#FOOD EQUITY

Text

JUST IDEAS AT JUST HARVEST

Just Harvest has all our admiration for their continued dedication to fighting hunger, and their unrelenting efforts to create equitable food systems inspire our own work focusing towards the same.

We’re also regularly impressed at their success in bringing together everyone from long-term activists to folks just beginning to feel the spark of curiosity with a wide variety of events. Case in…

View On WordPress

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Video

youtube

Student research project draws attention to price disparities in low-inc...

0 notes

Text

South LA Cafe: Fighting Inequity Through Coffee, Community and Connection in Historically Black Community

South LA Cafe, founded by Joe and Celia Ward-Wallace, is on a mission to fight racial, social, economic and food inequity through coffee, community and connection.

The cafe was created to provide fresh, affordable and healthy food options for the South LA community, which has been a food desert for decades. The cafe has become a central hub in the community, with a focus on preserving the…

View On WordPress

#Celia Ward-Wallace#coffee#community#community hub#COVID-19 testing#cultural erasure#culture preservation#economic equity#food desert#food equity#fresh food#gentrification.#healthy food#Joe Ward-Wallace#racial equity#social impact#South Central LA#South LA Cafe#vaccines

0 notes

Text

Making Fresh, Healthy Food Affordable for All: The Role of Community Supported Agriculture

Definition of Community Supported Agriculture (CSA)

Community Supported Agriculture (CSA) is a type of agriculture and food distribution system where members of a community come together to support a local farm. Members typically buy a share of the farm’s harvest in advance, which helps the farmer to cover the costs of production and provides the members with a regular supply of fresh, locally…

View On WordPress

#community bonding#community gardens#community supported agriculture#farmers market#food access#food bank#food cost#food deserts#food equity#food insecurity#food justice#food pantry#food system#healthy food affordability.#local food

0 notes

Text

FOOD, WATER, HOUSING, HEALTHCARE AND EDUCATION ARE BASIC FUNDAMENTAL HUMAN RIGHTS THAT SHOULD ALWAYS BE FREE!!!

#they should never have been monetised to begin with#p#hopecore#hopepunk#solarpunk#peaceful revolution#greenhorizon#anti capitalism#climate change solutions#naturecore#forestcore#lunarpunk#human rights#social justice#education#university#students#food security#food sovereignty#anti fascism#people and planet first#politics#news#world news#sustainability#housing crisis#homelessness#poverty#classism#social equity

165 notes

·

View notes

Note

You’ve probably been asked this question before, but does the government tax you for your commissions? If so, how?

i do pay taxes on my income yes, the 'how' is bit of a long and boring answer though so im going to put it under the cut (fyi im in australia so my info is only applicable to australians)

-first off, in australia you have a tax-free threshold of about $18,500, govt doesnt really seem to care if you report your earnings under that or not, idk though you should check whether or not you legally Have To. better to stay on the tax mans good side.

-i have an accountant who does the maths and lodges my taxes for me, all i have to do is payg the ATO an amount of money 4 times a year based on my reported earnings

-i report my earnings once a year around july-ish, but if you have a tax agent i believe the ATO tends to give you more leeway on When exactly you do your annual taxes

-i am a registered sole trader, this means that while i run a business, i don't have employees other than myself, so i dont pay the taxes business owners with employees would.

-businesses that make over 70k aud/year have to pay GST, which is a 10% tax on all sales within australia. this does not affect my customers abroad and it does mean my australian customers get a special invoice :)

-if you hold onto your receipts, you can get certain things as a tax write off, ex. new work computer, new drawing tablet, office chair, as long as it is justifiably related to your business and you dont abuse it, on the off chance you get audited youll be safe as houses

-see if any charities you donate to can be tax write-offs too. thats just general advice but plenty of charities are tax deductible so go crazy.

