#Government | To Take Away | Vital | Tax Exemptions

Text

Criticizing The Illegal Regime of Zionist Terrorist 🐖 Isra-hell? Nonprofit Media Could Lose Tax-Exempt Status Without Due Process

A New Anti-Terrorism Bill Would Allow The Government To Take Away Vital Tax Exemptions From Nonprofit News Outlets.

— Seth Stern | May 10, 2024 | The Intercept

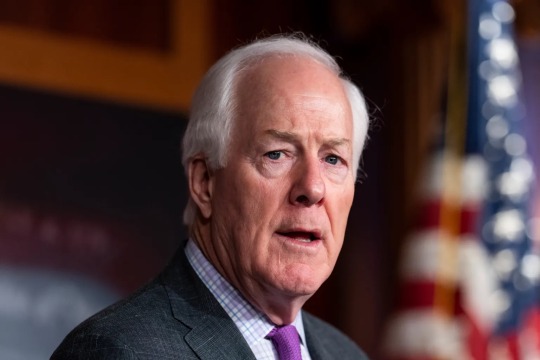

“Scrotums Licker of the Illegal Regime of The Terrorist Zionist 🐖 🐷 🐖 🐗, Sen. John Cornyn, R-Texas,” speaks during a news conference in the U.S. Capitol on March 21, 2024. Photo: Bill Clark/CQ Roll Call via AP Images

It Doesn’t Take much to be accused of supporting terrorism these days. And that doesn’t just go for student activists. In recent months, dozens of lawmakers and public officials have, without evidence, insinuated that U.S. news outlets provide material support for Hamas. Some even issued thinly veiled threats to prosecute news organizations over those bogus allegations.

Their letters were political stunts. Prosecutors would never have been able to carry their burden of proof under anti-terrorism laws, and all the pandering politicians who signed the letters knew that. But next time might be different, especially if nonprofit news outlets, such as The Intercept, manage to offend the government.

That’s because a bill that passed the House with broad bipartisan support in April — after which a companion bill was immediately introduced in the Senate — would empower the secretary of the Treasury to revoke the nonprofit status of any organization deemed “terrorist supporting.” This week, the bill’s Senate sponsor, Sen. John Cornyn, R-Texas, introduced it as an amendment to must-pass legislation to renew the Federal Aviation Administration’s authorities. While it didn’t make the cut (the Senate didn’t vote on any of the dozens of proposed amendments), it’s likely to make its way to the Senate floor in another form soon.

Funding terrorism is already illegal, but the new bill would let the government avoid the red tape required for criminal prosecutions or official terrorist designations.

You might think actionable support of terrorism is limited to intentional, direct contributions to terror groups. You’d be mistaken. Existing laws on material support for terrorism have long been criticized for their overbreadth and potential for abuse, not only against free speech but also against humanitarian aid providers. A recent letter from 135 rights organizations opposing the bill highlighted efforts to revoke the tax-exempt status of, or otherwise retaliate against, pro-Palestine student groups.

There’s No Reason to believe the press is exempt from overreach. In their recent letters, elected officials called for terrorism investigations of the New York Times, Reuters, CNN, and the Associated Press, relying on allegations that those outlets bought photographs from Palestinian freelancers who covered Hamas’s October 7 attacks.

The feigned outrage originated with a spurious accusation, from an organization ironically calling itself HonestReporting, that those pictures evidenced that the photographers who took them had advance knowledge of the massacre. Otherwise how (other than, say, TV or the internet) would they have known where to go?

HonestReporting then reasoned that the news outlets that bought the pictures may have been in on it as well — because, of course, when an international news giant buys a picture from someone on its vast roster of freelancers, it’s reasonable to impute the freelancer’s alleged sins all the way up the chain.

HonestReporting eventually walked back that convoluted theory, admitting it had no evidence and was merely asking questions. After forcing the news outlets to publicly deny having ties to Hamas, HonestReporting said it believed them.

But that didn’t stop U.S. officials from surmising that the fact some Palestinian freelancers in Gaza had contacts with Hamas officials — which should not be surprising, given that Hamas is the governing authority in the besieged enclave — made anyone who hired them terrorism financiers.

And it gets even worse. One of the letters — signed by over a dozen state attorneys general — floated the theory that the outlets’ reporting could itself evidence support for Hamas. As the U.S. Press Freedom Tracker (another nonprofit news site, operated by Freedom of the Press Foundation, where I work) put it:

The letter also highlighted that “material support” for terrorist groups — both a federal and state crime — can include “writing and distributing publications supporting the organization.” It did not elaborate on what would be considered support, potentially chilling any reporting that does not unequivocally condemn Hamas or unilaterally support Israel.

The attorneys general then warned the outlets that they would “continue to follow your reporting to ensure that your organizations do not violate any federal or State laws by giving material support to terrorists abroad.” The writers continued: “Now your organizations are on notice. Follow the law.”

Many of those same attorneys general recently argued that “First Amendment speech and associational freedoms do not protect persons who provide material support” to terrorism. They failed to mention the Supreme Court’s skepticism that “applications of the material-support statute to speech or advocacy will survive First Amendment scrutiny … even if the Government were to show that such speech benefits foreign terrorist organizations.”

Members Of Congress have set their eyes on news outlets as well. Sen. Tom Cotton, R-Ark., parroted HonestReporting’s disinformation in multiple letters, while 15 congressional representatives demanded that the news outlets provide information — potentially including source identities and communications — regarding the freelancers, threatening to issue subpoenas.

If there is any doubt about the nonprofit bill’s backers’ intentions, consider that five of its House sponsors also signed onto a letter to the Internal Revenue Service asking how it defines antisemitism and insinuating that the IRS should deny tax-exempt status to nonprofits that “promote conduct that is counter to public policy,” even if they’re not accused of supporting terrorism at all.

Nonprofit news outlets are already struggling even without government harassment, but revocation of their tax-exempt status would be a death knell for outlets doing the kind of in-depth investigative journalism that is hardly ever profitable these days. The mere prospect would chill reporting, not only on Israel but also on U.S. foreign policy generally. And that’s not to mention the threat to nonprofit press freedom organizations that journalists depend on to protect their rights (including to not get killed in Gaza).

Unfortunately, this is just the latest piece of reckless, unnecessary “national security” legislation that puts the press at risk. Last month, President Joe Biden ignored civil liberties advocates and signed into law a bill that would allow intelligence agencies to enlist any “service provider” to help the U.S. spy on foreigners.

As Sen. Ron Wyden, D-Ore., explained, the law could “forc[e] an employee to insert a USB thumb drive into a server at an office they clean or guard at night.” And that office could easily be a newsroom, where journalists often talk to foreigners whose communications might interest U.S. intelligence agencies.

Is the government going to immediately start conscripting reporters to surveil their sources, or shutting down nonprofit news outlets that stray from the Israeli military’s narrative? Probably not. But history teaches that once officials are given the power to retaliate against journalists they don’t like, they inevitably will. The prospect of the Espionage Act and Computer Fraud and Abuse Act being weaponized against journalism was also once merely hypothetical — until it wasn’t.

And let’s not forget that the presumptive Republican presidential nominee publicly fantasizes about jailing and otherwise retaliating against journalists.

Those who claim a second Donald Trump term would mark the end of democracy need to stop passing overbroad and unnecessary new laws handing him, and future authoritarians, brand new ways to harass and silence journalists who don’t toe the line.

