#Lihir

Note

What is your favorite species of fruit dove?? I just learned about them and they look so cool👀

I really cannot pick a favorite, I love this group of beautiful doves so much.

Some favorites are the Golden, Jambu, Yellow-bibbed, Superb, Orange, Rose-crowned, and Pink-headed.

Herps and Birds (and More) (Posts tagged fruit dove) (tumblr.com)

Do y'all have a favorite?

Here's one I haven't posted yet...

Claret-breasted Fruit Dove (Ptilinopus viridis), male, family Columbidae, order Columbiformes, Lihir Island, Papua New Guinea

photograph by Alexander Babych

170 notes

·

View notes

Text

Thanatology Bibliography

THANATOLOGY READINGS

Moll, Rob. (2010). The Art of Dying: Living Fully Into the Life to Come. Downers Grove, IL: InterVarsity Press. ISBN: 9780830837366

Parkes, C., Laungani, P. and Young, W. (1997). Death and Bereavement Across Cultures. London: Routledge. ISBN: 9780415131377

SELECTED BIBLIOGRAPHY

Alford, John & Catlin, George. (1993). The role of culture in grief. The Journal of Social Psychology, 133(2), 173-84.

Aries, Philippe. (1976). The Hour of Our Death. New York: Bantom.

Burton, Laurel., & Tarlos-Benka, Judy. (1997). Grief-Driven Ethical Decision-Making. Journal of Religion and Health, 36(4), 333-343. Retrieved from www.jstor.org/stable/27511175

Castle, Jason. & Phillips, William. (2003). Grief rituals: Aspects that facilitate adjustment to bereavement. Journal of Loss & Trauma, 8(1), 41-71.

Corr, Charles A., Donna M. Corr, and Kenneth J. Doka. (2019). Death & Dying, Life & Living. Boston, MA: Cengage.

Crunk, Elizabeth. Burke, Laurie., & Robinson, Mike. (2017). Complicated grief: An evolving theoretical landscape. Journal of Counseling & Development, 95(2), 226-233.

Doughty, Caitlin. (2015). Smoke gets in your eyes and other lessons from the crematory. New York: Northcott.

Dresser, Norine & Wasserman, Freda. (2010). Saying goodbye to someone you love: Your emotional journey through end-of-life and grief. New York: Demos Medical Publishing.

Frank, Arthur W. (2013). The wounded storyteller. Chicago: The University of Chicago Press.

Guinther, Paul.,Segal, Daniel. (2003). Gender differences in emotional processing among bereaved older adults. Journal of Loss & Trauma, 8(1), 15-33.

Heath, Yvonne. (2015). Love your life to death: How to plan and prepare for end of life so you can live life fully now. Canada: Marquis Publishing.

Hemer, Susan. (2010). Grief as social experience: Death and bereavement in lihir, papua new guinea¹. The Australian Journal of Anthropology, 21(3), 281-297.

Kalanithi, Paul. (2016). When Breath Becomes Air. New York: Random House.

Kellehear, Allan. (2002). Grief and loss: Past, present and future. Medical Journal of Australia, 177(4), 176-177.

Kwon, Soo-Young. (2006). Grief ministry as homecoming: Framing death from a korean-american perspective. Pastoral Psychology, 54(4), 313-324. doi:10.1007/s11089-005-0002-1

Lawrence, Elizabeth., Jeglic, Elizabeth., Matthews, Laura., & Pepper, Carolyn. (2006). Gender differences in grief reactions following the death of a parent. Omega - Journal of Death and Dying, 52(4), 323-337.

Leone Fowler, Shannon. (2017). Traveling with Ghosts. New York: Simon & Schuster.

Lewis, Clive Staples. (2009). The Problem of Pain. New York: Harper.

Lopez, Sandra. (2011). Culture as an influencing factor in adolescent grief and bereavement. Prevention Researcher, 18(3), 10-13.

McCreight, Bernadette. (2004). A grief ignored: Narratives of pregnancy loss from a male perspective.Sociology of Health & Illness, 26(3), 326-350.