#croaks#make sure to fact check me against the ato website if any of this is relevant to you btw#i dont think im wrong but i could be#also with the price of food and living and the fact that im 23 with very little to my name in terms of equity#it does rankle a bit that i have to pay so much while rupert murdoch pays $0#money sucks but i need it to live

189 notes

·

View notes

Text

i think I'd take the "glass child" shit more seriously if 98% of the ppl i see talking about it weren't like "My sibling was physically disabled and my parents took care of them??!?! Why wasn't I given breakfast in bed??? I mean, I know I'm capable of getting food and my siblings physically couldn't, but this is just so unfair!!! Btw I have visual snow syndrome so I'm like just as disabled as my paralyzed sibling!!"

#max squawks#like maybe there are rare cases where a child is ACTUALLY neglected bc of a disabled sibling#but like#most ppl claiming to be glass children just seem to not know the difference between equity and equality#like my parents sometimes can't pick me up or get me food bc they're busy with work#but it's not fucking child neglect#I am perfectly capable of getting those things on my own#a parent giving their disabled child stuff that they don't give their abled child isn't “neglect”#it's literally just caring for a disabled person#that's like seeing people in wheelchairs at the hospital and going “so these people get wheelchairs while I have to walk??”#while ignoring the fact that those people actually need wheelchairs to get around and you do not#ok sorry for the rant#I just really hate the term “glass child”#ableism#disability#glass child

19 notes

·

View notes

Text

can’t wait for the everlasting debate ‘but doesn’t feminism mean you treat women the same so if you’re gonna hit people you can hit women’ to turn to other marginalised groups too. like if it’s okay to call a white person a stupid white bastard we wanna treat people of colour the same right—

#like. I know we have ‘I don’t see colour’#and it’s obviously bullshit#and we’ve got a long way to go with unpacking how we see people of different races#like damn stop thinking that bc someone’s from Africa they’re starving#but also. unpack the systems that cause the world to have inequalities in access to food#and you have to actually. put things right. not just try act as if all the hurt that is done doesn’t exist#which hopefully we’ve figured out how to apply to gender hopefully that’s intuitive#some ways of of superficially ‘helping’ are infantilising and will in the end lead to that group being exploited by others#empower. capacity build. indigenous folk. trans folk. nd folk. learn to see value so much more broadly#and strength. please. learn broader ways to see strength that aren’t mutually exclusive with vulnerability#but back to my post. I hope it all makes sense why we have accommodations for neurodivergence and stuff#instead of just. people are theoretically equal so we treat them the same. learn the concept of equity

3 notes

·

View notes

Text

Coming soon at the 2024 Pennsylvania Farm Show- “Connecting Communities & Opportunities: Building Equity in the Food System”

The New Year kicks off at the Pennsylvania Farm Show Complex and Expo Center with the 2024 Pennsylvania Farm Show, beginning Saturday, January 6th and running through Saturday, January 13th.

The jam-packed schedule of events includes “Connecting Communities & Opportunities: Building Equity in the Food System”, a co-presentation of PA Preferred, the PA Department of Agriculture’s Project…

View On WordPress

0 notes

Text

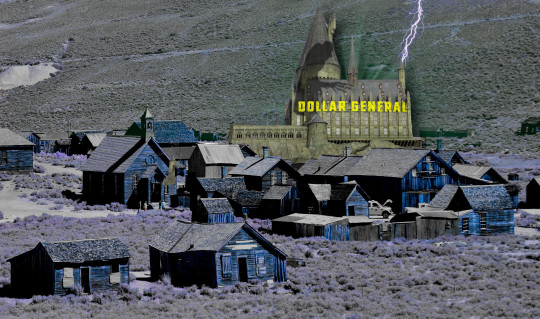

Rural towns and poor urban neighborhoods are being devoured by dollar stores

Across America, rural communities and big cities alike are passing ordinances limiting the expansion of dollar stores, which use a mix of illegal predatory tactics, labor abuse, and monopoly consolidation to destroy the few community grocery stores that survived the Walmart plague and turn poor places into food deserts.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

"The Dollar Store Invasion," is a new Institute For Local Self Reliance (ILSR) report by Stacy Mitchell, Kennedy Smith and Susan Holmberg. It paints a detailed, infuriating portrait of the dollar store playback, and sets out a roadmap of tactics that work and have been proven in dozens of places, rural and urban:

https://cdn.ilsr.org/wp-content/uploads/2023/01/ILSR-Report-The-Dollar-Store-Invasion-2023.pdf

The impact of dollar stores is plainly stated in the introduction: "dollar stores drive grocery stores and other retailers out of business, leave more people without access to fresh food, extract wealth from local economies, sow crime and violence, and further erode the prospects of the communities they target."

