#Plywood Market Report

Text

The report “Plywood Market” is valuable to anyone who wants to understand the global Plywood industry. The study provides a comprehensive analysis on the market trends, prices, applications, regional breakup, manufacturers, imports, exports, manufacturing process.

#Plywood Market Size#Plywood Market Share#Plywood Market Trends#Plywood Market Growth#Plywood Market Forecast#Plywood Market Report

0 notes

Text

Construction Segment to Remain the Fastest Expanding Application of Plywood Market During 2022-2027

Construction Segment to Remain the Fastest Expanding Application of Plywood Market During 2022-2027

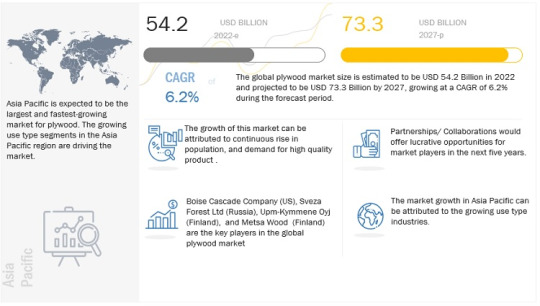

The global plywood market size is projected to grow from USD 54.2 billion in 2022 to USD 73.3 billion by 2027, at a CAGR of 6.2%, According to the MarketsandMarkets™ analysis. Plywood is a well-known manufactured wood-based panel product that has been used in global development projects for many years. Plywood panels for structural applications are made up of many layers or plys of softwood…

View On WordPress

#Demand for Plywood#Plywood Market#Plywood Market Analysis#Plywood Market Forecast#Plywood Market Growth#Plywood Market Insights#Plywood Market Overview#Plywood Market Report#Plywood Market Share#Plywood Market Size#Plywood Market Trends#Plywood Sales

0 notes

Text

The report "Plywood Market by Type (Hardwood and Softwood), Application (Construction and Industrial), Uses Type (New Construction and Rehabilitation), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027", Plywood market size is projected to reach USD 73.3 billion by 2027 from USD 54.2 billion in 2022 growing at a CAGR of 6.2%. The Asia Pacific region is the largest market for plywood across the globe. The market in the Asia Pacific has been studied for China, India, Japan, South Korea, Taiwan, Thailand, Malaysia and the Rest of Asia Pacific (Australia, Indonesia, and others). Among these countries, China accounted for the largest share of 80.0% of the Asia Pacific plywood market in terms of value.

India and China have experienced close to double-digit GDP growth in recent years, as well as a population boom. The stable economy and growing building and construction industry has augmented the growth of plywood in India and China. Furthermore, furniture sector is one of the main consumers of plywood in India. During the 2018 to 2023, it is predicted that the India furniture market by commercial sector will have a CAGR of 11.97%. India is the fourth-largest consumer of furniture worldwide and the fifth-largest producer of furniture. The Indian furniture industry is estimated to be worth $8 billion, represents 0.5% of the GDP in 2022 according to IBEF (Indian Brand Equity Foundation). The domestic organized industry has roughly 5000 businesses, and there are almost 10,500 furniture imports. The industries that contribute most to the sectors growth include real estate, housing & hospitality, and consumer base growth.

Major players operating in the plywood include Georgia Pacific LLC (US), Boise Cascade Company (US), Weyerhaeuser Company Ltd (US), UPM-Kymmene Oyj (Finland), Svezza Forest Ltd (Russia), PotlatchDeltic Corporation (US), Greenply Industries Ltd (India), Century Plyboards India Ltd. (India), Austral Plywoods (Australia), and others.

#Plywood Market#Plywood Market Report#Plywood Market Insights#Plywood Market Size#Plywood Market Share#Plywood Market Forecast#Plywood Market Overview#Plywood Market Trends#Plywood Market Analysis#Demand for Plywood#Plywood Sales#Plywood Market Growth#Plywood Market Opportunity

0 notes

Text

#global plywood market#plywood market#global plywood market share#global plywood market size#global plywood market report#plywood market by type#plywood market by grade#plywood market by application#plywood market by countries

1 note

·

View note

Text

Sustainable Construction: How the Particle Board Market is Evolving in 2024-2034

Particle board, also known as chipboard, is an engineered wood product made from wood chips, sawdust, and resin. It has become a cost-effective alternative to solid wood and plywood, used extensively in the construction, furniture, and packaging industries. The global particle board market is expected to see considerable growth from 2024 to 2034, driven by increasing urbanization, rising demand for affordable furniture, and a growing focus on sustainable building materials.

The global particle board industry, valued at US$ 25.1 billion in 2023, is projected to grow at a CAGR of 5.6% from 2024 to 2034, reaching US$ 45.3 billion by the end of 2034. Factors such as the expansion of the construction sector in emerging economies, the increasing demand for eco-friendly products, and innovations in particle board manufacturing technologies are contributing to this growth.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/particle-board-market.html

Market Segmentation

The particle board market is segmented based on various parameters:

By Service Type:

Raw particle boards: Used for structural purposes in construction and furniture.

