#Major Currencies' Meltdown

Text

I was going to do a double post but I figured I’d condense this because the posts would’ve related anyways:

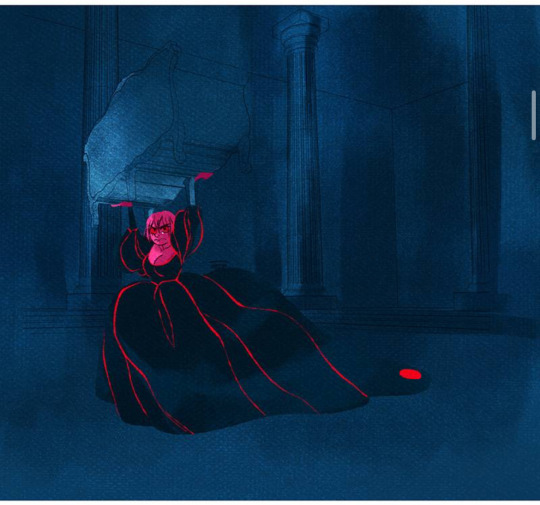

For the newest chapter 267, literally wtf was Persephone’s “meltdown”?

I don’t know what Rachel was thinking, but there was zero dramatic impact in Persephone picking up a single couch and throwing it, especially since for the large majority of the chapter, we see her in such a disheveled state.

I was hoping for a really cool moment like back before the trial arch when she sprouts those vines from her back. Imagine if that had happened and she reopened her old scars, that would’ve been sick. Plus, it would’ve been a cool parallel to the scars that Demeter has.

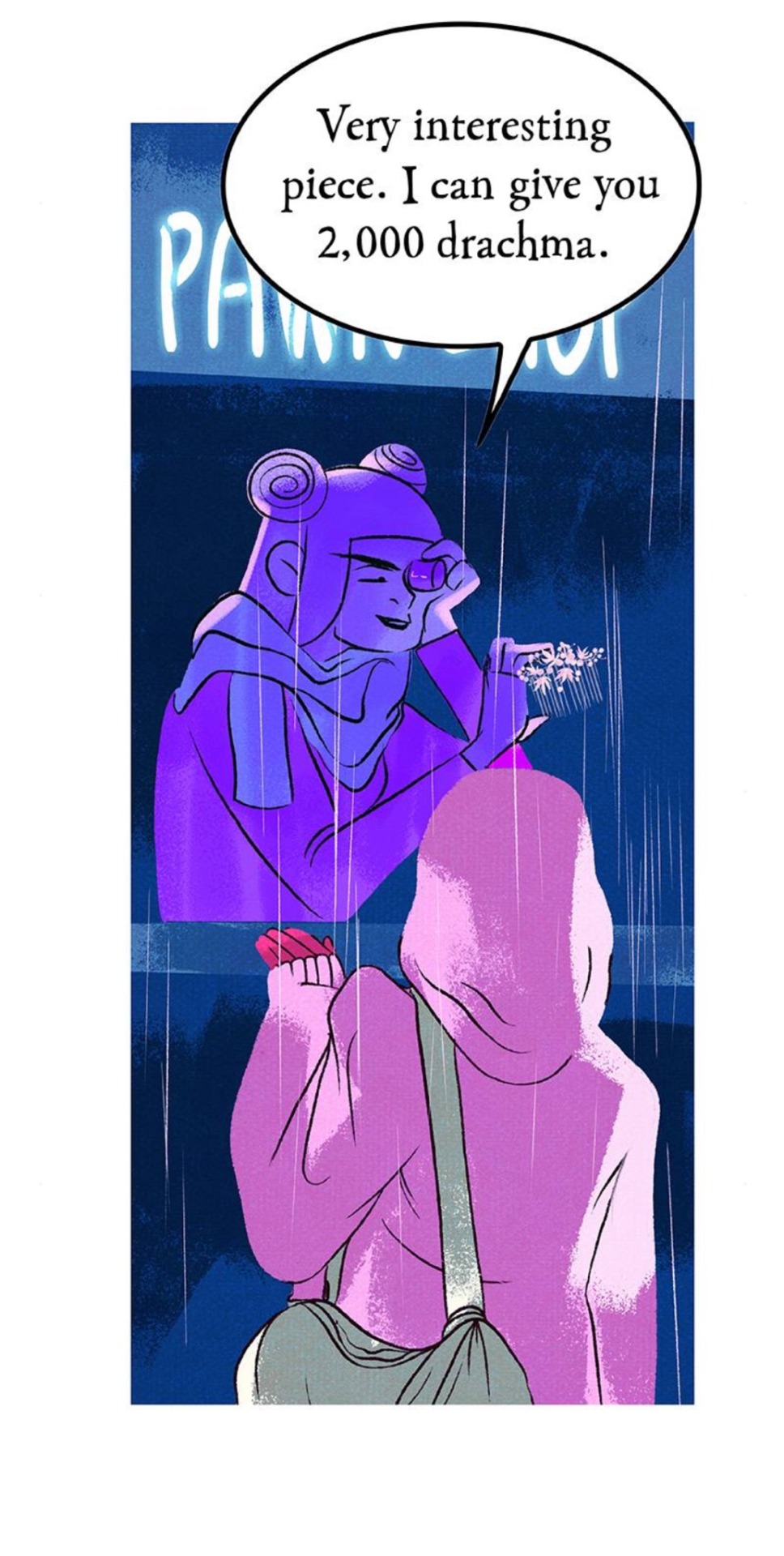

BUT while going back and looking for this panel, I reread the scene where Persephone sells the comb Hades gave her and discovered this:

Maybe I’m being nitpicky, but why tf does Persephone have cash? Yes, yes, the realms are more modern, yada, yada, but drachma in Ancient Greece were coins like the Athenian drachma pictured below:

Greece didn’t start printing paper drachma until the 1900s, and even then, the colors of the paper were mainly earthy colors like red, light brown, and yellow. The 500 drachma was green, but not the aggressive green that is associated with American currency and not the green depicted in the above panel.

Maybe I’m reading too much into it, but this is yet again just another example of the disrespect Rachel has for Greek culture. Not only that, but how Rachel has either Americanized or Eurocentricized a story that should’ve remained Greek centric. Like, she couldn’t even depict the currency used by Greece (before it got replaced by the euro in 2002)? As people here have heard me say before: the devil is in the details. I know that the end of the day, it probably doesn’t matter to Rachel or a large majority of her audience. But it does. But all these little missed details, all these slights, have stacked on top of each other and amalgamated into what we have today.

Anyways.

#anti lore olympus#lo critical#anti lo persephone#unpopular lo#lore olympus#unpopular lore olympus#anti lo#lore olympus critical#lo critique#lore olympus criticism#lore olympus hate#lo hate#Greeks if you want to chime in feel free#anti lo hades#also why does Persephone shrink in the 2 panels#like she shrinks when she throws the couch

97 notes

·

View notes

Text

Gold as an Investment

Before jumping on the gold bandwagon, let us first put a damper on the enthusiasm around gold and examine some reasons why investing in gold poses some fundamental issues.

The main problem with gold is that, unlike other commodities such as oil or wheat, it does not get used up or consumed. Once gold is mined, it stays in the world. A barrel of oil, on the other hand, is turned into gas and other products that are expended in your car's gas tank or an airplane's jet engines. Grains are consumed in the food we and our animals eat. Gold, on the other hand, is turned into jewelry, used in art, stored in ingots locked away in vaults, and put to a variety of other uses. Regardless of gold's final destination, its chemical composition is such that the precious metal cannot be used up—it is permanent.

Because of this, the supply-demand argument that can be made for commodities such as oil and grains doesn't hold so well for gold. In other words, the supply will only go up over time, even if demand for the metal dries up.

History Overcomes the Supply Problem

Like no other commodity, gold has held the fascination of human societies since the beginning of recorded time. Empires and kingdoms were built and destroyed over gold and mercantilism. As societies developed, gold was universally accepted as a satisfactory form of payment. In short, history has given gold a power surpassing that of any other commodity on the planet, and that power has never really disappeared.