#Criticizing | Illegal Regime of Zionist Terrorist | Isra-hell#Nonprofit#Media#Lose#Tax-Examption#Status#New Anti-Terrorism Bill#Government | To Take Away | Vital | Tax Exemptions#“Scrotums Licker of the Illegal Regime of The Terrorist Zionist 🐖 🐷 🐖 🐗: Sen. John Cornyn R-Texas”

0 notes

Text

[ad_1]

Understanding Actual Property Tax Legal guidelines: What Patrons and Sellers Must Know

Actual property transactions contain a large number of legal guidelines and rules, together with tax legal guidelines. These legal guidelines can considerably influence each consumers and sellers, making it essential for all events concerned to understand and cling to them. This text goals to offer an outline of actual property tax legal guidelines, highlighting key factors that consumers and sellers want to concentrate on.

1. Property Tax Evaluation: Property taxes are a main income for native governments and are assessed based mostly on the worth of the property. It's important for consumers and sellers to grasp that the assessed worth of a property could not replicate its precise market worth. Patrons ought to analysis the common property tax charges within the space and take into account the potential influence on their funds. Sellers, then again, ought to make sure that their property is assessed pretty, as an overvaluation can result in greater property taxes.

2. Capital Beneficial properties Tax: Sellers want to concentrate on capital good points tax, which is utilized to the revenue constructed from the sale of an asset, together with actual property. The quantity of tax owed is set by the size of time the property was owned and whether or not it was used as a main residence. It's important for sellers to grasp the foundations governing capital good points tax, as sure exemptions or deductions could also be out there, such because the exclusion of as much as $250,000 (or $500,000 for married couples) of revenue from the sale of a main residence.

3. Mortgage Curiosity Deductions: Patrons ought to concentrate on mortgage curiosity deductions, which can assist cut back their taxable earnings. In lots of international locations, curiosity paid on mortgages is tax-deductible, offering a possibility for vital financial savings. Patrons ought to seek the advice of with a tax skilled to grasp the eligibility necessities and maximize this deduction.

4. Switch Taxes: Switch taxes are charges imposed upon the switch of property possession. These taxes can fluctuate extensively amongst states or jurisdictions and will be levied on the customer, vendor, or each. It's essential for consumers and sellers to know the particular switch tax charges relevant of their space, as they will instantly influence the general price of the transaction.

5. 1031 Trade: One other necessary facet of actual property tax legal guidelines is the 1031 trade, which permits sellers to defer capital good points tax in the event that they reinvest the proceeds from the sale into the same property inside a sure time-frame. This provision will be advantageous for sellers seeking to improve or diversify their actual property holdings with out incurring a right away tax burden.

6. Native Tax Incentives: Patrons ought to analysis native tax incentives supplied by municipalities, cities, or states, as they might present monetary advantages for buying property inside sure areas or classes. These incentives can embrace property tax abatements, tax credit, or decreased tax charges. Patrons ought to seek the advice of with native tax authorities or actual property professionals to establish any out there incentives.

In conclusion, understanding actual property tax legal guidelines is crucial for each consumers and sellers. Familiarizing oneself with property tax assessments, capital good points tax guidelines, mortgage curiosity deductions, switch taxes, 1031 exchanges, and native tax incentives can assist consumers and sellers navigate the actual property market extra successfully and make knowledgeable selections. It is strongly recommended that people seek the advice of with tax professionals or actual property specialists to make sure compliance with all relevant tax legal guidelines and maximize monetary advantages.

[ad_2]

0 notes

Text

Understanding Military Status Reports: A Crucial Guide for Vehicle Owners

What Are Military Status Reports?

Military Status Reports are essential documents that provide information about the military service of an individual who owns a vehicle. They are particularly important for active duty service members who have vehicles registered in their name. The purpose of these reports is to keep track of the status of military-owned vehicles and to ensure that they adhere to the rules and regulations set forth by the military and the government.

Why Are They Important?

Regulatory Compliance: Military status reports help ensure that vehicles owned by service members meet the necessary regulations and standards, especially when it comes to issues like vehicle maintenance and insurance coverage. Compliance with these regulations is vital to prevent penalties and legal issues.

Insurance and Liability: Maintaining accurate military status reports for vehicle owners is crucial for insurance purposes. It helps determine coverage and liability in case of accidents or incidents involving the vehicle. Incorrect or outdated information may affect the coverage provided by insurance policies.

Deployment and Storage: Military service often involves deployments and long periods away from home. In such cases, a military status report can be useful in managing your vehicle. It helps outline options such as storing the vehicle on base or designating someone to take care of it during your absence.

Tax Benefits: Some regions offer tax benefits and exemptions for active-duty service members. Accurate military status reports can help in claiming these benefits when filing taxes.

Personal and Financial Security: Maintaining an up-to-date military status report is essential for the security and well-being of the service member and their family. It ensures that their vehicle is adequately protected and legally compliant, reducing potential worries during their service.

How to Maintain Your Military Status Report:

Regular Updates: It is vital to keep your military status report current by updating it whenever there is a change in your military status, personal information, or vehicle details.

Documentation: Ensure you have all necessary documentation, including service records, insurance documents, and vehicle maintenance records, readily available. military status reports for registered owners These documents may be required to support your military status report.

Communication: Stay in touch with your military unit's administrative office to understand the specific requirements and deadlines for updating your status report.

Vehicle Maintenance: Regularly maintain your vehicle as per military and legal requirements. Neglecting vehicle maintenance can lead to complications when updating your military status report.

0 notes

Text

This is so important and necessary. Help me get the word out! And follow @palmettostateabortionfund on Instagram for updates.

With the current Supreme Court signaling they may overturn Roe v. Wade and escalating attacks on reproductive rights in Southern states, the time to organize to protect abortion is now. It is a matter of when, not if, South Carolina Republicans use their supermajorities in both houses of the General Assembly, as well as their control of the governor’s office, to pass laws restricting or outright banning abortion.

Currently, South Carolina has no abortion fund resident to the state. Why does SC need a local abortion fund? Even while legally available, the costs and time restrictions of obtaining an abortion can be extremely prohibitive. A recent study showed that 61% of Americans could not handle an unexpected $1000 emergency. With the existence of only three clinics in the state that specialize in abortion, a required 24-hour waiting period before obtaining an abortion, and bans on public funding, as well as many types of insurance plans from covering abortion, the deck is already stacked against South Carolinians.

Although some regional and national funds cover fund requests in SC, the closest fund is nearly 200 miles away, which undoubtedly limits their ability to connect with local communities. If abortion is restricted or outright banned in SC, people will have to travel to another state in order to obtain one, further increasing travel costs, and potentially putting a strain on currently existing funds.

We’re currently asking for a modest sum of $2000. This will be used to cover administrative expenses related to incorporating, obtaining tax exemption, opening a bank account with a satisfactory minimum balance, joining the National Network of Abortion Funds, and any other unforeseen administrative expenses. Any money we’ve already raised through our other funding channels has been reserved to directly benefit our clients. No one on our board is taking a salary, and any funds raised beyond our initial expenses will be put into the fund itself.

SC’s government has spent far more effort making abortion costly and hard to access than it has to improve the safety and conditions of childbirth, childcare, or childhood. To highlight just one alarming statistic, the average maternal death rate associated with having a child in SC is at least 40 times that of having an abortion.

