#GST Regulations

Text

Legal Precision Unveiled: Unraveling the Intricacies of Input Tax Credit Quandaries

Delving deeper into the intricate tapestry of Goods and Services Tax (GST) implications, the saga of Input Tax Credit (ITC) assumes greater complexity, offering a nuanced perspective on the petitioner-assessee’s odyssey.

Embedded within the labyrinth of statutory constructs, the petitioner’s invocation of Input Tax Credit (ITC) rights under section 16 of the CGST Act unfolds against the backdrop…

View On WordPress

#assessing authority#Chartered Accountant#GST regulations#Ingram Micro India#Input Tax Credit#judicial scrutiny#judiciary#landmark case#legal documentation#legal intricacies#legal landscape#legal odyssey#legal recalibration#procedural norms#regulatory compliance#Show Cause Notice#State Tax Officer#statutory provisions#tax disputes

0 notes

Text

0 notes

Text

Tax Compliance Services

We provide comprehensive tax compliance services, GST litigation, and Real Estate Regulation Act support across India. Our expert guidance ensures your business remains compliant with all regulations. Trust us to handle your tax needs efficiently, allowing you to focus on growing your business. Stay compliant and stress-free with our professional services.

1 note

·

View note

Text

How can businesses stay informed about updates and changes in GST regulations?

Staying informed about updates and changes in GST regulations is essential for businesses to maintain compliance and adapt to evolving tax requirements. Some ways to stay informed include:

Subscribing to official GST portals and government websites for regular updates and notifications.

Following reputable tax publications, blogs, and news outlets that cover GST-related developments.

Participating in industry forums, seminars, and webinars focused on GST topics to gain insights and exchange knowledge with peers and experts.

Engaging with professional tax advisors or consultants who can provide personalized guidance and updates on GST regulations relevant to the business.

Read our blog for more information!

#GST#Compliance#Business#Taxation#India#Regulations#Transparency#Simplicity#Fairness#LegalCompliance#gstfiling#businesssupport#taxcompliance#financialhealth#gststructure#financialmanagement#gstreturns#businesstaxes#taxregulations#businesscompliance

0 notes

Text

GST Return Filing and New Regulations

Goods and Services Tax (GST) is a comprehensive indirect tax implemented in India on July 1, 2017. It aimed to simplify the tax structure by subsuming various taxes under one umbrella. GST return filing is a critical aspect for businesses to comply with tax regulations.

GST Return, GST Return Filing, ,GST New Regulations, GST Return New Regulations

1 note

·

View note

Text

The Act aims to protect the interests of shareholders, investors, and other stakeholders and maintain the integrity of the corporate sector. Below are some important provisions related to damages for fraud under the Companies Act, 2013:

Section 447 - Punishment for Fraud:

Section 447 of the Companies Act, 2013, deals with the punishment for fraud. If any person is found to be involved in fraudulent activities, they may be punished with imprisonment for a term not less than six months, which may extend to ten years. Additionally, they may be liable to pay a fine that is equal to or greater than the amount involved in the fraud.

Section 448 - Punishment for False Statement:

Under Section 448, if any person makes a false statement or provides false information in any company-related documents, financial statements, or records, they can be punished with imprisonment for a term that may range from six months to ten years. They may also be liable to pay a fine that is equal to or greater than the amount involved in the fraud.

Section 449 - Punishment for False Evidence:

Section 449 deals with the punishment for false evidence. If any person knowingly provides false evidence during any company-related proceedings, they can be punished with imprisonment for a term that may range from three years to seven years. They may also be liable to pay a fine.

Section 450 - Punishment for Misleading Statements:

Section 450 provides for punishment if any person publishes or circulates misleading information or statements with the intention to deceive investors, shareholders, or the public. Such individuals may be punished with imprisonment for a term that may range from three years to five years, along with a fine.