Miller, Eric. (2015). Evaluations of hypothetical bereavement and grief: The influence of loss recency, loss type and gender. International Journal of Psychology: Journal International De Psychologie, 50(1), 60-3. doi:10.1002/ijop.12080

Northcott, Herbert.C., & Wilson, Donna.M. (2017). Dying and death in Canada (3rd ed.) Toronto: University of Toronto Press.

Nuland, Sherwin B. (1995). How We Die. New York: Vintage.

Penman, Emma., Breen, Lauren., Hewitt, Lauren., & Prigerson, Holly. (2014). Public attitudes about normal and pathological grief. Death Studies, 38(8), 510-516.

Rosenstein, Donald L. & Yopp, Justin M. (2018). The Group: Seven widowed fathers reimagine life. New York: Oxford University Press.

Rubinstein, Gidi. (2004). Locus of control and helplessness: Gender differences among bereaved parents. Death Studies, 28(3), 211-223.

Sandburg, Sheryl, & Grant, Adam. (2017). Option B: Facing Adversity, Building Resilience, and Finding Joy. New York: Knopf Doubleday Publishing Group.

Schonfeld, Davis., Quackenbush, Mike., & Demaria, Thomas. (2015). Grief across cultures: Awareness for schools. Nasn School Nurse (print), 30(6), 350-2.

Stelzer, Eva-Maria., Atkinson, Ciara., O'Connor, Mary F., & Croft, Alyssa. (2019). Gender differences in grief narrative construction: A myth or reality? European Journal of Psychotraumatology, 10(1),

Stroebe, Margaret., & Schut, Hank. (1998). Culture and grief. Bereavement Care, 17(1).

Swinton, John and Richard Payne. (2009). Living Well and Dying Faithfully. Grand Rapids: Eerdmans.

Tarakeshwar, Nalini., Hansen, Nathan., Kochman, Arlene., & Sikkema, Kathleen. (2005). Gender, ethnicity and spiritual coping among bereaved hiv-positive individuals. Mental Health, Religion & Culture, 8(2), 109-125.

Versalle, Alexis. & McDowell, Eugene. (2005). The attitudes of men and women concerning gender differences in grief. Omega - Journal of Death and Dying, 50(1), 53-67.

Walter, Tony. (2010). Grief and culture. Bereavement Care, 29(2), 5-9.

Walter, Tony. (2010). Grief and culture: A checklist. Bereavement Care, 29(2), 5-9.

Winkel, Heidemarie. (2001). A postmodern culture of grief? On individualization of mourning in Germany. Mortality, 6(1), 65-79.

3 notes

·

View notes

Text

Çok güzel yerler gezip paylaşan bir sayfa her ülkenin özellikle Havalimanı nereden nasıl gidilir vs tüm detaylarını anlatıyor

Papua Yeni Gine'deyim [Papua Yeni Gine - Lihir]

https://www.youtube.com/watch?v=FTMR-Z95G48

0 notes

Text

Dove viene estratto la maggior parte dell'oro mondiale

Miniere d’oro: i 10 giacimenti più grandi e importanti nel mondo. Quali sono le miniere che producono più oro al mondo? In questo articolo vedremo quali sono i 10 giacimenti minerari più importanti per l’estrazione aurifera.

L'oro è forse il metallo più iconico di tutti i tempi: la sua origine è legata a stelle di grandi dimensioni e qui, sulla Terra, il suo particolare colore lo ha resto uno tra i materiali più ambiti fin dall'alba della civiltà – tanto che ancora oggi la sua produzione procede a pieno ritmo.

Ma, a proposito, quali sono le miniere che al mondo ne estraggono di più? In questo articolo vedremo quali sono le più grandi miniere di oro al mondo, dove si trovano e quanto metallo prezioso sono riuscite a produrre nel 2021.

1. Nevada Gold Mines (USA)

Al primo posto della classifica troviamo una miniera americana che ha fatto registrare nel 2021 una produzione di poco inferiore alle 94 tonnellate. Ci troviamo in Nevada e la fortuna della Nevada Gold Mines è legata alla presenza del cosiddetto "Carlin Trend", un particolare tipo di formazione geologica composta da livelli ricchi di mineralizzazioni aurifere: pensate che questo sistema di estende per circa 56 km ed è in corso di estrazione dall'ormai lontano 1965.