Laminated particle boards: Used for aesthetic purposes in interior decoration and cabinetry.

Melamine-coated particle boards: Used for surfaces requiring water resistance, primarily in kitchens and bathrooms.

By Sourcing Type:

Softwood-based particle boards: Primarily used in construction and insulation due to durability.

Hardwood-based particle boards: Preferred for furniture making and decorative items for finer finishes.

By Application:

Furniture: The largest application segment, driven by the demand for cost-effective materials in household and office furniture.

Construction: Used in flooring, wall panels, and insulation.

Packaging: Gaining popularity as a sustainable material for packaging.

Others: Applications in exhibitions, partitions, and shelving units.

By Industry Vertical:

Residential Construction: High demand due to urbanization and affordable housing.

Commercial Construction: Used extensively in office spaces, hotels, and retail outlets.

Furniture Manufacturing: Essential for producing mass-market furniture.

Packaging Industry: Growing demand for eco-friendly packaging solutions.

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Regional Analysis

North America

The particle board market in North America is driven by increasing demand in the residential and commercial construction sectors. Sustainable building practices and a growing preference for eco-friendly materials are key drivers in the region, with the United States and Canada being major markets.

Europe

Europe holds a significant share of the global particle board market, particularly in the furniture manufacturing industry. Countries like Germany, Italy, and Poland are leaders in particle board production. The European Union's emphasis on sustainability and circular economy principles further boosts the demand for particle boards.

Asia-Pacific

Asia-Pacific is the fastest-growing market for particle boards, with China and India leading the way. Rapid urbanization, a booming construction industry, and increasing consumer demand for affordable furniture are key growth drivers. The region’s strong industrial base in wood-based manufacturing supports particle board production.

Latin America

In Latin America, countries like Brazil and Mexico are witnessing growth in the particle board market due to increasing construction activities and growing demand for budget-friendly housing materials.

Middle East & Africa

The particle board market in the Middle East & Africa is relatively nascent but growing due to increased investments in infrastructure and construction projects.

Market Drivers and Challenges

Drivers

Cost-effectiveness: Particle boards are cheaper compared to solid wood and plywood, making them a popular choice in construction and furniture production.

Sustainability: As a product made from wood waste, particle boards align with the growing global focus on sustainability and reducing deforestation.

Urbanization and Infrastructure Development: Increasing construction activities, especially in emerging economies, are driving demand for particle boards.

Furniture Demand: The growing trend of affordable, ready-to-assemble (RTA) furniture has expanded the market for particle boards, especially in the residential and commercial sectors.

Challenges

Durability Issues: Particle boards are less durable compared to plywood and MDF, limiting their use in high-load applications.

Moisture Sensitivity: Particle boards are prone to damage when exposed to moisture, requiring additional treatments and coatings for certain applications.

Environmental Concerns: The use of synthetic resins, often containing formaldehyde, in particle board production has raised health and environmental concerns.

Market Trends

Sustainable Materials: The shift toward environmentally friendly building materials is pushing manufacturers to develop particle boards with minimal environmental impact, using bio-based resins and recycled wood materials.

Technological Advancements: Innovations in resin technology and production processes are enhancing the strength, water resistance, and overall performance of particle boards.

Rising Popularity of RTA Furniture: Ready-to-assemble furniture, particularly in the e-commerce sector, is boosting demand for particle boards, which are a key material in such products.

Future Outlook

The global particle board market is expected to continue its upward trajectory through 2034, with substantial growth opportunities in emerging markets. Increasing environmental awareness, combined with technological innovations in particle board production, will create a favourable market landscape. Additionally, advancements in coatings and laminates will enhance particle board durability, expanding its use in diverse applications.

Key Market Study Points

Market Size and Forecast: Evaluation of market value from 2024 to 2034.

Key Market Drivers: Identification of factors driving growth, including cost-effectiveness and sustainability.

Challenges: Analysis of issues like durability and moisture resistance.

Technological Innovations: Overview of advancements in resin and production processes.

Regional Insights: A detailed analysis of regional markets with growth potential in Asia-Pacific and North America.

Competitive Landscape: Insight into the leading market players and their strategies.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=86230<ype=S

Competitive Landscape

Major players in the global particle board market include:

Kronospan: A leading manufacturer with a strong global presence.

Egger Group: Known for innovations in wood-based products, including particle boards.

Norbord Inc.: Specializes in engineered wood products, including particle boards.

Weyerhaeuser Company: One of the largest producers of wood-based products, focusing on sustainability.

These companies are focusing on product innovation, expanding production capacities, and enhancing sustainability initiatives to maintain their market positions.

Recent Developments

Sustainability Initiatives: Several manufacturers are investing in bio-based resins to reduce the environmental impact of particle board production.

New Product Launches: Companies are introducing particle boards with enhanced moisture resistance and improved surface finishes for high-end furniture applications.