It's important to note that these provisions are applicable to individuals who are involved in fraudulent activities or provide false information intentionally. The penalties mentioned in these sections are significant to deter individuals from engaging in fraudulent practices and to safeguard the interests of the company and its stakeholders.

Read more: https://myefilings.com/damages-for-fraud-under-the-companies-act-2013/

#company registration#damages#fraud#myefilings#business#taxes#india#company#accounting#finance#income taxes#income tax#gst#tax fraud#reuters#regulations

0 notes

Text

Fire At Galar Fossil Restoration Lab

(GBC)- At approximately 4:00 GST fire crews were called to a structure fire at the Fossil Restoration Lab on Galar Route 6. No injuries were reported, but structural damage was extensive and multiple valuable fossil specimens are missing and presumed destroyed.

The Galar Fossil Restoration Lab has previously been the subject of controversy due to allegations that proper Pokemon welfare regulations are not being followed. Arson investigators have advised that the fire looks to have been deliberately started using Fire-type attacks, and authorities in Hammerlocke and Stow-on-Side are looking for information as to potential suspects.

3 notes

·

View notes

Text

GST Return Filing Services in Delhi By SC Bhagat & Co.

The Goods and Services Tax (GST) system in India has streamlined the taxation process, but it can still be complex for businesses to navigate. Accurate and timely GST return filing is crucial for businesses to avoid penalties and ensure smooth operations. If you’re looking for reliable GST Return Filing Services in Delhi, SC Bhagat & Co. offers expert assistance tailored to your business needs.

Why GST Return Filing is Important?

GST return filing is a legal obligation for businesses registered under the GST regime. It involves submitting details of sales, purchases, output GST (on sales), and input tax credit (GST paid on purchases) to the government. Filing returns correctly and on time ensures:

Compliance with Regulations: Non-compliance with GST regulations can result in hefty fines and interest on unpaid taxes.

Input Tax Credit: Proper filing allows businesses to claim input tax credits, reducing the overall tax burden.

Avoid Penalties: Timely filing helps avoid late fees and penalties, which can accumulate quickly.

Smooth Audits: Maintaining accurate records through return filing facilitates hassle-free audits.

Types of GST Returns in India

Different types of GST returns need to be filed depending on the business type and activities. Here's an overview of the major returns:

GSTR-1: Details of outward supplies of goods and services (sales).

GSTR-3B: Summary return showing total taxable value and taxes paid.

GSTR-4: Return for composition scheme taxpayers.

GSTR-9: Annual return for normal taxpayers.

GSTR-10: Final return when GST registration is canceled.

Why Choose SC Bhagat & Co. for GST Return Filing Services in Delhi?

Expert Team: SC Bhagat & Co. has a team of experienced professionals who specialize in GST regulations. They stay updated with the latest changes in GST laws to ensure compliance and accuracy in your filings.

End-to-End Service: From compiling the necessary data to submitting the return on time, SC Bhagat & Co. provides comprehensive GST return filing services. They handle everything, so you don’t have to worry about the complexities involved.

Customized Solutions: Every business is unique, and so are its GST filing requirements. SC Bhagat & Co. offers personalized services that cater to the specific needs of your business, ensuring that you only pay the taxes you owe and nothing more.

Timely Filing: SC Bhagat & Co. prioritizes deadlines and ensures that all GST returns are filed within the stipulated time frame, avoiding any late penalties.

Affordable Services: High-quality service doesn’t have to come with a high price tag. SC Bhagat & Co. offers competitive rates for their GST return filing services, making them accessible to small and medium-sized businesses in Delhi.

Common GST Filing Challenges Solved by SC Bhagat & Co.

Errors in Data Entry: Mistakes in entering sales and purchase data can lead to discrepancies. SC Bhagat & Co. ensures that all data is accurately compiled to avoid errors.

Complex Tax Rules: GST laws are constantly evolving, making it hard for businesses to stay compliant. With their expert knowledge, SC Bhagat & Co. keeps your business updated with the latest regulations.

