#Crypto Business Solutions

Text

An Ultimate Guide to Understanding Tokenomics

In the ever-changing world of Digital Currency, it can be hard to understand the specifics of tokenomics. This guide provides an in-depth overview of the concept of tokenomics and its fundamental principles. It explains the different components of tokenomics, such as token supply, token distribution, token incentives and token utility, and provides insight into how tokenomics works and why it is important. At the end of this guide, readers will have a comprehensive understanding of tokenomics and its importance in the Cryptocurrency market.

We understand the importance of having a secure and reliable platform to create and manage digital assets. That's why we offer our Crypto Token Development Solutions and Crypto Coin Development Solutions to give users the power to create and manage their own tokens and coins with confidence. Our solutions provide users with a secure and scalable platform that is easy to use and understand. We take the security of your coins seriously and strive to provide the best solutions for our clients.

Table of Contents:

I. What is Tokenomics?

II. Token Supply

III. Token Distribution

IV. Token Incentives

V. Token Utility

VI. How Tokenomics Works

VII. Conclusion

I. What is Tokenomics?

Tokenomics is the study of the economic aspects of digital tokens and their use within a blockchain network. Tokenomics focuses on the supply, distribution, incentives, and utility of tokens and how they relate to the blockchain network. Tokenomics is important because it helps to understand the dynamics of the cryptocurrency market and how different tokens interact with each other. It also provides insight into how tokens can be used to incentivize certain behaviors and how tokenomics can be used to create a better user experience.

II. Token Supply

The supply of tokens is one of the most important components of tokenomics. The supply of tokens determines the total number of tokens that are available in the market and affects the price of the tokens. The supply of tokens can be determined through a variety of methods including mining, staking, and airdrops. The supply of tokens is important because it affects the value of the tokens and the price of the tokens in the market.

III. Token Distribution

Token distribution is the process of distributing tokens to different participants in the network. Token distribution is important because it helps to ensure that the tokens are distributed fairly and that the tokens are being used for their intended purpose. Token distribution can be done through a variety of methods including mining, airdrops, staking, and token sales.

IV. Token Incentives

Token incentives are rewards given to users for taking certain actions or behaviors. Token incentives are important because they help to encourage certain behaviors and incentivize users to take certain actions. Token incentives can be used to increase the number of users on a platform, encourage users to hold onto tokens for longer periods of time, and create a more active user base.

V. Token Utility

Token utility is the use of tokens to provide access to a product or service. Token utility is important because it allows users to purchase goods or services without having to exchange fiat currency. Token utility can be used to provide access to digital products or services, such as software licenses, and can also be used to purchase physical goods or services.

VI. How Tokenomics Works

The economic structure of cryptocurrency determines the incentives that draw investors to buy and keep certain coins or tokens. The monetary policy of each crypto is exclusive, like all paper money. Cryptoeconomics is focused on analyzing the incentives that control the circulation of tokens as well as the utility of tokens that determine their requests. If the utility provides appropriate rewards, it can properly assist projects to appreciate in value as demand and supply are changed drastically. There are some key factors that crypto project makers can manipulate that have an effect on token economics.

Mining and staking

For foundational blockchains like Ethereum 1.0 and Bitcoin, miners receive rewards for verifying transactions in a distributed computing network. Staking offers a similar incentive, requiring users to lock up a certain amount of coins via a smart contract, which is the mechanism employed by blockchains like EOS. Ethereum 2.0 is also set to adopt this approach.

Token burns

Certain protocols or blockchains "burn" tokens in order to reduce the number of coins in circulation. This goes along with the laws of supply and demand, as lessening the amount of tokens available should help to increase its value as the leftovers become more and more rare (deflationary model).

Yields

Financial platforms with decentralized structures provide high yields to attract individuals to purchase and deposit tokens. These yields are given out in the form of new tokens. These tokens are put into liquidity pools, which are massive collections of digital currencies that back up systems such as decentralized exchanges and credit networks.

Vesting periods and token allocation

Crypto projects are typically set up to distribute tokens with precision. Frequently, specific amounts of tokens are kept for venture capitalists or developers, but they are unable to trade them until a predefined period has elapsed. In the long run, this has an effect on the quantity of coins in circulation. Preferably, there needs to be a system in which tokens are allocated in a way that reduces the effect of issuance and the speed at which tokens are released on the supply and cost of tokens.

