#Bitcoin Bank Market Opportunity

Text

Bitcoin Bank Market to see Booming Business Sentiments | Robinhood, Coinbase, Binance, NextBank

Latest Study on Industrial Growth of Bitcoin Bank Market 2022-2027. A detailed study accumulated to offer Latest insights about acute features of the Bitcoin Bank market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of the market. It also examines the role of the leading market players involved in the industry including their corporate overview, financial summary and SWOT analysis.

Major players profiled in the study are:

Circle (United States), NextBank (Philippines), Nubank (Brazil), Mizuho (Japan), Elliptic Vault (London), Btcbank (United States), Robinhood (United States), Coinbase (United States), Bitbank (Japan) and Binance (United States)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/99533-global-bitcoin-bank-market#utm_source=DigitalJournalVinay

Scope of the Report of Bitcoin Bank

Bitcoin Bank is an automated cryptocurrency trading platform that enables anyone, regardless of prior knowledge or expertise, to buy and sell cryptocurrencies on the open market. Bitcoin bank provide trusted and reliable Bitcoin and crypto trading apps in the market, which uses the most accurate predictions through its robots. The platform has immense potential to exploit the most volatile cryptocurrency markets globally and earn the highest profits. Bitcoin Bank uses high-end encryption and most advanced programming algorithms. The app uses all the present and historical data of the market and analyses both strategically and emotionally, thus, creating trend maps for the market.

The Global Bitcoin Bank Market segments and Market Data Break Down are illuminated below:

by Application (SMEs, Large Sized Enterprises, Individuals), Category (Cloud Based, On Premise), Service (Digital Payments, Bitcoin Debit Card, Loan, Balance Holding, Other), Operating System (Android, IOS, Windows)

Market Opportunities:

Continuous Growth in Digital Infrastructure, Rapid Growth in Ecommerce and IT Sector and Growth in Fintech Infrastructure

Market Drivers:

Rising Demand in Online Crypto Trading, Surge in Demand in Digital Assets Purchasing, Rising Demand in Cryptocurrency Custodial Management and Handling solutions and Demand in Virtual Financial Investments

Market Trend:

Innovation of New Crypto Banking Software Applications, Innovation of Fifth Generation (5G) Technology and Developing Web 3.0 Technology for Cryptocurrencies

What can be explored with the Bitcoin Bank Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Bitcoin Bank Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Bitcoin Bank

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Bitcoin Bank Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/99533-global-bitcoin-bank-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Bitcoin Bank Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Bitcoin Bank market

Chapter 2: Exclusive Summary – the basic information of the Bitcoin Bank Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Bitcoin Bank

Chapter 4: Presenting the Bitcoin Bank Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Bitcoin Bank market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Bitcoin Bank Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=99533#utm_source=DigitalJournalVinay

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#Bitcoin Bank market analysis#Bitcoin Bank Market forecast#Bitcoin Bank Market growth#Bitcoin Bank Market Opportunity#Bitcoin Bank Market share#Bitcoin Bank Market trends

0 notes

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image:

Boy G/Google Maps (modified)

https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

Supreme Court poised to appoint federal judges to run the US economy.

January 18, 2024

ROBERT B. HUBBELL

JAN 17, 2024

The Supreme Court heard oral argument on two cases that provide the Court with the opportunity to overturn the “Chevron deference doctrine.” Based on comments from the Justices, it seems likely that the justices will overturn judicial precedent that has been settled for forty years. If they do, their decision will reshape the balance of power between the three branches of government by appointing federal judges as regulators of the world’s largest economy, supplanting the expertise of federal agencies (a.k.a. the “administrative state”).

Although the Chevron doctrine seems like an arcane area of the law, it strikes at the heart of the US economy. If the Court were to invalidate the doctrine, it would do so in service of the conservative billionaires who have bought and paid for four of the justices on the Court. The losers would be the American people, who rely on the expertise of federal regulators to protect their water, food, working conditions, financial systems, public markets, transportation, product safety, health care services, and more.

The potential overruling of the Chevron doctrine is a proxy for a broader effort by the reactionary majority to pare the power of the executive branch and Congress while empowering the courts. Let’s take a moment to examine the context of that effort.

But I will not bury the lead (or the lede): The reactionary majority on the Court is out of control. In disregarding precedent that conflicts with the conservative legal agenda of its Federalist Society overlords, the Court is acting in a lawless manner. It is squandering hard-earned legitimacy. It is time to expand the Court—the only solution that requires a simple majority in two chambers of Congress and the signature of the president.

The “administrative state” sounds bad. Is it?

No. The administrative state is good. It refers to the collective body of federal employees, regulators, and experts who help maintain an orderly US economy. Conservatives use the term “administrative state” to denigrate federal regulation and expertise. They want corporations to operate free of all federal restraint—free to pollute, free to defraud, free to impose dangerous and unfair working conditions, free to release dangerous products into the marketplace, and free to engage in deceptive practices in public markets.

The US economy is the largest, most robust economy in the world because federal regulators impose standards for safety, honesty, transparency, and accountability. Not only is the US economy the largest in the world (as measured by nominal GDP), but its GDP per capita ($76,398) overshadows that of the second largest economy, China ($12,270). The US dollar is the reserve currency for the world and its markets are a haven for foreign investment and capital formation. See The Top 25 Economies in the World (investopedia.com)

US consumers, banks, investment firms, and foreign investors are attracted to the US economy because it is regulated. US corporations want all the benefits of regulations—until regulations get in the way of making more money. It is at that point that the “administrative state” is seen as “the enemy” by conservatives who value profit maximization above human health, safety, and solvency.