Delayed Filings: Late filings lead to penalties, but SC Bhagat & Co. ensures timely submissions, minimizing risks of fines.

Mismatch in Input Tax Credit: They help reconcile input tax credit claims, ensuring you don’t lose out on eligible credits due to mismatched data.

How to Get Started?

Partnering with SC Bhagat & Co. for GST return filing in Delhi is easy. Simply reach out to their team, and they will guide you through the process, offering personalized assistance based on your business requirements.

Conclusion

Accurate and timely GST return filing is essential for maintaining tax compliance and maximizing input tax credits. With SC Bhagat & Co.’s GST Return Filing Services in Delhi, businesses can enjoy peace of mind knowing their GST obligations are handled by experts. Save time, avoid penalties, and stay compliant by letting SC Bhagat & Co. manage your GST returns.

2 notes

·

View notes

Text

Business Setup in India by MAS LLP: Your Partner for Growth

Setting up a business in India is a lucrative opportunity due to its growing economy, diverse market, and skilled workforce. However, navigating the legal and regulatory framework can be challenging. That’s where MAS LLP steps in, offering expert assistance to help you establish your business smoothly and efficiently.

Why Choose MAS LLP for Business Setup in India?

MAS LLP is a leading consultancy that specializes in business formation and compliance services. With years of experience, MAS LLP has assisted numerous entrepreneurs and companies in setting up their businesses across India. Here’s why partnering with MAS LLP is a smart choice:

Comprehensive Services

MAS LLP provides a full suite of services, from company registration and legal compliance to tax advisory and financial consulting. Their team of experts ensures that every step of the business setup process is handled professionally.

Expert Knowledge of Indian Regulations

India's business environment is governed by complex laws and regulations, including the Companies Act, FDI norms, and various tax laws. MAS LLP has in-depth knowledge of these regulations, ensuring that your business complies with all legal requirements from the start.

Tailored Solutions for Different Business Structures

Whether you are looking to establish a private limited company, a partnership, an LLP, or a sole proprietorship, MAS LLP can help you choose the right structure based on your business goals and operational needs.

Steps to Setting Up a Business in India with MAS LLP

Business Structure Selection

Choosing the right business structure is crucial for long-term success. MAS LLP provides guidance on selecting the best structure, whether it's an LLP, private limited company, or branch office.

Company Registration

MAS LLP will help you with the process of registering your business with the Ministry of Corporate Affairs (MCA). This includes obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and filing the required documents for incorporation.

Tax Registration

Once your business is registered, MAS LLP assists in obtaining necessary tax registrations such as GST, PAN, and TAN, ensuring your company is compliant with India’s tax laws.

Legal Compliance

Keeping up with regulatory requirements is essential for any business. MAS LLP provides ongoing legal compliance support, including annual filings, audit reports, and statutory compliance.

Banking and Financial Setup

MAS LLP also assists with setting up business bank accounts, payment gateways, and financial structuring, helping you manage your financial operations efficiently.

Why Set Up a Business in India?

India is a growing economy with a young, dynamic workforce and a vibrant consumer market. By setting up your business here, you tap into a diverse and large customer base, benefit from government incentives for startups, and gain access to various sectors like IT, manufacturing, and retail.

Additionally, India offers excellent opportunities for foreign investors with simplified FDI policies. With MAS LLP by your side, you can navigate the challenges of setting up a business in India with ease and focus on what really matters—growing your business.

Conclusion

MAS LLP is your go-to partner for setting up a business in India. Their expertise in regulatory compliance, business formation, and financial consulting ensures that you can establish your business smoothly and start operating without any legal or financial hurdles.

Whether you are a local entrepreneur or a foreign investor, MAS LLP offers tailored solutions to meet your unique business needs. Get in touch with MAS LLP today and take the first step towards establishing a successful business in India!