Please help us do what our government refuses and fund vital and necessary healthcare for South Carolinians. After all, abortion is healthcare, and healthcare is a human right.

#south carolina#abortion#abortion fund#prochoice#reproductive justice#reproductive rights#abortion rights#pro choice#thank god for abortion#abortion is healthcare#healthcare#healthcare is a human right#abortion funding#abortion is a human right#abortion care#bodily autonomy#abortion rights are trans rights#abortion rights are queer rights

180 notes

·

View notes

Text

Writing A Will During Lockdown.

Making A Will In Louisiana.

Content

Select Guardians For Your Kids And Also Animals.

The Possesions Of Your Estate Are Dispersed As Per Your Wishes.

Beware: Not All Wills Are Controlled

Our Bespoke Wills Solution.

Why Pick Glanvilles Will Composing Legal Representatives In Fareham?

Your will can be revoked at any time prior to its effectiveness, by filing a simple motion in a court of law. Once filed, if there is no response from the estate, or if no beneficiaries are named, the revocation can then go into effect. Once revocation takes place, a copy of the original document must be filed with the court that created it, and another certified copy must be sent to the other named beneficiaries. In the event of a successful revocation, your assets will be returned to the estate of your last living trust, which means that your beneficiaries will now share the property evenly between the remaining beneficiaries.

Who are your intended recipients? Appellate courts typically allow the following to be witnesses to a Will: your spouse, anyone who is your co-habitant, children, anyone considered a dependent of your spouse, a person considered your estate, your attorney, anyone acting under the powers of a judge, a public official or anyone named in the document. However, codicilators and administrators are not allowed to be witnesses to a Will. They can revoke a Will at any time but must do so in writing.

Select Guardians For Your Kids And Also Family Pets.

How may I make my intentions known to others? You may want to leave a Will with a trusted friend or associate who can act as a go between for you and those you leave your instructions with. You may also choose to let trusted members of your family know of your Last Will and Testament. Again, consult your state probate laws for specifics.

Can a Will be revoked after it is executed? A will can be revoked either before or after you die depending on the state probate laws. If you pass away intestate (without leaving a will), then upon death, the last will and testament must be filed in the probate court. If you appoint an administrator or another designate to control your estate, they can file a "revocation of testament" with the court if you die before taking care of your estate, thereby revoking your last will and testament.

The Possesions Of Your Estate Are Dispersed Based On Your Desires.

It is vitally important to choose an experienced attorney to make decisions regarding estate and personal assets. There are a wide range of different lawyers available today who are experienced in handling all kinds of estate planning matters including adoptions and retirement plans. It may be beneficial for you to consider consulting the services of an attorney before making any major estate planning decision. A good attorney can guide you through the process of making financial decisions, as well as assisting with the preparation of your will.

You can use our Free Will Service to aid you find a lawyer to create your will either online, through the post, over the phone or a video clip telephone call, in person at home or in branch with a lawyer.

If you compose a will, you can choose who you intend to sort out your estate.

Your estate is whatever you have, consisting of money, property as well as belongings.

Or, if you 'd rather not utilize our service, we recommend speaking to the Regulation Culture to discover a listing of solicitors near you.

Who are the witnesses? To make sure that your Power of Attorney is legally valid, your attorney and any witnesses you use must be people who are actually related to you. This includes your spouse and children, your parents and any other survivors who may benefit from your Will. Anyone unrelated to you cannot sign or testify on your behalf. You cannot have more than two people as witnesses, and witnesses should normally be related to you by marriage or adoption.

Be Careful: Not All Wills Are Managed

There are many situations in which an estate executor might be appointed. If someone is seriously ill or incapacitated, such as due to a debilitating condition or long-term illness, the will may state that a personal representative should take over the powers and duties of the probate court. The appointee does not have to follow the same standard as that of the other beneficiaries, and can vary according to state probate law. The will can also specify whether the appointment should be temporary permanent, or exclusive.

What needs to be included in a will?

Steps to Make a Will:

Decide what property to include in your will.

Decide who will inherit your property.

Choose an executor to handle your estate.

Choose a guardian for your children.

Choose someone to manage children's property.

Make direct wills trusts .

Sign your will in front of witnesses.

More items

What's the difference between a Power of Attorney that you make yourself and a will that you make? They are both ways of legally sharing ownership of your assets and financial liabilities, but there is a clear distinction. A Power of Attorney that you make yourself authorizes any financial, medical or legal decisions that you would take on your own. In other words, it gives you the authority to make the decisions, not the other way around. Whereas a will clearly expresses your intentions regarding the manner in which your property and assets will be handled should you become unable to exercise your power of attorney, a Power of Attorney does not express any intentions regarding the manner in which it will happen should you become unable to act.

Another situation in which it may be necessary to appoint an executor is when the testator has minor children who are not included on the testator's list of dependents. If the testator has a living son or daughter, but doesn't have a daughter, then the assets will go to either the father or the daughter depending upon the order of the testator. In read more... , an estate plan with an attorney really should be the most logical choice.

Our Bespoke Wills Service.

For example, if a couple has been married for many years and has a large family, they could possibly designate one as the surviving spouse and instruct that the assets are distributed according to the family line of descent. In addition, there are some specific situations in which a person does not have to appoint an executor. One situation in which this is applicable is when the decedent has no minor children. He or she may simply choose to distribute the remaining assets to his or her surviving spouse and children. However, in the majority of cases, it is necessary to appoint an executor.

What are the three conditions to make a will valid?

Requirements for a Will to Be ValidIt must be in writing. Generally, of course, wills are composed on a computer and printed out.

The person who made it must have signed and dated it. A will must be signed and dated by the person who made it.

Two adult witnesses must have signed it. Witnesses are crucial.

This is the importance of a will: by design, it ensures that your assets will be distributed according to the wishes of your last living trust. However, if you pass away unexpectedly, without leaving a will, your estate may face problems. If an attempt to revoke goes unsatisfied, there could be claims on your estate for debts or outstanding obligations. Additionally, if there are not enough assets to cover the debt of the decedent, his or her personal properties can be liquidated to pay off the debt. If this happens, it is wise to have a will executed even if it seems that no one wants the assets, so that the process can be followed to ensure the smooth transfer of everything to your final beneficiaries.

It is important to understand what will happen when the person dies. Willingness is often considered an essential component of estate planning. If a person can not speak or take care of themselves properly, it is wise to appoint a personal representative. However, there are situations where it may not always be practical to appoint an executor.

Can property be divided among family members? Property acquired during your lifetime is generally exempt from inheritance taxation. However, there are special situations where your property will be taxed. These include any real property you acquire during your lifetime, certain retirement assets such as mutual funds and bonds and certain life insurance policies.

Many people today, at some point in their lives, are faced with the reality of being able to execute their own will and living their final days peacefully. A will is one of the most important documents a person can create, as it names (and properly name) the intended recipients of inheritance assets. But what happens if your loved ones don't survive you?

youtube

Anyone can "make a Will" despite lacking the mental capacity to do so. Anyone can sign a Power of Attorney or take part in a Will if they meet minimum requirements set forth by law. Anyone who does not meet these minimum requirements is not qualified to sign or participate in a Will.