2. Muruntau (Uzbekistan)

Quella di Muruntau in Uzbekistan è una miniera a cielo aperto che ha prodotto quasi 85 tonnellate nel 2021. La struttura è lunga circa 3,3 km, larga 2,5 km, con una profondità di circa 600 metri ed è gestita dalla compagnia statale Navoi. Si stima che questa miniera abbia ancora più di 4200 tonnellate di riserve d'oro, quindi è molto probabile che anche nei prossimi anni continuerà a trovarsi tra i primi posti di questa classifica.

3. Grasberg (Indonesia)

La miniera di Grasberg è situata nella provincia indonesiana di Papua e nel 2021 ha prodotto circa 38,8 tonnellate d'oro. È stata scoperta nel 1936 da un geologo olandese e, dopo essere stata una miniera a cielo aperto dal 1990 al 2019, è stata poi convertita in miniera sotterranea. Pensate che tutt'oggi è una tra le miniere di oro e rame più importanti del mondo.

4. Olimpiada (Russia)

La miniera di Olimpiada ha prodotto nel 2021 circa 33,5 tonnellate d'oro e si trova in una delle province aurifere più prolifiche di tutta la nazione. Qui la produzione è iniziata nel 1996 e oggi copre circa la metà di tutto l'oro prodotto dalla Polyus, la principale compagnia russa ad operare nel settore.

5. Pueblo Viejo (Repubblica Dominicana)

La miniera Pueblo Viejo in Repubblica Dominicana ha prodotto 23,8 tonnellate nell'ultimo anno e si trova a circa 100 km di distanza dalla capitale del Paese Santo Domingo. La miniera è gestita dalla Pueblo Viejo Dominicana Corporation, una joint venture tra i due grandi player del settore Barrick (60%) e Newmont (40%).

6. Kibali (Repubblica Democratica del Congo)

La miniera di Kibali, nella Repubblica Democratica del Congo, si trova a circa 210 km dal confine con l'Uganda e nel 2021 ha fatto registrare una produzione aurifera pari a circa 23 tonnellate. La miniera è entrata in attività nel 2013 e attualmente le operazioni vengono svolte sia a cielo aperto che in sotterraneo.

7. Cadia (Australia)

La miniera di Cadia si trova in Australia e nel 2021 la sua produzione si è aggirata attorno alle 22 tonnellate. Si tratta di una delle miniere più grandi di tutta l'Australia e viene sfruttata principalmente per la produzione di oro e rame.

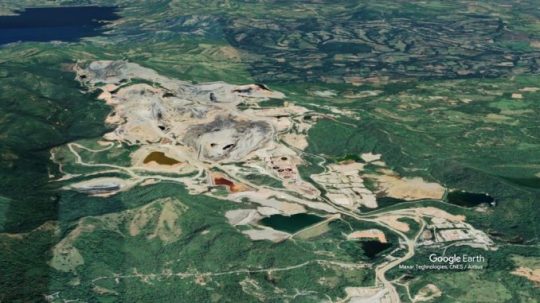

8. Lihir (Papua Nuova Guinea) - 20,90 t

La miniera di Lihir, in Papua Nuova Guinea, ha estratto nell'ultimo anno poco meno di 21 tonnellate d'oro ed è situata all'intero del cratere di un vulcano ormai estinto.

9. Canadian Malartic (Canada) - 20,27 t

La Canadian Malartic è la miniera più grande di tutto il Canada e nell'ultimo anno ha estratto poco più di 20 tonnellate d'oro. Si tratta di una miniera prevalentemente a cielo aperto, anche se è stato intrapreso il progetto Odissey che punta alla trasformazione della Canadian Malartic in una miniera sotterranea entro il 2028: la vita prevista della struttura verrà così estesa fino ad almeno il 2039.