The U.S. monetary system was based on a gold standard until the 1970s.

1

Proponents of this standard argue that such a monetary system effectively controls the expansion of credit and enforces discipline on lending standards because the amount of credit created is linked to a physical supply of gold. It's hard to argue with that line of thinking after nearly three decades of a credit explosion in the U.S. led to the financial meltdown in the fall of 2008.

From a fundamental perspective, gold is generally viewed as a favorable hedge against inflation. Gold functions as a good store of value against a declining currency.

2

Investing in Gold

The easiest way to gain exposure to gold is through the stock market, via which you can invest in the shares of gold-mining companies. Investing in gold bullion won't offer the leverage you would get from investing in gold-mining stocks. As the price of gold goes up, miners' higher profit margins can boost earnings exponentially. Suppose a mining company has a profit margin of $200 when the price of gold is $1,000. If the price rises 10%, to $1,100 an ounce, the operating margin of the gold miner goes up to $300—a 50% increase.

Of course, there are other issues to consider with gold-mining stocks, namely political risk (because many operate in developing nations) and the difficulty of maintaining gold production levels.

The most common way to invest in physical gold is through an exchange-traded fund (ETF) like the SPDR Gold Shares (GLD), which simply holds gold.

When investing in ETFs, pay attention to net asset value (NAV), as the purchase price can at times exceed NAV by a wide margin, especially when the markets are optimistic.

A list of gold-mining companies includes Barrick Gold Corp. (ABX.TO), Newmont Corp. (NEM), and Agnico Eagle Mines Ltd. (AEM), among others. Passive investors who want great exposure to the gold miners may consider the VanEck Vectors Gold Miners ETF (GDX), which includes investments in all the major miners.

Alternative Investment Considerations

While gold is a good bet on inflation, it's certainly not the only one. Commodities in general benefit from inflation because they have pricing power. The key consideration when investing in commodity-based businesses is to go for low-cost producers. More conservative investors would also do well to consider inflation-protected securities like Treasury Inflation-Protected Securities, or TIPS. The one thing you don't want is to be sitting idle—in cash, thinking you're doing well—while inflation is eroding the value of your dollar.

Gold Price Performance

The price of gold depends on a complex array of factors. Because gold is priced in dollars, the value of the U.S. currency can have a significant impact on the performance of the precious metal. A strong dollar makes gold more expensive for buyers in other countries, potentially leading to lower gold prices. On the other hand, a weaker dollar makes gold more affordable for international purchasers and may bring increased prices. Since gold is seen as a hedge against inflation, the decline in value of fiat currencies and the market's expectations surrounding inflation can also affect gold prices.

3

These factors seem to be evident in the yellow metal's recent price history. Throughout most of 2022, despite soaring levels of inflation, gold prices actually dipped, likely driven lower by sustained strength in the dollar against other currencies. More recently, with inflation remaining stubbornly persistent despite the Federal Reserve's attempts to bring it under control, gold prices have recovered to more than $1,875 per ounce in January 2023, from around $1,656 per ounce in September 2022.

3

What's to Come

You can't ignore the effect of human psychology when it comes to investing in gold. The precious metal has always been a go-to investment during times of fear and uncertainty, which tend to go hand in hand with economic recessions and depressions.

In the articles that follow, we examine how and why gold gets its fundamental value, how it's used as a form of money, and which factors subsequently influence its price on the market—from miners to speculators to central banks. We will look at the fundamentals of trading gold and what types of securities or instruments are commonly used to gain exposure to gold investments. We'll look at using gold both as a long-term component of a diversified portfolio and as a short-term day trading asset. We'll look at the benefits of gold but also examine the risks and pitfalls and see if it lives up to the "gold standard."

What Makes Gold Valuable?

Aside from its literal shine and the symbolic relationship with wealth that has lasted throughout human civilization, gold plays an important role as a store of value and a medium of exchange. Unlike other commodities, gold does not get used up or consumed, imbuing the precious metal with a sense of everlasting value. Gold serves as a hedge against the declining value of currencies through inflation, which leads many investors to consider gold an alternative asset and a way of safeguarding their wealth.

What Is the Gold Standard?

Under the gold standard, the value of a currency is pegged to the value of gold. The Bretton Woods Agreement, which formed the framework for global currency markets starting at the end of World War II, established that the U.S. dollar was convertible to gold at a fixed rate of $35 per ounce, with other world currencies valued in relation to the dollar.

4

President Nixon ended the convertibility of the dollar to gold in 1971, signaling the end of the gold standard.

How Can I Invest in Gold?

There is a wide variety of options for investors who want exposure to gold. It's possible to invest directly in gold bullion, although the costs of storing and insuring physical gold can be significant. Investors also can turn to exchange-traded funds (ETFs) that hold the precious metal or purchase shares of mining companies whose stock prices are correlated to gold's price performance.

The Bottom Line

Gold has held a special place in the human imagination since the beginning of recorded time. From an investment perspective, gold is attractive because of its potential to remain strong in difficult financial environments and to hedge against inflationary declines in the value of fiat currencies.

Although the U.S. dollar and other world currencies are no longer pegged to gold—as was the case when many countries operated under the gold standard—the precious metal continues to play an important role in the global economy.

ARTICLE SOURCES

PART OF

Investing in Gold

Investing in Gold1 of 30

Why Gold Matters: Everything You Need to Know2 of 30

Why Has Gold Always Been Valuable?3 of 30

What Drives the Price of Gold?4 of 30

What Moves Gold Prices?5 of 30

Gold Standard: Definition, How It Works, and Example6 of 30

Gold: The Other Currency7 of 30

How to Invest in Gold: An Investor’s Guide8 of 30

Gold Bug9 of 30

8 Good Reasons to Own Gold10 of 30

4 Ways to Buy Gold11 of 30

Does It Still Pay to Invest in Gold?12 of 30

The Best Ways To Invest In Gold Without Holding It13 of 30

How to Buy Gold Bars14 of 30

The Best Strategy for Gold Investors15 of 30

The Most Affordable Way to Buy Gold: Physical Gold or ETFs?16 of 30

The Better Inflation Hedge: Gold or Treasuries?17 of 30

Has Gold Been a Good Investment Over the Long Term?18 of 30

Trading the Gold-Silver Ratio19 of 30

How to Trade Gold in 4 Steps20 of 30

Gold Option21 of 30

How To Buy Gold Options22 of 30

Using Technical Analysis in Gold Miner ETFs23 of 30

Day-Trading Gold ETFs: Top Tips24 of 30

Gold ETFs vs. Gold Futures: What's the Difference?25 of 30

Should You Get a Gold IRA?26 of 30

How to Buy Gold With Your 401(k)27 of 30

Gold IRA Definition28 of 30

When and Why Do Gold Prices Plummet?29 of 30

The Effect of Fed Funds Rate Hikes on Gold30 of 30

Related Articles

Business man trader investor analyst using mobile phone app and laptop

INVESTING

How to Invest in Commodities

Pile of Gold Bars

GOLD

Does It Still Pay to Invest in Gold?

Gold Bars

STOCKS & BOND NEWS

Top Gold Stocks for Q2 2023

GOLD

The Better Inflation Hedge: Gold or Treasuries?

GOLD

The Best Ways To Invest In Gold Without Holding It

Gold bars are placed on United States banknote

INVESTING

How to Invest in Gold and Silver

Related Terms

Gold IRA Definition

A gold IRA is a retirement investment vehicle used by individuals who hold gold bullion, coins, or other approved precious metals. more

Troy Ounce: Definition, History, and Conversion Table

A troy ounce is a unit of measurement for precious metal weight that dates to the Middle Ages. One troy ounce is equal to 31.10 grams. more

Gold Bug

A “gold bug” is somebody who is especially bullish on gold. more

Dollar Bear

A dollar bear is an investor who is pessimistic, or "bearish," about the prospects of the U.S. dollar (USD). They are the opposite of a dollar bull. more

Gold Standard: Definition, How It Works, and Example

The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. more

Precious Metals: Definition, How to Invest, and Example

Precious metals are rare metals that have a high economic value, such as gold, silver, and platinum.