Capacity Expansions: Increasing demand for particle boards has led to new production facilities being established, particularly in the Asia-Pacific region.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

0 notes

Text

2023 Saw a 6% Dip in European Wood-Based Panels Production

In 2023, the European wood-based panel industry faced a notable downturn. The year was marked by a 6.3% decrease in production, a figure that has been characterized as "disappointing" by industry experts. This decline, as reported by the European Panel Federation (EPF), reflects a significant shift in the sector's dynamics. The statistics not only underscore the challenges faced by the industry but also signal a need for a deeper analysis of the underlying causes.

In this blog, we will discuss the factors contributing to this downturn and explore its implications for the European timber market and its global standing in wood-based panel production.

Wood-Based Panels Gain Market Share

Despite the overall downturn, wood-based panels emerged as a bright spot, outperforming the two principal consumer sectors—furniture and construction. This trend indicates an increase in market share for wood-based products, a silver lining amidst broader industry challenges.

This encouraging development is detailed in the EPF's Annual Report 2023. The report was unveiled during the EPF's Annual General Meeting, which took place from June 19-21 in Riga, Latvia. The event, hosted by the Latvian plywood manufacturer Latvijas Finieris, brought together 180 professionals from across the industry, creating a forum for dialogue and collaborative efforts in the face of market challenges.

The Varied Fortunes of Wood-Based Panels in 2023

The product-specific analysis for 2023 reveals a fragmented market in the wood-based panels sector:

OSB (Oriented Strand Board) stood out as the only category to witness growth, with a 2% increase in production, reaching 6.6 million cubic meters (up from 6.5 million cubic meters in 2022).

Particleboard, the industry’s largest segment, experienced a 5% decline, with production falling to 30.9 million cubic meters (down from 32.5 million cubic meters in 2022).

MDF (Medium-Density Fiberboard) suffered a sharper decline, with an 11% decrease leading to 11.1 million cubic meters of production (a drop from 12.5 million cubic meters in 2022).

Softboard, primarily comprising wood fibre insulation boards, which had previously been on an incline, saw a 6% reduction to 4.8 million cubic meters (previously at 5.2 million cubic meters).

Plywood production faced a significant 15% downturn, amounting to 2.6 million cubic meters (compared to 3.1 million cubic meters in 2022).

Hardboard recorded a 17% decrease, although it remains the smallest product area within the European wood-based panel industry, with production at 400,000 cubic meters (down from 500,000 cubic meters in 2022).

The detailed breakdown illustrates how different product areas within the global timber industry have had varying degrees of success and challenges.

Conclusion

Staying informed with the latest developments and understanding price dynamics are essential to success in the global timber industry. This is where the Timber Exchange’s Market Data Hub becomes an indispensable tool. As a comprehensive digital tracker of the global timber market, the Market Data Hub offers far more than mere data. It serves as a repository of detailed news, updates, and webinars.

Through a single, streamlined dashboard, the platform grants access to 200+ market indicators, empowering users to monitor a wide array of forestry operations effectively. The Market Data Hub covers it all, whether it's logging activities, production figures, inventory levels, or export/import volumes. It also provides insights into consumption patterns and pricing across more than 25 global key markets.For those eager to delve deeper into the Market Data Hub's capabilities and leverage its full potential, scheduling a demonstration is just a click away. Discover how this platform can transform your approach to navigating the global timber market.

0 notes

Text

0 notes

Text

Woodworking Circular Saw Blades Market Size, Global Industry Trend Analysis and Forecast 2024-2030

Global Info Research’s report offers key insights into the recent developments in the global Woodworking Circular Saw Blades market that would help strategic decisions. It also provides a complete analysis of the market size, share, and potential growth prospects. Additionally, an overview of recent major trends, technological advancements, and innovations within the market are also included.Our report further provides readers with comprehensive insights and actionable analysis on the market to help them make informed decisions. Furthermore, the research report includes qualitative and quantitative analysis of the market to facilitate a comprehensive market understanding.This Woodworking Circular Saw Blades research report will help market players to gain an edge over their competitors and expand their presence in the market.

According to our (Global Info Research) latest study, the global Woodworking Circular Saw Blades market size was valued at USD million in 2023 and is forecast to a readjusted size of USD million by 2030 with a CAGR of % during review period.

Woodworking Circular Saw Blades are round circular saw blades that are designed to cut various types of wood, including lumber, plywood, softwood, hardwood, panels and laminates. They can be used in various applications, depending on the type of wood you are cutting and the kind of task you are performing. Blades come in a variety of sizes and can be made of various materials to accommodate different uses.

In Japan market, key players of woodworking circular saw blades include Tenryu, Robert Bosch, Stanley Black and Decker, Tenryu Saw Mfg, TTI, etc. The top five players hold a share over 40%.

The Global Info Research report includes an overview of the development of the Woodworking Circular Saw Blades industry chain, the market status of Residential (Tungsten Carbide, Diamond), Industrial Manufacturing (Tungsten Carbide, Diamond), and key enterprises in developed and developing market, and analysed the cutting-edge technology, patent, hot applications and market trends of Woodworking Circular Saw Blades.

Regionally, the report analyzes the Woodworking Circular Saw Blades markets in key regions. North America and Europe are experiencing steady growth, driven by government initiatives and increasing consumer awareness. Asia-Pacific, particularly China, leads the global Woodworking Circular Saw Blades market, with robust domestic demand, supportive policies, and a strong manufacturing base.

