#Benefits to Wealth Managers

Text

Sell GCM or ALCA to wealth managers?

What makes 3rd Parties Like Wealth Managers Refer to Care Managers?

Do you want to sell to wealth managers? Why would third parties like wealth managers trust officers, sell to GCM or ALCA by referring clients to a care manager If you have an Aging Life or GCM business you need to know. It is the benefits you bring to the 3rd party and their aging client.

Benefits you bring to the 3rd…

View On WordPress

#aging family#aging life care manager#aging parent care#aging parent crisis#benefits of ALCA#Benefits Of Geriatric Care Managers#benefits to 3rd parties#Benefits to Wealth Managers#Benefits VIP Clinets#care manager#Features and Benefits#Features and Benefits of GCM#geriatric care manager#marketing to wealth manager#nurse advocate#nurse care manager#Sell Benefits#wealth managers#webinar Benefit or Features#Webinar Features and Benefits

0 notes

Text

Can i lose weight by dieting only

Embarking on a weight loss journey is a common goal for many individuals worldwide. The question that often arises is, "Can I lose weight by dieting only?"

This comprehensive article explores the effectiveness of weight loss through dietary changes alone, shedding light on its possibilities, challenges, and the key factors that contribute to success. Continue reading

#health#health is wealth#health tech#health services#health science#health journey#health blog#health & fitness#health benefits#health news#weight loss#weight lifting#weight loss journey#fat loss#exercise#weight goals#weightloss#weight mention#weight management

3 notes

·

View notes

Text

6 Powerful Benefits of Proper Small Business Project Management

Introduction

Effective project management is pivotal to small businesses’ success in today’s rapidly evolving business landscape. It involves systematically planning, organizing, and overseeing tasks and resources to achieve specific objectives. By embracing proper project management, small businesses can streamline their operations, enhance productivity, improve resource allocation, mitigate…

#becoming an entrepreneur#benefits of project management#benefits of project management for small businesses#original content#productivity#project management#project management for small business#tips and tricks#wealth

0 notes

Text

Addressing Special Needs in Your Estate Plan: Why Should You Do It?

Ensure your loved one with special needs is protected in your estate plan. Learn how to secure their future without risking government benefits through Special Needs Trusts and other strategies. Contact Wills & Trusts Wealth Management today for tailored guidance on special needs estate planning.

#estate planning UK#protecting benefits Estate Plan UK#guardianship arrangements UK#Wills & Trusts Wealth Management#preserving government benefits UK

0 notes

Text

The Benefits Of Working With A Wealth Management Company

In today’s complex financial landscape, individuals and families face an array of investment choices, financial instruments, and economic conditions. The decision to manage wealth effectively can be daunting. This is where wealth management companies come in, offering professional expertise and personalized services that can significantly enhance financial well-being.

Here are some key benefits of working with a wealth management company in Fort Worth TX.

Personalized Financial Planning

Wealth management companies provide tailored financial planning services that align with your unique goals and circumstances. They take the time to understand your financial situation, risk tolerance, and long-term objectives, creating a customized strategy that addresses your specific needs. This personalized approach helps ensure that your investments and financial decisions are aligned with your life goals, whether that’s funding a child's education, purchasing a home, or planning for retirement.

Comprehensive Wealth Management Services

A wealth management company offers a wide range of services beyond just investment management. These may include estate planning, tax optimization, retirement planning, and insurance services. By providing a holistic approach to financial management, these firms can help you manage all aspects of your financial life. This comprehensive service allows for better coordination and integration of your financial strategies, which can lead to more effective outcomes.

Access to Expertise

Wealth management firms employ a team of experienced financial advisors, investment analysts, tax specialists, and estate planning attorneys. This collective expertise can be invaluable in navigating the complexities of financial markets and tax regulations. With access to these professionals, you can benefit from informed decisions based on market insights, research, and strategic thinking that may be difficult to replicate on your own.