Invest with us today with Royallis Gold.

2 notes

·

View notes

Text

Stock markets plunge on US recession fears

New Post has been published on https://sa7ab.info/2024/08/06/stock-markets-plunge-on-us-recession-fears/

Stock markets plunge on US recession fears

Wall Street stocks deepened their losses Monday, and Tokyo had its worst day in 13 years as panic spread across trading floors over fears of recession in the United States.

Wall Street’s tech-heavy Nasdaq Composite index tumbled 6.3 percent at the open, with the S&P 500 falling 4.2 percent and the Dow dropping 2.7 percent.

Major European indices were down around three percent in afternoon trading.

Tokyo’s Nikkei sank more than 12 percent on its worst day since the 2011 Fukushima crisis. It also suffered its biggest-ever points loss, shedding 4,451.28.

A weak US jobs report on Friday triggered the market meltdown. The report showed that the unemployment rate reached its highest since October 2021.

The report came two days after the US Federal Reserve decided, as expected, to keep interest rates at a 23-year high while signalling that it could cut them in September.

“Investors are gripped by fears that the Federal Reserve has waited too long to pivot on its policy, especially in light of Friday’s disappointing US jobs data and a slew of other weak economic indicators pointing toward a looming recession,” said market analyst Fawad Razaqzada at City Index and FOREX.com.

Friday’s much-anticipated report showed the US economy added just 114,000 jobs last month, well down from June and far fewer than expected, and unemployment at 4.3 percent.

The news came a day after lacklustre factory data.

Investors fear the Fed’s high rates, which aimed to slash inflation, could be plunging the economy towards a hard landing and recession instead of the soft landing sought by the central bank.

Expectations that the Fed could cut more aggressively than expected starting in September or even be forced into an emergency reduction this month sent the dollar sliding against the yen.

The Japanese currency was boosted also by a Bank of Japan interest-rate hike last week, analysts said.

The dollar went under 142 yen for the first time since January.

Bitcoin, oil retreat

Markets tumbled on Monday, with Brent North Sea crude reaching its lowest level in over six months despite heightened Middle East tensions. Bitcoin slumped more than 10 percent to under $50,000.

“Aside from ongoing worries about a US recession, the continuation of the pressure on markets has been attributed to the unwinding of the yen carry trade and geopolitical fears surrounding an expected Iranian military retaliation against Israel after Israel killed a high-ranking Iranian military official,” said Briefing.com analyst Patrick O’Hare.

Many investors have borrowed at low interest rates in a weak yen to invest in higher-yielding currencies, but the abrupt surge in the yen and interest rate moves are upending the trade.

Some analysts pointed to the “Sahm rule”, which says an economy is in the early stages of recession if the three-month moving average of unemployment is 0.5 percentage points above its low over the previous 12 months. That was triggered by Friday’s data.

O’Hare also noted big falls in tech and semiconductor shares.

That helped fuel sharp drops in Asia markets, and US tech shares also pulled down Wall Street indices.

Shares in AI chip manufacturer Nvidia plunged 14.6 percent at the start of trading on Monday.

Shares in Facebook and Instagram parent company Meta, slumped 7.2 percent.

Microsoft and Google’s parent company, Alphabet’s shares, were down around five percent.

Commodities under pressure

Commodities, including oil, natural gas, metals and agricultural products, also joined the global sell-off in equities.

Commodities had already taken a hit in recent weeks, weighed down by a sluggish economy in top buyer China, with crude oil down around 5% last week, copper hitting a four-month low on the London Metal Exchange, and corn near its weakest since 2020.

Crude oil dropped around 1 percent on Monday in volatile trade, less than losses on major equity indexes as US recession fears and possible implications for oil demand were somewhat mitigated by price support from rising tensions in the Middle East.

Copper prices tumbled over 3 percent to 4-1/2 month lows as a deteriorating demand outlook in China and the United States, the world’s two largest economies, triggered a sell-off of the metal used in power and construction.

Gold was last down around 2 percent.

European gas, power, and carbon contracts also fell.

European benchmark gas for the month ahead sank around 4% from the previous session, under pressure from panic selling in line with the wider sell-off as well as other factors, according to one trader.

0 notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

0 notes

Text

In the heart of Silicon Valley, amidst the cacophony of start-ups and the whispers of venture capitalists, there was a man who went by the name of Alexander Sterling. His story was not of a prodigy programmer or a business magnate born into riches, but rather a tale of fortuitous timing, relentless belief in technology, and an uncanny knack for risk-taking.

Alexander grew up in a middle-class family, his childhood was neither lavish nor wanting. He had an early fascination with computers and the burgeoning internet, spending countless hours learning to code and reading about the titans of the tech industry. Yet, his true moment of epiphany didn’t come until his college years at Stanford, where he majored in economics. It was 2009, and the world was still reeling from the financial crisis. It was in this climate that Alexander first heard about Bitcoin – a decentralized digital currency that was the antithesis of everything that had led to the financial meltdown.

At first, Alexander was skeptical, as were many. But as he delved deeper into the white papers and forums, he became convinced of its potential. He started investing what little savings he had, often facing ridicule from peers and concern from his family. But Alexander saw something they didn't – a future where currency was not bound by borders or controlled by a central entity.

Years went by, and Alexander’s investment remained stagnant. He worked various jobs, from a barista to a data analyst, all the while keeping a close eye on the ebb and flow of Bitcoin. His breakthrough came in the unprecedented bull run of 2017. As the value of Bitcoin soared to heights unimaginable, Alexander’s holdings transformed from modest savings to a small fortune.

But even as others cashed out, Alexander held firm. He believed in the long-term value of Bitcoin, not just as a digital asset but as a revolution in how we perceive and use money. His conviction paid off once again when institutional investors started to embrace cryptocurrency, catapulting its value to new peaks.

With his new-found wealth, Alexander didn’t rush to buy mansions or sports cars. Instead, he channeled his resources into philanthropy, funding educational initiatives that aimed to bridge the technological divide. He also became a venture capitalist, but with a twist. He invested in start-ups that aimed to leverage blockchain technology for social good, from sustainable energy projects to platforms that promoted financial inclusivity.

Alexander Sterling, the man in the picture, stood not just as a testament to the wealth that Bitcoin could bring, but as a beacon of what one could do with such wealth. His story was a mix of timing, belief, and a touch of destiny – a modern-day Midas who turned digital coins into real-world change.

0 notes

Text

▚ (EMs) Financial Spillovers to Emerging Markets!

≣Foreword :

The purpose of this paper is to estimate the bond market linkages between emerging market (EM) and advanced market (AM) yields by estimating yield equations for EMs as a function of AM yields and illustrating the quantitative macroeconomic effects on EMs of global yield shocks in a multi-country dynamic stochastic general equilibrium modeling model.

Keywords: Cross-border flows, international financial spillovers; macroprudential policy coordination; cost benefit analysis; international financial organizations.

➲ Key Points:

⇝Financial Globalization and Emerging Economies

⇝Factors For Financial Risk Management

⇝Spillover Effects and Financial Meltdown

Financial globalization has been a very dynamic component of the continued globalization experienced by the world in recent years. Capital flows to a large number of emerging economies are expanding rapidly.

Abstract: This paper discusses the scope for international macroprudential policy coordination in a financially integrated world economy. The particular case of currency unions is discussed, as is the issue of whether coordination of macroprudential policies simultaneously requires some degree of monetary policy coordination. Much of this analysis focuses on the potential for countercyclical policy coordination between major advanced economies and a group identified as systemic middle-income countries (SMICs). Sections 5 and 6 consider practical ways to promote international macroprudential policy coordination. Following a discussion of Basel III’s principle of reciprocity and ways to improve it, the paper advocates a further strengthening of the current statistical, empirical, and analytical work conducted by the Bank for International Settlements, the Financial Stability Board, and the International Monetary Fund to evaluate and raise awareness of the gains from international coordination of macroprudential policies. The last section brings together some of the key policy lessons that can be drawn from the analysis.