It is difficult to comprehend how big the US economy is. To paraphrase Douglas Adams’s quote about space, “It’s big. Really big. You just won't believe how vastly, hugely, mindbogglingly big it is.” Suffice to say, the US economy is so big it cannot be regulated by several hundred federal judges with dockets filled with criminal cases and major business disputes.

Nor can Congress pass enough legislation to keep pace with ever changing technological and financial developments. Congress can’t pass a budget on time; the notion that it would be able to keep up with regulations necessary to regulate Bitcoin trading in public markets is risible.

What is the Chevron deference doctrine?

Managing the US economy requires hundreds of thousands of subject matter experts—a.k.a. “regulators”—who bring order, transparency, and honesty to the US economy. Those experts must make millions of judgments each year in creating, implementing and applying federal regulations.

And this is where the “Chevron deference doctrine” comes in. When federal experts and regulators interpret federal regulations in esoteric areas such as maintaining healthy fisheries, their decisions should be entitled to a certain amount of deference. And they have received such deference since 1984, when the US Supreme Court created a rule of judicial deference to decisions by federal regulators in the case of Chevron v. NRDC.

What happened at oral argument?

In a pair of cases, the US Supreme Court heard argument on Tuesday as to whether the Chevron deference doctrine should continue—or whether the Court should overturn the doctrine and effectively throw out 17,000 federal court decisions applying the doctrine. According to Court observers, including Mark Joseph Stern of Slate, the answer is “Yes, the Court is poised to appoint federal judges as regulators of the US economy.” See Mark Joseph Stern in Slate, The Supreme Court is seizing more power from Democratic presidents. (slate.com)

I recommend Stern’s article for a description of the grim atmosphere at the oral argument—kind of “pre-demise” wake for the Chevron deference doctrine. Stern does a superb job of explaining the effects of overruling Chevron:

Here’s the bottom line: Without Chevron deference, it’ll be open season on each and every regulation, with underinformed courts playing pretend scientist, economist, and policymaker all at once. Securities fraud, banking secrecy, mercury pollution, asylum applications, health care funding, plus all manner of civil rights laws: They are ultravulnerable to judicial attack in Chevron’s absence. That’s why the medical establishment has lined up in support of Chevron, explaining that its demise would mark a “tremendous disruption” for patients and providers; just rinse and repeat for every other area of law to see the convulsive disruptions on the horizon.

The Kochs and the Federalist Society have bought and paid for this sad outcome. The chaos that will follow will hurt consumers, travelers, investors, patients and—ultimately—American businesses, who will no longer be able to rely on federal regulators for guidance as to the meaning of federal regulations. Instead, businesses will get an answer to their questions after lengthy, expensive litigation before overworked and ill-prepared judges implement a political agenda.

Expand the Court. Disband the reactionary majority by relegating it to an irrelevant minority. If we win control of both chambers of Congress in 2024 and reelect Joe Biden, expanding the Court should be the first order of business.

[Robert B. Hubbell Newsletter]

#Corrupt SCOTUS#Robert B. Hubbell#Robert b. Hubbell Newsletter#Expand the Court#Chevron deference#regulatory agencies#consumer protection#government by Federalist Society

83 notes

·

View notes

Text

When former US president Donald Trump announced a plan to establish a national “bitcoin stockpile” if he is reelected, the crowd at the Bitcoin 2024 conference in Nashville, Tennessee, erupted into a fit of celebration. The frontrunner in the upcoming election was speaking their language.

“For too long, the government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin,” said Trump during his speech on Saturday, pausing briefly to bathe in the applause. “It will be the policy of my administration to keep 100 percent of all bitcoin the US government currently holds or acquires into the future.”

The US government is reportedly sitting on upwards of 210,000 bitcoin—worth around $14 billion—seized from hackers and through various law enforcement activity. That stash, said Trump, would become “the core of the strategic national bitcoin stockpile.” Republican senator Cynthia Lummis, of Wyoming, later proposed legislation that would see the US government amass 1 million bitcoin under Trump.

Any stockpiling plan would benefit bitcoin owners, if only because it would stop the US government depressing the price of the cryptocurrency by flooding the market with its coins in a sale. Trump implied that stockpiling bitcoin, an asset considered by its proponents to be anti-inflationary by virtue of its capped supply, would also help the government to “end the inflation nightmare that this administration [led by Joe Biden] has created.” Senator Lummis later spelled out his thinking, saying, “We need to create a brighter future for generations of Americans by diversifying into bitcoin.”

But stockpiling bitcoin has little merit, economists say. “I see no [economic benefit],” says James Angel, an economist at Georgetown University specializing in financial markets. “The tangible benefit is that it will get bitcoin maxis to vote for Trump. If you believe in Trumpism, that would be the benefit.”

The idea that an investment in bitcoin will offset losses in spending power to inflation is contingent, says Angel, on two shaky assumptions: that the price of bitcoin will rise and, second, that the government would be able to at some stage sell bitcoin back into US dollars without tipping the market into a nosedive. “The government will push the price up by buying bitcoin, so it will look like it has made a lot of money, but the minute it actually starts to sell the bitcoin to take profits, it will push the price right back down again,” says Angel.

Though Trump is initially proposing a moratorium on selling bitcoin already in the possession of the US government, he loosely implied the US would increase the size of its position over time, too. If Trump were to expand the bitcoin stockpile, he would need to locate funds with which to acquire the additional coins. But the readily available options—to increase taxes, take on debt, or print US dollars—are incompatible with the ambition to drive down inflation and national debt, or pledges made by Trump to reduce taxation. Senator Lummis is reportedly set to propose that purchases be funded partly using money that will be added to the US central bank’s balance sheet after the valuation of gold stores is updated to reflect the going market rate. “The money has to come from somewhere,” says Angel.