6 notes

·

View notes

Text

Can I Start a Soap Packaging Business from Home in Canada?

Starting a soap packaging business from home in Canada is not only feasible but also a potentially lucrative venture. With the rise in the popularity of artisanal and small-batch soaps, the demand for unique, high-quality packaging is growing. If you're considering diving into this industry, here's a comprehensive guide to help you navigate the process.

1. Understanding the Market

Before launching your soap packaging business, it's crucial to research the market. Identify the types of soap products you want to cater to—whether it's handmade artisanal soaps, organic soaps, or luxury bath products. Understand the packaging needs of these different types of soaps and the preferences of your target customers. This will help you tailor your offerings and stand out in a competitive market.

2. Legal and Regulatory Requirements

Starting a home-based business in Canada requires adherence to several legal and regulatory standards. Here are some key steps:

Business Registration: Register your business name with your provincial or territorial government. You may also need to register for a GST/HST number if your revenue exceeds the threshold for small suppliers.

Home-Based Business Regulations: Check local zoning laws and homeowners' association rules to ensure you can legally operate a business from your home.

Health and Safety Compliance: Ensure that your packaging materials comply with Canadian regulations for health and safety. For instance, if you plan to use materials that come into direct contact with soap, ensure they are safe and non-toxic.

3. Setting Up Your Home Workspace

Creating an efficient workspace is crucial for a successful packaging business. Designate a specific area in your home for packaging activities. This space should be clean, organized, and suitable for the tasks you'll perform, such as cutting, folding, and assembling packaging materials.

Invest in essential tools and equipment like cutting machines, label printers, and sealing devices. Ensure your workspace adheres to health and safety standards to prevent contamination and ensure product quality.

4. Sourcing Packaging Materials

The quality of your packaging materials is critical. Source high-quality, eco-friendly materials to appeal to environmentally-conscious customers. Consider various options like biodegradable wrappers, recyclable boxes, and attractive labels. Establish relationships with reliable suppliers to ensure you get the best materials at competitive prices.

5. Developing Your Brand

Branding is key to differentiating your packaging business from competitors. Develop a unique brand identity that reflects the quality and style of your packaging. Create a memorable logo, design eye-catching packaging, and build a cohesive brand image that resonates with your target market.

6. Marketing and Sales

Effective marketing strategies are essential for attracting clients to your packaging business. Leverage digital marketing platforms such as social media, email campaigns, and a professional website to showcase your packaging designs. Participate in local trade shows, craft fairs, and networking events to connect with potential clients in the soap industry.

Offer samples to soap manufacturers and retailers to demonstrate the quality and appeal of your packaging. Building strong relationships with your clients can lead to repeat business and referrals.

7. Financial Management

Proper financial management is crucial for the sustainability of your business. Keep track of all expenses, including materials, equipment, and marketing costs. Set competitive prices for your packaging solutions while ensuring they cover costs and provide a profit margin. Consider using accounting software or hiring a financial advisor to manage your finances effectively.

8. Scaling Your Business

As your business grows, you may consider scaling up operations. This could involve expanding your product line, investing in advanced packaging machinery, or hiring additional staff. Continuously assess market trends and customer feedback to adapt and improve your offerings.

Conclusion

Starting a soap packaging business from home in Canada is a viable and rewarding opportunity for entrepreneurs with a passion for design and a keen eye for detail. By understanding the market, adhering to regulations, and focusing on quality and branding, you can build a successful business that meets the needs of soap makers and appeals to consumers. With careful planning and strategic execution, your home-based packaging business can thrive in the dynamic Canadian market.

2 notes

·

View notes

Text

ComplyHub Consultant specializes in expert compliance and regulatory services, guiding businesses through the complexities of legal requirements. Whether it's company registration, GST compliance, labor law adherence, or environmental regulations, ComplyHub ensures your business stays fully compliant. Rely on ComplyHub Consultant for efficient, reliable, and all-encompassing compliance solutions tailored to your needs.