Author : Ausija Kazmi

#finance#markets#currency#statistics#books & libraries#crossborder#sdgs2030#articles#business#history#literature#work#Spotify

1 note

·

View note

Text

Sen. Elizabeth Warren has a new warning for Treasury Secretary Janet Yellen: Stop saying it’s OK for banks to get bigger.

The Massachusetts Democrat in a letter Tuesday to Yellen, top bank regulators and the Justice Department called out the Treasury secretary and Acting Comptroller of the Currency Michael Hsu for recent comments that signaled an openness to further bank consolidation amid industry weakness exposed by the meltdowns of Silicon Valley Bank and other lenders.

Yellen has said that more mergers could be healthy, while Hsu, who regulates the largest U.S. lenders, has told Congress in recent weeks that his agency is “committed to being open-minded” on the issue.

Warren said Yellen and Hsu appear to be taking “the wrong lessons” from the failures of SVB, Signature Bank and First Republic.

“Allowing additional bank consolidation would be a dereliction of your responsibilities, hurting American consumers and small businesses, betraying President Biden’s commitment to promoting competition in the economy, and threatening the stability of the financial system and the economy,” Warren wrote.

1 note

·

View note

Text

Bitcoin Fear and Greed Index Drops to "Fear" Territory: Is it Time to Buy?

The BTC Fear and Greed Index, a crucial indicator of market sentiment towards Bitcoin, recently plummeted into the "Fear" territory on June 13 and June 14. This drop marks the first time in months that the index has remained in this zone for consecutive days, raising concerns among investors. One potential explanation for this shift in sentiment could be attributed to the legal actions taken by the US Securities and Exchange Commission (SEC) against major cryptocurrency exchanges, Binance and Coinbase. These developments have triggered significant volatility in Bitcoin's price, leading to a series of highly unstable trading days and multi-month lows. In this article, we delve into the impact of the SEC's lawsuits and explore whether the current "Fear" zone presents a buying opportunity for investors.

The SEC Lawsuits and their Effect on Bitcoin

The legal battles initiated by the US SEC against Binance and Coinbase have reverberated throughout the entire cryptocurrency market, particularly impacting various altcoins accused of being unregistered securities. However, Bitcoin itself has not remained unscathed, experiencing a decline from over $27,000 to a multi-month low below $25,400 following the announcement of the lawsuits. Despite a partial recovery, it appears that the damage has been done, as indicated by the Bitcoin Fear and Greed Index, which has taken a downward trajectory.

On June 6, coinciding with the SEC's lawsuit against Coinbase and 24 hours after the lawsuit against Binance, the index entered the "Fear" zone for the first time in nearly three months. Although the SEC's claims primarily targeted altcoins, the impact on Bitcoin's sentiment was palpable. The index briefly returned to a more positive range, but on June 13 and June 14, it unexpectedly dropped back into the "Fear" zone, prompting speculation within the community that the panic induced by the SEC's actions had resurfaced. Presently, the index stands at 46, with a reading of 45 recorded yesterday, both of which fall within the "Fear" zone.

Throughout much of 2022, the Bitcoin Fear and Greed Index predominantly oscillated between "Fear" and "Extreme Fear" due to numerous scandals and market collapses, such as the Terra crash, Three Arrows Capital bankruptcy, and FTX meltdown. However, the sentiment towards Bitcoin started to shift at the beginning of 2023, coinciding with the cryptocurrency market's signs of recovery.

A Potential Buying Opportunity for Bitcoin?

Unlike several alternative coins, Bitcoin has yet to face the full extent of the SEC's regulatory crackdown (at least for now). Consequently, Bitcoin may emerge as the primary beneficiary amid this regulatory turmoil, as investors may choose to divest from other digital currencies and focus their attention on Bitcoin instead.

This viewpoint finds support from Michael Saylor, the Executive Chairman of MicroStrategy, who predicts that Bitcoin's market share dominance could reach 80% while its price surpasses $250,000 if current trends persist.

Additionally, the recently announced US Consumer Price Index (CPI) figures have instilled hope in investors that Bitcoin's valuation could initiate a new rally. The year-over-year increase in the CPI of 4% was slightly lower than the expected 4.1%, suggesting that the Federal Reserve might refrain from further raising benchmark interest rates. Such a potential shift in monetary policy could breathe new life into businesses, stimulate spending, and make cryptocurrencies even more attractive as investment options.

Taking these factors into account, the current presence of the Bitcoin Fear and Greed Index in the "Fear" zone may not be as daunting as it initially appears. In fact, it aligns with Warren Buffett's famous investment advice that encourages individuals to be greedy when others are fearful, and vice versa. Therefore, this period of fear may present a compelling opportunity for investors to consider entering the Bitcoin market. However, it is crucial to conduct thorough research, assess risk tolerance, and seek professional advice before making any investment decisions.

Conclusion

The BTC Fear and Greed Index dropping into the "Fear" territory indicates a shift in sentiment towards Bitcoin. The legal actions taken by the US SEC against Binance and Coinbase have not only affected altcoins but also contributed to Bitcoin's price decline. Nevertheless, this dip in sentiment could potentially present a buying opportunity for those interested in Bitcoin. With the SEC's focus primarily on altcoins, Bitcoin might emerge as the primary beneficiary amid the regulatory chaos. Moreover, positive developments such as the US CPI figures and potential shifts in monetary policy could further support Bitcoin's price rally. As the famous investment adage goes, one should be greedy when others are fearful. However, it is crucial to conduct thorough research and seek professional advice before making any investment decisions.

For more articles visit: Cryptotechnews24

Source: cryptopotato.com

Latest Posts

Read the full article

0 notes

Text

Copper Rod Prices Trend and Forecast

In the first quarter of 2023, the US market experienced a rise in Copper Rod prices due to the banking meltdown's impact on high inflation and high-interest rates. Market players had noted that lower copper prices led to increased market demand ahead of traditionally high-demand months, such as April and May. As market participants looked for signs of a solid post-pandemic recovery, a slowdown in inventory build-up had indicated a rise in demand, and lead times had also been reduced due to lower input demand and fewer logistical delays. This improvement was driven by a sharp drop in input purchasing by manufacturers. Firms had chosen to deplete inventories as stocks of purchased and finished goods contracted. Additionally, the failure of Silicon Valley Bank in mid-March had a modest impact. The US dollar had also risen against most major currencies, reversing recent losses. The market's preference for safe-haven assets had remained high due to continuing concerns about banking industry risks. Downstream businesses had taken a wait-and-see approach in the face of high copper prices. As a ripple effect, the Copper Rod (C110-1 inch) prices for Ex Alabama (USA) settled at USD 15698/MT.

0 notes

Text

Cryptocurrency Experts Weigh in on Bitcoin's Future: Will the Price Halve Before Retesting Highs in 2023?

The world of cryptocurrency started off the new year with an impressive month-long rally. Bitcoin, the top crypto, is trading near four-month highs after jumping above $22,300 on Friday. This marks a significant milestone for the digital currency, as it has surpassed its level prior to the collapse of the FTX exchange in November. In fact, its 14 days of consecutive gains as of Wednesday marked its longest winning streak since 2017. However, some analysts have issued warnings that the price of Bitcoin could halve before retesting highs in the second half of 2023.

Understanding the Factors Behind the Recent BTC Boom

There are several factors that have contributed to this early 2023 Bitcoin run. Global macro fundamentals, such as views on a Federal Reserve pivot, China's reopening, and an upgraded outlook for the Eurozone economy, have all played a role. According to Joel Kruger, market strategist at LMAX Group, these factors have encouraged longer-term players to build exposure at perceived discounted prices. These players are betting that most of the downside from the crypto implosions of 2022 are now fully priced in.