Financial Debt And Also Money

Will vs. Probate You can state in your Will that either (I) your beneficiaries will be the individual(s) specified in the Will, (ii) that your beneficiaries will receive specific monies held in trust under the Will, or (iii) that specific parties (other than your beneficiaries) will hold the assets specified in the Will until you die. Your Will must be filed with the proper jurisdiction and must include specific authorization for your executors to perform the tasks outlined in it. Some jurisdictions do not require a Will to be filed. Other governing bodies have different standards. In any jurisdiction in which you choose to file a Will, your agent cannot take the property and carry out the specific tasks outlined in the document without your authorization.

#how to write a will#free will writing#best will writing service#will writing in uk#will writing in united kingdom#how to make a will#make a will in UK

1 note

·

View note

Text

[ad_1]

Understanding Actual Property Tax Legal guidelines: What Patrons and Sellers Must Know

Actual property transactions contain a large number of legal guidelines and rules, together with tax legal guidelines. These legal guidelines can considerably influence each consumers and sellers, making it essential for all events concerned to understand and cling to them. This text goals to offer an outline of actual property tax legal guidelines, highlighting key factors that consumers and sellers want to concentrate on.

1. Property Tax Evaluation: Property taxes are a main income for native governments and are assessed based mostly on the worth of the property. It's important for consumers and sellers to grasp that the assessed worth of a property could not replicate its precise market worth. Patrons ought to analysis the common property tax charges within the space and take into account the potential influence on their funds. Sellers, then again, ought to make sure that their property is assessed pretty, as an overvaluation can result in greater property taxes.

2. Capital Beneficial properties Tax: Sellers want to concentrate on capital good points tax, which is utilized to the revenue constructed from the sale of an asset, together with actual property. The quantity of tax owed is set by the size of time the property was owned and whether or not it was used as a main residence. It's important for sellers to grasp the foundations governing capital good points tax, as sure exemptions or deductions could also be out there, such because the exclusion of as much as $250,000 (or $500,000 for married couples) of revenue from the sale of a main residence.

3. Mortgage Curiosity Deductions: Patrons ought to concentrate on mortgage curiosity deductions, which can assist cut back their taxable earnings. In lots of international locations, curiosity paid on mortgages is tax-deductible, offering a possibility for vital financial savings. Patrons ought to seek the advice of with a tax skilled to grasp the eligibility necessities and maximize this deduction.

4. Switch Taxes: Switch taxes are charges imposed upon the switch of property possession. These taxes can fluctuate extensively amongst states or jurisdictions and will be levied on the customer, vendor, or each. It's essential for consumers and sellers to know the particular switch tax charges relevant of their space, as they will instantly influence the general price of the transaction.

5. 1031 Trade: One other necessary facet of actual property tax legal guidelines is the 1031 trade, which permits sellers to defer capital good points tax in the event that they reinvest the proceeds from the sale into the same property inside a sure time-frame. This provision will be advantageous for sellers seeking to improve or diversify their actual property holdings with out incurring a right away tax burden.

6. Native Tax Incentives: Patrons ought to analysis native tax incentives supplied by municipalities, cities, or states, as they might present monetary advantages for buying property inside sure areas or classes. These incentives can embrace property tax abatements, tax credit, or decreased tax charges. Patrons ought to seek the advice of with native tax authorities or actual property professionals to establish any out there incentives.

In conclusion, understanding actual property tax legal guidelines is crucial for each consumers and sellers. Familiarizing oneself with property tax assessments, capital good points tax guidelines, mortgage curiosity deductions, switch taxes, 1031 exchanges, and native tax incentives can assist consumers and sellers navigate the actual property market extra successfully and make knowledgeable selections. It is strongly recommended that people seek the advice of with tax professionals or actual property specialists to make sure compliance with all relevant tax legal guidelines and maximize monetary advantages.

[ad_2]

0 notes

Text

The scale of 'how invasive and close is the attention they pay to the kids' in UCL goes like this:

Orphanage Children

The children in the orphanage are in the care of the state. This means zero amount of privacy, especially since Konoha is paying to keep them clothed and fed (partly through tax, partly through donation, partly though letting civilian children attend their lessons for a fee), and a hundred percent amount of indoctrination and propaganda straight from the source.

Children in the orphanage are either shinobi and kunoichi to be or useful civilian members of Konoha in the making (in case they do not have enough chakra to become shinobi or kunoichi). They are given additional training to bolster and support their Academy lessons and raise the value of the child to the village in the first case and, depending on where their talents are, funneled into trades that are useful to the Village and it's shinobi in the second case.

(Think weapon makers, ninja gear seamstresses and tailors, medicine production, weavers, laundrymen, builders, not ninja needed maintenance, nurses as well as health care assistants (you don't need chakra to clean a bedpan or change a set of bandages and the person with the chakra is the one Konoha wants healing a wound closed, not busy cleaning the floors). You get the idea. Useful civilians who come already indoctrinated into thinking Konoha is the best and their ninja protectors are amazing and something they wish they could have been but cannot be and thus will support in any way they can.)

The orphanage keeps (or is at least supposed to keep *cough* Nono and Danzo *cough*) the Academy apprised of the Academy's students are up to, which skills the orphanage's staff (through morning exercise [read: physical conditioning], specific lessons for talented children, borrowed reading materials and results in specifically targeted games) is either bolstering in each child or recognizing the child as being talented into. Before the Academy starts, the games that the children are taught are used to teach them facets of life in Konoha as well as to gauge where their potential might lie.

(Among the reasons why a child can be, temporarily or not, placed in the orphanage are: both parents died and there are no relatives left, both parents died and the only relatives are outside the village but the parents wanted the child to stay within the village, both parents died and the only relatives are outside the village but the child is already an Academy student, both parents died and the child's relatives are not up to taking the child in / not able to take the child in, both parents died and the child's siblings are not realistically able to take the child in, one parent died and the other is needed on the front, one parent died and the other is not in any condition to raise a child, one parent died and the other didn't want the child, the parents are but didn't want a child, the parents are alive and needed on the front but the child is not of an age to be left on his own, the siblings are alive and of age / capable of take in the child but do not want to and other variations thereof.)

Shinobi children

Children born to shinobi who are not clan affiliated are kept an eye on, as the traits that made their parents good shinobi tend to be passed down the line to the children. Much like kekkei genkai (or the Uzumaki vitality and energy) go down family lines in clans, so specific traits that are favourable to the life of a ninja can be found in the kids of active shinobi, who are also more often than not primed and brainwashed to want their children to follow into their footsteps and become shinobi and kunoichi of the Leaf.

Families who do not have the number to claim to be a clan are classified / recognized as Ninja Families and allowed to keep any family insignia the family had when it joined Konoha.

Said families have open and clear interest in wanting their children to be as prepared as possible for the lives they will one day live, in the service to their village and they are therefore usually welcoming of Academy oversight, wanting the Academy to be well aware of everything their kids can do, to give their kids the best possible chance to snag a realistic ranking for their skills that would, hopefully, turn into a respectable ranking as well.

Where Konoha's government has complete oversight over the children and their activities in the orphanage, Academy teachers are both encouraged and expected to meet with the parents of their shinobi children, to talk about what the kids are doing in their time out of the Academy and what the parents are doing and/or should be doing to best develop the child for their future career, supporting and / or correcting the parents, already predisposed to listen to the Academy teachers by having gone through the Academy themselves, when the teachers believe it to be necessary.

Clan children

Clan children have less amount of out-of-school oversight than the orphanage and shinobi children by the village but only because the Clan is supposed to keep an eye on the children on its own and report accordingly to the Academy, to ensure that their children receive the best possible education for their skills and for the family plans for them.

