowna and Okanagan Valley. Window Seal West has been serving its clients Canada-wide for over 10 years. Insulated glass units and vinyl window frames are custom made in our Calgary manufacture to insure the highest quality possible as well as a fast delivery time frame.

https://windows-west.ca/locations/airdrie/

Airdrie

403-774-7202

0 notes

Text

Corporate Accountant: Role and Responsibilities

Corporate accounting is something other than dealing with the financial and accounting systems of an organization or enterprise. Of course, business owners have to recruit or hire a corporate account to manage the details professionally.

Corporate accountants may easily manage financial and accounting tasks without any hassles. In case you need clarification on what corporate accountants do with your organization, here is a guide to follow. Of course, corporate accounting in Calgaryis there for you to guide you completely.

On the other hand, corporate accounting jobs and accountants will manage cash flow, expenditures, flow of revenue, and capital resource allocations. They can easily understand the role and are suitable for career paths as well. You can also learn about their duties and identify the relevant skills for achieving success with creating financial goals and statements.

Table of Contents

What a corporate accountant will do for your organization?

What do corporate accountants do on a daily basis?

Job brief of corporate accountants:

Responsibilities of corporate accountants:

Requirements and skills

How much do corporate accountants get paid?

Conclusion

What a corporate accountant will do for your organization?

Of course, an organization or enterprise usually keeps compliance with regulations and handles budgets for each department. Their role is to allocate funds for each department, supplies, and investments with other needs.

A corporate accountant will conduct audits and make sure to obtain executive solutions. The organizational goals are to work with budget constraints completely and do activities depending on the company’s requirements.

Likewise, corporate accountants are always best at noticing employee expenses and reporting according to the norms. They can easily handle the monthly cash flow analysis and prepare variance analysis. Their responsibility is to consolidate the statements and perform audits accordingly. It will review monthly reports and subsidiary ledgers as per the company norms.

Maintain company accounts

A corporate accountant must primarily be responsible for maintaining an accountant for the organization. Of course, it will often achieve collaboration with other professionals.

They can easily collaborate with departments to determine expenses and operating periods. It will generally monitor the revenue and expenses of an organization to overview the management decisions.

Often, their role is to involve expense management and payroll processing. Depending on the organization’s size, their work will encompass approving expenses and requests for employees and processing invoices. The payroll processing and calculating salaries is the right one to handle.

Prepare financial statements

Corporate accountants are mainly responsible for preparing and cross-checking the organization’s financial statements. Corporate accountants must handle financial reports, data, books, and expenditures as per the requirements. Thus, it will give you organization statements by their skills and tally the cash flow analysis. A professional corporate accountant will prepare a group consolidated quarterly with a management report.

Prepare the organization’s budget

Mainly, the corporate accountant will handle everything to accomplish targets by setting up meetings. An important aspect must be assigned by their budget constraints ideas and help them allocate optimum productivity.

Their role is to bring certain financial statements and data to be evaluated with budget-friendly statements. The accountants must collaborate with other managers to handle these budgets.

Liaise with other professionals

Corporate accountants must be responsible for delivering company financial health a good one. Their noticeable actions are to evaluate based on the junior accounting, and employees will discharge the duties and responsibilities.

It will allow them to liaise with the internal and external auditors. Their role is to bring the company to work with relevant financial obligations by reporting and recording the activities.

Provide strategic support

On the other hand, the corporate accountant role is to bring strategic support to handle executive and management teams. It must handle everything based on the appropriate commentary to handle team understanding in all possible ways.

They can easily advise the executive team to organize companies in preparing future activities. The future activities are always the best ones and handle supportive data-driven decision-making processes.

What do corporate accountants do on a daily basis?

In case your corporate offices or branches need accounting, you must hire a corporate accountant role. Of course, they will work on a daily basis and give you types of industries with working needs.

However, a corporate accountant’s role is to seek a clearer picture of tasks and handle the accountant’s role with each day’s purpose. They can find out a breakdown of the specialized skills and job postings based on the common skills and interpersonal qualities that must be assigned to a thriving workplace.

Job brief of corporate accountants:

On the other hand, corporate accountants are always specializing in handling business accounting and expertise ideas. However, the company will handle financial regulations, laws and policies.

Their duties are always going ahead with financial documents, presenting annual audits and monthly budgets, and monitoring expenditures. Their role is to bring financial regulations and ensure work with records and data handling.