The London-based financial services provider LMAX Group specializes in foreign exchange markets and cryptocurrency. They have noted that institutional adoption and regulatory clarity have become increasingly important in the crypto market. However, they believe there's still more room to close this gap, and that a more sustainable recovery will require deeper institutional adoption and regulatory clarity.

The Impact of the FTX Exchange Collapse on the Crypto Market

Last year saw a wave of bankruptcies from crypto firms as prices plummeted from all-time highs in late 2021. The spring collapse of Terra Labs' LUNA token and sister stablecoin TerraUSD was the first crypto-domino to fall, wiping out $60 billion in market value. This led to the bankruptcies of crypto firms including Three Arrows Capital, Voyager Digital, and Celsius Network.

FTX Group was the final major implosion to round out the year. The second-largest exchange by volume, FTX filed for bankruptcy after overleveraging and mishandling billions in customer funds with its sister firm Alameda Research. Another, BlockFi, filed for bankruptcy shortly after. Bitcoin and cryptocurrencies traded near two-year lows in the months following the meltdown.

Bitcoin Price Outlook

Despite the recent rally, Joel Kruger warns that the world's largest cryptocurrency isn't quite in the clear yet. He believes that the January price surge has perhaps run a little too far and fast, as per technical indicators showing a severe overextension. Kruger suggests that additional upside should be limited for now to allow for a period of consolidation and correction.

Fundamentally, global markets are still looking quite fragile and assurances of a Fed pivot could very well be overstated, says Krueger. As for crypto, he says the outlook is still "a little rocky." Speculation around the type and level of regulatory response could cause more short-term turbulence.

"We still wouldn't rule out the possibility for a deeper setback down toward $10,000 in the first half of the year," Kruger said. But additional Bitcoin setbacks below the $10,000 level "should be limited" ahead of the next big topside run.

This could lead to a strong Bitcoin recovery in the second half of the year, where it recovers above $50,000 and is "in a position to retest and break the record high," he said.

In conclusion, the recent BTC boom can be attributed to a combination of global macro fundamentals, institutional adoption, and regulatory clarity. However, there are also concerns about the potential for a price correction and the need for deeper institutional adoption and regulatory clarity for a more sustainable recovery. It's important for investors to keep a close eye on these factors and stay informed about the latest developments in the crypto market. While the current rally is certainly exciting, it's also important to remember that there is always a degree of uncertainty and risk involved in any investment. As always, investors should make sure to do their own research and consult with a financial advisor before making any decisions.

Original Article Here:

Read the full article

0 notes

Text

$80 Trillion…That We Know Of

The Bank of International Settlement (BIS) has finally admitted/warned that there are $80 Trillion in off-balance sheet dollar debts.

And they’re mostly in the form of Foreign Exchange (FX) Swaps.

Wait!

Hold on a second.

What does that mean?

Does the term “Credit Derivative Swaps” sound familiar?

If not, then think 2008 meltdown…where NOTHING got fixed.

Only this time it’s an $80 Trillion in Foreign Exchange alone.

Still confused?

This debt behemoth also involves pension funds and other ‘non-bank’ financial firms who are scared spitless of what could happen if this thing blows up.

And what they’re not telling you is that each ‘debt’ supposedly has a counter-party that has an asset behind it.

So, in theory, it should work out to be net zero.

But…and this is a Very Big Butt…

The $80 Tril is NOT ON the balance sheets of these banks.

So, the BIS decides that it’s time to raise concerns about something that they can’t even explain how it works, let alone find on the major banks balance sheets?

But don’t worry.

The BIS will eventually put their equivalent to Maxine Waters in charge of investigating this problem long after most of the damage is done.

And by damage we mean major defaults across the board for most of the largest financial institutions in the world.

$80 Trillion or possibly Quadrillion?

Keep in mind that the $80 Trillion is what they’ve admitted to knowing about.

But they won’t acknowledge that there are estimates out there that the derivative exposure may be in the Quadrillions.

Some perspective is in order here:

One Billion is One Thousand Million

One Trillion is One Thousand Billion

And One Quadrillion is One thousand Trillion…15 zeros after the 1.

The entire World’s GDP is $96 Trillion

Translation: the numbers involved in the derivatives market are mind boggling.

And they are mathematically impossible to reconcile on anyone’s balance sheet.

Conservatively the $80 Trillion FX swaps are almost as large as the world’s economy.

Read that line again.

So, you shouldn’t be surprised when we constantly remind you why these Boyz want to collapse the world economy.

It’s the perfect set up for the over-indebted nations (Including the USA) to:

Default on their debt

Usher in Digital Currencies so they can track EVERY TRANSACTION YOU MAKE

Is your head spinning yet?

Again, the question remains: How are you prepared to deal with this?

Learn what moves you should be making before the Political Chaos of 2023 strikes by reading our December issue of “…In Plain English” (HERE).

Share this with a friend…even if they don’t know anything about derivatives or FX Swaps.

They’ll thank YOU later.

Remember: We’re Not Just About Finance.

But we use finance to give you hope.

FYI

************************************

Invest with confidence.

Sincerely,

James Vincent

The Reverend of Finance

Copyright © 2022 It's Not Just About Finance, LLC, All rights reserved.

You are receiving this email because you opted in via our website.

Read the full article

0 notes

Text

A SPECIAL EVENING

Last night, a special evening. I spent it with Christina Oxenberg. Though she has lived in Key West since 2011, we never met before. I wish we had.

The evening began at Guy de Boer’s home. Drinks. Christina indulges in water only. I still trust her, however. Followed by dinner at Antonia’s. Finished the evening with a night cap at the Chart Room.

A writer. She has written a column for KONK Life for a number of years. Published 7 books. Articles printed in Allure and Huffington Post. Owns a knit wear company that sells worldwide.

I have read her KONK life writings. Superior. Unusual. Mystic. Subtle. You do not know where she is going., the point she wishes to make. Till the end. When it hits between the eyes.

Christina is of royal lineage. For real. Her mother was Princess Elizabeth of Yugoslavia. Her ancestry includes Serbia’s Karageorge, Greece’s King George I, Russia’s Tsar Alexander II, Russia’s Empress Catherine II, and Great Britain’s King George II.

As we arrived at the Pier House, Christina’s phone rang. It was David Wolkowsky. Christina and David are close friends. Chat on the phone once or twice a day. Visits him frequnetly at his home.

Christina was at David’s 99th birthday party I attended two weeks ago. I did not know her before. Did not meet her that evening. No recollection of have seen her.

I would have missed the boat were it not for last night.

David was thrilled to learn we were going to the Chart Room. He built the Pier House and created the Chart Room many many years ago.

Weather continues to be important. Hurricane season.

I made a mistake yesterday in advising Gordon had hit land off the Gulf as a category 1. It never reached hurricane status. At the moment, it remains a tropical storm moving 70 mph towards Arkansas.

Typical this time of the year, another is on the way. Florence. No screwing around here. Florence is 1,300 miles east off Bermuda and already a category 4.

Tracking not possible yet. It may turn right and stay in the Atlantic. Or, land somewhere on the east coast. May take 5 days to determine a reliable track. Then a few more days before Florence gets where ever she is going.

Social media taking a beating. Justified and non justified. Facebook millennials concerned. A recent Pew Research Center study indicated 44 percent of Americans 18-27 deleted their Facebook apps so far this year.

The concern leading to the deletions involved Facebook’s repeated failures to protect consumer data. The data that was shared and abused by a myriad of Facebook partners.

Michael Snyder is a nationally syndicated writer. His columns well researched and on point. He recently wrote re the world’s economy.

The world’s economy is on a downward thrust. Washington either is not aware or does not care. We hear nothing about it, other than the economy is good.

The problem at the moment involves 20 countries. Except for China, all emerging nations. During boom years, they all borrowed heavily. A high percentage of the loans denominated in U.S. dollars.

All in trouble economically. China included. A death spiral has begun. Most will crash. Those having U.S. denominated debt will not be able to make loan payments. U.S. and European banks will not be paid. Losses could be astronomical.