#Complyhub Consultant#Company Registration#Online Company Registration#Compliance Services#LLP Registration#Account Management#LLC Registration

2 notes

·

View notes

Text

Billing machines have become an essential tool for businesses across various sectors, streamlining the invoicing process and enhancing operational efficiency. This article explores the features, benefits, and types of billing machines, as well as their significance in modern commerce.

What is a Billing Machine?

A billing machine is a device specifically designed to generate invoices and manage transactions efficiently. It automates the billing process, allowing businesses to issue receipts quickly and accurately. Available in various forms such as portable, handheld, and point-of-sale (POS) systems, these machines cater to the needs of small businesses and large enterprises alike.

Key Features of Billing Machines

User-Friendly Interface: Many modern billing machines come with intuitive touchscreen interfaces that simplify the transaction process, making it easy for staff to operate without extensive training.

Fast and Accurate Billing: These machines are designed to process transactions rapidly, significantly reducing customer wait times and enhancing service efficiency.

Customizable Invoices: Users can personalize invoice templates to reflect their branding, including logos and business details, which adds a professional touch to customer interactions.

Comprehensive Reporting: Billing machines often provide detailed sales reports, inventory tracking, and financial records, enabling businesses to monitor performance and make informed decisions.

Tax Compliance: Many billing machines are equipped with features that ensure compliance with tax regulations, making it easier to calculate applicable taxes like GST or VAT.

Multiple Payment Options: They support various payment methods, including cash, credit/debit cards, and digital wallets, providing convenience to customers.

Benefits of Using Billing Machines

Increased Efficiency: Automating the billing process reduces manual errors and speeds up transactions, leading to improved cash flow and customer satisfaction.

Enhanced Security: Billing machines help in maintaining secure records of transactions, reducing the risk of loss or theft associated with cash handling.

Improved Inventory Management: Many billing machines come with inventory management features that allow businesses to track stock levels and set up alerts for low inventory, ensuring timely restocking.

Cost-Effectiveness: While the initial investment in a billing machine may be higher, the long-term savings in time and labor can be substantial, making them a cost-effective solution for businesses.

Types of Billing Machines

POS Systems: These are comprehensive solutions that combine billing, inventory management, and sales tracking, ideal for retail environments and restaurants.

Portable Billing Machines: These compact devices are perfect for businesses that require mobility, such as food trucks or market vendors.

Handheld Billing Machines: Designed for ease of use, these machines are often used in smaller retail settings or for on-the-go transactions.

Touchscreen Billing Machines: Featuring advanced technology, these machines offer a modern interface and are designed for high-volume transaction environments.

Conclusion

Billing machines are vital for modern businesses, providing a range of features that enhance efficiency, accuracy, and customer satisfaction. By automating the billing process, these machines not only save time but also contribute to better financial management and operational transparency. As technology continues to evolve, the capabilities of billing machines will likely expand, further transforming the way businesses handle transactions. Whether for a small shop or a large retail chain, investing in a reliable billing machine can significantly improve business operations.

2 notes

·

View notes

Text

How to Select the Right ERP Software for Your Indian Manufacturing Firm: Key Considerations

Introduction

In the dynamic landscape of the Indian manufacturing industry, the integration of an efficient Enterprise Resource Planning (ERP) system is paramount. Selecting the right ERP system for manufacturing industry can significantly impact a firm's operational efficiency, productivity, and overall competitiveness. This article delves into the crucial aspects of choosing the best ERP system tailored for the unique needs of Indian manufacturing firms.

Understanding the Unique Needs of the Indian Manufacturing Industry

1. Regulatory Compliance: Navigating the Complexities

One of the primary considerations for Indian manufacturers is ensuring compliance with local regulations. The selected ERP modules for manufacturing industry should seamlessly align with the Goods and Services Tax (GST) framework, a cornerstone of the Indian taxation system. It is imperative to choose a system that streamlines compliance with industry-specific regulations, safeguarding the manufacturing firm from legal complications.