Token supply

The total number of coins available is a major factor in determining the worth of a cryptocurrency over time. This figure gives an indication of the potential for price drop and whether the necessary techniques are available to regulate it. Generally speaking, if too many coins are issued, they will immediately lose value. This is applicable to crypto assets, which have an unlimited supply, with new coins usually entering the market in compliance with a predetermined plan.

FAQs

What Are the Different Types of Tokenomics?

There are several different types of tokenomics, each of which is suitable for different types of projects. The most common types of tokenomics are utility tokenomics, currency tokenomics, and asset tokenomics.

Utility tokenomics is used for projects that focus on providing access to a service or product. Currency tokenomics is used for projects that are focused on creating a digital currency. Asset tokenomics is used for projects that are focused on creating a digital asset.

What Are Some Examples of Tokenomics?

There are many examples of tokenomics in the blockchain world. One of the most popular is the Ethereum tokenomics model, which is based on the ERC-20 token standard. Other examples include the Bitcoin tokenomics model, which is based on the Bitcoin protocol, and the Ripple tokenomics model, which is based on the Ripple protocol.

What Are the Challenges of Tokenomics?

While tokenomics can be an effective way to create value for a project, there are a few challenges associated with it. One of the key challenges is that tokenomics requires careful planning and execution in order to be successful. The token distribution, usage models, and governance models must all be carefully considered to ensure that the project is successful. In addition, tokenomics is subject to the same risks that all digital assets are subject to, such as market volatility, regulatory uncertainty, and security vulnerabilities.

What Is the Future of Tokenomics?

The future of tokenomics is bright. As more projects turn to token-powered economic systems to drive value and incentivize users, tokenomics will become increasingly important in the blockchain space. We can expect to see more projects experimenting with different tokenomics models, as well as more tools and services that make it easier to create and manage token-based projects.

VII. Conclusion

Zeltatech provides reliable and secure Crypto Token Development and Crypto Coin Development Solutions. These solutions can help users create and manage their own coins and tokens with ease and confidence. Understanding tokenomics is essential for anyone looking to navigate the cryptocurrency market, and Zeltatech's solutions can help users take advantage of the benefits that tokens provide. By focusing on supply, distribution, incentives, and utility, tokenomics can help create a more efficient and secure system for cryptocurrency transactions. Zeltatech's solutions are designed to be reliable and secure, ensuring that users' coins and tokens are always safe and secure.

#Digital Business Solutions#Business Solutions Company#Crypto Business Solutions#Crypto Business Services#Blockchain Business Services#DApp Development#Dapps Development Services#dApp Development Company#dapp development agency#ethereum dapp development#Blockchain Development Service#NFT Development Company#Nft Development#zeltatech

0 notes

Text

If you don’t know how to choose US stocks, if you are still losing money, if you want to change, join our group: https://chat.whatsapp.com/GOy9A5sl74tHRuEHNpFIzp

You can contact me to receive new member benefits. 👉👉👉A set of stock selection strategy information that our agency has spent many years researching. We will also take you to experience our VIP real-time operations

#business#finance#streaming#stock market#investment#bitcoin#funny memes#investing#crypto#investing stocks#stock trading#mutual funds#stockstowatch#optionstrategybuilder#optionperks#ACLA24#ACLA24Leaders#youtube#youtube video#climate leaders#climate solutions#climate action#climate and environment#climate#climate change#climate and health#climate blog#climate justice#climate news#weather and climate

2 notes

·

View notes

Text

#kyc canada#kyc providers#business#kyc solution#Fraud Prevention#businesses#crypto#KYC solutions for Crypto#KYC for crypto exchanges

2 notes

·

View notes

Text

ChangeNOW Review: A One-Stop Shop for Buying and Swapping Crypto in 2024-2025

ChangeNOW: Quick, Secure, and Limitless Crypto Exchanges Imagine having access to instant swaps, over 1,000 tokens, and more than 1,000,000 asset pairs, all within a secure and user-friendly interface, without even needing to register on the platform. From what we've heard, ChangeNOW seems to cover all these aspects, and even more, so it just made sense to review its offerings and discover whether it really brings convenience to those seeking an all-in-one solution instead of managing multiple platforms. Non-Custodial Exchanges and Swaps If you hate jumping through hoops just to swap assets, you might like this one, since ChangeNOW keeps things simple with no registration needed. The platform actually allows users to enjoy lightning-fast swaps and exchanges while giving them the chance to maintain their privacy. But heads up – registered users do get some cool perks, which we'll dive into later on. Besides, the ChangeNOW Telegram bot offers a refreshing alternative for users looking to swap cryptocurrencies with even greater ease. Supporting over 1000 cryptocurrencies, this account-free and worry-free bot delivers instant transactions similar to the main service. ChangeNOW’s non-custodial nature ensures that your funds remain completely under your control, which is another strong benefit for those who prioritize security.