Responsibilities of corporate accountants:

Able to Gather financial data and ledgers

They can easily consolidate and analyze financial statements

One can prepare budgets and monitor expenditures

Their role is to handle monthly, quarterly and annual closings

Able to manage periodical reporting

Handle and oversee external and internal audits

Work and analyze finances to determine risks and create forecasts

Able to supervise Junior Accountants

Requirements and skills

Able to provide experience to work in corporate

Excellently handle accounting regulations and practices

Must have in-depth experience in risk analysis and forecasting

Proficient in MS Office and handling

Analytical mind with problem-solving skills

Excellent communication skills needed

How much do corporate accountants get paid?

As per the statistics, most corporate accountants will get an annual salary of USD 70.500. Of course, their additional experience and skills may require more pay for their role.

So, it is better to gain knowledge and skills regarding the corporate accountants. With certain skills, it is more valuable and hence payroll administration or SAP financial accounting will handle more outcomes.

Jobs in corporate accounting are always projecting 100% skills to work in possible ways. However, it mainly depends on the economy and fulfills economic growth as well. Their role is to bring financial accounting and statements to a professional level.

Conclusion

To conclude, corporate accounting Calgary is always expertise in managing financial statements, records, data and cash flow analysis. Of course, the organization has to collaborate with a corporate accountant to maximize their financial management role success. Generally, they will monitor the revenue and expenses to examine with the organization and provide an overview of management decisions.

Original Source: weeklyfanzine

#Financial Management#Accountant Role#Corporate Accounting#Financial Consulting Services Airdrie#Financial Planning Services Calgary#accounting#calgary accountants

0 notes

Text

Our goal is to make income tax planning and preparation understandable and uncomplicated. Well-informed clients make better decisions. Our customer-service approach ensures that the technical aspects are communicated in language that makes sense so that our clients understand how circumstances might impact them and their businesses.

#Accounting Services Airdrie#tax and accounting services Airdrie#accounting services company cochrane#tax and accounting services cochrane#Accounting Services irricana

0 notes

Text

Lean Six Sigma Green Belt Training and Certification Course in Calgary, Canada

Lean Six Sigma Green Belt Training and Certification Course in Calgary, Canada

Attend a workshop on six sigma in Calgary, Canada

Six Sigma Green Belt Institute in Calgary, Canada | Training & Cost

Lean six sigma green belt training course in Calgary, Canada is delivered by highly qualified trainers with extensive quality management experience. Lean Six Sigma Green Belt Certification is one of the most industry-recognized quality management certifications for professionals across the globe.

Anexas is the best institute for six sigma certification in Calgary, Canada that offers an internationally-recognized six sigma green belt training and certification program. It is kpmg approved six sigma training coaching center in Calgary, Canada. This lean six sigma green belt certification course in Banglore is ideal for individuals and enterprises that are looking to gain an in-depth understanding and ensure that you clear lean six sigma green belt certification exam in your first attempt.

The main takeaways from this lean six sigma green belt certification course in Calgary, Canada are that it prepares you for universally recognized certification to secure awesome jobs, promotions and pay hikes

The six sigma green belt certification will give you the credibility to bring about changes that will help your organization realize its vision and help you realize your potential. As a six sigma professional, you will wocontinuoustinual quality improvement by analyzing and solving quality problems, and strive to create a high performance organization.

We deliver lean six sigma green belt training in Calgary, Canada through classroom and live online classroom modes. Attend this lean six sigma green belt course from various available weekday and weekend schedules. Enroll now and gain this lean six sigma green belt certification in Calgary, Canada today.

According to a survey carried out by indeed.com, the salary for six sigma certified individuals routinely break into the $100,000+ pay bracket, and are among the highest-paid professionals globally.

About Six Sigma Course Speaker

Experience of starting up Lean Six Sigma training and consulting businesses in more than 6 countries. Trained around 25,000 professionals in Lean, Six Sigma (Black belts and Master Black Belts), Process Excellence, AI, Project Management, Accounting, Finance, Blue Ocean Strategy, SPC, Balanced Score Card and Soft Skills. Total 28 years of experience with 11 years in the manufacturing industry and 17 years in Service industry in various domains like Oil, Banking, manufacturing, IT, ITES, Healthcare, Finance, BPO, Insurance, Shipping, Supply Chain, Logistics, Petrochemicals, Steel, etc.

Read Complete Detail About The Course Trainer Here

or

Connect With on His LinkedIn Profile Here

Ready to get started on the path to Six Sigma Master Black Belt? Anexa's Lean Six Sigma master's program is taught by Green and Black Belt certified professionals with more than ten years of industry experience in implementing Quality Management and will help you become a Lean Six Sigma champion.