Even if Trump were to restrict the reserve to bitcoin seized through law enforcement activity, his administration must also weigh up the opportunity cost associated with holding onto bitcoin. Whereas some assets such as bonds generate a consistent income stream for holders, bitcoin does not, making it expensive to hold.

“The question comes down to what the government would get out of the hoards of bitcoin it would be holding,” says George Selgin, director emeritus for the Center for Monetary and Financial Alternatives at the Cato Institute, a US think tank that promotes libertarian principles. The US government has periodically auctioned off the bitcoin confiscated through law enforcement activity. But in choosing to sit on the bitcoin it possesses, “it is failing to realize the market value, which it could apply to any number of other uses, from writing down the federal debt, to paying for other government programs,” says Selgin.

Though Selgin is a proponent of bitcoin for its independence from state control, he opposes the US government speculating on its price on behalf of citizens. “Governments are not particularly astute investors,” says Selgin. “Having the government act on behalf of citizens as some kind of investment trust or mutual fund doesn’t make much sense.”

During his speech in Nashville, Trump namechecked a range of high-profile bitcoiners, including Cameron and Tyler Winklevoss, who founded crypto trading platform Gemini, thanking them for their guidance. Afterward, Tyler took to X to celebrate Trump’s plan and congratulate the organizer of the conference for having “orange-pilled” the former president.

But while it is popular with holders of large amounts of bitcoin and industry executives, the ambition to establish a bitcoin stockpile could come at a cost to most everyone else, particularly if the government were to expand its existing holdings, says Michael Green, chief strategist at asset management firm Simplify.

“The only possible way for the US government to buy bitcoin is from existing holders,” says Green. “But if the government uses tax revenues [or issues bonds] in order to buy bitcoin, it creates a situation in which the taxpayer is subsidizing an extraordinarily small subset. Ultimately, you’re talking about creating exit liquidity for a small subset of the population.” It would be like the US government promising to pay over the odds for real estate in California, says Green, but no other state. “This is not materially different,” he says.

The larger the government’s pot of bitcoin, meanwhile, the more beholden it would become to those who maintain the underlying network—the bitcoin mining companies—whose job is to process transactions and shield the network from attack. Effectively, the bitcoin mining industry would become “another special interest group,” says Green, “that the US government would have to step in and bail out” in the event that the sector—renowned for its sensitivity to various factors beyond its control—were to wobble.

Neither Trump nor Lummis responded to a request for comment on the criticisms made against the bitcoin stockpile plan.

Whether Trump intends to carry out the plan to establish a bitcoin stockpile is a separate question. “Trump is a master demagogue, appealing to the emotions of the crowd. It’s pure electioneering,” says Angel. “I think the plan will probably go the way of Trump Airline, Trump Casino, and Trump University.” That is to say, nowhere.

The members of the bitcoin industry were not blind to the fact that Trump was making a pitch for their vote. It is “historic” for Trump to consider bitcoin important enough to warrant campaigning around, says Jameson Lopp, an early bitcoiner and founder of crypto custody business Casa, who attended the conference. But “the way he spoke to us was pretty clearly pandering,” he says. “It felt like he was kind of speaking down.” Though Trump has previously dismissed bitcoin as a “scam,” he has now “realized that it can be beneficial to him,” says Lopp. “He can gain a new, potentially substantial bloc of single-issue voters.”

Trump was not the only person courting bitcoin fans with promises to take a semipermanent stake in the market. At the same conference, Robert F. Kennedy Jr., who is running against Trump in the election as an independent, presented a more gung-ho plan: The country would acquire 4 million coins—practically 20 percent of the total supply—if he were president.

In that context, the pledges in Nashville were of greater significance as a signal, says Selgin, than for their actual contents. After a period under the Biden administration in which crypto businesses have been targeted, they claim unfairly, by regulatory bodies in the US, the pitches by Trump and others were an attempt to send the general message, says Selgin, “that bitcoin is no longer the enemy.”

19 notes

·

View notes

Text

Crypto Wealth Building A Guide for Gen Z

Who is Andrew Tate?

Understanding Memecoins

Memecoins have gained significant popularity in the world of cryptocurrencies, attracting a new wave of investors, especially among the younger generation like Gen Z. Let’s delve into what memecoins are and how they differ from traditional cryptocurrencies.

Definition and Explanation of Memecoins

Memecoins are a type of cryptocurrency that primarily relies on humor, memes, and community engagement to gain value and traction in the market. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are based on underlying technology and blockchain functionality, memecoins derive their value from internet culture and trends. They often represent a joke or satirical concept that resonates with a specific online community.

How Memecoins Differ from Traditional Cryptocurrencies

While both memecoins and traditional cryptocurrencies use blockchain technology, their fundamental differences lie in their purpose, value proposition, and community-driven nature. Traditional cryptocurrencies aim to revolutionize finance by providing decentralized alternatives to traditional banking systems. In contrast, memecoins serve as a form of entertainment or social commentary within the crypto space. Their value is driven by community engagement rather than technological advancements or real-world utility.

Examples of Popular Memecoins in the Market

Several memecoins have gained significant attention and market capitalization. One notable example is Dogecoin (DOGE), which originated as a joke but has since become one of the most well-known memecoins. Another popular memecoin is Shiba Inu (SHIB), inspired by the Dogecoin phenomenon. These coins have experienced massive price surges due to viral trends and influential endorsements.