To Know More- ChangeNOW crypto exchange

#ChangeNOW crypto exchange#no registration crypto swaps#fiat to crypto swaps#instant crypto exchanges#API integration crypto#business crypto tools#non-custodial crypto exchange#crypto swapping platform#crypto widgets#crypto white label solutions

0 notes

Text

Fortify Your Defenses with Zigram's Cutting-Edge Data Breach Solutions

Enhance cybersecurity with Zigram's cutting-edge data breach solutions. Safeguard your business from threats with our proactive strategies and advanced technology. Your trusted partner in securing sensitive information.

#data breach solutions#aml screening#sanctions screening software#screening database#sanction screening aml#aml crypto#crypto compliance#watchlist screening#business verification#technical due diligence

0 notes

Text

User Acquisition Tactics for Crypto Exchanges: Insights from a Crypto Marketing Agency

Content marketing is a powerful tool utilized by crypto exchanges to attract and educate users. By producing high-quality blog posts, articles, videos, and infographics, exchanges can position themselves as authoritative sources of information in the crypto space. The content can cover a range of topics, such as crypto basics, investment strategies, market updates, and security measures.

A crypto marketing agency plays a crucial role in content marketing by assisting exchanges in creating engaging and informative content. They can provide valuable insights on trending topics, industry research, and keyword optimization to maximize the reach and visibility of the content. Additionally, they may also offer professional content creation services, ensuring the production of compelling material that resonates with the target audience.

2. Social Media Marketing: Building a Community

Social media platforms offer immense opportunities for crypto exchanges to connect with potential users and build a vibrant community. By establishing a strong presence on platforms like Twitter, Facebook, LinkedIn, and Reddit, exchanges can engage in direct conversations, share updates, and address user queries. Moreover, social media provides a platform for exchanges to showcase their unique selling propositions and differentiate themselves from competitors.

A crypto marketing agency can provide valuable insights into social media marketing strategies tailored specifically for crypto exchanges. They can assist in creating compelling social media profiles, developing a content calendar, and implementing effective engagement techniques. Furthermore, they can monitor social media conversations, gather user feedback, and provide valuable analytics to optimize the overall social media marketing efforts.

3. Influencer Partnerships: Leveraging Trust and Reach

Influencer marketing has become a prominent strategy for crypto exchanges to reach new users. Collaborating with influential figures in the crypto industry allows exchanges to tap into their existing fan base and leverage the trust and credibility they have established. Influencers can create sponsored content, participate in AMA (Ask Me Anything) sessions, or provide endorsements that resonate with their followers.

A crypto marketing agency can play a pivotal role in influencer partnerships by identifying suitable influencers aligned with the exchange's target audience. They have access to extensive networks and can negotiate partnerships, manage contracts, and track campaign performance. Additionally, they can provide valuable guidance on content strategy, ensuring that the collaboration aligns with the exchange's brand values and goals.

4. Referral Programs: Harnessing the Power of Networks

Referral programs have proven to be highly effective in user acquisition for crypto exchanges. By incentivizing existing users to refer their friends, exchanges can tap into the power of networks and rapidly expand their user base. Referral programs often provide rewards, such as discounts on trading fees, bonus tokens, or even cash incentives, to motivate users to spread the word.

A crypto marketing agency can assist in designing and implementing referral programs that encourage users to refer others. They can provide valuable insights on reward structures, referral tracking systems, and effective communication strategies. Moreover, they can leverage their expertise to optimize the referral program based on data analysis and user behavior patterns.

5. Search Engine Optimization (SEO): Boosting Organic Visibility

Search Engine Optimization (SEO) plays a vital role in increasing the organic visibility of crypto exchanges. By optimizing their websites and content for relevant keywords and improving their overall website structure, exchanges can rank higher in search engine results. This, in turn, drives organic traffic and increases the chances of acquiring new users.