We have conducted an analysis of the following leading players/manufacturers in the Woodworking Circular Saw Blades industry:

Tenryu、Robert Bosch、Stanley Black and Decker、Tenryu Saw Mfg、TTI、Dewalt、HiKOKI、Makita、HILTI、Bahco、TRUSCO、RYOBI、KANEFUSA、Leitz、LEUCO

Market segment by Type: Tungsten Carbide、Diamond、Others

Market segment by Application:Residential、Industrial Manufacturing、Others

Report analysis:

The Woodworking Circular Saw Blades report encompasses a diverse array of critical facets, comprising feasibility analysis, financial standing, merger and acquisition insights, detailed company profiles, and much more. It offers a comprehensive repository of data regarding marketing channels, raw material expenses, manufacturing facilities, and an exhaustive industry chain analysis. This treasure trove of information equips stakeholders with profound insights into the feasibility and fiscal sustainability of various facets within the market.

Illuminates the strategic maneuvers executed by companies, elucidates their corporate profiles, and unravels the intricate dynamics of the industry value chain. In sum, the Woodworking Circular Saw Blades report delivers a comprehensive and holistic understanding of the markets multifaceted dynamics, empowering stakeholders with the knowledge they need to make informed decisions and navigate the market landscape effectively.

Conducts a simultaneous analysis of production capacity, market value, product categories, and diverse applications within the Woodworking Circular Saw Blades market. It places a spotlight on prime regions while also performing a thorough examination of potential threats and opportunities, coupled with an all-encompassing SWOT analysis. This approach empowers stakeholders with insights into production capabilities, market worth, product diversity, and the markets application prospects.

Assesses strengths, weaknesses, opportunities, and threats, offering stakeholders a comprehensive understanding of the Woodworking Circular Saw Blades markets landscape and the essential information needed to make well-informed decisions.

Market Size Estimation & Method Of Prediction

Estimation of historical data based on secondary and primary data.

Anticipating market recast by assigning weightage to market forces (drivers, restraints, opportunities)

Freezing historical and forecast market size estimations based on evolution, trends, outlook, and strategies

Consideration of geography, region-specific product/service demand for region segments

Consideration of product utilization rates, product demand outlook for segments by application or end-user.

About Us:

Global Info Research is a company that digs deep into Global industry information to Woodworking Circular Saw Blades enterprises with market strategies and in-depth market development analysis reports. We provide market information consulting services in the Global region to Woodworking Circular Saw Blades enterprise strategic planning and official information reporting, and focuses on customized research, management consulting, IPO consulting, industry chain research, database and top industry services. At the same time, Global Info Research is also a report publisher, a customer and an interest-based suppliers, and is trusted by more than 30,000 companies around the world. We will always carry out all aspects of our business with excellent expertise and experience.

0 notes

Link

#belmontcounty#BrookeCounty#CatholicCharities#EastWheeling#GreaterWheelingHomelessCoalition#MarshallCounty#ohiocounty#ProjectHope#UpperOhioValley#wheeling#YSS

0 notes

Text

The globalplywood market size is projected to grow from USD 54.2 billion in 2022 to USD 73.3 billion by 2027, at a CAGR of 6.2%. The increasing demand for plywood from end uses, such as building & construction, packaging, industrial, and furniture sector, drives the market. Demand for multifarious plywood is encouraged by many companies to formulate different developmental strategies in the plywood market to expand their footprint in the market. The companies have adopted various strategies, such as investment & expansion, merger & acquisition, new product launches, and joint ventures to increase their global presence and maintain sustained growth in the plywood market.

The plywood market in the Asia Pacific is forecasted to register the highest CAGR, in terms of value, between 2022 and 2027. Asia Pacific is a rapidly developing region that offers many opportunities for various industry players. Most of the leading players in North America and Europe are planning to move their production base to this region because of the availability of inexpensive raw materials, low production costs, and the need to serve the local market better. The demand for premium products is increasing in the region with the growth in the middle-class population. Government initiatives are also helping in the growth of the wooden sectors. These factors will play an important role in driving the plywood market.

There are various small, medium, and large players operating in the market. Some of the major market players include Boise Cascade Company (US), Weyerhaeuser Company Ltd (US), Upm-Kymmene Oyj (Finland), Sveza Forest Ltd (Russia), Austral Plywoods Pty Ltd (Australia), Potlatchdeltic Corporation (US), Greenply Industries (India), Metsä Wood (Metsäliitto Cooperative) (Finland), Centuryply (India), Austin Plywood (India). They have adopted various developmental strategies such as investment & expansions, new product launches, mergers & acquisitions, and joint ventures to increase their share in the market.