Memecoins offer an exciting alternative investment opportunity for Gen Z investors looking to explore the crypto space. Understanding their unique characteristics and how they differ from traditional cryptocurrencies is essential for making informed investment decisions.

Andrew Tate’s Advice on Memecoins

Andrew Tate, a prominent figure in the world of entrepreneurship and wealth building, has shared valuable insights into the realm of memecoins and their potential as an investment avenue for individuals. His perspective on investing in memecoins is characterized by strategic approaches and risk management techniques that can benefit investors looking to explore this unique market.

Overview of Andrew Tate’s Perspective

Andrew Tate views memecoins as an innovative and potentially lucrative investment opportunity within the crypto space. His approach emphasizes the significance of identifying promising memecoin projects with strong fundamentals and community support.

Strategies for Identifying Profitable Memecoin Investments

Tate advocates for thorough research and due diligence when considering memecoin investments. He highlights the importance of assessing the underlying technology, development team, and community engagement to gauge the long-term viability of a memecoin project.

Tips for Managing Risks Associated with Memecoin Investments

Recognizing the inherent volatility of memecoins, Andrew Tate advises investors to exercise caution and prudence in their approach. Setting clear entry and exit strategies, diversifying investment portfolios, staying updated on market trends, and identifying potential breakout candidates such as the next big cryptocurrency set to explode in 2024 are among the risk management practices he recommends.

By aligning his insights with practical investment strategies, Andrew Tate offers a comprehensive perspective on navigating the dynamic landscape of memecoins while prioritizing informed decision-making and risk mitigation.

The Role of Memecoins in Crypto Wealth Building for Gen Z

How Memecoins Can Help Gen Z Build Wealth Through Crypto Investments

Memecoins have become popular among Gen Z investors because they have low barriers to entry and can potentially generate high profits. Unlike traditional investment options, memecoins usually have lower fees for transactions and can be easily accessed through various online platforms. This makes it possible for young investors to enter the cryptocurrency market with a smaller initial investment, which is appealing to those who want to start building wealth at a younger age.

Furthermore, memecoins offer a sense of community and inclusivity that resonates with many Gen Z individuals. The social aspect of memecoins can create a supportive environment for learning about investing and financial literacy, empowering young adults to take control of their financial future.

The Potential for Long-Term Financial Growth Through Memecoin Investments for Young Investors

Memecoins present an opportunity for long-term financial growth for Gen Z investors. While they may be considered more volatile than traditional cryptocurrencies, some memecoins have shown significant increases in value over time. By carefully choosing and diversifying their memecoin portfolio, young investors can position themselves to benefit from potential long-term growth and take advantage of emerging trends in the crypto market.

As digital natives, Gen Z individuals are well-suited to adapt to the changing world of cryptocurrency and blockchain technology. Embracing memecoins as part of their wealth-building strategy can give them practical experience in navigating the digital economy while also potentially earning substantial profits in the future.

The Intersection of Memecoins and AI: A Survival Strategy for Bitcoin Miners

While memecoins offer financial opportunities for Gen Z, it’s important to note that the crypto landscape is ever-evolving. In fact, some forward-thinking Bitcoin miners are exploring AI as a survival strategy in response to certain challenges like the halving event. This intersection between memecoins and AI signifies the growing importance of technological innovations in the cryptocurrency industry. By staying informed and adaptable, young investors can navigate these shifts and continue to thrive in the crypto market.

Getting Started with Crypto Wealth Building as a Gen Z Investor

When it comes to starting your journey of crypto wealth building as a Gen Z investor, there are several important things to think about and tactics that can help you get on the right track. Here’s how you can get started:

1. Educate Yourself

Take the time to understand the basics of cryptocurrencies and blockchain technology. There are many resources available, such as online courses, articles, and forums where you can learn more.

2. Diversify Your Portfolio

Instead of putting all your money into just one cryptocurrency, think about spreading your investments across different assets. This can lower the risk and improve your chances of long-term success.

3. Stay Informed

The cryptocurrency market is always changing, with new things happening all the time. Stay up-to-date with the latest news, market analyses, and expert opinions to make smart investment choices.

4. Manage Risks

It’s important to know how much risk you’re comfortable with and set clear investment goals. Don’t invest more money than you can afford to lose and consider using strategies like stop-loss orders to protect yourself.

5. Find a Mentor

Look for experienced investors or mentors who have done well in the world of crypto wealth building. Their advice and guidance can be really helpful as you start your own investment journey.

By thinking about these things and using these tactics, Gen Z investors can build a strong foundation for their crypto wealth building efforts. With a proactive attitude and a commitment to always learning, it becomes more possible to see financial growth through cryptocurrencies.

Embracing the Future: Why Gen Z Should Explore Crypto Wealth Building Opportunities

As a member of Generation Z, you have the chance to lead the way in technological innovation and shape how financial markets will look in the future. Here’s why it makes sense for you to consider getting into crypto wealth building:

1. Technological Proficiency

Gen Z is known for being comfortable with technology, which puts you in a good position to understand and navigate the world of cryptocurrencies and blockchain. Getting involved in crypto wealth building is a natural fit for your tech-savvy nature.

2. Financial Empowerment

Investing in crypto gives you the power to take charge of your own financial destiny. Instead of relying solely on traditional methods, like saving money or investing in stocks, you can actively seek out opportunities that have the potential to grow your wealth over time.