A crypto marketing agency can provide valuable SEO insights and services to crypto exchanges. They can conduct keyword research, optimize website content, improve metadata, and enhance website performance to ensure better search engine rankings. Additionally, they can monitor SEO analytics, identify trends, and implement strategies to stay ahead of competitors in the search engine landscape.

Conclusion

In the fiercely competitive crypto exchange landscape, user acquisition is a top priority. By employing various tactics such as content marketing, social media marketing, influencer partnerships, referral programs, and search engine optimization, exchanges can attract new users and stay ahead of the curve. The role of a crypto marketing agency is instrumental in this process, offering valuable insights, services, and expertise to enhance the effectiveness of user acquisition strategies. By leveraging the expertise of a crypto marketing agency, exchanges can unlock their full potential and build a thriving user base in the exciting world of cryptocurrencies.

#cryptoexchange#cryptomarketing#crypto business#crypto#web3marketing#web3 marketing agency#blockchain solutions#blockchaindevelopment

0 notes

Text

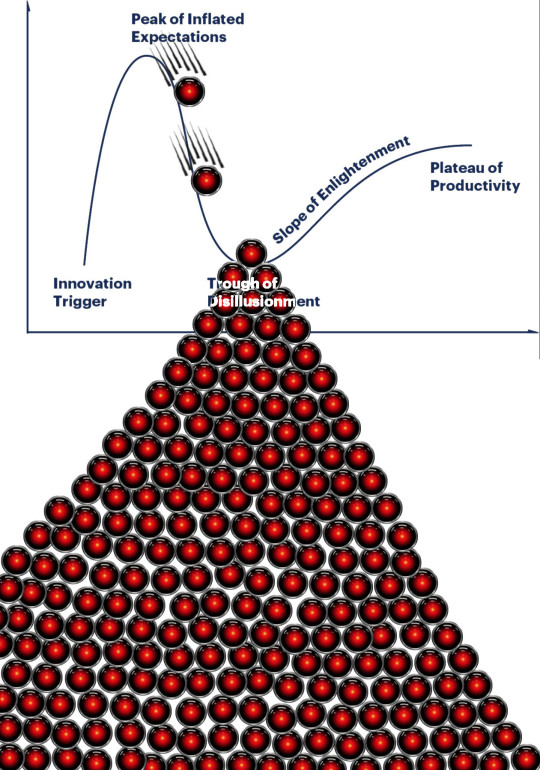

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Note

ive been seeing a lot of people say they’re going to leave this website, etc. im rly curious what you think of this? should we? are there better solutions rather than just leaving? asking in good faith, take care<3

I don't think tumblr's going to get better without the entire hierarchy of it being changed. But, I doubt that'll happen. Even if Matt faced consequences for his actions, the next person that'd fill in wouldn't be different enough to matter, tumblr has grown to a point that only businesses are gonna be able to buy it and none of them are gonna improve the state of things.

But, I've been here since like, 2009? It has never been welcoming to trans people. I'd argue it's a bit better now but it has never been welcoming to trans people or the lgbt at large. The reason we flocked here was because we built communities that looked out for each other and often times we go under the radar. I'd argue the transmisogyny and the targeted harassment are exactly the same as they were in 2015, it's just who's doing harassment campaigns have changed. Instead of truscum we got transandrophobia "truthers" spreading disdain, we still got terfs galore, anti-sjws stopped trying to rebrand and now are just admittingto to being nazis. The differences to me are A) we have the language to talk about crypto terfs established now. back in the day the dialog about it wasn't as good so trying to talk about it would result in a lot of drama (often times ending with a trans women being spammed with hate until she deleted) B) more trans people are aware that call out culture is a crock of shit that doesn't keep anyone safe, is often utilized by abusers trying to malign their victims more, and utilized by bigots and conservatives to try and oust trans women from their communities C) our communities are lot more robust. That outrage Matt felt? That wouldn't have happened back then.

I'm not leaving here but I do think I am going to sorta start to dip into other things more. Cohost is fun and there's people I like who are exclusively on Twitter. I've sat on a Blue Sky account for weeks but never did anything with it. Not to mention I own a url so I should make it a thing people can use.