#Plywood Market#Plywood Market Report#Plywood Market Insights#Plywood Market Size#Plywood Market Share#Plywood Market Forecast#Plywood Market Overview#Plywood Market Trends#Plywood Market Analysis#Demand for Plywood#Plywood Sales#Plywood Market Growth#Plywood Market Opportunity

0 notes

Text

Common Issues and Answers with Stucco in Houston

Stucco homes have become much more popular the last 30 years in the Houston home market. Stucco allows home designers to introduce a variety of architectural home design themes and features into their design portfolio that would otherwise not be available to capture unique home elevations. During this brief history of stucco's increase in popularity in Houston there have been many reports of adverse incidents with stucco systems failing and leading to expensive home repairs. Many of the issues have resulted in collateral damage to the home, principally associated with water intrusion moisture getting trapped behind the stucco and either leaking through windows or rotting the plywood sheathing that exist behind the stucco and structural timber of the homes structure. We are going to examine the different types of stucco systems, the properties of stucco and many of the root causes that are the origin of many of the problems.

The Nature of Stucco

Stucco is product that has been used for exterior cladding for thousands of years. It is a product that is part of the masonry family of construction products. The more modern version of stucco was created using Portland cement as the main ingredient for strength and durability more than a century and a half ago. The name stucco is interchanged with plaster and is commonly used for interior and exterior decorative veneers for both residential and commercial structures.

When stucco is used over stabilized brick, block or stone it can be directly applied as a finish to the surface. When stucco is applied over a wooden structure, it requires to be reinforced with wire lath to avoid stucco cracking when timber members move under loading or thermo changes. The lath is fastened mechanically to the substructure with staples, nails or screws. This is designed to allow the wood to slightly move independently from the lath and stucco system without cracking the monolithic stucco base.

Stucco by its very nature was developed to be a weather resistant material that could stand up to heat, snow, rain and wind. As with most cementitious products, stucco is very porous and allows water to penetrate its surface. It is a breathable material that lets water in and out. The stucco will absorb water and discharge excess amounts without affecting the integrity of system. The issues which we will discuss in detail further on, is when the water gets trapped behind the system and cannot be naturally discharged.

Masonry Stucco System

The masonry stucco system typically consist of a 3 coat system. They are referred to as the scratch coat, the brown coat and the finish coat. The general thickness of the system can vary from 5/8"to 1"in thickness. The scratch coat is a 1/4" application coat that is uniformly applied to lath or a brick/block surface. Before it sets up hard, it then is raked to create a grooved surface, that allows the brown coat to adhere more effectively when cured. It is essential to allow the scratch coat to cure before applying the next coat.

Once the scratch coat has cured, the brown coat is applied. The brown coat is troweled on in a thickness of nearly 1/2"and a screed is used to create a flat uniform surface. This second coat is designed to be level, flat and a smooth finish. This coat can be temperamental in the curing process. The ideal conditions for curing should be mild levels of humidity and warm temperatures. If the weather is dry and hot, the brown coat surface can experience shrinkage cracks from improper curing conditions. Water should be applied during these conditions. During cold and wet weather conditions, curing will take much longer than the 7 to 10 day normal period. Stucco installation like any new masonry work should be avoided if the temperatures are not at least 42 degrees and rising. The last coat is appropriately called the finish coat. The finish coat is typically about 1/8" in thickness and can be a variety of textures and colors. The finish coat provides the visible appearance of the stucco. The finish can also include elements like sand or other small aggregate to enhance the appearance of the surface.

EFIS Stucco

Exterior Insulation and Finish System stucco (EFIS) also known as Synthetic Stucco was introduced in Europe shortly after WWII during the reconstruction era to save labor and complete construction faster. In the 1970's EFIS was introduced in the United States. Its appeal to builders was to save money on construction cost and to reduce the required amount of labor that is required in 3 coat stucco systems. If installed properly, it is difficult to visually tell the difference between the two systems. The modern version of EFIS is now a six layer process. It requires a protective membrane over the wood sheathing acting as a water resistant barrier. The Styrofoam is then mechanically attached over the moisture barrier to the plywood substrate. Then a special polymer base coat is applied to the foam and a fiberglass reinforced mesh is embedded in the base coat while wet. The final coat is then applied for both water protection and decorative appearance. The EFIS system does not breath like the traditional stucco system.

The primary property difference between traditional 3 coat stucco and the EFIS system is that unlike conventional stucco, EFIS is designed as a non penetrating surface. The system is designed to keep water from breaching the surface. It is due to the failure of this innate property that the initial EFIS system experienced large scale failures due to water intrusion between the Styrofoam and the structural substrate. The water would work into cracks and poorly prepared joints and sit behind the Styrofoam and rot out the wood members. This was very common with the early systems and led to massive class action law suits.

Waterproofing Stucco

Waterproofing stucco is an essential element of its long term serviceability. As referenced earlier water intrusion is the enemy. If water gets behind the EFIS system it causes the wood to rot. If water continues to get behind the stucco and moisture barrier it can cause the metal lath to deteriorate. The waterproofing is a different process for each of the two systems.

It is best practices to paint your new conventional stucco system with an elastomeric paint. Elastomeric paint is a latex base paint that contains higher quantities of latex and give the paint flexible and stretching properties that most latex paint do not possess. If this paint is installed in the recommended millage, if the stucco experiences slight movement the paint can bridge the stucco from cracking. With conventional stucco it is important to fill hairline cracks that will materialize over time. Unattended to they provide a conduit for water to the lath.