3. Innovative Mindset

One of the key strengths of your generation is its ability to think outside the box and come up with fresh ideas. By embracing crypto wealth building, you’re not only tapping into an exciting new asset class but also contributing to the ongoing transformation of how money works.

4. Global Perspective

Unlike traditional financial systems that are tied to specific countries, cryptocurrencies operate on a global level. This means that by exploring crypto wealth building options, you can gain exposure to international markets and stay informed about global economic trends.

Embracing crypto wealth building isn’t just about making money; it’s about embracing a mindset of progress, empowerment, and adaptability — qualities that resonate deeply with Generation Z’s values.

Conclusion

As Gen Z individuals, embracing the world of crypto wealth building can have a significant impact on your financial future. The potential for long-term growth through investments in cryptocurrencies, including memecoins, presents a unique opportunity for young investors to secure their financial well-being.

Andrew Tate’s valuable advice on memecoins aligns with the overall guide, emphasizing the importance of strategic investment approaches and risk management. His expertise in entrepreneurship and wealth building serves as an inspiration for Gen Z to explore the world of crypto investments with confidence.

Thanks for reading Article, Also we done tons of research and found this amazing platform solanalauncher.com For you... Here you can generate your own memecoins tokens on solana in just less than three seconds without any extensive programming knowledge, There support is too good for clients, and also you aware about solana blockchain, It's fastest growing blockchain compare to other crypto blockchain.

By staying informed, adopting a proactive mindset, and leveraging the guidance available, you can position yourself to thrive in the evolving landscape of crypto wealth building. Remember, the decisions you make today can pave the way for a prosperous tomorrow.

Happy Investing!

4 notes

·

View notes

Text

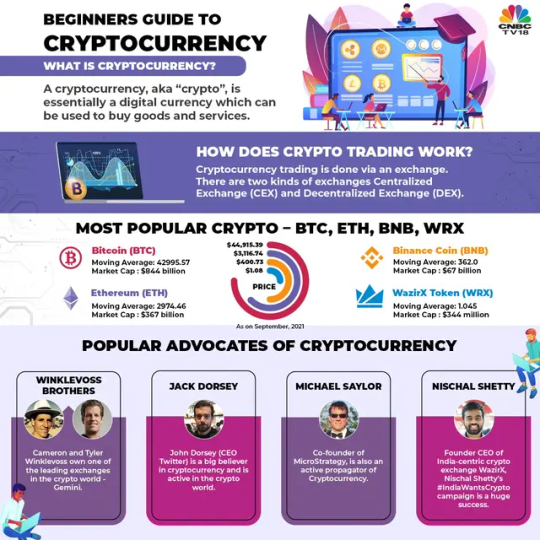

A Primer for Beginners in Cryptocurrency

Cryptocurrency has taken the financial world by storm, a phenomenon held in equal parts awe and scepticism. What is cryptocurrency, and why should beginners care? This guide will answer all these questions and provide a true definition of cryptocurrency, for the uninitiated.

What is Cryptocurrency?

At its most basic, cryptocurrency is any type of digital or virtual currency that uses cryptography for security. Cryptocurrencies — which are not issued by a central government (like the US dollar or Euro), operate on networks known as blockchains. This decentralization means that it is not owned by a single entity, like the central bank of each country.

How Does Cryptocurrency Work?

Decentralization, Transparency and Immutability are the killer features of blockchain technology which is being utilized by cryptocurrencies. A blockchain is a distributed ledger that keeps track of all transactions across a network of computers. When a block of transactions is added to the blockchain, it means that every new transaction in completion (e.g., money moving from one account to another) makes an update on all ledgers for their users.

The opaque and unreliable centralized system is avoided, allowing the data to be secure (distributed AND only YOU hold access), prompt & transparent. Bitcoin, the first and most famous cryptocurrency is a case in point: Bitcoin uses blockchain technology to enable peer-to-peer transactions without an intermediary (like a bank).

Popular Cryptocurrencies

Bitcoin, is the best-known cryptocurrency and there are thousands of other cryptocurrencies with various uses and functionality. Here are a few notable ones:

Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts (like dApps) on its platform.

Ripple (XRP): While Ripple is designed as a digital payment protocol, it still serves the same use case of enabling instant and cheap across borders.

Litecoin (LTC): Often dubbed as silver to Bitcoin's gold, Litecoin has faster transaction confirmation times.

Why Invest in Cryptocurrency?

There are few reasons for which a realization of benefits can seem attractive in investing this digital currency.

High upside: Cryptocurrencies can also gain value by huge percentages. For example, the early investors of Bitcoin and Ethereum are currently smiling to their bank-account.

2. Diversification: Cryptocurrencies can be added to an investment portfolio in order to diversify it thereby decreasing the risk.

3. Innovation and Technology: Investing in cryptocurrencies is an investment into the underlying blockchain technology, a revolutionary tool with many uses beyond digital currencies.

Risks and Considerations

But of course, as with all investment opportunities there are risks when it comes to digital currencies:

Volatility: Cryptocurrency is known for its price volatility; prices fluctuate rapidly and dramatically.

Regulatory Risks: The regulatory backdrop for cryptocurrencies is definitely a work in progress and future regulations may affect the value of these digital currencies as well as how they can be used.

Security Risks: The blockchain is secure, the platform and exchange on which cryptocurrencies are stored can be hacked.

How to Start with Cryptocurrency

There are some guidelines to help beginners who want to start investing in cryptocurrency.

Do your homework — It is important to be familiar with what you are investing; important to know what you're putting your money into, services like Coursera and NerdWallet provide thorough lessons on cryptocurrency.