This new report builds on ILSR's longstanding and excellent case-studies, augmenting them with the work of academic geographers who are just starting to literally map out the dollar store playbook, identifying the way that a dollar stores will target, say, the last grocery store in a Black neighborhood and literally surround it, like hyenas cornering weakened prey. This tactic is repeated whenever a new grocer opens in the neighborhood: dollar stores "carpet bomb" the surrounding blocks, ensuring that the new store closes as quickly as it opens.

One important observation is the relationship between these precarious neighborhood grocers and Walmart and its other big-box competitors. Deregulation allowed Walmart to ring cities with giant stores that relied on "predatory buying" (wholesale terms that allowed Walmart to sell goods more cheaply than its competitors bought them, and also rendered its suppliers brittle and sickly, and forced down the wages of those suppliers' workers). This was the high cost of low prices: neighborhoods lost their local grocers, and community dollars ceased to circulate in the community, flowing to Walmart and its billionaire owners, who spent it on union busting and political campaigns for far-right causes, including the defunding of public schools.

This is the landscape where the dollar stores took root: a nation already sickened by an apex predator, which left a productive niche for jackals to pick off the weakened survivors. Wall Street loved the look of this: the Private equity giant KKR took over Dollar General in 2007 and went on a acquisition and expansion bonanza. Even after KKR formally divested itself of Dollar General, the company's hit-man Michael M Calbert stayed on the board, rising to chairman.

The dollar store market is a duopoly. Dollar General's rival is Dollar Tree, another gelatinous cube of a company that grew by absorbing many of its competitors, using Wall Street's money. These acquisitions are now notorious for the weaknesses they exposed in antitrust practice. For example, when Dollar Tree bought Family Dollar, growing to 14,000 stores, the FTC waved the merger through on condition that the new business sell off 330 of them. These ineffectual and pointless merger conditions are emblematic of the inadequacy of antitrust as it was practiced from the Reagan administration until the sea-change under Biden, and Dollar Tree/Family Dollar is the poster child for more muscular enforcement.

The duopoly has only grown since then. Today, Dollar General and Dollar Tree have more than 34,000 US outlets - more than Starbucks, #Walmart, McDonalds and Target - combined.

Destroying a community's grocery store rips out its heart. Neighborhoods without decent access to groceries impose a tax on their already-struggling residents, forcing them to spend hours traveling to more affluent places, or living off the highly processed, deceptively priced (more on this later) goods for sale on the dollar store shelves.

Take Cleveland, once served by a small family chain called Dave's Market that had served its communities since the 1920s. Dave's store in the Collinwood neighborhood was targeted by Family Dollar and Dollar General, which opened seven stores within two miles of the Dave's outlet. The dollar stores targeted the only profitable part of Dave's business - the packaged goods (fresh produce is a money-loser, subsidized by packaged good).

The dollar stores used a mix of predatory buying and "cheater sizes" (packaged goods that are 10-20% smaller than those sold in regular outlets, which are not available to other retailers) to sell goods at prices that Dave's couldn't match, driving Dave's out of business.

Typical dollar stores stock no fresh produce or meat. If your only grocer is a dollar store, your only groceries are highly processed, packaged foods, often sold in deceptive single-serving sizes that actually cost more per ounce than the products that the defunct neighborhood grocer once sold.

Dollar stores don't just target existing food deserts - they create them. Dollar stores preferentially target Black and brown neighborhoods with just a single grocer and then they use predatory pricing (subsidizing the cost of goods and selling them at a loss) and predatory buying to force that grocery store under and tip the neighborhood into food desert status.