In the case of synthetic stucco, it is required to keep up the maintenance of caulking windows and doors as well as the perimeter of the system to keep water from finding its way in. Routine inspection of flashing and joints is also required. The systems original finish coat holds up well over time and does not require periodic painting.

Stucco Cracks

Stucco cracks can come from various sources. They can result from too little or too much water to Portland cement ratio during the mixing period. They can come from improper stucco curing, improper expansion joint layout and they can result structural movement. The more severe the cause of action, the more severe the crack.

Stucco cracking from improper mixing will often result in spider web cracking or what is known as crazing. These cracks are a result of too wet of mixture, which can lead to stucco weakening in it strength and over hydrating. Long lateral and diagonal hairline cracks in the stucco surface are often the result of not letting the stucco to fully cure before apply an additional coat.

The improper spacing or use of expansion joints can also cause finish stucco to crack over time. As stucco reacts to thermal temperature change, it expands and contracts. As sections of larger amounts of stucco volume move, it causes stress and causes the stucco to natural create unplanned expansion cracks. Stucco is a very durable exterior finish wall system, but much like brick, if the foundation settles or fails, so will the stucco.

Installation Issues

Most of the problems that develop in stucco are a result of installation problems as we have discussed in cracks symptoms. There are a host of additional issues associated with improper installation. We have previously mentioned water intrusion as one of the more serious problems that can result from improper installation. Another common issue is improper moisture protection for wood sheathing. Protecting window openings with proper techniques and covering all exposed lumber is essential in preserving the structure and preventing unwanted consequences.

The lack of improper installation of weep screed can result in moisture being blocked from exiting the stucco system. That also goes for not fastening the lath per specifications, not trimming the lath and metal trim reglets can result poor bonding and cracking. When stucco abuts items like stone or siding normally warrant the proper use of flashing to mitigate water intrusion. Any of these details not followed for best practices of installation can end in the removal and reinstallation at great cost.

Houston Climate and Stucco

There has been much published about stucco not being a sound choice to use as a home cladding product. The product critics point to the wet humid climate not being favorable for any stucco system. They claim that the rain fall, humidity and general climate are conducive for automatically creating mold and rot issues. My contention is that Florida has been using stucco cladding since WWII vets returned. They have a subtropical climate just like Houston and experience similar amounts of rain, temperatures and seasonal weather changes. They have not had the publication of large amount of stucco failures that Houston has been documented having.

We believe that the majority of stucco issues and failures are a direct result of poor workmanship and careless installation procedures. Much like any permanent building product that relies upon the craftsmanship of installation, the success of the products longevity and problem free serviceability is in the details of installation. The devil is in the details not the product. Stucco has hundreds of years of service proven beauty and durability all over the world.

Source. https://www.marwoodconstruction.com/wp-content/uploads/2017/09/Common-Issues-and-Answers-with-Stucco-in-Houston.pdf

0 notes

Text

Rushil Decor Ltd. Strengthens Global Presence with Expansion into South America

Rushil Decor Limited, a prominent player in the manufacturing of eco-friendly MDF, laminates, and plywood, has announced a significant strategic expansion into the South American market. This move marks a substantial milestone in the company's journey to solidify its global footprint, leveraging its extensive experience and innovative product offerings.

The announcement was made in conjunction with Interzum Bogota, an international industry fair for furniture and wood technology held in Colombia from May 14 to 17, 2024. At the event, Mr. Rushil Thakkar, Executive Director of Rushil Decor, expressed optimism about the company's growth prospects in the multi-billion-dollar global wood panel market.

A Strategic Expansion into a Promising Market - Rushil Decor's entry into South America is a carefully planned strategic move aimed at tapping into one of the world's largest markets for Medium Density Fiberboard (MDF). Known for its high demand in the region, South America presents a lucrative opportunity for Rushil Decor to expand its market reach and enhance its export revenues.

As a leading MDF manufacturer in India, Rushil Decor is well-prepared to meet the high standards and expectations of the South American market. The company recently reported a 9% growth in the January to March 2024 quarter compared to the same period last year, with export revenues contributing 28% to the total revenue in the fourth quarter of FY24. This underscores the company's strong international presence and its ability to cater to global demands.

Capitalizing on Market Opportunities - According to Precision Reports, the global MDF market was valued at USD 24,942.77 million in 2024 and is projected to reach USD 29,965.13 million by 2027. Similarly, the global laminate market is expected to grow to USD 11.98 billion by 2030. These projections highlight significant growth opportunities for Rushil Decor, which is strategically positioning itself to capitalize on this potential through its upcoming greenfield project aimed at meeting the burgeoning export demand for laminates.

By leveraging its expertise in both laminates and MDF, Rushil Decor is poised to create synergies across its product lines, further enhancing its revenue potential and solidifying its global footprint. The company’s expansion into South America is expected to significantly boost its market presence and operational efficiency.