2. Scalability: Growing with Your Business

As Indian manufacturing firms aspire for growth, scalability becomes a pivotal factor in ERP selection. Opt for a system that can effortlessly adapt to the evolving needs of your business. Scalability is particularly crucial for Indian manufacturers aiming for expansion in a market known for its dynamism and ever-changing demands.

3. Localization: Aligning with the Indian Operational Landscape

ERP software must be tailored to the nuances of the Indian market. Look for solutions offering localization features, including support for multiple languages, adherence to regional accounting standards, and culturally relevant interfaces. This ensures that the Best ERP for manufacturing industry seamlessly integrates into the operational fabric of your Indian manufacturing firm.

Key Features to Consider

1. Supply Chain Management: Navigating the Complex Web

Efficient supply chain management is integral for Indian manufacturers dealing with diverse suppliers and fluctuating market demands. The chosen ERP system should provide real-time visibility into the entire supply chain, encompassing procurement, production, and distribution. This ensures that your manufacturing firm can proactively respond to market changes and optimize resource allocation.

2. Production Planning and Control: Meeting the Complexities Head-On

The intricacies of manufacturing processes in India necessitate a comprehensive production planning and control module within the ERP system. Look for software that offers advanced features such as demand forecasting, capacity planning, and real-time monitoring of production processes. This empowers your manufacturing firm to enhance operational efficiency and meet customer demands with precision.

3. Quality Management: Upholding Excellence

Maintaining high-quality standards is non-negotiable for the success of any manufacturing firm. The ERP for manufacturing industry should include robust quality management modules that facilitate adherence to stringent quality control measures. This ensures that your products meet regulatory requirements and customer expectations, bolstering your reputation in the competitive Indian market.

Best ERP for the Indian Manufacturing Industry

1. Evaluating the Options

Selecting the best ERP for your Indian manufacturing firm involves a meticulous evaluation of available options. Consider industry-specific solutions renowned for their effectiveness in addressing the challenges prevalent in the Indian manufacturing landscape.

2. ERP Modules Specifically Tailored for Manufacturing

Explore ERP systems that offer modules explicitly designed for the manufacturing industry. These modules should cover essential aspects such as material requirements planning (MRP), shop floor control, and advanced planning and scheduling (APS). The seamless integration of these modules enhances operational visibility and control.

Customization and Integration: A Prerequisite for Success

1. Tailoring the ERP System to Your Needs

No two manufacturing firms are identical, and the chosen ERP system should accommodate this diversity. Look for software that allows customization to align with the unique processes and requirements of your Indian manufacturing firm. This ensures that the ERP system becomes an asset tailored to your specific needs rather than a one-size-fits-all solution.

2. Integration with Existing Systems

The ERP system should seamlessly integrate with existing software and systems within your manufacturing firm. This includes compatibility with Customer Relationship Management (CRM) software, Human Resource Management Systems (HRMS), and other relevant applications. A well-integrated ERP system for manufacturing industry streamlines data flow, minimizing redundancies and enhancing overall efficiency.

User-Friendly Interface and Training

Ensuring Adoption and Efficiency

An ERP system is only as effective as its adoption by the end-users. Prioritize user-friendly interfaces that facilitate easy navigation and understanding. Additionally, invest in comprehensive training programs to ensure that your team is proficient in utilizing the ERP system to its full potential. This approach maximizes the benefits derived from your ERP investment.

Cost Considerations: Balancing Investment and Returns

1. Calculating the Total Cost of Ownership (TCO)

While the initial cost of ERP implementation is a crucial consideration, it's equally essential to assess the Total Cost of Ownership (TCO) over the long term. Evaluate not only the upfront costs but also ongoing expenses related to maintenance, upgrades, and potential customization. This holistic approach ensures that the chosen ERP system aligns with your budgetary constraints without compromising on functionality.