Investment Diversification

One of the key strategies in wealth management is investment diversification. Wealth management companies have the tools and resources to construct a diversified portfolio tailored to your risk profile and investment objectives. Diversification helps mitigate risk by spreading investments across various asset classes, industries, and geographies. This approach can lead to more stable returns over time, reducing the impact of market volatility on your overall portfolio.

Risk Management

Effective wealth management includes a thorough assessment of risk and the implementation of strategies to manage it. Wealth management professionals can help identify potential risks to your financial health and develop plans to mitigate them. This may involve asset allocation strategies, insurance coverage, or establishing emergency funds. With a proactive approach to risk management, you can safeguard your wealth against unforeseen circumstances and market fluctuations.

Tax Efficiency

Navigating tax laws can be complex, and taxes can significantly impact your investment returns. Wealth management companies are well-versed in tax strategies that can enhance your after-tax returns. They can provide guidance on tax-efficient investment vehicles, timing of asset sales, and charitable giving strategies that can minimize your tax burden. By optimizing your tax situation, you can keep more of your hard-earned wealth working for you.

Long-Term Focus

Wealth management companies emphasize a long-term perspective in financial planning and investing. Instead of reacting to short-term market fluctuations, they encourage clients to stay focused on their long-term goals. This disciplined approach can help you avoid emotional decision-making during market downturns and lead to better investment outcomes over time.

Peace of Mind

Finally, working with a wealth management company provides peace of mind. Knowing that your financial affairs are being managed by professionals allows you to focus on other important aspects of your life, whether it’s your career, family, or hobbies. This peace of mind is invaluable and can lead to a more balanced and fulfilling life.

Conclusion

In summary, working with a wealth management company offers numerous benefits that can enhance your financial well-being. From personalized financial planning and comprehensive services to expert guidance and risk management, these firms can provide the support needed to navigate the complexities of wealth management. By leveraging their expertise and resources, you can build and preserve your wealth more effectively, ensuring a secure financial future for you and your family.

0 notes

Text

How to Save Taxes on Investments with Portfolio Management Services

Introduction

Navigating the world of investments can be challenging, especially when it comes to optimizing returns and minimizing tax liabilities. Fortunately, utilizing portfolio management services in India can be a game-changer. These services not only help in managing and growing your investment portfolio but also in strategically saving on taxes. Here’s a comprehensive guide on how to leverage investment portfolio management to save taxes effectively.

Understanding Portfolio Management Services

Portfolio management services (PMS) are specialized investment solutions offered by financial professionals or firms that help you manage your investment portfolio. These services are designed to align your investments with your financial goals while optimizing performance. Engaging a financial advisor or a portfolio management firm ensures that your investments are managed with a strategic approach, considering tax implications as part of the overall plan.

Why Tax Efficiency Matters

Taxes can significantly impact your investment returns. By employing a strategic approach to tax management within your portfolio, you can enhance your after-tax returns. Here’s how portfolio management services in India can assist you in this regard:

Tax-Loss Harvesting: This strategy involves selling investments at a loss to offset gains made elsewhere in your portfolio. A skilled portfolio management firm can identify opportunities to realize losses, thereby reducing your taxable income.

Capital Gains Management: Understanding the distinction between short-term and long-term capital gains is crucial. Investments held for over a year typically attract lower tax rates on gains. A financial advisor can guide you on maintaining investments for optimal periods to benefit from these tax advantages.

Dividend Taxation Planning: Dividends are often taxed differently than capital gains. Effective management of dividend-yielding investments can help you plan your tax liabilities better. Portfolio management services can provide insights into structuring your investments to minimize the impact of dividend taxes.

Utilizing Tax-Advantaged Accounts: In India, certain accounts like Equity Linked Savings Schemes (ELSS) or Public Provident Fund (PPF) offer tax benefits. A well-structured investment portfolio management strategy will incorporate these options to maximize tax savings.