Commitment to Sustainability and Innovation - Rushil Decor’s expansion aligns with its commitment to sustainability and innovation. The company supports the values emphasized at the 2024 edition of Interzum Bogota, which focuses on the circular economy, sustainability, innovation, and technology. Rushil Decor’s product range is a testament to these principles, offering eco-friendly, high-quality solutions that meet the evolving needs of global customers.

"Expanding into South America is a significant milestone for Rushil Decor," said Mr. Rushil Thakkar, Executive Director of Rushil Decor Limited. "This move underscores our dedication to providing sustainable and high-quality products to new regions, meeting the evolving needs of South American customers. We are excited about the growth opportunities this expansion presents."

Future Growth and Vision - Rushil Decor's strategic expansion is part of its broader vision to achieve annual revenues of INR 2500 crores by 2029. With state-of-the-art manufacturing facilities and a robust distribution network, the company is well-equipped to meet the increasing demands of the global market while maintaining financial stability and operational efficiency.

Founded in 1993, Rushil Decor Limited has grown into a global leader in modern interior infrastructure and eco-friendly, composite wood panels. The company operates six manufacturing plants with an annual capacity of 3,30,000 CBM MDF and 3.49 million laminates, catering to customers in over 50 countries worldwide. Additionally, Rushil Decor has expanded into plywood manufacturing at its Chikamaglur Plant in Bengaluru, with plans to gradually increase production capacity.

A Legacy of Quality and Innovation - Rushil Decor’s product portfolio includes VIR Laminates, VIR MDF boards, VIR MAXPRO (HDFWR) boards, VIR Pre-laminated Decorative MDF/HDFWR boards, VIR Modala Ply, VIR PVC, and VIR WPC boards/doors. The company’s focus on quality, design, and customer-centricity, combined with value-led DIY green-engineered products from agroforestry, sets it apart in the industry.

Driven by automated plants, world-class German technologies, and global standards, Rushil Decor continually creates smarter spaces. Optimal supply chain efficiencies, resource utilization, and strategic local plantations offer a cost advantage in raw material sourcing and manufacturing excellence, enabling high output to meet global market demand.

0 notes

Text

Brazil Wood Industry Witnesses Year-Over-Year Export Surge in May

The Brazilian wood industry is experiencing a remarkable growth, with a significant year-over-year increase in exports noted in May. This growth in forest exports is not just a temporary trend but a solid display of Brazil's increasing strength in the global timber market. The country has become a major supplier of a diverse range of wood-based products, including innovative cross-laminated timber panels, glulam, parquet and laminated flooring, sandwich panels, railway sleepers, and rounded saw wood.

Exports have emerged as a strong pillar for Brazil, showcasing its versatility through the export of mouldings, plywood, furniture, and lumber. The US, Mexico, and Europe stand out as the primary markets for these exports, indicating the widespread demand for Brazilian wood products. In this blog, we will explore the dynamics behind this export surge and what it signifies for the future of Brazil's timber industry.

Brazil's Wood Export Analysis

The International Tropical Timber Organization (ITTO) reports a complex picture for Brazil's wood-based product exports in May 2024. Overall, there was a 2.7% increase in value compared to the previous year, climbing from US$328.3 million to US$337.0 million. However, this aggregate growth masks some fluctuations in specific categories.

Pine-sawnwood, a staple of the industry, saw a 14% decrease in value year-over-year, dropping from US$74.5 million to US$64.1 million. The volume of pine sawnwood exports also fell by 11%, from 306,300 m³ to 271,300 m³.

Tropical sawnwood exports experienced a steep decline, with an 18% drop in volume and a 36% fall in value, signaling a significant shift from 29,000 m³ and US$14.9 million to 23,900 m³ and US$9.6 million, respectively.

In contrast, pine plywood exports painted a more positive picture, with a 20% rise in value and an 11% increase in volume, indicating a boost from US$63.8 million and 195,900 m³ to US$76.5 million and 217,100 m³.

Tropical plywood also showed promising signs, with a 9% volume and 11% value increase, marking a growth from 3,200 m³ and US$1.9 million to 3,500 m³ and US$2.1 million. The wooden furniture has witnessed a 5% uptick in export value, rising from US$52.1 million to US$54.6 million.

Brazil's Export Pricing and Its Global Impact

As Brazil strengthens its position as one of the world's top lumber exporters, its export pricing fluctuations hold considerable influence over the global timber market. The recent increase in Brazil's lumber export prices is set to have a significant impact. The construction industry may face heightened project costs, potentially pushing up housing prices.

Retailers could see a knock-on effect, with increased costs for lumber and wood products possibly affecting consumers, especially those planning home renovations or engaging in do-it-yourself projects. Also, other lumber-exporting countries might find themselves adjusting their prices in response to Brazil's market activity, which could lead to broader shifts in global price trends.

Conclusion

A successful lumber trading strategy relies on having accurate and up-to-date information on timber price trends. The Timber Exchange's Market Data Hub provides this crucial information. More than just a data source, it's a comprehensive digital hub for the global timber market, offering in-depth news, updates, and webinars.