Go anywhere you want, but also trans people aren't going to just disappear from tumblr. They've been trying to run us off of here for yearsssss, it didn't work then and it won't now.

42 notes

·

View notes

Text

#Digital Business Solutions#blockchian#business development#cryptocurrency#crypto#Crypto Business Solutions#Dapps Development Services#ZeltaTech

0 notes

Text

Clone high season 2 episode concepts that would've actually been fun/cool

Abe tries to get into "real magic" to impress Joan by hanging out with Aleister Crowley and Arthur Conan Doyle. Jokes about people being too into Harry Potter being lame, jokes about paranormal teen shows a la Sabrina, etc.

Ronald Reagan and Nixon gets JFK into presidential themed crypto

Mean Girls episode parody about the Salem Witch trials or Bloody Queen Mary. They write themselves.

Episode where the main cast keep finding dead bodies, basically tripping over them, parody of teen murder mysteries, twist ending that the bodies are all failed/early clones (like the clone equivalent of a stillbirth. there was no murder)

Yellow Jackets Parody episode. the bus is out of gas or something and they're stuck in a large parking lot but act like they're in the woods.

Traveling championship episode. Debate team has to compete against high school where all the students are robots programmed to behave like the greatest scientists/leaders of all time

Trans episode parody. Abe realizes he isn't aligned with the modern republican party anymore and is therefore a Democrat, treated as a self-aware bad analogy maybe to the point of other characters finding it tasteless/annoying/Abe looking for attention

Cyberbullying episode parody, bonus points if it's gossip girl

Secret cousin/twin parody episode --- obvious starting point would be like. Anastasia because of how many people famously claimed to be her.

Supernatural teen romance parody episode. Abe tries to become a vampire with like Edgar Allen Poe or someone to impress Joan.

"Save the community center" episode --- This could be a great Harriet focused episode about like a bake sale or something to fund the arts but everyone is over exaggerating the stakes and the drama of being/not being a good baker. "My grandmother used to bake these cookies for me.....until she DIED" "My mother baked these cookies for me everyday I was in the hospital after falling out of that helicopter and they gave me the strength to survive" "I can't bake....my mom was always too busy with her business to teach me....." etc.

Big Mouth/Sex Ed parody episode. I think it would be really funny if THIS had been their technology episode, like getting a computer virus is treated like getting a STD and the cast talk about browsing the internet like it's casual sex, etc.

parody of those tasteless episodes about how like bullying leads to school shootings. Have like Abe or Joan or someone try to reach out to Napoleon or someone because they eat alone at lunch and because they think it's silly and mean everyone is afraid of them but then they are just like a violent maniac already. the solution is to get rid of him.

this might sound dumb but remember that one episode of jimmy neutron where jimmy was banned from the science fair for being too smart and killing the morale of any other student interested in participating? What if Clone High did that but as like a parody of anti-trans sports legislation. All the cloned scientists are banned from the science fair because it's an unfair advantage. All the Politian clones are banned from debate club, etc.

Social media/parasocial relationships parody episode where like JFK and Abe become obsessed with one another's online accounts not knowing it's them, despite Joan repeatedly telling them this, it becomes completely unhealthy but then whenever they do hang out together face-to-face they hate it and decide the parasocial relationship was better actually.

PRANK YOUTUBE/TIKTOK PARODY EPISODE ABOUT DB COOPER AND HOUDINI COME ON COME ON COME ON THIS ONE IS SO FUCKING OBVIOUS

83 notes

·

View notes

Text

KYC Provider Canada

KYC is a mandatory process that financial institutions and other businesses follow to authenticate the identities of their customers. KYC Providers help and provide KYC API to verify users' and business identities. KYC Providers in the Canada also use various methods to verify identities, like id, document, and address verification.