10. Boddington (Australia) - 19,73 t

La miniera di Boddington, in Australia, ha prodotto nel 2021 poco più di 19 tonnellate d'oro e si tratta di uno dei principali poli estrattivi d'Australia sia per quanto riguarda l'oro che per il rame.

Read the full article

#benirifugio#Boddington#Cadia#CanadianMalartic#Grasberg#Kibali#Lihir#lingotti#miniera#miniere#Muruntau#NevadaGoldMines#Olimpiada#oro#PuebloViejo

0 notes

Text

Landowner company Anitua's new expansion strategy

Landowner company Anitua’s new expansion strategy

Diversified landowner company Anitua is on the comeback trail, according to Chief Executive Patrick Doekes. He tells Business Advantage PNG the Papua New Guinean landowner company is looking to streamline operations and expand its product offerings.

Credit: Anitua

Landowner company Anitua’s very growth has presented a managerial challenge to Patrick Doekes, who joined the business in July 2019 as…

View On WordPress

0 notes

Photo

A speedpaint of my Kelpie Snapper at FR, Lihir. I’m really getting into this ‘black’ velvet’ vibe I’ve been having lately.

#flight rising#fr#frfanart#fr art#fr art dragon#dragon#snapper dragon#snappers#snapper#snapper dragons#snipsnaps#my what big teeth you have#my art#art#horror#body horror

5 notes

·

View notes

Text

Conoce estos 5 Volcanes de Papua Nueva Guinea

Conoce estos 5 Volcanes de Papua Nueva Guinea

Existen un gran número de volcanes en Papua Nueva Guinea. Para aquellos a los que les guste este tipo de turismo; el turismo geológico, tenemos esta lista de 5 volcanes en Papua Nueva Guinea que por sus características, su ubicación o sus recursos pueden resultar de interés.

Los volcanes de Papua Nueva Guinea

Listado de los 5 volcanes de Papua Nueva Guinea que hemos seleccionado.

Monte Lamington

View On WordPress

0 notes

Text

Aofy Gold|The largest gold mines in the world

Which country holds the distinction for the largest gold producing mine? Who owns these mines? And how much gold does each contain? Let’s take a look!

Muruntau Gold Deposit, Uzbekistan, Asia

In 2016, this gold mine produced more than 60 tonnes of gold, making it the largest one in the world. Operated by the Uzbek government and co-owned by Navoi Mining, the mine is reported to have more than 5000 tonnes of gold reserves yet to be mined- that’s the weight of 25 blue whales!

Muruntau Gold Mine, Uzbekistan

Pueblo Viejo, Dominican Republic, South America

The Pueblo Viejo mine not only holds gold reserves but silver as well. Currently, it is jointly owned by Canadian companies, Barrick Gold Corporation and Goldcorp Inc. The mine’s latest reported gold output was 36 tonnes.

Pueblo Viejo Gold Mine, South America

Goldstrike, USA, North America

Located in the state of Nevada, this mine is also owned by Canada’s Barrick Gold Corp and produced an output of 34 tonnes of gold in 2016.

Goldstrike Gold Mine, USA

Grasberg, Indonesia, Asia

The largest gold mine in the world by area, Grasberg holds gold, copper, and silver reserves as well. This mine employs almost 20,000 people and is jointly owned by the American company Freeport McMoRan and the Indonesian government. 33 tonnes of gold was mined here as per latest available data.

Grasberg Gold Mine, Indonesia

Cortez, USA, North America

Another Barrick Gold Corp owned mine from Nevada, Cortez gold mine is the largest gold producer for both the company and the state. Last year, almost 33 tonnes of gold was produced here.

Cortez Gold Mine, USA

Carlin Trend, USA, North America

This mine has multiple locations across Nevada and was first explored in 1983 by America’s Newmont Mining Corporation. The latest reported gold output from the mine stands at a little less than 30 tonnes

Carlin Trend Gold Mine, USA

Olimpiada, Russia, Asia/Europe

One of the largest gold mines in the country, this mine started production in 1996, and produced 29.3 tonnes of gold in 2016

Olimpiada Gold Mine, Russia

Lihir, Papua New Guinea

Located in Oceania, a region centred on the islands of the central Pacific Ocean, the Lihir mine belonged to the company Lihir Gold Limited which had operations in neighbouring Australia and West Africa as well. Now owned by Australia’s Newcrest Mining, the mine produced a total of 28 tonnes of gold in 2016.