Dollar stores don't just target Black and brown urban centers; they also go after rural communities. The commonality here is that both places are likely to be served by independent grocers, not chains, and these indies can't afford a pricing war with the Wall Street-backed dollar store duopoly.

As mentioned, the "predatory buying" of dollar stores is illegal - it was outlawed in 1936 under the Robinson-Patman Act, which required wholesalers to offer goods to all merchants on the same terms. 40 years ago, we stopped enforcing those laws, leading the rise and rise of big box stores and the destruction of the American Main Street.

The lawmakers who passed Robinson-Patman knew what they were doing. They were aware of what contemporary economists call "the waterbed effect," where wholesalers cover the losses from their massive discounts to major retailers by hiking prices on smaller stores, making them even less competitive and driving more market consolidation.

When dollar stores invade your town or neighborhood, they don't just destroy the food choices, they also come for neighborhood jobs. Where a community grocer typically employs 12 or more people, Dollar General employs about 8 per store. Those workers are paid less, too: 92% of Dollar General's workers earn less than $15/h, making Dollar General the worst employer of the 66 large service-sector firms.

Dollar stores also lean heavily into the tactic of turning nearly every role at its store into a "management" job, because managers aren't entitled to overtime pay. That's how you can be the "manger" of a dollar store and take home $40,000 a year while working more than 40 hours every single week.

Understaffing stores turns them into crime magnets. Shootings at dollar stores are routine. Between 2014-21, 485 people were shot at dollar stores - 156 of them died. Understaffed warehouses are vermin magnets. In the Eastern District of Arkansas, Family Dollar was subpoenaed after a rat infestation at its distribution centers that contaminated the food, medicines and cosmetics at 400 stores.

The ILSR doesn't just document the collapse of American communities - it fights back, so this report ends with a lengthy section on proven tactics and future directions for repelling the dollar store invasion. Since 2019, 75 communities have blocked proposals for new dollar stores - more than 50 of those cases happened in 2021/22.

54 towns, from Birmingham, AB to Fort Worth, TX to Kansas City, KS, have passed laws to "sharply restrict new dollar stores, typically by barring them from opening within one to two miles of an existing dollar store."

To build on this momentum, the authors call for a "reinvigoration of antitrust laws," especially the Robinson-Patman Act. Banning predatory buying would go far to creating a level playing field for independent grocers hoping to fight off a dollar store infestation.

Further, we need the FTC and Department of Justice Antitrust Divition to block mergers between dollar-store chains and unwind the anticompetitve mergers that were negligently waved through under previous administrations (thankfully, top enforcers like Jonathan Kantor and Lina Khan are on top of this!).

We need to free up capital for community banks that will back community grocers. That means rolling back the bank deregulation of the 1980s/90s that allowed for bank consolidation and preferential treatment for large corporations, while reducing lending to small businesses and destroying regional banks. Congress should cap the market share any bank can hold, break up the biggest banks, and require banks to preference loans for community businesses. We also need to end private equity and Wall Street's rollup bonanza.

All of that sounds like a tall order - and it is! But the good news is that it's not just groceries at stake here. Every kind of community business, from pet groomers to hairdressers to funeral homes, falls into the antitrust "Twilight Zone," of acquisitions under $101m. With 60% of Boomer-owned businesses expected to sell in the coming decade, 2.9m businesses employing 32m American workers are slated to be gobbled up by private equity:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Whether you're burying a loved one, getting dialysis, getting your cat fixed or having your dog's nails trimmed, you are already likely to be patronizing a business that has been captured by private equity, where the service is worse, the prices are higher and the workers earn less for harder jobs. Everyone has a stake in financial regulation. We are all in this fight, except for the eminently guillotineable PE barons, and you know, fuck those guys

At the state level, the authors propose new muscular enforcement regimes and new laws to protect small businesses from unfair competition. They also call on states to increase the power of local governments to reject new dollar store applications, amending land use guidelines to require "cultivating net economic growth, ensuring that everyone has access to healthy food, and protecting environmental resources.