Tax-Efficient Asset Allocation: Different types of investments have varying tax treatments. A portfolio management firm will optimize asset allocation across various tax-efficient investment vehicles, balancing between equity, debt, and other instruments to enhance overall tax efficiency.

Choosing the Top Portfolio Management Services

Selecting the right portfolio management services in India can make a significant difference in your tax savings. Here’s what to look for when choosing the top portfolio management services:

Expertise and Experience: Look for firms with a proven track record in managing portfolios with a focus on tax efficiency.

Customization: Ensure that the services are tailored to your specific financial situation and goals.

Transparency: Choose firms that offer clear and transparent fee structures and performance reporting.

Reputation: Research and select firms with positive reviews and a strong reputation in the industry.

The Role of a Financial Advisor

A financial advisor plays a pivotal role in your tax-saving strategy. They provide personalized advice on tax-efficient investment strategies and help implement these strategies effectively. Whether you’re looking to optimize your investment returns or manage tax liabilities, a knowledgeable advisor can make all the difference.

Conclusion

Incorporating tax-saving strategies into your investment portfolio management can significantly enhance your financial outcomes. By leveraging portfolio management services in India, you gain access to expert guidance on tax-efficient investment strategies. Whether it’s through tax-loss harvesting, capital gains management, or optimizing asset allocation, professional portfolio management can help you keep more of your investment returns.

For optimal tax-saving strategies and effective investment management, consider partnering with a reputable portfolio management firm or a financial advisor. Their expertise will ensure that your investment portfolio is not only growing but also optimized for tax efficiency.

Feel free to reach out for more insights on how portfolio management services can help you achieve your financial goals while maximizing tax savings.

#wealth management services#portfolio managers#portfolio management services in india#portfolio management#portfolio management services#wealth management company#portfolio manager#sharemarket#investment portfolio#investment portfolio management#tax saving#elss tax benefits#taxes

0 notes

Text

Mastering Financial Literacy: A Complete Guide

Unlock your path to financial freedom! Dive into our comprehensive guide on financial literacy, budgeting, saving, investing, and retirement planning. Share your thoughts, ask questions, and join the conversation to take control of your financial future.

The Concept of Financial Literacy

Financial Literacy Concept

Did you know that one in five American adults would rather spend more time planning their vacations than managing their finances? A survey by MyBankTracker (n.d.) revealed that nearly 20.1 percent of American adults spend more time researching travel details than handling their money matters, yet 34 percent use an…

View On WordPress

#401(k) plans#active income sources#budgeting tips#building wealth#compound interest benefits#creating a budget#creating a will#credit scores and reports#debt consolidation strategies#debt management#effective budgeting methods#emergency fund importance#establishing trusts#estate planning#financial education resources#financial freedom journey#financial goals#financial literacy#financial security#financial stability#health insurance benefits#healthcare cost planning for retirement#improving credit ratings#inflation impact on savings#insurance coverage#investment diversification tips#investment options#IRAs#life insurance policies#long-term wealth accumulation plans

0 notes

Text

How Does Wealth Management Lead To Financial Growth in 2024?

Who doesn't want to maximize the growth capacity of their existing property? After all, this way, we can prepare everyone in our family for the uncertain economic future of the 21st century!

An actual strategy that can help us secure such a promise is Wealth Management. Proper Wealth Management helps not only in growing existing wealth and beating inflation but also in clearing out new income channels and securing our earnings legally. What are the best practices you can try? Here is what you should know.

Finance Management Strategies That Can Lead To Prosperity in 2024

AI Technology for Better Risk Management

With AI technology entering every sector, intelligent investors are using new types of tools to assist their decision-making. These automated services work even beyond human supervision!

Such models can be trained on past information using which they can make accurate predictions about the market's future. They can also help build financial discipline and earn you against risky ventures. They can highlight hidden aspects of the market that even trained professionals tend to overlook.

Creating a Long-term Financial Plan

A strategically planned Financial Plan involves more than investments - tracking your money, tax planning, and asset purchases all can be done in a much better way under professional supervision!