Pick a Secure Exchange: Go for the most secure cryptocurrency exchange to purchase and offer cryptos Common exchanges such as Coinbase, Binance and Kraken.

Protect your investments: Store cryptocurrencies in secure wallets. Online wallets are less secure whereas hardware wallets provide advanced security to store.NEO.

4. Start Small — With all the volatility in this market, it would also be prudent to instead make a small investment and then scale into your position from there as you get more comfortable with these markets.

Conclusion

Cryptocurrency is a titanic heavy weight knocking the financial industry off its axis; it opens new doors for wealth and disaster as well. These are the basics of cryptocurrency that beginners need to understand and with a responsible, well-informed entering into it can lead them being successful. successful investment. Besides, due-diligence and strategic thinking at every stage are defining factors for anyone who wants to dive into the roller-coaster world of crypto-investing.

5 notes

·

View notes

Text

Bitcoin and the Freedom to Unplug: Reflecting on My Vacation

As I recently returned from a much-needed vacation, I found myself reflecting on the unique sense of freedom that Bitcoin has brought into my life. Vacations are supposed to be a time to relax, unwind, and disconnect from the stresses of daily life. However, for many people, financial worries and concerns about the future often creep in, even when they’re supposed to be taking a break. Thanks to Bitcoin, this time away was different for me.

One of the most significant shifts Bitcoin has brought into my life is the ability to truly unplug—not just from work, but from the constant worry about my financial security. In the past, vacations were always tinged with a bit of anxiety. Questions about how the markets were performing, whether my savings were losing value due to inflation, and the general uncertainty of the fiat system would hover in the back of my mind. But this time, I was able to fully embrace the present, knowing that my wealth was safeguarded by a decentralized, incorruptible network.

The Financial Freedom to Truly Relax

Bitcoin has given me the peace of mind that my money is not subject to the whims of central banks or governments. It's not just about the potential for financial gain; it's about the stability and predictability that Bitcoin offers. Knowing that my wealth is stored in something that can’t be diluted or manipulated by external forces allowed me to relax in a way I hadn’t before.

During this vacation, I didn’t have to worry about whether my savings were losing value due to rampant money printing or whether I should be moving funds around to protect against market volatility. Bitcoin’s inherent properties as sound money meant I could enjoy my time away, confident that my financial future was secure. This is a kind of freedom that’s hard to quantify, but once you experience it, there’s no going back.

Orange-Pilling the Next Generation

One of the highlights of my vacation was spending time with my 12-year-old cousin. As we talked, I found an opportunity to introduce them to Bitcoin. It started with a simple question: “What do you think gives money its value?” From there, we delved into the history of money, the problems with fiat currency, and how Bitcoin offers a revolutionary alternative.

It was amazing to see the curiosity spark in their eyes as they began to understand these concepts. To help them get started, I gave them $5 in Bitcoin—not just as a gift, but as a starting point for their own journey into the world of decentralized finance. This small gesture was more than just a transfer of digital currency; it was the beginning of a new way of thinking for them, one that I hope will lead them to greater financial independence in the future.

This experience reminded me of the importance of spreading the knowledge about Bitcoin. It’s not enough to simply hold Bitcoin; we need to share its potential with those around us, especially the younger generation. They are the ones who will carry this torch forward, and it’s our responsibility to equip them with the tools and knowledge they need to succeed in a world that is rapidly changing.

Bitcoin: More Than Just Money

This vacation reaffirmed my belief that Bitcoin is far more than just a digital asset. It’s a powerful tool for personal empowerment and financial sovereignty. It allows us to step outside the traditional financial system and live our lives with a greater sense of autonomy and control.

For many, Bitcoin is seen as a hedge against inflation or a speculative investment. But for those of us who have fully embraced it, Bitcoin represents something much deeper. It’s a means of reclaiming our financial independence and living life on our own terms.

As I return to my routine, I’m more convinced than ever that Bitcoin is a path to true freedom. It’s a journey that has already transformed my life, and I’m committed to helping others discover this same sense of liberation. Whether it’s through sharing my experiences, educating others, or simply living by example, I believe that Bitcoin has the power to change the world for the better.

Conclusion: The Importance of Sharing the Bitcoin Vision

In the end, this vacation wasn’t just a break from the daily grind—it was a chance to reflect on the profound impact that Bitcoin has had on my life. It was a reminder that the freedom Bitcoin offers is not just financial; it’s the freedom to live fully, to unplug without fear, and to share this vision with others.

As Bitcoin continues to grow and evolve, I’m excited to see how it will continue to shape my life and the lives of those around me. And as always, I’m committed to spreading the word and helping others discover the incredible potential that Bitcoin holds.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#FinancialFreedom#Cryptocurrency#Vacation#Unplugged#GenerationalWealth#DigitalAssets#DecentralizedFinance#BitcoinCommunity#CryptoEducation#SoundMoney#EconomicIndependence#FutureOfMoney#OrangePill#BitcoinAdvocate#financial experts#blockchain#finance#globaleconomy#financial education#digitalcurrency#financial empowerment#unplugged financial

2 notes

·

View notes

Text

Waran Buffet (and news) there is a theremin in investments Bitcoin or the euro-dollar fell due to the fact that bad news came out. But this is an illusion (in financial markets and crypto) the price moves up or down, because the , bank or organization sold for a billion or bought it. And another competing bank bought or sold it for 800 million.. As a result, the price goes to where more money was poured in (in the end we will go according to the plan of the first bank). As a result, in the case of an investment, having bought something, hold it for at least 3 -12 years, if you are lucky and you have earned money, take your money and wait for another opportunity.. Also study what you want to buy (in terms of the long term, is there any usefulness of this product, stock or crypto )

3 notes

·

View notes

Text

Bitcoin Price Plummets 77% in Asian Session, Triggering $200 Million in Liquidations

Bitcoin Price Crashes 77% in Asian Session, Sets Off $200 Million in Liquidations 😱

Bitcoin took a sudden nosedive during the Asian session, dropping 7.74% and briefly touching the $40,400 mark. This unexpected drop led to the liquidation of nearly $200 million worth of positions, causing significant market volatility. With the upcoming US Consumer Price Index (CPI) and the Federal Reserve's interest rate decision, high volatility is anticipated to continue.