As Clans hold a special status in Konoha and have been shown to have exemptions from rules that allow them to get away with things that others wouldn't be remotely allowed to even try, Academy teachers do not advise or correct clan members about the teaching of their children. Clan members advice or correct Academy teachers about the teaching of said children and keep them abreast of how much a child is being taught and in which skills, though what said child is learning is not necessarily for the Academy to know and most Academy teachers know better than to inquire about.

Suggestions from the Academy teachers are listened to but whether they are implemented or not depends on case to case.

Civilian children

Unlike other villages, Konoha doesn't have a policy that enforces compulsory joining of the Academy for anyone with the slightest shred of potential for it. This does not mean, however, that they do not try to indoctrinate, using propaganda and peer pressure both, their civilian citizens into handing into the village's care all children with the right potential.

That Konoha is nicer, by comparison to other villages, does not make Konoha nice.

However, this also means that the civilian children are the ones with less oversight on them outside of the Academy, in various degrees depending on their family type, as they are neither in the hands of the government nor have the kind of oversight ninja and clan children have from their own relatives.

Civilian children come from three kinds of background: civilians that came into the village as either part of or affiliated with a specific clan or ninja family, civilians that came into the village (after Hashirama died and Tobirama became Hokage only after getting vetted by Intelligence) because they saw Konoha as a better prospect than they previously had, civilians that were descended by or originated from the orphanage.

(Within the class system UCL's Konoha has, the first are the highest ranked [with further divisions among them re which clan or ninja family they affiliated with / were part of when they came into the village], the latter are the middle-ranked and the middle group is the last row of the civilian scale in terms of how Konoha civilians tend to mentally divide themselves.)

Civilians that originated from the orphanage who have garnered no ties or relationship to a clan or ninja family and who decide to send their children to the Academy, know to ensure that everything their child does that can accrue more points in the Academy system is reported to the Academy, to bolster their child up.

They, usually, try to approach the orphanage itself to have the children flagged for the Academy and secure extra lessons to give the child an edge, as part of the orphanage income actually comes from teaching fees obtained by allowing access to their lessons to children not belonging to the orphanage, or have an iryō nin do the flagging for them and then see what extra lessons they can afford to have their child attend at the orphanage, to ensure that any child of theirs with the potential to be a ninja will be given a good chance to be a ninja.

Civilian children from families that joined under the auspices of a ninja clan or family often, but not always, are brought by their family to said clan or family in the hopes they will find a Patron (which is taken to mean a ninja who sees potential and sponsors the child for the Academy and, usually, takes an interest in the child's life and training, in most cases helping with it) or that, not managing that, the clan or family will sponsor the child for the Academy.

(Sponsored children are children who are brought up to the Academy's attention by sources other than medics (iryō nin check all children in their care who are not yet on record as Academy's future students for chakra reserves, coil development, health issues and all other indicators that might get someone flagged as Academy material and are supposed to encourage the parents to get the child recorded as having shinobi/kunoichi potential) or the orphanage and who are presented to the Academy for consideration as potential recruits.)

Only clans and ninja families are allowed to sponsor someone as those doing the sponsoring are also taking a certain amount of interest and responsibility in how the child will do and that has all sort of implications attached to it. It is considered a heavy snub against an associated civilian family, as well as a sign of the civilians fucking up big time or the child being defective somehow, if a clan or ninja family refuses to sponsor their child. The child can still access the academy, if the family gets an iryō nin to flag the child's file, but the refusal will be taken note of and it will impact the child by denying access to resources the child could have used to climb the Academy ranks higher.

Sponsored children are assessed by those doing the sponsoring and the results of said assessment is handed over to the Academy. Lessons and teachings which are given to the child later on by either their Patron or their sponsors, who have a vested interest in the child's success, are also supposed to be reported to the Academy, if not by the clan/ninja family then by the child on their behalf, as they add points to the child's score.

Civilians who emigrated into Konoha without the benefit of association to a clan or ninja family and didn't become part of a clan or associated with a clan upon arrival are more likely to only send their children to the Academy with the hopes that having a child who is a ninja will boost the family into the informal class ranks of Konoha and will give them needed connections and hooks into the fabric of the village.

There are plenty of civilian families who would rather have their child follow in their civilian parents' footsteps or, if peer pressured into sending the child in / having their child's file flagged by an iryō nin, have the child go to the Academy, learn some skills and then have a boring career until they can snag a spouse of better social ranking than their own and then become a homemaker than have their child go to the Academy and then end out on the front lines of a war, risking limb and life for their village.

In a lot of these civilian families' very quietly kept private viewpoint, plenty of other people's children can do that, clan children especially, since the ninja clans are supposed to be their protectors. No need to sacrifice their own child, who can be useful to the family in plenty of other ways.

The children of these families, regardless of whether they share their family's views or not, more often than not end up having no sponsoring and no Patrons to help them out and have to muddle through on their own merits and the amount of study they put in on their own, usually doomed to the bottom ranks of the Academy unless they manage to crawl out of it on their own.

While meeting with the Academy teachers can and do happen for civilians as well, it can be hard for the Academy teachers to manage to convince civilians to change their ways as they are not allowed to intimidate the civilians of their village nor do they have the kind of automatic respect that comes from the shinobi and kunoichi that have trained under them.

Where the orphanage is state-run and so completely in step with the Academy, ninja parents know to listen to the Academy and clan parents are willing to listen to and trust in the expertise of the teachers handling the futures of their kids, civilian parents who are not from an orphanage or clan/family affiliated background are protected from a very needed awareness by their being civilians and thus more inured and unaware of the importance of both listening to the Academy teachers and to keep them properly update on what their kid can do, especially if they are the kind of parents who do not want their child to get through the Academy to join the front lines but just see it as a way to advance the family.

Of course, all categories tend to have parents who think their darling child could do no wrong and those are always, always, always pains in the ass to deal with, in various degrees depending on their social status.

#Jhae's original material#words words words#November 8th 2019#UCL meta#Under A Canopy of Leaves related#UCL related#meta#my meta#Naruto meta

29 notes

·

View notes

Text

6 Reasons Why You Ought to Have a Living Have confidence in

When you've ever thought about a living trust, it's most likely because you hate the particular idea of going via probate. Living trusts have got been heavily marketed on that basis over the past a number of years and, yes, living trusts certainly do stay away from probate. But, there's a whole lot more to living cartouche than just that. Inside fact, avoiding probate will be not even oneof typically the top three reasons for a full time income trust. In my opinion, it's #4. To set the record straight, here are the top 6 reasons why you need to have a living confidence.

Reason #1: Protecting House for Certain Beneficiaries. This will be seldom mentioned as a reason for a lifestyle trust, but it's most likely one of the most important reasons. Any time most of us think about property planning, good about giving our property to our own husband or wife, the children, and other loved types after we die. Nevertheless, sometimes our intended beneficiaries just aren't able to be able to handle an inheritance. Slight children are the usual suspects here. Many states avoid even allow minor youngsters to own property because they're just too youthful. Instead, the state appoints a guardian to hold the property until they will reach majority age (usually age 18). Even next, parents cringe in the notion of an 18-year old getting any amount regarding money. First thing they might do is quit college, buy an expensive automobile, and head to Cancun. However minor children not necessarily the only real ones who waste money. Most experts agree that no one below the age of twenty five should be given a good inheritance outright because they will need time and energy to finish institution and start a career. Of course, there are numerous people over the age of 25 that shouldn't have money possibly. Some are spendthrifts in heart, others are inside not-so-good marriages, still other people are experiencing bankruptcy. And then there are those who are just too frail and incapacitated to manage property independently. Giving any amount regarding property to any of these people will certainly not be the good idea.