Creating a long-term plan starts by evaluating the present economic condition. After this, we attempt to cut our losses and magnify our strength so that every piece of wealth can attract its profit.

When you are new to all this, you can take the help of a Financial Advisors for Families. A Financial Advisor can guide you toward secure, stay practices. Retirement funds, estate planning, and medical insurance for old age all require consistent financial discipline.

Sustainable Investing

Simply put, this is the kind of investing that is gentle towards the environment and places great importance in upholding human rights and animal rights for one and all.

Investors have started showing more interest in companies with proper ESG compliance in the last few years. This is mainly because sustainable organizations have grown significantly in the last few years.

If your wealth management advisor has suggested you to diversify your portfolio further, make sure you go for businesses that have secured their future by discarding old, harmful practices and adopting innovative solutions!

Final Words

Wealth Management is an all-encompassing, long-term strategy that influences how we spend, earn, and allocate our resources. Financial growth that is slow and steady might sound boring, but this is precisely what will give you a comfortable and financially stable life! By following such practices, you can retire early, earn a lot of money, and do everything you always wanted to. But to make this goal more realistic, you must plan under the proper professional guidance as soon as possible!

0 notes

Text

What is a Financial Coach, and What do They do Exactly?

Discover the multifaceted role of a financial coach and how they serve as invaluable guides on the path to financial stability and prosperity. Explore the diverse services they offer and the transformative impact they can have on your financial well-being.

#Financial coach#Personal finance guidance#Budgeting assistance#Debt management strategies#Wealth building techniques#Financial education#Investment planning#Retirement preparedness#Financial empowerment#Money mindset transformation#Financial goal setting#Financial literacy#Financial wellness support#Savings tactics#Accountability in finances#Money management skills enhancement#Financial independence coaching#Comprehensive financial planning#Benefits of financial coaching#Gateway of Healing#dr.chandnitugnait

0 notes

Text

A Dive into the Psychology of Wealth

Unveiling the Intricacies of Money: A Dive into the Psychology of Wealth

In a world dominated by financial transactions and economic pursuits, our relationship with money extends far beyond the tangible bills and digital numbers in our bank accounts. The intricate dance between our emotions, behaviors, and financial decisions shapes what is known as the psychology of money. In this exploration,…

View On WordPress

#Abundance Mindset in Finance#Budgeting for Financial Success#Building a Positive Money Relationship#Celebrating Financial Milestones#Compound Interest Benefits#Diversifying Investment Portfolio#Emotional Intelligence in Finance#Financial Confidence through Knowledge#Financial Education Tips#Financial Mindset#Financial Wellness#Gratitude and Money#Holistic Financial Approach#Investment Wisdom from Successful Individuals#Living Below Your Means#Long-Term Financial Planning#Money Psychology#Risk Tolerance and Investments#Smart Money Habits#Wealth Management Strategies

0 notes

Text

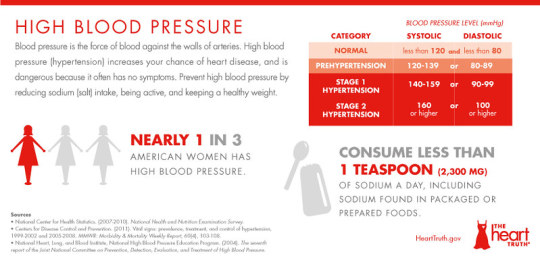

High blood pressure system and causes information

Increased blood pressure in the arteries is a medical disease known as hypertension, or high blood pressure. It’s a vital component of cardiovascular health that has broad effects on general wellbeing. This illness usually takes time to manifest, and until problems happen, it frequently remains asymptomatic.High blood pressure is caused by a number of variables, such as underlying medical…