#KYC Canada#KYC Providers#KYC API#KYC Services provider#KYC Solutions Provider#KYC Software#kyc verification#KYC verification Solutions#KYC Platform#KYC Solution#fiance#crypto#blockchain#bitcoin#insurance#finance#fintech#healthcare#business

3 notes

·

View notes

Note

Then the only Roy who isn't a fascist is Shiv, the other siblings are totally fine with Mencken if it serves their interests.

honestly this is a really simplistic read of what the show is saying about fascism, liberalism, and capitalism. literally all the roys are fascistic, including shiv, and that was already apparent in the first three seasons but is made doubly explicit by her getting into business with matsson. fascism is the natural logical extension of the roys' belief in hierarchy, biological superiority, domination, correct vs incorrect bodies, etc. like on a very basic level logan was a 'social darwinist' (like late career spencerian etc) and this is still the governing ideology at waystar because capitalism writ large, and consequently liberal democracy, is also hierarchical and requires this type of exploitation, hence the usefulness of racism, classism, etc for the nation-state. like, fascism is a proffered solution to the internal contradictions of liberal democracy. all of the roys profit from it and mencken is not the only manifestation of it on the show. he's the most spelled-out version but part of the commentary there is how the roys will identify mencken as being fascistic but not themselves. like it is so central to understanding anything this show is saying, eg, logan's ideological range is "crypto-fascists, right-wing nutjobs, venture capital dems, and centrist ghouls" ..... like, even kendall gets this. shiv is not even a demsoc like nate and nate is himself also working within the same political episteme as logan despite his idealistic beliefs. cmon now

63 notes

·

View notes

Text

If you have a bunch of trees, and you chop them down to make paper or lumber or whatever, you can sell the paper or lumber or whatever for money, but on the other hand trees store carbon and cutting them down is bad for climate change. If instead you do not chop down the trees, that is good for the environment, and it is a great innovation of modern finance that, now, you can get paid for not chopping down the trees. This is called “carbon credits.” There are measurement problems.

If you mine Bitcoin, you use a lot of electricity to run computers to perform calculations to get Bitcoins for yourself, which you can sell for money. But this is bad for the environment, because it uses electricity that is probably generated in ways that release carbon.[1] If you were to stop mining Bitcoin, conversely, that would be good for the environment. Can you get paid, though, for not mining Bitcoin? Oh yes, modern finance has solved that one too:

Bitcoin miner Riot Platforms Inc. made millions of dollars by selling power rather than producing the tokens in the second quarter as the crypto-mining industry continued to grapple with the impact of low digital asset prices.

The Castle Rock, Colorado-based company had $13.5 million in power curtailment credits during the quarter, while generating $49.7 million in mining revenue. Riot booked $27.3 million in power curtailment credits last year and $6.5 million in 2021 from power sales to the Electric Reliability Council of Texas, which is the grid operator for the Lone Star state. …

The company had $18.3 million in power credits in June and July based on its latest monthly operational updates, including $14.8 million in power curtailment credits received from selling power back to the ERCOT grid at market-driven spot prices under its long-term power contracts and $3.5 million in credits received from participation in ERCOT demand response programs.

Here is the 10-Q; this stuff is described in Note 8. Some of what is going on here is that Riot has a long-term power supply agreement in which TXU Energy Retail Co. has to supply it with electricity at fixed prices through 2030, and Riot has the option to sell the power back to TXU, at market rates, for credit against its future electric bills, when the spot price exceeds the contract price. But part of it is demand response, where ERCOT pays Riot cash for using less than its typical electrical load during periods of peak demand.

As with carbon credits, there are measurement problems; I have never mined a single Bitcoin, yet ERCOT has never sent me a penny for my forbearance. Still, how great is modern finance? Twenty years ago, if you had told people that one day they could get paid for not mining Bitcoin, they would have said “what?” But now it is possible. Modern finance created the problem (Bitcoin mining) and the solution (paying people not to mine Bitcoin); the overall result is that nothing happens and yet people get paid. Just a miracle of financial engineering.

Also: Riot is getting paid for not using electricity, but if you are an enterprising Bitcoin miner surely you should look into getting paid for not using carbon when you are not mining Bitcoin. Riot is not there yet, but it is possible to imagine a warming world in which energy prices go up and Bitcoin prices go down and Bitcoin miners can get paid more for not mining Bitcoin than for mining Bitcoin. Giant fortunes will be made by people who got in early to the business of not mining Bitcoin. The future is so good, man.

This is from Matt Levine's "Money Stuff" newsletter (which yes is under the Bloomberg masthead), which I highly recommend if you want some kind of awareness of what the finance yahoos are doing but want to feel like you're hearing it from a human person

43 notes

·

View notes

Text

Long-Term Strategy for Game Series Support

We're entering an era of Long-Term support for Video Games Series. (THAT'S A LIE, WEVE BEEN THERE FOR A MINUTE NOW.)