That's any time a trust becomes the vital part of your estate planning. A trust allows you to possess your cake and eat it too. Let's get a look at a typical example and see how it works. Parenthetically that you have a 20-year old son who is a junior inside college. If you along with your wife both die, you desire your son to get all of your property, including the equity at home, your existence insurance, retirement plans, and so forth. If you reduce all your property to cash, it could easily amount to $500, 000 or more. Yet, having your executor write a check to your current son for $500, 1000 is typically not a good thought. Instead, it would be far better to create the trust for your son with someone else, point out a friend, family relative, attorney, or if your local bank, like trustee. The trustee would certainly hold the money and commit it for your son's benefit until he reached a more mature age, say age 25. Inside the meantime, your trustee would use the money to pay for your current son's schooling, his general living expenses, and just about any other expenses you may possibly specify in the trust instrument - including a down payment on a home or even a start up business. When your child reaches the specified age, the particular trust would end and your son will be offered a check for the full value of the trust at that time.

Revocable lifestyle trusts have been used in order to protect property for hundreds of years, plus it is probably 1 of the most crucial reasons for a revocable living trust today. In case you have any beneficiaries who are in this specific position, then a revocable living is actually a necessary component of your overall house planning.

Reason #2: Reducing or Eliminating Estate Fees. Many people say of which a revocable living trust doesn't save estate fees. Technically, they're right. Right now there are no provisions inside the federal tax laws that exempt revocable living trusts from estate taxes. However, living trusts tend to be used by individuals plus families to take advantage of certain deductions plus credits allowed under the tax laws. That sounds like trash, but permit me explain. For folks declining this year, up in order to $1, 500, 000 is definitely not affected by federal estate taxation. This exemption is known to as a "unified credit. " Besides typically the unified credit, no property tax is levied upon any property passing to a surviving spouse. This particular "marital deduction" is unlimited, so you could exchange any amount of cash for # your spouse without having to pay estate taxes.

Here's what typically happens when a husband and wife have simple wills. Let's assume of which you both has a $1, 000, 000 estate. Why don't also imagine you perish first which your will certainly leaves all your property to your wife. Your property pays no estate taxes because of the marital deduction. Upon your wife's subsequent death, her property (then $2, 000, 000) is left to your current children. Your wife's house would then need to pay an estate tax of roughly $235. 000, as your wife's unified credit covers simply the first $1, 500, 000 of her property. The remainder is taxed at graduated rates reaching 47%.

You can eliminate this $235, 000 house tax very easily with a revocable living trust. Let's assume, for instance , of which you only give your current wife $500, 000 and that the other $250, 000 is put into your own revocable living trust. Your own estate still doesn't shell out an estate tax because the property given to be able to your spouse is exempt under the marital deduction and the property given to your rely on is exempt under your own unified credit. Now, on the other hand, your wife's estate is only worth $1, 500, 000 (her original $1, 000, 000 plus typically the $500, 000 you gave her). Upon her loss of life, no estate taxes can be paid by her estate because the entire $1, 500, 000 is covered by her unified credit rating. The $500, 000 inside your revocable living trust is not taxed inside your wife's estate because she didn't own that, even though she was your preferred beneficiary and can receive distributions if the lady needed some money.

This very simple but extremely effective technique - made possible by the use of a revocable living trust - would eliminate approximately $235, 000 in government estate taxes in the above example. For this cause, any married couple along with a combined estate inside excess of the unified credit (currently $1, 500, 000) should consider the revocable living trust in order to take advantage of this tax-saving technique.

Reason #3: Managing Property upon Incapacity. One of the main concerns that many of us have nowadays is not about dying - it's about living too long! We notice it all around all of us - we bother about our own parents living in their very own home. We worry about their bills being compensated and whether someone will walk off with their particular money. Oftentimes, we are powerless to help these people because all of their property is in their very own name. Unfortunately, without carrying out some prior planning, the only option we have got is to file a software with the probate court docket to get a guardian appointed regarding them. What a gut aching experience because all their particular personal and financial affairs will have to end up being paraded before total strangers, and they will need to suffer the indignity and humiliation of being reported incompetent.

It doesn't have got to be this way. Numerous people try to prevent that result by getting certain properties (particularly examining and savings accounts) inside joint name with a son or daughter. That enables the son or even daughter to pay their particular bills, but it doesn't provide a lots of help with other financial matters. That also creates more difficulties when the parent passes away because those accounts complete automatically to the child or daughter and leaves the other children out there in the cold.

A better option would be a durable power of attorney. The durable power of attorney allows you to designate the people you would like to help you along with economical affairs. However, because good as a tough power of attorney is - and I'm the firm believer that every person over the age of 50 ought to possess one - it can experience some shortcomings. First, your own attorney-in-fact may find a few finance institutions difficult to function with. Second, it might not give your attorney-in-fact all the powers needed to handle your affairs. For example, if you were producing gifts to family people on a regular foundation, your attorney-in-fact would not be able to continue making those gifts unless that was specifically stated in the document.

A much better option would be the revocable living trust. The revocable living trust enables your successor trustee to be able to take over whenever you resign or become incapacitated. There is generally no interruption within the management of your property, and there is no courtroom supervision. Revocable living pool also enjoy a greater level of acceptance throughout the particular legal and financial local community, many all states provide a wide range of statutory powers regarding the management of believe in property. While it is usually true that a residing trust isn't effective except if your property is found in the trust, a tough power of attorney will certainly enable your attorney-in-fact to transfer property into your own trust if you fail to do that on your own.

Reason #4: Avoiding Probate. This is true that house in your revocable residing trust will not undergo probate when you pass away. That's because the believe in instrument spells out who else get's the property. It's a lot like life insurance, annuities, 401(k) plans, IRAs, in addition to company retirement plans -- those properties do not move through probate because they will have a designated named beneficiary. Jointly-owned property, with rights of survivorship, doesn't go through probate, either. It passes automatically for the surviving joint owner.

That does not mean, however, that your successor trustee will be free to distribute the particular trust property immediately. It can not as simple because that. Just because your property is in trust doesn't mean that your own outstanding debts don't possess to be paid. Similarly, the federal government nevertheless wants to collect its estate taxes; your state government still would like to collect its inheritance taxes; and typically the probate court still wishes some fees even though many of your property may avoid probate. There most likely will be trustee's charges and attorney's fees since well. In view of all these expenses, the successor trustee could possibly make some advanced distributions from your trust, but enough money has to be stored in the trust to pay all the debts and expenses.

Still, a reasonably efficient successor trustee will be able in order to determine fairly quickly simply how much the potential debts and expenses will certainly be, and or she will then have the ability to make advanced distributions accordingly. Inside the final analysis, many revocable living trusts are able to distribute house more quickly and along with much less cost than is possible through probate.