A bubble exists. If matters continue as they are, our economy will take a hell of a hit. A recession resulting.

Enjoy your day!

A SPECIAL EVENING was originally published on Key West Lou

#Antonia's#Bubble#Chart Room#China#Christina Oxenberg#David Wolkowsky#Death Spiral#Facebook#FB#Guy deBoer#Hurricane Florence#Hurricane Gordon#Hurricane Update#Irma and Me#John#Key West#Key West Lou#Key West Lou Live#Key West Lou Live Video#Major Currencies' Meltdown#Michael Snyder#Pew Research Center#Rain#Royal Lineage#Weather

1 note

·

View note

Text

Lebanon is in crisis.

Voting (quell surprise) isn't likely to provide a solution.

Over 80% of the population is now in poverty, mainly thanks to a rapid succession of crises including covid19, the Beirut explosion, and shortages created by the Ukraine War.

"...Lebanese spend their days at the banks, waiting to see what meagre amounts they will be allowed to withdraw for the month. They install batteries and solar panels at great cost so their family can survive the humid summer months without electricity from the grid.

They hunt for medicine and fuel, and worry about securing the next meal for their kids.

It’s an economic meltdown and Sunday’s parliament elections are seen as a last chance to reverse course and punish the current crop of politicians who have driven the Mediterranean nation into the ground.

Instead, a widespread sense of apathy and pessimism prevails, with most observers agreeing the vote is unlikely to make much difference.

“Who should I vote for? Those who stole my money, plundered the country and exploded Beirut? Or those nobodies who cannot agree on anything?” said Samir Fahd, a schoolteacher whose once comfortable income of about $3,400 a month is now worth the equivalent of $200. ..."

"...Fahd, the schoolteacher, believes it is futile to expect change in a system based on sectarianism and large-scale patronage that he said is “administered by an entrenched mafia.”

“Elections don’t change anything, it’s all a joke and they are all coming back whether we like it or not,” said the 54-year-old. ..."

"...Lebanon’s demise has been staggering. In just two and a half years, the majority of the once middle-income population has been plunged into poverty, the national currency collapsed, and foreign reserves have run dry. The World Bank has described the crisis as among the world’s worst in over a century.

Tens of thousands have left the country, including nurses, professors, doctors and engineers. Last month, dozens of people drowned at sea after a boat carrying about 60 migrants capsized off the coast.

“Today the country stands as a ‘failing state’,” Olivier De Schutter, the U.N.’s special rapporteur on extreme poverty and human rights, said in a report published this week, after he visited Lebanon. He added that the country’s “political leadership is completely out of touch with reality.”

Many people say they are sick of the political class but don’t see an alternative. ..."

45 notes

·

View notes

Text

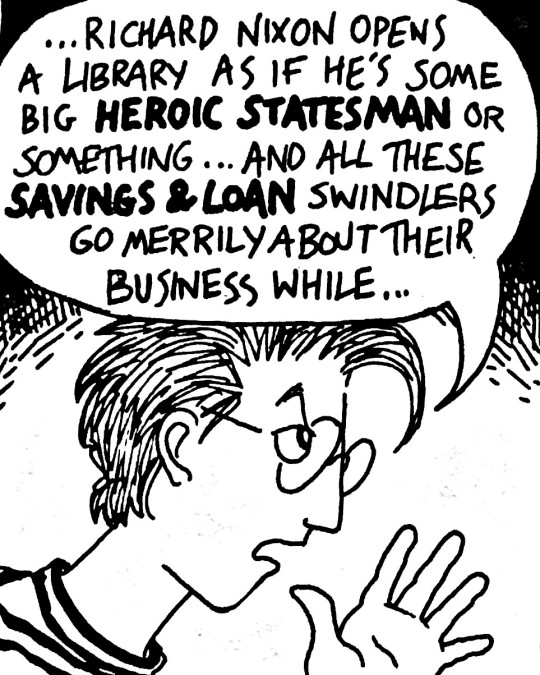

The S&L crisis perfected finance crime

When the Great Financial Crisis hit, suddenly there was a lot of talk about the Savings & Loan crises of the 1980s and 90s. I was barely a larvum then, and all I knew about S&Ls I learned from half-understood dialog in comics like Dykes to Watch Out For and Bloom County.

As the GFC shattered the lives of millions, I turned to books like Michael W. Hudson’s THE MONSTER to understand what was going on, and learned that the very same criminals who masterminded the S&L crisis were behind the GFC gigafraud:

https://memex.craphound.com/2011/03/07/the-monster-the-fraud-and-depraved-indifference-that-caused-the-subprime-meltdown/

Hudson’s work forever changed my views of Orange County, CA, a region I knew primarily through Kim Stanley Robinson’s magesterial utopian novel PACIFIC EDGE, not as the white-hot center of the global financial crime pandemic.

https://memex.craphound.com/2015/01/15/pacific-edge-the-most-uplifting-novel-in-my-library/

That realization resurfaced today as I read the transcript of UMKC Law and Econ prof Bill Black’s interview with Paul Jay on The Analysis, when Black says, “Orange County is the financial fraud capital of the world, not America, the world.”

https://www.youtube.com/watch?v=jFH5-5D5_Lc

Black is well-poised to tell the tale of the S&L crisis. He served as a bank regulator during the crisis, and his notes on the “Keating 5” meeting were the turning point for public and Congressional attention to the crime:

https://theanalysis.news/economy/the-best-way-to-rob-a-bank-is-to-own-one-bill-black-pt-1/

In 1998, he finished a criminology doctorate at UC Irvine (in Orange County!) on the S&L frauds, entitled “The Best Way to Rob a Bank is to Own One,” a title he used for his 2005 book (updated in 2013) on the scandal:

https://utpress.utexas.edu/books/blab2p

The S&L crisis shares a lot in common with today’s financial crimes, but it had one key difference: ultimately (with Black’s help), more than 30,000 criminal referrals were made against the bankers involved in the crisis, and more than 1,000 were convicted of felonies.

The story of the S&L crisis is both a roadmap for holding finance criminals to account (a roadmap we threw away and forgot about) and a roadmap for committing gross acts of financial crime with impunity (which the finance sector studied carefully and keeps close its heart).

Black calls finance a “crimogenic environment,” in where deregulated institutions become pathogenic, “like a cesspool that produces lots of bacteria and viruses and such and causes lots of infections.”

The S&L crisis began with the Carter-Ronald deregulatory blitz. Both presidents assumed that because S&Ls (a kind of bank) in California and Texas were doing really well after deregulation, that meant CA and TX had nailed it and their example could be expanded nationwide.

In reality, the rosiness of the California and Texas S&Ls’ books was the result of “control fraud,” when a person who controls the bank is stealing from it.

Black likens this to a homeowner who commits insurance fraud — an ultimate insider, who knows the code to de-activate the alarm system and also knows just where the most valuable items are kept.

The major control fraudster of the S&L crisis was Charles Keating, a “top 100 granter” who was among the 100 highest donors to Reagan and Bush I. Keating has stolen a vast fortune from Lincoln Savings, and he was able to trade some of that loot for political cover.

Keating hired Alan Greenspan (!) to lobby for him, and Greenspan suborned five senators (the “Keating Five”) who threatened regulators with dire consequences if they didn’t stop digging into S&Ls.

This was also a priority for Reagan, whose plan for vast tax-cuts for the wealthy might stumble if it the public found out that the US government needed billions to bail out these walking-dead fraud zombies.

Reagan turned to Ed Gray, a PR guy, to run the S&L operation. Gray was hand-picked by the S&L’s trade association, and they told him flat out that he was there to make S&Ls look good — not to blow them up by investigating their balance-sheets.

The problem is that Gray — who was a hardcore Reaganite partisan and deregulation true believer — was honest, and the fraud was so obvious. The Texas S&Ls were originating fraudulent loans to build housing tracts that didn’t exist.