Lihir Gold Mine, Papua New Guinea

Batu Hijau, Indonesia, Asia

Mined by the domestic company Amman Minerals, the Batu Hijau mine in Indonesia produced 26.7 tonnes of gold last year.

Bata Hijau Gold Mine, Indonesia

Boddington, Australia

The mine was first mined in 1987 but shut down in 2001. However, mining here was reopened in 2010 and this is now Australia’s largest gold mine. Owned by America’s Newmont, almost 25 tonnes of gold was produced here in 2016.

0 notes

Photo

It's only 8:30ish in the morning and you're already sweating. #NoFilters (at Lihir Town) https://www.instagram.com/p/CFYBNmTBjNNaGCISUKZDBbNC7EbIMu9BkrtcYA0/?igshid=g8xbtylvtzt3

0 notes

Text

How Jetson turned around Lihir

Click here for articles

June 07, 2019 at 11:03PM

0 notes

Text

Sticking points in Mining Act yet to be resolved, says Mining Minister Byron Chan

Sticking points in Mining Act yet to be resolved, says Mining Minister Byron Chan #PNG

The Minister for Mining, Byron Chan, says that the long-awaited amendments to Papua New Guinea’s Mining Act are ‘complete’. But, he tells Business Advantage PNG, there are still some contentious issues.

Byron Chan, Minister for Mining Source: Business Advantage International

Byron Chan says there has already been considerable work on the revisions to the 1992 Mining Act. ‘Everything is complete,…

View On WordPress

0 notes

Text

GFG Moves Forward on Two Fronts

Source: Bob Moriarty for Streetwise Reports 04/18/2019

Bob Moriarty of 321 Gold explains why he sees this explorer as undervalued and details the ways it is advancing its properties.

In my latest book I try to make the point that at resource stock market lows, you can’t give shares away. That is all by itself a great indicator of where we stand in the cycle. We are now easing into the weakest seasonal period of the year for gold and silver and many companies are selling near their yearly lows.

Gold and silver seem to have bottomed in late summer of 2018. Platinum tumbled to a new multi-year low in February of 2019. Shares generally are higher, some much higher but I think a correction would shake out the remainder of the bulls so I think we will be weak into mid-summer before gold and silver start to react to the Great Reset in progress.

When I go through the stocks I own and follow I am astonished at how cheap they seem. It’s not the same as 2001 and 2009 when a hundred companies were selling for less than the cash they have on hand but there appears to me to be a giant disconnect between price and value. Harvest season is approaching and there is a lot of low hanging fruit. It’s hard for me to believe prices to be so cheap for so long. It won’t last.

I’ve written before about an interesting project in Wyoming named the Rattlesnake project. It’s a large alkaline system similar in nature to Cripple Creek (28 million ounces) and Lihir (40 million ounces). Quinton Hennigh brought the project into Evolving Gold where they began to explore and drill the project. Evolving Gold later did a deal with Agnico Eagle that valued the project at about $110 million. During the decline from 2011 until 2015 when gold dropped, Agnico Eagle requested an extension of time and was refused by Evolving. Evolving couldn’t gain traction with either the project or the market and eventually GFG Resources Inc. (GFG:TSX.V; GFGSF:OTCQB) picked up the project as cheap as chips.

There is something I call the curse of large projects. When you have properties with giant potential such as porphyries or alkaline systems, they require tens of millions of dollars to prove up that resource. It’s hard for juniors, and many a poor boy has met his end trying to advance a billion ton project and blown the company sky high trying to raise the money.

GFG management was brilliant. They realized they needed two important parts. One, they needed a Plan B project that matched both the state of the market in general and their ability to raise money to advance it. They found several projects in Ontario in late 2017 and put them together to have an alternative news flow to Rattlesnake. And two, they searched to find a suitable partner for Rattlesnake with deep pockets who could do a proper job of advancing an alkaline gold project. They found such a partner in Newcrest. It’s just my opinion but I happen to think Newcrest is one of the top mining companies in the world.