View On WordPress

#Healthy Living Wellness Nutrition Exercise Mental Health Balanced Diet Fitness SelfCare WellBeing Lifestyle Choices Stress Manage#Hypertension BloodPressure Health#Risk Factors#alcohol consumption#Chronic kidney disease#Definition#Diabetes#general wellness#Genetic Factors#health and fitness#health and wealth coaching#health and wellness#health benefits#health care#Health Education#Health Savings#Health tips#healthcare#Healthcare Solutions#Healthcare Strategies#Healthcare Tips#healthy#healthy and fit#healthy diet#healthy drink#Healthy eating#healthy food#healthy habits#healthy hacks#Healthy Liver

0 notes

Text

Sell Benefits Not Features to Wealth Managers

Sell Benefits, not Features to Wealth Managers to Grow your Bottom Line

Selling benefits, not features, to wealth managers is a key to great marketing. Do you know how you do that?

When you market Geriatric care management, what makes the sale is ” What’s in it for me, the 3rd party?”. “Benefits answer that question for your targets.

Learn how to make an excellent marketing presentation that…

View On WordPress

#aging family#aging life care manager#aging parent care#aging parent crisis#Benefits#benefits of ALCA#Benefits Of Geriatric Care Managers#benefits to 3rd parties#black american geriatric care managers#black american social workers#Black Nurse Entrepreneurs#Black RN&039;s#Black travel nurses#care manager#case manager#dysfunctional aging family#Entitled Family#geriatric care manager#marketing to wealth manager#Narcissism#Narcissistic Personality#nurse advocate#nurse care manager#reaching top 10% elder#Wealth Management Banks#wealthy clients

0 notes

Text

How much protein is required for weight loss

Embarking on a weight loss journey? Discover the role of protein in achieving your goals. Learn about the optimal protein intake for effective weight loss and unveil the science behind this crucial nutrient.

Embarking on a weight loss journey requires careful consideration of various factors, and one crucial element often overlooked is protein intake. In this comprehensive guide, we'll delve into the world of protein and explore how the right amount can be your ally in shedding those extra pounds. Continue reading

#exercise#fat loss#health#health & fitness#health benefits#health is wealth#health blog#health journey#health news#lose weight fast#health science#weight mention#weight loss#weight lifting#weight goals#weight management#weight loss journey#diet#Protein for weight loss#Protein to weight loss#Protein food for weight loss

0 notes

Text

The Significance of Homeownership: Building Personal Wealth

Owning a home has long been considered a cornerstone of the American dream. Beyond just providing shelter, homeownership holds the potential to become the largest source of personal wealth for many individuals. In this blog post, we will explore the various reasons why homeownership is often seen as a powerful means to build personal wealth and discuss the key factors that contribute to this…

View On WordPress

#Appreciation in Property Value#assets vs liabilities#Compound Interest#dailyprompt#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#Generational Wealth#money#Money Fun Facts#Money Management#Moneymaking#Mortgage Payments Build Equity#Passive Income#Personal Finance#Personal Wealth#Real Estate#Tax Benefits#The Significance of Homeownership: Building Personal Wealth#Wealth

1 note

·

View note

Text

Discover the long-term benefits of having a solicitor in your corner. From saving time and money to avoiding legal pitfalls, retaining a solicitor ensures your assets are well-managed and your financial legacy is secure. Learn how Wills & Trusts Wealth Management can provide expert legal support for all life's challenges and opportunities.

#retain a solicitor#legal support#financial well-being#UK solicitors#Wills & Trusts Wealth Management#legal advice#continuous legal support#solicitor benefits#professional legal services#expert legal guidance#comprehensive legal services#personalised legal strategies

0 notes

Text

The Benefits of Working With A Wealth Management Company

Working with a wealth management company in Fort Worth TX offers personalized financial strategies tailored to your goals. Their expertise helps in optimizing investments, managing risk, and ensuring tax efficiency. Access to a team of professionals provides ongoing support and guidance, enabling you to navigate complex financial landscapes. Additionally, they can assist with estate planning and retirement strategies, ensuring your wealth is preserved and grown for future generations.

0 notes