Training Modes

- Instructor-led Classroom Training (view training dates and cost)

- Corporate Training (request for more information)

- Focused 1-to-1 Training

· Course material, 30 worked out projects, Online test for certification, Life time validity for certificate, Free online project guidance

Lean Six Sigma Green Belt Course Key Feature

· Free project certificate, Free one year online project guidance to help in your projects and achieve your goals, Two free follow up Skype sessions 1 hr each with experts coaches on line for any help if required

· Lifetime membership to Anexas Alumini group

· Life Time Tuition waiver for repeating this Workshop anywhere in the World by just paying the Venue charges, Our referral program helps you to get cash back benefits,

· Business Lunch and refreshment during the program, Online Customer support 24*7

Download detailed Lean Six Sigma Green Belt Course Syllabus (PDF)

Admission Requirements

The Six Sigma Green Belt certification training course is beneficial for engineers, managers, quality professionals and process owners with a minimum of 2 years work experience.

· Type: Multiple choice and scenario-based examination

Lean Six Sigma Green Belt Exam Format

· No Of Questions: 50

· Examination duration: 2 and Half Hours (150 Minutes)

· Exam Result: 30 marks required to pass, equivalent to 60%

Lean Six Sigma Green Belt Training Fees

· The Lean Six Sigma Green Belt Online Training cost in Calgary, Canada is CAD 318

Click here to view the Lean Six Sigma Green Belt Training Schedule in Calgary, Canada

Who Should Attend LSSGB Certification Training

Job roles that can benefit from Six Sigma Green Belt boot camp course include, but are not limited to:

· Engineers / Professionals / Executives who want to understand Six Sigma as a management tool for process and performance improvement at their work place

· Quality and Process Managers, Engineers and Executives who need to gain knowledge of Six Sigma in process / quality improvements

· Production Managers, Production Supervisors, and Customer Service Managers

· Consultants who want to add Six Sigma Green Belt in their service offerings and help their customers implement it

Accreditation

Anexas Is The Best Institute For Six Sigma Certification In Calgary, Canada That Offers An Internationally-Recognized Six Sigma Green Belt Training And Certification Program. The course is aligned with the certification exams of the leading Six Sigma Green Belt certification institutions ASQ and IASSC.

250000+ Trainees Can't Be Wrong...!!!

Read Anexas Calgary, Canada Reviews Here

This Lean Six Sigma Green Belt Training is available across multiple cities in Canada.

► Calgary ►Quebec City

►Edmonton ►Saskatoon

►Halifax ►Toronto

►Mississauga ►Vancouver

►Montreal ►Winnipeg

►Ottawa

FAQ about Six Sigma Green Belt Course. Read Here

Following is the Anexas's Six Sigma Green Belt Training Locations In Calgary, Canada. Find Your Nearest Place.....

Airdrie, Beiseker, Black Diamond, Calgary, Chestermere, Cochrane, Crossfield, EdenValley 216Foothills No. 31, MD ofHigh RiverIrricana, Longview, Okotoks, Rocky View County, Tsuu T'ina Nation 145, Turner Valley,

Anexas's Six Sigma training is designed to get you the knowledge you need to pass your exam on the first try. What are you waiting for?

Find our Certified Lean Six Sigma Green Belt Online Classroom training classes in Top Cities:

Name

Date

Place

Certified Lean Six Sigma Green Belt

31 Aug. 1 & 2nd September 2018, Weekend batch

Your City

View Details

Certified Lean Six Sigma Black Belt

21, 22, 28, 29 July 2018, Weekend batch

Your City

View Details

Certified PMP Course

18, 19, 25, 26 Aug 2018, Weekend batch

Your City

View Details

Need Training?

IASSC Lean Six Sigma Accredited Providers are recognized for maintaining consistent, high-quality and robust training standards in alignment with IASSC Accreditation Criteria. Whether you are searching for Elearning providers, classroom training, individual instructors, self study materials or certification preparation sources, start with the Providers who have earned our world recognized Accreditations. Six Sigma Green Belt Training in Calgary, Canada. Type of training. Quality management. Technology. Six Sigma Green Belt. Six Sigma Yellow Belt. Six Sigma Black Belt. Six Sigma White Belt. Lean Six Sigma Black Belt + more. Lean Six Sigma Green Belt. Mode of training. Classroom. Online.

Get Training

Related Search for Six Sigma Green Belt Training, Calgary, Canada

Six Sigma Green Belt Certification Training In Calgary, Canada, Six Sigma Green Belt Certification Courses In Calgary, Canada, Six Sigma Green Belt Classes In Calgary, Canada, Six Sigma Green Belt Institutes In Calgary, Canada, Six Sigma Green Belt Training Centers In Calgary, Canada.

0 notes