2. Return on Investment (ROI): Ensuring Long-Term Value

Consider ERP implementation as a strategic investment rather than a mere expense. Calculate the anticipated Return on Investment (ROI) based on enhanced operational efficiency, reduced lead times, and improved customer satisfaction. A thorough ROI analysis ensures that the chosen ERP system delivers long-term value and contributes to the overall success of your Indian manufacturing firm.

Vendor Reputation and Support

1. Choosing a Reliable Partner

Selecting an ERP vendor with a proven track record in the manufacturing industry is crucial. Research and assess the reputation of potential vendors, considering factors such as the number of successful implementations, customer reviews, and the vendor's financial stability. A reliable vendor ensures ongoing support and updates, safeguarding your investment and providing peace of mind.

2. Support and Training Services

Evaluate the support and training services offered by the Best ERP for manufacturing industry. Responsive customer support and comprehensive training programs contribute to a smooth implementation process and ongoing success. Prioritize vendors that prioritize customer satisfaction and offer tailored support to address the unique needs of your Indian manufacturing firm.

Conclusion

In conclusion, choosing the right ERP software for manufacturing industry requires a strategic approach that considers the unique challenges and opportunities in the dynamic Indian market. By prioritizing regulatory compliance, scalability, localization, and key features such as supply chain management, production planning, and quality control, you can identify an ERP solution that aligns seamlessly with the needs of your manufacturing operations. Additionally, evaluating customization options, integration capabilities, user-friendliness, cost considerations, and the reputation of ERP software providers ensures a well-informed decision that propels your Indian manufacturing firm toward enhanced efficiency, productivity, and long-term success.

#ERP for manufacturing industry#ERP system for manufacturing industry#ERP software for manufacturing industry#Best ERP for manufacturing industry#ERP modules for manufacturing industry#India#Gujarat#Vadodara#STERP#shantitechnology

7 notes

·

View notes

Text

What role can professional GST service providers play in assisting businesses?

Professional GST service providers offer specialized expertise and support to businesses in navigating the complexities of GST compliance. These providers can offer a range of services, including:

GST registration assistance: Helping businesses register under the GST regime and obtain GSTIN (Goods and Services Tax Identification Number).

GST return filing: Ensuring timely and accurate filing of GST returns, including GSTR-1, GSTR-3B, and GSTR-9, in compliance with regulatory requirements.

GST audit and advisory services: Conducting GST audits, providing advisory support on GST matters, and assisting businesses in resolving tax-related issues.

Training and education: Offering training programs and workshops to educate businesses and their employees on GST laws, procedures, and best practices.

Read our blog for more information!

#GST#Compliance#Business#Taxation#India#Regulations#Transparency#Simplicity#Fairness#LegalCompliance#gstfiling#gstreturns#businesstaxes#businesscompliance#gststructure#businesssupport#taxcompliance#financialhealth#financialmanagement#taxregulations

0 notes

Text

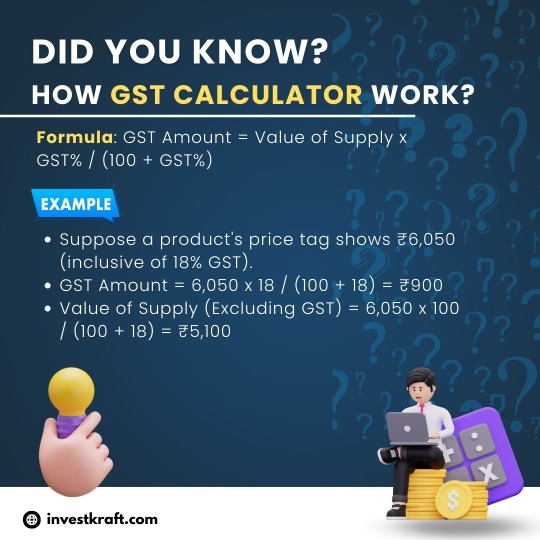

GST Confusion? Try Our Calculator for Easy Tax Calculation!