The deal is a little convoluted but basically Newcrest can increase their part of the Rattlesnake pie by making staged exploration investments of up to just short of $100 million to earn 75%. Clearly Newcrest sees the potential for millions of ounces of gold and is prepared to belly up to the bar to get their hands on it. It doesn’t hurt that former Evolving Gold president Quinton Hennigh used to work for Newcrest and they trust his judgment.

Investors tend to think of their shares as being lottery tickets. Commonly they want new lottery numbers to be announced every week. But junior resource companies have to think in terms of years of work to show real progress. GFG came up with a plan to advance the company via their investments in both Rattlesnake and Ontario and the pieces are starting to fall into place.

In Ontario at the Pen project, GFG drilled over 4,700 meters in nineteen holes in 2018. All of those results have been released and included a number of high-grade intercepts proving their geological model. The 2019 drill program is budgeted for $2.5 million and consists of two 4,000-meter programs. The Phase one two drill program started turning in February and will complete in April. There will be a constant news flow of results through the end of the year with Phase two starting in H2.

At Rattlesnake Newcrest is funding somewhere between $3 and $3.5 million for exploration with two drills starting in July. I would expect drilling to continue until winter arrives in October so the 2nd half of 2019 will have a lot of numbers for the lottery ticket holders.

GFG has one of the best management teams of all the companies I deal with. They are cashed up and I think there time is coming. With a market cap of under $20 million and a partner who has implied a value of over $33 million for GFG’s eventual 25% share of Rattlesnake, sooner or later a few resource investors will wake up.

GFG is an advertiser. I own shares bought in the open market and in the last PP. I am biased. Do your own due diligence.

GFG Resources

GFG-V $0.23 (Apr 17, 2019)

GFGSF OTCBB 92.8 million shares

GFG Resources website.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: GFG Resources. My company has a financial relationship with the following companies mentioned in this article: GFG Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of GFG Resources, a company mentioned in this article.

( Companies Mentioned: GFG:TSX.V; GFGSF:OTCQB,

)

from The Gold Report – Streetwise Exclusive Articles Full Text http://bit.ly/2vlwtal

from WordPress http://bit.ly/2Xv8CRr

0 notes

Text

GFG Moves Forward on Two Fronts

Source: Bob Moriarty for Streetwise Reports 04/18/2019

Bob Moriarty of 321 Gold explains why he sees this explorer as undervalued and details the ways it is advancing its properties.

In my latest book I try to make the point that at resource stock market lows, you can't give shares away. That is all by itself a great indicator of where we stand in the cycle. We are now easing into the weakest seasonal period of the year for gold and silver and many companies are selling near their yearly lows.

Gold and silver seem to have bottomed in late summer of 2018. Platinum tumbled to a new multi-year low in February of 2019. Shares generally are higher, some much higher but I think a correction would shake out the remainder of the bulls so I think we will be weak into mid-summer before gold and silver start to react to the Great Reset in progress.

When I go through the stocks I own and follow I am astonished at how cheap they seem. It's not the same as 2001 and 2009 when a hundred companies were selling for less than the cash they have on hand but there appears to me to be a giant disconnect between price and value. Harvest season is approaching and there is a lot of low hanging fruit. It's hard for me to believe prices to be so cheap for so long. It won't last.

I've written before about an interesting project in Wyoming named the Rattlesnake project. It's a large alkaline system similar in nature to Cripple Creek (28 million ounces) and Lihir (40 million ounces). Quinton Hennigh brought the project into Evolving Gold where they began to explore and drill the project. Evolving Gold later did a deal with Agnico Eagle that valued the project at about $110 million. During the decline from 2011 until 2015 when gold dropped, Agnico Eagle requested an extension of time and was refused by Evolving. Evolving couldn't gain traction with either the project or the market and eventually GFG Resources Inc. (GFG:TSX.V; GFGSF:OTCQB) picked up the project as cheap as chips.