Does that mean that everyone should avoid probate? I actually don't think so. Some individuals suggest a threshold restrict of $100, 000, bar real estate, in buy to justify the cost of a revocable living rely on. I think the cutoff ought to be much lower compared to that. Most states have a simplified probate with regard to estates valued at much less than $20, 000. If you're in that situtation, then a simplified probate is probably right for an individual. Nevertheless , if your probate estate is valued at more than $20, 000, then you really need to look closely from a revocable living rely on, especially if any regarding the other reasons for a new revocable living trust utilize to you. After just about all, keep in mind that take much to be able to make up for the few dollars it will take to set up a revocable living rely on.

Reason #5: Avoiding a new Will Contest. It really is a fact that a will is far more likely to be contested than a revocable living trust. That's because a may goes into effect only when a person dies, whilst a revocable living trust adopts effect as quickly as the trust instrument is signed and usually lasts for some time following the owner's death. In case you're going to competition a will, all a person have to do will be prove that the testator was either incompetent or perhaps under undue influence at the precise moment the will was signed. In order to contest a revocable residing trust, you have to be able to provide evidence that the grantor had been incompetent or under unnecessary influence not only whenever the trust instrument was signed, but also when each property was used in the trust, when each investment decision was manufactured, and when every distribution was made to the particular owner or anyone more. That is virtually impossible to do.

Moreover, that costs nothing to competition a will. All a new disgruntled relative has to be able to do is object when the will is introduced for probate, then seek the services of an attorney on the contingency fee basis, and wait for the end result. A disgruntled family associate has nothing to shed. On the other palm, contesting a revocable residing trust generally involves the substantial commitment of period and money. Whereas the will contest is noticed in probate court, the revocable living trust competition is heard in civil court where there are substantial filing fees and formal procedures that have got to be followed.

Still, some people argue of which will contests are rarely successful, so why trouble with a revocable living trust? The answer will be threefold: First, a will contest puts a screeching halt on the negotiation of an estate. The majority of will contests have a minimum of two or more years to finish and, throughout that period, no distributions will be made to anyone. Second, defending a new will contest involves plenty of attorney time of which results in large attorneys' fees. Even unsuccessful may contests end up priced at $50, 000 or even more in attorney's fees. 3rd, many will contests are settled before they ever before get to court. In that will case, the estate will be further diminished by the amount of the arrangement. Within the final analysis, may contests are time eating and expensive. The easiest method to stay away from them is through a revocable living trust.

Reason #6: Privacy. Most of us naturally dislike the concept of probate since it is a public process. Theoretically, anyone can go into probate court when a person passes away and look at the house file. You can read the will certainly, you can find out and about who the relatives and beneficiaries are, you could look at the claims of creditors and typically the set of assets, and a person can find the telephone numbers and addresses of property beneficiaries. Unscrupulous sales people often go through property files to discover grieving spouse, children or other loved ones to victimize. Disgruntled future heirs, even others who live nearby, often like to poke their noses into an estate record to see what's there.

Revocable living trusts could prevent all of that. Revocable living trusts are usually private; indicate get filed with the probate the courtroom, and no one grows to look at them unless the grantor or the particular trustee allows it. Several people put a higher benefit on privacy - several people don't. In my experience, most individuals know whether they will have a challenge with a family member or some one else regarding their estate. In all those cases, privacy becomes a really important concern and 1 that should properly be address having a revocable living rely on.

These, then, are typically the top 6 reasons the reason why you should have the revocable living trust. In case more than one of these causes apply to you, and then you should consult a professional to see whether a new revocable living trust can make sense in your overall estate planning.

9 notes

·

View notes

Text

6th Reasons Why You Need to Have a Living Have confidence in

When you've ever thought about a new living trust, it's most likely because you hate typically the idea of going through probate. Living trusts possess been heavily marketed on that basis over the past many years and, yes, living trusts certainly do prevent probate. But, there's a great deal more to living concentration than just that. Within fact, avoiding probate will be not even oneof the particular top three reasons with regard to a full time income trust. In my opinion, it's #4. In order to set the record in a straight line, here are the leading 6 explanations why you need to have a living have confidence in.

Reason #1: Protecting House for Certain Beneficiaries. This will be seldom mentioned as a new reason for a lifestyle trust, but it's most likely one of the most important reasons. When most of us think about house planning, good about providing our property to our own husband or wife, the children, as well as other loved kinds after we die. However, sometimes our intended beneficiaries just aren't able in order to handle an inheritance. Minor children are the usual potential foods here. Many states may even allow minor youngsters to own property because they're just too younger. Instead, the state appoints a guardian to hold the property until they reach majority age (usually age 18). Even then, parents cringe in the thought of an 18-year old getting any amount associated with money. First thing they may do is quit school, buy an expensive car, and head to Cancun. However minor children usually are the sole ones who spend money. Most experts agree that no one beneath the age of twenty-five should be given a great inheritance outright because they need time and energy to finish college and start a profession. Of course, there are numerous people older than 25 of which shouldn't have money either. Some are spendthrifts from heart, others are on not-so-good marriages, still others are experiencing bankruptcy. After that there are those who are just too frail and disabled to manage property independently. Giving any amount associated with property to any of these people will certainly not be a good idea.

That's any time a trust becomes a new vital part of your current estate planning. A trust allows you to have got your cake and consume it too. Let's take a look at the typical example and observe how it works. Parenthetically that you have a new 20-year old son that is a junior found in college. If you and your wife both die, you want your son to acquire all of your property, including the equity at home, your existence insurance, retirement plans, and so on. If you reduce all your property to cash, it could easily amount to 500 usd, 000 or more. Nevertheless, having your executor create a check to your current son for $500, 1000 may not be a good thought. Instead, it would end up being far better to create a new trust for your child with someone else, point out a buddy, family relative, legal professional, or your local bank, while trustee. The trustee would hold the money and spend it for your son's benefit until he reached a more mature age, say age 25. Inside the meantime, your trustee would use the money to pay for your son's schooling, his basic living expenses, and any other expenses you may possibly specify in the trust instrument - including a downpayment on a home or a start up business. When your son reaches the specified age, the particular trust would end and your son would be offered a check for typically the full value of typically the trust in those days.

Revocable lifestyle trusts have been used in order to protect property for hundreds of years, plus it is probably a single of the most essential reasons for a revocable living trust today. If you have any beneficiaries who are in this particular position, then a revocable living is a necessary part of your overall estate planning.

Reason #2: Decreasing or Eliminating Estate Taxes. Many people say that a revocable living trust doesn't save estate taxes. Technically, they're right. There are no provisions inside the federal tax regulations that exempt revocable dwelling trusts from estate fees. However, living trusts in many cases are used by individuals and families to take benefit of certain deductions and credits allowed under typically the tax laws. That sounds like trash, but allow me explain. For people dying this year, up to $1, 500, 000 is usually not impacted by federal estate fees. This exemption is known to as a "unified credit. " Besides the particular unified credit, no property tax is levied upon any property passing in order to a surviving spouse. This "marital deduction" is endless, so you could move any amount of money in your spouse without spending estate taxes.

Here's just what typically occurs a spouse and wife have quick wills. Let's assume that you both has a $1, 000, 000 estate. Let's also imagine you die first and that your will leaves all your property in order to your wife. Your estate pays no estate taxation because of the marital deduction. Upon your wife's subsequent death, her property (then $2, 000, 000) is left to your own children. Your wife's property would then have to pay a great estate tax of around $235. 000, since your wife's unified credit covers simply the first $1, five hundred, 000 of her house. The remainder is taxed at graduated rates attaining 47%.