A GST Calculator simplifies the complex task of computing Goods and Services Tax (GST) in India. It efficiently determines the GST amount payable or included in a transaction, enabling accurate financial planning for businesses and individuals. Investkraft, a trusted financial platform, offers a user-friendly GST Calculator on its website. This tool allows users to swiftly calculate GST on various goods and services, ensuring compliance with tax regulations. With Investkraft's GST Calculator, users can input transaction details effortlessly and obtain precise GST figures, minimizing errors and saving time. Whether for business invoicing, tax filing, or personal budgeting, this calculator proves invaluable in navigating the intricacies of GST, empowering users to make informed financial decisions with ease.

2 notes

·

View notes

Text

Mumbai's Premier Accounting Services: Expert Financial Solutions Await!

In the bustling metropolis of Mumbai, where businesses thrive in the fast-paced environment, the need for reliable and expert accounting services is more critical than ever. As the financial hub of India, Mumbai's economic landscape demands precision, accuracy, and a deep understanding of the complex financial intricacies that businesses face. This is where Mumbai's premier accounting services come into play, offering expert financial solutions that cater to the diverse needs of businesses across various sectors.

Tailored Solutions for Every Business: Mumbai's premier accounting services understand that each business is unique, with its own set of challenges and opportunities. These expert financial professionals take a personalized approach, tailoring their services to meet the specific needs of each client. Whether you are a startup looking to establish solid financial foundations or an established corporation seeking to optimize your financial processes, these accounting services have the expertise to deliver customized solutions that align with your business goals.

Comprehensive Accounting Services: The premier accounting services in Mumbai offer a comprehensive range of financial solutions that go beyond traditional bookkeeping. From tax planning and compliance to financial forecasting and budgeting, these experts cover every aspect of accounting to ensure your business operates smoothly and efficiently. By outsourcing your accounting needs to these professionals, you can focus on what you do best – growing your business.

Navigating the Complex Tax Landscape: Tax laws and regulations in India are constantly evolving, making it challenging for businesses to stay compliant. Mumbai's premier accounting services stay abreast of these changes and have a deep understanding of the local tax landscape. Whether it's filing income tax returns, managing Goods and Services Tax (GST) compliance, or navigating other tax obligations, these experts ensure that your business remains in good standing with the authorities.

Technology-driven Efficiency: In a city that never sleeps, efficiency is paramount. Mumbai's top accounting services leverage cutting-edge technology to streamline their processes, ensuring accuracy and timeliness in all financial operations. Cloud-based accounting systems, automation tools, and secure online platforms are integrated seamlessly into their workflow, providing clients with real-time access to financial data and reports.

Professional Expertise You Can Trust: The premier accounting services in Mumbai boast a team of seasoned professionals with a wealth of experience in accounting and finance. These experts are not just number crunchers; they are strategic partners invested in the success of your business. By entrusting your financial management to these professionals, you gain access to a pool of knowledge and expertise that can drive your business forward.

Cost-effective Solutions for Every Budget: Contrary to the misconception that expert financial services come with a hefty price tag, Mumbai's premier accounting services offer cost-effective solutions tailored to businesses of all sizes. By outsourcing your accounting needs, you eliminate the need for an in-house finance team, reducing overhead costs and allowing you to allocate resources more efficiently.

In conclusion, Mumbai's premier accounting services are the cornerstone of financial success for businesses in this vibrant city. With tailored solutions, comprehensive services, and a commitment to professionalism, these experts are ready to navigate the intricate financial landscape, providing businesses with the peace of mind they need to thrive in the competitive Mumbai business environment. Whether you're a small startup or a large corporation, expert financial solutions await you in the heart of India's financial capital.

2 notes

·

View notes