If all of this has you as fired up as it got me this morning, check out ILSR's "How to Stop Dollar Stores in Your Community" resources:

http://ilsr.org/dollar-stores

I’m kickstarting the audiobook for my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

Image:

Mike McBey (modified)

https://www.flickr.com/photos/158652122@N02/38893547595/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

[Image ID: A ghost town; it is towered over by a haunted castle with a Dollar General sign on it, with the shadow of Count Orlock cast over its tower. One of its turrets is being struck by lightning.]

#pluralistic#shrinkflation#institute for local self reliance#ilsr#dollar tree#dollar general#dollar stores#groceries#food deserts#kkr#pe#private equity#predatory buying#predatory pricing#Robinson-Patman Act#consolidation#monopoly#monopsony#care labor

187 notes

·

View notes

Text

RAGE RAGE RAGE RAGE AT INSTITUTIONAL SOLUTIONS THAT DONT ACTUALLY SOLVE FUCKING PROBLEMS

#Midwest College TM#putting everyone on a dining plan wont solve food insecurity you dipshits.#the dining halls are NOT friendly to dietary restrictions#and ppl can be food insecure ON the meal plans!!#also it'll be more expensive!!! part of the appeal of drawing into interest houses is that there is no meal plan requirement & it's cheaper#literally assuming that everyone food insecure is on full finaid is absurd. so fucking basic equality-not-equity liberal brain#this coming after the college terminated a program (anonymous; popular; & desired)#w a local food shelf bc it'd 'put strain' on them. & the shelf said uh no actually we want ppl to use our resources.#abhorrent. somebody get me a bat or shoot me out of a cannon.

3 notes

·

View notes

Text

EQUITY OVER EQUALITY ALWAYS

Never have I ever heard of a white woman preaching this (I’m sure it does happen but I have yet to see it more often) - let alone in a comedy stand up. Alex Borstein is a gift.

#this means a lot to me#it’s just an elementary introduction to the idea of equity#BUT WE NEED MORE OF THIS#equality means nothing#without equity#equity is the goal#and always will be#for women#for people of color#for indigenous people#for disabled people#for lgbtq+ people#for any marginalized group#also her stand up is hilarious as well as good food for thought#if not a bit sobering at the same time#her authenticity and vulnerability onstage is a gift#alex borstein#comedy#comedian#stand up comedy#op#ovrgrwn#video

2 notes

·

View notes

Text

Emma Scott Joins Vermont Law and Graduate School as Director of Food and Agriculture Clinic: A Bold Step for Food System Equity

Vermont Law and Graduate School (VLGS) has taken an exciting leap forward with the appointment of Emma Scott as the new director of the Food and Agriculture Clinic. With a stellar background in food law, policy, and social justice, Scott brings a wealth of experience to this role. She’s not just stepping into a position; she’s here to make a lasting impact, and the timing couldn’t be better.

A…

#agriculture law#agriculture policy#California Rural Legal Assistance Foundation#Center for Agriculture and Food Systems#clinical education#Emma Scott#experiential learning#farm bill policy#farmworker rights#farmworkers#Food and Agriculture Clinic#food justice#food law#food law and policy#Food Security#food system equity#food systems advocacy#H-2A visa program#Harvard Law School#immigrant workers#Social Justice#Sustainability#USDA programs#Vermont Law#Vermont Law and Graduate School

0 notes

Link

CPL's daily case study on tumblr.... CPL quantified the current and potential market for specialised fruit ingredients for a VDD pack leading to a sale by a Private Equity client.

0 notes

Text

Worst part of writing psychology essays is trying to find empirical articles that aren’t so hyper specific they hardly mention the topic you’re looking for

#I’m looking for articles on cognitive dissonance#every single one is like ‘cognitive dissonance and how it effects equity in the food-medicine industry in the west from 1990-1992’#I DONT NEED THAT 🤷🏽♀️#I need a simple article like this is so sick#early’s vent tag#law and order: svqueue

0 notes