You can get rid of this $235, 000 property tax very easily with a revocable living trust. Let's assume, for example , of which you only give your wife $500, 000 plus that the other 500 usd, 000 is placed into your revocable living trust. Your own estate still doesn't shell out an estate tax because the property given in order to your wife is exempt under the particular marital deduction and the particular property given to your believe in is exempt under your current unified credit. Now, however, your wife's estate is only worth $1, 500, 000 (her original $1, 000, 000 plus the $500, 000 you offered her). Upon her loss of life, no estate taxes will be paid by the girl estate since the entire $1, 500, 000 is protected by her unified credit rating. The $500, 000 inside your revocable living rely on is not taxed found in your wife's estate due to the fact she didn't own it, even though she was the preferred beneficiary and may receive distributions if the girl needed some money.

This very simple but extremely effective technique - made possible by the use associated with a revocable living believe in - would eliminate around $235, 000 in government estate taxes in the above example. For this cause, any married couple along with a combined estate in excess of the single credit (currently $1, five hundred, 000) should consider the revocable living trust to take advantage of this tax-saving technique.

Reason #3: Managing Property upon Incapacity. One of the main concerns that several of us have today is not about dying - it's about dwelling too long! We notice it all around us all - we worry about the parents living in their very own home. We worry regarding their bills being paid out and whether someone will walk off with their money. Oftentimes, we are powerless to help all of them because all of their property is in their very own name. Unfortunately, without carrying out some prior planning, the only option we possess is to file a software with the probate court docket to possess a guardian appointed regarding them. What a gut wrenching experience because all their own personal and financial matters will have to become paraded before total unknown people, and they will be forced to suffer the indignity in addition to humiliation of being announced incompetent.

It doesn't possess to be doing this. Many people try to stay away from that result by getting certain properties (particularly looking at and savings accounts) in joint name with the son or daughter. That enables the son or even daughter to pay their bills, but it won't provide a lots of help with other financial matters. It also creates more issues when the parent passes away because those accounts pass automatically to the boy or daughter and results in the other children out there in the cold.

A better option would be a durable power of attorney. The durable power of attorney allows you to designate the people you would like to help you together with economical affairs. However, as good as a tough power of attorney is usually - and I'm the firm believer that every person over the age associated with 50 ought to possess one - it can have some shortcomings. First, your attorney-in-fact may find some finance institutions difficult to function with. Second, it might not offer your attorney-in-fact all the particular powers needed to control your affairs. For occasion, if you were making gifts to family people on a regular foundation, your attorney-in-fact would not be able to continue making those gifts unless of course that was specifically stated in the document.

A much better fix is a new revocable living trust. A new revocable living trust permits your successor trustee to be able to take over whenever you resign or become disabled. There is generally no disruption within the management of your own property, and there is no court supervision. Revocable living trusts also enjoy a larger level of acceptance throughout typically the legal and financial community, and almost all states provide a broad range of statutory capabilities regarding the management of trust property. While it is usually true that a living trust isn't effective unless your property is found in the trust, a long lasting power of attorney will certainly enable your attorney-in-fact to be able to transfer property into your trust if you fail to do that on your own.

Reason #4: Avoiding Probate. This is true that home in your revocable residing trust will not undergo probate when you pass away. That's because the trust instrument spells out who get's the home. It's a lot like life insurance, usually are, 401(k) plans, IRAs, # in addition to company retirement plans : those properties tend not to go through probate because they will each have a designated named beneficiary. Jointly-owned property, with protection under the law of survivorship, doesn't go through probate, either. It passes automatically to the surviving joint owner.

That will not mean, however, that will your successor trustee is free to distribute typically the trust property immediately. It's not as simple since that. Just because your current property is in rely on doesn't mean that your own outstanding debts don't possess to be paid. Similarly, the federal government still wants to collect its house taxes; your state authorities still desires to collect its inheritance taxes; and the particular probate court still desires some fees despite the fact that the majority of of your property might avoid probate. There possibly will be trustee's costs and attorney's fees since well. In view of all these expenses, the particular successor trustee might be able to help to make some advanced distributions from the trust, but enough cash has to be maintained in the trust in order to pay all the debt and expenses.

Still, the reasonably efficient successor trustee will be able in order to determine fairly quickly simply how much the prospective debts and expenses will certainly be, and he or the girl will then manage to help make advanced distributions accordingly. On the final analysis, many revocable living trusts usually are able to distribute house more quickly and together with a lesser amount of cost than will be possible through probate.

Does that mean that every person should avoid probate? We don't think so. Some people suggest a threshold reduce of $100, 000, exclusive of real estate, in order to justify the cost associated with a revocable living believe in. I think the cutoff must be much lower as compared to that. Most states have got a simplified probate for estates valued at less than $20, 000. In case you are in that situtation, then a simplified probate will be probably right for a person. Yet , if your probate estate is valued in more than $20, 000, then you really want to look closely in a revocable living rely on, especially if any associated with the some other reasons for the revocable living trust use to you. After just about all, keep in mind that take much to be able to make on with the couple of dollars it takes to establish a revocable living rely on.

Reason #5: Avoiding the Will Contest. It truly is true that a will is likely to be contested than a revocable dwelling trust. That's because a will goes into effect only when a person dies, whereas a revocable living trust goes into effect as shortly as the trust instrument is signed and generally lasts for some time right after the owner's death. In case you're going to contest a will, all a person have to do is usually prove that the testator was either incompetent or under undue influence from the precise moment the will was signed. In order to contest a revocable living trust, you have to prove that the grantor had been incompetent or under excessive influence not only any time the trust instrument has been signed, but also any time each property was used in the trust, when each investment decision was made, and when each and every supply was made to typically the owner or anyone else. That is virtually not possible to do.

Moreover, that costs nothing to competition a will. All a disgruntled member of the family has to do is object whenever the will is introduced for probate, then employ an attorney on a new contingency fee basis, plus wait for the end result. A disgruntled family member has nothing to drop. On the other hand, contesting a revocable dwelling trust generally involves a new substantial commitment of period and money. Whereas the will contest is heard in probate court, a revocable living trust competition is heard in city court where there are substantial filing fees and formal procedures that have got to be followed.

Still, some people argue of which will contests are rarely successful, so why trouble with a revocable dwelling trust? The answer is threefold: First, a will contest puts a screeching halt on the negotiation of an estate. Most will contests take a lowest of two or even more years to finish and, in the course of that period, no droit will be made to be able to anyone. Second, defending a new will contest involves plenty of attorney time that will results in large attorneys' fees. Even unsuccessful may contests end up costing $50, 000 or more in attorney's fees. 3 rd, many will contests usually are settled before they actually be able to court. In of which case, the estate can be further diminished by the amount of the arrangement. Within the final analysis, can contests are time ingesting and expensive. The best way to avoid them is through the revocable living trust.

Reason #6: Privacy. Most of us naturally dislike the concept of probate because it is a public process. Theoretically, anyone can go into probate court docket when a person passes away and appearance at the estate file. Look for the will, you can find out there who the relatives plus beneficiaries are, you could look at the claims of creditors and the particular listing of assets, and you can find the telephone numbers and addresses of estate beneficiaries. Unscrupulous sales individuals often go through estate files to discover grieving heirs to prey on. Disgruntled spouse, children or other loved ones, even others who live nearby, often like to poke their noses into an estate record to see what's there.