There is something I call the curse of large projects. When you have properties with giant potential such as porphyries or alkaline systems, they require tens of millions of dollars to prove up that resource. It's hard for juniors, and many a poor boy has met his end trying to advance a billion ton project and blown the company sky high trying to raise the money.

GFG management was brilliant. They realized they needed two important parts. One, they needed a Plan B project that matched both the state of the market in general and their ability to raise money to advance it. They found several projects in Ontario in late 2017 and put them together to have an alternative news flow to Rattlesnake. And two, they searched to find a suitable partner for Rattlesnake with deep pockets who could do a proper job of advancing an alkaline gold project. They found such a partner in Newcrest. It's just my opinion but I happen to think Newcrest is one of the top mining companies in the world.

The deal is a little convoluted but basically Newcrest can increase their part of the Rattlesnake pie by making staged exploration investments of up to just short of $100 million to earn 75%. Clearly Newcrest sees the potential for millions of ounces of gold and is prepared to belly up to the bar to get their hands on it. It doesn't hurt that former Evolving Gold president Quinton Hennigh used to work for Newcrest and they trust his judgment.

Investors tend to think of their shares as being lottery tickets. Commonly they want new lottery numbers to be announced every week. But junior resource companies have to think in terms of years of work to show real progress. GFG came up with a plan to advance the company via their investments in both Rattlesnake and Ontario and the pieces are starting to fall into place.

In Ontario at the Pen project, GFG drilled over 4,700 meters in nineteen holes in 2018. All of those results have been released and included a number of high-grade intercepts proving their geological model. The 2019 drill program is budgeted for $2.5 million and consists of two 4,000-meter programs. The Phase one two drill program started turning in February and will complete in April. There will be a constant news flow of results through the end of the year with Phase two starting in H2.

At Rattlesnake Newcrest is funding somewhere between $3 and $3.5 million for exploration with two drills starting in July. I would expect drilling to continue until winter arrives in October so the 2nd half of 2019 will have a lot of numbers for the lottery ticket holders.

GFG has one of the best management teams of all the companies I deal with. They are cashed up and I think there time is coming. With a market cap of under $20 million and a partner who has implied a value of over $33 million for GFG's eventual 25% share of Rattlesnake, sooner or later a few resource investors will wake up.

GFG is an advertiser. I own shares bought in the open market and in the last PP. I am biased. Do your own due diligence.

GFG Resources

GFG-V $0.23 (Apr 17, 2019)

GFGSF OTCBB 92.8 million shares

GFG Resources website.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: GFG Resources. My company has a financial relationship with the following companies mentioned in this article: GFG Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of GFG Resources, a company mentioned in this article.

( Companies Mentioned: GFG:TSX.V; GFGSF:OTCQB, )

from https://www.streetwisereports.com/article/2019/04/18/gfg-moves-forward-on-two-fronts.html

0 notes

Text

Gonna Take Me From My Man Bab 2

Aku sampai di kontrakanku pada pukul sebelas malam. Entah berapa lama aku berdiri menatap gedung baru sore itu. Kekosongan melahap waktu begitu cepat. Keluar dari kampus, aku tak langsung pulang. Aku mengendarai mobilku tanpa peduli arah jalanan Solo yang belum kutahu. Musik mendentum keras dari audio mobil. Aku hanya ingin membuat perasaanku hampa sehingga aku tak merasakan apa-apa lagi untuk sementara.

Hingga jam munjukkan pukul sepuluh lima belas, aku memutuskan untuk pulang. Untung saja baterai HP ku belum mati, sehingga aku dapat mencari jalan pulang menggunakan Google Maps.

Pintu depan kututup di belakangku dan aku jatuh terduduk tanpa tenaga. Seluruh keinginanku untuk bertahan seolah tersedot ke dalam lubang hitam tak kasat mata yang berputar di sekelilingku sepanjang waktu. Aku mengecek HP ku sekali lagi. Sebuah pengingat yang sudah muncul pada pukul delapan kuabaikan dari tadi. Apa gunanya minum obat jika itu hanya membuatku merasa linglung dan kosong? Sama saja, bukan. Maka, aku membiarkan kantuk mengambil alih kendali dari perasaan sedih dan napasku perlahan menjadi teratur. Aku tertidur di lantai di depan pitu depan tanpa peduli mengunci pintunya.