When Gray went out to look at these building sites, he just found endless rows of desolate concrete pads — he called them “Martian landing pads” — and abandoned ruins. These were the collateral on billions in loans!

Gray is a believer in sound finance, and this is undeniable evidence that deregulation has led to catastrophically unsound practices, so he starts imposing regulation on the S&L sector.

Keating pulls strings to sideline Gray, but Gray keeps pushing. Keating gets the leadership of both parties in the House to sponsor legislation ordering him to stop. He keeps going.

Donald Regan — an ex-Marine who went from CEO of Merrill Lynch to Reagan’s Chief of Staff — leans hard on Gray, but Gray won’t stop.

The Office of Management and Budget swears out a criminal complaint against Black for closing too many S&Ls. He won’t stop.

They go after Gray’s guy in Texas, Joe Selby, a former acting Comptroller of the Currency with impeccable credentials, demanding that Gray fire Selby. Democratic Speaker Jim Wright says Selby should be fired because he’s gay. Gray won’t budge.

Homophobia turns out to be a powerful weapon for criminal impunity. Keating sued Black and the Federal Home Loan Bank of San Francisco, claiming the bank’s gay employees had conspired against Keating because Keating was an evangelical Christian.

Gray took finance crime seriously. He had two priorities: one, eject anyone committing fraud from working at any financial institution, and; two, criminally and civilly charge those former execs and take back all the money they stole and ruin them financially.

Black and colleagues took this to heart, making thousands of criminal referrals. When law enforcement refused to act on these, they started publishing their referrals, and newspapers published stories about how none of these criminal referrals were leading to prosecutions.

Gray eventually gets sidelined by a “team player,” the disgraceful Danny Wall, who studiously ignores all the crime that has been uncovered. But then Bush I replaces him with Tim Ryan, whose marching orders are to root out finance crime.

Ryan ultimately made over 30,000 criminal referrals over the S&L scandal, and brought prosecutions against elite criminals, including Neil Bush, the son of the President of the United States of America.

Black: “Tim Ryan sacrificed his career for the public knowingly…he’s been unemployable since.”

And as for Bush I, his first major legislative priority became the removal of financial crime from the jurisdiction of independent watchdogs, so this would never happen again.

This is as far as the interview gets (it’s part one of nine!), but it’s already answering some of the most important questions the Great Financial Crisis raised, like, “Why didn’t any of the bankers who stole trillions from the world go to jail?”

Image:

Dykes to Watch Out For strip #90 (1990), “The Solution,” Alison Bechdel

https://forums.somethingawful.com/showthread.php?threadid=3908728&userid=99998&perpage=40&pagenumber=10

298 notes

·

View notes

Text

How Sri Lanka’s economy destroyed itself

Our island neighbor is bleeding. With the annual inflation at 18.5% in March 2022, the story of Sri Lanka is heartbreaking, traumatic and unsettling. The truth about the country is that it has fallen into a debt trap due to poor governance, corruption and of course, a lot of foreign debt. And now, it is the people who have to suffer. While one is reading this from the comfort of an air-conditioned room, people in Sri Lanka stand in queues that extend 2-3 km long even just for food, fuel and medicines.

How bad is this Economic Crisis?

Going through its worst economic crisis since 1948 when the country gained independence, the prices of essential items in Sri Lanka have sky-rocketed. The price of a kg of rice was ₹290, and that of sugar is ₹240 in March end.

Citizens have to stand in long queues for hours even to get essential. The people have to face daily power cuts of more than seven hours in the scorching heat. The administration recently had to cancel the school examinations because of country’s failure to import paper.

The 5 main reasons which led to this crisis

1. Shortage of Foreign Reserves

The alleged economic mismanagement of successive governments led to depletion of 70% of Sri Lanka’s foreign reserves with only $2.31 billion left with debt repayment of over $4 billion. Sri Lanka’s high dependency on imports for essential items further adds fuel to the economic meltdown because the island nation lacks foreign reserves to pay for its import bills. The country could face a trade deficit of $10 billion this year.

2. The pandemic effect

The island nation's huge dependence on tourism and foreign remittances took a serious due to COVID-19 pandemic. Tourism, which accounts for over 10% of the Sri Lankan GDP, was hurt after it lost visitors from three key countries namely India, Russia and the UK.

3. Russia-Ukraine war-induced inflation

Crude oil prices hit a record high in 14 years with prices soaring over $125/barrel at the height of the crisis, as the ongoing Russia-Ukraine war resulted in steep price inflation of crude oil, sunflower oil and wheat. But helped by supplying 40,000 MT of diesel under a promised $500 million line of credit and also supplied over 2,00,000 MT of fuel in the last 50 days so far.

4. Agri sector crisis

On a sudden day, the President decided that the whole country’s agriculture be turned organic, thus banning all synthetic fertilizers and pesticides that was to be done over a period of 10 years. This drastically impacted the production volume, and the efficiency got reduced by 20 to 30%,consequently severely hitting the country's farm production.

5. President’s promises

The President of Sri Lanka, Gotabaya Rajapaksa, in his presidential campaign, promised that he would cut down the Value Added Tax to half, with the motive of increasing consumption among the citizens, as reduced taxes would encourage increased spending. When he won, he put that money where his mouth was. But the timing was ill-fated as after three months of execution of this, Covid-19 happened. Thus, the cut down in taxes led to the government saw a major revenue loss.

How has the Sri Lanka responded to the crisis so far?

Sri Lanka declared an economic emergency to control food supply amid soaring inflation in September 2021. The country also had devalued its currency and imposed import curbs on many items to prevent further depletion of its forex reserves. It had partially revoked the fertiliser ban as well. Sri Lanka has approached the International Monetary Fund (IMF) for debt restructuring and a possible bailout.

Conclusion

Huge piles of foreign debt, soaring inflation, depleting foreign currency reserves, devalued currency – Sri Lanka is the breathing, living example of everything that could ever go wrong with a nation's economy. However, it remains to be seen whether the desperate political measures like a new cabinet, resignation of lawmakers and changing the central bank chief will help Lanka salvage the economy that's currently in neck-deep in crisis. In addition to the above measures, the Sri Lankan government sought aid from the US, India and China. India has extended a $1billion line of credit for the supply of essential commodities already and financial assistance of $2.4 billion has also been provided by our country since January.

Let’s just hope that the “Go Gota Go” protest by Sri Lankan citizens comes to fruition.

2 notes

·

View notes

Text

Tuesday, August 24, 2021

Portland protests see clashes between far-right, far-left groups

(Reuters) Protests by rival far-right and left-wing groups in Portland descended into violence on Sunday, as the opposing sides engaged in clashes and at least one man was arrested for firing a gun at demonstrators. Nobody was hurt in an exchange of gunfire—and by Sunday evening there was no word on any injuries in numerous other skirmishes that saw opposing sides brawling, dousing each other in what appeared to be bear spray and breaking car windows of rivals. Police Chief Chuck Lovell said during a briefing on Friday that officers would not necessarily intervene to break up fights between the groups. But he added that “just because arrests are not made at the scene when tensions are high, does not mean that people won’t be charged with crimes.”

Henri hurls rain as system settles atop swamped Northeast

(AP) The slow-rolling system named Henri is taking its time drenching the Northeast with rain, lingering early Monday atop a region made swampy by the storm’s relentless downpour. Henri, which made landfall as a tropical storm Sunday afternoon in Rhode Island, has moved northwest through Connecticut. It hurled rain westward far before its arrival, flooding areas as far southwest as New Jersey before pelting northeast Pennsylvania, even as it took on tropical depression status. Over 140,000 homes lost power, and deluges of rain closed bridges, swamped roads and left some people stranded in their vehicles.