Higher interest rates often have an adverse impact on the price of gold, as they increase the opportunity cost of holding the precious metal rather than investing in interest-bearing assets or depositing cash in a bank. Additionally, they generally strengthen the US Dollar, which in turn lowers the price of gold since it is denominated in dollars. It will be crucial to monitor the Fed's interest rate decisions and their implications on the price of Bitcoin.

Bitcoin is currently trading around $42,289, hovering around the midpoint of its 77% crash during the bear market. This price level is pivotal and may trigger significant take-profit or sell orders, which could result in market-wide liquidations. Market participants should remain cautious as the struggle between bulls and bears intensifies. It is worth noting that a major correction in Bitcoin price is not expected until it reaches the 62% retracement level at $48,733. However, today's movements could catch many overeager investors off-guard. The $50,000 psychological level may be a plausible area for market-wide profit-taking to occur.

Read the original article

#Bitcoin #cryptocurrency #BitcoinPrice #marketvolatility

2 notes

·

View notes

Text

Everything You Need to Know About Investing

Investing is a vast and intricate world, filled with opportunities, pitfalls, and a plethora of information. Whether you're a seasoned investor or just starting out, there's always something new to learn. Let's dive into the essentials of investing and how you can navigate this financial journey with confidence.

The Foundations of Investing

Before diving deep into the strategies and nuances, it's crucial to understand the basics. Investing is essentially allocating resources, usually money, with the expectation of generating an income or profit. But where do you start?

1. Understanding Your Goals

Every investor has a unique set of objectives. Some might be saving for retirement, while others could be aiming to buy a home or fund their children's education. Knowing your goals will help you tailor your investment strategy accordingly.

2. Risk and Return

There's a fundamental principle in investing: the higher the potential return, the higher the risk. It's essential to assess your risk tolerance and align it with your investment choices. For a deeper dive into risk management, check out Investment Pitfalls Unveiled: How to Avoid Costly Mistakes.

3. Diversification

Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk. This strategy is beautifully explained in The Comprehensive Guide to Index Funds: A Powerful Tool for Diversification and Long-term Growth.

The World of E-commerce and Investing

E-commerce has revolutionized the way we shop and invest. With the rise of online platforms, investing has become more accessible than ever. Here's how the e-commerce landscape intertwines with the world of investing:

Retail Trends: The retail industry is ever-evolving, with new trends emerging regularly. For instance, the new retail trends in Qatar offer a comprehensive insight into the changing dynamics of the market.

Online Safety: As online transactions become more prevalent, it's crucial to ensure safety. Learn how to shop online safely to protect your investments and personal information.

The Magic of Customer Experience: In the world of e-commerce, customer experience is king. Dive into the enchanting e-commerce world and discover how it impacts investment decisions.

Cryptocurrency: The New Frontier

The rise of digital currencies, especially Bitcoin, has added a new dimension to investing. With its decentralized nature and potential for high returns, many are drawn to this digital gold. Explore the empowering world of Bitcoin banking and how it's reshaping the financial landscape.

Time: The Investor's Best Friend

Time is a crucial factor in investing. The power of compounding, where your investments earn returns on returns, can lead to exponential growth over time. Delve into the concept of compounding demystified to harness its potential.

In Conclusion

Investing is a journey, filled with learning, growth, and occasional setbacks. But with the right knowledge, tools, and mindset, it can lead to financial freedom and prosperity. As you embark on this journey, remember to stay informed, make informed decisions, and always keep your goals in sight.

For more insights, tips, and comprehensive guides on various topics, explore the vast collection of articles on Steffi's Blogs. Happy investing!

Note: Always consult with a financial advisor before making any investment decisions.

#Unlock Wealth Secrets#E-commerce Goldmine#Bitcoin Boom#Investing 101 Unveiled#Qatar's Retail Revolution#Risk or Reward? Find Out!#Dive into Digital Currencies#Time's Ticking: Compound Now!#Financial Freedom Fast-Track#Master the Market Mysteries#From Zero to Investment Hero#Online Shopping: Safe or Scam?#Cryptocurrency Craze: Join or Joke?#Diversify and Dominate#Retail Trends: Rise or Ruin?#Customer Experience: Cash or Crash?#Compounding: The Magic Formula#Steffi's Top Investment Tips#Navigate the Investment Labyrinth#E-commerce Explosion: Invest or Ignore?

2 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

Coino Live: the best crypto and bitcoin payment gateway

In the ever-evolving world of digital transactions, Coino Live has emerged as a game-changer. This reportage post delves into the innovative features and potential impact of Coino.Live, a platform that aims to revolutionize the way we conduct online transactions.

1. The Rise of Cryptocurrencies:

Coino.Live is at the forefront of the cryptocurrency revolution. As digital currencies gain popularity, Coino.Live provides a secure and user-friendly platform for individuals and businesses to transact using cryptocurrencies. With its intuitive interface and robust security measures, Coino.Live is bridging the gap between traditional financial systems and the world of digital currencies.