*

Cahaya matahari yang menyilaukan membangunkanku, dan aku tersentak duduk melihat jam di HP. Sial, HP nya mati. Aku melihat jam dinding dengan memasuki kamarku dan sekarang sudah pukul delapan kurang sepuluh menit! Padahal MOS dimulai pukul 6.30. Celaka!

Aku cepat-cepat mandi dan bersiap-siap, hanya membutuhkan lima belas menit. HP dalam kondisi mati, aku tidak mengecasnya semalam. Untung saja jalanan Solo tidak macet seperi jalanan di Jakarta. Aku sampai kampus pada pukul delapan empat puluh. Dan senior itu menghalangku ketika aku hendak masuk kerumunan. Sial, padahal tadi aku yakin sekali bisa lolos!

“Kenapa telat?” ujarnya dingin.

“Maaf kak, saya kesiangan,” ujarku pelan.

“Sudah mahasiswa, masih tidak bisa mengatur waktu. Kamu kira ini SMA?”

Aku tidak tahu harus menjawab apa. Jadi kujawab saja dengan meminta maaf lagi.

Senior itu tampaknya sedang kewalahan mengurusi maba-maba yang terlambat, sehingga tampaknya ia juga tidak ingin berlama-lama.

“Kamu sudah dapat tugas mencari buku dari pembimbing kemarin?”

“Sudah kak, saya disuruh cari bukunya Ayu Utami.”

“Sudah cari?”

“Belum, mengumpulkannya kan masih besok.”

“Ya sudah, sebagai hukuman kamu cari tiga buku lagi! Terserah buku apa saja.” Usai mengatakan itu, senior itu tampak sudah hendak pergi, namun mengurungkannya dan berbalik menghadapku.

“Hmm, cari bukunya Ika Natassa saja,” ujarnya lihir dekat telingaku. “Dan jangan kumpulkan ke panitia, kumpulkan saja di aku.”

Wow.

“Baik kak, Ika Natassa bagus kok.”

Dia mengangguk tak peduli lalu berlalu menghampiri maba telat yang lain. Aku menahan senyumku lalu masuk ke kerumunan.

Entah mengapa, hari ini tidak terasa seburuk semalam. Aku tidak merasa depresi. Semoga saja ini bertahan lama.

Menatap sekelilingku, mencari Gani. Tak kusangka aku dapat menyukainya begitu cepat. Biasanya, aku tertawa mendengar ungkapan cinta pada pandangan pertama. Namun ini…. Ah! Betapa memalukan aku terdengar sekarang. Tanpa sadar aku menangkupkan kedua tangan di mukaku dan segera melepaskannya.

“Kamu kenapa eh?”

Seorang perempuan berparas cantik di sampingku mengerutkan kening sambil menatapku.

“Ga kenapa-kenapa, hehehe.”

“Aku Riana,” ujarnya langsung memperkenalkan diri sambil mengulurkan tangannya. Aku menyambut salaman tangannya dengan canggung.

“Steven.”

“Kamu dari kelas C ya?” Ia mendekatkan dirinya ke arahku.

“Kok tahu?”

“Hahaha, iya dong, aku udah riset semua anak di calon kelasku, dan kamu salah satu yang paling menarik.”

“Menarik gimana?”

Namun sebelum Riana sempat menjawab pertanyaan tersebut, seorang maba menarik perhatian di atas panggung. Maba itu ternyata Gani! Ia maju menjawab pertanyaan dari kakak tingkat.

“Aduh, ganteng sekali…” ujar Riana sambil menahan dagunya dengan tangan kanannya.

Iya, Riana. Memang.

*

5 notes

·

View notes

Photo

Tatanua (Mask)

New Ireland, Lihir (uncertain)

Wood, Bast Fiber, Shell

Penn Museum

9 notes

·

View notes