Classes starting, but international students failing to get U.S. visas

(Reuters) Kofi Owusu occasionally waits outside the U.S. embassy in Accra to ask fellow students what they have done to secure a timely visa appointment. Classes for his master’s program at Villanova University in Pennsylvania are scheduled to start Monday, but his in-person interview appointment for a first-time U.S. student visa is still nine months away. It’s the second time the political science student from Ghana won’t make it to the United States in time for school. Visa processing is delayed as U.S. embassies and consulates operate at reduced capacity around the world due to the COVID-19 pandemic, leaving some students abroad unable to make it for the start of the academic year. The wait and the hassle threaten both the country’s standing as a preferred choice for international students and their economic contribution of around $40 billion annually to many universities and local economies. New international student enrollment in the United States dropped 43% in fall 2020 from the year prior, months after COVID sent the world into lockdown. The number of new students who actually made it onto campus in person declined by 72%, according to an enrollment survey by the Institute of International Education (IIE).

FDA approves Pfizer COVID-19 vaccine

(Bloomberg) The pioneering coronavirus vaccine made by pharmaceutical companies BioNTech and Pfizer was granted full approval by U.S. regulators. The government imprimatur is expected to trigger a flood of mandates by municipalities, agencies and private employers that had been waiting for the Food and Drug Administration sign-off. Following the announcement, the Pentagon said it would make vaccinations mandatory for military personnel worldwide and President Joe Biden called for mandates by companies.

Hospitals and Insurers Didn’t Want You to See Their Prices

(NYT) This year, the federal government ordered hospitals to begin publishing a prized secret: a complete list of the prices they negotiate with private insurers. The insurers’ trade association had called the rule unconstitutional and said it would “undermine competitive negotiations.” Four hospital associations jointly sued the government to block it, and appealed when they lost. They lost again, and seven months later, many hospitals are simply ignoring the requirement and posting nothing. But data from the hospitals that have complied hints at why the powerful industries wanted this information to remain hidden. It shows hospitals are charging patients wildly different amounts for the same basic services: procedures as simple as an X-ray or a pregnancy test. And in many cases, insured patients are getting prices that are higher than they would if they pretended to have no coverage at all. This secrecy has allowed hospitals to tell patients that they are getting “steep” discounts, while still charging them many times what a public program like Medicare is willing to pay.

‘A Beautiful Feeling’: Refugee Women In Germany Learn The Joy Of Riding Bikes

(NPR) Like most Americans, I learned to ride a bike as a kid. I still remember the glee after learning how to ride a bike on a subdivision road where I grew up in Florida. But girls around the world don’t always get to experience the joy of a first bike ride. In some countries, conservative societies frown upon women and girls who ride bikes—it’s not considered dignified or appropriate—and gives a girl too much independence. Joumana Seif, a Syrian lawyer and activist, recalls riding a bike as an 11-year-old in the capital city of Damascus. “For the people [watching on the street], and even for the children, it was shocking to them that I was riding a bike. They started to say, ‘Oh, shame on you, you are a girl riding a bike,’” Seif says. “It just wasn’t in our culture.” But it’s never too late to learn. In Germany, a nonprofit group called Bikeygees is teaching refugee women from countries such as Iran, Iraq and Syria how to ride. Since the group first started, it has taught 1,100 women how to ride a bike, says founder Annette Krüger. “It is possible to change the life of a woman in two hours. It is really magical,” says Krüger, an avid cyclist. “It’s a beautiful feeling when a person is riding a bike,” one refugee says with a broad grin.

Gunfire at Kabul airport kills 1 amid chaotic evacuations

(AP/Foreign Policy) A firefight at one of the gates of Kabul’s international airport killed at least one Afghan soldier early Monday, German officials said, the latest chaos to engulf Western efforts to evacuate those fleeing the Taliban takeover of the country. The shooting at the airport came as the Taliban sent fighters north of the capital to eliminate pockets of armed resistance to their lightning takeover earlier this month. The Taliban said they retook three districts seized by opponents the day before and had surrounded Panjshir, the last province that remains out of their control. The tragic scenes around the airport have transfixed the world. Afghans poured onto the tarmac last week and some clung to a U.S. military transport plane as it took off, later plunging to their deaths. At least seven people died that day, in addition to the seven killed Sunday. Tens of thousands of people—Americans, other foreigners and Afghans who assisted in the war effort—are still waiting to join the airlift, which has been slowed by security issues and U.S. bureaucracy hurdles. Meanwhile, Afghanistan faces a quickly deepening economic crisis, with financial hardships increasingly affecting those in Kabul and other cities. Banks remain closed, food prices are rising, and the value of the local currency has plummeted. The suspension of commercial flights to Kabul’s international airport has in some ways exacerbated the crisis, halting the flow of some medical supplies and aid.

US special operations forces race to save former Afghan comrades in jeopardy

(ABC News) Current and former U.S. military special operations and intelligence community operatives are using their own networks of contacts to get elite Afghan soldiers, intelligence assets and interpreters to safety as they’ve become increasingly disillusioned and fed up with the U.S. government-led evacuation effort in Kabul, ABC News has learned. One informal group, dubbed “Task Force Pineapple,” began as a frantic effort last weekend to get one former Afghan commando into Hamid Karzai International Airport as he was being hunted by Taliban who were texting him death threats. They knew he had worked with U.S. Special Forces and the elite SEAL Team Six for a dozen years, targeting Taliban leadership, and was therefore at high risk of reprisal. The former elite commando was finally pulled into the U.S. security perimeter at the airport, where he shouted the password “pineapple” to American troops at the checkpoint. Two days later, the group of his American friends and comrades also helped get his family inside the airport to join him. Other former members of the military and CIA have consolidated their own efforts with a separate group calling itself “Task Force Dunkirk,” a reference to the massive evacuation of British and other Allied forces from France in 1940 under threat of the Nazi juggernaut. Task Force Dunkirk and the groups it has banded together with have helped get at least 83 at-risk Afghans out of the country.

Lebanese hospitals at breaking point as everything runs out

(AP) Drenched in sweat, doctors check patients lying on stretchers in the reception area of Lebanon’s largest public hospital. Air conditioners are turned off, except in operating rooms and storage units, to save on fuel. Medics scramble to find alternatives to saline solutions after the hospital ran out. The shortages are overwhelming, the medical staff exhausted. And with a new surge in coronavirus cases, Lebanon’s hospitals are at a breaking point. The country’s health sector is a casualty of the multiple crises that have plunged Lebanon into a downward spiral—a financial and economic meltdown, compounded by a complete failure of the government, runaway corruption and a pandemic that isn’t going away. The collapse is all the more dramatic since only a few years ago, Lebanon was a leader in medical care in the Arab world. The region’s rich and famous came to this small Mideast nation of 6 million for everything, from major hospital procedures to plastic surgeries.

China changes law to allow married couples to have three kids

(NY Post) China will now allow married couples to legally have a third kid amid concerns that its shrinking number of working-age people will threaten the country’s future prosperity and global influence. China has tried for decades to control the population, beginning with a policy imposed in 1979 that strictly limited couples to one child. Couples who didn’t follow the rule faced fines or loss of jobs—and in some cases, mothers were forced to undergo abortions. A preference for sons also led parents to kill baby girls, causing a massive imbalance in the sex ratio. The number of working-age people, meanwhile, has fallen over the past decade and the population has barely grown, adding more strain to an aging society. With growing fears that the country would grow old before it became wealthy, the family planning rules were changed for the first time in 2015 to allow two children.

Cases up down under

(CNN) Australia, like China, New Zealand, and some other countries, has attempted to completely eradicate Covid-19 inside its borders. The strategy had largely worked until recently; Australia has just 44,026 confirmed Covid-19 cases and 981 deaths. But several major cities, including Sydney, Melbourne, and the capital Canberra, are again under lockdown as authorities struggle to contain an outbreak of the Delta variant. On Saturday, thousands took to the streets of Melbourne and Sydney to protest the long lockdowns; hundreds were arrested, and at least seven police officers were injured during violent clashes. In an opinion piece published Sunday, Prime Minister Scott Morrison hinted at an end to the country’s zero Covid-19 infections strategy, but warned Australians to expect a rise in infections as restrictions relax.

2 notes

·

View notes