As Developers and Publishers start shutting down online services for older games (and in some cases disabling the game entirely)

Which is necessary, considering that servers take money to continue running. And older game players simply aren't bringing in revenue to keep the lights on. (Because they're not bringing in any money)

The question that AAA developers should be asking; "How do we integrate our games backend into a shared eco-system in order to reduce costs for each individual game, and increase adoption of newer services/games for our players?"

This is a question that must be asked because Developers and Publishers already know how difficult it is to retain profits while competing with the Resale and Third-Party markets like GameStop.

Many developers have started creating "Always On" services which require the game to be connected to the internet in order to play offline portions. (To verify authenticity that the game was purchased from an official source and not pirated.)

After-all it's hard to continue paying for online services if pirates are using them.

Still, services like Hearthstone provide a free service, free product, and still manage to turn profit. Part of this is because of the competitive environment and sponsored tournaments.

By offering a prize, plenty of players can be convinced to play, just in case they feel like going pro next year.

But they probably won't. Despite that; the game is incredibly fun to play. Except when several players in a row have the exact combo that enables them to keep tempo, and so you gotta grin and bear it till it becomes fun again.

Or buy more cards.

Still, how do you create an environment for the casual players of casual games. Like Animal Crossing, or Pokemon. Since most Pokemon players aren't competitive.

After a half-a-decade, the business model dictates that you sell a new game to replace the old one.

Part of the problem here is that each new game has a lot of the same content as the old game, and thus; in order to switch you need throw away your old save file and start from scratch.

Many players that would do that just because they can would have done so already. And so older players may end up giving up both the old and new, simply because it's easier to do so.

Despite the newest games having a lot of the same content, a lot of old content is lost. Like the Story. What would traditionally be called the "Movie" or "Novel" portion. Depending on if it was a cutscenes or several hundred lines of text.

And so in order to re-experience the old content; many players may instead choose to simply to pirate the old content, or read about it from online sources.

Part of the solution is to simply offer the old content to new players. And to try to convince older players into the new areas by allowing them to bring their old content and achievements with them.

This can be accomplished a few different ways. Crypto is one way to create a ledger tied to a players account so that they can share their content between platforms and games.

Nearly every platform, PlayStation, XBOX, and while Nintendo doesn't offer a platform specific variant, game often still include achievements.

And this system can be used to store certain content on a player basis to brought into newer or different games.

This would also enable cross-game items/content/achievements that players could bring with them from series to series.

Which would be a boom for cross-promotional purposes. And by creating an environment and a system that enables to store this in the same place(cloud). You could also control for DataBase specifications in order to reduce size and increase speeds for each individual game.

Now, I am pretty well Versed in Learning Content Distribution. SCORM(This is an acronym you don't need to know, and would only raise more questions if I explain it, so I'll stick to the surface here.) SCORM, TinCan, and xAPI (not to be confused with Twitter) are specifications created for the Learning Management Environment (Education, College, Government, and corporate training models) in order to do exactly what I'm talking about with as little or as much data bandwidth requirements, is relatively secure and includes cross-service achievement-like systems.

As well as content-distribution systems.

I would assume there's a way to integrate it with Crypto. It would replace the monkey WEBMs with something more substantial.

And this service or system would allow not only players to bring their accounts and achievements and items with them from game to game (or from game to social media) but games to communicate with each other.

Again, I'm thinking "Eco-system" here. Publishers would be able to do large-scale cross-promotional events with many games simultaneously. And enable platform-hoping between games with content from each individual event.

What this means is that you would also be able to provide a place for those old games to exist, even if they don't participate it the Events anymore. AND encourage players to try new and other games because they don't lose their original save files doing so.

9 notes

·

View notes

Text

🚀 Looking for a way to buy dedicated servers with cryptocurrency? 💻💰 Check out this comprehensive guide on where to find the best providers that accept Bitcoin, Ethereum, and more!

🌐 From low-cost options to high-performance solutions, this guide covers everything you need to know to make an informed decision. Whether you're a developer, gamer, or business owner, finding the right server provider has never been easier!

🔗 Read the full article and explore providers like Ultahost, Vikhost, ServerMania, and more: https://medium.com/@jasun.mckarthy93/where-to-buy-dedicated-servers-with-crypto-a-comprehensive-guide-9ca2f336a68a

3 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

2 notes

·

View notes