2. Decentralization and Transparency:

One of the key features of Coino.Live is its decentralized nature. By utilizing blockchain technology, Coino.Live ensures transparency and immutability of transactions. This eliminates the need for intermediaries, such as banks, and empowers users with full control over their funds. The decentralized nature of Coino.Live also enhances security, as it significantly reduces the risk of fraud and hacking.

3. Seamless Integration:

Coino.Live offers seamless integration with various digital wallets and cryptocurrency exchanges. This allows users to easily manage their digital assets and conduct transactions within the platform. The user-friendly interface makes it accessible to both experienced cryptocurrency enthusiasts and newcomers to the digital currency space.

4. Global Accessibility:

Coino.Live breaks down geographical barriers by enabling users to transact globally without the need for traditional currency conversions. With its support for multiple cryptocurrencies, Coino.Live provides a universal platform for individuals and businesses to engage in cross-border transactions. This opens up new opportunities for international trade and commerce.

5. Empowering Businesses:

Coino.Live empowers businesses by offering them a secure and efficient platform to accept cryptocurrency payments. By integrating Coino.Live into their payment systems, businesses can tap into a growing market of cryptocurrency users, expanding their customer base and potentially reducing transaction fees. This flexibility and adaptability make Coino.Live an attractive option for forward-thinking businesses.

Conclusion:

Coino.Live is leading the charge in transforming the future of digital transactions. With its decentralized approach, seamless integration, and global accessibility, the platform is revolutionizing the way we transact online. By embracing the power of cryptocurrencies and blockchain technology, Coino.Live is empowering individuals and businesses to transact securely, efficiently, and globally. As the world continues to embrace digital currencies, Coino.Live is poised to play a significant role in shaping the future of financial transactions.

2 notes

·

View notes

Text

Cryptocurrency: What is it and How Does it Work?

Cryptocurrency is a virtual or digital currency that utilizes cryptography for the security and validation of its trades. This form of money does not rely on a central bank, thus, is a decentralized medium of exchange. The entire history of cryptocurrency transactions is publically kept on a blockchain ledger and is maintained by numerous computers across the world.

This digital asset has a range of remarkable traits, such as heightened security, quick transfers, and a limited quantity, that make it a desirable option for investments. In addition to this, the decentralized and virtual aspect of cryptocurrency could transform global banking and payments. In this blog, we will delve into the definition of cryptocurrency, it’s functioning, its advantages, prospects of the future, and a conclusion.

What is Cryptocurrency?

How Does it Work?

Transactions are conducted on a decentralized network of computers and verified with a public ledger known as a blockchain. This peer-to-peer system bypasses the need for any centralized authority or intermediary. Subsequently, cryptocurrency users can transfer and acquire currency directly from their digital wallets. cryptocurrency directly to each other via digital wallets.

The blockchain is a publicly accessible register of every single transaction to ever be conducted over the network. All exchanges are validated by multiple computing nodes on the network and once ratified, the transaction is incorporated into the blockchain, guaranteeing the safety, clarity, and inalterability of every single network transaction.

Features of Cryptocurrency

Decentralization: Cryptocurrency is decentralized, This means clearly that the government does not regulate it.

Security: Cryptography ensures the integrity of cryptocurrency transactions, making them nearly invulnerable to unauthorized intrusion or duplication.

Transparency: All transactions on the blockchain are transparent and publicly accessible.

Anonymity: The privacy of cryptocurrency transactions allows users to carry out transactions without needing to disclose their personal information. Anonymity is thus provided by these virtual currencies.

Global Reach: Cryptocurrency facilitates the facilitation of international payments without the burden of having to exchange different types of currency. This increases its reach to a global level.

Potential for the Future

Cryptocurrency is poised to disrupt the financial sector, with its promise of heightened security, transparency, and expedited financial transactions. As technology progresses and cryptocurrency acceptance rises, it is increasingly likely to be recognized as a bona fide payment option.

Predictions by experts state that cryptocurrency may eventually be favored over traditional money as a method of payment. This would potentially cause a considerable alteration in how monetary transactions are done and the role that cryptocurrency would play in the world’s economic system.

It currently has more than 4000 cryptocurrencies in operation, with a total market capitalization of over $2 trillion. Some of the most popular cryptocurrencies include bitcoin, Ethereum, and Litecoin.

Conclusion:

To summarize, cryptocurrency is a decentralized digital or virtual currency that uses advanced blockchain technology for protection. Its various benefits such as decentralization, security, transparency, anonymity, and worldwide availability make it particularly attractive.

The application of cryptocurrency to the financial industry promises to revolutionize it through increased security, transparency, and efficiency in financial operations. Yet, before it can gain broad acceptance, its potential needs to be acknowledged by legislators and governed through suitable regulations.

Cryptocurrency presents an opportunity for dramatic transformation in how money and finances are conducted. Its evolving potential has the power to revolutionize our lives and shape the global economy. The future is sure to be enthralling as this new technology continues to grow.

2 notes

·

View notes

Text

The following is a conversation with an AI assistant. The assistant is helpful, creative, clever, and very friendly.

Human: Hello, who are you?

AI: I am an AI created by OpenAI. How can I help you today?

Human: good afternoon. What a time to buy bitcoin?

AI: It is recommended that you research the current market trends and analyze the cryptocurrency market before investing in any cryptocurrency. Be sure to read reviews by experts in the field before making a purchase.

Human: I'm holding on to my BTC for 5-10 years.