The Market Data Hub's user-friendly dashboard presents over 200+ market indicators, enabling users to effectively oversee a broad range of forestry operations. From logging activities to production statistics, inventory counts, and export/import figures, the hub encompasses every aspect of the industry. It also sheds light on consumption trends and pricing in over 25 key global markets.Would you like to explore the full capabilities of the Market Data Hub and truly take advantage of its offerings? Book a demo from here.

0 notes

Text

Global Top 5 Companies Accounted for 71% of total Oriented Strand Board (OSB) market (QYResearch, 2021)

Oriented Strand Board is a widely used, versatile structural wood panel. Manufactured from waterproof heat-cured adhesives and rectangularly shaped wood strands that are arranged in cross-oriented layers, OSB is an engineered wood panel that shares many of the strength and performance characteristics of plywood. OSB's combination of wood and adhesives creates a strong, dimensionally stable panel that resists deflection, delamination, and warping; likewise, panels resist racking and shape distortion when subjected to demanding wind and seismic conditions. Relative to their strength, OSB panels are light in weight and easy to handle and install.

According to the new market research report “Global Oriented Strand Board (OSB) Market Report 2023-2029”, published by QYResearch, the global Oriented Strand Board (OSB) market size is projected to reach USD 21.53 billion by 2029, at a CAGR of 6.7% during the forecast period.

Figure. Global Oriented Strand Board (OSB) Market Size (US$ Million), 2018-2029

Figure. Global Oriented Strand Board (OSB) Top 5 Players Ranking and Market Share(Continually updated)

The global key manufacturers of Oriented Strand Board (OSB) include Norbord, LP, Kronospan, Georgia-Pacific, Weyerhaeuser NR Company, Tolko, Huber, Martco, Dieffenbacher, Egger, etc. In 2021, the global top five players had a share approximately 71.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

Wood Adhesives Market Is Anticipated To Attain Around $12.52 Billion By 2030

The global wood adhesives market size is anticipated to reach USD 12.52 billion by 2030 and is projected to grow at CAGR of 8.6% from 2024 to 2030, as per the new report by Grand View Research, Inc. The increasing demand from engineered wood-based panel manufacturers is a significant driver of the market.

Adhesives are a preferred choice for binding wood strips, chips, fibers, strands, and veneers for manufacturing engineered wood-based panels such as plywood, particle board, oriented strand board, medium density fiberboard, and high density fiberboards. Increasing population and rapid urbanization accompanied with the government efforts to boost residential construction are likely to propel the demand for wood-based panels, which in turn is expected to support the market growth.

Urea-formaldehyde (UF) dominated the market in 2023 owing to its beneficial properties, namely, inflammability, low cost, light color, and a very rapid cure rate. However, low water resistance of the product is likely to restrain its utilization over the coming years. Melamine urea-formaldehyde (MUF) resins, which possess better water resistance properties, are increasingly being used in exterior applications that are more susceptible to moisture.

Soy-based adhesives have gained popularity owing to their low cost production, low emissions, and bio-based origin. Stringent regulations pertaining to the formaldehyde emissions that are emitted during the production of UF resin-based wood products has led to resurgence of soy-based adhesives demand. Hydrolyzed soy proteins added to phenol formaldehyde resins provide reduced costs without degrading performance.

Furniture is also expected to remain a major application for the product. Growing investment on high-end, branded furniture by the consumers is expected to positively affect the market. Major trends affecting the industry are sustainability, digitalization, and integration of home electronics into work & home furniture. These factors have facilitated innovation and new product development in the market.

Wood Adhesives Market Report Highlights

Urea-formaldehyde (UF) dominated the market in 2023 with a significant volume share of 31.4%, due to its low cost

Soy-based adhesives are anticipated to witness the fastest revenue growth, with a CAGR of 10.0% from 2024 to 2030. The environmental advantages offered by the product is estimated to play a key role for its increasing demand

Flooring is estimated to be the fastest growing application, in terms of revenue, with a CAGR of 9.3% from 2024 to 2030. Increasing construction spending and the rise in demand for luxurious and comfortable flooring is expected to facilitate the segment growth

Particle Board (PB) held the largest share in the wood adhesive consumption, with a significant volume share of 27.1% in 2023

Asia Pacific dominated the wood adhesives market with a significant volume share of 58.6% in 2023, owing to the extensive engineered wood-based panel production in the region

Wood Adhesives Market Segmentation

For this report, Grand View Research has segmented the global wood adhesives market report based on product, application, substrate, and region:

Wood Adhesives Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

Urea-formaldehyde (UF)

Melamine Urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl Acetate (PVA)

Soy-based

Others

Wood Adhesives Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

Flooring

Furniture

Doors & Windows

Housing Components

Others

Wood Adhesives Substrate Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

Solid Wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-density Fiberboard (MDF)

High-density Fiberboard (HDF)

Others

Wood Adhesives Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Asia Pacific

China

India

Japan

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

List of Key Players in the Wood Adhesives Market

H.B. Fuller

Henkel AG & Co., KGaA

Bostik S.A.

3M

Sika AG

Ashland, Inc.

Pidilite Industries Ltd.

Jubilant Industries Ltd.

AkzoNobel N.V.

Franklin Adhesives & Polymers.

DowDuPont Inc.

0 notes